Abstract

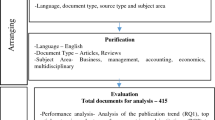

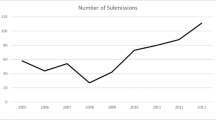

Over the past three decades, the banking industry has influenced by significant events such as deregulation, the advent of new technologies, the trend of globalization and financial crises. These events influenced the research areas of the field. This paper provides the study of an emerged timespan view of the development and evolution of banking literature from 1994 to 2017, during our explorations of literature from 1900 onward. It explores the changes, examines the conceptual orientations by the authors, and outlines the future study areas in the banking studies. We created a dataset of 8278 records of banking papers from Web of Science scientific citation indexing service. The results of scientometrics analysis of the articles indicate that banking literature falls into eight different coherent themes of study such as competition, debt, economies of scale, financial crises, credit, saving, banking in transition, and finance. Our findings show that among the eight emerged themes, the two study areas of financial crisis and competition are the youngest ones that will have a significant impact on the opening of future research avenues in banking studies.

Similar content being viewed by others

Notes

Industrial organization is a field that discusses the way firms compete with one another. It analysis the market and firm structure through the determinants of the firm, market organization and behavior of the firm (Cabral 2017).

Commercial papers and medium-term notes.

Privately-placed debt issues.

References

Adrian T, Ashcraft AB (2016) Shadow banking: a review of the literature. In: Banking crises. Palgrave Macmillan, London, pp 282–315

Allen L, Rai A (1996) Operational efficiency in banking: an international comparison. J Bank Finance 20(4):655–672

Altunbas Y, Evans L, Molyneux P (2001) Bank ownership and efficiency. J Money Credit Bank 33:926–954

Arencibia-Jorge R, Corera-Alvarez E, Chinchilla-Rodríguez Z, de Moya-Anegón F (2016) Scientific output of the emerging Cuban biopharmaceutical industry: a scientometric approach. Scientometrics 108(3):1621–1636

Baele L, De Jonghe O, Vander Vennet R (2007) Does the stock market value bank diversification? J Bank Finance 31(7):1999–2023

Barth JR, Caprio G Jr, Levine R (2004) Bank regulation and supervision: what works best? J Financ Intermed 13(2):205–248

Barth JR, Caprio G, Levine R (2008) Rethinking bank regulation: till angels govern. Cambridge University Press, Cambridge

Beccalli E (2007) Does IT investment improve bank performance? Evidence from Europe. J Bank Finance 31(7):2205–2230

Beccalli E, Anolli M, Borello G (2015) Are European banks too big? Evidence on economies of scale. J Bank Finance 58:232–246

Becht M, Bolton P, Röell A (2011) Why bank governance is different. Oxford Rev Econ Policy 27(3):437–463

Beck T, Demirgüç-Kunt A, Levine R (2006) Bank concentration, competition, and crises: first results. J Bank Finance 30(5):1581–1603

Beck T, De Jonghe O, Schepens G (2013) Bank competition and stability: cross-country heterogeneity. J Financ Intermed 22(2):218–244

Beltratti A, Stulz RM (2012) The credit crisis around the globe: why did some banks perform better? J Finance Econ 105(1):1–17

Benston GJ (1965) Branch banking and economies of scale. J Finance 20(2):312–331

Berger AN (1998) The efficiency effects of bank mergers and acquisition: a preliminary look at the 1990 s data. In: Bank mergers & acquisitions. Springer, Boston, pp 79–111

Berger AN, Bouwman CH (2009) Bank liquidity creation. Rev Financ Stud 22(9):3779–3837

Berger AN, Bouwman CH (2013) How does capital affect bank performance during financial crises? J Financ Econ 109(1):146–176

Berger AN, Humphrey DB (1991) The dominance of inefficiencies over scale and product mix economies in banking. J Monet Econ 28(1):117–148

Berger AN, Humphrey DB (1992) Megamergers in banking and the use of cost efficiency as an antitrust defense. Antitrust Bull 37(3):541–600

Berger AN, Humphrey DB (1997) Efficiency of financial institutions: international survey and directions for future research. Eur J Oper Res 98(2):175–212

Berger AN, Mester LJ (1997) Inside the black box: what explains differences in the efficiencies of financial institutions? J Bank Finance 21(7):895–947

