Abstract

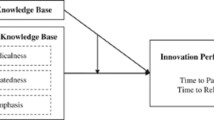

Innovation serves as a foundation for sustainable competitive advantage. Therefore, it is no surprise that firms seek to build an innovation base—a reservoir of inventions, ideas, and discoveries that serve as a platform for their innovation efforts. One approach for building an innovation base is acquisitions, though extant research reveals an equivocal verdict on whether acquisitions influence post-acquisition inventions. In this research, the authors focus on type of acquisition, acquisition behavior over time, and invention characteristics to investigate how acquisition behavior influences post-acquisition inventions. Analysis of 352 firms across five industries and 17 years reveals that firms who make acquisitions produce a stronger innovation base than those who make no acquisitions. Moreover, comparing effects across vertical and horizontal acquisitions, results indicate that the acquiring firm’s knowledge breadth plays an important role in determining which type of acquisition behavior generates the strongest influence on a firm’s innovation base.

Similar content being viewed by others

Notes

Although firms may pursue acquisitions for various reasons, industry research reveals that pursuit of growth and economies of scale are key drivers of M&A activity across the industries in our sample (e.g., Arensman 2007; Deloitte 2011; Maris 2012; PricewaterhouseCoopers 2011). While innovation plays an enabling role in firm growth and economies of scale, and firms may be specifically seeking innovation goals from their acquisitions, it is important to point out that regardless of the motivation for the acquisition, the acquiring firm gains the target firm’s resources during the acquisition.

We recognize that it is possible for firms following non-acquisition behavior to access external knowledge through other means. Our focus enables a direct comparison between acquisitions and no acquisitions. Further, inclusion of firms following non-acquisition behavior offers us a base against which to compare the effects of acquisition behavior on inventions.

It is possible that engaging in unrelated horizontal acquisitions will strain the firm’s resources to decrease the value of such a mixed acquisition approach. However, a vast majority of firms do not follow unrelated horizontal acquisition behavior (which was confirmed in our sample).

We performed a robustness check to determine whether results would differ if we removed the unrelated horizontal acquisitions from the analysis and found similar results.

We performed a robustness check on this proportion level, which we discuss in the Ancillary Analysis sub-section.

Estimation with a three-year post-acquisition period shows similar results, as discussed in the Ancillary Analysis sub-section and reported in Appendix A.

Analysis with all registered patents revealed similar results.

For example, one of Pfizer’s patents (patent #7,482,022) is entitled, “Palatable chewable tablet”. In the patent description, the Field of Invention (as stated within the patent documentation) is as follows: “The present invention relates to an oral chewable tablet, in particular, a chewable tablet that provides a palatable taste to mask the bitter taste of a pharmaceutical agent contained therein.” In the design and development of this invention, the two inventors reference 9 other U.S. patents (see www.uspto.gov). Therefore, this patent contains 9 backward citations. However, this patent has not yet been cited by any other patents, and therefore would receive 0 forward citations.

Poisson models are also the most appropriate for our analysis since they generate estimates that are consistent and asymptotically normal (Wooldridge 2001).

In our coding approach, we created two additional groups to account for firms that only engaged in a single acquisition.

We also examined our models using number of acquisitions rather than the contrast between acquisition and non-acquisition behavior. Results revealed a positive effect of total acquisitions when regressed upon invention importance (β = 69.83, p < 0.01) and when regressed upon invention domain (β = 185.09, p < 0.01).

References

Ahuja, G., & Katila, R. (2001). Technological acquisitions and the innovation performance of acquiring firms. Strategic Management Journal, 22, 197–220.

Albert, M. B., Avery, D., Narin, F., & McAlister, P. (1991). Direct validation of citation counts as indicators of industrially important patents. Research Policy, 20(3), 251–259.

Arensman, R. (2007). Top 50 electronics mergers and acquisitions of 2006. EDN Network, January, 23, 2007.

Asquith, P., Bruner, P., & Mullins, D. (1983). The gains to bidding firms from merger. Journal of Financial Economics, 11, 121–139.

Bahadir, S. C., Bharadwaj, S. G., & Srivastava, R. K. (2008). Financial value of brands in mergers and acquisitions: is value in the eye of the beholder? Journal of Marketing, 72(6), 49–64.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, 99–120.

Bierly, P., & Chakrabarti, A. (1996). Generic knowledge strategies in the U.S. pharmaceutical industry. Strategic Management Journal, 17(Winter Special Issue), 123–135.

