Abstract

This paper uses a broad geographical sample of economies to study stock market integration during the classical Gold Standard. It is novel in estimating a common or “global” component of stock market returns across all countries in the sample and studying how individual markets co-move with this. Variations in the integration of individual exchanges often appear related to large domestic financial and political crises as idiosyncratic shocks were more common than they are today. The results suggest that although overall integration rose during this period, it was low compared to more recent data. The results are robust to alternative formulations of the global component and alternative measures of returns.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The high degree of financial integration during the Classical Gold Standard is well established in the literature. Obstfeld and Taylor (2005) point to the role of the Gold Standard in driving a convergence in interest rates across countries and increases in capital flows. They refer to the period between 1870 and the First World War as when ‘the first age of globalization sprang forth’ (Obstfeld and Taylor 2005, p. 25). O'Rourke (2002, p. 2) notes that this was ‘the period that saw the largest decline ever in inter-continental barriers to trade and factor mobility’. Various other studies have shown that integration was high when measured by the efficiency of international arbitrage (Canjels et al. 2004), capital account openness (Quinn 2003), capital exports (Esteves 2006, 2011) and movements in sovereign bond markets (Volosovych 2011; Mauro et al. 2002).

However, while studies have considered various aspects of integration during this period, relatively little is known about the integration of stock markets generally. Nonetheless, as noted in Bekaert and Mehl (2019), more recent studies have challenged the view that financial globalization was largely driven by debt and foreign direct investment, opening a broader discussion on integration in other segments of financial markets.

This paper studies stock market integration across eight markets using monthly data capturing both the most industrialized countries and emerging markets, during the Classical Gold Standard. In the first instance, the data are used to identify a ‘global component’ of stock markets. The co-movement of the stock markets with this global component gives us a measure of the integration of each of the eight individual markets. While this method has been used in studies of more recent stock market data (Pukthuanthong and Roll 2009) and in measures of integration in other markets (Volosovych 2011; Ciccarelli and Mojon 2010) this is, to my knowledge, the first paper to do so for this period. In the first instance, these co-movements are related to historical events to understand the pattern of integration in individual markets.

This paper is novel in being the first to use such a broad geographic sample to study stock market integration during the Gold Standard period and relate it to historical events. Existing studies focusing on the Gold Standard period deal largely with the integration between two or three stock markets (for instance, Campbell and Rogers 2017; Stuart 2017, 2018). Some studies use long datasets reaching from the present day back to the Gold Standard. These use data on four or five markets during the Gold Standard, but their focus is generally to obtain an overall composite measure of integration rather than to explain the integration of individual markets and the discussion generally focusses on more recent developments (Goetzmann et al. 2005; Quinn and Voth 2008; Bastidon et al. 2018; Bekaert and Mehl 2019). As such, the developments in individual markets during the Gold Standard are not considered or placed within the context of historical events. There is therefore little comparable literature for this study.

The paper is also unusual in using a balanced sample of stock markets for the entire sample. Since existing studies use data from fewer countries for the time under review here, they generally add markets over time, which makes it difficult to interpret changes in the level of integration. As an example, consider the integration of two markets measured in each of two years using the average pairwise correlation. Suppose that the integration between these two markets is 0.20 in the first and second year. Assume furthermore that in the second year, data become available on a third market with a pairwise correlation of 0.30 with each of the other markets. Now measured integration – the average pairwise correlation – increases from the first to the second year, but this is only because of the addition of the third market to the sample. In contrast, when a balanced panel is used, changes in measured integration are not due to the inclusion of additional markets.

Having considered the integration of individual markets, we compute a composite measure of integration by taking the cross-sectional average of the individual measures of stock-market integration and relate changes in this composite measure to financial crises. The findings broadly support those in the literature that integration increased in the years before the First World War. However, the paper adds to the literature by showing that the findings are robust to (a) the way in which the stock indices have been compiled and (b) the methodology used. A further contribution of this paper is to study how financial crises have impacted on the overall level of integration during the Gold Standard.

Finally, there is frequent discussion in the literature about the level of integration during the Gold Standard compared to recent times. Some studies find that integration exhibited a ‘J-shaped’ or ‘swoosh’ trend whereby integration at the end of the twentieth century was higher than in the late-nineteenth century periods (Volosovych 2011; Bekaert and Mehl 2019), while others argue that integration or capital mobility was similar or higher in the Gold Standard compared to the Gold Standard (Baldwin and Martin 1999; Bordo and Murshid 2006; Bastidon et al. 2018). However, as noted above, these studies often use unbalanced panels to compare integration among a narrow set of markets during the Gold Standard with a much broader set of markets more recently. This paper adds to that discussion by comparing the level of integration in stock markets during the Gold Standard with that observed today using the same markets.

There are five main findings. First, all stock markets co-move with the global component, albeit to varying extents. Thus, there was integration across a broad sample of stock markets during this period.

Second, the pattern of integration in individual countries coincides with important historical events in these countries. In particular, large country-specific political upheavals, such as the revolution in Russia in 1905 and the devolutionist Home Rule movement in Ireland, and large financial crises, such as the Australian crisis of 1893 and the crisis in France in 1881 appear to reduce the integration of exchanges in the affected countries. International crises, particularly the 1907 financial crisis, are also apparent in the data. However, there is less evidence of widespread contagion during these episodes than is observed in the more recent data for the same countries.

Third, the overall level of integration increases during the Gold Standard, particularly in the first half of the sample period. However, reflecting the more idiosyncratic nature of shocks, the role of financial crises for overall integration is less clear. Nonetheless, there is tentative evidence that integration is reduced by financial crises.

Fourth, the level of integration of the stock markets studied during the Gold Standard was much lower than among the same eight markets in the last 35 years.

Fifth, the results are robust to the use of alternative stock price measures, alternative formulations of the global component and an alternative measure of integration.

The paper is structured as follows: The next section motivates the exchanges used in the study, discusses the data and presents some descriptive statistics. Section 3 discusses the choice of methodology. Section 4 presents the results both in terms of the integration of the individual exchanges and overall integration. Section 5 sets out the various robustness checks carried out. Section 6 concludes.

2 Exchanges and data

2.1 Exchanges

Monthly data from eight stock exchanges are collected from secondary sources for the period 1879–1914. The eight exchanges represent Australia, Belgium, France, Ireland, Germany, Russia, the UK and the US. To the author’s knowledge, this is the broadest geographical sample of monthly data that are available for the sample period considered here.Footnote 1 Moreover, the exchanges represent both industrialized and emerging market economies, which experienced interesting and important economic and political developments during the period. On the basis of GDP, the sample includes 6 of the 13 largest economies in 1900, a result that is more or less consistent through the nineteenth century.Footnote 2 Moreover, measures of market size calculated by Rajan and Zingales (2003) suggest that in 1913, several of the exchanges used here were large in international comparison (Table 1). By market capitalization as a percentage of GDP, the UK, Belgium and France are the third, fourth and fifth largest in a sample of 23 exchanges, only surpassed by exchanges in Cuba and Egypt where GDP was very low. Moore (2010) also provides data on the absolute size of market capitalization for 12 exchanges, by which count, the UK, US, France and Germany are the four largest exchanges in 1913. Finally, Rajan and Zingales (2003) also measure size by the number of listed firms on the exchange per million of population. By this measure, four of the ten largest exchanges (Belgium, Australia, UK and Germany) are included in the sample used here.

