Abstract

Even as more companies integrate artificial intelligence (AI) into their new products and services, little research outlines the strategic implications of such AI adoption. Therefore, the present study investigates how investors respond to announcements of new product innovations integrated with AI by non-software firms (AI-NPIs), with the prediction that they respond favorably if the firms feature a marketing department with substantial power; such firms likely possess the marketing resources and assets needed to ensure the success of AI-NPIs. An event study with a sample of 341 announcements by 77 S&P 500 firms between 2009–2018 supports this prediction. Furthermore, the relationship between marketing department power and investor response intensifies when the announcement (1) occurs in later innovation stages, (2) involves the sourcing of external innovation assets, and (3) refers to more complex innovations. These findings have both theoretical and managerial implications.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Artificial intelligence (AI), supported by increased computing power, decreased computing costs, big data, and advancements in machine learning algorithms and models, is essential to marketing (Huang & Rust, 2021), especially as traditional, non-software firms integrate it into their new products (Forbes, 2019). Business spending on AI-based solution development already is expected to exceed $97.7 billion by 2023 (IDC, 2019). Automobile manufacturers have adopted AI for various use cases for example, ranging from cars with AI-embedded braking systems to totally autonomous, AI-driven cars. Such offerings evoke changes in customer behavior, marketing processes, and business models (Davenport et al., 2020), such that AI-embedded new product innovations (AI-NPIs)—defined as the integration of AI into new products and services introduced by non-software firms—represents a significant strategic and managerial challenge. However, academic investigation of AI-NPI’s strategic implications is still rare and lacking in detail (Huang & Rust, 2021).

In an effort to address this gap, we focus on how shareholders value AI-NPIs and gauge stock market responses to such announcements. Understanding how shareholders value AI-NPIs is relevant; such strategic initiatives can have unprecedented effects and unfamiliar outcomes, and marketers must get ahead of this knowledge curve (Grewal et al., 2020). Consider the distinct investor responses to two similar announcements by Ford and General Motors (GM), regarding their innovation efforts to develop autonomous delivery vehicles, released in February and October 2018, respectively. Ford’s stock price dropped by 4.7%; GM’s announcement led investors to bump its stock prices by 4.6%. That is, two announcements, both from leading automobile manufacturers and pertaining AI-NPIs, led to opposite outcomes, indicating that investors expected GM would extract economic rents from its AI-NPI, but Ford would not. In that case, we confront a pressing research question: When and why do investors respond favorably to firms’ AI-NPIs?

We propose a framework derived from signaling (e.g., Connelly et al., 2011; Spence, 1973), screening (Bergh et al., 2014; Sanders & Boivie, 2004), and resource dependence (Salancik and Pfeffer, 1978) theories to answer this question. Specifically, we argue that even if AI-NPIs can produce rich technological and market opportunities, firms may struggle to establish viable marketing strategies and profitable business models for AI-NPIs, because the emerging technologies like AI remain in a state of constant flux (Srinivasan, 2008). Just announcing an AI-NPI may not be sufficient for investors to predict firms’ future cash flows, so they likely seek out and screen for additional information, such as the characteristics of the signaler (i.e., firm-level indicators) and the fit between the signaler and the signal (i.e., announcement), to establish their expectations (Connelly et al., 2011).

In screening for signaler characteristics, the unique capabilities offered by AI-NPIs also might influence investor responses in distinct ways. According to Puntoni et al. (2021), AI-NPIs help firms listen to customers, predict and respond to customer needs, provide social experiences, and produce delegated actions in real-time. In line with these benefits, we posit that marketing resources, competences, and assets, such as customer-connecting capabilities (Moorman & Rust, 1999), relational and intellectual market-based assets (Srivastava et al., 1998), and a market-oriented culture that emphasizes customer responsiveness and interdepartmental coordination (Kohli et al., 1993), increase the chances that a firm can use the unique capabilities offered by AI-NPIs to its advantage. Such marketing resources are intangible, so investors likely seek out indicators of whether a firm possesses such marketing resources. In particular, the power of the marketing department in a firm offers a relevant indicator; as resource dependence theory (RDT) posits, a department’s power depends on the extent to which its resources are critical for the firm’s success (Salancik and Pfeffer, 1978). Powerful marketing departments likely produce enhanced marketing resources, competences, and assets (Feng et al., 2015; Krush et al., 2015; Moorman & Rust, 1999; Verhoef & Leeflang, 2009), so investors can use marketing department power as an important indicator of the firm’s prospects and capacities to benefit from its AI-NPI effectively. Returning to the examples of Ford’s and GM’s AI-NPI announcements, we find in their 2017 annual proxy statements (DEF14A form) that GM’s top management team included 17% marketing executives, whereas Ford reported no marketing executives in this top level, in line with our reasoning.

Further, we apply RDT to predict that the positive relationship between marketing department power and investor response to announcements of AI-NPIs is moderated by characteristics of the innovation that may influence the perceived dependency on marketing resources for the success of an AI-NPI. These characteristics include the innovation’s stage, route, and complexity and investors may use it to assess the signal fit. Specifically, we argue that the relationship between marketing department power and investor response is strengthened when the AI-NPI (1) is at later innovation stages, (2) sources and absorbs external innovation assets, and (3) involves more complex innovations that incorporate (3a) product-platform-level (vs component-level) of AI adoption scope and (3b) fully autonomous (vs other) type of AI application in the NPI.

We test our hypotheses with 341 announcements of AI-NPIs by 77 firms listed in the S&P 500 over a ten-year period (2009 to 2018). Table 1 provides some illustrative announcement examples. The findings suggest that, on average, stock market responses to AI-NPI announcements do not differ significantly from zero, so investors avoid forecasting expected future cash flows solely on the basis of AI-NPI announcements. Rather, they respond positively to announcements by firms with more powerful marketing departments; we also find evidence of the hypothesized moderating effects of innovation characteristics.

The findings in turn make several contributions to innovation and marketing literature. First, we know of no prior investigations of the strategic value implications of AI-NPIs. By testing how investors assess and respond to firms’ signals of AI-NPIs, we clarify that mere signaling does not generate significant abnormal returns. Next, we offer new evidence regarding how a powerful marketing department can affect firm value (Feng et al., 2015; Srinivasan & Ramani, 2019), which also reveals an important avenue for continued research (Moorman & Day, 2016). As we demonstrate, a powerful marketing department can act as a reassurance and market indicator of the firm’s ability to extract economic rents from costly, risky investments, such as AI-NPIs. Finally, we offer the following three contributions to innovation literature. (A) Our study is the first to provide guidance on how and when complex AI-NPI can increase shareholder value. (B) We extend the literature on the relationship between different innovation characteristics and firm value (Borah & Tellis, 2014; Sood & Tellis, 2009) by establishing when the effects of different innovation characteristics on investor response tend to be stronger. (C) By outlining investors’ response process when they encounter AI-NPIs, we contribute to growing literature in the marketing domain pertaining to how innovation efforts affect firm value in stock markets (Kim & Mazumdar, 2016; Sharma et al., 2018; Warren & Sorescu, 2017a, 2017b). We provide a summary of representative sample of studies from the extant innovation literature to highlight the abovementioned contributions of our study in Table 2. We also summarize the differences between AI- and other-NPIs, which we will discuss in detail in the theoretical development section, in Table W11 of the Web Appendix.

In the next section, we offer our theoretical, conceptual framework. Then we outline our research methodology, including data sources, variable operationalization, and model specification. After we present the findings from the hypotheses tests, we conclude with a general discussion of the contributions, implications, and limitations of our study.

Theoretical framework

To understand how marketing department power affects investor responses to AI-NPI announcements, we develop a conceptual framework using information asymmetry, signaling, screening, and RDT. Information asymmetry theory acknowledges the imperfect information available in transactions of multiple parties (Stiglitz, 2002), such that one party lacks complete information about the quality or behavioral intentions of the other party. To resolve information asymmetry, signaling theory predicts that a sender, who is the party with more information (e.g., managers), sends signals to a receiver, or the party with incomplete information (e.g., investors), seeking to influence the receiver’s behavior (Spence, 1973, 1974). In our research context, firms might attempt to signal their quality and future performance (Connelly et al., 2011) to investors by announcing AI-NPIs. But investors still might not be able to estimate future cash flows on the basis of these announcements, because the emerging technologies underlying the new products are so complex, fast-evolving, and uncertain (Srinivasan, 2008). Therefore, investors screen for additional signals or indicators to resolve the information asymmetry and develop accurate expectations of the firm’s prospects (Bergh et al., 2014; Sanders & Boivie, 2004).

