Abstract

Access to credit is key to succeed in business. Theoretical models of credit under asymmetric information classify borrowers and grant or deny credit, typically based on incentive-compatible contracts with collateral. However, if women are particularly risk averse, female borrowers may be wrongly classified and denied credit. We conduct in three countries a laboratory experiment to study this systematic gender difference. Results show that incentive-compatible contracts with collateral fail to disclose women’s private information, while disclosing men’s private information. We suggest that banks should incorporate the gender difference in risk attitudes to avoid the glass ceiling in women’s access to credit.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Banks often cannot observe ex ante failure probabilities of potential borrowers. To deal with this informational asymmetry, banks may offer incentive-compatible contracts with collateral to induce borrowers to disclose their private information. Based on this disclosure and therefore self-selection in one of the two groups: Low-risk borrower or high-risk borrower, banks decide to grant or deny credit, respectively. Typically, theoretical models show that private information is fully disclosed in equilibrium, since high-risk and low-risk borrowers self-select by choosing different contracts. Low-risk borrowers choose higher collateral at a lower interest rate, while high-risk borrowers select contracts without collateral at a higher rate. The key is that the cost of investing in collateral is lower for low-risk borrowers as they have a lower probability of failure (See Comeig et al. 2014 for an empirical test on this theory).

However, this self-selection is achieved when potential borrowers are identical in every respect other than failure probability (Bester 1985). Smart (2000) shows that the addition of the customer’s degree of risk aversion can change the nature of equilibrium, and different risk classes may be pooled at a single contract in equilibrium (See also Finkelstein and McGarry 2006 for empirical results). Specifically, risk averse low-risk borrowers may not be willing to accept higher collateral to self-select. The reason is that the collateral choice is also closely connected to the degree of risk aversion (See Cohen and Einav 2007; Barseghyan et al. 2011). The higher the risk aversion the lower the willingness to accept higher collateral to self-select. Low collateral exposes individuals to a lower risk by paying a higher contract price (interest rate).

Women are generally found to be more risk averse than men in financial decision-making. For example, women have been found to be more risk averse in financial decisions in downside risk environments (Comeig et al. 2015), with respect to the pension allocation decision (Bajtelsmit et al. 1999), to have less risky asset portfolios than men (Halko et al. 2012; Jianakoplos and Bernasek 1998), and to report lower willingness to accept financial risk (Barsky et al. 1997). Similarly, laboratory experimental tests also showed that women are more risk averse than men in financial decision-making (See Charness and Gneezy 2012, Croson and Gneezy 2009, and Eckel and Grossman 2008, for a review).

If this is the case, women might not accept higher collateral to self-select. Thus, women’s contract choices, even being rational decisions for low-risk borrowers, will wrongly classify women as high-risk borrowers, in those generally accepted models. Whether men and women systematically differ in their contract choices in the self-selection mechanism with collateral is an important economic question leading to potential women credit rejections and creating an institutional barrier to female entrepreneurship. Additionally, from the bank’s point of view, the women’s reluctance to accept high collateral generates an adverse selection problem. Particularly risk averse individuals (i.e., women wrongly classified here as high-risk borrowers) might also be the best borrowers for the bank.

In this paper, we conduct a laboratory experiment on financial decision-making in three different European countries, specifically designed to study systematic gender differences in credit self-selection.

Results show that incentive-compatible contracts with collateral fail to disclose women’s private information, while they disclose men’s private information. Thus, low-risk women consumers do not self-select as “theoretical” good borrowers. Beside this contribution, results show that gender differences arise when subjects face low failure probabilities (90% success probability), i.e., downside risk as defined by Comeig et al. (2015), a small probability of a relatively low payoff.

Just a few experimental papers have focused on this self-selection mechanism: (i) Capra et al. (2009) have studied the effects of moral hazard on choices on incentive-compatible credit contracts with collateral and (ii) Bediou et al. (2013) have analyzed framing effects in the same incentive-compatible contracts. This paper’s approach is different. None of the previous experiments have studied the effect of gender on credit contract choices.

The remainder of the paper is organized as follows. The next section, Sect. 2, presents the review of the literature and the hypotheses. Section 3 shows the experimental design. Section 4 presents the results from the experiment, and the final section, Sect. 5, summarizes the main conclusions and presents implications that affect both academics and practitioners.

2 Review of literature and hypotheses development

The theoretical model of Bester (1985) on credit screening and self-selection considers a credit market with risk neutral firms, which can either be low risk (high probability of repaying the loan) or high risk (low probability of repaying the loan). In this model, banks cannot ex ante screen borrowers by risk, due to the asymmetric information context (only borrowers know their risk level). However, banks can force the borrower's self-selection by offering them a pair of incentive-compatible contracts, (a) and (b):

-

(a)

Has low interest rate and high collateral.

