Abstract

If the future is indeed uncertain, then is the subjective riskiness of future gains and losses amount-dependent? To address this question, we performed two experiments, one regarding hypothetical monetary gains and the other regarding hypothetical monetary losses. Our main objective was to determine whether the magnitude effect observed in delay discounting can be explained by the subjective probability of receiving a future outcome. We employed a well-grounded discounting paradigm with a fixed-sequence procedure and the Subjective Probability Questionnaire across different magnitudes of gains and losses. We replicated prior findings indicating that the magnitude effect (observed in delay discounting) or the reverse magnitude effect (observed in probability discounting) are present for monetary gains but not for monetary losses. We found that the subjective probability of receiving future outcomes is amount-dependent for gains but not for losses. We propose that the magnitude effect can be a by-product of the risk associated with future payoffs of different magnitudes, as shown by mediation analysis. Our secondary goal was to investigate the form of the subjective probability function over time to determine if the change in risk inherent in delay is best described by the hyperbolic or exponential equations. We demonstrate that delay and probability discounting, as well as the subjective probability function, are best described by a simple hyperbolic model.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

One common method to investigate the role of risk in intertemporal decision making is by stating it explicitly—directly—in the choice situation (Cox and Dallery 2016; Vanderveldt et al. 2015).

However, in most situations, the risk involved in choice is not stated in such a manner. Instead, risk is spontaneously incorporated in delays, i.e., it is implicit in time or in the occurrence of future events themselves. Patak and Reynolds (2007) and Reynolds et al. (2007) investigated how much risk is associated with delays. Using a rating scale, these authors found that people indeed spontaneously incorporate risk into delays. This concept was extended by Takahashi et al. (2007) who measured perceived risk of future gains, and found that this risk increased with the delay. Their findings were in line with the theory developed by Sozou (1998), who stated that one explanation for discounting could be that outcomes are devalued with increasing delay, because the perceived risk of not obtaining an outcome also increases with increasing delay. We extend this line of research by including in our studies different signs and magnitudes of the delayed outcomes.

Delay discounting refers to the fact that the subjective value of an outcome decreases with the increase in delay associated with its receipt (Mazur 1987). Similarly, probability discounting is defined as the decrease in the subjective value of an outcome due to decreasing probability of receiving the outcome (Rachlin et al. 1991). Although several mathematical formulations of this process have been proposed (Franck et al. 2015; Mckerchar et al. 2009; Sozou 1998; Takahashi et al. 2007), we focus on two models, the hyperbolic (Eq. 1; Mazur 1987):

and exponential (Eq. 2; Samuelson 1937):

where V denotes the subjective value of a delayed or probabilistic outcome, A is the nominal, undiscounted amount of gain or loss, X is the delay until or odds against its receipt, b is a free parameter describing the rate of discounting, and e is the base of the natural logarithm. We focus on these two selected approaches, to extend the findings by Takahashi et al. (2007) to the domain of losses, and to determine the mathematical model that would best describe the subjective probability of future events over time.

A number of theories address the question of why discounting occurs. Those theories attempt to relate the delay and risk involved in decision-making and conceptualize whether one of these factors is fundamental to the discounting process. For example, it was proposed that delay discounting could be considered as a more fundamental process because choice under risk, when repeated, reflects a situation of repeated lotteries (Rachlin et al. 1986, 1991; Vanderveldt et al. 2017). For example, when people play a lottery in which winning is highly probable, they will have to repeat it relatively few times to win, as compared to a lottery in which winning has a low probability. Thus, the waiting time for the reward to be received is crucial because of the time it takes for the lottery outcome to materialize. The opposite may also be possible; other authors argue that different types of decisions can be reduced to choice in probabilistic terms (Benzion et al. 1989; Green and Myerson 1996). For example, the receipt of a delayed reward is risky because future events might prevent the receipt of a reward, or the reward itself may be unavailable at the time of its anticipated receipt (Fehr 2002). Following this approach, Kagel et al. (1986) noted that discounting delayed payoffs may be an adaptive response to the uncertainty associated with waiting for a reward whose receipt is set in the future.

Relating risk and delay also seems grounded in evolutionary psychology in that longer delay is associated with greater risk. Sozou (1998) takes a parallel path to explain the process of discounting. According to his hypothesis, outcomes (gains) are discounted because time inherently reflects a component of risk. In other words, the subjective value of an outcome diminishes as a function of delay because there is a component of risk inherent in time. Effectively, the longer we wait, the less probable it is that a gain or loss will occur—and this probability changes based on delay lengths in a hyperbolic manner. From an ecological perspective previously proposed by Green and Myerson (1996), the more time passes, the more risk there is that the reward will not be obtained.

The observation that rewards are devalued in an amount-dependent fashion with an increasing delay to reward receipt is referred to as the magnitude effect and is one of the most robust behavioral phenomena documented in delay discounting (Chapman 1996; Thaler 1981). Two studies by Green et al. (2013, 2014) examined the relation of the amount with delay discounting in the domains of gains and losses. Their main finding seems clear: the magnitude effect, i.e., the slower discounting of larger outcomes in delay discounting, is present in the domain of gains but not in the domain of losses. Although a number of explanations for this element of the magnitude effect have been proposed (Ballard and Knutson 2009; Grace and McLean 2005; Green and Myerson 1996; Green et al. 2004; Loewenstein and Prelec 1992; Thaler 1981), we propose an alternative which relies directly on the characteristics of gains and losses. Specifically, we argue that the perception of certainty of future events, may account for the presence of the magnitude effect.

An intriguing question was formulated by Green and Myerson (1996), who asked directly from an ecological perspective: “is there some way in which there is less risk associated with waiting for a large reward than for a small reward?” From an empirical perspective, Białaszek et al. (2015) observed an amount-dependent relation of probability and delay discounting. Risk measures correlated with impulsivity only with small outcomes, and this relationship disappeared as the payoffs increased in value in the domain of gains. These results, when linked with the notion that delay discounting can be partially reduced to risk preferences, implies an amount-dependent level of risk and provides the basis for a possible explanation of the mechanism underlying the magnitude effect: larger rewards are discounted less steeply because they are perceived as more certain than smaller rewards.

We propose that the direct answer to the question of the amount-dependent degree of risk inherent in a delay is that larger rewards are perceived as more certain than smaller rewards. However, in the domain of losses, most studies have shown that there is no observed relation of the amount with the discounting rate (Baker et al. 2003; Estle et al. 2006; Green et al. 2014; McKerchar et al. 2013; Mitchell and Wilson 2010), with certain exceptions in reports of magnitude effects in losses that are similar to those seen in gains (Chapman 1996; Ostaszewski and Karzel 2002; Thaler 1981). In addition, we expect no amount-dependent relation of the degree of risk inherent in delay when small and large losses are compared. Subsequently, because both small and large losses might be perceived as having the same future certainty, the magnitude effect would not be present in this domain.

The risk inherent in delay is captured by the Subjective Probability Questionnaire (SPQ) score (Takahashi et al. 2007). This measure reflects an individual estimate of the likelihood of obtaining a monetary gain or incurring a loss at variable points in the future. The same Eqs. (1 and 2) can be used to fit the models to the function relating to the delay, probability, and subjective probability of obtaining a future outcome. Specifically, we investigated the mathematical formulation of the subjective probability of obtaining a future outcome by fitting the following two equations, hyperbolic:

and exponential:

where SP refers to the subjective probability of a future event (gain or a loss), expressed as its probability, b refers to the rate of change of that probability, and D stands for delay. In this case, as b increases, the more future events are perceived as being uncertain. Sozou (1998); see also Patak and Reynolds 2007) hypothesized that delay discounting stems from an increase in the subjective risk associated with the delay. With such an assumption, the exponential form of risk inherent in delay could not account for the well-documented empirical phenomenon of preference reversals in intertemporal choices (e.g., Ainslie 1975; Green et al. 1981). Takahashi et al. (2007) have shown that such a subjective probability function takes the hyperbolic form (Appendix III, Takahashi et al. 2007), which is why we hypothesize that the shape of the SPQ function should be hyperbolic. To the best of our knowledge, only Takahashi et al. (2007) have demonstrated, to date, that subjective probability changes, based on the hyperbolic model. We extend this research to the domain of losses to provide a rationale for the presence of the magnitude effect in delay discounting. The aims of the present study are: (1) to test the hypothesis of the mediating role of risk inherent in delay on the relation between amount of an outcome and delay discounting in the domains of gains and losses with similar procedures; (2) to demonstrate how delay discounting, probability discounting, and the subjective probability of obtaining future rewards are associated; and (3) to investigate the form of the delay discounting, probability discounting and the subjective probability of obtaining delayed rewards.

