Abstract

Digitalization can help suppliers cut ties with their intermediaries and offer products directly to consumers. Such a digital disintermediation strategy likely affects both digital and non-digital incumbents in ways difficult to predict by current marketing theory. In our empirical investigation of digital disintermediation in the multibillion-dollar filmed home entertainment industry, we draw on consumers’ viewing behaviors before and after the launch of the streaming service Disney+. The findings show that access to Disney+ substantially increased the streaming category in the short run, accelerating the demise of non-digital linear television. However, only the new digital service benefited, while streaming incumbents suffered negative outcomes, despite public claims to the contrary. In addition to foreshadowing Netflix’s subsequent difficulties in defending its leadership position, these findings offer suppliers successful ways to liberate themselves from powerful intermediaries and help incumbents brace for the competitive upheavals that a digital disintermediation strategy is likely to trigger.

Similar content being viewed by others

As digitalization has opened new routes to markets, established offline business models have been disrupted, and new digital companies have emerged (Avery et al., 2012). In particular, powerful intermediaries have taken control of the gateways between suppliers and end consumers (e.g., Gu & Zhu, 2021; Reinartz et al., 2019), including Amazon and Zappos as digital marketplaces, online travel agencies such as Expedia and Booking, and subscription streaming services such as Spotify and Netflix. Amazon now accounts for roughly 6% of total U.S. retail sales (Marketplace Pulse 2022), online travel agencies complete 51% of hotel bookings (King, 2021), and Netflix has more than 200 million subscribers worldwide (Truelist, 2022).

In response to these developments, some suppliers have initiated digital disintermediation (Gielens & Steenkamp, 2019; Gu & Zhu, 2021), in an effort to bypass the powerful intermediaries and sell directly to customers through their own digital channels (Zhou et al., 2022). Product manufacturers such as Million Dollar Shave Club and Kylie’s Cosmetics sell their goods exclusively through their websites, cutting out retailers; book authors can sell directly to readers using digital self-publishing services, bypassing publishers (Waldfogel & Reimers, 2015); and major film conglomerates (e.g., Disney, Paramount, Warner) sidestep streaming incumbents such as Netflix and Amazon Prime Video (hereinafter, Amazon), by making their content directly available through their own streaming services. Even as such digital disintermediation grows more prevalent in many markets (Gielens & Steenkamp, 2019), its wider effects remain unclear, including the ramifications for incumbent market players. Importantly, to what extent does consumer access to new digital supplier offerings cannibalize, complement, or leave unaffected both digital intermediaries (e.g., online retailers) and traditional, non-digital intermediaries (e.g., physical retail stores)?

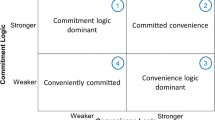

To address this question, we analyze a timely example in the filmed home entertainment industry: the launch of Disney’s subscription streaming service, Disney+. With this step, the company retired its prior revenue model, in which it distributed its offerings indirectly, and pulled its entertainment content from digital intermediaries such as Netflix and Amazon. Yet it maintained supplier relationships with non-digital intermediaries, such as linear television channels, as we illustrate in Fig. 1.

In trying to understand the consequences of digital disintermediation, we examine how consumers allocated their viewing time across incumbent offerings (digital and non-digital) after gaining access to Disney+, following its market launch. While market developments show that changes in consumer behavior due to digital disintermediation can be substantial, current marketing theory does not provide adequate guidance on whether each alternative offering might lose, benefit, or remain unaffected (Li et al., 2014; Van Crombrugge et al., 2022). For example, Disney+ might cannibalize digital streaming incumbents that become direct competitors that serve similar consumer needs (Cespedes & Corey, 1990) but no longer have access to Disney content. Some industry experts also argue that disintermediation hurts the overall digital filmed entertainment category due to “streaming overload” (Bohn, 2020), such that each of the many services offers only minimal value to consumers. On the one hand, as content grows increasingly fragmented across streaming services, related non-digital distribution categories (i.e., linear, free television) could become more attractive (again). On the other hand, the launch of Disney+ could lead to spillover effects that make digital streaming more attractive than traditional, non-digital alternatives, which would benefit the streaming category overall (e.g., Spangler, 2019). As Netflix founder and then-CEO Reed Hastings predicted, “the introduction of new services will likely lead to a shift in entertainment consumption from linear television to on-demand consumption” (Roettgers, 2019). If Disney+ primarily cannibalizes traditional, non-digital categories, it could have negative consequences for broadcasters and advertisers, which rely on linear television’s unparalleled ability to reach large, diverse audiences, but positive implications for digital intermediaries.

By shedding light on these contradictory effects, this study extends the nascent literature on (digital) disintermediation in two ways. First, we offer the first empirical assessment of the impact of disintermediation on incumbent offerings, extending the limited theoretical and empirical understanding of the concept (Gu & Zhu, 2021; Zhou et al., 2022). Related studies either examine why and when disintermediation occurs (Gu & Zhu, 2021; Zhou et al., 2022), focusing on the context of peer-to-peer service platforms (e.g., Airbnb), or descriptively show how disintermediation affects market structures, for example, by elevating the variety and quality of products (Waldfogel, 2012; Waldfogel & Reimers, 2015). We are not aware of any study that analyzes the competitive consequences of disintermediation—that is, whether and how it affects consumers’ demand for incumbent offerings. Insights into these effects are vital for market participants, as they help assess the economic viability of a disintermediation strategy and the need for countermeasures (or not) by incumbents.

Second, we investigate the effects of disintermediation not only on the disintermediated (i.e., bypassed) incumbents within the same category but also on incumbents in related categories that have not been disintermediated (i.e., where supplier relationships persist). We thus provide a more comprehensive understanding of the impact of disintermediation on industries and their multiple players, where prior studies are typically limited to two focal, closely related players (i.e., the supplier and a close incumbent). The launch of Disney+, as an instance of digital disintermediation, provides a powerful case in this regard, as it potentially affects different players in the dynamic, multibillion-dollar filmed home entertainment market (Hennig-Thurau & Houston, 2019). Specifically, Disney+ may affect both digital incumbents in the subscription streaming category (i.e., Netflix or Amazon Prime Video) and non-digital incumbents in the related television category (i.e., linear or pay television).

We show that the interrelationships among the disintermediating supplier, digital incumbents, and non-digital incumbents are far from trivial. Panel data analyses on media users’ viewing behavior before and after the launch of Disney+ show that cannibalization effects prevail for both disintermediated digital incumbents and related, non-digital incumbents. However, post hoc analyses reveal that these effects are contingent on consumer-specific moderators (e.g., older viewers are more likely to substitute non-digital, free television) and the time elapsed since the disintermediation event (i.e., cannibalization within the streaming category increases over time and decreases with respect to the related television categories). These findings have important implications for suppliers intending to follow a digital disintermediation strategy, as well as digital and non-digital incumbents that might face new competition as a result. They help streaming services and other actors involved in the distribution of filmed home entertainment navigate the currently unfolding fragmentation of the market, but also provide guidance for suppliers and intermediaries in other industries in which digital disintermediation may or is already occurring, such as retailing, real estate, or tourism (Gu & Zhu, 2021; Wigand, 2020).

Review of disintermediation and the related encroachment concept

When launching a digital direct channel, suppliers can take two general paths: they can cut ties with existing intermediaries and sell their goods exclusively through their own channels (termed “disintermediation”), or they can maintain existing supplier relationships while selling through their own channel as well (often termed “supplier encroachment”). Extant research has investigated both strategies to varying extents.

