Abstract

Improving energy efficiency is one of the most effective ways to combat climate change and global warming. Financial inclusion can facilitate the financing of energy-efficient technologies and environmental awareness programs. In this context, this study aims to investigate the asymmetric and causal relationships between financial inclusion and energy efficiency in the ten most energy-efficient countries over the period 1980q1–2018q4. For this purpose, the quantile-on-quantile approach, quantile regression, and quantile Granger causality test are applied in this study. The findings demonstrate that financial inclusion has a negative impact on energy intensity across all quantiles. Energy intensity also reduces financial inclusion. However, this effect is attenuated at higher quantiles. Moreover, all countries have bidirectional causality between financial inclusion and energy efficiency. Given these results, the study suggests that financial inclusion is an important determinant of energy efficiency and that financial conditions should be considered when implementing energy policies. This study will be conducive for policymakers to implement financial development strategies for investing in clean technologies to increase energy efficiency and solve environmental issues.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Fossil fuels have terrible consequences on the environment and human health and have done irreparable damage to both. Since the Industrial Revolution, using fossil fuels in manufacturing has been the largest obstacle to sustainable growth. Replacing fossil fuels with renewable energy sources like wind, tidal, solar, geothermal, biomass, and hydropower, as well as improving energy efficiency, are two crucial choices for reducing the environmental issues associated with energy.

Regarding the first choice, green and clean energy sources like renewable resources can stop environmental deterioration and promote sustainable growth (Danish & Ulucak, 2022; Kazemi & Kazemi, 2022; Konidari & Nikolaev, 2022). Renewable energy, however, may potentially have some unfavorable environmental effects. For example, waste released from biomass combustion and interference with the ecosystem and soil structure during the construction of hydropower plants can cause environmental destruction. Additionally, establishing renewable energy plants also requires using environmentally harmful fossil fuels (Saidi & Omri, 2020). Renewable energy is the fastest-growing form of energy in the world, while fossil fuels will continue to make up a large share of anthropogenic energy demand until at least 2050 (EIA, 2019). In 2018, fossil fuels accounted for 79.9% of total energy consumption (EC), while renewable and nuclear energy sources accounted for 17.9% and 2.2%, respectively (REN21, 2020). The share of renewable energy, which constituted 18.13% of the total global EC in 1999, has not changed for about 20 years (World Bank, 2021).

Fossil fuel dependence is a chronic environmental issue that must be addressed due to environmental concerns, despite rising investment in and incentives for renewable energy. For this, the efficient use of fossil fuels is the second option. The quantity of energy used to produce one unit of output is known as energy efficiency. At the United Nations (UN) Climate Change Conference in 2015, the importance of increasing energy efficiency to combat climate change was strongly emphasized. In addition, more efficient energy use is seen as the most important tool for achieving net zero-emissions targets (IEA, 2021). The scenario “Net-Zero Emissions by 2050” underlines that energy demand must be 8% lower than today but that energy resources should meet the needs of a doubling global economy and a population growing by 2 billion people by 2050. This means that future societies should achieve more success with every unit of energy used in heating, cooking, transportation, factory power, and similar activities by improving energy efficiency. For companies to make infrastructure and technology investments that enable efficient energy use, they must have access to credits and benefit from an effective financial mechanism. In this context, financial development and inclusion can affect energy efficiency (Latif et al., 2022; Li, 2022). Finally, boosting energy efficiency with stringent financial development plans can help minimize energy poverty (Al-Tal et al., 2021).

Financial development is shown in the expansion and promotion of financial activities such as foreign direct investment, stock market trading, and banking services (Nazir et al., 2018). When financial development affects EC by increasing economic efficiency, it also has implications for energy policies and carbon reduction strategies (Sadorsky, 2011). Financial sector development can influence EC by improving liquidity, providing cheap credit to consumers and producers, and encouraging the participation of foreign investors (Roubaud & Shahbaz, 2017). On the one hand, a developed financial sector can encourage firms to demand additional energy by providing access to cheap capital, purchasing more tools and equipment, and building new plants (Sadorsky, 2010). Financial development can lead to an increase in EC by enhancing economic growth, increasing capital market activity, and enabling the use of more energy-consuming products and services (Shahbaz et al., 2018a).

On the other hand, innovations in the financial sector expand cross-border investments and provide greater opportunities for access to advanced technologies and energy-efficient products (Zaidi et al., 2021). Financial development can provide access to advanced manufacturing opportunities by supporting research and development, economic development, technological advancement, and green FDI inputs. Thus, financial development can improve environmental quality through a cleaner production process (Abbasi & Riaz, 2016). Financialization also contributes to energy efficiency by providing funds for investment in energy-saving industries and infrastructures (Tang & Tan, 2014). At the same time, financial development can reduce EC by improving energy use efficiency (Islam et al., 2013).

Financial inclusion is an integral part of financial development, supporting the development of financial institutions and structures (Fareed et al., 2022; Le et al., 2020). Financial inclusion began to attract research interest in the early 2000s, which describes the right to ensure that businesses and individuals have access to financial services according to their needs (Demirguc-Kunt et al., 2017; Le et al., 2019). Financial inclusion is defined as a facilitator for achieving seven of the 17 sustainable development goals (SDGs) (World Bank, 2018). In the 2030 SDGs, financial inclusion is recognized as a tool to achieve other development goals (Zaidi et al., 2021).

Utilizing financial resources is crucial because, on the one hand, it makes it easier for people to use clean technologies and makes them more affordable and accessible to do so (Cui et al., 2022; IPA, 2017), while on the other, high levels of financial inclusion can lead to the accumulation of capital stock and lead to an increase in energy demand that could lead to environmental pollution (Qin et al., 2021; Rehman et al., 2022).

Despite the potential impact, the relationship between financial inclusion and EC or efficiency has not been empirically investigated for most energy-efficient countries.

Against this background, this study aims to investigate the impact of financial inclusion on energy efficiency/intensity in the most energy-efficient countries, namely Germany, Italy, France, the United Kingdom (UK), Japan, Spain, the Netherlands, China, Canada, and the United States (USA). This group of the most energy-efficient countries, including the G7 and China, is economically and environmentally important. In 2019, the G7 countries, China, Spain, and the Netherlands were responsible for 54% of the global primary EC (BP, 2020) and 62% of the global GDP (World Bank, 2021). Moreover, the financial inclusion of these countries is significantly higher than the global average (IMF, 2020). Furthermore, according to the report of the American Council for an Energy-Efficient Economy, these countries use their energy between 55 and 75% effectively (Castro-Alvarez et al., 2018). The reason is that most energy-efficient countries can also be financially successful, and the impact of financial inclusion in energy efficiency efforts can guide other countries’ financial and energy policies. The current study seeks answers to the following research questions to investigate this.

-

(i)

Does financial inclusion promote energy efficiency?

-

(ii)

Are the relationships between financial inclusion and energy intensity sensitive to quantiles?

-

(iii)

Is there a causal relationship between energy intensity and financial development?

The study contributes to the literature in three ways. (i) We believe this study is the first to look at the connection between financial inclusion and energy efficiency in the countries with the highest levels of energy efficiency. (ii) In doing so, we take into account a multifaceted and comprehensive financial indicator that consists of four distinct subcomponents, including financial institutions, market accessibility, efficiency, and depth. Previous studies, except Canh et al. (2020), have analyzed the effect of financial development indicators such as domestic credit to the private sector, broad money supply as a percentage of GDP, or indices formed by combining these variables on energy intensity (see, e.g., Pan et al., 2019; Adom et al., 2020). However, these studies do not include financial inclusion indicators such as financial depth and efficiency. In this respect, our study differs from previous studies and approaches the issue from a broader perspective. (iii) We use the quantile cointegration test, estimators, and causality test to investigate the interactions between financial inclusion and energy efficiency. Quantile analyses can give more effective results for non-normally distributed data. While the ordinary least squares method is based on the mean, the position measurement of quantile approaches is the median. It can provide comprehensive information by using the lower, middle, and upper parts of the series. Therefore, we analyze the relationship between financial progress and energy efficiency at specific quantiles from 0.05 to 0.95. By using the quantile approach and detailed data, we aim to contribute to the finance-energy nexus.

Figure 1 shows the study flowchart. The following sections of the study are structured as follows: The second section presents brief information on energy intensity and financial inclusion in the most energy-efficient countries. The third section reviews the literature on the relationship between finance and energy. The fourth section introduces the methodology and dataset used in the study. The fifth section exhibits and interprets the results. Finally, the sixth section discusses the conclusions and proposes policy recommendations.