According to Connelly et al. (2011), in response to signals from firms, investors might seek additional information to assess the signaler’s veracity to determine if the firm really possesses the unobservable quality that it claims, and the signal fit, which represents the extent to which the signal’s characteristics are congruent with the firm’s unobservable quality. In turn, investors respond more favorably if they perceive that the firm possesses high signaler veracity, especially if the signal characteristics fit well with the firm.

Signaler veracity

To extract economic rents from AI-NPIs, the firm must possess the necessary resources to benefit from its unique value. We build on the AI’s unique value proposition (Puntoni et al., 2021) and argue that marketing resources are critical for the success of AI-NPIs. We then turn to RDT, which predicts that the power of a department in a firm depends on the extent to which its resources are critical for firm’s success (Salancik and Pfeffer, 1978). Therefore, if a department that possesses critical resources for the success of AI-NPIs is powerful, it offers an indicator of signaler veracity.

Signal fit

The characteristics of the signal need to correlate with the signaler’s veracity and unobservable qualities (Connelly et al., 2011). For example, if the signal suggests that the innovation requires resources and competences held by the firm’s powerful marketing department, it should heighten perceptions of signal fit. In RDT, dependence on a powerful actor increases if the resources it possesses (1) have low perceived substitutability (Emerson, 1962; Hinings et al., 1974; Yli-Renko et al., 2001), (2) facilitate absorption of external resources (Barney, 1991; Harrigan & Newman, 1990; Pfeffer, 1976), and (3) help mitigate uncertainties and associated risks (Pfeffer & Salancik, 2003; Ruekert & Walker, 1987). Building on these notions, we predict that the relationship between marketing department power and investor responses is moderated by (1) the innovation stage because the substitutability of marketing resources varies in different stages of the innovation; (2) route to innovation because the marketing department’s role as a knowledge integrator to help the firm absorb external knowledge varies based on whether the innovation assets are developed internally or sourced from external sources; and (3) innovation complexity because the degree of uncertainty and risks varies based on the complexity of the NPI. While we discuss these innovation characteristics and how they affect investor response to AI-NPI in detail in subsequent sections, we also provide a summary of the terminologies in Table W12 of the Web Appendix.

Hypotheses development

Marketing department power and investor response to AI-NPI announcements

A powerful marketing department can improve firm performance by ensuring a clear focus on building, protecting, and leveraging market-based assets (Feng et al., 2015). Market-based assets can be intellectual or relational; they arise out of a firm’s interactions with members of the external environment, such as suppliers, customers, and competitors (Srivastava et al., 1998, 2001). These intangible assets are critical to the firm’s ability to manage its market and marketing ecosystem (Hewitt et al., 2021), and can be used to support its innovation initiatives and overcome uncertainties or risks associated with entering new markets (Srivastava et al., 1998). A powerful marketing department – a key indicator of marketing leadership (Srinivasan & Ramani, 2019)—likely advocates for building and protecting market-based assets, such as brands, channel partnerships, customer relationships, and market knowledge (Feng et al., 2015). Further, firms with powerful marketing departments are also more effective in deploying their market-based assets when pursuing growth opportunities, in that they attract more and higher quality resources through strong interdepartmental coordination efforts and top management attention (Feng et al., 2015). That is, the powerful marketing department is not just a custodian of market-based assets but also an effective manager of the related resources. As we have argued, a powerful marketing department that maintains these market-based assets also provides an indication of signaler veracity, because it can use its resources and competences to exploit the unique capabilities of AI-NPIs (Puntoni et al., 2021). For each of the capabilities linked to AI-NPIs (i.e., listening to customers, predicting and responding to customer needs, providing social experiences, and providing delegation experiences), we detail our predictions about the influence of the market-based assets that a powerful marketing department can build and access.

First, AI-NPIs enhance a firm’s listening capability because they can collect real-time data about customers and their environment through interactions, sensors, and wearable devices (Cukier, 2021; Puntoni et al., 2021). For example, GM’s “Marketplace,” an on-demand, in-car commerce platform that can be used while driving, gathers a vast range of data from real-time customer interactions, contexts (e.g., location, time of the day), and historical transactions. Such extensive data collection experiences also may threaten customers’ perceptions of ownership and control over their data, which can lead to negative responses, such as negative affect, moral outrage, or psychological reactance (Puntoni et al., 2021). Therefore, a firm introducing such an innovation needs the capability to identify customers for whom the benefits of the offering outweigh the risks (Bettany & Kerrane, 2016); it also should be able to build relational, market-based assets (Feng et al., 2015; Srivastava et al., 1998, 2001), such as customer trust, through its effective management of customer relationships and effective communication about the exchange (Cukier, 2021). A powerful marketing department, with its strong customer-connecting abilities (Moorman & Rust, 1999) and enhanced abilities to build and manage market-based assets (Feng et al., 2015), signals that the firm possesses the requisite resources and competences, including intellectual and relational assets, to mitigate customers’ privacy concerns about AI.

Second, with AI-NPIs, firms can predict and respond to customer needs in real time (Puntoni et al., 2021), such as with personalized recommendations that reflect customers’ “in-use” data (Kopalle et al., 2020). The ability to anticipate and respond to customer needs is essential to developing critical capabilities to survive in the fast-evolving market environment (Day, 2011; Kalaignanam et al., 2021). If firms seek to classify and categorize customers, according to their tastes and preferences, AI can be an excellent tool that can assess large amounts of information, even in real-time during customer interactions. For example, Walmart’s Polaris search engine helps shoppers browse, discover, and purchase items efficiently and intuitively, such that it delivers highly relevant results in response to their searches, then helps them discover new items. However, such classification tasks demand high levels of accuracy because incorrect classifications can cause customers to feel misunderstood or discriminated (Puntoni et al., 2021). To minimize classification errors, firms need their marketing departments to manage the quality and scope of customer intelligence (e.g., Cukier, 2021; Puntoni et al., 2021). A powerful marketing department prioritizes customer-centricity and customer relationship management, which itself involves a holistic approach to customer intelligence management. Because a powerful marketing department can manage intellectual and relational market-based assets well, it serves as an indicator of the success of AI-NPIs.

Third, a firm can provide social experiences in the form of real-time, reciprocal communication through AI-NPIs (Puntoni et al., 2021). For example, social robots offer emotionally meaningful service experiences (e.g., Miao et al., 2021; van Doorn et al., 2017). Such social experiences prompt an organic, emotional connection between customers and the brand, enhancing customers’ self–brand connections (MacInnis & Folkes, 2017) and engagement (Hollebeek et al., 2021), as well as their perceived brand equity (Keller, 1993). In turn, managing customers’ brand engagement can inform the success of AI-enabled social experiences. The marketing function is responsible for managing brand-related resources and competences, and a powerful marketing department likely possesses these critical resources.

Fourth, AI-NPIs provide a delegation experience. Customers rely on the AI solution to perform tasks they otherwise would do (Puntoni et al., 2021), such as placing an online order, booking an appointment, or driving to work. While these delegation experiences may help customers feel empowered, they may also increase perceptions of lower self-efficacy and concerns about being replaced (Puntoni et al., 2021). To identify appropriate opportunities for delegation experiences, firms need higher service orientation and the recognition that customers rely on their products to do things, not to be things (Cukier, 2021). For example, an announcement about autonomous cars by GM in 2016 details its intentions to “redefine traditional car ownership” by providing various services, such as on-demand ridesharing, short-term rentals, connected experiences, and personalized mobility services. Such a service-centric view aligns with a market-oriented culture (Vargo & Lusch, 2004). Strong marketing departments encourage market-oriented cultures that feature dedicated customer orientations (Homburg et al., 2015; Kiessling et al., 2016; Krush et al., 2015; Verhoef & Leeflang, 2009) and close interdepartmental coordination (Feng et al., 2015). Therefore, a powerful marketing department should signal an organization-wide market-oriented culture, which enhances the likely success of AI-NPIs. Combining our reasoning related to each capability, we hypothesize:

H1

There is a positive relationship between the firm’s marketing department power and investor responses to AI-NPI announcements.

