Abstract

With the vigorous promotion of energy conservation and implementation of clean energy strategies, China’s natural gas industry has entered a rapid development phase, and natural gas is playing an increasingly important role in China’s energy structure. This paper uses a Generalized Weng model to forecast Chinese regional natural gas production, where accuracy and reasonableness compared with other predictions are enhanced by taking remaining estimated recoverable resources as a criterion. The forecast shows that China’s natural gas production will maintain a rapid growth with peak gas of 323 billion cubic meters a year coming in 2036; in 2020, natural gas production will surpass that of oil to become a more important source of energy. Natural gas will play an important role in optimizing China’s energy consumption structure and will be a strategic replacement of oil. This will require that exploration and development of conventional natural gas is highly valued and its industrial development to be reasonably planned. As well, full use should be made of domestic and international markets. Initiative should also be taken in the exploration and development of unconventional and deepwater gas, which shall form a complement to the development of China’s conventional natural gas industry.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since 2000, China’s natural gas production and consumption have both maintained rapid growth, with an average annual growth rate of 11.9 % and 15.6 %, respectively. In 2014, China’s natural gas production reached 134.5 billion cubic meters, consumption totaled 185.5 billion cubic meters (BP 2015), which shows that China’s natural gas industry has entered a rapid development stage. All these are largely attributed to China’s vigorous promotion of energy conservation and implementation of a clean energy strategy, as well as the clean and efficient characteristics of natural gas itself. China’s natural gas industry has entered a “golden period” (Qiu 2008), and natural gas will play an increasingly important role in China’s energy structure. Therefore a reasonable and accurate forecast of natural gas production will greatly assist the healthy development of the natural gas industry.

Many scholars have conducted research into energy forecast models. Jebaraj and Iniyan included in detail all available models (Jebaraj and Iniyan 2006) and divided them into major categories such as energy planning, energy supply and demand, energy forecast, and optimization, whereby a full picture of developments in energy demand and supply models was fairly presented. This sets the basis for this paper’s overview of energy forecasting models. With regard to natural gas forecasting models, scholars have used methods like Artificial Neural Network (ANN) and scenario analysis to forecast natural gas consumption in areas such as Europe, Asia–Pacific, and East Africa (Szoplik 2015; Aguilera et al. 2014; Demierre et al. 2015) and countries like Italy, Croatia, and Turkey (Taşpınar et al. 2013; Bianco et al. 2014; Primoz et al. 2014). While the most famous forecasting model abroad for natural gas is still the Hubbert model. The United States renowned geologist Hubbert in 1956 put forward that the rate of mineral resources production over time would resemble a bell curve (Hubbert 1956), based on which the Hubbert model was proposed to forecast oil and gas production (Hubbert 1959). The model accurately predicted the oil and gas production in the Lower 48 US states and has become the main model for oil and gas production forecasts in foreign countries. All the models afterward were actually updates and improvements of the Hubbert model, among which the Multicyclic Hubbert model put forward by Al-Fattah and Startzman was the most well known (Al-Fattah and Startzman 1999), and was utilized in natural gas production forecast globally with great effect. In China, the famous geophysicist and academician Weng Wenbo, based on the theory that everything in the world follows the natural process of “rise-grow-mature-decay” (Tayfun 2007), proposed in 1984 the Weng model for oil and gas production forecast (Weng 1984), and for the first time predicted China’s natural gas production. Since then, with the development of the geological theory inside China, oil and gas production forecasting models began to emerge continuously. Among them, oilfield statistics-based HCZ model (Hu et al. 1995) and the Generalized Weng model (Chen 1996), gained the most attention, and are currently used in a wide range in China’s oil and gas production forecast; besides, there have also been studies (Feng et al. 2010; Boqiang and Ting 2012) in China on Multicyclic Hubbert models based on the research results of Al-Fattah and Startzman. It is to be noted that some studies on China’s natural gas production were based on combined forecasting (Yuan et al. 2007; Li et al. 2009), where predictions from different models were combined through optimization algorithms (Granger and Ramanathan 1984). From a mathematical point of view, combined forecasting could indeed promote forecasting accuracy (Wu 2007); while practically due to the uncertainty of every model’s forecasting result, combing the forecasts is no doubt a superposition of all the uncertainties, leading to discrepancies with the actual production in oil and gas fields, thus indicating a limitation therein. Taking all the models above, this paper takes the Generalized Weng model to forecast the growth trend of China’s natural gas production, based on which countermeasures and strategies for the natural gas industrial development are analyzed.