An overview of the most energy-efficient countries

As noted in the American Council for an energy-efficient economy report, energy efficiency is a neglected policy tool, even though it has proven benefits and is the largest source of meeting the world’s growing energy demand. Governments that promote and invest in energy efficiency can help their citizens save energy, meet energy needs more cost-effectively, and reduce reliance on energy imports (Castro-Alvarez et al., 2018). Therefore, most developed countries are eager to increase energy efficiency, as shown by world map scores.

As shown in Fig. 2, green indicates countries that use energy most effectively; yellow represents the middle; and grey shows countries with low efficiency. This classification is in line with the overall energy efficiency scores from Castro-Alvarez et al. (2018), which they produced by combining information on progress in transport, buildings, industry, and national energy efficiency. Figure 2 clearly shows that most developed countries use their energy more effectively than developing countries. All G7 countries are in the top 10 most energy-efficient countries. In terms of developing countries, China and Taiwan are the most energy-efficient countries. Table 1 presents the energy efficiency scores of these countries.

Source: Castro-Alvarez et al. (2018)

Most energy-efficient countries in the world.

We included eleven energy-efficient countries as our initial sample, based on the overall ranking (top 10 countries). However, Germany and Italy tied for a score (of 75.5) and ranked 1st. Similarly, Canada and USA tied for a score (of 55.5) and ranked 10th. The overall ranking is composed of the combination of four sectors (national efforts, buildings, industry, and transportation). Taiwan is part of China, and it is excluded from our sample due to its missing data, and the final sample consists of the top 10 countries. All information is obtained from the recently published report of the American Council for an Energy-Efficient Economy.

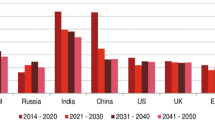

The Netherlands and Spain are also among the most energy-efficient countries. In the overall ranking, Germany and Italy share first place. While Japan is the efficiency leader in the industry category, France leads in the transport category. Spain and Germany are in first place in the building and national energy efficiency categories. China, the USA, and Canada do not use energy efficiently in the industrial sector. These countries are known to cause significant global environmental problems. Figure 3 illustrates that the USA and China have significantly reduced their energy intensity over the last 30 years. However, this improvement in energy efficiency must also be achieved in the industrial sector, especially to meet the goals of reducing CO2 emissions and sustainable development.

Figure 3 also shows that the energy intensities of countries are converging over time. This can be attributed to the level of technology that is developing and spreading around the world. At the same time, financial development and inclusion can effectively reduce energy intensity. Financial inclusion is important for tackling poverty and inequality (Chibba, 2009). Convenient and sustainable access to financial assets for more people and businesses supports economic development. In high-income countries, this can also increase the demand for environmental assets. Thus, it is also possible that there is a link between energy efficiency and progress in financial inclusion, such as savings, insurance, credit, payments, and money transfers. This is because as income and financial inclusion increase, communities become more conscious of energy resources, use environmental technologies, and adopt energy-saving opportunities. In this context, Fig. 4 presents the progress in financial inclusion in the most energy-efficient countries for the period 1980–2018.

In the 1980s, China and Italy lagged behind the other countries in financial inclusion, but the gap narrowed over time. In 2018, the global average financial inclusion was 0.33 (IMF, 2020). The financial inclusion of the ten most energy-efficient countries is significantly higher than the global average, suggesting a possible link between energy efficiency and financial inclusion.

Literature review

The progress in the financial sector has various implications for economic growth, the environment, and the energy sector. Discussions about the relationship between financial development and economic growth go back at least half a century (Goldsmith, 1969; Schumpeter, 1932). More recently, several studies have examined the impact of the financial system on environmental issues. Some researchers claim that financial development increases environmental degradation (Adams & Klobodu, 2018; Pata, 2018; Wang et al., 2020), while others argue the opposite (Bashir et al., 2020; Tamazian et al., 2009; Zaidi et al., 2019).

Similarly, the relationship between finance and energy has been analyzed in various studies. The literature on the finance-energy nexus can be divided into two strands.

The first strand concerns the impact of financial development on the EC. For instance, Sadorsky (2010) employed the generalized method of moments (GMM) for 22 emerging economies from 1990 to 2006 and reported that financial development indicators such as stock market turnover, market capitalization, and stock market value increased EC. Using the same method and data period for nine European economies, Sadorsky (2011) found that bank-related financial development and stock market turnover positively influence the EC. Zhang et al. (2011) applied the gray relational analysis from 1992 to 2009 and concluded that the development of the Chinese stock market caused a higher EC. Shahbaz and Lean (2012) utilized the autoregressive distributed lag approach (ARDL) for Tunisia from 1971 to 2008 and reported that financial development is positively associated with EC. Al-Mulali and Lee (2013) used the Pedroni cointegration and panel dynamic OLS tests for Gulf Cooperation Council countries from 1980 to 2009. The results indicated that financial development increases EC. Islam et al. (2013) conducted the ARDL procedure and vector error correction model (VECM) for Malaysia from 1971 to 2009. The results showed that financial development leads to an increase in EC. Tang and Tan (2014) performed ARDL, Johansen–Juselius cointegration, and Granger causality tests for Malaysia from 1972 to 2009 and concluded that financial development positively impacts the average EC. They also noted a bidirectional causality between the variables. Farhani and Solarin (2017) used the ARDL approach for the USA from 1973q1 to 2014q4 and found that financial development reduces energy demand. Mahalik et al. (2017) applied the Bayer–Hanck cointegration test, the ARDL approach, and the innovative accounting approach for Saudi Arabia from 1971 to 2011. Their findings suggest that financial development creates additional energy demand. Destek (2018) used the common correlated effect (CCE) estimator for 17 developing countries from 1991 to 2015 and concluded that bond market development leads to a decline in EC. Liu et al. (2018) performed the ARDL approach for China from 1980 to 2014 and concluded that financial development stimulates EC. Chiu and Lee (2020) utilized the panel smooth transition regression model for 79 countries from 1984 to 2015 and reported that financial development contributes to decreased EC.

In addition, some researchers have focused on the relationship between clean energy and financial development. Al Mamun et al. (2018) used mean-group and CCE estimators for 25 OECD countries and found that credit and equity market development promote clean energy production. Kutan et al. (2018) employed various panel data methods for four developing countries from 1990 to 2012, and their results revealed that stock market development plays a crucial role in promoting renewable EC. In contrast, Shahbaz et al. (2018b) performed panel mean group estimators for BRICS and Next-11 countries from 1992 to 2016 and reported that financial development reduces clean EC. Khan et al. (2022) concluded that improving energy efficiency reduces carbon emissions in the Next-11 countries. Raghutla et al. (2021) applied fully modified OLS for the top 10 investing countries from 1996 to 2007 and noted that a 1% increase in stock market capitalization reduces clean EC by 0.40%. All of these studies, except for Al Mamun et al. (2018), focused on EC, and none of them addressed the efficient use of energy. In addition to energy production and consumption activities, effective energy use is also important for improving environmental conditions.

Therefore, the second strand explores the nexus between financial development and energy intensity. While there is extensive literature examining the impact of financial development on environmental degradation and EC, the impact of financialization on energy efficiency/intensity is a research topic that has received little attention. A few researchers have started to examine the impact of financial development on energy efficiency. Aller et al. (2018) performed GMM for 28 Chinese provinces from 1999 to 2014 and argued that stock market capitalization has a vital role in improving energy efficiency. Chen et al. (2019) used a two-way fixed-effect model for 90 countries from 1990 to 2014. They found that financial development reduces energy intensity in non-OECD countries, while the influence of financialization on energy reduction in OECD countries is limited. The results of the study underscored that financial development is an effective way to reduce energy intensity. Pan et al. (2019) employed the structural vector autoregression model and directed acyclic graphs for Bangladesh from 1976 to 2016 and reported an inverted U-shaped relationship between energy intensity and the share of private credit in GDP. Adom et al. (2020) used ARDL, fully modified OLS, and canonical cointegrating regressions from 1970 to 2016 and concluded that financial development lowers energy intensity in Ghana. Ziolo et al. (2020) utilized a Tobit regression model for 37 OECD countries from 2000 to 2018 and found a positive bidirectional interaction between financial development and total factor energy efficiency. Yao et al. (2021) employed the GMM for BRICS and the Next-11 countries from 1995 to 2014. They calculated energy efficiency using environmental data analysis and found that financial development increases energy efficiency in both groups of countries.

