Abstract

Family firms play a significant role in national economies worldwide, accounting e.g. for 85% of all enterprises in the OECD countries as well as for the majority of companies in Central Europe. Previous scholarly research on family firms has mostly focused on the question of how they differ from public corporations, describing family firms as being more conservative, less risk-raking, or reluctant to grow—in sum, as being less entrepreneurial than their non-family counterparts. Similarly, the existing literature often criticizes the lack of innovation in family firms. But since innovation has long been discovered as one of the key drivers to company success, it is surprising that its role in family firms has been mostly neglected in existing academic research so far. The aim of this article is therefore to study the role of (managerial and organizational) innovation in family firms compared to non-family firms on the basis of an empirical survey of 533 companies from Finland, using structural equation modelling (MPlus) for the statistical analyses.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Family firms play a significant role in national economies worldwide, and strongly contribute to their growth and stability (Klein 2000; Tio and Kleiner 2005). Widely recognized, family firms account for 85% of all enterprises in the OECD countries as well as for 70–80% of all enterprises in Europe (Van den Berghe and Carchon 2003; Mandl 2008) as well as in the USA (Potts et al. 2001; Astrachan and Shanker 2003). In Finland, 80% of all companies are considered family firms (Finnish Family Firm Association 2010).

Previous scholarly research on family firms has mostly focused on the question of how they differ from public corporations. Family firms are often described as being conservative (Habbershon et al. 2003; Ward 2004); less risk-raking (Morris 1998); more long-term oriented (Sharma and Irving 2005); reluctant to grow and slow-growing (Taiguiri and Davis 1992; Poza et al. 1997); slow in decision-making; and unable to react or change in accordance with markets (Schulze et al. 2003; Lubatkin et al. 2007). They are often generally considered to be less entrepreneurial than their non-family counterparts. Similarly, the existing literature often criticizes the lack of innovation in family firms (Cabrera-Suárez et al. 2001; Carney 2005).

Innovations are a major driving force for entrepreneurship and (firm-level as well as economic) growth. Entrepreneurial firms are characterized by their commitment to innovation (Miller 1983; Covin and Slevin 1991). A marketplace that is more and more competitive continues to see increased interest in understanding the factors associated with innovation (Llach and Nordquist 2010). After all, the management of innovation, continual change, and generation-spanning corporate development are widely considered to be and discussed as the recipe for economic growth and long-term success. Because most companies in the western world are SME, with the majority of these being family firms, continuous innovation is seen as a primary element of company success. Against the background of global competition for technologies and markets, innovation management is seen as a core challenge for European companies. A deeper understanding of the influence of families on innovation in their firms can deliver important insights to help elaborate more widely on the potential of countries to remain as leaders in the global innovation context (Bergfeld and Weber 2011). Although innovation’s role has been studied in large and publicly traded firms (e.g. Zahra 1993) or high-tech ventures (e.g. Koberg et al. 1996), it’s those firms in particular that have remained in the hands of families which continue to be ignored by innovation researchers (Craig and Moores 2006). In their recent article, Rößl et al. (2010) even constitute a general “lack of research regarding the innovative activity of family firms” (p. 368).

The objective of this article is therefore to increase the—until now—limited understanding of the role of innovation in family firms. In this study, the aim is not to determine whether family firms are more, or less, innovative than non-family firms, as has been previously addressed in the literature. Instead, as family business research has shown, we posit that there are important differences between family and non-family firms, which have an effect on how firms innovate. Taking this as our starting point, we aim to study the role of management innovations between these two groups of firms. We will particularly focus on organizational and managerial innovation and how they affect corporate success. We are especially interested whether and to what extent the relationship between managerial and organizational innovation differs between family and non-family firms. For this, we present the assumption that organizational and managerial innovations lead to higher success in family firms, especially through their role as antecedents of successful product innovation (Damanpour et al. 1989; Armbruster et al. 2008). Innovations in turn lead to an improved overall competitive position (Damanpour et al. 1989; Zahra et al. 2004). This potential relationship was investigated on the basis of a large-scale quantitative empirical survey of 533 Finnish firms which will be analyzed using the help of the structural equation modeling technique.

2 Definitions and delimination of the subject

2.1 Family firms

Family firm research as a scholarly field is still considered to be in its early stages (Craig and Lindsay 2002). Litz (1995) calls family firms one of the most consistently overlooked organizational phenomena. Although the quantity as well as the quality of research on family firms is constantly increasing, as Chrisman et al. (2003) puts it, “much remains to be done”. For example, to date there is not even a generally accepted definition of what a family firm actually is (Chrisman et al. 2005; Di Toma and Montanari 2010; Kraus et al. 2011a). However, what is generally agreed on is that family firms can be regarded as contextual hybrids (Naldi et al. 2007), being the combination of two institutional influence systems of the family and the business (Gersick et al. 1997).

A definition has to distinguish family firms from public corporations, sole proprietorships, or from business partnerships in general, as well as from small and medium-sized enterprises (SME) which typically share many (if not even most) but not necessarily all characteristics of family firms. Many definitions thus do not succeed in delineating family firms from sole proprietorships or SME. In fact, except for a few large international family firms (Hennerkes 2004), a majority of family firms can in fact be regarded as SME. Following e.g. Reimers (2004), we regard the term “family firm” as independent of company size.

A range of attempts to narrow down this term are based on qualitative characteristics for the explication of family firms. Accordingly, Habbershon and Williams (1999) define family firms as unique bundles of resources and capabilities which result from interactions between the family and the company. According to Klein (2004), a company is a family firm if one of the three factors of equity capital, management and control is dominated entirely by the family, or if the lack of influence on one of the three factors is compensated by another factor. However, it is assumed that a stake in equity capital is a necessary requirement. From this perspective, family firms are defined as companies in which ownership belongs to one family or is distributed among several families and their members, and in which (apart from the entrepreneur) at least one supplemental family member actively participates in the company through his or her collaboration (Covin 1999; Carsrud 2006; Rutherford et al. 2006). The will to retain the company in the family on a long-term basis also should be added as a necessary prerequisite, along with the distribution of control among several family members (Sharma et al. 1997; Astrachan and Shanker 2003).

