Abstract

Brand alliances are becoming increasingly complex, as marketers have begun to combine not only two but multiple brands to foster spillover effects. A particularly complex brand-alliance strategy is team brands, which combine various brands under a team-brand name. Using data from the Marvel brand universe, we examine contingency factors of sales spillover effects between team brands (e.g., Avengers) and their constituent brands (e.g., Hulk). We investigate the moderating role of key network characteristics, describing the team-brand networks and the constituent brands’ roles within these networks from both a firm perspective (brand-brand networks reflecting managers’ decisions about which constituent brands to combine) and a consumer perspective (brand-association networks reflecting consumers’ team-brand associations). The results show that network characteristics strongly affect spillovers and, more importantly, that their effect depends on both the direction (spillover from constituent brands to team brands or vice versa) and the network (brand-brand vs. brand-association network).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

While brand alliances typically refer to joint marketing activities in which “two or more existing brands are combined into a joint product” (Keller & Swaminathan, 2019, p. 303, emphasis added), prior research has investigated brand alliances almost exclusively from a dyadic perspective (e.g., Keller & Lehmann, 2006; Park et al., 1996; Simonin & Ruth, 1998). However, in today’s branding environment, brands are often part of complex networks consisting of multiple brands (e.g., airline alliances such as Star Alliance, entertainment universes such as Marvel), which marketers combine to facilitate marketing efficiency through positive spillover effects (Lei et al., 2008). One multi-brand-alliance strategy exhibiting particularly complex network structures is team brands, which combine multiple brands under a team-brand name (i.e., a new brand name without referencing its constituent brands). While team brands are well known in the sports industry, with sports teams comprising professional athletes as human brands (e.g., Paris Saint-Germain featuring Kylian Mbappé, Lionel Messi, and Neymar), team brands are also common in the entertainment and consumer packaged goods (CPG) industry. For example, comic teams such as Marvel’s Avengers comprise multiple stand-alone comic-character brands, such as Captain America, Hulk, and Iron Man. In the case of CPG products, as another example, Mars Celebrations comprise multiple stand-alone product brands, such as Snickers, Bounty, and Twix.

With the increasing popularity in various contexts, team brands might be a promising way to boost sales through positive spillover effects between team and constituent brands (Park et al., 1996). Studying spillovers is at the heart of research on brand extensions and brand alliances. The main goal of combining constituent brands into team brands is to leverage the existing brand equity of constituent brands, to benefit from this in the form of increased brand awareness of the team brand and transferred brand associations, and reciprocally to enhance the performance of the constituent brand. Learning about the extent of such spillover effects and the key drivers that moderate them, as well as explaining under which conditions these valuable spillover effects increase or decrease, is therefore of high managerial importance. However, it is unclear how strong these spillover effects are because team brands consist of more than two constituent brands, resulting in more complex network structures that are less accessible for consumers. Therefore, from a managerial perspective, it is interesting and important to understand whether—and to what extent—(complex) multi-brand alliances drive sales through spillover effects. Furthermore, the more complex these structures become, the more difficult it becomes for firms to combine the constituent brands into team brands that can boost sales most efficiently. While some constituent brands might yield and receive high sales spillover effect in a given team brand, others might not. It is therefore of high managerial relevance to also learn about the moderators of these spillover effects, as they are critical to increasing the additional revenues that can be generated by a team brand strategy.

In light of these managerial challenges, academic research on team brands is surprisingly scarce. Yet, the findings from dyadic brand alliances cannot be transferred to multi-brand alliances because multi-brand alliances are potentially much larger in size and less constant in their composition (i.e., constituent brands may join or leave the team over time).

Given the conceptual differences between dyadic brand alliances and team brands, as well as the relevance of team brands in various contexts, this article investigates spillover effects in complex team brands. Specifically, we address the following research questions: To what extent do spillover effects occur from constituent brands to a team brand and vice versa, and, more importantly, which network-based contingency factors (i.e., network characteristics) moderate them? To answer these questions, we derive a conceptual model from accessibility-diagnosticity and spreading-activation theory (Collins & Loftus, 1975; Feldman & Lynch, 1988) and empirically test it using an extensive and unique panel dataset covering 29 constituent brands and eight team brands from the Marvel brand universe across a 10-year period. The resulting dataset of 6,552 constituent-brand comic issues (e.g., Incredible Hulk, Vol. 2, Issue 100) and team-brand comic issues (e.g., Avengers Assemble, Vol. 2, Issue 21) includes monthly unit sales for the constituent brands and team brands. All constituent brands featured as team members in team-brand comic issues in a given month reflect the underlying brand-brand networks (hereinafter BBNs) of the teams from a firm perspective. In addition, we obtained extensive data on online consumer-generated content (CGC) for each team brand based on 3,137,761 web entries, which we use to derive the underlying brand-association networks (hereinafter BANs) for the teams from a consumer perspective.

This research yields several contributions. First, we offer the first systematic analysis of sales spillover effects in complex multi-brand (vs. previously studied dyadic) alliances and determine their economic extent. Second, we theoretically derive a network-based set of contingency factors, which we use to explain the bidirectional sales spillovers. By examining how to leverage network theoretical constructs to create value in complex brand networks, we address corresponding calls for research (Campbell & Price, 2021; Swaminathan et al., 2020) and provide guidance to managers on how to improve sales spillover effects in multi-brand alliances. Third, this work contributes to brand-network research by being the first to combine and compare BBNs (e.g., Zhang et al., 2016) and BANs (e.g., Nam & Kannan, 2014) jointly. Using information from these two network types enables us to reflect both the firm and consumer perspectives and compare the differential moderating effects on sales spillovers.

Related literature

Spillover effects in brand alliances

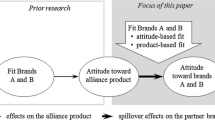

Prior research on brand alliances is characterized by a dyadic perspective (e.g., Keller & Lehmann, 2006; Park et al., 1996; Simonin & Ruth, 1998), focusing on pairs of brands and their combined branding activities. Prominent examples of such dyadic brand alliances are co-brands, in which two brand names are jointly used to mark a product or service (e.g., Park et al., 1996), either from the same or different companies (Keller & Swaminathan, 2019). Previous studies have documented spillover from a brand alliance to its constituent brands (e.g., Simonin & Ruth, 1998) and vice versa due to attitude-transfer processes (e.g., Park et al., 1996). In this process, positive associations and attitudes toward one partner brand can spill over to the other brand (Simonin & Ruth, 1998), and partner brands can convey otherwise unobservable quality information (Rao et al., 1999). Similarly, negative attributes such as incompetence and immorality may be transferred to a partner brand (Votola & Unnava, 2006), indicating the potential for negative spillover effects.

Such spillover effects are not necessarily symmetrical for different partner brands (Balachander & Ghose, 2003). For example, they are asymmetrically amplified by brand familiarity, so that less familiar brands experience stronger spillover effects than their more familiar partners (Simonin & Ruth, 1998). Moreover, as consumers often process one direction (e.g., from brand A to brand B) more frequently than another (e.g., from brand B to brand A), the strength of spillover effects also depends on the asymmetric strength of associations between brands (Lei et al., 2008). Furthermore, the perceived fit between the two constituent brands is an important moderator, as it can enhance the positive effects of the constituent brands on the brand-alliance product (e.g., Simonin & Ruth, 1998; Van der Lans et al., 2014).