Moreover, Australia experienced large capital inflows during the period, in a manner that marked it as an emerging market economy. British capital investment in Australia grew rapidly through the 1880s, reaching more than 10% of Australian GDP in 1888 (Quinn and Turner 2020, p. 78). This investment spilled into a property market already fuelled by a marriage boom, rising population and urbanization, and into which the domestic banking system was already lending heavily (Hickson and Turner 2002). The unwinding of the bubble, which began in 1888, but was full force in the early 1890s, saw British capital inflows slow as the Baring crisis took hold, and even reverse in 1893. As noted by Merrett (1989, p. 60), although other countries experienced crises in the 1890s, the extent of the crisis in Australia was ‘unmatched elsewhere’: GDP per capita did not return to its 1888 level until the 1900s.

Russia also experienced strong capital inflows followed by a financial crisis between 1899 and 1902, and subsequently the revolution in 1905. Rapid industrialization in the 1890s was interrupted when foreign capital inflows into government bonds and industrial securities declined in the aftermath of the Baring crisis. A rescue package was largely successful, but Lychakov (2020) notes that the effect was to re-distribute income and wealth from workers to capitalists. The revolution of 1905 began with labor strikes that are usually attributed to poor living conditions for workers (Korelin et al. 2005) and resulted in some constitutional reforms. Lenin later noted that the 1905 revolution was ‘The Great Dress Rehearsal’, without which the 1917 revolution would have been impossible (Ascher 1994).

Although not independent at the time, the devolutionist ‘Home Rule’ movement generated several political crises in Ireland during this period. Hickson and Turner (2005) identify an idiosyncratic slowdown in the Irish stock market after 1897.Footnote 3 They note that it was generally expected by the late 1890s that Home Rule would take place, leading to increasing uncertainty among investors. This was exacerbated by signs that the new regime, when it came to power, might follow redistributive policiesFootnote 4 and the fact that populist nationalism generally perceived banks to be working against the national interest (Ollerenshaw 1997).

In addition to these idiosyncratic shocks, there were several international crises. Neal and Weidenmier (2002) identify large international financial crises in 1890, 1893 and 1907. The Baring crisis in 1890 originated in the deterioration of the economy in Argentina which spilled over into the London market and then onwards. The 1893 crisis originated in the United States with a banking crisis combined with a currency crisis created by the Silver Purchase Act of 1893. Various studies argue that Australia, Italy, and Germany (Bordo and Eichengreen 1999) and Netherlands, Austria and Switzerland (Neal and Weidenmier 2002) were affected by it. Overall, however, the international spillovers from these crises appear to have been less pronounced than that of the 1907 crisis. That crisis originated from the Bank of England refusing to discount US bills in the wake of the San Francisco earthquake and was sparked by the failure of the Knickerbocker Trust. This crisis was very serious and its effects widespread: contagion has been identified as ‘nearly universal in Europe’ by Neal and Weidenmier (2002, p. 30).

There are therefore several interesting idiosyncratic and common shocks against which to consider the integration of stock markets during the period.

2.2 Data

The data sources and descriptions are provided in the Data Appendix. Naturally, our preference is to use indices that are as similarly constructed as possible. Where more than one index is available for an exchange, preference is given to indices of capital gains (price changes exclusive of dividends),Footnote 5 those with the broadest possible sectoral coverage and weighted by market capitalization.

Nonetheless, there are several ways in which the indices may differ. First, when the data is recorded is not uniform: data may be month-end or monthly averages. Moreover, due to time differences, trading will take place at different times, and therefore the issue of whether opening or closing prices are collected becomes relevant. However, in historical data, intra-day (or indeed daily) data are generally not available.Footnote 6 Second, the weighting is not always uniform. For instance, for Russian data, market capitalization is not available and so it is not possible to calculate a market-capitalization weighted index. Third, cross-listings are present in the indices. To the extent possible, series that capture domestic firms are used, however, this is not possible in all cases. Fourth, in the case of France, a blue-chip index is preferred to a broader index, since the broader index suffers from survivorship bias.

Some of these issues will tend to lower measured co-movements between series (narrower sectoral coverage, different weighting), while others (cross-listings) will tend to increase them. However, differences in index compilation are common in both historical and more recent studies.Footnote 7 As a robustness check, in Sect. 5 I show that using alternative measures of some of the markets does not materially impact the main results.

Average monthly percentage returns, variances and correlations for each market over the entire sample period are presented in Table 2. Average percentage returns are highest in Germany and the US, and lowest in France, Ireland and the UK. US returns exhibit the highest variance over the full sample, followed by the Russian and German indices. The Australian, Irish and UK returns have the lowest variance. The lower panel of Table 2 presents pairwise correlation coefficients for the returns. The highest correlation coefficients are between the UK and Belgian, Irish and US returns, and the Belgian and German returns, all of which are above 0.30, while Australia and Russia generally have low pairwise correlations.

What drives the individual pairwise correlations? In some cases, this is likely to be cultural, legal and institutional ties. Perhaps unsurprisingly, the pairwise correlation between the Irish and UK exchanges is particularly high. The close relationship between these two markets has been documented by Stuart (2018). The integration of ‘provincial’ UK stock exchanges with London has also been studied (Campbell et al. 2016).

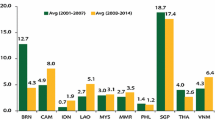

Correlations may also be driven by different sectoral representation across countries and indices. Figure 1 presents data on the sectoral composition of exchanges in 1900 by market capitalization. Information on the sectoral composition is not available for all indices and the data are primarily from Moore (2010), augmented with additional information where possible on the specific indices used in this study.Footnote 8 This limitation should therefore be borne in mind when interpreting the figure. It is evident that the sectoral distribution is not uniform across exchanges. For example, the Australian series, which has generally low pairwise correlations with the other series, is comprised entirely of manufacturing listings. In contrast, the figure is just 37% in the Belgian exchange, which has the second largest share of manufacturing. Similarly, the Belgian and German exchanges have a relatively high pairwise correlation. This may reflect the fact that both have a low weight on transport but relatively heavy weights on manufacturing, finance and resources.

Sectoral composition of indices. Sources: Moore (2010) except: Australia (from Lamberton 1958), Ireland (from Grossman et al. 2014) and Belgium (from Annaert et al. 2012). Sectoral data for Ireland are only provided for finance and railways (here included as transport); the remainder is listed as ‘other. For Belgium, the breakdown is for industrials (here included as manufacturing), mining (here included as resources) and finance and transport. The exact figure is reported for finance, while approximations of 20% are provided for the remaining sectors

On the other hand, the French exchange has generally low pairwise correlations with most other exchanges, except the German exchange. Both of these exchanges appear to have similar weights on finance and transport which may drive their pairwise correlation. However, the French exchange does not have a particularly unusual composition overall compared to the other exchanges. It therefore seems possible that the blue-chip nature of the French exchange may be resulting in lower correlations. I consider the impact of using a blue-chip index further in Sect. 5.