Berger AN, Mester LJ (2003) Explaining the dramatic changes in performance of US banks: technological change, deregulation, and dynamic changes in competition. J Financ Intermed 12(1):57–95

Berger AN, Hancock D, Humphrey DB (1993a) Bank efficiency derived from the profit function. J Bank Finance 17(2–3):317–347

Berger AN, Hunter WC, Timme SG (1993b) The efficiency of financial institutions: a review and preview of research past, present and future. J Bank Finance 17(2–3):221–249

Berger AN, Kashyap AK, Scalise JM, Gertler M, Friedman BM (1995) The transformation of the US banking industry: what a long, strange trip it’s been. Brook Papers Econ Act 1995(2):55–218

Berger AN, Demsetz RS, Strahan PE (1999) The consolidation of the financial services industry: causes, consequences, and implications for the future. J Bank Finance 23(2–4):135–194

Berger AN, Espinosa-Vega MA, Frame WS, Miller NH (2005a) Debt maturity, risk, and asymmetric information. J Finance 60(6):2895–2923

Berger AN, Frame WS, Miller NH (2005b) Credit scoring and the availability, price, and risk of small business credit. J Money Credit Bank 37(2):191–222

Berger AN, Miller NH, Petersen MA, Rajan RG, Stein JC (2005c) Does function follow organizational form? Evidence from the lending practices of large and small banks. J Financ Econ 76(2):237–269

Berger AN, Hasan I, Zhou M (2009a) Bank ownership and efficiency in China: what will happen in the world’s largest nation? J Bank Finance 33(1):113–130

Berger AN, Klapper LF, Turk-Ariss R (2009b) Bank competition and financial stability. J Financ Serv Res 35(2):99–118

Berger AN, Molyneux P, Wilson JO (2014) The Oxford handbook of banking. Oxford University Press, Oxford

Bikker JA, Haaf K (2002) Measures of competition and concentration in the banking industry: a review of the literature. Econ Financ Modell 9(2):53–98

Blundell-Wignall A, Slovik P (2011) A market perspective on the European sovereign debt and banking crisis. OECD J Financ Mark Trends 2010(2):9–36

Bonin JP, Hasan I, Wachtel P (2005) Bank performance, efficiency and ownership in transition countries. J Bank Finance 29(1):31–53

Bonin J, Hasan I, Wachtel P (2010) Banking in transition countries. In: Berger AN, Molyneux P, Wilson JOS (eds) Oxford handbook of banking. Oxford University Press, Oxford

Bonin J, Hasan I, Wachtel P (2014) Banking in transition countries. J Bank Finance 29:31–53

Boot AW (2000) Relationship banking: what do we know? J Financ Intermed 9(1):7–25

Boyd JH, De Nicoló G (2005) The theory of bank risk taking and competition revisited. J Finance 60(3):1329–1343

Brealey R, Leland HE, Pyle DH (1977) Informational asymmetries, financial structure, and financial intermediation. J Finance 32(2):371–387

Brunnermeier MK (2009) Deciphering the liquidity and credit crunch 2007–2008. J Econ Perspect 23(1):77–100

Burger A, Moormann J (2010) Performance analysis on process level: benchmarking of transactions in banking. Int J Banking Account Finance 2(4):404–420

Cabral LM (2017) Introduction to industrial organization. MIT Press, Cambridge

Callon M, Law J, Rip A (1986) Mapping the dynamics of science and technology. Springer, Berlin

Calomiris CW, Kahn CM (1991) The role of demandable debt in structuring optimal banking arrangements. Am Econ Rev 81(3):497–513

Campbel TS, Kracaw WA (1980) Information production, market signaling, and the theory of financial intermediation. J Finance 35(4):863–882

Campello M, Graham JR, Harvey CR (2010) The real effects of financial constraints: evidence from a financial crisis. J Financ Econ 97(3):470–487

Caprio G, Laeven L, Levine R (2007) Governance and bank valuation. J Financ Intermed 16(4):584–617

Carruthers BG, Lamoreaux NR (2016) Regulatory races: the effects of jurisdictional competition on regulatory standards. J Econ Lit 54(1):52–97

Casu B, Girardone C (2006) Bank competition, concentration and efficiency in the single European market. Manch School 74:441–468

