Abstract

This study proposes the energy conversion of vine prunings to supply energy to local wineries, with a focus on the Riunite & CIV branch winery located in Carpi (Modena, Italy), exploring the possibility of generating both electricity and heat through biomass gasification. A Matlab-Simulink model is used to evaluate the energy savings that can be achieved when an energy storage system is coupled with the combined heat and power generation system. Within this context, the results showed that it is possible to save \(\approx \)30% of the electricity and \(\approx \)60% of the thermal energy demanded by the winery. However, the economic viability of the project is hindered by high investment and operation costs. DPB is strongly affected by the cost of biomass and the energy prices, resulting in a profitable investment for electricity prices higher than 0.30 \(\div>\)0.57 €/kWh according to the different scenarios investigated.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In 2021, Italy once again confirmed itself in first place in the world for wine production with an estimated 50.3 million hectoliters produced. The Italian vineyard surface is 664,000 hectares while in the Emilia-Romagna region, it amounts to 53,000 hectares (Gruppo Italiano Vini, 2022). Every year, in the winter period following the harvest, the vineyards are pruned resulting in the production of a large quantity of residual biomass which ranges from 1 to 5 ton/ha (Ruiz et al., 2013; Ntalos & Grigoriou, 2002) depending on the type and age of the vineyard, the soil properties, and the pruning technique. According to a study by the Italian Ministry of Agriculture, biomass from vine prunings amounts to 87,000 tons for the Emilia-Romagna region (Gismondi, 2020). The disposal of vine prunings generally takes place through the shredding in the field, which allows the biomass to be reused as fertilizer but exposes the cultivation to the risk of spreading parasites that sometimes nest in the pruned branches. For this reason, in situ open burning of prunings is still permitted and widespread, leading to the generation of large quantities of persistent organic pollutants and particulate matter (Gonçalves et al., 2011).

The increasing awareness of environmental pollution has led to the development, in the last decade, of a recovery chain for pruning from vineyards and orchards. With particular reference to the Emilia-Romagna region, this recovery chain involves the baling or chipping of the prunings and their delivery to the nearest biomass thermoelectric power plant. However, the costs of the service are closely linked to the proximity of the collection basin to the power plant (Ahmed et al., 2019; Spinelli et al., 2010), and it is still difficult to raise farmers’ awareness of paying for the disposal of vine shoots when a free option, such as open burning, is currently available. More generally, moving away from the perspective of mere return of investment, the recovery of pruning for energy purposes is one of the activities that could mitigate the effects that the agricultural sector is having on climate change (Sharma et al., 2019; Piñeiro et al., 2020; Bizikova et al., 2020).

Unlike what happens nowadays for livestock waste, whose energy can be recovered through consolidated and widespread practice (Cucina, 2023) (also thanks to the advent of small-scale biogas production plants), the collection and recovery of lignocellulosic waste face logistical issues linked to the dispersion of the woody material, its high level of humidity, and the low energy density (Florindo et al., 2022). However, the high quality of the biomass generated through vine pruning has prompted numerous studies and research aimed at exploring various energy conversion methods, such as combustion, pyrolysis, and gasification, to tackle this matter. Several authors (including the authors of this paper) tested, with promising results, vineyard prunings as fuel for domestic stove both in chips and in pellets form (Giungato et al., 2018; Picchi et al., 2013; Zanetti et al., 2017); Giorio et al. tested the performance of medium-sized boilers (500 kW), finding that the high particulate emissions make abatement systems necessary (Giorio et al., 2019) and demonstrating that small-scale appliances may not be a ready-to-go option. In addition to combustion, the pyrolysis of vine prunings was laboratory-tested for the production of biochar, activated carbon, or bio-oil (Nabais et al., 2010; Calcan et al., 2022). To the best of our knowledge, research involving the gasification of these by-products is rarer and often refers to laboratory studies or trials conducted in pilot plants, without considering integration with an existing industrial entity (Brito et al., 2014; Biagini et al., 2015).

This study fits into this research gap, where the authors relied on extensive prior research on the gasification of vine prunings, applying the results to the wine industry.

This work proposes to convert the prunings into combustible gas (syngas) through the gasification process, using it to power internal combustion engines for the combined heat and power generation (CHP) for wineries. The aim of the study is a technical and economic evaluation of this business model that aims to evaluate the limits and key parameters for a virtuous use of vine prunings.

The case study is based on the Riunite & CIV winery branch located in Carpi—province of Modena (Italy) (Cantine Riunite & CIV Wineries Group, 2022). The Rinuite & CIV group relies on nine wineries, more than 1500 members, and includes more than 4600 hectares of vineyards. The cooperative group Riunite & CIV is also the owner of the Gruppo Italiano Vini (Italian Wines Group) (Gruppo Italiano Vini, 2022), ranking first in Italy and among the major wine producers in the world.

