Abstract

Research shows that marketing investments play a pivotal role in a firm’s own bankruptcy. However, there are even more firms that are not confronting bankruptcy themselves yet face spillovers from a rival’s bankruptcy. For such firms, it remains unknown whether their marketing investments affect these spillovers. We show that, in contrast to their generally positive effects in other contexts, advertising and R&D can either help or harm in the context of bankruptcy spillovers. The difference hinges on the industry’s growth and concentration. Advertising decreases (increases) a firm’s stock return when its rival files for bankruptcy in a low- (high-) growth industry and R&D decreases (increases) the stock return in a low- (high-) concentration industry. Further, advertising has a stronger effect in a higher concentration industry. The results provide insight on how a firm’s advertising and R&D help or harm its value, should one of its rivals file for bankruptcy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

When a firm experiences a crisis, it often generates spillovers that influence the stock returns (i.e., changes in stock price) of other firms in the industry. Indeed, marketing research reveals spillovers after a firm experiences a data breach (Martin et al., 2017) or product recall (Borah & Tellis, 2016; Cleeren et al., 2013; van Heerde et al., 2007) and finance research reveals spillovers after a firm files for bankruptcy (Helwege & Zhang, 2016; Jorion & Zhang, 2007; Lang & Stulz, 1992). Research further reveals that marketing investments mitigate the drop in stock price for the firm experiencing the crisis (Chen et al., 2009; Eilert et al., 2017; Gao et al., 2015; Martin et al., 2017). However, for the widespread number of firms not facing a crisis, extant research has not addressed whether and how these firms’ marketing investments affect stock return spillovers from a rival’s crisis. For instance, although extant research offers insight on how a firm’s marketing can help should it experience a crisis, research has remained silent on whether a firm’s marketing influences the danger or opportunity that may arise should a rival experience a crisis. Recognizing this potential value of marketing, we shift attention to firms who are not experiencing a crisis and study how marketing influences a firm’s stock return when a rival faces a crisis (see Table 1).

We also focus our attention on the crisis of bankruptcies for several reasons. First, corporate bankruptcies have a substantial economic and financial impact that makes marketing’s role during bankruptcies particularly important for managers to understand. For instance, over the past ten years, the combined assets of companies that filed for bankruptcy in the U.S. totaled more than $1 trillion.Footnote 1 Indeed, research shows that bankruptcy has a larger financial impact than other crises, with stock prices for the bankrupt firm falling more than 20% on average compared to less than 1% for other crises such as product recalls, deceptive advertising, and data breaches.Footnote 2 Compared to data breaches and product recalls, bankruptcies are also more likely to require a restructuring of the bankrupt firm and carry a higher risk that the bankrupt firm may not survive, each of which has an immediate impact on the competitive landscape in the industry.

Second, when a firm files for bankruptcy, it has the potential to generate widespread spillovers to other firms in the industry. Research shows that one firm’s bankruptcy can affect the sales and prices of other firms in the industry (Ozturk et al., 2016, 2019). Research also shows that bankruptcy can affect the stock returns for other firms in the industry, and business examples are prevalent. For example, when United Airlines filed for bankruptcy, stock prices of other firms in the airline industry dropped (e.g., by 10% for Midwest Express; 6% to 7% for American, Continental, and Delta; 4% to 5% for Alaska Air and Northwest; and 2% to 3% for JetBlue, KLM, and Southwest). Similarly, in the semiconductor industry, when Spansion filed for bankruptcy, stock prices of other firms in the industry dropped (by 13% for LSI; 8% to 9% for AMD, Fairchild, and National Semiconductor; 6% to 7% for ARM and Micron; and 2% to 4% for Analog Devices, Cypress Semiconductor, Infineon, and Texas Instruments). Third, though recent research in marketing has begun to examine bankruptcies (Antia et al., 2017; Jindal, 2020; Jindal & McAlister, 2015; Ozturk et al., 2019), there remains a dearth of insight regarding marketing’s effect on spillovers from a rival’s bankruptcy. Understanding whether marketing efforts are able to attenuate any stock price decline, or elevate a stock price increase, when a rival files for bankruptcy offers useful information for scholars and managers.

For a firm whose rival encounters a bankruptcy crisis,Footnote 3 we expect the firm’s marketing efforts to influence the spillovers generated by the rival’s bankruptcy. In terms of a firm’s marketing efforts, investments in advertising and R&D build shareholder value (e.g., Srinivasan, et al., 2011) and increase a firm’s stock return (e.g., Kim & McAlister, 2011; Srinivasan et al., 2009). Moreover, a firm’s investments in advertising and its investments in R&D are two marketing investments, in particular, that have been shown to influence a firm’s risk of filing for bankruptcy (Jindal & McAlister, 2015) and likelihood of bankruptcy survival (Jindal, 2020). Extant research also reveals that firm investments in advertising and R&D help investors form expectations about a firm’s future cash flows and influence the firm’s stock price (e.g., Chauvin & Hirschey, 1993; Joshi & Hanssens, 2010). What remains unknown is whether a firm’s advertising investments or its R&D investments benefit a firm when its rival files for bankruptcy (see Table 2). Indeed, although firm-specific investments in advertising and in R&D help investors form expectations, enabling them to serve as effective screens for investors, these investments may not necessarily benefit the firm as investors react to this new bankruptcy information.

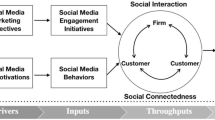

To understand marketing’s effect on bankruptcy spillovers, we draw from screening theory and the role of disabling conditions from information processing theory. Screening theory indicates that investors seek distinguishing information that is observable and serves as an indicator of the firm’s performance prospects (Sanders & Boivie, 2004; Weiss, 1995). From an information processing theory perspective, investors may also face disabling conditions brought about by characteristics of the industry in which the firm and rival operate. A disabling condition occurs when information generates greater uncertainty in the viability of an inference and casts “doubt on the sufficiency of the cause to bring about the effect” (Cummins, 1995, p. 647). It occurs across a wide array of information processing situations when individuals form inferences (e.g., Cummins et al., 1991; Markovits & Doyon, 2004), creating an intrusion in reasoning that leads individuals to reassess their inferences (e.g., Markovits & Doyon, 2004). Thus, the presence of new information (the rival’s bankruptcy) may lead investors to consider alternative explanations or shift their expectations of how the firm’s marketing will affect its future cash flows; these alternative explanations can take the form of disabling conditions (Cummins et al., 1991).

Because a rival’s bankruptcy can generate spillovers for all firms in an industry, investors will account for industry characteristics, with industry growth and industry concentration two important characteristics likely to shape their assessments (Srinivasan et al., 2009). Industry growth reflects the degree of expansion in customer demand within an industry, whereas industry concentration reflects the degree of competition in an industry, with lower (higher) competition in a high (low) concentration industry. When a rival’s bankruptcy is announced, the presence of this new information prompts investors to now assess the focal firm’s prospects based on available information, and we expect disabling conditions to occur that influence the extent to which investors perceive a firm’s marketing investments as credible screens under certain levels of industry growth and industry concentration. Therefore, while one might anticipate that advertising and R&D investments will always be beneficial as a firm faces spillovers from a rival’s bankruptcy, we argue otherwise and show that a firm’s advertising investments and its R&D investments can either help or harm a firm facing spillovers from a rival’s bankruptcy.

To test our conceptual framework, we follow extant research and use an event study to identify the change in a firm’s stock price that is caused by the announcement that the firm’s rival is filing for bankruptcy (e.g., Lang & Stulz, 1992). We model this stock return as a function of the firm’s advertising and R&D investments and the industry’s growth and concentration. We estimate the model using a data set of 4,923 firms across 163 industries that had a rival file for bankruptcy between 1980 and 2017.

