Abstract

Risk proneness and the lack of loss aversion are two different reasons to show varying degrees of risk-taking in decision situations. So far, little is known about the extent to which these two processes underly the influence of trait greed, trait anxiety, and age. The present study investigated risk- taking in decision making in these trait contexts using two variants of the Balloon Analogue Risk Task (BART) in an online study: A gain only and a mixed gambling BART. This was done to separate risk proneness from loss aversion. Individuals with high trait greed showed an increased risk decision-making behavior due to an increased risk proneness and not due to a reduced loss aversion. This is partly in contrast with previous findings in other tasks assessing risk proneness and loss aversion. These differences may be caused by the changes of perception during the gain only task. No significant effects were found for trait anxiety or age concerning risk-taking in decision-making behavior. Possible explanations for the lack of influence of these constructs are skewed distributions, omitting pathologically anxious subjects in anxiety and a restricted age range. The findings suggest that a lack of loss aversion is not a driving factor to explain elevated risk-taking in decision-making behavior in persons with high trait greed, but a higher reaction to reward in predominantly rewarding contexts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Every day we encounter situations where we may take risk in our decisions. Yet, some persons seize their opportunities without being afraid of losing, while others try to play it safe if losses are on the line and only want to “gamble” if no losses are to be expected (cf. Lejuez et al., 2002, 2003; Mussel et al., 2015). For example, for the personal retirement provisions, one person may choose to invest in secure government bonds with low but guaranteed return, while another may invest in shares with leverage, offering the possibility of high gains but also high losses that exceed the invested money many times. In this context, individual differences in two decision variables linked to the outcome and risk of the decisions are likely to impact decision-making: Loss aversion and risk proneness (cf. Martino et al., 2010; Phelps et al., 2014). In the present study, we investigated the relation of relevant personality traits to these two variables operationalizing a modified version of the Balloon Analogue Risk Task (BART, Lejuez et al., 2002).

Loss aversion and risk proneness

Loss aversion refers to the tendency to value losses more significantly than profits in decision-making (Kahneman & Tversky, 1979; Phelps et al., 2014). Thus, the term describes an avoidance of choices that may result in losses, even if they are accompanied by equal or larger gains, as the aversion against the losses drives the behavior.

Risk proneness, the opposite of risk aversion, on the other hand, can be defined as a general proneness to the uncertainty or variance of the outcome, regardless of whether the outcome is a potential gain or loss (Martino et al., 2010).

In situations where risk and potential loss are associated, it is hard to distinguish between these two constructs. Yet, recent studies have shown that proneness to risk and loss aversion can be measured and studied orthogonally in gambling tasks (Phelps et al., 2014). To do so, profits and losses are systematically controlled, thus disentangling the risk of a decision from the probability of a loss. Prior studies used gambling tasks to investigate the risk proneness and loss aversion independently (Li et al., 2019), by introducing different conditions.

In “gain only” (i.e., one can only win and not lose anything) and “loss only” (i.e., one can only loose and not gain anything) gambling tasks, individuals’ risk tolerance is assumed to be determined by their risk proneness (Li et al., 2019). In contrast, in “mixed gambling tasks”, where both gains and losses are possible, risk-taking is influenced by risk proneness and by loss aversion. To extend the previous literature beyond the gambling tasks that were predominantly used to disentangle risk proneness from loss aversion previously, in the present study, we experimentally realized this distinction using a well-known instrument for assessing risk propensity or risk behavior, the Balloon Analogue Risk Task (BART).

Modification of the balloon analogue risk task to measure loss aversion and risk proneness

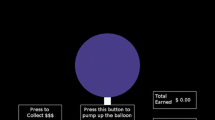

The Balloon Analogue Risk Task is a computer-based measure of risk behavior (Lejuez et al., 2002). In the task, participants earn money by virtually inflating a balloon via button click. Each click causes the balloon to gradually inflate and provide more money. After each inflation, the participant can decide whether they want to continue the inflation process or take the profits presently assigned to the balloon. If they continue to inflate and a predefined, yet for the participant unknown threshold based on probability for each balloon is reached, the balloon explodes, and all money of the balloon is lost. Thus, each additional inflation of the balloon bears a greater risk of explosion, but also a greater potential gain. If the participant decides to take the money of a balloon before it bursts, it will be added to their total balance. However, if the balloon explodes, the earnings of that attempt are lost. The primary score used to measure risk-taking in BART performance is the adjusted average number of unexploded balloons pumped. Thus, higher scores indicate a greater willingness to take risks.

