Abstract

This paper analyses the impact of sustainability through ESG factors on the default risk. The sample consists of 990 non-financial firms in the Eurozone over the period 2004–2020. The results show that ESG factors influence default risk, although this relationship could be influenced by the economic cycle. Also, the results highlight a significant interaction effect between firm size and ESG which affects default risk. Considering firm size by terciles, the evidence obtained shows that smaller and medium-sized firms have a positive net effect of a high ESG score on their default risk, while the opposite effect was found among larger firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The objective of this paper is to analyse the impact of sustainability on the default risk considering the non-financial business sector in the Eurozone. In this context, the analysis of the impact of sustainability on financial variables such as the default risk is relevant in order to motivate more and better adoption of sustainable practices and, at the same time, to consolidate this type of behaviour. Sustainability is considered through the ESG metric, which is an external, transparent and objective measure generated by third parties, accessible through the Refinitiv Eikon database, and which considers the performance, commitment and effectiveness of the sustainability practices developed by the company (Atif and Ali 2021).

The default risk of a company significantly affects different stakeholders, e.g. investors, management and financial institutions. If this risk results in the failure of the company, the consequences can be very negative for these stakeholders. It is, therefore, important to analyse the factors that may determine or explain the default risk so that managers and policy makers can mitigate it.

Interest in models for identifying and predicting default risk has transcended academia, especially as a consequence of the proliferation of such situations, for example, during periods of crisis such as the recent one generated by COVID-19. Indeed, corporate ratings of non-financial firms were particularly affected by the pandemic, experiencing a wave of downgrades that started in March 2020 and spiked in the third quarter of that year, coinciding with the second wave of COVID-19. This was accompanied by a significant increase in corporate bankruptcies in the EU27 (European Securities and Markets Authority (ESMA), 2021), which surpassed in 2020 the levels reached during the 2009 financial crisis (Serino et al. 2020).

Consequently, the study of the default risk has accentuated its importance as a business management tool, given that the social and economic well-being of various groups is influenced by the company’s capacity to generate sufficient resources. However, “sufficiency is not enough”, i.e. the ability to generate wealth in a sustainable way is a key issue in today’s environment. The new generations consider sustainability as a relevant factor in their purchasing and investment decisions so that sustainability is already beyond being conceived only as a legal framework of “obligatory” compliance, establishing itself in the collective social conscience. The year 2020 saw a marked increase in the demand for and analysis of sustainability-related information for both investment and borrowing decisions. In this context, reference must inevitably be made to ESG (Environmental, Social and Governance) criteria, which involve considering the effect that the company’s activity has on the environment (Environmental), on society or the social environment (Social), and how it articulates its corporate governance (Governance) (Broadstock et al. 2021). It should be noted that the terms sustainability and ESG cannot be considered strictly synonymous. Sustainability refers to the result of implementing responsible actions and strategies in the company, while ESG encompasses the criteria for analysing and evaluating such actions (Vives 2021). In practice, however, the two terms tend to be used synonymously. This paper will adopt this approach for the purposes of synthesis.

ESG factors have become popular among companies because they are increasingly valued by the market (Amel-Zadeh and Serafeim 2018). In fact, according to Georgeson’s ESG Investment Observatory, the pandemic situation generated by COVID-19 has accentuated the concern for these sustainability metrics at the level of companies and investors as well as at the level of society (Georgeson 2022). In this vein, the largest asset managers have encouraged this increased prominence by integrating ESG factors into their investment policies. For example, the asset manager BlackRock asked companies in March 2020 to disclose corporate sustainability information following the guidelines of the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD) (Comunicarseweb 2020).

The contributions of this research are threefold. First, this paper analyses the impact of sustainability on default risk. This is a little evaluated and inconclusive aspect in previous empirical literature, and almost unexplored, to our knowledge, in the Eurozone. Most previous research has focused on the study of sustainability in relation to variables such as profitability and firm value, with less attention paid to the default risk until recently. Sustainability is not only a legal but also an economic and social imperative for all companies today, so assessing its impact on different financial dimensions such as default risk is very important. Thus, the second contribution of this research concerns the focus of analysis which is on Europe and, particularly, the Eurozone. The analysis of this market is particularly relevant if we take into account the wide differences that exist with respect to the United States (which is the market on which most of the literature has focused so far) in terms of the level of adoption and sustainability practices. European companies generally have a higher level of sustainability dissemination than their US counterparts (Hartman et al. 2007; Fernández, Romero & Ruiz, 2014; Cai et al. 2016). Likewise, the assessment of ESG dimensions also varies across markets: while environmental and social scores are higher in European companies (Peiró and Segarra 2013; Mondejar, Peiró & Segarra, 2014; Segarra et al. 2016), governance scores are higher in the United States (Peiró and Segarra 2013). Part of these differences arise from the political, labour and cultural systems of each market (Baldini et al. 2016) as well as the legal and regulatory framework applicable in each case.

The third and final contribution relates to the period of analysis. The time horizon in this research will consider a recent period of years which is 2004–2020, which allows us to consider both the stages prior to the current pandemic situation and, where appropriate, to validate whether the models developed to date to explain the default risk are still valid in the new economic environment, characterised by a high level of uncertainty and some volatility in the markets, and with the inclusion of sustainability as a determinant.

The paper is organised in five sections. After this introduction, the second section presents the theoretical framework while the third section focuses on the empirical study, showing the sample, the methodology and the results obtained. Finally, section four identifies the main conclusions, and section five contains the bibliography.

2 Framework

The study of default risk has been an important and prolific line of research in scientific production for several decades, which can be organised around three axes: concept, methodology and determinants of default risk. Thus, there is no single definition of what a failed business is in the literature. Typically, a failed firm is associated with a firm that meets the legal requirements that verify a situation of actual or imminent financial insolvency. In relation to the methodology applied to identify and/or predict default risk, firstly, the pioneering work of Fitzpatrick (1932) and Smith and Winakor (1935) who applied univariate analysis and Beaver (1966) who proposed univariate discriminant analysis should be highlighted. Subsequently, methodologies with a multivariate approach were applied. Altman (1968) presented the Z-score model, the result of the application of the so-called multiple discriminant analysis methodology. At the end of the 1970s, Martin (1977) and Zmijewski (1984) proposed the use of logistic regression (logit and probit). In the 1990s, artificial intelligence techniques began to be applied, with the iterative or recursive partitioning algorithm, which allows results to be presented in the form of a binary decision tree, the rough sets methodology and neural networks (Serrano and Martín 1993). Finally, data envelopment analysis and survival analysis have been applied (Vivel-Búa et al. 2019).

