Abstract

The residential sector has a large potential to reduce its energy use. Improving the energy performance of buildings is one way to realise this potential. For single-family buildings, improving the energy efficiency by energy renovations can produce a net financial gain. However, there are unaccounted barriers that act as impediments for house-owners to undertake energy efficiency measures. This study postulates that transaction costs are such a barrier. Transaction costs are defined as the cost of making an economic exchange on a market in addition to the market price. The purpose is to empirically estimate the magnitude of the transactions costs and its determinants for energy efficiency measures in the residential sector. Specifically, the transaction costs for heat insulation and energy-saving windows in Swedish single-family buildings are assessed. The analysis is based on a unique dataset, constructed from a web-based survey. The results indicate that transaction costs for energy efficiency measures are considerable. The average transaction cost to make additional heat insulation is SEK 18,046 (EUR 1,510) and SEK 21,106 (EUR 1,766) to install energy-saving windows. The determinants of the transaction costs are cognitive limitations, social connectedness, asset specificity and previous experiences. Therefore, to reduce the transaction costs, the complexity of energy efficiency measures must be addressed, potential opportunistic behaviour must be reduced, and financial options expanded.

Similar content being viewed by others

Introduction

The residential sector accounts for approximately 40% of both the energy consumption and the energy related GHG emissions in Europe (EC, 2020). In this context, energy efficiency is a well-defined strategy for reducing the emission levels in the sector. However, despite energy efficiency programmes,Footnote 1 with the specific aim to promote energy efficiency measures in the residential sector, the progress is slow. A plausible explanation to this observation is the presence of high transaction costs (e.g., Lundmark, 2022; Ebrahimigharehbaghi et al., 2020). Transaction costs have been estimated to constitute roughly 20 percent of the project costs for energy efficiency projects in buildings (Ürge-Vorsatz et al., 2012) and 24–50 percent for energy renovation projects in single-family dwellings (Lundmark, 2022). Furthermore, it has been shown that transaction costs affect the decision process of households to energy renovate (Goodarzi et al., 2021; McCann & Claassen, 2016).

From an economic perspective, transaction costs can give rise to market failures, i.e., transaction costs cause an inefficient allocation of resources (Arrow, 1969). Transaction costs are the cost of making an economic exchange on a market above to the market price (Coase, 1937).Footnote 2 From this perspective and following the same path as the bulk of the economic literature, a transaction cost is defined as the opportunity cost for a given transaction for a specific good within a given institutional setting (e.g., Benham & Benham, 2000; Lundmark, 2022). They can be both ex-ante costs, associated with arranging a transaction, and the ex-post costs, associated with monitoring and enforcing the transaction (Matthews, 1986).

The presence of transaction costs suggests that energy efficiency measures by households can be more costly than what the corresponding market prices suggest. With high transaction costs, relatively fewer energy efficiency measures will be made compared to if the transaction costs are low, given the same investment cost. Therefore, it might be a good strategy to reduce the transaction costs associated with energy efficiency measures to reach the climate and energy target for the residential sector. However, our understanding of the factors affecting the magnitude of the transaction costs are still limited. Thus, before an appropriate strategy can be implemented, the magnitude of the related transaction costs and their determinants need to be addressed and empirically evaluated. Therefore, the purpose of this study is to identify and empirically estimate the impact of theoretically consistent determinants of transaction costs for energy efficiency measures in single-family dwellings in Sweden.

Sweden is an interesting case study since it has been estimated that its residential sector has a potential to reduce its energy use by 20% or more (Swedish National Board of Housing, Building and Planning, 2019). This corresponds to an energy-saving potential of 10.8 TWh per year.Footnote 3 More specifically, there are approximately two million detached and semi-detached single-family dwellings in the Swedish residential sector using 30.2 TWh of energy with a potential to reduce their energy use (Energimyndigheten, 2021; Weiss et al., 2012; Gram-Hanssen, 2014). Specifically, two types of energy efficiency measures for single-family dwellings are of interest: heat insulationFootnote 4 and energy-saving windows.Footnote 5 These measures are listed as having the highest payoffs for single-family dwellings in Sweden (Swedish National Board of Housing, Building and Planning, 2019). Moreover, Pardalis et al. (2019) indicate that windows and heat insulations (attic, cellar and walls) are common types of energy efficiency measures for single-family house-owners in Sweden, in addition to the more traditional aesthetic renovations. In fact, approximately 30% of the energy efficiency measures are for windows, 14 percent for attic insulation and 8% each for cellar and wall insulation.

The remainder of the paper is organised as follows: The next section, the relevant literature is outlined and placed in context. In the section Methods and materials, the theoretical aspects of transaction costs are explained and operationalised together with the empirical specification and data issues. This is followed by the section Results and discussion in which the results are presented and placed in a larger context. Finally, the Conclusion section wraps up the results and expand their implications into other domains.

Previous literature

The interest in energy efficiency measures in the residential sector has increased considerably since 2010 (Dolšak, 2023). Energy efficiency measures include measures with the specific purpose to save energy, increase energy efficiency and install production unit of renewable energy. In this context, energy renovations are defined as renovations with the purpose to reduce energy consumption by improving the energy performance of a dwelling. There are some review-studies discussing energy efficiency measures for the residential sector (Dolšak, 2023; Liu et al., 2022; Kastner and Stern, 2015; Friege & Chappin, 2014).

Studies analysing energy efficiency measures by households are numerous. The measures can be divided into investment and non-investment measures. The latter is a measure not involving capital expenditures, such as behavioural changes (Howard et al., 2017) and changing to energy efficient lighting, e.g., LED lighting (Caird et al., 2008), while the former usually involves capital investment, such as changing a heating system (Weiss et al., 2012); window replacements (Lundmark, 2022) or additional insulation (Fernandez-Luzuriaga et al., 2022). Nair et al., (2010) indicate that approximately 73% of owners of detached houses in Sweden have implemented some type of energy efficiency measures. However, only 16 percent are investment measures indicating that Swedish households are more likely to do non-investment energy efficiency measures.

It has been shown that potential energy savings are not a sufficient motivation for households in single-family dwellings to invest in energy efficiency measures (Gram-Hanssen, 2014; Pardalis et al., 2019). Rather, households base their investment decision on other aspects such as improving comfort (Mortensen et al., 2016), property value (Fuerst et al., 2015; Portnov et al., 2018) and aesthetic considerations (Pomianowski et al., 2019). Moreover, households are also reluctant to invest in energy efficiency measures due to a lack of understanding the economic benefits (Galvin, 2014), concerns for the process (Galvin & Sunikka-Blank, 2014) or reluctancy to disrupt everyday life (Vlasova & Gram-Hanssen, 2014). Additionally, investments in energy efficiency measures are characterised by uncertainties (de Wilde, 2019; Karvonen, 2013) and asymmetric information (Owen et al., 2014; Risholt & Berker, 2013).