For this study, we follow the definition by Rößl et al. (2010), and define a family firm as a company (1) of which several family members hold capital shares, (2) whose major business capital is held by one or more members of this family, (3) in which the strategic decisions are made by several family members based on the importance of their capital shares and/or are based on informal authority, whereas it is irrelevant if the entrepreneurial family itself constitutes the management or if it controls the company through a management appointed by the family, (4) on whose economic development several people in the family are directly financially dependent, since their individual capital incomes and/or their individual work incomes in the company generate a majority of their income, and (5) which, due to this importance for the family, is intended to be retained in the family’s sphere of influence.

2.2 Innovativeness of entrepreneurial firms

An innovation can be defined as the successful implementation of the processes where new creative ideas are put into practice within an organization (Rickards 1985; Schaper and Volery 2004). Specifically, innovation is the establishment of new concepts, procedures and/or technologies in an organization. For something to be understood as an innovation, it requires novelty; tangible qualities; must be the result of a deliberate action and not a coincidence; should aim to produce benefit; and be recognizable as something other than just a change to the typical routines (King and Anderson 2002).

Innovations are the expression of entrepreneurial activity and may contribute to the long-term survival of a (family) business (Leenen 2005). Innovativeness is a strategic orientation that many organizations require. It provides a way to adapt to technology, competition, and market changes (Dougherty and Hardy 1996). A significant segment of the literature on innovation management emphasizes the importance of innovation as a part of corporate strategy with the goal of keeping the company competitive and in business (Hakala 2011). Here, the assumption is always that innovation increases the uniqueness of systems, products, processes, and services, leading to higher profitability and more growth (Damanpour et al. 1989). Innovations allow a company to increase its return on investments, achieve a greater market share, and strengthen its overall competitive position. Innovations are always an indicator of corporate activity, and can be understood as an assurance that the (family) firm will not only continue operating but also grow for years to come (Leenen 2005; Bergfeld and Weber 2011).

According to Miller and Friesen (1983), “[…] an entrepreneurial firm is one that engages in product-market innovation, undertakes somewhat risky ventures, and is first to come up with ‘proactive’ innovations, beating competitors to the punch” (p. 771). An important element of an entrepreneurial innovative firm is the ability to adapt to changing market requirements (Teece et al. 1997), which often requires reinvention of the business model in order to realize the full potential of new product innovations and, more generally, enable the firm to remain innovative (Johnson et al. 2008). These business model innovations are essentially linked to new ways of organizing the company and its management systems, i.e. to managerial and organizational innovations (Doz and Kosonen 2010; Osterwalder and Pigneur 2010).

Management innovations work through technological product innovations. Organizational and managerial innovations (such as business model innovations) may not lead to value creation without technological product innovations (Chesbrough 2010; Teece 2010). Although work on non-technological innovation has existed for quite some time, most of the literature on innovation still focuses on technological product and process innovation (Birkinshaw et al. 2008). However, the need to understand administrative or management innovations is equally important. Studies have shown that management innovations, both managerial and organizational, lead to better firm-level performance, especially when implemented together with product innovations (e.g. Damanpour and Evan 1984; Damanpour et al. 1989; Sapprasert 2010). As highlighted in previous literature, the adoption and creation of innovation requires adaption and change for the innovating organization as well (e.g. Fagerberg 2003; Lorenz and Wilkinson 2003; Lam 2005). This literature emphasizes the combinatorial nature of innovation, put forth originally by Schumpeter (1934) where innovation requires the whole organization to be able to overcome inertia and develop new routines to appreciate the benefits of new innovations. Therefore, in order to innovate, firms are required to adapt their organization to the new products or process they wish to introduce. Firms need to adjust their organization to meet the requirements of the changing operational environment, be able to adopt new technologies, and commercialize their new products and processes. A recent example of management innovation leading the firm in becoming increasingly innovative is the open innovation model. A growing strand of research has shown that firms need external sources of knowledge and ideas to advance their technology, not only internal sources (Chesbrough 2003). To make the transition from the closed innovation model to the open innovation model, the firm needs to also create or adopt a different set of managerial and organizational tools. Firms need to be able to manage their R&D networks efficiently and have an organization capable of acquiring external knowledge.

Organizations with different structural forms vary in their patterns of learning and knowledge creation, giving rise to different types of innovative capabilities (Lam 2005). Innovations are strongly associated with the readiness to innovate that is embedded in the organizational culture. Consequently, one can derive two contrary propositions: First, readiness to innovate is the starting point for innovations. And, due to the high significance of reference figures, their “spirit of innovation” continues to have generation-spanning effects in family firms.

2.3 Management innovations

In this article we focus on two categories of innovations: managerial innovations and organizational innovations, which bring novelty to the way firms organize, structure and manage their processes. These types of innovations both belong to the broader category of management innovations,Footnote 1 which are elemental in the development of the firm and its products and processes. Management innovation includes the invention and implementation of management practice, management process, management techniques, and organizational structures that are intended to further organizational goals (Birkinshaw et al. 2008). Literature on management innovations underlines the fact that they are very different in nature compared to technological and especially product innovations (Alänge et al. 1998). This is because management innovation represents investments in knowledge, procedures, behavior and relations, but less when it comes to artifacts. Management innovations are typically tacit in nature and difficult to protect by patent (Teece 1980). These characteristics allow a higher level of subjective interpretation on the part of the potential user than with technological innovations, which increases the importance of social and political processes (Birkinshaw et al. 2008). Another important feature of management innovations is that very few organizations have well-established and specialized expertise in the area of management innovation. While product innovation is often specifically organized in R&D labs, this is not the case for management innovations. Due to their nature, management innovations are likely to generate uncertainty and ambiguity within the firm, with a higher impact than technological innovations. This leads to the need to establish legitimacy by validating the innovations independently from external sources, especially since the effects of management innovations are not as clear to employees or managers in the firm. So to summarize, the major difference between management innovations and technological innovations lies in the role of factors internal to the firm, i.e. the cultural, social, and political aspects of the organization (Alänge et al. 1998).