Moderating effects of innovation characteristics

Innovation Stage

According to RDT, market actors depend more on resources that are less substitutable (Emerson, 1962; Hinings et al., 1974; Yli-Renko et al., 2001). We posit that investors’ perceptions of signal fit improve when the substitutability of the marketing resources that support the success of AI-NPIs is low, as exists in later innovation stages. Innovation stages might be initiation, development, and commercialization (Sood & Tellis, 2009), which reflect the innovation’s market readiness (Prašnikar & Škerlj, 2006), and different resources and competences are needed at different stages (Kelm et al., 1995; Story et al., 2011). Although the marketing department has a key role for all three stages, we argue that the substitutability of its resources and competences will likely decrease as innovation progresses from initiation to commercialization for the following two reasons.

First, along with significant customer benefits, AI-NPIs may result in negative psychological consequences for customers (Puntoni et al., 2021), which can be impediments to new product success. The salience of these negative customer outcomes likely is particularly high in later innovation stages, when customers start sharing their concerns and usage experiences publicly. According to Cukier (2021), among businesses offering AI-NPIs, those that can (1) educate customers about why they collect data, (2) communicate effectively about the value exchange, and (3) achieve customer intimacy and trust can mitigate negative customer outcomes. Therefore, dependence on the marketing department’s resources and competences, such as customer-connecting capabilities, should increase in later innovation stages, when negative customer outcomes threaten to arise.

Second, AI is still an emerging technology that evokes uncertainty, especially about the reasoning for its algorithms’ outputs (e.g., Puntoni et al., 2021; Rai, 2019), which in turn can increase the perceived risk of adopting AI-NPIs. To counter such perceived risks, firms need to rely on their brand-related assets, especially during later stages of innovation (Chandy & Tellis, 2000; Dowling & Staelin, 1994; Eggers & Eggers, 2021; Sorescu et al., 2003; Srinivasan et al., 2009). Thus, we hypothesize that:

H2

The positive relationship between the firm’s marketing department power and investor responses to AI-NPI announcements is strengthened when the announcements are made during (a) development and (b) commercialization stages of the innovation process, compared with the initiation stage.

Route to innovation

New product innovations might emerge from three broad strategies for expanding an innovation portfolio: make, or internally developing the new product; buy and acquire innovation-related assets, such as patents, technology, and product, from outside sources; or ally, which entails collaborating with external entities, such as other firms and universities, to develop the innovation (Borah & Tellis, 2014; Geyskens et al., 2006; Kalaignanam et al., 2017). For several reasons, we anticipate that the two external routes to innovation (buy or ally) heighten the perceived criticality of marketing resources. In particular, according to Srinivasan (2008), integrating emerging technologies into new products requires shifting the locus of innovation outside the firm (especially for non-software firms, as we study), because these emerging technologies arise from the convergence of several distinct technology inputs that are nearly always located across several firms or even different industries. Thus, they need access to external knowledge, to enhance their own knowledge stores (Johnson et al., 2004), which in turn requires a knowledge integrator within the firm (Krush et al., 2015), to organize and disperse that knowledge. Marketing often functions as an effective knowledge integrator in interorganizational settings (Achrol & Kotler, 1999), enabling information to flow in from external resources and then out to other departments, due to its ability to integrate insights and then create, communicate, and deliver differentiated value in the marketplace (Krush et al., 2015; Srivastava et al., 1999).

Because emerging technologies feature complexity, span distributed knowledge domains, and evolve quickly, a new product innovation that includes them likely requires a difficult, time consuming, and highly unpredictable process (Srinivasan, 2008). External resources can help firms persist in this process (Barringer & Harrison, 2000; Haleblian et al., 2009; Hillman et al., 2009; Pfeffer and Salancik, 1978); a powerful marketing department also can offer valuable marketing resources. If it can exchange critical marketing resources for higher quality external innovation assets, it might exert greater influence, due to the complementarity of the interfirm technology and marketing resources (Katila et al., 2008). These complementary resources enable access to external innovation assets, so dependence on marketing resources, and the marketing department, should be greater when firms source external innovation assets.

H3

The positive relationship between the firm’s marketing department power and investor responses to its AI-NPI announcement is strengthened when the announcement refers to the integration of external innovation assets through (a) ally or (b) buy strategies, compared with make strategies.

Innovation complexity

Innovation complexity relates to the technical standards of the product and can be represented by the number of components, component interfaces, and subsystems in a product architecture (Clark & Wheelwright, 1993; Patel et al., 2014; Rogers, 2003). It increases uncertainty and risks for both firms (Ethiraj et al., 2012) and customers (Hoeffler, 2003), which may undermine market adoption of the new product (Arts et al., 2011). To gauge innovation complexity, we use two factors: AI adoption scope and the type of AI.Footnote 1 The scope measure pertains to whether AI is adopted at a product-platform or component level. The product-platform level comprises subsystems and interfaces that form a common structure from which a family of related products can be developed and produced efficiently (Sawhney, 1998). For example, an automobile manufacturer can adopt AI to develop autonomous cars, as a product-platform–level adoption, but also to develop smart braking systems, which is a component-level adoption. The former comprises multiple components, interfaces, and subsystems, so such innovations are more complex. Then the type of AI might be determined by its business application, as assisted, augmented, or autonomous (Garbuio & Lin, 2019). As a measure of innovation complexity, autonomous AI is the most complex, because it requires incorporating various structured and unstructured data collected by multiple components and sensors and then completing a task without any human intervention (Davenport et al., 2019).

In turn, we argue that innovation complexity positively moderates the relationship between marketing department power and investor responses. First, from an inside-out perspective, complex innovations require critical resources and competences provided by the marketing department. For example, to introduce product-platform innovations, firms must take advantage of their insights about customer behavior to identify segments of early adopters who might provide a foundation and base for expansion into other segments or markets (Sawhney, 1998). Similarly, autonomous AI increases the delegation experience (Puntoni et al., 2021), so firms need a service orientation mindset to market these products to customers (Cukier, 2021), which aligns with a market-oriented culture (Vargo & Lusch, 2004). Such complex innovations also entail more complex strategic decisions, which likely involve multiple departments and top management attention (Ethiraj et al., 2012; Robertson & Ulrich, 1998). Powerful marketing departments facilitate a market-oriented culture (e.g., Verhoef & Leeflang, 2009) and encourage interdepartmental coordination and can direct managers’ attention to strategic issues (Feng et al., 2015). Second, from an outside-in perspective, innovation complexity increases product-related uncertainty for customers (Hoeffler, 2003) and may disrupt market adoption (Arts et al., 2011). Similar to our reasoning related to emerging technologies, countering such uncertainties likely demands marketing resources, such as brand-related assets (Chandy & Tellis, 2000; Dowling & Staelin, 1994; Eggers & Eggers, 2021; Sorescu et al., 2003; Srinivasan et al., 2009).

H4

The positive relationship between a firm’s marketing department power and investor responses to its AI-NPI announcements is strengthened when the (a) AI adoption scope involves the product-platform level (cf. component level) and (b) AI is autonomous (cf. other applications).

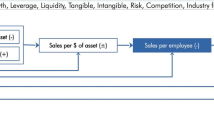

We present our conceptual framework in Fig. 1 and summarize the hypotheses in Table 3.

Research methodology

Sample selection

We use two criteria to select sample firms and still obtain a sufficient sample of announcements. First, larger firms are more likely to invest in emerging technologies (Chandy & Tellis, 2000; Spiceworks, 2019). Second, we sample firms listed on U.S. stock market, so that we can gather data about investor responses. Therefore, we rely on the list of Standard & Poor 500 (S&P 500) firms for our study, similar to previous marketing research (Bendig et al., 2018; Bommaraju et al., 2019). We obtain a list of constituent firms for 2019, from which we remove firms assigned to the “Computer Programming, Data Processing, and other Computer Related Services” category (standard industrial classification [SIC] 7371–7379), to ensure our focus on non-software firms. We also exclude Amazon and Netflix, whose operations rely extensively on software programming, such that introducing AI in their products would not qualify as an instance of AI-NPI as we have defined it. Furthermore, we exclude utilities (SIC 4900–4949) and financial firms (SIC 6000–6999), whose financial policies are subject to statutory capital requirements or regulatory supervision (Colla et al., 2013; Saboo et al., 2017). Thus, the sampling frame includes 324 firms, which we review for the decade between 2009 and 2018.