The rationale for investing in energy efficiency measures has also been studied (Portnov et al., 2018; Wilson et al., 2018; 2015; Gram-Hanssen, 2014). Usually, the rationale is analysed in terms of drivers and barriers of energy efficiency measures for households (Dolšak, 2023; Broers et al., 2019; Azizi et al., 2019; Baumhof et al., 2018; Mortensen et al., 2016; Mortensen et al., 2016; Ameli and Brandt, 2015; Nair et al., 2010). Commonly identified barriers to energy renovations for single-family house-owners are connected to information and decision-making (Pettifor et al., 2015; Wilson et al., 2015). Information issues include a perceived lack of credible and available information on potential energy efficiency measures, misperceptions of energy costs, uncertainty about financial benefits, and contractor reliability (Lundmark, 2022). Furthermore, the information type and its sources and channels are also important aspects for how the information is perceived by households (Goodarzi et al., 2021; Hrovatin and Zorić, 2018). The decision-making issues include the cognitive ability of making complex decisions. The decision is normally modelled as a binary choice with a wide range of analysed determinants. For instance, the importance of environmental attitudes (Martinsson et al., 2011), trust (de Wilde, 2019), energy audits (Murphy, 2014), social learning and practices (Karvonen, 2013; Darby, 2006), household preferences, attitudes and practices (Abreu et al., 2017; Poortinga et al., 2003), social networks (McMichael and Shipworth, 2013), and spatial resolution (Ahlrichs et al., 2022). In addition, grassroots initiatives (Oteman et al., 2017) and psychological aspects, e.g., comfort levels, living conditions (Klöckner and Nayum, 2016) have also been investigated as an integrated part of the decision-making process. Adjacent research includes diffusion and adaptation of renewable energy by households (Goodarzi et al., 2021; Sardianou and Genoudi, 2013; Moula et al., 2013).

An explanation for the reluctance of households to invest in energy efficiency measures is argued to be high transaction costs (Lundmark, 2022). Empirically, transaction costs have been analysed for a variety of situations. For example, the transaction costs for multiple land-use situations (Bostedt et al., 2015), land development (Zhuang et al., 2020), natural resource management (McCann et al., 2005), energy-using equipment (Howarth and Andersson, 1993), and forest carbon projects (Phan et al., 2017). From a policy perspective, transaction costs have been evaluated for agri-environmental policies (McCann and Claassen, 2016), planning policy (Shahab et al., 2018), energy efficiency policy (Valentová et al., 2018), climate policies (Ofei-Mensah & Bennett, 2013), water policy (Njiraini et al., 2017), governance strategies (Signorini, et al., 2015), and payment schemes for ecosystem services (Phan et al., 2017). Transaction costs have also been analysed in the context of investment in energy efficiency measures (Ebrahimigharehbaghi et al., 2019, 2020; Pardalis et al., 2019; Valentová et al., 2018; Mundaca et al., 2013). For example, the transaction costs for adopting thermal insulation have been estimated to be twice as high in comparison to the costs of materials and labour (Gerarden et al., 2017). The empirical literature on transaction costs for energy efficiency measures for households are either qualitative evaluation of conceptual frameworks of transaction costs (Ebrahimigharehbaghi et al., 2019, 2020; Fan et al., 2018; Wu et al., 2019), or quantitative assessment of the magnitude of transaction costs and their determinants (Lundmark, 2022; Wu et al., 2019; Kiss, 2016; Björkqvist and Wene, 1993). The latter studies express transaction costs in monetary terms (Kiss, 2016; Lundmark, 2022) or as workload, i.e., time, (Björkqvist and Wene, 1993).

Previous literature indicates that our knowledge regarding households’ rationale to investment in energy efficiency measures are well understood. It is also clear that transaction costs are an important factor to consider in this context. However, our empirical understanding of the underlying factors of the transaction costs is much more limited. Thus, this study provides new insights to our understanding of how transaction costs affect investments in energy efficiency measures by identifying and analysing their main determinants. This is done by specifying and combining a method to estimate the magnitude of transaction costs with a method to estimate their determinants, in a novel approach.

Methods and materials

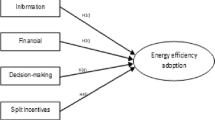

The methodological approach is based on a three-step procedure, as illustrated in Fig. 1. First, a survey is used to (a) elicit the information needed from the households to calculate the transaction costs, and (b) obtain data on control variables for the regression analysis. Second, the transaction costs, which is the dependent variable in the econometric specification, are calculated. Finally, the transaction costs are regressed on a set of control variables. The control variables are theoretically and empirically derived and hypothesised to have an impact on the magnitude of the transaction costs.

Theoretical foundation of transaction costs

Empirically, transaction costs are contextual and defined based on the opportunity costs that causes them. They can be expressed as the cost of investing in financial markets (Bhardwaj & Brooks, 1992), the cost of establish and maintaining property rights (McCann et al., 2005), the cost of market exchanges in excess of the production cost (Coggan et al., 2010), the cost of designing and using an institution (Marshall, 2013), or as the different between consumer and producer prices (Nilsson & Sundqvist, 2007). For energy efficiency measures, transaction costs occur associated with the search and information costs of planning, deciding, implementation and monitoring the project. These costs can be explicit costs, e.g., monetary expenditures, but also implicit costs expressed as the value of the time devoted towards the different elements of the transaction.

The magnitude of the transaction costs depends on transaction characteristics and on behaviour and social traits. Williamson (1979) argues for three dimensions of transaction characteristics affecting the transaction costs: uncertainty, frequency and asset-specificity. Uncertainty relates to the outcome of a transaction, which is affected by its complexity and asymmetric information (Coggan et al., 2010). For energy efficiency measures, uncertainties can be categorised as technical uncertainties (e.g., appropriateness and types of energy efficiency measures), and market uncertainties (e.g., energy prices and interest rates). In general, a high degree of uncertainty is expected to increase the transaction costs since more information needs to be processed and assimilated. Frequency refers to the regularity and the duration of a transaction. For one-time or occasional transactions, transaction costs associated with developing contractual procedures arises since each transaction is negotiated individually. More frequent transactions can reduce transaction costs by building trust (Vatn, 2005), facilitating standardised contracts (Coggan et al., 2013) and by allowing recycling of knowledge. Williamson (1979) concludes that occasional transactions that are non-standardised have most to benefit from adjudication. Finally, asset specificity refers to the degree an asset can be used or refitted for other purposes without losing efficiency. A high degree of specificity adds to the complexity of the transaction and is expected to result in higher transaction costs. For example, a high degree of asset specificity complicates the contract and monitoring process by necessitating non-standard solutions (Coggan et al., 2010, 2013). It can be categorised as site specificity, physical asset specificity and human asset specificity (Williamson, 1981, 1998). For energy renovation, the buildings geographical characteristics and location are classified as the site specificity, the buildings technical specifications as the physical asset specificity and the skills needed as the human asset specificity.

Furthermore, the dimensions of transaction cost characteristics are to be understood as a set of behaviour and social traits connected to the contractual process. Normally, the behavioural traits include forms of bounded rationality and opportunistic behaviour (Williamson, 1981, 1985). Bounded rationality suggests that individuals make rational decisions but with limited information and cognitive limitations. It affects transaction costs since more effort is needed to understand and interpret the information. Opportunistic behaviour occurs when an actor provides limited or selective information, or when they perform secretive or deceptive actions to promote their self-interest (Carson et al., 2006). It is expected to increase transaction costs since more effort needs to be devoted towards monitoring and developing more comprehensive contracts. In addition, the social traits include aspects such as reputation, reciprocity, common ideology, social norms and values, and social connectedness (Ducos et al., 2009; Phan et al., 2017). A common argument is that the social traits decrease the transaction costs by reducing the potential for opportunistic behaviour (Coggan et al., 2010). Social traits also affect transaction costs via knowledge generation that improves the decision-making ability (Coggan et al., 2013).

