Abstract

It is well known that both numerical and non-numerical magnitudes can be represented horizontally from left to right. Building on this knowledge, here we explored whether a similar spatial representation exists for the economic value of goods. Participants were presented with images of a reference and a target product and classified the economic value of the target as higher or lower than that of the reference (Experiments 1 and 2), or classified the target product as belonging to the same or different semantic category as the reference (Experiment 3). Responses were collected using lateralized keys. Evidence of a SNARC-like effect for economic value emerged, whereby low economic value was associated with the left side of space, and high economic value was associated with the right side of space. Importantly, this spatial representation appeared to be based on external spatial coordinates and only emerged when the economic value was treated as an explicit dimension. Regression analyses also ruled out the potential contributions of other dimensions, such as the presumed physical weight of the target products or their valence. These findings support the hypothesis of a general magnitude representation system.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Since ancient times, with the advent of trade and barter, the need to attribute economic value to objects has arisen to ensure the fairness of exchanges among people. For instance, on the basis of the economic value of an object, its quantity is generally adjusted to balance a given exchange. Just as the physical attributes of an object can be represented in units of measurement belonging to numerical linear systems (i.e., length in meters, mass in kilograms, etc.), the economic value of an object can be quantified in specific currencies (i.e., euro, dollar, etc.). However, while the physical attributes are observable and directly available to the sensory system, people do not possess a sensory organ devoted to the processing of economic value, which makes its estimation a relatively complex task.

On the one hand, there is a fairly objective component of economic value that can be identified as its market value, which in any case can vary over time or for other situational variables such as the historical frame or inflation. On the other hand, there is also a more subjective component linked to affective value or context that can change more from person to person. As an example, individuals tend to attribute a greater value to an object if they own it, compared to how much they would pay for the same object when it is not possessed (i.e., the ‘endowment effect’; see Kahneman et al., 1991). The economic value of an object can also vary depending on the situation in which it is embedded. For instance, a can of soda could have different prices depending on whether it is purchased in a supermarket, in a vending machine, or on a plane. As highlighted by Dehaene and Marques (2002), one specific difficulty in economic value estimation is related to high-value goods. This difficulty is both numerical (i.e., higher priced goods are more difficult to be evaluated on the basis of objective criteria because their value in the marketplace is more fluctuating) and related to purchasing-related factors (i.e., higher priced goods are associated with a lower frequency of purchasing). In addition, prices are not only numerically represented, but they are also assessed with respect to the perceived quality of objects (e.g., Rao & Monroe, 1989; Zeithaml, 1988).

As the literature suggests, people can be often influenced by environmental cues when assessing the economic value of objects. Among these cues, spatial location plays an important role in shaping perceived price and quality. Some studies show that people tend to consider products placed on the right side of their visual field as more expensive (and of better quality) relative to the same products placed on the left side of their visual field (see Cai et al., 2012; Giuliani et al., 2017; Valenzuela & Raghubir, 2015). Interestingly, this form of horizontal mapping of economic value appears to be largely independent of people’s explicit beliefs about how products are placed on store shelves (Valenzuela & Raghubir, 2015). Two psychological phenomena that may account for spatial asymmetries in price estimation are (1) the left-to-right spatial representation of magnitudes (e.g., Dehaene et al., 1993; Macnamara et al., 2018) and (2) the association between valence and horizontal space (e.g., Casasanto, 2009; Tversky, 2011). These two phenomena will be briefly discussed in the following paragraphs.

Magnitude and valence in horizontal space

In the psychological literature, there is consistent support for a space-numbers association. Larger numbers tend to be represented in the right part of the space, whereas smaller numbers tend to be represented in the left part of the space (for reviews, see Toomarian & Hubbard, 2018; Winter et al., 2015). The main empirical result that provides support for this association is the so-called SNARC effect (i.e., spatial numerical association of response codes effect). It consists of the fact that, when participants use lateralized response keys to respond to target numbers, larger numbers tend to be responded faster – i.e., with shorter response times (RTs) – with a right-side key than with a left-side key, whereas the opposite emerges for smaller numbers. This effect can be found both when number magnitude is task-relevant (i.e., magnitude comparison task; Dehaene et al., 1990) and when it is irrelevant (i.e., parity judgement task; Dehaene et al., 1993). This small-left/large-right association would reflect a left-to-right representation of numbers along the horizontal axis (i.e., the mental number line).

Interestingly, non-numerical quantities also appear to be mapped onto horizontal space (Macnamara et al., 2018). SNARC-like effects have been reported for a variety of non-numerical dimensions such as luminance (Fumarola et al., 2014; Ren et al., 2011), size (Prpic et al., 2020; Ren et al., 2011; Sellaro et al., 2015), weight (Dalmaso & Vicovaro, 2019), time (Ishihara et al., 2008), loudness (Chang & Cho, 2015), and even face age (Dalmaso et al., 2023a; see also Dalmaso & Vicovaro, 2021). Specifically, shorter RTs are typically observed when relatively large magnitudes are responded to with a right-side key compared to when they are responded to with a left-side key, whereas the opposite occurs for relatively small magnitudes. According to the ‘A Theory of Magnitude’ model (ATOM; Walsh, 2015), the observed similarities between spatial representations of numbers and non-numerical magnitudes are due to the existence of a general common system for magnitude processing. Holmes and Lourenco (2011) suggested that this general system of magnitude representation would extend to any dimension that can be evaluated along a less-more dimension, including qualitative concepts like emotions (but see Pitt & Casasanto, 2018).

A peculiarity that makes economic value rather different from other magnitudes is its tight connection with valence, which refers to the unpleasant-pleasant affective dimension of stimuli (e.g., Giuliani et al., 2021). High-value products are typically associated with a more positive valence with respect to low-value objects. For instance, Plassmann et al. (2008) showed that, if the hypothetical price of a bottle of wine is increased, this leads people to judge the wine contained in it as higher in terms of flavour, complexity, and pleasantness. It also leads to an increased activity of the orbitofrontal cortex, a brain region associated with experiences of pleasantness. In addition, Giuliani et al. (2021) showed that target products were evaluated more positively when they were primed by the picture of a 100-euro banknote compared to when they were primed by the picture of a 5-euro banknote.