Chen C (2004) Searching for intellectual turning points: progressive knowledge domain visualization. Proc Nat Acad Sci 101(Suppl 1):5303–5310

Chen C (1999) Visualising semantic spaces and author co-citation networks in digital libraries. Inf Process Manag 35(3):401–420

Chen C (2006) CiteSpace II: detecting and visualizing emerging trends and transient patterns in scientific literature. J Assoc Inf Sci Technol 57(3):359–377

Chen C (2012) Predictive effects of structural variation on citation counts. J Assoc Inf Sci Technol 63(3):431–449

Chen C (2014) The citespace manual. Retrieved from http://cluster.ischool.drexel.edu/cchen/citespace/CiteSpaceManual.pdf. Accessed 20 April 2018

Chen C, Song I-Y, Yuan X, Zhang J (2008) The thematic and citation landscape of data and knowledge engineering (1985–2007). Data Knowl Eng 67(2):234–259

Chen C, Ibekwe-SanJuan F, Hou J (2010) The structure and dynamics of cocitation clusters: a multiple-perspective cocitation analysis. J Assoc Inf Sci Technol 61(7):1386–1409

Claessens S, Laeven L (2004) What drives bank competition? Some international evidence. J Money Credit Bank 36(3):563–583

Claessens S, Demirgüç-Kunt A, Huizinga H (2001) How does foreign entry affect domestic banking markets? J Bank Finance 25(5):891–911

Courchane M, Nickerson D, Sullivan R (2002) Investment in internet banking as a real option: theory and tests. J Multinatl Financ Manag 12(4–5):347–363

Davies R, Tracey B (2014) Too big to be efficient? The impact of implicit subsidies on estimates of scale economies for banks. J Money Credit Bank 46(s1):219–253

Degryse H, Ongena S (2006) Competition and regulation in the banking sector: a review of the empirical evidence on the sources of bank rents. In: Boot AWA, Thakor A (eds) Handbook of financial intermediation and banking. Elsevier, Amsterdam

Degryse H, Kim M, Ongena S (2009) Microeconometrics of banking: methods, applications, and results. Oxford University Press, Oxford

Demirgüç-Kunt A, Detragiache E (1998) The determinants of banking crises in developing and developed countries. Staff Papers 45(1):81–109

Demirgüç-Kunt A, Huizinga H (2010) Bank activity and funding strategies: the impact on risk and returns. J Financ Econ 98(3):626–650

Deng S, Elyasiani E (2008) Geographic diversification, bank holding company value, and risk. J Money Credit Bank 40(6):1217–1238

DeYoung R (2010) Banking in the United States. In: The Oxford Handbook of Banking, Oxford University Press, Oxford

DeYoung R, Lang WW, Nolle DL (2007) How the Internet affects output and performance at community banks. J Bank Finance 31(4):1033–1060

DeYoung R, Evanoff DD, Molyneux P (2009) Mergers and acquisitions of financial institutions: a review of the post-2000 literature. J Financ Serv Res 36(2):87–110

Diamond DW (1984) Financial intermediation and delegated monitoring. Rev Econ Stud 51(3):393–414

Diamond DW (1991) Monitoring and reputation: the choice between bank loans and directly placed debt. J Polit Econ 99(4):689–721

Dick AA, Hannan TH (2010) Competition and antitrust in banking. In: Berger AN, Molyneux P, Wilson JOS (eds) Oxford handbook of banking. Oxford University Press, Oxford

Fama EF (1985) What’s different about banks? J Monetary Econ 15(1):29–39

Frame WS (2010) Technological change, financial innovation, and diffusion in banking. DIANE Publishing, Darby

Freixas X, Rochet JC (1997) Microeconomics of banking. MIT Press Books, Cambridge

Fries S, Taci A (2005) Cost efficiency of banks in transition: evidence from 289 banks in 15 post-communist countries. J Bank Finance 29(1):55–81

Goddard J, Wilson JO (2009) Competition in banking: a disequilibrium approach. J Bank Finance 33(12):2282–2292

Goddard J, Molyneux P, Wilson J (2001) European banking. Wiley, Chichester

Goddard J, Molyneux P, Wilson JO, Tavakoli M (2007) European banking: an overview. J Bank Finance 31(7):1911–1935