The following sections describe the case study and the energy exploitation strategy of vine prunings, which involves the combined use of biomass CHP and energy storage system (ESS) to meet the discontinuous demand for electrical and thermal energy to power the winery’s processes and provide space heating. After the study of the winery’s annual energy consumption, a Matlab-Simulink (Simulink Documentation, 2023) model was developed aiming to calculate the electricity and natural gas effectively not purchased from the national grid.

A series of scenarios have been developed by simulating different electricity and gas prices and calculating the respective discounted payback times (DPBs) of the initial investment. For each energy price condition, the impact of the biomass cost was therefore evaluated, considering feeding the gasifiers with both chipped and pelletized vine prunings.

Materials and methods

Presentation of the case study

The technical-economical analysis was focused on the Riunite & CIV winery located in Carpi—province of Modena (Fig. 1). The winery processes the grapes produced by 271 members for a total of 1174 ha (from the census on 2021 data) which leads to an estimated collecting potential of \(\approx \)1.2–5.9 kton of prunings per year. This highly fragmented production context is common in many Mediterranean countries such as Portugal, Spain, and Greece (Florindo et al., 2022) expanding the possible applications of this study.

The winery is involved in every stage of the wine production process, starting from the grape. The equipment employed in this procedure is mainly driven by electric motors and includes conveying augers, grape crushers, conveyor belts, and must cooling systems. The winery is connected to the natural gas grid which is mainly used for space heating and for the desulphurization of the must; processes occur through the use of gas boilers. The energy consumption profile of the winery was mapped over the period 2018–2019, considering the shares of electrical and thermal energy consumed.

With regard to the electrical energy consumption, the data was retrieved from the bills provided by the electricity operator, resulting in a total annual electrical consumption of 1176 MWh. The time resolution of the provided data corresponded to three time slots:

-

F1: Monday to Friday, 8:00 AM to 7:00 PM

-

F2: Monday to Friday, 7:00 AM to 8:00 AM & 7:00 PM to 11:00 PM; Saturday, 7:00 AM to 11:00 PM

-

F3: Monday to Saturday, 12:00 AM to 7:00 AM and 11:00 PM to 12:00 AM; Sundays and holidays, all day

The average electrical power demand was calculated by dividing the energy referred to each time slot by its time span. The data collected is shown in the graph of Fig. 2a; the smooth peak in the late-summer period corresponds to the harvesting season by vinegrowers, promptly followed by the grapes processing.

In line with the electricity usage, the gas consumption was mapped for the same period and is displayed in Fig. 2b. Unlike electricity, there is not a daily breakdown available, but consumption is given on a monthly basis. Consequently, the meter reading for each month has been evenly distributed across all days, losing resolution. The annual gas consumption was 55,582 Sm\(^3\)/year. The conversion into thermal energy was carried out through Eq. 1 (reported in kWh) in which V is the gas consumption in volume read on the meter, HHV is the higher heating value indicated by the gas network operator (on average \(\approx \)39.7 MJ/Stm\(^3\)), and C is a correction factor that varies according to the climate zone in which the meter is installed.

Through these data, the scenarios for the generation of both electrical and thermal energy were designed as described in the subsequent section.

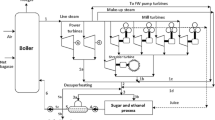

Energy production and storage systems

The energy conversion of vine pruning was achieved considering the use of commercial small-scale biomass CHP power plants operating through the gasification process. Gasification reactions take place in a vessel, known as a gasifier or gasification reactor where air, oxygen, or other gases react with the biomass (Reed & Das, 1988). The result is the thermo-chemical degradation of the solid wood into fuel gas (syngas). When air is used as a gasification agent, the syngas combustible compounds consist of H\(_2\), CH\(_4\), and CO and non-combustible compounds: CO\(_2\), H\(_2\)O, and N\(_2\) leading to a lower heating value (LHV) between 4 and 7 MJ/(Nm\(^3\)) (Basu, 2018; Soares & Oliveira, 2020). In biomass CHP, syngas is often used to power internal combustion engines which are capable of producing both electrical and thermal power. This study considered the use of a series of All Power Labs - Power Pallet 30 CHP gasifiers (PP30 from now on) leveraging their proven success in effectively operating with biomass sourced from vine prunings (Table 1) (Puglia et al., 2020; Allesina et al., 2018).

