Abstract

Current crises (i.e., climate crisis, COVID-19 pandemic, Russian invasion of Ukraine, and the resulting energy and food shortages) indicate the need for robust, and sustainable supply chains with regional food production and farmland to secure food supply in the European Union (EU). Recent research shows that organic food is more resilient to supply chain disruptions and price fluctuations. In this context, we examine an approach for the sustainable and resilient transformation of agri-food networks: can an adaptation of value added tax (VAT) levels work as a financial incentive to amplify resilient agricultural practices and sustainable dietary patterns? Within the setting of the amendment of the European framework directive on the use of VAT in 2022, we model the effects of adapting the current German VAT system by (1) reducing VAT on organic vegetarian food to 0% and (2) raising VAT on conventional meat and fish to 19%. Based on historical data on organic sales shares and price elasticities, we project sales shares differentiated by product group for each scenario. Then, we calculate expected tax revenues, changes in consumption patterns, and arising total external climate costs in Germany for both scenarios. Our results show that the overall consumption share of organic food would increase by 21.83% due to the modeled VAT reform compared to the status quo. Despite the VAT reduction to 0% on organic vegetarian products, the measure would yield €2.04 billion in extra tax revenues in Germany per year due to the increased taxation on conventional meat products. We find that annual environmental costs of €5.31 billion can be avoided as a result of lower external climate costs of organic and vegetarian food. Therefore, adjusting VAT rates in the food market can be a political instrument to drive organic food consumption and reduce animal livestock. This supports re-territorialization of agriculture and a more sustainable and resilient European food supply.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

There is broad scientific consensus that a sustainable transformation of agriculture is necessary to meet the 1.5 °C target of the Paris Agreement (UN 2015a), the Sustainable Development Goals (UN 2015b), and to stay within the planetary boundaries (Richardson et al. 2023). Moreover, in times of multiple crises (e.g., climate crisis, COVID-19, Russian invasion of Ukraine and the following energy and food shortages), and an increasing world population (UN 2015c), more resilient agri-food systems are needed to ensure global food security (Schipanski et al. 2016; European Commission 2020a; FAO 2021; IPCC 2022; Hassen and Bilalil 2022; Jagtap et al. 2022).

Resilience in the food security context is defined as the ability of an agri-food system to absorb chronic and acute perturbations (Walker et al. 2004; Darnhofer 2005; Bullock et al. 2017; Schemmel and Schumacher 2020). Highly interdependent food supply chains are prone to crises like pandemics or wars: Disruptions in supply chains during the COVID-19 pandemic spiked food prices (Kahiluoto 2020; Ben Hassen abd El Bilali 2022); the Russian invasion of Ukraine led to a cascade of consequences like canceled grain exports, labor shortages and missing access to fertilizers, and increasing food prices and restricted food availability on global markets (Ben Hassen and El Bilali 2022; Jagtap et al. 2022). Germany was affected by the mentioned crises with an average inflation of 13.3% for food products in 2022 (Federal Statistical Office 2023).

“Re-territorialization”, which refers to the process of returning control over food production and distribution to local communities and regions and involves a shift away from globalized, industrialized agriculture towards more localized and diversified food systems (Berti and Mulligan 2016; Van der Ploeg 2016), could contribute to an increase in resiliency and food safety in this context.

In this study, both an (1) increase in sales shares of organic farming and (2) the reduction of meat consumption/livestock farming are possible levers towards more sustainable, resilient, and re-territorialized agri-food systems that are examined in more detail.

Organic foods are not dependent on the import of conventional fertilizers and thus are less energy intensive and—in terms of energy—more resilient (Sanders and Heß 2019). Further, organic agriculture causes fewer negative externalities (all costs caused by the production of a product, that are not included in its price) than conventional agriculture (Reganold and Wachter 2016; Schemmel and Schumacher 2020; Pieper et al. 2020; Michalke et al. 2023) and certified supply chains (e.g., organic) are more adaptable against shakeouts (Muller et al. 2021). In addition, organic farming offers a high degree of correspondence with the criteria for resilience: shock absorbing ability, self-organization, and learning ability (Darnhofer 2005).

Since animal products (especially meat) likewise cause significantly higher environmental damage costs and negative health impacts than plant-based products (Bonnet et al. 2020; Pieper et al. 2020; Bandel et al. 2021; Gemmill-Herren et al. 2021; Michalke et al. 2023), market distortions between both organic and conventional products as well as animal-based and plant-based products occur. Therefore, besides an increase in demand for organic products, various studies identify the reduction of the global average demand for animal products—especially meat—as key to achieve more sustainable food systems through reduced environmental impact, and human health impacts (McMichael et al. 2007; Craig and Mangels 2009; Stehfest et al. 2009; Tilman and Clark 2014; Muller et al. 2017; Seidel et al. 2023).

Both (1) the increase of organic farming and (2) the reduction of meat production are in line with the goals of the German government's nutrition strategy (BMEL 2022), which sets the target of 30% organic farmland by 2030 (German Federal Government 2021), exceeding EU legislation mandating 25% organic farmland until 2030 (European Commission 2020a) and aims to transform consumption patterns towards a sustainable and health-promoting level.

Currently, only 10.87% of farmland in Germany is organically cultivated (BMEL 2021), the EU average in 2020 was 9.1% (Eurostat 2020). The current European common agricultural policy (CAP) is intended to achieve this goal with the support of an average of 54 billion subsidies per year (European Court of Auditors 2018; Nègre 2023) with only 30% of these distributed to rural development and organic farming while 70% are distributed to area payments (European Commission 2020b).Footnote 1 In relation to prevailing regulations, the European Court of Auditors (2021) sharply criticizes the present utilization of CAP funds, citing inadequacies in fostering organic farming expansion and reducing livestock farming.

Food prices generally have high impact on consumption patterns (Andreyeva et al. 2010; Seubelt et al. 2022), depending on foods’ price elasticities: Price elasticity indicates the extent to which the demand changes in response to a change in price (Varian 2016; Browning and Zupan 2020). Thus, a major problem at consumer level is the price of organic food, which is between 27 and 175% more expensive than conventional (Janson 2021). Therefore, the aspect of social inequality also plays a striking role: Seubelt et al. (2022) find costs for a healthy and environmentally-friendly diet (plant-based and organic food) in Germany to be substantially higher than for an environmentally harmful diet (omnivorous and conventional food). According to Kabisch et al. (2021), the standard diet and especially healthy eating are hardly affordable for low-income households: none of the diets proposed by the German Nutrition Society, including the German standard diet, could have been achieved with a monthly food budget of 150 euros per adult (which equals German unemployment assistance). Globally, Drewnowski (2020) highlights sustainable diets unaffordability for many, emphasizing the need for economic feasibility analyses in shaping dietary recommendations.