Despite disintermediation’s importance across various industries, from consumer goods to hospitality and entertainment markets, research on the strategy is limited (Gu & Zhu, 2021). A growing body of research focuses on disintermediation on peer-to-peer online service platforms, such as Airbnb or TaskRabbit. They quantify the extent to which clients and agents engage in disintermediation (Lin et al., 2022), identify antecedences of the strategy (e.g., trust [Gu & Zhu, 2021]; agent quality and tenure [Zhou et al., 2022]), or evaluate the efficiency of platform design choices in reducing disintermediation (Lin et al., 2022; Zhou et al., 2022). These studies thus focus on the conditions that lead to disintermediation, examining the circumstances under which it occurs and how it can be prevented (see Table 1). They neither examine the consequences that follow from disintermediation (i.e., post-disintermediation effects) nor generate insights beyond the specific context of peer-to-peer platforms, on which both suppliers and customers may bypass the intermediary (i.e., the platform) on a per-transaction basis (Zhou et al., 2022). However, this per-transaction decision to disintermediate (i.e., to perform the transaction outside the platform) is arguably not as consequential as a supplier’s strategic decision to disintermediate in a more traditional business setting, in which it represents a one-time event that requires, among other things, the resource-demanding introduction of a new channel (Chen et al., 2008).

Related to this research is a stream of macro-economic studies that examine the impact of disintermediation on market welfare in content industries, such as book publishing and music. For example, Waldfogel (2012) and Waldfogel and Reimers (2015) show that disintermediation leads to greater overall product variety, which benefits customers. Although these studies examine the consequences of disintermediation, they are mainly descriptive in nature, taking a macro perspective that focuses on the distribution of economic rents and (social) welfare. The impacts of disintermediation on consumer demand as well as the business implications for the disseminating supplier and incumbent intermediaries remain unexplored.

Digital disintermediation differs from the concept of supplier encroachment, a strategy in which the supplier launches a new direct channel while maintaining relationships with incumbent intermediaries instead of eliminating the intermediary.Footnote 1 Examples of supplier encroachment include large brands such as Apple or Nike, but also hotel and airline companies that encourage consumers to book rooms or flights directly through their websites (Gu & Zhu, 2021), while continuing to offer their services through online travel agencies. Contrary to the scarce literature on disintermediation, supplier encroachment (sometimes also referred to as multiple or dual distribution systems) has been studied more extensively in the fields of marketing, supply chain, and operations management (for a review, see Tahirov & Glock, 2022).

Several studies focus on the pre-encroachment phase, examining the conditions under which suppliers engage in encroachment and the possible implications for suppliers and intermediaries (e.g., Huang et al., 2019; Kumar & Ruan, 2006). These studies consider a range of drivers of encroachment success, such as customers’ channel preferences (e.g., Moorthy et al., 2018), information accessibility (e.g., Lei et al., 2014; Zhao & Li, 2018), demand uncertainty (e.g., Cao et al., 2010), suppliers’ marketing strategies (e.g., Kabadayi et al., 2007), and product substitutability (Matsui, 2016). Findings suggest that the impacts of encroachment depend on the specific assumptions and conditions considered in the study. While some studies conclude that encroachment benefits both intermediaries and suppliers through, for example, reduced wholesale prices (Arya et al., 2007; Chiang et al., 2003) or increased promotional activities (e.g., Tsay & Agrawal, 2004), others conclude that it may benefit only one party (e.g., Ha et al., 2016) or be even detrimental to both (e.g., Li et al., 2014).

Other studies examine how suppliers can manage the (new) direct channel and the channel conflicts that may arise (e.g., Van Crombrugge et al., 2022) post-encroachment. Channel conflict is an important issue in the encroachment context because the supplier wants to maintain relationships with intermediaries while also entering some degree of channel competition. To reduce this conflict and maintain good relationships, studies investigate various approaches, including revenue-sharing contracts (Xu et al., 2014), product differentiation (e.g., Vinhas & Anderson, 2005), and pricing schemes such as low-price guarantees (e.g., Jiang & He, 2021). Most studies on supplier encroachment employ an analytical approach based on game theory, focusing on the supplier–intermediary dyad, typically for the case of tangible products (Tahirov & Glock, 2022; Van Crombrugge et al., 2022). Research thus calls for validation through empirical studies as well as insights into virtual products (e.g., information content, music, movies), which are often marketed through direct channels (Tahirov & Glock, 2022).

In contrast with research on both disintermediation and supplier encroachment, the current study presents an empirical analysis of the consequences of digital disintermediation for a prevalent virtual product category—namely, filmed entertainment streaming. Our investigation covers the effects of disintermediation on both the bypassed intermediaries in the digital streaming category and the still included intermediaries in the related linear television category. In addition, we aim to gain deeper insights into the mechanisms that drive these effects (e.g., cannibalization, complementarity) and to investigate potential boundary conditions through post-hoc analyses.

Conceptual framework and hypotheses

To determine the demand consequences of digital disintermediation for intermediaries, we analyze how consumers allocate their relative viewing time (RVT). RVT measures the time consumers spend in a specific category, such as streaming, or on a particular service, such as Netflix, relative to the total time they spend on all forms of filmed home entertainment. Viewing time is a key demand metric in the filmed entertainment industry (Sherman, 2019) because it reflects consumers’ chosen allocation of their time, an important limited resource, as well as recurring consumption decisions. Other metrics, such as product adoption, are less granular and offer fewer insights, especially for television consumption, for which consumers “vote with their evenings” (Sherman, 2019).

We focus on whether and how consumers’ access to a new direct channel affects RVT for disintermediated incumbents in the streaming category and on related, non-digital categories (i.e., paid and free television). Distinct arguments favor cannibalization or complementarity, respectively, of incumbent services following digital disintermediation. In considering these conflicting theoretical logics, we offer competing hypotheses for both digital streaming and non-digital television categories.

Within-category effects of digital disintermediation

Access to a new digital service might cannibalize demand for digital incumbents for several reasons (Coughlan et al., 2006). Consumers have limited resources (e.g., money, time) that, once spent on one offering, can no longer be spent on another. So they must assign their individual resource allocation carefully across all offerings (Allen et al., 2022). In doing so, consumers may be more likely to substitute services that offer similar capabilities and serve similar consumer needs (Avery et al., 2012; Deleersnyder et al., 2002; Geyskens et al., 2002). Thus, when allocating resources (e.g., viewing time) among different filmed home entertainment services, consumers might reduce the shares previously assigned to incumbent streaming services that serve needs similar to those addressed by Disney+.

For suppliers with a strong brand, such as Disney, within-category cannibalization effects should be especially pronounced (Allen et al., 2022). Consumers are less uncertain and more excited about new offerings from suppliers with strong, well-known brands (Keller, 1993; Srivastava et al., 1998), particularly when they are the supplier’s main target group (e.g., young consumers, parents) or when they are loyal to that supplier. The more exciting an offering, the more likely it is to disrupt existing consumption habits and attract more consumer resources, at the expense of incumbents in the same category (Moe & Yang, 2009; Van Heerde et al., 2004). Disintermediation by strong brands should also render other incumbents less exciting by removing some high-quality content from their offerings, thus reducing consumers’ willingness to allocate further resources (i.e., viewing time) to them (Geyskens et al., 2002).

Finally, digital disintermediation could hurt digital incumbents by negatively affecting the entire category. If providers each offer only minimal value to consumers, with an increasingly fragmented assortment inducing higher search costs, the category becomes less attractive, and consumers are likely to seek alternatives (Donna et al., 2022). In the filmed entertainment context, consumers who experience so-called streaming overload (Bohn, 2020) might therefore decide to allocate less time to the streaming category, which includes incumbents.

H1a

Consumer access to a supplier’s new digital service is negatively associated with consumer demand for disintermediated digital incumbents.

Access to a supplier’s new service could also be positively associated with demand for disintermediated digital incumbents, due to positive spillover effects. As Wang et al. (2009) note, suppliers launching a direct channel often advertise heavily; such advertising efforts may increase awareness of and excitement for the entire digital category by reminding customers of its benefits (Allen et al., 2022; Gretz et al., 2019). As a consequence, they might allocate more resources not only to the new service but also to the digital incumbents’ offerings. Because these incumbents are more strongly associated with the category (Inman et al., 2004), marketing by a new digital service might create strong associations with them, particularly if the incumbents are first movers in the market (e.g., Netflix, Amazon) (Carpenter & Nakamoto, 1989).

