Abstract

In this paper, we rely on the information asymmetries framework and relationship lending theory to study how small and medium-sized enterprises (SMEs)’s access to bank credit improves after the issuance of a Minibond. Minibonds are fixed-income securities issued by SMEs aimed at supporting growth projects and refinancing operations. They were introduced by different European countries only recently, in response to the European sovereign debt crisis, which considerably constrained bank credit for SMEs.

Using a representative sample of Italian companies that issued Minibonds in the 2012–2020 period, we find support to our hypotheses. Issuing Minibonds helps SMEs access higher amounts of debt and improves credit conditions in terms of cost of debt and debt maturity, but with some caveats: only Minibonds issued with lower interest rates and longer maturities lead to better access to credit. Moreover, we find that some companies more exposed to information asymmetries (i.e. younger), with better access to transaction lending (depending on their location) and with larger amounts of collateral available (i.e., tangible assets) benefit more from Minibond issuance.

Similar content being viewed by others

1 Introduction

Small and medium-sized enterprises (SMEs) face many disadvantages in accessing external sources of finance relatively to large corporations, mainly due to their strong exposure to information asymmetries. Bank loans are the primary source of external financing for SMEs (Kwaak et al. 2021), yet those companies face high costs in accessing bank debt, especially during challenging market conditions. Bonds are often less expensive than loans due to lower monitoring costs and large corporations issue corporate bonds and sell them through secondary markets or private placement (Russ and Valderrama 2012). Small, unlisted companies typically rely on loans rather than bonds, but recently they have gained the possibility to issue a particular type of corporate bonds, i.e., Minibonds. Minibonds were introduced by different European countries in response to the global financial crisis and the subsequent European sovereign debt crisis, which considerably constrained bank credit for SMEs. Minibonds are fixed-income securities, below € 50 millions, with a medium–long term expiration date aimed at supporting growth projects, future developments and refinancing operations. 2021 and, especially, 2022 were two record years for Minibonds issuances. While private capital funds at a global and European level have seen lower fundraising, in a general difficult context due to rising of interest rates and inflation, Minibond placements thrived. Many SMEs’ senior executives also recognised the benefits of Minibond in terms of growing opportunities for their companies and visibility and interest by prospective financial partners following the Minibond issuanceFootnote 1.

Banks cope with the risk of lending to informationally opaque SMEs in several ways, including engaging in long-term personal relationships with them (“relationship lending”) but also tightening credit conditions in terms of higher collateral, higher interest rates (Ackert et al. 2007) and shorter debt maturities to improve monitoring (Datta et al. 2005; Rajan and Winton 1995). In this paper, we rely on the information asymmetries framework and relationship lending theory to study how SMEs’ access to bank credit improves after a sudden release of information on the company due to the issuance of a Minibond.

We focus on the Italian context. In Italy, the 2012 reform “Decreto Sviluppo” (Law Decree 83/2012, changed into Law 134/2012) removed pre-existing limitations on unlisted companies’ issuance of corporate bonds, provided that securities are negotiated in a regulated market (i.e., the ExtraMOT PRO segment of Borsa Italiana) or a multilateral trading platform (e.g., equity crowdfunding platforms).

As Minibonds are a very recent phenomenon, academic research on Minibonds is scarce and mostly explorative. Feihle and Lawrenz (2017) and Mietzner et al. (2018) focus on Minibonds issued in Germany, while Angelini et al. (2019), Ongena et al. (2021) and Altman et al. (2020) explore Italian data. The results thus far have highlighted some criticalities related to the issuance of Minibonds. Altman et al. (2020) raise concerns regarding the liquidity of Minibonds due to the high levels of information asymmetries, which might discourage investors from buying them. Mietzner et al. (2018) find that Minibonds ratings tend to be inflated and that good quality issuers underprice their Minibonds to overcome information asymmetry issues with their potential investors. Focusing on the performance of issuers, Angelini et al. (2019) and Feihle and Lawrenz (2017) both find a subsequent decrease in profitability, arguably due to the low quality of projects pursued with the proceedings from the issuance, although Ongena et al. (2021) find no significant impact on profitability.

While these results point to an allegedly limited relevance of Minibonds as a direct source of finance, the benefits of Minibonds issuance might be indirect. Related to the present study, Angelini et al. (2019) and Ongena et al. (2021) focus on the impact of Minibonds on the capital structure of issuers. Despite the similar sample on which the two studies are based, they found partially contrasting evidence. Angelini et al. (2019) find that Minibond issuers report lower leverage but a higher long-term debt ratio. Ongena et al. (2021) find that Minibonds substitute bank credit but lead to higher average leverage. Moreover, they find that Minibond issuers perceive a lower cost of bank debt, which is compensated by higher Minibonds coupon rates.

Overall, these studies present mixed evidence on the role of Minibonds on issuers’ ability to access external financing and, in particular, credit. Whether Minibonds substitute alternative sources of debt or help issuers raise more credit under better conditions is still an open question. This paper aims to answer to this question by considering the heterogeneity of the characteristics of Minibonds (e.g., amounts, interest rates, maturity, requirement of collateral) and their issuers (age, prevailing lending technology and availability of collateral), thus providing an original contribution to the emerging literature on Minibonds and, more in general, on our theoretical knowledge of SMEs’ access to bank credit. First, we theorize on the reasons why Minibonds can improve access to credit (in terms of both credit amount and credit conditions) under an information asymmetry framework and relying on the literature on relationship lending, which is the lending technology most frequently used by SMEs. We argue that Minibonds’ issuance consists of a new “information release” event, which might improve the creditworthiness of the issuers and help them renegotiate their lending conditions with their own (relationship) bank and, at the same time, access other (relationship and transaction) banks. Second, we examine the conditions under which such potential benefits of Minibond are more likely to materialize. We expect that the effect engendered by Minibond issuance will improve credit access, especially for companies that are characterized by higher information asymmetries, such as younger companies, companies who can benefit from easier access to transaction banks and companies with lower levels of tangible assets which can be pledged as collateral.

We test our hypotheses on a sample of 602 Italian SMEs, which are representative of the population of Italian SMEs that issued Minibonds in the period 2012–2020, and a comparable matched sample of non-issuers. Italy is an ideal testbed for our analyses because of the large number of SMEs in the economy (ISTAT 2021), the variety of firm-bank relationships accessible to SMEs (Bartoli et al. 2013) and the diffusion of Minibonds among them (Politecnico di Milano - Osservatorio Minibond 2021). In this context, we analyse how the issuance of the Minibond and its characteristics (i.e., amount raised, interest rate and maturity) influence total debt amount and credit conditions, finding support to our conjectures.

With this paper, we make different theoretical contributions. First, this research advances the literature investigating the effect of Minibond issuance on the access of SMEs to financing, reconciling the contrasting results found by previous literature. We contribute, more generally, to the understanding of SMEs’ access to credit, simultaneously considering different loan conditions such as collateral, interest rate and debt maturity (Brick and Palia 2007). Second, we contribute to lending mechanism theory by showing that a new “information release” event (i.e., Minibonds issuance) helps SMEs renegotiate their lending conditions with their own (relationship) bank and, at the same time, access other banks’ credit more easily. Third, the study contributes to the literature on the choice between bank credit and market-based finance. The theoretical literature analyses the benefits and costs connected to this decision, as well as the role played by company characteristics that may explain a stronger inclination or capacity to secure funding through capital markets (Diamond 1991; Goel and Zemel 2018; Holmström and Tirole 1998). However, much of the empirical literature on this subject has focused on large corporations (Morellec et al. 2014; Pagano et al. 1998; Schenone 2010) due to the lack of data about small businesses, among which the diffusion of non-bank debt finance is still limited. We make an important advancement on this topic by analysing a large sample of SMEs and testing whether bank credit and market-based debt for SMEs are complementary or substitutive.