Our study contributes to marketing theory and practice in three principal ways. First, we show that, in contrast to their generally positive effects in other contexts, advertising and R&D can either help or harm a firm in the context of bankruptcy spillovers. We argue that this difference hinges on the characteristics of the industry in which the firm and its bankrupt rival operate. Higher advertising investments help (harm) a firm confront bankruptcy spillovers in a high (low) growth industry, whereas higher R&D investments help (harm) a firm confront bankruptcy spillovers in a high (low) concentration industry. Second, our study contributes to an emerging stream of research on marketing’s effect in the context of bankruptcy. Importantly, we shift attention to the firm not facing bankruptcy, and reinforce the importance of understanding effects for the widespread number of firms that are not facing bankruptcy but are still impacted by a rival’s bankruptcy announcement. Third, our findings provide actionable insights for managers who make advertising and R&D investment decisions for their firms. While these investment decisions are within their control, we show that the returns to advertising and R&D are affected by two factors that are not within their control – a rival’s bankruptcy and the characteristics of the industry in which the firm and the bankrupt rival operate. Our results highlight the importance of accounting for factors that lie outside managers’ full control to improve their projections of potential returns when making advertising and R&D investment decisions. We find that, when a firm is faced with a rival’s bankruptcy, a one standard deviation (SD) change in its existing advertising shifts shareholder value by $79.61 million, on average, when industry growth is high versus low; whereas a one SD change in existing R&D changes shareholder value by $4.70 million, on average, when industry concentration is high versus low. Although managers generally cannot predict a rival’s bankruptcy, our estimation results offer an important benchmark as firms consider their own projections for advertising and R&D investments should a rival file for bankruptcy.

Conceptual model

Bankruptcy spillovers

According to the efficient market hypothesis, a firm’s stock price reflects all known information about the firm’s future cash flows (Fama, 1970). When new information is revealed to the stock market, investors may shift their expectations of the firm’s future cash flows, which changes the firm’s stock price. When a rival’s bankruptcy is announced, it informs investors that creditors were unwilling to renegotiate terms with the financially distressed rival (Gilson et al., 1990) and that the rival is so deeply in financial distress that it is going to default and seek the help of the bankruptcy court to pay its creditors. This new information causes investors to reassess their expectations of the future cash flows not just for the firm filing for bankruptcy but also for the other firms in the industry. Thus, a firm’s stock price can change when its rival’s bankruptcy is announced because investors expect the rival’s bankruptcy to spill over and affect the firm’s future cash flows.

These spillovers from a rival’s bankruptcy can be positive or negative. Positive spillovers occur when a rival’s bankruptcy causes investors to increase their assessment of another firm’s stock price. The bankrupt rival loses value (e.g., lost customers, ruined relationships, reduced customer support) regardless of whether it survives or is liquidated (Altman, 1984; Maksimovic & Titman, 1991). To the extent that investors expect a firm in the industry to capture a portion of the bankrupt rival’s lost value, they will expect positive spillovers and increase their expectations of the firm’s future cash flows, which increases its stock price (Jorion & Zhang, 2007; Lang & Stulz, 1992). Negative spillovers occur when investors expect factors that caused the rival’s bankruptcy (e.g., changes in customer preferences, issues in the supply chain, changes in regulations) to also affect another firm’s future cash flows, which decreases that firm’s stock price (Das et al., 2007; Lang & Stulz, 1992). Research has shown that, on average, a firm’s stock price drops when its rival’s bankruptcy is announced, which suggests that investors generally expect negative spillovers to outweigh positive spillovers from a rival’s bankruptcy (Chakrabarty & Zhang, 2012; Helwege & Zhang, 2016; Lang & Stulz, 1992). However, regardless of whether positive or negative spillovers occur, we expect a firm’s marketing efforts and industry conditions to influence investors’ assessments of a firm’s future cash flow prospects when a rival announces bankruptcy. While marketing and industry conditions are not new information, and investors’ reactions are to a rival’s bankruptcy, we expect information about a firm’s marketing efforts and the industry’s conditions will serve as screens that enable investors to lessen information assymetry about a firm’s performance prospects.

Uncertainty, screening, and disabling conditions

Investors face uncertainty in assessing a firm’s future cash flows, especially when one of its rivals announces bankruptcy. When information asymmetry exists between two parties, screening theory asserts that the party with less information initiates a search for observable information as proxies to assess parties with more information in order to reduce the information asymmetry (e.g., Hölmstrom, 1979; Riley, 2001). Given the uncertainty that investors face and the information asymmetry between firms and investors, investors seek out observable firm attributes or other screens to assess the firm’s unobservable financial prospects (Bergh et al., 2020; Sanders & Boivie, 2004). Without knowing whether a firm will be helped or harmed by a rival’s bankruptcy, investors will look for screens to resolve this uncertainty in order to form expectations of the firm’s future cash flows.

A screen’s credibility reflects the extent to which the information can discriminate the firm’s actual capabilities (Riley, 2001), allowing investors to meaningfully separate firms based on their performance prospects (Sanders & Boivie, 2004). Firms without the underlying capabilities to pursue future growth opportunities will not be in a position to have large investments in advertising or R&D. Therefore, a firm’s investments in advertising or R&D offer credible information to help investors form expectations about a firm’s future cash flows (e.g., Chauvin & Hirschey, 1993; Joshi & Hanssens, 2010). Accordingly, we argue that these two marketing investments will also help to shape investors’ expectations of a firm’s future cash flows when a rival announces bankruptcy.

However, we further expect the industry in which the firm and rival operate to shift the extent to which a firm’s investments in advertising and R&D are beneficial when a rival announces bankruptcy. As investors assess a firm’s capacity to benefit from or be harmed by a rival’s bankruptcy, the surrounding industry provides necessary information that will shape their inferences because both the firm and the rival face the same industry landscape. Drawing from information processing theory, disabling conditions generate uncertainty and lead individuals to question their inferences or causal deductions (e.g., Cummins, 1995; De Neys et al., 2002; Markovits & Doyon, 2004). In our setting, when investors learn of a rival’s bankruptcy, they need to assess how it will influence other firms in the industry. Although a firm’s investments in advertising and R&D are credible screens, we expect the industry in which the firm and rival operate to generate disabling conditions that shift investors’ assessments. In particular, when a firm announces bankruptcy, we expect investors to assess the extent to which the industry’s growth and its concentration shift the efficacy of advertising and R&D screens, making them more (less) credible for industries with higher (lower) growth or concentration. Overall, our framework addresses the screening effects from advertising and R&D investments, and the potential disabling effects from industry growth and concentration when investors are prompted with the rival’s bankruptcy announcement.

Advertising’s impact on bankruptcy spillovers

Firms invest in advertising to raise awareness, and to inform and persuade consumers. In elevating awareness, a firm’s advertising investments also enable the firm to deliver a message that can create strong, favorable, and unique associations in customers’ minds (Keller, 1993). The positive associations created through advertising increase purchase intentions, customer retention, and customer loyalty (Frennea et al., 2019; Tellis, 1988; Xiong & Bharadwaj, 2013). This, in turn, increases investors’ expectations of the firm’s future cash flows (Joshi & Hanssens, 2010; Kurt & Hulland, 2013; McAlister et al., 2016). Returns to advertising investments can therefore occur in the short-term and long-term. Accordingly, investors are likely to use a firm’s advertising investment as a credible screen of its performance potential when faced with spillovers from a rival’s bankruptcy. However, because the bankruptcy has the potential to impact all firms in the industry, investors assess the state of the industry when a rival announces bankruptcy. Therefore, as investors assess a firm’s prospects when a rival announces bankruptcy, we expect their assessments of advertising as a credible screen to depend on either the growth or the concentration of the industry in which the firm and its bankrupt rival operate.

