Abstract

We developed a “thinking-behavior-outcome” logical framework to explore the effect of entrepreneurs’ cognitive flexibility on dual innovation and the performance of new ventures, drawing on social cognitive theory, and collected data from a sample of 293 new ventures through a questionnaire to conduct an empirical analysis. We find that entrepreneurs’ cognitive flexibility may indirectly affect the performance of new ventures by influencing their dual innovation activities; resource management capabilities positively moderate the relationship between entrepreneurs’ cognitive flexibility and dual innovation. In addition, our study demonstrates that dual innovation equilibrium has a stronger effect on the performance of new ventures than single-dimensional innovation activities. Our study highlights the importance of entrepreneurial cognitive flexibility for new ventures to implement innovation strategies and improve performance. The findings not only help to clarify the relationship between entrepreneurs’ cognitive flexibility and new venture performance and to enrich social cognitive theory, but they also provide new perspectives on responses to enhance dual innovation capabilities of new ventures under the influence of COVID-19.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the era of the knowledge economy, new ventures have flourished and become an important force in promoting China’s economic development (Lin et al., 2018). However, new ventures have disadvantages such as a lack of resources and insufficient innovation capacity (Anwar et al., 2022). Under the pressure of uncertain markets, globalization, and increasing competition, many new business ventures have been eliminated after a short period of time. According to Anwar et al. (2020), over 70% of new ventures in China fail in the first year. Therefore, promoting the growth of new ventures and improving their performance have become key topics of discussion among scholars.

Prior research on performance enhancement in new ventures has focused extensively on the role of entrepreneurial orientation (Anwar et al., 2022), dynamic capabilities (Razmdoost et al., 2020), and external networks (Zhang et al., 2020). While previous research has provided important insights on how to enhance the performance of new ventures, relatively little research has been done from the perspective of entrepreneurs’ cognitive flexibility. The level of entrepreneurial cognitive flexibility (i.e., the tendency of entrepreneurs’ thinking to adapt to changes in the external environment) may be an important factor in promoting new ventures’ performance. Existing research shows cognitive flexibility helps increase entrepreneurs’ creativity, problem-solving abilities, and recognition of new semantic relationships (Dajani & Uddin, 2015). Entrepreneurs with high cognitive flexibility do not focus on one point but rather deal with the whole process, develop new ideas, and adopt solutions that are in sync with the changing environment (Martin et al., 2011). The development of effective cognitive thinking by entrepreneurs to quickly respond to environmental changes may be the key to the survival and growth of new ventures (Edwards et al., 2006). Therefore, in an increasingly competitive environment, exploring how entrepreneurs can exercise cognitive flexibility to enhance the performance of new ventures is worthwhile.

However, to date, scholars have not reached a “consensus” on the activities and behaviors through which cognitively flexible entrepreneurs indirectly influence new venture performance. Existing research linking entrepreneurs’ cognitive flexibility to firm performance suggests the process between entrepreneurs’ cognitive flexibility and firm performance falls primarily within the domain of innovation (Kiss & Barr, 2017). Scholars have found that flexible thinking is an essential characteristic of creativity (Tushman & O’Reilley, 1996). Cognitively flexible entrepreneurs tend to be innovative and change minded, which can, to some extent, facilitate innovative activities in new ventures, which in turn leads to improved performance (Oo et al., 2018). At the same time, cognitively flexible entrepreneurs can switch between different modes of thinking and are more likely to pursue both exploratory and exploitative innovations. Therefore, we incorporated dual innovation into our theoretical framework to examine its mediating effect between entrepreneurs’ cognitive flexibility and new ventures’ performance.

Moreover, among the existing studies on resources and capabilities, resource-based theory emphasizes that heterogeneous resources are the main inducing factor of performance differences (Barney et al., 2021) and firms need to acquire and maintain competitive advantages by continuously acquiring special resources. However, it is difficult for firms to develop core competencies by merely possessing heterogeneous resources and then neglecting to manage them. Therefore, scholars have begun to realize that competitive advantage is gained not only from possessing resources but, more importantly, from managing those resources (Ray et al., 2004). Resource orchestration theory emphasizes that the effectiveness of organizational resource allocation depends on the construction, allocation, and utilization of those resources (Chadwick et al., 2015), or in other words, only through effective resource management behaviors can resources be released. New ventures often face the dilemma of scarce resources and difficult access to heterogeneous resources, but if they can improve their resource management capabilities to better allocate and balance resources between exploitative and exploratory innovation (O’Reilly & Tushman, 2013), new ventures are more likely to compensate for the dilemma of core resource shortage and better promote dual innovation activities in new ventures. Based on this information, we introduce resource management capabilities as a moderating variable to explore their potential effect on the relationship between entrepreneurs’ cognitive flexibility and dual innovation.

Theoretical Framework

Social Cognitive Theory

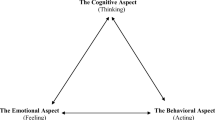

In the 1980s, Bandura proposed a social cognitive theory based on social learning theory. Social cognitive theory believes that people are subjective and self-regulating and that they not only passively reflect the social environment but also actively shape and change it (Liñán & Fayolle, 2015). SCT integrates cognitive, behavioral, and environmental perspectives to provide a comprehensive framework for examining individual cognition and its outcomes (Bandura, 2006), and part of the theory’s appeal is its focus on the influence of individual cognition on technological innovation behavior. Oo et al. (2018) found that entrepreneurs’ own cognitive thinking influences to some extent their behavior in dealing with innovative activities. Kiss et al. (2020) found that entrepreneurs with higher cognitive flexibility scores tend to be more likely to engage in creative activities, and that entrepreneurial innovative behavior may be an important component of a firm’s innovative activities. Therefore, social cognitive theory provides a useful framework to study the mechanisms by which cognitive factors explain innovative behavior. In our analysis, we draw on ideas from social cognitive theory to explore the impact of entrepreneurial cognitive flexibility on dual innovation and the performance of new ventures.