Boulding, W., & Staelin, R. (1995). Identifying generalizable effects of strategic actions on firm performance: the case of demand-side returns to R&D spending. Marketing Science, 14(3), G222–G236.

Cameron, A. C., & Trivedi, P. K. (1998). Regression analysis of count data. Cambridge: University Press.

Capron, L. (1999). The long-term performance of horizontal acquisitions. Strategic Management Journal, 20(11), 987–1018.

Capron, L., & Hulland, J. (1999). Redeployment of brands, sales forces, and general marketing management expertise following horizontal acquisitions: a resource-based view. Journal of Marketing, 63(2), 41–54.

Chandy, R., Prabhu, J. C., & Antia, K. D. (2003). What will the future bring? dominance, technology expectations, and radical innovation. Journal of Marketing, 67(3), 1–18.

Chandy, R., Narasimhan, O., Hopstaken, B., & Prabhu, J. (2006). From invention to innovation: conversion ability in product development. Journal of Marketing Research, 43(3), 494–508.

Chang, H. F. (1995). Patent scope, antitrust policy, and cumulative innovation. RAND Journal of Economics, 26(1), 34–57.

Cialdini, R. B. (2001). Influence. Needham Heights: Allyn & Bacon.

Clark, K. B. (1989). Project scope and project performance: The effects of parts strategy and supplier involvement on product development. Management Science, 35(10), 1247–1263.

Cohen, J., & Cohen, P. (1983). Applied multiple regression/correlation analysis for the behavioral sciences (2nd ed.). Hillsdale: Lawrence Erlbaum Associates.

Cohen, W. M., & Levin, R. C. (1989). Empirical studies of innovation and market structure. In R. Schmalensee & R. D. Willig (Eds.), Handbook of industrial organization (Vol. 2, pp. 1059–1107). New York: North-Holland.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: a new perspective on learning and Innovation. Administrative Science Quarterly, 35, 128–152.

Comanor, W. S. (1967). Market structure, product differentiation, and industrial research. The Quarterly Journal of Economics, 81(4), 639–657.

Day, G. S., & Wensley, R. (1988). Assessing advantage: a framework for diagnosing competitive superiority. Journal of Marketing, 52(2), 1–20.

Deloitte (2011). The deloitte consumer products M&A survey: stick or twist? December.

Dierickx, I., & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage. Management Science, 36(12), 1504–1511.

Dutta, S., Narasimhan, O., & Rajiv, S. (1999). Success in high-technology markets: is marketing capability critical? Marketing Science, 18(4), 547–568.

Ernst, H., & Vitt, J. (2000). The influence of corporate acquisitions on the behaviour of key inventors. R&D Management, 30(2), 105–119.

Fuller, K., Netter, J., & Stegemoller, M. (2002). What do returns to acquiring firms tell us? Evidence from firms that make many acquisitions. Journal of Finance, 57(4), 1763–1793.

Golub, G. H., & Van Loan, C. F. (1996). Matrix computations. Johns Hopkins: University Press.

Greene, W. H. (2008). Limdep: Econometric modeling guide, Economic Software Inc.

Griliches, Z. (1990). Patent statistics as economic indicators: a survey, Journal of Economic Literature, 28(4), 1661–1707.

Hall, B. H., Jaffe, A. B., & Trajtenberg, M. (2001a). Market value and patent citations: a first look. working paper, U.C. Berkeley.

Hall, B. H., Jaffe, A. B., & Trajtenberg, M. (2001b). The NBER patent citation data file: lessons, insights, and methodological tools, NBER working paper 8498.

Hauser, J., Tellis, G. J., & Griffin, A. (2006). Research on innovation: a review and agenda for marketing science. Marketing Science, 25(6), 687–717.

Hausman, J., Hall, B. H., & Griliches, Z. (1984). Econometric models of count data with an application to the patents-R&D relationship. Econometrica, 53(4), 909–938.

Helfat, C. E., & Raubitschek, R. S. (2000). Product sequencing: Co-evolution of knowledge, capabilities and products. Strategic Management Journal, 21(10–11), 961–980.

Henderson, R. M., & Clark, K. B. (1990). Architectural innovation: the reconfiguration of existing product technologies and the failure of established firms. Administrative Science Quarterly, 35(1), 9–30.

Hendricks, K. B., & Singhal, V. R. (2009). Demand–supply mismatches and stock market reaction: evidence from excess inventory announcements. Manufacturing & Service Operations Management, 11(3), 509–524.