The above studies focus on constrained indicators of financial development. However, financial development indicators and financial inclusion are not the same things. Financial development indicators include macroeconomic series such as definitions of money supply (M1, M2, and M3), measures of the stock market, and domestic credit as a share of GDP. In contrast, the G20 financial inclusion indicators are measured by three dimensions: access, use, and quality of financial services (Makina & Walle, 2019). In this context, the IMF's Financial Development Data Series can strongly reflect financial inclusion (IMF, 2020). This series is a multidimensional index that covers the depth, accessibility, and effectiveness of financial institutions and markets. Some researchers, such as Pata and Yilanci (2020) and Usman et al. (2021), examined the impact of the multidimensional financial development index on ecological footprint.

Moreover, Le et al. (2020), Renzhi and Baek (2020), Qin et al. (2021), and Zaidi et al. (2021) investigated the impact of financial inclusion indicators on CO2 emissions. Overall, the researchers investigated the environmental effects of financial inclusion but did not address the issue of energy efficiency. To our knowledge, only two studies have analyzed the nexus between energy and financial inclusion. Canh et al. (2020) applied different panel data methods to examine the impact of financial development on the energy intensity of production and consumption for 81 countries from 1997 to 2013. They used IMF financial data and examined the effects of financial inclusion indicators such as financial depth, efficiency, and accessibility on energy intensity. Their results revealed that financial inclusion decreases (increases) the energy intensity of consumption (production). Furthermore, Koomson and Danquah (2021) used Lewbel’s two-stage least squares method for Ghana from 2012 to 2017 and found that financial inclusion reduces energy poverty in Ghana.

As seen in the literature, there is a research gap in the interactions between financial inclusion and energy variables. For example, quantile dependence has not been considered in previous research. In addition, no study has focused on the most energy-efficient countries. This study aims to fill these gaps by investigating the relationship between energy intensity and financial inclusion using quantile approaches.

Data, theoretical framework, and research methodology

Data description and theoretical framework

In order to analyze the association between financial inclusion and energy efficiency in the ten most energy-efficient countries in the world, annual data from 1980 to 2018 were gathered and then converted into quarterly observations using a quadratic match-sum approach. This method adjusts for the seasonal and point-to-point variations in the data while converting low-frequency data into high frequency, as suggested by Sbia et al. (2014) and Haseeb et al. (2021).

Recent research frequently employs the quadratic match-sum method because it provides more accurate estimates than more complicated interpolation techniques (Arain et al., 2020; Shahbaz et al., 2018c). Following Usman et al. (2021), financial inclusion data is obtained from the International Monetary Fund (IMF) (https://data.imf.org/?sk=F8032E80-B36C-43B1-AC26-493C5B1CD33B). Financial inclusion is an index, and data range from 0 to 1. Energy efficiency data are measured by energy intensity, which is the ratio of energy consumption (gigajoule per capita) to GDP per capita (constant 2010 US dollars) and is sourced from BP statistics (https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html). Energy intensity indicates how much energy is consumed to produce one unit of economic output (Rajbhandari & Zhang, 2018). Energy intensity is the reciprocal of energy efficiency (Shahzad et al., 2022).

Figure 5 shows the theoretical background of the study. Financial inclusion is closely related to economic development, environmental quality, energy consumption, and efficiency. As noted by Tamazian et al. (2009), on the one hand, financial development can have a positive impact on environmental quality by financing environmental investments and projects with low-cost funds. On the other hand, environmental degradation can increase if firms in the industrial sector spend low-cost funds on fossil fuel use and mass production. The environmental impact of the financial sector depends on how governments drive financial development and inclusion. Countries that realize financial depth, efficiency, and access in an environmentally friendly manner will be able to reduce their energy intensity through renewable energy, environmental technologies, carbon taxes, and energy-saving technologies.

Research methodology

Quantile-on-quantile approach

In order to measure the quantile dependence between financial inclusion and energy efficiency in the world’s most energy-efficient countries, we employ the quantile-on-quantile (QQ) approach, a novel nonparametric econometric technique proposed by Sim and Zhou (2015). This method combines nonparametric estimation and quantile regression (QR). This approach has some advantages over traditional quantile regression (Hashmi et al., 2021). First, it can measure how the quantiles of the independent variables affect the conditional quantiles of the predicted variables, whereas the traditional QR neglects the likelihood of the states of the independent variables (Iqbal et al., 2021; Shahzad et al., 2020). Second, since the QQ technique is a kind of nonparametric quantile regression, it can avoid limiting parametric assumptions by revealing the complex aspects of the impact of explanatory variables (Lin & Su, 2020). Third, the QQ approach improves predictive ability by explaining more variations between constructs by comparing the quantile of the predictor variable with the quantile of the dependent variable (Shahzad et al., 2017).

The present study proposes the QQ models based on the nonparametric quantile regression, as described below;

where \({\mathrm{EI}}_{t}\) and \({\mathrm{FI}}_{t}\) are the energy intensity and financial inclusion in period t, respectively. \(\varphi\) is the \(\varphi\) th quantile of the traditional distributions of \({\mathrm{EI}}_{t}\) and \({\mathrm{FI}}_{t}\) in Eq. (1) and Eq. (2), respectively. \({\varepsilon }_{t}^{\varphi }\) is the quantile error term, and its conditional quantile distribution (\(\varphi\) th) is equal to zero. The standard Eq. (1) and Eq. (2) allow for the impact of different quantiles of financial inclusion (or energy intensity) on the quantile distribution of energy intensity (or financial inclusion); however, these models are unable to capture the dependency structure in its entirety. Because the term \({\gamma }^{\varphi }(.)\) is unknown and does not contain prior information about the linkage between FI and EI in both equations, we, therefore, emphasize the association between the \(\varphi\) th quantile of FI and the \(\varphi\) th quantile of EI, represented by \({P}^{\tau }\). This is done by estimating Eq. (1) and Eq. (2) in the neighborhood of \({P}^{\tau }({\mathrm{FI}}^{\tau } \mathrm{and }{\mathrm{EI}}^{\tau })\) using the local linear regression method. Since \({\gamma }^{\varphi }(.)\) is not known, the following Eq. (3) is restructured by using 1st-order Taylor expansion of \({\gamma }^{\varphi }(.)\) around quantiles of \({P}^{\tau }\) for \({\mathrm{FI}}^{\tau } \mathrm{and} {\mathrm{EI}}^{\tau }\) as follows;

where \({\gamma }^{{\varphi }^{0}}\) indicates the partial derivative of \({\gamma }^{\varphi }\) with respect to P and provides a similar explanation as the coefficients in a linear regression method. Furthermore, following Sim and Zhou (2015), we rename \({\gamma }^{\varphi }({P}^{\tau })\) and \({\gamma }^{{\varphi }^{0}}({P}^{\tau })\) to \({\gamma }_{0}\left(\varphi ,\tau \right)\) and \({\gamma }_{1}\left(\varphi ,\tau \right)\), respectively. Hence, we rewrite Eq. (3) as below;

By subtracting Eq. (4) from Eq. (1) or Eq. (2), we obtain the following equation.

where (*) signifies the conditional (\(\varphi\) th) quantile of energy intensity for Eq. (1) and the conditional (\(\varphi\) th) quantile of financial inclusion for Eq. (2). Unlike the standard quantile regression function, Eq. (5) implies a complete dependence structure between the \(\varphi\) th quantile of EI and the \(\tau\) th quantile of FI (and vice versa), since the parameters \({\gamma }_{0}\) and \({\gamma }_{1}\) are doubly indexed in \(\varphi\) and \(\tau\). Finally, we re-estimate Eq. (5) and obtain \({\widehat{P}}_{t}\), \({\widehat{P}}^{\tau }\), \({\widehat{\gamma }}_{0}\), and \({\widehat{\gamma }}_{1}\) by solving Eq. (6);

where \(\rho (u)\) signifies the “quantile loss function,” which is derived as \(\rho \left(u\right)=u\left(\varphi -I\left(u<0\right)\right).\) I is the indicator, K is the Kernel function, and h is the bandwidth parameter. We set the value of the bandwidth to h = 0.05 and use the Gaussian kernel to weight the observations in the neighborhood of \({P}^{\tau }({\mathrm{FI}}^{\tau } \mathrm{and} {\mathrm{EI}}^{\tau }\), because of its computational simplicity and efficiency.