2 Methodology and data

2.1 Methodology

Table 1 shows the mathematical expressions of Hubbert, HCZ, and Generalized Weng models.

As can be seen from the relationship between N pmax and N R , production forecast by the Hubbert model assumes a strictly symmetrical production peak. The HCZ model expects the production peak will occur when cumulative production reaches 36.8 % (1/e) of estimated total recoverable resources; while for the Generalized Weng model, production peak and recoverable resources are not necessarily correlated. Therefore, for oil & gas fields that have entered the declining stage after 50 % of reserves is recovered, a good result can be achieved when using the Hubbert model to make production forecasts; for fields that decline occurs after 36.8 % of reserves is recovered, the HCZ model would bring about a relatively accountable result; while the Generalized Weng model demonstrates a strong flexibility in forecasting with no specific requirements on the timing of the oil & gas fields’ decline, thus being more widely used in China. That is why this paper also adopts this model to make forecasts for natural gas production.

2.2 Interpretation of Generalized Weng model

-

(1)

Traditional interpretation Suppose a sequence Q t for historical natural gas production of a given oil & gas field:

$$Q_{t} = (Q_{ 1} ,Q_{ 2} , \ldots ,Q_{n} ),\quad t = 1, 2, \ldots ,n.$$(1)The cumulative production as of year m amounts to N pm :

$$N_{pm} = \sum\limits_{t = 1}^{m} {Q_{t} } ,\quad m \in \left[ {1,n} \right].$$(2)Then the Generalized Weng model can be applied in the natural gas production forecast and ultimate recoverable resources as follows:

$$Q = at^{b} e^{ - t/c}$$(3)$$N_{R} = ac^{b + 1} \varGamma \left( {b + 1} \right).$$(4)Through a logarithm process of formula (3), Professor Chen (1996) proposed the traditional interpretation of the Generalized Wend model, where semi-logarithmic relations between production (Q) and time (t) are

$$\ln \frac{Q}{{t^{b} }} = \ln a - \frac{1}{c}t.$$(5)Suppose the value of b can be inferred empirically, and an optimal segment selected from the time sequence generated through formula (5), then the values for both a and c can be determined using linear regression, whereby forecast production Q t f can be obtained as

$$Q_{t}^{f} = (Q_{1}^{f} ,Q_{2}^{f} , \ldots ,Q_{n}^{f} ),\quad t = 1, 2, \ldots ,n.$$(6)The correlation coefficient R regarding sequences of actual historical production and forecast production goes like

$$R = \frac{{\sum\limits_{t = 1}^{n} {\left[ {\left( {Q_{t} - \overline{{Q_{t} }} } \right)\left( {Q_{t}^{f} - \overline{{Q_{t}^{f} }} } \right)} \right]} }}{{\sqrt {\sum\limits_{t = 1}^{n} {\left( {Q_{t} - \overline{{Q_{t} }} } \right)^{2} } } \sqrt {\sum\limits_{t = 1}^{n} {\left( {Q_{t}^{f} - \overline{{Q_{t}^{f} }} } \right)^{2} } } }}.$$(7)Value b may not be exactly right due to the fact that it is given empirically beforehand. Chen (1996) then proposed that the value may only be optimal when on a linear trial and error basis, the highest degree of fitting (R) is reached. Linear trial and error process can be conducted via the spreadsheet program Excel’s Goal Seek tool. With the values for a, b, and c, respectively, being determined, this field’s future production can be forecast by trend extrapolation.

-

(2)

The second interpretation In order to determine value b more simply, other scholars (Zhao et al. 2009) have proposed the second interpretation of the Generalized Weng model, where formula (5) is translated as

$$\ln Q = \ln a + b\ln t - \frac{1}{c}t.$$(8)Make T 1 = ln t, T 2 = ln − t, formula (5) and (8) can then be translated into a linear equation with two unknowns:

$$\ln Q = \ln a + bT_{1} + \frac{1}{c}T_{2}.$$(9)Through some mathematical tools, the semi-log relationship between historical production (Q) and T 1/T 2 can be drawn into a three-dimensional space, by selecting data segments with better plane relations and conducting binary regressions thereto, the values for a, b, and c can then be determined.