To identify announcements of new AI-NPIs, we develop a list of keywords by building on insights from previous studies. For example, Garbuio and Lin (2019) outline three fundamental uses of AI by businessesFootnote 2: assisted (e.g., robotic process automation), augmented (e.g., personalization, fraud detection), and autonomous (e.g., driverless cars, chatbots). In turn, we include three sets of keywords in our searches: (1) “robotics”, “robotic process automation”, and “RPA” for assisted AI; (2) “machine learning”, “deep learning”, and “neural network” for augmented AI; and (3) “autonomous”, “chatbot”, “virtual agent”, “digital assistant”, “natural language processing”, “NLP”, and “computer vision” for autonomous AI. In addition, we include generic keywords such as “artificial intelligence” and “AI” to identify as many potential use cases as possible.

To compile announcements by sample firms, we then searched FactivaFootnote 3 for each firm’s name and the “new products and services” filter. The criteria for including an announcement in the final sample require it to refer to a new product or service introduction, with at least one component based on AI. The final sample consists of 341 announcements by 77 firms, from the list of 324 eligible S&P 500 firms we identified.

Event study

We used an event study methodology (Sorescu et al., 2017) to test our hypotheses. It relies on the efficient market hypothesis, which holds that the stock price of a firm adjusts to reflect new information, based on investors’ expectations of the firm’s future performance. The effect of new information on future performance expectations can be captured as abnormal returns, or stock returns in excess of the expected returns, based on actual market returns. Such methodologies are widely used in marketing (e.g., Boyd & Spekman, 2008; Kalaignanam & Bahadir, 2013; Swaminathan & Moorman, 2009), because they can (1) accurately isolate and reflect immediate responses to newly available information with minimal confounds; (2) measure expected future cash flows, because the stock market response is a forward-looking measure, and the full benefits of innovation may not be realized for several years (Raassens et al., 2012); and (3) support controlled quasi-experiments, in which post-event stock price behavior is tested relative to expected pre-event behavior, with a direct causal inference (Srinivasan & Hanssens, 2009). To calculate the expected returns for the event firms, we use a standard market model estimation, as recommended by finance (e.g., Dong, Li, et al., 2021; Dong, Young, et al., 2021; Fama, 1998, 2001; Mun, 2021) and marketing (e.g., Sorescu et al., 2017) scholars for short-term event studies and as has been used widely (e.g., Bhagwat et al., 2020; Lee et al., 2016). As robustness checks, we also conduct four-factor model estimations to calculate expected returns.

The estimation window for expected returns spans 240 trading days (t = -250 to t = -10). With a generalized autoregressive conditional heteroskedasticity (GARCH) estimation, we can produce more efficient estimates (Corhay & Rad, 1996; Talay et al., 2019). We calculate the abnormal returns as the difference between actual and expected returns:

where, for firm i on day t, Rit is the daily return, E[Rit] is the expected return, and ARit is the abnormal return. Finally, we compute cumulative abnormal returns (CAR) for several windows around the event day to address the possibility of information leakage or spillovers in the stock market (Bhagwat et al., 2020; Geyskens et al., 2002). The CAR for the span between \({t}_{1}\) and \({t}_{2}\) is the sum of abnormal returns on the stock from \({t}_{1}\) to \({t}_{2}\). Therefore,

Measures

We summarize the operationalization and data sources for each variable in Table 4.

Dependent variable (CAR [t1, t2])

To compute CAR, we need to include at least one day prior and one day after the announcement date, to account for potential information leakage and dispersion across investors (Sorescu et al., 2017; see also Bhagwat et al., 2020; Swaminathan & Moorman, 2009). The choice of shorter windows for CAR can be justified “if the purpose is to solely determine the direction of the effect caused by the event, rather than to accurately capture the entire change in stock prices that can be attributed to the update in expectations caused by the event” (Sorescu et al., 2017, p. 193–194). As our study is concerned with capturing how investor expectations are affected by the announcement of AI-NPIs, we report results for a five-day window of two days before and after the event, [-2, + 2], to ensure that we capture the entire range in stock prices attributable to changes in investor’s expectations due to the announcement more accurately. As a robustness check, we also report CARs computed using other time windows (e.g., [-1, + 2]) and estimation methods (e.g., four-factor model, ordinary least squares).

Independent variable

We operationalize the firm’s marketing department power by calculating a principal component analysis score for five items (Feng et al., 2015; Srinivasan & Ramani, 2019): (1) ratio of the number of marketing executives to the total number of executives in the top management team (TMT), (2) compensation of marketing TMT executives relative to all TMT executive compensation, (3) highest level of marketing TMT executives in the TMT hierarchy, (4) cumulative levels of all marketing executives in the TMT, and (5) the number of unique job responsibilities in the job titles of marketing TMT executives. All items are scaled relative to each year’s industry average of the respective item, according to the primary SIC listed by the firm. Then to compute relative marketing department power (RELMDP), we use a standardization approach (Campello, 2006; Kurt & Hulland, 2013) and divide the difference between the firm’s marketing department power and the marketing department power of all other firms in the same two-digit industry by the standard deviation of the industry. In robustness checks, we report analyses based on an absolute measure of marketing department power.

Moderators

We code the innovation-specific proposed moderator variables manually, using information provided in the announcements. Two independent coders reviewed all announcements and achieved inter-coder agreement greater than 86%; the few differences were resolved by discussion.

We operationalized innovation stage (STAGE), in line with Sood and Tellis (2009), as a three-part variable. The initiation stage includes announcements about funding (grants, advanced orders, funded contracts), alliance formation events (joint ventures, acquisitions), and expansions into new innovation projects. The development stage refers to prototypes and related events (working prototypes, exhibitions, new materials, equipment, and processes), patents, and preannouncements (i.e., more than one week ahead). Then in the commercialization stage, we find new product launches (initial shipments, new applications) and awards (external recognition of quality).

We follow Borah and Tellis (2014) in operationalizing the innovation route (ROUTE). A firm relies on a make strategy if the announcement indicates that it will develop the new product internally. It follows a buy strategy if the announcement describes acquiring some other firm, entirely or in part, explicitly to add AI to new products. Finally, we identify an ally route to innovation if the new product announcement mentions the firm collaborating with one or more external entities, such as in joint ventures, co-development efforts, technology licensing agreements, contracting with expert(s) or vendors, collaborating with universities or other research institutes, and participation in networks.

Finally, adoption scope (SCOPE) is a dummy variable, coded 1 if AI is adopted at the product-platform level and 0 at the component level. Then the type of AI (AI_TYPE) is another dummy variable, equal to 1 if the new product announcement refers to autonomous AI and 0 otherwise. Although we note three potential types of business applications, only two announcements in our sample refer to assisted AI, so we combine augmented and assisted AI as others, which takes a value of 0.

Control variables

We use several control variables, at different levels. First, regarding market focus (MARKET), our sample of S&P 500 firms with global operations might release announcements directed at specific markets, so we include a dummy variable, coded as 1 if the new product announcement indicates it is for the U.S. market and 0 otherwise. Events in different markets may lead to different outcomes (Zou et al., 2020). We relied on the same manual coding process, and the coders did not raise any disagreements about this variable.

Second, at the firm level, we use financial leverage (LEV), firm size (SIZE), and slack resources (SLACK) as control variables to capture various forms of firm resources, which in turn define the firm’s ability to invest in new growth opportunities, such as new products with emerging technologies (e.g., Chandy & Tellis, 2000; Fang et al., 2008; Kurt & Hulland, 2013; Lee & Grewal, 2004; Lenz et al., 2017). We operationalize financial leverage as the ratio of the firm’s long-term debt to total assets; firm size as its total assets; and slack as the result of the principal component analysis of retained earnings to asset and working capital to asset ratios. Moreover, we control for sales growth at the firm level (SGR), because it might reflect the results of the firm’s previous innovations (Ataman et al., 2008; Ittner & Larcker, 1997) and also affect innovation and associated outcomes (Luo & Du, 2015). We compute sales growth as year-on-year growth in the company’s revenues. Furthermore, strategic emphasis (STEMPH) is the extent to which the firm leans toward value creation or value appropriation (Mizik & Jacobson, 2003). If we measure the difference between R&D and selling, general, and administrative (SG&A) expenses, scaled to total assets, positive values indicate a stronger emphasis on value creation, whereas negative values indicate an emphasis on value appropriation. We use SG&A instead of advertising expenses because nearly half the firms in our firm do not report advertising expenses. Finally, to be consistent with the relative measure of the firm’s marketing department power (RELMDP), we apply a similar standardization procedure to calculate relative values of all the firm-level control variables.