A higher growth industry will enhance the credibility of a firm’s advertising investments when a rival files for bankruptcy, such that investors will perceive these investments to increase the firm’s future potential when the industry faces higher sales growth. A firm’s advertising investments increase current sales and elevate investors’ expectations for future sales (Joshi & Hanssens, 2010). Driving awareness and interest, advertising investments have the potential to directly attract customers. When a rival files for bankruptcy in a higher growth industry, the rival’s lost customers are likely to remain in the industry and search for new alternatives. A firm’s advertising communicates its strength in the market, and will boost awareness among the bankrupt rival’s customers. For investors, higher brand awareness also spills over to demand for the firm’s stock (Frieder & Subrahmanyam, 2005). Moreover, customers also purchase more in a high-growth industry, so the potential value that a firm’s advertising can capture from the bankrupt rival’s customers and from retaining the firm’s current customers are also larger. High growth industries also tend to pose more opportunities for firms (e.g., McDougall et al., 1994), so that investors view a firm’s higher advertising expenditures as a useful screen for the firm’s competitive viability in a higher growth industry when a rival announces bankruptcy. Thus, we expect a higher growth industry to strengthen the credibility of a firm’s higher advertising investments when its rival announces bankruptcy, thereby increasing its stock price. Accordingly, a firm’s higher advertising in a higher growth industry will attenuate any negative spillovers, or increase any positive spillovers, from a rival’s bankruptcy.

In contrast, a low growth industry involves stagnant or declining customer demand, as customers purchase less and fewer customers enter the industry than exit the industry. Although advertising can inform and persuade the bankrupt rival’s lost customers, some of these customers may leave the industry rather than buy from a different firm. Lower growth industries also add uncertainty as investors form expectations of a firm’s competitive viability when a rival announces bankruptcy. Thus, when a rival announces bankruptcy and investors assess a firm’s prospects, a low growth industry is likely to present a disabling condition as investors form inferences about whether a firm’s advertising investments will elevate future sales. In particular, in a lower growth or declining industry, firms are less likely to capture the bankrupt rival’s lost customers so this higher level of investment in advertising when there is stagnant or declining demand is likely to cause investors to reassess expectations that advertising is a useful screen for firm viability. Investors may view high advertising investments as wasteful, casting even greater uncertainty on the credibility of a firm’s advertising when its rival announces bankruptcy. As a result, the lower the industry growth, the less that a firm’s existing advertising investments will communicate a firm’s performance potential so that higher advertising will exacerbate the negative spillovers, or reduce the positive spillovers, from a rival’s bankruptcy. Therefore,

H1

The greater the industry’s growth, the more that advertising increases a firm’s stock return when a rival announces bankruptcy.

We also expect industry concentration to play an important role as investors assess the extent to which a firm’s level of advertising investments will be beneficial when a rival’s bankruptcy is announced. As investors assess the credibility of a firm’s advertising as a screen for future performance potential when a rival faces bankruptcy, we argue that advertising becomes a less credible screen when the firm and rival operate in a low concentration industry. The level of competition in an industry influences the degree of interference from a firm’s advertising (Vakratsas et al., 2004). An industry with a larger number of competitors generates a noisy background against which it becomes more challenging for a single firm’s messaging to be interpreted and understood (Basdeo et al., 2006). With greater competition in a low-concentration industry, advertising across the greater number of firms will generate more interference for a firm’s advertising message. This interference reduces the effectiveness of a focal firm’s advertising (Danaher et al., 2008; Keller, 1991; Vakratsas et al., 2004), which interferes with the signal’s effectiveness. Thus, when a rival’s bankruptcy is announced, low industry concentration acts as a disabling condition that elevates investor uncertainty about whether a firm’s higher advertising investments will be able to sufficiently capture the bankrupt rival’s lost value. Accordingly, when a rival’s bankruptcy is announced, higher advertising in a lower concentration industry will not attenuate a negative spillover effect and will instead increase it.

In contrast, with a lower degree of competition in a high concentration industry, there is, ceteris paribus, less interference across firms’ advertising messages. We expect a high concentration industry to strengthen the credibility of advertising as a valuable screen for investors. Advertising drives awareness, persuasion, and sales (e.g., Joshi & Hanssens, 2010; Srinivasan & Hanssens, 2009). With less interference in a less competitive industry, there are fewer industry rivals competing for stakeholder attention (Basdeo et al., 2006) so that a firm’s advertising investments have greater potential to reach customers and drive awareness and persuasion among the bankrupt rival’s lost customers. When a rival announces its bankruptcy, investors assess whether a firm’s existing advertising investments will help the firm capture the bankrupt rival’s lost value. In a high concentration industry, where fewer competitors tend to generate less noise that would interfere with a firm’s messaging (Basdeo et al., 2006), investors are likely to strengthen their expectations that a firm’s existing advertising investment will capture a greater portion of the bankrupt rival’s lost customers. Therefore, in a high concentration industry, investors are more likely to view higher advertising investments as a more credible screen of the firm’s competitive viability when a rival announces bankruptcy and increase the firm’s stock price. This further indicates that higher advertising in a higher concentrated industry will attenuate the negative spillovers, or increase the positive spillovers, from a rival’s bankruptcy. Hence,

H2

The greater the industry’s concentration, the more that advertising increases a firm’s stock return when a rival announces bankruptcy.

R&D’s impact on bankruptcy spillovers

Firms invest in R&D to build technological capabilities to pursue projects that they believe will increase their competitive standing. Although these investments enable the firm to develop patents and new processes, they must be combined with other efforts to create products that customers desire, and therefore these investments indirectly attract customers. Moreover, returns to R&D often materialize in the long-term, therefore the credibility of R&D as a screen is influenced by uncertainty associated with technological risk and market risk (Mansfield, 1981; Miller & Bromiley, 1990). Technological risks arise when investors are unable to see the connections between R&D and the eventual introduction of a new product. Market risks arise because competitors can take strategic actions that reduce the value of R&D prior to a product’s commercial launch (Doukas & Switzer, 1992). These risks influence investors’ assessments, and we argue that when a rival announces bankruptcy, the benefits of a firm’s R&D investments will depend on the degree of growth and concentration in the industry in which the firm and its bankrupt rival operate.

A high-growth industry is less likely to create a disabling condition for the efficacy of a firm’s R&D as a screen for investors when a rival announces bankruptcy, and may instead strengthen investors’ inferences about the value of a firm’s R&D investments. In industries with higher growth, customer demand rises as customers purchase more or new customers enter the market. Accordingly, there are more opportunities for a firm’s R&D to meet this growing demand. Investors are less likely to acknowledge the technological risk associated with a firm’s higher R&D investments in a high growth industry because there are more opportunities for these investments to produce products that satisfy the burgeoning range of customers. Thus, a higher growth industry strengthens the credibility of a firm’s R&D investments when its rival announces bankruptcy. Accordingly, higher R&D in a higher growth industry attenuates negative spillovers, or increases positive spillovers, from a rival’s bankruptcy.

In contrast, a low growth industry will generate a disabling condition, such that investors will have greater uncertainty about whether high R&D investments sufficiently serve as a proxy for the firm’s competitive viability when a rival announces bankruptcy. Although R&D investments enable a firm to develop products that meet the bankrupt rival’s customers’ preferences, customers are generally purchasing less or leaving the industry in a lower growth industry. This will also elevate the technological risk associated with the R&D investments, where greater uncertainty exists in understanding how the R&D may translate into products that fit shrinking customer demand. Accordingly, in a lower growth or stagnant industry, investors are more likely to question the screening credibility of a firm’s higher R&D investments when a rival announces bankruptcy. This further indicates that higher R&D in a lower growth industry increases negative spillovers, or attenuates the positive spillovers, from a rival’s bankruptcy. Hence,

H3

The greater the industry’s growth, the more that R&D increases a firm’s stock return when a rival announces bankruptcy.