Hypotheses Development

Entrepreneurs’ cognitive flexibility and new Venture performance

One of the most widely used definitions of cognitive flexibility that we adopted in this study refers to individuals’ ability to generate new strategies and solutions in response to environmental changes in the face of rapidly changing contexts (Miller et al., 2012). At the same time, they are able to flexibly mobilize their cognitive resources to choose solutions that are appropriate in different situations. Substantial empirical evidence now exists that entrepreneurs’ cognitive flexibility can drive the performance of new ventures (Liñán & Fayolle, 2015). Their behavior can take two forms, facilitative behavior, where new solutions are proposed to seize and exploit fleeting opportunities (Barbey et al., 2013), and prohibitive behavior, where problems and deficiencies in the firm are identified and adjustments are made (Miron-Spektor & Beenen, 2015).

First, entrepreneurs with high cognitive flexibility tend to work harder on information-seeking activities (Kiss et al., 2020) and stay focused and keenly aware of changes in the external environment (Dajani & Uddin, 2015). This suggests that entrepreneurs with cognitive flexibility are more likely to acquire new knowledge and information from the external environment (Martin et al., 2011), which can help them think outside of their old habits and develop new ideas through further learning (Barbey et al., 2013). In this way, new ventures have a greater probability of realizing new market opportunities, expanding their share of new markets, and thus increasing their profitability. Second, scholars have found that entrepreneurs with greater cognitive flexibility tend to be innovative and change minded (Martin & Wilson, 2016), and then adjust new ventures’ irrational goals, organizational structure and resource allocations, and transform pathways in a timely manner to avoid capacity rigidity and organizational inertia problems in new ventures. This suggests that entrepreneurs with cognitive flexibility are able to identify problems in the business in a timely manner and make adjustments to reduce the damage to new ventures’ cash flow from bad business. Therefore, we hypothesize the following:

H1: Entrepreneurs’ cognitive flexibility has a positive and significant effect on new venture performance.

Mediating Effect of Dual Innovation

Entrepreneurs’ cognitive flexibility and dual Innovation

Benner and Tushman (2003) classified innovation into exploitative and exploratory based on the nature of technological change and the degree of knowledge creation. Exploitative innovation is an incremental innovation activity in which firms improve and integrate existing knowledge and technology to meet the needs of existing consumer groups (Benner & Tushman, 2003), whereas exploratory innovation is a leapfrog innovation activity that creates new technology and products, and provides products and services to new consumer groups (Jansen et al., 2006). Due to their limited resources and experience, new ventures have difficulty balancing exploratory and exploitative innovation. Recent studies has found that cognitively flexible entrepreneurs to switch between and adjust to tasks by shifting their attention to different forms of thinking (Smith & Tushman, 2005). We believe that this may be an important differentiating factor for entrepreneurs to successfully cope with dual innovation.

First, research has shown that the higher the cognitive flexibility of entrepreneurs, the greater their search for external information (Li et al., 2013) and the greater their access to new information and knowledge in external networks (Wu & Shanley, 2009). Accordingly, entrepreneurs are more likely to generate completely new ideas and solutions to cope with environmental changes, providing guidance and assistance to corporate R&D activities and promoting exploratory innovation activities based on knowledge creation (Helfat & Peteraf, 2015). Furthermore, entrepreneurs with high cognitive flexibility tend to exhibit stronger curiosity and creativity (Martin & Wilson, 2016), which suggests that they are more likely to create a work climate that explores risk, tolerates failure, and inspires R&D staff to innovate, which in turn, helps new ventures to develop new technologies and products and enhances exploratory innovation activities in new ventures (Taylor & Greve, 2006).

Second, cognitively flexible entrepreneurs are willing to interpret existing knowledge and information from multiple perspectives. This suggests that they are more likely to improve the operational efficiency of existing knowledge, refine existing cognitive models. Consequently, all of this helps to provide more solutions for companies to optimize and enhance their current business. In addition, we believe that entrepreneurs with a high degree of cognitive flexibility tend to be more perceptive to changes that occur in the external environment (Barbey et al., 2013). Cognitively flexible entrepreneurs have the motivation and ability to link the external environment to their own body of knowledge and technological capabilities to choose the most contextually adaptive strategy. Accordingly, these strategies and solutions help new ventures to update and improve existing products and services to meet the needs of existing customer groups, which in turn, enhances the exploitative innovation activities of new ventures.

Dual Innovation and New Venture performance

From the existing literature, both technological innovations of dual innovation have a positive effect on the improvement of organizational performance (Li et al., 2021). The strategic innovation literature also argues that dual innovation is critical to the growth of business performance (Crossan & Apaydin, 2010). However, existing studies have mainly explored the relationship between dual innovation and mature firm performance (Agnihotri, 2015), few empirical studies have addressed new venture (Kiss et al., 2020). Therefore, great theoretical and practical value lies in exploring the relationship between dual innovation and the performance of new ventures.

Research has shown that new ventures that adopt an exploratory innovation strategy can stimulate the creation of new products and technologies by facilitating communication within and between different firms (Li et al., 2013). Through the new products and technologies created, new ventures are able to rapidly seize new market opportunities and meet the needs of new consumer groups, and then increase new market shares (O’Reilly & Tushman, 2013). In addition, research has also shown that exploratory innovation can help new ventures create entirely new value chain systems using new technologies and new knowledge (Karimi & Walter, 2016). Creating these value chain systems facilitates the creation of customer value and the capture of firm value, which further enhances the performance of new ventures.

In addition, scholars have found that through exploitative innovation, new ventures are able to replicate or apply developed knowledge to related areas of operation (Jansen et al., 2006). New ventures’ use of market-tested, more mature knowledge can reduce both problems in product development and innovation activities that are out of step with the market, and improve the survival and effectiveness of products in the market and to reduce the risk of exploratory innovation activities. In addition, existing research suggests that new ventures that adopt an exploitative innovation strategy are able to expand their relationship networks, become more sensitive to changes in consumer needs in the market, and explore market points of interest (Wang et al., 2012). Accordingly, new ventures update and improve existing products and services to provide superior services to existing customers (O’Reilly & Tushman, 2008). Therefore, we hypothesize the following:

H2: Dual innovation has a mediating effect between entrepreneurs’ cognitive flexibility and new venture performance.

Dual Innovation Balance and New Venture performance

The innovation process is complex and full of risks and uncertainties. Under the condition of limited resources, how should new ventures handle the complex relationship between exploratory and exploitative innovation, which has become a growing concern in both theoretical and practical circles.