-

(b)

Has high interest rate and low collateral.

Bester (1985) concludes that low-risk firms differentiate themselves from high-risk firms by accepting contract (a), with higher collateral. The reason is that collateral has a higher cost for those firms that may lose it, i.e., the high-risk firms.

As pointed out, this self-selection mechanism is achieved when borrowers are risk neutral. However, empirical and experimental studies have generally found that women are significantly more risk averse than men in financial decision-making; especially in downside risk decisions (Comeig et al. 2015), where there is a small probability of a relatively low payoff. Note that a low-risk borrower choosing loan contract (b), as defined by Bester (1985), represents a downside risk decision: there is a low probability of the ‘bad payoff,’ i.e., of losing the collateral.

Additionally, the empirical research of Bajtelsmit et al. (1999) found women more risk averse than men in financial decisions on pension allocation. Jianakoplos and Bernasek (1998) and Halko et al. (2012) found women had less risky asset portfolios than men, and Barsky et al. (1997) showed that women reported lower willingness to accept financial risk.

Experimental studies have also found that women are more risk averse than men when making financial decisions, as the literature reviews of Charness and Gneezy (2012), Croson and Gneezy (2009), and Eckel and Grossman (2008) showed.

The theoretical paper by Smart (2000) demonstrates that the addition of the customer’s degree of risk aversion can change the self-selection equilibrium of Bester (1985), resulting in different risk classes pooled at a single contract. Specifically, risk averse low-risk borrowers may not be willing to accept higher collateral to self-select.

The collateral choice is closely connected to the degree of risk aversion, as shown by Cohen and Einav (2007), Barseghyan et al. (2011) and Shih and Ke (2014). The higher the risk aversion the lower the willingness to accept higher collateral. Low collateral exposes individuals to a lower risk of a greater loss (the collateral) by paying a higher contract price (interest rate).

The goal of this paper is to experimentally test the consequences that women’s pattern of behavior toward risk carry over into the self-selection mechanism with collateral. Laboratory economic experiments are exceptionally well suited to test, under controlled conditions, the gender differences in financial decisions.

This is an important topic with implications on entrepreneurship opportunities. If women do not accept higher collateral to self-select, they will be wrongly classified by banks as high-risk borrowers, leading to potential women credit rejections and creating an institutional barrier for female entrepreneurship.

The scarcity of women engaged in entrepreneurial activities is well documented. The research of Coleman (2000), Kim (2007), Coleman and Robb (2012), Koellinger et al. (2013), and Anggadwita et al. (2021) showed that women still own significantly fewer business than men worldwide. There is substantial scope for further research on the reasons behind this gender gap in entrepreneurial propensity.

Financial limitations have been found in previous research. Mijid and Bernasek (2013) reported that women initiating ventures have less access to financial resources. Alsos et al. (2006) found that women entrepreneurs tend to start ventures with lower amounts of initial funding; and Kanze et al. (2018) showed that women are less likely to attract external funds.

It is important to note that Eddleston et al. (2016) found that when women entrepreneurs obtain loans, they are more likely to acquire smaller loans, and Wu and Chua (2012) showed that loans granted to women had significantly higher interest rates.

Among the underlying causes, subjective factors have been found. Koellinger et al. (2013) and Wagner (2004), using data from the Global Entrepreneurship Monitor (GEM) project, showed that subjective perceptions as self-confidence and fear of failure are key to explain the gender gap in entrepreneurship. Both perceptions, self-confidence and fear of failure, are closely connected to the individual’s degree of financial risk aversion.

Comeig and Lurbe (2018), in a review of economic laboratory experiments which analyzes men’s and women’s self-confidence and fear of failure, showed that correcting such subjective perceptions requires awareness and changing cultural factors.

Therefore, in this paper we contribute to raising awareness about the systematic gender differences in credit self-selection and screening, in contracts with collateral. Not taking into account this gender difference can lead to financial limitations toward women, damaging female entrepreneurship.

There are only a few experimental papers on screening. Most of them have focused on insurance and labor markets and on the principal’s behavior, not on the self-selection mechanism (e. g., Shapira and Venezia 1999; Posey and Yavas 2007; Kübler et al. 2008). On the other hand, the scarce experimental literature that has analyzed this self-selection mechanism in credit markets has focused on the effects of moral hazard (Capra et al. 2009) and on the framing effects of incentive-compatible contracts (Bediou et al. 2013). This paper’s approach is different; it studies the effect of gender on contract choices.