The remainder of the paper is structured as follows. Section 2 presents the theoretical background and sets forth our research hypotheses. Section 3 reviews the introduction of Minibonds in Italy. Section 4 introduces the data and describes the empirical strategy. Section 5 introduces the empirical model we resorted to in our analysis. Section 6 presents the results of the analysis. Finally, Sect. 7 discusses the results and conclusions.

2 Theoretical framework: information asymmetries and access to credit

Information asymmetry arises when the information about a company is not equally accessible by all company stakeholders. SMEs are especially exposed to information asymmetries because they often have a short track record, simplified and less transparent accounting practices, and limited media coverage. While bank loans are the most familiar source of financing for SMEs (Beck et al. 2008), bank officials often have scant information on their prospective clients to judge whether they will be willing and able to pay back their loans.

Banks typically cope with high information asymmetries by asking their borrowers for collateral, i.e., a title on a specific asset, typically tangible, on which the bank has a claim in case of the borrower’s default and which can be used as guarantee. Pledging collateral also reduces moral hazard by providing a disincentive for borrowers to default, thus deterring opportunism (Stiglitz and Weiss 1981). However, the limited size of SMEs imply that the banks can rely on smaller amounts of tangible assets to be pledged as collateral. Moreover, SMEs usually ask for relatively small loans, resulting in a disproportion between the costs associated with the due diligence and the returns that banks can reap from the loan. Lastly, smaller companies have profits that are more volatile and therefore a higher risk of bankruptcy (Hall et al. 2004; Sogorb-Mira 2005).

Substantial academic attention has been devoted to the importance of information asymmetries on credit access for SMEs (Kaposty et al. 2022). Banks can cope with the high information asymmetries and low level of collateral characterizing SMEs by tightening credit conditions, or by collecting additional (soft) information through relationship lending.

2.1 Credit conditions

Credit conditions offered by banks to the informationally opaque SMEs are usually tighter with respect to larger companies in terms of higher interest rates (Ackert et al. 2007), and shorter debt maturities (García-Teruel and Martínez-Solano 2007).

Higher interest rates boost the prospective returns of banks in case the loans do not default and compensate for the additional risk that banks undertake by lending to SMEs. Nevertheless, interest rates cannot be increased indefinitely. When information asymmetries are high, an excessively high interest rate might cause adverse selection, moral hazard and, therefore, high monitoring costs. As a result, banks can decide to keep credit supply below demand rather than tapping the extra loan demand at higher interest rates, resulting in credit rationing (Stiglitz and Weiss 1981).

Banks might also cope with information asymmetries by shortening the maturity of their loans. Shorter debt maturities are a monitoring mechanism for banks (Datta et al. 2005; Rajan and Winton 1995) because they imply more frequent debt renegotiations, when the lender can re-evaluate the borrowing firm’s financial position, check essential information, and examine managerial choices. The intensive scrutiny required in the debt renewal process can help discourage managers’ opportunistic conduct and mitigate agency problems. Short-term debt, however, is more costly for borrowers: it may expose borrowers to high roll-over risk and covenant violations, thereby exacerbating credit and liquidity shocks that the business may experience (Benmelech and Dvir 2013). Thus, firms with a large proportion of short-term debt in their debt maturity structure bear a greater refinancing risk, which may, in turn, have a negative impact on their future investments and growth prospects (Almeida et al. 2012).

2.2 Relationship and transaction lending

In addition to tightening credit conditions when lending to SMEs, some banks manage information asymmetries by monitoring their borrowers and acquiring important “soft” information about the firm’s economic prospects. In “relationship lending”, based on long-term, often exclusive, relationships between banks and companies, banks overcome information asymmetries thanks to the personal knowledge of the entrepreneur and of the company (Berger and Udell 2002; Cole 1998; Degryse and Van Cayseele 2000). Relationship lending is opposed to transaction lending, where banks are able to collect tangible information on their borrowers based on objective “hard” criteria, such as financial ratios, credit scores or the presence of collateral (Berger and Udell 2002, 2006). Relationship banks overcome problems of information opacity better than transaction-based lenders because they rely on proprietary information, which goes beyond a firm’s financial statements. Therefore, relationship lending is more readily available than transaction lending. However, relationship lending has different drawbacks for companies, including informational capture and higher interest rates (Agarwal and Hauswald 2011; Ioannidou and Ongena 2010). Specifically, the relationship bank gains confidential information that cannot be disclosed to other potential lenders, creating a monopoly of information. This gives the inside bank considerable negotiating power, which might lead to interest rates staying higher than they would be in market equilibrium. Borrowers have the possibility to reduce the risk of hold-up by diversifying their source of funding away from their main bank. Ioannidou and Ongena (2010) find that companies that switch banks obtain lower lending rates from the outside bank.

2.3 Minibonds as a release of new information on the firm

Few studies empirically analyse the relationship between information asymmetries and credit for SMEs. In terms of credit access, García-Teruel et al. (2014) show a positive association between accruals quality and bank debt, suggesting that higher precision of earnings reduces information asymmetries with banks and favours the access of firms to bank loans. Access to credit also improves after a decrease in information asymmetry due to affiliation with a third informed party, such as granting agencies (Martí and Quas 2018; Meuleman and De Maeseneire 2012).

As to credit conditions, Francis et al. (2017) find that loan spreads increase when companies voluntarily change their auditor company, consistent with an increase in information risk. Ortiz-Molina et al. (2008) find that the maturity of companies’ debt is shorter for firms that are more informationally opaque, in addition to firm owners that have poor credit histories and are less experienced. Bharat et al. (2008) find that the quality of information on the borrower, captured by accounting quality, lowers the spread of private debt, increases debt maturity and lowers the need for collateral.

Previous research also suggests that companies obtain better lending conditions, either from their current bank or switching to new ones, when additional “hard information” becomes available to them, notably when the company issues bonds or is listed. For instance, Hale and Santos (2009) show that firms obtain lower interest rates after a bond IPO. Schenone (2010) finds that after IPOs, the lending rates of firms with more intense firm-bank relationships decrease. Camisòn et al. (2022), using a sample of Spanish small and medium-sized family firms, show the importance of family reputational intangibles, with a positive indirect effect on firms’ leverage capacity.

In this paper, we consider Minibonds issuance as a sudden release of new information to the market, which substantially lowers information asymmetries between the SME and prospective lenders, thus easing access to credit.

Minibonds are typically bought by qualified investorsFootnote 2. Before the placing, companies have to prepare substantial documentation (Admission Document or a Prospectus, including the financial statements and future prospects, and possibly Minibonds’ rating) which is disclosed to potential investors. The admission document contains some fundamental information not easily accessible to investors before, including: risk factors of the issuer and the bond instrument; information on the issuer, organizational structure and shareholder structure; financial information relating to assets and liabilities, the financial situation, the profits or losses of the last accounting year, or the latest attached balance sheet; the characteristics of the bond instrument; any ESG disclosures if applicable. Risk factors are particularly relevant and include: risks connected to corporate leverage; the risks associated with the market in which the company operates; the risks of financial covenants and commitments envisaged in the bond issuance; the risks associated with the current economic situation; the risks of illiquidity of the bonds in the event that the investors are not entirely professional ones. In the Appendix is reported an example of the information that is released before the Minibond issuance. It refers to Shareholders Meeting’s minutes that approved the Minibond issuance. The document also reports the characteristics of the Minibond: the name of the arranger (i.e., the bank that will take care of the placement and identify the investors who will subscribe the minibonds), the total amount of the bond, the issue price, the minimum ticket size, the duration, the coupon rate and the reimbursement plan (e.g., amortising with 12-month grace period). The document also outlines the financial covenants that the company must comply with. Once the placing is concluded, the information on the successful issuance is announced publicly by the financial pressFootnote 3. In this moment, the bond issuance per se consists in a sudden release of information: the issuer suddenly becomes more visible to the market, and the fact that qualified investors have decided to buy Minibonds based on privately disclosed information is informative of the quality of the issuer. This additional information informs new prospective lenders about firm’s creditworthiness. Moreover, further information can be conveyed by bond analysis and investors who trade Minibonds (Hale and Santos 2009).