Quantile Granger causality in mean

In order to identify the direction of causality (in quantiles) between financial inclusion and energy intensity, we use quantile Granger causality in mean, which is recently proposed by Troster et al. (2018). According to Granger (1969), an independent variable (\({X}_{t}\)) has no causal impact on the dependent variable \(({Y}_{t})\), if previous \({X}_{t}\) does not contribute to the prediction of \({Y}_{t}\), and instead giving prior information about \({Y}_{t}\). Suppose there is a predictor vector \({V}_{t}\equiv {\left({V}_{t}^{Y},{V}_{t}^{X}\right)}^{^{\prime}}\in {\mathbb{R}}^{a}, a=b+c\), where \({V}_{t}^{X}\) is previous evidence set of \({X}_{t}\), \({V}_{t}^{X}:={\left({X}_{t-1},\dots {X}_{t-q}\right)}^{^{\prime}}\in {\mathbb{R}}^{c}\). We formulate a null hypothesis (\({X}_{t}\) does not Granger cause \({Y}_{t}\)) as under;

where \({F}_{Y}\left(\bullet |{V}_{t}^{Y},{V}_{t}^{X}\right)\) denotes the conditional distribution function for \({Y}_{t}\) given \({V}_{t}^{Y},{V}_{t}^{X}\), with respect to the null hypothesis from Eq. (7). Following Troster et al. (2018), we employ the DT test under the framework of the QAR model \(m(\bullet )\) for complete set of

, given the null hypothesis (\({X}_{t}\) does not Granger cause \({Y}_{t}\)) as under;

, given the null hypothesis (\({X}_{t}\) does not Granger cause \({Y}_{t}\)) as under;

where the factors \(\varphi \left(\tau \right), {\gamma }_{1}\left(\tau \right), {\gamma }_{2}\left(\tau \right),\) and \({\sigma }_{t}\) are calculated by maximum probability in a similar margin of quantiles and \({\psi }_{u}^{-1}(\bullet )\) is opposite to the “traditional normal distribution function.” In order to confirm the relationship between \({X}_{t}\) and \({Y}_{t}\), we measure the quantile autoregressive criteria in Eq. (8) as well as including another lagged variable. Finally, we formulate the QAR (1) model representing the lagged sign of another variable, as follows:

Results and discussion

Table 2 depicts the summary statistics and traditional unit root results for financial inclusion and energy efficiency for each country. The USA is a highly financially developed country with the highest mean value of financial inclusion (0.188), ranging from a minimum value of 0.108 to a maximum value of 0.225. Similarly, the UK has a high mean value of financial inclusion, which is 0.186, slightly lower than the USA. It is followed by Japan, Canada, and the Netherlands, with mean values of 0.177, 0.172, and 0.170, respectively. Germany and Spain are almost at the same level of financial inclusion, with mean values of 0.168 and 0.167, respectively, followed by France (0.152) and Italy (0.142). China is the least financially developed country with a mean value of financial inclusion (0.100), which is not surprising as China has only gained momentum in the last decade.

Concerning energy intensity, China has the highest mean value of 0.011, which means that China is a less energy-efficient country among all countries in the sample. Canada and the USA have almost similar mean values of energy intensity, which are 0.004 and 0.003, respectively. Germany, Italy, France, the UK, France, Spain, and the Netherlands have low and equal energy intensity values (0.002), meaning they are equally energy-efficient countries. Moreover, Japan is the most energy-efficient country, with a mean value of energy intensity (0.001).

The Jarque–Bera test statistics are statistically significant for both variables, implying that financial inclusion and energy intensity are not normally distributed in all countries. Traditional mean-based regression models are unsuitable when data are not normally distributed as they produce biased results (Cheng et al., 2021). In this case, a median-based quantile regression approach can be used, which is robust to non-normal distributions (Troster et al., 2018). Also, according to Balcilar et al. (2017), the quantile causality test is an appropriate choice for non-normal series. Therefore, we adopt quantile unit root, cointegration, regression, and causality approaches.

Before applying the quantile approaches, we examine the series using traditional unit root tests and correlation analyses. We perform the Augmented Dickey and Fuller (1981) (ADF) unit root test to determine the level of integration. The ADF test results show that financial inclusion and energy intensity are stationary at the first difference (i.e., 1(1)). We also employ the unit root test of Zivot and Andrews (1992) to capture the problem of a structural break in the time series. The results reveal that financial inclusion and energy intensity are significant at first differences, with single breaks in time, mainly in the 1990s.

Table 3 elucidates the coefficients of the correlation analysis between financial inclusion and energy intensity for all countries. The results reveal that financial inclusion is negatively associated with energy intensity in all countries. The USA has the highest correlation (− 0.934), followed by the UK (− 0.914), Canada (− 0.911), China (− 0.892), Italy (− 0.867), France (− 0.840), Germany (− 0.834), and the Netherlands (− 0.832), except for Spain (− 0.773) and Japan (− 0.699), where the strength of the correlation is moderate.

We then apply quantile approaches. First, we perform a quantile unit root test to investigate the stochastic properties of financial inclusion and energy intensity for the world’s most energy-efficient countries through a 19-fold grid of quantile distributions [0.05:0.95]. The results in Table 4 and Table 5 show the persistence coefficients and their respective t-statistics for all countries. The findings reveal that all variables exhibit non-stationary behavior at the level for all sample countries except for the USA, where energy intensity is stationary at most quantiles.

Second, we use the quantile cointegration test proposed by Xiao (2009) to discover the nonlinear cointegration between financial inclusion and energy intensity for the most energy-efficient countries in the world. Table 6 summarizes the findings of quantile cointegration, showing that financial inclusion and energy intensity have an asymmetric long-run relationship in the world's most energy-efficient countries. Therefore, we can proceed further with the quantile-on-quantile regression approach.

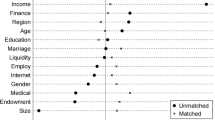

In the third step, we estimate the quantile-on-quantile regression approach. Figure 6 shows the structure of quantile dependence between financial inclusion and energy intensity (energy efficiency) in most energy-efficient countries. The country-specific interpretation of the QQ is explained below:

Germany

As evident from the graph, the association between energy intensity and financial inclusion is largely negative in the case of Germany, which means that an increase in financial inclusion there leads to an improvement in energy efficiency. Moreover, the graph shows the extremely negative impact in the lower quartiles of both variables, implying that when energy efficiency is highest but financial inclusion is lowest, financial inclusion boots energy efficiency the most. This part of the findings is similar to the empirical outcomes of Adom et al. (2020) and Chen et al. (2019), who argued that financial development reduces energy intensity (increases energy efficiency). In addition, Germany is one of the most energy-efficient countries in the G20 and the EU-28, with the lowest energy intensity. A significant reduction in energy intensity can be attributed to the following two main reasons: the substitution of electricity generation from nuclear and fossil fuels with electricity from cleaner energy sources and technological developments on the energy demand side.Footnote 1

On the other hand, the graph shows that when financial inclusion is high and energy intensity is low, the impact of an increase in financial inclusion on energy intensity is positive and weak (a slight decrease in energy efficiency). At the middle quantiles of both variables, the impact is moderately negative. The overall results show that the impact of financial inclusion on energy efficiency is quantile dependent and asymmetric with respect to the lower, upper, and middle parts of the distributions of both variables. However, the overall graph shows a significant negative association between FI and EI. Conversely, the second graph shows that energy intensity has a negative impact on financial inclusion negatively at all quantiles. The strong impact of EI on FI suggests that more energy efficiency needs more financial inclusion.

Italy

As in Germany, financial inclusion affects energy intensity negatively at most of the quantiles in Italy. Financial inclusion has a slightly negative to neutral effect on energy intensity at the lower and upper quantiles, thus showing a moderate impact. However, based on prior averages of energy intensity, financial inclusion has a very negative effect. The findings advocate that financial inclusion lowers energy intensity (increases energy efficiency), and this argument is in line with the previous verdicts of Adom et al. (2020) and Chen et al. (2019). The findings also derive from the shreds of evidence that primary energy consumption (energy demand) in Italy has been declining significantly since 2005, returning to the level of energy consumption in the 1990s. According to the recent report published by Odyssee-Mure,Footnote 2 final energy consumption was 115.9 Mtoe, which decreased by − 0.71% from 2000 to 2016. As a result, the primary and final energy intensities decreased by 11.8% and 7.9%, respectively. Meanwhile, fossil fuels decreased significantly from 2000 to 2016; oil products (− 24.2%), coal (− 52.4%), and natural gas (− 12.0%). In addition, renewable energy sources registered a high growth of over 300% and contributed 7.2% of final energy consumption in 2016. Italy strictly follows the National Energy Efficiency Action Plans and National Energy Strategy guidelines to achieve its SDGs and become a more energy-efficient country. The other graph shows that energy intensity strongly impacts financial inclusion at average values, while it is moderately negative at the lower and upper quantiles. Here again, the association between the two variables is largely negative at the upper, middle, and lower quantiles of the distribution.

