Abstract

This paper explores the relationship between family ownership and a firm’s leverage from the socioemotional wealth (SEW) theory. We propose that SEW objectives (i.e., family control, long-term horizon, and family firm reputation) might have a mediating effect on the family ownership-leverage link. In addition, we argue that an internal contingency—such as below aspiration performance—may moderate SEW’s influence on the family ownership-leverage relationship as a result of a shift in focus from non-economic to economic goals. Using a sample of European listed firms from 2011 to 2018, we find that the negative impact of family ownership on a firm’s leverage is mediated through SEW objectives. Moreover, our evidence suggests that a negative performance-aspiration gap weakens the mediating influence of these SEW objectives on leverage. Over all, our study reveals that SEW is a key channel which drives family firms’ reluctance to leverage.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Family firms (FFs) are a type of concentrated ownership company that exhibit some unique behavioural phenomena which do not occur in other concentrated ownership forms such as state-owned companies and foreign multinational corporations. Such unique attributes stem from idiosyncratic familiness, which reinforces the emotional attachment of family owners to their companies as well as from the undiversified and concentrated ownership positions usually held by family members (Singal and Singal 2011). The idiosyncrasy of family ownership and its influence on corporate leverage decisions—those concerned with how much debt to have in a firm’s capital structure—is attracting ever-increasing attention (e.g., Anderson et al. 2003; Camisón et al. 2022; Comino-Jurado et al. 2021; Gallo et al. 2004; Hansen and Block 2020; Molly et al. 2019; Poletti-Hughes and Martínez-García, 2022). However, the literature remains inconclusive about the association between family ownership and leverage (e.g., González et al. 2013; Hansen and Block 2020; Michiels and Molly 2017; Mishra and McConaughy 1999; Molly et al. 2019; Romano et al. 2001). The bulk of the research supports the notion that FFs are less likely to use leverage due to bankruptcy avoidance and family endowment preservation (Baixauli-Soler et al. 2021; Crespí and Martín-Oliver 2015; Mishra and McConaughy 1999). In contrast, another strand of literature suggests that FFs prefer leverage financing in order to avoid control dilution from additional equity issuance (Croci et al. 2011).

Socioemotional wealth (SEW)—which comprises all “non-financial aspects of the firm that meet the family’s affective needs” (Gomez-Mejia et al. 2007, p. 106)—is central to FFs’ decision-making. Even though SEW has been posited as a driver of family firm leverage, research so far has largely overlooked SEW’s multidimensional nature and its diversity across the FF universe (Chua et al. 2015; Gast et al. 2018; Umans et al. 2023). This has provided a narrow assessment of the role played by socioemotional endowment in FFs’ leverage decisions, resulting in insufficient knowledge about how different SEW objectives affect leverage in such businesses (e.g. Camisón et al. 2022; Croci et al. 2011; González et al. 2013; Setia-Atmaja et al. 2009). A better understanding of the underlying mechanisms through which family ownership shapes a firm’s leverage is thus needed (Molly et al. 2019). In this study, we draw on the SEW lenses to address this gap (Cesinger et al. 2016; Filser et al. 2018; Gast et al. 2018; Gomez-Mejia et al. 2007). Specifically, we seek to answer these key research questions: Do SEW objectives serve as an (indirect) channel in the relationship between family ownership and a firm’s leverage? Does a firm’s performance framing (a firm’s relative financial performance) shape the importance of this indirect channel driven by SEW objectives?

We propose that SEW objectives might serve as a channel that may indirectly drive the causal linkage between family ownership and a firm’s leverage. This is proposed on the grounds that family ownership is the antecedent that drives the pursuit of SEW objectives (Combs et al. 2023), which in turn shape a firm’s leverage. As family owners attach primary value to the socioemotional aspects of corporate ownership, we argue that family ownership might act as a driver of SEW (Schulze and Kellermanns 2015). In turn, we propose that this SEW developed by the owning family affects corporate leverage behaviour, thereby building a mediating path of causality. We consider threeFootnote 1 SEW objectives that mediate an (indirect) negative relationship between family ownership and leverage: (1) keeping control over the firm (family control), (2) perpetuating the family dynasty by ensuring the business is handed down to future generations (a long-term horizon), and (3) portraying a favourable image of the family firm (family firm reputation) (Naldi et al. 2013). Each of these three SEW objectives have been chosen as a mediator in the family ownership-leverage link because of the possible dissimilar prioritization of interests between debtholders and controlling shareholders, the long-range consequences of leverage adjustments (e.g. commitment of future cash flows), and the threat that default risk represents for the family’s reputational assets (Jensen and Meckling 1976), respectively. These three SEW objectives are conjectured to shape FFs’ lower propensity to leverage—compared to their non-family counterparts—through an indirect causal path of mediation. Moreover, we explore whether the strength of such a mediating effect of these three SEW objectives varies depending on the firm’s relative performance. A negative performance-aspiration gap is likely to urge FFs to prioritize economic goals over non-economic ones as a struggle for survival (Gomez-Mejia et al. 2018). We therefore suggest that performing below aspirations mitigates FFs’ reluctance towards leverage prompted by SEW objectives.

We obtain supportive evidence for our hypotheses on a sample of European listed firms from 2011 to 2018. Our results confirm that family ownership has a negative effect on leverage. We find that this causal relationship occurs indirectly, mediated by SEW objectives (family control, long-term horizon, and family firm reputation). Additionally, our evidence reveals that a negative performance aspiration gap weakens the reluctance that SEW objectives channel into the family ownership–leverage relationship, mitigating its negative mediating effect.

Our study makes several contributions. First, we expand existing literature into a new domain by bringing fresh insights into how the association between family ownership and leverage does not mainly run directly, but indirectly—channelled by SEW objectives. In so doing, we answer recent calls for further research into the role of non-economic goals embodied by SEW which family owners bring to their businesses (Baixauli-Soler et al. 2021; Cesinger et al. 2016; Davila et al. 2023; Filser et al. 2018; Gomez-Mejia et al. 2007; Molly et al. 2019). Our investigation refines our understanding of the family ownership–leverage relationship by exploring indirect causal pathways. Second, we improve current understanding of how poor firm performance may shape the effect of SEW objectives on a firm’s leverage, as a result of a shift in family owner prioritization of economic goals over non-economic ones. Our study expands current knowledge concerning what impact financial vulnerability (an internal threat) has on corporate leverage decisions. In the presence of unfavourable performance outcomes, family owners are more willing to assume SEW losses for the sake of ensuring firm survival. Consequently, their reluctance to engage in leverage weakens despite the fact that it might impair SEW preservation.

Finally, we illustrate to practitioners the trade-off between financial wealth and SEW considerations in FFs in leverage decisions. Our study presents relevant implications for business practice because it reveals how FFs display not only rational motivations but also emotional ones, which are a non-trivial underlying mechanism that channels FFs’ reluctance to leverage. However, under poor firm performance, FFs—for whom the emotional attachment to the firm is essential—display a shift in behaviour in favour of exhibiting a stronger preference for leverage. This illustrates FFs’ prioritization of economic goals over non-economic ones when financial vulnerability urges them to do so in order to ensure their survival.

2 Theoretical background and hypotheses development

2.1 Leverage decisions and family ownership

Research has devoted substantial efforts to understand how and why family ownership can play a role in leverage decisions (e.g., González et al. 2013; Hansen and Block 2020; Michiels and Molly 2017; Mishra and McConaughy 1999; Molly et al. 2019; Romano et al. 2001). A number of reasons have been put forward to explain why FFs are generally more reluctant towards leverage than their non-family counterparts (e.g. Baixauli-Soler et al. 2021; Crespí and Martín-Oliver 2015; Gallo and Vilaseca 1996; Mishra and McConaughy 1999; Schmid 2013). This notion provides the starting point for our baseline hypothesis. First, a firm’s leverage leads family owners to partly depend on external stakeholders such as creditors, who may undermine their autonomy and ability to influence corporate decisions from their dominant ownership position (Schmid 2013). Second, due to the stronger identification of family shareholders with the firm and their greater involvement in management, FFs find it less necessary to draw on external financing (Koropp et al. 2014) as an incentive to encourage them to behave in the best interest of the firm to which they feel attached.