Industry concentration also affects investor assessments about the returns to a firm’s R&D investment (Doukas & Switzer, 1992), which we expect to also impact a firm’s stock return when a rival announces its bankruptcy. A high-concentration industry will strengthen investors’ assessments that a firm’s R&D investments will benefit the firm. With less competition in the industry, there is less likelihood for product retaliation (e.g., Kuester et al., 1999). Further, firms in high-concentration industries vary substantially in how they allocate their R&D investments (Doukas & Switzer, 1992; Mansfield, 1981). Taken together, this reduces the vulnerability of the returns to a firm’s R&D investment to competitive actions (Scherer, 1980; Schumpeter, 1950). Therefore, in a high concentration industry when a rival announces bankruptcy, there is less likely to be interference on a firm’s R&D investments, alleviating market risk, and strengthening R&D as a screen of the firm’s competitive viability. Accordingly, higher R&D in a higher concentration industry attenuates negative spillovers, or increases positive spillovers, from a rival’s bankruptcy.

In contrast, a low concentration industry is more likely to generate a disabling condition that produces greater uncertainty as investors assess the ability of the R&D investment to benefit the firm when a rival announces bankruptcy. A low-concentration industry has a high degree of competition between firms and a higher likelihood of competitive actions or product retaliation (Kuester et al., 1999). Further, firms tend to adopt similar R&D allocation strategies (Doukas & Switzer, 1992; Mansfield, 1981), which increases the vulnerability of the returns to any one firm’s R&D investment to competitive actions (Chen, 1996). Thus, investors are likely to be more concerned with the market risk associated with a firm’s R&D investments in a lower concentrated industry when a rival announces bankruptcy. The heightened degree of competition also elevates the associated interference of a firm’s R&D, thereby attenuating R&D’s credibility of competitive viability when a rival’s bankruptcy is announced. This further indicates that higher R&D in a lower concentrated industry increases negative spillovers, or attenuates positive spillovers, from a rival’s bankruptcy. Hence,

H4

The greater the industry’s concentration, the more that R&D increases a firm’s stock return when a rival announces bankruptcy.

Empirical methodology

To test our hypotheses, we follow extant research on bankruptcy spillovers and use the event study methodology (Helwege & Zhang, 2016; Jorion & Zhang, 2007; Lang & Stulz, 1992). This methodology was developed by finance researchers and has also been broadly used in marketing (for a review of event studies in marketing, see Sorescu et al., 2017). There have been over 500 event studies published in the finance literature alone (Kothari & Warner, 2007) and research contends that “most of what we know about the effect of marketing on firm value comes from event studies” (Sorescu et al., 2017, p. 187).

We follow the predominant approach adopted in extant event studies and use two stages for our empirical analysis. In the first stage, we measure the investor reaction to a rival’s bankruptcy (i.e., the portion of a firm’s stock return that is caused by the announcement that its rival is filing for bankruptcy). Over a short time-horizon (+ / − 2 days from the rival’s bankruptcy announcement), we isolate the portion of the firm’s daily stock return that is caused by the rival’s bankruptcy announcement from the portion that is caused by other contemporaneous factors. We then test the significance of the mean of the investor reaction to a rival’s bankruptcy (i.e., whether the spillovers from the rival’s bankruptcy have a significantly positive or negative effect on the focal firm’s stock price). We use the investor reaction for each individual firm as the dependent variable in our second-stage model.

In the second stage, we test how advertising and R&D investments affect the investor reaction to a rival’s bankruptcy. Although a firm’s marketing spending is not new information to investors at the time of the rival’s bankruptcy (investors learned about it when the firm released its prior financial report), it can affect the extent to which investors react to the new information that a rival is filing for bankruptcy. We use the second-stage results to test our hypotheses (H1–H4).

First stage: Investor reaction to a rival’s bankruptcy

To measure the investor reaction to a rival’s bankruptcy, we need to isolate the portion of the firm’s stock return that is caused by the rival’s bankruptcy announcement from the portion that is caused by other factors. That is, the investor reaction to a rival’s bankruptcy is

where Rit is the stock return for firm i and E[Rit] is the stock return for firm i that would have been expected had there not been an announcement on day t that its rival was filing for bankruptcy (i.e., the counterfactual stock return).

We estimate the counterfactual stock return using the following specification:

where Rmt is the stock return for the entire stock market when the rival’s bankruptcy is announced on day t. We chose this specification, which is referred to as the “market model” in marketing and finance literature, for three reasons. First, its statistical properties for short-term event studies (i.e., studies capturing investor reaction over a few days surrounding an event) are well documented (e.g., Brown & Warner, 1985). Second, it is the predominant specification that has been used for counterfactual stock returns in extant research on the investor reaction to rival bankruptcies (Helwege & Zhang, 2016; Jorion & Zhang, 2007; Lang & Stulz, 1992). Third, it is consistent with the guidance in recent marketing research to use specifications developed for short-term windows, rather than those developed for longer-term windows (e.g., the Fama & French (1993) specification), in short-term event studies (Sorescu et al., 2017).

The parameters \({\widehat{\alpha }}_{i}\) and \({\widehat{\beta }}_{i}\) in Eq. 2 are estimated from the following model:

where ϵid is the error term for firm i on trading day d < t, using daily stock return data from the year prior to the rival’s bankruptcy announcement. We follow extant bankruptcy spillover research (Helwege & Zhang, 2016; Lang & Stulz, 1992) and estimate the parameters using a window that starts one year (250 trading days) prior to the rival bankruptcy announcement and ends 50 trading days prior to the announcement (details on the estimation of Eq. 3 are presented in Web Appendix A). Substituting Eq. 2 into Eq. 1 provides us with the measure for the investor reaction to (i.e., the firm’s stock return that is caused by) a rival’s bankruptcy.

Eliminating confounding events

A key assumption in event studies is that the investor reaction on day t is caused solely by the event that occurs on day t. However, in some cases, a firm may experience multiple events on the same day. For example, a firm may announce a new product on the same day that its rival’s bankruptcy is announced. In such cases, we would not be able to disentangle the investor reaction that was caused by the rival’s bankruptcy announcement from the investor reaction that was caused by the new product announcement. Therefore, to cleanly identify the investor reaction to a rival’s bankruptcy, we eliminate firms that have confounding events (i.e., events that occur at the same time that the rival’s bankruptcy is announced). Following recent marketing research (e.g., Sorescu et al., 2017), we use a three-day window surrounding the date of the rival’s bankruptcy announcement to identify confounding events. We also consider alternative approaches to handling confounded events in our robustness analyses.

Average investor reaction to a rival’s bankruptcy

To test the significance of the average investor reaction to a rival’s bankruptcy (i.e., whether the spillovers from the rival’s bankruptcy have a significantly positive or negative effect on the focal firm’s stock price), we calculate the average value of Investor reactionit. The most widely used approaches for testing the significance of average investor reaction in event studies are the Patell (1976) t-statistic and the Boehmer et al. (1991) t-statistic. Both of these tests rely on the assumption that the investor reaction is not correlated across multiple firms at the time of the event. However, in our context, where there are multiple firms in the same industry that are exposed to the same rival’s bankruptcy announcement, this assumption is not valid. Consequently, the use of such test statistics can understate the standard errors. Therefore, we use the “crude dependence adjustment” test statistic proposed by Brown and Warner (1980), which is not sensitive to stock return correlations across firms.

Second stage: Marketing’s effect on investor reaction to a rival’s bankruptcy

In the second stage, we test marketing’s effect on investor reaction to a rival’s bankruptcy. We model the investor reaction, captured in the first stage, as a function of the firm’s advertising and R&D, the industry’s growth and concentration, and other control variables. In this section, we describe the predictor variables, specify our model, discuss our identification strategy, and explain our estimation approach.