France

The strength of the association between financial inclusion and energy intensity (efficiency) is similar in direction, quantiles, and magnitude to a greater extent in France than in Germany. For the lower quantiles of both variables and the upper quantiles of financial inclusion, the impact on energy intensity (efficiency) is strong and negative (positive). In contrast, it is moderately negative for the upper and middle quantiles of energy intensity. These results show that financial inclusion has the strongest positive influence on energy efficiency, as the level of financial inclusion was previously higher and energy intensity lower in France. The overall findings are parallel to those of Adom et al. (2020) and Chen et al. (2019). Despite the rapid progress in financial development and economic growth, France ranks third among the most energy-efficient countries globally due to its stringent energy-saving targets and programs such as tax incentives and loan strategies to attract more investment in clean energy projects.Footnote 3 In addition, the other graph shows that energy intensity (efficiency) has a strong and negative (positive) influence over financial inclusion in the lower quantiles of energy intensity and the lower to middle quantiles of financial inclusion. The association is moderately negative at the middle quantiles of both variables, suggesting that higher energy efficiency attracts greater financial development.

The UK

The impact of financial inclusion on energy intensity (efficiency) is positive (negative) at lower quantiles (0.05 to 0.20) of energy intensity, irrespective of the given quantile of financial inclusion. However, at higher quantiles of energy intensity, the association is close to zero at all the quantiles of financial inclusion. This shows that the dependence structure between the two variables is highly sensitive to the prior levels of energy intensity (efficiency) in the case of the UK. At a higher (lower) level of prior energy intensity (efficiency), financial inclusion promotes (inhibits) further energy intensity (efficiency). From the lower to the middle quantiles (0.20 to 0.50) of energy intensity, financial inclusion has a negative effect on energy intensity, which has a positive effect on improving energy efficiency. Hence, the favorable impact of financial inclusion on energy efficiency in the UK is more pronounced when the prior energy intensity levels are close to their median values. These findings support the existing research outputs of Adom et al. (2020) and Chen et al. (2019).

Moreover, according to the report published by the Department for Business, Energy and Industrial Strategy,Footnote 4 the UK economy is mounting while energy intensity is falling for a number of reasons: industrial energy consumption per million gross value-added falling to 89.4 toe in 2019, down from 166.2 toe in 1990. Similarly, energy consumption in the service sector per million units of gross value-added reduced to 15.6 toe, compared to 27.3 toe in 1990. Furthermore, household energy consumption decreased from 1.8 toe in 1990 to 1.5 toe in 2019. The significant falls in energy consumption in industry, households, and services tend to reduce energy intensity or increase energy efficiency in the UK. The other graph shows the reverse impact of energy intensity on financial inclusion, which is significantly negative in all parts of the joint distribution. The negative impact is largest at the lower quantiles of energy intensity. Hence, we can say that the dependence structure is more sensitive to prior energy intensity levels than financial inclusion.

Japan

Japan is a little different from the other countries discussed above. The overall relationship ranges from zero to negative, with no positive values in any of the quantiles of either variable. Compared with other quantiles, financial inclusion has a stronger negative impact in the lower quantiles (0.05 to 0.40). This impact keeps getting weaker as we move toward the upper quantiles (0.45 to 0.95). This shows that financial inclusion has a more favorable effect on energy efficiency when the prior level of financial inclusion and energy intensity is lower. This is in line with the case of Japan, which initially pursued rapid industrialization and then recently made it more efficient and sustainable by adopting sophisticated technologies and innovations. On the other hand, energy intensity has a negative impact on financial inclusion at all quantiles, with the negative impact being largest at the upper quantiles of energy intensity.

Spain

The case of Spain is interesting because of the dynamic impact of financial inclusion on energy intensity in different quantiles. It ranges from positive to zero to negative, depending on the level of the distribution. The dynamic impact is negative in the lower quantiles (0.05 to 0.30) and close to zero at the middle quantiles (0.50 to 0.70) of energy intensity, irrespective of the given quantiles of financial inclusion. Financial inclusion positively affects energy intensity at the middle quantiles of financial inclusion (0.40 to 0.60) and the lower quantiles (0.20) of energy intensity. These results imply that financial inclusion is beneficial to improving energy efficiency when the prior level of financial inclusion and energy intensity in Spain is lower. The findings can be justified by existing studies such as Adom et al. (2020) and Chen et al. (2019). However, as seen in the other graph, the impact of energy intensity on financial inclusion is U-shaped and more sensitive to the prior energy intensity levels. The association is more negative when the energy intensity is in the middle than in the lower or upper quantiles.

Netherlands

In contrast to other countries, the impact of financial inclusion on energy intensity in the Netherlands depends more on the prior quantiles of financial inclusion. For the middle and upper quantiles (0.50 to 0.95) of financial inclusion and the lower and upper quantiles of energy intensity, financial inclusion has a slightly positive (negative) effect on energy intensity (efficiency). However, this impact is negligible due to the weak positive association between financial inclusion and energy intensity. The association is more negative in the middle parts of the energy intensity distribution, irrespective of the given quantiles of financial inclusion. The effects are close to zero for the lower quantiles of financial inclusion and the upper quantiles of energy intensity. The overall results show a negative association between financial inclusion and energy intensity. These findings support the results of Adom et al. (2020) and Chen et al. (2019). Final energy consumption in the Netherlands was 58.1 Mtoe in 2018 (coal 1.4%, natural gas 33.6%, bioenergy and waste 2.5%, electricity 16.0%, district heat 3.4%, oil 42.8%), significantly decreasing by 5% since 2008.Footnote 5 As a result, the energy intensity of the Netherlands decreased to 63 toe/US$ million in 2018, a significant decrease of 14% since 2008. The Netherlands strictly adheres to the Dutch National Energy and Climate Plan and aims to decrease greenhouse gas emissions by 49% by 2030 and 95% by 2050.

The other graph indicates that the reverse impact of energy intensity on financial inclusion is strongly negative, with extreme values at the middle quantiles of energy intensity and sensitivity to the prior energy intensity levels as for most other countries in our sample.

China

The Chinese case is slightly different from the other countries, as indicated by the comparatively higher values of the negative impact on the z-axis. Huge variations in the coefficients are observed within the different quantiles of energy intensity and financial inclusion. For the lower and upper quantiles of energy intensity, the impact is close to zero, regardless of the level of financial inclusion, which is comparable to many other countries. The impact is strongly negative for the lower quantiles of financial inclusion and the middle quantiles of energy intensity.

This negativity is much larger than in the majority of the other countries in our sample. This shows that the positive impact of financial inclusion on energy efficiency is more pronounced in China, considering that financial development was lower before and the energy system was efficient on average. This also implies that gaining an advantage from financial inclusion to improve energy efficiency primarily requires energy consumption to reach a certain level (almost close to the average). The reverse impact of energy intensity on financial inclusion is largely negative, with extreme values when the prior level of energy intensity is in the lower quantiles (0.05 to 0.20).

Canada and the USA

The dependence structure between energy intensity and financial inclusion is very similar in the case of Canada and the USA. The impact of financial inclusion on energy intensity is largely negative at the lower quantiles of energy intensity, regardless of the respective levels of financial inclusion, and extremely negative at the lower quantiles of both variables in both countries. The impact is moderately negative at all quantiles of financial inclusion, from the lower-middle to the upper quantiles (0.25 to 0.95) of energy intensity. The reverse impact of energy intensity on financial inclusion is similar in both countries and shows similar shapes and colors in the two graphs. This influence is extremely negative at the lowest quantiles of energy intensity. It then continues to be less negative as we move to the upper quantiles of energy intensity, irrespective of the quantiles of financial inclusion. Thus, as in most other countries, the prior energy intensity levels are more important for the dependence structure between the two variables in Canada and the USA.