Based on previous literature results and by presenting ad hoc incentive-compatible contracts à la Bester (1985), we test the following hypotheses:

H1

Incentive-compatible contracts with collateral screen men of different risk levels but fail to screen women by risk level.

H2

There is a gender difference when applicants face high collateral loans.

3 Method

In order to study if women are more risk averse than men in this financial decision-making setting and, therefore, women do not accept higher collateral to self-select, we design and run an economic experiment based on Bester (1985) incentive-compatible contracts with collateral.

The experiment consists on a sequence of two phases: (i) we first measure individual risk attitudes and also individual ambiguity attitudes within undergraduate students of three different European countries and (ii) we then offer those subjects menus of two incentive-compatible contracts to study self-selection.

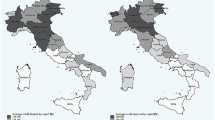

The experiment has been run in north, central, and south Europe. The goal was to control for possible cultural differences among Central Europe (Switzerland), Atlantic (UK), and Mediterranean (Spain) European countries.

At the end of the experiment, subjects answered a sociodemographic questionnaire to control for differences in technical skills and wealth between men and women. The answers showed no significant differences in these two factors between men and women.

3.1 Test on individual risk and ambiguity attitudes

To measure attitudes toward risk and ambiguity, subjects are confronted with nine lottery pairs in 2 different conditions: risk and ambiguity. The lottery pairs follow Blavatskyy (2009) test on risk and ambiguity attitudes, based on Holt and Laury (2002) test on risk attitudes. We use three different stimuli (cards, bars, and gambles). Each lottery is presented twice to each subject in order to control for the effect side (left/right) and colors. Figure 1 shows the screen’s design.

3.2 Test on self-selection mechanism

To study the women’s patterns of behavior in the self-selection mechanism, we use five incentive-compatible contract menus (with collateral) to induce subjects to disclose their private information. We follow the experimental design and menus presentation of Bediou et al. (2013), who used the contract menus originally designed by Capra et al. (2009). This contract design is based on the Bester’s (1985) principal agent game of credit screening.

Table 1 shows the 5 menus of contracts offered to the subjects and Table 2 presents the expected returns on each contract for both, low-risk individuals and high-risk individuals.

In the experiment, subjects choose between the two contracts (and a safe option). All subjects had the safer project (were low-risk borrowers) during ten rounds and had the riskier project (were high-risk borrowers) the other ten rounds. The safer project, s, has 90% chance of success, and the risky project, r, has 50% chance of success. Appendix presents the instructions used in this experiment.

Each individual started each round with a wealth of 300 units. Each subject chose one or none of the two offered contracts in each round. The subjects who did not choose any contract received a return of 30 monetary units in that round. Under Expected Utility, as in Bester’s (1985) model, the individual-expected payoffs were as follows:

Thus, in each of the rounds a pair of theoretically incentive-compatible contracts (gr, gs) was offered: \(\tilde{O}_{r} \left( {g_{r} } \right) \ge \tilde{O}_{r} \left( {g_{s} } \right){\mkern 1mu} {\text{and}}{\mkern 1mu} \;\tilde{O}_{s} \left( {g_{s} } \right) \ge \;\tilde{O}_{s} \left( {g_{r} } \right)\).

The within subjects design allows us to control for individual differences in personality or risk attitude. Half of the subjects played with the riskier project first to control for order effects.

Therefore, the design of the experiment controls for the treatment order and the presentation (right/left; blue/yellow colors). Also, by presenting two times the same contract, the design allows for indifference (i.e., an indifferent participant may choose contract r once and contract s once).

The 143 subjects of the experiment were students from the University of Geneva, Switzerland (23 men, 24 women), the University of Valencia, Spain (24 men, 24 women), and the University of East Anglia, UK (24 men, 24 women). They were recruited from various courses and grades using flyers. The individuals read the instructions and we answered their questions. During the experiment, the subjects received no feedback and were not allowed to communicate with the rest of the participants. At the end of the experiment, they received their earnings (the average payment was 15 Euros). Subjects were paid one round drawn at random per treatment in the first phase (6 rounds in total). In the second phase, subjects were paid two rounds drawn at random: one from the low risk and one from the high-risk project. Given that the experiment was run in different countries with different currencies, British Pound, Swiss Franc, and Euro, we used ECUs as experimental monetary units, to homogenize the three different currencies during the experiment.

Each session lasted approximately one hour and 15 min and was run at: (i) the University of Geneva, either at the laboratory of the Swiss Center for Affective Sciences or at the laboratory of the Faculty of Psychology; (ii) the University of Valencia, at the Laboratory for Research in Experimental Economics (LINEEX); and (iii) the Centre for Behavioral and Experimental Social Science at the University of East Anglia. The experiment was run in different time periods in each country.