Predictor variables

We measure the predictor variables using data that are available to investors at the time of the rival’s bankruptcy announcement, which are obtained from the firm’s most recent financial report prior to its rival’s bankruptcy announcement. The predictor variables are not new information for investors at the time of the announcement. Instead, the rival’s bankruptcy announcement is the new information that causes the investor reaction (i.e., the change in the firm’s stock price). The predictor variables influence the effect of the rival’s bankruptcy announcement on the firm’s stock return by impacting investors’ expectations of how the rival’s bankruptcy will affect the firm’s future cash flows.

We calculate Advertisingit as the advertising intensity (i.e., advertising expenditures divided by sales), and R&Dit as the R&D intensity (i.e., R&D expenditures divided by sales), reported by firm i prior to the announcement of its rival’s bankruptcy on day t. We scale advertising and R&D by sales to emulate the approach that firms use for their budgeting in practice (e.g., Sridhar et al., 2016). Scaling by sales also provides a measure that is normalized across firms of different sizes. This latter feature is needed for our sample because our data set includes firms that vary greatly in size. We also consider alternative measures for advertising and R&D in our robustness analyses.

We measure Industry growthit as the estimated industry sales growth over the past five years, following extant literature (Dess & Beard, 1984; McAlister et al., 2016; Sridhar et al., 2016). With this approach, we first estimate the industry sales growth coefficient by regressing firm i’s industry sales on time for the last five years. We then calculate Industry growthit as the estimated sales growth coefficient from this regression divided by the industry’s five-year sales average using data reported by the industry’s firms prior to the announcement of the rival’s bankruptcy on day t (see Web Appendix B). We calculate Industry concentrationit as firm i’s industry Herfindahl–Hirschman index (HHI) using data reported by the industry’s firms prior to the announcement of the rival’s bankruptcy on day t.Footnote 4

Extant research on bankruptcy spillovers predominantly controls for the following variables in its models: the firm’s size, leverage, and cash flow similarity with the bankrupt rival (Chakrabarty & Zhang, 2012; Helwege & Zhang, 2016; Lang & Stulz, 1992). Therefore, in alignment with extant research, we also include the firm’s size, leverage, and cash flow similarity with the bankrupt rival as control variables in our model. We calculate Sizeit as the natural logarithm of assets, and Leverageit as the long-term debt divided by assets, reported by firm i prior to the announcement of its rival’s bankruptcy on day t. We follow extant literature on bankruptcy spillovers and calculate Cash flow similarityit as the correlation between firm i’s daily stock returns and the bankrupt rival’s daily stock returns for the year preceding the announcement of the rival’s bankruptcy on day t (e.g., Lang & Stulz, 1992). We note that the evidence on the effects of these control variables have been mixed. Size has been shown to have a statistically insignificant effect (Helwege & Zhang, 2016), leverage has been shown to have a negative effect by some (Asness & Smirlock, 1991) and insignificant effect by others (Chakrabarty & Zhang, 2012), and cash flow similarity has been shown to have a negative effect by some (Helwege & Zhang, 2016) and an insignificant effect by others (Chakrabarty & Zhang, 2012).

We also control for the following factors that may have led to the rival’s bankruptcy: the bankrupt rival’s size, the bankrupt rival’s leverage, a dummy variable for whether the rival’s bankruptcy was caused by tort debt, the number of bankruptcies in the industry, and a dummy variable for whether there was a recession. We calculate Rival sizet as the natural logarithm of assets, and Rival leveraget as the long-term debt divided by assets, reported by the rival prior to the announcement of its bankruptcy on day t. We set Tortt to one if the rival’s bankruptcy on day t was caused by tort debt (e.g., asbestos, environmental, fraud, patent infringement, pension, or product liability claims), and zero otherwise. We calculate Industry bankruptciest as the number of large firms that filed for bankruptcy in the industry over the last three years before the rival’s bankruptcy on day t. Lastly, we set Recessiont to one if the rival’s bankruptcy announcement on day t occurred during a recession and is set to zero otherwise. Per the National Bureau of Economic Research (NBER), the following time periods in our data set occurred during a recession: January 1980–July 1980, July 1981–November 1982, July 1990–March 1991, March 2001–November 2001, and December 2007–June 2009. We also consider additional macroeconomic, firm, and innovation control variables in our robustness analyses.

Model

We specify the following model for investor reaction to a rival’s bankruptcy:

where Controlsit is a vector of control variables that includes Sizeit, Leverageit, Cash flow similarityit, Industry growthit, Industry concentrationit, Rival sizet, Rival leveraget, Tortt, Recessiont, industry dummy variables, and year dummy variables; and εit is the error term for firm i when its rival’s bankruptcy is announced on day t.

To identify the effects of advertising and R&D investments on investor reaction to a rival’s bankruptcy, Advertisingit and R&Dit need to be exogenous in our model (i.e., E[Advertisingit × εit] = E[R&Dit × εit] = 0). As is typical for studies of large business investments, we are not able to run an experiment in which we set the treatments. Instead, our estimation of the effects depends on the assumption that we have controlled for all the confounding variables that jointly influence both the firm’s advertising and R&D investments as well as the investor reaction to its rival’s bankruptcy. Since variables that influence investor reaction to a rival’s bankruptcy might also be correlated with advertising and R&D investments, we include variables that extant literature has shown influence this investor reaction as control variables in our model.

In addition, there are other unobserved variables that might also influence this investor reaction (e.g., macroeconomic effects, firm strategy). If these unobserved variables are correlated with advertising and R&D investments, omitting them would result in issues of endogeneity (e.g., Wooldridge, 2002). Therefore, we include year dummy variables to capture unobserved macroeconomic effects and industry dummy variables to capture unobserved industry effects. Further, to control for unobserved firm characteristics, we use a random-effects panel data model with the following composite error: εit = λi + uit, where λi is a firm-specific random error term that captures unobserved firm effects and uit is the random component that varies across firms and over time. Lastly, to control for any remaining unobservable time-varying characteristics (e.g., management’s ability) that influence investor reaction to a rival’s bankruptcy and are correlated with the firm’s advertising and R&D investments, we use a two-stage least-squares (2SLS) instrumental variables approach (for an explanation of how instrumental variables control for unobservable time-varying characteristics, see Wooldridge, 2002).

Following extant marketing research on advertising and R&D in bankruptcy and other contexts (Jindal, 2020; Sridhar et al., 2016; Srinivasan et al., 2018), we use the average advertising intensity (advertising expenditures divided by sales) and the average R&D intensity (R&D expenditures divided by sales) for the other firms in the same industry as firm i to serve as the instruments for Advertisingit and R&Dit. We calculate the instruments using data at the time of firm i’s most recent financial report prior to the announcement of its rival’s bankruptcy on day t. We use six instruments in total, peer-average advertising and R&D intensities, and their respective interactions with industry growth and industry concentration.

For the instruments to be valid, they must be relevant (i.e., correlated with the associated potentially endogenous regressors) and must meet the exclusion restriction (i.e., not correlated with the error term εit). We argue that the instruments in our analysis are relevant because (1) other firms that operate in the same industry face similar conditions to the focal firm, and (2) they reflect the industry’s norms for advertising and R&D. As industry norms change, so do the expectations of customers who purchase from firms in the industry. Therefore, a change in industry norms for advertising and R&D investments will affect the firm’s advertising and R&D investment decisions, respectively. Consistent with our arguments, we find that the coefficient estimates for the instruments are significant (p < 0.01) in all of the associated first-stage regressions (presented in Web Appendix C), providing evidence that the instruments are relevant.

We argue that the instruments meet the exclusion restriction because the industry’s most recent norms for advertising and R&D do not affect the stock return for an individual firm when its rival’s bankruptcy is announced, after controlling for other variables in the model. Even if industry participants strategically adjusted their advertising or R&D in anticipation of the rival’s bankruptcy, if would not affect an individual firm’s stock return beyond its effect on that firm’s advertising and R&D spending.