With regard to industry-level factors, we control for competitive intensity (HHI), industry sales growth (INDSGR), and the firm’s membership in a manufacturing industry (MANF), because industry contexts influence strategic initiatives (Lee & Grewal, 2004) and thus firm performance (Fang et al., 2008). Competitive intensity is assessed with the Herfindahl–Hirschman index (HHI), the industry’s sales growth indicates year-on-year growth in industry sales, and membership in a manufacturing industry is a dummy variable that indicates if the firm’s SIC is between 20 and 39.

Model specification

In addition to the information provided in the announcement, investors only have access to publicly available, firm- and industry-level observable factors to update their beliefs about a firm’s future performance. Therefore, we specify the model using CAR [-2, + 2] as the dependent variable and one-year lagged measures of all firm- and industry-level control variables including marketing department power as the key firm-level independent variable. That is, investors likely use only publicly available firm- and industry-level information, referring to prior time periods. We specify the model with firm-level clustered standard errors to account for heteroskedasticity. Thus, for firm i and announcement j during year t, we specify:

where, CARij is cumulative abnormal returns over the five-day window [-2, + 2], RELMDPi(t-1) is the marketing department power of the firm in year t – 1, STAGEij is the innovation stage, ROUTEij is the route to innovation, SCOPEij is the adoption scope, and AI_TYPEij is the type of AI. Furthermore, MARKETij is the market focus of the announcement, and FIRM_IND_CONTROLSi(t-1) represents a vector of firm-level (LEV, SIZE, SLACK, SGR, STEMPH) and industry-level control variables (HHI, INDSGR, MANF) in year t-1.

Specification tests

Multicollinearity

We present the summary statistics and bivariate correlation matrix for the variables in Table 5. Low correlations among variables and variance inflation factors less than the critical value of 10 suggest that multicollinearity is unlikely to influence the results.

Self-selection bias

Firms’ decisions to announce the adoption of AI in their new products is endogenous, so there is potential for self-selection bias in our data. We apply the two-stage Heckman (1979) procedure, with likely predictors of AI-NPI announcements, to estimate the inverse Mills lambda, then include it as a control in our model specification (see Table W1 in the Web Appendix). That is, in the first stage, in addition to the firm- and industry-level variables in our model specification, we include announcement prevalence in the industry to meet the exclusion restriction. An industry’s tendency to announce new products should affect the likelihood of the firm’s announcement but not the firm’s stock performance. We compute this measure as the number of other firms that make an announcement in the same industry, scaled to the total number of other firms in the industry (for a similar approach, see Feng et al., 2020). The instrument is significantly correlated with firm’s decision to adopt (r = 0.39; p < 0.01), and it significantly predicts the likelihood of adoption in the first stage (p < 0.01). Then in the second stage, we include the inverse Mills ratio (IMR) estimated from the selection model in our analysis to account for potential selection bias. However, IMR is not significant (p > 0.1), so self-selection bias appears unlikely to affect our results.

Endogeneity

There may be concerns regarding endogeneity, because the reasons for marketing department power are unobserved. Further, some of the moderators (route to innovation, adoption scope, type of AI) also depend on unobserved firm factors, so they raise concerns about potentially endogenous interactions. To counter such concerns, we use a control function (CF) approach, which provides a relatively simple, effective way to deal with interactions that involve endogenous regressors (Woolridge, 2015). It involves two stages. First, we regress the potentially endogenous regressor on instruments that can explain the exogenous variation. Instead of fitting the predicted values in the second stage, we control for the fitted residuals, that is, the CF computed from the first stage (Papies et al., 2017). The CF captures the endogenous portion of the regressor, and thus we account for unobserved variation that makes the regressor endogenous by including it as a control. We rely on industry averages of the respective endogenous regressors, which have good predictive power and meet the exclusion restriction, as instruments (Srinivasan & Ramani, 2019). Then we derive the standard errors, using a bootstrap approach. The significance of fitted residuals in the second stage indicates the presence of endogeneity concerns (Papies et al., 2017; Woolridge, 2015), but none of the fitted residuals is significant (p > 0.1), so we do not retain them in our estimation.Footnote 4

Results

Descriptive findings

Announcements

The number of AI-NPI announcements by non-software firms has been on the rise. As we show in Fig. 2, more than 75% of all announcements in our sample occur between 2016 and 2018. This trend demonstrates the growing interest in AI-NPIs and highlights the importance of understanding how investors perceive such firm initiatives. Further, we also present a breakup of the AI-NPI announcements across industries in Table 6. Approximately 78% of all announcements are made by manufacturing firms indicating that the manufacturing industry sees significant value in adopting AI. This could potentially be because physical goods, such as autonomous cars or other consumer electronics products (e.g., smartphones) can be fitted with sensors to collect first-party data about customer interactions with the products and their environment. Such first-party data can significantly improve customer intelligence management and customer experiences, and thus enable firms to deliver higher customer value.

Main effect of AI-NPI announcements

On average, the CAR [-2, + 2] to AI-NPI announcements of -0.01% is not significantly different from 0 at a 10% significance level. However, we note substantial variability in investor responses. For example, the CAR [-2, + 2] for 173 of the 341 announcements are positive, but 168 announcements evoke negative returns. We also find a large standard deviation of 3.1%. Therefore, investors do not expect all announcing firms to achieve successful adoptions of AI in new products and subsequent positive future performance. Instead, to update their beliefs about the firm’s future performance, they likely turn to other signals.

Hypotheses tests

We estimate the model in Eq. (3) using a main-effects only model (M1) for H1, then the full model with interactions (M2) to test H2–H4. We report the results in Table 7.

Effect of marketing department power

In support of H1, we find a significant effect of marketing department power on investor response (\(\beta\)= 1.54E-03, t = 2.65), such that investors update their expectations of the firm’s future performance positively if the firm’s marketing department has higher (vs. low) power. Marketing department power thus functions as an indicator of signaler veracity—that is, a firm-level characteristic that indicates its ability to earn economic rents from strategic initiatives such as AI in new products.

Moderating effects of innovation characteristics

Compared with the initiation stage, the conditional effect of marketing department power on investor responses is positive but not significant in the development stage (\(\beta\) = 1.81E-03, t = 1.47) and positive and significant in the commercialization stage (\(\beta\) = 2.86E-03, t = 1.97), in support of H2b but not H2a. Investors seem to value marketing department power more during the commercialization stages specifically, due to the greater dependency on resources and competences provided by the marketing department (see Fig. 3a).

Interaction plots. a Interaction effects of marketing department power (MDP) and innovation stage; b Interaction effects of marketing department power (MDP) and route to innovation; c Interaction effects of marketing department power (MDP) and AI adoption scope; d Interaction effects of marketing department power (MDP) and AI Type

In support of both H3a and H3b, the effect of marketing department power is positive and significant for both ally (\(\beta\) = 2.72E-03, t = 2.48) and buy (\(\beta\) = 5.05E-03, t = 2.91) announcements, relative to the make announcement. Figure 3b depicts the interactive effects of marketing department power and route to innovation on investor responses. Investors perceive a greater dependency on the resources and competences managed by the marketing department when the routes to innovation involve external actors.

The interaction between marketing department power and adoption scope is significant; compared with component-level adoption, the effect of marketing department power is positive and significant for product-platform–level adoption of AI (\(\beta\) = 2.71E-03, t = 2.22). This finding indicates greater dependence on marketing resources and competences for product-platform levels of adoption, as illustrated in Fig. 3c. Finally, we find a significant interaction between marketing department power and type of AI; compared with augmented/assisted AI, for the autonomous form, the effect of marketing department power is positive and significant (\(\beta\) = 2.27E-03, t = 2.00), in line with our predictions and as we depict in Fig. 3d.