Additionally, since families are usually major and under-diversified investors (Anderson et al. 2003), they face a higher risk exposure to the firm, which can be exacerbated by higher leverage due to financial distress and bankruptcy concerns (Mishra and McConaughy 1999; Prencipe et al. 2008; Zellweger 2017). In addition, the family business acts as a repository of the family’s total wealth (Becerra et al. 2020). In light of these arguments, our baseline hypothesis establishes the direct relationship between family ownership and leverage as follows:

Baseline Hypothesis

Family ownership has a negative effect on a firm’s leverage.

Family and non-family firms differ substantially in nature. A family firm is a firm dominantly controlled by a family with the vision to potentially maintain family control across generations (Zellweger 2017). SEW is a distinguishing feature for FFs (Gomez-Mejia et al. 2011). From the SEW lenses, family members seek to create not only financial value, but also additional non-financial goals which non-family firms do not pursue (Debicki et al. 2016). Such non-financial benefits from family ownership are referred to as SEW. According to this perspective, any potential decline in SEW is seen as a severe loss by the family owners, who weigh SEW losses more heavily than gains. SEW preservation sparks a strong desire to keep ownership and control of the company in the hands of family shareholders and to influence corporate decision-making (Berrone et al. 2012), such as leverage decisions, accordingly. We therefore focus on SEW goals as primary reference points for FFs. In the following sub-sections, we develop hypotheses concerning how SEW might serve as a mediating channel of causality to draw the relationship between family ownership and a firm’s leverage, which is our core research question.

Specifically, we consider that SEW entails three main objectives (Berrone et al. 2010, 2012; Gomez-Mejia et al. 2011; Naldi et al. 2013): maintaining family control, adopting a long-term horizon, and achieving family firm reputation. Each mediation hypothesis corresponds to each of these three SEW objectives. To elaborate our hypotheses, our rationale is as follows. First, the literature suggests that family ownership is an antecedent of SEW, because ownership by various family members strengthens SEW (Chen et al. 2022). Therefore, the greater the family ownership, the stronger the SEW endowment (Berrone et al. 2012; Gomez-Mejia et al. 2007). Creating and preserving family SEW is considered to be more important for firms with a higher level of family ownership than for firms with a family weaker presence in the ownership structure. In a first step, therefore, we assume that SEW is a positive function of family ownership (Miller and Breton-Miller 2014). Greater family ownership builds stronger SEW endowment, which will be signalled by those SEW objectives (Berrone et al. 2012; Gomez-Mejia et al. 2007). Second, to elaborate each hypothesis, we contend that the three SEW objectives are associated with a lower family firm propensity to use leverage.

2.2 Leverage decisions in FFs: the mediating role of family control

As the family ownership stake increases, firms may not only have a greater ability to exert family control but may also be more concerned about maintaining it, due to their greater affective endowment and the prioritization of SEW preservation (Berrone et al. 2012; Gomez-Mejia et al. 2007, 2011). This positive association between family ownership and family control is the initial causal mechanism in the mediating pathway through SEW, as given by the family control objective.

In turn, stronger family control might deter the use of leverage by firms. Consistent with the SEW approach, stronger family control increases the family’s desire to influence decision-making guided by non-economic goals to a greater extent, even at the expense of financial utility (Berrone et al. 2012; Davila et al. 2023; Gomez-Mejia et al. 2007). Since leverage brings about greater external monitoring over firms, this might jeopardize the owning family’s dominant position and deteriorate their SEW endowment (Gallo et al. 2004; Koropp et al. 2014; Schmid 2013). Similarly, debt covenants and disclosure requirements are likely to restrict FFs’ ability to curb SEW losses (Jain and Shao 2015).

Additionally, the strict payment policy associated to leverage brings about greater risk in terms of financial distress costs and the likelihood of bankruptcy (Mishra and McConaughy 1999; Prencipe et al. 2008; Zellweger 2017). This also further exacerbates families’ reluctance to leverage as a result of their more salient risk awareness. Family owners are usually undiversified investors who might therefore be less tolerant to engage in risk-taking such as the greater bankruptcy concerns which emerge from the increased use of leverage. These adverse effects of leverage are likely to be perceived as more detrimental in firms with higher family ownership as a result of their greater prioritization of emotional goals. Taking all these arguments together, family owners may consider leverage as a major threat to their SEW objective of family control.

Based on this discussion—and given that participation in ownership provides the family with greater family control which in turn triggers greater reluctance to leverage—we posit that family control channels an indirect effect between family ownership and leverage:

Hypothesis 1

Family control mediates the negative relationship between family ownership and a firm’s leverage.

2.3 Leverage decisions in FFs: the mediating role of the long-term horizon

We expect family ownership to positively impact the time horizon of decisions. Family owners invest their personal wealth in the business, building an emotional connection that encourages family members to have a longer-term horizon in corporate decision-making (Miller et al. 2008). Family capital providers usually exhibit a longer horizon (i.e., family investors are willing to wait longer to be paid back their initial outlay than their non-family counterparts). Complementarily, greater family ownership sparks a keener interest in ensuring the firm’s survival and continuation over future generations (Berrone et al. 2012; Gomez-Mejia et al. 2007). As a result, family ownership is generally considered to favour a longer-range time perspective (Brigham et al. 2014; Lumpkin and Brigham 2011; Zellweger 2007), which is another SEW objective (Berrone et al. 2012; Naldi et al. 2013). Such a positive association between family ownership and a long-term horizon is the initial causal mechanism in the mediating channel through SEW as given by this second SEW objective.

In turn, we argue that this longer-term FF horizon might encourage such firms to use leverage to a lesser extent. Higher leverage may be too risky a financial strategy for FFs since a firm’s goals unfold over an extended period (Brigham et al. 2014; Le Breton-Miller and Miller 2006; Lumpkin et al. 2010; Lumpkin and Brigham 2011; Zellweger et al. 2012). Bankruptcy resulting from the inability to service debt payments becomes an even worse scenario for FFs, as their owners stand to lose not only their financial wealth but also their SEW. Since leverage sparks a greater default risk and commits future cash flows, FFs with longer-term horizons may avoid leverage in order to minimize their risk exposure (Wennberg et al. 2011) and concerns about the volume of debt being passed on to future generations (Crespí and Martín-Oliver 2015).

To sum up, since family ownership endows the firm with a long range vision—which might in turn discourage leverage—we propose an indirect negative effect between family ownership and a firm’s leverage channelled through the SEW objective of a long-term horizon:

Hypothesis 2

A long-term horizon mediates the negative relationship between family ownership and a firm’s leverage.

2.4 Leverage decisions in FFs: the mediating role of family firm reputation

Family ownership is likely to promote family firm reputation as a result of stronger ties of family owner identity to the firm (Berrone et al. 2010). Such a strong identification of family members with their firms makes family firm image and reputation a top priority since family owners find it difficult to distance themselves from the negative consequences of any damage caused to the reputation of their firm (Berrone et al. 2012; Deephouse and Jaskiewicz 2013; Jiang et al. 2020; Naldi et al. 2013). Although every firm is keen to ensure a good reputation for itself—a critical intangible asset—SEW preservation creates major pressure in FFs to additionally safeguard the family’s good name (Berrone et al. 2010; Jiang et al. 2020). FFs place greater emphasis (than their non-family firm counterparts) on sustaining family and business reputation in the community (Villalonga 2018) because of the eagerness of family owners to protect their unique family assets, their intergenerational aspirations and their inclination to forge stable relationships with their stakeholders. Supporting this idea, evidence documents that FFs are more willing to engage in socially responsible strategies (Berrone et al. 2010; Combs et al. 2023; Dyer and Whetten 2006; García-Sánchez et al. 2021; Nikolakis et al. 2022; Stock et al. 2023; Sun et al. 2023), due mainly to the incentive to preserve the owning family’s SEW.

In turn, having a stronger family firm reputation within the community in which companies are embedded might affect a firm’s leverage. Reputational assets have a signalling usefulness for lenders about a firm’s future commitment and, as a result, these intangible assets may increase a firm’s leverage capacity (Balakrishnan and Fox 1993). Creditors may be willing to provide financial resources more cheaply to FFs that have a better reputation, which indirectly reflects family values (such as trust) and the company’s commitment to its stakeholders (e.g., Comino-Jurado et al. 2021; Arzubiaga et al. 2023). However, in spite of such advantages in terms of access to external financing, SEW preservation might still discourage FFs from drawing on leverage (Baixauli-Soler et al. 2021; Hansen and Block 2020). Since family owners are more concerned about how the family presents itself to the community (Niehm et al. 2010), FFs may pursue a different financing strategy from that undertaken by other types of investors. FFs are likely to display more conservative behaviour when engaging in leverage in order to limit their exposure to bankruptcy risk (Hansen and Block 2020; Jara et al. 2018; Mishra and McConaughy 1999). Default risk poses a major threat to the reputation of both the firm and the family, which can damage FFs’ reputational advantages in the community where their businesses operate. The threat of potential bankruptcy from excessive leverage is likely to exacerbate stronger risk aversion in FFs than in their non-family counterparts since the former not only take into account reputation erosion in terms of economic losses but also in terms of SEW losses.