Focusing on the determinants of default risk, it should first be noted that there are two perspectives in the literature on the causes of business failure: deterministic and voluntaristic (Heracleous and Werres 2016). According to the deterministic perspective constituted by the classical industrial organisation and organisational ecology literature, there are exogenous factors that cannot be fully controlled by managers, influencing their responsiveness to changes in the environment and industry conditions (Barro and Basso 2010; Fernandes and Artes 2016; Vivel-Búa and Lado-Sestayo 2023). Thus, failure is due to the effect of these environmental factors (Vivel-Búa et al. 2019). The voluntarist perspective, on the other hand, is constituted by organisational psychology and organisational studies, and argues that business failure is a consequence of managerial activity (Mellahi and Wilkinson 2004). It, therefore, emphasizes the importance of firm-level factors as a cause of failure. Most of the literature on business failure has focused on the debate whether the causes of failure can be explained by firm-level or industry-level factors (Vivel-Búa et al. 2018). However, recent research has shown that both factors can be relevant to provide a better explanation of the causes of failure, so an integrative approach is important (Vivel-Búa and Lado-Sestayo 2023).

At the empirical level, previous studies have identified a wide range of variables that can be incorporated into the analysis as determinants of default risk, based more on statistical regularity than on economic reasoning. In general, the most commonly used variables refer to a broad set of ratios constructed from the company’s accounting information and which, in the opinion of the researchers, could indicate whether or not the business is performing adequately. The most popular ratios refer to profitability, indebtedness, financial equilibrium and economic structure (Vivel-Búa et al. 2018). However, previous literature has also highlighted that other factors related to internal management and the macroeconomic and social environment to which it has been subjected should be considered, including variables such as market data, the structure of demand, the degree of competitive rivalry, interest rates and unemployment rates, among others. Sustainability can also be considered in this set of variables, which, to date, has been little explored in the area of default risk, as discussed in more detail in the following section.

2.1 Sustainability as a determinant of default risk

There is an important strand of recent literature that has focused on assessing the impact of companies’ adoption of sustainability practices on their performance and/or value (Park et al. 2017). Overall, the evidence is inconclusive. There are studies that find that sustainable behaviour in companies has a positive impact on their cash flows and reduces their cost of capital (Friede et al. 2015), because it improves reputational image, mitigates risk and increases innovativeness (Vishwanathan et al. 2019). However, there is also evidence of a neutral or non-significant effect (García et al. 2010) or even a negative effect (Zhao and Murrell 2016).

In the case of financial risk, the available literature is scarce, both at a general and sectoral level. There are studies that consider financial risk, concluding that sustainability can influence its management (Sassen et al. 2016; Limkriangkrai, Koh & Durand, 2017), and even that its effect on risk can be heterogeneous, i.e., higher in times of crisis and lower in times of “stability” (Bouslah, Kryzanowski & M’Zali, 2018; Broadstock et al. 2021).

Only a small group of fairly recent papers specifically analyse the relationship between sustainability and the default risk, focusing on the US non-financial market: Atif and Ali (2021), Habermann and Fischer (2021), Boubaker et al. (2020), Cooper and Uzun (2019), and Lin and Dong (2018). All found evidence of a negative relationship between the default risk and corporate sustainability, with the exception of Habermann and Fischer (2021). These authors found that, in a period of economic boom, first, sustainability seems to have no effect on the default risk, except for the governance factor where they find a negative relationship; second, increasing the level of sustainability, with the consequent consumption of resources by the firm, increases the default risk due to costs outweighing benefits. Atif and Ali (2021) specifically analyse the relationship between ESG disclosure and default risk, considering the life cycle of the firm. These authors conclude that sustainability reduces the default risk because it favours a reduction in the volatility of profitability and the cost of debt, although this is only corroborated in companies that are in mature stages.

Once there is evidence of a mostly negative relationship between sustainability and the default risk, it is important to identify the theoretical underpinnings that could explain this link. Thus, the stakeholder theory (Freeman 1984) can be used. According to this theoretical approach, long-term business viability depends on good stakeholder relationships with each other and with the company, defined as any individual or group of individuals who can affect or be affected by the achievement of business objectives. Adopting a high degree of sustainability in the company’s activity helps the company to improve its reputational image, creating a long-term link not only with the stakeholders with whom it relates directly, but also with society. In this way, the company can capitalise on the benefits of its “sustainable” activity in other strategies such as, for example, managing its financial risk, offsetting the costs involved in implementing sustainability, and leading to a reduction in its default risk. Along these lines, according to Atif and Ali (2021), there are three channels through which sustainability can contribute to reducing the default risk:

-

Sustainability has a positive impact on profitability as a result of an improvement in the value of the company. Brand image, customer satisfaction and customer loyalty are increased in companies with high levels of sustainability, generating a positive impact on their profitability. According to previous literature on business failure, there is a negative relationship between performance and default risk, hence sustainability contributes to reducing the default risk.

-

Sustainability reduces the volatility of performance or cash flow due, on the one hand, to the positive reputational image it generates of the company itself and, on the other hand, to the good relationship it contributes to having with all actors in the financial markets. Sustainability contributes to a higher level of loyalty and trust between the company and its stakeholders, even in the face of critical situations or negative events (Godfrey et al. 2009). More stable performance lowers potential default and improves access to resources in the market, reducing the default risk.

-

Sustainability reduces agency costs and information asymmetries (Cormier et al. 2010; Rossi and Harjoto 2020). Investors evaluate the company on the basis of the information it generates, both financial and non-financial. Disclosure of sustainability information contributes to a higher level of confidence, contributing to a higher level of trust and loyalty between investors and the firm (Atif and Ali 2021). Empirical evidence in previous literature has shown that this symmetry favours the availability of resources through borrowing and/or lower costs of borrowing (Atif and Ali 2021; Cheng et al. 2014; Cormier et al. 2011). According to Vivel-Búa et al. (2018), this availability of resources in better or easier conditions reduces the risk of failure. However, Habermann and Fischer (2021) indicate that agency theory as a justification for the relationship between default risk and sustainability is not helpful when considering the business cycle, i.e. prosperity versus crisis. This is in line with the evidence they found for the US, with the absence of a negative impact of sustainability on the default risk in good economic times, only existing in periods of crisis.

In summary, according to this theoretical framework, the first hypothesis to be tested in this research is as follows:

H1: Sustainability is negatively related to the default risk.

According to Habermann and Fischer (2021), the positive effect of sustainability on profitability is diluted over time and, by extension, also on the default risk. This approach is in line with institutional theory, which emphasizes the social dimension of firms, and establishes that their organisational structure is conditioned by internal and external factors in such a way that those belonging to the same field tend to resemble each other more and more as time goes by (Hannan and Freeman 1984). This isomorphism is related to three factors. First, pressure from the environment which, for example, through legislation, can contribute to business standardisation. Second, inertia and convergence to success, i.e. imitating successful companies, legitimising and generalising their patterns of action. Third, the regulatory framework at the level of training and professional practice of managers which generates similar “forms and styles” of action. In short, this theory establishes that companies converge with the patterns that characterise their environment, in such a way that, within the same area, they are homogenised at a structural and operational level. In this line, Brower and Dacin (2020) found that, in the period 1991–2008, US companies that adopted sustainability practices earlier generated a greater positive effect on their profitability and value than those that adopted them later, although over time the impact was diluted.

