Abstract

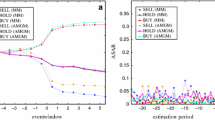

We examine the stock recommendations of Jim Cramer televised on CNBC’s Mad Money, and document significant market reactions (i.e., announcement returns and volume) to Cramer’s recommendations, particularly for small capitalization stocks. The following findings indicate that the announcement returns are primarily due to price pressure from uninformed trading as opposed to the recommendations providing new value related information: announcement returns reverse following buy recommendations; bid-ask spreads temporarily decline; and there is no evidence of positive longer-term abnormal returns. One implication, when considered in combination with other works, is that investors should be cautious in following stock recommendations announced in the mass-media.

Similar content being viewed by others

Notes

A typical Mad Money show during our sample period consists of two general parts: a “discussion segment” in which Cramer discusses his own stock picks; and a “lightning round” where he gives his opinion on stocks about which callers inquire.

We became aware of the work of Engelberg et al. only after generating our first results for this paper and Neumann and Kenny after submitting our paper for publication.

See Feinberg’s (2006) article in Kiplinger’s Personal Finance.

Our request to CNBC for data summarizing earlier shows has gone unfulfilled.

We group Guest Interview recommendations into Cramer’s discussion segment. During the 13 month period of our sample, there were also 6 recommendations of “hold and homework.” We exclude these 6 observations from our sample. In early 2007 and after the end of our sample period, TheStreet.com’s Mad Money summaries were changed to list additional “segments” called Featured Stock, Game Plan, Mailbag, and Sudden Death that we would consider sub-segments of either a discussion segment or a lightning round.

Compared to equity analysts, Cramer is more likely to issue a sell recommendation. Womack (1996) reports that for analysts of major US brokerages “new buy recommendations occur seven times more often than sell recommendations.”

Results using a four factor abnormal returns model (i.e., Fama/French factors plus a momentum factor) for buy and sell recommendations are qualitatively the same as presented in Table 4, the exceptions being that abnormal returns for sell reaffirmations and DS sells of large and mid capitalization stocks are not statistically significant.

For Table 4, Initial occurrence and Buy and sell reaffirmations observations for buy and sells do not sum to the buy and sell observations in Table 4 Full sample because buy (sell) observations that first follow an earlier sell (buy) recommendation during our sample period do not appear in Table 4 Initial occurrence and Buy and sell reaffirmations.

We also consider discussion segment calls to be stronger than lightning round calls because Cramer independently selects the stocks to discuss in the former but not the latter, where viewer input plays a large role.

Glosten and Milgrom (1985) propose that the adverse selection component of the bid-ask spread varies with the perceived information advantage of the investor trading. The lower the perceived information advantage, the lower the bid-ask spread. By definition, uninformed traders have no information advantage.

As an additional caveat, we note that ideally one would compute returns using stock prices as of immediately after Mad Money recommendations airing. However, these recommendations are made after hours and we have no access to intra-day or after hours trading data.

References

Barber B, Loeffler D (1993) The “Dartboard” column: second-hand information and price pressure. Journal of Financial and Quantitative Analysis 28:273–284

Barber B, Lehavy R, McNichols M, Trueman B (2001) Can investors profit from the profits? Security analyst recommendations and stock returns. Journal of Finance 56:531–563

Barber B, Reuven L, Trueman B (2007) Comparing the stock recommendation performance of investment banks and independent research firms. Journal of Financial Economics 85:490–517

Beltz J, Jennings R (1997) Wall Street Week with Louis Rukeyser recommendations: trading activity and performance. Review of Financial Economics 6:15–27

Brown S, Warner J (1985) Using daily stock returns: The case of event studies. Journal of Financial Economics 14:3–31

Carhart M (1997) On persistence in mutual fund performance. Journal of Finance 52:1063–1086

Chordia T, Shivakumar L (2006) Earnings and price momentum. Journal of Financial Economics 80:627–656

Engelberg J, Sasseville C, Williams J (2007) Attention and asset prices: The case of Mad Money. Working paper, Kellogg School of Management, Northwestern University

Fama E, and French K (1993) Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33:3–56

Feinberg A (2006) Booyah! The manic universe of Jim Cramer. Kiplinger’s Personal Finance 60:38–43

Ferreira E, Smith S (2003) Wall $treet Week: Information or entertainment?. Financial Analysts Journal 59:45–53

Greene J, Smart S (1999) Liquidity provision and noise trading: Evidence from the “Investment Dartboard” column. Journal of Finance 54:1885–1900

Glosten L, Milgrom P (1985) Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. Journal of Financial Economics 14:71–100

Jensen M (1967) The performance of mutual funds in the period 1945–1964. Journal of Finance 23:389–416

Kacperczyk M, Sercu A (2007) Fund manager use of public information: New evidence on managerial skills. Journal of Finance 62:485–528

Kosowski R, Timmermann A, Wermers R, White H (2006) Can mutual fund “stars” really pick stocks? New evidence from a bootstrap analysis. Journal of Finance 61:2551–2595

Liang B (1999) Price pressure: evidence from the ‘‘Dartboard’’ column. Journal of Business 72:119–134

Michaely R, Thaler R, Womack K (1995) Price reactions to dividend initiations and omissions: Overreaction or drift? The Journal of Finance 40:573–608

Neumann J, and Kenny P (2007) Does Mad Money make the market go mad? The Quarterly Review of Economics and Finance 47:602–615

Odean T (1999) Do investors trade too much? American Economic Review 89:1279–1298

Patell J (1976) Corporate forecasts of earnings per share and stock price behavior: Empirical tests. Journal of Accounting Research 12:246–274

Pari R (1987) Wall $treet Week recommendations: yes or no? Journal of Portfolio Management 13:74–76

Sant R, Zaman M (1996) Market reaction to Business Week ‘Inside Wall Street’ column: a self-fulfilling prophecy. Journal of Banking and Finance 20:617–643

Womack K (1996) Do analysts’ recommendations have investment value? Journal of Finance 41:137–167

Author information

Authors and Affiliations

Corresponding author

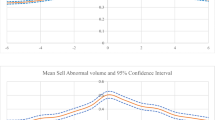

Appendix: The Michaely et al.’s test for abnormal volume

Appendix: The Michaely et al.’s test for abnormal volume

This appendix details our application of the Michaely et al. (1995) test statistic for abnormal volume. Let TO denote daily turnover computed as volume divided by total outstanding shares for a stock. Compute mean TO for a 100 day pre-event period for each stock, as shown in Eq. 4, where i denotes stock i and t denotes day t.

Abnormal portfolio volume for day t is the computed as the average (for n stocks in the sample) of day t volume divided by mean pre-event volume, and then subtracting one:

The test statistic for abnormal volume, which we denote as t-stat 2 in Table 7, is calculated using a pre-event standard deviation:

Rights and permissions

About this article

Cite this article

Keasler, T.R., McNeil, C.R. Mad Money stock recommendations: market reaction and performance. J Econ Finance 34, 1–22 (2010). https://doi.org/10.1007/s12197-008-9033-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-008-9033-7