4 Results

4.1 Attitudes toward risk and ambiguity

Figure 2 shows that most of the subjects (represented by dots) were concentrated in the fourth quadrant: risk and ambiguity averse individuals. The proportion of risk averse individuals was higher than the proportion of risk neutral or risk-seeking individuals. Similarly, the proportion of ambiguity averse individuals was higher than the proportion of ambiguity neutral or ambiguity-seeking individuals.

This pattern is found in each of the three countries and overall.

Regarding the gender attitudes, Fig. 2 shows that women were, overall, more concentrated in the fourth quadrant than men. The results of the Mann–Whitney test showed significant gender differences in risk attitudes but not in ambiguity attitudes (p = 0.0159 and p = 0.9586, respectively). Thus, gender differences in risk attitudes were found, being women more risk averse than men.

When studying this effect by countries using a Kruskal–Wallis test with all countries, women’s risk attitudes did not differ by country (p = 0.1856). There were no significant differences in men’s attitudes toward risk by country either (p = 0.5648). So the overall result of significant gender differences in risk attitudes, being women more risk averse than men, applies.

However, this result does not correlate to ambiguity attitudes. Using a spearman correlation test, ambiguity and risky choices were independent in both genders (p = 0.1897 for women and p = 0.3041 for men).

By country, using a Mann–Whitney test, Swiss men were found to be more ambiguity averse than Spanish and British men (p = 0.0013 and p = 0.0529, respectively).

In conclusion, after analyzing the results on attitudes toward risk from the first part of the experiment, by country and overall, significant gender differences in risk attitudes were found; being women more risk averse than men.

It is important to note that, as the theoretical work of Smart (2000) pointed out, with systematic gender differences in risk attitudes, different risk classes (low risk and high risk) may be pooled at a single contract in equilibrium, and incentive-compatible contracts with collateral may fail to disclose women’s private information.

In order to prepare the previously analyzed data on risk and ambiguity decisions, given that the attitudes tests were run with three different stimuli (cards, bars, and gambles) and repeated twice to control the left/right effect, we used the average switch point from safer (unambiguous) to risk (ambiguous) option.

To do so, we calculated if there was a Unique Switching Point (USP) for each subject and condition. This was done by comparing the lowest (highest) probability at which a subject chooses the safe (unambiguous) option, with the highest (lowest) probability at which each subject chooses the risky (ambiguous) option. If the two values did not overlap, then the subject had a USP, which means that she/he was choice consistent. Otherwise, the subject’s choices were considered inconsistent.

We created this average only when subjects selected a unique switching point (subjects faced decision problems in a random order and, therefore, they were not restricted to select a unique switching point). Using a Fisher’s exact test, there were no differences between stimulus and side effect (given the high number of tests, they are available upon request).

Table 3 shows the percentage of women and men who had always a USP in all tests, some USP in the three different stimulus, and were inconsistent in all of them.

4.2 Self-selection test

The results of the experiment run in the three countries are summarized in Fig. 3 and Table 4. Figure 3 shows the histograms of the overall results by gender and project type. Most of the men with the safer project chose the high collateral (HC) contract, 67.88%, whereas just the 49.72% of women with safer project chose the high collateral contract. Table 4 confirms that low-risk women (women with safer project) did not self-select by choosing the contract with high collateral (p = 0.3056).

Results did not show significant differences between the choice of the low and the high collateral contract in women with the safer project, the one banks want to grant credit. Therefore, low-risk women did not self-select by choosing the contract theoretically designed for low-risk borrowers and women’s screening failed to occur. This result supports H1: Incentive-compatible contracts with collateral screen men of different risk levels but fail to screen women by risk level.

As Mann–Whitney tests from the second part of Table 4 show, there are no gender differences in choices when subjects have the riskier project (p = 0.1746 for low collateral contracts, and p = 0.8503 for high collateral contracts).

However, there are significant gender differences in choices when subjects have the safer project (p = 0.0121 for low collateral contracts, and p = 0.0013 for high collateral contracts). Note that borrowers with a safer project, i.e., low probability of failure, are the target borrowers for the banks and other credit service business, the borrowers that may get credit. If women do not self-select in this case, by choosing the high collateral contract they face a barrier in obtaining funds.

Figure 4 and Table 5 show the results by country. As can be seen in Table 5, there were not significant differences across countries in the choices of the high and low collateral contract. In each country men disclosed its private information with this self-selection mechanism, whereas low-risk women did not.

Using Mann–Whitney test for each country pairs, we found the same results as Kruskal–Wallis test with all countries.