Finally, Habermann and Fischer (2021) also underline that sustainability can be conceived as a hypocritical behaviour in the company to only obtain short-term profits, which would increase the default risk in the medium and long term. Therefore, it is also important to consider the particularities of the time horizon being assessed. Internal stakeholders, e.g. employees, and external stakeholders, e.g. investors, may perceive dissonance between what the company claims to do in terms of sustainability and what it actually does (Carlos & Lewis, 2018). This would lead to a “punishment” for the company, which would erode its value and, by extension, increase its default risk.

Consequently, the second hypothesis to be tested in this investigation is:

H2: The impact of sustainability on default risk is different depending on the economic cycle.

In conclusion, and as a summary of this section, it can be stated that, while recognising the importance of sustainability in business activity, there is a line of academic literature that is still unexplored, at least sufficiently, and whose results are not conclusive regarding the impact of this variable on the default risk. This research aims to contribute to its development by analysing the non-financial and listed corporate sector in the Eurozone, testing the two hypotheses indicated above.

2.2 Sustainability in european corporate finance

As mentioned in previous sections, the present article assesses the effect of sustainability, proxied by ESG factors, on the default risk faced by European non-financial listed companies. In this section, two relevant questions in this regard are tackled: (1) What are the European regulations on corporate sustainability disclosure? (2) Given that most research has focused on non-financial U.S. companies, why do we consider it is worth analysing the specific case of European firms separately?

In relation to the first question, there are several international standards for the preparation and disclosure of non-financial sustainability information, and many initiatives are underway. Thus, the need to harmonise these standards has been expressed in different contexts, both at corporate and institutional level, and important efforts are currently being made. The independent international organisation known as the Global Reporting Initiative (GRI), a pioneer in promoting the disclosure of information on sustainability, joined forces in 2013 with the Carbon Disclosure Project (CDP), a benchmark organisation in terms of climate data, to align the parameters they consider in their reports. Subsequently, in 2019, the Corporate Reporting Dialogue was created, where the main providers of standards are represented in order to encourage a discussion in the interests of harmonisation. More recently, in mid-2021, the International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB) merged to form the Value Reporting Foundation (VRF). Also, at the end of 2021, the IFRS Foundation (International Financial Reporting Standard Foundation), a benchmark organisation dedicated to the development of international financial and non-financial reporting standards, announced the creation of a new board called the International Sustainability Standards Board (ISSB). This board will aim to develop a global platform for sustainability reporting standards, where the initiatives of the Climate Disclosure Standards Board (CDSB) and the VRF will be integrated in a coordinated manner. In September 2020, Measuring Stakeholder Capitalism Towards Common Metrics and Consistent Reporting of Sustainable Value Creation was published by the Big Four, i.e. the world’s largest consulting and accounting/auditing firms Deloitte, Ernest Young, KPMG and PricewaterhouseCoopers. They propose a metric based on four pillars: people, planet, prosperity and governance. In the opinion of the international metrics issuing bodies, this proposal integrates many of the indicators already proposed by them and used to date.

Focusing on Europe, it should be noted that the European Union (EU) published the Non-Financial Reporting Directive (NFRD) in 2014, which indicates what information on sustainability should be published, not representing a standard per se but accepting others developed by third parties. In this way, the aim was to promote the application of these metrics in Europe by making them mandatory. At the beginning of 2020, the EU decided to review this directive, creating a working group led by the European Financial Reporting Advisory Group (EFRAG). Its objective with this review is to define a set of recommendations on the sustainability standards to be used in the publication of information with the intention of regulating them in the future.

Regarding the second question, the main reason why the study of the European case deserves particular attention relies on the fact that there are remarkable differences in terms of sustainability adoption and practices between both major markets. Therefore, the impact of sustainability on default risk may also vary geographically. While European companies hold the leadership in the dissemination of sustainability and they are all equally committed to reporting on this subject, their North American counterparts generally show a lower degree of disclosure and they are less systematic in the dissemination of this information (Hartman et al. 2007; Fernández, Romero & Ruiz, 2014; Cai et al. 2016).

Not only the overall degree of corporate sustainability disclosure differs among markets, but also the most valued ESG dimensions and the specific practices implemented in each of them. Actually, environmental scores, and, therefore, the level of corporate disclosure regarding environmental activities, are significantly higher in European countries than in the U.S. (Peiró and Segarra 2013; Mondéjar, Peiró & Segarra, 2014; Segarra et al. 2016). These ratings follow a clear upward trend in Europe, while their increase is less pronounced in the U.S (Peiró and Segarra 2013). There are two factors that may be underpinning these results: (1) the significant prevalence of public concern on climate change issues in Europe as compared to the U.S (Pew Research Centre 2013; Gallego et al. 2017); and (2) the higher degree of regulation and commitment regarding greenhouse emissions, waste, recycle practices and eco-innovations promulgated in Europe (Peiró and Segarra 2013; Segarra et al. 2011, 2012).

Concerning the social dimension of ESG, European companies also show on average significantly higher scores as compared to those located in the U.S. Social responsibility has increased in Europe, while North America remains in a static position in this dimension (Peiró and Segarra 2013). As for the Corporate Governance component, the situation reverses. North American companies show higher scores, (Peiró and Segarra 2013). All these findings are in line with the results found by Kaiser (2020), who highlighted that European companies show on average higher scores in the environmental and social dimensions as opposed to the corporate governance component. The exact opposite happens in the U.S.

From the above statements, it is clear that there are remarkable differences in terms of ESG adoption and disclosure between Europe and North America, but where do these differences come from? Research has shown that country-level characteristics play a relevant role. In fact, the political, labour and cultural systems significantly affect companies’ ESG dissemination practices (Baldini et al. 2016). The lower harmony scores of the U.S. in contrast to Europe may partially explain its lower income adjusted country-median corporate social performance values (Cai et al. 2016). Another factor affecting corporate sustainability reporting is the regulatory framework. Europe has a higher level of regulation concerning sustainability dissemination practices than the U.S. Concretely, the previously mentioned Directive 2014/95/EU (of 22 October 2014) (Camilleri 2015; Coluccia et al. 2018; La Torre et al. 2018; García 2021), also known as the Non-Financial Reporting Directive (NFRD), determines the non-financial and diversity information that must be disclosed by certain large firms. (Corporate sustainability reporting, 2021). For its part, even though the U.S. signed guidelines of the OECD covering issues such as human rights, corruption, labour standards, the environment and other topics related to corporate behaviour (Hartman et al. 2007), it will not be until 2023 that the Securities exchange commission (SEC) will require publicly listed companies to submit, in addition to their Annual Reports, their Sustainability Reports (Cruz 2021).

