Abstract

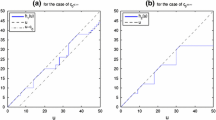

In this paper, a Markov-dependent risk model with a threshold strategy is considered. The expected discounted dividend payments satisfy some integro-differential equations. The analytical solutions to these systems are given. Finally, some numerical examples in some special cases are provided.

Similar content being viewed by others

References

De Finetti B. Su un’impostazione alternativa della teoria collectiva del rischio[J]. Tansactions of the XVth International Congress of Actuaries, 1957, 2: 433–443.

Albrecher H, Claramunt M M, Mármol M. On the distribution of dividend payments in a Sparre Andersen model with generalized Erlang(n) interclaim times[J]. Insurance Mathematics and Economics, 2005, 37(1): 324–334.

Albrecher H, Boxma O. On the discounted penalty function in a Markov-dependent risk model[J]. Insurance Mathematics and Economics, 2005, 37(2): 650–672.

Gerber H U, Shiu E S W. On optimal dividend strategies in the compound Poisson model[J]. North American Actuarial Journal, 2006, 10(3): 68–84.

Lin X S, Willmot G E, Drekic S. The classical risk model with a constant dividend barrier: Analysis of the Gerber-Shiu discounted penalty function[J]. Insurance: Mathematics and Economics, 2003, 33: 551–566.

Lin X S, Pavlova K P. The compound Poisson risk model with a threshold dividend strategy[J]. Insurance Mathematics and Economics, 2006, 38: 617–627.

Li Shuangming, Lu Yi. Moments of the dividend payments and related problems in a Markov-modulated risk model[J]. North American Actuarial Journal, 2007, 2: 65–76.

Li Shuangming, Lu Yi. The Markovian regime-switching risk model with a threshold dividend strategy[J]. Insurance Mathematics and Economics, 2009, 44: 296–303.

Zhu Jinxia, Yang Hailiang. Ruin theory for a Markov regime-switching model under a threshold dividend strategy [J]. Insurance Mathematics and Economics, 2008, 42: 311–318.

Liu Juan, Xu Jiancheng. Moments of the discounted dividends in a Markov-dependent risk model[J]. Acta Mathematica Scientia, Series A, 2009, 29(5): 1390–1397(Ch).

Liu Juan, Xu Jiancheng, Hu Yijun. Severity of ruin in a Markov-dependent risk model[J]. Wuhan Journal of Natural Sciences, 2009, 14(6): 470–474(Ch).

Liu Juan, Xu Jiancheng, Hu Yijun. On the expected discounted penalty function in a Markov-dependent risk model with constant dividend barrier[J]. Acta Mathematica Scientia, Series B, 2010, 30(5):1481–1491(Ch).

Burton T A. Volterra Integral and Differential Equations[M]. Singapore: World Scientific Press, 2005.

Author information

Authors and Affiliations

Corresponding author

Additional information

Foundation item: Supported by the Science and Technology Foundation of Hubei Province (D20092207) and the Hubei Normal University Post-Graduate Foundation (2010C17)

Biography: LIU Juan, female, Ph.D., Lecturer, research direction: insurance mathematics.

Rights and permissions

About this article

Cite this article

Liu, J., Xu, J. & Hu, H. Dividend payments with a threshold strategy in a Markov-dependent risk model. Wuhan Univ. J. Nat. Sci. 16, 11–15 (2011). https://doi.org/10.1007/s11859-011-0703-5

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11859-011-0703-5