Unlike the gambling tasks used to investigate the difference of loss aversion and risk proneness previously (e.g., Li et al., 2019), the BART offers intuitive sequential risk-taking with direct feedback, where participants may learn directly from their experiences. This highly ecologically valid measure (Lejuez et al., 2003) was used to gather different insights, as the intensity of the situation (cf. Rodrigues et al., 2021) as well as the context varies considerably in comparison to a gambling task (cf. Li et al., 2019). In our study, a modified BART was used to differentiate between loss aversion and risk proneness. Resembling the modifications made by Li et al. (2019), we introduced a gain only condition (i.e., no loss was possible and even a balloon burst was compensated with a gain worth a quarter of the respective balloon value) and a mixed condition (i.e., gains and losses were possible, if the balloon burst, its value was subtracted from the total balance). One complication of the modified BART is the sequential feature. Participants get feedback for every inflation step of a trial. This may raise the question about the gain only BART, whether participants already see their potential money in their trial as money they already have and therefore perceive a burst as loss of money. In our line of argument, we think that the participants may experience the trials in our modified BART differently than in the normal BART, especially due to their knowledge of our version of the mixed BART, as well as our participant incentive structure, where we reinforced the highest total score (see method section below). In the mixed BART, they experience, that a burst of a balloon in a trial leads to a decrease in the total balance or secured money they have earned in previous trials or as starting value. Due to this experience and the reinforcement structure, the reference frame in this modified variant of the BART is no longer the money one can gain during the trial, but the overall money they have. With this perspective, our mixed BART causes wins if money is successfully secured and losses if a balloon bursts, while the gain only causes wins if money is successfully secured and wins if the balloon bursts. Based on the previous findings in the gambling task, we expected the inflation behavior of the gain only condition to be driven by risk proneness (Li et al., 2019),while in the mixed condition the driving forces should be both, risk proneness and loss aversion (Li et al., 2019). Hence, we may extract measures of risk proneness (i.e., inflation behavior in the gain only condition) and loss aversion from the modified BART. Our measure of loss aversion constructs from the difference of mixed BART and gain only since the gain only task was expected to be driven by risk proneness, while the mixed BART should be driven by risk proneness and loss aversion, leaving the difference of these tasks with loss aversion as the driving construct (see e.g., Bateman et al., 1997; Kahneman et al., 1990, 1991).

Beyond the differences in task performance in these variants of BART, we were interested in trait relations of these two aspects of risk-taking behavioral decisions, to identify possible underlying processes of the decisions (cf. Tett & Guterman, 2000).

Trait influences on the modified balloon analogue risk task

Personality traits have been known to influence behavioral decisions in economic context and more specifically also in BART. Using a modified version of BART, we were interested in the predictive value of trait greed, trait anxiety and age for either loss aversion or risk proneness, as each of them has been found to influence decisions in BART and partly also were related to the concepts of loss aversion and risk proneness previously (see below).

The first personality trait we wanted to investigate and that is known to influence economic decision-making and more specifically BART is greed (e.g., Mussel et al., 2015, 2018; Mussel & Hewig, 2016, 2019; Rodrigues, Caporale, et al., 2022; Seuntjens et al., 2015, 2016).Greed can be defined as the excessive, insatiable desire and striving for more (especially money and material things) even at the expense of others (Balot, 2020; Mussel & Hewig, 2016). Although greedy personalities expect to be happier with more money, they keep readjusting their desire and expectations, always wanting more (Seuntjens et al., 2015). However, greed can entail both positive effects, such as higher income, and negative effects, such as a higher likelihood of saving less money, or having financial debt (Seuntjens et al., 2016). Nevertheless, greed is often thought to have a selfish nature, which is an extreme and immoral form of self-interest at the expense of others (Balot, 2020). Furthermore, greed has been associated with antisocial, unethical, and deviant behaviors (Mussel et al., 2015), including excessive risk-taking despite impending losses that go well beyond personal concern to consequences for companies or even society.

The empirical findings on the influence of the personality trait greed on risky decision behavior seem partly inconsistent. Yet, these seemingly contradictory findings can be integrated, as they have been established using different types of paradigms or approaches: First, it was found that trait greed predicts individual risk-taking, which was shown using BART, as well as classical risk games (Mussel et al., 2015; Mussel & Hewig, 2016). Furthermore, individuals with high trait greed showed blunted neural response to losses compared to gains, indicating difficulties in learning from mistakes, punishments, or negative events, contributing to higher risk-taking in decision-making in the future (Mussel et al., 2015; Mussel & Hewig, 2019). However, on a trait level of risk-taking propensity, there was no association found to trait greed (Seuntjens et al., 2015). Hence, an influence of trait greed might only be given for risky decision-making on the behavioral level and may not transfer to risk-taking propensity at the trait level. Interestingly, in the context of disentangling loss aversion and risk proneness with gain only and mixed gambling tasks, trait greed was significantly correlated with risky decisions in mixed gambling tasks, but not in gain only or loss only gambling tasks (Li et al., 2019). This indicates that trait greed may be tied to loss aversion but not to risk proneness in this context, as the mixed gambling tasks are expected to be driven by both loss aversion and risk proneness, while the gain or loss only tasks are solely driven by risk proneness (Li et al., 2019). Nevertheless, these findings are not entirely contradictory to previous findings about positive correlations of risky behavior and trait greed in general, as different tasks may lead to different trait activation intensities (Mussel et al., 2015; Rodrigues et al., 2021; Rodrigues, Weiß, et al., 2022; Tett & Guterman, 2000). For example, the task proposed by Li et al. (2019) as compared to the one by Mussel et al. (2015) may not have been of sufficient intensity to activate a relation of risk propensity with trait greed.

Yet, in this study, we opted to hypothesize according to the more recent findings of Li et al. (2019) that trait greed would be linked to a reduced loss aversion (i.e., difference of mixed – gain only BART) and not to risk proneness (i.e., gain only BART).

The second trait we wanted to investigate concerning a specific relation to loss aversion and risk proneness in the modified BART was trait anxiety. Trait anxiety refers to the stable tendency to notice, experience, and report negative emotions such as fears, worries, and anxieties across many situations (Gidron, 2020). Further, trait anxiety is characterized by perceiving environmental stimuli (e.g., events or statements from others) as threatening after an initial shift of attention to it (Gray & McNaughton, 2000).