This new realise of information will strengthen the bargaining power of the borrowing company, and will improve the lending conditions offered by the current inside bank (likely offering relationship lending). At the same time, as new information becomes available, the inside bank will lose the monopoly of information on the issuer, and new (relationship and transaction) banks will be more inclined to lend to the issuers. This has the double effect of making more debt available to the issuing companies and, as the sources of finance diversify, of improving the lending conditions from both the inside and new banks. Hypothesis 1 follows.

Hypothesis 1

Minibond issuance improves companies’ access to credit in terms of larger debt amounts and better credit conditions (i.e., lower cost of debt and higher debt maturity).

2.4 The role of age

The release of new information on the SMEs, related to Minibond issuance, should benefit more companies that are, a priori, characterized by higher information asymmetries.

This is the case for younger companies, which have a shorter track record in terms of both accounting data and credit history (Carpenter and Petersen 2002). Younger companies are particularly susceptible to information asymmetry effects since their short track record makes it more difficult for financial institutions to gather information and, then, to judge their quality (Hall 2002). The available empirical studies support the contention that young companies are more information opaque (Brown et al. 2009; Colombo et al. 2013; Guariglia 2008), have more difficult access to credit and face worse credit conditions (Ayyagari et al. 2007). For instance, Petersen et al. (1994) find a negative relationship between firm age and cost of debt in a sample of US-based small businesses. Accordingly, we propose the following research hypothesis:

Hypothesis 2

Younger companies benefit more from Minibond issuance in terms of better access to credit.

2.5 The role of local lending technology

The benefits of issuing Minibonds might also be stronger for SMEs that have better opportunities to renegotiate their lending conditions, switching to other banks. Specifically, we argue that SMEs might switch from a relationship lending technology, based on the exchange of “soft information”, to a transaction lending technology, relying on new external information provided by the issuance of the Minibond. The possibility of carrying out this switch arguably depends on the local prevailing lending technology, and specifically is higher when transaction lending prevails.

In fact, the distance between companies and their banks is a fundamental factor in gaining access to loans. The collection of soft information usually requires contact between lender and borrower, and this is facilitated by geographic proximity. However, distance drives the following fundamental trade-off in the availability and pricing of credit: the closer a firm is to its branch office, the more likely the relationship bank is to offer credit, but also the more it charges ceteris paribus (Agarwal and Hauswald 2010). Informationally opaque firms, such as SMEs, tend to have closer banks, and bank transactions are still very likely to be conducted in person (Petersen and Rajan 2002). We expect that SMEs that are located in geographical areas where transaction lending prevails, thanks to the credit-quality information of the Minibond issuance, are more likely to switch bank, and, therefore, have higher chances of accessing additional loans with better conditions. Thus, we propose the following hypothesis:

Hypothesis 3

Companies located in geographical areas where transaction lending prevails benefit more from Minibond issuance in terms of better access to credit.

2.6 The role of tangible assets

As previously mentioned, pledging collateral can have a mitigating effect on informational asymmetries (Bester 1985, 1987; Berger and Udell 1990, 2006), and moral hazard (Stiglitz and Weiss 1981) for companies.

Lenders typically view tangible assets as a reliable form of collateral. Therefore, SMEs with higher values of tangible assets possess substantial collateral and are more likely to already have established relationships with banks and a track record of securing traditional loans. In contrast, SMEs with lower values of tangible assets find it more challenging to access credit from banks, as their limited tangible assets may not sufficiently mitigate lenders’ perceived risk. The decrease in information asymmetry associated with the Minibond issuance will be more beneficial for companies with lower value of tangible assets, which are expected to more significantly improve their access to credit following the Minibond issuance. Thus, we propose the following hypothesis:

Hypothesis 4

Companies with higher values of tangible assets benefit less from Minibond issuance in terms of better access to credit.

3 Research framework: the minibond market in Italy

Minibonds were introduced by different European countries in response to the global financial crisis (Anderloni and Braga 2019). In Germany, minibonds have been present since 2000 and are listed at local stock exchanges sometimes in their own segment, including but not limited to exchanges in Düsseldorf, Stuttgart, Munich, and also in Deutsche Börse Group and Frankfurt Stock Exchange. In the United Kingdom, Minibonds have been traded since 2010 through the Order Book for Retail Bonds (segment of the London Stock Exchange) and more recently through crowdfunding platforms. In Spain, the Mercado Alternativo de Renta Fija (MARF) was set up in 2013 to allow access to capital markets for SMEs. Minibonds were introduced in France only in 2016; therefore, the market is still thin with respect to other countries but developing quickly. French Minibonds are placed with the support of a registered online intermediary, including investment service providers and crowdfunding platforms.

We tackle our research questions in the context of Minibonds issued in Italy.

Between 2012 and 2013, the Italian government passed four decreesFootnote 4 to encourage SMEs and unlisted firms to use alternative credit channels in response to the European sovereign debt crisis and consequently bank credit rationing. The first act, “Decreto Sviluppo” (Law Decree 83/2012, turned into Law 134/2012), lifted the restrictions on unlisted companies for the issue of corporate bonds. Unlisted companies were allowed to issue bonds, which are called Minibonds, as long as the securities were traded on a regulated exchange or in a multilateral trading facility and in compliance with some disclosure requirements (see below). The act also extended to Minibonds the same tax treatment established for bonds issued by listed firms, including tax relief on issuance expenditures and interest costs and a preferential tax regime for the interest income gained by investors.

Following these regulatory changes, Borsa Italiana (i.e., the Milan Stock Exchange) established, in February 2013, an ad hoc multilateral trading facility, the ExtraMOT PRO, open only to professional investors and designed for the issue of bonds and other debt securities by companies not listed on regulated markets, SMEs or issuances with a value of less than € 50 million. The new trading segment increases the visibility of companies and allows them to benefit from reducing the costs of public debt funding. The listing fee for regular bonds on this segment amounts to € 2,500. If the security is already listed on other markets (i.e., in a dual listing process), the fee is reduced to € 500. For the placement of Minibonds, the fee is equal to a decreasing percentage of the placement value, between 0.0025% and 0.01% with a minimum value of € 4,500.

The listing requirements on ExtraMOT PRO are simplified with respect to the MOT market, which is open to retail investors. Since ExtraMOT PRO is solely available to professional investors, the listing procedure is not subject to the EU Prospectus Directive and does not require prior permission by the CONSOB, i.e., the Italian financial market regulatory body. As a result, the time it takes to list a security is considerably shortened; in most cases, the security is permitted to trade within seven working days after the first application to Borsa Italiana. Concerning disclosure requirements, the issuer needs to publish an Admission Document (or a Prospectus, at the issuer’s discretion, mainly for amounts above € 200 million) and the annual financial statements for the last two years, having at least the last one audited. The company must also include on its website a section dedicated to investors, where it must publish the Admission Document (or the Prospectus). In the case that a rating is assigned to the firm or to the bond, the issuer has to disclose it as well. Figure 1 illustrates the timeline and stages of a typical Minibond issuance. The process comprises a first phase, where the feasibility of the issuance is assessed. This phase is followed by the actual structuring and placement of the bond. The main stages include the structuring of the offering terms and bond characteristics (after around 1 month from the starting of the process), the marketing phase, where the issuance is presented to potential investors and information on the company is, therefore, disclosed (after around 2 months), and the due diligence. In general, the entire process is rather quick (4.5 months) compared to the issuance of a regular bond on the stock exchange. After around 2 months from company’s decision to issue the Minibond, information starts to be shared with potential investors, it is, however, when the placement takes place that most of the benefits for the company materialize, since the news of the issuance is publicly released.