Goddard J, Molyneux P, Wilson JO (2010) Banking in the European Union. In: The Oxford handbook of banking, second edition. Oxford University Press, pp 807–843

Gupta R, Gupta B, Kumar A (2017) Mobile banking: a of global scientometric assessment publications output during 2007–16. Int J Inf Dissem Technol 7(2):128

Hanafizadeh P, Keating BW, Khedmatgozar HR (2014) A systematic review of Internet banking adoption. Telemat Inf 31(3):492–510

Hannan TH (1991) Foundations of the structure-conduct-performance paradigm in banking. J Money Credit Bank 23(1):68–84

Hannan T, McDowell J (1984a) Market concentration and the diffusion of new technology in the banking industry. Review Econ Stat 66(4):686–691

Hannan T, McDowell J (1984b) The determinants of technology adoption: the case of the banking firm. RAND J Econ 15(3):328–335

Hasan I, Marton K (2003) Development and efficiency of the banking sector in a transitional economy: Hungarian experience. J Bank Finance 27(12):2249–2271

Haubrich JG (1989) Financial intermediation: delegated monitoring and long-term relationships. J Bank Finance 13(1):9–20

Hernández-Murillo R, Llobet G, Fuentes R (2010) Strategic online banking adoption. J Bank Finance 34(7):1650–1663

Hughes JP, Mester LJ (2010) Efficiency in banking: theory, practice, and evidence. In: The Oxford handbook of banking, second edition, Oxford University Press, pp 463–485

Inderst R, Mueller HM (2008) Bank capital structure and credit decisions. J Financ Intermed 17:295–314

Index F. T. B. C. (2015). FT Bowen Craggs Index

Ivashina V, Scharfstein D (2010) Bank lending during the financial crisis of 2008. J Financ Econ 97(3):319–338

Jiménez G, Saurina J (2006) Credit cycles, credit risk, and prudential regulation. Int J Central Bank 2:65–98

Jiménez G, Lopez JA, Saurina J (2013) How does competition affect bank risk-taking? J Financ Stab 9(2):185–195

Jones KD, Critchfield T (2005) Consolidation in the US banking industry: is the long, strange trip about to end. FDIC Bank Rev 17:31

Kashyap AK, Stein JC (2000) What do a million observations on banks say about the transmission of monetary policy? Am Econ Rev 90(3):407–428

Keeley MC (1990) Deposit insurance, risk, and market power in banking. Am Econ Rev 1183–1200

Khan GF, Wood J (2015) Information technology management domain: emerging themes and keyword analysis. Scientometrics 105(2):959–972

Kim MC, Chen C (2015) A scientometric review of emerging trends and new developments in recommendation systems. Scientometrics 104(1):239–263

Kirzner IM (2002) The meaning of the market process: essays in the development of modern Austrian economics. Routledge, Abingdon

Krampen G (2016) Scientometric trend analyses of publications on the history of psychology: is psychology becoming an unhistorical science? Scientometrics 106(3):1217–1238

Kroszner RS, Laeven L, Klingebiel D (2007) Banking crises, financial dependence, and growth. J Financ Econ 84(1):187–228

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny RW (1997) Legal determinants of external finance. J Finance 53:1131–1150

La Porta R, Lopez-de-Silanes F, Shleifer A (2002) Government ownership of banks. J Finance 57(1):265–301

Laeven L, Levine R (2009) Bank governance, regulation and risk taking. J Financ Econ 93(2):259–275

Leon F (2015) Measuring competition in banking: a critical review of methods. Working Papers, HAL. (No halshs-01015794)

Lerner A (1995) The concept of monopoly and the measurement of monopoly power. In: Essential readings in economics. Palgrave, London, pp 55–76

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality and causes. J Monet Econ 46(1):31–77

Leydesdorff L (2005) Similarity measures, author cocitation analysis, and information theory. J Assoc Inf Sci Technol 56(7):769–772

Leydesdorff L, Rafols I (2009) A global map of science based on the ISI subject categories. J Assoc Inf Sci Technol 60(2):348–362

Lin X, Zhang Y (2009) Bank ownership reform and bank performance in China. J Bank Finance 33(1):20–29

Liu H, Molyneux P, Wilson J (2013) Competition in banking: measurement and interpretation. Edward Elgar Publishing, pp 197–215