Moreover, assuming the new service increases the quality and variety of content available in the digital category, it may increase the category’s appeal and consumers’ satisfaction with it (Harutyunyan & Jiang, 2019; Waldfogel & Reimers, 2015). A supplier’s decision to disintermediate may enhance this attractiveness effect further if it encourages incumbents to expand their portfolios and invest in new content (Waldfogel, 2012). With disintermediation, the products or content offered by each service become more unique, which should promote multihoming (Jiang et al., 2019; Li & Zhu, 2021)—that is, consumers might not substitute time spent with one streaming service for another but rather split it among multiple services, which is likely to increase the overall time spent in the digital streaming category at the expense of non-digital categories (e.g., free television).

H1b (competing)

Consumer access to a supplier’s new digital service is positively associated with consumer demand for disintermediated digital incumbents.

These two opposing effects also might cancel each other out, which would leave demand for the disintermediated digital incumbents unaffected.

Between-category effects of digital disintermediation

The logic leading to H1b implies that digital disintermediation can cannibalize demand from incumbents competing in non-digital categories. In general, increased competition hurts incumbents’ performance (e.g., Ailawadi, 2021; Cleeren et al., 2010). Thus, the launch of a direct channel, even in a neighboring category that serves related needs, may have similar effects because it intensifies competition and reduces the attractiveness of incumbents in this category.

In addition, access to the new digital service, enhanced attention to the digital category in general (due to the supplier’s entry and intensified by its marketing), and the potential increase in streaming content variety due to disintermediation could reduce consumers’ enthusiasm for non-digital alternatives. Therefore, the positive spillover effects underlying H1b may lead to decreased demand (i.e., viewing time) for non-digital television.

H2a

Consumer access to a supplier’s new digital service is negatively associated with consumer demand for related non-digital incumbents.

At the same time, access to the new digital service may be associated with positive effects for non-digital incumbents, especially if the digital and non-digital channels offer complementary capabilities and serve different consumer needs (Avery et al., 2012). In our research context, the supplier’s new direct digital channel offers products similar to those offered by non-digital incumbents but has different capabilities (e.g., non-linear vs. linear content access).

Because consumers tend to look for variety in content and channel capabilities and might have different preferences, the new digital channel may not cannibalize demand (i.e., viewing time) for non-digital incumbents (e.g., free television). Instead, digital disintermediation may even harm the digital streaming category through fragmentation and overload (Bohn, 2020), which may increase demand for non-digital incumbents, as we argue in the context of H1a. If consumers perceive that each of the many individual streaming services offers minimal value due to fragmented offerings, they may allocate more (viewing) time to non-digital categories. Moreover, the additional channel increases consumers’ search costs in the digital category, which could induce them to watch whatever is on television rather than having to choose from the variety of content offered by different streaming services (Donna et al., 2022; Moorthy et al., 2018). The fragmentation could further annoy consumers, reducing their satisfaction with the streaming category.

H2b (competing)

Consumer access to a supplier’s new digital service is positively associated with consumer demand for non-digital incumbents.

Similar to the within-category effects, the mechanisms leading to cannibalization or complementarity may cancel each other out, which would result in a null effect.

In summary, theoretical arguments suggest that a supplier’s digital disintermediation strategy could exert a negative impact on digital incumbents, whereas different arguments suggest that the strategy might have a positive impact. Similarly, theoretical arguments exist for both a negative and a positive impact on non-digital incumbents. We summarize the potential logic for these cannibalizing and complementary effects in Table 2.

Given the contradicting rationales presented, empirical evidence is required to provide clarification. Note that because we investigate relative viewing times as the main outcome variable, the postulated effects are not independent. For example, if consumers spend more time on one category, by definition they must spend less time on the other. Only a limited number of constellations are possible at the category level, such as lose–win (share of streaming incumbents decreases, while share of television incumbents increases; H1a and H2b), win–lose (share of streaming incumbents increases, while share of television incumbents decreases; H1b and H2a), or lose–lose (all incumbents lose, only the new entrant wins; H1a and H2a). The win–win (i.e., all incumbents increase their shares), win–no effect (i.e., streaming incumbents increase their shares, while television incumbents remain stable), or no effect–win (i.e., streaming incumbents remain stable, while television incumbents increase their share) outcomes are impossible.

Market and data

We use the launch of the streaming service Disney+ in Germany to test the proposed relations in the filmed home entertainment market. As Europe’s largest economy, with estimated total filmed home entertainment revenues of $21 billion (FFA, 2020; VAUNET, 2020), Germany represents one of the most important markets for media companies and subscription-based streaming services outside North America (Alexander, 2020). The German media landscape also features a strong free television segment, comprised of public channels and commercial channels,Footnote 2 and a few pay television networks. In addition, subscription streaming has experienced immense growth in Germany, paralleling other major Western economies. Netflix and Amazon, which entered the market in 2014, were the dominant players. Apple TV+ and national providers represented second-tier services that, at the time of our data collection (March–December 2020), had not captured substantial market shares (Markander & Haslam, 2021).

We collected extensive, self-reported, individual-level consumer data about media consumption behavior using an online recontact design, which enabled us to assess each consumer’s viewing behavior at different times (shortly before, three months after, and nine months after the launch of Disney+). We commissioned industry experts from the research firm Kantar to recruit suitable consumers from its panel and ensure high data quality (for details on the sampling and the sample’s suitability for analysis, see Web Appendix W1). We gathered self-reported data because consumer usage data are only publicly available for linear television (set-top-box data). As no observational data to date can reflect individual consumers’ time allocations across categories, the use of self-reported data remains the industry standard (e.g., Mai & Rühle, 2020).Footnote 3

The data from our main sample contain responses from 1180 respondents, between 16 and 59 years of age (Mage = 40.0 years; SDage = 10.1; 54.4% female), who completed both waves (t = 0 and t = 1) of the recontact study, which we needed to conduct a difference-in-differences (DID) analysis. Of the 1993 respondents who took part in the first wave,Footnote 4 59.2% completed the second wave three months later. We excluded 68 consumers (5.4%) who reported implausible viewing times, which left a final sample of 1180 respondents, as described in Table 3, column 2.Footnote 5

As noted, the focal dependent variable in our analyses is consumers’ RVT for different media categories (i.e., subscription streaming, free television, pay television) and incumbents (e.g., Netflix, public free television). Streaming companies regard RVT as a key metric; as Netflix’s founder Reed Hastings stated, “[t]he real measurement will be time.… What mix of all the services do [consumers] end up watching?” (Sherman, 2019). Such a mix of services can best be captured with a relative measure that reflects changes in time allocations across entertainment media and enables comparisons among individual viewers who might exhibit different absolute levels of viewing hours. We assess absolute viewing times as a robustness check.

To ensure the reliability of respondents’ reports of their viewing behavior, we used a multi-stage procedure that helps reduce task complexity (see Web Appendix W2). For each media category, respondents first noted which streaming services and television networks they had accessed during the past two weeks and the previous day to set an individual reference point. They then reported the time spent on an average weekday and weekend day, which we used to calculate our focal measure. Respondents apportioned the time spent on each category to different services and networks, allowing us to construct RVTs for each incumbent. We also gathered socio-demographic, psychographic, and situational variables to serve as covariates in our models. Table 4 summarizes our variable descriptions, and Table 5 reports their correlations.Footnote 6

To explain consumer reactions to access to Disney+ (vs. the decision to adopt Disney+), we sought to recruit a representative sample of Disney+ adopters (for a similar approach in the music streaming industry, see Wlömert & Papies, 2016). In the sample, 187 respondents had access to Disney+ at t = 1, representing 15.8% of all respondents. In detail, 27.8% of respondents aged 16–29 years had access, whereas only 15.8% of those aged 30–49 years and 7.3% of those aged 50–59 years did. This distribution matches industry reports (Die Medienanstalten, 2020), indicating our sample’s adequacy. Both the absolute and percentage treatment group sizes are comparable to self-reported panel samples used in prior studies on filmed home entertainment (e.g., Hennig-Thurau et al., 2007). We note that 114 (61.0%) of Disney+ adopters subscribed to Disney+ themselves (directly adopted or bundled with another subscription); the others used shared accounts with family or peers. Thus, having access to Disney+ does not necessarily mean that consumers actively adopted a paid subscription. A majority (56.1%, or 105 adopters) claim to be the primary Disney+ user in their household, 52 (27.8%) of whom are the only users.