Robustness checks

The strength and significance of our results might be affected by some variable operationalizations or some observations in our data set. To test the robustness of our results, we thus conducted several additional analyses. Overall, the results are robust to alternate operationalizations of dependent and independent variables, outliers, removal of isolated industry-level events from the sample, removal of observations from industries with higher AI familiarity, and the inclusion of time fixed effects and other control variables (e.g., announcement specificity, radicalness of the innovation). We elaborate on these findings in the Web Appendix.

Discussion

Emerging technologies, particularly AI-based ones, are pervasive and affect competitive dynamics, business models, and customer behavior in a wide range of industries, including those not traditionally considered technology-intensive (Davenport et al., 2020; Srinivasan, 2008). To establish how new product innovations, based on a pervasive, emerging technology such as AI, can affect firm value, we sought insights into how investors incorporate new information about a non-software firm’s decision to adopt AI in its new products into their expectations of the firm’s future performance. Our findings indicate that investors’ responses are not driven entirely by information available in the firm’s new product announcements. Rather, they reflect investors’ beliefs about the firm’s abilities to reap economic benefits from AI-NPIs and the congruent characteristics of the innovation. Specifically, investors are more likely to respond positively to AI-NPI announcements by firms with more powerful marketing departments, because they expect such firms to possess the necessary resources and market-based assets to benefit from the unique capabilities offered by the AI-NPIs. This effect also is amplified by congruent signal characteristics, such as innovation stage, route, and complexity.

Theoretical contributions

Adopting emerging technologies, such as AI, offers a rich source of market opportunities for some firms and challenges for others (Srinivasan, 2008). However, we lack insights into which firms benefit most from such adoptions and when. In attempting to provide some insights along these lines, we contribute to several streams of literature. For example, in relation to emerging research on AI’s strategic impact, we offer a comprehensive framework for analyzing investors’ responses to announcements of AI-NPIs. Marketing literature offers some valuable conceptual predictions about the impact of AI (Davenport et al., 2020; Grewal et al., 2020; Huang & Rust, 2021; Puntoni et al., 2021), but empirical research mainly investigates consumer outcomes (Longoni & Cian, 2020; Longoni et al., 2019; Luo et al., 2019) or the effects on employees (Luo et al., 2021). To the best of our knowledge, no prior study has investigated the strategic value implications of AI-NPIs. Our findings indicate that, on average, neither signaling by firms nor the complexity of AI-NPI generates significant abnormal returns. Instead, investors use firm-level indicators and their fit with the innovation characteristics to update their beliefs about the firm’s prospects, associated with introducing the AI-NPI.

We also expand scarce literature on the effects of a strong marketing department on firm value (Feng et al., 2015; Srinivasan & Ramani, 2019). Marketing department power can influence firm value through several mechanisms, such as resource attraction and interdepartmental coordination (Feng et al., 2015), less myopic spending (Srinivasan & Ramani, 2019), or a reduced likelihood of product-harm crises (Kashmiri et al., 2017). We uncover yet another important mechanism and provide relevant evidence for firms, namely, that a powerful marketing department provides reassurance to the market about its ability to extract economic rents from costly or risky investments. At least from an external stakeholder perspective, marketing department power suggests organization-wide availability or dissemination of intellectual and relational market-based assets and market-oriented culture.

With regard to new product innovation literature, we offer three contributions. First, we demonstrate when complex innovations are expected to succeed. Specifically, Sawhney (1998) provides conceptual insights on the benefits of platform-thinking, but the current study offers the first empirical evidence regarding how and when it can increase shareholder value. We find that platform-thinking in new product innovation contexts does not elicit positive investor responses on its own, but it affects firm value positively if the firm also has a strong marketing department. The combination of platform-thinking and assets required to benefit thus appears necessary; investors also expect firms with powerful marketing departments to possess such assets. Similarly, our study is the first to offer insights on which AI business applications investors reward. In line with the previous finding about platform-thinking, while investors do not respond differentially to different types of AI applications, they respond favorably to complex business applications involving autonomous AI from firms with strong marketing department power. Second, Sood and Tellis (2009) include both innovation stage and route to innovation in their framework, but most prior studies investigate each characteristic alone. Further, previous studies also address only the main effects of innovation stage and route to innovation on investor responses (e.g., Borah & Tellis, 2014; Sood & Tellis, 2009). By investigating when the effects of innovation characteristics grow stronger, we find, in contrast with Sood and Tellis (2009), that the returns to commercialization-stage announcements are significantly higher, especially if the marketing department is powerful, compared with those made during the initiation and development stages. In turn, we posit that returns to announcements might depend on nuanced elements, such as the underlying technology behind the innovation. Third, we help clarify how innovation affects firm value in stock markets (Borah & Tellis, 2014; Kim & Mazumdar, 2016; Sharma et al., 2018; Warren & Sorescu, 2017a, 2017b). Our study provides key insights into the process investors undertake when responding to AI-NPI.

Managerial implications

Firms are spending heavily to integrate AI into their new products or develop AI-based solutions; our study offers insights for managers of non-software firms related to how stock markets are likely to respond to announcements of such innovations. The adoption of AI can be costly, and AI-NPI is a costly signal. However, announcing these innovations cannot overcome the challenge of information asymmetry for investors. Instead, they seek more information to determine the firm’s ability to benefit from AI-NPIs. Thus, only 51% of the announcements in our sample generated positive responses from investors. For managers, we caution that announcements of AI-NPIs may not be effective signals on their own and could even have negative impacts on firm value.

When external stakeholders like investors are unsure about the firm’s ability to extract value from the innovation, they assess the firm’s prospects by investigating whether it possesses the resources and assets required to commercialize the innovation. However, such resources and assets are mostly intangible, so external stakeholders need other, observable signals; as we show, firms that establish strong marketing departments provide such an indicator of the organization-wide availability and leveraging of intangible, market-based assets (e.g., customer intelligence management, customer-connections, market-oriented culture). Therefore, firms should take this opportunity to demonstrate their commitment to the creation and use of necessary assets and capabilities to the key external stakeholders, such as investors and partners. In turn, their signaling efforts also have significant economic impacts. For example, the difference between predicted returns to announcements by firms in which the marketing departments are more, versus less, powerful (one standard deviation above and below the mean) is approximately 0.72%. In our sample, the average firm was valued at approximately $110.3 billion, so it would translate into approximately $790 million in market capitalization. When announcing their costly and risky endeavors, managers should be mindful of how such endeavors may be perceived by external stakeholders and what additional information they may need to assess the firm’s prospects.

Finally, innovation characteristics, including announcement timing (i.e., innovation stage), method of innovation asset management (i.e., route to innovation), and perceived complexity of innovation (i.e., technology adoption scope and the type of technology), can influence the relationship between marketing department power and investor responses to AI-NPIs. When they pursue such innovation initiatives, firms with strong marketing departments thus should (1) time their announcements when the innovation is more market-ready, (2) consider acquiring innovation assets from external resources rather than making them, and (3) pursue more challenging opportunities through platform-thinking in their adoption scope and/or adopting advanced forms of the technology (e.g., autonomous AI).

Limitations and further research

Our study is not without limitations. The sample consists only of large, publicly traded companies. Thus, the findings might not generalize to all firms, such as startups. In addition to testing the effects of AI-NPIs initiatives by small and medium-sized firms, including start-ups, additional research might gather larger samples. Our sample of 341 announcements by 77 firms over 10-year period is comparable to other event studies (e.g., Boyd & Kannan, 2018; Park et al., 2019), but larger samples might increase the generalizability of our findings. Our sample also involves non-software firms; it may be worth investigating whether investor responses to AI-NPIs vary for software firms. Because software firms already rely on AI-driven solutions, investors may have incorporated the benefits of AI solutions for software firms into their expectations already, so AI-NPI announcements would generate weaker abnormal returns, relative to the outcomes for non-software firms. Efforts to explore this possibility might identify other factors that investors use to update their expectations.