Operationalisation of transaction costs

Before the impact of the identified determinants can be assessed, the transaction costs must be estimated. The transaction costs \((c)\) are empirically measured as the economic value of the resources used in the energy renovation process by the household defined as the opportunity cost of time plus the monetary expenditures made excluding the actual investment cost (Lundmark, 2022; Valentová et al., 2018; Coggan et al., 2017; 2014; Wang, 2003; Benham & Benham, 2000)Footnote 6:

for household \(i\) and type of energy efficiency measures \(r\) \((r=\mathrm{1,2})\) where \(k\) is a household specific time-adjustment coefficient, \(t\) is the reported time devoted towards transaction cost \(j\), \(s\) is the opportunity cost of time and \(m\) is monetary expenditures.

Nine transaction cost components are included \((j=1,\dots ,9)\) divided into three groups. The first group of transaction costs include information search costs to find information on different types of energy renovations, their appropriateness for the specific building and the possible need for permits (Wilson et al., 2018; Stiess & Dunkelberg, 2013). Specifically, this includes search costs on performance of energy renovation and contractors (e.g., material choices and competence), authorisations and rules (e.g., building permits and standards) and subsidies and grants (e.g., investment grant and tax deductions). The second group includes evaluating costs connected to the effort of finding and negotiating with contractors, designing an implementation plan, assessing the energy performance and investment costs, reaching contractual agreements, and applying for support with appropriate authorities. Specifically, transaction costs associated with contract negotiation (e.g., price comparison and functionality), work coordination (e.g., towards and between contractors, and self-work) and work adjustments (e.g., time adjustments and attendance) are included. The final group includes implementation costs connected to the monitoring and enforcement of the contractual obligations of the energy renovation project. Specifically, this includes transaction costs associated with controlling performed work (e.g., quality and functionality), follow-up on performed work (e.g., permit process and moisture and mould problems) and adjusting other functions of the dwelling (e.g., ventilation and electrical installations).

The opportunity cost of time \((s)\) is measured as hourly labour costs based on the reported monthly income by the households \((y)\) divided by a fixed number of working hours per month \((\overline{h })\).

The time-adjustment coefficient \((k)\) is added to correct for potential time-bias by the household since they are asked to value past costs, i.e., it is assumed that households do not have perfect recollection of time and money spent.Footnote 7 The coefficient is expressed as the ratio between stated time \(({\tau }^{s})\) and actual time \(({\tau }^{a})\). The stated time is based on the respondents’ self-assessment of the time they spend answering the survey, while the actual time spent answering the survey is reported in the web-based survey. If \(k>1\) it is assumed that households underestimate the time of previous tasks.

Econometric model

To estimate the impact of the determinants on the transaction costs an econometric model is used. The general model is described as:

where \(\mathbf{x}\) is a vector of the transaction characteristics including variables measuring asset specificity (e.g., building characteristics), frequency (e.g., experience) and uncertainty (e.g., on energy-savings), \(\mathbf{z}\) is a vector of the behavioural traits including opportunistic behaviour (e.g., trust) and bounded rationality (e.g., cognitive limitations), and \(\mathbf{w}\) is a vector of social traits (e.g., socio-economic variables). Equation (4) is estimated separately for heat insulation and energy-saving windows. The variation in institutional factors is assumed to be captured by a regional dummy variable \((d)\). The error term \(\left(\varepsilon \right)\) is assumed to be normally distributed with mean zero and variance \({\sigma }^{2}\).

Data

A random selection of 10,000 single-family house-owners were invited to complete a web-based survey. The survey was designed to provide information on the parameters and variables needed to estimate the transaction costs, according to Eq. (1–3), and on the determinants outlined in Eq. (4). Only energy renovations made during the last 5 years were asked to respond to the survey (Royer, 2011). In total, 2,848 responses were received, of which 2,458 were generally usable (1,272 for heat insulation and 1,186 for energy-saving windows). However, due to partially completed responses, the sample is further reduced depending on analysis. To avoid miscalculations of average values, non-answers are regarded as missing observations, while active zero answers were included. Moreover, missing observations on monthly disposable income are replaced with national mean income level of SEK 34,000 (EUR 2,845)Footnote 8 and it is assumed an average monthly workload of 160 h. For information on survey design and questions please see the supplementary materials. The regression data is available on request.

Table 1 presents descriptive statistics for the socio-economic and asset specificity variables. National averages are also included to make an evaluation of the representativeness of the sample. The comparisons are not straight-forward but for most variables the sample corresponds relatively well with the national average except for age (the sample has an older average age) and gender (an overrepresentation of males). The high average age suggests that the sample also might have a disproportionately high share of retirees. However, the national average age is for the population, not for single-family house-owners. Thus, the national average age for single-family house-owners might be close to the sample mean. However, a high share of retirees could explain the lower income levels (assuming retirees earn less).

Summary statistics on behaviour and social traits as well as for uncertainties variables are presented in Table 2. The level of experience of energy renovations is captured by three binary questions indicating a progression of experience from (1) the household having friends, neighbours or close relatives that have done energy renovations, (2) to have helped them do the energy renovation, and (3) to have done energy renovations previously themselves. Based on these questions, a single matric is constructed by horizontally adding the three experience levels. As such, the constructed experience variable has three discrete steps where each subsequent step signifies a higher experience level. A fourth binary experience variable indicates whether the household has made other types of renovations to the dwelling during the last 5 years. Two binary questions regarding membership in house owners’ associations and in environmental organisations are used to construct a binary social connectedness variable. Following Coggan et al., (2014), social connectedness refers to the connection a household has with other households, groups or organisations, and is constructed as the merged combination of the two membership questions, i.e., membership in either of the organisation types sets the social connectedness variable to unity. The level of trust is measured by two questions on a 10-grade Likert-scale regarding the level of trust the house-owner has towards information from the public sector and from environmental organisations. The constructed trust variable is based on the mean of the answers to the two questions. Generally, as suggested by the median, information from the public sector (8) is trusted to a higher degree compared to information from environmental organisations (6). The house-owners perceived uncertainty is measured along two dimensions, investment costs and energy-savings, using a 10-grade Likert-scale. The constructed uncertainty variable is also based on the mean of the answers to the uncertainty questions. In general, the median uncertainties are higher for energy-saving potential than for the investment costs. This can partly be explained by the fact that investments costs are often contractually regulated which reduces its uncertainty. The perceived complexity of the different transaction costs components is used to construct a variable of the house-owners’ cognitive limitations. The perceived complexities are answered on a 10-grade Likert-scale (not shown in the Table) and the constructed cognitive limitation variable is based on the mean of these answers. It is expected that the transaction costs will increase with greater cognitive limitations. Finally, the house-owner’s self-assessments of their environmental awareness is measured on 10-grade Likert scales.

Table 3 presents descriptions and frequencies of the categorical variables. Approximately 39% of the respondents are retirees, which corresponds well with the relatively high average age in the sample. Most commonly, the dwellings are detached and have wood facades. Most of the households have also lived in their current dwellings for more than 15 years and have a university degree.

Results and discussion

Estimated transaction costs

For the determination of transaction costs, the respondents were asked to state the total time \((t)\) devoted to tasks associated with the transaction costs components using a 10-step Likert-scale question, where each step represents a span of ten hours. The median value of the chosen hour span is used in the calculations. Information on the monetary expenditures \((m)\) associated with the transaction cost components were obtained by open-ended questions. Table 4 presents descriptive statistics for the hours and expenditures devoted to the energy renovation projects, as well as the calculated opportunity cost of time (cf. Equation 2) and transaction costs (cf. Equation 1). On average, 8.9 h are spent on heat insulation and 7.9 h on energy-saving windows. The average expenditures \((\overline{m })\) are SEK 355 (EUR 29.7) and SEK 514 (EUR 43) for heat insulation and energy-saving windows, respectively. The average opportunity cost of time \((\overline{s })\) is SEK 1,907 (EUR 159.6) per hour for heat insulation and SEK 2,425 (EUR 202.9) per hour for energy-saving windows. The average transaction cost \((\overline{c })\) is SEK 18,046 (EUR 1,510) for heat insulation, with a standard deviation of SEK 36,289 (EUR 3,037), and SEK 21,106 (EUR 1,766) for energy-saving windows, with a standard deviation of SEK 35,594 (EUR 2,979). The average time-adjustment coefficient \((\overline{k })\) is 1.87 for both samples \((r)\). This suggests that households tend to underestimate the duration of previous tasks. That is, the measured actual time (\({\tau }^{a}\)) is higher than the stated time (\({\tau }^{s}\)).