We argue that if new ventures rely on only one of the innovation activities, either exploitative or exploratory, their business risk is significantly increased and their performance is affected. Existing research suggests that when new ventures focus too much on exploitative innovation at the expense of exploratory innovation, team members tend to focus on existing knowledge and technology and rely too much on the original path to combine technology and knowledge at the expense of other more effective solutions (Li et al., 2021). Accordingly, this focus tends to create team members’ stereotypes and reduces the organization’s access to heterogeneous information and resources from innovation networks, which may lead to “capability rigidity” and hinder further innovation and growth of new ventures (Kiss et al., 2020). Conversely, when new ventures focus too much on exploratory innovation at the expense of exploitative innovation, they tend to devote more of their limited resources to exploratory innovation activities. Studies have shown that exploratory innovation is characterized by high risk and uncertainty, both of which make it easy for new ventures to fall into the “innovation trap,” resulting in the “explore-fail-explore” cycle, which may eventually fail due to resource depletion (O’Reilly & Tushman, 2013). At the same time, if a new product is developed without a sound marketing strategy or fails to solve a customer’s “pain point,” it may not open up the market, and the innovation may not be rewarded.

Real-world business practices also show that new ventures can quickly become extinct because of severe imbalances when they rely on purely exploratory or exploitative innovations. We argue that when new ventures can find a relative balance between exploratory and exploitative innovation, they can develop new products and services to explore new markets through exploratory innovation. At the same time, new ventures can improve and enhance existing products and services to strengthen existing markets through exploitative innovation and assist exploratory innovation to improve the effectiveness of new product development. At this point, exploitative and exploratory innovation activities are synergistic, which significantly reduces the riskiness of innovation activities and more effectively improves the performance of new ventures (O’Reilly & Tushman, 2013). Therefore, we hypothesize the following:

H3: The effect of dual innovation equilibrium on the performance of new ventures is stronger than that of single-dimensional innovation activities.

Moderating effect of Resource Management Capability

A firm develops resource management capability by constructing, integrating, and utilizing resources (Lahiri et al., 2012). Resource orchestration theory suggests that resources themselves are not necessarily the key to effective operations but rather their management (Chadwick et al., 2015). The same resources are combined for different purposes or approaches, which may ultimately lead to different outcomes.

We argue that new ventures with high resource management capabilities can effectively enhance the effectiveness of entrepreneurs’ cognitive flexibility for dual innovation. Specifically, high resource management capabilities compensate to some extent for the lack of core resources in new ventures by optimizing and reorganizing existing resources (Chadwick et al., 2015). This facilitates the concrete landing of solutions generated by cognitively flexible entrepreneurs and provides appropriate resource support for dual innovation in new ventures. In addition, high resource management capabilities enable new ventures to quickly and accurately acquire, integrate, and release resources needed for dual innovation based on market needs and opportunities, better allocate and balance resources between exploitative and exploratory innovation, and increase the effectiveness of dual innovation activities (O’Reilley & Tushman, 2013). Conversely, new ventures with low resource management capabilities tend to lose sight of one or the other, or the resource categories are too convergent or discrete, which tends to gradually reinforce single-dimensional innovation behavior (Kiss et al., 2020), reducing its effect on dual innovation. In summary, we argue that high resource management capabilities can optimize the effect of entrepreneurs’ cognitive flexibility generation and thus effectively promote dual innovation activities in new ventures. Therefore, we hypothesize the following:

H4: Resource management capabilities positively moderate the relationship between entrepreneurs’ cognitive flexibility and dual innovation.

Method

Power Analysis

We performed power analysis using G*Power 3.1 software to determine the appropriate sample size required for this study (Faul et al., 2009). Specifically, we estimated the sample size needed based on a regression model with seven explanatory variables (four control variables plus one independent variables and two mediator variables, totaling seven explanatory variables) assuming an effect size of f2 = 0.15, an alpha error of 0.05, and beta power of 0.95. The resulting minimum sample size was calculated to be 153. This suggests that our study required a minimum of 153 samples to detect effects.

Sample and data Collection

To test our hypothesis, we used a questionnaire to collect data from 293 entrepreneurs of Chinese new ventures. We chose to conduct the survey in China because China is the fastest growing economy in the world in terms of emerging markets, new ventures have become an important force for China’s economic development, and new ventures’ share of China’s economic output is large (Lin et al., 2018). In addition, among the listed companies in China’s Growth Enterprise Market and New OTC Market, there are a large number of new ventures with large space for sample selection, and exhaustive annual reports publicly disclosed by companies, which provide rich data for our study. Therefore, the research target of this paper are mainly from the new ventures in Growth Enterprise Market and New OTC Market. Referring to Li and Atuahene-Gima’s (2001) definition of new ventures, we selected firms that are less than eight years old for the study.

Pretest

First, we translated the English scale and back-translated it to ensure its accuracy and invited five experts in the innovation field to identify and revise the items. Second, we selected 15 entrepreneurs for the pretest, adjusted the expression of the items based on the feedback during the pretest to ensure the surface validity and content validity of the scale within an acceptable range, and formed the final questionnaire. After completing the pretest, we randomly sampled 500 entrepreneurs and contacted them via email and phone to confirm their consent to participate in a survey on their firm’s innovation activities.

Formal research

We conducted formal research through both field and online research. To ensure the authenticity of the data in both types of research, we carefully communicated to the entrepreneurs that the survey was for academic research purposes only and that any information would be kept strictly confidential. For offline research, we communicated with the entrepreneurs and confirmed the research time; then the research team went to the companies to collect data in the field, mainly in Qingdao, Jinan, and Beijing. Because of the geographic distance and the COVID-19, we sent the questionnaires to some of the entrepreneurs via email for online research and informed them of the research notes; then the entrepreneurs returned the completed questionnaires via email. Based on previous experience and the nature of the variables, we adopted three stages of data collection, each three months apart, which can attenuate the homoscedasticity bias to some extent and also provide a more precise measure of causality.

In the first period, we distributed the control variables and independent variable questionnaires to 500 entrepreneurs. We collected 369 questionnaires, and obtained 341 valid questionnaires by excluding those with three or more missing questions and those with obvious patterns of responses. In the second period, the 341 entrepreneurs that had filled in the questionnaires effectively in the first periods were given mediator and moderator questionnaires. From those, we collected 324 questionnaires, and obtained 312 valid questionnaires by excluding those with three or more omitted questions and those with obvious patterns of answers. In the third period, the 312 entrepreneurs that had filled in the questionnaires effectively in the first two periods were given the dependent variable questionnaires. Among them, 299 questionnaires were collected, and by excluding those with three or more omitted questions and those with obvious answer patterns, we finally obtained 293 valid questionnaires, with a valid return rate of 58.6%.