4 Data and method

4.1 Empirical approach

To answer our research questions, we use a counterfactual approach and compare the access to credit of SMEs that issued Minibonds with companies that did not issue Minibonds but were otherwise very similar. Regarding the first group of companies, we retrieved from the Crowdinvesting Observatory of Politecnico of Milan all companies who issued Minibonds in Italy from 2012 to the end of 2020. The sample of issuers is described in detail in Sect. 5.2. The control group of companies is extracted from Bureau Van Dijk database Orbis and further refined to select only companies similar to the Minibond issuers, using a sophisticated matching approach described in Sect. 5.3. Our econometric analysis is conducted in a panel setting in which both issuers and matched companies are observed between 2010 and 2020.

4.2 Sample of issuers

We retrieved the list of Minibonds issuance, as of December 31, 2020, from the Crowdinvesting Observatory of Politecnico of Milan. According to the Observatory database, 1,008 Minibonds were issued by 680 companies between 2012 and 2020. The Observatory provided us with information on the issuers’ VAT code and the Minibonds issuance date, amount rates and effective rates. To retrieve further information on the Minibond issuing companies, we matched the list of Minibond issuers with the Bureau Van Dijk database Orbis. We retrieve information on foundation year, location and industry for 638 companies that we identified in Orbis, while a complete set of the relevant accounting data for the period 2009–2020 was available only for 546 companies (80.29% of the population). Table 1 shows the distribution of the population of companies that issued Minibonds and of the sample used in the analysis, including the main characteristics of the companies (i.e., region, industry, age class at the time of the issuance) and the characteristics of the Minibonds (i.e., year of the first issuance, amount, effective rateFootnote 5 and maturity). Chi2 tests reveal that the two distributions are mostly not significantly different at conventional significance levels, suggesting that selection biases are not a concern in our analysis. The only exception is the age at the time of the first issuance: as we need accounting information at least one year before the Minibond issuance, the sample systematically excludes companies that issued Minibonds when they were younger than 1 year. However, if we also exclude those companies from the population, we find a statistically similar distribution along age classes for population and sample companies.

4.3 Control group

To build our control sample, we first retrieved from the Orbis database a stratified random sample of companies. We define strata based on the distribution of Minibond issuers across industries, regions and four percentiles based on the foundation year. For each stratum, we compute the number of issuers falling in that stratum, for which we could retrieve accounting data. We then look in Orbis for 50x the number of issuers in that stratum. After removing Minibond issuers, we end up with a sample of 30,832 companies that did not issue Minibonds but that had the same distribution across industries, regions and foundation periods of the sample issuers.

As a second step, we perform a 2-step matching procedure to identify, out of the non-issuers sample, a control group of companies that more closely resemble issuers (i.e., the “treated” companies) in terms of observable characteristics. Specifically, we first use coarsened exact matching (CEM, Iacus et al. 2012), followed by propensity score matching (PSM, Rosenbaum and Rubin 1983). PSM selects matched companies on the basis of a propensity score, i.e., the probability to “be treated” (in this case, to issue a Minibond) estimated based on a set of matching variables. CEM enforces a stronger control of the balancing of the matched sample because it matches directly on matching variables, rather than a combination of those (i.e., the propensity score). Moreover, for continuous variables, the balancing is not focused exclusively on the mean but on the entire variable distribution. Using CEM followed by PSM, we combine the benefits of the two matching methods.

To run the matching, we use company-year observations in which companies issued a Minibond for the issuers and all company-year observations for the non-issuers. The matching variables of the CEM are the companies’ age classes, year, macro-region and industries (NACE Rev. 2 Codes, aggregated as shown in Table 1). The CEM creates strata along all of these dimensions and then keeps only observations that fall in strata in which there are both issuers and non-issuers. In other words, the CEM guarantees the overlap of control group companies and the group of issuers along all these dimensions simultaneously. The CEM discards approximately 9.69% of companies, leaving us with 27,844 non-issuers. The PSM is then used to identify, among companies selected with the CEM, those with the highest propensity score of issuing a Minibond. We estimate the propensity score with a probit in which the dependent variable is 1 for issuers and 0 for non-issuers. Regarding the matching variables, we include companies’ age (lnAget, i.e., the age of the company in logarithm of years plus one), companies’ size (lnSalest.1, i.e., the lag of the natural logarithm of sales plus one), companies’ debt (lnDebtt−1, i.e., the logarithm of total financing debt), cost of debt (CostDebtt−1, i.e., the financial interest paid in a given year, divided by the total debt in the balance sheet of the company in the year beforeFootnote 6, see Bliss and Gul 2012), debt maturity (DebtMaturityt−1, i.e., the long-term debt divided by total debt, see Antoniou et al. 2006) and percentage of intangible assets (Intangiblest−1, i.e., the intangible fixed assets divided by total assets), to capture the presence of collateral. We also include year, industry (NACE Rev. 2 Codes aggregates) and macro-region dummies. Based on the results of the probit, we compute a propensity score, and for every issuer, we pick the 2 non-issuers with the closest propensity score (“nearest neighbours”). We end up with 820 matched non-issuers that enter into our estimates.Footnote 7

To assess the appropriateness of our matching algorithm, we test the balancing of matching variables after matching, including lnAget, lnSalest−1, Intangiblest−1, lnDebtt−1, CostDebtt−1 and DebtMaturityt−1 and macro-region, industry and year dummies. Results on the continuous variables are shown in Table 2. Before matching, companies issuing Minibonds tend to be older (p-value < 5%), larger (p-value < 1%), with much higher intangibility (p-value < 1%), with higher levels of debt (p-value < 1%), which is cheaper (p-value < 1%) and more long term (p-value < 1%) with respect to the randomly extracted group of companies who did not issue Minibonds. After the matching, all of these differences are neutralized and not statistically significant at standard confidence intervals. Similarly, with respect to discrete variables, any difference in the distribution of Minibond issuers across macro-regions, industries and years, with respect to non-issuers, is neutralized after the matching procedure (χ2(4) = 2.49 for macro-regions, χ2(21) = 7.49 for industries and χ2(8) = 4.10 for years). As a further proof of the balancing of the matching, Rubin’s B, i.e., the absolute standardized difference of the means of the linear index of the propensity score in the treated and matched groups, drops from 229.2 before matching to 20.4 after matching. Rubin’s R, i.e., the ratio of the variances of the propensity score in the two groups, is 0.34 before matching and 1.17 after matching. Values of Rubin’s B below 25 and R between 0.5 and 2 are generally considered indicators of balanced matching (Rubin 2001).

Last, we build a panel database of bond issuers and matched companies, in which all companies are observed yearly, between 2010 and 2020.

5 Model

We use different model specifications to test the effect of Minibonds issuance on access to credit finance in terms of amount and credit conditions (Hp1). Specifically, our dependent variables capture the amount, interest rate and maturity of the debt raised by bank. Unfortunately, we do not have access to loan-based information, therefore we carefully clean accounting data on total financial debt and debt conditions (interest rates and maturity), to account for the fact that these amounts are influenced by Minibonds issuance “by construction”: for example, the amount issued through Minibonds mechanically increases the amount of debt raised, and Minibond’s maturity influences the maturity of total debt.

We therefore build dependent variables related to debt raised by banks using both the information on total debt (from accounting data) and the information on the Minibond. The use of such dependent variables aims to account for the direct effect of Minibond issuance on company balance sheet and, more importantly, to correctly estimate the improved access to credit engendered by Minibond issuance through the reduction of information asymmetries.

Our first dependent variable is lnBankDebt, i.e., the logarithm of the difference in thousand EUR (plus 1) between the book value of total financial debt and the total amount of Minibonds issued and still outstanding in a particular year. Total financial debt is the sum of short-term debt (called “Loans” in Orbis) and long-term debt and captures access to financial debt in general. The total amount of Minibonds outstanding is computed using the information on the amount issued with Minibonds by a company, cumulating the amounts over time (in case of several Minibonds issued by the same company) and setting the amount to 0 after the maturity date of each bond.

As the distribution of lnBankDebt is similar to a normal distributionFootnote 8, we chose fixed effect linear regressions as model specifications, which allow us to focus on variation in the variable across time rather than across companies and to control for any time-invariant firm-specific omitted variable.