The previous literature on management innovation has not clearly distinguished between different types of innovations (e.g. Kimberly and Evanisko 1981; Damanpour 1987). However, recent studies have started to analyze management innovations in a more precise way (Sapprasert 2010). For example, Bodas Freitas (2008) shows differences in the diffusion of managerial and organizational innovations. We have delineated between two types of management innovations, namely organizational and managerial innovation. Organizational innovation refers to a new organization of work, management structures, or relationships with external partners. Managerial innovation refers to innovations in management systems, knowledge management, and supporting activities. Following Wengel et al. (2000), we distinguish between the two in the following way: organizational innovations encompass responsibilities, accountability, command lines and information flows. They focus on the divisional structure of functions, and for example change the number of hierarchical levels. Managerial innovations on the other hand affect the operations and procedures of the enterprise such as the specifications of responsibilities, the content of commands and of information flows, and the way they are dealt with. They involve the speed and flexibility of production and the reliability of products and production processes.

3 Innovation in family firms

3.1 Literature review

There has so far been a clear lack of scholarly research regarding the innovative activity of family firms (Leenen 2005). As of January 2011, in the Family Business Review (FBR), the major family firm research journal published by SAGE Publications, only three articles from a total of 23 volumes have contained the word “innovation” in their title. According to Gudmundson et al. (2003), “research examining the relationship between innovation and ownership structure appears to be nonexistent” (p. 3). In their recent research note on the topic, Craig and Moores (2006) state that they “believe there is still limited research that has explored innovation within family firms” and that “…there is potential for further study of innovation in family firms…” (p. 8). So in recent years, the topic has fortunately started to receive increasing interest (Rößl et al. 2010).

To the knowledge of the authors, the following surveys are the only studies addressing this issue empirically:

Morck et al. (2000) show on the basis of a Canadian sample that family firms controlled by heirs were less active in R&D than their non-family counterparts of the same age and size in the same industries. Litz and Kleysen (2001) conducted a case study analyzing the entrepreneurial activity of a jazz musician with a special focus on the sustainability of the commercial innovations regarding the ensuing family generations. Gudmundson et al. (2003) examine the influence of organizational culture, ownership structure (family vs. non-family firms) and of customer types on the initiation and implementation of innovative processes in a quantitative empirical survey. In summary, they note: “The results suggest that initiation and implementation of innovation are significantly enhanced […] when it is a family-owned business. Family firms have unique characteristics positively related to implementation of innovation […]” (p. 14). However, differences in organizational culture interfere with this effect. Leenen (2005) examines the drivers of innovations in family firms, i.e. why innovative projects are initiated; whether innovations in family firms emerge incrementally rather than radically; if product or process innovations prevail; and how organizational culture, management style or the choice between family members as CEO or the use of an external CEO influence the innovative process. In their longitudinal 10-year study of 67 established Australian family firms, Craig and Moores (2006) determined that organizational structure is related to innovation within family firms. Also, firms having a greater amount of innovation have less formality and are more de-centralized. In addition, well-established family firms seem to place a high level of significance on innovation and strategy practices. The authors were also able to show strong interactions between innovative strategy and environmental uncertainty attributed to technological change. Llach and Nordquist (2010) found differences with regard to the role of human, social and marketing capital for innovation when comparing 22 family and 22 non-family firms from Spain. These are interesting findings, because some of them stand in contrast to the conventional wisdom that sees family firms as being less innovative than non-family firms. And finally, Bergfeld and Weber (2011) just recently compared 62 family and 62 non-family “dynasties” of family firms (i.e. older than 100 years) from Germany, and found that successful dynastic families define innovation as the ability to constantly address new markets and technologies based on a clear long-term strategy.

In sum, the results of the very few existing empirical studies on the topic of innovation in family firms are still contradictory to a certain extent. And, no large scale quantitative study has emerged so far. This is where the following research takes up its work.

3.2 Development of hypotheses

In this study, we put forth the hypothesis that management innovations lead to higher corporate success, especially through their role as an antecedent of successful product innovation. Firm growth has become the major indicator for overall corporate success within entrepreneurship and SME research (Carton and Hofer 2006). Talking about “entrepreneurial” family firms always means discussing innovation- and growth-oriented family firms. We thus we also use firm growth as an indicator of corporate success in our empirical study.

The main core of innovation study literature has focused on product innovations and the relationship between product innovativeness and corporate success. This literature stems back to the seminal work of Schumpeter (1934, 1942) who emphasized innovations as the core aspect of firm survival among the “perennial gale of creative destruction”. Research has shown over and over again that firms require the development of new products if they want to gain competitive advantage (e.g. Teece 1986). In this article we do not focus on explicit product innovations, but on the orientation or inclination towards product innovations instead, which we call product innovation intensity or innovativeness.Footnote 2 We define innovation as the introduction of new products, meaning that product innovativeness refers to the extent to which the firm creates and is oriented towards introducing new products.

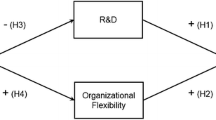

Although the performance effects of management innovations are more difficult to discern beforehand (Birkinshaw et al. 2008), which affects their adoption rate, earlier studies have shown that both managerial and organizational innovations lead to better firm-level performance (e.g. Damanpour and Evan 1984; Damanpour et al. 1989; Sapprasert 2010). Management innovations focus on the core organizational routines of firms, as well as the way firms organize their workforce, knowledge management system, and decision making mechanisms. These routines are by nature stable and slow to change (Nelson and Winter 1982; Hannan and Freeman 1984; Dosi et al. 2000). Management innovations, by introducing change to these routines, enable the firm to escape the harmful effects of inertia. Our central argument is that in addition to product innovations, firms also need managerial and organizational innovations to achieve corporate success. Management innovations present a direct source of competitive advantage by having a significant impact on business performance with regard to productivity, quality and flexibility (Armbruster et al. 2008). Empirical research has previously shown that especially when implemented together with product innovations, management innovations are related to positive outcomes (Damanpour and Evan 1984; Damanpour et al. 1989; Bodas Freitas 2008; Sapprasert 2010). Theoretical literature suggests that management innovation is a necessary precondition for technical innovation (Lam 2005). Both of these act as the antecedents and facilitators of an efficient use of technical product and process innovation, because the ability for firms to introduce new products depends on the degree to which the organizational structures and processes respond to the use of these new technologies (Armbruster et al. 2008). Management innovations enable the firm to become more innovative by e.g. enabling it to shift towards an open business model (Chesbrough 2010). This leads us to propose that product innovation intensity partially mediates the effects of organizational and managerial innovations on corporate success. We therefore present the following hypotheses:

-

Hypothesis 1a: Managerial innovation has a positive effect on corporate success.

