Abstract

This study investigates the influence of top managers’ individual innovation behavior on firm-level innovation activities, specifically on exploration and exploitation. The influence of individual actions depends on managerial discretion, which is dependent on the ownership context of a business. Thus, this study explores how family ownership moderates the relationships between a top manager’s individual innovation behavior and firm-level exploration and exploitation. Based on a sample of 195 firms, of which 120 are family firms, our findings depict highly significant relationships between managers’ individual innovation behavior and firm-level exploration and exploitation innovation. Furthermore, we find differences regarding these relationships between family firms and their non-family counterparts. We contribute to literature showing that family firms provide a unique context for leveraging a top manager’s individual innovation behavior into firm-level exploration activities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Innovation, the bedrock of business “survival and growth” (Zahra and Covin 1994, p. 183), is an important phenomenon investigated at multiple levels (individual, team and organizational) and in several disciplines (Baregheh et al. 2009; Damanpour and Schneider 2006). At the individual level, the innovation behavior of organizational actors, be it managerial or non-managerial, is considered a fundamental driver of organizational innovation (Wu et al. 2014). At the firm-level, exploration and exploitation are two forms of organizational innovation crucial for a company’s prosperity (Lavie et al. 2010). These are two main activities among which organizations split their concentration and assets (Benner and Tushman 2003; Voss et al. 2008), and about which scholars underscore the need for their appropriate management for organizational longevity (Benner and Tushman 2002; de Visser and Faems 2015; Levinthal and March 1993).

Jung et al. (2008) observe that in spite of several factors seen to spur innovation at the organizational level including leadership (Mumford and Gustafson 1988), creative work environment (Amabile 1998), and organizational culture and climate (Mumford and Gustafson 1988), there is a paucity of studies examining the influence of top managers’ behavior on organizational innovation. Despite some contributions to the questions whether and how individual innovation behavior translates into company level outcomes several issues remain unclear resulting in calls for further investigations (de Visser and Faems 2015; Gupta et al. 2006). Especially, organizational characteristics are important determinants of the level of managerial discretion [the breath of options at a manager’s disposal during strategic decision making (Finkelstein and Boyd 1998)] which is decisive for the extent to which managerial behavior can be translated into to company level outcomes (Crossland and Hambrick 2011; Finkelstein and Boyd 1998; Hambrick and Finkelstein 1987). In this respect, previous research provides evidence that ownership structures are determinants of innovation outcomes at the company level. More specifically, there is substantial evidence that family owned businesses are more efficient in turning innovation inputs into innovation outputs (Duran et al. 2016; Matzler et al. 2015). Some studies however also found that performance can be hurt, when family firms promote CEOs based on family ties rather than on merit (Pérez-González 2006) or, as shown in a study that compares performance of private equity firms to non-private equity firms, that family firms run by external CEOs show high performance levels, as they have higher levels of management practices (Bloom et al. 2015).

In this study, we therefore investigate how family ownership interacts with the relationship between top managers’ innovation behavior and firm-level exploration–exploitation activities. Family firms provide high levels of discretion and autonomy to executives (Davis et al. 2010), and could be conducive contexts for managers exercising individual innovation behavior to ensue in firm-level innovation behaviors, especially relative to exploration and exploitation. Indeed, some scholars underscore the importance of innovation behavior research in family firms (e.g. Kraus et al. 2012) given their governance by “a unique set of norms, cultures, and processes that are not found in nonfamily firms” (Kraus et al. 2012, p. 89).

In testing our hypotheses, we use a dataset with information on 195 top managers of small and medium sized enterprises in Tyrol, Austria. We focus on the individual innovation behavior of top executives in SMEs as these executives have been shown to be an important influence on company innovativeness (de Visser and Faems 2015; Lefebvre and Lefebvre 1992) and more influential in small firms than in larger companies (de Visser and Faems 2015; Papadakis and Barwise 2002). Besides, Anderson et al. (2014) in their review of studies on individual innovation observe a marked absence of research on such actors.

Theoretically, our study extends the research exploring the effect of executives’ behavior on firm-level outcomes (Kraiczy et al. 2015; Ling et al. 2008) pertinent to multilevel analysis of innovation. It accentuates the effect of individual innovation behavior on firm-level innovation activities of exploration and exploitation and points to the importance of ownership structures for transforming individual executive behaviors into company level outcomes. Furthermore, we contribute to literature on family firms which studies the impact of top manager behavior on organizational outcomes. Tretbar et al. (2016) review outcomes of upper echelons research in family firms and make evident that innovation outcomes are largely neglected.

The remainder of the paper is as follows: First, we provide a theoretical background and draw on insights from upper echelons theory and literature on strategic orientations to develop our hypotheses and research model. Next, we test the theoretical model and report our empirical findings. Further, we present theoretical and managerial implications. Finally, we point out limitations and suggest opportunities for future research.

2 Theoretical background

Top managers’ behaviors and idiosyncrasies are deemed to have a bearing on organizational outcomes (Hambrick and Mason 1984). There have been efforts to elucidate firm-level innovation by studying top managers’ attributes or group demographics (Alexiev et al. 2010). These studies assume that executives and their dispositions are important determinants of firm innovation and some have concentrated on associating top management characteristics with firm-level outcomes of R&D spending (Barker and Mueller 2002), strategic decision making (Papadakis and Barwise 2002) and new product moves (Srivastava and Lee 2005). Others have looked at the link between managerial risk-taking propensity and organizational innovative behavior and performance (e.g. Kraiczy et al. 2015). Although in family business research the upper echelons perspective has been used to study organizational outcomes (Tretbar et al. 2016), little attention has been given to exploring the link between top management behavior and firm-level innovation activities specific to exploration and exploitation (de Visser and Faems 2015; Gupta et al. 2006). An important, yet overlooked, behavioral dimension is individual innovation behavior. It is defined as “the intentional creation, introduction and application of new ideas within a work role, group or organization, in order to benefit role performance, the group, or the organization” (Janssen 2000, p. 228). Individual innovation behavior can be expected to influence innovation outcomes at the company level. In their comprehensive level-of-analysis framework that reviews literature on individual, team, organizational, and multilevel innovation, Anderson et al. (2014) come to the conclusion that “there has been a marked absence of research into senior management team (SMT) innovation“ and that studies focusing on innovation behavior at this level seem to be highly valuable. Innovation behavior at the senior management level may be “robustly affecting organizational practices and the management of innovation processes in workplace settings” (p. 1321).

Exploration and exploitation is a widely adopted and highly relevant framework to categorize learning processes and innovation outcomes (Gupta et al. 2006). Exploration focuses on creating variety, developing new knowledge, and building pertinent competences for long-term durable success (March 1991). Thus‚ exploration is associated with autonomy, improvisation and chaos (Molina-Castillo et al. 2011; Yalcinkaya et al. 2007), radical change and experimentation that enable the formation of new relationships, products and services, and methods (Augusto and Coelho 2009). These may all be dependent on the attitude and behavior of top managers. Firms that engage in exploratory innovation pursue and develop new knowledge, and depart from existing practices (Menguc and Auh 2006) and tend to epitomize the values of their top managers (Webster 1988).

Contrastingly, exploitation is associated with value creation through existing or slightly modified competences (Voss et al. 2008), promoting routine-based and repetitive paths to organizational change (Molina-Castillo et al. 2011). It further builds on existing knowledge and allows organizations to realize the advantages of improvements. Exploitation enables the organization to handle resources more productively (Benner and Tushman 2003), leading to greater efficiency and innovation development (Molina-Castillo et al. 2011). Similarly to exploration, the exploitative activities of a firm may be inextricably linked to the behavior of its executives.

While there have been some attempts to address the above-mentioned gap, none seem to do so fully. For example, Alexiev et al. (2010) examined the association of executives’ advice seeking behavior with firm-level exploration, but not of exploitation. Kraiczy, et al. (2015) show that a CEO’s risk taking propensity triggers innovation. Moreover, de Visser and Faems (2015) inquired into the effect of CEO cognitive styles on exploration–exploitation activities. They show that these individual level exploration–exploitation behaviors influence organizational level innovation outcomes by determining R&D investment activities. Thus, there is evidence that organizational structures are decisive for translating individual level behavior to the company level.