In addition to addressing these limitations, several interesting research opportunities exist to clarify the strategic value implications of AI-NPIs. First, we explore the interactive effects of signaler veracity and signal characteristics, but additional research might note the interactive effects of different indicators of signaler veracity. For example, investor responses could be affected by the interaction of marketing department power and other marketing measures, such as advertising spending, brand equity, marketing capability, and the CEO’s marketing background. Second, we explore the effect of marketing department power relative to competitors; the power maintained by other departments in the firm could indicate crucial resources and assets, such that it serves as another indicator of signaler veracity. A relevant question is whether investors value intra-firm marketing department power (i.e., relative other departments, such as finance) or interfirm marketing department power more. Third, Talay et al. (2017) consider the extent to which investor responses predict the product’s market performance. In a similar vein, researchers might investigate whether marketing department power translates into the superior market performance of AI-NPIs.

Notes

We thank the anonymous reviewer for suggesting the inclusion of “type of AI” in our model.

Other typologies are available (Davenport and Ronanki, 2018), but they suggest similar business applications.

This database covers major news and business publications in the United States. Our procedure required filtering a large number of announcements, but we consider our approach robust. Even if it may leave some announcements unidentified, we believe that such events are less likely to reach the wide investment community, and their impact is likely to have little impact on investor responses.

As an alternative, we also try to address the potential endogeneity concerns using the instrument-free Gaussian Copula approach (Park and Gupta, 2012) and similar to the findings of CF approach, the copula term is not significant indicating that estimates are unlikely to be biased due to endogeneity.

References

Achrol, R. S., & Kotler, P. (1999). Marketing in the network economy. Journal of Marketing, 63(4_suppll), 146–163.

Arts, J. W., Frambach, R. T., & Bijmolt, T. H. (2011). Generalizations on consumer innovation adoption: A meta-analysis on drivers of intention and behavior. International Journal of Research in Marketing, 28(2), 134–144.

Ataman, M. B., Mela, C. F., & Van Heerde, H. J. (2008). Building brands. Marketing Science, 27(6), 1036–1054.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Barringer, B. R., & Harrison, J. S. (2000). Walking a tightrope: Creating value through interorganizational relationships. Journal of Management, 26(3), 367–403.

Bendig, D., Willmann, D., Strese, S., & Brettel, M. (2018). Share repurchases and myopia: Implications on the stock and consumer markets. Journal of Marketing, 82(2), 19–41.

Bergh, D. D., Connelly, B. L., Ketchen, D. J., Jr., & Shannon, L. M. (2014). Signalling theory and equilibrium in strategic management research: An assessment and a research agenda. Journal of Management Studies, 51(8), 1334–1360.

Bettany, S. M. M., & Kerrane, B. (2016). The socio-materiality of parental style: Negotiating the multiple affordances of parenting and child welfare within the new child surveillance technology market. European Journal of Marketing, 50(11), 2041–2066.

Bhagwat, Y., Warren, N. L., Beck, J. T., & Watson, G. F., IV. (2020). Corporate sociopolitical activism and firm value. Journal of Marketing, 84(5), 1–21.

Bhattacharya, A., Morgan, N. A., & Rego, L. L. (2021). EXPRESS: Examining Why and When Market Share Drives Firm Profit. Journal of Marketing, 2224292110319–. https://doi.org/10.1177/00222429211031922

Bommaraju, R., Ahearne, M., Krause, R., & Tirunillai, S. (2019). Does a customer on the board of directors affect business-to-business firm performance? Journal of Marketing, 83(1), 8–23.

Borah, A., & Tellis, G. J. (2014). Make, buy, or ally? Choice of and payoff from announcements of alternate strategies for innovations. Marketing Science, 33(1), 114–133.

Boyd, D. E., & Kannan, P. K. (2018). (When) Does Third-Party Recognition for Design Excellence Affect Financial Performance in Business-to-Business Markets? Journal of Marketing, 82(3), 108–123.

Boyd, D. E., & Spekman, R. E. (2008). The market value impact of indirect ties within technology alliances. Journal of the Academy of Marketing Science, 36(4), 488.

Campello, M. (2006). Debt financing: Does it boost or hurt firm performance in product markets? Journal of Financial Economics, 82(1), 135–172.

Chandy, R. K., & Tellis, G. J. (2000). The incumbent’s curse? Incumbency, size, and radical product innovation. Journal of Marketing, 64(3), 1–17.

Chen, Y., Ganesan, S., & Liu, Y. (2009). Does a firm’s product-recall strategy affect its financial value? An examination of strategic alternatives during product-harm crises. Journal of Marketing, 73(6), 214–226.

Clark, K. B., & Wheelwright, S. C. (1993). Managing new product and process development: text and cases. The Free Press.

Colla, P., Ippolito, F., & Li, K. (2013). Debt specialization. Journal of Finance, 68(5), 2117–2141.

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011). Signaling theory: A review and assessment. Journal of Management, 37(1), 39–67.

Corhay, A., & Rad, A. T. (1996). Conditional heteroskedasticity adjusted market model and an event study. Quarterly Review of Economics and Finance, 36(4), 529–538.

Cukier, K. (2021). Commentary: How AI shapes consumer experiences and expectations. Journal of Marketing, 85(1), 152–155.

Davenport, T. H., & Ronanki, R. (2018). Artificial intelligence for the real world. Harvard Business Review, 96(1), 108–116.

Davenport, T., Guha, A., Grewal, D., & Bressgott, T. (2020). How artificial intelligence will change the future of marketing. Journal of the Academy of Marketing Science, 48(1), 24–42.

Day, G. S. (2011). Closing the marketing capabilities gap. Journal of Marketing, 75(4), 183–195.

Dong, Y., Li, C., & Li, H. (2021a). Customer concentration and M&A performance. Journal of Corporate Finance, Forthcoming.

Dong, Y., Young, D., & Zhang, Y. (2021). Familiarity bias and earnings-based equity valuation. Review of Quantitative Finance and Accounting, 57(2), 795–818.

Dotzel, T., & Shankar, V. (2019). The relative effects of business-to-business (vs. business-to-consumer) service innovations on firm value and firm risk: An empirical analysis. Journal of Marketing, 83(5), 133–152.

Dowling, G. R., & Staelin, R. (1994). A model of perceived risk and intended risk-handling activity. Journal of Consumer Research, 21(1), 119–134.

Eggers, F., & Eggers, F. (2021). Drivers of autonomous vehicles—analyzing consumer preferences for self-driving car brand extensions. Marketing Letters. https://doi.org/10.1007/s11002-021-09571-x

Emerson, R. M. (1962). Power-dependence relations. American Sociological Review, 27(1), 31–41.

Ethiraj, S. K., Ramasubbu, N., & Krishnan, M. S. (2012). Does complexity deter customer focus? Strategic Management Journal, 33(2), 137–161.

Fama, E. (1998). Market efficiency, long-run negative drift of post-listing stock returns. Journal of Financial Economics, 49(3), 283–306.

Fama, E. F. (2001). Market efficiency, long-term returns, and behavioral finance (pp. 174–200). University of Chicago Press.

Fang, E., Palmatier, R. W., & Steenkamp, J. B. E. (2008). Effect of service transition strategies on firm value. Journal of Marketing, 72(5), 1–14.

Feng, H., Morgan, N. A., & Rego, L. L. (2015). Marketing department power and firm performance. Journal of Marketing, 79(5), 1–20.

Feng, H., Morgan, N. A., & Rego, L. L. (2020). The impact of unprofitable customer management strategies on shareholder value. Journal of the Academy of Marketing Science, 48(2), 246–269.

Forbes. (2019). How can non-tech companies compete in the digital age? Retrieved 9 September 2020, from: https://www.forbes.com/sites/quora/2019/03/06/how-can-non-tech-companies-compete-in-the-digital-age/#300dd4552b59

Garbuio, M., & Lin, N. (2019). Artificial intelligence as a growth engine for health care startups: Emerging business models. California Management Review, 61(2), 59–83.

Geyskens, I., Gielens, K., & Dekimpe, M. G. (2002). The market valuation of internet channel additions. Journal of Marketing, 66(2), 102–119.

Geyskens, I., Steenkamp, J. B. E., & Kumar, N. (2006). Make, buy, or ally: A transaction cost theory meta-analysis. Academy of Management Journal, 49(3), 519–543.