-

Hypothesis 1b: Organizational innovation has a positive effect on corporate success.

-

Hypothesis 2: Product innovation intensity has a positive effect on corporate success.

-

Hypothesis 3a: Organizational innovation has a positive effect on product innovation intensity.

-

Hypothesis 3b: Managerial innovation has a positive effect on product innovation intensity.

Differences in family and non-family firms with regard to management innovation are perhaps even more evident than in technological innovations due to the importance of social and political processes (Birkinshaw et al. 2008). As discussed above, the internal and cultural aspects of the firm are central to management innovations. Organizational culture plays an important role in defining the innovativeness of a firm (De Brentani and Kleinschmidt 2004; Naranjo-Valencia et al. 2011). On the other hand, family business research has shown that family firms differ in their values and attitudes, objectives, and strategic behavior from non-family firms (e.g. Donckels and Fröhlich 1991). This leads us to hypothesize that organizational and managerial innovations have a different level of importance in family firms when compared to non-family firms. A recent study focusing on the adoption of management practices points to this as well: Battisti and Iona (2009) show that managerial innovations are not as readily adopted in family firms. It is speculated that a more concentrated ownership structure reduces the need to adopt management practices. Non-family firms require more centralized management systems and are thus quicker to adopt managerial innovations. However, existing studies have highlighted the importance of organizational culture in the pursuit of competitive advantages in family firms (e.g. Zahra et al. 2004). Family firms profit from their organizational culture which, for example, tends to have fewer issues with principle agent problems and reduced reliance on formal controls and coordination. These traits make the family firm a more efficient innovator when it comes to the effects of organizational innovation. In other words, family firms gain more from organizational than managerial innovations, while non-family firms need new management systems to manage growth. As Craig and Moores (2006) point out, it is the organizational structures that enhance innovativeness in family firms. Organizational innovations align these structures to enable innovation and corporate success. This leads us to the next hypotheses:

-

Hypothesis 4a: The positive relationship between organizational innovation and corporate success is higher in family firms than in non-family firms.

-

Hypothesis 4b: The positive relationship between managerial innovation and corporate success is higher in non-family firms than family firms.

The following figure illustrates our underlying conceptual model, including the stated hypotheses:

4 Empirical investigation

4.1 Data

This study used a unique Finnish dataset of 533 firms to study the differences between family and non-family-owned firms in the role of organizational innovation in growth performance. We aimed to analyze how organizational and managerial innovation is associated with the growth performance of firms, and how this relationship differs in family and non-family firms.

We applied quantitative survey data to test our hypotheses. The data was collected from Finnish firms operating in the food industry (NACE 10–11); the media (NACE 18, 58–61); and the maritime industry, including ship building (NACE 301) and all sub-contracting sectors (furnishing, maintenance etc.). A sample of 2,227 firms was selected for the data collection by using a stratified sampling of the official business register of Statistics Finland. This data was collected through computer-aided telephone interviews in the late spring of 2009. The survey was targeted at key respondents (e.g. Kumar et al. 1993; Lechner et al. 2006) in management positions (i.e. owners, CEOs, general managers) as the supposedly most knowledgeable sources of information. Contacting the 2,227 firms resulted in a total of 535 responses and a response rate of 24%, which can be seen as rather high for management studies (Wolff and Pett 2007). For a non-response bias, examinations were conducted to determine the differences between early and late respondents. No statistical differences were discovered between the two groups (Kanuk and Berenson 1975; Armstrong and Overton 1977; Newby et al. 2003).

The analysis covered the size of the 533 firms that responded and the firms that did not participate in the survey. The size distribution of the participating firms was slightly, but non-linearly, skewed towards larger firms, which is a relatively typical outcome in these kinds of surveys. The share of family firms in the entire dataset was 42% (226 firms). Distinguishing organizations by type is crucial in innovation research (Damanpour 1991), and as a result, we expected interesting results in the comparison of the two groups.

The distribution of family firms among different industry sectors resulted in the following: 69% of the respondents were from the food industry, 32% from the media sector, and 43% from the maritime industry. These survey participants considered their firms to be family businesses. Table 1 describes some descriptive statistics about the two groups of firms. The average size (measured by either the number of employees or turnover) of the family firms is somewhat smaller than the non-family firms. However, when we exclude the two largest firms from the sample, the average size of the non-family firms decreases to 128 employees and 32 MEUR.Footnote 3 The age distribution does not differ considerably between the groups.

4.2 Measures

In building our measurement model we utilized established measures. Survey constructs for measuring organizational and managerial innovation are still scarce. We adopted items developed for the Community Innovations Surveys, which have been conducted since the mid-1990s in the European Union member states and which are coordinated by EUROSTAT. The methodology for measuring managerial and organizational innovation is described in the Oslo Manual (2005) of the OECD. All scale items were scored using a Likert-type scale with response options from 1 (“totally disagree”) to 7 (“totally agree”), with higher scores indicating higher levels of the construct in question.

Corporate success

Success was analyzed by means of three self-reported measures of firm growth. The respondents were asked to respond to the statements about the growth of their sales and personnel in comparison to their competitors. The corporate success construct emphasized the relative growth performance of the firm.

Product innovation intensity

Product innovativeness was measured by means of three self-reported measures. The respondents were asked to respond to the statements about their relationship to product and service innovation, which measures the extent to which the firm aims to create product and service innovations. Firms scoring high on this measure are oriented towards product innovation, whose intensity measure was adopted from Jansen et al. (2006).

Managerial innovation

Managerial innovation was measured using three self-reported measures. The respondents were asked to respond to the statements about whether they have introduced new knowledge management systems during the last three-year period.