With respect to credit conditions, our second dependent variable is BankDebtCost, i.e., the financial interest paid in a given year for bank debt, divided by the total bank debt (i.e., total debt in the balance sheet of the company minus Minibonds outstanding) in the year beforeFootnote 9 (Bliss and Gul 2012). The financial interest paid in a given year for bank debt is computed as the total financial interest paid annually as reported in the company balance sheet, minus the interest paid on Minibonds in each year. The latter is computed separately for each issued Minibond and each year as the Minibond effective rate multiplied by the amount outstanding, and then cumulated over each Minibond.

The third dependent variable is BankDebtMaturity, i.e., the long-term bank debt divided by total bank debt (Antoniou et al. 2006). To compute long-term bank debt, we used the balance sheet information on total long-term debt and subtracted the outstanding amount of Minibonds with maturity longer than 1 year.

Both BankDebtCost and BankDebtMaturity are expressed as percentages varying between 0 and 1; therefore, we use fractional logit models with correlated random effects to analyse them, as suggested by Papke and Wooldridge (2008).

We are interested in capturing the effect on these dependent variables of Minibond issuance (Hp1). We therefore create a dummy MB_step, which is a dummy turning from 0 to 1 in the year of Minibond issuance for issuers, and equal to 0 for control group companies. We expect this variable to have a positive coefficient in the lnBankDebt model. Furthermore, if Minibonds improve the conditions of access to bank debt, in terms of lower cost of capital and longer maturity, MB_step should have a negative coefficient in the BankDebtCost model and a positive coefficient in the BankDebtMaturity model.

To test our hypotheses on the role of information asymmetries in influencing the effect of Minibond issuance (Hp2), we resort to the use of a moderator. Specifically, Young is a dummy variable equal to 1 for companies that at the time of the matching were younger than 13 years old, corresponding to the first quartile of the distribution of the age of sample companies at the time of the issuanceFootnote 10. We interact Young with the MB_step dummy and, in line with Hp2 on a more beneficial issuance of Minibonds in terms of access to credit markets, we expect a positive coefficient in the model of lnBankDebt and BankDebtMaturity and a negative coefficient in the model of BankDebtCost.

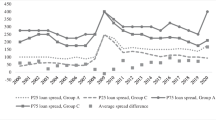

We proceed in a similar way to test our third hypothesis on the local prevailing lending technology (Hp3). As previously mentioned, relationship lending technology is often characterized by exclusive long-term relationships with banks, while in transaction lending, companies tend to engage in multiple-bank borrowing (Carletti et al. 2007). We retrieved from Banca D’Italia the information on the number of single-bank and multiple-bank borrowing by companies in each Italian province (NUTS3) and each year (we used the information at 31th December of each year).Footnote 11 By dividing the number of multiple borrowers by the total number of borrowers in each province, we generated the variable MultipleLendingp, t capturing the prevalence of transaction lending technology in province p and year t. We then interact this variable with the MB_step dummy and expect a positive coefficient in the model of lnBankDebt and BankDebtMaturity and a negative coefficient in the model of BankDebtCost, coherently with the hypothesis that the benefits of issuing Minibonds are stronger when a company is located in geographical areas were transaction (i.e., multiple) lending prevails.

With respect to our hypotheses on the role of tangible assets in influencing the effect of Minibond issuance (Hp4), we use as moderator the variable lnTangiblest−1, equal to the logarithm of the amount of a company’s tangible fixed assets in the previous year. We expect that companies with larger amounts of tangible assets have an easier access to bank debt, while the interaction between lnTangiblest−1 with the MB_step dummy should have, according to a weaker beneficial effect of Minibonds on the access to credit (Hp4), a negative coefficient in the model of lnBankDebt and BankDebtMaturity and a positive coefficient in the model of BankDebtCost.

We also include in all models control variables that capture Minibonds’ characteristics. MB_amount is the logarithm of the total amount of Minibonds issued (in million EUR, plus 1) by companies and still outstanding in a particular year. To compute it, we used the information on the amount issued with Minibonds by a company, cumulating the amounts over time (in case of several Minibonds issued by the same company) and setting the amount to 0 after the maturity date of each bond. MB_rate and MB_maturity are respectively equal to the effective rate (in percentage) and maturity (in years) of the Minibonds for all years after the bond issuance and are 0 before the issuance and for control group companies. While the information on Minibonds characteristics has been used to compute the dependent variables on bank debt, we believe that the inclusion of MB_amount, MB_rate and MB_maturity in the models as controls might still bear interesting results because Minibonds characteristics are per se a release of information on the company. For instance, one could argue that larger Minibonds, with lower effective rates and longer maturities are informative of the issuing company’s trustworthiness as a borrower, and therefore might lead to stronger improvements in the access to credit than the issuance of smaller Minibonds, with high interest rates and shorter maturities.

As additional control variables, we use regressors that are quite established in the corporate structure literature. We control for age, size and leverage with lnAge, lnSales and Leverage. Furthermore, to control for liquidity, we use CashFlowRatio and LiquidityRatio, respectively equal to the ratio of cash flow and of cash and cash equivalents on total assets. The company company’s tangibility with the IntangibleRatio, equal to the ratio of intangible fixed assets to total assets. Last, AssetsMaturity is the ratio of tangible fixed assets to depreciation and captures the extent to which the assets of a company have long maturity. As companies need to match the maturity of liabilities with the maturity of assets, this variable is an important determinant of the maturity ratio of the debt of companies, as shown by Antoniou et al. (2006). All these variables are lagged to avoid reverse causality. Descriptive statistics and the correlation matrix are shown in Tables 3 and 4.

In the linear regressions (when the dependent variable is lnBankDebt), we add company fixed effects. In the fractional models (i.e., when the dependent variables are the ratios BankDebtCost and BankDebtMaturity), we add company random effects and industry and regional dummies, and, following Papke and Wooldridge (2008), we simulate fixed effects by including the time averages of the covariates and clustering the standard errors. In all models, we include year fixed effects.

6 Results

6.1 Effect of minibonds on access to bank debt

In Table 5, we show the results on the effect of Minibond issuance on beneficiaries’ access to bank debt. The dependent variable is lnBankDebt. In Column I, we report estimates of the baseline model with the control variables and our main dependent variable, MB_step. In Column II, we add as further regressors the total amount of Minibonds issued (MB_amount), the Minibond effective rate (MB_rate) and the Minibond maturity (MB_maturity). Footnote 12

In terms of our control variables, we find positive coefficients, significant at least at the 5% level, for lnAget−1, lnSalest−1,Leveraget−1, CashFlowRatiot−1, and AssetsMaturityt−1. Unsurprisingly, older and larger companies with higher ability to generate cash flows and higher assets maturities tend to raise more bank debt. IntangibleRatiot−1 has a positive coefficient, significant at the 5% level, in line with the fact that firms with high amounts of tangible assets could use tangibles as collateral that reduces the perceived risk of banks, allowing them to raise more debt (Frank and Goyal 2003; Harris and Raviv 1991). Instead, LiquidityRatiot−1 has a negative sign, significant at the 5% level, as companies with higher slack of financial resources are likely less in need of external financing.

Regarding our Hp1 and focusing on the first two Columns of the table, we do not find a significant coefficient for MB_step in Columns I-II. Instead, we find a negative and significant coefficient for MiniB_rate in column II, suggesting that the release of information linked with Minibond issuance can harm, rather than benefit issuers in their ability to raise bank debt when the effective rate of the Minibonds is higher, suggestive of a lower credit worthiness. Minibonds amounts or maturities do not exert an effect on the amount of bank debt raised.

In column III, we test our Hp2 on a more beneficial effect of Minibond issuance for younger companies. We find support to this hypothesis, as the interaction between MiniB_step and the Young dummy is positive and significant at the 5% level. In other terms, the issuance of Minibond benefits only the youngest companies, for which information asymmetry are higher. Specifically, younger companies are able to raise 34.6% (e0.297-1) more bank debt after the issuance of the Minibond.