Measurement

Independent variable

The measure of cognitive flexibility is based on a measure developed and validated by Martin and Rubin (1995) and ranges from 1 (strongly disagree) to 5 (strongly agree). The scale measures the performance of entrepreneurs in terms of thinking, perceptions, and behaviors, including 12 questions such as “I can communicate an idea in many different ways”, “I am willing to solve problems creatively”, “I have many possible ways to behave in any situation” and “When faced with a real-life problem on a particular topic, I apply my knowledge flexibly”.

Mediating variable

The measure of dual innovation is based on a measure developed and validated by Jansen et al. (2006), consisting of 14 items rated on a scale from 1 (strongly disagree) to 5 (strongly agree). The scale measures the performance of new ventures’ innovation activities in terms of products, services, and markets, and includes seven exploitative innovation questions such as “The company can regularly implement small improvements to existing products and services”, and “The company can maximize the development and utilization of existing markets through economies of scale”, and seven exploratory innovation questions such as “The company can continue to invent new products and services”, and “The company can often make effective use of new opportunities in those new markets”.

The balance of dual innovation

We derive the mathematical expression (x + y) / 2 that measures the balance of dual innovation (exploratory innovation (x) and exploitative innovation (y)).

Moderator

The measure of resource management capability is based on a measure developed and validated by Wayne et al. (2005), ranging from 1 (strongly disagree) to 5 (strongly agree). The scale measures the performance of new ventures in acquiring, integrating, and utilizing resources, including 10 questions such as “The company can acquire resources according to the requirements of the changing external environment”, “The company can integrate various resources according to development needs” and “The company can allocate various resources reasonably according to the changing environment”.

Dependent variable

To measure the performance of new ventures, we use the Performance Scale developed by Li and Atuahene-Gima (2001) for Chinese new ventures, which consists of 9 items on a scale of 1 (strongly disagree) to 5 (strongly agree). The scale measures the performance of new ventures in terms of profit, return, cash flow, and market share growth, covering five financial questions and four market questions.

Control Variables

First, we controlled for entrepreneurial education, where the educational background of entrepreneurs influences to some extent their own perceptions and the importance they place on innovative activities (Sousa et al., 2019). We measured the level of education of entrepreneurs by the highest degree they obtained. The codes were as follows: 1 = high school education or less, 2 = junior college’s degree, 3 = undergraduate’s degree, 4 = master’s degree, and 5 = doctoral degree. Second, we controlled for firm size because different firm sizes may affect the effect of entrepreneurial cognitive flexibility on firm innovation (Agnihotri, 2015). In SMEs, entrepreneurs play a central role in corporate decision-making and strategic choices (Kiss & Barr, 2017). As firm size increases, the influence of entrepreneurs tends to be diminished. We coded 50 and below as 1, 51–100 as 2, 101–500 as 3, 501–1000 as 4, and 1001 and above as 5. Again, we controlled for industry type because firms in high tech industries are more likely to carry out various innovative activities compared to other industries (Visnjic et al., 2019). We categorized the industry types into high tech industry, traditional manufacturing, business services, financial industry, real estate industry, and other industries and coded them as follows: 1 = high tech industry, 2 = traditional manufacturing, 3 = business services, 4 = financial industry, 5 = real estate industry, and 6 = other industries. Finally, we also control for the business region of the enterprise, which influences the growth process and experience of the enterprise to some extent and has an impact on the strategic decision of the enterprise (Ma et al., 2013). Therefore, we divided the business operation regions of the enterprises into Yangtze River Delta region, Beijing-Tianjin-Tanggu region, Pearl River Delta region, Midwest region, and Northeast region, and coded them as follows: 1 = Yangtze River Delta region, 2 = Beijing-Tianjin-Tanggu region, 3 = Pearl River Delta region, 4 = Midwest region, and 5 = Northeast region.

The education of entrepreneurs is mainly concentrated in junior college’s degree (15.02%), undergraduate’s degree (50.51%), and master’s degree (25.26%); the size of enterprises is mainly concentrated in 51–100 people (26.96%) and101-500 people (23.55%); the industry distribution is in high tech industry (16.72%), traditional manufacturing industry (23.21%), business services industry (24.91%), financial industry (19.80%), real estate industry (8.87%), and other industry (6.49%); enterprises’ business regions are distributed in the Yangtze River Delta region (18.09%), Beijing-Tianjin-Tangshan region (23.89%), Pearl River Delta region (32.08%), Midwest region (20.48%), and northeast region (5.46%).

Results

Reliability and validity

In terms of reliability test, we evaluated by calculating Cranbach’s α coefficient and combined reliability (CR). The results show the Cranbach’s alpha coefficient of cognitive flexibility is 0.961, the Cranbach’s alpha coefficient of exploitative innovation is 0.928, the Cranbach’s alpha coefficient of exploratory innovation is 0.932, the Cranbach’s alpha coefficient of resource management capability is 0.948, and the Cranbach’s alpha coefficient of new venture performance is 0.945. At the same time, the CR value of cognitive flexibility was 0.955, the CR value of exploitative innovation was 0.929, the CR value of exploratory innovation was 0.933, the CR value of resource management capability was 0.949, and the CR value of new venture performance was 0.946. In summary, the values of Cranbach’s α coefficient and CR of all variables were above 0.7, indicating that the scale as a whole had good reliability.

To test the validity of our constructed model, validated factor analysis (CFA) was first performed to test the discriminant validity. The results were shown in Table 1. The five-factor model (χ2/ Df = 1.480, p < 0.05; RMSEA = 0.041, RMR = 0.024, CFI = 0.960, TLI = 0.957, IFI = 0.960) had the best fit indicators compared to the four-factor, three-factor, two-factor, and one-factor models. In addition, the square root of the AVE values of each variable is greater than the correlation coefficients with other variables, indicating that the study model has good discriminant validity among the constructs. In terms of convergent validity, the five-factor model fit was good (χ2/ Df = 1.480, p < 0.05; RMSEA = 0.041, RMR = 0.024, CFI = 0.960, TLI = 0.957, IFI = 0.960). Also, the factor loadings corresponding to the question items were all greater than 0.7 and the AVE values were all greater than 0.5, indicating that our measures had good convergent validity.