Even if consumers are willing to pay more for sustainable food (de-Magistris and Gracia 2016; Li and Kallas 2021; Michalke et al. 2022), a decrease in the purchase of organic products in Germany by 4.1% (DBV 2023) could be observed in 2022 due to high inflation rates (Federal Statistical Office 2023). This is reflected in the fact that the share of organic retail brands related to supermarkets increased by 9.3% year-on-year in Q1 2022, while the share of more expensive organic manufacturer brands fell by 11.4% over the same period (GfK 2022).

In times of multiple crises, the rate of price increase for organic food is more gradual compared to conventional food due to its increased resilience (Neglian and Mertens 2023; BÖLW 2023). Consequently, the price gap between conventional and organic food is narrowing, suggesting that transitioning to organic products now incurs lower additional costs than in the past, which implies that a switch to organic products entails lower additional costs than before (Schemmel and Schumacher 2020; GfK 2022).

Various measures can succeed in contributing to an agri-food system transition towards more organic farming and less meat production. Informational campaigning on environmental damage of animal products—especially meat—can improve customer awareness (Stoll-Kleemann and Schmidt 2017; Bonnet et al. 2020; Penz and Hofmann 2021; Michalke et al. 2022), but for a significant reduction of meat consumption for the society as a whole, informational strategies are not an effective tool (Zur and Klöckner 2014; Sanchez-Sabate and Sabate 2019). In particular, policy measures based on TCA can create incentives for a transformation of agri-food systems (Pretty et al. 2010; Eyhorn et al. 2019; El-Hage Scialabba & Obst 2021; Michalke et al. 2022) including regulatory and legal measures, advisory and institutional measures, and economic incentives (Pretty et al. 2010). On the other hand, consumers can exert pressure with their consumption decisions: The share of organically farmed land, for example, increases with the higher demand for organic products (Springmann et al. 2017; UBA 2017).

Sharing 10.4% of the EU’s agricultural area (Eurostat 2020), Germany could pioneer to implement the necessary transition towards increased food security and resilience on a European level in the medium to long term. Measures achieving such resilient agri-food systems can promote strong local market chains, production diversity, and food self-sufficiency (Rotz and Fraser 2015; Heck et al. 2020).

Moreover, a transformation of agri-food systems can lead to the aforementioned re-territorialization, which, in this context, can help to reduce the environmental impacts of food production and distribution, support local economies, provide healthier and more culturally appropriate food options for communities (Kremen and Miles 2012; De Schutter 2014; Maye et al. 2016; Matei et al. 2017), and promote food sovereignty (De Schutter 2014; Rossi 2017; Altieri and Nicholls 2020).

Effective measures towards a more sustainable and resilient food system can take the form of positive and negative financial incentives, which can be implemented with the help of taxes and subsidies (Pretty et al. 2010; Eyhorn et al. 2019; Hendriks et al. 2021). One major challenge within the agri-food sector is to create a fair playfield for all stakeholder groups involved (Antonaras and Kostopoulos 2021; Michalke et al. 2022). This challenge could be addressed with the "carrots and sticks" principle of Holden and Jones (2021): Environmentally friendly farming methods are subsidized ("carrots") and damaging farming methods are held financially responsible ("sticks"). These incentives could ensure that companies produce more sustainable food through targeted subsidies or less tax burden. In addition, reduced VAT on foods with low negative externalities could provide purchasing incentives for more climate-friendly products (Reisch et al. 2013; El-Hage Scialabba et al. 2021). Moreover, according to Figeczky et al. (2021), dual action should always be taken such as rewarding positive effects while minimizing negative effects. In Denmark, a dual action approach involves taxing pesticide use in agriculture combined with supportive political measures; similar strategies are observed in Sweden, Norway, and France (Böcker and Finger 2016; Pedersen and Nielsen 2017; Sachse and Bandel 2019; Sud 2020). Other studies (Böcker and Finger 2016; Slunge and Alpizar 2019) emphasize that the inclusion in national laws and a detailed differentiation of different substances/production processes can help in making measures as effective as possible, especially if taxation is removed or lower tax rates for less hazardous products are offered (Figeczky et al. 2021). Milošević et al. (2020) also point out that tax incentives for organic products would lead to healthy diets.

The EU took a step in this direction by recommending the variation of VAT rates to incentivise sustainable consumption (European Parliament 2022). To elaborate, the reduction of VAT to 0% on sustainable products and its increase on environmentally harmful products to maximum 25% is thus a possibility for the member states to set incentives for consumption and to reach the goals of, e.g., the “Farm to Fork” strategy (European Commission 2020a).

This paper will therefore examine whether the results of the present study could be especially transferable to other European countries, as VAT in the same or similar configuration is implemented in every EU member state (European Commission 2020c). So far, the reduction of the tax on organic food with already existing instruments (VAT, EU organic logo) and its effects have hardly been explored.

To target the research gap raised here, we will address the following research question in this study: How does the adjustment of the VAT for different food groups impact: (1) German tax revenues, (2) climate externalities, and (3) the change in people’s consumption patterns? Furthermore, we investigate to what extent this adaptation leads to more resilient agri-food systems and is in line with actual European (e.g., Farm to Fork strategy or EU Green Deal) and German sustainability contracts and targets (e.g., organic strategy 2030; BMEL 2023).

First, we project sales shares in Germany differentiated by product group for two scenarios: (1) 2022 actual VAT rates with 7% VAT (reduced rate in Germany) on staple food and 19% VAT (regular rate in Germany) on non-staple food products, and (2) changes to 0% VAT on organic vegetarian food as the proxy for sustainable foods and 19% VAT on conventional meat as the proxy of unsustainable foods, based on historical data and both price and cross-price elasticity effects. We then calculate expected tax revenues, changes in consumption patterns, and arising total external climate costs in Germany for both scenarios.

In the Materials and methods section, we describe our methodological framework and present the input data. Further, we discuss arising uncertainties of the calculations. Subsequently, we present the results, before they are reflected in the Discussion. Hereafter, we discuss the implications of implementing a VAT change in terms of its socially just implementation and international sustainability agreements. Finally, we summarize the paper with the conclusion and a short outlook.

