Abstract

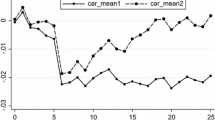

This paper investigates the impact of political connections on firm operational efficiencies. We test the political interventions in investment and employment decisions. Our results provide strong support for the presence of investment inefficiencies and excessive employment amongst politically connected firms, whereas the detrimental effect of political interventions is substantially larger on employment decisions. We further find that such operational inefficiencies are more pronounced for low-growth connected firms. Finally, the economy-wide cost of the excessive employments is estimated to be 0.19 % of GDP annually.

Similar content being viewed by others

Notes

Operational efficiency is the ability of a firm to produce its products in the most cost-effective manner possible while still ensuring the high quality of its products. In the current context, firms establish political connections to reduce the cost of resources required in production.

We restrict ourselves only to observe altered employment size as an outcome of political interference. Unfortunately, the unavailability of data did not allow us to examine politically motivated hiring of inept employees that is also a significant aspect of political interference in employment decisions.

Throughout this paper we use terms ‘operations’ and ‘activities’ interchangeably which refers only to firm investment and employment decisions.

It is worth mentioning that we constrained ourselves to the investigation of the impact of political connections on investment and employment efficiencies and thereby calculating economy-wide cost caused by such operational inefficiencies. Our analysis does not examine the channels of political extraction—ways through which politicians distort the investment and employment efficiencies of the connected firms. These ways may include undertaking projects with negative NPV, hiring incapable employees or providing protection to unproductive labour which encourages them to keep doing so. Additionally, Boubakri et al. (2013) shows that politically connected firms undertake risky investments and we suspect that such pattern of risky investment decisions is also one of the channel which affects negatively on investment efficiency. The data unavailability on the variables involved did not allow us to examine these channels.

Though cost of political connections also includes the cost of political donation, gifts, and bribes we confine ourselves only to ex post cost of political connections.

Data is available at the following URL: http://www.ecp.gov.pk/.

We have the most firms from textiles and trade industry (132), followed by basic industries, including petroleum (67), and then construction (58).

The results of Lagrangian multiplier (LM) test suggest that the cohort effect is zero and pooled regression is appropriate for estimating the employment model, whilst the random effect model is suitable for investment efficiency model. Further, the results of the Hausman test for investment efficiency model could not reject the null hypothesis, therefore implying that the random effects model outperforms the fixed-effects model.

Recall that a negative sign on interactive term indicates that sensitivity of investment expenditure to investment opportunities, investment efficiency, is distorted by firm’s political connections.

For instance, Ittafaq textile mills and Khalid Siraj textile mills, are owned by Nawaz Sharif (three times elected Prime Minister) located in his constituency in the city of Lahore. Similarly, Gujarat silk mill is connected to Chaudhry Pervaiz Elahi (Member of National Assembly) and is located in his constituency in the city of Gujarat.

Sugar mills belong to Food and Tobacco industries.

The importance of these two cities as the leading industrial hubs of country has been discussed in Rehman (2006).

Employee investment mostly refers to capital investment that firms make in the workplace for employee inducement, such as pay, benefits, career opportunities (Romzek 1990).

The pooled regression includes industry and time effects and R 2 of the estimation is 0.084.

References

Aggarwal RK, Felix M, Wang T (2012) Corporate political contributions: investment or agency? http://ssrn.com/abstract=972670

Asquer R, Calderoni F (2011) Family matters: testing the effect of political connections in Italy. In: Symposium: democracy and its development 2005–2011. Centre for the Study of Democracy, UC Irvine

Bartel A, Harrison A (2005) Ownership versus environment: disentangling the sources of public sector inefficiency. Rev Econ Stat 87:135–147

Belghitar Y, Clark E, Kassimatis K (2011) The prudential effect of strategic institutional ownership on stock performance. Int Rev Financ Anal 20:191–199

Bertrand M, Kramaraz F, Schoar A, Thesmar D (2007), Politicians, firms and the political business cycle: evidence from France. Working paper series, University of Chicago

Blanchard O, Lopez-de-Si Lanes F, Shleifer A (1994) What do firms do with cash windfalls? J Financ Econ 36:337–360

Blundell R, Bond S, Devereux MP, Schiantarelli F (1992) Investment and Tobin’s Q: evidence from company panel data. J Econom 51:233–257

Boubakri N, Cosset J, Walid S (2008) Political connections of newly privatized firms. J Corp Finance 14:654–673

Boubakri N, Cosset J, Walid S (2012a) The impact of political connections on firms’ operating performance and financing decisions. J Financ Res 35:397–423

Boubakri N, Guedhami O, Mishra D, Walid S (2012b) Political connections and the cost of equity capital. J Corp Finance 18:541–559

Boubakri N, Mansi S, Walid S (2013) Political institutions, connectedness, and corporate risk-taking. J Int Bus Stud 44:195–215

Bunkanwanicha P, Wiwattanakantang Y (2009) Big business owners in politics. Rev Econ Stud 22:2133–2168

Bushman R, Piotroski J, Smith A (2007) Capital allocation and timely accounting recognition of economic losses. Working paper, The University of North Carolina at Chapel Hill, Stanford University and the University of Chicago

Campbell JY (1996) Understanding risk and return. J Polit Econ 104:298–345

Chen S, Sun Z, Tang S, Wu D (2011) Government intervention and investment efficiency: evidence from China. J Corp Finance 17:259–271

Claessens S, Feijen E, Laeven L (2008) Political connections and preferential access to finance: the role of campaign contributions. J Financ Econ 88:554–580

