Abstract

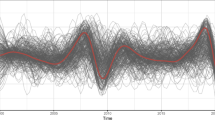

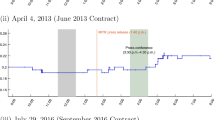

We analyze the dynamic structure of lower tail dependence coefficients within groups of assets defined such that assets belonging to the same group are characterized by pairwise high associations between extremely low values. The groups are identified by means of a fuzzy cluster analysis algorithm. The tail dependence coefficients are estimated using the Joe–Clayton copula function, and the 75th percentile within clusters is used as a measure of each cluster’s overall tail dependence. The interdependence structure of the clusters’ tail dependence dynamics is then analyzed in order to determine whether the pattern of a cluster can be predicted based on the past values of the others, using a Granger causality approach. The hypothesis of a possible regime switching dynamics in tail dependence is also investigated by means of a Threshold Vector AutoRegressive model and the results are compared to those obtained with a linear autoregression. The whole procedure is described with reference to a case study dealing with the assets composing Eurostoxx 50, but it can be viewed as the proposal of a general method, that can be relevantly applied to whatever set of asset returns time series.

Similar content being viewed by others

Notes

The second step has been performed using the R package VineCopula (Schepsmeier et al. 2018).

The cluster composition is supposed to be fixed in the rolling window analysis.

There are other ways to compute joint membership degrees to clusters. We have verified that \(m_{h,t}^{(k)} = \min \left( m_i(k),m_j(k) \right) \) leads to very similar results in the terms of the final time series to be analyzed.

We used the R package igraph (Csardi and Nepusz 2006).

References

Balla E, Ergen I, Migueis M (2014) Tail dependence and indicators of systemic risk for large us depositories. J Financ Stab 15:195–209

Billio M, Getmansky M, Lo AW, Pelizzon L (2012) Econometric measures of connectedness and systemic risk in the finance and insurance sectors. J Financ Econ 104(3):535–559

Campello RJ, Hruschka ER (2006) A fuzzy extension of the silhouette width criterion for cluster analysis. Fuzzy Sets Syst 157(21):2858–2875

Csardi G, Nepusz T (2006) The igraph software package for complex network research. Int J Complex Syst 1695:1–19

De Luca G, Zuccolotto P (2011) A tail dependence-based dissimilarity measure for financial time series clustering. Adv Data Anal Classif 5(4):323–340

De Luca G, Zuccolotto P (2015) Dynamic tail dependence clustering of financial time series. Stat Pap 58:1–17

De Luca G, Zuccolotto P (2017) A double clustering algorithm for financial time series based on extreme events. Stat Risk Model 34:1–12

Di Narzo AF, Aznarte JL, Stigler M, Tsung-Wu H (2020) tsDyn: nonlinear time series models with regime switching. https://cran.r-project.org/web/packages/tsDyn/

Disegna M, D’Urso P, Durante F (2017) Copula-based fuzzy clustering of spatial time series. Spat Stat 21:209–225

Durante F, Pappadà R, Torelli N (2014) Clustering of financial time series in risky scenarios. Adv Data Anal Classif 8(4):359–376

Durante F, Pappadà R, Torelli N (2015) Clustering of time series via non-parametric tail dependence estimation. Stat Pap 56(3):701–721

D’Urso P, Cappelli C, Di Lallo D, Massari R (2013) Clustering of financial time series. Phys A Stat Mech Appl 392(9):2114–2129

D’Urso P, De Giovanni L, Massari R (2016) Garch-based robust clustering of time series. Fuzzy Sets Syst 305:1–28

D’Urso P, De Giovanni L, Massari R (2019) Trimmed fuzzy clustering of financial time series based on dynamic time warping. Ann Oper Res 2019:1–17

Ferraro M, Giordani P, Serafini A (2019) Fclust: an R package for fuzzy clustering. The R Journal 11. https://journal.r-project.org/archive/2019/RJ-2019-017/RJ-2019-017.pdf

Hansen BE (1999) Testing for linearity. J Econ Surv 13(5):551–576

Hubrich K, Teräsvirta T (2013) Thresholds and smooth transitions in vector autoregressive models. Adv Econom 32:273–326

Joe H (1997) Multivariate models and multivariate dependence concepts. CRC Press, Boca Raton

Joe H (2005) Asymptotic efficiency of the two-stage estimation method for copula-based models. J Multivar Anal 94:401–419

Lafuente-Rego B, Vilar JA (2016) Clustering of time series using quantile autocovariances. Adv Data Anal Classif 10(3):391–415

Lafuente-Rego B, D’Urso P, Vilar JA (2018) Robust fuzzy clustering based on quantile autocovariances. Stat Pap 2018:1–56

Liu X, Wu J, Yang C, Jiang W (2018) A maximal tail dependence-based clustering procedure for financial time series and its applications in portfolio selection. Risks 6(115):1–26

Lo MC, Zivot E (2001) Threshold cointegration and nonlinear adjustment to the law of one price. Macroecon Dyn 5:533–576

Patro DK, Qi M, Sun X (2013) A simple indicator of systemic risk. J Financ Stab 9(1):105–116

Ruspini EH (1969) A new approach to clustering. Inf Control 15(1):22–32

Ruspini EH, Bezdek JC, Keller JM (2019) Fuzzy clustering: a historical perspective. IEEE Comput Intell Mag 14(1):45–55

Schepsmeier U, Stoeber J, Brechmann EC, Graeler B, Nagler T, Erhardt T (2018) VineCopula: statistical inference of vine copulas. R package version 2.1.8. Available on CRAN

Sims C (1980) Macroeconomics and reality. Econometrica 48:1–48

Vilar JA, Lafuente-Rego B, D’Urso P (2017) Quantile autocovariances: a powerful tool for hard and soft partitional clustering of time series. Fuzzy Sets Syst 340:38–72

Winkler R, Klawonn F, Kruse R (2011) Fuzzy clustering with polynomial fuzzifier function in connection with m-estimators. Appl Comput Math 10(1):146–163

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

De Luca, G., Zuccolotto, P. Regime dependent interconnectedness among fuzzy clusters of financial time series. Adv Data Anal Classif 15, 315–336 (2021). https://doi.org/10.1007/s11634-020-00405-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11634-020-00405-8