Differences in terms of investors and consumers’ preferences also play an important role in explaining ESG disclosure. Evidence found by Amel-Zadeh and Serafeim (2018) shows that investors are more ESG aware in Europe than in the U.S., as they believe more strongly that engaging with firms can bring changes in the corporate sector concerned with ESG issues. In line with these conclusions, Duuren, Plantinga, & Scholtens (2016) argue that U.S.-based portfolio managers are sceptical about the benefits of responsible investing, whereas Europeans are more optimistic. These authors also highlight that most U.S.-based managers attach a lower weight to environmental and social factors, whereas they attach a high weight to the corporate governance component, as European investors. As for consumers’ preferences, research shows that European consumers are more willing than U.S. customers to support responsible businesses, as they are more concerned with the fact that legal and ethical standards are conformed. For their part, U.S. consumers value more corporate economic responsibilities (economic performance of the firm) (Maignan 2001).

3 Empirical analysis

3.1 Sample and variables

The sample considers all non-financial and listed companies in the Eurozone that score on the ESG metric, available in the Refinitiv Eikon database, and over the period 2004–2020. To avoid the influence of outliers, the procedure established by Billor et al. (2000) defined as blocked adaptive computationally efficient outlier nominators was performed. 60 observations out of the 7,050 initially identified were detected as potential outliers and were eliminated. Consequently, the final sample consists of 6,990 observations (990 firms) over the whole period.

The default risk is measured through the dependent variable Altman Z-score (Z-SCORE), that is a very popular measure in previous empirical research (Vivel-Búa et al. 2018). A higher Altman Z-score implies lower default risk. Specifically, if a firm obtains a score below 1.88 it indicates that it is close to bankruptcy, while if the value is above 2.99 it is less likely. A score in the range 1.88–2.99 is considered a questionable business situation. According to Habermann and Fischer (2021), using the Z-SCORE as a proxy for default risk has two advantages. First, it is a proxy that previous researchers have demonstrated its high accuracy and quality in predicting default risk (Altman et al. 2016); second, it facilitates the construction of a large and robust sample since it is a variable available for almost all listed companies.

Focusing on sustainability-related variables, this paper uses Refinitiv ESG scores available in the Refinitiv Eikon database. Compared to other ratings, Refinitiv ESG scores are less prone to selection bias and perform better in terms of variability and distribution (Habermann and Fischer 2021). Moreover, these scores cover 80% of global market capitalization and are based on publicly reported company data. All data is controlled and verified ensuring its standardization, comparability and reliability.

Refinitiv ESG score is constructed considering ten categories grouped into three dimensions: Environment, Social, and Governance (Table 1). It should be noted that these dimensions were considered in the empirical study at the aggregate level (ESG) and individually (E_SCORE, S_SCORE, G_SCORE). The scores are provided in the form of numbers ranging from 0 to 100. Therefore, the higher the value of the score, the better the company’s position in terms of sustainability. The environmental score refers to the company’s impact on the natural environment, including air, land and water, and considering entire ecosystems. The social score considers the company’s ability to build trust and loyalty with its staff, customers, and society using best management practices. Finally, the governance score measures a company’s systems and processes that ensure that its board members and executives act in the best long-term interests of its shareholders.

Finally, as control variables, we use a set of variables presented in Table 2, which were selected according to previous literature (Atif and Ali 2021) and were available in the Refinitiv Eikon database. Thus, with respect to size, Rommer (2005) refers to the liability of smallness to indicate that larger firms are more likely not to fail because, compared to small firms, they have production levels close to the minimum efficient volume in their sector of activity. Moreover, these firms have a higher level of diversification of activity, which acts as a hedge against risk in negative economic cycles. Finally, they have easier access to financial resources, tax benefits and qualified personnel. Consequently, the expected relationship between size and distance to default is positive.

In relation to profitability, this refers to the firm’s ability to generate profits in such a way that this availability of resources positively influences the distance to default. According to Esteve-Pérez and Mañez-Castillejo (2008), high profitability can also be a sign of greater efficiency and a better positioning of the firm in the market, both contributing to increase the distance to default. Liquidity, on the other hand, refers to the firm’s ability to meet its short-term debts and was already used in the first studies on default risk, being significant (Altman 1968; Ohlson 1980; Zmijewski 1984). Since then, liquidity has been included in almost all research that has analysed this aspect. The reason for considering it as a relevant variable is that many firms with liquidity problems subsequently go bankrupt, even if they are profitable from an operational point of view. Shapiro and Titman (1985) argue that failure to meet financial obligations due to liquidity problems eventually leads to insolvency situations with associated transaction costs. The indebtedness or financial structure of the firm is another popular variable in the previous literature on business failure, since it refers to long-term solvency and thus the ability to meet long-term liabilities, expecting a negative relationship with the distance to default. Finally, this empirical study considers the variable Price to Book which contributes to consider market information, and not only that of an accounting nature as in the previous variables. This variable is a proxy for growth opportunities so that a positive relationship with the distance to default is expected.

3.2 Descriptive analysis

Table 3 shows the descriptive statistics of the dependent variable (Z-SCORE) and the independent variables of the model. The mean value of the ESG variable is 52.338 with respect to a maximum value of 100. Considering the three ESG pillars, the highest mean value is found in the S_SCORE variable (55.705), which corresponds to the company, while the other two pillars, E_SCORE and G_SCORE, present very similar mean values and are close to 50. The average company has a size of 15,613 million euros and good financial health according to its average level of liquidity and profitability. Also, the average indebtedness is around 62.041 of its assets.

If we analyse the correlation matrix between the independent variables (Table 4), we observe that the ESG variable and the variable related to the three pillars (E_SCORE, S_SCORE, G_SCORE) are highly significantly correlated with size. This may influence the empirical study, i.e. the significance of the coefficients of these variables. For this reason, we have estimated the variance inflation factor (VIF) of a linear regression model for each of the proxy variables of the ESG scores. The results obtained confirm that there is no redundant information and therefore multicollinearity does not affect the significance of the coefficients.

3.3 Methodology

The methodology applied consists of estimating dynamic panel data models using the generalised method of moments (GMM). Specifically, these models are dynamic because they include lags of the explained variable (Arellano and Bond 1991). Thus, the results obtained are robust to unobservable heterogeneity and possible endogeneity problems (Arellano and Bover 1995; Arellano 2003). Moreover, these models reduce the effects of multicollinearity and improve the efficiency of the estimates (Baltagi 2015), compared to other GMM estimators such as the one proposed by Anderson and Hsiao (1982). It should also be noted that this methodology is especially designed for analysis with a large number of firms in a short time period and where the independent variables are not strictly exogenous, but are correlated with the errors, as in this research (Roodman 2009a, b).

The expression of the model to be estimated is:

Where i represents firm and t represents each year.

It has been decided to use a two-stage estimate because it is more asymptotic efficient than one step using the covariance matrix Windmeijer’s finite-sample correction for the two-step covariance matrix (Windmeijer 2005). To avoid problems of over-identification, one instrument for each variable and lag distance was considered (Arellano and Bover 1995).