Method

Two analogous studies were conducted, one in the domain of gains and the other in the domain of losses. We investigated delay discounting, probability discounting, and the subjective probability of receiving or losing hypothetical monetary outcomes across small and large payoffs. The tasks and analyses in both experiments were very similar.

Participants

The participants were undergraduate university students recruited on-campus. The research protocol was approved by the local Ethics Committee, and participants gave informed consent prior to participation. As compensation, the participants were given bonus course credit for their participation. A total of 141 participants (71 in small gain condition, 70 in large gain condition) completed Study 1. Study 2 was based on responses from 145 participants (72 in small loss condition, 73 in large loss condition). All of the participants were undergraduate students (Study 1: 113 females and 28 males, M (SD) = 27.32(8.09) years; Study 2: 115 females and 30 males, M (SD) = 27.33(7.97) years).

Procedure and Materials

The procedures in Study 1 and 2 were very similar, with the main difference, that payoffs in the first one were gains, and in the second one – losses. All of the participants completed a delay discounting task, an SPQ task, and probability discounting task. The order of the delay and probability discounting tasks was counterbalanced, however the SPQ task always directly followed the delay discounting task. Within the delay tasks delays were always presented in ascending order, and the probabilities were presented in descending order. Delay and probability discounting tasks, as well as the SPQ tasks, were performed in two groups of participants, separate for gains and losses.

For the discounting tasks, we used a fixed choice procedure with a titrating value in a mixed experimental design, with outcome magnitudes (PLN 100 and 20,000; PLN 1 equaled approximately 0.26 USD at the time of the study) as the between-subjects factor; the within-subjects factors included varying delay times (1 month, 6 months, 1 year, 3 years, 5 years, 10 years, and 20 years) or probabilities of receiving gain or a loss (95%, 90%, 75%, 50%, 33%, 10%, and 5%). Participants were tasked with choosing from pre-set lists of hypothetical monetary alternatives for each delay period and the probability of receiving a payoff. The behavioral discounting tasks were administered using the pen-and-paper method. Choice alternatives were contained in Columns A and B on separate pages. Whether the amount was a gain or a loss and its delay and probability were specified at the top of every page. Column A included rows with immediate or certain payoff alternatives, whereas Column B included rows with payoff alternatives that were delayed or probable. The participants indicated their preferences by circling a chosen option in each appropriate row, until their preferences shifted from Column A to Column B, and then they marked all remaining values from that column to the bottom of the page.

Given that the initial choice between payoffs in Column A and Column B was made in the topmost row, the difference between the tasks in gains and losses conditions was that for gains, the first value in Column A was a nominal, undiscounted amount available immediately that then decreased in subsequent rows. For losses, the first value in column A was 0, which increased in subsequent rows. Effectively, immediate or certain alternatives were presented in a descending order (from PLN 100 or 20,000 to 0 in 32 decrements) in the gain condition or in an ascending order (from 0 to PLN 100 or 20,000 in 32 increments) in the loss condition. However, the delayed or probable alternatives were held constant at PLN 100 or 20,000 PLN for small and large payoff conditions, respectively. The procedures in Study 2 differed from that of Study 1 in that immediate or certain losses were presented in an ascending order (as opposed to Study 1, where immediate or certain gains were presented in a descending order), so that in both studies participants switched from Column A to Column B. Such choice is more natural, because of the way we are thought to read in our culture (from left to right). Such task presentation ensured also standard instructions given by team pollsters in case of any questions regarding the procedure. Each delay time or probability condition was presented on a separate page in gains and in losses.

The SPQ task was similar to a fill-in-the-blank method (Weatherly et al. 2011) and was presented on a single page. This task is used to measure the subjective probability of gaining or losing a specified amount of money after a given delay. The task was based on the previously developed Delay-Discounting Certainty Questionnaire (DDCQ), developed by Patak and Reynolds 2007, and a version adapted from the SPQ used by Takahashi et al. (2007). Our version differed from previous approaches in that it included both small and large payoff amounts of both possible gains and losses. We refer throughout to this procedure as yielding the estimate of future uncertainty, i.e., the risk inherent in delay. The procedures were identical for both domains. The gain condition included estimates of certainty associated with gaining PLN 100 or PLN 20,000, whereas the loss domain included estimates of certainty associated with losing PLN 100 or PLN 20,000. In every version of the SPQ (small or large gain and small or large losses), there were seven questions corresponding to seven delay periods: 1 month, 6 months, 1 year, 3 years, 5 years, 10 years, 20 years. These delays were identical to those in the delay discounting procedure. Similarly, as in the discounting procedures, this task was also presented with minimal information regarding the nature of the source or the form of the payoffs.

In the SPQ task, participants estimated the subjective degree of the certainty of receiving (or losing) a small or large (PLN 100 or PLN 20,000) monetary gain (or loss) delayed by 1 month, 6 months, 1 year, 3 years, 5 years, 10 years, and 20 years. An example of an instruction for the SPQ task in Study 1 (here: small monetary gains/losses with the first delay time of one month) was as follows (in Polish; instructions in brackets refer to either gain or loss conditions):

If you were to [receive/lose] PLN 100 in 1 month, how certain would you be of getting [losing] that money?

I estimate the certainty of [obtaining/losing] PLN 100 in 1 month at ___% (fill with a value from 0 to 100)

Measures and Analysis

The procedures used in the present study allow for inferences of the indifference points for each delay time and probability of payoff receipt, i.e., values that are equivalent for immediate or certain payoffs and their delayed or probable alternatives. In a fixed choice procedure with titrating value, an indifference point is taken from the last immediate or certain amount chosen over its delayed or probable alternative. This procedure is a standard, widely used discounting task (Madden et al. 1997; Odum et al. 2006; Rachlin et al. 1991).

Out of 286 cases, data for 13 were excluded from the analyses (in Study 1: 2 cases from large gain condition; in Study 2: 5 cases from small loss condition and 6 cases in large loss condition) due to nonsystematic discounting. The data were assumed to be systematic when the following criteria were met in both conditions (delay and probability): (1) the value of the first indifference point (with the highest probability or shortest delay) was higher than the last indifference point (this criterion assumes that delay decreases the value of a reward), and (2) the participant’s indifference points did not increase across consecutive delays (or probabilities) by more than 35% of the larger later or larger more probable reward. These criteria are similar to those used by Johnson and Bickel (2008), Berry et al. (2014), and Białaszek et al. (2015). The exclusion of 13 cases from the analyses did not affect analytical decisions or the conclusions drawn from the data.

For the primary analysis, mediation analysis was performed on the area under the curve (AUC; Myerson et al. 2001) to test the hypothesis of the mediating role of risk inherent in delay on the relationship between the amount of the reward and the discounting rate. We used the AUC instead of estimated parameters from model fits because the parameters are typically highly skewed, and the AUC is more normally distributed. In delay discounting, the AUC was computed for each participant, where the subjective value of the delayed outcomes changed in the function of delays. In probability discounting, as suggested by Rachlin et al. (1991), the probabilities were transformed into odds against (OA) through the following transformation: OA = (1-p)/p, where p is the probability of an outcome, and the AUC was obtained for each participant, reflecting the relation of the subjective value of outcomes against the OA. The AUC for SPQ scores was obtained for each individual, by computing area between points representing the subjective probability of a future outcome (SPQ score) in a function of delays. To verify our mediation hypothesis, we used the Process macro for SPSS (Hayes 2018). As suggested by Hayes and Scharkow (2013), to test the indirect effect in statistical mediation analysis, we used the recommended percentile bootstrap CI method.