In Fig. 7, we compare the coefficients from the quantile regression with our QQ estimates. From the similar plots, it can be seen that both methods produce similar results, highlighting the robustness of our results and confirming the correctness of the QQ method. The results of the quantile Granger causality are presented in Table 7 and Fig. 8. We observe bidirectional causality between financial inclusion and energy intensity (efficiency) in the lower and upper quantiles for Germany, Italy, France, the UK, Spain, and the Netherlands except for China, where bidirectional causality is found for all quantiles at 1% and 5% level of significance levels. In addition, Japan, Canada, and the USA show similar results, and we found bidirectional causality in the lower quantiles [0.20, 0.25, 0.30] and the upper quantiles [0.65, 0.70, 0.75, 0.80] at 1% and 5% significance levels. The overall results reveal bidirectional causality, meaning that variations in financial inclusion cause energy efficiency and vice versa. In other words, financial inclusion and energy efficiency have a cyclical influence on each other. Despite rapid financial development and economic growth, these countries lower their energy intensity (increase their energy efficiency) by exploiting technological innovations in energy demand and switching from dirty energy to clean energy resources. At the same time, energy efficiency leads to greater financial development through public, private, and foreign investment in the industrial and service sectors of these most energy-efficient countries.

Concluding remarks and policy implications

On the one hand, financial inclusion plays a key role in developing a strong and resource-rich financial infrastructure conducive to economic growth and SDG achievement. On the other hand, financial inclusion can cause extreme climate change and global warming through intensive energy consumption. These environmental issues can be solved by using energy as efficiently as possible. Therefore, improving energy efficiency is the main dilemma for policymakers and financial analysts nowadays. Hence, it will allow the researchers to explore the finance-energy nexus using the most energy-efficient countries as an example.

To check how financial inclusion affects energy intensity (energy efficiency) and vice versa, this study employs novel quantile methods such as quantile unit root, quantile cointegration, quantile-on-quantile approach, and quantile Granger causality test. These methods give an asymmetric and heterogeneous association between financial inclusion and energy intensity (efficiency) through an equal grid of 19 quantile distributions [0.05:0.95]. With the help of the quantile cointegration test, we observe asymmetric cointegration between financial inclusion and energy intensity (energy efficiency) for the ten most energy-efficient countries.

The desirable outcome further enables us to estimate the quantile-on-quantile (QQ) method. One of the main advantages of using the QQ method is that it provides a complete dependence structure between two variables in an asymmetric form of the quantile distribution (Sim & Zhou, 2015). The overall QQ findings reveal a strong negative association between financial inclusion and energy intensity and vice versa in most energy-efficient countries. Financial inclusion is found to lower energy intensity and, alternatively, promotes energy efficiency in the most energy-efficient countries in the world when the guidelines of SDG UN are strictly followed. Moreover, the negative impact of energy intensity on financial inclusion means that more energy efficiency needs more financial development in a country through attracting public, private, and foreign investment in green technologies and clean energy resources. Finally, the quantile Granger causality confirms the bidirectional causality between financial inclusion and energy efficiency in most of the quantiles for all sample countries. This study offers the robustness of the empirical findings in Fig. 5 by comparing the quantile regression coefficients with QQ regression, suggesting that QQ models’ findings are more reliable than linear models.

The current study provides some useful insights for policymakers. First, using a sample of the most energy-efficient countries globally, this study provides an example of the other least energy-efficient countries on how these financially developed countries lower their energy intensities (improve energy efficiency). Second, this study postulates that energy efficiency is an effective way to combat environmental issues despite rapid financial development and economic progress. The regulatory authorities of these most energy-efficient nations should increase their efforts to introduce financial programs such as tax incentives (reduced corporate tax rates) and credit strategies to attract more private investment in clean energy projects to achieve further sustainable development. Third, policymakers should increase awareness of the urgent need to invest in energy-efficient technologies, increase employment opportunities, reduce energy intensity and production costs, and improve environmental quality and energy security. Finally, countries should move towards rapid industrialization and make it more efficient and sustainable through clean energy resources and advanced technological innovations.

Access to large datasets was severely constrained. Therefore, in order to enhance the number of observations, the authors transform the annual data set into a quarterly dataset. The authors believe that the empirical evidence presented in this paper will inspire other researchers to investigate the relationship between other transmission indicators and energy efficiency. Future studies may consider more thorough methods to gauge energy efficiency, like dynamic DEA modeling.

Data availability

Data will be provided upon request.

Notes

KFW Research: How energy-efficient is Germany? (https://www.kfw.de/PDF/Download-Center/Konzernthemen/Research/PDF-Dokumente-Fokus-Volkswirtschaft/Fokus-englische-Dateien/Fokus-2018-EN/Focus-No.-213-July-2018-Energy-efficiency-Germany.pdf).

The reports describe the innovative measure and energy efficiency policies mentioned in National Energy Strategy (NES) and National Energy Efficiency Action Plans (NEEAP). (https://www.odyssee-mure.eu/publications/national-reports/energy-efficiency-italy.pdf).

American Council for an Energy-Efficient Economy (ACEEE) published the international energy efficiency rankings.

International Energy Agency (IEA) (https://www.connaissancedesenergies.org/sites/default/files/pdf-actualites/The_Netherlands_2020_Energy_Policy_Review.pdf).

References

Abbasi, F., & Riaz, K. (2016). CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy, 90, 102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Adams, S., & Klobodu, E. K. M. (2018). Financial development and environmental degradation: Does political regime matter? Journal of Cleaner Production, 197, 1472–1479. https://doi.org/10.1016/j.jclepro.2018.06.252

Adom, P. K., Appiah, M. O., & Agradi, M. P. (2020). Does financial development lower energy intensity? Frontiers in Energy, 14(3), 620–634. https://doi.org/10.1007/s11708-019-0619-x

Aller, C., Herrerias, M. J., & Ordóñez, J. (2018). The effect of financial development on energy intensity in China. The Energy Journal, 39(SI1), 25–38. https://doi.org/10.5547/01956574.39.SI1.call

Al Mamun, M., Sohag, K., Shahbaz, M., & Hammoudeh, S. (2018). Financial markets, innovations and cleaner energy production in OECD countries. Energy Economics, 72, 236–254. https://doi.org/10.1016/j.eneco.2018.04.011

Al-Mulali, U., & Lee, J. Y. (2013). Estimating the impact of the financial development on energy consumption: Evidence from the GCC (Gulf Cooperation Council) countries. Energy, 60, 215–221. https://doi.org/10.1016/j.energy.2013.07.067

Al-Tal, R., Murshed, M., Ahmad, P., Alfar, A. J., Bassim, M., Elheddad, M., ... & Mahmood, H. (2021). The non-linear effects of energy efficiency gains on the incidence of energy poverty. Sustainability, 13(19), 11055. https://doi.org/10.3390/su131911055

Arain, H., Han, L., Sharif, A., & Meo, M. S. (2020). Investigating the effect of inbound tourism on FDI: The importance of quantile estimations. Tourism Economics, 26(4), 682–703. https://doi.org/10.1177/1354816619859695

Balcilar, M., Bouri, E., Gupta, R., & Roubaud, D. (2017). Can volume predict Bitcoin returns and volatility? A quantiles-based approach. Economic Modelling, 64, 74–81. https://doi.org/10.1016/j.econmod.2017.03.019

Bashir, M. F., Ma, B., Shahbaz, M., & Jiao, Z. (2020). The nexus between environmental tax and carbon emissions with the roles of environmental technology and financial development. Plos One, 15(11), e0242412. https://doi.org/10.1371/journal.pone.0242412

BP, 2020. Statistical review of world energy 2020 69th edition. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2020-full-report.pdf (accessed 7 June 2021)

Canh, N. P., Thanh, S. D., & Nasir, M. A. (2020). Nexus between financial development & energy intensity: Two sides of a coin? Journal of Environmental Management, 270, 110902. https://doi.org/10.1016/j.jenvman.2020.110902

Castro-Alvarez, F., Vaidyanathan, S., Bastian, H., King, J., 2018. The 2018 International Energy Efficiency Scorecard. Report I1801, American Council for an Energy-Efficient Economy, Washington, DC.