The magnitude of the transaction costs corresponds to 29.8% of the investment costs for heat insulations and 57.7% for energy-saving windows. Mundaca (2008) finds that transaction costs constitute between 10 and 30% of the total investment costs for energy renovations while Björkqvist and Wene (1993) find shares between 13 and 28%. The opportunity cost of time is the dominating element in the estimated transaction costs. For heat insulation it constitutes 94% of the transaction costs and for energy-saving windows 90.8%. A small but positive correlation exists between reported income and monetary expenditures for both heat insulation and energy-saving windows, albeit the sample is significantly reduced since several households did not report on monetary expenditures (void answers). The positive correlations suggest that low-income households have a higher willingness to invest private time to, e.g., search for information, while high-income households are more likely to outsource these activities. Similar patterns are found by Coggan et al., (2014).

Determinants of the transaction costs

Three statistical tests indicate that the transaction costs are not normally distributed.Footnote 9 Since the transaction costs are censored at zero, i.e., they cannot be negative, a Tobit model is considered more appropriate compared to an ordinary least square model, or a generalised least square model. A statistical significance threshold of ten percent is used. Explanatory variables not statistically significant at that level are subsequently dropped from the regression. Initial regressions indicated that the households’ educational level and area of education as well as their type of employment and occupation have no explanatory power and are therefore dropped stepwise to avoid confounding effects. Furthermore, the following dwelling characteristics variables have no explanatory power: the construction year and type of dwelling, the type of heating system and façade and the dwelling locality. Furthermore, the inclusion of the uncertainty variable reduced to sample size due to missing observations to such an extent that the variable is dropped from the regression. For the regional dummy variables, the county of Norrbotten is the reference case. The regressions are made using STATA (version 17) and the main results are summarised in Table 5 and the effect of the 20 dummy variables controlling for regional effects are presented in Table 6 in the Appendix.

Discussion of the results

Some of the results differ between the two types of energy renovation, while some are comparable between the models. However, the determinants of transaction costs associated with heat insulation are better identified and with a better statistically significant compared to energy-saving windows. That is, the transaction costs for heat insulation are better explained by the model compared to energy-saving windows. The likelihood ratio tests indicate that the null hypothesis that all regression coefficients are zero can be rejected.

For both types of energy renovations, trust and environmental awareness are not statistically significant, neither are size of the dwelling, whether it has a basement or not, number of children and age. Previous studies have mainly analysed the effect of these variables on the decision-making process for energy renovations. Our results estimate the impact of these variables on the transaction costs, but a positive effect would imply higher transaction cost and therefore also a reduced likelihood of doing an energy renovation.

For environmental awareness, previous studies partly support our finding, i.e., that the environmental awareness of households has no effect (e.g., Achtnicht, 2011; Achtnicht & Madlener, 2014; Baumhof et al., 2017). The statistically insignificant results for some of the socio-economic variables (size of the dwelling, basement or not, number of children and age) are also partly supported by previous studies. However, more commonly these variables are found to have a negative effect (Dolšak, 2023).

The effects of bounded rationality on transaction costs can be assessed by the households’ cognitive limitations. It is expected that cognitive limitation will have a positive effect on transaction costs, i.e., the higher the perceived complexity of the energy renovation the higher the transaction costs is expected to be. The results indicate that cognitive limitations are statistically significant for heat insulation but not for energy-saving windows. This suggest that heat insulation is perceived as a more complex process since it is less standardised compared to energy-saving windows. Previous studies assessing cognitive limitations have not been identified, but Coggan et al., (2014) find that bounded rationality has an impact on transaction costs, and Kastner and Stern (2015) find mixed results for the manner the decisions is made in. The result indicates that if the cognitive limitation increases by one step, the transaction costs for heat insulation would increase by approximately SEK 1,800 (EUR 150.6). Conversely, if the perceived complexity of undertaking a heat insulation renovation would be reduced, so would the transaction costs.

The impact of opportunistic behaviour is assessed by the trust and social connectedness variables. The trust variable is not found to be statistically significant, contrasting the results to that of previous studies which normally find that trust is an important variable (e.g., de Wilde, 2019; Bolton et al., 2023). This inconsistency can plausible be explained by different institutional and social settings, as well as different practices in the analysed countries. Another explanation for the inconsistency could be the applied method, where data based on a small sample of interviews might be difficult to generalise to an entire population. Social connectedness refers to the connections a household has to social groupings or organisations. Social connectedness is statistically significant for heat insulation but not for energy-saving windows. This can be explained by that opportunistic behaviour is more likely the more complex a renovation is. That is, complex renovation increases the risk of asymmetric information that can be exploited by e.g., contractors. Interestingly, if the household is social connected the likelihood of opportunistic behaviour increase, with increased transaction costs consequently. Alternatively, this can be interpreted as an indication that social connectedness follows a high aspiration for validation or confirmation, which increases the transaction costs. Coggan et al., (2014) also finds a positive relationship between social connectedness and transaction costs. Paraphrasing their argument is that being a member of many organisations not exclusively engaged in energy renovations, increases transaction costs due to the effort involved in the interaction with these organisations. On a wider scale of social influences, Kastner and Stern (2015) find a predominantly positive effect. The results indicate that households with social connectedness have transaction costs roughly SEK 11,000 (EUR 920) higher than households without social connectedness.

The frequency of which a particular type of transaction occurs is expected to affect the transaction costs. The frequency is proxied by two experience variables. The result indicates that if the experience of energy renovation increases, the transaction costs would increase by almost SEK 7,800 (EUR 653) for heat insulation and by approximately SEK 5,800 (EUR 485) for energy-saving windows. If the household has previous experience of other types of renovations, the transaction costs for heat insulation would increase by almost SEK 13,600 (EUR 1,138) and by SEK 14,500 (EUR 1,213) for energy-saving windows. The results seem counter-intuitive since experience is expected to accumulate knowledge that reduces transaction costs. Indeed, Kastner and Stern (2105) identify two studies that estimate a positive relationship between the likelihood of doing an energy renovation and experience with retrofit measures. However, it can be argued that the frequency is still not high enough for the transaction costs to be reduced. Even occasional transactions of this type still require the development of individual contractual procedures. That is, even with experience of previous energy renovations, the projects are sufficiently unique to make knowledge transfers difficult. Instead, the previous projects have made the transaction costs transparent and tangible (Phan et al., 2017).