Concerning decisions under risk, previous findings suggest that pathologically anxious personalities exhibit reduced risk-taking behaviors compared to healthy participants (Giorgetta et al., 2012; Mueller et al., 2010). In a recent study, disentangling risk proneness and loss aversion, it was shown that pathologically anxious persons had significantly lower risk proneness (measured in a gain only gambling task), but loss aversion (mixed with risk proneness, measured in a mixed gambling task) was equivalent compared to the healthy individuals (Charpentier et al., 2017). Similarly, in nonclinical populations, risk aversion in a gain only task has been found in high trait anxiety as well using extreme groups of high and low trait anxiety (see Schmidt et al., 2018). The increased risk aversion may be caused by biased risk assessment (Charpentier et al., 2017) and overestimation of the risk of negative events (Butler & Mathews, 1983), resulting in a withdrawal from risky decisions. However, concerning loss aversion in the non-clinical context, individuals with high trait anxiety had increased loss aversion in a gambling task in MRI while engaging in decision-making behavior under risk (Xu et al., 2020). Additionally, in the same study, despite fewer “gamble” decisions in anxious individuals, no significant group difference was found in subjective risk proneness. This finding suggests that the conservative decision bias in trait anxiety may be caused by a fear of losses rather than an unease concerning risk. This dominant role of loss aversion in maladaptive risk assessment was further supported by disorganization of emotion-related and cognitive-control-related neural networks (Xu et al., 2020). Hence, there is mixed evidence, that may be explained by a change in quality when trait anxiety gets to a pathological level. On pathological level, risk proneness seems to be lower than in controls (Giorgetta et al., 2012; Mueller et al., 2010), while on high trait anxiety level (without being pathological), loss aversion seems to be higher than for low trait anxiety (Xu et al., 2020), although some researchers find also positive relations of high trait anxiety and risk proneness as reported for pathological levels (Schmidt et al., 2018).

As we did not plan to include pathologically anxious individual but collect our sample from healthy participants with differences in trait anxiety, we hypothesized trait anxiety being positively linked to loss aversion (Xu et al., 2020), although some findings also point to a positive relation with risk proneness (Schmidt et al., 2018). As for trait greed before, we utilized the difference of mixed BART and gain only BART as a marker for loss aversion (see above).

The last individual difference variable we expected to be differentially linked to the two aspects of risk-taking behavior is age. Age has been found to influence decision-making behavior over the life span. Concerning the risk proneness, in the so called “cup task” (a gain only gambling task), where the participant has to choose from several cups, risky behavior decreases over the life span (Weller et al., 2011, p. 20). For loss aversion, an increase for age was found in risky and risk-free decision-making in a simple lottery task (Gächter et al., 2021). As there seems to be effects for both, increased loss aversion and decreased risk proneness with age, we expected that age would predict less inflations of balloons, both in the mixed gambling BART and in the gain only gambling BART (to assess risk proneness), as well as their difference index (to assess loss aversion).

Summing up the goal of our study, we were interested in disentangling risk proneness and loss aversion as driving concepts in risk-taking behavior using the modified BART. Additionally, we wanted to investigate the differential influences of trait greed, trait anxiety, and age on these two aspects of risky decision behavior. Concerning our hypotheses, we expected trait greed and trait anxiety lead to a high subjects’ difference in the average number of inflations of the balloons between the mixed gambling BART task and the gain only gambling BART task. Also, we expected age to be related to less inflations of the balloons in general.

Materials and methods

Ethical statement

The study was carried out in accordance with the recommendations of “Ethical guidelines, of the psychological association of the country of the institution with written informed consent from all subjects. All subjects gave written informed consent in accordance with the Declaration of Helsinki before they participated in the experiment. The protocol was approved by the local ethics committee.

Preregistration and data availability

The preregistration (blinded) of the study is given here: https://osf.io/fv29z/?view_only=5490a21747164c938c17ff7e54529289. The data is provided in the following repository: https://osf.io/yn68u/?view_only=e6d8fcf34edf4df99ca225682461d937.

Participants

The calculation of the minimum sample size was performed using the computer program G*Power (Version 3.1.9.7) (Faul et al., 2007, 2009) with an estimated effect size of r = .292 (Huo et al., 2020), power = 0.8 and alpha = 0.05 led to a required number of 87 subjects.

Data collection took place from June 9 to June 28, 2021, and the study completion time was approximately 30 min. Subjects (native speakers, older than 18 and no mental illness) were recruited via social media, email distribution lists, and local participant platforms.

Seven subjects were excluded from the sample because of incomplete data or they were identified as statistical outliers (see preregistration: mean values or participation time: z > 3.29, Tabachnick & Fidell 2014).

The final sample included 105 subjects (51 female, mean age = 35.75 years, SD = 11.86 years). As the study contained audio effect (balloon burst and “banking in” sound if the money was secured), we asked whether the participants heard the sounds. 36.19% (38 participants) reported not to have heard the sounds, but all participants were included nevertheless, as the visual properties and information was deemed the more important part of the paradigm, while the audio only underlined the visual information. The participants did not get a direct monetary compensation for participation. Instead, their performance in the BART was recorded and the person with the highest score obtained won 50€ as a prize. All participants were informed of this procedure before their participation. Additionally, for psychology students, the study was one of many studies where they were able to get course credits for their participation if they wanted.