In the final step of the analysis, we investigated the form of the delay discounting, probability discounting and the subjective probability of obtaining delayed rewards, which consisted of comparing the model fits described by Eqs. 1, 2 and 3 to the indifference points obtained from delay discounting, probability discounting, and SPQ. To fit the models, a nonlinear regression approach was used to estimate the residual sum of squares that were subsequently used to compute the second order Akaike Information Criterion (AICc; Akaike 1974). Following the guidelines from Burnham and Anderson (2002), we used the second-order AIC, which has an additional term for bias correction when the proportion of the data points to the number of parameters is low. The ΔAICcFootnote 1 enabled us to identify the best fitting model, which in this case, resulted in ΔAICc = 0.Footnote 2 Lower delta values for a model or AIC corresponded with a better model fit.

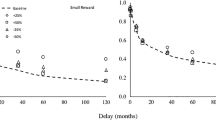

Results and Summary of Study 1: Gains

This part of the analyses was performed on data collected from 139 participants. As reported in the general method section, two cases were excluded due to nonsystematic discounting. First, we performed separate ANOVAs to test the basic effects of three measures: delay and probability discounting, and the risk inherent in delay. The dependent variable was always the AUC and group median indifference points under which the area was calculated are presented in Fig. 1. We found a magnitude effect present in delay discounting (F(1, 137) = 7.625; p = .007; η2 = .053), which means that large rewards (M (SD) = 0.432(0.253); 95% CI [0.369, 0.475]) were discounted at a slower rate than small rewards (M (SD) = 0.310(0.269); 95% CI [0.248, 0.371]) and a reverse magnitude effect in probability discounting (F(1, 137) = 29.696; p < .001; η2 = .178), which means that large gains (M (SD) = 0.130(0.126); 95% CI [0.089, 0.172]) were discounted at a higher rate than small payoffs (M (SD) = 0.289(0.206); 95% CI [0.249, 0.330]). The demonstration of the basic effects with regard to delay and probability discounting replicated previous findings. Furthermore, we found that obtaining large gains in the future was perceived as more probable (M (SD) = 0.446(0.256); 95% CI [0.387, 0.505]) than obtaining small gains (M (SD) = 0.305(0.234); 95% CI [0.248, 0.363]) at the same time (F(1, 137) = 11.442; p = .001; η2 = .077). This difference between the subjective probability (estimation of future risk) of small and large rewards led us to consider an implicit risk measure as a possible mediator in analysis of the magnitude effect in delay discounting.

In the second step, we used mediation analysis to investigate whether the risk inherent in delay, as measured by the SPQ AUC, would mediate the relationship between the amount of a reward and the delay discounting rate. Bootstrapping (n = 10,000 resamples, 95% CI) revealed a significant indirect effect of the amount of the reward on the discounting rate through the risk inherent in delay (SPQ AUC) (a × b = 0.049; BootSE = 0.019; BootCI(0.017; 0.091). Concurrently, the direct effect becomes statistically nonsignificant in the tested model (c’ = 0.074; SE = 0.044; BootCI(−0.013; 0.016). The model coefficients are shown in Table 1. These findings demonstrate that the magnitude effect in delay discounting may be attributed not only to the amount of reward itself but also it may be explained by the implicit risk that is linked to the delays in which rewards could be obtained in the future.

Table 2 presents the correlations between the main measures in our study. We found that there was a weak correlation between the SPQ score and delay discounting in the small reward (PLN 100) conditions; however, this correlation became moderate in the large reward conditions. Furthermore, the correlation between the SPQ score and probability discounting was not significant in the small reward (PLN 100) conditions but became significant (although weakly) in the large reward (PLN 20,000) conditions. For both small and large rewards, there was a significant relation between delay and probability discounting, suggesting that these processes shared some common variance (Table 2).

The final step in the analysis aimed to answer the question of whether the mathematical form of the investigated measures was hyperbolic, i.e., whether the subjective probability decay function could be specifically described in this form (as measured by the SPQ score). The analysis was performed on the full sample without excluding nonsystematic data because the curve-fitting process was able to detect nonsystematic data, effectively yielding a poor fit. In both the large and small gain conditions, analyses of AICc and ΔAICc values on group and individual levels, pointed to better fit of the hyperbolic model. Both indexes have the smallest values (smaller value corresponds to a better model fit) for the hyperbolic model in delay and probability discounting conditions, as well in SPQ across amount conditions (Table 3).

In the domain of gains, we found robust effects, i.e., for the magnitude effect in delay discounting and reverse magnitude effect in probability discounting. We also observed that large hypothetical monetary gains were subjectively perceived as more probable than small monetary gains. These results may explain the presence of the magnitude effect in delay discounting, because risk inherent in delays mediates the impact of amount of delay discounting rate. However, we note that we provide an indirect proof, because the design of the study does not allow for inferring a direct causal relationship between future certainty of a payoff and the rate of delay discounting. The correlations between probability and delay discounting were positive and significant, indicating that these processes are interrelated, at least to some degree. In addition, in both magnitude amounts, the SPQ score is correlated with a measure of delay discounting, indicating that the more the future is perceived as certain, the less discounting is associated with delay. Our final finding is that the shape of both discounting functions and the function relating the subjective perception of risk associated with delay fits best with the hyperbolic model.

Results and Summary of Study 2: Losses

We used the same type of data analysis in Study 2 as we employed in Study 1. The analyses were performed on AUC measures, from which we excluded 11 cases due to nonsystematic data. However, model fitting was performed on the full sample from this study. Neither the magnitude effect in delay discounting (F(1, 132) = 3.594; p = .060; η2 = .027; for small losses (M (SD) = 0.605(0.338); 95% CI [0.523, 0.687]), and large (M (SD) = 0.494(0.342); 95% CI [0.411, 0.576])) nor the reverse magnitude effect in probability discounting (F(1, 132) = 0.269; p = .605; η2 = .002; for small losses (M (SD) = 0.290(0.216); 95% CI [0.231, 0.350]), and large (M (SD) = 0.268(0.272); 95% CI [0.209, 0.328])) was found to be significant. In addition, there were no differences in the estimations of the subjective probability of incurring a small or large future loss (F(1, 132) = 0.270; p = .604; η2 = .002; for small losses (M (SD) = 0.442(0.314); 95% CI [0.367, 0.517]), and large (M (SD) = 0.414(0.309); 95% CI [0.339, 0.489])). The median group indifference points, showing three dependent variables between two amounts conditions, are presented in Fig. 2. Although all of the relations are not significant, some caution should be taken when interpreting the data, particularly the delay discounting results. Figure 2 shows an amount-dependent rate of discounting in delays of 10 and 20 years. However, this does not yield an overall significant result in AUC measures.

Similar to Study 1, in Study 2, we again performed mediation analysis with the AUC computed for delay discounting as a dependent variable, the loss amount as an independent variable, and the SPQ AUC as a mediator. Unlike in the gains conditions, in the losses condition, we found no support for the mediating role of risk inherent in delays on the relationship between the amount of loss and the rate of delay discounting. The bootstrapped confidence interval for the indirect effect did include zero (a × b = −0.005; BootSE = 0.011; BootCI(−0.030; 0.017), which means that this effect is not statistically significant. In addition, the direct effect in this model was not statistically significant (c’ = −0.107; SE = 0.058; BootCI(−0.222; 0.009). All coefficients for this model are presented in Table 4. This mediation analysis showed that in the domain of monetary losses, the risk inherent in delays (as measured by the SPQ AUC) does not mediate the relationship between the amount of reward and the discounting rate.

In Table 5, we present correlations between the AUC obtained in delay and probability discounting and in the SPQ score for the small and large loss conditions. There were no systematic correlations between the three measures. Only the delay and probability discounting seemed to be correlated; however, the relationship can only be classified as weak.