Since it is difficult to find good contemporaneous instrumental variables because of the correlation with the disturbance, the lags of the variables are used. This selection of instrumental variables based on the orthogonal conditions that exist between the lags of the explanatory variables improves the estimation efficiency with respect to other GMM estimators such as the estimator proposed by Anderson and Hsiao (1982). To keep sample size and the lagged dependent variable in the model, the instruments were considered from 2003 instead of 2004. The Sargan test and the Hansen test have been carried out as a way of testing for possible specification problems. To analyse the existence of first and second order autocorrelation, the Arellano and Bond (1991) test is used, so the absence of autocorrelation of order 1 or the presence of autocorrelation of order 2 points potential misspecification errors in the model. The regressors are considered strictly exogenous, with the exception of the lag variable. If first order autocorrelation is detected the model is estimated considering the regressor as not strictly exogenous, so the second and following lags are included as instruments, while if second order autocorrelation is detected the second lag of dependent variable is included in the model.

Finally, although the models are estimated for the overall study period, i.e. 2004–2020, it should also be noted that three sub-periods are considered in order to assess the robustness of the results and to consider three different socio-economic environments: 2004–2007 (pre-crisis), 2008–2012 (crisis), 2013–2019 (post-crisis). The first sub-period (2004–2007) was marked by the economic boom. The Gross Domestic Product (GDP), which is the most widely used indicator to measure economic activity, grew at an annual rate of between 1% and 4% in the European Union during these years. In the second sub-period (2008–2012), the European economy was hit hard by the financial crisis, with GDP falling by more than 4% in 2009 and again in 2012. The last sub-period of analysis (2013–2019) was marked by gradual economic recovery, with annual GDP growth rates close to 2%. Although some European countries were affected to a greater extent, it is possible to state that, in general, a similar pattern was observed for the Eurozone as a whole (Eurostat 2021). The year 2020 is not included in the time division by sub-periods because the SARS-CoV pandemic started in that year and has lasted until today, which could distort the characterisation of this sub-period as a time of economic recovery after the 2008 crises.

Finally, due to the high linear correlation identified in the descriptive analysis between the ESG and SIZE variables, the empirical study has considered the inclusion of an interaction term to isolate the individual and joint effect between both variables.

3.4 Results

Tables 5, 6, 7 and 8 show the results obtained considering the Z-SCORE as the dependent variable, and sustainability measured through the ESG score both at the aggregate level (Table 5) and individually for each pillar (Tables 6, 7 and 8). The first estimate (GLOBAL) was made for the total time period, i.e. 2004–2020, and the other three estimates considering the three sub-periods, 2004–2007 (PRE-CRISIS), 2008–2012 (CRISIS) and 2013–2019 (POST-CRISIS).

The results obtained in Table 5 indicate that the default risk and sustainability are negatively related, i.e. the higher the ESG variable of the company, the higher its Z-SCORE. This, therefore, confirms H1. This evidence is also found for US companies by other authors such as Atif and Ali (2021), Boubaker et al. (2020), Cooper and Uzun (2019), and Lin and Dong (2018). However, this result does not hold for the PRE-CRISIS sub-period in the estimated models for the Environment (Table 6) and Governance pillars (Table 8) where no significant relationship is found between both variables (Z-SCORE and ESG). This relationship between these variables is only significant in the model estimated for the social pillar during the PRE-CRISIS period. This could be related to the popularity of Corporate Social Responsibility (CSR) in companies in those years, i.e. the social dimension of their activity, and ESG criteria were not yet part of corporate plans. In fact, at the European level, Shahrour et al. (2021) found that CSR mitigates the probability of default in the Eurozone, especially during periods of crisis, which reinforces the evidence obtained in this research also focused on the European market but considering such a popular and valued metric in the financial environment as the ESG Score from Refinitiv Eikon database.

Consequently, it could be affirmed that the economic environment conditions the relationship between sustainability and the default risk but only when we consider sustainability individually through each of its three dimensions, confirming H2. This result would be in line with the evidence obtained by Habermann and Fischer (2021) in the US non-financial sector. As discussed in the Framework, these authors found that, in a period of economic stability or boom, sustainability does not contribute significantly to the default risk. Business investment in sustainability is likely to be higher in this favourable economic environment so that the costs they assume outweigh the benefits they might gain in the short term. However, this should not discourage investment in sustainability since, in times of economic instability or crisis, sustainability does contribute to a lower default risk, generating a break-even point with respect to costs (Boubaker et al. 2020; Cooper and Uzun 2019).

The interaction variable ESG*SIZE shows a negative sign, so the impact of an improvement in ESG score decreases with increasing firm size or vice versa (Table 5). That means that the marginal effect of increasing ESG score, or SIZE varies by the level of these variables. In fact, the marginal effect will be the value of the individual coefficient plus the value of the coefficient in the interaction term multiplied by the value of both variables. Consequently, the negative sign means that the net effect of increasing ESG Score or SIZE could change depending on the base level. In the next section, we explore the role of size and ESG investment in more detail.

Finally, with respect to the control variables, these present the expected sign and most of them are significant in both the GLOBAL model and in the estimations by sub-periods and by ESG pillar.

3.5 The role of firm size and ESG investment on the default risk

As a consequence of the relationship found between SIZE and ESG with respect to the default risk in the previous empirical analysis, this section studies them in greater depth and the joint impact of both variables on the Altman Z-Score. It should be noted that the results presented in this section refer to the GLOBAL model, although they are maintained when we consider the models estimated for each economic cycle (PRE-CRISIS, CRISIS and POST-CRISIS).

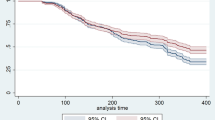

Figure 1 shows the impact of ESG and SIZE on the Z-SCORE considering different ESG values and SIZE tertiles. To do so, the impact of ESG and SIZE on the entire data sample was estimated using the results of the GLOBAL model. The sample was then divided into ten categories according to ESG score, and into three groups according to SIZE. The median and interquartile range of impact was then estimated. The results show that, while smaller and medium-sized companies show a positive net effect of a high ESG score, the opposite is true for larger companies. Thus, higher ESG performance values have a negative net effect on default risk.

To further explore the relationship between ESG and SIZE, Fig. 2 shows a violin plot of both variables, representing the distribution of the sample as a function of the SIZE variable and considering different ESG scores. The results show that the highest ESG scores are concentrated in the largest companies, with an uneven distribution, and corroborating the positive correlation between both variables observed in the descriptive analysis. Thus, in the highest ESG scores it is very difficult to find smaller companies, which is particularly striking from 80 ESG points onwards.

Figure 3 shows the estimated impact on the Z-SCORE (Y-axis) of the variables SIZE (Z-axis) and ESG (X-axis) using the GLOBAL model and all observations used in the model estimation. The results indicate that an increase in ESG reduces the default risk, i.e. it increases the Z-SCORE for all firms except those with a very large size. It is worth mentioning that for very high ESG scores, the number of observations for smaller firms is practically non-existent. These results would indicate that the extra ESG investment effort of larger firms (SIZE) may not be rewarded by an increase in their Z-SCORE. Therefore, above a certain SIZE, the company’s effort to improve its ESG score not only does not increase, but also reduces the distance to default.