Hitt, M. A., Hoskisson, R. E., & Ireland, R. D. (1990). Mergers and acquisitions and managerial commitment to innovation in M-form firms. Strategic Management Journal, 11(Special Issue), 29–47.

Hitt, M. A., Hoskisson, R. E., Ireland, R. D., & Harrison, J. S. (1991). Effects of acquisitions on R&D inputs and outputs. Academy of Management Journal, 34(3), 693–706.

Hult, G. T. M., & Ketchen, D. J. (2001). Does market orientation matter? A test of the relationship between positional advantage and performance. Strategic Management Journal, 22(9), 899–906.

Jaffe, A. B., & Trajtenberg, M. (2002). Patents, citations & innovations: a window on the knowledge economy. Cambridge: MIT Press.

Jensen, M. (1988). Takeovers: their causes and consequences. Journal of Economic Perspectives, 2(1), 21–48.

Khoury, T. A., & Pleggenkuhle-Miles, E. G. (2011). Shared inventions and the evolution of capabilities: examining the biotechnology industry. Research Policy, 40(7), 943–956.

King, D. R., Dalton, D. R., Daily, C. M., & Covin, J. G. (2004). Meta-analyses of post-acquisition performance. Strategic Management Journal, 25(2), 187–200.

King, D. R., Slotegraaf, R. S., & Kesner, I. (2008). Performance implications of firm resource interactions in the acquisition of R&D-intensive firms. Organization Science, 19(2), 327–240.

Kogut, B., & Zander, U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383–397.

Lanjouw, J. O., & Schankerman, M. (2001). Characteristics of patent litigation: a window on competition. The RAND Journal of Economics, 32(1), 129–151.

Lanjouw, J. O., & Schankerman, M. (2004). Patent quality and research productivity: measuring innovation with multiple indicators. The Economic Journal, 114(495), 441–465.

Leonard-Barton, D. (1992). Core capabilities and core rigidities: a paradox in managing new product development. Strategic Management Journal, 13(Summer), 111–125.

Levin, R. C., Klevorick, A. K., Nelson, R. R., & Winter, S. G. (1987). Appropriating the returns from industrial research and development. Brookings Papers on Economic Activity, 3, 783–820.

Maris, D. (2012). What’s really driving the pharma M&A frenzy. April: Forbes. 27.

Menon, T., & Pfeffer, J. (2003). Valuing internal vs. external knowledge: explaining the preference for outsiders. Management Science, 49(4), 497–513.

Merges, R. P., & Nelson, R. R. (1994). On limiting or encouraging rivalry in technical progress: the effect of patent scope decisions. Journal of Economic Behavior & Organization, 25(1), 1–24.

Mizik, N. (2010). The theory and practice of myopic management. Journal of Marketing Research, 67(4), 594–611.

Modi, S., & Mishra, S. (2011). What drives financial performance—resource efficiency or resource slack? Evidence from U.S. based manufacturing firms from 1991 to 2006. Journal of Operations Management, 29, 254–273.

Moorman, C., & Miner, A. S. (1997). The impact of organizational memory on new product performance and creativity. Journal of Marketing Research, 34(1), 91–106.

Moorman, C., & Slotegraaf, R. J. (1999). The contingency value of complementary capabilities in product development. Journal of Marketing Research, 36(2), 239–257.

Narasimhan, O., Rajiv, S., & Dutta, S. (2006). Absorptive capacity in high-technology markets: the competitive advantage of the haves. Marketing Science, 25(5), 510–524.

Narin, F., Hamilton, K. S., & Olivastro, D. (1997). The increasing linkage between U.S. technology and public science. Research Policy, 26, 317–330.

Narin, F., Noma, E., & Perry, R. (1987). Patents as indicators of corporate technological strength. Research Policy, 16, 143–155.

Nonaka, I. (1994). A dynamic theory of organizational knowledge creation. Organization Science, 5(1), 14–37.

Peteraf, M. A. (1993). The cornerstone of competitive advantage: a resource-based view. Strategic Management Journal, 14(3), 179–91.

Porac, J. F., Wade, J. B., & Pollock, T. G. (1999). Industry categories and the politics of the comparable firm in CEO compensation. Administrative Science Quarterly, 44(1), 112–144.

Porter, M. E. (1987). From competitive advantage to corporate strategy. Harvard Business Review, 65(3), 43–59.

Prabhu, J. C., Chandy, R. K., & Ellis, M. E. (2005). The impact of acquisitions on innovation: poison pill, placebo, or tonic? Journal of Marketing, 69(1), 114–130.