Materials and methods

In this section, we describe the calculation and prediction of changes in tax revenues in Germany without and with an adaptation in VAT structures (scenario 1 and 2). We furthermore determine the impact of different VAT structures on external costs in Germany.

Please find the input data and calculations in S3.

Data and calculations

BÖLW (2022a) provides historical sales shares of organic food, which we used to run an exponential smoothing algorithm to estimate sales shares of organic food in 2023. Since the share of organic meat products differs from that of organic vegetarian products, we used values derived from BÖLW (2022b) and adapted to German consumption patterns based on BLE (2021) to obtain the most accurate sales share of organic meat possible.

To obtain total tax revenues, we used the total expenditures on food and non-alcoholic beverages in Germany by the Federal Statistical Office (2022). To differentiate between the different food groups, we used current data from the 5-yearly sample survey of income and consumption from the Federal Statistical Office (2021). Due to lacking data, we had to assume that 50% of foodstuff without further description, which represents 4.1% of total sales, is currently taxed at 7%. This value is reasonable, since the fraction of processed foods taxed at 19% in this group is presumably higher than the average fraction in all foodstuffs, because the reduced tax rate is foremost applied for staples, which mainly are categorized in the remaining categories.

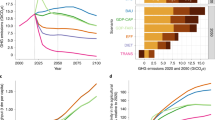

To calculate valid values for the sales shares and consequently tax revenues from different food groups, we took price elasticity effects into account (Fig. 1). The general price elasticity of organic food is derived from Schröck (2013). This is the only study yet to explicitly calculate a general price elasticity for organic food. For consistency, we also derived price elasticity of meat products from this study. The value of − 0.85 is comparable to results of other studies calculating the price elasticity of meat products, as they yield price elasticities between − 0.68 (Andreyeva et al. 2010) and − 1.0 (Bunte et al. 2007). The cross-price elasticity of meat products of 1.3, which assesses the increase in demand of organic meat due to a price increase of conventional meat, is derived from Bunte et al. (2007).

Method in short

A reduction in VAT on products with the EU organic logo would lead to an altered sales share of organic products due to the price elasticity and substitution effect. The same effect would occur when the conventional meat products, currently taxed at 7%, would be taxed at 19% VAT.

We assessed the expected share of organic vegetarian products following a reduction in VAT on organic vegetarian products to 0% and an increase in VAT on conventional meat products to 19%. For this, we first performed an exponential smoothing forecast algorithm on the sales shares of organic products using historical data since 2010 and projected the sales share for 2023

This algorithm projects the expected sales share sob of organic food in 2023 in Germany to be at 6.90% based on organic foods sales shares from 2010 to 2021. Please find a legend with all variable definitions in Fig. 2 at the end of this section.

Since the sales share of organic meat products differs from the sales share of organic vegetarian products, we determined the expected sales share of organic vegetarian products by extracting meat products out of the calculation

We subtract the product from the share of organic meat within overall meat products, the share of meat products, and the total annual sales in German retail stores from the expected sales share of organic products, and further divide it by the product of the share of vegetarian products with the total annual sales in German retail stores. The expected sales share of organic products in vegetarian food in 2023 hence turns out to be at 7.72%.

The share of organic meat in total retail expenses was calculated to be at 0.65% by multiplying the share of organic food in meat products with the overall sales share of meat products

With the derived data differentiating between conventional and organic vegetarian foods and meat products, we could identify VAT revenues when no changes to VAT structure took place.

If VAT on conventional meat products was raised to 19%, the share of conventional meat would decrease due to price elasticity. The new share of conventional meat products would therefore be at 16.74%

Here, we subtract the relative effect of price elasticity due to the higher VAT on conventional meat from the share of conventional meat previous to the VAT adaptation.

The new share of organic meat would differ according to the cross-price elasticity between organic and conventional meat

The share is calculated to be at 0.75% analogous to formula (5).

To include the decrease of VAT on organic vegetarian food to 0%, we determined its new share in vegetarian food by adding the effect of price elasticity to the previously calculated expected share of organic vegetarian products

This is also done by adding the price elasticity multiplied with the previous share of organic vegetarian food and the relative price change due to the VAT adaptation to the previously calculated share of organic food in vegetarian food (2). Since some vegetarian food is taxed at 7% and some at 19%, we differentiate according to the share of vegetarian food taxed at the respective rates. The share of organic food in vegetarian food after a tax adaptation would be at 8.19%.

By assuming the total spendings for food as stable, we were able to quantify the overall share of vegetarian products including the effects of people shifting from buying meat to buying vegetarian alternatives. We assumed the shifting into conventional and organic plant-based food and dairy to be proportional to the shares of these respective food groups before

Therefore, the sales share of vegetarian food after the VAT adaptation is calculated to be one minus the sales shares of conventional (4) and organic meat products (5), which results in 82.51%.

Since we already determined the sales shares of organic vegetarian food, we could now calculate the shares of organic and conventional vegetarian food after the adaption of VAT

Here, we differentiate between organic and conventional food by applying the previously calculated share of organic food in vegetarian food (6) to the calculated sales share of vegetarian food (7). The sales shares of vegetarian organic and conventional food would be 6.76% and 75.75%, respectively.

We could then quantify tax revenues in Germany due to organic and conventional vegetarian and non-vegetarian food before and after the introduction of a VAT change.

First, we calculated current tax revenues for conventional and organic vegetarian food:

For conventional vegetarian food, this is

Tax revenues from organic vegetarian food were determined as follows:

Here, we multiply shares of the total annual food sales in German retail stores with their respective tax shares. The shares here are differentiated in dairy products, which are taxed at 7%, plant-based food taxed at 7%, and plant-based food taxed at 19% due to the differentiated taxation at 7% and 19% in Germany. The results are then multiplied with the share of conventional and organic food within vegetarian food (2) to get the respective annual tax revenues of 13.72 billion € for conventional, and 1.15 billion € for organic vegetarian food.

The share of vegetarian food that is taxed at 7% was calculated by assessing the shares of plant-based food and dairy as well as the share of plant-based food taxed at the reduced VAT rate

The result of (12) is 72.97%, by summing up the share of plant-based food taxed at 7%, and the share of dairy in vegetarian products.