Finally, all possible interaction results between the SIZE and ESG variables have been estimated using the GLOBAL model and the results are plotted in Fig. 4. Each line in the contour plot represents the same impact value on the Z-SCORE. It should be noted that some combinations have not been observed in the sample and could be totally atypical and unrealistic as, for example, no ESG values higher than 85 points have been observed for companies in the first quartile by size. However, Fig. 4 allows for further interpretation of the results obtained. Thus, it can be seen that, in general, an increase in ESG score increases the distance to default for the vast majority of companies. Focusing on the 20% of observations of larger firms (80th percentile), which are also those with higher ESG scores, the results seem to indicate the opposite, i.e. that a decrease in their ESG score would lead to an increase in the Z-SCORE. In our view, the fact that companies have frontloaded their ESG investments or that they have institutional investors that demand a higher commitment to ESG criteria could justify why these companies choose to achieve higher ESG scores, i.e. invest more in sustainability, than what would be optimal according to the models and from a business default risk perspective.

4 Conclusions

The objective of this research has been to analyse the impact of ESG factors on the default risk considering the Eurozone and the period 2004–2020. The study of the sustainability-default risk binomial is relevant because it can contribute to a greater and better adoption of “sustainable” practices and, at the same time, consolidate this type of behaviour. However, to our knowledge, very few studies have analysed these variables jointly and, for the most part, they have referred to the US market.

The current pandemic has helped factors such as sustainability, digitalisation and operational flexibility, among others, which were already identified in companies’ strategic plans, to achieve greater prominence. Thus, their implementation and corporate development has been accelerated, as they are more than necessary conditions for the recovery and positive evolution of companies, especially after the upturn in business bankruptcies generated by the recent COVID-19 pandemic.

Focusing on sustainability, ESG factors have become popular in recent years not only in the markets but also in society, with an increasing demand for this type of information in order to make investment and debt decisions. In fact, many investment funds have demanded and even required companies to publish this type of information alongside their traditional economic and financial reports. Today, companies must not only be profitable, showing good financial health, but must also be committed to their environment, considering factors such as the environment, society and corporate governance.

The results obtained confirm that investment in sustainability reduces the default risk. However, this relationship could be influenced by the economic cycle when we consider each ESG pillar in isolation in the empirical analysis. Specifically, considering a period of economic and social stability such as 2004–2007, sustainability does not have a significant impact on default risk in the Environment and Governance pillars. The negative relationship between sustainability and default risk is only maintained in the social pillar, perhaps due to the rise of CSR in those years when ESG criteria had not yet reached a notable popularity among companies. This is in line with the evidence obtained in the US market by Habermann and Fischer (2021). It is likely that the increased investment in sustainability that companies make during these economic boom periods generates a significant amount of costs that cannot pay off in the short term. However, as this research shows, in periods of crisis, there is a positive effect of this corporate commitment to sustainability as we find that the company’s sustainability score reduces the default risk.

Another relevant result found in this research is that the return on investment in sustainability is conditional on the size of the company. Specifically, the impact of an improvement in the ESG score decreases as the size of the firm increases. Thus, sustainability reduces the distance to default beyond a certain firm size. However, companies may decide to continue investing in sustainability for other reasons, such as access to institutional investors who make sustainability investment imperative, reduced cost of financing due to a certain sustainability score, etc. In this way, the higher default risk could be compensated by access to cheaper and/or higher volume resources.

In summary, this research has contributed to identifying empirical evidence on the relationship between sustainability and default risk in the Eurozone over a recent and extended period of time. In doing so, it strengthens previous literature that has focused on the US despite the fact that there are notable differences between European and US companies in the implementation of sustainability practices and their disclosure. Moreover, it has not only been important to explore the situation in the Eurozone market, but also to underline that there are particularities that need to be taken into account in an empirical study of this nature. In particular, we refer to the economic cycle and the size of the company. In fact, as future lines of research, it would be interesting to study these variables in greater depth by extending the focus of analysis to SMEs and broadening the time horizon to include recent years after the pandemic. Moreover, it would also be interesting to further explore the role of firm age as previous literature has identified this variable as an important determinant of default risk. In fact, one limitation of this research is that it does not study the effect of this variable in depth because we did not have information for a large number of companies.

Finally, the results of this research have important implications. They contribute to assessing the potential of information and, consequently, of corporate sustainability performance for investment appraisal and, thus, facilitate the availability of resources for those companies with a better position, actual and potential, in this area. Indeed, from a creditor perspective, this research helps creditors to consider the sustainability of potential borrowers in their credit analysis. At the policy level, the evidence obtained can facilitate actions that promote sustainable behaviour in companies and their information dissemination.

Data Availability

The manuscript has no associate data.

References

Altman EI (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Finance 23(4):589–609. https://doi.org/10.1111/j.1540-6261.1968.tb00843.x

Altman EI, Iwanicz-Drozdowska M, Laitinen EK, Suvas A (2016) Financial distress prediction in an international context: a review and empirical analysis of Altman’s zscore model. J Int Financial Manage Acc 28(2):131–171. https://doi.org/10.1111/jifm.12053

Amel-Zadeh A, Serafeim G (2018) Why and how investors use ESG information: evidence from a global survey. Financial Anal J 74(3):87–103. https://doi.org/10.2469/faj.v74.n3.2

Anderson TW, Hsiao C (1982) Formulation and estimation of dynamic models using panel data. J Econ 18(1):47–82. https://doi.org/10.1016/0304-4076(82)90095-1

Arellano M (2003) Discrete choices with panel data. Investigaciones económicas 27(3):423–458

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277. https://doi.org/10.2307/2297968

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econ 68(1):29–51. https://doi.org/10.1016/0304-4076(94)01642-d

Atif M, Ali S (2021) Environmental, social and governance disclosure and default risk. Bus Strategy Environ 30(8):3937–3959. https://doi.org/10.1002/bse.2850

Baldini M, Maso LD, Liberatore G, Mazzi F, Terzani S (2016) Role of country- and firm-level determinants in environmental, social, and governance disclosure. J Bus Ethics 150(1):79–98. https://doi.org/10.1007/s10551-016-3139-1

Baltagi BH (2015) The Oxford handbook of panel data. Oxford Handbooks

Barro D, Basso A (2010) Credit contagion in a network of firms with spatial interaction. Eur J Oper Res 205(2):459–468

Beaver WH (1966) Financial ratios as predictors of failure. J Accounting Res 4:71–111. https://doi.org/10.2307/2490171

Billor N, Hadi AS, Velleman PF (2000) Bacon: blocked adaptive computationally efficient outlier nominators. Comput Stat Data Anal 34(3):279–298. https://doi.org/10.1016/s0167-9473(99)00101-2

Boubaker S, Cellier A, Manita R, Saeed A (2020) Does corporate social responsibility reduce financial distress risk? Econ Model 91:835–851. https://doi.org/10.1016/j.econmod.2020.05.012