Additionally, we ran logistic models to confirm that self-selection was influenced by gender and not by country, as descriptive statistics showed. Table 6 displays the results of the logistic analysis. The self-selection option equals 1 if the subject chose low collateral with the riskier project and high collateral with the safer project. In the overall model, safer project variable indicated that having the safer project decreased the probability of choosing the best option (the option designed by the theoretical model to screen low risk from high-risk borrowers). This effect came from the women’s choices. Low-risk women did not self-select by choosing the contract with high collateral. This was shown in the variable interactions: logistic models ran with the interaction safer project and ambiguity and safer project and risk attitudes. Both attitudes significantly interacted with the safer project (Model 1); they also interacted with gender (Model 2).

Model 1 shows that interaction safer project–ambiguity attitude acted in opposite direction to safer project–risk attitude interaction: The higher the risk aversion the lower the probability of choosing the contract defined by the theoretical model.

However, the higher the ambiguity aversion, the higher probability of choosing the contract defined by the theoretical model.

Model 2 shows this effect specifically in women choices.

In conclusion, results showed that the probability of choosing the theoretical self-selection option depended on gender and supports H1: Incentive-compatible contracts with collateral screen men of different risk levels but fail to screen women by risk level. Also, the H2 is confirmed: Gender differences appeared when subjects were expected to choose high collateral (customers with safer project). There is a gender difference when applicants face high collateral loans.

The overall logit model, from Table 6, also shows that self-selection did not depend on the country.

In summary, the results of the experiment showed

-

1.

Men borrowers self-selected but women borrowers did not self-select following the theoretical model designed for a uniform risk attitude: Theoretical incentive-compatible contracts with collateral used to induce borrowers to disclose their private information fail to disclose women’s private information.

-

2.

Gender differences arose when borrowers faced low-risk projects: 90% success probability and 10% failure probability. When subjects faced high-risk projects: 50% success probability, no gender differences in behavior were found.

At this point it is important to highlight that subjects with safer projects were equally rational deciding high collateral or low collateral contract. Given that the high collateral contract had a higher variance, decisions depended on the risk-taking behavior.

5 Concluding remarks and discussion

We have conducted an experiment to study the extent to which the women’s pattern of behavior toward risk carry over into the theoretical and widely applied self-selection mechanism with collateral, a problem which reduces women’s access to funds. This problem affects female entrepreneurs negatively which, in turn, has important economic and policy implications.

Extant theories on credit screening assume that borrowers’ preferences among different combinations of price and collateral systematically depend on the risk level of their projects. The contract with high collateral and low interest rate is the one theoretically chosen by the low-risk borrowers. Banks, in turn, extract information from this borrower’s choice and grant credit mainly to those who chose high collateral (and low interest rate).

However, these models so far have not addressed an important question for such settings: Does the women’s risk-taking behavior interfere with the self-selection mechanism? Results from this research show that women avoid the high collateral contract. In this way, gender does affect the contract choice and interferes with the screening mechanism. This result suggests gender differences in self-selection that can negatively affect women in price and access to credit and entrepreneurship.

The results of this experiment clearly indicate that men and women differ in their choices under this credit screening mechanism. Consequently, incentive-compatible contracts with collateral fail to disclose women’s private information: Low-risk women borrowers do not self-select as the good borrowers they really are, due to the design of the generally accepted credit screening mechanism.

This research contributes to raising awareness about the systematic gender difference in credit self-selection and screening, in contracts with collateral. Credit service businesses, such as banks, along with women themselves, and society at large, should pay attention to this bias in order to reduce discrimination and unbalanced entrepreneurship opportunities.

Failure to take into account this gender difference can create financial constraints for women, undermining female progress and entrepreneurship.

5.1 Academic and practitioner’s implications

On one hand, given the results of this paper and other experimental and empirical literature showing gender differences in risk-taking behavior, academic theoretical models should start incorporating such differences. When constructing an economic model, the first step is to depict how economic agents cope with uncertainty (risk, ambiguity, or both) and then, based on those agent’s uncertainty preferences, the equilibrium interactions are reached.

It is important to note that nowadays algorithms are becoming ubiquitous in credit markets. Those algorithms are based on theoretical models and grow from experience. Algorithms perform the first screening in granting or denying credit. If the theoretical model is already leaving behind a big portion of the population (women), algorithms will grow with only half of the experience and may reinforce the barriers to female progress and entrepreneurship.