The heat recovery system of the PP30 consists of a three-stage heat exchanger, capturing heat from three distinct sources: syngas cooling, engine coolant, and exhausts. These heat sources converge at a plate heat exchanger, serving as a thermal interface connecting the system to the local heat load (i.e., the winery). The PP30 is capable of generating 20 kW of continuous electrical power and 40 kW of thermal power by recovering heat from exhaust gas and from the engine cooling loop. Biomass consumption was measured in a previous study and calculated in 23 kg/h of dry biomassFootnote 1 (Puglia et al., 2020). The power plant was considered to be active 8 h a day from 8 AM to 4 PM, 5 days a week for 52 weeks, and for an annual total of 2080 hours. The discontinuous operation has been imposed for the necessary maintenance that these machines need (Wei et al., 2009) and in order to dedicate the personnel already present in the winery to this activity. The scenario investigated considers the installation of ten PP30, operating in parallel, for a total electrical and thermal power of 200 kW and 400 kW, respectively. In order to optimize the use of the electricity generated, the installation of an energy storage system (ESS) with a storage capacity of 1 MWh was considered. ESS of this type are normally containerized, and in this case, it fits in two 20’ containers (refer to Fig. 3). These choices have been driven by the currently available spaces within the winery. About the thermal energy production through the PP30, it was chosen to consider a utilization factor (\(f_{th}\)) equal to 45%, considering to exploit the thermal energy mainly in the colder months by adopting the necessary thermal storage. The simple relation between the thermal energy available to the winery (\(E_{th,gen}\)) and the thermal energy recovered from the PP30 (\(E_{th,PP30}\)) through the utilization factor is reported in Eq. 2.

Matlab-Simulink model

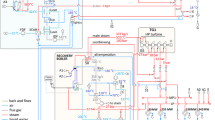

The winery has been represented on a Matlab-Simulink model which consists of four functional blocks: energy generation from PP30s, energy storage system (ESS), winery electrical-thermal loads, and the grid. The grid is viewed as an energy reservoir with pricing modeled across various scenarios.

The Simulink model is reported in the block diagram of Fig. 4. Blocks are divided into subsystems according to each function: production, consumption, or storage of energy.

The whole model follows the electric energy balance reported in Eq. 3:

These four terms respectively represent the power supplied by the gasifier (\(P_{gasifier}\)), by the storage system (\(P_{ESS}\)), by the grid (\(P_{grid}\)), and the power required by the winery (\(P_{load}\)). From Eq. 3, it is therefore possible to obtain the power that the grid and the storage system must supply to the winery (Eq. 4):

where

The fed of electricity into the grid is not considered, and thus, \(P_{grid}\ge 0\). The storage system is then loaded or unloaded according to the energy availability and winery demand. More specifically, the block that describes this situation is represented in Fig. 5.

It was imposed that the power transfer in the charge or discharge phase between the storage system and the PP30s takes place when the state-of-charge (SOC) is between 0.2 and 0.9 (do Nascimento & Rüther, 2020). The combined charge–discharge efficiency of the ESS was set to 0.92 (Arcos-Vargas et al., 2020) (often known as round trip efficiency), while other losses (e.g., HVAC for container cooling) which would require a more detailed analysis of the ambient conditions are not considered in this study. The block describing the battery charging and discharging phase is shown in Fig. 6.

The Simulink model enabled the quantification of electricity saved from the grid, allowing the estimation of economic savings based on input parameters. Additionally, the model was employed to calculate the potential savings in natural gas consumption.

Economic analysis

The economic feasibility analysis is based on the investment costs and variable costs associated with the operation and maintenance of the power generation system and on the gas and electrical energy savings generated from it. The inflation rates relating to the cost of electricity and natural gas were chosen at 2.8%.Footnote 2 The cost of each PP30 is 65,472 €(manufacturer quotation) while the annual cost for its maintenance was considered equal to 80 €/MWh adapting the results from Wei et al. (2009) on a similar size gasifier. The ESS investment cost is estimated at 450 €/kWh (Mongird et al., 2020). The price of grape pellets was assumed to be 178 €/t (Toscano et al., 2018; Associazione Italiana Energie Agroforestali, 2023) which is competitive with respect to the price of A1 EN Plus pellets which cost approximately 230 €/t it is observed that in 2021–2022, the price of A1 EN Plus pellets reached 340 €/t (Associazione Italiana Energie Agroforestali, 2023)). The price of the wine pruning chips was estimated at 83 €/t (Toscano et al., 2018; Associazione Italiana Energie Agroforestali, 2023). Lower costs can be achieved if the pellet or chip production is internalized within the winery activities, as demonstrated by Toscano et al. (2018). The sale of biochar, vegetable carbon resulting from the biomass gasification process, was also considered. The selling price was estimated at 300 €/t (as per producer quotation) while the production was considered equal to 5% \(\frac{m}{m}\) of the total biomass consumptionFootnote 3. Furthermore, the biochar market is not yet consolidated, and the selling price mainly depends on the technology used (Nematian et al., 2021). In this regard, a sensitivity analysis was conducted on the sales price of biochar by varying this between 200 and 500 €/ton. To be recognized and sold as soil amendment, the biochar needs to meet specific requirements reported in the European Biochar Certificate or the International Biochar Initiative (Ravenni et al., 2018). In Italy, the certification is carried out by the iChar association, and this practice has a one-off cost of 1250 €. The baseline for the cost of electricity was taken as 0.16 €/kWh while the price of gas was 0.479 €/\(Sm^3\). These were taken from the annual history of the respective winery bills in the period 2018–2019, considered a period of time undisturbed by recent fluctuations.

Given these assumptions, an assessment of net present value was conducted, factoring in expenses, savings, and revenue generated by utilizing the gasifier as an energy source. The analysis mainly follows Eq. 7:

where

NPV = net present value, representing the current value of future cash flows.