Method and identification

For the main analysis, we compare RVT allocations across categories and incumbents for consumers who had access to the new channel at t = 1 and those who did not. Figure 2 provides an illustration. If Disney+ access were random among consumers, we could identify causal treatment effects by comparing the RVTs between adopters and non-adopters. Instead, consumers self-select into Disney+ access, and adopters might differ systematically from non-adopters. Therefore, to eliminate sources of endogeneity and identify causal effects, we perform several steps.

We begin with a DID model (Aral & Dhillon, 2021; Xu et al., 2017) with two time points (i.e., before and after the launch of Disney+; see Gill et al., 2017). A DID model offers a strong means to reduce potential selection bias, because it addresses group differences that result from self-selection through the inclusion of group-specific fixed effects (Angrist & Pischke, 2009; Gill et al., 2017); time-specific fixed effects capture average, unobserved changes that might affect both adopter and non-adopter groups from before to after the launch of Disney+. For example, people in both groups might have spent more time at home due to the COVID-19 pandemic, which might have increased their total streaming consumption. Although group and time effects can capture structural differences between the groups as well as seasonal (or other) influences on entertainment consumption, our focus is on the interaction between the two variables, which is less likely to suffer from endogeneity (Gill et al., 2017).

The DID specification relies on an assumption of parallel trends between the treatment and control groups, such that in the absence of the treatment (here, access to Disney+), the groups would behave similarly over time. This assumption could be violated if omitted variables affected both Disney+ access and the outcome variables in a manner not captured by the fixed effects. For example, if the COVID-19 pandemic influenced people’s allocation of viewing time in the Disney+ adopter group differently than in the non-adopter group (e.g., consumers adopted Disney+ because they expected to stay home more and spend additional time on subscription streaming), time fixed effects might not suffice to rid the model of endogeneity. We thus employ two remedies. First, our use of RVT as the dependent variable reduces the possibility of bias due to dynamic differences. Even if Disney+ adopters expected to spend more time at home and therefore increased their entertainment consumption more than non-adopters, the RVT between the categories or incumbents would not necessarily shift. Consumers could simply add the additional time to different categories in their usual proportions. Thus, for bias to occur, the two groups would systematically need to shift their relative time allocation differently in the absence of the Disney+ launch, which seems unlikely.

Second, we add an extensive set of individual-level covariates (socio-demographic, psychographic, and situational variables) to our model, including variables to control for differences in the effects of the pandemic, beyond average group effects.Footnote 7 The treatment effects, given the covariates, are exogenous if the covariates that affect self-selection are observable and included in the outcome equation (Angrist & Pischke, 2009; Gill et al., 2017). This exogeneity condition also holds in case the observables (e.g., children in the household) capture the effects of related, unobservable variables that could affect both selection and outcome (e.g., preference for family-friendly content). We specify the resulting DID model with covariates as

where RVT denotes relative viewing time for individual i at time t in category f, access is an indicator variable that takes the value of 1 if individual i has access to Disney+ and 0 otherwise, time is an indicator variable representing the time point (0 or 1), covariate is a vector representing our set of 18 (time-invariant) observables (see Table 4), and ε is the error term. The treatment effects of interest are the coefficients of the interaction between group and time effects, β3f.

The extensive set of covariates we employ could exclude any remaining correlation between the error term and the regressors from the DID model. However, because other omitted endogenous variables (theoretically) exist that we do not account for, we also consider a control function approach, using Heckman-type endogenous switching regressions, to model the selection process explicitly (Heckman, 1979). The results, depicted as part of our robustness checks, do not indicate any differences compared with the model specified in Eq. 1.

Main analysis: How access to Disney+ influences viewing time allocation

Model-free evidence

Figure 3 shows the mean RVT values before (t = 0) and three months after the entry of Disney+ (t = 1) for adopters and non-adopters.Footnote 8 It indicates a positive association of Disney+ access with total subscription streaming (upper left), as well as negative associations with incumbent subscription streaming (upper right) and free television (lower left).

Causal interpretation of this evidence is difficult though because, as noted, we cannot account for potential endogeneity arising from users self-selecting into Disney+ access. When we compare demographics and initial viewing time proportions across the treatment and control groups, we find structural differences, which could produce a bias. For example, Disney+ adopters tend to be younger than non-adopters (M(access)age = 35.4 years, M(no access)age = 40.9 years) and live in households with three or more members (51.3% adopters, 37.0% non-adopters). Furthermore, at t = 0, Disney+ adopters allocate nearly as much of their viewing time to subscription streaming as they do to free television (36.7% adopters, 22.0% non-adopters), which is the most popular category among non-adopters (39.4%, 56.9%). We address these issues in the formal econometric analyses.

DID main effects of Disney+ access on RVTs

We conducted several analyses on RVTs for (1) total subscription streaming (including Netflix, Amazon, and Disney+), (2) incumbent subscription streaming (Netflix and Amazon), (3) free television (all major public and commercial networks), and (4) pay television (all major networks). For each model, we sample posterior distributions using 50,000 Markov chain Monte Carlo draws and disregard the first 20,000 draws for calibration. Because the data include observations from the same respondent at two occasions, we allow them to correlate across time.

Table 6 summarizes the treatment effects (β3 access × time) for the plain DID model and the model augmented with the set of covariates. The results for the treatment effects do not differ substantially across the two model specifications. However, divergences among other estimates (see Web Appendix W4 for a complete account of model parameters) suggest that endogenous self-selection into Disney+ access affects the results to a certain degree. Adding covariates to the DID model proves sufficient to eliminate this bias (see Gill et al., 2017). We provide a range of alternative models and robustness checks in Web Appendices W5 and W6, which all support the results reported here.

Effect of digital disintermediation on digital incumbents

In the streaming category, access to Disney+ is associated with an increase in consumers’ total viewing time by 7.5 percentage points three months after the launch, equivalent to more than 20 minutes per day for an average consumer—a substantial increase, considering that subscription streaming accounted for 26.3% of entertainment media consumption before Disney+‘s market entry in our data. With the emergence of a new player on the market, the entire category thus seems to benefit.

Yet incumbents show decreased RVTs, contrasting Reed Hastings’s assertion that Netflix would not be hurt by Disney+‘s entry. Specifically, Disney+ adopters (vs. non-adopters) reduced their viewing of incumbent streaming services by 3.7 percentage points on average, in support of H1a rather than the competing hypothesis, H1b. Netflix suffered the bulk of this reduction (2.6 percentage points), whereas Amazon Prime’s RVT is affected to a much lesser and not significant degree (−.8 percentage points). Thus, Disney+, with an average viewing time share of 11.1%, seems to represent a serious competitor for Netflix, the largest digital incumbent. Netflix is also positioned more similarly to Disney+ than Amazon, as it licenses more content from Disney. Respondents’ assessments further suggest that Netflix did not offer a strong competitive reaction to Disney’s market entry, whereas Amazon did (as we discuss in more detail in the “Managerial implications”). Thus, disintermediation by Disney made Netflix lose some of its appeal among consumers.