3 Methodology

3.1 Measuring integration

In this paper, I apply a global component methodology which has been used in various strands of the literature on integration (e.g., Pukthuanthong and Roll (2009; Volosovych 2011; Ciccarelli and Mojon 2010; Gerlach and Stuart 2021). The methodology used here draws most heavily on the first two of these papers. Specifically, I calculate the global component as the first principal component of the data (Volosovych 2011) and then regress the returns of each index on the global component. Integration is then measured using the r-squareds from these regressions (Pukthuanthong and Roll 2009).

In standard principal component analysis, the components are calculated by obtaining the eigenvectors and eigenvalues of the variance–covariance matrix. The eigenvectors are sorted by decreasing eigenvalues to obtain the weightings. These weightings are then multiplied by the underlying series – in this case, the returns series. As a result, eight principal components are obtained.Footnote 9 The first principal component is the series obtained by multiplying the eigenvector associated with the largest eigenvalue by the underlying series and is therefore the component that captures the most variance.

Once the global component is estimated, the r-squared is stored from a regression of the global component on the return on each exchange. That is:

where \(r_{i,t}\) is the return on exchange i at time t and \(r_{t}^{g}\) is the global component. Since there is evidence that over the sample period the variance–covariance matrix of the returns changed,Footnote 10 I use a rolling window. Thus, the global component computed for the three-year period January 1879 to December 1881 is included in Eq. (1) and the measure of integration is reported for 1880. The window is then rolled forward one year, and the process repeated.Footnote 11

This analysis is conducted for each of the eight stock price series and two measures of integration are then calculated: the individual level of integration of each market is measured using the r-squared from these regressions, and the mean of the individual r-squareds at each point in time is the measure of overall integration.Footnote 12

3.2 Discussion of global component methodology

The literature on historical stock market integration provides many methods for measuring integration and co-movements in data. These include the r-squared from the regression of returns on one index on those of another (Campbell and Rogers (2017)), average pairwise rolling correlations of a set of returns (Goetzmann et al. 2005; Quinn and Voth 2008), factor models (Bekaert and Mehl 2019), multivariate GARCH models (Stuart 2017, 2018) and network analysis (Bastidon et al. 2018; Bastidon et al. 2019).

To the author’s knowledge, the global component methodology has not previously been applied to historical data. One question is why this is the case. The broader sample in this paper compared to other studies of the same period means that this is a particularly interesting methodology to use. In a study with data on three or four exchanges, the concept of a ‘global component’ is poorly defined, whereas with the eight exchanges included here it becomes possible to estimate it more precisely. Nonetheless, the number of series is somewhat smaller than that used in Pukthuanthong and Roll (who use 17 series compared to 8 here).

This raises the question of whether the smaller number of series used here could lead to one exchange having an outsize impact on the global component. In principal component analysis, this is possible if one series has a particularly large variance compared to the others. For this reason, standardized data are used for the analysis.Footnote 13

Furthermore, to avoid any suspicion that a high co-movement between an individual series and the global component is driven by that series having a heavy weight in the global component, in Sect. 5 I carry out a robustness check in which I calculate the global components separately for each exchange, using the other seven series only. Overall, this has little impact on the results. Thus, it appears that the global component methodology works well on the data presented here.

A second question is the use of monthly data in this study compared to Pukthuanthong and Roll’s (2009) study of more recent stock market integration, which uses daily data. The concept of a 'global component’ has been used to measure integration in other markets besides stock returns and using data at a similar or lower frequency compared to that used here. In particular, Ciccarelli and Mojon (2010) employ several methods to calculate a global component of (monthly) inflation rates across countries using several methods, in the period since 1960. In a historical setting, Gerlach and Stuart (2021) use a similar methodology to study co-movements in annual inflation rates between countries during the Gold Standard. Volosovych (2011) calculates a global component of 15 countries’ monthly sovereign bond yields over a sample period beginning in 1875. Finally, in the absence of daily data, historical studies of stock market integration are generally carried out on monthly or even annual data.

However, exactly how the global component is calculated varies across studies. Therefore, in Sect. 5 I calculate the global component using two alternative methodologies (Pukthuanthong and Roll (2009; Ciccarelli and Mojon 2010). Moreover, in Sect. 5 I also compare the results using the global component methodology to the average pairwise rolling correlations, which is one of the more widely used methods in the historical stock market literature.

4 Results

4.1 Factor loadings and principal components

Principal component analysis provides additional insights into the nature of co-movements in the series during this time. First, Fig. 2 shows the average proportion of the variance accounted for by each principal components over the sample period. Although it rises somewhat over the sample period, the first principal component generally accounts for approximately 20 to 40 per cent of the variance in the series. This is lower than the proportion of variance the first principal component accounts for in the more recent data since 1985 for the same exchanges (over 90 per cent) (see Sect. 4.4 and the Data Appendix for a discussion of more recent data).Footnote 14

Second, the factor loadings, or weights, used to calculate the principal components are often negative, indicating that at least one exchange moves in a different direction from the global component (Fig. 3). It is relatively rare for more than one country to have a negative loading at the same time. However, less than a third of the time (30 per cent), the first principal component loads positively onto all eight series. For instance, around the episodes of international contagion identified by Neal and Weidenmier (2002) in the early 1890s and around the crisis of 1907, usually one or two exchanges has a negative loading. This implies that the full sample of countries was not affected by the crisis and that it was limited in geographical scope.

In contrast, similar analysis carried out on recent data for the same countries indicates that almost always the first principal component loads positively on all series. Thus, the nature of shocks has changed: many of the shocks during the Gold Standard were not so much ‘global’ as specific to one or two countries. Overall, these stylized facts from the principal component analysis suggest that shocks were more idiosyncratic during the Gold Standard than they are today.

4.2 Which exchanges were most integrated?

With this in mind, we turn to Fig. 4, which shows the 5-year moving average of the r-squareds from the individual country level regressions in Eq. (1). In many cases, large financial and political events appear to impact the integration of the individual exchanges. Perhaps unsurprisingly, the UK exchange, as the largest exchange during this sample period, is among the most highly integrated throughout most of the sample. The US, which was growing in size and influence as a financial center, shows a marked increase in integration over the sample. The French market was highly integrated at the start of the sample period, but there is rapid disintegration in the wake of the crash of 1882. This was the worst crisis experienced by the Paris stock market in the nineteenth century, requiring an emergency loan from the Banque de France to avoid a closure (White 2007). The level of integration does not begin to recover until the late 1890s.

The global component generally explained the least variation in the Australian returns, where the r-squared is always below 0.15. However, the level of integration of the Australian exchange is generally increasing in the second half of the 1880s, as capital flowed into the economy, particularly the booming property market. As the bubble unwinds the level of integration declines and trends downwards until at least the mid-1900s, in line with Quinn and Turner’s (2020) assessment that the effects of the Australian bubble were long lasting.

The level of integration of the Russian market rose from the late 1880s, before leveling out in the early 1890s when capital flows slowed in the wake of the international crises in the early 1890s. However, integration rises again, and sharply, in the late-1890s as the economy industrialized and capital flowed into the country, reaching a peak during the financial crisis between 1899 and 1902. There is a rapid decline thereafter, which is compounded in the wake of the Revolution of 1905.

The integration of the Irish market increases rapidly in the first half of the sample, reaching a peak in the late 1890s, at just the time that Hickson and Turner (2002) identify how increasing uncertainty around the Irish political situation gave rise to an idiosyncratic decline in the Irish stock market. The uncertainty around the Home Rule movement remained unresolved until after the First World War and the level of integration generally declines for the remainder of the sample.