\(I_0\) = initial investment, the cost at time zero.

\(CF_t\) = cash flow at time t, which can be positive (inflows) or negative (outflows).

r = discount rate, reflecting the rate of return or cost of capital.

n = number of years, indicating the time span over which cash flows occur and are discounted.

Cash flows were modeled as electricity savings, natural gas savings, and annual revenue from the sale of biochar. Year by year, cash flows were discounted using the discount rates for electricity and gas indicated previously. Equation 8 reports the discounting calculation for the cash flows.

where

i represents the current year (from 0 to n).

k stands for the discount rate of electricity and gas.

Rather than analyzing the DPB time as the discount rate varies, in this work, we chose to maintain a constant discount rate r = 6% (Colantoni et al., 2021; Guercio, 2011) and to investigate the variation in the DPB (Eq. 9) as the price of electricity and gas varies.

where

X is the last period (year) with a negative discounted cumulative cash flow.

Y is the absolute value of discounted cumulative cash flow at the end of the period X.

Z is the discounted cash flow during the period after X.

The variation ranges were considered 0.16\(-\)0.576 €/kWh for the electricity and 0.479–1.628 €/\(Sm^3\) for the gas. In Italy, a succession of incentivizing tariffs has unfolded in recent decades: some focused on subsidizing electricity or thermal energy production (feed-in-tariff), while others offered tax deductions for investment costs. To create a generalized yet realistic analysis, a scenario with a 50% tax deduction over a 10-year period was considered. The next section of the article outlines the key findings derived from the techno-economic analysis.

Results

Table 2 summarizes the expenditure items and operating conditions of the case investigated. The outcomes derived from the Simulink model indicate an annual 31.2% reduction in purchased electricity expenses, alongside a 60.8% savings from recovered thermal energy during the winter season.

This is due to the discontinuous production of energy from biomass, associated with the operation only during the working hours of the winery. It should be noted that this assumption is conservative and that 24/7 options could be investigated as future work. In this case, additional labor should be considered, and Wei et al. (2009) can be considered a reference for its calculation. Figure 7 shows the SOC of the ESS revealing minimal utilization of the storage system during winter due to decreased electricity demand from the winery. However, a high consumption of natural gas was observed in the same period, and in order to better exploit the energy produced by the gasifier, it would be useful to consider electrifying part of the boilers (for space heating) currently fueled by gas (Tables 3 and 4). Actions of this type are also in line with European and national planning which expect a progressive electrification of the primary energy system with a view to total decarbonization by 2050 (European Commission and for Climate Action, 2019).

Figure 8 shows, by way of example, the trend of the NPV in the case of feeding the gasifier with pellets and chips for average electricity and gas prices equal to 0.352 €/kWh and 1.053 respectively €/Sm\(^3\). DPB is respectively equal to 21.3 and 13.3 years.

The DPB time of the investment was then calculated for each scenario, and results are condensed in the graphs of Figs. 9a and b and 10a and b. Detailed numerical values of DPBs are reported in Tables 5, 6, 7, and 8, while NPV at 30 years are reported in the Tables 9, 10, 11, and 12. Regarding the investigated scenarios without incentives (Fig. 9), it is observed that with the use of pellets, there is a DPB of less than 10 years only when (I) electricity prices are above 0.49 €/kWh and the cost of gas is equal to the maximum analyzed (1.628 €/Sm\(^3\)), or (II) for electricity prices higher than the maximum considered (0.57 €/kWh) when the cost of gas is equal to 0.766 €/Sm\(^3\). The DPB is always greater than 10 years for baseline energy prices, justifying the difficulty with which these systems are spreading.

The situation is different in case the gasifier powered by vine pruning chips is considered. In this case, the lower price of the biomass leads to a DPB (I) of less than 10 years for electricity prices higher than 0.38 €/kWh, when the cost of gas is equal to the maximum analyzed (1.628 €/Sm\(^3\)) or (II) for prices of electricity above 0.49 €/kWh when the cost of gas is at the minimum (0.479 €/Sm\(^3\)). Once more, this comparison highlights how the cost of biomass stands as one of the key parameters significantly affecting the investment outcome. However, it should be noted that by reducing the biomass preprocessing, uncertainties regarding the correct functioning of the gasifier increase. Past tests have in fact demonstrated how shredded vine prunings lead to frequent bridging phenomena in the feed hopper and in the PP30 reactor (Allesina et al., 2018). Although the quality of syngas is not different from that generated via pellets, these disadvantages lead to necessary investments linked to the redesign of some components of the gasifier. Considering now the hypothetical incentive that leads to the tax deduction of 50% (Fig. 10), it is observed that with the use of pellets, the DPB is lower than 10 years when (I) the price of electricity exceeds 0.41 €/kWh and the cost of gas is equal to the maximum analyzed (1.628 €/Sm\(^3\)) or (II) for electricity prices higher than 0.52 €/kWh when the cost of gas is equal to 0.479 €/Sm\(^3\).