Organizational innovation

Organizational innovation was measured by means of three self-reported items. The respondents were asked to respond to the statements about whether they have introduced new organizational structures, employee decision making, or networks during the last three-year period. The descriptive statistics and correlation matrices of the measures can be found in Table 2:

4.3 Measurement model

To test our research hypotheses, we followed a two-step approach for structural equation modeling using MPlus 6 (Hair et al. 2010). To test for differences between groups, we estimated a moderation model, where we divided the sample into the two groups of family firms and non-family firms. First, we assessed and validated our measurement model, followed by an estimation of the structural equation model depicted in Fig. 1. Since we were estimating a moderator model with two groups, we first tested whether our measurement model worked for both of the sub-samples. As the values were above the critical level of 0.9 for CFI, the RMSEA values below .08, and the SRMR values below .08, this proved to be the case (Table 3). The chi2 value was significant for all the measurement models. However, this is normal for models with a large number of indicators (Hair et al. 2010), and since all fit indices indicated good fit, we can safely assume that the model is appropriate for the data, and proceeded to examine the structural model. We then tested the measurement model fit for the full sample estimated with the two groups. This also proved reasonable (Table 3).

We then evaluated the measurement models based on three criteria: convergent validity, discriminant validity, and reliability. Table 4 provides the figures for our evaluation. Here, it can be seen that our constructs in both sub-samples were valid and reliable. Convergent validity is summarized by the average variance extracted (AVE), which was over 0.50 for all the constructs. Similarly, the construct reliability was over 0.70 for all the constructs. The right-hand side of Table 4 gives us a matrix where the correlation between the constructs is compared to the square root of AVE, which is on the diagonal. From this we can see that all of the values on the diagonal are higher than their pairs, which indicates good discriminant validity.

4.4 Results

To test the hypothesized model, we split our sample into two groups and estimated a two-group structural equation model. To test the dichotomous moderator variable, we utilized the family firm moderator to divide the sample into groups, and performed a Chi-square test of the significance of the difference between the designated structural parameters across groups (see e.g. Hair et al. 2010). As expected, the result was that the coefficients from product innovation intensity to corporate success were statistically non-different between the groups. Also, the coefficients from organizational innovation to product innovation intensity did not differ between the groups. The goodness of fit statistics suggest that the structural models fit the data well (Table 5).

The results are summarized in Fig. 2 for the family firms and Fig. 3 for the non-family firms. Our results show that the positive influence of product innovation on corporate success exists. Organizational and managerial innovations play an important role as well. However, as hypothesized, we did not find the managerial innovation to be significantly related to corporate success for the family firms. Organizational innovations on the other hand seem to be important for family firms. They have a direct effect on corporate success, as well as an indirect effect through product innovation intensity (significant indirect effect 0.108***). In non-family firms, managerial innovation comes out as an important factor in corporate success. This is also the case for organizational innovation. Here, however, they have an effect only through product innovation. We find a significant indirect effect from organizational innovation, to product innovation intensity, all the way to corporate success (0.117***).

From the figures above, we can discern that hypotheses 1a and 1b were only partially supported. Managerial innovation was positively related to corporate success in non-family firms, but not family firms. The exact opposite applies for organizational innovation. Hypothesis 2 was supported; product innovation intensity had a positive effect on corporate success in both kinds of firms. Hypothesis 3a was not supported; we did not find managerial innovation to have a positive effect on product innovation intensity. This was a somewhat surprising finding. It may be that managerial innovations are more oriented towards making the firm cost-efficient, but not necessarily more innovative (Bodas Freitas 2008). This idea is supported by the fact that managerial innovations have a positive effect on corporate success (with non-family firms). On the other hand, hypothesis 3b was supported, and we found organizational innovation to have a positive effect on product innovation intensity. Both moderating hypotheses were supported. The effect of organizational innovation on corporate success for family firms was higher than for the non-family firm group. Managerial innovation, on the other hand, had a larger effect on corporate success for the non-family firms. Table 6 summarizes our results.

5 Discussion and conclusion

The goal of our study has been to increase our knowledge on the differences in innovative behavior that can be found between family and non-family firms. Here, the interrelations between innovation and corporate success are essential for both everyday business and research. Innovation is an entrepreneurial skill that can be applied by family firms to achieve a competitive advantage. Although some areas of family firm research have in fact begun to consider innovation, there is a general lack of empirical studies on innovation and how it is used in family businesses. Studies in the past on the innovation found in family firms have led to findings contradicting one another. Just about all researchers see family firms as conservative and stable, which is a result of their tradition and aversion towards risk. This is one reason why the lack of innovation in family firms continues to be a topic found in the literature.

Nevertheless, there is also research showing that family firms can be entrepreneurial as well (Naldi et al. 2007). With this in mind, we examined the innovative behavior of family firms on the basis of a large scale empirical survey from Finland, and found that the effects of management innovations on corporate success differ to some extent between family and non-family firms. In fact, for family firms, organizational innovations seem to be more important than managerial innovations. They have a positive relationship with overall corporate success as well as product innovation intensity. This means that if a family firm rebuilds e.g. its organization of work, its management structure, or its relationships with external partners, i.e. if it “renews” itself constantly (Floyd and Wooldridge 1999), then following the logic of increasingly changing markets, it is more likely to innovate new products and to grow. Organizational innovations were important antecedents in both family and non-family firms, although in the latter there was no direct relationship with corporate success, but only one with increasing product innovations. Managerial innovations again were only important in non-family firms having a direct positive relationship to corporate success. This means that e.g. innovations in management systems, knowledge management, or supporting activities seem to be less important for family firms. This is in line with existing research on family firms which finds longer-term planning horizons and more constant, sometimes even more conservative, leadership (e.g. Habbershon et al. 2003).

Future studies should aim to elaborate on the underlying reasons for these findings. It would be especially interesting to understand in greater detail how the organizational culture plays a role in the innovation processes of family firms. Although it has been shown that the organizational culture plays an important role in the way firms innovate (Çakar and Ertürk 2010; Naranjo-Valencia et al. 2011), there is still little research on the relationship between organizational culture and the different types of innovation in the family firm context.