Among others, ownership and governance structures influence managerial discretion and as a consequence transforming individual level behavior into company level outcomes (Crossland and Hambrick 2011; Finkelstein and Boyd 1998; Hambrick and Finkelstein 1987). It has been argued that family ownership may be related to managerial discretion (Plöckinger et al. 2016). Concerning company level innovation activities, previous research highlights that especially family owned companies seem to differ from other ownership structures. In family owned companies entrepreneurial activities are influenced by family related goals (Kallmuenzer et al. 2018). Furthermore, there is evidence that family firms are more efficient in turning innovation inputs into innovation outputs (Duran et al. 2016; Matzler et al. 2015). Family firms provide a very unique setting for managerial behavior (Hiebl 2012; Kraus et al. 2012). For instance, interpersonal trust plays a crucial role for family business governance (Senftlechner and Hiebl 2015). Furthermore, family firms are long-term oriented which provides managers with the freedom to pursue projects with outcomes distant in time like exploration activities (König et al. 2013).

Despite the importance of family businesses for the overall economy (Astrachan and Shanker 2003) and the evidence about the unique characteristics of family firms in terms of innovation activities and governance (Duran et al. 2016; Matzler et al. 2015; Senftlechner and Hiebl 2015), research investigating the role of executive behavior for company level innovation outcomes is lacking. One of the few exceptions is a study by Kraiczy et al. (2015). The authors show that a CEOs risk taking propensity in family firms is positively related to new product portfolio innovativeness.

Drawing on upper echelons theory (Hambrick 2007; Hambrick and Mason 1984) and the concept of managerial discretion (Hambrick and Finkelstein 1987), and applying them to organizational exploration and exploitation (March 1991), we develop hypotheses aiming at answering the following research questions. First, how are individual behavioral characteristics (more specifically individual innovation behavior) of top managers related to company level innovation activities (i.e. exploration and exploitation)? Second, do managerial behaviors have a stronger impact on exploration and exploitation orientation in family compared to non-family firms? By doing so, this paper extends research by showing how individual managerial innovation behavior impacts company level exploration and exploitation behavior in family firms as compared to non-family firms. Overall, examining the individual innovation behavior and firm-level exploration–exploitation connection carries important benefits for research and practice as innovation behavior in general is decisive for a sustainable company development.

3 Hypotheses

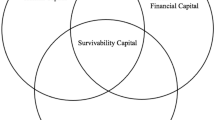

Figure 1 presents our research framework, in which individual innovation behavior is suggested to positively influence firm-level exploration and exploitation activities. Furthermore, we argue that the strength of these relationships depends on whether the business is a family firm or not. The sections that follow develop the hypotheses accordingly.

3.1 Impact of individual innovation behavior on company-level exploration and exploitation

Individual innovation is a multistage process that encompasses the recognition of problems and the generation of ideas or solutions, the seeking of sponsorship for the idea, coalition building to support it, and the completion of the idea (e.g. producing a prototype, a model, a process) (Scott and Bruce 1994). Thus, individual innovation behavior includes the generation and implementation of new ideas (Shin et al. 2017). As innovation in practice rather emerges from discontinuous activities than from discrete, sequential stages (Schroeder et al. 1989), individuals may be involved in any of these activities at any time (Scott and Bruce 1994). We expect an influence on both, firm-level exploration and exploitation because individual innovation behavior yields “ideas, processes, products or procedures” (de Jong and den Hartog 2010, p. 24) which are “either novel or adopted” (Scott and Bruce 1994, p. 581). One crucial aspect of individual innovation behavior is idea generation which relates to the development of new products, services or processes and new market entry but also to improvements in current work processes and rearranging and combining existing concepts for problem solving (de Jong and Hartog 2010). Thus, individual innovation behavior encompasses the refinement of existing knowledge associated to exploitation as well as the development of new knowledge associated to exploration (cp. He and Wong 2004; Lubatkin et al. 2006; March 1991). In the following, we outline theoretical and empirical evidence for the link between executive individual innovation behavior and firm-level exploration and exploitation.

As per the upper echelons theory, top managers’ experiences, values, and personalities shape how they personally interpret strategic situations and how they act on them, which in turn affects the organization’s strategic choices and performance (Hambrick and Mason 1984). Thus, the key premise of this paper is that top managers’ individual innovation behavior affects firm-level exploration and exploitation.

In addition and similar to the upper echelons theory, the strategic orientations literature seems relevant in associating the behaviors of top managers with firm-level innovation activities. Top managers are said to “shape the values and orientation of an organization” (Kirca et al. 2005, p. 25). Strategic orientations are described as “the strategic directions implemented by a firm to create the proper behaviors for the continuous superior performance of the business” (Gatignon and Xuereb 1997, p. 78). In this sense, top managers are seen to send clear signals about priorities through their attitudes and behaviors (Jaworski and Kohli 1993) and encourage all individuals towards similar behavior (Jaworski and Kohli 1993). Thus, their innovative behaviors stemming from their values and beliefs might consequently result in firm-level exploration and exploitation.

Further, there is evidence that top managerial characteristics produce firm-level outcomes such as R&D spending (Barker and Mueller 2002), strategic decision making (Papadakis and Barwise 2002) and new product moves (Srivastava and Lee 2005). Besides, the attitudes of executives have particularly been deemed as important determinants of organizational level innovation (Alexiev et al. 2010; Kraiczy et al. 2015). Indeed, it has been shown in entrepreneurial research that entrepreneurs’ attributes (creativity and positive affect) engender firm-level innovation (Baron and Tang 2011). Another stream of research uses an attention-based view to explain top management influence on firm-level innovation (Li et al. 2013), arguing that “top management’s attending to, examining, and evaluating new knowledge and information” (p. 893) influences new product introductions. Yadav et al. (2007), use an attentional perspective to develop a model that shows how CEOs positively, directly and over the long term influence how their company identifies, develops and deploys new technologies. In their longitudinal study they show that CEOs are critical drivers of innovation.

In light of this, we posit that individual innovation behavior of top managers—which entails how they engage, introduce and apply new ideas and methods (Wu et al. 2014)—influences an organization’s innovation activities of exploration and exploitation; and hypothesize that:

H1a

Managers’ individual innovation behavior fosters a company’s exploration innovation.

H1b

Managers’ individual innovation behavior fosters a company’s exploitation innovation.

3.2 The moderating role of family ownership

Family firms have been argued to display direct as well as indirect encouragements towards engagement in exploitation (Bammens et al. 2015), as family owners have strong incentives or reasons to act in the long-term interest of the organization (Miller and Le Breton-Miller 2005b). Accordingly, managers in such firms are often encouraged to carefully exploit existing resources and make the best out of them (Spriggs et al. 2013). Thus, family firms are seen to encourage competent utilization of personnel and flowering collaborations (Daily and Dollinger 1992) beneficial for the pursuit of exploitative innovation activities. Furthermore, there is evidence that family firm image and reputation increases their customer focus and bonds and consequentially helps family firms to detect specific customer needs and increases their ability to respond innovatively to these needs fostering exploitation (Arzubiaga et al. 2017).

Exploitative innovations generally occur more informally and are facilitated by intimate knowledge of existing processes and methods of work that enable improvements along given paths (Ireland and Webb 2007). Specifically in the context of innovation often associated with uncertainty, such informal activities thrive best when there is significant managerial discretion (Balkin et al. 2000). Managerial discretion refers to the breath of options at a manager’s disposal during strategic decision making (Finkelstein and Boyd 1998).

While managers in non-family firms act within a relatively tight corset (Hoskisson et al. 2002), managers in family firms face less bureaucracy and less internal and external ‘checks and balances’ (Carney 2005). The power of decision makers in family-influenced firms is typically non-negotiable (König et al. 2013), as it relies on familial ties with the owners. “Turf battles” that slow down decision making or processes of interpretation (Hill and Rothaermel 2003, p. 262) are less likely to occur in family firms (König et al. 2013). Thus, managers in family firms will face less political resistance (Sirmon et al. 2008) and dispose of significant legacy of innovation success (Block et al. 2013). Moreover, it seems plausible for top managers in family firms to have a greater decision-making authority and autonomy, or as Miller and Le Breton-Miller (2005a) put it, ‘command’. Their attitudes and behaviors will have a stronger impact than in non-family firms, where bureaucracy and political resistance reduce their influence.