The next part of the analysis focused on the mathematical form of the SPQ score, i.e., the subjective probability decay function. In all of the conditions, we found that the hyperbolic model obtained a better fit for the subjective probability estimations. Also, the hyperbolic model obtained a better fit than the exponential in probability discounting. All of the model fit indices are presented in Table 6 for delay and probability discounting and for the SPQ score in small and large losses conditions. As in the gain conditions, following previous research, we found that the hyperbolic model in general better fits the data on both group and individual levels (Table 6). There is, however, one exception, i.e., in the delay discounting of large losses, where the median AICc points to a better fit of the exponential model. In small losses the superior is the hyperbolic model, however the ΔAICc supports the hyperbolic model.

In this study, we demonstrated that in the loss domain, the risk inherent in delay is amount-independent and, with or without SPQ AUC as a mediator, the magnitude effect in delay discounting is absent. Furthermore, the rate of probability discounting was similar, regardless of whether the participants discounted small or large losses. In addition, there was no systematic pattern of correlations between the three dependent variables observed. The form of delay discounting, probability discounting, and subjective probability of incurring delayed losses was in general hyperbolic.

Discussion

The present study sought to investigate the relationships among delay discounting, probability discounting, and the risk that is incorporated into delays (SPQ) in the domains of monetary gains and in losses of varying magnitudes. Our main finding is that risk incorporated into delay is amount-dependent in the domain of gains and amount-independent in the domain of losses. In other words, small monetary gains are perceived as less certain in time than large monetary gains. However, regardless of the amount, small and large losses are perceived as equally probable in the future. We propose that this finding may explain the magnitude effect present in delay discounting. Larger monetary gains are discounted at a lower rate, due to their increased subjective certainty to participants. Our mediation analysis confirmed the hypothesis that the relationship between the amount and delay discounting rate is mediated by the subjective probability of a future gain. Due to the correlational nature of our research, the reverse is also plausible, i.e., larger gains might be more certain due to the lower rate at which they are discounted. However, our main finding remains that participants perceive the certainty of future gains occurring in amount-dependent faction, whereas in the domain of losses certainty is amount-independent. Taken together, the results confirm previous results regarding the presence (for gains) or absence (for losses) of such effects as the magnitude effect (in delay discounting) or the reverse magnitude effect (in probability discounting). Furthermore, we show that the subjective probability of future rewards, i.e., the certainty of obtaining future consequences, declines hyperbolically in both loss and gain domains.

As shown by analyses of delay discounting across a wide range of amounts in the domain of gains and losses, the present study confirms the effects found in previous research (Green et al. 2013, 2014). In addition, previous research demonstrates that there is a reverse magnitude effect in probability discounting in gains (Green et al. 1999; Myerson et al. 2011) but also that probability discounting is amount-insensitive in the domain of losses (Green et al. 2014). All of these previous results were replicated in our two experiments.

To date, few explanations of the magnitude effect have been proposed (Grace and McLean 2005; Loewenstein and Prelec 1992; Myerson and Green 1995; Sawicki and Markiewicz 2016; Thaler 1981). However, there is not enough evidence yet to fully support any of the explanations mentioned above. For example, in mental accounting theory (Shefrin and Thaler 1988), the magnitude effect is the consequence of processing different magnitudes in separate mental accounts. Unexpected (typically small) and planned (typically large) amounts are connected to savings and planning (Loewenstein and Thaler 1989). This explanation, although straightforward and vivid, has little empirical support. Furthermore, it is unlikely that for each amount, a separate mental account would be created. In addition, this explanation does not explain why the magnitude effect is absent in the domain of losses. Another account views the magnitude effect as an effect of increasing the proportional sensitivity property of the utility function (Loewenstein and Prelec 1992), but Grace and McLean (2005) challenge this approach, obtaining different effects than those predicted by such theory.

Different explanations of not only the magnitude effect but also the mechanism of discounting (either probability or delay) are proposed by more behaviorally oriented research. For example, Raineri and Rachlin (1993) based their explanation on the assumption that all consumption takes time. The more of a given good we obtain, the more time we must invest to consume it, giving rise to a magnitude effect. Furthermore, such a view makes an implicit assumption that delay discounting is more of a basic process. Indeed, Vanderveldt et al. (2017) showed that probability discounting can be reduced to delay discounting. In their study, people treated long strings of gambles similarly to delay discounting. The opposite is also possible—that the delay may be viewed as risk. The other explanation, i.e., that risk is more fundamental, was proposed by Kagel et al. (1986) and provides some basis for the explanation as to why discounting takes a hyperbolic—and not exponential—form (Green and Myerson 1996). A similar account was more formally presented by Sozou (1998) and later modified and tested by Takahashi et al. (2007).

We propose that the underlying mechanism of the magnitude effect can be explained (at least partially) by the subjective probability of obtaining a reward or the subjective probability of losing a specified amount. We propose that in the domain of gains, the magnitude effect is present because larger payoffs are perceived as more probable. This effect was not present in losses where the participants perceived large and small losses as equally probable. In present results, the absence of the magnitude effect in losses coincided with lack thereof in the SPQ; it can be argued that loss discount rates were affected by delay time and not by their magnitudes. Correspondingly, one hypothesis proposed to account for the magnitude effect asymmetry between gain and loss domains is the dread effect, defined as the aversive anticipation of future losses (Loewenstein 1987; Loewenstein and Prelec 1991, 1993; Story et al. 2013), resulting in a preference to expedite losses and experiencing them sooner rather than later (to “get them out of the way”). Assuming the differential processing of future gains and losses, one explanation of the absence of the magnitude effect in losses could be that the aversive anticipation (dread) of future losses is a dominating decision component—which can effectively be amount-independent. Therefore, the individual preference to have an anticipated loss “out of the way” as soon as possible would be similar regardless of its amount. This explanation seems consistent with reports from Berns et al. (2006), who have incorporated the experiential (dis)utility of dread in the outcome utility model. The authors suggest that changes in preferences of negative outcomes do not result from the impact of the delay time on the outcome utility, but rather, what differentiates those preferences is the dread effect linked to loss delay and not its magnitude.

Present findings also relate to existing evidence on the effect of anticipated outcome on likelihood judgements. One possible explanation for larger rather than smaller rewards to be perceived as more probable to occur is the outcome desirability bias (for a review, see Krizan and Windschitl 2007). Specifically, more desirable outcomes should elicit an increase in the extent of expectations that such an outcome would occur. Therefore, if larger gains or smaller losses are more desirable than smaller gains or larger losses, they should elicit relatively higher optimism as to their future occurrence than the alternative, and result in elevated likelihood judgements pertaining to their occurrence at different points in time. Considering that empirical findings reviewed by Krizan and Windschitl (2007) suggest the desirability bias to be present in outcome predictions, but not in likelihood judgements, involving games of chance (see Krizan and Windschitl 2007), we provide some evidence that the desirability bias might be present in intertemporal choice, i.e., impacting the subjective probability estimates of an outcome occurring over time, depending on the desirability of that outcome. However, provided such an account is true, we should observe amount-dependent likelihood judgements (SPQ score) in gains and in losses, i.e., as larger gains (more desirable) are perceived as more likely, so should smaller losses (more desirable) be perceived as more likely. This was not the case in our study, as the difference between the subjective probability of obtaining a small or large future loss did not reach significance. Although, we do mention a visual trend (see Fig. 2) in that more delayed small losses (more desirable) seemed to be perceived as more likely to occur. Such an observation should be confirmed by future research to establish if desirability effects could be present in intertemporal choice.

Of note, the link between discounting rates and subjective probability estimations of outcome occurrence might also be explained by differential learning history with respect to outcome expectations, payoff amounts, delays, and outcome probabilities (for example, see Lee et al. 2012). It is plausible that such a learning history could produce greater devaluation of expected smaller rather than larger payoffs. Effectively, this learning history could influence both discounting rates of larger or smaller payoffs and subjective probability estimations. For example, although a payoff is cued to be received following a given delay time, learning history with probabilistically received payoffs can influence the subjective value of that payoff, as well as the subjective probability of its occurrence.