We quantified current annual tax revenues from conventional meat as 2.45 billion € by multiplying the share of conventional meat with total annual sales in German retail stores, and its tax share

Correspondingly, we calculated tax revenues due to organic meat to be 0.09 billion €

Including the increase of VAT for conventional meat products to 19% and the decrease of VAT for organic vegetarian products to 0%, the tax revenues due to the different food groups are as follows:

Conventional vegetarian food:

Organic vegetarian food:

Conventional meat:

Organic meat:

We here multiply the expected sales shares after a tax adaptation with total annual sales in German retail stores, and the respective tax shares. Tax revenues from conventional vegetarian, organic vegetarian, conventional meat, and organic meat products would amount to 13.94 billion €, 0€, 5.41 billion € and 0.10 billion €, respectively.

Due to the different VAT rates of various product groups, sales shares do not precisely reflect consumption shares. To be able to assess changes in consumption patterns, an adjustment towards these net consumption shares is necessary. This also enables the possibility to subsequently determine changes in total external climate costs caused by the consumption of foods.

To calculate net consumption shares, we first eliminated VAT rates from the determined sales shares and then scaled the resulting factors to 1.

Please find the calculations in S1.

The computed net consumption shares allow the calculation of arising external climate costs. By quantifying external climate costs arising before and after the adjustment in VAT rates using external climate cost premiums for the conventional and organic food from scientific literature, we could determine the expected reduction in external climate costs arising due to food consumption in Germany.

Please find the calculations in S2.

Dealing with uncertainties

This novel approach and especially the data basis of this study were subject to some uncertainties.

Both the Ministry of Finance and the Federal Statistical Office stated that they did not have data for VAT revenues from food retailing differentiated by VAT rates. Due to this unavailability, we calculated these revenues based on the 5-yearly sample surveys of income and consumption from the Federal Statistical Office (2021). Especially for unspecified food products, which accounted for a sales share of about 4%, we estimated the share of foods taxed at the reduced VAT rate of 7% at 50% due to the unavailability of corresponding data. Further, mixed foods (e.g., ready meals that contain a small percentage of meat) were difficult to categorize. Nevertheless, the impact of this vagueness was negligible, even if all or no unspecified products would be taxed at the regular VAT rate. The resulting net consumption shares would differ by less than 0.05%.

Further uncertainties arose from the shares of conventional and organic meat and non-meat products, which were based on the 5-year sample surveys from BLE (2021), and the Federal Statistical Office and BÖLW (2022a). This study is in line with the other studies assessing similar issues (Statista 2023).

We used an exponential smoothing algorithm to determine expected shares of organic food in 2023 based on historical data since 2010. The confidence interval of the resulting organic share at a confidence level of 95% is ± 0.44%.

The shifting effect from conventional foodstuff towards products with the EU organic logo was considered using price elasticity and substitution effects. We calculated the measure´s resulting share of conventional meat using the price elasticity of meat products and the resulting share of organic meat following the cross-price elasticity of conventional and organic meat. The used price elasticities were derived from scientific literature and subject to some uncertainties. The shifting effect from conventional meat towards vegetarian products was included. We herein assumed that the share of organic food in the substitute vegetarian food consumed did not differ from the organic share in all vegetarian food.

The effect of switching from conventional vegetarian food to organic meat was considered negligible, since conventional vegetarian products are usually cheaper in comparison and abstaining from meat is often a conscious lifestyle decision (Ion 2007; Fox and Ward 2008), so there are no scientifically verifiable cross-price elasticities for this effect.

Since foodstuff prices are subject to high inflation rates of on average 13.4% in Germany in 2022 (Federal Statistical Office 2023), and people tend to switch to cheaper foodstuff in response (DBV 2023), we assumed conservatively that total sales in retail stores would be stable. If total sales rise, Germany would generate even more tax revenues due to foodstuffs, which significantly enhances the option of a VAT adjustment.

The calculation of emitted external climate costs was based on price premium data from Pieper et al. (2020). In a first step, they aggregated food-specific greenhouse gas emissions using the material-flow analysis tool Global Emissions Model for Integrated Systems (IINAS 2017) into the categories plant-based, animal-based, or dairy products. In a second step, they monetize these aggregated emissions using the cost rate of 180€ per ton of CO2 equivalent emission rate recommended by the Federal Environment Agency (Umweltbundesamt 2019), which seems reasonable, because it is very close to IPPCs evaluation of 181$ per ton of CO2 equivalent emission, which equals 170€ and represents the mean of all available studies with a time preference rate of 1%. The authors are therefore able to calculate product group specific environmental cost premiums. Contrary to our approach, which deals with consumption quantities, Pieper et al. (2020) calculated price premiums based on production quantities. Hence, slight ambiguities did arise. Further, the used recommended price factor for the emissions of CO2 equivalents rises over time, which is why we assumed external climate costs to rise proportionally to food prices. Hence, we used the price premiums calculated by Pieper et al. (2020) as they are.

Both geopolitical and climate risks affect food prices, and the tax revenues calculated in this study. Although those risk factors cannot be foreseen precisely, global political, as well as climatic developments indicate a rising likelihood of both political and environmental crises. This highlights the need for a sustainable and resilient food economy. Thus, our calculations are not only subject to some uncertainties, but also highlight the uncertainty and low resilience of the current food system itself.

Results

Using the input data, we derived tax revenues due to conventional and organic non-meat and meat products. Additionally, we investigated the impact of the measure on the consumption of different food categories and calculated annual external costs in Germany that would be saved by eliminating the VAT on organic vegetarian food and raising VAT on meat products to 19%.

Figure 3 illustrates the changes in sales shares, tax revenues, and net consumption shares and external climate costs that would occur with a socio-ecological tax adaptation.

Changes in sales and consumption shares through adapted VAT rates

As can be seen in Tables 1 and 2, adjusted VAT rates would have significant impacts on food consumption as well as tax revenues in Germany. Due to the rise of the VAT from 7 to 19% for conventional meat, and the introduction of 0% VAT on organic vegetarian products, the sales shares and the net consumption shares would shift significantly.

Lower tax rates on more resilient organic foods and higher tax rates on less resilient meat products mean that the share of taxes in the sales shares of vegetarian and organic foods is significantly lower than in animal-based and conventional foods. As a result of non-uniform taxation, sales shares do not show the change in consumption patterns sufficiently, which is the reason why we extracted tax revenues from determined sales shares to get net consumption shares. Hence, in the following, we describe the shifts in net consumption shares.