Like magnitude, valence is also spatially coded. In particular, when presented with stimuli associated with positive valence, people tend to respond faster with a right- than with a left-side key, whereas the opposite occurs for stimuli associated with negative valence (see, e.g., Dalmaso et al., 2023c; de la Vega et al., 2012; Kong, 2013; Pitt & Casasanto, 2018; Root et al., 2006). In addition, the association between valence and space appears to be mediated by handedness. For instance, Casasanto (2009) showed that right handers preferred to place positive and negative valence stimuli on the right side and on the left side, respectively, whereas the opposite pattern emerged for left handers. Additionally, left handers tended to attribute a more positive value to stimuli presented on the left than to stimuli presented on the right, whereas the opposite was true for right handers. For instance, Kong (2013) found that right handers responded faster to positive words and positive facial emotions with a right-side key than with a left-side key, whereas left handers showed the opposite (see also de la Vega, 2012; Pitt & Casasanto, 2018). According to the body-specificity hypothesis put forward by Casasanto (2009, 2011), these lateralised effects would be related to people’s motor interactions with the environment. Given that actions performed with the dominant hand are more fluent (i.e., easier and more precise) than those performed with the non-dominant hand, and given that action fluency has a positive adaptive value, people would tend to associate the side of their dominant hand with positive valence (i.e., a ‘right-good/left-bad’ association for right handers, and a ‘right-bad/left-good’ association for left handers; see also Brunyé et al., 2012; Kong, 2013).

The spatial representation of economic value: magnitude or valence?

Given that economic value is linked to both magnitude and valence, it remains unclear whether the spatial biases in price estimation tasks observed in previous studies (see Cai et al., 2012; Giuliani et al., 2017; Valenzuela & Raghubir, 2015) can be better understood in terms of a left-to-right representation of magnitude, or in terms of a space-valence association. On the one hand, Cai et al. (2012) found a reversed association between horizontal space and estimated economic value when participants were primed with numerical stimuli characterized by a small-right/large-left association. This suggests that the spatial representation of economic value is related to a general mechanism of spatial representation of magnitude (see also Valenzuela & Raghubir, 2015). On the other hand, Giuliani et al. (2017) found that the spatial location of the stimuli affected the estimated price but not the estimated physical weight and argued that this would indicate a partial dissociation between the spatial representation of economic value and the spatial representation of other magnitudes.

Giuliani et al. (2021) presented the participants with pictures of 5- and 100-euro banknotes, as well as with scrambled images of the same banknotes. Participants’ task was to press lateralized response keys to classify the stimulus as depicting a banknote or not. Faster and more accurate responses emerged when the 100-euro banknote was responded to by pressing a right-side key compared to a left-side key. No space-related response biases emerged for the 5-euro banknote. On the one hand, these results confirm the existence of an association between high economic value and the right side of space. On the other hand, it remains unclear if this result was driven by the association between magnitude and space (i.e., a 100-euro banknote is larger in magnitude than a 5-euro banknote) or by the association between valence and space (i.e., a 100-euro banknote is higher in valence than a 5-euro banknote).

Outline of the present study

In the case of banknotes, a nearly perfect correlation presumably exists between magnitude (i.e., the ‘value’ of the banknote) and valenceFootnote 1. However, the latter correlation is less obvious in the case of goods. For instance, a well-designed reading lamp may have a more positive valence with respect to a badly designed large polluting car, even though the latter certainly has a higher economic value than the former. In other words, disentangling the spatial representations of magnitude and valence appears to be possible by shifting the focus from banknotes to goods.

The current study explored the existence of a relationship between the typical economic value and horizontal space using a speeded manual classification task. In Experiment 1, participants were presented sequentially, in the centre of the screen, with the picture of a reference product and the picture of a target product. They pressed a left-side key or a right-side key to determine whether the economic value of the target was higher than that of the reference or lower than that of the reference. Experiment 2 was the same as Experiment 1, except that the participants had to respond with their hands crossed. This was meant to test if the possible relationship between space and economic value is related to the side of response effector (i.e., right and left hand) or whether it is a more abstract and extra-personal representation (i.e., right and left space). Crucially, independent samples of participants also rated each product in terms of price, valence, and several other dimensions, and linear regression analyses were performed to test which of these attributes were predictive of the results of Experiments 1 and 2. Lastly, in Experiment 3, the same procedure as in Experiment 1 was used, except that participants had to decide whether the target stimulus belonged to the same category as the reference stimulus (i.e., ‘food’ or ‘non-food’). This made the economic value an implicit dimension, enabling us to test whether the possible relationship between space and economic value can be automatically activated despite its irrelevance to the task.

We anticipate here the main results, which can be summarised as follows: (1) high economic value is associated with the right side of space and low economic value is associated with the left side of space; (2) this representation emerges at an abstract level rather than being body-specific; (3) the spatial representation of economic value is driven by magnitude rather than by valence; (4) a spatial representation of economic value only emerges when economic value is relevant to the task (i.e., it is not automatically activated).

Experiment 1

Materials and methods

Participants

Twenty-five right-handed participants (11 males), recruited within the university campus, voluntarily took part in the experiment (mean age = 23 years; SD = 2.8). The sample size was based on previous studies (see Ren et al., 2011; Dalmaso & Vicovaro, 2019) that reported reliable SNARC-like effects with similar (or even smaller) sample sizes.

Stimuli

The stimulus material was composed of 20 pairs of pictures of objects that were presented twice in a counterbalanced order (Table 1). Because SNARC-like effects can emerge from coding the physical size of objects (e.g., Prpic et al., 2020; Ren et al., 2011; Sellaro et al., 2015), the pairs of objects were selected following the criterion of minimizing size and shape differences between the two items, while maximizing their price differences. Pictures of objects contained in the following databases were used: (i) the Snodgrass and Vanderwart (1980) picture set, (ii) the HIT (Hatfield Image Test; Adlington et al., 2009), (iii) the BOSS (Bank Of Standardized Stimuli; Brodeur et al., 2014), and (iv) the FRIDa (Foodcast Research Image Database; Foroni et al., 2013). Each pair contained a relatively less expensive object A and a relatively more expensive object B. The comparison was always referred to within a given pair, not to the whole sample of objects. The pictures were 10 cm both in height and width (400 × 400 px) and presented at the centre of the screen. All the pictures are available on OSF. (https://osf.io/8ta54/?view_only=33361c3df2c047ed99e2761a883f7c9d) in Online Resource 1.

Procedure

The participants were tested in a quiet room and sat comfortably at 60 cm from a computer monitor. Here and in the following experiments, participants read and signed an informed consent form approved by the local ethics committee before starting the experiment. The presentation of stimuli was handled by using E-prime software (Psychology Software Tools Inc., Pittsburgh, PA) on a Windows computer (screen resolution: 1280 × 768 px). At the beginning of each trial, a fixation cross was presented in the centre of the screen. After a random interval between 300 and 800 ms, the first stimulus (i.e., the reference stimulus), was presented for 300 ms, followed by a fixation cross (500 ms) and then by the second stimulus (i.e., the target stimulus) that also remained on the screen for 300 ms (see also Ren et al., 2011).