Family-controlled firms create a unique management situation resulting in distinctive constituencies for the firm. Some claim that the intersection of the family with the business creates a synergy in top management teams (TMTs) not present in TMTs of firms with no family control (Ensley and Pearson 2005). As a result, families that hold a majority of ownership in the firm are often overseen by a group or team of people whose combined dispositions and higher decision-making discretion augments their individual potential in shaping organizational outcomes in general (Carney 2005), and innovation activities (i.e. exploitation) in particular (Block et al. 2013). As such, we posit that the discretion of managers in family-owned firms will strengthen the influence of an individual’s innovative behavior on firm-level exploitation.

While the intention of the family to exploit existing assets to a maximum may be straightforward, it can also be seen that the contemplated pronounced empowerment to act accordingly (Finkelstein and Hambrick 1990), may lead to a more dedicated workforce, spurring managers’ attempts to generate creative ideas for improvements (Bammens et al. 2010). Furthermore, family firm managers usually enjoy much longer tenures than non-family firm managers (Zahra 2005), allowing them to use their intimate knowledge for productivity, by combining and reusing existing resources in the firm (Bammens et al. 2015; Ireland and Webb 2007) which constitutes firm-level exploitative innovation.

To sum up, individual innovation behavior of managers in family firms should be fostered by their usually higher discretion to act, their more intimate knowledge of resources necessary to exploit, and their higher dedication to the firm. This ultimately fosters firm-level exploitation activities. Thus, we hypothesize that:

H2a

In family owned businesses the positive relationship between managers’ individual innovation behavior and exploitation is stronger than in non-family owned businesses.

The moderating effect of family ownership on the relationship between top managers’ individual innovation behavior and exploration is not as straight forward as the effect on the previously discussed relationship between top managers’ individual innovation behavior and exploitation. In this respect, Arzubiaga et al. (2017) find that different facets of family involvement influence exploration outcomes in family firms differently. While an increasing proportion of family members in the TMT weakens the effect of exploration on performance, an increasing number of family generations in the TMT strengthens the exploration-performance relationship (Arzubiaga et al. 2017). The authors reason that while a high proportion of family members in the TMT in general decreases knowledge diversity, higher generational involvement adds to knowledge diversity which in turn fosters exploration. A further reason for differences concerning exploration in family firms pertains to the inability of family owners to easily liquidate their ownership which makes them susceptible to altruism and holdup (Schulze et al. 2001) and often reduces the flexibility and celerity through which they are able to seize opportunities and respond to the environment (Spriggs et al. 2013).

Innovative action in the form of exploration, that is particularly associated with complexity, risk, speculation and ambiguity (March 1991), has been therefore said to stand in conflict with family ownership, in that decision-makers often feel emotionally tied to existing resources. While this often leads to a more efficient use of existing assets (Duran et al. 2016) in the form of exploitation, such strong ties usually make it more difficult for family owners to engage in exploration, as this generally requires a substantial departure from existing assets (March 1991). Family-owned firms usually hold strong relationships within the organization and the community which facilitates efficient use of existing connections and knowledge bases, and provides a tendency to avoid exploratory activities that might jeopardize these assets. Nonetheless, such long-term relationships also enable access to information, knowledge and resources that are usually not available via conventional market exchange (Rothaermel and Hess 2007).

Further, family ownership is often associated with long tenures (Zahra 2005). While this often implies a more comprehensive knowledge base for managers and a more efficient use of existing assets, it might come at the expense of exploration, indicating rigidity of mental models or frames (Kaplan and Tripsas 2008). According to Hambrick (2007) long-tenured executives tend to become “stale in the saddle” (p, 337). Notwithstanding, such extended tenures also have been shown to encourage investment in long-term projects, since longer tenures free managers from the need to produce short-term gains and enhances their confidence and knowledge about the firm, and render them less fearful about risky projects, such as exploration (Le Breton-Miller and Miller 2006). Hence, family firms have been shown to engage in exploration when departing from existing paths is required (Miller and Le Breton-Miller 2006).

For successfully introducing exploration in a company, Miller and Le Breton-Miller (2006) argue that it is necessary “that a firm’s controlling owners or their managerial agents have the discretion, knowledge, incentives, and resources to be able to adapt effectively” and that “family-controlled businesses often have an edge in satisfying all these conditions” (p. 214). The authors ascribe this to the unique governance systems of family firms (please refer to Senftlechner and Hiebl (2015) for a comprehensive review of family firm governance) which are shaped through distinct agency (fewer agency costs due to an alignment of management and ownership) and stewardship (good stewardship due to strong emotional incentives to take care of future generations) contexts yielding a long term perspective of business related issues (Miller and Le Breton-Miller 2006).

Thus, despite the highlighted challenges, family ownership might still positively moderate the relationship between top managers individual innovation behavior on firm-level exploration. According to König et al. (2013) family firms’ long-term focus enables them to provide their managers with freedom to pursue exploration opportunities despite associative risks. They also contend that certain inherent characteristics of family-influenced businesses (continuity and command) permit them to confront a key barrier to family firms’ adoption of technological innovation: organizational formalization, which is “the extent to which a given organization has standardized and stabilized its processes of screening for, interpreting, and reacting to changes in the environment” (p. 423). As a result, family firm managers’ higher levels of autonomy help decrease formalization (König et al. 2013).

Considering that autonomous strategic behavior constitutes one of the bases for innovative behavior (Burgelman 1983), family control has been said to increase the levels of autonomy for decision-makers in two ways: externally and internally. From an external perspective, managers in family firms are often released from the calculative or instrumental rationality imposed by capital markets and institutions (Carney 2005), allowing them to pursue opportunities that are often not rationalizable by pure economic short-term criteria (König et al. 2013). Generally, most firms are usually keen on exploiting, since external capital providers tend to be impatient for growth and profits (Benner 2010), and formalized resource allocation processes reinforce organizational preferences for efficiency and reproduction (König et al. 2013), providing higher impetus for exploiting rather than exploring. Yet, scholars argue that managers in family-owned firms enjoy freedom from external pressures requiring of them short-term financial gains, thus allowing them to explore more freely than in non-family firms (Stubner et al. 2012).

From an internal stand point, the utilization of formal monitoring tools by family firms seems uncommon (Senftlechner and Hiebl 2015). Family firms are said to promote a heightened role of community, incompatible with high levels of formalization, and are often characterized by a heightened sense of sentiment and emotions (Gomez-Mejia et al. 2001). Such emotional ties are less formalized than pure rational contracts (Sirmon and Hitt 2003). As a consequence, family firms develop more trust-based and informal forms rather than contract-based managerial forms of governance (Carney 2005; Quinn et al. 2018; Senftlechner and Hiebl 2015). However, family firms can benefit from properly designed control systems (Hiebl et al. 2012; Quinn et al. 2018). For instance, the outcomes of individual managerial autonomy on company performance is further strengthened when family firms employ further control mechanisms like regular direct observations or the evaluation of short term performance and long term goal achievement (Kallmuenzer et al. 2018). Overall, family firms provide an environment conducive to innovation and creativity, whereby individuals have the liberty to oversee an idea from conception to implementation (Burgelman 1983; Kallmuenzer et al. 2018). In this sense, family firms generate new radical combinations of productive resources (Zellweger and Sieger 2012).

In light of this, the influence of managerial individual innovative behavior on firm-level exploration in family-owned firms might thus be facilitated by trust-based relationships which yield company internal human capital that equips them with a superior access to knowledge and resources otherwise not available (Duran et al. 2016), constituting a manifestation of dynamic capabilities central in the context of exploration (Ambrosini et al. 2009). According to Spriggs et al. (2013), even though family-owned firms might be reluctant to engage in new ventures, they are expected to explore new innovations that form the basis of future success. Therefore, we argue that one central advantage pertains to their ability to ensure that the individual innovative behavior of their top managers is exploited to the maximum. Thus, we hypothesize that:

H2b

In family-owned businesses, the positive relationship between managers’ individual innovation behavior and exploration is stronger than in non-family-owned businesses.

4 Method

4.1 Sample

Data collection was conducted with an online survey (mid to end August, 2014) targeting CEOs and other key informants of small and medium-sized (SME ≤ 250 employees) enterprises in Tyrol, Austria. The survey was sent out to a cross-industry sample of 1500 companies that had been chosen randomly from a purchased list of organizations. A reminder was sent out after one week in order to increase the return rate. In total, 237 questionnaires were completed.