Team brands as a brand-alliance strategy

One brand-alliance strategy exhibiting particularly complex alliance structures is team brands, which can occur both within firms (e.g., Celebrations) and across firms (e.g., Star Alliance, with 26 member airlines operating as independent firms). A team brand combines various brands under a team-brand name, such as professional sports teams (e.g., Los Angeles Lakers) consisting of athlete brands (e.g., LeBron James and Dwight Howard). Other examples for team brands in the domain of human brands include musical “supergroups,” whose members are successful as solo artists or as members of other successful groups (e.g., The Three Tenors, featuring José Carreras, Plácido Domingo, and Luciano Pavarotti), and television shows consisting of several human brands (e.g., America’s Got Talent, currently featuring Simon Cowell, Heidi Klum, Howie Mandel, and Sofia Vergara). Team brands are also popular for narrative products featuring character brands, such as DC’s comic teams (e.g., Suicide Squad, featuring among others Deadshot and Harley Quinn). In addition, team brands appear in other domains, such as CPG products with Frito-Lay’s Munchies (consisting of Doritos, Cheetos, Sun Chips, and Rold Gold brands) and Mars’ Celebrations (consisting of Snickers, Bounty, Twix, and many other brands).

These examples imply several conceptual differences between dyadic brand alliances and team brands (Table 1). First, team brands consist of a significantly higher number of constituent brands. As a consequence, team-brand names typically do not refer to all team members involved but feature new brand names, meaning consumers cannot directly infer from the team-brand name which constituent brands belong to the alliance. By contrast, typical naming approaches in dyadic brand alliances, such as Apple Watch Nike+ or Tide Plus A Touch of Downy Liquid Laundry Detergent, refer to the involved constituent brands. This distinction sets multi-brand alliances, particularly team brands, apart from the previously described research stream on dyadic brand alliances, as this difference potentially hinders a direct association transfer from the constituent brands to the focal alliance’s offerings and vice versa. Rather, the network of constituent brands and corresponding associations in consumers’ minds form the basis for spillover effects, requiring additional research to capture the nature of these effects and offer guidance on how to manage this distinct type of brand alliance.

Second, the composition of the team brand can change over time. For example, Mars removed Twix from the Celebrations brand and later added it back. Likewise, the composition of human brands participating in America’s Got Talent typically changes from season to season. As a consequence, investigating spillover effects in multi-brand alliances requires capturing the time-variant nature underlying these spillover effects.

Third, team brands comprise a complex network of relationships between their constituent brands, while dyadic brand alliances are characterized by a single relationship between brands. Common measures of dyadic fit between two brands only insufficiently capture the extent to which a large number of interconnected brands fit together. For example, while Don Cheadle’s character War Machine appears less frequently in dyadic co-brands, he is an important member of the Avengers’ team with various interconnections between him and the team members. In other words, the sum of dyadic relationships in a multi-brand alliance does not capture the alliance as a whole, as the characteristics of a multi-brand network, such as the centrality of the network’s constituent brands, cannot be derived from dyadic relationships. Instead, coordinating a network of relationships between constituent brands requires measuring their level of integration within the alliance network as a whole. In doing so, we believe it is beneficial to capture the network from both a firm perspective (i.e., the network-based centrality of the constituent brands within the alliance’s BBN) and a consumer perspective (i.e., the network-based centrality of the constituent brands within the alliance’s BAN) rather than only distinguishing between high and low integration in dyadic alliances (Newmeyer et al., 2014).

Despite these conceptual differences and the economic importance of team brands as a prominent form of multi-brand alliance, there is almost no research on team brands, with the exception of some scattered findings on professional sports teams. Specifically, prior research has documented that an athlete brand’s popularity can benefit from strong team performance (Yang & Shi, 2011) and that team-brand attractiveness (number of TV viewers for a game) increases if the focal team comprises highly popular athlete brands (Hausman & Leonard, 1997). Furthermore, regarding team brand–athlete brand matching, alliances between high brand-equity athletes and medium brand-equity teams generate the highest brand-alliance value, implying that top athlete brands (defined by fan-based popularity) are not necessarily better off when entering a top team (defined by revenues from live attendance and broadcasting; Yang et al., 2009).

Research on professional sports teams offers initial insights into the relationships between team brands and their constituent brands. However, the nature of spillover effects considering the network-based specifics of such multi-brand alliances has neither been conceptually proposed nor empirically examined so far. In addition, findings from professional sports teams cannot be readily generalized to other industries, as athlete brands cannot perform in their main professional domain without their team brands (e.g., LeBron James cannot play basketball without the Los Angeles Lakers), which contrasts other industries in which a team brand’s constituent brands also offer their own stand-alone products in the same professional domain (e.g., Wolverine is featured in his own Wolverine comic issues, but also in the X-Men comic issues).

To advance the understanding of multi-brand alliances, we approach brand alliances from a network-based perspective. In doing so, we contribute to the theoretical and empirical understanding of spillover effects in complex branding environments in several ways. Specifically, after conceptually demonstrating how team brands as multi-brand alliances differ from dyadic alliances, we theoretically hypothesize and empirically test how network metrics moderate spillover effects in multi-brand alliances. The network perspective is essential for capturing the various relationships between brands in this multi-brand setting. By jointly using two networks (i.e., BBN and BAN), we investigate spillover effects in complex multi-brand alliances from both the firm and consumer perspectives and compare the differential effects of the two networks on sales spillovers.

Contingency framework and hypotheses

Overview

Figure 1 depicts the network-based contingency framework of this research. It comprises bidirectional sales spillover effects between team-brand sales and constituent-brand sales. The analysis of monetary spillover effects is at the heart of brand management research and of high relevance to brand managers. We expect a positive bidirectional relationship, meaning that higher constituent-brand sales should result in higher team-brand sales and vice versa. This expectation is based on cross-selling effects (Kumar et al., 2008) from positive attitude transfers (Park et al., 1996). Thus, team (constituent) brand sales are a function of the number of consumers who purchase the constituent (team) brand comic and the likelihood of a positive attitude transfer. While the number of purchases depends on the popularity of and demand for the respective brand, we propose that the attitude transfer depends on the key characteristics of two distinct networks: the firm-based network and the consumer-based network of the team brand.

Table 2 depicts the key characteristics of a team’s BBN and BAN. The firm-based network (or the BBN) results from managerial decisions about which constituent brands to combine into a team brand (e.g., Captain America, Hulk, Iron Man, Black Widow, Thor, and others form the BBN of the Avengers by jointly appearing as team members in Avengers comics). The consumer-based network of the respective team brand (or the BAN) consists of consumers’ brand associations with the team and its constituent brands. We observe online conversations about the brands and treat words that appear together with the brand as brand associations. For example, a forum post stating “The Avengers are powerful” and a second post stating “I love the Avengers movie” would imply a BAN that connects the associations “powerful,” “love,” and “movie” to the “Avengers” node in the Avengers’ BAN. Furthermore, the associations “love” and “movie” are linked because they appear in the same post.

Based on the theoretical notion that consumer knowledge can be described as a network of interconnected information nodes (Collins & Loftus, 1975), a network perspective allows to conceptualize how consumers access information about brands that are part of multi-brand alliances. As team brands combine multiple constituent brands, access to information from a particular constituent brand depends not only on the relationship between the team brand and the constituent brand, but also on the team brand’s relationships with all other constituent brands within the team. Thus, accessing information about a particular constituent brand depends on the position of that constituent brand within a team brand’s network of constituent brands (BBN) and their respective associations (BAN).