Procedure

The study was conducted online using SoSci Survey (Leiner, 2021). All subjects participated in the study voluntarily (also the psychology students that could choose to participate in this or many other studies to gain their course credits). The subjects were informed about the processing of the data (especially the procedure concerning contacting the winner via email and the necessary data storage of this personal information until the end of the study), gave their consent, and received an explanation about the aim of the study at the end of the experiment. Since the study contained audio effects (for inflation, balloon burst and securing the money), participants were instructed how to activate them in their individual internet browser. Also, they were asked whether they experienced the audio effects. The study was composed of two parts (see also Figure S1 in supplement):

In the first part, demographic data (age, gender, monthly income and highest education) trait greed (“the GR€€D scale”, Mussel & Hewig 2016) and trait anxiety („State-Trait-anxiety inventory“, STAI, trait part, Laux et al., 1981) was assessed. As an additional variable, trait anger („State-Trait Anger Expression Inventory“, STAXI trait part, Schwenkmezger & Hodapp 1991) was assessed, but not analyzed for the current study.

In the second part, after an explanation of the experimental task, the subjects went through two variants of the BART (Lejuez et al., 2002) with 40 balloons per condition and 5 balloons of practice before. The participants were presented with a green balloon displaying the amount of money in the currency of the country. The participants were given two options: They could take the money displayed on the balloon or they could inflate the balloon and double the money. If they chose to inflate, the money of the balloon rose, yet also the risk of bursting increased. If they chose to take the money of the balloon, it was added to their total balance. As participants were not informed of the probabilistically predetermined rising of burst risk by 7% per inflation from 15 to 71% with a final increase by 29% to 100% for the 10th inflation, see (Mussel et al., 2015), they also experienced bursts of the balloon if they chose to inflate them. A bursting of the balloon entailed different events depending on the BART conditions:

In the mixed gambling BART, if the balloon burst, the full value displayed in the balloon was subtracted from the total credit (a negative total credit was also possible as a result).

In the gain only gambling BART variant, if the balloon burst, the value currently displayed in the balloon was not deducted from the total credit, but a quarter of this value (e.g., 250, if the balloon displayed 1000) was credited to the total credit. We chose to enhance the gain aspect of our gain only variant, although a “normal” BART (i.e., only having gains and a burst of the balloon simply does not lead to any gain but no loss) would also be a gain only task already. Yet, we wanted to maximize the effects of the differences concerning gain only and mixed gambling tasks as well as focus on the perspective of the total balance explained above. Therefore, we implemented a gain in case of non-successful inflation.

Trait measurements

The Gr€€D scale (Mussel & Hewig, 2016), used to measure greed is a self-assessment questionnaire with twelve items on a seven-point response scale. Example items read: “Earning a lot of money is my most important goal,“ or “When I think about what I already have, the thought of what I would like to have next immediately comes to mind”. The Gr€€d scale has an internal consistency of Cronbach´s α = 0.90 (Mussel et al., 2018). In our data, we found a Cronbach´s α = 0.869 and McDonald´s ω = 0.873.

To measure trait anxiety, the trait part of the State Trait Anxiety Inventory (STAI) in the German version was used (Laux et al., 1981; Spielberger, 1988). Examples items are (e.g., “I feel secure,“ (inverted) “I worry about possible mishaps,“ “Unimportant thoughts run through my mind and weigh me down”). The STAI has an internal consistency of Cronbach´s α = 0.90 (Laux et al., 1981). In our study we found Cronbach´s α = 0.931 and McDonald´s ω = 0.934.

Data analysis

To test our hypotheses, linear regressions with the traits greed, anxiety and age as predictors and the difference in the average number of unexploded balloon inflations between the mixed gambling BART and the gain only BART, as well as the difference in the average number of absolute balloon inflations as criteria were computed. To avoid suppression effects, as intercorrelation of the traits were expected, the regressions were done separately for each trait and criterion, as has been mentioned in the preregistration. The significance level was set at α = 0.05. The traits greed and anxiety and the age of the subjects were z-standardized. Because of the profits even when a balloon burst in the gain only BART variant, it was reasonable to assume increased balloon inflation and, consequently, more frequent balloon bursts in this condition. Therefore, not only the adjusted average number of inflations for unexploded balloons was measured, but also the unadjusted average number of inflations for the absolute balloons (including the exploded balloons), as both measurements should yield similar results (Lejuez et al., 2002).

On exploratory level, trait greed was used as a predictor for the inflation behavior in four separate regression models for the mixed and the gain only task, for either the inflation behavior concerning all balloons as dependent variable or only concerning the ones that did not explode.

All statistical analyses were done using open-source statistical software Jamovi (The jamovi project, 2021).

Results

Descriptive

The descriptive and the bivariate correlation of the measured variables can be seen in supplemental Tables S2 and S3, revealing a substantial yet not perfect correlation between the two different conditions (gain only vs. mixed) of the modified BART.

Confirmatory analyses

To test whether trait greed predicted increased risk-taking decision-making behavior due to reduced loss aversion, two linear regressions were conducted. Trait greed predicted the difference in the mean number of times balloons were inflated without explosion (between the mixed gambling and the gain only BART) significantly (β = − 0.19, t(103) = 1.997, p = .048). It was possible to explain 3.73% of the variance of the criterion with the predictor trait greed (Fig. 1 A). Also, for the difference in inflations (between the mixed gambling and the gain only BART) in total, trait greed was a significant predictor (β = − 0.21, t(103) = 2.201, p = .03). It was possible to explain 4.49% of the variance of the criterion with the predictor trait greed (see Fig. 1B). However, as the effect was in the opposite direction as expected, the first hypothesis could not be confirmed.