Previous research has shown that organizational culture is responsible for the innovativeness of a family firm (e.g., Naranjo-Valencia et al. 2011), the management style of its leaders (e.g., Leenen 2005) as well as a less formal and more de-centralized structure (e.g., Craig and Moores 2006). In short, if a family firm wants to grow, be innovative and entrepreneurial, it should (constantly) question itself about whether the culture within the firm as well as the applied leadership style of the entrepreneur is also entrepreneurial (e.g., Blumentritt et al. 2005), and if its organizational structure still fits the requirements of a rapidly changing environment. In other words, is the firm actively pursuing an entrepreneurial strategy? The complex and constantly changing interplay of these domains—strategy, entrepreneur, environment, and organizational structure—or, in other words, the “optimal configuration” (e.g., Kraus et al. 2011b) of the family firm is the final influence variable of corporate success. We follow Pittino and Visintin (2009) with their conclusion in summarizing previous research that the strategic orientation of a family firm is strongly dependent on (1) the leadership’s role in fostering risk-taking and entrepreneurial behavior, (2) the profile, competences and motivation of the owner(s), and (3) the characteristics and specialization of the members of the firm’s dominant coalition. The most important driver for entrepreneurial behavior in family firms—as in most other (usually non-publically traded) SME is thus the person of the (family firm) entrepreneur (or the entrepreneurial team). Future research on the topic of innovation in family firms should therefore concentrate on the interplay of the four configurational domains mentioned, and should pay particularly close attention to the role of the family firm entrepreneur as being responsible for the strategic decisions within the company.

This study of course also holds several limitations. First, it entails cross-sectional data from only one country (Finland). Further research in other countries should be undertaken in order to evaluate whether our results might be country-specific. Second, the use of objective measures does not solve the problem of the one measuring point. A longitudinal design should be implemented for more thorough analysis, along with a follow-up study. Third, the use of growth as a measure of corporate success might be questioned. Although a generally accepted indicator for success in SME and entrepreneurship research (see e.g. Carton and Hofer 2006), not all enterprises want to grow. This might be the case for family firms in particular. To avoid this problem it could be helpful to collect different objective measures of financial success and analyze whether there are differences between the groups in performance measures. It is also possible that the performance of family firms is reflected in their growth more than with profitability. And it’s possible that profit-maximizing behavior is not present among the family firms, i.e. although they are financially less efficient, they use their company as a direct tool to increase the owners’ welfare. This kind of behavior requires more analysis concerning the financial efficiency between these groups. Fourth, this study used CEOs and owners as respondents, which might cause a bias due to these respondents’ tendency to reply positively to questions related to corporate success and innovation. However, since there is no reason to think that this bias differs between family and non-family firms, it is of no major concern. Last but not least, the question of whether innovative behavior changes over time within corporate development, e.g. with a change of management due to intergenerational or external succession, might also be an interesting avenue for further research.

Notes

Management innovations are sometimes called organizational innovations (e.g. Alänge et al. 1998) or administrative innovations (e.g. Damanpour and Evan 1984). But since we distinguish between managerial and organizational innovations, we adopt the terminology from Birkinshaw et al. (2008) to reduce ambiguity. Also, in some cases, organizational innovation has been used to broadly refer to any type of innovation created by an organization (e.g. Wolfe 1994).

Jansen et al. (2006) call this exploratory innovativeness as opposed to exploitative innovation, which refers to technology adoption and incremental improvement.

Removing the outliers did not change the results, so these were kept in the dataset in the analysis reported below.

References

Alänge S, Jacobsson S, Jarnehammar A (1998) Some aspects of an analytical framework for studying the diffusion of organizational innovations. Technol Anal Strateg Manag 10(1):3–20

Armbruster H, Bikfalvi A, Kinkel S, Lay G (2008) Organizational innovation: the challenge of measuring non-technical innovation in large-scale surveys. Technovation 28(10):644–657

Armstrong S, Overton TS (1977) Estimating nonresponse bias in mail surveys. J Mark Res 14(3):396–402

Astrachan J, Shanker M (2003) ‘Family Businesses’ contribution to the US economy: a closer look. Family Bus Rev 16(3):211–219

Battisti G, Iona A (2009) The intra-firm diffusion of complementary innovations: evidence from the adoption of management practices by British establishments. Res Policy 38(8):1326–1339

Bergfeld M-M, Weber F-M (2011) Dynasties of innovation: highly performing German family firms and the owners’ role for innovation. Int J Entrep Innov Manag 13(1):80–94

Birkinshaw J, Hamel G, Mol MJ (2008) Management innovation. Acad Manag J 33(4):825–845

Blumentritt T, Kickul J, Gundry LK (2005) Building an inclusive entrepreneurial culture—effects of employee involvement on venture performance and innovation. Int J Entrep Innov 6(2):77–84

Bodas Freitas IM (2008) Sources of differences in the pattern of adoption of organizational and managerial innovations from early to late 1990s in the UK. Res Policy 37(1):131–148

Cabrera-Suárez K, De Saá-Pérez P, Garcia-Almeida D (2001) The succession process from a resource- and knowledge-based view of the family firm. Family Bus Rev 14(1):37–46

Çakar ND, Ertürk A (2010) Comparing innovation capability of small and medium-sized enterprises: examining the effects of organizational culture and empowerment. J Small Bus Manag 48(3):325–359

Carney M (2005) Corporate governance and competitive advantage in family-controlled firms. Entrep Theory Pract 29(3):249–265

Carsrud AL (2006) Commentary: “Are we family and are we treated as family? Nonfamily employees’ perceptions of justice in the family firm”: It all depends on perceptions of family, fairness, equity, and justice. Entrep Theory Pract 30(6):855–860

Carton RB, Hofer CW (2006) Measuring organizational performance–metrics for entrepreneurship and strategic management research. Edward Elgar, Cheltenham

Chesbrough H (2003) Open innovation: the new imperative for creating and profiting from technology. Harvard Business School Press, Boston

Chesbrough H (2010) Business model innovation: opportunities and barriers. Long Range Plann 43(2–3):354–363

Chrisman JJ, Chua JH, Sharma P (2003) Current trends and future directions in family business management studies: toward a theory of the family business. Coleman White Paper series

Chrisman JJ, Chua J, Sharma P (2005) Trends and directions in the development of a strategic management theory of the family firm. Entrep Theory Pract 29(5):555–575