Masciandaro D, Quintyn M (2016) The governance of financial supervision: recent developments. J Econ Surv 30(5):982–1006

Mian AR, Sufi A (2009) The consequences of mortgage credit expansion: evidence from the US mortgage default crisis. Quart J Econ 124:1449–1496

Micco A, Panizza U, Yanez M (2007) Bank ownership and performance. Does politics matter? J Bank Finance 31(1):219–241

Mitchell K, Onvural NM (1996) Economies of scale and scope at large commercial banks: evidence from the Fourier flexible functional form. J Money Credit Bank 28(2):178–199

Morris SA, Yen G, Wu Z, Asnake B (2003) Timeline visualization of research fronts. J Assoc Inf Sci Technol 54(5):413–422

Nickerson D, Sullivan RJ (2003) Financial innovation, strategic real options and endogenous competition: theory and an application to Internet banking. Federal Reserve Bank of Kansas City Payments System Research Working Paper PSR WP, 03-01

Panzar JC, Rosse JN (1982) Structure, conduct, and comparative statistics. Bell Telephone Laboratories, Murray Hill

Panzar JC, Rosse JN (1987) Testing for "Monopoly" equilibrium. J Indust Econ 35(4):443–456

Petersen MA, Rajan RG (1994) The benefits of lending relationships: evidence from small business data. J Finance 49(1):3–37

Petersen MA, Rajan RG (2002) Does distance still matter? The information revolution in small business lending. J Finance 57(6):2533–2570

Popov A, Udell GF (2012) Cross-border banking, credit access, and the financial crisis. J Int Econ 87(1):147–161

Porta RL, Lopez-de-Silanes F, Shleifer A, Vishny RW (1998) Law and finance. J Polit Econ 106(6):1113–1155

Pulley LB, Braunstein YM (1992) A composite cost function for multiproduct firms with an application to economies of scope in banking. Rev Econ Stat 74(2):221–230

Rajan RG, Zingales L (1998) Power in a theory of the Firm. Q J Econ 113(2):387–432

Reinhart CM, Rogoff KS (2011) From financial crash to debt crisis. Am Econ Rev 101(5):1676–1706

Rotolo D, Rafols I, Hopkins MM, Leydesdorff L (2017) Strategic intelligence on emerging technologies: scientometric overlay mapping. J Assoc Inf Sci Technol 68(1):214–233

Saloner G, Shepard A (1992) Adoption of technologies with network effects: an empirical examination of the adoption of automated teller machines. National Bureau of Economic Research

Santomero AM, Eckles DL (2000) The determinants of success in the new financial services environment: now that firms can do everything, what should they do and why should regulators care? Federal Reserve Bank of New York. Econ Policy Rev 6:11–23

Santos JA (2001) Bank capital regulation in contemporary banking theory: a review of the literature. Financ Mark Inst Instr 10(2):41–84

Sapienza P (2002) The effects of banking mergers on loan contracts. J Finance 57(1):329–367

Small H (1973) Co-citation in the scientific literature: a new measure of the relationship between two documents. J Assoc Inf Sci Technol 24(4):265–269

Small H, Greenlee E (1986) Collagen research in the 1970s. Scientometrics 10(1–2):95–117

Small H, Sweeney E, Greenlee E (1985) Clustering the science citation index using co-citations. II. Mapping science. Scientometrics 8(5–6):321–340

Stein JC (2002) Information production and capital allocation: decentralized versus hierarchical firms. J Finance 57(5):1891–1921

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Stiroh KJ (2004) Diversification in banking: is noninterest income the answer? J Money Credit Bank 36:853–882

Sullivan R, Wang Z (2005) Internet banking: an exploration in technology diffusion and impact. Federal Reserve Bank of Kansas City Payments System Research Working Paper, 05–05

Tsoulfidis L (2011) Classical vs. neoclassical conceptions of competition. Discussion paper series 2011_11, Department of Economics, University of Macedonia

Vidgen R, Henneberg S, Naudé P (2007) What sort of community is the European conference on information systems? A social network analysis 1993–2005. Eur J Inf Syst 16(1):5–19

Vives X (2001) Competition in the changing world of banking. Oxf Rev Econ Policy 17(4):535–547