The impact of asset specificity is assessed by the variables related to the dwelling characteristics. A high degree of asset specificity is hypothesised to increase the transaction costs of energy renovations. However, since only number of rooms and number of floors are statistically significant and only for heat insulation, little support is found for the hypothesis. That is, asset specificity captures the inherent differences of energy renovation projects, but it does not translate into higher transaction costs. In fact, none of the variables are statistically significant for energy-saving windows. For heat insulation, multi-storey dwellings reduce the transaction costs (increase the likelihood of doing an energy renovation), while the number of rooms increase the transaction costs (decrease the likelihood of doing an energy renovation). This is contrary to Gamtessa (2013) who finds a negative effect of the number of floors on the likelihood of doing an energy renovation. In latter case, the number of floors might capture other aggravating aspects of an energy renovation outweighing the effect it might have on the transaction costs. As such, a direct comparison with previous studies is difficult since different variables are used. However, living space (size) is commonly included in other studies as well but has been estimated to have a positive effect on the likelihood of doing an energy renovation (Nauleau, 2014), a neutral effect (statistically insignificant) (Dolšak et al., 2020) and a negative effect (Gamtessa, 2013). This is supported by Kastner and Stern (2015) that also find mixed results in their review. Similarly, little support is also found for the hypothesis of site specificity, as indicated by the regional dummy variables (they are mostly statistically insignificant).

Finally, the social traits, proxied by socio-economic variables, are included as control variables. The results indicate that they are not comparably affecting the two types of energy renovations. For instance, gender is affecting the transaction costs for energy-saving windows but not for heat insulations. The number of adults in the household and property value are affecting the transaction costs for heat insulation but not for energy-saving windows. Income level and mortgage size affect the transaction costs for both types of energy renovations. Energy renovations are commonly financed by remortgaging the dwelling. This involves additional transactions costs which can be expected to increase with the mortgage size. The results indicate that the transaction costs increase by around SEK 1,100 (EUR 92) per million SEK in mortgage, for both types of energy renovations. Since the transaction costs are measured as the opportunity cost of time, households valuing their time higher compared to other households are expected to have higher transaction costs (per unit of time). That is, household specific salaries are used to derive an internal labour cost associated with the transaction costs. High-income households are thus expected to have higher transaction costs compared to low-income households. However, the results indicate that the income effect on transaction costs is low. This suggests that energy renovations are not driven by income levels. However, there might be distributional effects since low-income households do not have the same opportunity to outsource activities associated with the transaction costs. The income levels affect the transaction costs, albeit on a very low level. If the income increases by SEK 1,000 (EUR 84), the transaction costs would increase by SEK 27.6 (EUR 2.3) for heat insulation and by SEK 319 (EUR 26.7) for energy-saving windows. Property value can be used as a proxy for the size of the energy renovation projects. The results indicate that it has a small effect on the transaction costs for heat insulation and no effect on the transaction costs for energy-saving windows. Therefore, in the latter case, transaction costs can be considered as a fixed cost and do not scale-up with larger projects. Consequently, high-valued dwellings are more likely to undergo energy renovations since the transaction costs represent a lower share of the property value compared to low-valued dwellings. That is, large projects are more likely to absorb the transaction costs compared to small projects making transaction costs a less deterring factor for energy renovations. Direct support towards low-value dwellings can be a way to increase the rate of energy renovations. Property value is only statistically significant for heat insulation. If the property value increases by one million SEK (EUR 83,682), the transaction costs would increase by SEK 664 (EUR 55.6). This is consistent with previous research that concludes that their transaction costs are predominantly fixed costs (Coggan et al., 2014).

Conclusions

To expediate the potential of energy savings in the residential sector, the transaction costs associated with energy efficiency measures must be identified, estimated and properly addressed. In this study, a theoretical consistent approach to empirically estimated transaction costs for heat insulations and energy-saving windows and their determinants is developed. The primary determinants of transaction costs are the frequency by which similar transactions occur, behaviour traits, such as social connectedness and cognitive limitations, and social traits, such as income level, property value, mortgage and household size. Interesting, asset specificity is only influencing the transaction costs to a lesser degree. Thus, these are the areas that firms and organisations, as well as the public sector, must address to reduce the transaction costs.

The results indicate that the average transaction cost for single-family house-owners in Sweden to make additional heat insulation is SEK 18,046 (EUR 1,510) and SEK 21,106 (EUR 1,766) to install energy-saving windows. These results are based on an opportunity cost of time that equals the households’ hourly earnings. This corresponds to approximately 30% of the investment costs for heat insulations and 58% for energy-saving windows. Thus, a primary conclusion is that transaction costs are a major barrier for households to undertake energy efficiency measures. Consequently, by reducing the complexity of investments in energy efficiency measures, the transaction costs can also be reduced, which would increase the likelihood of households to investment in energy efficiency measures. That is, by eliminating superfluous practices and bureaucracy more households would undertake energy renovations and thus help achieve energy and climate policy targets.

The results also provide interesting policy insights. In general, if the benefits do not outweigh the costs, including transaction costs, energy renovations will not occur and the expected energy-saving potential will not be realised, even with the most ambitious policy targets. Both from a national (Swedish), and EU perspective, the transaction costs associated with energy renovation must be addressed to design effective policies. If improving the energy efficiency in the residential sector is considered a priority, policies should primarily be designed and directed towards reducing transaction costs faced by households (e.g., unbiased information packages, local advise services, establishing forums for knowledge transfer). Otherwise, energy efficiency improvements in the residential sector, especially for single-family dwellings, might not be such a low-hanging fruit as expected. To address the issue of transaction costs acting as a barrier for energy renovations, multiple policy designs might be called on, based on not only basic economic assumptions or climate responsibilities, but also on our understanding of how households fail to adhere to these assumptions, i.e., bounded rationality and the impact of behaviour traits. The importance of behaviour traits, especially for heat insulation, suggest a bottom-up approach in policy design might be more appropriate compared to a top-down approach. In addition, the policy design should also consider the heterogeneity of households, such as income level, mortgage size and the structure of the household, to reduce the impact of transaction costs. Furthermore, the policies must be design not to add additional transaction costs. Complicated compliance or understanding of policies might, contrary to its intentions, instead increase the transaction costs.

There are several avenues that can further develop this line of research. Firstly, an explicit policy analysis that assess the impact of specific policies on the transaction costs would provide detailed information on policy issues. Secondly, by expanding the types of energy efficiency measures analysed, it would be possible to draw conclusions on the cost-efficiency of the different measure including transaction costs. Thirdly, information types and sources on energy efficiency measures have an impact on trust, uncertainty, and reliability, all of which affect transaction costs. Therefore, it would be interesting to analyse the specific impacts of information issues. Finally, it would be interesting to expand the scope of the analysis to a larger policy area, such as the EU. However, to this end a new survey needs to be design and distributed to collect the necessary data across EU member states.

Notes

Energy Efficiency Directive (EED) and Energy Performance of Building Directive (EPBD) are the main energy efficiency programs in EU affecting energy renovations. EED was amended in 2018 with an energy efficiency target for 2030 of at least 32.5 percent, compared to 2005 levels (EC, 2018). Furthermore, a proposed revision of the EED requires the public sector to energy renovate three percent of its buildings each year, compared to the one percent energy renovated today (EC, 2020; 2021).

There are also definitions for managerial transaction costs (e.g., for measures taken within an organisation), and political transaction costs (e.g., designing and implementing policies).

Based on energy use for heating and hot water in one-, two- and multi-dwellings in 2020 (Energimyndigheten, 2022).

Building additional thermal insulation of the dwelling’s climate shell, usually exterior walls, floors, attics or cellars.

Windows that are adapted to conserve energy by reducing the heat leakage.