In the case of an incentivized power plant powered by vine chips, there is a DPB of less than 10 years for (I) electricity prices above 0.30 €/kWh when the cost of gas is equal to the maximum analyzed (1.628 €/Sm\(^3\)) or (II) for electricity prices above 0.41 €/kWh when the cost of gas is equal to the minimum (0.479 €/Sm\(^3\)). It is relevant to note how, even in the presence of a tax incentive, the “vine chips-no tax deduction” option (Fig. 9b) remains more convenient compared to “vine pellets-tax deduction” (Fig. 10a). In the author’s opinion, this might suggest the convenience of incentivizing plants that are fueled with raw or minimally processed biomass, shifting investments toward the development of agnostic technologies that are less sensitive to the particle size and quality of fuel used.

Eventually, it is observed that the sensitivity of the economic analysis with respect to the price of gas is lower than the price of electricity, given both the initial imbalance between the two specific costs, consumption rates, and the thermal energy utilization factor used. In this regard, a sensitivity analysis was conducted on the thermal energy utilization factor (baseline value set to 45%), calculating the alteration in payback period for the two ends of \(f_{th}\) examined: 30% and 60%.

Three cases were then analyzed:

-

Case 1: price of electricity 0.576 €/kWh and price of natural gas 1.628 €/Stm\(^3\) (e.g., the scenario that offers more convenient DPBs).

-

Case 2: price of electricity 0.16 €/kWh (baseline) and price of natural gas 1.628 €/Stm\(^3\) (higher end).

-

Case 3: price of electricity 0.576 €/kWh (higher end) and price of natural gas 0.479 €/Stm\(^3\) (baseline).

For all cases, the cost of biomass was set at the two conditions tested in this work: 83 €/ton for vine chips and 178 €/ton for vine pellets. The scenario with minimum electricity and natural gas prices has not been investigated since it generates return times higher than Case 2 and is definitely not useful for this analysis. Figure 11 and Table 3 report the results in the different conditions. Variation of \(f_{th}\) of the ±33% generates a variation of the DPB of \(\approx \) 9–13% in Case 1 (high both gas and electricity prices) and \(\approx \) 3–5% in Case 3 (high electricity, low gas). More significant fluctuations occur for Case 2 (low electricity, high gas), in which the DPB varies up to over 50%. However, the condition of Case 2 is never profitable, reporting DPBs exceeding 20 years in all conditions.Footnote 4

In all scenarios, an annual income of 7176.00 €, from the sale of biochar, is considered. A sensitivity analysis was therefore conducted in order to identify the impact of the selling price of biochar on the DPB of the investment. Figure 12 and Table 4 illustrate the results obtained considering the range of biochar selling prices: 500 €/ton (on the higher end) and 200 €/ton (on the lower end) for each type of biomass investigated in this work. The variations in the DPB are limited to a few percentage points in Cases 1 and 3 which correspond to the scenarios with high electricity prices. The right half of Table 4 also shows the DPBs in the different cases, with variations in the order of 2–3 years for Case 1 and Case 3. Case 2 stands apart due to its combination of low electricity costs and elevated natural gas prices: in this condition, the DPB variations generated by biochar sales price are higher (up to 10.2%). However, DPBs higher than 26 years (up to 67.3 years) show that it is not a truly viable scenario. In conclusion, the biochar selling price does not hold as strong a sway as the costs associated with electricity, biomass, natural gas, and the thermal utilization factor.

Beyond the economic implication generated by a developing market, we must consider the value linked to the removal of atmospheric carbon that gasification technology makes possible through biochar. To this end, interesting results could be obtained by extending this research to an environmental analysis on the entire wine supply chain, analyzing the impact that the adoption of carbon capture and storage (CCS) technologies could generate.