On the other hand, credit service businesses, such as banks, should pay attention to this bias. Essentially, the women’s reluctance to accept high collateral generates an adverse selection problem for the bank. The women wrongly classified here as high-risk borrowers are particularly risk averse, so they may also be the best borrowers for the bank, low-risk borrowers. Therefore, some human factor should be introduced in the first screening of borrowers in order to perceive these gender biases and classify low-risk woman borrowers as low-risk borrowers, regardless of their collateral choice.

Women, in turn, have to be aware of the consequences and limitations this lack of self-selection entails. Correcting such biases requires awareness, experience, and changing cultural factors that may be connected to social experiences.

References

Alsos GA, Isaksen EJ, Ljunggren E (2006) New venture financing and subsequent business growth in men- and women-led businesses. Entrep Theory Pract 30(5):667–686. https://doi.org/10.1111/j.1540-6520.2006.00141.x

Anggadwita G, Ramadani V, Permatasari A, Alamanda DT (2021) Key determinants of women’s entrepreneurial intentions in encouraging social empowerment. Serv Bus 15:309–334. https://doi.org/10.1007/s11628-021-00444-x

Bajtelsmit VL, Bernasek A, Jianakoplos NA (1999) Gender differences in defined contribution pension decisions. J Financ Serv Res 8:1–10. https://doi.org/10.1016/S1057-0810(99)00030-X

Barseghyan L, Prince J, Teitelbaum JC (2011) Are risk preferences stable across contexts? Evidence from insurance data. Am Econ Rev 101:591–631

Barsky RB, Kimball MS, Juster FT, Shapiro MD (1997) Preference parameters and behavioral heterogeneity: An experimental approach in the health and retirement survey. The National Bureau of Economic Research. Working Paper No. 5213. https://www.nber.org/papers/w5213

Bediou B, Comeig I, Jaramillo-Gutiérrez A, Sander D (2013) The role of «perceived loss» aversion on credit screening: an experiment. Span J Financ Accoun 42:83–97. https://doi.org/10.1080/02102412.2013.10779741

Bester H (1985) Screening vs. rationing in credit markets with imperfect information. Am Econ Rev 75:850–855

Blavatskyy PR (2009) Betting on own knowledge: experimental test of overconfidence. J Risk Uncertain 38:39–49. https://doi.org/10.1007/s11166-008-9048-7

Capra CM, Comeig I, Fernández MO (2009) Moral Hazard and Credit Screening. In Anderssen, Braddock and Newham (ed) Modeling and simulation Society of Australia and New Zealand and International Association for mathematics and computers in simulation. pp 1425–1431

Charness G, Gneezy U (2012) Strong evidence for gender differences in risk taking. J Econ Behav 83:50–58. https://doi.org/10.1016/j.jebo.2011.06.007

Cohen A, Einav L (2007) Estimating risk preferences from deductible choice. Am Econ Rev 97:745–788

Coleman S (2000) Access to capital and terms of credit: a comparison of men- and women-owned small businesses. J Small Bus Manag 38(3):37–52

Coleman S, Robb A (2012) A rising tide: financing strategies for women-owned firms. Stanford University Press, Stanford, CA

Comeig I, Lurbe M (2018) Gender behavioral issues and entrepreneurship. Inside the mind of the entrepreneur. Springer, Cham, pp 149–159

Comeig I, Del Brío E, Fernández MO (2014) Financing successful small business projects. Manag Decis 52:365–377. https://doi.org/10.1108/MD-01-2012-0051

Comeig I, Holt CA, Jaramillo-Gutiérrez A (2015) Dealing with risk: gender, stakes, and probability effects. Discussion papers in economic behaviour 0215, University of Valencia, ERI-CES

Croson R, Gneezy U (2009) Gender differences in preferences. J Econ Lit 47:448–474

Eckel CC, Grossman PL (2008) Men, women and risk aversion: experimental evidence. In: Plot C, Smith V (eds) Handbook of experimental economics results. Elsevier, New York

Eddleston KA, Ladge JJ, Mitteness C, Balachandra L (2016) Do you see what i see? Signaling effects of gender and firm characteristics on financing entrepreneurial ventures. Entrep Theory Pract 40(3):489–514. https://doi.org/10.1111/etap.12117

Finkelstein A, McGarry K (2006) Multiple dimensions of private information: evidence from the long term care insurance market. Am Econ Rev 96:938–958

Halko ML, Kaustia M, Alanko E (2012) The gender effect in risky asset holdings. J Econ Behav Organ 83:66–81. https://doi.org/10.1016/j.jebo.2011.06.011

Holt CA, Laury SK (2002) Risk aversion and incentive effects. Am Econ Rev 92:1644–1655

Jianakoplos NA, Bernasek A (1998) Are women more risk averse? Econ Inq 36:620–630. https://doi.org/10.1111/j.1465-7295.1998.tb01740.x