To characterize the position of a node (e.g., a brand) in a network, prior marketing research has often referred to the concept of centrality. Centrality captures importance (Henderson et al., 1998; Grewal et al., 2006) and accessibility (Stephen & Toubia, 2010; Ansari et al., 2018) of a node. Accordingly, we describe the constituent brands’ roles in these networks in terms of their degree centrality—that is, the number of edges that are directly connected to each constituent brand’s node in the BBN (i.e., edges to other constituent brands) and in the BAN (i.e., edges to other brand associations) in a given month. In addition, both networks can be described in terms of their network size—that is, the number of nodes that constitute the network. In our case, these nodes include the number of brands (BBN) or brand associations (BAN) in the respective network in a given month. Network size has often been used in prior studies to capture consumers’ knowledge about brands (Krishnan, 1996; Meyers-Levy, 1989; Nam & Kannan, 2014). While network size represents the network level, describing the network as a whole, degree centrality represents the node level, describing the role of each constituent brand in the team-brand network.

Drawing on accessibility-diagnosticity theory (Feldman & Lynch, 1988) and spreading-activation theory (Collins & Loftus, 1975), we derive theoretical expectations of the contingency effects of network size and degree centrality on sales spillover effects. Both network metrics can help us theoretically predict when brand information is more accessible and, thus, when a sales spillover effect is more likely to occur. From a managerial perspective, network size and degree centrality convey relevant information to practitioners as both can be actively changed by managers.

The contingency effects of network characteristics

A sales spillover effect is more likely if consumers use information about the team-brand comic (constituent-brand comic) they have already purchased to decide whether to buy a constituent-brand comic (team-brand comic). In line with accessibility-diagnosticity theory (Feldman & Lynch, 1988), we expect that the team brand (constituent brand) is more likely to act as a source of information if (1) it is accessible (i.e., readily available for judgment), (2) other information is less accessible, and (3) it is perceived as diagnostic of (i.e., relevant to) the other brand(s). Because many different brands (in the BBN) and associations (in the BAN) can influence consumer decision-making, we first need to understand—and theoretically predict—when such information becomes more (or less) accessible in consumers’ minds. We therefore enrich the accessibility-diagnosticity theory with the spreading-activation theory of memory (e.g., Collins & Loftus, 1975), which explains when information stored in networks is accessible. According to this theory, information cues are stored in consumer memory as interconnected nodes. Access to information first requires activation of the respective node, and the activation then spreads through the connected nodes. For example, if the cue “spider” is activated, the activation likely spreads to the connected node of “Spider-Man,” making this constituent brand more likely to be accessed and used in consumer decision-making.

In the following sections, we first discuss how our network-based contingency factors (i.e., network size and degree centrality) moderate the sales spillover effects of constituent brands on their team brand (as part of the team-brand model). We then derive the corresponding effects for the constituent-brand model, detailing how the network-based contingency factors moderate the influence of a team brand on its constituent brand.

The contingency effects of network size in the team-brand model

A high number of constituent brands (i.e., high BBN size) and associations (i.e., high BAN size) in a team-brand network means that more information cues (i.e., nodes with informational value) are accessible. Thus, high BBN size and BAN size likely increase the number of potential access paths of a focal constituent brand to its team brand, because the activation of a cue depends on the activation of the connected cues (Krishnan, 1996). The more paths lead to a constituent brand, the more likely consumers will access the brand and use it as a source of information when deciding whether to purchase the team-brand product.

However, information cues will compete for attention, and consumers make decisions based on the most accessible information cue without retrieving all possible information cues (i.e., all nodes stored in the network). Information cues that compete for attention with the focal constituent brand could be other constituent brands (in the BBN) or associations (in the BAN). A higher number of competing information cues will make it less likely that consumers will access the information cue of the focal constituent brand (Meyvis & Janiszewski, 2004). In other words, when consumers evaluate a team brand (i.e., activate the node), activation spreads to all connected nodes, and the likelihood that activation spreads to the node of a focal constituent brand decreases with the total number of nodes. Therefore, we propose that BBN and BAN size decrease the likelihood that a specific constituent brand is used as an information cue for the team brand, which in turn weakens the sales spillover effect from the constituent brand to the team brand. For example, high BBN size of the Avengers network implies that a large number of constituent brands (e.g., Captain America, Hulk) form the team brand. Similarly, high BAN size of the Avengers network implies that consumers have a large number of associations with the team brand in their minds. This high accessibility of other brands and associations decreases consumers’ likelihood to access the focal constituent brand’s information. In turn, positive associations of the focal constituent brand are less likely to spill over to the team brand, which decreases the likelihood that consumers will use the constituent brand as a source of information when deciding to purchase the team-brand comic. Thus:

H1a

The higher the number of constituent brands in a team’s BBN (i.e., the higher the BBN size), the weaker is the spillover effect of constituent-brand sales on team-brand sales.

H1b

The higher the number of associations in a team’s BAN (i.e., the higher the BAN size), the weaker is the spillover effect of constituent-brand sales on team-brand sales.

The contingency effects of degree centrality in the team-brand model

BBN centrality reflects the degree to which constituent brands are integrated into their team’s BBN. A constituent brand with high BBN centrality (i.e., a high number of edges connecting the constituent brand with other constituent brands) has a large number of associated information cues (i.e., other constituent brands) that can help activate it. A highly integrated constituent brand should therefore be more accessible in consumers’ minds than a constituent brand with a low level of integration. This high accessibility should then translate into a higher likelihood of using the constituent brand as a source of information when deciding whether to purchase the team-brand product. In the Marvel context, high BBN centrality of, for example, Captain America within the Avengers’ BBN implies that Captain America jointly appears with many other constituent brands of the Avengers’ network. Thus, information about Captain American is more accessible in consumers’ minds than constituent brands with low BBN centrality, which likely sparks spillover effects. We therefore propose the following:

H1c

The more integrated a constituent brand is in a team’s BBN (i.e., the higher the BBN centrality), the stronger is the spillover effect of constituent-brand sales on team-brand sales.

BAN centrality reflects the degree to which constituent brands are integrated into their team’s BAN. A constituent brand with high BAN centrality shares many associations with other constituent brands and therefore might be more accessible through the activation of any of the shared associations. However, would a constituent brand that shares many associations with its team brand still be diagnostic (i.e., is the information it provides relevant to evaluate the team brand)? We argue that a constituent brand with high BAN centrality likely contributes less additional information to consumers’ understanding of the respective team brand because it conveys the same information as other constituent brands (Krishnan, 1996). Consequently, high BAN centrality should translate into low diagnosticity of a constituent brand for its team brand, and thus the positive spillover effect of the constituent brand on the team brand should decrease. For example, high BAN centrality of Captain America within the Avengers’ BAN implies that Captain America shares many associations with other constituent brands of the Avengers’ network (e.g., “Civil War,” “patriotic,” “S.H.I.E.L.D.”), making him prototypical of the Avengers. By contrast, Dr. Strange may have less overlap with the other constituent brands in the Avengers’ network, and consumers might have unique associations in mind (e.g., “surgeon,” “intellectual,” “bookish”). Captain America should therefore be less diagnostic in consumers’ evaluations of the team (i.e., contributes less additional information to consumers’ understanding of the team brand) than Dr. Strange, likely reducing his effect on the team brand. Thus:

H1d

The more integrated a constituent brand is in a team’s BAN (i.e., the higher the BAN centrality), the weaker is the spillover effect of constituent-brand sales on team-brand sales.

The contingency effects of network size in the constituent-brand model

We next turn to the hypotheses dealing with the effect of team-brand sales on constituent-brand sales. Relating to the contingency effect of network size, we propose that a high number of constituent brands (i.e., high BBN size) and associations (i.e., high BAN size) in a team-brand network could affect accessibility of the team-brand node in two ways. As argued in H1a and H1b, more information might also mean that information cues have to compete for attention. This would imply that when consumers evaluate a constituent brand (i.e., activate the node of the constituent brand; Krishnan, 1996), this activation is less likely to spread to and activate the team-brand node. For example, Meyers-Levy (1989) shows that consumers are less likely to recall a brand name when a high amount of information is associated with it (i.e., high BAN size). However, a greater number of information cues related to the team brand also means that more pathways could activate the team-brand node, which in turn increases the likelihood that consumers will access the team brand and use it for decision-making.