In column IV, we investigate the role of the prevailing lending technology in the geographical area where the companies are located. We do not find any significance for MultipleLending variable or its interaction with MiniB_step, nor any support to our Hp3.

In Column V we include the amount of tangible assets available to the company, lnTangiblest−1, as well as its interaction with MiniB_step. As expected, because of the higher value of the collateral, companies with more tangible assets tend to have higher amounts of bank debt (significant at the 1% level) and to benefit less from the issuance of Minibonds (significant at the 10% level), coherently with Hp4.

6.2 Effect of minibonds on the cost of bank debt

In Table 6, we report the results of the fractional logit models with random effects using BankDebtCost as the dependent variable. Column I shows the baseline model, while Column II includes the total amount of Minibonds issued (MB_amount), the Minibond effective rate (MB_rate) and the Minibond maturity (MB_maturity).

Not surprisingly, our control variables suggest a negative relationship between companies’ cost of bank debt and companies’ age (significant at the 10% level), cash flow ratio and liquidity ratio (significant at least at the 10% level), as banks expect higher returns when lending to younger companies and companies which are less liquid and less able to generate cash flows. We also find a negative coefficient for leverage (significant at the 1% level), in line with the rationale that companies that are offered loans at attractive interest rates borrow larger amounts (e.g., Vander Bauwhede et al. 2015).

The coefficient of MB_step is positive and significant in Column I, suggesting an increase in the cost of bank debt for Minibond issuers. However, once we control for the Minibond characteristics, the coefficient switches to the expected negative sign, although it is not significant.

Regarding the Minibond characteristics, we find a positive coefficient for MiniB_rate, significant at the 1% level. As expected, there is a positive correlation between the interest rate of Minibonds and the interest rate that companies pay for their bank credit in the years following the issuance. In other terms, companies with lower creditworthiness pay higher cost of bank debt and market debt, unsurprisingly. MiniB_maturity has the expected negative sign (significant at the 1% level), in line with the fact that issuing Minibonds with longer maturities entails a release of positive information on the issuer creditworthiness which lowers the cost of bank debt. Instead, the coefficient of MiniB_amount is positive and significant, against our expectations: rather than conveying positive information on the issuer creditworthiness, larger Minibond issuance increases the total debt exposure of the company, which arguably results in a higher probability of bankruptcy and therefore a higher cost of bank debt.

To test Hp2 on the higher benefits of issuing Minibonds for younger companies, in Column III we include the interactions between MiniB_step and Young, which is however not significant, revealing that age does not significantly influence the Minibond issuance effect on the cost of debt. Results shown in Column IV, where we introduce the interaction between MiniB_step and MultipleLending, support Hp3 on the higher benefits of issuing Minibonds for companies located in geographical areas where transaction lending prevails. The interaction has the expected negative sign (significant at the 10%) level, suggesting that the more the local banking technology is oriented towards multiple borrowing (typical of transaction lending), the lower is the cost of bank debt that Minibond issuers tend to pay. In Column IV, the interaction between MiniB_step and lnTangiblest−1 is not significant, not supporting Hp4 relatedly to the role of collateral in moderating the effect of issuing Minibonds on the cost of credit.

6.3 Effect of minibonds on the maturity of bank debt

In Table 7, we report the results of the fractional logit models with random effects, in which BankDebtMaturity is the dependent variable. In Column I, we test our Hp1 on a positive effect of Minibonds issuance on the bank debt maturity, to which we do not find support as the coefficient of MiniB_step is not significant. Results do not change when we include variables capturing the total amount of Minibonds issued (MB_amount), the Minibond effective rate (MB_rate) and the Minibond maturity (MB_maturity), as we do in Column II. However, we find that the lower Minibond interest rates and longer Minibond maturities are informative of the issuer’s creditworthiness, and lead to higher bank debt maturity (effects significant at the 5% level). In other terms, only Minibonds issued with low cost of capital or high maturity convey information to banks, which leads to higher bank debt maturity.

Regarding our control variables, as expected, the results suggest a positive relationship between companies’ bank debt maturity and leverage, cash flow ratio (both significant at the 1% level) and liquidity ratio (at least 10% significance level). This evidence is in line with the assumption that the maturity of companies’ bank debt is shorter for firms that are less liquid.

In Column III we test whether younger Minibond issuers are more likely to secure bank debt with longer maturities (Hp2), finding that it is the case: the interaction of MiniB_step and Young is positive and significant (at the 5% level). Similarly, in Column IV we find support to the idea that companies located in geographical areas where the transaction lending technology prevails are more likely to benefit from Minibond issuance: the interaction between MiniB_step and MultipleLending is positive and significant (at the 5% level) in line with Hp3. Lastly, the interaction between MiniB_step and lnTangiblest−1 is also significant in Column V, supporting Hp4 on a lower benefit of issuing Minibonds for companies with higher value of collateral.

Summarizing, we find weak support to Hp1: not all Minibond are perceived by banks as informative of the issuer creditworthiness, but only those with certain characteristics. Issuing bonds with low interest rates leads to an easier access to bank credit in terms of larger amounts, lower cost, and longer maturity. Longer Minibonds maturities are also informative to banks, and lead to lower cost of bank debt and longer bank debt maturity. Instead, issuing larger Minibonds leads to an increase in the cost of bank debt, possibly because of the higher total leverage of the company. We also find support to the idea that the level of information asymmetries, the local banking system and the presence of collateral play a role in moderating the effectiveness of Minibonds in improving the access to bank debt. Smaller companies issuing Minibonds, companies located in provinces where the multiple transaction lending prevails and companies with lower values of collateral are more likely to benefit from the Minibonds issuance in terms of better credit conditions.

6.4 Robustness checks

Our results show that, at least under some circumstances, Minibond issuers are able to collect more debt and benefit from better credit conditions than a control group of companies.

While we interpret our results as the effectiveness of the Minibond issuance (at least under certain circumstances) in conveying information to the lenders, it is important that we consider the alternative explanation that our results are driven by a selection effect, rather than the Minibond issuance per se. In fact, our result might be due to some unobserved characteristics that make Minibond issuers “different” from our control group and that we do not properly take into account, nor in our matching algorithm nor in our econometric specification with fixed effects (which takes into account time invariant unobservable factors). To exemplify, Minibond issuers’ managers might have taken a finance course which improved their financial knowledge and which made them more likely than other managers to both (1) issue Minibonds and (2) obtain better credit conditions when negotiating with banks. Such effect would not be due to the reduction of information asymmetry engendered by the Minibond issuance, but to an exogenous unobservable factor.

This omitted variable issue creates a sample selection: issuers are sampled differently from control group companies. This in turn might lead to endogeneity affecting our results and creating biases in our coefficients. To tackle this issue, we rely on a Heckman two-step procedure (Heckman, 1979). We generate a dummy equal to 1 for companies that issued Minibonds in the year of the issuance and 0 otherwise (MB). In the first step, we use this dummy as a dependent variable in a probit model with random effects, in which we include as control variables, industry, year and region dummies, and, as exclusionary restrictions, the logarithm of the number of Minibonds issued in the focal region, sector and year (lnNumberMBr, s,t), and the average amount of the Minibonds issued in the focal region, sector and year (AverageMBamountr, s,t). The exclusionary restrictions are meant to capture variations in the probability of issuing a Minibond but are not correlated to our main dependent variables (lnBankDebt, BankDebtCost, BankDebtMaturity). We use the linear prediction of the probit specification to compute an inverse Mills ratio (IMR). In a second step, we ran our main models, adding the IMR and bootstrapping the standard errors in 100 repetitions. The results are shown in Table 8.