The net consumption share of meat products in the German food market would drop to 16.02%, a relative decrease by over 18.76%. Net consumption shares of conventional foodstuff would decrease by 1.61% from 93.13% without any measures to 91.63% with the introduction of VAT adjustments.

Correspondingly, the net consumption share of vegetarian products would increase by 4.61–83.98% and the net consumption share of organic products would increase to 8.37% of total consumption through the VAT adjustment (+ 21.83%).

The net consumption share of organic meat, that is not subject to any VAT change, would significantly increase from 0.67 to 0.78% (+ 16.34%). This is mainly caused by consumers switching from organic meat to conventional meat. The share of conventional meat products, however, would drop from 19.05 to 15.24%, which represents a relative decline of 19.99%. Substitutional effects (replacement of conventional meat products with the conventional vegetarian products) would benefit the share of sales of conventional vegetarian products, which would see a slight rise of total net consumption shares from 74.08 to 76.39% (+ 3.12%). Net consumption shares of organic vegetarian products would increase significantly by 22.41% from 6.20% to 7.59% given a VAT reduction on these products to 0%.

These results highlight the main effects of the VAT adaption, the significant increase in shares of organic foods and vegetarian foods, which is accompanied by a decrease in shares of particularly conventional meat products.

Effects of VAT adaptation on tax revenues in Germany

Macroeconomically speaking, even though total sales of meat would decrease, the tax revenues of meat would rise by nearly €3 billion to €5.51 billion from previous €2.54 billion annually (cf. Table 3). This is partly due to the increasing sales share of organic, but mainly due to the VAT increase for conventional meat, which sees a 120.79% tax revenues raise. Tax revenues for organic vegetarian food would be zero translating to a loss of €1.15 billion annually. Tax revenues due to conventional vegetarian products would slightly rise to €13.94 billion, €220 million (1.55%) more than its pretax reform tax revenues (Table 3). In total, the German state would generate €2.04 billion additional annual tax revenues by increasing the VAT for conventional meat to 19% and waiving any VAT for organic vegetarian products.

Implications of VAT adaptations on climate externalities

We calculated that external climate costs due to meat consumption would drop significantly by 19.08% from €38.35 billion to €31.04 billion per year. External climate costs due to consumption of vegetarian food would rise slightly by about €2.01 billion (3.69%) from €54.42 billion to €56.43 billion annually. Because of the generally lower external climate costs of vegetarian products this rise is still substantially lower than the abatement of external climate costs by the VAT adjustment and its resulting sales share shift. In total, external climate costs of food consumption in Germany would decrease by 5.72%. This translates to a drop from €92.78 billion to €87.47 billion or total annual abatement of €5.31 billion of external climate costs (cf. Table 4).

The tax adjustment would therefore not only significantly reduce external climate costs, but also provide higher food security due to its accompanying shifting effect towards both more resilient and sustainable food.

Discussion

In our discussion, we investigate the presented results regarding VAT adjustments for different food groups in terms of resilience, climate externalities, and (inter-)national sustainability agreements, and also discuss the possibility and necessity of a socially acceptable implementation.

Can a VAT adaptation lead to re-territorilization and contribute to a more resilient food market?

Our results show that the adjustment of the VAT (0% VAT on organic vegetarian and 19% on conventional meat products) would have a significant effect on the share of organic products in total sales: An increase of 8.20% for organic vegetarian products and 14.58% for organic meat highlights the measures possible contribution as an important step towards the set political goals. Assuming that organic land use would increase in proportion to organic consumption share, which is reasonable based on its relative historical proportionality (BLE 2022; BÖLW 2022b), organic land use would increase from a projected 11.03% based on BMEL (2021) to a projected 13.44% in 2023 if VAT adjustment were to be implemented. Being the federal government's guiding principle for sustainable agricultural farming (BMEL 2023), increasing the proportion of organic products is not only necessary to achieve the German (30% by 2030) and European targets (25% by 2030), but could also create a more resilient and thus crisis-proof food market (cf. Introduction).

Moreover, a reduction of animal products represents an inevitable step towards reducing environmental pressure and ensuring resilient agri-food supply chains. In the current crisis, the supply of feed imports (e.g., from Ukraine and Russia) for livestock production proved to be particularly difficult (Ben Hassen and El Bilali 2022; Jagtap et al. 2022). The measure presented could contribute to this as follows: the reduction of the consumption of conventional meat by 19.99% and the simultaneous increase in consumption of organic meat (16.34%).

A reduction of meat production and a higher share of organic food that are better suited to local conditions (Stahlbrand 2016) can contribute to re-territorialization of agriculture (Berti 2020). This can promote the use of locally available resources (e.g., plant-based protein), which can help to reduce dependence on imported inputs and support local economies (Reganold and Wachter 2016). Organic agriculture also emphasizes a more localized and diversified approach to food production, as it often involves smaller scale, family-owned farms that prioritize soil health, biodiversity, and community relationships (Rovai and Andreoli 2016; Matei et al. 2017). Furthermore, it leads to a shift towards decentralized and diversified agri-food systems that are less reliant on synthetic inputs and monoculture crops (Kremen and Miles 2012).

Additionally, vegetarian and organically produced foods cause less climate externalities. Kurth et al. (2019) estimate externalities from agricultural production of €90 billion/year in Germany, which is very close to the value of external climate costs we obtained in our calculations (€92.78 billion). The measure identified here could help reduce those externalities. According to our findings, the VAT adjustment (cf. Table 4) would save external climate costs of €5.31 billion (− 5.72%). Importantly, the used externality calculations underlie limitations and merely approximate reality. Aspects like animal welfare (Scherer et al. 2018; Rasidovic et al. 2023) and health costs (Hendriks et al. 2021; Seidel et al. 2023) are not represented in these data yet. However, the result would then be even more in favor of the savings potential of external costs. A recent study from Funke et al. (2022) states that external costs of beef are on average between $5.75 and $9.17 per kg and proposes a tax on meat for high-income countries of 20–60% according to meat type. Springmann et al. (2018) calculate a global average optimal tax of $0.28 per kg of red meat and $1.45 per kg for processed meat due to their corresponding health costs. Hayes (2016) highlights the imposition of taxes as a way to internalize external (health) costs.