Turning to large, international crises, given the three-year window, the effects of the Baring crisis in 1890 and crisis of 1893 are difficult to disentangle. Furthermore, with the exception of Germany, the US and Ireland, the level of integration of most exchanges appears relatively stable. However, the failure of the Knickerbocker Trust in the US and the crisis of 1907 is also an interesting episode. Neal and Weidenmier (2002) find that this crisis had widespread spillovers, particularly in Europe. The effect is an increase in measured integration in France, Russia, Germany, the UK and Belgium. In contrast, the US, which had effectively been excluded from the London discount market in the year prior to the crisis, becomes less integrated over this period. Neal and Weidenmier (2002) identify this as an example of what can happen when a country is excluded from an interdependent system when its financial needs are greatest: attempts to shelter the rest of international system from an idiosyncratic shock in one financial center are likely to prove fruitless.

4.3 Overall integration during the Gold Standard

The overall level of integration is measured by the cross-sectional average of the eight individual r-squareds from the regression in Eq. (1) in each window. The results are presented in Fig. 5. Two points are of note. First, following an initial decline, the average r-squared increases through to the end of the nineteenth century. Thus, the first part of the classical Gold Standard era was one during which markets became more integrated. Second, after reaching a maximum level around the turn of the century, integration levelled out or increased only marginally. Overall, it appears that perhaps the benefits of the Gold Standard for integration were largely realized at the start of the sample period.

Compared to the existing literature, Goetzmann et al. (2005) find a similar decline in integration the early 1880s, while those authors and Bekaert and Mehl (2019) find that integration subsequently increased almost continuously until the First World War. Quinn and Voth (2008) also find an increase in integration from the start of their sample period in the 1890s until 1913, although in their study integration peaks in the early 1900s. Overall, although the patterns are not identical, the results are broadly similar in finding an increase in integration in the years before 1913.

The large international crises identified by Neal and Weidenmier (2002) in 1890, 1893 and 1907 are not very marked in the overall pattern of integration. This may be because, as noted, idiosyncratic shocks were more important then than now. Moreover, even when there were spillovers, markets were affected in different ways, as we have seen with the failure of the Knickerbocker Trust in 1907. However, the measure of integration does appear to be somewhat more volatile around these periods.

To consider the role of financial crises in more detail, in addition to the number of series on which the first principal component loads negatively at each point in time, Fig. 3 shows the number of countries experiencing a crisis (banking, currency or twin crisis) in a given year. This indicator is sourced from Bordo et al. (2001) who describe their measures in detail (Bordo et al. (2001), p. 55). Specifically, banking crises are defined if financial distress leads to “the erosion of most or all of aggregate banking system capital”. Currency crises are defined as “a forced change in parity, abandonment of a pegged exchange rate, or an international rescue”. Moreover, the authors construct an index of exchange market pressure,Footnote 15 with a currency crisis occurring when this index exceeds a critical threshold. From Fig. 3 it appears that there is some correlation between this crisis indicator and negative loadings: periods of negative loadings cluster around the financial crises in the early 1890s and 1907 and the depression in the early- to mid-1880s.

I begin by estimating a univariate regression of overall integration on the crisis indicator, and find it is significant with a negative sign, suggesting that financial crises reduce integration (Table 3).Footnote 16 This is in line with the evidence in Fig. 3 that usually only one or two countries experience negative factor loadings in a given window. However, other factors could also impact stock market co-movements, including trade openness, inflation rates and government surpluses (see Volosovych (2011) for a discussion).Footnote 17 I therefore next regress the measure of integration on the crisis indicator and this set of control variables. The coefficient on the crisis indicator is still significant and negative (Table 3). While this provides some evidence for the role of financial crises in driving the pattern of integration/disintegration during the period, it is noted that the result is not completely robust to the use of other measures of the global component, as shown in Sect. 5.

4.4 How integrated were stock markets?

Whether the level of integration during the Gold Standard was high or low is difficult to judge in isolation. There is a discussion in the literature regarding the relative levels of integration during the Gold Standard and the more recent period. For instance, Baldwin and Martin (1999) argue that capital mobility was perhaps higher during the classical gold standard than in recent decades. Bordo and Murshid (2006) draw the same conclusion while Bastidon et al. (2018) argue that financial market integration exceeded that of the late nineteenth century only in the 10 years prior to the publication of their study. In contrast, Volosovych (2011) and Bekaert and Mehl (2019) find that integration exhibited a ‘J-shaped’ or ‘swoosh’ trend whereby integration at the end of the twentieth century was higher than in the late-nineteenth century periods, with a decline in integration in between.

Therefore, I next compare the level of integration during the Gold Standard obtained above with more recent data. For this analysis I collect data for the same set of countries from the OECD for the period 1985 to 2020 (the same length as the sample for the Gold Standard above).Footnote 18 Russian data is not available prior to 1997 and is therefore excluded from this analysis.Footnote 19

Using all three methodologies, the level of integration, as measured by the average r-squareds, ranges from 0.56 to 0.93 (Fig. 6). Thus, the level of integration is significantly higher in more recent times than it was during the Gold Standard across all measures. Indeed, the average r-squareds in the recent data are approximately twice as large compared to those during the Gold Standard. This result suggests stock market integration exhibited a ‘J-shaped’ or ‘swoosh’ pattern similar to the findings of Volosovych (2011) and Bekaert and Mehl (2019).

5 Robustness

5.1 Weighting, stock choice and cross-listings

To check that these results are not driven by the specific measure of stock prices chosen, I first test alternative measures which are available for the various stock markets and compare the average r-squareds from the resulting estimates from Eq. (1). I report the correlation of the resulting average r-squareds with those obtained using the baseline series as in Table 4 while Fig. 7 shows the various measures of integration obtained using these alternative series.

In the first instance, I consider the Irish data since price-weighted and unweighted series are both available from the same underlying dataset as the baseline, market-capitalization weighted series. Interestingly, the correlation between the new measure of integration and the baseline measure is never less than 0.91 (Table 4).

Unweighted indices are also available for Belgium and France from the same sources as the baseline specification. When all three of these series (including for Ireland) are substituted into the analysis, the overall findings are unchanged (Fig. 7), although the correlation coefficient between the average r-squareds is somewhat lower at 0.64 (Table 4).

Alternative price-weighted data are available for the UK and US although these series differ from those used in the baseline specification in more ways than the weighting.Footnote 20 These additional differences will tend to reduce the correlation. Nonetheless, Fig. 7 shows that the general trend remains the same, although the correlation coefficients also in this case are about 0.64 (Table 4).

Finally, I include the most diverse set of data series possible in the analysis (the price-weighted data for the UK, US and Ireland and the unweighted data for Belgium and France, as well as the baseline data for Germany and Russia).Footnote 21 Changing all five series like this leads to a lower correlation coefficient, at 0.39. However, the overall pattern of integration during the period, as illustrated in Fig. 7, is broadly the same. Overall, it seems that the weighting of the series is not driving the results.

Weighting is not the only way in which series can differ. Some series include a narrower set of firms that others. For instance, the French index is a blue-chip index. To understand what the effect of this might be, I use a blue-chip index calculated by Campbell, et al. (2019) for the UK. The results are presented in the lower panel of Table 4 and Fig. 7. The correlation coefficients are in the region of 0.97 and above, and the overall pattern of integration is generally unchanged.