In the field of family business research, so far no commonly accepted definition of family businesses has evolved (Steiger et al. 2015). However, most frequently studies rely on a combination of criteria measuring companies’ self-perception as being a family firm and family control in terms of ownership, management and governance (Steiger et al. 2015). We follow this approach and apply two criteria proposed by Zahra et al. (2007). Thus, for distinguishing family from non-family businesses, respondents were asked to indicate whether they were family businesses or not. Of the 237 firms, 162 defined themselves as being a family firm. In order to make sure that the families were really in the position to influence the company, we asked the respondents to pinpoint the extent of family ownership (please refer to the measurement section for the exact measure). The major part of the family businesses held 100% of the shares of their business. In order to compare family with non-family businesses, we excluded all businesses where family influence could have been diminished due to a low percentage of ownership by the family. Thus, we considered those firms where a family held more than 50% ownership (Kallmuenzer et al. 2018; Zahra et al. 2007). Although, the online survey explicitly addressed managers, we controlled for position in the company in order to guarantee that only managers answered the questionnaire. 17 additional cases had to be deleted because the respondents were employees without managerial competences. Finally, all businesses not meeting the SME definition (≤ 250 employees) were deleted from the dataset. The final sample resulted in 195 firms, of which 120 are classified as family and 75 as non-family firms. Thus, the final return rate is 13%. Table 1 presents the descriptive statistics for the sample and subsamples.

In order to investigate a possible non-response bias, we followed the recommendations by Armstrong and Overton (1977) and compared early with late respondents. Late respondents are expected to show similar characteristics as non-respondents (Armstrong and Overton 1977). As we found no significant differences, we conclude that a possible non-response bias is not an issue for this research.

4.2 Measurement

The survey measurement was adapted from existing scales. The adoption of existing scales is advantageous, since having been tested in previous studies, they are considered to be reliable and valid (Bryman and Bell 2011).

4.2.1 Family ownership

Family ownership was measured using two items. Item one asked respondents whether their business was a family business (1 = family business; 0 = non-family business). Item two covered the percentage of family ownership along seven categories (1 = 0%; 2 = 1–5%; 3 = 6–25%; 4 = 26–50%; 5 = 51–75%; 6 = 76–99%; 7 = 100%). We considered companies as family owned when they indicated to be a family business and when the family held more than 50% of firm ownership (Kallmuenzer et al. 2018; Zahra et al. 2007).

4.2.2 Individual innovation behavior

Individual innovation behavior of top managers was measured using six items derived from Scott and Bruce (1994). All items loaded highly on the proposed construct and revealed satisfactory values for construct reliability (CR) as well as average variance extracted (AVE) (Bagozzi and Yi 1988) (see Table 2). Individual innovation behavior was assessed using a 5 point Likert scale whereby respondents indicated their level of agreement.

4.2.3 Exploitation and exploration

Six items each for measuring a company’s exploration and exploitation innovation behavior were drawn from Lubatkin et al. (2006). Again the items were measured with 5 point Likert scales. Due to low or unclear loadings, one item of the construct exploration innovation, and two items of the construct exploitation innovation were excluded. AVE and CR were well above the proposed thresholds (Bagozzi and Yi 1988).

4.2.4 Control variables

We control for age, gender, education, tenure and for the position in the company as potential influence factors of individual innovation behavior. Age, education and tenure were selected because there is empirical evidence that these variables are associated to individual innovation behavior (Scott and Bruce 1994). We included gender as a control variable, because previous research (Amabile et al. 2005) hints that genders might differ in terms of creativity which is a salient driver of innovation behavior. Position was incorporated because hierarchical influences may determine to what extent managers can exert individual innovation behavior. Regarding the evaluation of exploitation and exploration, we control for tenure and position in the company to ensure that the evaluation of this construct is not biased through individual level key informant differences. Furthermore, these constructs may be impacted through company and industry level differences. Therefore, in terms of company level characteristics, we control for company size in terms of employees and revenue and company age (Kellermanns et al. 2012; Zahra et al. 2008). We incorporated size in terms of employees because it may act as a proxy capturing the amount of human capital of a company. Human capital is positively associated to company innovation outcomes (Dakhli and De Clercq 2004). We control for revenue, because it is a proxy for financial resources the company can mobilize for pursuing innovation activities. In terms of industry level characteristics, we control if the company is a manufacturing or a service business or another kind of business (e.g. a construction company which often encompasses manufacturing and service aspects). This procedure is in line with other studies investigating family businesses (e.g. Beck et al. 2011).

Age was measured on a scale from 1 to 6 (1 = < 20 years; 2 = 21–29 years; 3 = 30–39 years; 4 = 40–49 years; 5 = 50–59 years; to 6 = ≥ 60 years). Gender (1 = male; 0 = female), position in the company and industry were coded as dummy variables. The variable position in the company was split up into four dummy variables (1 = hold the position; 0 = does not hold the position) covering the managerial positions owner, CEO, associate manager and other managerial positions (e.g. department head and authorized officers/managers). Education was measured on a scale from 1 to 5 (1 = compulsory education to 5 = academic education). Revenue was measured on a scale from 1 to 6 (1 = ≤ 2 mil. Euros to 6 = > 250 mil. Euros). We measured tenure, as the number of years a respondent worked in the company, size as the number of employees, and company age as the number of years the company exists.

4.3 Method

Partial least square (PLS) structural equation modelling (SEM) was conducted to test the hypotheses. SEM was the preferred choice over a standard regression analysis for two reasons: First, the study model encompasses two dependent variables. Interfering effects between the two independent variables cannot be detected with an ordinary regression analysis. SEM enables researchers to investigate such relationships simultaneously (Hair et al. 2014). Second, the study model involves latent constructs. SEM is the preferred choice in this respect (Bollen and Lennox 1991). We decided to apply PLS SEM instead of a covariance based (CB) approach to SEM because the items of the survey are not normally distributed. On average the items of our latent variables displayed a skewness of − .75 and a kurtosis of .89. PLS requires no strict normal distribution of the data (Astrachan et al. 2014) and can cope with skewness and kurtosis values between 1 and − 1 (Hair et al. 2014). PLS SEM is also considered as being superior to CB SEM in cases when the sample size is small relative to the number of variables (Astrachan et al. 2014; Hair et al. 2012). Therefore, PLS-SEM is appropriate for applications when strong assumptions are not realizable and is often termed as a distribution-free “soft modeling approach” (Hair et al. 2012, p. 416). Furthermore, the prediction oriented nature of this research aiming at explaining the endogenous variables makes PLS SEM the preferred choice, because PLS SEM maximizes the explained variance of the dependent latent constructs while CB SEM aims at perfectly fitting observed and expected covariances (Hair et al. 2012, p. 416).

PLS SEM relies on resampling techniques such as bootstrapping when testing the significance of relationships (Henseler et al. 2009). As such, all estimates are derived on the basis of 5000 bootstrapping runs (Hair et al. 2012). The number of cases is fixed to 195 in accordance with the sample size and the sign change option is set to construct-level sign changes (Tenenhaus et al. 2005). We conducted all calculations using SmartPLS 3.2.7 software (Ringle et al. 2015).

5 Analysis and results

5.1 Measurement reliability and validity

The measurement model was examined by investigating composite factor loadings and composite reliability (CR) respectively. Cronbach alpha (α) and average variance extracted were also calculated. All items load highly (.66–.87) on the proposed latent variables. Furthermore, AVE (.63–.64), CR (.87–.91) and α (.80–.89) clearly meet the thresholds proposed in literature (Bagozzi and Yi 1988; Hair et al. 2012; Hulland 1999). Recently, Henseler et al. (2014) proposed the use of the standardized root mean square residual (SRMR) as an absolute measure of model fit for PLS. SRMR builds on the observed and the expected covariance matrix and transforms them into correlation matrices. SRMR measures the discrepancy between the observed and predicted correlations. Values lower than.08 indicate a satisfactory model fit (Hu and Bentler 1998). The SRMR value for the study model is .07 indicating model fit. Table 2 presents the survey items and the psychometric properties of the survey scales.