Column I of Table 8 shows the result of the first step Probit models, in which both our exclusion restrictions have positive and significant coefficients as expected: it is more likely to issue a Minibond in regions, industries and years where there was more total issuance and where the average amount raised was higher. Moreover, we find that younger companies, with higher sales, leverage and cash flows, lower liquidity and more intangibility were more likely to issue Minibonds. In the second step of our analysis, we adopt our main independent variables and find that our results remain unchanged when we include the IMR. Issuing Minibonds with lower interest rate allows companies to raise more bank debt, with lower interest rates and longer maturities. Issuing Minibonds with longer maturities improves the conditions at which companies access debt, while issuing larger Minibonds increases the bank debt interest rates. When we look at the moderators, we still find that after Minibond issuance, younger companies can raise more bank debt and enjoy longer debt maturities. Minibond issuers located in regions where multiple borrowing prevails benefit from better conditions when accessing bank loans. Lastly, Minibond issuers with more collateral benefit less in terms of amounts of credit raised and credit maturity. In short, this analysis allows us to conclude that our main results are robust to endogeneity concerns.

As a second robustness check, we consider the effect on the access to credit of issuers of an additional characteristic of Minibonds: the presence of external and internal guarantees. In fact, Minibonds are typically issued with guarantees attached.Footnote 13 The different types of guarantees may have a different impact on the amount and conditions extended by the inside and outside banks. Guarantees may be external and provided by a public guarantor, i.e., the European Investment Fund, the regional or National governments. In these cases, the Minibonds do not rely on the companies’ assets as collateral, which instead can be used by prospective banks to secure their credit. In other terms, the external guarantees should not increase the risk perceived by banks on the issuers as potential borrowers and, if any, they may even have a positive effect on future credit. In other cases, the guarantees are offered internally by the company, in the form of guarantees on the company’s assets pledged as collateral. In these cases, there might be competition for the company’s collateral between the Minibond and the prospective bank debt. Therefore, companies using their assets as collateral for Minibonds might have a more difficult access to additional bank debt. We test this conjecture including, in our main models, two step variables turning from 0 to 1 for issuers, in the year in which Minibonds were issued with external guarantees (MiniB_ExtGuaranteet) and with internal guarantees (i.e., used the collateral as guarantee) (MiniB_IntGuaranteet). Results of this analysis are shown in Table 9. We find that external guarantees improve the access to credit by increasing the amount of bank debt that a company manage to collect after the Minibond issuance (MiniB_ExtGuaranteet has a positive and significant coefficient at the 1% level in Column I) but they have no effect on the cost of debt or debt maturity (Columsn III and V). On the other hand, internal guarantees do not limit the amount of bank debt raised after the Minibond issue (i.e., the coefficient of MiniB IntGuaranteet in Column II of Table 9 is non-significant at standard confidence levels). However, they increase the cost of new bank debt, coherently with the fact that banks are more cautious to lend to companies whose collateral has already been pledged for the Minibonds (MiniB_IntGuaranteet has a positive and significant coefficient in Column IV). Also, for internal guarantees we do not find any effect on bank debt maturity.

7 Discussion and conclusions

This paper aimed to understand whether the issuance of Minibonds, which constitutes an innovative channel of market debt financing for SMEs, has an impact on access to credit for issuers, and how this effect may depend on the level of information asymmetries, local prevailing lending technology and value of collateral of issuing firms compared to a control sample of non-issuers. Relying on the information asymmetries framework and relationship lending theory, we argue that Minibonds’ issuance consists of a new “information release” event, which improves the creditworthiness of the issuers and helps to improve their access to credit in terms of bank debt amount and bank debt conditions (interest rates and maturity). We found that Minibond issuance does not automatically improve the access to credit, but the effect depends on Minibond characteristics and on issuers’ age, location and value of collateral. Issuing Minibonds with lower interest rates and longer maturities is more beneficial to credit access, while issuing larger Minibonds increases the cost of bank debt, likely because of the overall higher leverage. We also notice that Minibonds that rely on the companies’ assets as collateral lead to an increase in the cost of new credit. Moreover, we revealed that when companies are affected by stronger information asymmetries, the benefits of the Minibond issuance are stronger. In particular, Minibonds allow younger companies to improve their credit conditions in terms of higher bank debt amounts and longer maturities. Companies located in regions with a prevailing transaction lending technology benefit more from more favourable conditions when raising bank debt. We interpret this result as a combined effect of the information released by the company after Minibond issuance and the increased likelihood that these companies switch from relationship banks to transaction banks. Lastly, companies with higher values of intangibles assets benefit less from Minibonds when raising bank debt, because they can already count on higher value of collateral which is used by banks to counteract information asymmetries. Overall, our results provide compelling evidence that Minibonds improve the access conditions to debt financing for SMEs in the years following the issuance, but the effect depends on both Minibonds and issuers’ characteristics.

With these results, we contribute to several research streams. First, in analysing the impact of Minibond issuance on SMEs’ access to capital, we harmonize previously contradictory findings (Angelini et al. 2019; Ongena et al. 2021). We explain why and under which conditions Minibonds issuance may boost credit availability and improve credit conditions for SMEs. Second, we add new evidence to the lending technology theory: we show that the issuing of Minibonds enables SMEs to renegotiate their financing terms with their own (relationship) bank, while also gaining access to other banks, depending on the level of ex-ante information asymmetries and the availability of transaction banks in the local market. Third, the study adds to the literature on the alternative choice between bank credit and market-based finance, which focuses mostly on large firms and is sparse on SMEs (e.g., Pagano et al. 1998; Schenone 2010). We significantly contribute to this field by demonstrating that bank credit and market-based debt are complementary forms of financing for SMEs, rather than substitutes.

In terms of managerial implications, our findings encourage SMEs that are considering issuing Minibonds, pointing to advantages in terms of simultaneous improvement in access to credit. Such findings are particularly relevant in the post-COVID-19 era, as the severe economic impact of COVID-19 reduced the access for many companies to bank lending (Ҫolak and Öztekin 2021) and threatened business continuity in many cases.

Moreover, the results of our study highlight important implications for the design of policy initiatives supporting financing solutions. During the COVID-19 crisis, governments all around the world promptly stepped in to provide liquidity and guarantees to businesses more severely threatened by the pandemic. However, bureaucracy delays and a lack of efficient transmission mechanisms weighted on companies’ business and balance sheets. Hence, alternative sources of financing became fundamental for many SMEs to fill liquidity needs and realize important investments to be able to regain momentum after the pandemic downturn.

In this context, private debt is emerging as an important complementary funding component: our study suggests that deregulation reforms aiming to remove previous restrictions on the use of market-based finance, such as the introduction of Minibond, may significantly favour funding diversification. Furthermore, provided that SMEs may still satisfy a significant part of their funding needs through bank credit, this study finds that this diversification can be beneficial in many ways: better financing conditions on bank loans, larger fund availability, and a more balanced maturity profile.

The findings provided in this paper open several avenues for future research. First, we analysed the effect of Minibonds on subsequent access to debt financing, but the information release due to Minibond issuance could also be informative for prospective equity providers, including private equity or secondary markets. Second, while we focus mainly on Minibonds amount, rates and maturities, future studies could investigate the role of additional Minibond features that might affect the strength of the “information release”, such as the presence of rating. Third, we show that the improvement in credit access conditions is related to the level of information asymmetries faced by companies issuing Minibonds and the local prevailing lending technology. Further research could identify additional relevant characteristics of issuers and of the local ecosystem in which companies operate (e.g., industry, location, prior sources of funding, access to public funds, etc.). We also offer suggestive evidence that the local prevalence of transaction lending influences the probability that a company can renegotiate its credit conditions after an information release, arguably because of a bank switch or bank diversification. Nevertheless, we did not have access to information on the use of relationship or transaction lending at the company level. Thus, future studies can investigate whether and how the effect of Minibonds on access to bank debt would be different specifically for companies relying on transaction or relationship lending and further substantiate our preliminary results.