Correlation analysis

To ensure that multicollinearity did not influence the results, we performed descriptive statistical analyses for each variable. The results show that the correlation coefficients between all variables are below 0.70, indicating that the impact of multicollinearity in this study was small. Also, as seen in Table 2, cognitive flexibility was significantly positively correlated with dual innovation (r = 0.322, P < 0.01; r = 0.339, P < 0.01). Cognitive flexibility was significantly positively correlated with the performance of new ventures (r = 0.430, P < 0.01). Dual innovation was significantly positively correlated with the performance of new ventures(r = 0.265, P < 0.01; r = 0.360, P < 0.01). The above results are consistent with our research hypothesis.

Regression analysis

We use hierarchical regression approach to test for H1 and H3. First, model 1 contains the results of the baseline model with control variables only. In model 2, we add the independent variable (cognitive flexibility), and the results show a positive and significant effect of cognitive flexibility on the performance of new ventures (M2, β = 0.425, p < 0.01). H1 is validated.

From Table 3 we can see that the balance of dual innovation has a positive and significant effect on the performance of new ventures (M5, β = 0.374, p < 0.01), and the effect of dual innovation balance on the performance of new ventures is better than exploitative innovation (M3, β = 0.247, p < 0.01), exploratory innovation (M4, β = 0.356, p < 0.01) single dimension of innovation activity. H3 is validated.

Mediating Effect Test

To verify the mediating effect of dual innovation between cognitive flexibility and new venture performance, we applied the bootstrap method to verify the mediating effect (Hayes, 2009). We set the number of samples to 5000 with 95% confidence intervals using the Process 2.16 macro program. As can be seen from Table 4, the p-values of the mediating effect between cognitive flexibility and new venture performance for exploitative and exploratory innovations are 0.042 and 0.000, respectively; while the confidence intervals at the 95% level are (0.001, 0.093) and (0.025, 0.157), respectively. Both of which do not include 0, indicating that dual innovation has a mediating effect in the relationship between cognitive flexibility and new venture performance. H2 is verified.

Moderating Effect Test

We examined the moderating effect of resource management capabilities using the Process 3.4 macro program (Hayes, 2009). As can be seen from Table 4, the p-values of the interaction term between cognitive flexibility and resource management capability on exploitative and exploratory innovation are 0.001 and 0.002, respectively, while the confidence intervals at the 95% level are (0.099, 0.358) and (0.082, 0.346), respectively, neither of which includes 0. This indicates that resource management capability has a moderating effect between cognitive flexibility and dual innovation, thus verifying H4. To further clarify the moderating effect of resource management capability, this paper performs a simple slope analysis. We add or subtract one standard deviation from the mean value of resource management capability, in order to get the two Numbers as a benchmark for the drawing. From Figs. 1 and 2, we can see that the positive effect of cognitive flexibility on dual innovation is stronger when the degree of resource management capability is high compared to contexts where the degree of resource management capability is low, again verifying the existence of the moderating effect of resource management capability.

Robustness test

To ensure the stability and general applicability of the study results, we performed additional tests. Because the paper’s research target was mainly the new ventures in the Growth Enterprise Board and New OTC Market, we used the average ROI of the local Growth Enterprise Board and New OTC Market of the surveyed firms instead of self-rated dependent variable (data from the China Economic and Financial Research Database) for alternative tests (Kogan & Papanikolaou, 2013). As seen in Table 3, cognitive flexibility has a positive contribution to the ROI (M7, β = 0.155, p < 0.05); dual innovation has a mediating effect between cognitive flexibility and the ROI (M11, β = 0.144, p < 0.05). These results are generally consistent with our baseline regression findings, thus increasing the robustness of our results.

Common method variance tests

Data generated from single-respondent surveys can create common method variance problems (CMV). To address this issue, we implemented procedural remedies during the data collection phase. Specifically, we adopted three phases of data collection, with each time period separated by three months, which can attenuate the common method variance problem (CMV) to some extent. We also conducted a factor analysis by means of Harman’s one-way ANOVA test to assess the common method variance problem (CMV). The results showed that the variance explained by the first principal component was 33.4% and the total variance explained was 70.3%, which did not exceed 50% of the total explained variance, indicating that our homogeneous variance problem had a low impact. In addition, we performed additional tests. For the dependent variable we used an alternative measure, using the average ROI of the local Growth Enterprise Board and New OTC Market of the surveyed firms as a proxy (Kogan & Papanikolaou, 2013). As we can see from Table 3, hypotheses H1, H2 are supported. These results are generally consistent with our initial findings, indicating that our common method variance problem (CMV) is less influential.

Discussion

This is an empirical study of the cognitive flexibility of entrepreneurs. We draw on the perspectives of social cognitive theory to examine the role of entrepreneurs’ cognitive flexibility in the pursuit of dual innovation and new ventures’ performance.

First, our findings suggest that entrepreneurial cognitive flexibility has a positive and significant impact on the performance of new ventures. Cognitively flexible entrepreneurs are more likely to consider an idea from various perspectives, design multiple solutions to a problem, and switch their thinking and behavior effectively across situations to choose the most effective solution, thus contributing with greater probability to the improvement of performance. Second, we further find that the effect of entrepreneurial cognitive flexibility on the performance of new ventures is mediated by dual innovation. Entrepreneurs with higher cognitive flexibility tend to be more stronger curiosity and creativity (Tushman & O’Reilley, 1996), while they are more likely to switch and adapt between different modes of thinking and more likely to pursue both exploratory and exploitative innovation activities (Martin et al., 2011), which in turn facilitates the improvement of new ventures’ performance. Again, our findings suggest that dual innovation balance has a better effect on new venture performance than single-dimensional innovation activities. By combining both exploitative and exploratory types of innovation, dual innovation strategies can maintain short-term performance and gain long-term competitiveness, improving the performance of new ventures to a greater extent. Finally, our findings suggest that resource management capabilities positively moderate the relationship between entrepreneurs’ cognitive flexibility and dual innovation. Entrepreneurs’ cognitive flexibility generates solutions more at the brainstorming level, and resource management capabilities facilitate the specific implementation of solutions generated by cognitively flexible entrepreneurs by better distributing resources between exploitative and exploratory innovation (Chirico et al., 2011) to improve the facilitation of the dual innovation activities of new ventures.