One of the most obvious approaches to relate risk and time is to examine correlations. It is not a dominant theoretical approach to propose that the longer one can wait, the more one can risk (Green et al. 2013; Mishra and Lalumière 2017). Instead, it is more common that the correlation between risk taking (probability discounting) and the ability to wait (expressed as delay discounting) should be negative if these constructs measure the same underlying trait—impulsivity. In such cases, impulsivity in risk taking would be risking the larger reward, foregoing the certain one, and in terms of delay, choosing what is immediate instead of a larger delayed option. Thus far, the empirical tests have been rather consistent, with researchers finding no correlation or a positive (mostly weak) correlation between rate of delay and probability discounting (Białaszek et al. 2015; Holt et al. 2003; Mitchell 1999; Myerson et al. 2003).

Furthermore, Sozou’s hypothesis with amendments from Takahashi et al. (2007) predicts a positive relation of delay discounting and the SPQ score. Our results are consistent with this notion—the less uncertain the future, the shallower the discounting. However, this theory does not specify the relation of probability discounting and the SPQ score. In fact, in our opinion, probability discounting and the SPQ score should be independent because future uncertainty connected to obtaining a gain or a loss is a different construct than devaluation in the function of probability. In other words, the SPQ score does not have to be correlated with probability discounting because the SPQ score simply states the individual’s perception of a future event, i.e., one that can be probable or not. However, SPQ should be correlated with the rate of delay discounting—the more likely the event in future, the more subjective value the event has for the decision maker.

Although Sozou’s theory is an important attempt to explain why discounting occurs, it also does not consider either the sign of the outcome or its magnitude. Therefore, the present experiments were conducted not only to directly test the theory but also to test additional hypotheses derived from the research field of discounting, particularly recent findings on the presence of the magnitude effect across a wide range of amounts in the domain of gains and its absence in losses (Green et al. 2013, 2014), in addition to earlier work that provided hypotheses relating the amount of future payoffs and their riskiness (Green and Myerson 1996). The explanation that the risk inherent in delay, i.e., an uncertain future, can be a mechanism underlying delay discounting is based on theoretical assumptions, and the design of our study does not allow for a causal inference. Moreover, it does not directly explain the presence of a reverse magnitude effect in probability discounting at each explicit probability of payoff occurrence. Instead, we focus primarily on the delay discounting mechanism.

Some limitations of this study relate to the general aspects of the procedure and data analysis. As we mentioned earlier, the design of our study does not allow for a causal inference, i.e., showing that the risk inherent in delay is responsible for the magnitude effect. This would be possible in an experiment in which the amount of risk inherent in delay would be systematically varied across conditions. Another concern is that in both studies, we used only one direction of presenting the immediate or certain values. Although Robles and Vargas (2008) and Robles et al. (2009) reported that discounting rates are dependent on the ascending or descending order, Rodzon et al. (2011) did not replicate this finding, obtaining similar estimates in the descending fixed-order sequence and multiple staircase method (which they referred to as the titrating method). In addition, there is a growing body of research (Beck and Triplett 2009; Hardisty et al. 2013a, b; Weatherly and Derenne 2013) that uses only fixed-direction sequencing (usually ascending) to present the outcomes, and we used such an approach to make the procedure shorter. In addition, another concern is related to the results of Study 2 in particular. A closer inspection of Fig. 2 suggests there may have been a difference between delay discounting rates of losses of different magnitudes. Specifically, the indifference points in the two largest delays (10 and 20 years) seem to point to possible amount-dependency in the domain of losses. Despite this observation, we noted no significant overall differences in discounting rate regarding delayed losses. One of the hypotheses that requires further investigation is that, although at the general, molar level, there is no amount-dependency in the discounting of delayed losses, more molecularly oriented analyses might yield insight into the possible interaction of the amount and delay in single indifference points (Yi et al. 2007). We are also aware that our results might be partially due to our choice of methods. There is a similarity among tasks that we used, and therefore similar response patterns might be artifactually generated by participants.

Hardisty et al. (2013a, b) showed that the discount rate can be negative for small losses. However, the procedure that we used does not allow for such choices. This procedural restriction is one of the limitations of the present study. This limitation is not only a problem for this procedure but also with others previously used (e.g., the adaptive staircase procedure; Du et al. 2002). Although less frequently used, one solution might be to use other adaptive procedures that allow participants to go beyond the outcome nominal value, such as Parameter Estimation by Sequential Testing (PEST; Klein-Flügge et al. 2015; Taylor and Creelman 1967). We used a standard and well-established procedure to ensure that the results are comparable with those in previous works and to extend this line of research to the domain of losses and outcome magnitudes.

In our study, the observed level of risk associated with a delay (SPQ) is substantial. However, research shows that when risk is delayed, it is less aversive than the same amount of risk accompanied by an immediate consequence (Noussair and Wu 2006; Shavit and Rosenboim 2015), which might suggest that although the present estimation of future uncertainty is much higher, when this uncertainty becomes delayed, it has a smaller impact on our decisions than when presented immediately, which may explain why we obtain such a degree of perception of the risk associated with delayed rewards. This effect may also be a by-product of the nature of the payoffs used in this study and their hypothetical nature. However, a large body of research shows that the procedures that involve hypothetical payoffs and real payoffs are comparable in this regard (Johnson and Bickel 2002; Madden et al. 2003; Matusiewicz et al. 2013). Nonetheless, previous studies (Patak and Reynolds 2007; Reynolds et al. 2007) also found similar results; that is, high risk associated with delayed rewards was obtained when quasi-real rewards were used, and one choice at the end of the procedure was honored. We used hypothetical payoffs because as just noted, such procedures yield reliable behavioral data. Furthermore, the range of amounts and delays that are usually used in research on discounting exceeds those that are practical to schedule for a real payoffs experiment. Nevertheless, we think that using real rewards and real losses might be interesting in studying, for example, sources of possible risk inherent in delay, other than trustworthiness of the payer.

In a simplified laboratory setting, it is assumed that the outcomes are perceived by participants as certain if they are stated as certain. Although the instructions state that the rewards will be certain, there is a possibility that participants will spontaneously incorporate risk into delays. The study by Kidd et al. (2013) showed that changing the reliability of the environment that we live in impacts our intertemporal decisions. By creating reliable and unreliable environments, they showed that children waited for the promised reward more than in an unreliable environment, where the choice consequences were not certain. It would be beneficial to study this notion or, to put it simply, the impact of instructions on delayed discounting results. Additionally, a common assumption is that impulsivity is a vice whereas self-control is a virtue, but in some environments, it may be more beneficial to take more now. For example, Otto et al. (2012) showed that some environmental scenarios can promote choosing a smaller immediate option when choosing one yields the larger overall payoff. A similar thing occurs when the future is uncertain and is not predictable. Our research showed that people attribute less risk to the future receipt of large positive payoffs. If the stakes are high, why not go for it? Small gains would not give us an advantage, but it would be the best strategy to gain something of exceptional value. On the other hand, we ask the question of why this mechanism is absent in negative outcomes. In modern societal environments, losses might seem inevitable, e.g., whether the loss is a small parking ticket or a demand for a large payment from the tax office, sooner or later we have to face them. A potential explanation comes from Berns et al. (2006), who demonstrated that individuals who dreaded a negative outcome to a different degree (mild or extreme dreaders) displayed no differential sensitivity to the magnitude of that outcome. The feelings of dread might be amount insensitive, but domain specific.

In the present research, we focused on the implicit nature of risk incorporated into the delay in obtaining future outcomes. There is much evidence suggesting that the risk inherent in delay might be a moderator in intertemporal choice. Notably, this viewpoint might explain why experimentally observed discount rates are higher compared to market interest rates (Senecal et al. 2012; see also Ainslie and Haslam 1992; Chabris et al. 2008; Frederick et al. 2002; Reynolds 2006). Indeed, recent findings point to the relationship between the utility derived from risk preferences and delay discounting rates (for a review, see Cheung 2016). Furthermore, Ferecatu and Önçüler (2016) have observed lower discount rates jointly elicited by delay and risk, compared to those under the assumption of risk neutrality. Findings that risk attitude can impact the delay discounting rate (Lopez-Guzman et al. 2018) have profound implications for attributing the differences between various populations to impulsivity, when in fact these results might reflect risk-taking. Here, we explored another possibility by inferring the risk preference from the valuation of future prospects. Positive correlations between the SPQ and delay and probability discount rate demonstrate (indirectly) that risky and intertemporal choices share some basic characteristics. For example, Luckman et al. (2018) have demonstrated that the choices under risk and delay can be explained by the same underlying model. We propose further research to include simultaneous discounting factors, as well as to disentangle the effects of risk and delay in choice situations.