Finally, cross-listings are likely to cause co-movement between indices. In the baseline specification, I have used indices focused on the domestic market where possible. However, Campbell et al. (2019) also provide a broad index of all listings on the London market.Footnote 22 In the first instance, I include this in the model as before. The correlations is always in excess of 0.90 (Table 4). Next, I look at the loading of the first principal component on the UK series when the broader and baseline (narrower) indices are used (Fig. 8). The evolution of the factor loadings through the 3-year windows is similar: as might be expected the broader series generally has a marginally higher factor loading, but this is relatively constant throughout the sample period. There is a period in the late 1880s when the factor loading turns negative for both series and it takes a little longer for the broad index to regain positive loadings. However, overall, the mean difference between the two series is less than 0.03. This suggests that cross-listings are not significantly altering the main findings.

Overall, therefore, the choice of weighting and the general composition of the index does not have a significant impact on the broad pattern of integration during the Gold Standard.

5.2 Rolling correlations

To ensure that the global component methodology is not driving the results, I next compare my results with a rolling average pairwise correlations which are used in the existing literature to calculate integration (Goetzmann et al. 2005; Quinn and Voth 2008). Specifically, I calculate pairwise correlations for every series on the same rolling 3-year window as used in the earlier analysis, resulting in 28 correlation coefficients in each of the 33 windows. The average of these 28 correlation coefficients is calculated and presented in Fig. 5 (read off the right-hand axis). Overall, the pattern is very similar to the baseline measure of integration, and the correlation coefficient is 0.83. In terms of the role of crises, results from regressions of the rolling correlation on the crisis indicator are included in Table 3 and suggest that the crisis indicator is statistically significant.

Overall, it seems that the methodology to capture the global component is not driving the main results of the paper.

5.3 Alternative calculations of the global component

Existing studies use various methods to calculate the ‘global component’. I therefore calculate the global components in two alternative ways. The first draws on Pukthuanthong and Roll (2009) who use ‘out-of-sample’ principal components as the global component while the second draws on Ciccarelli and Mojon (2010), who use the unweighted average as the global component of inflation rates across countries using several methods, in the period since 1960. Although on the surface these methods may appear quite different, all three are essentially (weighted) averages of the data.Footnote 23

To calculate ‘out-of-sample’ principal components, Pukthuanthong and Roll (2009) use a lagged variance–covariance matrix to calculate weightings and applies these to current data. Thus, the weightings (eigenvectors) computed from the three-year period January 1879 to December 1881 variance–covariance matrix are applied to the returns in the period January 1882 to December 1884. The window is then rolled forward one year, and the process repeated.

The average of the r-squareds from Eq. (1) using the first out-of-sample principal component and the cross-sectional mean are also presented in Fig. 5.Footnote 24 The pattern is similar to that when the standard calculation of the first principal component is used. The pairwise correlation coefficients between the three measures is never less than 0.83. Overall, it seems that all three measures of the global component yield a similar conclusion regarding the path of integration.

Turning to the role of crises, results for regressions of these measures of integration on the crisis indicator are included in Table 3. For the most part, the crisis indicator is not significant, although the p-value in a univariate regression of integration measured using the cross-sectional mean on the crisis indicator is 0.051. These results suggest that it is difficult to draw firm conclusions on the role of financial crises for overall integration.

5.4 Global component calculated separately for each country

To check that the results are not driven by one country being heavily weighted in the global component, Pukthuanthong and Roll (2009) propose that separate principal components be calculated excluding each index in each window. For instance, if we are measuring the level of integration of the US market, the principal component is calculated using the variance–covariance matrix and returns of the other seven markets only. I next employ this method for all three measures of the global component. A separate global component is calculated for each market, denoted, \(r_{i,t}^{g}\), with the effect that Eq. (1) is now written:

The average r-squareds are also presented in Fig. 5 (dashed line). Compared to the average r-squared calculated using \(r_{t}^{g}\), it is notable that while the overall level of integration is much lower, the pattern of integration does not change. Indeed, the correlation between the average r-squareds using this method and the baseline method is 0.98. Overall, it appears that estimating the global component in this manner does not have a significant impact on the overall pattern of integration, although it does markedly affect the absolute level of measured integration.

5.5 Additional principal components

Selecting the number of principal components to use to capture the ‘global components’ is arbitrary. In contrast to Volosovych (2011; Pukthuanthong and Roll 2009) use the first 10 principal components when measuring integration which account for approximately 90 per cent of the variation in their returns series. Figure 2 shows that to capture a similar proportion of the variance, six or seven of the eight principal components would have to be used. This raises the danger of overfitting. I therefore next include both the second and third principal components in Eq. (1) to test whether this affects the measured integration. The average adjusted r-squared from this model is included in Fig. 9. For comparison, Fig. 9 also includes the adjusted r-squared from the baseline model. Overall, the estimated level of integration rises when additional principal components are added, however, the pattern of integration over the period remains remarkably unchanged.

6 Conclusions

This paper examines the integration of stock markets during the classical Gold Standard, using monthly data on indices in Australia, Belgium, France, Germany, Ireland, Russia, the UK and the US. To my knowledge, it is the most comprehensive comparative study of the behavior of stock return integration during this period. Moreover, it is the first to do so using a methodology to capture ‘global components’ of stock returns rather than rolling correlations or a factor model.

Overall, the results indicate that all the exchanges co-moved with the global component, although the level of integration varied across exchanges and through time. Variations in the integration of individual markets through time often appear to relate to large financial or political crises in individual countries, for instance, political crises in Russia and Ireland and financial crises in Australia and France. Moreover, the movements in the wake of the 1907 crisis fit with the existing historical narrative of contagion. Nonetheless, testing whether the overall level of integration is affected by financial crises yields only tentative evidence that, reflecting the more idiosyncratic nature of shocks at the time, crises reduced integration. Finally, comparing with the level of integration in more recent data for the same countries it is clear that the stock markets were substantially less integrated during the Classical Gold Standard than today. The results appear robust to a number of checks.

Notes

Goetzmann et al. (2005, Table 1 ) use data for the period under review for five exchanges. For much of their nineteenth century sample period, Bekaert and Mehl (2019, Appendix A) and Bastidon et al. (2018, Fig. 2) have data on four exchanges. Quinn and Voth (2008, Table 1) provide information on their capital openness data, but their stock market data sample is not included. However, like Eichengreen and Tong (2003), they use the Global Financial Database which Eichengreen and Tong (2003, Table 1) note included data on four exchanges for much of the sample period used in this study.

Based on data from Groningen Growth and Development Centre: https://www.rug.nl/ggdc/historicaldevelopment/maddison/.

Also identified in the data compiled by Grossman et al. (2014).

For instance, a campaign against railway rates and charges began around this time, resulting in the Vice-Regal Commission being appointed in 1906 which found that the railways should be run in the interests of the country rather than in the interests of shareholders (Stephenson, 1910).

A related issue is the ‘arrival of information’ during the period. Since the data are at a monthly frequency, it is possible that there is a lag in the arrival of information to more remote exchanges, particularly, in Russia and Australia. However, major cities were connected by the telegraph by this time and an analysis of the correlations of these two series and the UK series, indicates that the highest correlation is contemporaneous.