Gielens, K., Geyskens, I., Deleersnyder, B., & Nohe, M. (2018). The new regulator in town: The effect of Walmart’s sustainability mandate on supplier shareholder value. Journal of Marketing, 82(2), 124–141.

Grewal, D., Hulland, J., Kopalle, P. K., & Karahanna, E. (2020). The future of technology and marketing: A multidisciplinary perspective. Journal of the Academy of Marketing Science, 48(1), 1–8.

Haleblian, J., Devers, C. E., McNamara, G., Carpenter, M. A., & Davison, R. B. (2009). Taking stock of what we know about mergers and acquisitions: A review and research agenda. Journal of Management, 35(3), 469–502.

Harrigan, K. R., & Newman, W. H. (1990). Bases of interorganization co-operation: Propensity, power, persistence. Journal of Management Studies, 27(4), 417–434.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47(1), 153–161.

Hewett, K., G. T. M. Hult, M. K. Mantrala, N. Nim, and K. Pedada (2021). Cross-border marketing ecosystem orchestration: A conceptualization of its determinants and boundary conditions. International Journal of Research in Marketing, Forthcoming.

Hillman, A. J., Withers, M. C., & Collins, B. J. (2009). Resource dependence theory: A review. Journal of Management, 35(6), 1404–1427.

Hinings, C. R., Hickson, D. J., Pennings, J. M., & Schneck, R. E. (1974). Structural conditions of intraorganizational power. Administrative Science Quarterly, 19(1), 22–44.

Hoeffler, S. (2003). Measuring preferences for really new products. Journal of Marketing Research, 40(4), 406–420.

Hollebeek, L. D., Sharma, T. G., Pandey, R., Sanyal, P., & Clark, M. K. (2021). Fifteen years of customer engagement research: a bibliometric and network analysis. Journal of Product & Brand Management, Forthcoming

Homburg, C., Vomberg, A., Enke, M., & Grimm, P. H. (2015). The loss of the marketing department’s influence: Is it really happening? And why worry? Journal of the Academy of Marketing Science, 43(1), 1–13.

Huang, M. H., & Rust, R. T. (2021). A strategic framework for artificial intelligence in marketing. Journal of the Academy of Marketing Science, 49(1), 30–50.

IDC. (2019). Worldwide spending on artificial intelligence systems will be nearly $98 billion in 2023, According to new IDC spending guide. Retrieved 9 September 2020, from: https://www.idc.com/getdoc.jsp?containerId=prUS45481219#:~:text=According%20to%20the%20recently%20updated,will%20be%20spent%20in%202019.

Ittner, C. D., & Larcker, D. F. (1997). Product development cycle time and organizational performance. Journal of Marketing Research, 34(1), 13–23.

Johnson, J. L., Sohi, R. S., & Grewal, R. (2004). The role of relational knowledge stores in interfirm partnering. Journal of Marketing, 68(3), 21–36.

Kalaignanam, K., & Bahadir, S. C. (2013). Corporate brand name changes and business restructuring: Is the relationship complementary or substitutive? Journal of the Academy of Marketing Science, 41(4), 456–472.

Kalaignanam, K., Kushwaha, T., & Swartz, T. A. (2017). The differential impact of new product development “make/buy” choices on immediate and future product quality: Insights from the automobile industry. Journal of Marketing, 81(6), 1–23.

Kalaignanam, K., Tuli, K. R., Kushwaha, T., Lee, L., & Gal, D. (2021). Marketing agility: The concept, antecedents, and a research agenda. Journal of Marketing, 85(1), 35–58.

Kashmiri, S., Nicol, C. D., & Arora, S. (2017). Me, myself, and I: Influence of CEO narcissism on firms’ innovation strategy and the likelihood of product-harm crises. Journal of the Academy of Marketing Science, 45(5), 633–656.

Katila, R., Rosenberger, J. D., & Eisenhardt, K. M. (2008). Swimming with sharks: Technology ventures, defense mechanisms and corporate relationships. Administrative Science Quarterly, 53(2), 295–332.

Keller, K. L. (1993). Conceptualizing, measuring, and managing customer-based brand equity. Journal of Marketing, 57(1), 1–22.

Kelm, K. M., Narayanan, V. K., & Pinches, G. E. (1995). Shareholder value creation during R&D innovation and commercialization stages. Academy of Management Journal, 38(3), 770–786.

Kiessling, T., Isaksson, L., & Yasar, B. (2016). Market orientation and CSR: Performance implications. Journal of Business Ethics, 137(2), 269–284.

Kim, T., & Mazumdar, T. (2016). Product concept demonstrations in trade shows and firm value. Journal of Marketing, 80(4), 90–108.

Kohli, A. K., Jaworski, B. J., & Kumar, A. (1993). MARKOR: A measure of market orientation. Journal of Marketing Research, 30(4), 467–477.

Kopalle, P. K., Kumar, V., & Subramaniam, M. (2020). How legacy firms can embrace the digital ecosystem via digital customer orientation. Journal of the Academy of Marketing Science, 48(1), 114–131.

Krush, M. T., Sohi, R. S., & Saini, A. (2015). Dispersion of marketing capabilities: Impact on marketing’s influence and business unit outcomes. Journal of the Academy of Marketing Science, 43(1), 32–51.

Kurt, D., & Hulland, J. (2013). Aggressive marketing strategy following equity offerings and firm value: The role of relative strategic flexibility. Journal of Marketing, 77(5), 57–74.

Lee, R. P., & Grewal, R. (2004). Strategic responses to new technologies and their impact on firm performance. Journal of Marketing, 68(4), 157–171.

Lee, R. P., Chen, Q., & Hartmann, N. N. (2016). Enhancing stock market return with new product preannouncements: The role of information quality and innovativeness. Journal of Product Innovation Management, 33(4), 455–471.

Lenz, I., Wetzel, H. A., & Hammerschmidt, M. (2017). Can doing good lead to doing poorly? Firm value implications of CSR in the face of CSI. Journal of the Academy of Marketing Science, 45(5), 677–697.

Longoni, C., Bonezzi, A., & Morewedge, C. K. (2019). Resistance to medical artificial intelligence. Journal of Consumer Research, 46(4), 629–650.

Longoni, C., & Cian, L. (2020). Artificial Intelligence in Utilitarian vs Hedonic Contexts: The “Word-of-Machine” Effect. Journal of Marketing. https://doi.org/10.1177/0022242920957347

Luo, X. (2008). When marketing strategy first meets wall street: Marketing spendings and firms’ initial public offerings. Journal of Marketing, 72(5), 98–109.

Luo, X., & Du, S. (2015). Exploring the relationship between corporate social responsibility and firm innovation. Marketing Letters, 26(4), 703–714.

Luo, X., Qin, M. S., Fang, Z., & Qu, Z. (2021). Artificial intelligence coaches for sales agents: Caveats and solutions. Journal of Marketing, 85(2), 14–32.

Luo, X., Tong, S., Fang, Z., & Qu, Z. (2019). Frontiers: Machines vs. humans: The impact of artificial intelligence chatbot disclosure on customer purchases. Marketing Science, 38(6), 937–947.

MacInnis, D. J., & Folkes, V. S. (2017). Humanizing brands: When brands seem to be like me, part of me, and in a relationship with me. Journal of Consumer Psychology, 27(3), 355–374.

Mathys, J., Burmester, A. B., & Clement, M. (2016). What drives the market popularity of celebrities? A longitudinal analysis of consumer interest in film stars. International Journal of Research in Marketing, 33(2), 428–448.

Miao, F., Kozlenkova, I. V., Wang, H., Xie, T., & Palmatier, R. W. (2021). An emerging theory of avatar marketing. Journal of Marketing, 0022242921996646.

Mizik, N., & Jacobson, R. (2003). Trading off between value creation and value appropriation: The financial implications of shifts in strategic emphasis. Journal of Marketing, 67(1), 63–76.

Moorman, C., & Day, G. S. (2016). Organizing for marketing excellence. Journal of Marketing, 80(6), 6–35.

Moorman, C., & Rust, R. T. (1999). The role of marketing. Journal of Marketing, 63(4_suppl1), 180–197.

Mun, K. C. (2021). Stock market reaction and adjustment speed to multiple announcements of accounting restatements. Journal of Economics and Finance, Forthcoming.