Effect of digital disintermediation on related non-digital incumbents

Although Disney does not disintermediate the non-digital category, the expansion of subscription streaming is negatively associated with traditional, non-digital television, in line with H2a and in contrast with H2b. Disney+ substitutes especially for free television, which loses 3.6 percentage points of RVT. Consumers reduced their consumption of public free television channels (−2.5 percentage points) after gaining access to Disney+, whereas commercial free television appeared more resilient. Although its content supply is not affected, the television category seemingly became less attractive to adopters, suggesting they prefer on-demand access to Disney content over scheduled programming. Pay television also forfeits some viewing time, though due to high variability, we find only marginally significant effects. Still, the estimated effects are relatively strong with respect to the limited time consumers spend viewing the category (−1.4 percentage points), hinting at a substantial substitution of pay television use when Disney+ hit the market. Altogether, our results suggest that digital disintermediation by Disney+ pulls consumers toward the streaming category and away from linear free and pay television (beyond the generally negative trend already occurring). Both digital and traditional non-digital incumbents are cannibalized in the short run, leaving Disney as the only winner in terms of content consumption and suggesting a lose–lose constellation for others.

Additional analyses

We conducted additional analyses to gain further insights into the underlying mechanisms of our main results. In particular, we investigate the implications of consumers’ reallocated viewing time for digital streaming incumbents’ bottom lines and probe longer-term effects.

Examining the mechanisms: Moderation analyses

We investigate two potential moderators, in an attempt to shed light on the competitive mechanisms rooted in digital disintermediation: consumers’ initial use of streaming services and their age. By distinguishing consumers who already used at least one subscription streaming service before Disney’s entry (“initial streamers”) from those who did not (“initial non-streamers”), we can determine whether Disney+ adds new consumers to the streaming market and if incumbents benefit from their entry. Because non-streamers have not used a streaming service before, their awareness of and experience with the category and its benefits should be comparably low. Thus, digital disintermediation through Disney should exert disproportionately strong positive effects on this group by raising awareness and excitement (H1b). Access to Disney+ might induce non-streamers to familiarize themselves with streaming and then allocate time to the new but also incumbent services. Then access to Disney+ would not only increase non-streamers’ RVT of the new service but also trigger positive spillovers to other services in the streaming market. Initial streamers, by contrast, are more likely to substitute for incumbent streaming services with Disney+ (H1a).

Table 7 summarizes the moderating effects, which reflect the three-way interaction of the treatment effects—access × time—with the moderator (see also Fig. 4).Footnote 9 Initial non-streamers increase their RVT of subscription streaming drastically after gaining access to Disney+ (βStreaming = .210, 99% highest posterior density interval [HDI] below zero), as shown in column 1. They also allocate more time to incumbent streaming services than initial streamers (βIncumbents = .117, 99% HDI below zero); this effect, which we also show in Panel B of Fig. 4, indicates complementary effects for those new to subscription streaming as a result of Disney’s digital disintermediation efforts. Access to Disney+ tends to induce initial non-streamers to multihome streaming services by also adopting Netflix and/or Amazon, in line with our argument that the novel channel may stir up excitement and attract new customers to digital streaming. Furthermore, multihoming may be attractive to gain access to the unique content provided by each streaming service (Landsman & Stremersch, 2011). Initial non-streamers also substitute pay television more than initial streamers (βPayTV = −.050, 99% HDI below zero; Panel C, Fig. 4). Thus, the complementary effects of attracting new customers to the streaming category seem to come at the expense of non-digital television.

Our main analysis, which reports net effects, indicates that category expansion effects are dominated by within-category cannibalization. Because only roughly 13% of all Disney+ adopters are non-streamers, and streamers cannibalize rather than complement their use of streaming incumbents (in line with H1a), the overall effect is negative.

With respect to consumers’ age, awareness effects brought about by the launch of Disney+ might be greater for older (i.e., >30 years) viewers who watch television as their primary source of home entertainment. Because the Disney brand is well-known among this segment, access to Disney+ could raise their interest in streaming in general, showcasing the benefits compared with watching television (H1b and H2a). Younger consumers, by contrast, are likely more familiar with streaming and spend less time with linear television (Statista, 2021). They are thus less likely to substitute television and more likely to substitute streaming incumbents, for variety seeking or due to Disney’s strong brand pull (H1a).

The results show that older viewers indeed substitute free television more strongly in the three months after the launch (βFreeTV = −.068, 99% HDI below zero; Table 7, column 2; Fig. 4, Panel D). They also tend to increase time allocated to subscription streaming incumbents and to Netflix in particular, though these estimates remain statistically non-significant due to the high variability. These results lend partial support to the argument that, for specific consumer segments, digital disintermediation and the greater variety of unique content increase a category’s attractiveness, from which not only the new service but also digital incumbents can benefit (H2a).

Overall, the moderation analyses back the mechanisms underlying our hypotheses and substantiate understanding of the effects we find in our main analysis. Digital disintermediation can attract new consumers to a digital category, resulting in category expansion effects for specific segments from which digital incumbents also benefit. This expansion implies reduced use of incumbent offerings in non-digital categories (i.e., television networks), even though these incumbents are not disintermediated. In our empirical context, however, the segments of new consumers cannot compensate for the competitive pressure the supplier’s new digital service imposes on digital incumbents across all consumers.

Bottom-line consequences: Effects of Disney+ on paid subscriptions

Viewing times represent a key metric that indicates business health (Sherman, 2019), but they cannot reveal whether the streaming category and its incumbents lost or gained paying customers with the entry of Disney+. To uncover such bottom-line effects, we estimate the same model but use each respondent’s number of total and incumbent streaming subscriptions as dependent variables. To proxy for the revenue effects of Disney+ access, we include only a respondent’s own paid subscriptions (not shared subscriptions). We again use access to Disney+ as the DID group variable to assess potential substitution and complementary effects.

Estimation results show that total (paid) streaming subscriptions increase substantially after consumers gain access to Disney+ (βTotalSub = .623, 99% HDI above zero); that is, Disney+ expands the total number of own paid streaming subscriptions, in addition to viewing hours spent. The average Disney+ adopter increases the number of paid streaming subscriptions by approximately .6, compared with non-adopters. This evidence indicates that adopters do not substitute streaming subscriptions one-for-one but instead add the new channel to their portfolio of existing subscriptions. Correspondingly, the number of (paid) subscriptions to incumbent streaming services (Netflix and Amazon) remains fairly stable (βIncumbents = .014, 90% HDI includes zero). Our results, suggesting that consumers gained access to Disney+ in addition to their existing subscriptions, resonate with our theoretical reasoning that Disney+, having fostered variety and differentiation among streaming services due to digital disintermediation, serves as a complement in consumers’ subscription streaming portfolios.

Longer-term effects

Although the focus of this research is on the launch of Disney+ and its subsequent impact on media consumption, longer-term effects can be informative, as they capture persistent changes in consumer behavior. In entertainment and some other industries, the launch period and the months that follow often are highly dynamic, marked by massive advertising campaigns and prerelease chatter, competitive signals, and diverse reactions (Houston et al., 2018).

To analyze longer-term effects, we aimed to record the viewing behavior of the same respondent pool nine months after the launch of Disney+ (December 11–24, 2020). We chose this time frame in close coordination with Kantar, surmising that nine months represents a reasonable time to have become familiar with changes in the streaming category (including ample time to decide whether to maintain or cancel existing subscriptions, which had monthly cancellation policies) while still retaining a sufficient number of respondents to elicit valid results.Footnote 10 Of the 689 (58.4%) sample consumers who participated in both the first (t = 0) and this third (t = 2) data collection, we excluded 33 (4.8%) because of implausible viewing times. Thus, the final data set consists of 656 respondents (Mage = 42.5 years; SDage = 9.4; 53.2% female), which makes for 1312 observations when combined with the initial data from before the Disney+ launch. We identify 85 Disney+ adopters, 66 (77.6%) of whom were already part of the adopter group in our main analysis. Thus, we can gauge how viewing behavior changes over time.