Based on these arguments, we posit that a family firm’s reputation will mediate the relationship between family ownership and leverage: family ownership fosters a family firm’s reputation which, in turn, discourages firms from using leverage.

Hypothesis 3

Family firm reputation mediates the negative relationship between family ownership and a firm’s leverage.

2.5 Leverage decisions in FFs: negative performance aspirations gap

Corporate outcomes in terms of SEW become a primary reference point for FFs’ decision-making (Berrone et al. 2012; Gomez-Mejia et al. 2010). Scholars have recently shifted attention towards exploring which contingency factors might shape the influence of SEW vis-à-vis economic goals when driving FFs’ decision-making in an effort to understand its diversity across contexts (Kotlar et al. 2018; Molly et al. 2019). One such contingency is a firm’s performance hazard (Baixauli-Soler et al. 2021; Gomez-Mejia et al. 2018).

Drawing on the behavioural perspective—on which the SEW approach is anchored (Chua et al. 2015)—individuals’ behaviour depends on how they perceive their outcomes relative to a neutral reference point (Fiegenbaum et al. 1996; Kahneman and Tversky 1979). In the domain of losses (i.e., outcomes below the reference point), individuals behave in a more risk-seeking manner, whereas in the domain of gains (i.e., outcomes above the reference point), risk-averse behaviour dominates. Family owners wish to avoid the worst scenario of organizational failure which would lead to losing not only SEW but also financial (and often undiversified) wealth (Baixauli-Soler et al. 2021). Accordingly, the literature suggests that FFs display stronger emotional attachment to themselves than non-family firms do (Berrone et al. 2012; Gomez-Mejia et al. 2007, 2011) and are therefore prone to base their strategic choices not only on the potential financial outcomes but also on the expected SEW gains and losses (e.g., Cuevas-Rodríguez et al. 2023; Gomez-Mejia et al. 2023). Indeed, SEW preservation can even lead to suboptimal decisions from an economic perspective (Chirico et al. 2020) because “when family firms choose between an action that would confer gains (but a subsequent reduction of SEW) and an alternative action that would protect SEW (but with uncertain economic benefits), they would tend to favor the latter” (Cuevas-Rodríguez et al. 2023, p. 226). Moreover, under financial vulnerability, FFs are likely to prioritize economic goals over SEW preservation in firms’ decision-making (Fang et al. 2021; Gomez-Mejia et al. 2018).

Given the negative framing associated to the negative performance aspiration gap—when a firm’s performance falls below the aspiration level—this contingency is expected to prompt risk-seeking behaviour (Fiegenbaum et al. 1996; Kahneman and Tversky 1979). Such underperformance levels might be interpreted by family owners as a threat to the continuity of their business (Chrisman and Patel 2012; Fang et al. 2021; Gomez-Mejia et al. 2018; Minichilli et al. 2016). Since FFs will be willing to take more risks to protect their SEW than non-FFs, we posit that a negative performance aspiration gap is likely to curb risk aversion to leverage, prompted by SEW objectives. This shift in behaviour might be explained by FFs’ willingness to engage in greater risk-taking (e.g. such as higher distress risk from a greater use of leverage) with the ultimate aim of overcoming business difficulties and safeguarding the firm’s survival (Baixauli-Soler et al. 2021; Hussinger and Issah 2019). As a consequence, we expect a negative performance aspiration gap to curb risk aversion to leverage, prompted by SEW objectives.

Taking all these arguments together, we expect SEW objectives to lead to lower leverage reluctance in firms that suffer from a negative performance aspiration gap and, therefore, to exert a weaker mediating (negative) effect between family ownership and a firm’s leverage.

Hypothesis 4

The mediating effect of SEW objectives on the family ownership–leverage relationship is weaker under a negative performance aspiration gap.

Table 1 summarizes the hypotheses of our study.

3 Data and empirical design

3.1 Data and sample

Our study is based on a sample of European publicly traded firms from 2011 to 2018. The European setting proves interesting for our research purposes because its widespread use to investigate financial decisions in the family business domain helps in terms of the comparability of our results to earlier literature (e.g., Camisón et al. 2022; Comino-Jurado et al. 2021; Molly et al. 2019; Vieira 2017), and also because FFs account for over 60% of all companies in this setting and thereby play a key role in the European economy.Footnote 2 We use the ORBIS database by Bureau van Dijk to collect annual accounting data at firm-level. ORBIS also provides comprehensive information about the type of shareholders, their identity and their equity stake, as well as some corporate governance characteristics. Our sample comprises both FFs and NFFs. In order to identify family ownership, we gather data on those ultimate shareholders who are individuals or families. We use the Eikon platform by Refinitiv (formerly, Thomson Reuters ASSET4) to obtain the ESG scores (environmental, social, and governance) of a firm’s sustainability performance. This widely used database provides objective, systematic and auditable data on ESG.Footnote 3

Our sample selection starts by identifying all listed firms in ORBIS from fifteen European countries (Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Spain, Sweden, Switzerland, and the UK). Most of these have been considered in studies on capital structure and/or family ownership, such as Azofra et al. (2020), Croci et al. (2011), Cuadrado-Ballesteros et al. (2017), Keasey et al. (2015), and Requejo et al. (2018).

We exclude financial firms (SIC 6000-6999) because of the idiosyncrasy of this industry and its regulatory and supervisory framework. We also remove firm-year observations with missing values either in our variables or in any ownership/governance variables which are key to identifying shareholders’ surnames. In order to mitigate the influence of outliers and/or minimize potential recording errors in databases, firm-year observations with negative values of common equity, sales, and debt are also removed (Fuente and Velasco 2020; Saona and San Martín, 2018). Additionally, our estimation methodology—the two-step generalized method of moments (GMM) estimator—is based on the assumption of the absence of second-order residual serial correlation. To test such a requirement, we can only keep those firms with a minimum of four consecutive firm-year observations. These sample selection filters restrict our final sample to 3713 firm-year observations (758 firms). Table 2 summarizes the distribution of observations by country and year. The countries with the greatest representation in the sample are the UK (26.56%), France (19.39%), and Germany (14.71%). As panel B shows, the distribution of observations is quite similar across years.

3.2 Variable definitions

Table 10 in the Appendix summarizes all the variable definitions.

3.2.1 Dependent and explanatory variables

Our dependent variable is a firm’s leverage (LEVERAGE), which is measured by the ratio of long-term and short-term financial debt to the book value of assets (Comino-Jurado et al. 2021; Crespí and Martín-Oliver 2015; Rajan and Zingales 1995). Our core explanatory variable is family ownership. We define FAMILY20, which equals one if the ultimate owner at the 20% control threshold is an individual or a family, and zero otherwise. This threshold is widely applied in the literature (Murro and Peruzzi 2019; Setia-Atmaja et al. 2009), thus enhancing the comparability of our results. We also approximate family ownership by FAMILYOWN, which is the percentage of shares held by the largest individual/family shareholder (Setia-Atmaja et al. 2009). We identify family shareholdings by taking those held by a family or aggregating equity stakes across individuals from a single family (Keasey et al. 2015).