Discriminant validity is tested applying the Fornell-Larcker Ratio (Fornell and Larcker 1981). In this respect, we compare the latent variable correlations with the squared root of the AVEs of the respective latent constructs. As all the squared roots of the AVEs exceeded the correlations between the latent variables, the proposed constructs display discriminant validity. Table 3 shows the results for this analysis. Furthermore, we investigated the cross loadings of the items between the latent variables. All the items loaded highest on the proposed latent constructs, again indicating discriminant validity (Chin 1998).

5.2 Common method bias analyses

In line with Podsakoff et al. (2003) and Williams et al. (2003), a common method factor was incorporated into the model. To do so in PLS, we draw on suggestions by Liang et al. (2007). We compared the substantive factor loadings of the items on the respective latent variables to the loadings on the method factor. This analysis shows that all the items load highly (.57– .97) and significantly at p = .000 on the proposed latent constructs. In contrast, the loadings on the common method factor are very low (− .20 to .22) and mostly not significant. The average loading on the method factor is .01 compared to .80 on the latent variables. We therefore find a ratio of 79.37:1. Thus, we do not consider common method bias an issue. Table 4 summarizes these findings.

5.3 Inner model evaluation

Before testing the hypotheses, we investigated the inner model and calculated f2 and q2 effect sizes (Hair et al. 2012). f2 effect sizes provide evidence to what extent a path contributes to the explanatory power of a research model (to R2). q2 effect sizes display the model’s predictive power by deleting single data points and controlling how accurately the model predicts these data points (Hair et al. 2014, 2012). We find moderate f2 effect sizes for the paths between individual innovation behavior of top managers and exploitation (f2 = .18) and exploration (f2 = .26) (Cohen 1988). All the other effect sizes are weak. These results underline the explanatory power of individual innovation behavior of top managers for explaining exploration and exploitation. Table 5 summarizes the results and presents the path coefficients together with the respective T statistics and significance levels as well as the f2 effect sizes for all paths.

For calculating the q2 effect sizes we ran blindfolding using the cross-validated redundancy approach (Hair et al. 2012). Following propositions made in literature (Hair et al. 2012), we set the omission distance to 7 which is a number between 5 and 10, but not a multiple of the sample size (N = 195). For the evaluation of q2 effect sizes, we find weak to moderate effect sizes of individual innovation behavior of top managers on exploitation (.09) and exploration (.13) (Chin 1998; Henseler et al. 2009). Thus, the latent construct shows predictive relevance (Chin 1998; Henseler et al. 2009). We also investigated potential multicollinearity issues by calculating variance inflation factors (see Table 5). The variance inflation factors (1.05–3.80) are well below the threshold of 10 recommended in literature (O’Brien 2007).

5.4 Hypothesis testing

Figure 2 and Table 5 illustrate the results of testing hypothesis 1. Hypotheses 1 predicted a positive relationship between individual innovation behavior of top managers and a company’s exploration and exploitation behavior. Both relationships are positive and significant. The path between individual innovation behavior of top managers and exploration (β = .43, p < .01) is slightly stronger compared to the path between individual innovation behavior and exploitation (β = .39, p < .01). The proposed relationships yield R2s of .19 for exploitation and .26 for exploration. Building on these results, we can confirm H1a and H1b.

The control variables exert only two significant influences on the latent variables. Being an owner positively influences individual innovation behavior (β = .18, p < .10) and company age (β = − .18, p < .05) negatively influences the exploration behavior of companies.

Hypotheses 2 predicted that the positive relationships between individual innovation behavior of top managers and a company’s exploration and exploitation behavior are stronger in family firms compared to non-family firms. For testing hypothesis two, we split the sample in family (n = 120) and non-family firms (n = 75) and conducted a multi group analysis. We followed the parametric approach to multi group analysis in PLS for calculating T statistics for the observed group differences. This test is a modification of the two independent samples t test (Henseler et al. 2009). As this test assumes a normal distribution of data which is at odds with the distribution free character of PLS (Sarstedt et al. 2011), we also tested significance of group differences applying the nonparametric confidence set approach (Sarstedt et al. 2011) which builds on bias corrected confidence intervals (Efron 1987; Efron and Tibshirani 1986). Two groups differ significantly when the estimate of segment one does not fall into the bias corrected confidence interval of the estimate of segment two and vice versa. Sarstedt et al. (2011) propose to calculate 95% bias corrected confidence intervals in order to minimize potential Type-II errors. Overall, we considered a path to differ significantly across groups when both tests confirmed significance. Table 6 presents these calculations.

Before investigating the structural model, we checked for possible differences in the measurement models of the two subsamples. No significant differences were found. Figure 3 presents the study model for the family business subsample. Again we find highly significant relationships between individual innovation behavior of top managers and a company’s exploration (β = .58, p < .01) and exploitation behavior (β = .49, p < .01). The proposed relationships yield R2s of .31 for exploitation and of .42 for exploration. Four control variables exert significant influences. Being an owner (β = − .33, p < .05) impacts exploitation behavior. Furthermore, company age (β = − .18, p < .05), being a service business (β = − .27, p < .05) and revenue (β = − .29, p < .05) influence exploration.

Figure 4 illustrates the calculations for the non-family business subsample. For non-family businesses, the relationships between individual innovation behavior of top managers and exploration (β = .31, p < .05) and exploitation (β = .26, p < .05) also turn out to be positive and significant, but lower in magnitude compared to family businesses. The proposed relationships yield R2s of .22 for exploitation and .15 for exploration. Three control variables impact the latent variables. Age (β = .30, p < .05) and owner (β = .46, p < .01) influence individual innovation behavior. Furthermore, company age (β = − .48, p < .05) impacts exploitation behavior.

This first examination of the results indicates some difference between family and non-family businesses. However, the multi group analysis does not reveal that all these differences are significant across groups. In examining differences concerning the control variables between groups, we find that only the paths between age and individual innovation behavior, owner and individual innovation behavior, company age and exploitation and owner and exploitation differ significantly across groups. The differences concerning the paths between company age and exploration and service business and exploration are not significant across groups (see Table 6).

For the hypothesized main effects, the subsamples differ significantly only regarding the relationship between individual innovation behavior of top managers and exploration. We provide evidence that the effect of individual innovation behavior of top managers on exploration is stronger in family businesses. More specifically, we find that while individual innovation behavior of top managers strongly drives exploration in family firms (β = .58, p < .01), the effect is far weaker in non-family firms (β = .31, p < .01). Furthermore, the R2 for exploration differs significantly at the 5% level between the two subsamples (ΔR2 = .27; T statistic = 2.45). Therefore, individual innovation behavior of top managers explains exploration to a greater extent in family businesses. Following this analysis, H2a has to be rejected and H2b is supported. Table 6 summarizes the results of the multi-group analysis.

6 Discussion and conclusion

This study shows that individual innovation behavior of top managers positively shapes firm level exploration/exploitation activities and thus confirms the importance of executives’ behavior for achieving firm-level outcomes (Alexiev et al. 2010; Damanpour and Schneider 2006; de Visser and Faems 2015). The underlying study extends current research in the area of family firm innovation by focusing on how family-owned firms transform top managers’ individual behavior in firm-level innovative activities (Ling et al. 2008). A comparison of family businesses with non-family businesses revealed a stronger effect of individual innovation behavior of top managers on firm-level explorative innovation in family businesses. We also find that while family ownership moderates the relationship between managerial innovation behavior and exploration, the same did not hold true for the relationship between managerial innovation behavior and exploitation. Indeed, consistent with propositions about managerial discretion from upper echelons theory, we argue that managers specifically in family-owned firms dispose of a higher latitude to engage in explorative innovation. These findings are important contributions to organizational ambidexterity research in family businesses that sees in family management and ownership interesting variables that are expected to explain different levels of ambidexterity (e.g. Goel and Jones 2016; Hiebl 2015). Our findings also corroborate literature on ambidexterity that links family firm characteristics to the simultaneous pursuit of exploration and exploitation (Allison et al. 2014; Lubatkin et al. 2006; Stubner et al. 2012).