-

(3)

New interpretation There are several issues regarding the interpretation that Chen proposed (Chen 1996). First is that estimated recoverable resources (NR) are not taken into account in the calculation process, since resources determine production and will undoubtedly constrain the growth trend thereof. Also, relationship between historical cumulative production and estimated residual recoverable resources, that constitute the whole recoverable resources, is not fully considered. For natural gas production forecast of any oil & gas field, it should always be based on estimated residual recoverable resources, since the historical cumulative production is just “as is” and has no impact on future production. Therefore, of all the estimated recoverable resources, it is the residual recoverable resources that determine the future production growth trend. The traditional Generalized Weng model is a full-cycle one, where the values of parameters are determined from regression to certain data segments, then comes the forecast based on all the estimated recoverable resource; since historical cumulative production is not excluded, a high forecast maybe suggested. Furthermore, after value b is given then regression being made, randomness and subjectivity are implied when optimal segment selected from the time sequence generated on semi-logarithmic relations between historical production (Q) and time (t), which may in turn, affect the forecast result. Lastly, determining value b from higher coefficient R may not be solidly based since the latter shall not be the sole element to decide the accuracy of the forecast.

Even though the second interpretation does describe and improve the process for determining value b, the above-mentioned issues still apply. Also, data segments with better plane relations are located from a three-dimensional space, where difficulty and subjectivity is implied, making no guarantee to the accuracy of the forecast. The dependence on some advanced mathematical tools would further restrict the wider application of this interpretation.

In order to more accurately forecast China's natural gas production, based on the above interpretations and China’s current conditions, this paper proposes a new interpretation of the Generalized Weng model.

-

(1)

For formula (5), value b is still given empirically to determine the semi-logarithmic relations between historical production (Q) and time (t).

-

(2)

The regression data segment (S) for a given oil & gas block’s natural gas production is implied when t = m:

$$S = \left( {\ln \frac{{Q_{m} }}{{t^{b} }},\ln \frac{{Q_{m + 1} }}{{t^{b} }}, \ldots ,\ln \frac{{Q_{n} }}{{t^{b} }}} \right),\quad t\,<\,m.$$(10) -

(3)

Linear trial and error is still needed in getting the right value for b, while the coefficient R, which is more mathematical oriented, is ignored in this paper, and such index more reflective of oil & gas field’s actual conditions as estimated residual recoverable resource is adopted. Also, as is well known, that with the new round of evaluation for China’s oil and gas resources having been successfully implemented, a clearer picture is presented regarding the oil and gas resources for different regions of China. For a given oil & gas field, when reaching the stage of rapid growth, its cumulative natural gas production goes like

$$N_{pm} = \sum\limits_{t = 1}^{m} {Q_{t} } ,\quad m \in \left[ {1,n} \right).$$(11)The residual natural gas estimated recoverable resource N Rr at this time point can be inferred as

$$N_{Rr} = N_{R} - N_{pm} = N_{R} - \sum\limits_{t = 1}^{m} {Q_{t} } ,\quad m \in \left[ { 1,n} \right).$$(12)When the values for a, b, and c are determined through regression, the estimated recoverable natural gas resources N R fof China can be deduced from formula (4):

$$N_{R}^{f} = ac^{b + 1} \varGamma \left( {b + 1} \right).$$(13)Before the time point when t = m, forecast cumulative natural gas production N pm f would be

$$N_{pm}^{f} = \sum\limits_{t = 1}^{m} {Q_{t}^{f} } ,\quad m \in \left[ { 1,n} \right).$$(14)As it is mentioned above, it is the estimated residual natural gas resources that determine future production trends. Residual recoverable resources at time point m can be inferred based on formula (13) and (14):

$$N_{Rr}^{f} = N_{R}^{f} - N_{pm}^{f} = ac^{b + 1} \varGamma \left( {b + 1} \right) - \sum _{t = 1}^{m} Q_{t}^{f} ,\;\;\;m \in \left[ {1, n} \right).$$(15)In getting the right b value via Goal Seek, forecast residual recoverable resources after the time point of t = m must be equal to that of the actual, whereby the conclusiveness of residual estimated recoverable resources on future production trend can be reflected. The corresponding mathematical expressions are as follows:

$$\left\{ \begin{aligned} &N_{Rr} = N_{R} - N_{pm} = N_{R} - \sum\limits_{t = 1}^{m} {Q_{t} } \hfill \\ &N_{Rr}^{f} = N_{R}^{f} - N_{pm}^{f} = ac^{b + 1} \varGamma \left( {b + 1} \right) - \sum\limits_{t = 1}^{m} {Q_{t}^{f} } \hfill \\ &Opt.b,s.t.N_{Rr} = N_{Rr}^{f} \hfill \\ &m \in \left[ {1,n} \right) \hfill \\ \end{aligned} \right.$$(16)As can be inferred from above, that model-based forecast of recoverable resources N R f may not be equal to actual recoverable resources N R , which is mainly due to the inequality of forecast and actual cumulative production before forecasting point (t = m); whereas after the forecasting point, Goal Seek of b ensures the estimated residual recoverable resource to be an actual one, thus guaranteeing the accuracy of the forecasting base.

-

(4)

Finally, the values for a, b, and c can be decided through the above processes, then future natural gas production for a given region can be forecast by trend extrapolation.

By proposing a new interpretation of the Generalized Weng model, this paper aims at promoting the reasonableness of forecasts. Although many studies do suggest a Multicyclic Generalized Weng Model, we are of the opinion that it is the residual natural gas resources that determine future production trends. Hence, the forecasting base should be the future production trend instead of the full-cycle trend, given that in different periods, the production growth may vary greatly, thus it might be only reasonable to make forecasts based on production growth in recent years; also, while fitting the whole historical production enhances accuracy, it does not bring strong reasonableness. Therefore, this paper adopts the traditional Generalized Weng model in making the forecast.

In order to better forecast and analyze China’s natural gas production development on a regional basis, this paper divides China into 9 geological regions as follows:

-

Northeast Region: Heilongjiang, Jilin, Liaoning;

-

Bohai Region: Beijing, Tianjin, Hebei, Shandong;

-

Yangtze River Delta: Shanghai, Jiangsu, Zhejiang;

-

Southeast Region: Fujian, Guangdong, Guangxi, Hainan;

-

Central Region: Inner Mongolia, Shaanxi, Shanxi, Ningxia;

-

Mid-South Region: Henan, Hubei, Hunan, Anhui, Jiangxi;

-

Western Region: Xinjiang, Qinghai, Gansu;

-

Southwest Region: Sichuan, Chongqing, Tibet, Yunnan, Guizhou;

-

Offshore: including offshore part of Bohai Bay, East China Sea and Yellow Sea, Yingge Sea, Beibu Gulf, while the South China Sea is not included.

2.3 Data

In the forecast, statistics for China’s estimated recoverable natural gas resources come from the evaluation results made by Ministry of Land and Resources, while data for oilfields are based on company data.

Resources are the prerequisite for production forecasts. The national oil and gas resource evaluation shows that China’s estimated recoverable natural gas resources are about 22 trillion cubic meters with the proved rate being 11.1 percent. Estimated recoverable resources and proved recoverable reserves for the above 9 regions are shown in Table 2.

By attributing gas production in each oilfield to its corresponding geological region, this paper comes up with gas production in the 9 regions of China shown in Fig. 1. Since the Southeast Region did not have gas production until 2002, it is difficult to make a reasonable forecast based on historical production statistics; also, given the fact that the estimated recoverable natural gas resources of this region only totals 3.7 billion cubic meters and has little impact on the national output in the future, production in this region is therefore not included in the whole forecasting picture. Yangtze River Delta will not be shown in the figures because of the low percentage, but will be presented in the legend as it is included in calculation of national production.

3 Results

Based on the estimates of recoverable natural gas resources, estimated remaining recoverable resources and historical production data of each region, forecasting of their gas production was made with the Generalized Weng model by linear trial and error, with results shown in Fig. 2. Accuracy of the forecasting is secured by basing it on the actual estimated remaining recoverable resources.

Mid-South Region is an exception, the production there has gradually been declining in recent years; while the estimated residual recoverable resources still make up 73.7 % of total recoverable resources, whereby a potential for production increase can still be inferred. Therefore, it is forecast that a new growth trend will emerge soon in this area soon.