3.2.2 Mediating variables

We disaggregate SEW into three different objectives: family control, long-term horizon, and family firm reputation. First, with regard to family control, we rely on the presence of the family in the board of directors (Molly et al. 2019; Requejo et al. 2018). We define FAMCONTROL, which is a dummy equal to one if there are members of the main family shareholder in the board of directors, and zero otherwise. Second, we approximate a firm’s long-term horizon using Kappes and Schmid’s (2013) index. Given our research focus, we select six long-term indicators based on investment policiesFootnote 4 (R&D to sales, capital expenditures to sales, and depreciation to fixed assets) and leverage policies (cash to total assets, current assets to current liabilities, and long-term debt to total debt). Using each indicator and firm’s primary industry, we rank our sample firms in deciles and assign scores based on the decile in which each firm is located (from 10 for firms in the top decile to 1 for firms in the bottom decile). Based on these, we follow Kappes and Schmid (2013) to compute an overall long-term index (LTindex) and two long-term sub-indexes focused on investment and leverage policies (LTinvesting and LTfinancing). These three indexes range between 0 and 1. The closer they are to 1, the more long-term oriented the firm is. Finally, family firm reputation comprises aspects such as firm management integrity, a high level of firm involvement in solving community problems, or established ethical and transparency procedures (Santiago et al. 2019) in order to avoid dishonouring the family name. Such aspects of family firm reputation belong to ESG (environmental, social, and governance) practices. Following prior works (Lo and Kwan 2017; Naldi et al. 2013), family firm reputation (REPUTATION) is captured by a firm’s commitment to sustainability practices as proxied by the ESG score (environmental, social, and governance) (Fuente and Velasco 2022). Due to the stronger identity overlap of family owners with their businesses than non-family owners (Leitterstorf and Rau 2014), for whom a matching between their behaviour and socially responsible practices by their companies is not so easily perceived by stakeholders, ESG performance scores are likely to proxy a family firm’s reputation (and that of its family owners) more accurately than in the case of non-family firms.

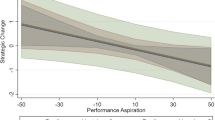

3.2.3 Contingency variable: the negative performance-aspiration gap

The negative performance-aspiration gap variable (ASPIRATION) captures negative deviations in profitability aspirations. It is calculated as the absolute difference between a firm’s performance (return on assets) and the average performance of its 2-digit SIC industry peers if negative, and zero otherwise (Muñoz-Bullón et al. 2019).

3.2.4 Control variables

We control for a set of firm characteristics that are known to affect firm leverage (Crespí and Martín-Oliver 2015; Croci et al. 2011; Daskalakis et al. 2017; DeAngelo et al. 2006; Flannery and Rangan 2006; Molly et al. 2019; Rajan and Zingales 1995): asset tangibility, size, growth opportunities, profitability, the importance of trade credit, cash holdings, interest burden, retained earnings, and firm age. Asset tangibility (TANG) is defined as the ratio of tangible assets to total assets. Tangible assets offer better collateral for loans and have a higher liquidation value than intangible assets, and are therefore expected to positively impact a firm’s leverage. A firm’s size (SIZE) is measured as the natural logarithm of the book value of assets. Larger firms have lower asset volatility and lower default risk, which facilitates access to financial markets and more favourable borrowing conditions. Growth opportunities (GROWTH) are approximated by the annual rate change in total sales, although what impact they have on capital structure remains ambiguous. The pecking order theory predicts that high-growth firms require more leverage to fund their greater investment activity. However, from the trade-off theory, a negative association between growth opportunities and leverage is expected on the grounds that growth opportunities exacerbate the costs of financial distress and the agency problems of underinvestment (Rajan and Zingales 1995).

Profitability (PROFITABILITY) is captured by the return on assets. The trade-off theory expects a positive association with leverage in order to benefit from interest tax shields, while the pecking order theory predicts a positive relation between profitability and leverage as a result of the greater availability of internal funds. The importance of net trade credit (NTCS) is given by the difference between trade payables and trade receivables divided by total sales. Cash holdings (CASH) are approximated by the ratio of cash to total assets and are negatively associated with leverage. Under the pecking order theory, firms initially rely on internal funds before leverage in an effort to minimize adverse selection costs. Interest burden (FINEXP) is defined as the ratio of financial expenses to total sales and associates positively with a firm’s leverage. Retained earnings (RETAINED) are captured by the ratio of retained earnings to total assets (DeAngelo et al. 2006) and are expected to enhance leverage capacity. Finally, a firm’s age (AGE) is proxied by the natural logarithm of the difference between each year and the firm’s founding year. Older firms are expected to have lower leverage, which is supported in the family firm domain (Comino-Jurado et al. 2021) although some studies also challenge this finding by showing that first-generation firms evidence a greater use of equity over debt (Sonfield and Lussier 2004).

3.3 Empirical models and estimation method

Figure 1 illustrates our mediating model. We propose that family ownership can have a twofold impact on a firm’s leverage: a direct effect (path c), our baseline hypothesis, and an indirect effect (path c’) through SEW objectives (Hypothesis 1 to 3). To test for mediating effects, we follow Baron and Kenny’s (1986) methodologyFootnote 5 based on four conditions: (i) there must be a significant relationship between the independent variable (either FAMILY20 or FAMILYOWN) and the dependent variable (LEVERAGE) (the direct effect, path c); (ii) a significant relation also exists between the independent variable and the mediating variable (each SEW dimension) (path a); (iii) the mediating variable is also significantly related to the dependent variable (LEVERAGE) (path b); (iv) the effect of the independent variable on the dependent variable decreases (partial mediation) or even disappears (full mediation) once the mediator is entered in the model (path c’).

The baseline model to evaluate condition (i) [Eq. (1)] concerning the direct effect of family ownership on a firm’s leverage (path c) is (Daskalakis et al. 2017; Flannery and Rangan 2006):

where i and t identify each firm and year (t ranges from 1 to 8), respectively. LEVERAGEi,t-1 denotes the lag of firm i’s leverage, FAMILYi,t is family ownership (either FAMILY20 or FAMILYOWN), the vector Xi,t represents the set of firm-level control variables, ηi denotes the individual effect, and εi,t is the random disturbance. Year, industry and country fixed-effects are included in all the regressions (YEARt, INDUSTRYi, COUNTRYi). The inclusion of country fixed effects controls for time-invariant heterogeneity across our sample countries.

To test the impact of family ownership on each SEW dimension (condition (ii), path a), we specify Eq. (2):

SEW refers to the dimension of socioemotional wealth, either family control, long-term horizon or family firm reputation.

Baron and Kenny’s (1986) condition (iii) concerning the existence of a significant relation between the mediator and the dependent variable (path b) is estimated as:

Finally, we regress the dependent variable on both the independent variable and the SEW mediating variable simultaneously to evaluate condition (iv) (path c’):

To test the mediating role of each SEW dimension, we follow these four stages for family control, long-term horizon, and family firm reputation, separately (Hypotheses 1, 2 and 3, respectively). Additionally, to evaluate how the internal contingency of the negative performance-aspiration gap moderates the previous mediating relationships (Hypothesis 4), we follow Muller et al.’s (2005) approach to test for moderated mediation by considering two-way interaction effects with aspiration gap in the mediating model. To do so, we estimate the direct path and the mediating paths by reformulating previous equations with the addition of the two-way interaction term with the moderating variable (ASPIRATION):

Our models are estimated by using the two-step GMM system estimator by Blundell and Bond (1998), which is widely adopted in studies on capital structure (Daskalakis et al. 2017; Fuente and Velasco 2020; Keasey et al. 2015; Serrasqueiro et al. 2016). The appropriateness of this panel data methodology for our research is borne out by the fact that the GMM system estimator deals with the three major sources of endogeneity: unobserved heterogeneity, simultaneity, and dynamic endogeneity (Ullah et al. 2018). Unobserved heterogeneity is represented by the individual effect ηi and is removed by taking first differences. This effect captures certain unobservable time-constant firm-specific characteristics which also play a part in determining capital structure, such as corporate culture or management. By using instrumental variables of available lags and levels of the endogenous variables, GMM eliminates the need to identify external instruments and produces more efficient and consistent estimations compared to other econometric techniques (Arellano and Bond 1991; Bhargava and Mishra 2014; Ullah et al. 2018).

Together with the parameter estimates, several tests are conducted. First, the Wald test evaluates the goodness-of-fit and supports the joint significance of the explanatory variables. Second, the Arellano and Bond (1991) m2 statistic supports the lack of second-order serial correlation in the first-difference residuals and thereby backs up the consistency of our results. Finally, the Hansen J-statistic evaluates instrument exogeneity and confirms the validity of our instruments.

3.4 Summary statistics

Table 3 presents the summary statistics. On average, debt accounts for 23.02% of total assets. Mean family ownership is 16.62% of total ownership. Companies exhibit a medium average level of long-term horizon (0.56), which is higher in the investment dimension (0.62) than the financing dimension (0.50).

Table 11 of the Appendix reports the pairwise correlations between variables. Among the significant coefficients, FFs are associated with less leverage, smaller size, richer cash holdings, lower financial expenses, greater retained earnings, older age, and a more long-term horizon in their investment policies.