In the context of exploration, top managers’ individual innovative behavior in family-owned firms will likely translate into more explorative actions due to discretion in the form of job autonomy which is a key determining factor towards creating new opportunities (Crossland and Hambrick 2011). A further reason might be found in the distinct form of governance and facilitation of mutual trust (Cruz et al. 2010). Trust might account for why family firm managers generally dispose of higher latitude, which in turn translates in firm-level exploration. Previous research has found that family firms, while investing less in innovation, have a higher conversion of innovation input (e.g. R&D expenses) into innovation output (Duran et al. 2016; Matzler et al. 2015). These studies argue that idiosyncrasies (e.g. higher control level in family firms, family wealth concentration, and higher importance of non-financial goals) explain why family firms are innovators that are more effective. As these studies however do not explicitly differentiate between exploration and exploitation, our findings contribute to this stream of literature and point to an important question that should be addressed in future research: Does the observation that ‘doing more with less’ (Duran et al. 2016; Matzler et al. 2015) in family firm innovation also hold for both exploration and exploitation? We found that in family firms individual innovation behavior of managers has a stronger effect on exploration than on exploitation. This finding is also corroborated by König et al. (2013) who argue that family firms strive for continuity, command, community, and connections (the ‘Four Cs’ (see Miller and Le Breton-Miller 2005a)) and, as a consequence, “recognize discontinuous technologies later than their less family-influenced counterparts, they implement adoption decisions more quickly and with more stamina” (p. 418). As exploration needs more resources, is more risky and more long-term oriented, managerial discretion, control, and persistence in implementation may be more important than in exploitative innovation. As there is very limited empirical research on exploration and exploitation in family businesses (Veider and Matzler 2016), such research questions offer promising research avenues and contribute to the stream of literature studying upper echelons effects in family firms (e.g. Stubner et al. 2012; Tretbar et al. 2016).

We also explicate some significant group differences regarding our employed control variables. Company age was found to negatively influence exploitation outcomes in non-family businesses and has no effect in family businesses. This finding is in line with previous research showing that company age affects non-family business stronger than family firms. Although, Craig and Dibrell (2006) find a negative effect of age on innovation in family firms, they detect an even stronger effect for non-family firms. Furthermore, age and owner increase individual innovation behavior in non-family firms, hinting that in such firms position and demographics might play a greater role for engaging in innovative behavior.

The study shows that family businesses can harness managerial innovation behavior at the individual level and exploit the positive outcomes of firm-level explorative and exploitative activities. To do so, they should consider the factors that serve as antecedents of individual innovation behavior, such as proactiveness (Seibert et al. 2001), locus of control (Harper 1996), problem solving style (Scott and Bruce 1998), autonomy (Spreitzer 1995), and job complexity (Oldham and Cummings 1996) as highlighted by de Jong (2007). Family businesses should also focus on certain individual characteristics (e.g. individual innovation behavior) in their manager recruiting and development programs for non-family managers. Furthermore, when new generations of family members are introduced into the company they usually go through a period of familiarization by working in different positions. Family firms should try to outline the importance of individual innovation behavior and actively trigger such behavior during these periods. Younger generations often bring in new perspectives. Thus, during transition periods these perspectives can be actively inquired which might lead to first attempts of individual innovation behaviors. Moreover, actively leveraging individual manager behaviors at the work place could trigger positive outcomes. As such, creativity enhancing trainings could further strengthen managerial innovation behavior.

The study at hand is not free of limitations. First, the research was carried out in Tyrol, Austria. Thus, we cannot rule out that the specific regional and cultural context influences the results. This might pose problems to the generalizability of the results, especially to other regions outside the German speaking parts of Europe. Future studies should therefore test the robustness of the findings by considering distinct regional, cultural and company contexts. Furthermore, family firms differ from other business and among each other in terms of structure and governance (Quinn et al. 2018; Steiger et al. 2015). Future studies should therefore dig deeper and analyze how distinct family business characteristics like for instance family business culture or the share of family and non-family managers involved in the business impact the proposed relationships. A further investigation of influences stemming from such variables as whether the founder is still involved in the business or from generational contexts of the family business could enable further interesting insights (Beck et al. 2011; Miller and Le Breton-Miller 2011).

As the study is cross sectional in design measuring the relationships ex post, future research could choose a longitudinal design in order to investigate the proposed relationships at different times, especially regarding the influence of family ownership on the discussed constructs. This could also shed light on possible endogeneity issues, which can barely be excluded in cross sectional surveys. Additionally, research should also replicate these relationships applying other methods to check the robustness of these findings. Specifically, experimental research is encouraged in order to provide additional empirical support to the causality of the relationship between individual level and company level innovation. So far this link is only established theoretically. This research builds on single key informants. Key informants involve a potential risk that their views vary systematically from others (Kumar et al. 1993). This key informant cross-sectional design was necessary because of the high positions held by the targeted respondents. Higher managerial positions come along with high time pressure. As a consequence, the willingness of managers to answer questionnaires is generally low. Thus, receiving several responses from multiple key informants from a company is very unlikely. Although this design has deficiencies (as described above), one advantage is that sample sizes are larger and thus ensure more statistical power. Still, future research might attempt to distinguish between different types of managers within the family firm. It could specifically contrast family to non-family managers, incorporate several means like using other data sources (e.g. archival data investigations), investigate distinct key informants (e.g. supervisor ratings conducted by simple employees) and apply other designs (e.g. longitudinal) in order to investigate these deficiencies.

There might be further influential variables which could impact these relationships and would provide fertile opportunities for further research initiatives. For instance, previous research has highlighted the importance of generational transitions on innovation activities in family firms (Beck et al. 2011). During generational transitions the diversity of goals of family members is greater (Kotlar and De Massis 2013). Conflicts that develop during such periods could impact the relationship between individual and company level variables. Furthermore, recent research highlighted the importance of socioemotional wealth (SEW). According to Kraiczy et al. (2014) a high SEW orientation in a family firm might affect their level of innovation behavior and would likely impede managerial discretion. Indeed, some studies emphasize a direct impact of SEW on family firm behavior (Gómez-Mejia et al. 2011). As such, we suggest that research considers such variables in future research initiatives.

In addition, whereas managers in family firms have been argued to efficiently translate managerial innovative behavior into more firm-level exploratory innovation activities, we did not test the antecedents of individual innovative behavior. In fact, some managers might originally face a lower tendency to engage in innovation activities. Whereas this is a general phenomenon and affects most companies (Fleming 2001), the social system of the family might create a synergy in top management teams that is not present in boards of firms with no family ownership (Nordqvist 2012). The sample underlying this study consists mainly of owner managers and CEOs (see Table 1). Future investigations might therefore also target other managerial positions especially as our results hint that different managerial positions might have distinct influences in family and non-family firms.

Further, even though cohesive family teams work well together, are more flexible and react faster (Ensley and Pearson 2005), this synergy, in combination with extended tenures (Berrone et al. 2010) might also result in more homogeneous top management teams (Sirmon and Hitt 2003) that holds the risk for rigid mental models inhibiting innovative activities (König et al. 2013). Future research might thus take a closer look at the antecedents of individual innovative behavior and examine whether they differ between family and non-family firms. Indeed, one might test whether different ownership structures foster pre-selection of managers that fit well into existing teams, which might result in lower individual innovative behaviors of managers. One could also test if family members in the top management teams are more susceptible to rigidity than managers not related to the owning family.

In this paper, we have presented a richer understanding of individual innovation behavior of top managers and firm-level innovation activities within firms, highlighting the importance of top managers’ individual innovation behavior in explaining firm-level innovation activities of exploration and exploitation. Having also detected a strong moderation effect of family ownership on the aforementioned relationship, future research might look to examine the characteristics of family firms spurring executives towards individual innovation behaviors that consequently result in firm-level innovation activities, and their potential applicability in non-family business contexts.