Conclusions

This work explored the techno-economic viability of converting vine prunings into electrical and thermal energy, through the gasification process, to reduce electricity and natural gas drawn from the grid by a winery located in northern Italy (Emilia-Romagna region). Experimental data obtained from past research were applied in a real-case context to assess the limits and potential of this technology, which was still relatively uncommon until today. The configuration studied involved the use of ten commercial biomass microgasifiers operating in parallel for the combined production of heat (400 kW) and electricity (200 kW). The power plants were expected to operate for 8 hours a day, 5 days a week, with any surplus electricity not immediately used by the winery being stored in a 1 MWh energy storage system. The entire process was simulated in the Matlab-Simulink environment, calculating the primary energy savings achieved by feeding the gasifiers with both pellets and chips produced from vine prunings. The findings demonstrate the potential to substitute approximately 30% of the required electricity and about 60% of the necessary thermal energy for the winery. The greatest uncertainty in this calculation is linked to the thermal energy utilization factor, which is difficult to estimate a priori without a detailed representation of the thermal systems and a daily mapping of gas consumption. The economic viability of the project was evaluated through the net present value methodology, fitting the research into a still little explored framework by calculating how variations in energy market prices, biochar selling price, and biomass cost affect the DPB of the investment. High costs associated with the investments, supplying of biomass fuel and O &M of the gasifiers, result in competitive DPBs (<10 years calculated over the different conditions of gas prices) only when the electricity prices are averagely above 0.49\(\div>\)0.576 €/kWh or 0.38\(\div>\)0.49 €/kWh if pellets or chips are respectively used. It is also noted that the case study demonstrates lower sensitivity to the price of natural gas with respect to the electricity one. The development of such renewable energy sources has been and still is facilitated through several strategies; the tax deduction for 50% of the investment in 10 years hypothesized and tested in the model also proves effective in the case of gasifiers powered by pellets, bringing the convenience to 0.41\(\div>\)0.52 €/kWh for pellets and 0.30\(\div>\)0.41 €/kWh for chips. Shifting from the framework of tax deduction or feed-in tariff, which, nonetheless, greatly supported (and support) the advancement of emerging and promising technologies, the economic valorization of the increased environmental sustainability or exploration of alternative energy markets is necessary. A prospective market lies within the battery electric vehicle (BEV) charging infrastructure, where costs often exceed 0.70 €/kWh, especially for high-power charging (HPC) systems. The winery can indeed be one of the key locations for the electrification of private transportation, offering quality service in rural areas and reducing the costs of adapting the electrical grid, which is often weak in such contexts.

Data availability

Data are available on request.

Notes

It must be highlighted that Puglia et al. measured biomass consumption at electrical power output lower than 20 kW. However, it is the closest data to operating conditions currently available.

Since the fluctuations in energy prices are much more significant than the chosen discount rate, a sensitivity analysis was conducted on these prices.

This is an average value measured through several experimental campaigns on PP30 running with vine pruning pellets (Puglia et al., 2020). It must be underlined that the biochar discharge rate depends on the shaking strategy of the reactor grate and other studies have reported a value equal to 2% \(\frac{m}{m}\) running on wood chips (Wei et al., 2009).

In the case of gasifier feed with pellets, the DPB in Case 2 exceeds the cutoff value (99 years) set in the model.

References

Ahmed, O. Y., Ries, M. J., & Northrop, W. F. (2019). Emissions factors from distributed, small-scale biomass gasification power generation: Comparison to open burning and large-scale biomass power generation. Atmospheric Research, 200, 221–227. ISSN 1352-2310. https://doi.org/10.1016/j.atmosenv.2018.12.024. URL https://www.sciencedirect.com/science/article/pii/S1352231018308811.

Allesina, G., Pedrazzi, S., Puglia, M., Morselli, N., Allegretti, F., & Tartarini, P. (2018). Gasification and wine industry: report on the use vine pruning as fuel in small-scale gasifiers. https://api.semanticscholar.org/CorpusID:164486112

Arcos-Vargas, Á., Canca, D., & Núñez, F. (2020). Impact of battery technological progress on electricity arbitrage: An application to the Iberian market. Applied Energy, 260, 114273. ISSN 0306-2619. https://doi.org/10.1016/j.apenergy.2019.114273. URL https://www.sciencedirect.com/science/article/pii/S0306261919319609.

Associazione Italiana Energie Agroforestali. (2023). Aiel - associazione italiana energie agroforestali. Website, 2023 Accessed. URL http://www.aielenergia.it. P. IVA: 07091431002.

Basu, P. (2018). Chapter 7 - Gasification Theory, pages 211 – 262. Academic Press, third edition edition, 2018. ISBN 978-0-12-812992-0. https://doi.org/10.1016/B978-0-12-812992-0.00007-8.

Biagini, E., Barontini, F., & Tognotti, L. (2015). Gasification of agricultural residues in a demonstrative plant: Vine pruning and rice husks. Bioresource Technology, 194, 36–42. ISSN 0960-8524. https://doi.org/10.1016/j.biortech.2015.07.016. URL https://www.sciencedirect.com/science/article/pii/S0960852415009694.

Bizikova, L., Nkonya, E., Minah, M., et al. (2020). A scoping review of the contributions of farmers’ organizations to smallholder agriculture. Nature Food, 1, 620–630. https://doi.org/10.1038/s43016-020-00164-x

Brito, P. S. D., Oliveira, A. S., & Rodrigues, L. F. (2014). Energy valorization of solid vines pruning by thermal gasification in a pilot plant. Waste and Biomass Valorization, 5, 181–187. https://doi.org/10.1007/s12649-013-9246-7

Calcan, S. I., Pârvulescu, O. C., Ion, V. A., Rǎducanu, C. E., Bǎdulescu, L., Dobre, T., Egri, D., Mot, A., Popa, V., & Crǎciun, M. E. (2022) Valorization of vine prunings by slow pyrolysis in a fixed-bed reactor. Processes10(1). ISSN 2227-9717. https://doi.org/10.3390/pr10010037. URL https://www.mdpi.com/2227-9717/10/1/37.