To estimate our model, we use a 2SLS random-effects approach, which we estimate using feasible generalized least squares. Because the investor reaction for firms in the same industry as the bankrupt rival may be correlated, we calculate standard errors that are clustered by industry to appropriately evaluate the statistical significance of the coefficient estimates. These cluster-robust standard errors are a generalization of heteroskedastic robust standard errors that account for cross-sectional correlation across observations for a given industry (Arellano, 1987; White, 1980).

Data

First stage: Investor reaction to a rival’s bankruptcy

We obtain data on bankruptcy filings from the UCLA-LoPucki Bankruptcy Research Database (BRD), which has been used in recent marketing (e.g., Jindal & McAlister, 2015), finance (e.g., Bernile et al., 2017), accounting (e.g., Mayew et al., 2014), management (e.g., Xia et al., 2016), and law (e.g., Jacoby & Janger, 2013) research. This database includes information on each of the large public companies that filed for bankruptcy in U.S. courts since 1980. A company is considered large if it has at least $100 million in assets (as measured in 1980 dollars) and is considered public if it filed an annual report (Form 10-K) with the Securities and Exchange Commission prior to the bankruptcy filing. A benefit of using this database is that it allows us to focus on bankruptcies of large rivals, which are more likely to spill over to other firms in the industry than are bankruptcies of small rivals.

For each bankruptcy filing, we identify the first date that the bankruptcy was announced in order to focus on the initial date that investors would be aware of the impending bankruptcy filing. To identify these dates, we use two sources. First, we search for bankruptcy news reports associated with the company in the RavenPack News Analytics database. Second, we search for the word “bankruptcy” along with the company’s name in the LexisNexis database. We reconcile any differences between the two sources by manually verifying the earliest date of an announcement in news archives.

We obtain stock return data from the Center for Research in Security Prices (CRSP) at the University of Chicago’s Booth School of Business. We select all firms from 1980 to 2017 that are in the same industry as the bankrupt rival and that report the data required to calculate the predictor variables in our model. Following extant research on bankruptcy spillovers (e.g., Helwege & Zhang, 2016), we define a firm as being in the same industry as a bankrupt rival if both firms operate in the same four-digit Standard Industrial Classification (SIC) industry.

To cleanly identify the investor reaction to a rival’s bankruptcy, we eliminate firms that have concurrent events during the three-day window surrounding the date of the rival’s bankruptcy announcement. We identify these events using the RavenPack News Analytics and LexisNexis databases. We find that the most commonly occurring confounding events are earnings releases, product releases, announcements of a new business contract, executive appointments, dividend announcements, acquisition announcements, partnership announcements, and award announcements. In our robustness analyses, we consider less conservative approaches to identification and report results of these analyses.

Our data set includes 4,923 firm observations for 542 rival bankruptcies that were announced from 1980 to 2017. Each observation includes daily stock return data for the firm and stock market from one year before the rival’s bankruptcy announcement through two days after the announcement. The bankruptcies in our data set were filed by rivals under either Chapter 11 (Reorganization) or Chapter 7 (Liquidation) of the U.S. Bankruptcy Code.Footnote 5 Specifically, 538 (99.26%) of the rival bankruptcies were filed under Chapter 11 and four (< 1%) were filed under Chapter 7.Footnote 6 We present the number of bankruptcies by year and by industry in Web Appendices D and E. Overall, our data set covers 163 industries, revealing that bankruptcies are prevalent across a wide range of industries.

Second stage: Marketing’s effect on investor reaction to a rival’s bankruptcy

We add the data for each of the predictor variables to the investor reaction captured in the first stage. For the marketing and accounting variables, we obtain the data reported by firms in their financial statements from Standard & Poor’s Capital IQ Compustat database. To calculate industry growth and industry concentration, we use all the firms in the entire Compustat database, including those that are not in our sample. We obtain daily stock returns from CRSP to calculate Cash flow similarity, bankruptcy information from the BRD to calculate Tort, and economic cycle information from NBER to calculate Recession. We Winsorize all continuous variables at the 99% level to reduce the influence of outliers. Values higher than the 99th percentile of each variable are set to the 99th percentile value, and values lower than the first percentile of each variable are set to the first percentile value.

We present the descriptive statistics in Table 3 and the histograms for the main variables in Web Appendix F. We present the correlation matrix in Table 4. To further diagnose multicollinearity, we compute condition indexes and variance inflation factors. The maximum condition index is 8.57, which is below the recommended threshold of 30 (Belsley et al., 1980), and the maximum variance inflation factor is 1.32, which is below the recommended threshold of 10 (Marquardt, 1970), indicating that multicollinearity does not present a concern.

First stage results: Investor reaction to a rival’s bankruptcy

We present the results of the investor reaction to a rival’s bankruptcy in Table 5. We find that Investor reactionit is significant (p < 0.05) on the day of the rival’s bankruptcy announcement (day 0), but not before or after (days − 2, − 1, + 1, + 2). Therefore, we use the Investor reactionit values that are calculated on day 0 as the dependent variable in our second-stage model. The negative coefficient estimate indicates that on the day of the rival’s bankruptcy announcement, the investor reaction is negative, which is consistent with findings for negative spillovers in extant bankruptcy spillover research (Chakrabarty & Zhang, 2012; Helwege & Zhang, 2016; Lang & Stulz, 1992).

Robustness to alternative parameter estimation windows

In our original analysis, we used a window that started one year (250 trading days) prior to the rival bankruptcy announcement and ended 50 trading days prior to the announcement to estimate parameters \({\widehat{\alpha }}_{i}\) and \({\widehat{\beta }}_{i}\) from Eq. 3. To assess the robustness of our results, we re-estimated Investor reactionit using alternative parameter estimation windows that end 45 to 5 trading days prior to the announcement. We present the results in Web Appendix G.

Across all the alternative parameter estimation windows, we find that investor reaction to a rival’s bankruptcy is significant (p < 0.05) on the day of the announcement (day 0), but not before or after (days − 2, − 1, + 1, + 2). We also find that investor reaction does not significantly differ across the alternative parameter estimation windows (the range is from − 0.21 to − 0.22).

Expanding the time surrounding the rival’s bankruptcy announcement

We also ran additional analyses in which we measured Investor reactionit for a full month surrounding the rival’s bankruptcy announcement (there are 21 trading days in a month, on average) rather than five days (i.e., + / − 2 days surrounding announcement). Across this broader time frame, we continue to find that investor reaction to a rival’s bankruptcy is significant on the day of the announcement (p < 0.05), but not before or after (see Web Appendix G for results).

Second stage results: Marketing’s effect on investor reaction to a rival’s bankruptcy

Model-free evidence

First, to explore whether model-free evidence is consistent with our conceptual arguments, we calculate the average investor reaction to a rival’s bankruptcy for subsamples of our data set. This model-free evidence is presented in Fig. 1. We separate firms by whether they have low (bottom quartile) or high (top quartile) advertising investments in Panels I and II and R&D investments in Panels III and IV. Panels I and III further separate firms that are in industries with low growth (classified as a declining industry, Industry growth < 0) versus high growth (classified as a growing industry, Industry growth > 0). Panels II and IV separate firms that are in industries with low versus high industry concentration. Based on the U.S. Federal Trade Commission’s classification of industries with HHI above 0.25 as “highly concentrated,” we define the low condition as Industry concentration < 0.25 and the high condition as Industry concentration > 0.25.Footnote 7

Figure 1, Panel I indicates that firms with high advertising have a lower investor reaction for low-growth industries, whereas they have a higher investor reaction for high-growth industries. This is consistent with our hypothesis that advertising hurts a firm facing bankruptcy spillovers in a declining industry and helps in a growing industry. Panel II indicates that firms with high advertising have a higher investor reaction in both low- and high-concentration industries. The larger slope for high-concentration industries is consistent with our hypothesis that the greater the industry’s concentration, the more that advertising increases a firm’s stock return when its rival files for bankruptcy.