In contrast with the team-brand model, the constituent-brand model comprises direct pathways between all nodes (i.e., constituent brands in the BBN and associations in the BAN) and the team-brand node, as only one team brand (vs. multiple constituent brands) can be accessed. Therefore, we propose that the positive effect dominates and high BBN and BAN size increase the accessibility of the team brand, which in turn translates into stronger sales spillover from the team brand to its constituent brands:

H2a

The higher the number of constituent brands in a team’s BBN (i.e., the higher the BBN size), the stronger is the spillover effect of team-brand sales on constituent-brand sales.

H2b

The higher the number of associations in a team’s BAN (i.e., the higher the BAN size), the stronger is the spillover effect of team-brand sales on constituent-brand sales.

The contingency effects of degree centrality in the constituent-brand model

When consumers evaluate a constituent brand (i.e., activate the node), activation spreads to all connected nodes, and the likelihood that the team-brand node will be activated increases with the total number of pathways between the constituent brand and the team brand. A central constituent brand has more pathways to the team-brand node and therefore is more likely to activate the team-brand node. We therefore expect that the team-brand node is more accessible in consumers’ minds when evaluating a constituent brand with a high level of integration (i.e., high BBN centrality) than for a constituent brand with a low level of integration. In other words, high BBN centrality increases the accessibility of team-brand information and, thus, the likelihood that positive associations with the team brand will spill over to the constituent brand. In the Marvel context, high BBN centrality of, for example, Black Widow within the Avengers’ BBN implies that Black Widow jointly appears with many other constituent brands of the Avengers’ network (i.e., is connected to the information nodes of other constituent brands) and thus has more pathways to the team-brand node. When consumers evaluate a Black Widow comic, information about the Avengers is more accessible than when consumers evaluate a comic of a constituent brand with low BBN centrality. Thus:

H2c

The more integrated a constituent brand is in a team’s BBN (i.e., the higher the BBN centrality), the stronger is the spillover effect of team-brand sales on constituent-brand sales.

We expect that a high level of integration of a constituent brand into a team’s BAN reduces consumers’ perceptions of the constituent brand as a stand-alone brand. Rather, consumers are likely to perceive the constituent brand as an integral part of the team with overlapping associations. While this centrality likely increases the accessibility of the team-brand node through the activation of any of the shared associations, the team brand is unlikely to be diagnostic, as it does not add new information to the constituent brand. In the Marvel context, high BAN centrality implies that Black Widow shares many associations with other constituent brands of the Avengers’ network. Thus, the team brand should be less diagnostic for the evaluation of a constituent brand with high BAN centrality (i.e., it contributes less additional information to the understanding of the constituent brand) than for a constituent brand with low BAN centrality. Thus:

H2d

The more integrated a constituent brand is in a team’s BAN (i.e., the higher the BAN centrality), the weaker is the spillover effect of team-brand sales on constituent-brand sales.

Data and measures

Sample

We test our hypotheses in the Marvel brand universe, one of the largest brand universes in the entertainment industry (Harrison et al., 2019). The advantage of investigating brand alliances within one brand universe is that firm-specific factors (e.g., industry, image) are constant across all observed brand alliances, which might increase the internal validity of our findings. With its strategy to build comic-character brands and combine them into team brands, thereby developing an entire brand universe with a multitude of interconnected brands, Marvel is among the most successful brands across the globe and has redefined entertainment branding. Unsurprisingly, other entertainment companies are trying to embrace a similar strategy (Harrison et al., 2019).

Marvel offers a suitable empirical context for several reasons. First, Marvel heavily uses team brands, such as the Avengers, Defenders, Fantastic Four, Guardians of the Galaxy, X-Force, and X-Men (Harrison et al., 2019). Second, with a comic market share of nearly 40% in the United States (Alverson, 2022), Marvel reaches wide audiences. Third, in addition to the comic format, team brands such as the Avengers have been extended into the motion picture category, with Avengers: Endgame being, at the time of writing, the second most successful movie of all time, making approximately $2.8 billion at the box office (Boxofficemojo, 2022). Fourth, Marvel consumers are well aware of the connections between team brands and constituent brands, which is a necessary condition for spillover effects to occur. A survey of Marvel comic readers supports this notion, as they were able to assign constituent brands to team brands with an accuracy of 70% (see Web Appendix A for details). Additionally, the internet is replete with anecdotal evidence that Marvel consumers care about the composition of team brands. For example, consumers discuss which constituent brands should join a team or which constituent brands benefit most from their teams (Harth, 2022). Such discussions suggest that associations between team brands and constituent brands influence purchase decisions, making them a suitable context for examining sales spillover effects.

We compiled an extensive longitudinal dataset on Marvel’s constituent brands and team brands over a 10-year period (from November 1, 2005 to October 31, 2015), representing a time of intensive franchise and brand-combination activities (Hennig-Thurau & Houston, 2019). We use comics as our focal market for three reasons. First, Marvel commercializes new brands as comics before extending them to other formats. Second, the comic market is characterized by a substantial number of new releases, offering a rich sales dataset. Third, Marvel uses its comic format as a “test market” to try out new brand combinations (Han, 2017), which reduces concerns about selection effects due to strategic management decisions in our dataset. In addition to the comic market as our focal market, we consider extensions into Marvel’s other two main markets—movies and TV shows.

We constructed the dataset in three steps, leading to three inclusion criteria that were applied to all team and constituent brands. First, to gain an overview of Marvel’s brand universe, we considered all team and constituent brands communicated on the corporate website. Second, to identify relevant constituent brands, we kept all constituent brands that are featured in their own stand-alone comic series (i.e., a series is defined as six or more issues with the constituent brand in the title; see How to Love Comics, 2021) and are members of movie and TV show casts within our observation period. Third, to analyze constituent brands within their team brands, we identified relevant team brands by checking whether each team had its own comic series and whether at least one of the identified constituent brands was communicated as a member of the team on the corporate website (for screenshots of Marvel’s corporate website, see Web Appendix B). This procedure resulted in 29 constituent brands and eight team brands (Web Appendix C lists all 37 brands included in our analyses and relates the team brands to their constituent brands).

Dependent variables

Team and constituent brands are abundant in different comic issues (e.g., Dark Reign Fantastic Four, Vol. 1, Issue 4; Fearless Defenders, Vol. 1, Issue 9; Uncanny X-Men, Vol. 3, Issue 22) that are part of comic series (e.g., Uncanny X-Men, Vol. 3, Issue 22, is part of the comic series Uncanny X-Men).Footnote 1 In total, our dataset covers 6,552 comic issues from the North American comic market collected from Comichron. It includes 2,775 team-brand comic issues (42.4%) and 3,777 constituent-brand comic issues (57.6%), which are part of 973 comic series. In several cases, the team and constituent brands appeared in multiple comic issues in one month. For example, in June 2014, X-Men published seven issues (e.g., Amazing X-Men, Vol. 2, Issue 8; Uncanny X-Men, Vol. 3, Issue 22), while its constituent brand Wolverine published four issues. Thus, we calculate the first dependent variable, team-brand sales, by aggregating monthly comic unit sales for the comic issues of each team brand (i.e., the sales of comics for which the team brand is part of the comic title). Likewise, we calculate the second dependent variable, constituent-brand sales, by aggregating monthly comic unit sales of the comic issues for each constituent brand (i.e., the sales of comics for which the constituent brand is part of the comic title).

