Abstract

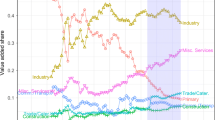

This paper uses time-series evidence on construction movements to examine the convergence of regional business cycles in the decades that followed Italy’s unification. The aggregate series point to cyclical convergence, but a sector-level analysis traces this result to the decline in differentiated “regional-policy” shocks. The regional market cycles diverged, as regions specialized in different sectors of production; market-cycle convergence is observed only within the “industrial triangle,” the regions of which also developed different specializations. This suggests that the balance between growing interdependence and growing differentiation is not general, as the current literature presumes, but specialization-specific.

Similar content being viewed by others

Notes

No attempt is made here to address the very different question of the consequences of cyclical convergence or divergence, that is, whether from this particular point of view the unification of Italy appears in retrospect, or that of Europe in prospect, as a Good Thing or a Bad Thing. One cannot seriously discuss 1861 (or 1992) and All That without a critical review of the literature on optimal currency areas and more; but that would much overstep the limits we have set ourselves, to say nothing of those imposed by the editor.

The broader aggregate is of course less volatile, relative to itself, than its directly cyclical component, but these differences in the cycles' relative amplitudes are here immaterial.

The interpretation put forth in the preceding paragraph states that a construction boom is (really) sufficient to cause a general boom; the alternative considered here presumes that a general boom is (really) necessary for a construction boom, and therefore that the latter allows us to infer the former.

According to the most recent estimates at constant prices (which are not here the appropriate ones, but the current-price series are yet to be revised), from 1861 to 1913 the share of agriculture declined from some 50% to 40% (Fenoaltea 2005). Maddison's estimates yield a far sharper drop, but as is well known he illogically combined his series with the back-cast sector weights implied by the Istat series rather than with those implied by his own (Maddison 1991; Bardini et al. 1995).

While the national construction cycle was clearly based on a cycle in the supply of (foreign) capital rather than on a demographic cycle (Fenoaltea 1988), the spatial distribution of construction was presumably associated with demographic flows (Ciccarelli and Fenoaltea 2008). Italy was the source of massive emigration, but net migration rates varies widely (Fenoaltea 2003b). Some regions were simply abandoned, others witnessed significant return migration: the decision to return at all, the choice of where to (re)locate and invest one's savings clearly depended on the regions' perceived prospects, and not on a possible run of above- or below-average harvests.

The essential indicators are tax roll data for buildings, physical completed mileage data for railways, and (national- and local-government) budget expenditure data for other infrastructure; the occasional frailties of these series that may impinge on the present analysis will be noted as they become relevant.

For a discussion and assessment of the Dutch and British time-series estimates, see Smits et al. (2000). The only visible omission in their discussion is the apparent neglect of the quality, as opposed to the mere existence, of the surviving data: in the Italian case, at least, the greatest errors of the early estimates stemmed from the presence, rather than the frequent absence, of historical statistics (Fenoaltea 2005, 2006).

The calculated deviation cycles are stationary by construction; the calculated trends are not, and as a practical measure (quasi-) stationarity is achieved by taking growth rates (Appendix 1).

The OLS linear time trends have t statistics equal to 1.1 and −1.3, respectively, for the dynamic correlations and interquartile ranges of the cyclical deviations, and to 0.1 and −5.4, respectively, for those of the trend growth rates.

The early aggregate construction estimates contain those for buildings, and are correspondingly contaminated, but the point made here applies a fortiori to Fig. 1.

Here, the corresponding (truncated-sample) OLS linear time trends are all statistically significant, with t statistics equal to −14.4 and 3.3, respectively, for the correlations and interquartile ranges of the cyclical deviations, and to −10.1 and 3.0, respectively, for those of the trend growth rates.

The pattern of the corresponding OLS linear time trends recalls that of Fig. 1, but with stronger results: the time trends’ t statistics are equal to 2.4 and −2.0, respectively, for the correlations and interquartile ranges of the cyclical deviations, and to 1.2 and −5.6, respectively, for those of the trend growth rates. To avoid zero or negative trend values, the railway-construction series are here increased by a uniform constant before being transformed.