Kanze D, Huang L, Conley MA, Higgins ET (2018) We ask men to win and women not to lose: closing the gender gap in startup funding. Acad Manage J 61(2):586–614. https://doi.org/10.5465/amj.2016.1215

Kim G (2007) The analysis of self-employment levels over the life-cycle. Q Rev Econ Finan 47(3):397–410. https://doi.org/10.1016/j.qref.2006.06.004

Koellinger P, Minniti M, Schades C (2013) Gender differences in entrepreneurial propensity. Oxf Bull Econ Stat 75(2):213–234. https://doi.org/10.1111/j.1468-0084.2011.00689.x

Kübler D, Müller W, Normann HT (2008) Job market signaling and screening: an experimental comparison. Games Econ Behav 64:219–236. https://doi.org/10.1016/j.geb.2007.10.010

Mijid N, Bernasek A (2013) Gender and the credit rationing of small businesses. Soc Sci J 50(1):55–65. https://doi.org/10.1016/j.soscij.2012.09.002

Posey LL, Yavas A (2007) Screening equilibria in experimental markets. Geneva Risk Insur Rev 32:147–167. https://doi.org/10.1007/s10713-007-0007-z

Shapira Z, Venezia I (1999) Experimental test of self-selection and screening in insurance decisions. Geneva Risk Insur Rev 24:139–158. https://doi.org/10.1023/A:1008737526974

Shih TY (2014) Ke SC (2014) Determinates of financial behavior: insights into consumer money attitudes and financial literacy. Serv Bus 8:217–238. https://doi.org/10.1007/s11628-013-0194-x

Smart M (2000) Competitive insurance markets with two unobservables. Int Econ Rev 41:153–169

Wagner J (2004) What a difference a Y makes—Female and male nascent entrepreneurs in Germany. Small Bus Econ 28:1–21. https://doi.org/10.1007/s11187-005-0259-x

Wu Z, Chua JH (2012) Second-order gender effects: the case of U.S. small business borrowing cost. Entrep Theory Pract 36(3):443–463. https://doi.org/10.1111/j.1540-6520.2012.00503.x

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature. Funding was provided by Ministerio de Economía, Industria y Competitividad, Gobierno de España (Grant Nos. PID2019-110790RB-I00, RTI2018-096927-B-I00), Generalitat Valenciana (Grant No. PROMETEO/2019/095), and Universitat Jaume I (Grant No. UJI-B2018-76).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

1.1 Instructions (English)

Hello,

In this part of the experiment you are going to take a series of decisions in which you must choose between 2 situations.

These 2 situations will be represented by cards, bars, or pie charts. In each of these situations there are two possible conditions:

-

Condition 1: All the information is displayed on the screen. Both situations have the same probability to occur, but the amounts of points (ECUs) you can win are different.

-

Condition 2: There is missing information on the screen. The amount of points (ECUs) you can win is the same in both situations, but the probability of occurrence is unknown in one of the situations.

Your earnings will be determined by the amount of ECUs you obtain from your decisions: 250 ECUs = 1 Pound. One of the choices of each type of representation will be randomly selected to determine your earnings. That is, you will be paid for 6 of your choices. You can earn as much as 25 or 28 pounds. Therefore, is very important that you understand very well the instructions before you begin.

The following screenshots show one example for each one of the existing conditions.

Important: The probabilities and ECUs you can win will vary in each decision. Take your time and think thoroughly before taking your decision.

Condition 1

All the information is displayed on the screen.

The 2 situations have the same probabilities, but the ECUs to win are different.

CARDS | There are 2 decks of cards which contain 4 blue cards and 6 yellow cards On the left side, A, the blue cards are worth 400 ECUs and the yellow ones 10 ECUs On the right side, B, the blue cards are worth 200 ECUs and the yellow ones 160 ECUs Choose the deck of your preference, A (left) or B (right) Click A or B to indicate your choice After making your choice, the computer will randomly draw either a blue card (4 chances out of 10) or yellow (6 chances out of 10) | |

BARS | There are two bars that contain 3 blue boxes and 7 yellow boxes On the left side, A, the blue boxes are worth 200 ECUs and the yellow ones 160 ECUs On the right side, B, the blue boxes are worth 400 ECUs and the yellow ones 10 ECUs Choose the bar of your preference, A (left) or B (right) Click A or B to indicate your choice After making your choice, the computer will randomly draw either blue (3 chances out of 10) or yellow (7 chances out of 10) | |

PIES | There are two pies that contain 70% of blue and 30% of yellow On the left side, A, the blue cards are worth 400 ECUs and the yellow ones 10 ECUs On the right side, B, the blue cards are worth 200 ECUs and the yellow ones 160 ECUs Choose the chart of your preference, A (left) or B (right) Click A or B to indicate your choice After making your choice, the computer will randomly draw a color either (blue: 7 chances out of 10; yellow: 3 chances out of 10) |

If you have a question, raise your hand and an experimenter will come to answer you personally. When you are ready, click the Start button.