Independent variables

The focal measures for spillovers of comic unit sales are constituent-brand comic sales in the team-brand model (i.e., constituent-brand pent-up sales) and team-brand comic sales in the constituent-brand model (i.e., team-brand pent-up sales). For both spillover variables, we accumulated the unit sales of the respective other brand (i.e., team-brand sales for the constituent brand and vice versa). Constituent-brand comics and team-brand comics are usually, but not always, published monthly, and one brand can only have sales effects on the other brand’s comics if the other brand publishes a comic to be sold. Therefore, we assume that spillover effects accumulate over the months with no published comics (i.e., pile up as unobservable increased market buzz) and materialize in the first month when at least one new comic issue is released. For example, for Hulk as a constituent brand to spill over to his team brand (i.e., Avengers), the Avengers must have a comic on the market that can be purchased in that month. We therefore accumulate all Hulk comic sales up to the first month in which the Avengers publish a new comic. We refer to this measure as “pent-up sales”; it is generated for constituent brands in the team-brand model and for team brands in the constituent-brand model.

Moderating variables

BBN variables

To capture the firm perspective, we consider the managerial decisions about which constituent brands should appear together in a team brand’s products. These joint appearances in a given month are represented as the BBN for each team brand in month t. Specifically, whenever a constituent brand appears as a team member in one of the focal team’s comic issues in month t, it represents a node in the BBN. Further, two brands that appear jointly in one comic issue are connected by an edge in the network. As teams often release multiple comic issues with different sets of comic-character brands in one month, not all comic-character brands are connected with each other. Together, these nodes and edges form the BBN of the team brand. Figure 2 (Panel A) illustrates an exemplary BBN.

Example of a BBN and a BAN of X-Men. Notes: Panel A shows the BBN of the team brand X-Men from February 2013 based on 13 comic issues. Panel B shows the BAN of the team brand X-Men from February 2013 based on 4,253 web entries. We excluded verbs (e.g., do, find, go) for readability purposes. We used the tool InMap from Insius to illustrate both networks to ensure visual comparability. The arrows point to the constituent brands that are part of our sample and relevant for our analyses

From the BBN for each team brand for each month, we derive the two BBN-based moderating variables. Specifically, we calculate the network characteristic BBN size by counting the number of constituent brands in a team brand’s BBN in a given month. We count all constituent brands in a team brand’s BBN (not only those that are part of our sample) to derive an overall network-size measure. Furthermore, we calculate the network characteristic BBN centrality by counting the number of edges of the focal constituent brand with all other constituent brands in the network in a given month.

BAN variables

To capture consumers’ associations with the team brands and their constituent brands for each month, we obtained extensive data on online chatter (CGC) for each team brand based on 3,137,761 web entries from Insius, a company specialized in web and social media monitoring. We identified relevant web entries by searching for texts on the team brands (i.e., text containing the focal team brand’s name in combination with the word “Marvel”). Following the literature on extracting brand associations and their interconnections from textual content (Gensler et al., 2016), we converted these consumer-generated web entries into networks of associations and edges for each team brand. Specifically, each word that occurs in the text of the web entry represents an association and is added to the BAN as a node and linked to the respective team brand through an edge. If two associations appear in the same web entry (e.g., same blog), they are linked through an edge in the team brand’s BAN, as these associations are connected in consumers’ minds.

Web Appendix D explains how we derive BANs from CGC in more detail. Figure 2 (Panel B) illustrates an exemplary BAN. As the panel shows, the superordinate team-brand node of X-Men is in consumers’ minds, and the depicted network involves both team-brand-specific associations and other associations. In this example, the BAN involves associations that are specific to the team brand, such as “mutant” and “uncanny,” and associations that are general to all brands in the universe, such as “Marvel” and “superhero.” Moreover, as each constituent brand is typically connected with its team in consumers’ minds, the constituent brands appear as associations (i.e., nodes) in the team brand’s BAN.

From the BAN for each team brand for each month, we derive the two BAN-based moderating variables. Specifically, we calculate the network characteristic BAN size by counting the number of associations in a team brand’s BAN in a given month. Furthermore, for each focal constituent brand of a team brand in a given month, we calculate the network characteristic BAN centrality by counting the number of edges that connect the focal constituent brand’s node with other associations in the network.

Control variables

We include several control variables to account for other factors that could drive comic brand sales. Given the serial nature of comics and their subsequent monthly releases, we control for lagged sales—that is, sales from the previous month (i.e., team-brand and constituent-brand sales lag). We also account for brand extensions of the constituent brands and team brands to other formats. The brands in our sample were not only marketed in the comic format but also extended to the movie and TV formats, especially with the growth of Marvel Cinematic Universe in the last decade. Therefore, we control for movie and TV viewers for both team brands and constituent brands as time-varying brand characteristics (i.e., team-brand movie viewers, team-brand TV viewers, constituent-brand movie viewers, and constituent-brand TV viewers).

Table 3 lists all the variables and their operationalizations. Web Appendix E provides descriptive statistics. As model-free evidence for a sales spillover effect, we observe a significantly positive correlation between team-brand sales and constituent-brand pent-up sales (r = .171, p < .001) as well as a significantly positive (though a bit weaker) correlation between constituent-brand sales and team-brand pent-up sales (r = .069, p < .001).

Modeling approach

To test our hypotheses, we need to address four main methodological challenges: (1) unobserved heterogeneity across brands and time, (2) unobserved effects driving the strategic selection of constituent brand, (3) different release intervals (of serialized products), and (4) the clustered data structure. These four challenges guide our data preparation and model selection, which leads us to use fixed-effects panel models. We include clustered standard errors in the constituent-brand model to account for the clustered structure of our data in that model.

Modeling challenges

Unobserved heterogeneity across brands and time

In line with research on social networks in marketing (e.g., Dost et al., 2019) and on endogeneity (e.g., Papies et al., 2017), we exploit the panel structure in the dataset by using two panel models, employ fixed effects (i.e., brand and time fixed effects) to control for unobserved effects, and include control variables. A fixed-effects panel-regression approach that leverages the panel structure of the dataset (comics, movies, and TV shows with regularly released new products) to control for unobserved brand and time effects should account for a significant part of the unobserved effects in our dataset.

Regarding fixed effects, some individual brand characteristics may influence comic sales (e.g., comic-character brands have different superpowers or differ in their general popularity). The chosen panel-model specification, in combination with fixed effects at the constituent-brand level (fixed-effect constituent brand) and at the team-brand level (fixed-effect team brand), controls for this unobserved heterogeneity across constituent brands and team brands (i.e., differencing out this heterogeneity). Moreover, unobservable factors that are common to all brands but vary by period (e.g., unobserved changes in society’s taste for comics) may influence the comic unit sales and cause endogeneity issues if not accounted for. For example, an endogeneity problem may arise when there is growing interest in superhero brand franchises as a reaction to unobserved demand shocks. Therefore, we use time fixed effects (fixed-effect year).

In addition, we include a lagged dependent variable in the model. While constituent-brand fixed-effects control for unobserved sources of heterogeneity that are brand-specific and constant over time, unobserved factors might also vary over time. If unobserved decisions by Marvel simultaneously affect comic sales and any of our independent variables (i.e., lead to endogeneity in our independent variables), these decisions are likely also to affect lagged sales. Thus, controlling for lagged sales helps account for time-varying unobserved effects (Germann et al., 2015).