In Panel 2, the OLS linear time trends have t statistics equal to 5.8 and −6.1, respectively, for the dynamic correlations and interquartile ranges of the cyclical deviations, and to 3.6 and −9.1, respectively, for those of the trend growth rates. In Panel 3, the corresponding t statistics are equal to −7.8 and 6.6, respectively, for the dynamic correlations and interquartile ranges of the cyclical deviations, and to −12.4 and 5.0, respectively, for those of the trend growth rates. The contrast between the post-1895 interquartile ranges in Panels 2 and 3 reflects of course the virtual halt to new construction to extend the major network, and the renewed boom in other rail-related new construction.

Here, the t statistics associated with the OLS linear time trends are equal to −5.5 and 2.7, respectively, for the correlations and interquartile ranges of the cyclical deviations, and to 6.2 and −4.4, respectively, for those of the trend growth rates.

The North-West includes Piedmont, Liguria, and Lombardy; the Center/North-East, Venetia, Emilia, Tuscany, the Marches, Umbria and Latium; the South, the Abruzzi, Campania, Apulia, Basilicata, Calabria, Sicily and Sardinia. The literature on the "Southern question" is immense; see most recently Felice (2007) and the extensive bibliography therein.

In the North-West, the linear time trends are positive and statistically significant, with t statistics respectively equal to 2.3 for the correlations of the cyclical deviations, and to 7.5 for those of the trend growth rates.

The rolling correlations calculated in Kuznets (1928) select the uniform kernel for the given bandwidth.

An account of the derivation of the new estimates is available on request.

References

A’Hearn B (2005) Finance-led divergence in the regions of Italy. Financ Hist Rev 12:7–41

Banti AM (1996) Storia della borghesia italiana. L’età liberale, Donzelli, Rome

Bardini C, Carreras A, Lains P (1995) The national accounts for Italy, Spain and Portugal. Scand Econ Hist Rev 43:115–147

Baxter M, King RG (1999) Measuring business cycles: approximate band-pass filters for economic time series. Rev Econ Stat 81:575–593

Belke A, Heine JM (2006) Specialisation patterns and the synchronicity of regional employment cycles in Europe. Int Econ Econ Policy 3:91–104

Christiano LJ, Fitzgerald TJ (2003) The band pass filter. Int Econ Rev 44:435–465

Ciccarelli C, Fenoaltea S (2007) Business fluctuations in Italy, 1861–1913: the new evidence. Explor Econ Hist 44:432–451

Ciccarelli C, Fenoaltea S (2008) Construction in Italy’s regions, 1861–1913. Riv stor econ 24:303–340

Ciccarelli C, Fenoaltea S (2009a) La produzione industriale delle regioni d’Italia, 1861–1913: una ricostruzione quantitativa. 1. Le industrie non manifatturiere. Banca d’Italia, Rome

Ciccarelli C, Fenoaltea S (2009b) Shipbuilding in Italy, 1861–1913: the burden of the evidence. Hist Soc Res 34(2):333–373

Cogley T, Nason JM (1995) Effects of the Hodrick-Prescott filter on trend and difference stationary time series. Implications for business cycle research. J Econ Dyn Control 19:253–278

Daniele V, Malanima P (2007) Il prodotto delle regioni e il divario Nord-Sud in Italia (1861–2004). Riv pol econ 97(3-4):267–340

Durbin J, Koopman SJ (2001) Time series analysis by state space methods. Oxford University Press, Oxford

Esposto AG (1992) Italian industrialization and the Geschenkronian “great spurt”: a regional analysis. J Econ Hist 52:353–362

Federico G (2007) Market integration and market efficiency: the case of 19th century Italy. Explor Econ Hist 44:293–316

Felice E (2007) Divari regionali e intervento pubblico. Per una rilettura dello sviluppo in Italia, Il Mulino, Bologna