References

Alexiev AS, Jansen JJP, Van den Bosch FAJ, Volberda HW (2010) Top management team advice seeking and exploratory innovation: the moderating role of TMT heterogeneity. J Manag Stud 47(7):1343–1364. https://doi.org/10.1111/j.1467-6486.2010.00919.x

Allison TH, McKenny AF, Short JC (2014) Integrating time into family business research: using random coefficient modeling to examine temporal influences on family firm ambidexterity. Fam Bus Rev 27(1):20–34. https://doi.org/10.1177/0894486513494782

Amabile TM (1998) How to kill creativity. Harvard Bus Rev 76(5):76–87

Amabile TM, Barsade SG, Mueller JS, Staw BM (2005) Affect and creativity at work. Adm Sci Q 50(3):367–403. https://doi.org/10.2189/asqu.2005.50.3.367

Ambrosini V, Bowman C, Collier N (2009) Dynamic capabilities: an exploration of how firms renew their resource base. Br J Manag 20(s1):9–24. https://doi.org/10.1111/j.1467-8551.2008.00610.x

Anderson N, Potočnik K, Zhou J (2014) Innovation and creativity in organizations: a state-of-the-science review, prospective commentary, and guiding framework. J Manag 40(5):1297–1333. https://doi.org/10.1177/0149206314527128

Armstrong JS, Overton TS (1977) Estimating nonresponse bias in mail surveys. J Mark Res 14(3):396–402. https://doi.org/10.2307/3150783

Arzubiaga U, Maseda A, Iturralde T (2017) Exploratory and exploitative innovation in family businesses: the moderating role of the family firm image and family involvement in top management. Rev Manag Sci. https://doi.org/10.1007/s11846-017-0239-y

Astrachan JH, Shanker MC (2003) Family businesses’ contribution to the U.S. Economy: a closer look. Fam Bus Rev 16(3):211–219. https://doi.org/10.1111/j.1741-6248.2003.tb00015.x

Astrachan CB, Patel VK, Wanzenried G (2014) A comparative study of CB-SEM and PLS-SEM for theory development in family firm research. J Fam Bus Strateg 5(1):116–128. https://doi.org/10.1016/j.jfbs.2013.12.002

Augusto M, Coelho F (2009) Market orientation and new-to-the-world products: exploring the moderating effects of innovativeness, competitive strength, and environmental forces. Ind Mark Manag 38(1):94–108. https://doi.org/10.1016/j.indmarman.2007.09.007

Bagozzi RP, Yi Y (1988) On the evaluation of structural equation models. J Acad Mark Sci 16(1):74–94. https://doi.org/10.1007/bf02723327

Balkin DB, Markman GD, Gomez-Mejia LR (2000) Is CEO pay in high-technology firms related to innovation? Acad Manag J 43(6):1118–1129. https://doi.org/10.2307/1556340

Bammens Y, Gils AV, Voordeckers W (2010) The role of family involvement in fostering an innovation-supportive stewardship culture. Acad Manag Proc 1:1–6. https://doi.org/10.5465/ambpp.2010.54495865

Bammens Y, Notelaers G, Van Gils A (2015) Implications of family business employment for employees’ innovative work involvement. Fam Bus Rev 28(2):123–144. https://doi.org/10.1177/0894486513520615

Baregheh A, Rowley J, Sambrook S (2009) Towards a multidisciplinary definition of innovation. Manag Dec 47(8):1323–1339. https://doi.org/10.1108/00251740910984578

Barker VL, Mueller GC (2002) CEO characteristics and firm R&D spending. Manag Sci 48(6):782–801. https://doi.org/10.1287/mnsc.48.6.782.187

Baron RA, Tang J (2011) The role of entrepreneurs in firm-level innovation: joint effects of positive affect, creativity, and environmental dynamism. J Bus Ventur 26(1):49–60. https://doi.org/10.1016/j.jbusvent.2009.06.002

Beck L, Janssens W, Debruyne M, Lommelen T (2011) A study of the relationships between generation, market orientation, and innovation in family firms. Fam Bus Rev 24(3):252–272. https://doi.org/10.1177/0894486511409210

Benner MJ (2010) Securities analysts and incumbent response to radical technological change: evidence from digital photography and internet telephony. Organ Sci 21(1):42–62. https://doi.org/10.1287/orsc.1080.0395

Benner MJ, Tushman M (2002) Process management and technological innovation: a longitudinal study of the photography and paint industries. Adm Sci Q 47(4):676–706. https://doi.org/10.2307/3094913

Benner MJ, Tushman ML (2003) Exploitation, exploration, and process management: the productivity dilemma revisited. Acad Manag Rev 28(2):238–256. https://doi.org/10.2307/30040711

Berrone P, Cruz C, Gomez-Mejia LR, Larraza-Kintana M (2010) Socioemotional wealth and corporate responses to institutional pressures: do family-controlled firms pollute less? Adm Sci Q 55(1):82–113. https://doi.org/10.2189/asqu.2010.55.1.82

Block J, Miller D, Jaskiewicz P, Spiegel F (2013) Economic and technological importance of innovations in large family and founder firms: an analysis of patent data. Fam Bus Rev 26(2):180–199. https://doi.org/10.1177/0894486513477454

Bloom N, Sadun R, Van Reenen J (2015) Do private equity owned firms have better management practices? Am Econ Rev 105(5):442–446. https://doi.org/10.1257/aer.p20151000

Bollen K, Lennox R (1991) Conventional wisdom on measurement: a structural equation perspective. Psychol Bull 110(2):305–314. https://doi.org/10.1037/0033-2909.110.2.305

Bryman A, Bell E (2011) Business research methods, 3rd edn. Oxford University Press, Oxford

Burgelman RA (1983) Corporate entrepreneurship and strategic management: insights from a process study. Manag Sci 29(12):1349–1364. https://doi.org/10.1287/mnsc.29.12.1349

Carney M (2005) Corporate governance and competitive advantage in family-controlled firms. Entrep Theory Pract 29(3):249–265. https://doi.org/10.1111/j.1540-6520.2005.00081.x

Chin WW (1998) The partial least squares approach for structural equation modeling. In: Marcoulides GA (ed) Methodology for business and management. Lawrence Erlbaum Associates Inc., Mahwah, pp 295–336

Cohen J (1988) Statistical power analysis for the behavioral sciences. Lawrence Erlbaum Assoc Inc, Hillsdale

Craig J, Dibrell C (2006) The natural environment, innovation, and firm performance: a comparative study. Fam Bus Rev 19(4):275–288. https://doi.org/10.1111/j.1741-6248.2006.00075.x

Crossland C, Hambrick DC (2011) Differences in managerial discretion across countries: how nation-level institutions affect the degree to which CEOs matter. Strateg Manag J 32(8):797–819. https://doi.org/10.1002/smj.913

Cruz CC, Gómez-Mejia LR, Becerra M (2010) Perceptions of benevolence and the design of agency contracts: CEO-TMT relationships in family firms. Acad Manag J 53(1):69–89. https://doi.org/10.5465/amj.2010.48036975

Daily CM, Dollinger MJ (1992) An empirical examination of ownership structure in family and professionally managed firms. Fam Bus Rev 5(2):117–136. https://doi.org/10.1111/j.1741-6248.1992.00117.x

Dakhli M, De Clercq D (2004) Human capital, social capital, and innovation: a multi-country study. Entrep Reg Dev 16(2):107–128. https://doi.org/10.1080/08985620410001677835

Damanpour F, Schneider M (2006) Phases of the adoption of innovation in organizations: effects of environment, organization and top managers. Br J Manag 17(3):215–236. https://doi.org/10.1111/j.1467-8551.2006.00498.x

Davis JH, Allen MR, Hayes HD (2010) Is blood thicker than water? A study of stewardship perceptions in family business. Entrep Theory Pract 34(6):1093–1116. https://doi.org/10.1111/j.1540-6520.2010.00415.x

de Jong J (2007) Individual Innovation: The Connection Between Leadership and Employees’ Innovative Work Behavior. Dissertation. University of Amsterdam, Amsterdam

de Jong J, den Hartog D (2010) Measuring innovative work behaviour. Creat Innov Manag 19(1):23–36. https://doi.org/10.1111/j.1467-8691.2010.00547.x

de Visser M, Faems D (2015) Exploration and exploitation within firms: the impact of CEOs’ cognitive style on incremental and radical innovation performance. Creat Innov Manag 24(3):359–372. https://doi.org/10.1111/caim.12137

Duran P, Kammerlander N, Mv Essen, Zellweger T (2016) Doing more with less: innovation input and output in family firms. Acad Manag J 59(4):1224–1264. https://doi.org/10.5465/amj.2014.0424

Efron B (1987) Better bootstrap confidence intervals. J Am Stat Assoc 82(397):171–185. https://doi.org/10.1080/01621459.1987.10478410