Following the presentation of the two stimuli, participants specified if the target was more expensive or less expensive than the reference. Participants were asked to fixate on the centre of the monitor and to respond as quickly and accurately as possible, using the index finger of the left and right hand, respectively, on the left key ‘S’ and the right ‘4’ (on the number pad) of a QWERTY keyboard. A new trial started when a response was provided or after a 1500 ms timeout limit. In the congruent condition, participants pressed the left key for the ‘less expensive’ response and the right key for the ‘more expensive’ response. In the incongruent condition, the association between response keys and ‘less expensive’ and ‘more expensive’ responses was inverted (less expensive - right key, more expensive - left key). Each response was followed by visual feedback, which remained on the screen for 500 ms: A green circle for correct responses and a red circle for errors and missed responses (i.e., responses not provided within the timeout limit). In each block, the 20 pairs of stimuli were presented twice, in a counterbalanced order (i.e., A-reference/B-target and B-reference/A-target; See Fig. 1 for the experimental paradigm).To avoid participant’s expectations about the order of the stimulus in a pair, each of the stimulus images that formed the 20 experimental pairs was matched with a new image, leading to 40 control trials. In each block, each participant was exposed to 20 randomly selected control trials. The responses to the control trials were not included in the data analysis.

The congruent and incongruent conditions were presented in different blocks lasting around 10 min each, separated by a pause. Participants initiated the next block at their discretion. The two blocks order was counterbalanced among participants. In each block there were 40 experimental trials and 20 control trials presented in random order. Before the experimental trials, 10 practice trials were presented to the participants to familiarize them with the task.

Results

The average percentage of errors (PEs) was 15.14%. The RTs associated with incorrect responses were excluded from the dataset. Then, RTs exceeding ± 3 SD from the mean of all RTs were considered outliers, and thus removed from the dataset. For each participant, we then calculated the average RT and the errors percentage, separately for the four experimental conditions resulting from the combination of the factors response side and relative price (see below). Three participants, due to their poor performance (i.e., an error rate greater than 2 SD in at least one experimental condition), were excluded from subsequent analyses as they were considered outliers.

Repeated measures analyses of variance (ANOVAs) were used, one on RTs and another one on PEs with Response Side (left/right) and Relative Price (less expensive/more expensive) as within-subjects factors.

RTs

As regards the RT analysis, the Response Side main effect was not significant [F1,21 = 4.10 p = .056, η2p = 0.16], whereas the main effect of Relative Price was significant [F1,21 = 9.775, p = .005, η2p = 0.32]. Moreover, a significant interaction was found [F1,21 = 7.151, p = .014, η2p = 0.25]. Duncan’s post-hoc comparisons showed that the ‘more expensive’ response was faster with the right-side key than with the left-side key (p = .031; 423 ms vs. 543 ms). Furthermore, responses provided with the right-side key were faster when they were associated with the ‘more expensive’ response than when they were associated with the ‘less expensive’ response (p = .019; 423 ms vs. 558 ms; see Fig. 2a). No other post-hoc comparison was statistically significant.

Mean RTs (a) and mean percentage of errors (b) from Experiment 1, as a function of response side (horizontal axis) and relative price (different colours). The error bars represent the standard error of the mean. The horizontal blue lines in the upper part of the graph indicate the statistically significant comparisons

PEs

As regards the analysis of the PEs, the main effect of Response Side was not significant [F1,21 = 0.007, p = .93, η2p < 0.001], as well as the main effect of Relative Price [F1,21 = 0.97, p = .34, η2p = 0.04]. However, the interaction was significant [F1,21 = 11.65, p = .003, η2p = 0.36]. Duncan’s post-hoc comparisons indicated that the error rate was lower for the ‘less expensive’-left key association than for the ‘less expensive’-right key association (p = .03; 8.4% vs. 18.6%). The opposite was true for the ‘more expensive’ response (p = .033; 7.2% vs. 17.2%). Furthermore, error rate was significantly smaller when the left-side key was associated with the ‘less expensive’ response than when it was associated with the ‘more expensive’ response (p = .047; 8.4% vs. 17.2%). The opposite was true for the right-side key (p = .02; 7.2% vs. 18.6%; See Fig. 2b).

Discussion

The analysis of RTs and PEs provided support for the existence of a SNARC-like effect for product prices, whereby goods were systematically associated with horizontal spatial positions from left to right, based on their price.

Experiment 2

In this second experiment, participants were presented with the same task as in the first experiment, except that they had to respond with their hands crossed. If the space-economic value association that emerged in Experiment 1 was mainly driven by a space-valence mapping, then, because the space-valence mapping is body-specific (Casasanto, 2009, 2011), it appears reasonable to expect that the space-economic value association may reverse when participants respond with crossed hands. Indeed, in a body-specific perspective, the effector with which the response is provided (i.e., dominant vs. non-dominant hand) appears to be more relevant than the external spatial coordinates of the response keys. On the other hand, previous studies suggest that spatial representations of magnitudes remain unchanged even when participants respond with their hands crossed (Dehaene et al., 1990; Gevers & Lammertyn, 2005; Müller & Schwarz, 2007; cf. Wood et al., 2006), which suggests that these representations rely on external spatial coordinates rather than on manual preference.

Materials and methods

Participants

A new sample of twenty-five right-handed participants (13 males), recruited within the university campus, voluntarily took part in the experiment (mean age = 23.95 years; SD = 3.45). The determination of the sample size was based on the same criteria as in Experiment 1.

Stimuli and procedure

The stimuli and the procedure were the same as in Experiment 1, except that participants responded with crossed hands. Hence, in the congruent condition, they used the index finger of the right hand on the left key for the ‘less expensive’ response and the index finger of the left hand on the right key for the ‘more expensive’ response. In the incongruent condition, the associations were inverted (less expensive – right key – left hand; more expensive – left key – right hand). See Experiment 1 for further details.

Results

The data were analysed as in Experiment 1. The average error rate was 17.85%. Two participants, due to their poor performance (i.e., an error rate greater than 2 SD in at least one experimental condition), were excluded from subsequent analyses because they were considered outliers.

RTs

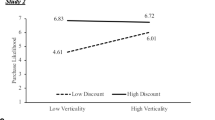

As regards the analysis of the RTs (see Fig. 3a), the main effect of Response Side was not significant [F1,22 = 1.46, p = .24, η2p = 0.06], as well as the main effect of Relative Price [F1,22 = 0.21, p = .65, η2p = 0.01]. However, there was a significant interaction [F1,22 = 9.49, p = .005, η2p = 0.30]. Duncan’s post-hoc comparisons showed that the ‘more expensive’ response was faster with the right-side key than with the left-side key (p = .038; 472 ms vs. 621 ms). Furthermore, responses provided with the right-side key were faster when they were associated with the ‘more expensive’ response than when they were associated with the ‘less expensive’ response (p = .031; 472 ms vs. 611 ms).