Fenoaltea S (1983) Italy. In: O’Brien PK (ed) Railways and the economic development of Western Europe. Macmillan, London, pp 49–120

Fenoaltea S (1984) Railway construction in Italy, 1861–1913. Riv stor econ 1, International issue: 27–58

Fenoaltea S (1986) Public works construction in Italy, 1861–1913. Riv stor econ 3, International issue: 1–33

Fenoaltea S (1987) Construction in Italy, 1861–1913. Riv stor econ 4, International issue: 21–53

Fenoaltea S (1988) International resource flows and construction movements in the Atlantic economy: the Kuznets cycle in Italy, 1861–1913. J Econ Hist 48:605–638

Fenoaltea S (2003a) Notes on the rate of industrial growth in Italy, 1861–1913. J Econ Hist 63:695–735

Fenoaltea S (2003b) Peeking backward: regional aspects of industrial growth in post-Unification Italy. J Econ Hist 63:1059–1102

Fenoaltea S (2005) The growth of the Italian economy, 1861–1913: preliminary second-generation estimates. Eur Rev Econ Hist 9:273–312

Fenoaltea S (2006) The reconstruction of historical national accounts: The case of Italy. Paper presented at the XIV International Economic History Congress, Helsinki, August 2006, session 103

Friedman M (1957) A theory of the consumption function. Princeton University Press, Princeton

Gerschenkron A (1955) Notes on the rate of industrial growth in Italy, 1881–1913. J Econ Hist 15:360–375

Hallett AH, Richter C (2008) Have the Eurozone economies converged on a common European cycle? Int Econ Econ Policy 5:71–101

Harvey AC, Jaeger A (1993) Detrending, stylized facts and the business cycle. J Appl Econometrics 8:231–247

Hodrick RJ, Prescott EC (1997) Postwar US business cycles: an empirical investigation. J Money Credit Banking 29:1–16

King RG, Rebelo ST (1993) Low frequency filtering and real business cycles. J Econ Dyn Control 17:207–231

Kuznets S (1928) On moving correlation of time sequences. J Am Stat Assoc 23:121–136

Leser CEV (1961) A simple method of trend construction. J R Stat Soc Series B (Stat Methodol) 23:91–107

Maddison A (1991) A revised estimate of Italian economic growth, 1861–1989. BNL Quarterly Review 177:225–241

Maravall A, del Rio A (2007) Temporal aggregation, systematic sampling, and the Hodrick-Prescott filter. Comput Stat Data Anal 52:975–998

Mitchell WC (1927) Business cycles: The problem and its setting. National Bureau of Economic Research, New York

Montoya LA, de Haan J (2008) Regional business cycle synchronization in Europe? Int Econ Econ Policy 5:123–137

Orphanides A, van Norden S (2002) The unreliability of output gap estimates in real time. Rev Econ Stat 84:569–583

Proietti T (2009) Structural time series models for business cycle analysis. In: Mills T, Patterson K (eds.), Handbook of econometrics, vol. 2. Applied econometrics. Palgrave, London, pp 385–433

Ravn MO, Uhlig H (2002) On adjusting the Hodrick-Prescott filter for the frequency of observations. Rev Econ Stat 84:371–375

Ripa di Meana A, Sarcinelli M (1992) Unione monetaria, competizione valutaria e controllo della moneta: è d’aiuto la storia italiana? In: de Cecco M (ed) Monete in concorrenza. Prospettive per l’integrazione monetaria europea. Il Mulino, Bologna, pp 81–138

RiskMetrics Group (1996) RiskMetrics—technical document, 4th edn. J.P. Morgan/Reuters, New York

Romeo R (1959) Risorgimento e capitalismo. Laterza, Bari

Sala-i-Martin X (1996) The classical approach to convergence analysis. Economic Journal 106:1019–1036

Schumpeter JA (1939) Business cycles: A theoretical. historical and statistical analysis of the capitalist process, McGraw-Hill, New York

Smits JP, Horlings E, van Zanden JL (2000) Dutch GNP and its components, 1800–1913. GGDC Research Monograph 5, Groningen