The approach chosen for estimating the monetary value of the time component of the transaction costs is based on the opportunity cost of the time spend on, e.g., searching for information by the households. The opportunity cost of time is assumed to equal a foregone wage. That is, instead of searching for information an hour it is assumed that the household has the option to work an additional hour. Even if the information search is carried out on dedicated leisure time it has the same opportunity cost since there is a trade-off between work and leisure based on the same logic. For households not participating in the labour market the opportunity cost of time would be the salary if they did get a job (in this case it assumed they enter the labour market with the median salary). Also, for households working for a salary and a fixed number of hours, the principle is the same. If they cannot work more hours in their current job, it is possible to take a second job. This approach has the benefit of generating household specific transaction costs based on their respective opportunity cost of time. It has also been argued that an appropriate approach to estimate the transaction costs is based on the number of hours households devote towards the different tasks, i.e., transaction costs measured in temporal instead of monetary terms. As such, households would have the same value of an hour and the complexity of the opportunity cost of time would be avoided. However, this approach does not fully account for the heterogeneity of the transaction costs across households.

For a more detailed discussion of the time-adjustment coefficient and its implementation see Lundmark (2022).

The exchange rate at the date the survey was completed (1. June 2021) is used to convert SEK to Euro (11.95 SEK per Euro).

References

Abreu, M. I., Oliveira, R., & Lopes, J. (2017). Attitudes and practices of homeowners in the decision making process for building energy renovation. Procedia Engineering, 172, 52–59.

Achtnicht, M. (2011). Do environmental benefits matter? Evidence from a choice experiment among house owners in Germany. Ecological Economics, 70, 2191–2200.

Achtnicht, M., & Madlener, R. (2014). Factors influencing German house owners’ preferences on energy retrofits. Energy Policy, 68, 254–263.

Ahlrichs, J., Wenninger, S., Wiethe, C., & Häckel, B. (2022). Impact of socio-economic factors in local energetic retrofitting needs – A data analytics approach. Energy Policy, 160, 112646.

Ameli, N., & Brandt, N. (2015). Determinants of households’ investment in energy efficiency and renewables: evidence from the OECD survey on household environmental behaviour and attitudes. Environmental Research Letters, 10, 044015.

Arrow, K. J. (1969). The Organization of Economic Activity: Issues Pertinent to the Choice of Market versus Non-Market Allocations (pp. 1–16). Washington DC: Joint Economic Committee of Congress.

Azizi, S., Nair, G., & Olofsson, T. (2019). Analysing the house-owners’ perceptions on benefits and barriers of energy renovation in Swedish single-family houses. Energy & Buildings, 198, 187–196.

Baumhof, R., Decker, T., Röder, H., & Menrad, K. (2017). An expectancy theory approach: What motivates and differentiates German house owners in the context of energy efficient refurbishment measures? Energy and Buildings, 152, 483–491.

Baumhof, R., Decker, T., Röder, H., & Menrad, K. (2018). Which factors determine the extent of house owners’ energy-related refurbishment projects? A motivation-opportunity-ability approach. Sustainable Cities and Society, 36, 33–41.

Benham, A., & Benham, L. (2000). Measuring the costs of exchange. In C. Ménard (Ed.), Institutions, contracts and organisations: Perspectives from New Institutional Economics (pp. 367–375). Cheltenham, UK: Edward Edgar.

Bhardwaj, R., & Brooks, L. (1992). The January anomaly: Effects of low share price, transaction costs, and the bid-ask bias. Journal of Finance, 47, 553–574.

Björkqvist, O. and C-O, Wene. (1993). A study of transaction costs for energy investment in the residential sector. In: Proceedings of the 1993 Summer Study. The European Council for an Energy Efficient Economy (ECEEE), Stockholm, p. 23–30. Available at https://www.eceee.org/library/conference_proceedings/eceee_Summer_Studies/1993/Panel_3/p3_3/ (accessed 2021–10–21).

Bolton, E., Bookbinder, R., Middlemiss, L., Hall, S., Davis, M., & Owen, A. (2023). The relational dimensions of renovation: Implications for retrofit policy. Energy Research and Social Science, 96, 102916.

Bostedt, G., Widmark, C., Andersson, M., & Sandström, C. (2015). Measuring transaction costs for pastoralists in multiple land use situations: Reindeer husbandry in Northern Sweden. Land Economics, 91(4), 704–722.

Broers, W. M. H., Vasseur, V., Kemp, R., Abujidi, N., & Vroon, Z. A. E. P. (2019). Decided or divided? An empirical analysis of the decision-making process of Dutch homeowners for energy renovation measures. Energy Research & Social Science, 58, 101284.

Caird, S., Roy, R., & Herring, H. (2008). Improving the energy performance of UK households: Results from surveys of consumer adoption and use of low- and zero-carbon technologies. Energy Efficiency, 1, 149–166.

Carson, S. J., Madhok, A., & Wu, T. (2006). Uncertainty, opportunism and governance: The effects of volatility and ambiguity on formal and relational contracting. Academy of Management Journal, 49(5), 1058–1077.

Coase, R. H. (1937). The nature of the firm. Economica, 4(16), 386–405.

Coggan, A., Whitten, S. M., & Bennett, J. (2010). Influences of transaction costs in environmental policy. Ecological Economics, 69, 1777–1784.

Coggan, A., Buitelaar, E., Whitten, S., & Bennett, J. (2013). Factors that influence transaction costs in development offsets: Who bears what and why? Ecological Economics, 88, 222–231.

Coggan, A., van Grieken, M., Boullier, A., & Jardi, X. (2014). Private transaction costs of participating in water quality improvements programs for Australia’s Great Barrier Reef: Extent, causes and policy implications. Australian Journal of Agricultural and Resource Economics, 59, 499–517.

Coggan, A., van Grieken, M., Jardi, X., & Boullier, A. (2017). Does asset specificity influence transaction costs and adoption? An analysis of sugarcane farmers in the Great Barrier Reef catchments. Journal of Environmental Economics and Policy, 6(1), 36–50.

D’Agostino, R. B., Belanger, A. J., & D’Agostino, R. B., Jr. (1990). A suggestion for using powerful and informative tests of normality. American Statistician, 44, 316–321.

Darby, S. (2006). Social learning and public policy: Lessons from an energy-conscious village. Energy Policy, 34, 2929–2940.

de Wilde, M. (2019). The sustainable housing question: On the role of interpersonal, impersonal and professional trust in low-carbon retrofit decisions by homeowners. Energy Research and Social Science, 51, 138–147.

Dolšak, J. (2023). Determinants of energy efficient retrofits in residential sector: A comprehensive analysis. Energy and Buildings, 282, 112801.

Dolšak, J., Hrovatin, N., & Zoric, J. (2020). Factors impacting energy-efficient retrofits in the residential sector: The effectiveness of the Slovenian subsidy program. Energy and Buildings, 229, 110501.

Ducos, G., Dupraz, P., & Bonnieux, F. (2009). Agri-environment contract adoption under fixed and variable compliance costs. Journal of Environmental Planning and Management., 52(5), 669–687.

Ebrahimigharehbaghi, S., Qian, Q. K., Meijer, F. M., & Visscher, H. J. (2019). Unravelling Dutch homeowners’ behaviour towards energy efficiency renovations: What drives and hinders their decision-making? Energy Policy, 129, 546–561.

Ebrahimigharehbaghi, S., Qian, Q. K., Meijer, F. M., & Visscher, H. J. (2020). Transaction costs as a barrier in the renovation decision-making process: A study of homeowners in the Netherlands. Energy & Buildings, 215, 109849.

EC – European Commission. (2018). Amending Directive 2012/27/EU on energy efficiency. L 328/210 (21.12.2018). Accessible on: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:OJ.L_.2018.328.01.0210.01.ENG.