4 Results

4.1 Baseline model

Table 4 displays the results of our baseline model [Eq. (1)] which evaluates the direct effect of family ownership on a firm’s leverage. This estimation (path c) is common to all mediating models. As expected, family ownership discourages leverage, which is consistent with existing evidence (Crespí and Martín-Oliver 2015; Gallo and Vilaseca 1996; Mishra and McConaughy 1999). The coefficient of FAMILY20 is negative, and displays statistical significance (p < 0.05). The leverage ratio is 0.45 percentage points lower in FFs compared to NFFs. FAMILYOWN also presents a negative and statistically significant coefficient (p < 0.01) and indicates that a 10% increase in family ownership implies a 0.37% decline in leverage.

Control variables display the expected signs. Larger firms, high-growth firms and those with higher levels of net trade credit hold more leverage, probably as a result of their easier access to financial markets and their greater funding demands. More profitable and cash-rich companies exhibit lower leverage ratios, which is consistent with the pecking order theory. In addition, the older the age, the lower the leverage that firms hold.Footnote 6

A number of robustness analyses are conducted to further explore the underlying mechanisms of the direct effect of family ownership on a firm’s leverage. First, we repeat our estimations by debt maturity. Table 13 in the Appendix reports these results. FFs’ reluctance to leverage remains statistically significant for short-term but not long-term debt. This finding agrees with evidence such as Molly et al. (2019) showing that short-term borrowings pose the greatest threat to family control as a result of their greater financing risk, greater bankruptcy risk, and closer monitoring. As debt maturity and the idiosyncrasy of short-term borrowings lie outside the scope of our study, we base our subsequent mediating analyses on total debt (LEVERAGE). Moreover, since the direct relationship between family ownership and long-term debt displays no statistical significance, it would not be reasonable to test for mediating effects in such a relation.

Second, we focus on the subsample of FFs (FAMILY20 = 1). We consider whether the presence of a member of the main family shareholder in the CEO position—which is a SEW-preserving mechanism (Baixauli-Soler et al. 2021)—might affect the results. These results are shown in Table 14. of the Appendix. Consistent with the SEW preservation argument, the presence of a family CEO drives family firm reluctance to total and long-term debt, but has no significant effect on short-term debt. On average, a family CEO reduces a firm’s leverage by about 3–4 percentage points in FFs.

4.2 Leverage and family ownership: the mediating effect of family control

Having confirmed a significant direct effect of family ownership on LEVERAGE (path c, condition (i)), this section evaluates whether this direct relationship is mediated by family control (FAMCONTROL). Table 5 provides the regression results to test Hypothesis 1. Columns (1) and (2) estimate the effect of family ownership on the mediating variable FAMCONTROL. Since in this particular case the dependent variable is a dichotomous variable, we run logit regressions. As expected, greater family ownership is positively associated with FAMCONTROL. We therefore confirm the statistical significance of path a (condition (ii)). Next, we need to determine whether the mediating variable has a significant impact on LEVERAGE (path b, condition (iii)). As shown in column (3), family control discourages firms from leverage—consistent with SEW theory. FAMCONTROL has a negative and significant effect on LEVERAGE (β = − 0.0266, p < 0.05), suggesting that leverage is 2.66 percentage points lower in firms with family representation on the board of directors. Finally, we consider the effect of family ownership and the mediating variable of family control simultaneously on LEVERAGE (path c’, condition (iv)). As reported in the last two columns, the effect of family ownership on LEVERAGE is no longer significant once we consider FAMCONTROL. These results suggest that FAMCONTROL fully mediates the relationship between family ownership and a firm’s leverage, thus supporting Hypothesis 1. Results are robust to the alternative proxies for family ownership, either FAMILY20 or FAMILYOWN.

In additional robustness estimations, we use an alternative proxy for family control: the percentage of family directors over total directors in the board (%FAMDIRECTORS). Results are displayed in Table 15 of the Appendix. Our evidence also holds with this alternative proxy. A stronger presence of family directors in the board deters leverage (β = − 0.0292, p value < 0.05). Family ownership loses its statistical significance when %FAMDIRECTORS is included, thereby confirming the mediating effect of this latter variable in the relationship between family ownership and leverage.

4.3 Leverage and family ownership: the mediating effect of the long-term horizon

Again, we draw on the significant direct effect of family ownership on LEVERAGE tested in path c (condition (i)). Hypothesis 2 predicts that a long-term horizon mediates the relationship between family ownership and leverage. Results are displayed in Table 6. The first two columns confirm that family ownership has a significant impact (p < 0.05) on the mediating variable (LTindex). The greater the family ownership, the more long-term a firm’s horizon is, which ties in with SEW theory. As a result, condition (ii) of mediation is fulfilled (path a). We then evaluate the statistical significance of path b (condition (iii)). Our results show that LTindex has a negative and significant impact on LEVERAGE (β = − 0.1034, p < 0.10). This is consistent with SEW theory predictions that greater default risk associated with leverage poses a threat to SEW preservation in the long run and sparks concerns about liabilities transmitted to future generations. The last two columns regress LEVERAGE on both the family ownership variable and the mediator (LTindex) (path c’, condition (iv)). Our findings do not support Hypothesis 2: although family ownership (measured by either FAMILY20 or FAMILYOWN) loses its statistical significance, LTindex becomes non-statistically significant, thereby failing to support the existence of mediation for long-term horizon considered as a whole. Table 7 presents robustness analyses by decomposing long-term horizon into two components: long-term horizon in investment decisions (LTinvesting) in Panel A, and long-term horizon in leverage decisions (LTfinancing) in Panel B. In these cases, partial mediation is supported for both subcomponents of long-term horizon. For instance, in Panel A, the effect of FAMILY20 becomes non-statistically significant (β = − 0.0033, p > 0.10) and consequently decreases its significance in comparison with the baseline model (β = − 0.0045, p < 0.05). Similar evidence is found when using LTfinancing as an alternative proxy for long-term horizon. Results also hold when family ownership is measured on a continuous basis through FAMILYOWN. These results suggest that LTindex may constitute too wide a construct, which accounts for many heterogeneous aspects of a firm’s policies whose aggregation into one single measure might be obscuring a significant impact.

4.4 Leverage and family ownership: the mediating effect of family firm reputation

We now assess the last mediating path in the family ownership–leverage association through family firm reputation. Table 8 shows the estimations. The first two columns estimate the association between family ownership and the mediating REPUTATION variable, confirming the statistical significance of path a (condition (ii)). Results tie in with SEW predictions that family ownership has a positive and significant effect on a family firm’s reputation. For example, FAMILY20 (β = 0.0147, p < 0.01) indicates that a family firm’s reputation is 1.47 percentage points higher in FFs than in NFFs. The following stage is given by path b, which is estimated in column (3). We find that a stronger family firm reputation deters leverage (β = − 0.0860, p < 0.01). Finally, we run the regression of path c’ (condition (iv)) by considering the effect of family ownership, controlling for the mediating REPUTATION. As the last two columns show, the family ownership variable is no longer significant. Hence, REPUTATION fully mediates the relationship between family ownership and leverage, which strongly supports Hypothesis 3. Our results hold when using either FAMILY20 or FAMILYOWN.

4.5 Robustness path analyses of mediation: structural equation models (SEM)

For robustness purposes, Table 16. of the Appendix repeats the mediation analyses by applying an alternative methodological approach based on paths: structural equation modelling, which has been applied extensively in the latest research (Obaydin et al. 2021; Stutz et al. 2022). Our main results remain similar: evidence reveals that family control, long-term horizon (when accounting for the sub-dimensions of investing and financing separately), and family firm reputation play a mediating role in the association between family ownership and leverage.Footnote 7 At the bottom of each panel, we conduct the Sobel (1982) test, which is widely used to assess the strength of indirect (mediating) effects: this test supports the mediating role of the aforementioned SEW objectives, except for family firm reputation, which lacks statistical significance. This finding suggests that—even though family firm reputation carries a mediating effect in the family ownership–leverage relationship according to the causal paths regression results—this mediating driven effect is very weak.

4.6 Negative performance-aspiration gap as a contingency in the mediating models

This section develops the empirical testing of Hypothesis 4 to assess whether an internal contingency such as ASPIRATION affects (moderates) the mediating role played by SEW objectives in the family ownership–leverage relationship. To do so, we follow Muller et al.’s (2005) approach to test for moderated mediation, which occurs when the mediating process depends on the value of a moderator variable. In order to estimate path c’, the moderator (ASPIRATION) and the two-way interaction effect between the moderator and the corresponding SEW mediating variable (ASPIRATION × FAMCONTROL, ASPIRATION × LTindex and ASPIRATION × REPUTATION) are therefore considered. Results of these regressions are shown in Table 9.