Chibba, M. (2009). Financial inclusion, poverty reduction and the millennium development goals. The European Journal of Development Research, 21(2), 213–230. https://doi.org/10.1057/ejdr.2008.17

Chiu, Y. B., & Lee, C. C. (2020). Effects of financial development on energy consumption: The role of country risks. Energy Economics, 90, 104833. https://doi.org/10.1016/j.eneco.2020.104833

Chen, Z., Huang, W., & Zheng, X. (2019). The decline in energy intensity: Does financial development matter? Energy Policy, 134, 110945. https://doi.org/10.1016/j.enpol.2019.110945

Cheng, C., Ren, X., Dong, K., Dong, X., & Wang, Z. (2021). How does technological innovation mitigate CO2 emissions in OECD countries? Heterogeneous analysis using panel quantile regression. Journal of Environmental Management, 280, 111818. https://doi.org/10.1016/j.jenvman.2020.111818

Cui, L., Weng, S., & Song, M. (2022). Financial inclusion, renewable energy consumption, and inclusive growth: Cross-country evidence. Energy Efficiency, 15(6), 1–19. https://doi.org/10.1007/s12053-022-10051-y

Danish, & Ulucak, R. (2022). Analyzing energy innovation-emissions nexus in China: A novel dynamic simulation method. Energy, 244, 123010. https://doi.org/10.1016/j.energy.2021.123010

Demirguc-Kunt, A., Klapper, L., Singer, D., 2017. Financial inclusion and inclusive growth: A review of recent empirical evidence. Policy research working paper series 8040, the World Bank

Destek, M. A. (2018). Financial development and energy consumption nexus in emerging economies. Energy Sources, Part b: Economics, Planning, and Policy, 13(1), 76–81. https://doi.org/10.1080/15567249.2017.1405106

Dickey, D. A., & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica: Journal of the Econometric Society, 49(4), 1057–1072. https://doi.org/10.2307/1912517

EIA, 2019. International Energy Outlook 2019 with projections to 2050. https://www.eia.gov/outlooks/ieo/pdf/ieo2019.pdf (accessed 2 June 2021).

Fareed, Z., Rehman, M. A., Adebayo, T. S., Wang, Y., Ahmad, M., & Shahzad, F. (2022). Financial inclusion and the environmental deterioration in Eurozone: The moderating role of innovation activity. Technology in Society, 69, 101961.

Farhani, S., & Solarin, S. A. (2017). Financial development and energy demand in the United States: New evidence from combined cointegration and asymmetric causality tests. Energy, 134, 1029–1037. https://doi.org/10.1016/j.energy.2017.06.121

Goldsmith, R. W. (1969). Financial structure and development. Yale University Press.

Granger, C. W. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica: Journal of the Econometric Society, 37(3), 424–438.

Hashmi, S. H., Fan, H., Fareed, Z., & Shahzad, F. (2021). Asymmetric nexus between urban agglomerations and environmental pollution in top ten urban agglomerated countries using quantile methods. Environmental Science and Pollution Research, 28(11), 13404–13424.

Haseeb, M., Kot, S., Hussain, H. I., & Kamarudin, F. (2021). The natural resources curse-economic growth hypotheses: Quantile–on–Quantile evidence from top Asian economies. Journal of Cleaner Production, 279, 123596. https://doi.org/10.1016/j.jclepro.2020.123596

IEA, 2021. Net zero by 2050 hinges on a global push to increase energy efficiency, IEA, Paris https://www.iea.org/articles/net-zero-by-2050-hinges-on-a-global-push-to-increase-energy-efficiency (accessed 14 June 2021).

IMF, 2020. IMF data: access to macroeconomic & financial data. https://data.imf.org/?sk=F8032E80-B36C-43B1-AC26-493C5B1CD33B (accessed 6 June 2021).

IPA, 2017. Climate change and financial inclusion. https://www.poverty-action.org/sites/default/files/publications/Climate-Change-Financial-Inclusion_Final.pdf (accessed 5 June 2021).

Iqbal, N., Fareed, Z., Wan, G., & Shahzad, F. (2021). Asymmetric nexus between COVID-19 outbreak in the world and cryptocurrency market. International Review of Financial Analysis, 73, 101613. https://doi.org/10.1016/j.irfa.2020.101613

Islam, F., Shahbaz, M., Ahmed, A. U., & Alam, M. M. (2013). Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Economic Modelling, 30, 435–441. https://doi.org/10.1016/j.econmod.2012.09.033

Kazemi, M., & Kazemi, A. (2022). Financial barriers to residential buildings’ energy efficiency in Iran. Energy Efficiency, 15(5). https://doi.org/10.1007/s12053-022-10039-8

Khan, S., Murshed, M., Ozturk, I., & Khudoykulov, K. (2022). The roles of energy efficiency improvement, renewable electricity production, and financial inclusion in stimulating environmental sustainability in the Next Eleven countries. Renewable Energy, 193, 1164–1176. https://doi.org/10.1016/j.renene.2022.05.065

Kutan, A. M., Paramati, S. R., Ummalla, M., & Zakari, A. (2018). Financing renewable energy projects in major emerging market economies: Evidence in the perspective of sustainable economic development. Emerging Markets Finance and Trade, 54(8), 1761–1777. https://doi.org/10.1080/1540496X.2017.1363036

Konidari, P., & Nikolaev, A. (2022). Incorporating barriers in scenarios for energy efficiency improvement and promoting renewable energy in the Bulgarian residential sector. Energy Efficiency, 15(7). https://doi.org/10.1007/s12053-022-10058-5

Koomson, I., & Danquah, M. (2021). Financial inclusion and energy poverty: Empirical evidence from Ghana. Energy Economics, 94, 105085. https://doi.org/10.1016/j.eneco.2020.105085

Latif, Y., Shunqi, G., Fareed, Z., Ali, S., & Bashir, M. A. (2022). Do financial development and energy efficiency ensure green environment? Evidence from RCEP economies. Economic Research-Ekonomska Istraživanja, 1–22

Le, T. H., Chuc, A. T., & Taghizadeh-Hesary, F. (2019). Financial inclusion and its impact on financial efficiency and sustainability: Empirical evidence from Asia. Borsa Istanbul Review, 19(4), 310–322. https://doi.org/10.1016/j.bir.2019.07.002

Le, T. H., Le, H. C., & Taghizadeh-Hesary, F. (2020). Does financial inclusion impact CO2 emissions? Evidence from Asia. Finance Research Letters, 34, 101451. https://doi.org/10.1016/j.frl.2020.101451

Li, T. (2022). Energy productivity and financial inclusion: Evidence from non-parametric novel panel methods. Energy Efficiency, 15(7), 1–16. https://doi.org/10.1007/s12053-022-10057-6

Lin, B., & Su, T. (2020). The linkages between oil market uncertainty and Islamic stock markets: Evidence from quantile-on-quantile approach. Energy Economics, 88, 104759. https://doi.org/10.1016/j.eneco.2020.104759

Liu, L., Zhou, C., Huang, J., & Hao, Y. (2018). The impact of financial development on energy demand: Evidence from China. Emerging Markets Finance and Trade, 54(2), 269–287. https://doi.org/10.1080/1540496X.2017.1358609

Mahalik, M. K., Babu, M. S., Loganathan, N., & Shahbaz, M. (2017). Does financial development intensify energy consumption in Saudi Arabia? Renewable and Sustainable Energy Reviews, 75, 1022–1034. https://doi.org/10.1016/j.rser.2016.11.081

Makina, D., Walle, Y.M., 2019. Financial inclusion and economic growth: evidence from a panel of selected African countries. In Extending Financial Inclusion in Africa (pp. 193–210). Academic Press.

Nazir, M. R., Nazir, M. I., Hashmi, S. H., & Fareed, Z. (2018). Financial development, income, trade, and urbanization on CO2 emissions: New evidence from Kyoto annex countries. Journal on Innovation and Sustainability RISUS, 9(3), 17–37.