Results are obtained as follows based on Fig. 2:

-

(1)

Rising output of natural gas in all regions From the perspective of the estimated resource base shown in Table 3, apart from the Mid-South Region of China, all the other regions demonstrate a remaining estimated recoverable to original gas in place ratio of over 75 %, which on one hand means that abundant resources are available for future production, but on the other also implies that China’s natural gas industry is still in its early stage of development. Furthermore, in light of output, all the regional natural gas production will continue to rise, among which the Yangtze River Delta has the longest rising period with only small production scales, imposing no substantial effect on the overall growing trend of national production. The Mid-South Region, though in recent years having achieved rapid growth in natural gas production, will have a short period of high production due to its weak resource base, which means that the current production scale will be difficult to maintain for a long time and a rapid downward trend is soon to come unless additional reserves are discovered. The Western, Central, Southwest, and Offshore Regions will be the main battlefields for the development of China’s natural gas industries in the future. Among them, the Western and Central regions will both turn into “one hundred billion cubic meter p.a. natural gas zones”; and even though the current natural gas production in the Western Region is lower than that of the Central Region, however the huge resource potential in the Western Region will bring a faster production growth than the latter, making it the main natural gas producing area of China with a peak annual production of over 160 billion cubic meters.

Table 3 Forecast results of China’s regional natural gas output -

(2)

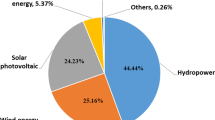

Rapid upward trend of national natural gas production As of 2014, China’s cumulative natural gas production totals 1.5 trillion cubic meters, accounting for only 5 % of estimated recoverable resources, which indicates that a great growth potential still lies ahead. A superposition of production in all regions could come up with the growth trend of national natural gas production as shown in Fig. 3. As can be seen therein, China’s natural gas production will continue to maintain a rapid growth, and output breakthroughs of 200/300/323 billion cubic meters will occur in year 2020/2030/2036, respectively, followed by a gradual decline. Also, there shall be room for China’s natural gas production that is three times as high as in 2014; and China’s annual natural gas production is estimated to remain above 300 billion cubic meters p.a. for 15 consecutive years from 2030 to 2044, making natural gas an important energy source for China’s economic and social development.

With the same approach used in natural gas forecasting, China’s oil production is also predicted with results shown in Fig. 3. Projections indicate that China’s oil production will continue to grow, reaching a peak production of 214 million tonnes p.a. or 237 billion cubic meters of gas equivalentFootnote 1 in 2024. However, China’s oil production growth potential is relatively small with growth being moderate. With the rapid rise in gas production, China will move into a stage where oil and natural gas will both dominate the energy structure around year 2020. Natural gas will play an increasingly important role in China’s energy industry, and oil and natural gas together will provide more abundant energy sources for China’s economic and social development.

-

(3)

Uneven regional distribution of China’s natural gas production to remain Results also show that uneven regional distribution will continue for China’s natural gas production, as shown in Fig. 4. In 2014, the four regions of top natural gas production were Western, Central, Southwest, and Offshore, which together accounted for 82.2 % of China’s total gas production. In the future, these four regions will still be the most important sources of China’s natural gas output, but with a different scenario. The Western Region’s natural gas output will make up about 50 % of China’s overall natural gas production, up from the 32.0 % in 2014. The Central region will have an early gas production peak and fast growth, and this will also be later followed by a fast declining rate of gas production, signifying a downward trend of its gas output ratio in China’s total gas production from 2020; Natural gas production in the Southwest and Offshore Regions will increase moderately with a long growth period, and their ratios of gas output in China’s total gas production will show a change from decline to increase. Overall, the Central and Western Regions will be the main sources of China’s natural gas production with the Offshore Region being the new growth point. The Eastern Region, although the production of the old gas fields there still grows, it will gradually account for a lower proportion of China’s nationwide output, leading to a decline of its status in China’s natural gas industry. Therefore, based on Central and Western Regions, exploring the Offshore Region and stabilizing the Eastern Region will be the reasonable choice for the current development of China’s natural gas industry.

-

(4)

Comparison of forecast results In IEA’s World Energy Outlook 2015 and BP’s Energy Outlook 2035, China’s natural gas production has been forecast as in Table 4. These two forecasts, together with the one made in this paper, are all optimistic in general, with an increase of average annual production of 4.1 %, 5.1 %, and 4.4 % respectively, a conclusion drawn from the estimated resources base and government policy support. Also, the minor annual increase difference among these three also justifies the forecast in this paper. For the year of 2030, IEA’s forecast result shows a slightly lower estimate, while BP’s results show almost no differences, in comparison with the forecast result in this work; while from 2030, BP foresees the fastest growth due to the perception that nonconventional natural gas will grow dramatically then in China.