As far as family control is concerned, results in Panel A support that FAMCONTROL fully mediates the relationship between family ownership and leverage. Interestingly, our empirical findings show that such a mediating influence is moderated by ASPIRATION since the interaction term FAMCONTROL × ASPIRATION is positive as well as statistically and significantly different from zero (β = 0.1235, p < 0.01). This means that the negative mediating effect driven by FAMCONTROL in the family ownership–leverage relationship (β = − 0.0185, p < 0.01) weakens or can even be reversed under higher levels of ASPIRATION. This finding supports Hypothesis 4. We proceed in a similar way with our second dimension of SEW; namely LTindex. Results are shown in Panel B. We find that the association between family ownership and LEVERAGE is mediated in full by LTindex. Again, we observe that the sign of the mediating variable LTindex changes depending on the level of ASPIRATION because the interaction term LTindex × ASPIRATION is positive and statistically significant (β = 0.4202, p < 0.05). Panel C re-estimates by using REPUTATION, with results proving to be robust to this SEW dimension. Over all, these findings support Hypothesis 4 that ASPIRATION moderates the mediating influence of SEW objectives in the family ownership–leverage linkage.

5 Discussion and conclusions

How do leverage decisions in FFs differ from those of non-family firms? The literature has mostly explored the direct linkage between family ownership and a firm’s leverage. Our study shows that this provides too narrow a perspective and restricts a finer-grained appraisal of how SEW objectives shape the relationship between family ownership and leverage. Specifically, we focus on how family ownership affects a firm’s leverage through the mediating channel of three SEW objectives: retaining family control, ensuring a long-term horizon, and maintaining family firm reputation. In this way, we help to identify the underlying mechanisms which shape FFs’ reluctance to leverage.

Our results confirm the baseline hypothesis that FFs are more reluctant to use leverage than non-family firms, which agrees with the bulk of the research (Baixauli-Soler et al. 2021; Gallo and Vilaseca 1996; Mishra and McConaughy 1999; Schmid 2013). This suggests that leverage may threaten family affective endowment (Gomez-Mejia et al. 2007) compared to non-family counterparts (who are more focused on financial wealth).

In addition, our evidence shows that the nature of the relationship between family ownership and leverage is not a direct one, but rather an indirect relationship which is channelled by SEW objectives. We find that unique objectives embedded in SEW, such as family control, long-term horizon, and family firm reputation, mediate the effect of family ownership on corporate leverage. Furthermore, our research shows that family ownership is a primary antecedent which endows these SEW objectives.

Our results thus shed further light on the underlying mechanisms which shape family firm reluctance to leverage. The pursuit of non-financial goals is one distinctive feature of FFs (Berrone et al. 2012; Cesinger et al. 2016; Davila et al. 2023; Filser et al. 2018; Gast et al. 2018; Gomez-Mejia et al. 2007, 2011; Gomez-Mejia and Herrero 2022), such that SEW objectives might enable a better understanding of corporate decision-making such as leverage decisions. First, family control sparks a mediating effect in the family ownership–leverage relationship because this source of financing can weaken the owning family’s maintaining control over the company. Likewise, our findings show that a long-term horizon also mediates the relationship between family ownership and leverage. This is consistent with the notion that FFs are less willing to engage in leverage to curb their risk exposure and to ensure the best preservation of SEW legacy for future generations (Kotlar et al. 2018). Finally, we find that family firm reputation is also another indirect channel which drives the effect of family ownership on leverage. This finding agrees with the fact that leverage aggravates exposure to financial distress risk, which can erode a key SEW dimension such as firm reputation (Jiang et al. 2020).

Our evidence also reveals that a firm’s underperformance (i.e., performance below the aspiration level) can weaken the negative mediating effect propelled by SEW objectives on the family ownership–leverage relationship. Financial vulnerability changes FFs’ reference point in their decision-making process so that family owners are more willing to assume SEW losses in order to avoid the worst scenario of organizational failure which would lead to losing not only SEW but also financial wealth (Baixauli-Soler et al. 2021). When experiencing below-par performance outcomes, family owners are likely to take greater account of non-economic goals (even at the expense of sacrificing a part of SEW) in order to maximize the likelihood of firm survival and protect a firm’s overall wealth (Gomez-Mejia et al. 2018). Consequently, under poor performance, economic concerns become a top priority (even in family firms) when making leverage decisions (Fang et al. 2021; Gomez-Mejia et al. 2018).

5.1 Contributions

Our investigation contributes to the literature in several ways. First, we put forward an indirect channel of causality in the association between family ownership and leverage. While research has principally been based on generic firm-level driving factors of capital structure (e.g., Daskalakis et al. 2017; Flannery and Rangan 2006; Rajan and Zingales 1995), we propose mechanisms linked to the role of family ownership (family owners’ SEW objectives). Rather than proposing a direct association between family ownership and leverage, we hypothesize an indirect one (channelled by SEW objectives). To the best of our knowledge, the role played by certain SEW objectives in leverage decisions has remained largely understudied (Baixauli-Soler et al. 2021). We broaden current knowledge about the role of SEW in family firm financing behaviour and provide evidence that SEW (as a multidimensional construct) serves as an intermediate causal mechanism in the association between family ownership and a firm’s leverage (e.g. Baixauli-Soler et al. 2021; Comino-Jurado et al. 2021; Molly et al. 2019; Poletti-Hughes and Martínez-García, 2022). Our findings suggest that the unique nature of FFs brings unique affective motives (e.g., family control, long-term horizon, and family firm reputation) (Naldi et al. 2013) into corporate decision-making, which must be accounted for in order to reach a more comprehensive understanding of the diverse decisions that firms make in terms of leverage. By approaching SEW as a multidimensional construct, we shed further light on the motivations of leverage decisions and provide a more fine-grained knowledge to make sense of why some FF decisions do not sometimes obey purely economic goals. Our mediating approach favours a better understanding of how leverage decisions differ not only across different levels of family ownership but also within the universe of FFs, depending on the richness of their SEW endowment. In this way, we answer calls to extend the theoretical underpinnings of SEW within the domain of FF leverage (Jain and Shao 2015; Michiels and Molly 2017; Molly et al. 2019).

Second, we provide a better understanding of how a negative performance aspiration gap can moderate the effect of SEW objectives on a firm’s leverage, thereby modifying family owners’ preference for leverage. Whereas the literature has explored external shocks, such as the last financial crisis (e.g. Crespí and Martín-Oliver 2015; Serrasqueiro et al. 2016), our analysis expands the thus far scarce evidence on whether FFs’ leverage choices differ under conditions of financial vulnerability (an internal threat). This contingency has already been considered when exploring other strategic decisions—such as M&A, internationalization, or R&D (Chrisman and Patel 2012; Gomez-Mejia et al. 2018; Minichilli et al. 2016)—but its effect on leverage has so far been neglected (Baixauli-Soler et al. 2021). Our study therefore complements existing research and provides a more fine-grained understanding of the family firm-leverage linkage. Our evidence is consistent with studies which argue that FFs pay more attention to financial goals when performance is below aspirations (Chrisman and Patel 2012; Fang et al. 2021; Gomez-Mejia et al. 2018). Under adverse performance outcomes, family owners are more willing to accept SEW losses in order to guarantee the firm’s survival, and their reluctance to leverage financing diminishes even in spite of its detrimental consequences for SEW preservation.

5.2 Implications for managerial practice

From a managerial perspective, we provide practitioners with an illustration of the trade-off between economic-driven and affective-driven motives in FFs in the particular domain of leverage decisions. Our research reveals that the nature of FFs brings affective motives (e.g., family control, long-term horizon, and family firm reputation) which channel FFs’ reluctance to leverage. By acknowledging a multidimensional perspective of SEW, we provide decision makers with a fresh perspective to raise their awareness about how corporate decision-making does not always respond to purely rational patterns of behaviour, but that emotional concerns also play an important role. We show that family firm owners and managers—in spite of their sensitiveness to the risk of financial distress which increases with leverage—cannot escape from the influence of SEW objectives. Such objectives unavoidably affect a family firm’s behaviour, restricting the leverage that the firm pursues, which sometimes results in inefficient decisions (e.g., when excessive reluctance to leverage leads firms to forgo valuable future growth opportunities). Our study suggests that a firm’s attitude to leverage needs to be reassessed on the basis of the relative performance scenario each firm faces. Otherwise, a leverage policy which only serves SEW goals but which is not adequately aligned to the remaining corporate decisions and outcomes might prompt the failure of the firm as a whole. Our research points to the important role played by managers in promoting optimal prioritization between economic and emotional goals in order to avoid poor decision-making in this regard.