A recent study from Hülsbergen et al. (2023) shows that 30% organic farming in Germany (government's target till 2030) would save externalities in the amount of €4 billion/year in comparison to the current system. Similar studies from Reganold and Wachter (2016) assume that a switch to organic production would reduce the external costs of UK agricultural production by 75% (from £1514 million per year to £385 million per year). Likewise, Pretty et al. (2005) show that a transition to fully organic land management could save about three-quarters of the external costs.

Effects of fiscal incentives on organic food and meat consumption

In the debate on implementing measures to boost the consumption of resilient and sustainable food and/or limiting the consumption of less resilient or sustainable foodstuff—no matter in which way—it is always necessary to strive for an implementation that is as socially responsible as possible. Social strata with lower incomes tend to be less able to afford a sustainable diet (Darmon and Drewnowski 2008) and, with regard to food security, are most affected by price changes (Brinkman et al. 2010; Dorward 2012).

First the purchasing power of organic products must be considered. Currently, organic products are on average more expensive (cf. introduction) and therefore accessible to a smaller proportion of society as a whole. A reduction of VAT on organic products would additionally make organic food accessible to a larger proportion of society. Based on various studies, which show that the majority of the German and European population trust the national and European organic logo (Hempel and Hamm 2016; Murphy et al. 2022), no societal pressure can be expected for this steering effect. Moreover, the measure of reducing VAT for organic food would not put any consumer in a financially worse position.

On the other hand, if the price of conventional meat is increased, major social debates are to be expected. Nutrition, especially meat consumption is a very emotional topic, which is on a sociodemographic level influenced by age, gender, and socioeconomic status (Stoll-Kleemann and O’Riordon 2015; Macdiarmid et al. 2016), so negative incentives in this market are always associated with public debates. Roosen et al. (2022) calculate a welfare loss of 0.83 euros per household per month for a VAT rise to 19% on meat (no differentiation between organic and conventional). In the context of the planetary health diet (Willett et al. 2019) and the external costs of meat, the question arises to what extent meat is still a staple food that should be relieved from taxation (Funke et al. 2022).

An adaptation of VAT rates would benefit society by generating more than €2 billion in extra tax revenues, which in the long run could be reinvested to ensure a socially just implementation of 19% VAT on meat products. Additionally, a significant reduction of CO2 equivalents of German agriculture would reduce the likelihood that Germany will have to continue to buy additional emission allowances in the future to offset missed climate targets (BMWK 2022). In a study on the economic, environmental, and social performance of European certified foods, Bellassen et al. (2022) find positive effects for society as a whole: more jobs (+ 14%), higher labor productivity (+ 32%), and higher wages (+ 32%). On the economic side, organic farms generally obtain higher net results despite their lower yields. Moreover, organic value chains tend to attract younger and better educated workers (Koesling et al. 2008; Finley et al. 2018).

In the future, social and climate justice—based on a growing world population and ongoing overconsumption—will always go hand in hand with land justice and food security. According to the FAO, 77% of agricultural land is currently used for the production of meat and dairy products, but these provide only 18% of global calories and 37% of global proteins (Ritchie and Roser 2013). Furthermore, the question of social implementation exceeds the level of consumption also to the farmers, whereby the European Commission (2020a) provides a guarantee of a decent income support to farmers.

Beyond the measures presented here and others with push and pull factors towards sustainable agriculture, social protection programs will be needed to ensure that rural households are resilient in the face of shocks. However, this requires first recognizing that current environmental, economic, or social structures trap people in a vicious cycle of poverty and conflict, and that current systems are neither sustainable nor resilient (FAO 2021).

It is indeed possible to use other instruments such as informational campaigns (e.g., Graham and Abrahamse 2017; Michalke et al. 2022), nudging (e.g., Kurz 2018; Coucke et al. 2022), or labels (e.g., Grunert et al. 2014; Lohmann et al. 2022) as push and pull factors for a transformation of nutrition. Due to the time urgency of such measures, it is necessary to translate these scientific findings into political action. A large number of studies show that fiscal policy instruments, such as the incentives examined with VAT, have one of the greatest leverage effects (Pretty et al. 2010; Eyhorn et al. 2019; El-Hage Sciaballa et al. 2021). The adjustment of VAT has become possible and also politically desirable through a renewal of the EU directives on the use of VAT through incentives and a minimum taxation of more sustainable products to 0% (cf. Introduction) on the part of the nation states. Implementations of these are currently being discussed in the Netherlands with the proposal: 0% on fruit and vegetables and 25% on meat (VVD et al. 2021; Djojosoeparto et al. 2022). In Germany, the Minister of Food and Agriculture is also arguing for a VAT reduction for "healthy food" (fruit, vegetables and legumes) to 0% (ZDF 2023). Eykelenboom et al. (2020) have already proven that tax incentives are supported by as much as 40% to 55% of the Dutch population depending on the use of the additional tax revenue. A German survey of the population on reducing the tax on fruit and vegetables while increasing taxes on meat looks similarly divided: 46% in favor and 46% against (Forsa 2022). Perino and Schwickert (2023) even find general support for a meat tax in Germany. Therefore, in the following, only the extent to which this measure is in line with selected international and national agreements and what contribution it could make to the aforementioned goals will be examined.

To adjust the VAT, it must comply with the three aspects of neutrality, simplicity, and workability. Furthermore, it is important that such a measure is in harmony with the current international and national sustainability agreements. The measure presented is in line with the following Sustainable Development Goals (UN 2015b): 2 (no hunger), 3 (good health and well-being), 6 (clean water and sanitation), 12 (sustainable consumption and production), 13 (climate action), and 15 (life on land). In addition, various goals from the European “Farm to Fork” strategy are taken up (European Commission 2020a). In particular, this measure would help to reduce use of fertilizers due to the regulations in organic farming and the reduced livestock farming, to move to a more plant-based diet with less red and processed meat (human and environmental health aspects), and to progress towards the goal of 25% organic agriculture by 2030. Overall, the measure would also have the potential to boost the EU Green deal. The European Parliament (2022) is actually proposing this very approach calculated in this paper: The sixth VAT directive allows member states to better target rates to promote organic fruits and vegetables, for example. EU tax systems should also aim to ensure that the price of different foods reflects their true costs in terms of use of finite natural resources, pollution, greenhouse gas emissions, and other environmental externalities. Furthermore, the EU is aware that a sustainable food chain will change the economic fabric of many EU regions.