The last promising hypothesis for further research comes from Reynolds et al. (2007). In that study, the authors compared adolescent smokers and nonsmokers and found that smokers perceived delayed rewards as less certain, which might possibly explain the differences in relation to addiction and increased temporal discounting that has been shown by recent robust meta-analyses (Amlung et al. 2017) and would provide a basis for experiments that also consider the perception of the certainty of future events.

Taken together, our findings provide a possible account for the mechanism of the magnitude effect, which, in our opinion, might be a product of the effects of large monetary gains being perceived as more certain across delays. We did not find an amount-dependent relation of the future inherent risk perception and the rate of temporal discounting in the domain of losses, which is in line with previous findings. We are aware, however, that we did not test any other explanations provided by theories explaining the magnitude effect.

Notes

Calculated using the formula ΔAICc = n*ln(SSe/n) + 2*p + (2*p*(p + 1))/(n-p-1), where n is number of data points (indifference points), p refers to the number of parameters in a model, and SSe is the residual (error) sum of squares obtained from nonlinear regression.

ΔAICc was calculated as the difference between AICc of a given model and AICc of the model with the best fit (lowest value), resulting in ΔAICc = 0 for the best model

References

Ainslie, G. (1975). Specious reward: A behavioral theory of impulsiveness and impulse control. Psychological Bulletin, 82(4), 463–496. https://doi.org/10.1037/h0076860.

Ainslie, G., & Haslam, N. (1992). Hyperbolic discounting. In G. Loewenstein & J. Elster (Eds.), Choice over time (pp. 57–92). New York: Russell Sage Foundation.

Akaike, H. (1974). A new look at the statistical model identification. IEEE Transactions on Automatic Control, 19(6), 716–723. https://doi.org/10.1109/TAC.1974.1100705.

Amlung, M., Vedelago, L., Acker, J., Balodis, I., & MacKillop, J. (2017). Steep delay discounting and addictive behavior: A meta-analysis of continuous associations. Addiction, 112(1), 51–62. https://doi.org/10.1111/add.13535.

Baker, F., Johnson, M. W., & Bickel, W. K. (2003). Delay discounting in current and never-before cigarette smokers: Similarities and differences across commodity, sign, and magnitude. Journal of Abnormal Psychology, 112(3), 382–392. https://doi.org/10.1037/0021-843X.112.3.382.

Ballard, K., & Knutson, B. (2009). Dissociable neural representations of future reward magnitude and delay during temporal discounting. NeuroImage, 45(1), 143–150. https://doi.org/10.1016/j.neuroimage.2008.11.004.

Beck, R. C., & Triplett, M. F. (2009). Test-retest reliability of a group-administered paper-pencil measure of delay discounting. Experimental and Clinical Psychopharmacology, 17(5), 345–355. https://doi.org/10.1037/a0017078.

Benzion, U., Rapoport, A., & Yagil, J. (1989). Discount rates inferred from decisions: An experimental study. Management Science, 35(3), 270–284. https://doi.org/10.1287/mnsc.35.3.270.

Berns, G. S., Chappelow, J., Cekic, M., Zink, C. F., Pagnoni, G., & Martin-Skurski, M. E. (2006). Neurobiological substrates of dread. Science, 312(5774), 754–758. https://doi.org/10.1126/science.1123721.

Berry, M. S., Sweeney, M. M., Morath, J., Odum, A. L., & Jordan, K. E. (2014). The nature of impulsivity: Visual exposure to natural environments decreases impulsive decision-making in a delay discounting task. PLoS One, 9(5), e97915. https://doi.org/10.1371/journal.pone.0097915.

Białaszek, W., Gaik, M., McGoun, E., & Zielonka, P. (2015). Impulsive people have a compulsion for immediate gratification certain or uncertain. Frontiers in Psychology, 6, 1–6. https://doi.org/10.3389/fpsyg.2015.00515.

Burnham, K. P., & Anderson, D. R. (2002). Model selection and multimodel inference: A practical information-theoretic approach (2nd ed.). Springer-Verlag. https://doi.org/10.1016/j.ecolmodel.2003.11.004

Chabris, C. F., Laibson, D., Morris, C. L., Schuldt, J. P., & Taubinsky, D. (2008). Individual laboratory-measured discount rates predict field behavior. Journal of Risk and Uncertainty, 37(2–3), 237–269. https://doi.org/10.1007/s11166-008-9053-x.

Chapman, G. B. (1996). Temporal discounting and utility for health and money. Journal of Experimental Psychology: Learning, Memory, and Cognition, 22(3), 771–791. https://doi.org/10.1037/0278-7393.22.3.771.

Cheung, S. L. (2016). Recent developments in the experimental elicitation of time preference. Journal of Behavioral and Experimental Finance, 11, 1–8. https://doi.org/10.1016/j.jbef.2016.04.001.

Cox, D. J., & Dallery, J. (2016). Effects of delay and probability combinations on discounting in humans. Behavioural Processes, 131, 15–23. https://doi.org/10.1016/j.beproc.2016.08.002.

Du, W., Green, L., & Myerson, J. (2002). Cross-cultural comparisons of discounting delayed and probabilistic rewards. Psychological Record, 52(4), 479–492.

Estle, S. J., Green, L., Myerson, J., & Holt, D. D. (2006). Differential effects of amount on temporal and probability discounting of gains and losses. Memory & Cognition, 34(4), 914–928. https://doi.org/10.3758/BF03193437.

Fehr, E. (2002). The economics of impatience. Nature, 415(6869), 269–272. https://doi.org/10.1038/415269a.

Ferecatu, A., & Önçüler, A. (2016). Heterogeneous risk and time preferences. Journal of Risk and Uncertainty, 53(1), 1–28. https://doi.org/10.1007/s11166-016-9243-x.

Franck, C. T., Koffarnus, M. N., House, L. L., & Bickel, W. K. (2015). Accurate characterization of delay discounting: A multiple model approach using approximate bayesian model selection and a unified discounting measure. Journal of the Experimental Analysis of Behavior, 103(1), 218–233. https://doi.org/10.1002/jeab.128.

Frederick, S., Loewenstein, G., & O’donoghue, T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40, 351–401. https://doi.org/10.1257/002205102320161311.

Grace, R. C., & McLean, A. P. (2005). Integrated versus segregated accounting and the magnitude effect in temporal discounting. Psychonomic Bulletin & Review, 12(4), 732–739. https://doi.org/10.3758/BF03196765.

Green, L., & Myerson, J. (1996). Exponential versus hyperbolic discounting of delayed outcomes: Risk and waiting time. American Zoology, 36, 496–505. https://doi.org/10.1093/icb/36.4.496.

Green, L., Fisher, E. B., Perlow, S., & Sherman, L. (1981). Preference reversal and self control: Choice as a function of reward amount and delay. Behaviour Analysis Letters, 1(January), 43–51.

Green, L., Myerson, J., & Ostaszewski, P. (1999). Amount of reward has opposite effects on the discounting of delayed and probabilistic outcomes. Journal of Experimental Psychology. Learning, Memory, and Cognition, 25(2), 418–427. https://doi.org/10.1037/0278-7393.25.2.418.

Green, L., Myerson, J., Holt, D. D., Slevin, J. R., & Estle, S. J. (2004). Discounting of delayed food rewards in pigeons and rats: Is there a magnitude effect? Journal of the Experimental Analysis of Behavior, 81(1), 39–50. https://doi.org/10.1901/jeab.2004.81-39.