Data are not included on Russia here since we do not have data on market capitalization.

To conduct principal component analysis, the returns series must be stationary. To test that, I use an Elliott-Rothenberg-Stock test. Here, the lag length is selected for the test using the Hannan-Quinn criterion. The test rejects the null of a unit root for all eight series at the 1% level. This result is robust to whether a trend is included or excluded from the test.

A rolling window is used since a Jennrich (1970) test for equality of correlation matrices in the first and final thirds of the sample period rejects the null hypothesis of equality (p-value = 0.000), with the implication that the variance–covariance matrix changed over time.

In total, there are 33 windows.

This approach is also similar to that of Goetzmann et al. (2005), in that, once they obtain their individual measures of integration for the each exchange (in their case, pairwise correlations rather than r-squareds), they then calculate overall integration as the mean of the individual measures at each point in time.

Standardized to a mean of zero and standard deviation of 1. This is standard in principle component analysis.

It is also lower than the proportion of variance accounted for by the first principal component in Volosovych’s (2011) study of sovereign bond yields for a similar period (80 per cent). However, it is not clear that the level of integration between stock and bond markets is comparable (see, for instance, Berben and Jansen (2009) who study both using data for the US and European countries). In addition, the geographical samples also differ between the two studies.

This is calculated as a weighted average of exchange rate change, short-term interest rate change, and reserve change relative to the same for the center country, the UK before 1913 and the US after.

Following Volosovych (2011), the fraction of countries experiencing a financial crisis in each year is used in the regression.

Data were obtained from the Bordo et al. (2001) and the Jorda, Schularick and Taylor databases. Alongside the variables used in the analysis, Volosovych (2011) also suggested the currency peg, capital controls, economic disasters and hyperinflations might be associated with the measure of integration, but there is little or no movement in these variables during this sample period.

The sample begins in May 1985, when Belgian data become available.

See the Data Appendix for a discussion.

See Data Appendix for sources.

I am grateful to an anonymous referee for this suggestion.

Moore (2010, Table 13) indicates that cross-listed securities are highest between London and the 14 other exchanges (including Berlin, New York, Paris and Sydney) over the period 1913–1925.

Consider a weighted average, \(r_{t}^{g} = \mathop \sum \nolimits_{i = 1}^{n} \left( {w_{i,t} \times r_{i,t} } \right)\), where \(r_{t}^{g}\) is the global return at time t, \(r_{i,t}\) is the return on exchange i, and \(w_{i,t}\), is the weighting on exchange i, where the weights sum to one, \(\mathop \sum \nolimits_{i = 1}^{n} w_{i,t} = 1\). In the case of principal components, the weightings, \(w_{i,t} ,\) are the eigenvectors of the variance-covariance matrix. Pukthuanthong and Roll’s (2009) innovation is to apply the weights to the returns in the subsequent window which avoids the weights being based on recent movements in the data and thus ‘building in’ co-movement. In the third methodology, the cross-sectional mean, the weightings, \(w_{i,t}\), are set to be 1/n and are therefore chosen entirely independently of the data.

The results are missing for the first three years of the sample period due to the use of lagged variance–covariance matrix in the calculation of the out-of-sample principal components.

If prices are also missing in this source, the authors use the average of the bid and ask price when published in the price listings.

References

Annaert J, Buelens F, De Ceuster MJK (2012) New Belgian stock market returns: 1832–1914. Explor Econ Hist 49:189–204

Ascher A (1994) The revolution of 1905: Russia in disarray. Stanford University Press

Baldwin R, Philippe M (1999) Two waves of globalisation: superficial similarities, fundamental differences. NBER working papers series, working paper 6904

Bastidon C, Bordo M, Parent A, Weidenmier M (2018) Stock market integration Since 1885: a network perspective, Paper presented at the 2018 WEHC, Mimeo

Bastidon C, Bordo M, Parent A, Weidenmier M (2019) Towards an unstable hook: the evolution of stock market integration since 1913. NBER working papers, pp 26166

Bekaert G, Mehl A (2019) On the global financial market integration “swoosh” and the trilemma. J Int Money Financ 94:227–245

Berben R-P, Jansen WJ (2009) Bond market and stock market integration in Europe: a smooth transition approach. Appl Econ 41(24):3067–3080

Bordo M, Murshid AP (2006) Globalization and changing patterns in the international transmission of shocks in financial markets. J Int Money Financ 25(4):655–674

Bordo M, Eichengreen B, Klingebiel D, Martinez-Peria MS, Rose AK (2001) Is the crisis problem growing more severe? Economic Policy 16(32):53–82

Bordo M, Eichengreen B (1999) Is our current International economic environment unusually crisis prone?. Capital flows and the International financial system, Reserve Bank of Australia

Campbell G, Rogers M (2017) Integration between the London and New York stock exchanges, 1825–1925. Econ Hist Rev 70(4):1185–1218

Campbell G, Grossman RS, Turner JD (2019) Before the cult of equity: new monthly indices of the British share market, 1829-1929. SSRN Electron J. https://doi.org/10.2139/ssrn.3404050

Canjels E, Prakesh-Canjels G, Taylor AM (2004) Measuring market integration: foreign exchange arbitrage and the gold standard, 1879–1913. Rev Econ Stat 86(4):868–882

Ciccarelli M, Mojon B (2010) Global Inflation. Rev Econ Stat 92(3):524–535

Cowles A (1939) The 3rd, and associates common stock indices, Cowles commission for research in economics, 2nd edn. Principa Press Inc, Bloomington

De Long JB, Brecht M (1992) Excess volatility and the German stock market 1876–1990. NBER working papers, pp 4054

Donner O (1934) Die Kursbildung am Aktienmarkt, Vierteljahreshefte zur Konjunkturforschung, Sonderheft 36

Eichengreen B and Tong H (2003) Stock market volatility and monetary policy: what the historical record shows. In: Richards A, Robinson T (eds) Reserve Bank of Australia 2003 conference: asset prices and monetary policy, 108–42. Sidney, AU, Reserve Bank of Australia

Esteves R (2006) Between imperialism and capitalism. European capital exports before 1914, University of Oxford, Mimeo

Esteves R (2011) The belle epoque of international finance: French capital exports, 1880‐1914. SSRN Elect J. https://doi.org/10.2139/ssrn.2024984

Gerlach S, Stuart R (2021) International co-movements of inflation, 1851–1913. CEPR discussion Paper, pp 15914

Goetzmann WN, Huang S (2018) Momentum in imperial Russia. J Financ Econ 130(3):579–591

Goetzmann WN, Ibbotson RG, Peng L (2001) A new historical database for the NYSE 1815 to 1925: performance and predictability. J Financ Markets 4(1):1–32

Goetzmann WN, Li L, Rouwenhorst KG (2005) Long-term global market correlations. J Bus 78(1):1–38

Grossman RS, Lyons RC, O’Rourke KH, Ursu MA (2014) A monthly stock exchange for Ireland, 1864–1930. Eur Rev Econ Hist 18(3):248–276

Hickson CR, Turner JD (2002) Free banking gone awry: the Australian banking crisis of 1893. Financ Hist Rev 9:147–167

Hickson CR, Turner JD (2005) The rise and decline of the Irish stock market, 1865–1913. Eur Rev Econ Hist 9(1):3–33