This measure also takes up aspects of the EUs’ Biodiversity Strategy (e.g., promotion of a sustainable tax system, the German coalition agreement (e.g., area target of 30% organic farming), is in line with the UN food system summit (e.g., strengthening resilience) and is neither in conflict with the German nor the European legal framework conditions.

Conclusion

Current crises indicate the need for robust and sustainable supply chains, with regional food production and farmland to secure food supply in the EU. Current political and economic framework conditions provide no sufficient incentives for existing national and international sustainability goals in the agri-food sector. In particular, too few efforts are underway to reduce meat consumption and strengthen organic agriculture.

However, both developments are crucial concerning sustainable and, above all, crisis-proof and thus more resilient forms of agriculture and the associated supply chains. Although informational campaigns, nudges, or labels can help to move consumer behavior in this direction, changed framework conditions are still required on the part of policymakers to develop the necessary leverage effect. This study has therefore focused on a specific financial policy instrument to control consumption and the subsequent agriculture: The VAT in Germany.

Although the VAT was not designed to transform the agri-food system, the European Parliament (2022) proposed VAT calibrations in the current directive and recommended to the member states a use in the form of a steering work for more sustainability.

Applied to the framework of Germany, a reduction of VAT on organic vegetarian foodstuff and an increase of VAT on conventional meat products would yield more than 2 billion € in extra tax revenues per year, which could be used to compensate meat producers and promote transition to resilient and sustainable agriculture. The measure would be accompanied by the concurrent increase of the consumption share of organic food (+ 21.83%) and vegetarian food (+ 4.61%), while the consumption of especially conventional meat products would decline by 19.99%. By reducing total external climate costs of foodstuff by 5.31 billion € annually, an adaptation of VAT rates would also contribute to avoiding externalities, which would benefit social welfare and reduce Germany's compensation payments due to its missed climate targets.

The calculations regarding sales and consumption shares, VAT, and climate externalities show that with this existing and tested system (VAT, EU organic logo)—which is in line with the German Constitution and the European Framework Directive—a quick and simple steering effect with positive effects for the German state budget, lower environmental damage costs (externalities), as well as a higher share of organic products and associated higher organic cultivation areas would be possible.

Given the positive effects of organic agriculture identified in previous chapters, targeted measures under this management system are particularly effective, and through appropriate measures, agriculture can also contribute to the reduction of environmental damage caused by other sectors of the economy. Moreover, the instrument could have a positive impact on the labor market and help to make organic food affordable for a larger part of the German population.

As the most populous country in Europe, Germany could play a pioneering role here. However, due to the European internal market and the current CAP, a medium-term implementation at EU level would be desirable and should be combined with further measures (e.g., nitrogen tax, subsidy reform). Furthermore, at the global level, it is of great importance to align agricultural value chains in such a way that they can contribute to poverty reduction and sustainable development. In addition, according to Kassie et al. (2022), "[…] there is a need to properly measure the extent to which policies distort commodity chain market prices and to understand the impact of protection on other sectors […]." This step is inevitable to turn the associated findings to create regulatory policy instruments like tax measures.

Overall, adjusting VAT rates in the food system would be a powerful, and quickly implementable political instrument for driving organic food consumption and reducing animal livestock, which supports transitioning towards a more sustainable and resilient European food supply.

Data avialiability

The data presented in this study are available in the attached supplementary files. It can be found under the link mentioned at the point “Supplementary Information". Please contact the corresponding author for further requests.

Notes

The CAP is divided into two pillars: (1) "Direct support", allocating predominantly area-based funds to facilitate agricultural operations for farmers and (2) "Rural development", designed to enact measures fostering social and environmental sustainability in rural areas. About 70% of the total funds are distributed to the first pillar and 30% to the second pillar (Nègre 2023).

References

Altieri MA, Nicholls CI (2020) Agroecology and the emergence of a post COVID-19 agriculture. Agric Hum Values 37(3):525–526. https://doi.org/10.1007/s10460-020-10043-7

Andreyeva T, Long MW, Brownell KD (2010) The impact of food prices on consumption: a systematic review of research on the price elasticity of demand for food. Am J Public Health 100(2):216–222. https://doi.org/10.2105/AJPH.2008.151415

Antonaras A, Kostopoulos A (2021) Stakeholder agriculture. True cost accounting for food. Routledge, London, pp 125–147

Bandel T, Köpper J, Mervelskemper L, Bonnet C, Scheepens A (2021) The business of TCA: assessing risks and dependencies along the supply chain. True cost accounting for food. Routledge, London, pp 209–220

Bellassen V, Drut M, Hilal M, Bodini A, Donati M, de Labarre MD, Filipović J, Gauvrit L, Gil JM, Hoang V, Malak-Rawlikowska A, Mattas K, Monier-Dilhan S, Muller P, Napasintuwong O, Peerlings J, Poméon T, Tomić Maksan M, Török Á, Veneziani M, Vittersø G, Arfini F (2022) The economic, environmental and social performance of European certified food. Ecol Econ 191:107244. https://doi.org/10.1016/j.ecolecon.2021.107244

Ben Hassen T, El Bilali H (2022) Impacts of the Russia-Ukraine war on global food security: towards more sustainable and resilient food systems? Foods 11(15):2301. https://doi.org/10.3390/foods11152301

Berti G (2020) Sustainable agri-food economies: re-territorialising farming practices, markets, supply chains, and policies. Agriculture 10(3):64. https://doi.org/10.3390/agriculture10030064

Berti G, Mulligan C (2016) Competitiveness of small farms and innovative food supply chains: the role of food hubs in creating sustainable regional and local food systems. Sustainability 8(7):616. https://doi.org/10.3390/su8070616

BLE (Bundesanstalt für Landwirtschaft und Ernährung) (2021) Bericht zur Markt- und Versorgungslage Fleisch. https://www.ble.de/SharedDocs/Downloads/DE/BZL/Daten-Berichte/Fleisch/2021BerichtFleisch.pdf?__blob=publicationFile&v=2. Accessed 16 Jan 2023

BLE (Bundesanstalt für Landwirtschaft und Ernährung) (2022) Strukturdaten zum Ökologischen Landbau in Deutschland. https://www.ble.de/DE/Themen/Landwirtschaft/Oekologischer-Landbau/_functions/StrukturdatenOekolandbau_table.html. Accessed 26 Jan 2023