Constituent brand selection

Although Marvel uses its comic format to explore new brand combinations on a large scale (Han, 2017), decisions about which constituent brands to include in a focal team-brand comic are still unlikely to be totally random. For example, when Marvel expects (e.g., from market research) that the addition of a particular constituent brand to the Avengers’ team could increase sales of the team brand in a given month, it is more likely to select that constituent brand as part of the team. Assuming that Marvel’s decision is a function of some unobservable variables, we face an omitted variable bias in our estimates if these variables are correlated with team-brand sales and our explanatory variables (e.g., constituent-brand pent-up sales). To prevent potential selection bias associated with the decision to select a particular constituent brand in a specific month, we apply the Heckman (1979) correction.

In the first step, we model the selection probability Sit using a panel-data probit model, with the dependent binary variable Sit = 1 if constituent brand i is part of at least one of its team-brand comics in month t (i.e., was selected to be part of the team; Sit = 0 otherwise). An approach often used in marketing literature is to observe the behavior of similar units at the same time, such as firms in the same industry or geographic area. Similar to Hughes et al. (2019), we use the selection of a constituent brand’s most similar constituent brand and its most similar antagonist brand (i.e., the villain characters selected for the comic; see Web Appendix B for a screenshot of characters appearing in a comic issue) as explanatory variables. In this regard, two brands are deemed similar if they frequently appear together in a team across the range of comic issues we observe, as in the case with transient cliques within teams. For each constituent brand, we count (1) how often it appears with each other constituent brand (i.e., we count the number of months in which both the focal and the other constituent brand are featured in the team-brand comic) and (2) how often it appears with each antagonist brand. We then define the most similar constituent and antagonist brands by the respective maximum count. The rationale for this approach is that Marvel likely has information that is unobservable by the researcher but that influences the decision to select constituent brands into the team in a given month. Including the selection of the most similar constituent and antagonist brands in the probit model allows us to predict the probability of selecting a focal constituent brand based on unobservable characteristics shared by the constituent brand and its most similar constituent brand and antagonist brand, respectively. While the appearance of a particular constituent brand might affect sales, team-brand comics in general are unlikely to generate higher sales if constituent brands and antagonist brands that are most similar to the selected constituent brands are also selected. Therefore, we argue that both variables fulfill the exclusion criterion (Heckman, 1979). We estimate the following equation:

where α3 is a constituent-brand fixed effect to control for the baseline difference in the probability of brand i appearing in its team-brand comic and α4 is a yearly fixed effect to control for variation across time. The selection of both the most similar constituent brand (α1 = 1.226, p < .001) and the most similar antagonist brand (α2 = .612, p < .001) has a significantly positive effect on the selection probability of the focal constituent brand. A likelihood ratio test for nested models confirms that the full model significantly increases the log-likelihood (LLH) compared with a baseline model with intercept and fixed effects on the constituent-brand and year level (LLHbaseline = −1,607, LLHfull = −1,421; χ2 = 370.76, p < .001). We then use the estimated probit model to calculate the inverse Mills ratio (IMRit) for selecting constituent brand i in month t and add the variable to our models to control for the selection process (Heckman, 1979). We include the IMR in both models, as unobservable characteristics that drive Marvel’s likelihood to include a constituent brand in the team-brand comic might affect both team- and constituent-brand sales.

Different release intervals of serialized products

The particularities of the comic market require us to account for the characteristics of serialized products. Specifically, release intervals of comic series can differ across brands, which poses a challenge when estimating spillover effects of team- and constituent-brand sales. That is, some constituent and team brands do not release comic issues every month, while other brands release various comic issues (that are part of different comic series) per month. Importantly, if a comic series is ongoing, new comic issues are usually released every month (Marvel, 2021) and consumers usually purchase comic issues in the month of the release (Comichron, 2021). Thus, we use the idea of a stock specification to capture the focal independent variables (e.g., Burmester et al., 2016)—constituent-brand pent-up sales and team-brand pent-up sales—which builds up until the corresponding brand’s release, enabling spillover effects to occur. To build these two variables, we use the Koyck (1954) model, with the respective variables determined as follows:

where Xkt denotes the unit sales of brand k in month t (= 0, ..., 120). Given the monthly release schedule of new comic issues and to account for purchases in the month of the release, we set λ to 1 and thus allow the full comic sales of the other brand to be stocked (i.e., the team-brand pent-up sales are stocked for the respective constituent brand and vice versa). Over a short period, we assume brand buzz in the market to remain stable until a new comic issue of the other brand’s comic series is released (i.e., a constituent brand’s comic issue in the team-brand model and a team brand’s comic issue in the constituent-brand model). Note that the average time interval between releases of comic series is relatively short, which makes a decay of brand buzz resulting in a spillover coefficient of less than 1 unlikely. Consequently, the stock accumulates until the month when the other brand’s new comic issue is released (at which point, we set the stock to 0).

We build the control variables the same way. Only if a brand’s comic is released in month t can the stocked number of movie and TV viewers have an effect on corresponding comic sales (e.g., a Hulk movie can only boost Hulk’s constituent comic sales in month t if a constituent comic is released in month t). Consequently, the stock accumulates until the month when the brand’s new comic issue is released (at which point, we set the stock to 0).

Clustered data structure

We use clustered error terms in the constituent-brand model to control for the clustered data structure of some of our observations in that model. Constituent brands are clustered in team brands because multiple constituent brands are part of the same team brand. We allow the error terms to correlate for constituent brands from the same team brand (i.e., clusters). Two variables are clustered (i.e., vary only) at the team level: BBN size and BAN size. These variables do not vary between constituent brands of the same team brand (e.g., Hulk and Iron Man are part of the same team, so they have the same value for BBN size in a given month; likewise, they have the same value for BAN size). We measure all other variables at the constituent-brand level. These variables vary between the constituent brands of the same team brand (e.g., the constituent-brand sales of Hulk are different from those of Iron Man for a given month despite both being part of the Avengers).

Model specifications

To account for skewed variables and to interpret the coefficients as elasticities, we adopt a log-log formulation. Following other entertainment studies observing no sales for a given month (e.g., Papies & Van Heerde, 2017), we add 1 to the original variable to avoid taking a natural logarithm of 0 (e.g., as comic sales may be 0 in a given month). As we analyze interaction effects, we centralize our variables by their grand means, which allows us to interpret the main effects to hold at the mean level of the independent variables (Papies & Van Heerde, 2017). The different structures of the team- and constituent-brand data (i.e., in contrast with the team-brand data, the constituent-brand data are clustered) require two panel-model specifications: the team-brand model (Eq. 3) and the constituent-brand model (Eq. 4).

Team-brand model

We model comic sales of team-brand j in month t as

where the variables are as defined in Table 3. The term β0 is the intercept, εit is the error term, and β1 measures the sales spillover from the focal constituent brand to the team brand. Note that the nature of team brands means per definition that several constituent brands share the same team (e.g., Captain America and Hulk are both team members of the Avengers). Using several constituent brands of one team in the team-brand model would have meant averaging sales as well as the network-based variables, resulting in network measures that are difficult (or meaningless) to interpret (e.g., the mean BBN centrality of Captain America and Hulk together). To enhance the interpretability of the results, we randomly selected one focal constituent brand i from the team members and used this focal constituent brand in the team-brand model. Web Appendix C lists the brands used in the main analysis; we subsequently report robustness checks controlling for mean constituent-brand sales, mean BBN centrality, and mean BAN centrality of the team’s other constituent brands in our sample.

Constituent-brand model

We model comic sales of constituent brand i in month t as

where the variables are as defined in Table 3. The term γ0 is the intercept, μit is the error term, and γ1 measures the sales spillover from the team brand to the constituent brand.