Mean RTs (a) and mean percentage of errors (b) from Experiment 2, as a function of response side (horizontal axis) and relative price (different colours). The error bars represent the standard error of the mean. The horizontal blue lines in the upper part of the graph indicate the statistically significant comparisons

PEs

As regards PEs analysis, the Response Side main effect was not significant [F1,22 = 0.13, p = .72, η2p = 0.006], as well as the main effect of Relative Price [F1,22 = 3.96, p = .06, η2p = 0.15]. However, the interaction between Response Side and Relative Price was statistically significant [F1,22 = 20.232, p < .001, η2p = 0.48]. Duncan’s post-hoc comparisons indicated lower error rate when the ‘less expensive’ response was associated with the left-side key than when it was associated with the right-side key (p = .012; 14.1% vs. 23%). The opposite was true for the ‘more expensive’ response (p = .029; 11.3% vs. 18.9%). Lastly, the error rate was significantly smaller when the right-side key was associated with the ‘more expensive’ response than when it was associated with the ‘less expensive’ response (p = .002; 11.3% vs. 23%; see Fig. 3b).

Discussion

The analysis of RTs and the PEs confirmed the presence of a SNARC-like effect for product prices. Moreover, the results suggest that the spatial representation of goods, based on their prices, depends on external spatial coordinates (left-low price and right-high price) rather than manual preference (left hand-low price and right hand-high price). These findings are consistent with previous SNARC and SNARC-like research and provide evidence for a magnitude-based representation of economic value.

Integrative analyses

The above-reported results revealed an effect of space-quantity compatibility when economic value was relevant to the task. These results were obtained within a binary classification task, where prices were coded as ‘more than’ or ‘less than’ a reference. However, if prices are horizontally mapped along a left-right continuum, then, in accordance with the SNARC effect (Dehaene et al., 1990, 1993), the relative advantage in terms of RTs for left-side responses, compared to right-side responses, should decrease with the economic value of the target stimulus. In other words, the results of Experiments 1 and 2 should reveal a negative relationship between the economic value of the target stimulus and the mean difference between the right-side RTs and left-side RTs. Moreover, the possible effects of other qualitative and quantitative properties of the stimuli need to be controlled, to exclude that the results of Experiments 1 and 2 may reflect spatial representations based on these properties, rather than on economic value.

First, two rating tasks were carried out in order to measure the properties under examination: (1) a qualitative rating task where the valence, arousal, familiarity, and ambiguity of the stimuli were evaluated, and (2) a quantitative rating task where the price and weight of the stimuli were estimated. Finally, by means of linear regression analyses, we tested whether any of these ratings were related to differences in reaction times between right and left responses in Experiments 1 and 2. As it will be made clear shortly, all these variables could be potentially relevant to the spatial representation of the stimuli.

Qualitative and qualitative ratings

Regarding the qualitative part, by means of the visual analogue scale (VAS), a new sample of 12 participants (5 males; mean age = 28.25 years; SD = 5.39) evaluated each of the 40 items according to the following questions (the order of questions was counterbalanced between participants): Valence (‘How negative/positive is the item represented in the image?’; 0 = ‘very negative’ - left labelled, 100 = ‘very positive’ - right labelled; Arousal (‘How much interest has the presented image aroused in you?’; 0 = ‘not at all’ - left labelled, 100 = ‘very much’ - right labelled); Familiarity (‘How often do you encounter what is represented in the picture in your daily life?’; 0 = ‘never’ - left labelled; 100 = ‘very often’ - right labelled); Ambiguity of the image (‘How easy/difficult is to understand what is represented in the image?’; 0 = ‘very easy’ - left labelled; 100 = ‘very difficult’ - right labelled). Participants saw each picture individually in a random order (see Experiment 1 for further details on screen size, sitting distance, and picture size). Each picture remained on screen for the time necessary for the evaluation of the four dimensions by using a VAS graphically presented below the picture, moving a cursor on a horizontal line of about 800 px in length. Questions relative to each dimension appeared above the picture and lasted until the response was given. Then the following question and its relative VAS appeared. Once all dimensions were evaluated for a picture, the next picture appeared, and the procedure started from the beginning. Questions order was counterbalanced across participants (for a similar procedure see also Manippa et al., 2021).

Valence refers to the unpleasant-pleasant affective dimension of stimuli and it has been found to be related to horizontal space (see the Introduction). Arousal refers to the low-high salience dimension of stimuli, which can be considered an affective magnitude, potentially coded in the horizontal space (Holmes et al., 2019; Manippa et al., 2021). Familiarity refers to how often we see a given stimulus, which can potentially lead to laterality effects too (Blois-Heulin et al., 2012; Giuliani et al., 2018).

Sometimes these dimensions covary with economic value, in the sense that more expensive objects can be associated with higher quality and desirability, thus being judged more pleasant and arousing than less expensive objects (Giuliani et al., 2017; Plassmann et al., 2008). On the contrary, expensive items are supposedly rarer in everyday life and, therefore, less familiar than less expensive ones (Worchel et al., 1975).

Regarding the rating task for the quantitative variables, the procedure was similar to that adopted by Giuliani et al. (2017). Besides the estimated price, we also measured the estimated weight of the stimuli because previous studies suggest that weight can be a spatially-coded dimension (Dalmaso & Vicovaro, 2019; Vicovaro & Dalmaso, 2021). In a free estimation task, a new sample of 22 participants (10 males; mean age 29.7 years; SD = 13.6) estimated the price in euro and the weight in kilograms of each of the 40 items. The rating task was administered via an online Qualtrics survey (Qualtrics, Provo, UT). Participants who had preliminarily provided their consent to participate were sent a link to the survey and were recommended to take the survey in a quiet comfortable room, using a computer or a laptop. Each participant was presented with a price rating task and a weight rating task, in random order. On each trial, one of the 40 items was randomly presented at the centre of the screen; by means of written instructions, participants were informed that they had to estimate the item price in Euro (price rating task) or its weight in kilograms (weight rating task) by typing the estimated value within the space provided below the item. Participants had to click a button in order to confirm the response and to proceed to the following trial. No time limits were provided for each response. One participant failed to understand the instructions of the weight rating task, as revealed by unreasonable weight estimates, and therefore she was excluded from the initial sample.

Regression analyses

Ratings of price and weight were characterized by some extreme values; for instance, the item ‘crown’ was estimated to cost more than one million euros, and the item ‘car’ was estimated to weigh more than one ton. The mean ratings of price and weight were log-transformed, to use these in linear regression analyses.