PricewaterhouseCoopers (2011). Driving Value: Automotive M&A Insights 2010. (Source: www.pwc.com/auto)

Puranam, P., & Srikanth, K. (2007). What they know vs. what they do: how acquirers leverage technology acquisitions. Strategic Management Journal, 28(8), 805–825.

Ramaswamy, K. (1997). The performance impact of strategic similarity in horizontal mergers: evidence from the U.S. banking industry. Academy of Management Journal, 40(3), 697–715.

Rego, L. L., Billett, M. T., & Morgan, N. A. (2009). Consumer-based brand equity and firm risk. Journal of Marketing, 73(6), 47–60.

Reitzig, M., & Puranam, P. (2009). Value appropriation as an organizational capability: the case of IP protection through patents. Strategic Management Journal, 30(7), 765–789.

Rindfleisch, A., & Moorman, C. (2001). The acquisition and utilization of information in new product alliances: a strength of ties perspective. Journal of Marketing, 65(2), 1–18.

Robinson, R. B., & Pearce, J. A. (1983). The impact of formalized strategic planning on financial performance in small organizations. Strategic Management Journal, 4(3), 197–207.

Rusli, E. M. (2012). On wall street, renewed optimism for deal-making. The New York Times—Dealbook, January 2.

Schilling, M. A., & Phelps, C. C. (2007). Interfirm collaboration networks: the impact of large-scale network structure on firm innovation. Management Science, 53(7), 1113–1126.

Scotchmer, S. (1991). Standing on the shoulders of giants: cumulative research and the patent law. The Journal of Economic Perspectives, 5(1), 29–41.

Singh, H., & Montgomery, C. A. (1987). Corporate acquisition strategies and economic performance. Strategic Management Journal, 8(4), 377–386.

Slotegraaf, R. J., & Dickson, P. R. (2004). The paradox of a marketing planning capability. Journal of the Academy of Marketing Science, 32(4), 371–385.

Slotegraaf, R. J., Moorman, C., & Inman, J. J. (2003). The role of firm resources in returns to market deployment. Journal of Marketing Research, 40(3), 295–309.

Smith, D. K., & Alexander, R. C. (1988). Fumbling the Future. Morrow, New York.

Sorescu, A. B., Chandy, R. K., & Prabhu, J. C. (2007). Why some acquisitions do better than others: product capital as a driver of long-term stock returns. Journal of Marketing Research, 44(1), 57–72.

Swaminathan, V., Murshed, F., & Hulland, J. (2008). Value creation following merger and acquisition announcements: the role of strategic emphasis alignment. Journal of Marketing Research, 45(February), 33–47.

Trajtenberg, M. (1990). A penny for your quotes: patent citations and the value of innovations. RAND Journal of Economics, 21(1), 172–187.

Wade, M., & Hulland, J. (2004). Review: the resource-based view and information systems research: review, extension, and suggestions for future research. MIS Quarterly, 28(1), 107–142.

Walker, R. D. (1995). Patents as scientific and technical literature. Lanham: Scarecrow Press.

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171–180.

Wind, J., & Mahajan, V. (1997). Issues and opportunities in new product development: an introduction to the special issue. Journal of Marketing Research, 34(1), 1–12.

Wuyts, S., Dutta, S., & Stremeresch, S. (2004). Portfolios of interfirm agreements in technology-intensive markets: consequences for innovation and profitability. Journal of Marketing, 68(2), 88–100.

Ziedonis, R. M. (2004). Don’t fence me in fragmented markets for technology and the patent acquisition strategies of firms. Management Science, 50(6), 804–820.

Acknowledgements

The authors appreciate the valuable comments from Frank Acito, Jonlee Andrews, Aric Rindfleisch, and Demetrios Vakratsas on prior versions of this manuscript. In addition, the authors appreciate the financial support of the Social Sciences and Humanities Research Council of Canada (SSHRC) awarded to the first author and of Whirlpool Corporation awarded to the second author. The authors also thank Ayushman Dutta, Julia Hoenig Ferguson, Sowmya Gogineni, Rahul Gupta, Kelly Roses, Caroline Roux, James Sturgeon, Judy Xian, and Jason Yau for their valuable research support.

Author information

Authors and Affiliations

Corresponding author

Appendix A

Appendix A

Rights and permissions

About this article

Cite this article

Mishra, S., Slotegraaf, R.J. Building an innovation base: exploring the role of acquisition behavior. J. of the Acad. Mark. Sci. 41, 705–721 (2013). https://doi.org/10.1007/s11747-013-0329-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11747-013-0329-6