Table 4 Comparison of natural gas production forecast

4 Discussions and policy implications

Based on the forecast results, the following views are drawn:

-

Natural gas will change China’s energy consumption structure In 2014, natural gas accounted for only 6.5 % of China’s total energy consumption, a ratio that is far less than the developed world average. The proportion of natural gas in a country’s energy consumption structure is an important criterion in deciding a scientific and reasonable energy consumption structure of that country. For a long time, China has been a coal consuming country and has not paid enough attention to natural gas development, which resulted in a relatively low natural gas yield. If China wants to change the long-standing coal-dominated energy consumption structure to achieve a cleaner and more efficient development of the national economy, increasing natural gas consumption is the most realistic and scientific choice (Ma and Li 2010). With the rapid increase in natural gas production, as well as the establishment of a large number of natural gas pipelines and other facilities, China’s natural gas consumption is sure to rise dramatically.

-

Natural gas will promote the new development of the oil and gas industry After a long period of growth, our country’s oil production will inevitably begin to decline, which requires new resources to be in place in order to meet continuous economic development. In 2020, China’s natural gas production will exceed that of the oil, and peak gas will come later with a much higher yield, providing a richer source of energy than oil. Therefore, under the current circumstances, natural gas is the best strategic resource to replace the petroleum resources. Oilfields discovered in last century like Daqing and the Bohai Bay Basin have contributed to the substantial increase of our country’s oil production and reserves, prompting the first rapid development of China’s oil and gas industry; whereas now, when oil production lacks steam in growth and may soon begin to fall, natural gas, being an important substitute resource, will promote the new development of China’s oil and gas industry through its rapidly growing production and ever rising status.

-

Unconventional gas resources will form an important supplement to China’s natural gas industry In recent years, with the evidence from the US shale gas revolution, unconventional gas resources have attracted universal attention. China has abundant unconventional gas resources (Jia et al. 2012), which will gradually become economically available as technological breakthroughs occur. Nevertheless, these resources are not included into the forecast in this paper due to the bloom prospect and the very fact that current low international oil prices have affected high-cost projects, particularly the development of these unconventional gas resources. However, once it is economically viable to exploit these resources, they shall form a great supplement to the development of China’s natural gas industry.

Rapid growth in natural gas production will promote fast development of China’s natural gas industry. To promote scientific and reasonable development, this paper also proposes the following suggestions based on production forecast results:

-

(1)

Strengthening planning to increase natural gas production Early in 2005, Qiu and Fang (2005) suggested to strengthen the planning of oil production and postponing peak oil by lowering oil production to a proper level. The same will go for our country’s natural gas production (Liu and Li 2005; Zhang and Li 2006). Although its production peak is a long way off according to the forecast, limited total resources require reasonable planning and economical use; therefore, with domestic resources and market taken into basic account, foreign natural gas resources might be made full use of (Hu 2014) to meet fast-growing domestic consumer demands.

Increase in natural gas imports from abroad will bring greater dependence. Oil and gas security has always been a hot topic in our country. But a country’s energy security cannot simply be measured by its dependence on foreign oil and gas, obtaining a stable supply of oil and gas at a reasonable price is the real point, as it is for Japan. China imported about 58 billion cubic meters of natural gas in 2014, a 32.4 % dependence on foreign gas which implied gas security in general. The current international oil prices have brought forward a favorable opportunity which we should seize. The import of foreign natural gas resources could be strengthened. Also a moderate slowdown in domestic natural gas production to conserve resources or acceleration in the discovery of additional domestic gas reserves will both help make full use of domestic and foreign markets to meet the domestic gas demand in economic and social development.

-

(2)

Enhancing natural gas exploration and development While taking advantage of current favorable circumstances to fully utilize foreign natural gas resources is an important aspect in promoting China’s natural gas industrial development, the domestic market would remain its cornerstone. More efforts should be put into the development of domestic natural gas resources. Exploration should be strengthened to find more natural gas resources (Xu et al. 2009) and development should be reinforced to enhance oil recovery, so that more reserves could be turned into production. All our previous Gas Resources Assessments have shown that China’s natural gas estimated resources have entered a period of rapid growth. Natural gas reservoir genesis needs to be further studied and considered with theoretical and technological innovations being strengthened, based on which exploration and development should be reinforced in order to achieve new breakthroughs. Central, Western, and Offshore Regions host relatively more natural gas resources, thus should be the focus of future exploration and development areas in China.