First, using separate simple regression analyses, we explored the possible existence of a relationship between the mean rated price of the 40 items and their mean rated valence, arousal, familiarity, ambiguity, and weight. The results are shown in Table 2. As expected, there was a positive relationship between price and arousal and a negative relationship between price and familiarity, although the latter relationship was a non-statistically significant trend. Contrary to expectations, there was no relationship between price and valence. Additionally, a positive relationship between price and weight emerged, and no relationship between price and ambiguity. The scatterplots representing the relationship between price and the other variables are represented in Online Resource 2.

Merging the results from Experiments 1 and 2 we calculated, for each of the 40 items, the difference between the mean RTs associated with right-side key responses and the mean RTs associated with left-side key responses (hereafter ∆RT). Then we evaluated, separately for the two experiments, the possible existence of a negative linear relationship between the ∆RT of the 40 items and the mean ratings for each of the six rated properties of the items (i.e., valence, arousal, familiarity, ambiguity, weight, price). One simple linear regression analysis was run for each property and each experiment. The results reported in Table 3 show that, in both experiments, the only statistically significant negative relationship was that between ∆RT and price. This finding suggests that, in both experiments, the items were mapped along a left-to-right continuum according to a quantitative, magnitude-based representation of economic value. Instead, the results run against the hypothesis of a spatial representation of the items based on any other of the qualitative or quantitative properties considered here, valence included. The scatterplots representing the relationship between ∆RT and the mean rated properties of the items are provided in the Online Resource 3 (Experiment 1) and Online Resource 4 (Experiment 2).

Experiment 3

In Experiments 1 and 2, the economic value was an explicit dimension, as participants had to evaluate the relative economic value of the target and the reference object. Experiment 3 tested if an association between economic value and space can also emerge when the economic value is task-irrelevant, which would indicate that the association can be activated automatically. In this regard, it is known that the SNARC effect consistently emerges even when the number magnitude is task-irrelevant (i.e., when participants have to classify the target number as even or odd; e.g., Dehaene et al., 1993). The picture is less clear for non-numerical magnitudes, as some studies have reported evidence of implicit SNARC-like effects (Chang & Cho, 2015; Fumarola et al., 2014; Sellaro et al., 2015), whereas others have not (Dalmaso et al., 2023b; Mariconda et al., 2022; Prpic et al., 2020; Vicovaro & Dalmaso, 2021; see also Macnamara et al., 2018).

Materials and methods

Participants

A new sample of twenty-five right-handed participants (14 males), recruited within the university campus, voluntarily took part in the experiment (mean age = 23.88 years; SD = 2.95). The sample size was determined following the same principle reported for Experiment 1.

Stimuli and procedure

The same stimuli of Experiments 1 and 2 were used in Experiment 3. Apart from the fact that participants were required to indicate whether the second object of each pair (i.e., the target object) belonged to the same category as the first one, the procedure was similar to that of Experiment 1. The two categories were ‘food’ and ‘non-food’. In the ‘left-same’ condition, participants used the left hand on the left key (S) of the keyboard for the response ‘same category’ and the right hand on the right key (4) of the keyboard for the response ‘different category’. In ‘right-same’ condition, the key assignment was reversed (right hand – ‘same category’; left hand – ‘different category’).

The trial list was prepared by combining experimental pairs and control pairs. The experimental pairs were those used in the previous experiments (see Table 1), all of them associated with the response ‘same category’ of non-food items. These 20 experimental pairs were presented twice in each block, by counterbalancing the order of the stimuli in each pair. The control pairs (reported in Online Resource 5) were 40 combinations associated with the response ‘different category’ (20 food/non-food and 20 non-food/food). The pictures of the stimuli are available in Online Resource 1 (https://osf.io/8ta54/?view_only=33361c3df2c047ed99e2761a883f7c9d).

The ‘left-same’ and ‘right-same’ conditions were presented in different blocks lasting around 12 min each, separated by a pause. Blocks order was counterbalanced among participants. In each block there were 40 experimental trials and 40 control trials presented in random order. Before the experimental trials, 10 practice trials were presented to familiarize the participants with the task.

This design is an adaptation of Sellaro et al. (2015) who used the categorization of object animacy (living/non-living entities) to test the effect of stimulus size, which was irrelevant to the task.

Results

The data were analysed as in Experiments 1 and 2. The average error rate was 14.25%. Data analysis was limited to experimental trials. Here, the factor Response Side was obtained from ‘left-same’ and ‘right-same’ responses, since all experimental pairs belonged to the ‘same’ object category. The response was always to the target, meaning the second object of each pair presented in ascending A-B or descending B-A order of Relative Price. Although the Relative Price was irrelevant here, this factor was identical to previous experiments, distinguishing the responses to relatively less expensive targets A and relatively more expensive targets B.

Due to their poor performance (i.e., an error rate greater than 2 SD in at least one experimental condition) two participants were excluded from subsequent analyses as they were considered outliers.

RTs

The Response Side main effect was significant [F1,22 = 7.7, p = .01, η2p = 0.26]. This was probably due to the effect of the dominant hand, as the responses were faster when they were provided with the right hand compared to the left hand (405 ms vs. 466 ms). The Relative Price main effect was not significant [F1,22 = 3.57, p = .07, η2p = 0.14], as well as the interaction [F1,22 = 0.04, p = .84, η2p = 0.002].

PEs

No significant effects emerged (Response Side [F1,22 = 2.55, p = .12, η2p = 0.10]; Relative Price [F1,22 = 2.99, p = .1, η2p = 0.12]; Response Side × Relative Price [F1,22 = 0.94, p = .95, η2p < 0.001]).

General discussion

Economic value influences human behaviour and decision-making. Despite its abstract nature, some studies have explored its conceptual relationships with physical space. Specifically, research has investigated how the spatial location of a product affects people’s perception of its quality and price (Cai et al., 2012; Giuliani et al., 2017; Valenzuela & Raghubir, 2015). These studies have highlighted how products positioned on the right side of the observer’s visual field are often perceived as more expensive and of higher quality compared to products positioned on the left side.

In the current work, we explored the horizontal spatial representation of economic value through a speeded manual classification task based on the comparison of pairs of product images. In three experiments, the picture of a reference product and the picture of a target product were centrally presented. Participants were required either to classify the economic value of the target as higher or lower than that of the reference (i.e., economic value as an explicit task-relevant dimension; Experiments 1 and 2), or to classify the target object as belonging to the same semantic category or to a different semantic category with respect to the reference object (i.e., economic value as an implicit task-irrelevant dimension; Experiment 3). Responses were provided through lateralized response keys, according to the classical settings able to elicit instances of SNARC and SNARC-like effects. Furthermore, independent samples of participants were tasked with evaluating each product in terms of price, valence, and other dimensions, and linear regression analyses were carried out to determine which of these attributes could be predictive of the results of Experiments 1 and 2. The next paragraphs summarize and discuss the main results.