Furthermore, family business consultants could provide guidance for FFs in business practice by encouraging them to undertake a more comprehensive assessment of the business conditions as well as those of the firm environment in order to ensure a rational balance between economic and non-economic (SEW) considerations. As shown, non-economic objectives are more salient in FFs and the latter’s strong desire to ensure affective endowment preservation may alter their perception of how much leverage it might be optimal to engage in. Consultants are likely to play a very useful role in this regard in order to ensure not only an optimal choice of leverage but also a good match between financing and investment policies in a firm. These decisions are two sides of the same coin which need to be optimally aligned. Assessment of SEW losses and gains may also play a part in some of the strategic decisions facing FFs and may differentiate them from those made by their non-family firm counterparts.

5.3 Limitations and future research lines

Some limitations of this study could be addressed in a future research agenda. First, future research could examine how SEW’s influence on the family ownership–leverage relationship might change across the business cycle. It would be particularly interesting to delve into the role of SEW during the COVID crisis, given the unique characteristics of this shock, rooted in a worldwide health emergency and the highly disruptive effects that lockdowns had for all economic sectors—particularly non-essential businesses. Second, further evidence about alternative financing sources (e.g. internal funds, external equity) might also further our knowledge about the trade-off between financial and emotional goals when making leverage decisions (Croci et al. 2011; Koropp et al. 2014). It might be of particular interest to consider additional characteristics of financing sources such as their maturity, which might interact with the long-term horizon prompted by SEW endowment (Molly et al. 2019). Second, our study is focused on publicly traded FFs in line with studies such as Anderson et al. (2003) and Croci et al. (2011). Given that publicly listed firms have wider financing sources available (Hansen and Block 2020), the generalizability of our results to private FFs invites future inquiry (e.g., Baixauli-Soler et al. 2021; Molly et al. 2019; Romano et al. 2001). The particular characteristics of private firms—such as their being more credit constrained or their greater information opaqueness—may affect leverage differently. For instance, the latest developments in entrepreneurial financing (e.g., crowdfunding) may become especially important when studying the leverage decisions of private FFs. Likewise, it might be insightful to look at how SEW objectives affect leverage decision-making depending on the institutional context, particularly the degree of investor and creditor protection (Jara et al. 2018). Third, given the increasing interest in FFs’ leverage behaviour, a meta-analytical approach may clarify the conflicting findings (Hansen and Block 2020). Similarly, future work might promote a more comprehensive appraisal of SEW by constructing proxies based on secondary data (Berrone et al. 2012; Naldi et al. 2013). This line of research could be helpful to operationalize the measures for family firm reputation on the basis of corporate sustainable practices (Naldi et al. 2013), since the still limited coverage of ESG data in public databases restricts the scope of our analysis.

Additionally, a finer-grained appraisal of the degree of familiness might advance literature in this field by further capturing heterogeneity across the family firm universe. Drawing on proxies to capture certain variables empirically also adds another limitation to our study, particularly in those connected to SEW. It may also prove interesting to explore further how the degree of concentration of family wealth—which sparks prudent and conservative decisions—influences corporate decision-making and, in particular, leverage levels. This will require collecting primary data such as those from survey-based and quantitative interview techniques. Subsequent research could consider alternative mediating paths which could channel the relationship between family ownership and leverage, and apply methodological developments such as Preacher and Hayes’s (2008) bootstrap procedure for more comprehensive analyses of mediating relationships. Finally, future research that considers additional contingency variables other than performance aspirations (e.g., generational stage, firm size) could be theorized and tested to improve our knowledge of how FFs’ behaviour is context-dependent (Sonfield and Lussier 2004).

5.4 Conclusion

The literature has documented that family ownership drives different leverage choices in comparison to other types of ownership, and has called for a deeper understanding of the underlying mechanisms (Anderson et al. 2003; Gallo et al. 2004; González et al. 2013). Koropp et al. (2014, p. 308) point out that “FFs’ behaviour, regarding their financing decisions, is unique due to the specific properties these firms possess”. Research highlights the underdevelopment of studies about the impact of SEW on corporate leverage behaviour (Jain and Shao 2015). This paper extends current knowledge about how family ownership shapes leverage decisions. We add to the literature by positing a mediating role played by SEW objectives (family control, long-term horizon, and family firm reputation) on the relationship between family ownership and a firm’s leverage. Relying on a multidimensional view of SEW proves to be relevant, since focusing on one single dimension might hide crucial aspects in financial decision-making. Leverage decisions cannot be fully understood if a number of more specific SEW objectives are overlooked (Molly et al. 2019). Moreover, the use of panel data techniques allows causality (not simple correlation) to be inferred between our study variables (Audretsch et al 2019).

Additionally, our findings offer interesting insights by exploring how internal contingences threatening SEW preservation (such as negative performance aspiration gap) affect the role of SEW in the family ownership–leverage relationship. Performance aspiration gap is a major reference point in strategic decision-making (Gomez-Mejia et al. 2018; Minichilli et al. 2016) and may determine the importance which FFs attach to affective endowment. In FFs, a shift of focus is found towards economic goals when performance falls below aspirations due to greater financial vulnerability, with FFs placing less emphasis on SEW goals and, instead, pursuing more risk-seeking behaviour by increasing leverage.

Notes

The FIBER model (Berrone et al. 2012) condenses the objectives of SEW into three that influence FFs’ strategic behaviour.

One major limitation pointed out by many studies stems from the still limited coverage of ESG data (Verheyden et al. 2016), especially for non-US companies. As a result, the number of observations decreases in the estimations in which ESG scores are entered to proxy for a family firm’s reputation. Since we are unable to overcome this data restriction, it is pointed out in the study’s limitations and mentioned as a research extension.

The rationale of this measure is that corporate decision-making (in terms of investment and financing policies) will mirror a firm’s long-term horizon, as shown by prior research (Flammer and Bansal 2017). We thank an anonymous reviewer for highlighting this issue.

Table 12 of the Appendix reports robustness analyses controlling for a firm’s percentage of shares traded over total shares (collected from the Eikon database). It captures the ease with which a firm can access alternative financing sources (i.e., equity financing). It has a positive and statistically significant effect on LEVERAGE, which could be explained by the lower informational asymmetries of firms that are more actively traded in equity financial markets. Our main results are robust to the inclusion of this control variable. We exclude it from this article’s core analyses because their missing values further restrict our sample size. We thank an anonymous reviewer for this suggestion.

Results are also robust when using FAMILYOWN, and are available upon request.

References

Anderson R, Mansi S, Reeb D (2003) Family founding ownership and the agency cost of debt. J Financ Econ 68(2):263–285. https://doi.org/10.1016/S0304-405X(03)00067-9

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297. https://doi.org/10.2307/2297968

Arzubiaga U, De Massis A, Maseda A, Iturralde T (2023) The influence of family firm image on access to financial resources in family SMEs: a signalling theory perspective. Rev Manag Sci 17:233–258. https://doi.org/10.1007/s11846-021-00516-2

Audretsch DB, Belitski M, Desai S (2019) National business regulations and city entrepreneurship in Europe: a multilevel nested analysis. Entrep Theory Pract 43(6):1148–1165. https://doi.org/10.1177/1042258718774916

Azofra V, Rodríguez-Sanz JA, Velasco P (2020) The role of macroeconomic factors in the capital structure of European firms: how influential is bank debt? Int Rev Econ Fin 69:494–514. https://doi.org/10.1016/j.iref.2020.06.001

Baixauli-Soler S, Belda-Ruiz M, Sánchez-Marín G (2021) Socioemotional wealth and financial decisions in private family SMEs. J Bus Res 123:657–668. https://doi.org/10.1016/j.jbusres.2020.10.022

Balakrishnan S, Fox I (1993) Asset specificity, firm heterogeneity and capital structure. Str Man J 14(1):3–16. https://doi.org/10.1002/smj.4250140103

Baron RM, Kenny DA (1986) The moderator-mediator variable distinction in social psychological research: conceptual, strategic and statistical considerations. J Pers Soc Psychol 51(6):1173–1182. https://doi.org/10.1037//0022-3514.51.6.1173