-

(3)

Implementing inter-regional natural gas transport pipelines As outlined in the forecasts, western and offshore areas are to be important sources of our country’s natural gas production, while the output of mature fields in the eastern region will gradually decline. Natural gas, being a source of cleaner and more efficient energy, will have a great development potential in the future in China, where the consumption for natural gas will increase dramatically. The natural gas industry in China should be domestically based, supplying sufficient energy for the national economic development. Therefore, we should put great efforts into developing our country’s natural gas industry while implementing interregional natural gas transport pipelines in the meantime, as the main production areas shift from the east to the west and offshore. China needs to push for sustainable and orderly development of the natural gas industry.

-

(4)

Speeding up technological innovation Technological innovation can help promote development breakthroughs and lower cost. Our country has complex geological conditions, especially in mid-western and offshore areas, thus only advanced technology can help achieve breakthroughs. For those mature oilfields in the eastern region, it is also necessary to make use of technological innovation to lower costs and extend the life of oilfields. In general, our country’s technology level still falls behind some foreign countries, only through more focus and innovation input into technology can our oil and gas industry develop sustainably.

-

(5)

Concentrating more on unconventional and deepwater gas resources China is rich in unconventional oil and gas, among which the coal bed methane recoverable resource is estimated to exceed 11 trillion cubic meters and oil sands a total of 2.3 billion tonnes. Under certain technical and economic conditions, these resources can gradually be exploited and utilized. Therefore, the focus on conventional natural gas resources should also be accompanied by the strengthening of study of unconventional oil and gas resources to promote their exploration and development. Recently, CNPC and Sinopec have achieved breakthroughs in shale gas exploiting, with which Sinopec has planned to build 5 billion cubic meters and 10 billion cubic meters per annum of shale gas production capacity, respectively, in 2015 and 2017. This is also pointed out in the Chinese Energy Development Strategy Action Plan 2014–2020, China’s shale gas and CBM production shall both reach 30 billion cubic meters p.a.by 2020, thus forming an important complement to conventional natural gas production in China. In addition, deepwater natural gas exploration and development is another important direction of China’s natural gas industry, in particular in the resource-rich South China Sea deepwater areas, where China National Offshore Oil Corp. (CNOOC) has commenced the commercial exploitation in the northern part. The exploration and development of natural gas resources lags in its southern part of the South China Sea, which should be an important area of our country’s deepwater gas development.

5 Conclusions

This paper uses the Generalized Weng model to forecast Chinese regional natural gas production, This shows that China’s natural gas production has great growth potential, that production will keep growing for a long time in most regions; also that the rapid growth of natural gas production will help China enter a stage where oil and natural gas will together dominate the energy structure, providing abundant sources for China’s energy consumption. Furthermore, the uneven regional distribution of output makes “based in the Central and Western Regions and exploring the Offshore Region” a reasonable choice for the development of China’s natural gas industry.

The forecast also shows that China’s natural gas production will maintain a rapid growth with peak gas of 323 billion cubic meters coming in 2036; in 2020, natural gas production will surpass that of oil.

Large-scale production has yet to come for unconventional natural gas resources in China, thus they not included into the full forecast in this paper. With future technological breakthroughs, these resources will probably enter a gradual exploitation phase, forming a critical supplement to our country’s existing natural gas production; therefore continuous attention needs to be paid to them.

Notes

Per BP Statistical Review of World Energy, 1 ton of oil = 1110 cubic meters natural gas equivalent.

References

Aguilera RF, Inchauspe J, Ripple RD. The Asia Pacific natural gas market: large enough for all? Energy Policy. 2014;65:1–6.

Al-Fattah SM and Startzman RA. Analysis of worldwide natural gas production. Charleston: SPE Eastern Regional Meeting held in Charleston; 1999.

Bianco V, Scarpa F, Tagliafico LA. Scenario analysis of nonresidential natural gas consumption in Italy. Appl Energy. 2014;113:392–403.

BP Statistical Review of World Energy June 2015. London: BP. 2015. From http://www.bp.com/ reports and publications.

Chen YQ. Derivation and application of the generalized Weng model. Nat Gas Ind. 1996;3:22–6 (in Chinese).

Chinese Ministry of Land and Resources. A new round of China’s oil and gas resources evaluation in 2014. Beijing: Geological Publishing House; 2015. p. 1–54.

Demierre J, Bazilian M, Carbajal J, et al. Potential for regional use of East Africa’s natural gas. Appl Energy. 2015;143:414–36.