Theoretical contributions

Our study makes several contributions. First, in existing research, social cognitive theory is commonly applied in the field of sociological and educational research (Liñán & Fayolle, 2015) and is less addressed in existing research in the field of innovation (Kiss et al., 2020). We draw on social cognitive theory to link the literature on thinking cognitively and innovation to explore the potential mechanisms of entrepreneurs’ cognitive flexibility on dual innovation and in the performance of new ventures. The findings suggest that the entrepreneurs’ cognitive flexibility of entrepreneurs may play an important role in the successful pursuit of dual innovation activities and new venture performance. In this way, we extend the research on social cognitive theory to the innovation domain, which enriched the knowledge of social cognitive theory to a certain extent.

Second, we have contributed to dual innovation activities. In the context of industrial transformation and upgrading in China, it is particularly important to clarify how new ventures can enhance dual innovation while our understanding of the relationship between entrepreneurial cognitive flexibility and dual innovation remains limited. In this context, we linked the literature on thinking cognitively and innovation to include this antecedent explanatory variable of cognitive flexibility in the research model of dual innovation. The empirical results suggest that cognitively flexible entrepreneurs are more willing to engage in dual innovation activities. Thus, our findings add a new explanatory logic to the study of dual innovation drivers. This finding also supports the social cognitive theory that individuals’ cognitive thinking influences their behavior in dealing with innovative activities (Oo et al., 2018).

Again, we also contribute to the performance of new ventures. We explore the potential mechanisms of entrepreneurs’ cognitive flexibility in the performance of new ventures and demonstrate that the cognitive flexibility of entrepreneurs may play an important role in the successful pursuit of new venture performance. Existing research is unclear about how entrepreneurs’ cognitive flexibility affects new venture performance (Liñán & Fayolle, 2015). We validate the role of dual innovation as a “pivot” in the process of entrepreneurs’ cognitive flexibility influencing new venture performance and identify a new pathway from entrepreneurs’ cognitive flexibility to new venture performance. At the same time, we empirically demonstrate that the effect of dual innovation balance on the performance of new ventures is better than that of single-dimensional innovation activities, providing new ideas for new ventures to improve their performance.

Finally, most of the existing literature emphasizes the important role of heterogeneous resources in the dual innovation process and does not draw attention to the management and optimization of resources. We linked the literature related to cognitive flexibility and resource management by introducing resource management capabilities as a moderating variable and verified that resource management capabilities positively moderate the relationship between entrepreneurs’ cognitive flexibility and dual innovation. In this way, our study reveals how resource management ability influence the path of entrepreneurial cognitive flexibility to promote new ventures’ dual innovation activities, and enriches the theoretical research on the combination of resource management ability and entrepreneurial cognition to a certain extent. Our study also enriches the knowledge of resource orchestration theory to a certain extent (Chadwick et al., 2015), extending the applicability of resource orchestration theory in entrepreneurial cognitive contexts.

Practical implications

First, we found that cognitive flexibility is an important factor in promoting dual innovation in new ventures and improving their performance. Given its importance, entrepreneurs should consciously train and enhance this skill. On the one hand, we suggest that entrepreneurs can enhance their cognitive flexibility by training their critical or divergent thinking to avoid the trap of stereotypes (Barbey et al., 2013). On the other hand, entrepreneurs can further enhance their cognitive flexibility by building flexible organizational structures and expanding their relational networks (Martin et al., 2011) to enhance specialized knowledge-seeking capabilities (Kiss et al., 2020).

Second, our study found that dual innovation has a significant effect on the performance of new ventures, and the effect of dual innovation equilibrium on the performance of new ventures is stronger than that of single-dimensional innovation activities. Therefore, new ventures should invest more in R&D activities, encourage exploration and risk-taking behavior, and create an organizational climate conducive to innovation. At the same time, new ventures should effectively coordinate exploitative and exploratory innovation activities to maximize the performance of new ventures (O’Reilly & Tushman, 2013).

Again, we find that resource management capabilities may play a moderating role in entrepreneurs’ cognitive flexibility for dual innovation and are a necessary complementary part of the pathway of entrepreneurs’ cognitive flexibility to dual innovation research. New ventures often face the dilemma of resource scarcity, and new ventures should focus on improving their comprehensive capabilities of acquiring, utilizing, creating, and optimizing resources (Chadwick et al., 2015) to better allocate and balance resources between exploitative and exploratory innovation to achieve sustainable development of new ventures.

Implications and Limitations

Although our research has achieved some research results, there are some limitations that represent opportunities for future research. First, we explored only the positive effects of cognitive flexibility on dual innovation and new venture performance. Excessive cognitive flexibility may give rise to a variety of “peculiar” and market-disconnected solutions and ideas, reducing the effectiveness of innovation activities. In the future, we should further explore the effective boundary of cognitive flexibility so as to give full play to its positive effects and reduce its negative effects on dual innovation and new venture performance. Second, the variable survey in this paper uses the subjective evaluation type questionnaire method, which makes it difficult to avoid the phenomenon of personal subjective preference and may cause bias in the research results. In the future, we can adopt a contextual experiment to measure cognitive flexibility variables. Again, the role of entrepreneurs’ cognitive flexibility and dual innovation capability on the performance of new ventures may change gradually over time and with changes in the environment. In the future, we should consider adopting a cross-time series approach to collect data to enhance the reliability of the study results. Finally, our goal in this study was to provide the most plausible and theoretically grounded explanation linking entrepreneurs’ cognitive flexibility to dual innovation activities. However, the management literature suggests that entrepreneurial personality traits (e.g., extroversion, easygoingness, responsibility, emotional stability, openness to experience) influence business intentions, creativity, and the success of the firm (Presenza et al., 2020). Therefore, we suggest that entrepreneurial personality traits may also play an important role in the pursuit of dual innovation activities and new venture performance, and that future research could be conducted in more depth from the perspective of entrepreneurial personality traits, which may yield a more comprehensive understanding of the existing findings.