Tondl G, Traistaru-Siedschlag I (2006) Regional growth cycle convergence in the European Union. Europainstitut Working paper No. 71

Toniolo G, Conte L, Vecchi G (2003) Monetary union, institutions, and financial market integration: Italy, 1862–1905. Explor Econ Hist 40:443–461

Trinchieri G (2001) Industrie chimiche in Italia dalle origini al 2000. Arvan-Mira, Venice

Wallis KF (1974) Seasonal adjustment and relations between variables. J Am Stat Assoc 69:18–31

Zamagni V (1978) Industrializzazione e squilibri regionali in Italia. Il Mulino, Bologna

Zamagni V (1993) The economic history of Italy, 1860–1990: Recovery after decline. Clarendon Press, Oxford

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

The dynamic correlations in Figs. 1, 2, 3, 4 and 5 are based on a decomposition of the regional series y it , t = 1, …, T, i = 1, …, N, into a (flexible) trend μ it , and a deviation cycle ψ it :

These components are here estimated by the Leser-Hodrick-Prescott (LHP) filter with a smoothness parameter set equal to the value suggested by Ravn and Uhlig for annual data, so that the corresponding trend filter can be interpreted as a low-pass filter with a cut-off period of 10–12 years. The component ψ it thus retains to a great extent the fluctuations in the series that have a periodicity smaller than 12 years.Footnote 17

As is well known, at the end of the sample the LHP-filtered components are of questionable reliability (Orphanides and Van Norden 2002). In principle, the LHP estimates could be adapted to the characteristics of the present series using appropriate techniques (Proietti 2009). In fact, the dynamic relationship between filtered time series is least distorted if the same (possibly suboptimal) filter is applied to all the series (Wallis 1974).

The LHP filter, like the Baxter and King (1999) or Christiano-Fitzgerald (2003) filters, is invariant to the properties of the time series under investigation. Such algorithms may yield filtered series that display spurious cycles, that is, cycles not actually present in the original series; this is known in the time-series literature as the Slutsky-Yule effect.

The distortions that may be induced by the LHP filter have been discussed by King and Rebelo (1993), Harvey and Jaeger (1993), and Cogley and Nason (1995). These authors document that, when the series to which the filter is applied is difference stationary (e.g., a random walk, or an integrated random walk), the detrended series can display spurious cyclical behavior. As a matter of fact, the transfer function will display a distinctive peak at business-cycle frequencies which is only due to the leakage from the non-stationary component.

While the problem is thus in ipsis rebus, its seriousness depends on one’s objective, and the corresponding characterization of the cyclical component in economic time series. No attempt is made in this paper to identify particular shocks and dynamic transmission mechanisms; the filter’s purpose is here essentially pragmatic, descriptive, and in keeping with the band-pass paradigm the cycle corresponds simply to the fluctuations within a prescribed range of periodicities. In such a context, the possible incidence of spurious components is not of compelling concern.

The overall evidence arising from unit roots tests (not reported for brevity) is that the levels of the series are integrated of order one; the null of integration is strongly rejected for the changes of the series. Under these circumstances, when the LHP filter is applied to the series y it , both the estimated cycle and the trend changes are stationary.

The short-term comovements (see e.g., Fig. 1, graph 1) are evaluated by considering the deviations ψ it ; the long-term comovements (e.g., Fig. 1, graph 3), by considering the trend growth rates g it = (μ it − μ it−1 )/μ it−1 . The latter may be considered as a smoothed version of the original series’ growth rate (the low-pass component thereof).