Pan, X., Uddin, M. K., Han, C., & Pan, X. (2019). Dynamics of financial development, trade openness, technological innovation and energy intensity: Evidence from Bangladesh. Energy, 171, 456–464. https://doi.org/10.1016/j.energy.2018.12.200

Pata, U. K. (2018). Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. Journal of Cleaner Production, 187, 770–779. https://doi.org/10.1016/j.jclepro.2018.03.236

Pata, U. K., & Yilanci, V. (2020). Financial development, globalization and ecological footprint in G7: Further evidence from threshold cointegration and fractional frequency causality tests. Environmental and Ecological Statistics, 27(4), 803–825. https://doi.org/10.1007/s10651-020-00467-z

Qin, L., Raheem, S., Murshed, M., Miao, X., Khan, Z., Kirikkaleli, D., 2021. Does financial inclusion limit carbon dioxide emissions? Analyzing the role of globalization and renewable electricity output. Sustainable Development. https://doi.org/10.1002/sd.2208

Raghutla, C., Shahbaz, M., Chittedi, K. R., & Jiao, Z. (2021). Financing clean energy projects: New empirical evidence from major investment countries. Renewable Energy, 169, 231–241. https://doi.org/10.1016/j.renene.2021.01.019

Rehman, M. A., Fareed, Z., & Shahzad, F. (2022). When would the dark clouds of financial inclusion be over, and the environment becomes clean? The role of national governance. Environmental Science and Pollution Research, 29(19), 27651–27663.

Rajbhandari, A., & Zhang, F. (2018). Does energy efficiency promote economic growth? Evidence from a multicountry and multisectoral panel dataset. Energy Economics, 69, 128–139. https://doi.org/10.1016/j.eneco.2017.11.007

REN21, 2020. Renewables 2020 Global Status Report (Paris: REN21 Secretariat). https://www.ren21.net/wp-content/uploads/2019/05/gsr_2020_full_report_en.pdf (accessed 2 June 2021).

Renzhi, N., & Baek, Y. J. (2020). Can financial inclusion be an effective mitigation measure? Evidence from panel data analysis of the environmental Kuznets curve. Finance Research Letters, 37, 101725. https://doi.org/10.1016/j.frl.2020.101725

Roubaud, D., & Shahbaz, M. (2017). Financial development, economic growth, and electricity demand: A sector analysis of an emerging economy. The Journal of Energy and Development, 43(1/2), 47–98.

Saidi, K., & Omri, A. (2020). The impact of renewable energy on carbon emissions and economic growth in 15 major renewable energy-consuming countries. Environmental Research, 186, 109567. https://doi.org/10.1016/j.envres.2020.109567

Sadorsky, P. (2010). The impact of financial development on energy consumption in emerging economies. Energy Policy, 38(5), 2528–2535. https://doi.org/10.1016/j.enpol.2009.12.048

Sadorsky, P. (2011). Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy, 39(2), 999–1006. https://doi.org/10.1016/j.enpol.2010.11.034

Sbia, R., Shahbaz, M., & Hamdi, H. (2014). A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Economic Modelling, 36, 191–197. https://doi.org/10.1016/j.econmod.2013.09.047

Schumpeter, J. (1932). The theory of economic development. Harvard University Press.

Shahbaz, M., & Lean, H. H. (2012). Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy, 40, 473–479. https://doi.org/10.1016/j.enpol.2011.10.050

Shahbaz, M., Nasir, M. A., & Roubaud, D. (2018a). Environmental degradation in France: The effects of FDI, financial development, and energy innovations. Energy Economics, 74, 843–857. https://doi.org/10.1016/j.eneco.2018.07.020

Shahbaz, M., Destek, M. A., & Polemis, M. L. (2018b). Do foreign capital and financial development affect clean energy consumption and carbon emissions? Evidence from BRICS and Next-11 countries. SPOUDAI-Journal of Economics and Business, 68(4), 20–50.

Shahbaz, M., Zakaria, M., Shahzad, S. J. H., & Mahalik, M. K. (2018c). The energy consumption and economic growth nexus in top ten energy-consuming countries: Fresh evidence from using the quantile-on-quantile approach. Energy Economics, 71, 282–301. https://doi.org/10.1016/j.eneco.2018.02.023

Shahzad, S. J. H., Shahbaz, M., Ferrer, R., & Kumar, R. R. (2017). Tourism-led growth hypothesis in the top ten tourist destinations: New evidence using the quantile-on-quantile approach. Tourism Management, 60, 223–232. https://doi.org/10.1016/j.tourman.2016.12.006

Shahzad, F., Fareed, Z., Wan, Y., Wang, Y., Zahid, Z., & Irfan, M. (2022). Examining the asymmetric link between clean energy intensity and carbon dioxide emissions: The significance of quantile-on-quantile method. Energy & Environment, 0958305X221102049.

Shahzad, F., Shahzad, U., Fareed, Z., Iqbal, N., Hashmi, S. H., & Ahmad, F. (2020). Asymmetric nexus between temperature and COVID-19 in the top ten affected provinces of China: A current application of quantile-on-quantile approach. Science of the Total Environment, 736, 139115. https://doi.org/10.1016/j.scitotenv.2020.139115

Sim, N., & Zhou, H. (2015). Oil prices, US stock return, and the dependence between their quantiles. Journal of Banking & Finance, 55, 1–8. https://doi.org/10.1016/j.jbankfin.2015.01.013

Tamazian, A., Chousa, J. P., & Vadlamannati, K. C. (2009). Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy, 37(1), 246–253. https://doi.org/10.1016/j.enpol.2008.08.025

Tang, C. F., & Tan, B. W. (2014). The linkages among energy consumption, economic growth, relative price, foreign direct investment, and financial development in Malaysia. Quality & Quantity, 48(2), 781–797. https://doi.org/10.1007/s11135-012-9802-4

Troster, V., Shahbaz, M., & Uddin, G. S. (2018). Renewable energy, oil prices, and economic activity: A Granger-causality in quantiles analysis. Energy Economics, 70, 440–452. https://doi.org/10.1016/j.eneco.2018.01.029

Usman, M., Makhdum, M. S. A., & Kousar, R. (2021). Does financial inclusion, renewable and non-renewable energy utilization accelerate ecological footprints and economic growth? Fresh evidence from 15 highest emitting countries. Sustainable Cities and Society, 65, 102590. https://doi.org/10.1016/j.scs.2020.102590

Wang, L., Vo, X. V., Shahbaz, M., & Ak, A. (2020). Globalization and carbon emissions: Is there any role of agriculture value-added, financial development, and natural resource rent in the aftermath of COP21? Journal of Environmental Management, 268, 110712. https://doi.org/10.1016/j.jenvman.2020.110712

World Bank, 2018. Financial Inclusion. https://www.worldbank.org/en/topic/financialinclusion/overview (accessed 3 June 2021).

World Bank, 2021. World Development Indicators. https://databank.worldbank.org/source/world-development-indicators (accessed 3 June 2021).

Xiao, Z. (2009). Quantile cointegrating regression. Journal of Econometrics, 150(2), 248–260. https://doi.org/10.1016/j.jeconom.2008.12.005

Yao, X., Yasmeen, R., Hussain, J., & Shah, W. U. H. (2021). The repercussions of financial development and corruption on energy efficiency and ecological footprint: Evidence from BRICS and next 11 countries. Energy, 223, 120063. https://doi.org/10.1016/j.energy.2021.120063

Zaidi, S. A. H., Zafar, M. W., Shahbaz, M., & Hou, F. (2019). Dynamic linkages between globalization, financial development and carbon emissions: Evidence from Asia Pacific Economic Cooperation countries. Journal of Cleaner Production, 228, 533–543. https://doi.org/10.1016/j.jclepro.2019.04.210

Zaidi, S. A. H., Hussain, M., & Zaman, Q. U. (2021). Dynamic linkages between financial inclusion and carbon emissions: Evidence from selected OECD countries. Resources, Environment and Sustainability, 4, 100022. https://doi.org/10.1016/j.resenv.2021.100022

Zhang, Y. J., Fan, J. L., & Chang, H. R. (2011). Impact of China’s stock market development on energy consumption: An empirical analysis. Energy Procedia, 5, 1927–1931. https://doi.org/10.1016/j.egypro.2011.03.331

Ziolo, M., Jednak, S., Savić, G., & Kragulj, D. (2020). Link between energy efficiency and sustainable economic and financial development in OECD countries. Energies, 13(22), 5898. https://doi.org/10.3390/en13225898

Zivot, E., & Andrews, D. W. K. (1992). Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business & Economic Statistics, 10(3), 25–44. https://doi.org/10.1198/073500102753410372

Acknowledgements

We are grateful for the valuable contributions and constructive comments of eight anonymous reviewers.

Funding

Zeeshan Fareed acknowledges the financial support provided by the Fundação para a Ciência e a Tecnologia (FCT), the Portuguese public agency that supports science, technology and innovation, in all scientific domains, under responsibility of the Ministry for Science, Technology and Higher Education [grant number UIDP/04011/2020]. Open access funding provided by FCT|FCCN (b-on).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article