Green, L., Myerson, J., Oliveira, L., & Chang, S. E. (2013). Delay discounting of monetary rewards over a wide range of amounts. Journal of the Experimental Analysis of Behavior, 100(3), 269–281. https://doi.org/10.1002/jeab.45.

Green, L., Myerson, J., Oliveira, L., & Chang, S. E. (2014). Discounting of delayed and probabilistic losses over a wide range of amounts. Journal of the Experimental Analysis of Behavior, 101(2), 186–200. https://doi.org/10.1002/jeab.56.

Hardisty, D. J., Appelt, K. C., & Weber, E. U. (2013a). Good or bad, we want it now: Fixed-cost present Bias for gains and losses explains magnitude asymmetries in intertemporal choice. Journal of Behavioral Decision Making, 26(4), 348–361. https://doi.org/10.1002/bdm.1771.

Hardisty, D. J., Thompson†, K. F., Krantz†, D. H., & Weber, E. U. (2013b). How to measure time preferences: An experimental comparison of three methods. Judgment and Decision making, 8(3), 236–249. https://doi.org/10.1007/s10826-012-9600-6.

Hayes, A. F. (2018). Introduction to mediation, moderation, and conditional process analysis: A regression-based approach (second Edi). New York: The Guilford Press.

Hayes, A. F., & Scharkow, M. (2013). The relative trustworthiness of inferential tests of the indirect effect in statistical mediation analysis. Psychological Science, 24(10), 1918–1927. https://doi.org/10.1177/0956797613480187.

Holt, D. D., Green, L., & Myerson, J. (2003). Is discounting impulsive? Evidence from temporal and probability discounting in gambling and non-gambling college students. Behavioural Processes, 64(3), 355–367. https://doi.org/10.1016/S0376-6357(03)00141-4.

Johnson, M. W., & Bickel, W. K. (2002). Within-subject comparison of real and hypothetical money rewards in delay discounting. Journal of the Experimental Analysis of Behavior, 77(4), 129–146. https://doi.org/10.1901/jeab.2002.77-129.

Johnson, M. W., & Bickel, W. K. (2008). An algorithm for identifying nonsystematic delay-discounting data. Experimental and clinical psychopharmacology, 16(3), 264. https://doi.org/10.1037/1064-1297.16.3.264

Kagel, J. H., Green, L., & Caraco, T. (1986). When foragers discount the future: Constraint or adaptation? Animal Behaviour, 34, 271–283. https://doi.org/10.1016/0003-3472(86)90032-1.

Kidd, C., Palmeri, H., & Aslin, R. N. (2013). Rational snacking: Young children’s decision-making on the marshmallow task is moderated by beliefs about environmental reliability. Cognition, 126(1), 109–114. https://doi.org/10.1016/j.cognition.2012.08.004.

Klein-Flügge, M. C., Kennerley, S. W., Saraiva, A. C., Penny, W. D., & Bestmann, S. (2015). Behavioral modeling of human choices reveals dissociable effects of physical effort and temporal delay on reward devaluation. PLoS Computational Biology, 11(3), 1–31. https://doi.org/10.1371/journal.pcbi.1004116.

Krizan, Z., & Windschitl, P. D. (2007). The influence of outcome desirability on optimism. Psychological Bulletin, 133(1), 95–121. https://doi.org/10.1037/0033-2909.133.1.95.

Lee, D., Seo, H., & Jung, M. W. (2012). Neural basis of reinforcement learning and decision making. Annual Review of Neuroscience, 35(1), 287–308. https://doi.org/10.1146/annurev-neuro-062111-150512.

Loewenstein, G. (1987). Anticipation and the valuation of delayed consumption. The Economic Journal, 97(387), 666–684. https://doi.org/10.2307/2232929.

Loewenstein, G., & Prelec, D. (1991). Negative time preference. The American Economic Review, 81(2), 347–352. https://doi.org/10.1126/science.151.3712.867-a.

Loewenstein, G., & Prelec, D. (1992). Anomalies in intertemporal choice: Evidence and an interpretation. The Quarterly Journal of Economics, 107(2), 573–597. https://doi.org/10.2307/2118482.

Loewenstein, G. F., & Prelec, D. (1993). Preferences for sequences of outcomes. Psychological Review, 100(1), 91–108. https://doi.org/10.1037/0033-295X.100.1.91.

Loewenstein, G., & Thaler, R. H. (1989). Anomalies: Intertemporal choice. Journal of Economic Perspectives, 3, 181–193. https://doi.org/10.1257/jep.3.4.181.

Lopez-Guzman, S., Konova, A. B., Louie, K., & Glimcher, P. W. (2018). Risk preferences impose a hidden distortion on measures of choice impulsivity. PLoS One, 13(1), e0191357. https://doi.org/10.1371/journal.pone.0191357.

Luckman, A., Donkin, C., & Newell, B. R. (2018). Can a single model account for both risky choices and inter-temporal choices? Testing the assumptions underlying models of risky inter-temporal choice. Psychonomic Bulletin & Review, 25(2), 785–792. https://doi.org/10.3758/s13423-017-1330-8.

Madden, G. J., Begotka, A. M., Raiff, B. R., & Kastern, L. L. (2003). Delay discounting of real and hypothetical rewards. Experimental and Clinical Psychopharmacology, 11(2), 139–145. https://doi.org/10.1037/1064-1297.11.2.139.

Madden, G. J., Petry, N. M., Badger, G. J., & Bickel, W. K. (1997). Impulsive and self-control choices in opioid-dependent patients and non-drug-using control patients: Drug and monetary rewards. Experimental and clinical psychopharmacology, 5(3), 256. https://doi.org/10.1037/1064-1297.5.3.256

Matusiewicz, A. K., Carter, A. E., Landes, R. D., & Yi, R. (2013). Statistical equivalence and test-retest reliability of delay and probability discounting using real and hypothetical rewards. Behavioural Processes, 100, 116–122. https://doi.org/10.1016/j.beproc.2013.07.019.

Mazur, J. E. (1987). An adjusting procedure for studying delayed reinforcement. In J. E. Mazur, J. A. Nevin, & H. Rachlin (Eds.), Quantitative analysis of behavior: Vol. 5. The effect of delay and of intervening events of reinforcement value (pp. 55–73). Hillsdale: Erlbaum.

McKerchar, T. L., Green, L., Myerson, J., Pickford, T. S., Hill, J. C., & Stout, S. C. (2009). A comparison of four models of delay discounting in humans. Behavioural Processes, 81(2), 256–259. https://doi.org/10.1016/j.beproc.2008.12.017.

McKerchar, T. L., Pickford, S., & Robertson, S. E. (2013). Hyperboloid discounting of delayed outcomes: Magnitude effects and the gain-loss asymmetry. The Psychological Record, 63(3), 441–451. https://doi.org/10.11133/j.tpr.2013.63.3.003.

Mishra, S., & Lalumière, M. L. (2017). Associations between delay discounting and risk-related behaviors, traits, attitudes, and outcomes. Journal of Behavioral Decision Making, 30(3), 769–781. https://doi.org/10.1002/bdm.2000.

Mitchell, S. H. (1999). Measures of impulsivity in cigarette smokers and non-smokers. Psychopharmacology, 146(4), 455–464. https://doi.org/10.1007/PL00005491.

Mitchell, S. H., & Wilson, V. B. (2010). The subjective value of delayed and probabilistic outcomes: Outcome size matters for gains but not for losses. Behavioural Processes, 83(1), 36–40. https://doi.org/10.1016/j.beproc.2009.09.003.

Myerson, J., & Green, L. (1995). Discounting of delayed rewards: Models of individual choice. Journal of the Experimental Analysis of Behavior, 64(3), 263–276. https://doi.org/10.1901/jeab.1995.64-263.

Myerson, J., Green, L., & Warusawitharana, M. (2001). Area under the curve as a measure of discounting. Journal of the Experimental Analysis of Behavior, 76(2), 235–243. https://doi.org/10.1901/jeab.2001.76-235.