Trait greed and the difference between mixed and gain only pumping behavior for not exploded balloons (A) or all balloons (B). Note: Y-axis intercept = difference in average number of inflations of unexploded balloons (mixed - gain only BART) as criterion; X-axis intercept = trait greed as predictor. The shaded areas depict SEM

The two linear regression analyses to test whether trait anxiety prediceds reduced risky decision-making behavior due to increased loss aversion were not significant. For either difference in inflation behavior, for unexploded balloons (β = 0.06, t(103) = − 0.63, p = .532) (see Figure S4A in supplemental material) as well as for all balloons (β = 0.05, t(103) = − 0.51, p = .615) (Figure S4B in supplemental materials), trait anxiety was not a significant predictor. Thus, the second hypothesis could also not be accepted.

To address the question whether age predicted reduced risky decision-making behavior due to increased risk aversion as well as loss aversion, two linear regressions were performed. For age as predictor, again, no significant influence was found. Neither on the average inflation of unexploded balloons β = 0.05, t(103) = 0.42, p = .675) (see Figure S5A in supplemental materials), nor on all balloons (β = − 0.05, t(103) = 0.52, p = .602) (see Figure S5B in supplemental materials) there was any significant effect. Thus, the third hypothesis could also not be accepted. All results mentioned above can be seen in Table 1.

Exploratory studies

To investigate the influence of trait greed on the risk-taking in decision-making behavior in BART further, four linear regressions were performed (see Table 2; Fig. 2). Only in the gain only tasks there was a significant prediction of the behavior by greed

Discussion

The aim of the present study was to disentangle risk proneness and loss aversion in a modified BART and investigate the influence of trait greed, trait anxiety, and age on these aspects of risky decision behavior. We hypothesized a positive relation of trait greed to loss aversion, which would have been expressed by a positive relation of trait greed to the difference of the mixed and gain only BART. However, instead of an expected positive relation to this difference, it was shown that there was a significant negative relation of trait greed on this difference in risk-taking behavior between these conditions of the modified BART. This negative relation and further exploration of a positive link of trait greed and the gain only task suggested that the influence of trait greed is not due to decreased loss aversion as seen in the research findings of Li et al. (2019), but due to a higher risk proneness. This significant effect was evident for either the unexploded balloons or all balloons in total. These findings contrast to the findings of Li et al. (2019), yet Li et al. (2019) used a different task. One explanation of these divergent findings could be that the differences of the properties in a gambling task compared to the BART may have caused differences in trait activation intensity (Mussel et al., 2015; Rodrigues et al., 2021; Tett & Guterman, 2000) or ecological validity (cf. Lejuez et al., 2003) that may account for the differences in empirical findings.

While the conclusions of Li et al. (2019) cannot be supported, the present results instead confirm the findings of Mussel et al. (2015), who found that trait greed can predict individual risk-taking. In their study, Mussel et al. (2015) also used a gain only BART, but without an amplificated gain (i.e., providing no gain, but also no loss in case of a balloon burst), as it was used in our study, where a burst balloon even led to winning some money in the trial. Integrating the findings of Li et al. (2019), Mussel et al. (2015) and the present study, the task used to investigate the trait relation of decision-making behavior is important, as the strength and the quality of the influence of trait greed may depend on the specific properties of the measurement paradigm, i.e., economic game. However, it is important to note that there are only absent or positive relations of risk propensity and trait greed in the literature. Our findings, although having no psychophysiological data may also provide alternative interpretations or even shed new light on the interpretation of the physiological findings from Mussel et al. (2015). In their study, they were investigating the psychophysiology involved in BART in relation to trait greed. The authors found a reduced feedback-related negativity (FRN) for bursts, compared to non-bursts of the balloon in persons having high trait greed, which they interpreted as reduced loss aversion. Yet, bursts were associated with no gain, rather than the loss of money already secured. Interpreting the results in the light of our finding that greedy individuals might rather be characterized by higher risk propensity in situations in which only gains can be expected, the results of Mussel et al. (2015) may just indicate that a “non-gain” is not seen as grave by a person with high trait greed compared to less greedy persons, while the FRN of a real loss in the context of BART remains to be investigated. A replication and similar interpretation of these psychophysiological findings in a “gain only” social good design concerning persons with high trait greed only showing a difference in processing of good and bad outcomes indicated by the FRN in contexts relevant for them is given by Mussel and Hewig (2019). Nevertheless, the influence of the experimental variation, especially of our “exaggerated” gain only task (i.e., providing a quarter of the profits in case of balloon burst) seems to change the perception of the burst of the balloon rather drastically, and therefore the total lack of loss leads to a full development of the relation of greed and pumping behavior. These bursts of balloons in the gain only condition may instead of a loss be seen as a dampened win, although one loses some money. This sheds additional light on the danger of having to choose between options that do not encompass outcomes with loss along the line for greedy persons, as they may not see a problem if they still win something, and such situations may make them particularly vulnerable to taking high risks. However, it is questionable whether the electro-cortical evaluation processes (i.e., FRN) line up with the behavioral responses one-to-one. Hence, this experiment should be repeated after careful consideration of sampling size, possible extreme groups sampling in the context of trait greed as well as further exaggeration of the parameters of the paradigm with EEG to compare the differences in FRN response when a gain only BART is used compared to mixed BART task in the context of trait greed. Such a study may be able to confirm possible differences in processing when no “real” loss is at stake and may help to disentangle mixed findings about trait greed and behavior as well as the electro-cortical response of feedback processing from the behavioral response. Additionally, other measurements of loss aversion should be added to confirm the finding in BART.