Results

We estimated four models. The first two are the team-brand (M1) and constituent-brand (M2) models without interaction effects; the second two are the team-brand (M3) and constituent-brand (M4) models with interaction effects (Table 4). All models exhibit a good fit, with an adjusted R-square between .847 and .892; multicollinearity is not a concern, as variance inflation factors are less than or equal to 2.783 in the main-effects models and 5.357 in the models with interaction effects.

Spillover effects of team- and constituent-brand sales

As expected, we find a significantly positive spillover effect from the constituent brands to their team brands (.218; p < .001). Likewise, we find a significantly positive spillover effect from the team brands to their constituent brands (.299; p < .001). To account for potential correlations of the error terms in the team-brand and constituent-brand models, we run a seemingly unrelated regression (SUR) model including essentially the same variables as in M1 and M2. As the equations in a SUR model need to have the same unit of analysis, we use mean values (at the team level) for the constituent-brand variables. The results confirm the robustness of our analyses (see Web Appendix F for the detailed results).

Contingency factors of sales spillover from constituent brands to team brands

Moderating effects of network size

In line with H1a, we find that as the number of other constituent brands in a team’s BBN increases (i.e., higher BBN size), the positive spillover effect of focal constituent-brand pent-up sales on team-brand sales becomes significantly weaker (−.117; p < .001). This finding lends empirical support to the notion that the high accessibility of other constituent brands decreases the likelihood that consumers will use a focal constituent brand when making judgments about a team, which in turn attenuates the sales spillover from the constituent brand to the team brand. As the interaction effect of BAN size and constituent-brand pent-up sales on team-brand sales is not significant (−.065; p > .10), H1b is not supported.

Moderating effects of degree centrality

H1c states that the more integrated a focal constituent brand is in a team’s BBN (i.e., the higher the BBN centrality), the stronger is the spillover effect of focal constituent-brand pent-up sales on team-brand sales. In line with H1c, we find a marginally significant and positive interaction between BBN centrality and constituent-brand pent-up sales (.028; p < .10). This finding provides empirical support for the notion that a high level of integration of the constituent brand in a team’s BBN, which translates into high accessibility of the constituent brand for the team brand, enhances the positive spillover effect of the constituent brand on team-brand sales.

By contrast, H1d suggests that the more integrated a focal constituent brand is in a team’s BAN (i.e., the higher the BAN centrality), the weaker is the spillover effect of focal constituent-brand pent-up sales on team-brand sales. The significant and negative interaction effect (−.036; p < .01) supports this hypothesis. A high level of integration into the team in consumers’ minds implies that a focal constituent brand shares many associations with other constituent brands and thus conveys few unique information pieces (i.e., low diagnosticity), which attenuates the positive spillover effect of the constituent brand on team-brand sales.

Contingency factors of sales spillover from team brands to constituent brands

Moderating effects of network size

H2a states that the higher the number of other constituent brands in a team’s BBN (i.e., higher BBN size), the stronger is the spillover effect of team-brand pent-up sales on constituent-brand sales. As the interaction between BBN size and team-brand pent-up sales is not significant (−.008; p > .10), H2a is not supported.

In support of H2b, we find that as the number of associations in a team’s BAN increases (i.e., higher BAN size), the positive spillover effect of team-brand pent-up sales on constituent-brand sales becomes significantly stronger (.214; p < .01). This finding provides empirical support for the notion that a high number of team-brand associations makes a team brand more accessible in consumers’ minds, which increases the spillover effect on its constituent brands.

Moderating effects of degree centrality

H2c states that the more integrated a constituent brand is in a team’s BBN (i.e., higher BBN centrality), the stronger is the spillover effect of team-brand pent-up sales on constituent-brand sales, due to the increased accessibility of team-brand information (the activation of the team-brand node). As the interaction between BBN centrality and team-brand pent-up sales is not significant (−.016; p > .10), H2c is not supported.

Finally, in support of H2d, we find that the more integrated a constituent brand is in a team’s BAN (i.e., higher BAN centrality), the weaker is the positive spillover effect of team-brand pent-up sales on constituent-brand sales (−.203; p < .001). A high level of integration in a team’s BAN implies that consumers perceive the constituent brand as an integral part of its team brand (vs. a stand-alone brand) with overlapping associations. This, in turn, decreases the diagnosticity of the team brand for the evaluation of the constituent brand (as the team brand conveys few new information pieces), weakening any spillover effects on the constituent brand.

Controls

The effects of the control variables are face valid. The effects of the lagged team-brand sales on team-brand sales and the lagged constituent-brand sales on constituent-brand sales are significant and positive, suggesting that sales from the previous month enhance today’s sales and that consumers indeed consume comics serially. Furthermore, we observe cross-format spillovers, as additional TV viewers significantly increase comic sales for both the team-brand model and the constituent-brand model, suggesting that the serial format of TV shows positively spills over to comics, another serial format. The same applies for movie viewers in the constituent-brand model, suggesting that exposure to a particular character brand on the big screen makes consumers want to learn more about the particular character brand in comic stories—an effect that we do not find when estimating the team-brand model. We find a significant effect of the IMR in both team-brand models (M1 and M3), indicating that not controlling for Marvel’s selection of constituent brands would bias our main estimates. The effects of the control variables are robust across the base models (M1 and M2) and interaction-effects models (M3 and M4).

Robustness checks

We conduct three additional robustness checks. First, we account for the potential endogeneity of constituent-brand pent-up sales, team-brand pent-up sales, BBN size, and BBN centrality using a Gaussian copula approach (Becker et al., 2022; Park & Gupta, 2012). Including Gaussian copulas for the spillover and BBN-related variables supports the robustness of our initial results, as it does not change the substantive findings of either the team-brand model or the constituent-brand model. Notably, the marginally significant interaction between constituent-brand pent-up sales and BBN centrality in M3 (.028; p < .10) turns significant when including Gaussian copulas (.032; p < .01), in further support of H1c (see Table G.1 in Web Appendix G and Table H.1 in Web Appendix H for the detailed results).

Second, we include a variable named Marvel NOW! reflecting the comic branding used for the relaunch of several ongoing comic series in October 2012 (i.e., dummy variable taking the value 1 in the months after the relaunch) in both the team-brand model and the constituent-brand model. This relaunch entailed changes in new creative teams, new character designs, and new storylines to attract new readers, thereby representing a major intervention of Marvel. Including this control variable further supports the robustness of our results, as it does not cause notable changes in the effects of our focal variables as reported in Table 4, which leaves the results of our hypotheses testing unchanged (see Table G.2 in Web Appendix G and Table H.2 in Web Appendix H for the detailed results).

Third, in view of the random selection of one constituent brand per team for the team-brand model, we re-estimate the team-brand model and also include the mean constituent-brand sales, mean BBN centrality, and mean BAN centrality of the team’s other constituent brands in our sample. This approach helps control for the effect of the other team members on the team brand’s comic sales (see Kupfer et al., 2018). Including these control variables supports the robustness of our initial results (see Table G.3 in Web Appendix G for the detailed results).

General discussion

The findings of this research provide evidence of positive spillovers for both team and constituent brands, thereby indicating that this type of multi-brand alliance is a promising branding strategy. A contingency analysis further shows that network characteristics affect spillovers from a team brand to its constituent brands differently than spillovers from constituent brands to their team brand. Specifically, spillovers from constituent brands to their team brand increase if these brands are highly integrated into the team’s BBN. However, they decrease if the constituent brands are highly integrated into the team’s BAN, and they may even vanish if the team features many constituent brands. In turn, spillovers from the team brand to its constituent brands increase if this brand offers many associations but decrease if the constituent brands are highly integrated into the team’s BAN.