Cantine Riunite & CIV Wineries Group. (2022). URL www.riuniteciv.com. Accessed 23 June 2022.

Colantoni, A., Villarini, M., Monarca, D., Carlini, M., Mosconi, E. M., Bocci, E., & Rajabi Hamedani, S. (2021). Economic analysis and risk assessment of biomass gasification CHP systems of different sizes through Monte Carlo simulation. Energy Reports, 7, 1954–1961. ISSN 2352-4847. https://doi.org/10.1016/j.egyr.2021.03.028. URL https://www.sciencedirect.com/science/article/pii/S2352484721001979.

Cucina, M. (2023). Integrating anaerobic digestion and composting to boost energy and material recovery from organic wastes in the circular economy framework in Europe: A review. Bioresource Technology Reports, 24, 101642. ISSN 2589-014X. https://doi.org/10.1016/j.biteb.2023.101642. URL https://www.sciencedirect.com/science/article/pii/S2589014X23003134.

do Nascimento, Á. D. J., & Rüther, R. (2020). Evaluating distributed photovoltaic (PV) generation to foster the adoption of energy storage systems (ESS) in time-of-use frameworks. Solar Energy, 208, 917–929. ISSN 0038-092X. https://doi.org/10.1016/j.solener.2020.08.045. URL https://www.sciencedirect.com/science/article/pii/S0038092X20308768.

European Commission and Directorate-General for Climate Action. (2019). Going climate-neutral by 2050 - A strategic long-term vision for a prosperous, modern, competitive and climate-neutral EU economy. Publications Office. https://doi.org/10.2834/02074

Florindo, T., Ferraz, A. I., Rodrigues, A. C., & Nunes, L. J. R. (2022). Residual biomass recovery in the wine sector: Creation of value chains for vine pruning. Agriculture, 12(5). ISSN 2077-0472. https://doi.org/10.3390/agriculture12050670. URL https://www.mdpi.com/2077-0472/12/5/670.

Giorio, C., Pizzini, S., Marchiori, E., Piazza, R., Grigolato, S., Zanetti, M., Cavalli, R., Simoncin, M., Soldá, L., Badocco, D., & Tapparo, A. (2019). Sustainability of using vineyard pruning residues as an energy source: Combustion performances and environmental impact. Fuel, 243, 371–380. ISSN 0016-2361. https://doi.org/10.1016/j.fuel.2019.01.128. URL https://www.sciencedirect.com/science/article/pii/S0016236119301280.

Gismondi, R. (2020). An integrated analysis of the main statistical and administrative sources on wine production in Italy (un’analisi integrata delle principali fonti statistiche e amministrative sulla produzione di vino in italia) n. 8/2020 isbn 978-88-458-2036-6. National Institute of Statistics: Istat Working Papers.

Giungato, P., Barbieri, P., Cozzutto, S., & Licen, S. (2018). Sustainable domestic burning of residual biomasses from the Friuli Venezia Giulia region. Journal of Cleaner Production, 172, 3841–3850. ISSN 0959-6526. https://doi.org/10.1016/j.jclepro.2017.05.190. URL https://www.sciencedirect.com/science/article/pii/S0959652617311435.

Gonçalves, C., Evtyugina, M., Alves, C., Monteiro, C., Pio, C., & Tomé, M. (2011). Organic particulate emissions from field burning of garden and agriculture residues. Atmospheric Research, 101(3), 666–680. ISSN 0169-8095. https://doi.org/10.1016/j.atmosres.2011.04.017. URL https://www.sciencedirect.com/science/article/pii/S0169809511001281. International Conference on Nucleation and Atmospheric Aerosols (Part 2).

Gruppo Italiano Vini. (2022). https://www.gruppoitalianovini.it. Accessed 23 June 2022

Guercio A (2011) Mini e micro cogenerazione a biomassa. Tecnologie e criteri progettuali. Flaccovio Dario, 2011. ISBN 9788857901039.

Mongird, K., Viswanathan, V., Balducci, P., Alam, J., Fotedar, V., Koritarov, V., & Hadjerioua, B. (2020). An evaluation of energy storage cost and performance characteristics. Energies, 13, 3307. https://doi.org/10.3390/en13133307

Nabais, J. M. V., Laginhas, C., Carrott, P. J. M., & Ribeiro Carrott, M. M. L. (2010). Thermal conversion of a novel biomass agricultural residue (vine shoots) into activated carbon using activation with CO2. Journal of Analytical and Applied Pyrolysis, 87(1), 8–13. ISSN 0165-2370. https://doi.org/10.1016/j.jaap.2009.09.004. URL https://www.sciencedirect.com/science/article/pii/S0165237009001284.

Nematian, M., Keske, C., & Ng’ombe, J. N. (2021). A techno-economic analysis of biochar production and the bioeconomy for orchard biomass. Waste Management, 135, 467–477. ISSN 0956-053X. https://doi.org/10.1016/j.wasman.2021.09.014. URL https://www.sciencedirect.com/science/article/pii/S0956053X21005031.