First, in Experiments 1 and 2, when the economic value was conceived as an explicit dimension, evidence of a horizontal space-price association was found. Relatively more expensive products elicited faster responses with a right- than with a left-side key, whereas the opposite occurred for relatively cheaper products. These findings support the hypothesis of a left-to-right spatial representation of economic value, where low-value goods are represented on the left and high-value objects on the right.

Second, Experiment 2 showed that even when participants provided a response with their hands crossed, a left-to-right spatial representation of economic value emerged. This suggests that the relationship between economic value and horizontal space has an abstract and extra-personal nature, rather than being dependent on specific response effectors. This finding contradicts Casasanto’s (2009, 2007) body-specific hypothesis, which predicted that economic value would be represented based on the effector used for the response. However, it is consistent with previous research demonstrating that spatial representations of magnitudes tend to persist even when participants respond with their hands crossed (Dehaene et al., 1990; Gevers & Lammertyn, 2005; Müller & Schwarz, 2007; cf. Wood et al., 2006).

Third, although evidence of a SNARC-like effect emerged for products’ typical economic value, to rule out the possibility that this effect was due to spatially represented qualitative or quantitative properties of the stimuli that could be related to economic value, we needed to control for these factors. We conducted integrative analyses that tested the correlations between reaction times, price, valence, and other dimensions rated by participants. Our analyses revealed that the correlation between ∆RT and price was negative and statistically significant, indicating that right-side key responses were faster compared with left-side key responses as the target product’s price increased. This supports the notion that magnitude drives the spatial representation of economic value, as valence did not reliably predict the results from Experiments 1 and 2. These results fit nicely to the ATOM model (Walsh, 2015) and to the hypothesis of a general system for magnitude representation (Holmes & Lourenco, 2011).

Fourth, a space-price association failed to emerge when the economic value was considered an implicit dimension (Experiment 3). This differs from previous research that shows how a SNARC or a SNARC-like effect may still emerge when participants respond to stimulus features that are irrelevant to the target dimension (e.g., Dehaene et al., 1993; Sellaro et al., 2015). The results of the present study are however consistent with those of some previous studies that failed to find implicit SNARC-like effects (Dalmaso et al., 2023b; Mariconda et al., 2022; Prpic et al., 2020; Vicovaro & Dalmaso, 2021). This suggests that the explicit processing of price-relevant information is necessary for the emergence of the spatial representation of prices.

Finally, the findings presented in this study reveal an uneven pattern of results. Specifically, the disparities between the ‘less expensive’ and ‘more expensive’ categories were consistently more pronounced when the responses were given the right-side key, as opposed to the left-side key. This unbalanced pattern aligns with previous research in SNARC-like tasks, as documented in recent work (e.g., Dalmaso & Vicovaro, 2019; Dalmaso et al., 2023b; Giuliani et al., 2021). Giuliani et al. (2021) suggested a plausible explanation for this phenomenon. They proposed that spatial representations of non-numerical quantities may be more unstable and ambiguous compared to numerical values. This instability could result in less defined response patterns. Despite this insight, it is worth noting that no studies have specifically investigated the causes of these imbalances and therefore more research is necessary.

Magnitude, valence, or both?

According to previous studies, the main factors that can potentially mediate the connection between product price and space are valence (i.e., the unpleasant-pleasant affective dimension of stimuli) and objective economic value. Evidence for a spatial representation of goods based on economic value emerges from the present set of experiments. In this regard, it is worth highlighting that the economic value is typically represented by numerical currency values (e.g., 10 Euros, 100 Euros, etc.), and that the participants in Experiments 1 and 2 were explicitly required to classify the economic value of the target stimulus relative to the economic value of the reference stimulus. It can be speculated that this prompted the activation of a space-magnitude mapping similar to that involved in SNARC and SNARC-like effects.

With respect to economic value, valence has a more subjective nature and has only a moderate correlation with economic value (recall the reading lamp vs. the old car example cited in the introduction). A close to null correlation was observed between economic value and valence for the type of stimuli used in our experiments. We speculate that the explicit task of classifying stimuli based on economic value may have minimized the influence of valence on ∆RTs. However, it is possible that valence may affect the spatial representation of stimuli in different contexts. For example, when target stimuli are banknotes instead of goods with a specific economic value, valence could become a more salient dimension (see, e.g., Giuliani et al., 2021). Banknotes can be used to purchase goods with high valence, which may translate into a higher valence value for the banknotes themselves. Therefore, valence could play a more significant role when the economic value is represented by a currency instead of a specific product.

It is worth highlighting certain limitations of the present study. Firstly, our experiments exclusively involved Western participants with a left-to-right orientation in reading, writing, and finger-counting, which are known influential factors in SNARC and SNARC-like effects (e.g., Dehaene et al., 1993; Pitt & Casasanto, 2020). Future research may benefit from cross-cultural comparisons that include participants with right-to-left reading or finger-counting orientations, examining how these factors mediate the strength and direction of the SNARC-like effect for economic value. A second limitation pertains to the separation of the speeded classification task and the ratings of valence, price, and other dimensions, conducted by distinct participant samples. A more refined investigation could be achieved in a future study by having the same participants perform both the classification and rating tasks, enabling a more precise exploration of the relationship between explicitly perceived economic value and valence of a good and its spatial representation.

Conclusion

Our study provides novel evidence of a SNARC-like effect for economic value. The results support the idea that the goods were mapped along a left-to-right axis based on a magnitude-based representation of their economic value. Importantly, the results contradict the idea that the spatial representation of the goods was driven by valence or any of the qualitative or quantitative attributes rated by the participants.

We also found that the SNARC-like effect emerged only when the economic value was a task-relevant dimension and not when it was task-irrelevant. This suggests that the space-price association is driven by the explicit processing of the economic value dimension. In other words, the effect was only present when participants had to explicitly compare the economic value of the stimuli. These findings highlight that specific task demands can shape the spatial representation of economic value.

Data availability

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

Notes

A further problem with banknotes is that they have numbers printed on them, which may automatically activate a number-space association that is independent of economic value per se.

References

Adlington, R. L., Laws, K. R., & Gale, T. M. (2009). The Hatfield Image Test (HIT): A new picture test and norms for experimental and clinical use. Journal of Clinical and Experimental Neuropsychology, 31(6), 731–753. https://doi.org/10.1080/13803390802488103.