Concerning trait anxiety there were no significant effects found in our study. One possible explanation for a lack of effect would be an insufficient degree of variance in trait anxiety or a lack of pathological anxiety in the sample. In the work of Giorgetta et al. (2012) and Mueller et al. (2010) and the supporting and more detailed findings by Charpentier et al. (2017), pathologically anxious personalities were specifically compared to healthy subjects to conclude that the pathologically anxious exhibited reduced risk-taking behaviors. Also, in Schmidt et al. (2018) an extreme group design using trait anxiety was used to increase statistical test power. Further, in the contrasting findings of Xu et al. (2020), in which reduced risky decision-making behavior resulted from reduced loss aversion, extreme groups in trait anxiety were used to investigate the effect. This suggests that to achieve a significant effect, a random sample with test participants who only exhibit mildly increased trait anxiety may not be sufficient and that extreme groups in trait anxiety or pathologically anxious test subjects may be necessary. However, this null finding allows to question the generalizability of the results previously mentioned and whether the findings are only given for pathological or extreme groups of trait anxiety and not for the personality aspect of anxiety, which the results of Xu et al. (2020) may also suggest. However, the absence of the effect could also be due to sample homogeneity and therefore no reliable conclusion can be drawn concerning this question other than that a random sample may not be sufficient to determine the possibly rather small effect of trait anxiety.

Concerning age, no significant effect was found in our sample. This lack of effect could be due a restriction in our age range. In the study by Weller et al. (2011), subjects aged five − 85 years were used. In our study, we excluded participants under the age of 18. Additionally, the age group between 25 and 35 was disproportionately overrepresented. Interestingly, in the study by Weller et al. (2011), no effect was found for the age group from 18 to 22 years old, which represented the largest proportion of our subjects. Perhaps this is also the reason that our sample was not able to reveal an effect. Hence, as in the case of trait anxiety, further research and systematic subject selection might be the key to find these hypothesized effects.

Limitations

One important limitation of our study is BART itself. Although the aim was to investigate the relation of trait greed to behavioral decisions in specific variations of this task, it is questionable, whether the sequential nature of the BART leads to a real “gain-only” experience in this condition. For example, if the balloon bursts after several inflations, part of the won money is still lost. Beside this concern about the perception of the task, also a statistical dependency problem concerning the results is given: The correlations in both conditions (mixed and gain only) were in the positive direction (0.13 < r < .30), but only the difference score that should address the loss aversion is negative. Hence, the interpretation of the loss aversion (i.e., difference score of mixed – gain only) is dependent on the risk proneness (i.e., gain only) and therefore as it is not separately measured, a negative relation is only deducted by the lower positive relation of the mixed gambling task compared to the gain only task. However, the ratio of loss aversion and risk proneness driving the mixed gambling task in a 1 to 1 ratio is only a theoretical constraint and empirical research would be needed to confirm this expectation directly in gambling tasks as well as in this modified BART.

The present study was collected exclusively online and lacks the experimental settings and control of a laboratory. Hence, the internal validity could be limited. Yet, it has been shown that BART is robust against being measured online and that the validity of the task is not endangered by this type of data collection (Schluter et al., 2018).

Furthermore, the participants were informed that the person with the highest total credit earned in the BART receives a prize of 50€. This was done following the example of Mussel et al. (2015), who provided 100€ for this purpose. This procedure could have encouraged the subjects to show increased risk behavior and to inflate the balloons more often than they would have without this incentive for high scores. Nevertheless, this incentive was retained to provide a better comparability with previous studies (e.g., Mussel et al., 2015).

Concerning the variety of possible influences of personality traits on the risk-taking decision-making, future research should also consider alternative personality models to examine personality traits related to risky decision behavior such as the HEXACO model of personality structure (Lee & Ashton, 2004). Additionally, trait impulsiveness may also be a valiant control variable to account for spontaneous decisions that could not be inhibited (Li et al., 2019).

Since the beginning of 2020, the COVID-19 pandemic containment measures such as lockdowns, quarantine regulations, and social distancing have shaped everyday life. The pandemic with its measures is associated with increases in state and trait anxiety, generalized anxiety, stress, and depression. The study reported here was conducted during the time of the COVID-19 pandemic. This may have had a particular impact on the study concerning trait anxiety and its impact on risky decision-making behavior (e.g., Anglim & Horwood 2021; Karing, 2021), which may have undermined or distorted effects that were previously found.

Conclusion and research outlook

The present study is the first to investigate the influence of the personality traits greed, anxiety and the demographic variable age on risky decision-making behavior using variants of the BART, differentiating between risk proneness and loss aversion. It was shown that individuals with high trait greed express increased risky decision-making behavior due to increased risk proneness and not due to decreased loss aversion. No significant effect was found between the personality trait anxiety or age and risk-taking decision behavior. These findings question the generalizability of previous findings. Concerning trait greed, the task to investigate trait-behavior relations seems to be important, while for age and anxiety, the specific manifestation and variation of the trait or the age range may be vital for revealing an effect. While differences in trait anxiety may not be sufficiently large in some cases and the effects may only be found for pathological samples, the influence of age may only occur in specific timeframes of one´s life.

Yet, the finding concerning trait greed may have practical implications. A lack of loss aversion is not necessarily the driving factor to explain risky decision-making behavior given by greedy persons, but a higher reaction to reward in a predominantly rewarding context may be relevant to explain their decision-making. Accordingly, depending on the tasks, greed might be an either important or neglectable personality trait concerning economic decisions and its implications for business may be reconsidered, especially if two options with no direct losses all along the line are available, which might make greedy people seek higher risks.