Conclusions

In this study, we linked the literature on social cognitive theory and innovation to examine how entrepreneurs’ cognitive flexibility affects dual innovation activities and new venture performance. Our findings suggest that cognitively flexible entrepreneurs have a positive and significant impact on new venture performance (H1). Dual innovation has a mediating effect on the process of entrepreneurs’ cognitive flexibility affecting the performance of new ventures (H2). Also, we found that dual innovation balance has a better effect on new venture performance than single-dimensional innovation activities (H3). Finally, we verified that resource management capabilities positively moderate the relationship between entrepreneurs’ cognitive flexibility and dual innovation (H4). Overall, the findings of this study add evidence to social cognitive theory, the influence of cognitive flexibility on the performance of new ventures, and the antecedents of dual innovation.

Data Availability

All data generated or analyzed during this study are included in this published article.

References

Agnihotri, A. (2015). Low-cost innovation in emerging markets. Journal of Strategic Marketing, 23(5), 399–411. https://doi.org/10.1080/0965254X.2014.970215

Anwar, M., Clauss, T., & Issah, W. B. (2022). Entrepreneurial orientation and new venture performance in emerging markets: the mediating role of opportunity recognition. Review of Managerial Science, 16(3), 769–796. https://doi.org/10.1007/s11846-021-00457-w

Bandura, A. (2006). Toward a Psychology of Human Agency. Perspectives on Psychological Science, 1(2), 164–180. https://doi.org/10.1111/j.1745-6916.2006.00011.x

Barbey, A. K., Colom, R., & Grafman, J. (2013). Architecture of cognitive flexibility revealed by lesion mapping. Neuroimage, 82, 547–554. https://doi.org/10.1016/j.neuroimage.2013.05.087

Barney, J. B., Ketchen, D. J., & Wright, M. (2021). Resource-Based Theory and the Value Creation Framework. Journal of Management, 47(7), 1936–1955. https://doi.org/10.1177/01492063211021655

Benner, M. J., & Tushman, M. L. (2003). Exploitation, exploration, and process management: The productivity dilemma revisited. Academy of Management Review, 28(2), 238–256. https://doi.org/10.5465/amr.2003.9416096

Chadwick, C., Super, J. F., & Kwon, K. (2015). Resource orchestration in practice: CEO emphasis on SHRM, commitment-based HR systems, and firm performance. Strategic Management Journal, 36(3), 360–376. https://doi.org/10.1002/smj.2217

Crossan, M. M., & Apaydin, M. (2010). A multi-dimensional framework of organizational innovation: A systematic review of the literature. Journal of management studies, 47(6), 1154–1191. https://doi.org/10.1111/j.1467-6486.2009.00880.x

Dajani, D. R., & Uddin, L. Q. (2015). Demystifying cognitive flexibility: Implications for clinical and developmental neuroscience. Trends in neurosciences, 38(9), 571–578. https://doi.org/10.1016/j.tins.2015.07.003

Edwards, J. R., Cable, D. M., Williamson, I. O., Lambert, L. S., & Shipp, A. J. (2006). The phenomenology of fit: linking the person and environment to the subjective experience of person-environment fit. Journal of applied psychology, 91(4), 802–827. https://doi.org/10.1037/0021-9010.91.4.802

Faul, F., Erdfelder, E., Buchner, A., & Lang, A. G. (2009). Statistical power analyses using G*Power 3.1: Tests for correlation and regression analyses. Behavior Research Methods, 41(4), 1149–1160. https://doi.org/10.3758/BRM.41.4.1149

Hayes, A. F. (2009). Beyond Baron and Kenny: Statistical mediation analysis in the new millennium. Communication monographs, 76(4), 408–420. https://doi.org/10.1080/03637750903310360

Helfat, C. E., & Peteraf, M. A. (2015). Managerial cognitive capabilities and the microfoundations of dynamic capabilities. Strategic Management Journal, 36(6), 831–850. https://doi.org/10.1002/smj.2247

Jansen, J. J., Van Den Bosch, F. A., & Volberda, H. W. (2006). Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Management Science, 52(11), 1661–1674. https://doi.org/10.1287/mnsc.1060.0576

Karimi, J., & Walter, Z. (2016). Corporate entrepreneurship, disruptive business model innovation adoption, and its performance: The case of the newspaper industry. Long Range Planning, 49(3), 342–360. https://doi.org/10.1016/j.lrp.2015.09.004

Kiss, A. N., & Barr, P. S. (2017). New product development strategy implementation duration and new venture performance: A contingency-based perspective. Journal of Management, 43(4), 1185–1210. https://doi.org/10.1177/0149206314549251

Kiss, A. N., Libaers, D., Barr, P. S., Wang, T., & Zachary, M. A. (2020). CEO cognitive flexibility, information search, and organizational ambidexterity. Strategic Management Journal, 41(12), 2200–2233. https://doi.org/10.1002/smj.3192

Kogan, L., & Papanikolaou, D. (2013). Firm characteristics and stock returns: The role of investment-specific shocks. Review of Financial Studies, 26(11), 2718–2759. https://doi.org/10.1093/rfs/hht026

Lahiri, S., Kedia, B. L., & Mukherjee, D. (2012). The impact of management capability on the resource-performance linkage: Examining Indian outsourcing providers. Journal of World Business, 47(1), 145–155. https://doi.org/10.1016/j.jwb.2011.02.001

Li, H. Y., & Atuahene-Gima, K. (2001). Product innovation strategy and the performance of new technology ventures in China. Academy of management Journal, 44(6), 1123–1134. https://doi.org/10.2307/3069392

Li, Q., Maggitti, P. G., Smith, K. G., Tesluk, P. E., & Katila, R. (2013). Top management attention to innovation: The role of search selection and intensity in new product introductions. Academy of Management Journal, 56(3), 893–916. https://doi.org/10.5465/amj.2010.0844

Li, R., Peng, C., Koo, B., Zhang, G., & Yang, H. (2021). Obtaining sustainable competitive advantage through collaborative dual innovation: empirical analysis based on mature enterprises in eastern China. Technology Analysis and Strategic Management, 33(6), 685–699. https://doi.org/10.1080/09537325.2020.1839043

Lin, Y. H., Chen, C. J., & Lin, B. W. (2018). The dual-edged role of returnee board members in new venture performance. Journal of Business Research, 90, 347–358. https://doi.org/10.1016/j.jbusres.2018.05.021