EC – European Commission. (2020). A renovation wave for Europe – greening our buildings, creating jobs, improving lives. COM/2020/662 final, Brussels. Accessible on: https://ec.europa.eu/energy/sites/ener/files/eu_renovation_wave_strategy.pdf

EC – European Commission. (2021). Proposal for a DIRECTIVE OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on energy efficiency (recast). COM/2021/558 final, Brussels. Accessible on: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52021PC0558

Energimyndigheten – Swedish Energy Agency. (2021). Energy statistics for dwellings and non-residential premises. Available online: https://www.energimyndigheten.se/en/facts-and-figures/statistics/. Accessed: 2021–12–09.

Energimyndigheten – Swedish Energy Agency. (2022). Energy in Sweden Facts and Figures 2022. Available: http://www.energimyndigheten.se/statistik/energilaget/. Accessed: 2022–03–15.

Fan, K., Chan, E. H. W., & Qian, Q. K. (2018). Transaction costs (TCs) in green buildings (GB) incentive schemes: Gross floor area (GFA) concession scheme in Hong Kong. Energy Policy, 119, 563–573.

Fernandez-Luzuriaga, J., Flores-Abascal, I., del Portillo-Valdes, L., Mariel, P., & Hoyos, D. (2022). Accounting for homeowners’ decision to insulate: A discrete choice model approach in Spain. Energy and Buildings, 273, 112417.

Friege, J., & Chappin, E. (2014). Modelling decisions on energy-efficient renovations: A review. Renewable and Sustainable Energy Reviews, 39, 196–208.

Fuerst, F., McAllister, P., Nanda, A., & Wyatt, P. (2015). Does energy efficiency matter to home-buyers? An investigation of EPC ratings and transaction prices in England. Energy Economics, 45, 145–156.

Furubotn, E. G., & Richter, R. (2005). Institutions and economic theory: The contribution of the new institutional economics (2ed). The University of Michigan Press.

Galvin, R. (2014). Why German homeowners are reluctant to retrofit. Building Research and Information, 42(4), 398–408.

Galvin, R., & Sunikka-Blank, M. (2014). The UK homeowner retrofitter as an innovator in a socio-technical system. Energy Policy, 74, 655–662.

Gamtessa, S. F. (2013). An explanation of residential energy-efficiency retrofit behavior in Canada. Energy and Buildings, 57, 155–164.

Gerarden, T. D., Newell, R. G., & Stavins, R. N. (2017). Assessing the energy-efficiency gap. Journal of Economic Literature, 55(4), 1486–1525.

Goodarzi, S., Masini, A., Aflaki, S., & Fashimnia, B. (2021). Right information at the right time: Re-evaluating the attitude–behaviour gap in environmental technology adoption. International Journal of Production Economics, 242, 108278.

Gram-Hanssen, K. (2014). Existing buildings – Users, renovations and energy policy. Renewable Energy, 61, 136–140.

Howarth, R. B., & Andersson, B. (1993). Market barriers to energy efficiency. Energy Economics, 15(4), 262–272.

Howard, R., Restrep, L., & Chang, C.-Y. (2017). Addressing individual perceptions: An application of the unified theory of acceptance and use of technology to building information modelling. International Journal of Project Management, 35(2), 107–120.

Hrovatin, N., & Zorić, J. (2018). Determinants of energy-efficient home retrofits in Slovenia: The role of information sources. Energy & Buildings, 180, 42–50.

Kalkuhl, M., Edenhofer, O., & Lessmann, K. (2012). Learning or lock-in: Optimal technology policies to support mitigation. Resource and Energy Economics, 34, 1–23.

Karvonen, A. (2013). Towards systemic domestic retrofit: A social practices approach. Building Research and Information, 41(5), 563–574.

Kastner, I., & Stern, P. C. (2015). Examining the decision-making processes behind household energy investments: A review. Energy Research & Social Science, 10, 72–89.

Kiss, B. (2016). Exploring transaction costs in passive house-oriented retrofitting. Journal of Cleaner Production, 123, 65–76.

Klöckner, C. A., & Nayum, A. (2016). Specific barriers and drivers in different stages of decision – Making about energy efficiency upgrades in private homes. Frontiers in Psychology, 7, 1362.

Lin, B., & Li, X. (2011). The effect of carbon tax on per capita CO2 emissions. Energy Policy, 39, 5137–5146.

Liu, G., Ye, K., Tan, Y., Huang, Z., & Li, X. (2022). Factors influencing homeowners’ housing renovation decision-making: Towards a holistic understanding. Energy and Buildings, 254, 111568.

Lundmark, R. (2022). Time-adjusted transaction costs for energy renovations for single-family house-owners. Energy Economics, 114, 106327.

Mack, G., Kohler, A., Heitkämper, K., & El-Benni, N. (2019). Determinants of the perceived administrative transaction costs caused by the uptake of an agri-environmental program. Journal of Environmental Planning and Management, 62(10), 1802–1819.

Mäklarstatistik. (2022). Svensk mäklarstatistik. www.maklarstatistik.se. Accessed: 2022–03–24.

Marshall, G. R. (2013). Transaction costs, collective action and adaptation in managing complex social–ecological systems. Ecological Economics, 88, 185–194.

Martinsson, J., Lundqvist, L. J., & Sundström, A. (2011). Energy saving in Swedish households. The (relative) importance of environmental attitudes. Energy Policy, 39, 5182–5191.

Matthews, R. (1986). The economics of institutions and the sources of growth. Economic Journal, 96(384), 903–918.

McCann, L., & Claassen, R. (2016). Farmer transaction costs of participating in federal conservation programs: Magnitudes and determinants. Land Economics, 92(2), 256–272.

McCann, L., Colby, B., Easter, K. W., Kasterine, A., & Kuperan, K. V. (2005). Transaction cost measurement for evaluating environmental policies. Ecological Economics, 52, 527–542.

McMichael, M., & Shipworth, D. (2013). The value of social networks in the diffusion of energy efficiency innovations in UK households. Energy Policy, 53, 159–168.

Mogensen, D., & Gram-Hanssen, K. (2023). Why do people (not) energy renovate their homes? Insights from qualitative interviews with Danish homeowners. Energy Efficiency, 16, 40.

Mortensen, A., Heiselberg, P., & Knudstrup, M. (2016). Identification of key parameters determining Danish homeowners’ willingness and motivation for energy renovations. International Journal of Sustainable Built Environment, 5, 246–268.

Moula, M. E., Maula, J., Hamdy, M., Fang, T., Jung, N., & Lahdelma, R. (2013). Researching social acceptability of renewable energy technologies in Finland. International Journal of Sustainable Built Environment, 2, 89–98.

Mundaca, L. (2008). Markets for energy efficiency: Exploring the implications of an EU-wide ‘Tradeable White Certificate’ scheme. Energy Economics, 30, 3016–3043.

Mundaca, L., Mansoz, M., Neij, L., & Timilsina, G. R. (2013). Transaction costs analysis of low-carbon technologies. Climate Policy, 13(4), 490–513.

Murphy, L. (2014). The influence of energy audits on the energy efficiency investments of private owner-occupied households in the Netherlands. Energy Policy, 65, 398–407.

Nair, G., Gustavsson, L., & Mahapatra, K. (2010). Factors influencing energy efficiency investments in existing Swedish residential buildings. Energy Policy, 38(6), 2956–2963.

Nauleau, M.-L. (2014). Free-riding on tax credits for home insulation in France: An econometric assessment using panel data. Energy Economics, 46, 78–92.