Blois-Heulin, C., Crével, M., Böye, M., & Lemasson, A. (2012). Visual laterality in dolphins: Importance of the familiarity of stimuli. BMC Neuroscience, 13, 9. https://doi.org/10.1186/1471-2202-13-9.

Brodeur, M. B., Guérard, K., & Bouras, M. (2014). Bank of standardized stimuli (BOSS) phase II: 930 new normative photos. PLOS One, 9(9), e106953. https://doi.org/10.1371/journal.pone.0106953.

Brunyé, T. T., Gardony, A., Mahoney, C. R., & Taylor, H. A. (2012). Body-specific representations of spatial location. Cognition, 123(2), 229–239. https://doi.org/10.1016/j.cognition.2011.07.013.

Cai, F., Shen, H., & Hui, M. K. (2012). The effect of location on price estimation: Understanding number-location and number-order associations. Journal of Marketing Research, 49(5), 718–724. https://doi.org/10.1509/jmr.11.0203.

Casasanto, D. (2009). Embodiment of abstract concepts: Good and bad in right- and left-handers. Journal of Experimental Psychology: General, 138(3), 351–367. https://doi.org/10.1037/a0015854.

Casasanto, D. (2011). Different bodies, different minds: The body specificity of language and thought. Current Directions in Psychological Science, 20(6), 378–383. https://doi.org/10.1177/0963721411422058.

Chang, S., & Cho, Y. S. (2015). Polarity correspondence effect between loudness and lateralized response set. Frontiers in Psychology, 6, 683. https://doi.org/10.3389/fpsyg.2015.00683.

Dalmaso, M., & Vicovaro, M. (2019). Evidence of SQUARC and distance effects in a weight comparison task. Cognitive Processing, 20(2), 163–173. https://doi.org/10.1007/s10339-019-00905-2.

Dalmaso, M., & Vicovaro, M. (2021). Is face age mapped asymmetrically onto space? Insights from a SNARC-like task. Symmetry, 13(9), 1617. https://doi.org/10.3390/sym13091617.

Dalmaso, M., Pileggi, S., & Vicovaro, M. (2023a). Face age is mapped into three-dimensional space. Cognitive Science, 47, e13374. https://doi.org/10.1111/cogs.13374.

Dalmaso, M., Schnapper, Y., & Vicovaro, M. (2023b). When time stands upright: STEARC effects along the vertical axis. Psychological Research Psychologische Forschung, 87(3), 894–918. https://doi.org/10.1007/s00426-022-01693-9.

Dalmaso, M., Vicovaro, M., & Watanabe, K. (2023c). Cross-cultural evidence of a space-ethnicity association in face categorisation. Current Psychology, 42, 15883–15892. https://doi.org/10.1007/s12144-022-02920-7.

de la Vega, I., de Filippis, M., Lachmair, M., Dudschig, C., & Kaup, B. (2012). Emotional valence and physical space: Limits of interaction. Journal of Experimental Psychology: Human Perception and Performance, 38(2), 375–385. https://doi.org/10.1037/a0024979.

Dehaene, S., & Marques, J. F. (2002). Cognitive euroscience: Scalar variability in price estimation and the cognitive consequences of switching to the euro. Quarterly Journal of Experimental Psychology a Human Experimental Psychology, 55(3), 705–731. https://doi.org/10.1080/02724980244000044.

Dehaene, S., Dupoux, E., & Mehler, J. (1990). Is numerical comparison digital? Analogical and symbolic effects in two-digit number comparison. Journal of Experimental Psychology: Human Perception and Performance, 16(3), 626–641. https://doi.org/10.1037/0096-1523.16.3.626.

Dehaene, S., Bossini, S., & Giraux, P. (1993). The mental representation of parity and number magnitude. Journal of Experimental Psychology: General, 122(3), 371–396. https://doi.org/10.1037/0096-3445.122.3.371.

Foroni, F., Pergola, G., Argiris, G., & Rumiati, R. I. (2013). The FoodCast research image database (FRIDa). Frontiers in Human Neuroscience, 7, 51. https://doi.org/10.3389/fnhum.2013.00051.

Fumarola, A., Prpic, V., Da Pos, O., Murgia, M., Umiltà, C., & Agostini, T. (2014). Automatic spatial association for luminance. Attention Perception & Psychophysics, 76(3), 759–765. https://doi.org/10.3758/s13414-013-0614-y.

Gevers, W., & Lammertyn, J. (2005). The hunt for SNARC. Psychology Science, 47(1), 10–21.

Giuliani, F., D’Anselmo, A., Tommasi, L., Brancucci, A., & Pietroni, D. (2017). Hemispheric asymmetries in price estimation: Do brain hemispheres attribute different monetary values? Frontiers in Psychology, 8, 2042. https://doi.org/10.3389/fpsyg.2017.02042.

Giuliani, F., Manippa, V., Brancucci, A., Tommasi, L., & Pietroni, D. (2018). Side biases in euro banknotes recognition: The horizontal mapping of monetary value. Frontiers in Psychology, 9, 2293. https://doi.org/10.3389/fpsyg.2018.02293.

Giuliani, F., Manippa, V., Brancucci, A., Palumbo, R., Tommasi, L., & Pietroni, D. (2021). How emotional is a banknote? The affective basis of money perception. Psychological Research, 85(8), 3010–3025. https://doi.org/10.1007/s00426-020-01457-3.

Holmes, K. J., & Lourenco, S. F. (2011). Common spatial organization of number and emotional expression: A mental magnitude line. Brain and Cognition, 77(2), 315–323. https://doi.org/10.1016/j.bandc.2011.07.002.

Holmes, K. J., Alcat, C., & Lourenco, S. F. (2019). Is emotional magnitude spatialized? A further investigation. Cognitive Science, 43(4), e12727.

Ishihara, M., Keller, P. E., Rossetti, Y., & Prinz, W. (2008). Horizontal spatial representations of time: Evidence for the STEARC effect. Cortex; a Journal Devoted to the Study of the Nervous System and Behavior, 44(4), 454–461. https://doi.org/10.1016/j.cortex.2007.08.010.

Kahneman, D., Knetsch, J. L., & Thaler, R. H. (1991). Anomalies: The endowment effect, loss aversion, and status quo bias. Journal of Economic Perspectives, 5(1), 193–206. https://doi.org/10.1257/jep.5.1.193.

Kong, F. (2013). Space-valence associations depend on handedness: Evidence from a bimanual output task. Psychological Research Psychologische Forschung, 77(6), 773–779. https://doi.org/10.1007/s00426-012-0471-7.