Data availability

The data, materials and the statistical analyses are available on the OSF repository (non-frozen version of the project: https://osf.io/yn68u/). For further interest beyond these analyses and data contact the first author. preregistration: https://osf.io/fv29z

References

Anglim, J., & Horwood, S. (2021). Effect of the COVID-19 Pandemic and Big Five Personality on Subjective and Psychological Well-Being. Social Psychological and Personality Science, 12(8), 1527–1537. https://doi.org/10.1177/1948550620983047

Balot, R. K. (2020). Greed and Injustice in Classical Athens. Greed and Injustice in Classical Athens. Princeton University Press. https://doi.org/10.1515/9780691220154

Bateman, I., Munro, A., Rhodes, B., Starmer, C., & Sugden, R. (1997). A Test of the Theory of Reference-Dependent Preferences*. The Quarterly Journal of Economics, 112(2), 479–505. https://doi.org/10.1162/003355397555262

Butler, G., & Mathews, A. (1983). Cognitive processes in anxiety. Advances in Behaviour Research and Therapy, 5(1), 51–62. https://doi.org/10.1016/0146-6402(83)90015-2

Charpentier, C. J., Aylward, J., Roiser, J. P., & Robinson, O. J. (2017). Enhanced Risk Aversion, But Not Loss Aversion, in Unmedicated Pathological Anxiety. Biological Psychiatry, 81(12), 1014–1022. https://doi.org/10.1016/j.biopsych.2016.12.010

Faul, F., Erdfelder, E., Buchner, A., & Lang, A. G. (2009). Statistical power analyses using G*Power 3.1: Tests for correlation and regression analyses. Behavior Research Methods, 41(4), 1149–1160. https://doi.org/10.3758/BRM.41.4.1149

Faul, F., Erdfelder, E., Lang, A. G., & Buchner, A. (2007). G*Power 3: A flexible statistical power analysis program for the social, behavioral, and biomedical sciences. Behavior Research Methods, 39(2), 175–191. https://doi.org/10.3758/BF03193146

Gächter, S., Johnson, E. J., & Herrmann, A. (2021). Individual-level loss aversion in riskless and risky choices. Theory and Decision. https://doi.org/10.1007/s11238-021-09839-8

Gidron, Y. (2020). Trait Anxiety. In M. D. Gellman (Ed.), Encyclopedia of Behavioral Medicine (pp. 2255–2256). Springer International Publishing. https://doi.org/10.1007/978-3-030-39903-0_1539

Giorgetta, C., Grecucci, A., Zuanon, S., Perini, L., Balestrieri, M., Bonini, N., Sanfey, A. G., & Brambilla, P. (2012). Reduced risk-taking behavior as a trait feature of anxiety. Emotion (Washington D C), 12(6), 1373–1383. https://doi.org/10.1037/a0029119

Gray, J. A., & McNaughton, N. (2000). The Neuropsychology of Anxiety: An Enquiry into the Functions of the Septo-Hippocampal System. Oxford University Press.

Huo, H., Zhang, R., Seger, C. A., Feng, T., & Chen, Q. (2020). The effect of trait anxiety on risk-taking: Functional coupling between right hippocampus and left insula. Psychophysiology, 57(10), e13629. https://doi.org/10.1111/psyp.13629

Kahneman, D., Knetsch, J. L., & Thaler, R. H. (1990). Experimental Tests of the Endowment Effect and the Coase Theorem. Journal of Political Economy, 98(6), 1325–1348. https://doi.org/10.1086/261737

Kahneman, D., Knetsch, J. L., & Thaler, R. H. (1991). Anomalies: The Endowment Effect, Loss Aversion, and Status Quo Bias. Journal of Economic Perspectives, 5(1), 193–206. https://doi.org/10.1257/jep.5.1.193

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–292. https://doi.org/10.2307/1914185

Karing, C. (2021). Prevalence and predictors of anxiety, depression and stress among university students during the period of the first lockdown in Germany. Journal of Affective Disorders Reports, 5, 100174. https://doi.org/10.1016/j.jadr.2021.100174

Laux, L., Glanzmann, P., Schaffner, P., & Spielberger, C. D. (1981). State-Trait-Angstinventar [State-Trait Anxiety Inventory]. Hogrefe.

Lee, K., & Ashton, M. C. (2004). Psychometric Properties of the HEXACO Personality Inventory. Multivariate Behavioral Research, 39(2), 329–358. https://doi.org/10.1207/s15327906mbr3902_8

Leiner, D. J. (2021). SoSci survey [computer software].http://www.soscisurvey.de

Lejuez, C. W., Aklin, W. M., Zvolensky, M. J., & Pedulla, C. M. (2003). Evaluation of the Balloon Analogue Risk Task (BART) as a predictor of adolescent real-world risk-taking behaviours. Journal of Adolescence, 26(4), 475–479. https://doi.org/10.1016/S0140-1971(03)00036-8

Lejuez, C. W., Read, J. P., Kahler, C. W., Richards, J. B., Ramsey, S. E., Stuart, G. L., Strong, D. R., & Brown, R. A. (2002). Evaluation of a behavioral measure of risk taking: The Balloon Analogue Risk Task (BART). Journal of Experimental Psychology: Applied, 8(2), 75–84. https://doi.org/10.1037/1076-898X.8.2.75

Li, W., Wang, H., Xie, X., & Li, J. (2019). Neural mediation of greed personality trait on economic risk-taking. ELife, 8. https://doi.org/10.7554/eLife.45093

Martino, B. D., Camerer, C. F., & Adolphs, R. (2010). Amygdala damage eliminates monetary loss aversion. Proceedings of the National Academy of Sciences, 107(8), 3788–3792. https://doi.org/10.1073/pnas.0910230107