Myerson, J., Green, L., Scott Hanson, J., Holt, D. D., & Estle, S. J. (2003). Discounting delayed and probabilistic rewards: Processes and traits. Journal of Economic Psychology, 24(5), 619–635. https://doi.org/10.1016/S0167-4870(03)00005-9.

Myerson, J., Green, L., & Morris, J. (2011). Modeling the effect of reward amount on probability discounting. Journal of the Experimental Analysis of Behavior, 95(2), 175–187. https://doi.org/10.1901/jeab.2011.95-175.

Noussair, C., & Wu, P. (2006). Risk tolerance in the present and the future: An experimental study. Managerial and Decision Economics, 27(6), 401–412. https://doi.org/10.1002/mde.1278.

Odum, A. L., Baumann, A. A. L. L., & Rimington, D. D. (2006). Discounting of delayed hypothetical money and food: Effects of amount. Behavioural Processes, 73(3), 278–284. https://doi.org/10.1016/j.beproc.2006.06.008.

Ostaszewski, P., & Karzel, K. (2002). Discounting of delayed and probabilistic losses of different amounts. European Psychologist, 7(4), 295–301. https://doi.org/10.1027//1016-9040.7.4.295.

Otto, A. R., Markman, A. B., & Love, B. C. (2012). Taking more, now: The optimality of impulsive choice hinges on environment structure. Social Psychological and Personality Science, 3(2), 131–138. https://doi.org/10.1177/1948550611411311.

Patak, M., & Reynolds, B. (2007). Question-based assessments of delay discounting: Do respondents spontaneously incorporate uncertainty into their valuations for delayed rewards? Addictive Behaviors, 32(2), 351–357. https://doi.org/10.1016/j.addbeh.2006.03.034.

Rachlin, H., Logue, A. W., Gibbon, J., & Frankel, M. (1986). Cognition and behavior in studies of choice. Psychological Review, 93(1), 33–45. https://doi.org/10.1037/0033-295X.93.1.33.

Rachlin, H., Raineri, A., & Cross, D. (1991). Subjective probability and delay. Journal of the Experimental Analysis of Behavior, 55(2), 233–244. https://doi.org/10.1901/jeab.1991.55-233.

Raineri, A., & Rachlin, H. (1993). The effect of temporal constraints on the value of money and other commodities. Journal of Behavioral Decision Making, 6(2), 77–94. https://doi.org/10.1002/bdm.3960060202.

Reynolds, B. (2006). A review of delay-discounting research with humans: Relations to drug use and gambling. Behavioural Pharmacology, 17(8), 651–667. https://doi.org/10.1097/FBP.0b013e3280115f99.

Reynolds, B., Patak, M., & Shroff, P. (2007). Adolescent smokers rate delayed rewards as less certain than adolescent nonsmokers. Drug and Alcohol Dependence, 90(2–3), 301–303. https://doi.org/10.1016/j.drugalcdep.2007.04.008.

Robles, E., & Vargas, P. A. (2008). Parameters of delay discounting assessment: Number of trials, effort, and sequential effects. Behavioural Processes, 78(2), 285–290. https://doi.org/10.1016/j.beproc.2007.10.012.

Robles, E., Vargas, P. A., & Bejarano, R. (2009). Within-subject differences in degree of delay discounting as a function of order of presentation of hypothetical cash rewards. Behavioural Processes, 81(2), 260–263. https://doi.org/10.1016/j.beproc.2009.02.018.

Rodzon, K., Berry, M. S., & Odum, A. L. (2011). Within-subject comparison of degree of delay discounting using titrating and fixed sequence procedures. Behavioural Processes, 86(1), 164–167. https://doi.org/10.1016/j.beproc.2010.09.007.

Samuelson, P. A. (1937). A note on measurement of utility. The Review of Economic Studies, 4(2), 155. https://doi.org/10.2307/2967612.

Sawicki, P., & Markiewicz, Ł. (2016). You cannot be partially pregnant: A comparison of divisible and nondivisible outcomes in delay and probability discounting studies. Psychological Record, 66(1), 1–8. https://doi.org/10.1007/s40732-015-0144-1.

Senecal, N., Wang, T., Thompson, E., & Kable, J. W. (2012). Normative arguments from experts and peers reduce delay discounting. Judgment and Decision making, 7(5), 568–589 Retrieved October 29, 2018 from http://www.pubmedcentral.nih.gov/articlerender.fcgi?artid=3626281&tool=pmcentrez&rendertype=abstract.

Shavit, T., & Rosenboim, M. (2015). Is there time discounting for risk premium? Journal of the Experimental Analysis of Behavior, 103(2), 393–404. https://doi.org/10.1002/jeab.139.

Shefrin, H. M., & Thaler, R. H. (1988). The behavioral life-cycle hypothesis. Economic Inquiry, 26(4), 609–643. https://doi.org/10.1111/j.1465-7295.1988.tb01520.x.

Sozou, P. D. (1998). On hyperbolic discounting and uncertain hazard rates. Proceedings of the Royal Society B: Biological Sciences, 265(1409), 2015–2020. https://doi.org/10.1098/rspb.1998.0534.

Story, G. W., Vlaev, I., Seymour, B., Winston, J. S., Darzi, A., & Dolan, R. J. (2013). Dread and the disvalue of future pain. PLoS Computational Biology, 9(11), e1003335. https://doi.org/10.1371/journal.pcbi.1003335.

Takahashi, T., Ikeda, K., & Hasegawa, T. (2007). A hyperbolic decay of subjective probability of obtaining delayed rewards. Behavioral and Brain Functions, 3(1), 52. https://doi.org/10.1186/1744-9081-3-52.

Taylor, M. M., & Creelman, C. D. (1967). PEST: Efficient estimates on probability functions. The Journal of the Acoustical Society of America, 41(4), 782–787. https://doi.org/10.1121/1.1910407.

Thaler, R. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters, 8(3), 201–207. https://doi.org/10.1016/0165-1765(81)90067-7.

Vanderveldt, A., Green, L., & Myerson, J. (2015). Discounting of monetary rewards that are both delayed and probabilistic: Delay and probability combine multiplicatively, not additively. Journal of Experimental Psychology. Learning, Memory, and Cognition, 41(1), 148–162. https://doi.org/10.1037/xlm0000029.

Vanderveldt, A., Green, L., & Rachlin, H. (2017). Discounting by probabilistic waiting. Journal of Behavioral Decision Making, 30(1), 39–53. https://doi.org/10.1002/bdm.1917.

Weatherly, J., & Derenne, A. (2013). Testing the reliability of paper-pencil versions of the fill-in-the-blank and multiple-choice methods of measuring probability discounting for seven different outcomes. The Psychological Record, 63(4), 835–862. https://doi.org/10.11133/j.tpr.2013.63.4.009.

Weatherly, J. N., Derenne, A., & Terrell, H. K. (2011). Testing the reliability of delay discounting of ten commodities using the fill-in-the-blank method. The Psychological Record, 61(1), 113–126. https://doi.org/10.1007/BF03395749.

Yi, R., Chase, W. D., & Bickel, W. K. (2007). Probability discounting among cigarette smokers and nonsmokers: Molecular analysis discerns group differences. Behavioural Pharmacology, 18(7), 633–639. https://doi.org/10.1097/FBP.0b013e3282effbd3.

Acknowledgements

This work was supported by the National Science Centre, Poland (https://ncn.gov.pl; grant 2015/19/D/HS6/00770). We thank the members of the Behavioral Economics Research Group (BERG) at the SWPS University of Social Sciences and Humanities for our valuable discussions.

Data Availability

The datasets generated during and/or analyzed during the current study are available from the corresponding author on reasonable request.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Ethical Approval

All procedures performed in studies involving human participants were in accordance with the ethical standards of the institutional and/or national research committee and with the 1964 Helsinki declaration and its later amendments or comparable ethical standards.

Informed Consent

Informed consent was obtained from all individual participants included in the study.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Białaszek, W., Marcowski, P. & Ostaszewski, P. Risk inherent in delay accounts for magnitude effects in intertemporal decision making. Curr Psychol 40, 1680–1695 (2021). https://doi.org/10.1007/s12144-018-0092-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12144-018-0092-4