Coad A, Broekel T (2012) Firm growth and productivity growth: evidence from a panel VAR. Appl Econ 44:1251–1269

Daveri F (2002) The new economy in Europe: 1992–2001. Oxf Rev Econ Policy 18:345–362

Dessi R, Robertson D (2003) Debt, incentives and performance: evidence from UK panel data. Econ J 113:903–919

Dombrovsky V (2008) Do political connections matter? Firm-level evidence from Latvia. Stockholm School of Economics in Riga, BICEPS Working paper series

Faccio M (2006) Politically connected firms. Am Econ Rev 96:369–386

Fan JPH, Wong TJ, Zhang T (2007) Politically connected CEOs, corporate governance, and post-IPO performance of China’s newly partially privatized firms. J Financ Econ 84:343–364

Fisman D, Fisman R, Galef J, Khurana R (2006) Estimating the value of connections to Vice-President Cheney. Working paper, Columbia University, Reported in NBER Digest

Frank MZ, Goyal V (2009) Capital structure decisions: which factors are reliably important? Financ Manag 38:1–37

Fraser DR, Zhang H, Derashid C (2006) Capital structure and political patronage: the case of Malaysia. J Bank Finance 30:1291–1308

Gelos G, Werner A (2002) Financial liberalization, credit constraints, and collateral: investment in the Mexican manufacturing sector. J Dev Econ 67:1–27

Guedhami O, Pittman J, Saffar W (2014) Auditor choice in politically connected firms. J Account Res 52:107–162

Gul FA (1999) Growth opportunities, capital structure and dividend policies in Japan. J Corp Finance 5:141–168

Hainmueller J, Eggers A (2011) Political capital: corporate connections and stock investments in the U.S. congress, 2004–2008. Q J Polit Sci 9:169–202

Harris JR, Schiantarelli F, Siregar MG (2000) The effect of financial liberalization on the capital structure and investment decisions of Indonesian manufacturing establishments. World Bank Econ Rev 8:17–47

Heckman J (1979) Sample selection bias as a specification error. Econometrica 47:153–161

Hirth S, Uhrig-Homburg M (2010) Investment timing, liquidity, and agency costs of debt. J Corp Finance 16:243–258

Hubbard RG (1998) Capital-market imperfections and investment. J Econ Lit 36:193–225

Hung M, Wong TJ, Zhang T (2007) Political relations and overseas stock exchange listing: evidence from Chinese state-owned enterprises. Working paper, University of Southern California, the Chinese University of Hong Kong and City University of Hong Kong

Jensen MC (1986) Agency cost of free cash flow, corporate finance, and takeovers. Am Econ Rev 76:323–329

Khwaja AI, Mian AR (2005) Do lenders favour politically connected firms? Rent provision in an emerging financial market. Q J Econ 120:1371–1411

Kumar S, Hyodo K (2001) Price-earnings ratios in Japan: recent findings and further evidence. J Int Financ Manag Account 12:24–49

Li H, Meng L, Zhang J (2006) Why do Entrepreneurs enter politics? Evidence from China. Econ Inq 44:559–578

Li H, Meng H, Wang Q, Zhou LA (2008) Political connections, financing and firm performance: evidence from Chinese private firms. J Dev Econ 87:283–299

Love I (2003) Financial development and financing constraints: international evidence from the structural investment model. Rev Financ Stud 16:765–791

Niessen A, Ruenzi S (2010) Political connectedness and firm performance: evidence from Germany. Ger Econ Rev 11:441–464

Papadogonas T, Voulgaris F (2005) Labour productivity growth in Greek manufacturing firms. Oper Res Int J 5:459–472

Rajan RG, Zingales L (1995) What do we know about capital structure? Some evidence from International data. J Finance 50:1421–1460

Ratti R, Lee S, Seol Y (2008) Bank concentration and financial constraints on firm-level investment in Europe. J Bank Finance 32:2684–2694

Rehman UR (2006) Who owns Pakistan, 5th edn. Mr. Books (Pvt.) Ltd., Islamabad

Robinson JA, Torvik R (2005) White elephants. J Public Econ 89:197–210

Romzek BS (1990) Employee investment and commitment: the ties that bind. Public Adm Rev 50:374–382

Shleifer A, Vishny R (1994) Politicians and firms. Q J Econ 109:995–1025

Shyam-Sunder L, Myers SC (1999) Testing static trade-off against pecking order models of capital structure. J Financ Econ 51:219–244

Smith CW Jr, Watts RL (1992) The investment opportunity set and corporate financing, dividend, and compensation policies. J Financ Econ 32:263–292

Tobin J (1969) A general equilibrium approach to monetary theory. J Money Credit Bank 1:15–29

Wakelin K (2001) Productivity growth and R&D expenditure in U.K. manufacturing firms. Res Policy 30:1079–1090

Wolfers J (2002) Are voters rational? Evidence from gubernatorial elections. Stanford GSB research paper no. 1730

Xu X, Wang Y (1999) Ownership structure, corporate governance, and corporate performance. China Econ Rev 10:75–98

Yeh Y, Shu P, Chiu S (2013) Political connection, corporate governance and preferential bank loans. Pac Basic Finance J 21:1079–1101

Zheng Y, Zhu Y (2010) Bank lending incentives and firm investment decisions in China. J Multinatl Financ Manag 23:146–165

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Saeed, A., Belghitar, Y. & Clark, E. Political connections and firm operational efficiencies: evidence from a developing country. Rev Manag Sci 11, 191–224 (2017). https://doi.org/10.1007/s11846-015-0185-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-015-0185-5