Figure 1, Panel III indicates that firms with high R&D have a higher investor reaction in both low- and high-growth industries. The smaller slope for high-growth industries is inconsistent with our hypothesis that the greater the industry’s growth, the more that R&D increases a firm’s stock return when its rival files for bankruptcy. In Panel IV, the model-free evidence is consistent with our hypothesis and shows that firms with high R&D have a lower investor reaction in low-concentration industries, whereas they have a higher investor reaction in high-concentration industries. While these data summaries are not formal tests, they provide some evidence that is consistent with H1, H2, and H4 and inconsistent with H3.

Model estimation results

We first estimate a baseline model without the interactions and then estimate the full model. The baseline model provides estimates of the average effects for advertising and R&D across all values of industry growth and industry concentration. The full model provides coefficient estimates for the interaction effects, which we use to test our hypotheses.

We present the estimation results for both models in Table 6. For the baseline model, we find that the coefficient estimates for advertising (4.61, p > 0.10) and R&D (0.07, p > 0.10) are not significant. Because advertising and R&D have the potential to either help or harm in the context of bankruptcy spillovers, the insignificant average effects may be a result of averaging opposing positive and negative effects.

For the full model, we find that the coefficient estimate for the interaction between advertising and industry growth is positive and significant (\({\widehat{\gamma }}_{1}\) = 29.10, p < 0.01), providing support for H1. We also find that the coefficient estimate for the interaction between advertising and industry concentration is positive and significant (\({\widehat{\gamma }}_{2}\) = 24.43, p < 0.01), providing support for H2.

For R&D, we find that the interaction between R&D and industry growth is not significant (\({\widehat{\gamma }}_{3}\) = − 0.00, p > 0.10), failing to support H3. However, we find that the interaction between R&D and industry concentration is positive and significant (\({\widehat{\gamma }}_{4}\) = 0.50, p < 0.05), providing support for H4. Lastly, we note that the coefficient estimates for advertising (\({\widehat{\gamma }}_{5}\) = − 3.81, p < 0.05) and R&D (\({\widehat{\gamma }}_{6}\) = − 0.13, p < 0.01) are the point estimates for the hypothetical case where Industry growthit = Industry concentrationit = 0, which does not exist in our data set.

Figure 2 presents the plotted interactions using Aiken & West’s (1991) method. Panel I shows that the effect of advertising on the investor reaction to a rival’s bankruptcy is negative for low, and positive for high, industry growth. The difference in the slopes is statistically significant (t = 2.87, p < 0.01). Panel II indicates that the effect of advertising is positive for both low and high industry concentration and we find that the difference in these slopes is also statistically significant (t = 4.16, p < 0.01). For R&D, Panel III shows that its effect is slightly negative for both low and high industry growth and the difference in these slopes is not statistically significant (t = –0.01, p > 0.10). Lastly, Panel IV shows that the effect of R&D is negative for low, and positive for high, industry growth. The difference in these slopes is statistically significant (t = 2.18, p < 0.05).

Effect sizes

To quantify the size of effects for advertising and R&D, we calculate the change in predicted investor reaction associated with a change in advertising and R&D investments. For each moderator condition, we calculate the predicted investor reaction when advertising is set to one SD below and above its mean value (and we do the same for R&D). To quantify the financial value of these effects, we use the average shareholder value (i.e., stock price multiplied by the number of outstanding shares) for a firm in our data set ($4.62 billion) to calculate the associated change in average shareholder value. The results are presented in Table 7.

We find that an increase in advertising raises the predicted investor reaction (column III, 0.32% to 3.03%) and shareholder value (column IV, $14.94 million to $140.25 million) in three of the four moderator conditions. Focusing on industry growth, we find that an increase in advertising investments increases the predicted investor reaction 1.72% ($79.61 million) more when the industry has high growth than when it has low growth. Specifically, increasing advertising decreases investor reaction − 0.99% (− $45.75 million) when the industry has low growth, whereas it increases investor reaction 0.73% ($33.86 million) when the industry has high growth. For industry concentration, we find that increasing advertising increases the predicted investor reaction 2.71% ($125.31 million) more when the industry has high concentration than when it has low concentration.

The effect sizes for R&D are substantially smaller than those for advertising across all moderator conditions (column III, − 0.04% to 0.06%). In contrast to advertising’s effects, increasing R&D increases the predicted investor reaction to a rival’s bankruptcy in only one of the four moderator conditions (column III, 0.06% in high industry concentration). We find that the effect of increasing R&D on the change in predicted investor reaction is not substantially different when the industry has high growth than when it has low growth (column III, 0.00%; column IV, − $0.01 million). In contrast, the effect of increasing R&D on the change in predicted investor reaction is markedly different when the industry has high concentration than when it has low concentration (column III, 0.10%; column IV, $4.70 million). Specifically, increasing R&D decreases investor reaction − 0.04% (− $1.83 million) when the industry has low concentration, whereas it increases investor reaction 0.06% ($2.87 million) when the industry has high concentration.

Additional analyses

To investigate the robustness of our results, we consider alternative approaches for handling confound events, alternative measures for advertising and R&D, and alternative instruments. We also examine whether results remain consistent if we consider other potential control variables.

Robustness to alternative approaches for handling confounded events

In our original analysis, to cleanly identify investor reaction to a rival’s bankruptcy, we eliminated observations that had a confounded event at the time of the rival’s bankruptcy announcement. We used a three-day window surrounding the date of the rival’s bankruptcy announcement, which is a conservative approach. To assess the robustness of our results, we re-estimated our model using a one-day window to remove confounds. That is, we eliminated a confounded event only if it occurred on the same day as the rival’s bankruptcy announcement, which resulted in 261 additional observations. We find that the results, presented in Web Appendix H (Model M1), are consistent with those in Table 6.

We also re-estimated our model without eliminating any of the observations with a confounding event, which results in 435 additional observations. We find that these results, presented in Web Appendix H (Model M2), are also consistent with those in Table 6.

Robustness to alternative measures for advertising and R&D

To further assess the robustness of our results, we consider alternative measures for advertising and R&D that use the firm’s spending in these areas relative to the bankrupt rival’s spending. That is, we measure advertising (R&D) as the firm’s advertising (R&D) intensity minus the bankrupt rival’s advertising (R&D) intensity. We find that the results, presented in Web Appendix I (Model M1), are consistent with those in Table 6.

Robustness to alternative instruments

To assess the robustness of our results to our instrumental variables measures, we consider alternative instruments for advertising and R&D that are weighted by how similar the industry peer is to the focal firm (Lim et al., 2020; Shi et al., 2021). We present the detailed approach used to measure these instruments in Web Appendix J. We find that the results using these alternative instruments, presented in Web Appendix I (Model M2), are consistent with those in Table 6.

Robustness to additional macroeconomic variables

Our model includes a recession variable and year dummy variables to control for macroeconomic effects. To assess the robustness of our results to additional macroeconomic factors, we add stock market growth to our model. We follow extant literature and calculate stock market growth using a regression of the stock market’s value over time using stock market data from the previous five years prior to the rival’s bankruptcy announcement (e.g., Jindal & McAlister, 2015). We use the regression coefficient divided by the average of the previous five years’ stock market value as the measure for stock market growth. We find that the results, presented in Web Appendix K (Model M1), are consistent with those in Table 6.

We also consider whether stock market growth moderates the effects of advertising and R&D. The results, presented in Model M2, indicate that stock market growth has a positive moderating effect on advertising, but does not significantly moderate R&D’s effect. We continue to find that the results for testing our hypotheses are consistent with those in Table 6.

Interaction between advertising and R&D

To assess whether advertising and R&D have a significant interaction effect on the investor reaction to a rival’s bankruptcy, we include this interaction in our model. The results, presented in Web Appendix K (Model M3), indicate the interaction between advertising and R&D is not significant. We also find that including this interaction does not affect the results of our hypotheses tests.

