Abstract

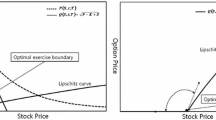

In this paper, a simple algorithm to improve the computational accuracy of the analytical approximation for the value of American put options and their optimal exercise boundary proposed by Zhu (Int. J. Theor. Appl. Finance 9(7):1141–1177, 2006) is presented. In the current approach, Zhu’s simple approximation formula is used as an initial guess for the optimal exercise boundary of American put options. The determination of an improved optimal exercise boundary is then achieved by setting a null value of the Theta of option on the optimal exercise boundary. Numerical test results show that the improvement in accuracy is indeed significant in determining the optimal exercise boundary.

Similar content being viewed by others

References

Abramowitz, M., Stegun, I.A.: Handbook of Mathematical Functions with Formulas, Graphs and Mathematical Tables. Dover, New York (1972), pp. 302

Barone-Adesi, G., Whaley, R.: Efficient analytical approximation of American option values. J. Finance 42, 301–320 (1987)

Basso, A., Nardon, M., Pianca, P.: Discrete and continuous time approximations of the optimal exercise boundary of American options. Pubblicazione del Dipartimento di Matematica Applicata dell’Universit1 Ca’ Foscari di Venezia. Working Paper No. 105, pp. 1–24 (2002)

Barles, G., Burdeau, J., Romano, M., Samscen, N.: Critical stock price near expiration. Math. Finance 5(2), 77–95 (1995)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–654 (1973)

Broadie, M., Detemple, J.: American option valuation: new bounds, approximations, and a comparison of existing methods. Rev. Financ. Stud. 9, 1211–1250 (1996)

Bunch, D.S., Johnson, H.: The American put option and its critical stock price. J. Finance 5, 2333–2356 (2000)

Carr, P., Jarrow, R., Myneni, R.: Alternative characterizations of American put options. Math. Finance 2, 87–106 (1992)

Crank, J.: Free and Moving Boundary Problems. Clarendon, Oxford (1984)

Elliott, C.M., Ockendon, J.R.: Weak and Variational Methods for Moving Boundary Problems. Pitman, Boston (1982)

Geske, R., Johnson, H.E.: The American put option valued analytically. J. Finance 39, 1511–1524 (1984)

Golub, G.H., Ortega, J.M.: Scientific Computing and Differential Equations. Academic Press, New York (1992), p. 150

Huang, J.-Z., Subrahmanyam, M.G., Yu, G.G.: Pricing and hedging American options: a recursive integration method. Rev. Financ. Stud. 9, 277–300 (1996)

Johnson, E.H.: An analytical approximation for the American put price. J. Financ. Quant. Anal. 18, 141–148 (1983)

Karatzas, I., Shreve, S.E.: Methods of Financial Mathematics. Springer, Berlin (1998), pp. 67–80

Kim, I.J.: The analytic valuation of American puts. Rev. Financ. Stud. 3, 547–572 (1990)

MacMillan, L.: Analytical approximation for the American put option. Adv. Futures Options Res. 1, 119–139 (1986)

Wu, L., Kwok, Y.K.: A front-fixing finite difference method for the valuation of American options. J. Financ. Eng. 6(2), 83–97 (1997)

Zhu, S.-P.: A new analytical-approximation formula for the optimal exercise boundary of American put options. Int. J. Theor. Appl. Finance 9(7), 1141–1177 (2006)

Zhu, S.-P.: An exact and explicit solution for the valuation of American put options. Quant. Finance 6(3), 229–242 (2006)

Zhu, S.-P., He, Z.-W.: Calculating the early exercise boundary of American put options with an approximation formula. Int. J. Theor. Appl. Finance 10(7), 1203–1227 (2007)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhu, SP. A simple approximation formula for calculating the optimal exercise boundary of American puts. J. Appl. Math. Comput. 37, 611–623 (2011). https://doi.org/10.1007/s12190-010-0454-z

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12190-010-0454-z