Condition 2

The amount of ECUs you can win is the same in the 2 situations, but the probabilities are unknown in one of the 2 situations. There is missing information.

CARDS | The blue cards are worth 500 ECUs and the yellow ones 10 ECUs On the left side, A, there are 4 blue cards and 6 yellow On the right side, B, you don't know the number of blue and yellow cards With probability 1/9 there will be 1 blue card and 9 yellow, with that same probability (1/9) there will be 2 blue cards and 8 yellow cards… and so on up to 9 blue cards and 1 yellow card with that same probability (1/9) Choose the deck of your preference, A (left) or B (right) Click A or B to indicate your choice After making your choice, the computer will randomly draw either a blue card (4 chances out of 10 on the left; X chances out of 10 on the right) or yellow (6 chances out of 10 on the left; 10-X chances out of 10 on the right) | |

BARS | The blue boxes are worth 500 ECUs and the yellow ones 10 ECUs On the left side, A, you don't know the number of blue and yellow boxes On the right side, B, there are 3 blue boxes and 7 yellow Choose the bar of your preference, A (left) or B (right) Click A or B to indicate your choice After making your choice, the computer will randomly draw either blue (X chances out of 10 on the left; 3 chances out of 10 on the right) or yellow (10-X chances out of 10 on the left; 7 chances out of 10 on the right) | |

PIES | The blue part is worth 500 ECUs and the yellow part 10 ECUs On the left side, A, there are 70% blue and 30% yellow On the right side, B, you don't know the proportion of blue and yellow Choose the pie of your preference, A (left) or B (right) Click A or B to indicate your choice After making your choice, the computer will randomly draw (blue: 7 chances out of 10 on the right and X chances out of 10 on the left; or yellow: 3 chances out of 10 on the right and 10-X chances out of 10 on the left) |

If you have a question, raise your hand and an experimenter will come to answer you personally. When you are ready, click the Start button.

In this second part you will participate in a decision-making experiment.

The experiment simulates a market with a seller and a buyer. You will be the buyer during all the experiment. You have to decide between two contracts. Each time, you can choose 1 out of the 2 contracts or none of them. Each contract corresponds to an investment product which is defined by a PRICE and a GUARANTEE.

If you choose a contract, you don’t pay it at beginning but at the end of the round.

The PRICE you pay depends on the success or failure of the investment you choose.

In case of SUCCESS, you pay the PRICE indicated in the contract.

In case of FAILURE, you pay the amount of the GUARANTEE.

If you choose not to take any contract, the 300 ECUs will be invested in a safe asset that yields 30 ECUs.

This part has two treatments. Before each treatment you will receive more detailed instructions.

In the following screens we present 2 examples corresponding to each treatment.

If you have a question, raise your hand and an experimenter will come to answer you personally. When you are ready, click the Start button.

In this example, the contracts A and B have a 50% probability of success and a 50% probability of failure.

In case of success, in addition to your 300 ECUs endowment, you earn 905 ECUs if you choose contract A (net of the price of 175 ECUs) and 795 ECUs if you choose contract B (net of the price of 285 ECUs).

In case of failure, in addition to your 300 ECUs endowment, you lose 225 ECUs from the guarantee if you choose contract A and 75 ECUs from the guarantee if you choose contract B.

If you choose no contract, in addition to your 300 ECUs endowment you earn 30 ECUs.

In this example, the contracts A and B have a 90% probability of success and a 10% probability of failure.

In case of success, you earn 725 ECUs if you choose contract A (net of the price of 175 ECUs) and 615 ECUs if you choose contract B (net of the price of the price of 285 ECUs). Your 300 ECUs endowment is included.

In case of failure, you earn 75 ECUs if you choose contract A (net of the guarantee of 225 ECUs) and 225 if you choose contract B (net of the guarantee of 75 ECUs). Your 300 ECUs endowment is included.

If you choose no contract, you earn 330 ECUs.

If you have a question, raise your hand and an experimenter will come to answer you personally. When you are ready, click the Start button.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Comeig, I., Jaramillo-Gutiérrez, A. & Ramírez, F. Are credit screening contracts designed for men?. Serv Bus 16, 883–905 (2022). https://doi.org/10.1007/s11628-022-00485-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11628-022-00485-w