Becerra M, Cruz C, Graves C (2020) Innovation in family firms: the relative effects of wealth concentration versus family-centered goals. Fam Bus Rev 33(4):372–392. https://doi.org/10.1177/0894486520953700

Berrone P, Cruz C, Gomez-Mejia L, Larraza-Kintana M (2010) Socioemotional wealth and corporate responses to institutional pressures: do family-controlled pollute less? Adm Sci Q 55(1):83–113. https://doi.org/10.2189/asqu.2010.55.1.82

Berrone P, Cruz C, Gomez-Mejia LR (2012) Socioemotional wealth in family firms: theoretical dimensions, assessment approaches, and agenda for future research. Fam Bus Rev 25(3):258–279. https://doi.org/10.1177/0894486511435355

Bhargava H, Mishra A (2014) Electronic medical records and physician productivity: evidence from panel data analysis. Manag Sci 60(10):2543–2562. https://doi.org/10.1287/mnsc.2014.1934

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Brigham KH, Lumpkin GT, Payne T, Zachary MA (2014) Researching long-term orientation: a validation study and recommendations for future research. Fam Bus Rev 27(1):72–88. https://doi.org/10.1177/0894486513508980

Camisón C, Clemente JA, Camisón-Haba S (2022) Asset tangibility, information asymmetries and intangibles as determinants of family firms leverage. Rev Manag Sci 16(7):2047–2082. https://doi.org/10.1007/s11846-022-00522-y

Cesinger B, Hughes M, Mensching H, Bouncken R, Fredrich V, Kraus S (2016) A socioemotional wealth perspective on how collaboration intensity, trust, and international market knowledge affect family firms’ multinationality. J World Bus 51(4):586–599. https://doi.org/10.1016/j.jwb.2016.02.004

Chen W, Zhou AJ, Zhou SS, Hofman PS, Yang X (2022) Deconstructing socioemotional wealth: social wealth and emotional wealth as core properties of family firms. Manag Organ Rev 18(2):223–250. https://doi.org/10.1017/mor.2022.1

Chirico F, Gomez-Mejia LR, Hellerstedt K, Withers M, Nordqvist M (2020) To merge, sell, or liquidate? Socioemotional wealth, family control, and the choice of business exit. J Manag 46(8):1342–1379. https://doi.org/10.1177/0149206318818723

Chrisman JJ, Patel PJ (2012) Variations in R&D investments of family and non-family firms: behavioral agency and myopic loss aversion perspectives. Acad Manag J 55(4):976–997. https://doi.org/10.5465/amj.2011.0211

Chua JH, Chrisman JJ, De Massis A (2015) A closer look at socioemotional wealth: its flows, stocks, and prospects for moving forward. Entrep Theory Pract 39(2):173–182. https://doi.org/10.1111/etap.12155

Combs JG, Jaskiewicz P, Ravi R, Walls J (2023) More bang for their buck: why (and when) family firms better leverage corporate social responsibility. J Manag 49(2):575–605. https://doi.org/10.1177/01492063211066057

Comino-Jurado M, Sánchez-Andújar S, Parrado-Martínez P (2021) Reassessing debt-financing decisions in family firms: family involvement on the board of directors and generational stage. J Bus Res 135:426–435. https://doi.org/10.1016/j.jbusres.2021.06.060

Crespí R, Martín-Oliver A (2015) Do firms have better access to external finance during crises? Corp Gov Int Rev 23(3):249–265. https://doi.org/10.1111/corg.12100

Croci E, Doukas J, Gonenc H (2011) Family control and financing decisions. Eur Financ Manag 17(5):860–897. https://doi.org/10.1111/j.1468-036X.2011.00631.x

Cuadrado-Ballesteros B, Rodríguez-Ariza L, García-Sánchez I, Martínez-Ferrero J (2017) The mediating effect of ethical codes on the link between family firms and their social performance. Long Rang Plan 50(6):756–765. https://doi.org/10.1016/j.lrp.2016.11.007

Cuevas-Rodríguez G, Pérez-Calero L, Gomez-Mejia LR, Kopoboru Aguado S (2023) Family firms’ acquisitions and politicians as directors: a socioemotional wealth approach. Fam Bus Rev 36(2):223–253. https://doi.org/10.1177/08944865231162404

Daskalakis N, Balios D, Dalla V (2017) The behaviour of SMEs’ capital structure determinants in different macroeconomic states. J Corp Fin 46:248–260. https://doi.org/10.1111/j.1468-036X.2011.00631.x

Davila J, Duran P, Gomez-Mejia LR, Sanchez-Bueno MJ (2023) Socioemotional wealth and family firm performance: a meta-analytic integration. J Fam Bus Strategy 14(2):1–13. https://doi.org/10.1016/j.jfbs.2022.100536

DeAngelo H, DeAngelo L, Stulz R (2006) Dividend policy and the earned/contributed capital mix: a test of the life-cycle theory. J Fin Econ 81(2):227–254. https://doi.org/10.1016/j.jfineco.2005.07.005

Debicki BJ, Kellermanns FW, Chrisman JJ, Pearson AW, Spencer BA (2016) Development of a socioemotional wealth importance (SEWi) scale for family firm research. J Fam Bus Strategy 7(1):47–57. https://doi.org/10.1016/j.jfbs.2016.01.002

Deephouse DL, Jaskiewicz P (2013) Do family firms have better reputations than non-family firms? An integration of socioemotional wealth and social identity theories. J Manag Stud 50(3):337–360. https://doi.org/10.1111/joms.12015

Dyer G, Whetten D (2006) Family firms and social responsibility: preliminary evidence from the S&P 500. Entrep Theory Pract 30(6):785–802. https://doi.org/10.1111/j.1540-6520.2006.00151.x

Fang CH, Memili E, Chrisman JJ, Tang L (2021) Narrow-framing and risk preferences in family and non-family firms. J Manag Stud 58(1):201–235. https://doi.org/10.1111/joms.12671

Fiegenbaum A, Hart S, Schendel D (1996) Strategic reference point theory. Strateg Man J 17(3):219–235. https://doi.org/10.1002/(SICI)1097-0266(199603)17:3%3c219::AID-SMJ806%3e3.0.CO;2-N

Filser M, De Massis A, Gast J, Kraus S, Niemand T (2018) Tracing the roots of innovativeness in family SMEs: the effect of family functionality and socioemotional wealth. J Prod Innov Manag 35(4):609–628. https://doi.org/10.1111/jpim.12433

Flammer C, Bansal P (2017) Does a long-term orientation create value? Evidence from a regression discontinuity. Strateg Man J 38(9):1827–1847. https://doi.org/10.1002/smj.2629

Flannery M, Rangan K (2006) Partial adjustment toward target capital structures. J Fin Econ 79(3):469–506. https://doi.org/10.1016/j.jfineco.2005.03.004

Fuente G, Velasco P (2020) Capital structure and corporate diversification: is debt a panacea for the diversification discount? J Bank Financ 111:105728. https://doi.org/10.1016/j.jbankfin.2019.105728

Fuente G, Velasco P (2022) Bank debt signalling and corporate sustainability: does incongruence blur the message? Finance Res Lett 46A:102288. https://doi.org/10.1016/j.frl.2021.102288

Gallo MA, Vilaseca A (1996) Finance in family business. Fam Bus Rev 9(4):387–401. https://doi.org/10.1111/j.1741-6248.1996.00387.x

Gallo MA, Tapies J, Cappuyns K (2004) Comparison of family and nonfamily business: financial logic and personal preferences. Fam Bus Rev 17(4):303–318. https://doi.org/10.1111/j.1741-6248.2004.00020.x

García-Sánchez IM, Martín-Moreno J, Akbar-Khan S, Hussain N (2021) Socio-emotional wealth and corporate responses to environmental hostility: are family firms more stakeholder oriented? Bus Strategy Environ 30(2):1003–1018. https://doi.org/10.1002/bse.2666

Gast J, Filser M, Rigtering JC, Harms R, Kraus S, Chang ML (2018) Socioemotional wealth and innovativeness in small- and medium-sized family enterprises: a configuration approach. J Small Bus Manag 56(S1):53–67. https://doi.org/10.1111/jsbm.12389

Gomez-Mejia LR, Herrero I (2022) Back to square one: the measurement of Socioemotional Wealth (SEW). J Fam Bus Strategy 13(4):1–9. https://doi.org/10.1016/j.jfbs.2021.100480