Clearly, all these avenues for future research should be ideally tested on a much broader sample, both in terms of geographic scope and in terms of time frame. Specifically, we anticipate that cross-country differences in the development of financial markets and financial institutions are likely to play a role in the effectiveness of Minibonds in improving access to credits for SMEs. Moreover, a longer time horizon is needed to study the long-term effects of Minibond issuance as well as the role of changes in financial ecosystems. Notably, after the time frame of our study, COVID-19 started spreading globally. It is well known that banking systems and banking relationships operate differently in times of crisis (Casey and O’Toole 2014; Ivashina and Scharfstein 2010; Quintiliani 2017). Future research might use the COVID-19 crisis as an opportunity to analyse whether Minibonds improve SMEs’ access to credit amid economic turmoil.

Data availability

My manuscript has no associate data.

Notes

For instance, see: https://www.unicreditgroup.eu/en/press-media/press-releases/2021/unicredit-si-conferma-leader-di-mercato-nei-minibond--raggiunta-.html; 9° Italian Report on Minibonds (2023), Politecnico di Milano.

The typical Minibonds investors according to the “9° Italian Report on Minibonds” (2023), Politecnico di Milano include: Italian banks (33%), private debt funds (around 24%), foreign banks and funds (17%), governmental (national and regional) funds (17%), asset and wealth management funds (7%).

D.L. 83 of the 22nd June 2012 (“Decreto Sviluppo”), D.L. 179 of the 18th October 2012 (“Decreto Sviluppo Bis”), D.L. 145 of the 23rd December 2013 (“Decreto Destinazione Italia”) and D.L. 91 of the 24th June 2014 (“Decreto Competitività”).

For coupon minibonds, which are issued at par, the effective rate is the coupon rate at the time of the issuance (most of the Minibonds have floating rates). For zero coupon bonds, the rate is computed based on the selling price and the face value of the bonds.

To avoid outliers and possibly wrong values, we discard cases in which CostDebt is lower than 0 or higher than the 95th percentile of the distribution (corresponding to a 53.08% interest rate).

To be more precise, some 824 control group companies are selected by our matching algorithm. However, only 820 of them enter in our estimates because of missing data on some of the covariates. For simplicity, in the remainder of the section we discuss solely the final sample of 546 treated and 820 control group companies (1366 in total) who enter in our estimates.

The distribution of lnBankDebt is similar to a normal distribution with mean in 8.65, but it cannot take values lower than 0 by construction. For this reason, we repeated the analysis using a panel Tobit regression with explicit left-limit of the dependent variable set to 0. As Tobit regression does not allow for the inclusion of fixed effects, we follow Papke and Wooldridge (2008) and we simulate fixed effects by including the time averages of the covariates in the regression. Results, available from the authors upon request, are virtually identical to those reported here.

To avoid outliers and possibly wrong values, we exclude from the analysis cases in which BankDebtCost is lower than 0 or higher than 1.

We are not arguing that 13 years old companies are not start-ups nor can be considered young companies in absolute terms. However, in our sample of SMEs issuing Minibonds, the average age at the issuance is 27 years (the median is 24), with some companies issuing Minibonds when they were older than 100 years. Companies with less than 13 years (the average is 8 among them), are relatively young, and therefore the argument of information asymmetries or lack of information altogether holds more than for more established companies.

The data (item TRI30431) was retrieved in September 2022 from the following website: https://www.bancaditalia.it/pubblicazioni/condizioni-rischiosita/2022-condizioni-rischiosita/statistiche_STACORIS_20220630.pdf.

To rule out multicollinearity issues, we monitor the mean Variance Inflation Factor of the model, which is 4.01 in Column I and 5.12 in Column II. These values should not be considered as problematic according to James et al. (2017). However, in Column III, the VIF for the lnAge variable is above the recommended threshold of 10, which is not surprising considering that such model also includes the Young dummy variable. Therefore, we replicated our analyses excluding the variable lnAge, finding virtual identical results. As such, we are confident that multicollinearity issues do not threaten the validity of our results. Results of this check on multicollinearity issue is not reported in the text for the sake of brevity but is available from the authors upon request.

In an unreported set of analyses, we also considered another characteristic of Minibonds: the presence of a rating. Arguably, the presence of a rating for the minibonds conveys more information to the prospective lenders, which should influence issuers access to bank debt. In our sample, 29% of Minibonds had a rating upon issuance. In the database, rating is expressed as A (investment grade), B or C (speculative). We controlled for such rating in the analysis through step variables, turning from 0 to 1 for the companies issuing minibonds with each rating in a given year (and staying 0 for companies never issuing minibonds). Results, available upon request, show that issuing minibonds with A and B ratings did not lead to marginally better access to credit as none of the variables related to A and B ratings are significant. Instead, issuing Minibonds with speculative grades (C) seem to convey negative information to prospective lenders, and lead to an increase in the cost of bank debt (p-value < 1%). However, C ratings do not seem to influence the amount of maturity of the credit accessed after the minibond issuance.

References

Ackert LF, Huang R, Ramírez GG (2007) Information opacity, credit risk, and the design of loan contracts for private firms. Financ Mark Institutions Instruments 16:221–242

Agarwal S, Hauswald R (2010) Distance and private information in lending. Rev Financ Stud 23:2758–2788. https://doi.org/10.1093/rfs/hhq001

Agarwal S, Hauswald RBH (2011) The choice between Arm’s-Length and relationship debt: evidence from eLoans. SSRN Electron J. https://doi.org/10.2139/ssrn.1306455

Almeida H, Campello M, Laranjeira BA, Weisbenner SJ (2012) Corporate debt maturity and the Real effects of the 2007 credit Crisis. Crit Financ Rev 1:3–58. https://doi.org/10.2139/ssrn.1405505

Altman EI, Esentato M, Sabato G (2020) Assessing the credit worthiness of Italian SMEs and mini-bond issuers. Glob Financ J 43:100450. https://doi.org/10.1016/j.gfj.2018.09.003

Anderloni L, Braga MD (2019) Mini-Bonds: An Emerging Link in the Intermediation Chain in Europe, in: Quas, A., Alperovych, Y., Bellavitis, C., Paeleman, I., Dzidziso Samuel, K. (Eds.), New Frontiers in Entrepreneurial Finance Research. Word Scientific, pp. 207–240

Angelini MS, Gennaro A, Giovannini R (2019) Financial policy of Italian SMEs: the impact of mini-bond. Corp Ownersh Control 16:113–128. https://doi.org/10.22495/COCV16I3ART10

Antoniou A, Guney Y, Paudyal K (2006) The determinants of debt maturity structure: evidence from France, Germany and the UK. Eur Financ Manag 12:161–194. https://doi.org/10.1111/j.1354-7798.2006.00315.x

Ayyagari M, Beck T, Demirguc-Kunt A (2007) Small and Medium Enterprises across the Globe. Small Bus Econ 29:415–434. https://doi.org/10.1007/s11187-006-9002-5

Bartoli F, Ferri G, Murro P, Rotondi Z (2013) SME financing and the choice of lending technology in Italy: complementarity or substitutability? J Bank Financ 37:5476–5485. https://doi.org/10.1016/J.JBANKFIN.2013.08.007

Beck T, Demirgüç-kunt A, Martinez MS (2008) Bank Financing for SMEs around the World. World Bank Policy Res Work Pap n 4785:1–43

Benmelech E, Dvir E (2013) Does short-term debt increase vulnerability to Crisis? Evidence from the east Asian Financial Crisis. J Int Econ 89:485–494. https://doi.org/10.1016/j.jinteco.2011.12.004

Berger AN, Udell GF (1990) Collateral, loan quality and bank risk. J Monet Econ 25:21–42. https://doi.org/10.1016/0304-3932(90)90042-3

Berger AN, Udell GF (2002) Small Business Credit Availability and relationship Lending: the importance of Bank Organisational structure. Econ J 112:F32–F53. https://doi.org/10.1111/1468-0297.00682

Berger AN, Udell GF (2006) A more complete conceptual framework for SME finance. J Bank Financ 30:2945–2966. https://doi.org/10.1016/j.jbankfin.2006.05.008

Bester H (1985) Screening vs rationing in Credit Markets with Imperfect Information. Am Econ Rev 75:850–855