Macnamara, A., Keage, H. A. D., & Loetscher, T. (2018). Mapping of non-numerical domains on space: A systematic review and meta-analysis. Experimental Brain Research, 236(2), 335–346. https://doi.org/10.1007/s00221-017-5154-6.

Manippa, V., Giuliani, F., Brancucci, A., Tommasi, L., Palumbo, R., & Pietroni, D. (2021). Affective perception of Euro banknotes: Cognitive factors and interindividual differences. Psychological Research Psychologische Forschung, 85(1), 121–132. https://doi.org/10.1007/s00426-019-01240-z.

Mariconda, A., Prpic, V., Mingolo, S., Sors, F., Agostini, T., & Murgia, M. (2022). A systematic investigation reveals that Ishihara et al.’s (2008) STEARC effect only emerges when time is directly assessed. Scientific Reports, 12, 18822. https://doi.org/10.1038/s41598-022-23411-6.

Müller, D., & Schwarz, W. (2007). Is there an internal association of numbers to hands? The task set influences the nature of the SNARC effect. Memory & Cognition, 35(5), 1151–1161. https://doi.org/10.3758/bf03193485.

Pitt, B., & Casasanto, D. (2018). Spatializing emotion: No evidence for a domain-general magnitude system. Cognitive Science, 42(7), 2150–2180. https://doi.org/10.1111/cogs.12568.

Pitt, B., & Casasanto, D. (2020). The correlations in experience principle: How culture shapes concepts of time and number. Journal of Experimental Psychology: General, 149(6), 1048–1070. https://doi.org/10.1037/xge0000696.

Plassmann, H., O’Doherty, J., Shiv, B., & Rangel, A. (2008). Marketing actions can modulate neural representations of experienced pleasantness. Proceedings of the National Academy of Sciences of the United States of America, 105(3), 1050–1054. https://doi.org/10.1073/pnas.0706929105.

Prpic, V., Soranzo, A., Santoro, I., Fantoni, C., Galmonte, A., Agostini, T., & Murgia, M. (2020). SNARC-like compatibility effects for physical and phenomenal magnitudes: A study on visual illusions. Psychological Research Psychologische Forschung, 84(4), 950–965. https://doi.org/10.1007/s00426-018-1125-1.

Rao, A. R., & Monroe, K. B. (1989). The effect of price, brand name, and store name on buyers’ perceptions of product quality: An integrative review. Journal of Marketing Research, 26(3), 351–357. https://doi.org/10.2307/3172907.

Ren, P., Nicholls, M. E., Ma, Y. Y., & Chen, L. (2011). Size matters: Non-numerical magnitude affects the spatial coding of response. PLOS One, 6(8), e23553. https://doi.org/10.1371/journal.pone.0023553.

Root, J. C., Wong, P. S., & Kinsbourne, M. (2006). Left hemisphere specialization for response to positive emotional expressions: A divided output methodology. Emotion, 6(3), 473–483. https://doi.org/10.1037/1528-3542.6.3.473.

Sellaro, R., Treccani, B., Job, R., & Cubelli, R. (2015). Spatial coding of object typical size: Evidence for a SNARC-like effect. Psychological Research Psychologische Forschung, 79(6), 950–962. https://doi.org/10.1007/s00426-014-0636-7.

Snodgrass, J. G., & Vanderwart, M. (1980). A standardized set of 260 pictures: Norms for name agreement, image agreement, familiarity, and visual complexity. Journal of Experimental Psychology: Human Learning and Memory, 6(2), 174–215. https://doi.org/10.1037/0278-7393.6.2.174.

Toomarian, E. Y., & Hubbard, E. M. (2018). On the genesis of spatial-numerical associations: Evolutionary and cultural factors co-construct the mental number line. Neuroscience and Biobehavioral Reviews, 90, 184–199. https://doi.org/10.1016/j.neubiorev.2018.04.010.

Tversky, B. (2011). Spatial thought, social thought. In T. W. Schubert, & A. Maass (Eds.), Spatial dimensions of social thought (pp. 17–38). De Gruyter. https://doi.org/10.1515/9783110254310.17.

Valenzuela, A., & Raghubir, P. (2015). Are consumers aware of top–bottom but not of left–right inferences? Implications for shelf space positions. Journal of Experimental Psychology: Applied, 21(3), 224–241. https://doi.org/10.1037/xap0000055.

Vicovaro, M., & Dalmaso, M. (2021). Is ‘heavy’ up or down? Testing the vertical spatial representation of weight. Psychological Research Psychologische Forschung, 85(3), 1183–1200. https://doi.org/10.1007/s00426-020-01309-0.

Walsh, V. (2015). A theory of magnitude: The parts that sum to number. In R. C. Kadosh, & A. Dowker (Eds.), The Oxford handbook of numerical cognition (pp. 552–565). Oxford University Press.

Winter, B., Matlock, T., Shaki, S., & Fischer, M. H. (2015). Mental number space in three dimensions. Neuroscience and Biobehavioral Reviews, 57, 209–219. https://doi.org/10.1016/j.neubiorev.2015.09.005.

Wood, G., Nuerk, H. C., & Willmes, K. (2006). Crossed hands and the SNARC effect: A failure to replicate Dehaene, Bossini and Giraux (1993). Cortex; a Journal Devoted to the Study of the Nervous System and Behavior, 42(8), 1069–1123. https://doi.org/10.1016/s0010-9452(08)70219-3.

Worchel, S., Lee, J., & Adewole, A. (1975). Effects of supply and demand on ratings of object value. Journal of Personality and Social Psychology, 32(5), 906–914. https://doi.org/10.1037/0022-3514.32.5.906.

Zeithaml, V. A. (1988). Consumer perceptions of price, quality, and value: A means-end model and synthesis of evidence. Journal of Marketing, 52(3), 2–22. https://doi.org/10.2307/1251446.

Funding

Open access funding provided by Università degli Studi di Padova within the CRUI-CARE Agreement. No funding was received to assist with the preparation of this manuscript.

Open access funding provided by Università degli Studi di Padova

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by FG and MV. The first draft of the manuscript was written by FG and LB and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Approval was obtained from the ethics committee of the Department of Psychological, Health and Territorial Sciences, University “G. d’Annunzio” of Chieti-Pescara. The procedures used in this study adhere to the tenets of the Declaration of Helsinki.

Financial interests

The authors have no relevant financial or non-financial interests to disclose.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Consent for publication

The authors affirm that human research participants provided informed consent for publication of the data.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Giuliani, F., Brunello, L., Dalmaso, M. et al. The right side of price: evidence of a SNARC-like effect for economic value. Curr Psychol 43, 18330–18343 (2024). https://doi.org/10.1007/s12144-024-05612-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12144-024-05612-6