Bouslah K, Kryzanowski L, M’Zali B (2018) Social performance and firm risk: impact of the financial crisis. J Bus Ethics 149(3):643–669. https://doi.org/10.1007/s10551-016-3017-x

Broadstock DC, Chan K, Cheng LTW, Wang X (2021) The role of ESG performance during times of financial crisis: evidence from covid-19 in China. Finance Res Lett 38:101716. https://doi.org/10.1016/j.frl.2020.101716

Brower J, Dacin PA (2020) An institutional theory approach to the evolution of the corporate Social performance – corporate financial performance relationship. J Manage Stud 57(4):805–836. https://doi.org/10.1111/joms.12550

Cai Y, Pan CH, Statman M (2016) Why do countries matter so much in corporate social performance? J Corp Finance 41:591–609. https://doi.org/10.1016/j.jcorpfin.2016.09.004

Camilleri MA (2015) Environmental, social and governance disclosures in Europe. Sustain Acc Manage Policy J 6(2):224–242. https://doi.org/10.1108/sampj-10-2014-0065

Carlos WC, Lewis BW (2018). Strategic silence: Withholding certification status as a hypocrisy avoidance tactic. Administrative Science Quarterly, 63(1), 130–169. https://doi.org/10.1177/0001839217695089

Cheng B, Ioannou I, Serafeim G (2014) Corporate social responsibility and access to finance. Strateg Manag J 35(1):1–23. https://doi.org/10.1002/smj.2131

Coluccia D, Fontana S, Solimene S (2018) Does institutional context affect CSR disclosure? A study on eurostoxx 50. https://doi.org/10.20944/preprints201806.0004.v1

Comunicarseweb (2020) BlackRock anuncia desinversiones para las empresas que no gestionen el riesgo climático [Press release]. https://www.comunicarseweb.com/noticia/blackrock-anuncia-desinversiones-para-las-empresas-que-no-gestionen-el-riesgo-climatico

Cooper E, Uzun H (2019) Corporate social responsibility and bankruptcy. Stud Econ Finance 36(2):130–153. https://doi.org/10.1108/sef-01-2018-0013

Cormier D, Ledoux MJ, Magnan M, Aerts W (2010) Corporate governance and information asymmetry between managers and investors. Corp Governance: Int J Bus Soc 10(5):574–589. https://doi.org/10.1108/14720701011085553

Cormier D, Ledoux MJ, Magnan M (2011) The informational contribution of social and environmental disclosures for investors. Manag Decis 49(8):1276–1304. https://doi.org/10.1108/00251741111163124

Cruz ARD (2021) SEC to make sustainability reporting mandatory by 2023 [Press release]. https://businessmirror.com.ph/2021/08/30/sec-to-make-sustainability-reporting-mandatory-by-2023/

Duuren EV, Plantinga A, Scholtens B (2016). ESG integration and the Investment Management Process: Fundamental Investing reinvented. Journal of Business Ethics, 138(3), 525–533. https://doi.org/10.1007/s10551-015-2610-8

Esteve-Pérez S, Mañez-Castillejo JA (2008) The resource-based theory of the firm and firm survival. Small Bus Econ 30(3):231–249. https://doi.org/10.1007/s11187-006-9011-4

European Commission (2021), September 15 Corporate sustainability reporting [Press release]. https://ec.europa.eu/info/business-economy-euro/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en

European Securities and Markets Authority (ESMA) (2021) ESMA Report on Trends, Risks and Vulnerabilities. https://www.esma.europa.eu/sites/default/files/library/esma50-165-1842_trv2-2021.pdf

Eurostat (2021) A macro-economic overview [Press release]. https://ec.europa.eu/eurostat/cache/digpub/european_economy/bloc-1a.html?lang=en

Fernandes GB, Artes R (2016) Spatial dependence in credit risk and its improvement in credit scoring. Eur J Oper Res 249(2):517–524

Fernández-Feijoo B, Romero S, Ruiz S (2014) Commitment to corporate social responsibility measured through global reporting Initiative Reporting: factors affecting the behavior of companies. J Clean Prod 81:244–254. https://doi.org/10.1016/j.jclepro.2014.06.034

Fitzpatrick PJ (1932) A comparison of the ratios of successful industrial enterprises with those of failed companies. The Accountants Publishing Company

Freeman RE (1984) Strategic management: a stakeholder approach. Pitman

Friede G, Busch T, Bassen A (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies. J Sustainable Finance Invest 5(4):210–233. https://doi.org/10.1080/20430795.2015.1118917

Gallego I, Ortas E, Vicente JL, Álvarez I (2017) Institutional constraints, stakeholder pressure and corporate environmental reporting policies. Bus Strategy Environ 26(6):807–825. https://doi.org/10.1002/bse.1952

García IM (2021) Corporate social reporting and assurance: the state of the art. Revista De Contabilidad 24(2):241–269. https://doi.org/10.6018/rcsar.409441

García R, Ariño MA, Canela MA (2010) Does social performance really lead to financial performance? Accounting for Endogeneity. J Bus Ethics 92(1):107–126. https://doi.org/10.1007/s10551-009-0143-8

Georgeson (2022) ESG Investment 7ª edition. https://content-assets.computershare.com/eh96rkuu9740/HT37u59VtbMAiW4aYR370/064607131f0e95f632c072f6ac45d882/Estudio-Observatorio-ESG-2022-def.pdf

Godfrey PC, Merrill CB, Hansen JM (2009) The relationship between corporate social responsibility and shareholder value: an empirical test of the risk management hypothesis. Strateg Manag J 30(4):425–445. https://doi.org/10.1002/smj.750

Habermann F, Fischer FB (2021) Corporate social performance and the likelihood of bankruptcy: evidence from a period of economic upswing. J Bus Ethics. https://doi.org/10.1007/s10551-021-04956-4

Hannan MT, Freeman J (1984) Structural inertia and organizational change. Am Sociol Rev 49(2):149–164. https://doi.org/10.2307/2095567

Hartman LP, Rubin RS, Dhanda KK (2007) The communication of corporate social responsibility: United States and European Union multinational corporations. J Bus Ethics 74(4):373–389. https://doi.org/10.1007/s10551-007-9513-2

Heracleous L, Werres K (2016) On the road to disaster: Strategic misalignments and corporate failure. Long Range Plann 49(4):491–506. https://doi.org/10.1016/j.lrp.2015.08.006

Kaiser L (2020) ESG integration: value, growth and momentum. J Asset Manage 21(1):32–51. https://doi.org/10.1057/s41260-019-00148-y

La Torre M, Sabelfeld S, Blomkvist M, Tarquinio L, Dumay J (2018) Harmonising non-financial reporting regulation in Europe. Meditari Account Res 26(4):598–621. https://doi.org/10.1108/medar-02-2018-0290

Limkriangkrai M, Koh SK, Durand RB (2017). Environmental, social, and governance (ESG) profiles, stock returns, and financial policy: Australian evidence. International Review of Finance, 17(3), 461–471. https://doi.org/10.1111/irfi.12101