Jorion P, Goetzmann WN (1999) Global stock markets in the twentieth century. J Finan 54(3):953–980. https://doi.org/10.1111/0022-1082.00133

Korelin A, Pushkareva I, Koroleva N, Tyutyukin S, Khristoforov I (2005) Pervaja revoljucija v Rossii. Vzgljad cherez stoletie, pamjantniki Istoricheskoj Mysli, Moscow

Lamberton DML (1958) Security prices and yields 1875–1955. Pamphlet, sydney stock exchange research and statistical Bureau, Sydney

Le Bris D, Hautcoeur P (2010) A challenge to triumphant optimists? a blue chips index for the Paris stock-exchange (1854–2007). Financ Hist Rev 17(2):141–183

Lychakov N (2020) The distributional effect of a financial crisis: Russia 1899–1905. Scand Econ Hist Rev 69(2):140–157

Mauro P, Sussman N, Yafeh Y (2002) Emerging market spreads: then versus now. Quart J Econ 117:695–733

Merrett DT (1989) Australian banking practice and the crisis of 1893. Aust Econ Hist Rev 29(1):60–85

Moore GH (1961) Business cycle indicators. In: basic data on cyclical indicators. NBER and princeton university press, vol 2

Moore L, (2010) World Financial Markets, 1900–1925. Available at http://lyndonmoore.yolasite.com/resources/World%20Financial%20Markets.pdf

Neal L, Weidenmier M (2002) Crises in the global economy from tulips to today: contagion and consequences’. NBER working paper, pp 9147

O’Rourke KH (2002) Europe and the causes of globalization, 1790 to 2000. In: Kierzkowski H (ed) Europe and globalization. Palgrave Macmillian, London

Obstfeld M, Taylor AM (2005) Global capital markets: integration, crisis, and growth. Cambridge University Press, Cambridge

Ollerenshaw P (1997) The business and politics of banking in Ireland 1900–1943. In: Cottrell PL, Teichova A, Yuzawa T (eds) Finance in the age of the corporate economy, Ashgate press

Pukthuanthong K, Roll R (2009) Global market integration: an alternative measure and its application. J Financ Econ 94(2):214–232

Quinn DP (2003) Capital account liberalization and financial globalization, 1890–1999: a synoptic view. Int J Financ Econ 8(3):189–204

Quinn DP, Voth H-J (2008) A century of global market correlations. Am Econ Rev: Papers Proceed 98(2):535–540

Quinn W, Turner JD (2020) Boom and bust: a global history of financial bubbles. Cambridge University Press, Cambridge

Rajan RG, Zingales L (2003) The great reversals: the politics of financial development in the twentieth century. J Financ Econ 69(1):5–50

Shiller RJ (2005) Irrational exuberance 2nd edn. Princeton university press, Broadway books

Stephenson WT (1910) Report of the vice-regal commission on irish railways, including light railways. Econ J 20:484–487

Stuart R (2017) Co-movements in stock market returns, Ireland and London, 1869–1929. Financ Hist Rev 24(2):167–184

Stuart R (2018) The co-movement of the Irish, UK and US stock markets, 1869–1925. Essays Econ Business History 36(1):23–46

Volosovych V (2011) Measuring financial market integration over the long run: is there a U-shape? J Int Money Financ 30(7):1535–1561

White EN (2007) The crash of 1882 and the bailout of the Paris Bourse. Cliometrica 1:115–144

Acknowledgements

I am grateful to David LeBris for providing French data, Marc DeLoof for providing Belgian data, Ronan Lyons for providing data from Grossman et al. (2014), Gareth Campbell for providing data from Campbell and Rogers (2017) and Adrian Pagan and Paula Drew for assistance in obtaining the Australian data. I would like to thank Daniel Kaufmann, John Turner, Richard Grossman, Stefan Gerlach and Morgan Kelly and participants at seminars at the Bank for International Settlements, Queen’s University Belfast and the Graduate Institute, Geneva, and at the EHES congress 2018 and the FRESH conference 2017 for helpful comments.

Funding

Open access funding provided by University of Neuchâtel.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Data Appendix

Data Appendix

1.1 Australia

1879–1913 Australian data are from Lamberton (1958). The data refer to prices on the Sydney Exchange. Lamberton compiled indices for ‘Financial’ listings, ‘Mining’ listings and ‘Industrial and commercial’ listings. The latter is used in the analysis here. ‘A chained value ratio formula has been used and the indices are intended to show what would have happened to an investor's funds if, at the beginning of 1875, he had bought all shares quoted on the Sydney Stock Exchange, allocating his purchases among the individual issues in proportion to their total monetary value, and each month by the same criterion redistributed his holdings among all quoted shares. No allowance has been made for cash dividend payments, brokerage or taxation.’ (Lamberton (1958) p. 254). Monthly high and low prices were recorded for all shares traded and this list constituted the population for sampling purposes. The sample used then comprised all shares which had sold each month for any three years between 1875 and 1936. Although inter-company shareholdings were extensive and lead to duplication of weights, no adjustments were made. Oversea investment in Australian companies was not eliminated from the number of shares for the value product calculation.

1984–2020 Data are sourced from the OECD’s Main Economic Indicators database. Data relate to share prices on the Australian Stock Exchange. From April 2000, all figures refer to the S&P/ASX 200 which represents approximately 89 per cent of the total market capitalization of the Australian market. Prior to April 2000, the ‘All Ordinaries’ index is used. The index is chain-linked and weighted by market capitalization. Data are end-month figures.

1.2 Belgium

1879–1913 Belgian data are from Annaert et al. (2012) and were provided on request by the authors. The data relate to the Brussels stock exchange. The data are end-of-month, market-capitalization weighted, nominal returns without dividends for each month. The main source for the stock prices is the original Official Quotation Lists of the BSE. In case a stock did not trade at the last trading day of the month, the price series from the Moniteur BelgeFootnote 25 (up to 1878) or Official Quotation Lists (after 1878) are used to complement the database for the period 1832–1878.

1984–2020 Data are sourced from the OECD’s Main Economic Indicators database. Data refer to the Belgian All Shares Index quoted on the Brussels Stock Exchange. The index is computed using a Paasche formula. The daily value of the index is computed by dividing the stock capitalization of all quotations included in the index with the amount denominated “divisor” or base. New shares are included in the index as soon as they are introduced on the Stock Exchange. Similarly suppressed shares are excluded from the index on the day of delisting. Foreign registered companies and investment funds are excluded. The index is computed by the Brussels Stock Exchange based on January 1980 = 1000. Data refer to the price on the 25th of each month.

1.3 France

1879–1913 French data are sourced from Le Bris and Hautcoeur (2010) on request from the authors. The data related to the Paris official stock exchange. They are a market-capitalization weighted index, in this instance of the top 40 stocks rated by market capitalization on French exchanges each year. The composition and weights are adjusted yearly to avoid survivor bias. The index focusses on French stocks (defined by legal status, rather than place of activity). Capitalizations are calculated based on data collected for all French stocks listed on the Paris official stock exchange for the first Friday of each year. The 40 highest capitalizations are included in the index for the following year, with two exceptions: when various securities of the same firm are listed, only stock with the highest capitalization is considered; and firms with less than 10,000 shares are excluded. For the 40 firms in the index, the author collects monthly prices and calculates the market index by weighting these prices by market capitalizations. The authors note that they chose to build a blue-chip index as it reflects the stocks held by most investors.