Nilsson, F. (2009). Transaction costs and agri-environmental policy measures: Are preferences influencing policy implementation? Journal of Environmental Planning and Management, 52(6), 757–775.

Nilsson, M., & Sundqvist, T. (2007). Using the market at a cost: How the introduction of green certificates in Sweden led to market inefficiencies. Utilities Policy, 15, 49–59.

Njiraini, G. W., Thiam, D. R., & Coggan, A. (2017). The analysis of transaction costs in water policy implementation in South Africa: Trends, determinants and economic implications. Water Economics and Policy, 3(1), 1650020.

Ofei-Mensah, A., & Bennett, J. (2013). Transaction costs of alternative greenhouse gas policies in the Australian transport energy sector. Ecological Economics, 88, 214–221.

Oteman, M., Kooij, H.-J., & Wiering, M. A. (2017). Pioneering renewable energy in an economic energy policy system: The history and development of Dutch grassroots initiatives. Sustainability, 9, 550.

Owen, A., Mitchell, G., & Gouldson, A. (2014). Unseen influence – the role of low-carbon retrofit advisers and installers in the adoption and use of domestic energy technology. Energy Policy, 73, 169–179.

Pardalis, G., Mahapatra, K., Bravo, G., & Mainali, B. (2019). Swedish house owners’ intentions towards renovations: Is there a market for one-stop-shop? Buildings, 9, 164.

Pettifor, H., Wilson, C., & Chryssochoidis, G. (2015). The appeal of the green deal: Empirical evidence for the influence of energy efficiency policy on renovating homeowners. Energy Policy, 79, 161–176.

Phan, T.-H.D., Brouwer, R., & Davidson, M. D. (2017). A global survey and review of the determinants of transaction costs of forestry carbon projects. Ecological Economics, 133, 1–10.

Pomianowski, M., Antonov, Y. I., & Heiselberg, P. (2019). Development of energy renovation packages for the Danish residential sector. Energy Procedia, 158, 2847–2852.

Poortinga, W., Steg, L., Vlek, C., & Wiersma, G. (2003). Household preferences for energy-saving measures: A conjoint analysis. Journal of Economic Psychology, 24(1), 49–64.

Portnov, B. A., Trop, T., Svechkina, A., Ofek, S., Akron, S., & Ghermandi, A. (2018). Factors affecting homebuyers’ willingness to pay green building price premium: Evidence from a nationwide survey in Israel. Building and Environment, 137, 280–291.

Risholt, B., & Berker, T. (2013). Success for energy efficient renovation of dwellings—learning from private homeowners. Energy Policy, 61, 1022–1030.

Royer, A. (2011). Transaction costs in milk marketing: A comparison between Canada and Great Britain. Agricultural Economics, 42, 171–182.

Sachs, J., Meng, Y., Giarola, S., & Hawkes, A. (2019). An agent-based model for energy investment decisions in the residential sector. Energy, 172, 752–768.

Sardianou, E., & Genoudi, P. (2013). Which factors affect the willingness of consumers to adopt renewable energies? Renewable Energy, 57, 1–4.

SCB – Statistics Sweden. (2022). Statistical database. www.statistikdatabasen.scb.se. Accessed: 2022–03–24.

Shahab, S., Clinch, J. P., & O’Neill, E. (2018). Accounting for transaction costs in planning policy evaluations. Land Use Policy, 70, 263–272.

Shapiro, S. S., & Francia, R. S. (1972). An approximate analysis of variance test for normality. Journal of the American Statistical Association, 67, 215–216.

Shapiro, S. S., & Wilk, M. B. (1965). An analysis of variance test for normality (complete samples). Biometrika, 52, 591–611.

Signorini, G., Ross, R. B., & Peterson, H. C. (2015). Governance strategies and transaction costs in a renovated electricity market. Energy Economics, 52, 151–159.

Siskos, P., Capros, P., & De Vita, A. (2015). CO2 and energy efficiency car standards in the EU in the context of a decarbonization strategy: A model-based policy assessment. Energy Policy, 84, 22–34.

Stiess, I., & Dunkelberg, E. (2013). Objectives, barriers and occasions for energy efficient refurbishment by private homeowners. Journal of Cleaner Production, 48, 250–259.

Swedish National Board of Housing, Building and Planning. (2019). Underlag till den tredje nationella strategin for energieffektiviserande renovering [in Swedish]. Available online: https://www.boverket.se/en/start/publications/publications/. Accessed: 2021–11–26.

Ürge-Vorsatz, D., Eyre, N., Graham, P., Harvey, D., Hertwich, E., Jiang, Y., . . . Jochem, E. (2012). Energy End-Use: Buildings. In: Global Energy Assessment Writing Team (Author), Global Energy Assessment: Toward a Sustainable Future (pp. 649–760). Cambridge: Cambridge University Press. https://doi.org/10.1017/CBO9780511793677.016

Valentová, M., Lízal, L., & Knápek, J. (2018). Designing energy efficiency subsidy programmes: The factors of transaction costs. Energy Policy, 120, 382–391.

Vatn, A. (2005). Rationality, institutions and environmental policy. Ecological Economics, 55, 203–217.

Vlasova, L., & Gram-Hanssen, K. (2014). Incorporating inhabitants’ everyday practices into domestic retrofits. Building Research and Information, 42(4), 512–524.

Wang, N. (2003). Measuring transaction costs: An incomplete survey. Ronald Coase Institute, Working paper no 2.

Weiss, J., Dunkelberg, E., & Vogelpohl, T. (2012). Improving policy instruments to better tap into homeowner refurbishment potential: Lesson learned from a case study in Germany. Energy Policy, 44, 406–415.

Williamson, O. E. (1979). Transaction-Cost Economics: The Governance of Contractual Relations. Journal of Law & Economics, 22(2), 233–261.

Williamson, O. (1981). The economics of organization: The transaction cost approach. American Journal of Sociology, 87(3), 548–577.

Williamson, O. (1985). The economic institutions of capitalism: Firms, markets and relational contracting. The Free Press.

Williamson, O. (1998). Transaction cost economics: How it works, where is it headed. De Economist, 146(1), 23–58.

Wilson, C., Crane, L., & Chryssochoidis, G. (2015). Why do homeowners renovate energy efficiently? Contrasting perspectives and implications for policy. Energy Research & Social Science, 7, 12–22.

Wilson, C., Pettifor, H., & Chryssochoidis, G. (2018). Quantitative modelling of why and how homeowners decide to renovate energy efficiently. Applied Energy, 212, 1333–1344.

Wu, H., Qian, Q. K., Straub, A., & Visscher, H. (2019). Exploring transaction costs in the prefabricated housing supply chain in China. Journal of Cleaner Production, 226, 550–563.

Xu, X., He, P., Xu, H., & Zhang, Q. (2017). Supply chain coordination with green technology under cap-and-trade regulation. International Journal of Production Economics, 183, 433–442.

Zhuang, T., Qian, Q. K., Visscher, H. J., & Elsinga, M. G. (2020). An analysis of urban renewal decision-making in China from the perspective of transaction costs theory: The case of Chongqing. Journal of Housing and the built Environment, 35, 1177–1199.

Acknowledgements

The author is thankful for financial support from the Swedish Energy Agency (project number: 49550-1).

Funding

Open access funding provided by Lulea University of Technology.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Lundmark, R. Understanding transaction costs of energy efficiency renovations in the Swedish residential sector. Energy Efficiency 17, 20 (2024). https://doi.org/10.1007/s12053-024-10198-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12053-024-10198-w