Because some respondents dropped out from the data collection, the data set differs from the initial data set (see Web Appendix W1), which could systematically affect the estimation. For example, respondents who dropped out could be less interested in streaming, which could create a confound. To account for this potential dropout bias, we applied a selection model (Heckman, 1976). Because observations of RVT are missing for respondents who did not take part in this third data collection, we model self-selection into the survey response explicitly (Maddala, 1985; Wooldridge, 2002, p. 566) and add an exclusion restriction to better identify the effects (Bushway et al., 2007). This exclusion restriction is based on whether those who dropped out used a mobile device to access the first or second survey. Using mobile devices to answer a survey increases task complexity and cognitive load (Chae & Kim, 2004; Kannan & Li, 2017), which can increase users’ propensity to drop out between or during questionnaires. We confirm that mobile survey respondents dropped out more than desktop respondents (60.3% vs. 37.6%). By contrast, the device respondents used to access the previous surveys is unlikely to be related to omitted variables such as streaming interest, so arguably, it should not affect time spent with entertainment media beyond the covariates we include in our model (e.g., consumers’ age). Therefore, we specify our selection model for dropout correction as

where the outcome Eq. 2.1 is identical to our original Eq. 1 and Eq. 2.2 denotes consumers’ selection (dropping out of our data collection) as a function of the covariates used in Eq. 2.1 and the exclusion restriction, namely, mobile device access.Footnote 11

We employ a Bayesian full-information maximum likelihood estimator that calculates both equations simultaneously. Table 8 presents the results of the three model variants: the plain DID model without dropout bias correction (Model 4a), a dropout-adjusted model (Model 4b), and a dropout-adjusted model that includes only long-term Disney+ adopters who gained access right after the launch (Model 4c). With the last model, we can test for possible differences in viewing behavior between early and late adopters. In the adjusted models, we find significant correlations between the error terms and a significant selection effect coefficient, so failing to account for dropouts would lead to biased results.

The results, which need to be interpreted with caution because of the smaller sample size and less efficient bias correction method, reveal a consistent pattern. We still observe trends toward substitution, but consumers tend to intensify their within-category substitution of subscription streaming while reducing their between-category substitution of traditional television. The previously observed expansion of subscription streaming as a whole becomes less pronounced in the long run (βTotalSub = .038, 90% HDI includes zero). The coefficient of incumbent subscription streaming almost doubles (βIncumbentSub = −.061, 95% HDI below zero), while the between-category effect for free television is roughly halved. Contrary to the results in the main analysis, Netflix appears less affected by Disney’s digital disintermediation than Amazon (βNetflix = −.017, 90% HDI includes zero; βAmazon = −.044, 95% HDI below zero).

Regarding the effects of Disney+ access on the paid streaming subscriptions, we find that, over time, access to Disney+ increases the total number of streaming subscriptions (βTotalSub = .458, 99% HDI above zero) but does not affect the number of incumbent streaming subscriptions (βIncumbentSub = −.023, 90% HDI includes zero). That is, Netflix and Amazon do not appear to lose paying subscribers after those consumers gain access to Disney+. We also find no empirical evidence of the complementary effects proposed by Netflix’s Reed Hastings.

Discussion

Suppliers in different markets are shaking up their industries by launching direct-to-consumer (DTC) channels that leverage the benefits of digitalization (Reinartz et al., 2019). Suppliers with their own digital direct sales channel now represent the rule rather than the exception (Gielens & Steenkamp, 2019). Most suppliers pursue an encroachment strategy (i.e., continue to maintain relationships with established intermediaries), while others apply a more radical (digital) disintermediation approach, in which they cut ties with intermediaries after establishing the digital direct channel. Examples of digital disintermediation include authors using self-publishing tools to cut out commercial publishers (Waldfogel & Reimers, 2015), homeowners bypassing real estate agents (Levitt & Dubner, 2009), hotel chains launching their own booking platforms to exclude online travel agencies (Vivion, 2015), and filmed entertainment suppliers launching their own streaming services and removing their content from streaming incumbents. The consequences of such digital disintermediation for suppliers and intermediaries are complex and not well understood.

Against this background, we offer the first empirical investigation of the multifaceted market shifts that follow when a supplier applies digital disintermediation, drawing on the launch of the streaming service Disney+ in the German filmed home entertainment market. We show that digital disintermediation may accelerate digital category growth while sparking strong within-category and temporary, weaker between-category cannibalization. Cannibalization effects thus dominate with respect to viewing times, particularly among consumers who used subscription streaming before Disney+‘s launch (more strongly reducing time allocated to streaming incumbents) and older viewers (more strongly reducing time allocated to traditional free television). On the positive side for digital incumbents, we find that these shifts in time allocation do not translate into cancellations of existing subscriptions, at least not in the time frame of our study.

Theoretical contributions

Extant theory has left it unclear whether disintermediation leads to cannibalization, complementarity, or null effects. In contrast with assessments by some industry analysts, our findings suggest that the new service does not induce consumers to turn their backs on an increasingly fragmented digital category but instead generates additional demand, with category expansion as an overarching outcome of digital disintermediation in the disintermediated category. However, incumbent intermediaries do not benefit from this general trend, so cannibalization of incumbents emerges as the prevalent mechanism in both digital and non-digital categories. By stressing the need to separate these types of effects and categories, we present initial evidence to resolve the theoretical ambiguity that points to cannibalization or complementarity. Beyond conceptual and typological insights, our main findings and moderation analyses suggest complex interrelations among digital entrants, digital incumbents, and non-digital incumbents that research should consider when analyzing disintermediation strategies.

The conceptual development and empirical results also indicate the need to distinguish between the strategy of disintermediation, which entails cutting ties with incumbent intermediaries, and the concept of supplier encroachment, which implies launching an own channel while maintaining supplier relationships with incumbent intermediaries. While extant theory has occasionally lumped the two strategic approaches together (e.g., Gielens & Steenkamp, 2019), they likely exert differential effects on incumbents. More empirical evidence is certainly warranted, but our research supports the need for greater conceptual clarity in terms of nascent supplier distribution strategies.

Finally, we introduce consumption time as a relevant metric to evaluate product and service performance in use-based industries, especially in (but not limited to) disintermediation contexts. We consider the allocation of consumption time particularly important for subscription services with annual or monthly payments (e.g., music streaming, online gaming, app use), whose economic power is vastly expanding. The decision to cancel such services is often long-term and deliberate, even when short-term opportunities to do so exist. Thus, time allocation may be a valuable indicator of long-term effects, well before they can be captured by revenues. The divergent performances of Disney+ and Netflix offer a case in point (Grimes, 2022), with Disney+ breaking subscription records and Netflix struggling. From a more general perspective, time allocation also could be a suitable metric in industries in which multihoming is common. In recessions, for example, consumers might cancel the services they use the least, so information about their time allocation can give managers early warnings of potential revenue hits and allow them to take action. Researchers should add such metrics to their repertoire of outcome variables to account for shifts to subscription-based business models.

Managerial implications

Incumbent companies’ maneuvering in digitally disintermediated and related industries often relies on managers’ intuition, despite the growing importance of DTC strategies (Gu & Zhu, 2021). Our empirical results offer some recommendations to help managers address the competitive pressures arising in increasingly fragmented market spaces.