Feng LY, Wang JL, Zhao L. Construction and application of multicyclic models for natural gas production forecasting. Nat Gas Ind. 2010;30(7):110–2 (in Chinese).

Granger C, Ramanathan R. Improved methods of combining forecasting. J Forecast. 1984;2:197–204.

Hu B. Oil and gas cooperation between China and Central Asia in an environment of political and resource competition. Pet Sci. 2014;11:596–605.

Hu JG, Chen YQ, Zhang SZ. A new model for predicting production and reserves of oil and gas fields. Acta Pet Sin. 1995;1:79–86 (in Chinese).

Hubbert MK. Nuclear energy and the fossil fuels. Meeting of the Southern District, Division of Production, American Petroleum Institute. San Antonio: Shell Development Company; 1956.

Hubbert MK. Techniques of prediction with application to the petroleum industry. 44th Annual Meeting of the American Association of Petroleum Geologists. Dallas: Shell Development Company; 1959. p. 43.

Jebaraj S, Iniyan S. A review of energy models. Renew Sustain Energy Rev. 2006;10:281–311.

Jia CZ, Zheng M, Zhang YF. China’s unconventional hydrocarbon resources and their exploration and development prospects. Pet Explor Dev. 2012;39(2):129–36 (in Chinese).

Lin Boqiang, Wang Ting. Forecasting natural gas supply in China: production peak and import trends. Energy Policy. 2012;49:225–33.

Li JC, Dong XC, Gao J. Optimized combination forecasting and analysis of our country’s natural gas production. Futur Dev. 2009;7:65–9 (in Chinese).

Liu CX, Li HX. Problems and strategies of China’s natural gas industry. Pet Sci. 2005;9:80–92.

Ma YF, Li YL. Analysis of the supply-demand status of China’s natural gas to 2020. Pet Sci. 2010;7:132–5.

Primoz P, Bozidar S, Goran Š, et al. Comparison of static and adaptive models for short-term residential natural gas forecasting in Croatia. Appl Energy. 2014;129:94–103.

Qiu ZJ, Fang H. Some opinions about sustainable development of petroleum resources in China. Acta Pet Sin. 2005;26(2):1–2 (in Chinese).

Qiu ZJ. China’s natural gas industry to usher in golden development [EB/OL]. Xinjiang Information Network. 2008. From http://www.xj.cei.gov.cn/e/DoPrint/?classid=39&id=32037, (in Chinese).

Szoplik J. Forecasting of natural gas consumption with artificial neural networks. Energy. 2015;85:1–13.

Taşpınar F, Çelebi N, Tutkun N. Forecasting of daily natural gas consumption on regional basis in Turkey using various computational methods. Energy Build. 2013;56:23–31.

Tayfun B. Development of mature oil fields—a review. J Pet Sci Eng. 2007;57:221–46.

Weng WB. The foundation of the forecasting theory. Beijing: Petroleum Industry Press; 1984 (in Chinese).

Wu YL. Study of a concise algorithm for approximately optimal combining forecasting with non-negative weights. Colleague Math. 2007;1:132–3 (in Chinese).

Xu ZY, Yue DL, Wu SH, et al. An analysis of the types and distribution characteristics of natural gas reservoirs in China. Pet Sci. 2009;6:38–42.

Yuan AW, Sun GS, Yang XY, et al. A new model for forecasting natural gas production. Nat Gas Ind. 2007;2:84–6 (in Chinese).

Zhang BS, Li J. Oil and gas supply and demand in China and its development strategy. Pet Sci. 2006;3(1):92–6.

Zhao L, Feng LY, Lu XA, et al. Comparison of two methods for generalized Weng model Xinjiang. Pet Geol. 2009;3:658–60.

Acknowledgments

The authors would like to thank the National Social Science Funds of China (13&ZD159) and the, National Natural Science Foundation of China (71303258, 71373285), MOE (Ministry of Education in China) Project of Humanities and Social Sciences (13YJC630148), and Science Foundation of China University of Petroleum, Beijing (ZX20150130) for sponsoring this joint research.

Author information

Authors and Affiliations

Corresponding author

Additional information

Edited by Xiu-Qin Zhu

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Li, SQ., Zhang, BS. & Tang, X. Forecasting of China’s natural gas production and its policy implications. Pet. Sci. 13, 592–603 (2016). https://doi.org/10.1007/s12182-016-0101-x

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12182-016-0101-x