Efron B, Tibshirani R (1986) Bootstrap methods for standard errors, confidence intervals, and other measures of statistical accuracy. Stat Sci 1(1):54–75. https://doi.org/10.2307/2245500

Ensley MD, Pearson AW (2005) An exploratory comparison of the behavioral dynamics of top management teams in family and nonfamily new ventures: cohesion, conflict, potency, and consensus. Entrep Theory Pract 29(3):267–284. https://doi.org/10.1111/j.1540-6520.2005.00082.x

Finkelstein S, Boyd BK (1998) How much does the CEO matter? The role of managerial discretion in the setting of CEO compensation. Acad Manag J 41(2):179–199. https://doi.org/10.2307/257101

Finkelstein S, Hambrick DC (1990) Top-management-team tenure and organizational outcomes: the moderating role of managerial discretion. Adm Sci Q 35(3):484–503. https://doi.org/10.2307/2393314

Fleming L (2001) Recombinant uncertainty in technological search. Manag Sci 47(1):117–132. https://doi.org/10.1287/mnsc.47.1.117.10671

Fornell C, Larcker DF (1981) Evaluating structural equation models with unobservable variables and measurement error. J Mark Res 18(1):39–50. https://doi.org/10.2307/3150979

Gatignon H, Xuereb J-M (1997) Strategic orientation of the firm and new product performance. J Mark Res 34(1):77–90. https://doi.org/10.2307/3152066

Goel S, Jones RJ (2016) Entrepreneurial exploration and exploitation in family business: a systematic review and future directions. Fam Bus Rev 29(1):94–120. https://doi.org/10.1177/0894486515625541

Gomez-Mejia LR, Nuñez-Nickel M, Gutierrez I (2001) The role of family ties in agency contracts. Acad Manag J 44(1):81–95. https://doi.org/10.5465/3069338

Gómez-Mejia LR, Cruz C, Berrone P, Castro JD (2011) The bind that ties: socioemotional wealth preservation in family firms. Acad Manag Ann 5(1):653–707. https://doi.org/10.5465/19416520.2011.593320

Gupta AK, Smith KG, Shalley CE (2006) The interplay between exploration and exploitation. Acad Manag J 49(4):693–706. https://doi.org/10.5465/amj.2006.22083026

Hair JF, Sarstedt M, Ringle CM, Mena JA (2012) An assessment of the use of partial least squares structural equation modeling in marketing research. J Acad Mark Sci 40(3):414–433. https://doi.org/10.1007/s11747-011-0261-6

Hair JF, Hult GTM, Ringle CM, Sarstedt M (2014) A primer on partial least squares structural equation modeling (PLS-SEM). SAGE Publications, Thousand Oaks

Hambrick DC (2007) Upper echelons theory: an update. Acad Manag Rev 32(2):334–343. https://doi.org/10.2307/20159303

Hambrick DC, Finkelstein S (1987) Managerial discretion: a bridge between polar views of organizational outcomes. Res Organ Behav 9:369–406

Hambrick DC, Mason PA (1984) Upper echelons: the organization as a reflection of its top managers. Acad Manag Rev 9(2):193–206. https://doi.org/10.2307/258434

Harper DA (1996) Entrepreneurship and the market process—an enquiry into the growth of knowledge. Routledge, London

He Z-L, Wong P-K (2004) Exploration versus exploitation: an empirical test of the ambidexterity hypothesis. Organ Sci 15(4):481–494. https://doi.org/10.1287/orsc.1040.0078

Henseler J, Ringle CM, Sinkovics RR (2009) The use of partial least squares path modeling in international marketing. In: Sinkovics RR, Ghauri PN (eds) New challenges to international marketing. Advances in international marketing, Vol 20. Emerald Group Publishing Limited, Bingley, pp 277–319

Henseler J et al (2014) Common beliefs and reality About PLS: comments on Rönkkö and Evermann (2013). Organ Res Methods 17(2):182–209. https://doi.org/10.1177/1094428114526928

Hiebl MRW (2012) Risk aversion in family firms: what do we really know? J Risk Financ 14(1):49–70. https://doi.org/10.1108/15265941311288103

Hiebl MRW (2015) Family involvement and organizational ambidexterity in later-generation family businesses: a framework for further investigation. Manag Dec 53(5):1061–1082. https://doi.org/10.1108/md-04-2014-0191

Hiebl MRW, Feldbauer-Durstmüller B, Duller C, Neubauer H (2012) Institutionalisation of management accounting in family busniesses—empirical evidence form Austria and Germany. J Enterp Cult 20(04):405–436. https://doi.org/10.1142/s0218495812500173

Hill CWL, Rothaermel FT (2003) The performance of incumbent firms in the face of radical technological innovation. Acad Manag Rev 28(2):257–274. https://doi.org/10.2307/30040712

Hoskisson RE, Hitt MA, Johnson RA, Grossman W (2002) Conflicting voices: the effects of institutional ownership heterogeneity and internal governance on corporate innovation strategies. Acad Manag J 45(4):697–716. https://doi.org/10.2307/3069305

Hulland J (1999) Use of partial least squares (PLS) in strategic management research: a review of four recent studies. Strateg Manag J 20(2):195–204. https://doi.org/10.1002/(sici)1097-0266(199902)20:2%3c195:aid-smj13%3e3.0.co;2-7

Ireland RD, Webb JW (2007) Strategic entrepreneurship: creating competitive advantage through streams of innovation. Bus Horiz 50(1):49–59. https://doi.org/10.1016/j.bushor.2006.06.002

Janssen O (2000) Job demands, perceptions of effort-reward fairness and innovative work behaviour. J Occup Organ Psychol 73(3):287–302. https://doi.org/10.1348/096317900167038

Jaworski BJ, Kohli AK (1993) Market orientation: antecedents and consequences. J Mark 57(3):53–70. https://doi.org/10.2307/1251854

Jung D, Wu A, Chow CW (2008) Towards understanding the direct and indirect effects of CEOs’ transformational leadership on firm innovation. Leadersh Q 19(5):582–594. https://doi.org/10.1016/j.leaqua.2008.07.007

Kallmuenzer A, Strobl A, Peters M (2018) Tweaking the entrepreneurial orientation–performance relationship in family firms: the effect of control mechanisms and family-related goals. Rev Manag Sci 12(4):855–883. https://doi.org/10.1007/s11846-017-0231-6

Kaplan S, Tripsas M (2008) Thinking about technology: applying a cognitive lens to technical change. Res Pol 37(5):790–805. https://doi.org/10.1016/j.respol.2008.02.002

Kellermanns FW, Eddleston KA, Sarathy R, Murphy F (2012) Innovativeness in family firms: a family influence perspective. Small Bus Econ 38(1):85–101. https://doi.org/10.1007/s11187-010-9268-5

Kirca AH, Jayachandran S, Bearden WO (2005) Market orientation: a meta-analytic review and assessment of its antecedents and impact on performance. J Mark 69(2):24–41. https://doi.org/10.1509/jmkg.69.2.24.60761

König A, Kammerlander N, Enders A (2013) The family innovator’s Dilemma: how family influence affects the adoption of discontinuous technologies by incumbent firms. Acad Manag Rev 38(3):418–441. https://doi.org/10.5465/amr.2011.0162

Kotlar J, De Massis A (2013) Goal setting in family firms: goal diversity, social interactions, and collective commitment to family-centered goals. Entrep Theory Pract 37(6):1263–1288. https://doi.org/10.1111/etap.12065

Kraiczy ND, Hack A, Kellermanns FW (2014) New product portfolio performance in family firms. J Bus Res 67(6):1065–1073. https://doi.org/10.1016/j.jbusres.2013.06.005

Kraiczy ND, Hack A, Kellermanns FW (2015) What makes a family firm innovative? CEO risk-taking propensity and the organizational context of family firms. J Prod Innov Manag 32(3):334–348. https://doi.org/10.1111/jpim.12203

Kraus S, Pohjola M, Koponen A (2012) Innovation in family firms: an empirical analysis linking organizational and managerial innovation to corporate success. Rev Manag Sci 6(3):265–286. https://doi.org/10.1007/s11846-011-0065-6

Kumar N, Stern LW, Anderson JC (1993) Conducting interorganizational research using key informants. Acad Manag J 36(6):1633–1651. https://doi.org/10.2307/256824