Digital incumbents should treat supplier disintermediation like head-on competition, in contrast with Netflix’s Reed Hastings’s assertion that Disney+ would benefit his firm (and those of other digital incumbents) by increasing the attractiveness of the digital category. Many companies still seem to underestimate the power of their suppliers in a digitalized market environment and the corresponding threat that digital disintermediation can pose to their incumbent business. Retailers such as Home Depot are even threatening their suppliers with relationship termination if they open their own direct channel, thus ultimately forcing them to disintermediate (Tsay & Agrawal, 2004; Yoon, 2016). In the case of Netflix, only after several months of competition did Hastings come to realize that “Disney is our biggest rival.… If you’d asked us a year ago ‘What are the odds that they’re going to get to 60 million subscribers in the first year?’ I’d be like zero. I mean how can that happen?” (Shaw, 2020). Even if a strong brand, such as Disney, grows the entire category (at the expense of other categories), it also pulls a wealth of content from others (Netflix and Amazon) by engaging in disintermediation, inducing consumers to spend less time with these services. Consumers might not have abandoned digital incumbents altogether, and revenues initially were less affected. However, in line with the predictive nature of viewing time for monetary spending decisions, market data suggest that declines in consumption today translate into monetary losses in the future. After two years, Disney+ is adding 14 million subscribers per month (Cerullo, 2022), while Netflix’s growth has stalled (Grimes, 2022).

So, what can digital incumbents do to combat such a detrimental development? For one, they could try to prevent digital disintermediation from happening. Thus, rather than risk open confrontation, they should nurture supplier relationships to create mutually beneficial business models. They could foster these, for instance, through signals of sustaining mutual dependencies (e.g., by not vertically integrating into the supplier’s business) or forgo exploitation of platform power (e.g., by keeping revenue share models fair for all parties). Netflix, instead, sent confrontational signals by pumping billions of dollars into its own content creation, trying to liberate itself from Hollywood powerhouses and threatening Disney with marginalization on its platform. Such a decision certainly shaped Disney’s strategy, as is obvious from its CEO’s statements that Disney would risk losing “control of its destiny” without digital disintermediation (Bob Iger, qtd. in Castillo, 2017). If intermediaries want to prevent similar disintermediation efforts by their (key) suppliers, they need to make the collaboration worth their while. For example, in the related music streaming business, Spotify focuses on cooperation instead of confrontation, largely refraining from producing its own content and sharing its revenues and transactional data with suppliers, which effectively discourages them from digital disintermediation. Yet, without vertical integration, Spotify’s growth and profit potential are limited, which may be the price it pays to maintain a stable collaborative network.Footnote 12

If digital disintermediation cannot be prevented, incumbents need to brace for it and adopt a robust competitive reaction. In our models, access to Disney+ prompted a strong substitution for time spent with Netflix immediately after launch but then shifted, substituting more for Amazon in the long run. This shift is in line with consumers’ perceptions of both services’ changing content quality, underlying the importance of a strong reaction in programming. Specifically, consumers indicated that Netflix’s content appeared relatively weaker right after the launch of Disney+, especially those with access to Disney+ (21.1% viewed Netflix’s content as worse than before, compared with only 12.8% for Amazon), but Netflix recovered strongly, such that after nine months, 37.9% of respondents viewed Netflix’s content as better than before the Disney+ launch, compared with only 26.9% for Amazon (Table 9). Thus, Netflix’ long-term competitive reaction seems to have dampened the initial strong substitution effect of Disney+, following Hastings’s acknowledgment of Disney+ as a strong competitor. These results also indicate that Netflix did not brace for strong competitive effects when Disney+ first came to market, failing to counter them through a concerted content push, in line with its CEO’s expectation of complementary effects. Amazon being hurt more strongly in the long run might indicate that consumers are only willing to allocate their time to a limited number of streaming services, with weaker offerings being tossed aside. Amazon’s decision to spend more than $8 billion to acquire MGM, the studio that holds the rights to the James Bond and Rocky franchises (Porter, 2021), appears to represent its effort to also address the changed market realities.

For suppliers to strong intermediaries, digital disintermediation can be a means to liberate themselves and launch their business into the digital age. Our findings suggest that Disney+ was able to capture a significant share of consumers’ viewing time (>11%) right away, substantially shifting the balance of power. It ended Netflix’s and Amazon’s long-standing domination and enlarged its share of the $86 billion video streaming market (Stoll, 2022). However, digital disintermediation is not an easy feat and may not be a viable strategy for all suppliers. Disney effectively bet the company’s future on its disintermediation attempt, investing large amounts of money and putting its reputation on the line. Considering the enormous resource requirements on the supply side and the crucial need to mobilize consumer demand, only certain suppliers can successfully execute a digital disintermediation strategy, as indicated by subsequent less successful launches of streaming services (e.g., Paramount+, Peacock). Managers of suppliers need to assess their company’s determination (e.g., how willing it is to risk the company), resources (e.g., whether it can sustain prolonged profit forfeits), and market positioning (e.g., whether its assortment is strong enough to pull consumers from intermediaries) to decide whether taking the step is worthwhile. The British hotel chain Premier Inn, which owns roughly 800 hotels, decided to pursue this option. Unlike most competitors, it does not allow digital intermediaries such as Booking.com to list its properties and instead serves customers exclusively through its own website and app to counter the dominance of digital travel agencies (Whyte, 2017).

Digital disintermediation also has important implications for related firms operating mainly in non-digital categories. As our results provide evidence that non-digital incumbents are not necessarily immune to digital disintermediation, they need options for mitigating its negative consequences. We suggest a mix of incisive (service) adaptations, along with (product) differentiation. Non-digital incumbents should close the distribution gap with digital channels, while strengthening their own unique capabilities. In the filmed entertainment context, necessary changes to linear television must supersede prior initiatives dramatically. We propose that television networks should extend and upgrade their digital offers by including catch-up possibilities for movies, series, and shows based on a simple and engaging user experience. This would move them somewhat closer to the digital category, which has become the gold standard for usability and fast access. To this end, especially established public television networks might require nothing less than a cultural transformation to align their business with digital consumers’ needs and abandon the outdated ideas of their existing revenue models.

Furthermore, non-digital incumbents should promote channel capabilities that give them an edge over digital alternatives. For example, television networks traditionally offer different types of content from streaming services, such as daily news and talk shows, in addition to movies and series. Free commercial and pay television networks also may have the upper hand when it comes to live events such as sports broadcasts, which are highly valued by consumers and might explain why they are less affected by Disney’s disintermediation strategy. Still, digital incumbents such as Amazon and new players such as DAZN (streaming entrant targeting the live sports category) have already begun to overcome this “last bastion” of television. If it falls, networks’ options will become even more limited, and their advertising-based revenue model will come under threat.

Limitations and avenues for further research

Our study has several limitations that offer avenues for further research. First, we focus on filmed home entertainment as a single (albeit economically significant) industry, an approach that allows us to assess the consequences of digital disintermediation in detail (for the benefits of this approach, see Stremersch et al., 2023). Although we believe that many of our results are transferable to other industries in which digital intermediaries threaten the market power of established suppliers, gathering empirical evidence of competitive dynamics triggered by digital disintermediation in other markets would help broaden our understanding.

Second, our findings are based on consumers’ self-reporting of their home entertainment viewing behaviors. Thus far, there is no systematic way to track such behaviors across the different categories (e.g., streaming, free television, pay television) and services (e.g., Netflix, Amazon). However, other industries might be less constrained in this respect. Thus, examining the consequences of digital disintermediation using a comprehensive set of observational data would be worthwhile to overcome the limitations of self-reporting (Bound et al., 2001).

Third, we focus on demand effects of digital disintermediation and consumers’ allocation of time across alternative services. A novel avenue for future research would be to include consequences for costs and profitability of such a strategy particularly from the supplier side, as building a new distribution channel requires substantial resources. Recent developments in the streaming business reflect the role of costs, as suppliers, including Disney, are now considering a shift in their strategic focus from consumer adoption to profitability as a next step (Barnes, 2023).

Fourth, because Disney is the disintermediating supplier in our study, our findings are based on digital disintermediation by a well-known, strong brand. We do not know the extent to which these findings hold for lesser-known brands. The effects might differ because DTC strategies tend to require broad appeal, a loyal fan base, and substantial financial resources. Further research should investigate the effects of disintermediation for weaker brands.