The concordance of the regional cycles is evaluated by the average (\( \bar{r}_{t} \)) of the N(N − 1)/2 pairwise dynamic correlation coefficients r ij, t between the cyclical variables. With i and j denoting the regions and t time,

The dynamic correlation coefficient between two time series z i and z j (where z equals ψ in the one case and g in the other) at time t is defined as

where m t (·) denotes a kernel function, i.e., a set of non-negative weights symmetric around time t non-increasing in the distance from time t, and summing up to one. Expression (3) computes a local correlation coefficient with a greater weight on the observations in the neighborhood of time t, as defined by the bandwidth of the kernel.Footnote 18

In practice, this non-parametric concordance statistic requires selecting a kernel m t (·) and a bandwidth. The recent literature proposes a family of estimators, with varying weights on the observations (Proietti 2009). Here, the kernel is allowed to adapt automatically at the boundaries of the sample space, and the bandwidth is related to the time horizon at which the correlation is computed. Specifically, the running means are estimated using a two-sided exponentially weighted moving average (EWMA) with weights determined by a smoothing parameter (λ) related to the cut-off period p and the signal-to-noise ratio. The actual computation of m t (q t ), where q t is alternatively z it , z jt , \( z_{it}^{2} \), \( z_{jt}^{2} \) and z it z jt , is performed by the Kalman filter and smoother (Koopman 2001). This tool is applied to the local level model \( q_{t} = q_{t}^{ * } + \varepsilon_{t} \) and \( q_{t}^{*} = q_{{t - 1}}^{*} + \eta _{t}, \) where ε and η are both white noise, and λ is related to \( \sigma_{\eta }^{2} /\sigma_{\varepsilon }^{2} \). The filter m t (q t ) emerges as the estimate of the underlying component \( q_{t}^{ * } \). The choice of the λ parameter entails a bandwidth of 12 years.

RiskMetrics follows a semiparametric approach, computing m t (q t ) with the one-sided EWMA

where λ is a smoothing constant between 0 and 1; in practice, λ is set ad hoc at 0.04 and 0.06 (RiskMetrics Group 1996). The two-sided EWMA used here is a smoother as well as a filter, and it eliminates the phase shift originating from the use of a one-sided filter. Moreover, the value of the smoothing constant is here related to a particular time horizon, and not simply assumed.

Estimates of \( \bar{r}_{t} \) were also computed constraining the true dynamic correlations to zero. The simulations generated 10,000 replicate sets of 16 independent series of 53 observations under a range of assumptions as to their serial correlation. The mean dynamic correlations of the simulated cycles averaged very close to zero, with 95% of the results falling between approximately −0.05 and 0.10. This narrow simulation envelope suggests that the correlations generated by the present procedure are not induced by the procedure itself.

The computations were carried out in Ox, and the programs are available on request.

Appendix 2

The statistics in Table 1 are obtained from the benchmark estimates transcribed in Table 2. The latter replicate those in Fenoaltea (2003b), Table 2 and Appendix Table 2, with updated figures for textiles, clothing, metalmaking, non-metallic mineral products, and chemicals.Footnote 19 The measures of structural dissimilarity in Table 1, panel A are, in each benchmark year, the simple average

where i and j index the regions ordered as in Table 2, and N is the number of differences d ij for i ≠ j. In turn,

where s is the manufacturing sector index (s = 1,…,12) and

The elements VA s,i and L i for each year appear in the corresponding panel of Table 2, cols. 1–12 and col. 13, respectively.

The measures for Italy in col. 1 are obtained with i = j = 1,…,16 (N = 120); those for the North-West in col. 2, with i = j = 1, 2, 3 (N = 3); those for the Center/North-East in col. 3, with i = j = 4,…,9 (N = 15); and those for the South in col. 4, with i = j = 10,…,16 (N = 21).

The estimates in Table 1, panel B are themselves, in each year,

with i and s defined as above, s = 1,…,12, and, again, i = 1,…,16 for Italy (col. 1), i = 1, 2, 3 for the North-West (col. 2), i = 4,…,9 for the Center/North-East (col. 3), and i = 10,…,16 for the South (col. 4).

Rights and permissions

About this article

Cite this article

Ciccarelli, C., Fenoaltea, S. & Proietti, T. The effects of unification: markets, policy, and cyclical convergence in Italy, 1861–1913. Cliometrica 4, 269–292 (2010). https://doi.org/10.1007/s11698-009-0046-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11698-009-0046-z