Mueller, E. M., Nguyen, J., Ray, W. J., & Borkovec, T. D. (2010). Future-oriented decision-making in Generalized Anxiety Disorder is evident across different versions of the Iowa Gambling Task. Journal of Behavior Therapy and Experimental Psychiatry, 41(2), 165–171. https://doi.org/10.1016/j.jbtep.2009.12.002

Mussel, P., & Hewig, J. (2016). The life and times of individuals scoring high and low on dispositional greed. Journal of Research in Personality, 64, 52–60. https://doi.org/10.1016/J.JRP.2016.07.002

Mussel, P., & Hewig, J. (2019). A neural perspective on when and why trait greed comes at the expense of others. Scientific Reports, 9(1), https://doi.org/10.1038/s41598-019-47372-5

Mussel, P., Reiter, A. M. F., Osinsky, R., & Hewig, J. (2015). State- and trait-greed, its impact on risky decision-making and underlying neural mechanisms. Social Neuroscience, 10(2), 126–134. https://doi.org/10.1080/17470919.2014.965340

Mussel, P., Rodrigues, J., Krumm, S., & Hewig, J. (2018). The convergent validity of five dispositional greed scales. Personality and Individual Differences, 131, 249–253. https://doi.org/10.1016/J.PAID.2018.05.006

Phelps, E. A., Lempert, K. M., & Sokol-Hessner, P. (2014). Emotion and decision making: Multiple modulatory neural circuits. Annual Review of Neuroscience, 37, 263–287. https://doi.org/10.1146/annurev-neuro-071013-014119

Rodrigues, J., Allen, J. J. B., Müller, M., & Hewig, J. (2021). Methods matter: An examination of factors that moderate predictions of the capability model concerning the relationship of frontal asymmetry to trait measures. Biological Psychology, 158, 107993. https://doi.org/10.1016/j.biopsycho.2020.107993

Rodrigues, J., Caporale, L., Euen, I., Schäfer, S., Schneider, B., & Hewig, J. (2022). You get what you deserve! Reactance, greed and altruism in the dictator game with offer suggestions by the receiver. Personality and Individual Differences, 185, 111271. https://doi.org/10.1016/j.paid.2021.111271

Rodrigues, J., Weiß, M., Mussel, P., & Hewig, J. (2022). On second thought … the influence of a second stage in the ultimatum game on decision behavior, electro-cortical correlates and their trait interrelation. Psychophysiology, 59(7), e14023. https://doi.org/10.1111/psyp.14023

Schluter, M. G., Kim, H. S., & Hodgins, D. C. (2018). Obtaining quality data using behavioral measures of impulsivity in gambling research with Amazon’s Mechanical Turk. Journal of Behavioral Addictions, 7(4), 1122–1131. https://doi.org/10.1556/2006.7.2018.117

Schmidt, B., Kanis, H., Holroyd, C. B., Miltner, W. H. R., & Hewig, J. (2018). Anxious gambling: Anxiety is associated with higher frontal midline theta predicting less risky decisions. Psychophysiology, 55(10), e13210. https://doi.org/10.1111/psyp.13210

Schwenkmezger, P., & Hodapp, V. (1991). The state-trait anger expression inventory. Zeitschrift Fur Klinische Psychologie Psychopathologie Und Psychotherapie, 39(1), 63–68.

Seuntjens, T. G., van de Ven, N., Zeelenberg, M., & van der Schors, A. (2016). Greed and adolescent financial behavior. Journal of Economic Psychology, 57, 1–12. https://doi.org/10.1016/j.joep.2016.09.002

Seuntjens, T. G., Zeelenberg, M., Van De Ven, N., & Breugelmans, S. M. (2015). Dispositional greed. Journal of Personality and Social Psychology, 108(6), 917–933. https://doi.org/10.1037/pspp0000031

Spielberger, C. D. (1988). Manual for the state trait anger expression inventory. Psychological Assessment Resources. http://www.worldcat.org/title/staxi-2-state-trait-anger-expression-inventory-2-professional-manual/oclc/44846684

Tabachnick, B. G., & Fidell, L. S. (2014). Using multivariate statistics. Pearson.

Tett, R. P., & Guterman, H. A. (2000). Situation Trait Relevance, Trait Expression, and Cross-Situational Consistency: Testing a Principle of Trait Activation. Journal of Research in Personality, 34(4), 397–423. https://doi.org/10.1006/jrpe.2000.2292

The jamovi project (2021). jamovi (Version 1.8) [Computer Software]. Retrieved from https://www.jamovi.org.

Weller, J. A., Levin, I. P., & Denburg, N. L. (2011). Trajectory of risky decision making for potential gains and losses from ages 5 to 85. Journal of Behavioral Decision Making, 24(4), 331–344. https://doi.org/10.1002/bdm.690

Xu, P., Van Dam, N. T., van Tol, M. J., Shen, X., Cui, Z., Gu, R., Qin, S., Aleman, A., Fan, J., & Luo, Y. (2020). Amygdala-prefrontal connectivity modulates loss aversion bias in anxious individuals. Neuroimage, 218(116957). https://doi.org/10.1016/j.neuroimage.2020.116957

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rodrigues, J., Ruthenberg, P., Mussel, P. et al. Never mind losing the pound… still got the penny! The influence of trait greed on risky decision behavior in a mixed and gain only BART. Curr Psychol 42, 24399–24409 (2023). https://doi.org/10.1007/s12144-022-03553-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12144-022-03553-6