Waltman L, van Eck NJ, Noyons EC (2010) A unified approach to mapping and clustering of bibliometric networks. J Informetr 4(4):629–635

White HD, McCain KW (1998) Visualizing a discipline: an author co-citation analysis of information science, 1972–1995. J Am Soc Inf Sci 49(4):327–355

Wilson JO, Casu B, Girardone C, Molyneux P (2010) Emerging themes in banking: recent literature and directions for future research. Br Account Rev 42(3):153–169

World Bank Data (2018) Individuals using the internet (% of population). Retrieved from World Bank Data: https://data.worldbank.org/indicator/IT.NET.USER.ZS. Accessed 20 April 2018

Zaher TS, Kabir Hassan M (2001) A comparative literature survey of Islamic finance and banking. Financ Mark Inst Instr 10(4):155–199

Zhao D, Strotmann A (2008) Evolution of research activities and intellectual influences in information science 1996–2005: introducing author bibliographic-coupling analysis. J Assoc Inf Sci Technol 59(13):2070–2086

Zhao T, Casu B, Ferrari A (2010) The impact of regulatory reforms on cost structure, ownership and competition in Indian banking. J Bank Finance 34(1):246–254

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Comprehensive query used to extract documents from Web of Science (WoS) through advanced search; resulted in extracting 12,417 documents as of December 23, 2017

ti = (bank OR Banking) AND WC = (ECONOMICS OR BUSINESS FINANCE OR BUSINESS OR MANAGEMENT OR POLITICAL SCIENCE OR INTERNATIONAL RELATIONS OR LAW OR COMPUTER SCIENCE CYBERNETICS OR OPERATIONS RESEARCH MANAGEMENT SCIENCE OR COMPUTER SCIENCE INFORMATION SYSTEMS OR COMPUTER SCIENCE ARTIFICIAL INTELLIGENCE OR MULTIDISCIPLINARY SCIENCES OR TELECOMMUNICATIONS OR COMPUTER SCIENCE INTERDISCIPLINARY APPLICATIONS OR SOCIAL SCIENCES MATHEMATICAL METHODS OR CULTURAL STUDIES OR INFORMATION SCIENCE LIBRARY SCIENCE OR PUBLIC ADMINISTRATION OR COMPUTER SCIENCE THEORY METHODS OR SOCIOLOGY OR SOCIAL SCIENCES INTERDISCIPLINARY OR COMPUTER SCIENCE HARDWARE ARCHITECTURE OR COMPUTER SCIENCE SOFTWARE ENGINEERING OR MATHEMATICS INTERDISCIPLINARY APPLICATIONS OR ETHICS OR INDUSTRIAL RELATIONS LABOR OR STATISTICS PROBABILITY OR SOCIAL ISSUES) AND SU = (BUSINESS ECONOMICS OR INFORMATION SCIENCE LIBRARY SCIENCE OR GOVERNMENT LAW OR COMPUTER SCIENCE OR SOCIOLOGY OR SOCIAL ISSUES OR INTERNATIONAL RELATIONS OR PUBLIC ADMINISTRATION OR EDUCATION EDUCATIONAL RESEARCH OR SOCIAL SCIENCES OTHER TOPICS OR SCIENCE TECHNOLOGY OTHER TOPICS OR TELECOMMUNICATIONS OR MATHEMATICAL METHODS IN SOCIAL SCIENCES) NOT ti = (filter* OR river OR “West bank” OR Soil* OR Medic* OR “Food bank” OR “Food banking” OR Milk OR “Cell bank” OR “Cell Banking” OR River* OR “Eye bank” OR “eye banking” OR “DNA bank” OR “DNA banking” OR DNA OR “Question bank” OR “question banking” OR “Seed bank” OR “seed banking” OR “Protein bank” OR “protein banking” OR “Item bank” OR “item banking” OR “Blood bank” OR “Blood banking” OR “Trauma bank” OR “trauma banking” OR “Data bank” OR “data banking” OR “Water bank” OR “water banking” OR “Biology” OR Carcin* OR Tissue OR “Cord bank” OR “cord banking” OR Cord* OR stem* OR “stem banking” OR “stem cell” OR Genet*) NOT WC = RELIGION NOT AU = NULL NOT AU = unknown* NOT IS = 9* |