Managerial implications

Our findings show that team brands are a promising branding strategy that can offer substantial economic benefits, as evidenced by the sizable elasticities of the corresponding spillover effect obtained from our log-log models (.218 in the team-brand model and .299 in the constituent-brand model). To illustrate this economic impact of multi-brand alliances for both team brands and their constituent brands, we ran M1 for each constituent brand and M2 for each team brand individually. Most brands show significant, positive spillover effects, with elasticities ranging from .027 to .907 for constituent brands and .311 to .704 for team brands (see Web Appendix I). For dominant superheroes such as Captain America (1.457 standard deviations above the mean BBN centrality), a 1% increase in the unit sales of Avengers comics increases the unit sales of Captain America comics by .48%, which translates into monthly dollar salesFootnote 2 of $13,646 on average in North America. For a B-League hero such as Ant-Man (.688 standard deviations below the mean BBN centrality), a 1% increase in the unit sales in Avengers comics increases the unit sales of Ant-Man comics by .24%, which translates into monthly dollar salesFootnote 3 of $521 on average in North America. The other way around, a 1% increase in the unit sales of Captain America increase Avengers sales by .14%, which translates into dollar salesFootnote 4 of $15,981. Similarly, a 1% increase in the unit sales of Ant-Man increases Avengers unit sales by .16%, which translates into dollar sales of $18,264.

These examples show that sales of constituent brands with high BBN centrality, such as Captain America, are more influenced by sales of their team brand than sales of constituent brands with comparatively low BBN centrality, such as Ant-Man. However, both constituent brands exert a similar spillover effect on their team brand, which can be explained by the finding that BBN centrality has a sizeable positive effect in the constituent-brand model but not in the team-brand model. The same pattern holds for other constituent brands, like Loki and Thor. These examples not only emphasize the economic potential of team brands as multi-brand alliances within the Marvel brand universe but also illustrate that spillover effects depend on the direction (spillover from constituent brands to team brands or vice versa) and vary across constituent brands, indicating the relevance of contingencies.

By analyzing the effects of network-based contingency factors for both directions, we offer managers insights into how these spillovers can be strategically increased and which factors attenuate spillover effects in multi-brand alliances. In terms of enhancing team-brand sales, constituent brands are helpful if they are highly integrated into the team’s BBN (i.e., have high BBN centrality), meaning they are connected to many other constituent brands through joint appearances in the team brand’s products. By contrast, positive spillovers decrease if constituent brands are highly integrated into their team’s BAN (i.e., have high BAN centrality), meaning they fail to add unique associations and may also decrease if the team features many constituent brands next to the focal one (i.e., has high BBN size).

These findings can help managers boost team-brand sales—namely, by learning which constituent brands to choose (or avoid) and how to integrate them. Constituent brands should be compatible with other constituent brands in their respective teams so they can connect with many other constituent brands and become strongly integrated into the team’s BBNs (i.e., have high BBN centrality). By contrast, constituent brands should only be weakly integrated into the team’s BAN (i.e., have low BAN centrality). Managers should thus include constituent brands into a team brand that offer distinct associations (e.g., Iron Man associated with “armored suit,” “genius,” and “Jarvis”) rather than many shared associations with the corresponding team brand. Last, a constituent brand is particularly helpful in fostering team-brand sales, if there are only a limited number of other team members who might distract consumers’ attention.

In addition, our findings can help constituent-brand managers evaluate different team-brand options. Specifically, team brands are particularly beneficial for fostering constituent-brand sales when they offer many associations (i.e., have high BAN size), suggesting the inclusion of constituent brands into relatively strong team brands to generate equity transfers. Constituent brands should also only be weakly integrated into the team’s BAN (i.e., have low BAN centrality). Maximizing shared associations may risk the constituent brand losing its appeal as a stand-alone brand, which decreases the impact of team-brand sales on constituent-brand sales. Constituent-brand managers should thus focus on distinct associations of their constituent brand (e.g., Spider-Man associated with “high school,” “kid,” and “web-shooter”) when communicating about the brand rather than emphasizing shared associations with a potential team brand (e.g., Avengers associated with “heroes,” “mighty,” and “S.H.I.E.L.D.”).

These recommendations offer important insights for managers. However, for these insights to become truly actionable, it is important to ensure not only that such knowledge resides with constituent- and team-brand managers but also that—at least in this domain—it transfers to the creators of such brands (i.e., the writers in the case of narrative products such as comic books and TV series). Feedback loops, in which the creators are given economic feedback, can help achieve this, such as through so-called special character contracts (Marvel) or equity (DC) (Thielmann, 2021).

In terms of the applicability of our findings to other managerially relevant contexts and other types of multi-brand alliances, we emphasize the particularities of our empirical context: we analyzed humanoid character brands in the entertainment industry with comics as the focal market. What other settings offer comparable characteristics that may facilitate the generalizability of our managerial implications? We propose four different branding contexts in which a network-based perspective and, thus, the pattern of results we found are likely applicable, with decreasing similarity and applicability.

The results are most applicable to other fictitious cartoon-character brands that interact in teams within entertainment products, such as TV shows or video games (e.g., Kermit, Miss Piggy, and Fozzie Bear in The Muppet Show, Mario, Luigi, Yoshi, and Princess Peach teaming up in Super Mario Bros.). Other cartoon-character brands exhibit characteristics similar to comic characters as they offer, for example, the same possibilities for human-like interactions (e.g., collaborating with or fighting each other). In addition, we expect the results to apply to a wider circle of human brands, such as music bands (e.g., Mick Jagger, Ron Wood, Keith Richards, and Charlie Watts as members of The Rolling Stones) or actors in movies (e.g., Daniel Radcliffe, Rupert Grint, and Emma Watson in the cast of Harry Potter). Actors as human brands represent constituent brands that are combined through a movie as an intermediary platform (Allen et al., 2022) with other actors in the cast, representing the team. Applying a network-based perspective to movie casts could assist studios and producers in selecting individual actors who are most promising to be successful as a whole.

The findings may also apply to some service brands offering hedonic and emotional benefits based on experiential products (Nyffenegger et al., 2015), such as traveling with airlines that are part of airline alliances (e.g., One World, Star Alliance). Some similarities may also exist with product brands (e.g., Celebrations) featuring multiple constituent brands (e.g., Mars, Snickers, Twix). Here, the product brand represents a sample of multiple constituent brands, which might help increase sales of the constituent brands and reduce the consumption risk for consumers (Bawa & Shoemaker, 2004). For example, similar to watching The Avengers to identify one’s favorite character, consuming Celebrations could help consumers identify their favorite tastes in the Mars product portfolio, thereby increasing subsequent sales of the constituent brands’ stand-alone products (e.g., Snickers chocolate bar).

Contributions to theory

This research contributes to several important literature streams. First, it contributes to the brand-alliance literature by extending knowledge on spillover effects and their moderating variables in brand alliances, particularly multi-brand alliances. To date, research has largely focused on studying brand alliances from a dyadic perspective, examining pairs of brands and their combined branding activities (e.g., Park et al., 1996; Simonin & Ruth, 1998). The present research defines the team-brand phenomenon and conceptually distinguishes it from previously studied dyadic brand alliances in terms of the number of constituent brands, the name reference to constituent brands, the composition of the team brand over time, and appropriate metrics to measure the relationship between the brands (see Table 1). Drawing on accessibility-diagnosticity theory (Feldman & Lynch, 1988) and the spreading-activation theory of memory (Collins & Loftus, 1975), we theoretically derive and empirically test a set of network-based contingency factors that moderate spillover effects in multi-brand alliances such as team brands. In this way, we advance conceptual understanding of multi-brand alliances and provide a theoretical foundation for studying contingency factors of spillover effects in complex brand alliances.