Liñán, F., & Fayolle, A. (2015). A systematic literature review on entrepreneurial intentions: citation, thematic analyses, and research agenda. International Entrepreneurship and Management Journal, 11(4), 907–933. https://doi.org/10.1007/s11365-015-0356-5

Ma, X., Tong, T. W., & Fitza, M. (2013). How much does subnational region matter to foreign subsidiary performance? Evidence from Fortune Global 500 Corporations’ investment in China. Journal of International Business Studies, 44(1), 66–87. https://doi.org/10.1057/jibs.2012.32

Martin, L., & Wilson, N. (2016). Opportunity, discovery and creativity: A critical realist perspective. International Small Business Journal, 34(3), 261–275. https://doi.org/10.1177/0266242614551185

Martin, M. M., Staggers, S. M., & Anderson, C. M. (2011). The relationships between cognitive flexibility with dogmatism, intellectual flexibility, preference for consistency, and self-compassion. Communication Research Reports, 28(3), 275–280. https://doi.org/10.1080/08824096.2011.587555

Martin, M., & Rubin, R. (1995). A new measure of cognitive flexibility. Psychological Reports, 76(2), 623–626. https://doi.org/10.2466/pr0.1995.76.2.623

Miller, T. L., Grimes, M. G., McMullen, J. S., & Vogus, T. J. (2012). Venturing for others with heart and head: How compassion encourages social entrepreneurship. Academy of Management Review, 37(4), 616–640. https://doi.org/10.5465/amr.2010.0456

Miron-Spektor, E., & Beenen, G. (2015). Motivating creativity: The effects of sequential and simultaneous learning and performance achievement goals on product novelty and usefulness. Organizational Behavior and Human Decision Processes, 127, 53–65. https://doi.org/10.1016/j.obhdp.2015.01.001

O’Reilly, I. I. I., C. A., & Tushman, M. L. (2008). Ambidexterity as a dynamic capability: Resolving the innovator’s dilemma. Research in Organizational Behavior, 28, 185–206. https://doi.org/10.1016/j.riob.2008.06.002

O’Reilly, I. I. I., C. A., & Tushman, M. L. (2013). Organizational ambidexterity: Past, present, and future. Academy of Management Perspectives, 27(4), 324–338. https://doi.org/10.5465/amp.2013.0025

Oo, P. P., Sahaym, A., Juasrikul, S., & Lee, S. Y. (2018). The interplay of entrepreneurship education and national cultures in entrepreneurial activity: a social cognitive perspective. Journal of International Entrepreneurship, 16(3), 398–420. https://doi.org/10.1007/s10843-018-0229-4

Presenza, A., Abbate, T., Meleddu, M., & Sheehan, L. (2020). Start-up entrepreneurs’ personality traits. An exploratory analysis of the Italian tourism industry. Current Issues in Tourism, 23(17), 2146–2164. https://doi.org/10.1080/13683500.2019.1677572

Ray, G., Barney, J. B., & Muhanna, W. A. (2004). Capabilities, business processes, and competitive advantage: choosing the dependent variable in empirical tests of the resource-based view. Strategic Management Journal, 25(1), 23–37. https://doi.org/10.1002/smj.366

Razmdoost, K., Alinaghian, L., & Linder, C. (2020). New venture formation: A capability configurational approach. Journal of Business Research, 113, 290–302. https://doi.org/10.1016/j.jbusres.2019.09.047

Smith, W. K., & Tushman, M. L. (2005). Managing strategic contradictions: A top management model for managing innovation streams. Organization Science, 16(5), 522–536. https://doi.org/10.1287/orsc.1050.0134

Sousa, M. J., Carmo, M., Gonçalves, A. C., Cruz, R., & Martins, J. M. (2019). Creating knowledge and entrepreneurial capacity for HE students with digital education methodologies: Differences in the perceptions of students and entrepreneurs. Journal of Business Research, 94, 227–240. https://doi.org/10.1016/j.jbusres.2018.02.005

Taylor, A., & Greve, H. R. (2006). Superman or the fantastic four? Knowledge combination and experience in innovative teams. Academy of Management Journal, 49(4), 723–740. https://doi.org/10.5465/amj.2006.22083029

Tushman, M. L., & O’Reilly, I. I. I., C. A (1996). Ambidextrous organizations: Managing evolutionary and revolutionary change. California Management Review, 38(4), 8–30. https://doi.org/10.2307/41165852

Visnjic, I., Ringov, D., & Arts, S. (2019). Which Service? How Industry Conditions Shape Firms’ Service-Type Choices. Journal of Product Innovation Management, 36(3), 381–407. https://doi.org/10.1111/jpim.12483

Wang, C. L., Tee, D. D., & Ahmed, P. K. (2012). Entrepreneurial leadership and context in Chinese firms: a tale of two Chinese private enterprises. Asia Pacific Business Review, 18(4), 505–530. https://doi.org/10.1080/13602381.2012.690257

Wu, J. F., & Shanley, M. T. (2009). Knowledge stock, exploration, and innovation: Research on the United States electromedical device industry. Journal of Business Research, 62(4), 474–483. https://doi.org/10.1016/j.jbusres.2007.12.004

Zhang, J. A., O’Kane, C., & Chen, G. (2020). Business ties, political ties, and innovation performance in Chinese industrial firms: The role of entrepreneurial orientation and environmental dynamism. Journal of Business Research, 121, 254–267. https://doi.org/10.1016/j.jbusres.2020.08.055

Acknowledgements

This study is supported by the National Social Science Fund Key Project of China (20AZD095). The authors would like to express their gratitude to the usable answers of survey respondents and valuable comments of the anonymous reviewers.

Funding

This study is supported by the National Social Science Fund Key Project of China (20AZD095).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design (mainly from Qingjin Wang). Material preparation, data collection and analysis were performed by Kaiyun Zhang, Changlin Han, Yang Gao. The first draft of the manuscript was written by Renbo Shi and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethical Statement

In the research process of this paper, there is no ethical issues, no moral disputes, after the review of the academic department of Qingdao University.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest. All authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wang, Q., Shi, R., Zhang, K. et al. The impact of entrepreneurs’ cognitive flexibility on the business performance of New Ventures: an empirical study based on Chinese New Ventures. Curr Psychol 42, 24668–24681 (2023). https://doi.org/10.1007/s12144-022-03532-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12144-022-03532-x