The initial result is refined by LANGUAGES: (ENGLISH) AND DOCUMENT TYPES: (ARTICLE) | |

Indexes = SCI-EXPANDED, SSCI, A&HCI, ESCI Timespan = All years |

Appendix B

Top 5 landmark nodes across clusters identified based on burst strength

Cluster ID | Author(s) (year) | Title |

|---|---|---|

#0 | Laeven and Levine (2009) | Bank governance, regulation and risk taking |

Barth et al. (2004)a | Bank regulation and supervision: what works best? | |

Beck et al. (2006) | Small and medium-size enterprises: Access to finance as a growth constraint | |

Boyd and De Nicoló (2005)a | The theory of bank risk taking and competition revisited | |

Claessens and Laeven (2004) | What drives bank competition? Some international evidence | |

#1 | Petersen and Rajan (1994)a | The benefits of lending relationships: Evidence from small business data. |

Berger et al. (1995) | The transformation of the US banking industry: What a long, strange trip it’s been | |

Freixas and Rochet (1997) | Microeconomics of Banking | |

Keeley (1990) | Deposit insurance, risk, and market power in banking. | |

Diamond (1991)a | Monitoring and reputation: The choice between bank loans and directly placed debt | |

#2 | Berger and Humphrey (1997)a | Efficiency of financial institutions: International survey and directions for future research |

Berger and Mester (1997)a | Inside the black box: What explains differences in the efficiencies of financial institutions? | |

Claessens et al. (2001)a | How does foreign entry affect domestic banking markets? | |

Berger et al. (1999) | The consolidation of the financial services industry: Causes, consequences, and implications for the future. | |

Mitchell and Onvural (1996) | Economies of scale and scope at large commercial banks: Evidence from the Fourier flexible functional form | |

#3 | Beltratti and Stulz (2012) | The credit crisis around the globe: Why did some banks perform better? |

Berger and Bouwman (2013) | How does capital affect bank performance during financial crises? | |

Ivashina and Scharfstein (2010) | Bank lending during the financial crisis of 2008. | |

Brunnermeier (2009) | Deciphering the liquidity and credit crunch 2007–2008. | |

Demirgüç-Kunt and Huizinga (2010) | Bank activity and funding strategies: The impact on risk and returns | |

#4 | Berger et al. (2005b) | Does function follow organizational form? Evidence from the lending practices of large and small banks. |

Boot (2000) | Relationship banking: What do we know? | |

Kashyap and Stein (2000) | What do a million observations on banks say about the transmission of monetary policy? | |

Petersen and Rajan (2002) | Does distance still matter? The information revolution in small business lending | |

Stein (2002) | Information production and capital allocation: Decentralized versus hierarchical firms. | |

#5 | Berger et al. (1993a)a | The efficiency of financial institutions: A review and preview of research past, present and future. |

Berger and Humphrey (1991) | The dominance of inefficiencies over scale and product mix economies in banking | |

Berger et al. (1993b) | Bank efficiency derived from the profit function | |

Pulley and Braunstein (1992) | A composite cost function for multiproduct firms with an application to economies of scope in banking | |

Berger and Humphrey (1992) | Megamergers in banking and the use of cost efficiency as an antitrust defense | |

#7 | Bonin et al. (2005)a | Bank performance, efficiency, and ownership in transition countries. |

Fries and Taci (2005) | Cost efficiency of banks in transition: Evidence from 289 banks in 15 post-communist countries | |

Hasan and Marton (2003) | Development and efficiency of the banking sector in a transitional economy: Hungarian experience | |

Lin and Zhang (2009) | Bank ownership reform and bank performance in China | |

Bank ownership and efficiency in China: What will happen in the world’s largest nation? | ||

#8 | La Porta et al. (2002)a | Government ownership of banks |

Porta et al. (1998) | Law and finance | |

Rajan and Zingales (1998) | Power in a Theory of the Firm | |

La Porta et al. (1997) | Legal determinants of external finance | |

Levine et al. (2000) | Financial intermediation and growth: Causality and causes |

Rights and permissions

About this article

Cite this article

Hanafizadeh, P., Marjaie, S. Trends and turning points of banking: a timespan view. Rev Manag Sci 14, 1183–1219 (2020). https://doi.org/10.1007/s11846-019-00337-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-019-00337-4