Ntalos, G. A., & Grigoriou, A. H. (2002). Characterization and utilisation of vine prunings as a wood substitute for particleboard production. Industrial Crops and Products, 16(1), 59–68. ISSN 0926-6690. https://doi.org/10.1016/S0926-6690(02)00008-0. URL https://www.sciencedirect.com/science/article/pii/S0926669002000080.

Picchi, G., Silvestri, S., & Cristoforetti, A. (2013). Vineyard residues as a fuel for domestic boilers in trento province (Italy): Comparison to wood chips and means of polluting emissions control. Fuel, 113, 43–49, 2013. ISSN 0016-2361. https://doi.org/10.1016/j.fuel.2013.05.058. URL https://www.sciencedirect.com/science/article/pii/S0016236113004705.

Piñeiro, V., Arias, J., Dürr, J., et al. (2020). A scoping review on incentives for adoption of sustainable agricultural practices and their outcomes. Nature Sustainability, 3, 809–820. https://doi.org/10.1038/s41893-020-00617-y

Puglia, M., Torri, G., Martinelli, V., & Tartarini, P. (2020). Vine prunings agro - energetic chain: Experimental and economical assessment of vine pellets use in gasification power plants. In: European Biomass Conference and Exhibition Proceedings, pages 92–96.

Ravenni, G., Sárossy, Z., Ahrenfeldt, J., & Henriksen, U. B. (2018). Activity of chars and activated carbons for removal and decomposition of tar model compounds - A review. Renewable and Sustainable Energy Reviews, 94, 1044–1056. ISSN 1364-0321. https://doi.org/10.1016/j.rser.2018.07.001. URL http://www.sciencedirect.com/science/article/pii/S1364032118305033.

Reed, T. B., & Das, A. (1988). Handbook of biomass downdraft gasifier engine systems

Ruiz, J. A., Juárez, M. C., Morales, M. P., Muñoz, P., & Mendívil, M. A. (2013). Biomass logistics: Financial & environmental costs. case study: 2 mw electrical power plants. Biomass and Bioenergy, 56, 260–267. ISSN 0961-9534. https://doi.org/10.1016/j.biombioe.2013.05.014. https://www.sciencedirect.com/science/article/pii/S0961953413002420.

Sharma, B., Vaish, B., Monika, et al. (2019). Recycling of organic wastes in agriculture: An environmental perspective. International Journal of Environmental Research, 13, 409–429. https://doi.org/10.1007/s41742-019-00175-y

Simulink Documentation. (2023). Simulation and model-based design. MathWorks. https://www.mathworks.com/products/simulink.html

Soares, J., & Oliveira, A. C. (2020). Experimental assessment of pine wood chips gasification at steady and part-load performance. Biomass Bioenergy, 139, 105625. ISSN 0961-9534. https://doi.org/10.1016/j.biombioe.2020.105625. URL https://www.sciencedirect.com/science/article/pii/S0961953420301598.

Spinelli, R., Magagnotti, N., & Nati, C. (2010) Harvesting vineyard pruning residues for energy use. Biosystems Engineering, 105(3), 316–322. ISSN 1537-5110. https://doi.org/10.1016/j.biosystemseng.2009.11.011. URL https://www.sciencedirect.com/science/article/pii/S1537511009003432.

Toscano, G., Alfano, V., Scarfone, A., & Pari, L. (2018). Pelleting vineyard pruning at low cost with a mobile technology. Energies, 11(9), 2477. https://doi.org/10.3390/en11092477

Wei, L., Pordesimo, L. O., To, F., Herndon, C., & Batchelor, W. (2009). Evaluation of micro-scale syngas production costs through modeling. Transactions of the ASABE, 52, 1649–1659. https://doi.org/10.13031/2013.29116.

Zanetti, M., Brandelet, B., Marini, D., Sgarbossa, A., Giorio, C., Badocco, D., Tapparo, A., Grigolato, S., Rogaume, C., Rogaume, Y., & Cavalli, R. (2017). Vineyard pruning residues pellets for use in domestic appliances: A quality assessment according to the EN ISO 17225. Journal of Agricultural Engineering, 48(2), 99–108. https://doi.org/10.4081/jae.2017.612. https://www.agroengineering.org/index.php/jae/article/view/612

Funding

Open access funding provided by Università degli Studi di Modena e Reggio Emilia within the CRUI-CARE Agreement. Project funded under the National Recovery and Resilience Plan (NRRP), Mission 04 Component 2 Investment 1.5 - NextGenerationEU, Call for tender n. 3277 dated 30/12/2021, Award Number: 0001052 dated 23/06/2022.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

All authors have no conflicts of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix. Additional results

Appendix. Additional results

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Morselli, N., Puglia, M., Capozzolo, G. et al. A technical-economic analysis of integrating vine prunings energy conversion systems for CHP production in local wineries. Energy Efficiency 17, 36 (2024). https://doi.org/10.1007/s12053-024-10214-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12053-024-10214-z