Finally, we only implicitly consider potential competitor reactions, such as expanding and improving their offerings in response to Disney’s disintermediation strategy. We anticipate that consumers’ decision to shift their time allocation reflects the category’s or service’s perceived (content) quality. If incumbents adapted their offerings, in response to or anticipation of Disney’s market entry during our study time frame, it could have dampened the effects, and our estimates would reflect a conservative assessment of the impacts on incumbents. Although we offer some descriptive insights in the “Managerial implications” section, we do not investigate specific actions that incumbents took to defend against the threat of Disney+ and whether those actions might have changed their competitive positions or consumers’ use of their services. A more holistic understanding of competitive dynamics could result from detailed examinations of the effects of new product launches by incumbents trying to mitigate the cannibalization effects of digital disintermediation.

Notes

Some authors do not distinguish between the two concepts, such as Gielens and Steenkamp (2019) in their review of retailing trends, in which they note two “digital disintermediation” options for brands—creating their own website or opening designated brand stores—and discuss their likely effects on branding activities.

Some free television networks also launched on-demand services, providing mainly catch-up content and previews of linearly aired programs, along with a few original, digital-only shows.

Research companies have begun gathering data on subscription streaming behavior, but even so, they limit their scope to content consumers watch on a television set (vs. mobile devices) and to selected streaming services.

For the first and second waves of data collection, 2751 and 2250 respondents, respectively, initially accessed the questionnaire, and 1940 and 1248 respondents completed it.

In Table 3, we also include descriptives for our long-term sample that we use in additional analyses.

Although price information typically is critical for competitive market analyses, it is less relevant to our analysis of consumers’ RVT. We aim to explain entertainment consumption upon gaining access to Disney+, not the decision to access Disney+ itself (for which price information could be important). Thus, even if access to streaming services were free of charge, consumers would still need to allocate their limited time across services.

The inclusion of covariates represents an alternative to sample-matching approaches (Gill et al., 2017). We use a propensity score weighting approach as a robustness check, which confirms our results.

For similar figures related to public/commercial free television and subscription streaming services, see Web Appendix W3.

These three-way interaction models also mechanically control for the lower-order interaction terms access × time, access × moderator, and time × moderator.

In support of our re-contact timing, industry evidence suggests that many consumers cancel new subscription services within the first three to six months after initial subscription (Howland, 2018).

Examination of the results of the selection equation reveals that mobile device access significantly affects dropout, confirming the relevance of our exclusion restriction (see Web Appendix W7).

Spotify has nevertheless taken steps toward vertical integration, which has caused concern among some of its key suppliers (Sisario, 2018). As an alternative, the intermediary has recently extended its product portfolio to podcasts produced by a set of smaller producers, from which vertical integration is less of a threat.

References

Ailawadi, K. L. (2021). Commentary: Omnichannel from a manufacturer’s perspective. Journal of Marketing, 85(1), 121–125.

Alexander, J. (2020). Netflix already won the US; now it needs the world. The Verge. www.theverge.com/2020/2/20/21142065/netflix-streaming-wars-subscriber-growth-disney-international. Accessed 22 January 2020.

Allen, B. J., Gretz, R. T., Houston, M. B., & Basuroy, S. (2022). Halo or cannibalization? How new software entrants impact sales of incumbent software in platform markets. Journal of Marketing, 86(3), 59–78.

Angrist, J. D., & Pischke, J. S. (2009). Mostly harmless econometrics: An empiricist’s companion. Princeton University Press.

Aral, S., & Dhillon, P. S. (2021). Digital paywall design: Implications for content demand and subscriptions. Management Science, 67(4), 2381–2402.

Arya, A., Mittendorf, B., & Sappington, D. E. M. (2007). The bright side of supplier encroachment. Marketing Science, 26(5), 651–659.

Avery, J., Steenburgh, T. J., Deighton, J., & Caravella, M. (2012). Adding bricks to clicks: Predicting the patterns of cross-channel elasticities over time. Journal of Marketing, 76(3), 96–111.

Barnes B. (2023). Searching for streaming profit, Disney cuts $5.5 billion in costs. The New York Times. https://www.nytimes.com/2023/02/08/business/disney-earnings.html. Accessed 23 Mar 2023.

Bohn, D. (2020). The streaming wars have barely started and they’re already exhausting. The Verge. https://www.theverge.com/2020/1/17/21069703/streaming-wars-peacock-subscription-fatigue-exhaustion-apple-hbo-hulu-netflix-quibi-disney-augh. Accessed 9 January 2021.

Bound, J., Brown, C., & Mathiowetz, N. (2001). Measurement error in survey data. In J. J. Heckman & E. Learner (Eds.), Handbook of econometrics (Vol. 5, pp. 3705–3843). North-Holland.

Bushway, S., Johnson, B. D., & Slocum, L. A. (2007). Is the magic still there? The use of the Heckman two-step correction for selection bias in criminology. Journal of Quantitative Criminology, 23(2), 151–178.

Cao, W., Jiang, B., & Zhou, D. (2010). The effects of demand uncertainty on channel structure. European Journal of Operational Research, 207(3), 1471–1488.

Carpenter, G. S., & Nakamoto, K. (1989). Consumer preference formation and pioneering advantage. Journal of Marketing Research, 26(3), 285–298.

Castillo, M. (2017). Disney will pull its movies from Netflix and start its own streaming services. CNBC.com. https://www.cnbc.com/2017/08/08/disney-will-pull-its-movies-from-netflix-and-start-its-own-streaming-services.html. Accessed 19 Jan 2023.

Cerullo, M. (2022). Disney streaming beats out rival Netflix in number of subscribers. CBS News. www.cbsnews.com/news/disney-beats-out-rival-netflix-in-streaming-subscribers. Accessed 29 Jan 2023.

Cespedes, F. V., & Corey, E. R. (1990). Managing multiple channels. Business Horizons, 33(4), 67–78.

Chae, M., & Kim, J. (2004). Do size and structure matter to mobile users? An empirical study of the effects of screen size, information structure, and task complexity on user activities with standard web phones. Behaviour & Information Technology, 23(3), 165–181.

Chen, X., John, G., & Narasimhan, O. (2008). Assessing the consequences of a channel switch. Marketing Science, 27(3), 398–416.

Chiang, W. K., Chhajed, D., & Hess, J. (2003). Direct marketing, indirect profits: A strategic analysis of dual–channel supply–chain design. Management Science, 49(1), 1–20.

Cleeren, K., Verboven, F., Dekimpe, M. G., & Gielens, K. (2010). Intra-and interformat competition among discounters and supermarkets. Marketing Science, 29(3), 456–473.

Coughlan, A. T., Anderson, E. T., Stern, L. W., & El-Ansary, A. I. (2006). Marketing channels (7th ed.). Prentice Hall.

Deleersnyder, B., Geyskens, I., Gielens, K., & Dekimpe, M. G. (2002). How cannibalistic is the Internet channel? A study of the newspaper industry in the United Kingdom and the Netherlands. International Journal of Research in Marketing, 19(4), 337–348.

Die Medienanstalten (2020). Video digitalisierungsbericht. https://www.die-medienanstalten.de/fileadmin/user_upload/die_medienanstalten/Publikationen/Digibericht_Video/Digibericht_Video_20/Digitalisierungsbericht_Video_2020_Chartreport.pdf. Accessed 2 June 2021.

Donna, J. D., Pereira, P., Pires, T., & Trindade, A. (2022). Measuring the welfare of intermediaries. Management Science, 68(11), 8083–8115.

FFA (2020). Der Home-Video-Markt im Jahr 2019. www.ffa.de/aid=1394.html?newsdetail=20200624-1351_ffa-studie-der-home-video-markt-im-jahr-2019-svod-anbieter-knacken-milliardenmarke. Accessed 25 May 2021.

Geyskens, I., Gielens, K., & Dekimpe, M. G. (2002). The market valuation of internet channel additions. Journal of Marketing, 66(2), 102–119.