Covin TJ (1999) Profiling preference for employment in family-owned firms. Family Bus Rev 7(3):287–296

Covin JG, Slevin DP (1991) A conceptual model of entrepreneurship as firm behaviour. Entrep Theory Pract 16(1):7–24

Craig J, Lindsay NJ (2002) Incorporating the family dynamic into the entrepreneurship process. J Small Bus Enterp Dev 9(4):416–430

Craig J, Moores K (2006) A 10-year longitudinal investigation of strategy, systems, and environment on innovation in family firms. Family Bus Rev 19(1):1–10

Damanpour F (1987) The adoption of technological, administrative, and ancillary innovations: impact of organisational factors. J Manag 13(4):675–688

Damanpour F (1991) Organizational innovation: a meta-analysis of effects of determinants and moderators. Acad Manag J 34(3):555–590

Damanpour F, Evan WM (1984) Organizational innovation and performance: the problem of “Organizational Lag”. Adm Sci Q 29(3):392–409

Damanpour F, Szabat KA, Evan WM (1989) The relationship between types of innovation and organizational performance. J Manag Stud 26(6):587–601

De Brentani U, Kleinschmidt EJ (2004) Corporate culture and commitment: impact on performance of international new product development programs. J Prod Innov Manage 21(5):309–333

Di Toma P, Montanari S (2010) The definitional dilemma in family business research: outlines of an ongoing debate. Int J Entrep Ventur 2(3/4):262–275

Donckels R, Fröhlich E (1991) Are family businesses really different? European experiences from STRATOS. Family Bus Rev 4(2):149–160

Dosi G, Nelson RR, Winter SG (2000) The nature and dynamics of organizational capabilities. Oxford University Press, New York

Dougherty D, Hardy C (1996) Sustained product innovation in large, mature organizations: overcoming innovation-to-organization problems. Acad Manag J 39(5):1120–1154

Doz YL, Kosonen M (2010) Embedding strategic agility: a leadership agenda for accelerating business model renewal. Long Range Plan 43(2/3):370–382

Fagerberg J (2003) Schumpeter and the revival of evolutionary economics: an appraisal of the literature. J Evol Econ 13(2):125–159

Floyd SW, Wooldridge B (1999) Knowledge creation and social networks in corporate entrepreneurship: the renewal of organizational capability. Entrep Theory Pract 23(3):123–143

Gersick K, Davis J, Hampton M, Lansberg I (1997) Generation to generation: life cycles of the family business. Harvard Business School Press, Boston

Gudmundson D, Tower CB, Hartman EA (2003) Innovation in small businesses: culture and ownership structure do matter. J Dev Entrep 8(1):1–17

Habbershon TG, Williams M (1999) A resource-based framework for assessing the strategic advantages of family firms. Family Bus Rev 12(1):1–25

Habbershon TG, Williams M, MacMillan I (2003) A Unified systems perspective of family firm performance. J Bus Ventur 18(4):451–465

Hair JF, Black B, Babin B, Anderson RE, Tatham RL (2010) Multivariate data analysis, 7th edn. Upper Saddle River, Prentice Hall

Hakala H (2011) Strategic orientations in management literature: three approaches to understanding the interaction between market, technology, entrepreneurial and learning orientations. Int J Manag Rev, in press, doi:10.1111/j.1468-2370.2010.00292.x

Hannan MT, Freeman J (1984) Structural inertia and organizational change. Am Sociol Rev 49(2):149–164

Hennerkes B-H (2004) Die Familie und ihr Unternehmen. Frankfurt Campus

Jansen JJP, Van Den Bosch FAJ, Volberda HW (2006) Exploratory innovation, exploitative innovation, and performance: effects of organizational antecedents and environmental moderators. J Manag 52(11):1661–1674

Johnson MW, Christensen CM, Kagerman H (2008) Reinventing your business model. Harvard Bus Rev 86(12):51–59

Kanuk L, Berenson C (1975) Mail surveys and response rates: a literature review. J Mark Res 12(4):440–453

Kimberly JR, Evanisko MJ (1981) Organizational innovation: the influence of individual, organizational, and contextual factors on hospital adoption of technological and administrative innovations. Acad Manag J 24(4):689–713

King N, Anderson N (2002) Managing innovation and change–a critical guide for organizations, 2 edn. Thomson, London

Klein SB (2000) Family business in Germany: significance and structure. Family Bus Rev 13(3):157–182

Klein S (2004) Familienunternehmen: theoretische und empirische Grundlagen. Wiesbaden, Gabler

Koberg CS, Uhlenbruck N, Sarason Y (1996) Facilitators of organizational innovation: the role of life-cycle stage. J Bus Ventur 11(2):133–149

Kraus S, Fink M, Harms R (2011a) Family firm research: sketching a research field. Int J Entrep Innov Manag 13(1):32–47

Kraus S, Kauranen I, Reschke CH (2011b) Identification of domains for a new conceptual model of strategic entrepreneurship using the configuration approach. Manag Res Rev 34(1):58–74

Kumar N, Stern LW, Anderson JC (1993) Conducting interorganizational research using key informants. Acad Manag J 36(6):1633–1651

Lam A (2005) Organizational innovation. In: Fagerberg J, Mowery DC, Nelson RR (eds) The Oxford Handbook of innovation. Oxford University Press, Oxford, pp 115–147

Lechner C, Dowling M, Welpe I (2006) Firm networks and firm development: the role of the relational mix. J Bus Ventur 21(4):514–540

Leenen S (2005) Innovation in family businesses–a conceptual framework with case studies of industrial family firms in the German “Mittelstand”. St. Gallen, HSG

Litz RA (1995) The family business: toward definitional clarity. Family Bus Rev 8(2):71–81

Litz RA, Kleysen RF (2001) Your old man shall dream dreams, your young man shall see visions: toward a theory of family firm innovation with help from the Brubeck Family. Family Bus Rev 14(4):335–351

Llach J, Nordquist M (2010) Innovation in family and non-family businesses:a resource perspective. Int J Entrep Ventur 2(3/4):381–399