1984–2020 Data are sourced from the OECD’s Main Economic Indicators database. The SBF250 index of the Société des Bourses Françaises is designed to reflect the evolution of both the whole market. The SBF250 is compiled as a total index and for 12 sectors which are aggregated into 3 groups (industrial, service and financial). Selection of the sample is based on the representativeness of each company to the total capitalization in each of 12 economic sectors and is based on the regularity of trading. Units in investment funds are excluded but shares of foreign companies listed on the Paris Stock Exchange may be included. Dividend yields are excluded. Monthly data are averages of daily quotations.

1.4 Germany

1879–1913 The German data are taken from the NBER macrohistory database which is sourced from Donner (1934). The index begins in 1870, and then includes banks, railroads and mining companies. However, after their nationalization in 1890, railroads are no longer included. Other industries are added as they become available. De Long and Brecht (1992, p. 4) note that, ‘especially from 1890 on, the Donner index is a sample of Germany’s largest companies, weighted toward those heavy industries in which Germany’s companies were largest’. The series is composed of two separate series spliced together. These series are described as: an unweighted index of representative stocks for the period 1871–1889 and a weighted index of a larger number of stocks for the period 1890–1913.

1984–2020 Data are sourced from the OECD’s Main Economic Indicators database. Data correspond to the CDAX-GESAMTINDEX (KURS) index. Monthly data are averages of daily closing prices.

1.5 Ireland

1879–1913 Irish data are from Grossman et al. (2014). They represent listings on the Dublin, Cork and Belfast exchanges, and are a market-capitalization weighted capital gains series. The data are sourced from Investor’s Monthly Manual and covering 118 securities issued by 94 firms, and cover railway, finance and industrial/retail sectors. Companies traded on the exchanges but without significant activities in Ireland were excluded. Grossman et al. (2014) provide both a market-capitalization weighted index and an unweighted index in their paper, and also provided the underlying series to this author, from which a price-weighted index was calculated.

1984–2020 Data are sourced from the OECD’s Main Economic Indicators database. Overall share price index measures the change in the prices of ordinary stocks and shares quoted on the Irish Stock Exchange (ISEQ). The ISEQ indices include all domestic and Northern Ireland companies quoted on the Official List and Developing Companies Market equities of the Irish Stock Exchange (78 companies). The index is an arithmetic mean weighted according to the market capitalization of the company. The national base of the index is 4 January 1988. Monthly data are arithmetic averages of daily closing prices.

1.6 Russia

1879–1913 Russian data are calculated by the author using data from the Yale International Centre for Finance’s St Petersburg Stock Exchange Project. Goetzmann and Huang (2018) and Lychakov (2019) also construct indices from this database. The data are end-of-month stock prices for all companies listed on the St. Petersburg Stock Exchange and was collected from five different sources. As set out by Goetzmann and Huang (2018, p. 6), ‘from the periods of January 1865 to December 1890, January 1893 to December 1893, and January 1897 to December 1904, end-of-month prices are from the Yearbook of the Finance Ministry. From January 1891 to November 1892, end-of-month prices are from the Bulletin of the Finance, Industries, and Trade. For the month of December 1892, end-of-month stock prices are from the Stock Exchange Newsletter. For the periods of January 1894 to December 1896, January 1905 to December 1911, and January 1914 to July 1914, end-of-month stock prices are from the Commercial and Industrial Newspaper. Finally, from January 1912 to December 1913, end-of-month stock prices are directly from the St. Petersburg Stock Exchange.’ The index is an unweighted price series. When no price (arising from no transactions) is reported for a month, the average of the latest bid and ask prices was used.

1985–2020 Data for Russia are not available prior to 1997 from Bloomberg, Datastream or the OECD, and it is therefore excluded from the analysis of more recent data. The stock market in St Petersburg was closed following the revolution in 1917, and it was not until 1990 that Soviet citizens were permitted to buy stocks, bonds and other securities. See: https://www.nytimes.com/1990/11/14/business/stock-exchange-in-moscow.html

1.7 UK

1879–1913 Data for the UK are from Campbell et al. (2019). The underlying data are sourced from the Investor’s Monthly Manual as collected and reported by the International Center for Finance (ICF) at Yale University for the period studied here, and are a market-capitalization weighted series of capital gains. The IMM classified securities by industry sector. However, as noted by the authors, the digitised IMM only includes a broad distinction between banks, railways and miscellaneous. Nevertheless, the authors manually tag companies the originals of the IMM. The authors present a broad, a narrow (domestic) and a blue-chip index. Domestic shares accounted for over 90 per cent of the total market capitalization until the 1840s, 65 per cent by the 1870s and approximately 40 per cent in 1913. Although the blue-chip companies were few in number, they were very large, representing more than half of the value of all domestic equities in our sample throughout almost the entire sample period.

Alternative price-weighted data for the UK used in Sect. 5.1 are sourced from Campbell and Rogers (2017). The author’s used the Investors’ Monthly Manual (IMM) to obtain data on companies listed on the LSE between 1869 and 1925. The original data has been inputted by the Yale International Center for Finance, and includes ordinary equities, preference shares, and corporate bonds.

1984–2020 Data are sourced from the OECD’s Main Economic Indicators database. The FTSE-100 is a capitalization-weighted price index of the 100 largest UK companies by market value. Component companies of this index must meet a number of requirements set out by the FTSE Group, including having a full listing on the London Stock Exchange with a Sterling or Euro dominated price on the Stock Exchange Electronic Trading Service (SETS), and meeting certain tests on nationality, free float, and liquidity. The index represents approximately 80% of the UK market. Data are averages of daily prices. The base of the index is 01.01.1984.

1.8 US

1879–1913 For the US, the data are the Common Stock Price Index compiled by the Cowles Commission (Cowles 1939) obtained through the St Louis Federal Reserve Economic Data (FRED) website. Moore (1961, p.24) notes that for the period 1871 to 1917 the index includes ‘virtually all industrial, public utility, and railroad common stocks actively traded on the New York Stock Exchange’, but that for the most part, the railroad stock component ‘dominates the total, since relatively few industrial and public utility stocks were traded, especially before 1900’. The prices used in the Cowles Commission index, in general, are arithmetic averages of the highest and lowest prices of the month weighted by the number of shares outstanding at the end of the month.Footnote 26

Alternative price-weighted US data used in Sect. 5.1 is taken from Goetzmann et al., (2001). For the period under review, the authors collected end-of-month prices for NYSE stocks from the major New York newspapers, specifically, the New York Herald and the New York Times. When no transaction took place in the last week, the authors used the average of the latest bid and ask prices.

1984–2020 Data are sourced from the OECD’s Main Economic Indicators database. Data refer to the composite index of all common stock listed on the New York Stock Exchange. All listed companies, including investment funds and foreign-registered companies, are included in the index. The index is calculated on the basis of daily prices which are arithmetic means, weighted according to the market capitalization of the company at current value. Data are averages of daily rates.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Stuart, R. Measuring stock market integration during the Gold Standard. Cliometrica 18, 191–220 (2024). https://doi.org/10.1007/s11698-023-00265-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11698-023-00265-0