Robustness to additional firm variables

Our model controls for the firm’s size, leverage, and cash flow similarity with its bankrupt rival. To assess the robustness of our results to additional firm variables we add to our model the firm’s liquidity, profitability, and market share. We measure liquidity as the firm’s current assets divided by its current liabilities; profitability as the firm’s earnings before interest, taxes, depreciation, and assets divided by sales; and market share as the firm’s sales divided by the industry’s sales. Since the financial information needed to calculate liquidity and profitability is missing for some firms, the data set used for this robustness analysis has 251 fewer observations. We find that the results, presented in Web Appendix L (Model M1), are consistent with those in Table 6.

We also consider whether the firm’s cash flow similarity with its bankrupt rival moderates the effects of advertising and R&D. The results, presented in Model M2, indicate that cash flow similarity has a positive moderating effect on advertising, but does not significantly moderate R&D’s effect. We continue to find that the results for testing our hypotheses are consistent with those in Table 6.

Robustness to additional innovation variables

Because investors face higher uncertainty for R&D investments, we assess the robustness of our results to additional innovation variables. R&D investments are an input to innovation, whereas patents and products are outputs. Therefore, we add to our model the firm’s patents and new product announcements to control for their effects. We measure the firm’s patents as the number of patents granted to the firm divided by the firm’s assets. We obtain patent data from the NBER Patent Data Project, which runs through 2006. We measure the firm’s new product announcements as the number of new product announcements divided by the firm’s assets. We follow Warren and Sorescu (2017) and obtain new product announcements from the RavenPack database. Due to missing data, our estimation is based on 1,238 fewer observations. We find that both patents and new product announcements do not have a significant effect on the investor reaction to a rival’s bankruptcy. Further, the estimation results using the additional innovation variables, presented in Web Appendix L (Model M3), are consistent with those in Table 6.

Discussion and implications

For the widespread number of firms not facing bankruptcy, spillovers from a rival’s bankruptcy significantly affect their stock returns. In this research, we develop a conceptual model and provide robust empirical evidence for how a firm’s existing investments in advertising and R&D impact the investor reaction to a rival’s bankruptcy, revealing the importance of marketing efforts in helping a firm face spillovers from a rival’s bankruptcy. These results, which span 163 industries and 38 years, are robust to (1) alternative approaches for handling confounded events; (2) alternative measures for advertising and R&D; (3) alternative instruments; (4) macroeconomic conditions, including recessions and stock market growth; (5) the interaction between advertising and R&D; (6) the firm’s liquidity, profitability, market share, and similarity with its bankrupt rival; and (7) the firm’s patents and new product announcements.

Implications for theory and practice

Importantly, we show that when a rival’s bankruptcy is announced, a firm’s investments in advertising and R&D investments are not universally beneficial. Instead, advertising and R&D can either help or harm a firm in the context of bankruptcy spillovers, with the difference hinging on the industry’s growth and concentration (Fig. 2). A firm’s existing advertising investments increase its stock return when a rival files for bankruptcy in a growing industry whereas they decrease the firm’s stock return when a rival files for bankruptcy in a declining industry. A firm’s existing R&D investments increase its stock return when a rival files for bankruptcy in a high-concentration industry, whereas they decrease the firm’s stock return when a rival files for bankruptcy in a low-concentration industry. Thus, a firm’s investments in advertising and R&D play a meaningful role in how investors assess the firm’s potential performance prospects. These results not only reinforce the importance of marketing efforts but also underline the differential value of firm-specific investments that arise when new shocks occur within an industry.

We also broaden two streams of extant research. First, we add to a recent stream of research that has focused on the role of marketing investments for the bankrupt firm (Antia et al., 2017; Jindal, 2020; Jindal & McAlister, 2015) by shifting the lens to focus on the role of marketing investments for the other firms that operate in the same industry as the bankrupt firm. Our study focuses on how marketing investments are critical, because even if a firm is not facing bankruptcy itself, a rival’s bankruptcy can spill over to impact stock prices of other firms in the industry.

Second, we add to the literature that focuses on a firm’s ex post strategic responses to a rival’s bankruptcy to recognize the effects of ex ante investments. Such literature has shown that firms respond to a rival’s bankruptcy by changing their product variety (Ren et al., 2019) and prices (Ozturk et al., 2016). Further, their sales can be affected by a rival’s crisis (e.g., Giannetti & Srinivasan, 2021; Ozturk et al., 2019). We show that a firm’s marketing investments prior to a rival’s bankruptcy announcement also play a significant role in affecting investors’ expectations of the firm’s future prospects.

The findings from our research also have important implications for managers. Foremost, managers need to recognize that even if their own firm is performing well, a large rival’s bankruptcy can generate negative investor reactions for their firm. This vulnerability, along with the influence that a firm’s advertising and R&D investments have on investor reaction to a rival’s bankruptcy, highlights the importance of marketing efforts. This finding enhances the ability to account for marketing’s contribution, with accountability being a main driver of marketing’s influence within a firm, in terms of its perceived importance and respect in the boardroom (Verhoef & Leeflang, 2009). Furthermore, operating in industries with low or declining growth or with low concentration generates greater uncertainty that prompts investors to reassess whether advertising and R&D investments offer credible signals when a rival announces bankruptcy. Managers of firms operating in a growing industry can look to their firm’s advertising investments to improve investor reaction to a rival’s bankruptcy; however, managers of firms operating in a declining industry should focus their efforts elsewhere. Managers of firms operating in a high-concentration industry can look to their firm’s R&D investments to improve the investor reaction to a rival’s bankruptcy, but managers of firms operating in a low-concentration industry need to recognize that their R&D efforts can exacerbate the negative spillovers. Importantly, investors are reacting to the rival’s bankruptcy but are assessing firms based on their extant marketing investments and the credibility of these investments in terms of the industry environment.

Limitations and future directions

As with all research, limitations that exist in our research offer avenues for future research. First, as we investigate the roles of advertising and R&D investments on investor reaction to a rival’s bankruptcy, we measure these investments using the aggregate advertising investments and R&D investments reported by firms in their financial statements to investors. Given the potential for differential effects across areas of investment, future research could consider the types of advertising used and the types of R&D pursued to gain a nuanced understanding of which forms of investment are most effective. For example, advertising investments could be separated by price-oriented versus differentiation-focused messages, or by traditional versus digital media. Investments in R&D could be separated by process versus product, or radical versus incremental innovations. Future research could also consider investigating specific marketing assets, such as brand equity, that are built through a combination of marketing activities and investments across advertising, R&D, and other domains.

Second, we consider how the industry’s growth and concentration moderate the effects of advertising and R&D investments on investor reaction to a rival’s bankruptcy. Future research could explore additional factors that may also influence marketing’s impact on investor reaction to a rival’s bankruptcy. For example, future research could investigate whether a firm’s strategy influences the effect of marketing investments on investor reaction to a rival’s bankruptcy. To take an initial glance into this influence, we followed the approach from McAlister et al. (2016) to investigate whether the effects for advertising investments differ for firms that have a differentiation versus a cost leadership strategy. Although we found no significant difference between such firms, future research could consider other firm characteristics that may play a significant role. Future research could also explore whether the effects of advertising and R&D investments are moderated by the industry’s growth and concentration outside the context of a rival’s bankruptcy.

Third, future research could explore factors that influence the moderating effects of industry growth and industry concentration on advertising and R&D (i.e., three-way interactions). For example, future research could examine whether the moderating effects are different between firms that are market leaders versus those that are not. To provide some initial insight into this possibility, we added three-way interactions between the marketing variable (advertising or R&D), the industry moderator (growth or concentration), and a market leader dummy variable (set to 1 if the firm’s market share is greater than 20%, 0 otherwise). We found that the three-way interaction between advertising, industry, and market leader was negative and significant, suggesting that the industry growth’s moderating effect on advertising is lower for market leaders. Further research could further explore this possibility in greater detail.