Lorenz E, Wilkinson F (2003) Organisational change, human resource management and innovative performance: comparative perspectives. Cambridge J Econ 27(2):239–241

Lubatkin MH, Ling Y, Schulze WS (2007) An organizational justice-based view of self-control and agency costs in family firms. J Manag Stud 44(6):955–971

Mandl I (2008) Overview of family business relevant issues. Final Report, project on behalf of the European Commission, Vienna, Austrian Institute for SME Research

Miller D (1983) The correlates of entrepreneurship in three types of firms. Manage Sci 29(7):770–791

Miller D, Friesen PH (1983) Innovation in conservative and entrepreneurial firms: two models of strategic momentum. Strateg Manag J 3(1):1–25

Morck R, Strangeland DA, Yeung B (2000) Inherited wealth, corporate control, and economic growth: the Canadian disease. In: Morck R (ed) Concentrated corporate ownership. University of Chicago Press, Chicago, pp 319–369

Morris MH (1998) Entrepreneurial intensity. Quorum, Westport

Naldi L, Nordquist M, Sjoeberg K, Wiklund J (2007) Entrepreneurial orientation, risk taking and performance in family firms. Family Bus Rev 20(1):33–47

Naranjo-Valencia JC, Jiménez-Jiménez D, Sanz-Valle R (2011) Innovation or imitation? The role of organizational culture. Manag Decis 49(1):55–72

Nelson RR, Winter SG (1982) An evolutionary theory of economic change. Harvard University Press, Cambridge

Newby R, Watson J, Woodliff D (2003) SME survey methodology: response rates, data quality, and cost effectiveness. Entrep Theory Pract 28(2):163–172

OECD (2005) Oslo manual: guidelines for collecting and interpreting innovation data, 3rd edn. OECD, Paris

Osterwalder A, Pigneur Y (2010) Business model generation: a handbook for visionaries, game changers and challengers. Wiley, Hoboken

Pittino D, Visintin F (2009) Innovation and strategic types of family SME–a test and extension of Miles and Snow’s configurational model. J Enterp Cult 17(3):257–295

Potts TL, Schoen JE, Engel Loeb M, Hulme FS (2001) Effective retirement for family business owner-managers: perspectives of financial planners, Part I. J Financial Plan 14(6):102–115

Poza EJ, Alfred T, Maheshwari A (1997) Stakeholder perceptions of culture and management practices in family and family firms. Family Bus Rev 10(2):135–155

Reimers N (2004) Private Equity für Familienunternehmen: Nachfolgelösung und Wachstumsfinanzierung im deutschen Mittelstand. Wiesbaden, Gabler

Rickards T (1985) Stimulating innovation: a systems view. Frances Pinter, London

Rößl D, Fink M, Kraus S (2010) Are family firms fit for innovation? Towards an agenda for empirical research. Int J Entrep Ventur 2(3/4):366–380

Rutherford MW, Muse LA, Oswald SL (2006) A new perspective on the developmental model for family business. Family Bus Rev 19(4):317–333

Sapprasert K (2010) Determinants and effects of organisational innovation. In Sapprasert K (ed) Exploring Innovation in Firms: Heterogeneity, technological and organisational innovation, and firm performance. Oslo: University of Oslo (Ph.D. dissertation)

Schaper M, Volery T (2004) Entrepreneurship and small business: a Pacific Rim perspective. Wiley, Milton

Schulze W, Lubatkin M, Dino R (2003) Exploring the agency consequences of ownership dispersion among the directors of private family firms. Acad Manag J 46(2):174–194

Schumpeter JA (1934) The theory of economic development. Harvard University Press, Cambridge

Schumpeter JA (1942) Capitalism, socialism and democracy. Harper & Brothers, New York

Sharma P, Irving GP (2005) Four bases of family business successor commitment: antecedents and consequences. Entrep Theory Pract 29(1):13–33

Sharma P, Chrisman JJ, Chua JH (1997) Strategic management of the family business: past research and future challenges. Family Bus Rev 10(1):1–36

Taiguiri R, Davis JA (1992) On the goals of successful family companies. Family Bus Rev 5(1):43–62

Teece DJ (1980) The diffusion of an administrative innovation. Manage Sci 26(5):464–470

Teece DJ (1986) Profiting from technological innovation. Res Policy 15(6):285–305

Teece DJ (2010) Business models, business strategy and innovation. Long Range Plan 43(2–3):172–194

Teece D, Pisano G, Shuen A (1997) Dynamic capabilities and strategic management. Strateg Manag J 18(7):509–533

Tio J, Kleiner BH (2005) How to be an effective chief executive officer of a family owned business. Manag Res News 28(11–12):142–153

Van den Berghe LAA, Carchon S (2003) Agency relations within the family business system: an exploratory approach. Corporate Governance 11(3):171–179

Ward JL (2004) Perpetuating the family business: 50 lessons learned from long-lasting, successful families in business. Palgrave Macmillan, Basingstoke

Wengel J, Lay G, Nylund A, Bager-Sjögren L, Stoneman P, Bellini N, Bonaccorsi A, Shapira P (2000) Analysis of Empirical Surveys on Organisational Innovation and Lessons for Future Community Innovation Surveys, Scientific Follow-up of the Community Innovation Survey (CIS) Project CIS 98/191. European Commission, Brussels

Wolfe RA (1994) Organizational innovation: review, critique and suggested research. J Manag Stud 31(3):405–431

Wolff JA, Pett TL (2007) Learning and small firm growth: the role of entrepreneurial orientation. Acad Manag Proc, pp 1–6

Zahra S (1993) New product innovation in established companies: associations with industry and strategy variables. Entrep Theory Pract 18(2):47–70

Zahra SA, Hayton JC, Salvato C (2004) Entrepreneurship in family vs non-family firms: a resource-based analysis of the effect of organizational culture. Entrep Theory Pract 28(4):363–381

Open Access

This article is distributed under the terms of the Creative Commons Attribution Noncommercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Kraus, S., Pohjola, M. & Koponen, A. Innovation in family firms: an empirical analysis linking organizational and managerial innovation to corporate success. Rev Manag Sci 6, 265–286 (2012). https://doi.org/10.1007/s11846-011-0065-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-011-0065-6