Lin KC, Dong X (2018) Corporate social responsibility engagement of financially distressed firms and their bankruptcy likelihood. Adv Acc 43:32–45. https://doi.org/10.1016/j.adiac.2018.08.001

Maignan I (2001) Consumers’ perceptions of corporate Social Responsibilities: a cross-cultural comparison. J Bus Ethics 30(1):57–72. https://doi.org/10.1023/a:1006433928640

Martin D (1977) Early warning of bank failure. J Banking Finance 1(3):249–276. https://doi.org/10.1016/0378-4266(77)90022-x

Mellahi K, Wilkinson A (2004) Organizational failure: a critique of recent research and a proposed integrative framework. Int J Manage Reviews 5(1):21–41

Mondejar JA, Peiróo A, Segarra M (2014) The impact of Social policies´ Promotion and the moderating role of location on firm´ s Environmental Scores. Int J Environ Res 8(4):1005–1010. https://doi.org/10.22059/ijer.2014.793

Ohlson JA (1980) Financial ratios and the probabilistic prediction of bankruptcy. J Accounting Res 18(1):109–131. https://doi.org/10.2307/2490395

Park S, Song S, Lee S (2017) Corporate social responsibility and systematic risk of restaurant firms: the moderating role of geographical diversification. Tour Manag 59:610–620. https://doi.org/10.1016/j.tourman.2016.09.016

Peiró A, Segarra M (2013) Trends in ESG practices: differences and similarities across major developed markets. Sustain Appraisal: Quant Methods Math Techniques Environ Perform Evaluation 125–140. https://doi.org/10.1007/978-3-642-32081-1_6

Pew Research Centre (2013) Climate Change and Financial Instability Seen As Top Global Threats. https://www.pewresearch.org/global/2013/06/24/climate-change-and-financial-instability-seen-as-top-global-threats/

Rommer AD (2005) A comparative analysis of the determinants of financial distress in French, Italian and Spanish firms. (Danmarks Nationalbank Working Paper No. 26). https://www.econstor.eu/bitstream/10419/82324/1/486538389.pdf

Roodman D (2009a) A note on the theme of too many instruments. Oxf Bull Econ Stat 71(1):135–158. https://doi.org/10.1111/j.1468-0084.2008.00542.x

Roodman D (2009b) How to do xtabond2: an introduction to difference and system GMM in stata. The Stata Journal: Promoting Communications on Statistics and Stata 9(1):86–136. https://doi.org/10.1177/1536867x0900900106

Rossi F, Harjoto MA (2020) Corporate non-financial disclosure, firm value, risk, and agency costs: evidence from italian listed companies. RMS 14(5):1149–1181. https://doi.org/10.1007/s11846-019-00358-z

Sassen R, Hinze A, Hardeck I (2016) Impact of ESG factors on firm risk in Europe. J Bus Econ 86(8):867–904. https://doi.org/10.1007/s11573-016-0819-3

Segarra M, Peiró A, Miret L, Albors J (2011) Eco-innovación, una evolución de la innovación? análisis empírico en la Industria Cerámica española. Boletín De La Sociedad Española De Cerámica y Vidrio 50(5):253–260. https://doi.org/10.3989/cyv.332011

Segarra M, Merello P, Segura M, Peiró Á, Maroto C (2012) Proactividad medioambiental en la empresa: Clasificación Empírica y Determinación de Aspectos clave (Environmental proactiveness in the company: an empirical categorization and its key components). TEC Empresarial 6(1):35. https://doi.org/10.18845/te.v6i1.583

Segarra M, Peiró A, Mondéjar J, Sáez FJ (2016) Friendly environmental policies implementation within the company: an ESG ratings analysis and its applicability to companies’ environmental performance enhancement. Global NEST Journal 18(4):885–893. https://doi.org/10.30955/gnj.001553

Serino N, Kesh SK, Pranshu S (2020), August 20 Default, transition, and recovery: Corporate defaults in Europe hit an all-time high [Press Release]. https://www.spglobal.com/ratings/en/research/articles/200820-default-transition-and-recovery-corporate-defaults-in-europe-hit-an-all-time-high-11622576

Serrano C, Martín B (1993) Predicción de la crisis bancaria mediante el empleo de redes neuronales artificiales. Revista Española de Financiación y Contabilidad 22(74):153–176

Shahrour MH, Girerd-Potin I, Taramasco O (2021) Corporate social responsibility and firm default risk in the eurozone: a market-based approach. Managerial Finance 47(7):975–997. https://doi.org/10.1108/mf-02-2020-0063

Shapiro A, Titman S (1985) An Integrated Approach to Corporate Risk Management. Midl Corp Finance J 3:41–56

Smith RF, Winakor AH (1935) Changes in Financial Structure of Unsuccessful Industrial Corporations. Bureau of Business Research, Bulletin No. 51. Urbana: Univ. of Illinois Press

Vishwanathan P, van Oosterhout H, Heugens PP, Duran P, Essen M (2019) Strategic CSR: a concept building meta-analysis. J Manage Stud 57(2):314–350. https://doi.org/10.1111/joms.12514

Vivel-Búa M, Lado-Sestayo R (2023) Contagion effect on business failure: a spatial analysis of the hotel sector. J Hospitality Tourism Res 47(3):482–502. https://doi.org/10.1177/10963480211023804

Vivel-Búa M, Lado-Sestayo R, Otero-González L (2018) Risk determinants in the hotel sector: risk credit in msmes. Int J Hospitality Manage 70:110–119. https://doi.org/10.1016/j.ijhm.2017.11.004

Vivel-Búa M, Lado-Sestayo R, Otero-González L (2019) Influence of firm characteristics and the environment on hotel survival across msmes segments during the 2007–2015 period. Tour Manag 75:477–490. https://doi.org/10.1016/j.tourman.2019.06.015

Vives A (2021), January 2 ¿Cuántos esquemas/estándares de información sobre sostenibilidad se necesitan? Primera parte: ¿Cuántos hay? [Press release] https://www.agorarsc.org/cuantos-esquemas-estandares-de-informacion-sobre-sostenibilidad-se-necesitan-primera-parte-cuantos-hay/

Windmeijer F (2005) A finite sample correction for the variance of linear efficient two-step GMM estimators. J Econ 126(1):25–51. https://doi.org/10.1016/j.jeconom.2004.02.005

Zhao X, Murrell AJ (2016) Revisiting the corporate social performance-financial performance link: a replication of Waddock and graves. Strateg Manag J 37(11):2378–2388. https://doi.org/10.1002/smj.2579

Zmijewski ME (1984) Methodological issues related to the estimation of financial distress prediction models. J Accounting Res 22:59. https://doi.org/10.2307/2490859

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Vivel-Búa, M., Lado-Sestayo, R., Martínez-Salgueiro, A. et al. Environmental, social, and governance perfomance and default risk in the eurozone. Rev Manag Sci (2023). https://doi.org/10.1007/s11846-023-00702-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11846-023-00702-4