BMEL (Bundesministerium für Ernährung und Landwirtschaft) (2021) Ökologischer Landbau nach Verordnung (EG) Nr. 834/2007 i.V.m. Verordnung (EG) Nr. 889/2008 in Deutschland im Jahr 2021. https://www.bmel.de/SharedDocs/Downloads/DE/_Landwirtschaft/Biologischer-Landbau/OekolandbauInDeutschland2021.pdf?__blob=publicationFile&v=2. Accessed 26 Jan 2023

BMEL (2022) Eckpunktepapier: Weg zur Ernährungsstrategie der Bundesregierung. https://www.bmel.de/SharedDocs/Downloads/DE/_Ernaehrung/ernaehrungsstrategie-eckpunktepapier.pdf?__blob=publicationFile&v=4 Accessed 14 Nov 2023

BMEL (2023) Bio-Strategie 2030: Nationale Strategie für 30 Prozent ökologische Land- und Lebensmittelwirtschaft bis 2030. https://www.bmel.de/DE/themen/landwirtschaft/oekologischer-landbau/bio-strategie-2030.html Accessed 20 Nov 2023

BMWK (Bundesministerium für Wirtschaft und Klimaschutz) (2022) Germany acquires emission allowances for failures to meet climate targets between 2013 and 2020. Berlin. 10/24/2022. https://www.bmwk.de/Redaktion/EN/Pressemitteilungen/2022/10/20221024-germany-acquires-emission-allowances-for-failures-to-meet-climate-targets-between-2013-and-2020.html. Accessed 26 Jan 2023

Böcker T, Finger R (2016) European pesticide tax schemes in comparison: an analysis of experiences and developments. Sustainability 8(4):378. https://doi.org/10.3390/su8040378

BÖLW (Bund ökologische Landwirtschaft) (2022a) Anteil von Bio-Lebensmitteln am Lebensmittelumsatz in Deutschland in den Jahren 2010 bis 2021 [Graph]. In Statista. https://de.statista.com/statistik/daten/studie/360581/umfrage/marktanteil-von-biolebensmitteln-in-deutschland/. Accessed 23 Aug 2022

BÖLW (Bund ökologische Lebensmittelwirtschaft) (2022b) Branchenreport 2022. https://www.boelw.de/fileadmin/user_upload/Dokumente/Zahlen_und_Fakten/Broschuere_2022/BOELW_Branchenreport2022.pdf. Accessed 26 Jan 2023

BÖLW (Bund ökologische Lebensmittelwirtschaft) (2023) Bio wirkt als Inflationsbremse. https://www.boelw.de/news/bio-wirkt-als-inflationsbremse/. Accessed 23 Jan 2023

Bonnet C, Bouamra-Mechemache Z, Réquillart V, Treich N (2020) Viewpoint: regulating meat consumption to improve health, the environment and animal welfare. Food Policy 97:101847. https://doi.org/10.1016/j.foodpol.2020.101847

Brinkman H-J, de Pee S, Sanogo I, Subran L, Bloem MW (2010) High food prices and the global financial crisis have reduced access to nutritious food and worsened nutritional status and health. J Nutr 140(1):153S-S161. https://doi.org/10.3945/jn.109.110767

Browning EK, Zupan MA (2020) Microeconomics: theory and applications. Wiley, Hoboken

Bullock JM, Dhanjal-Adams KL, Milne A, Oliver TH, Todman LC, Whitmore AP, Pywell RF, Bardgett R (2017) Resilience and food security: rethinking an ecological concept. J Ecol 105(4):880–884. https://doi.org/10.1111/1365-2745.12791

Bunte F, van Galen MA, Kuiper WE, Bakker JH (2007) Limits to growth in organic sales: price elasticity of consumer demand for organic food in Dutch supermarkets. https://library.wur.nl/webquery/wurpubs/reports/351868. Accessed 22 Dec 2022

Coucke N, Vermeir I, Slabbinck H, Geuens M, Choueiki Z (2022) How to reduce agri-environmental impacts on ecosystem services: the role of nudging techniques to increase purchase of plant-based meat substitutes. Ecosyst Serv 56:101444. https://doi.org/10.1016/j.ecoser.2022.101444

Craig WJ, Mangels AR (2009) Position of the American Dietetic Association: vegetarian diets. J Am Diet Assoc 109(7):1266–1282. https://doi.org/10.1016/j.jada.2009.05.027

Darmon N, Drewnowski A (2008) Does social class predict diet quality? Am J Clin Nutr 87(5):1107–1117. https://doi.org/10.1093/ajcn/87.5.1107

Darnhofer I (2005) Resilienz und die Attraktivität des Biolandbaus für Landwirte. In: Groier M, Schermer M (eds) Bio-Landbau in Österreich im internationalen Kontext. Bundesanstalt für Bergbauernfragen, Wien, pp 67–84

DBV (Deutsche Bauernverband) (2023) Marktbericht zum Jahreswechsel 2022/23. https://www.bauernverband.de/topartikel/marktbericht-zum-jahreswechsel-2022-23. Accessed 14 Jan 2023

de-Magistris T, Gracia A (2016) Consumers’ willingness-to-pay for sustainable food products: the case of organically and locally grown almonds in Spain. J Clean Prod 118:97–104. https://doi.org/10.1016/j.jclepro.2016.01.050

De Schutter O (2014) Final Report: The Transformative Potential of the Right to Food; Report to the 25th Session of the Human Rights Council HRC/25/57; Human Rights Council: Geneva

Djojosoeparto SK, Kamphuis CBM, Vandevijvere S, Poelman MP (2022) How can national government policies improve food environments in the Netherlands? Int J Public Health 67:1–14. https://doi.org/10.3389/ijph.2022.1604115

Dorward A (2012) The short- and medium—term impacts of rises in staple food prices. Food Security 4(4):633–645. https://doi.org/10.1007/s12571-012-0210-3

Drewnowski A (2020) Analysing the affordability of the EAT–lancet diet. Lancet Glob Health 8:e6–e7. https://doi.org/10.1016/S2214-109X(19)30502-9

El-Hage Scialabba N, Obst C (2021) From practice to policy: new metrics for the 21st century. True cost accounting for food. Routledge, London, pp 13–25

El-Hage Scialabba N, Obst C, Merrigan KA, Müller A (2021) Conclusion: mobilizing the power and potential of true cost accounting. true cost accounting for food. Routledge, London, pp 263–273

European Commission (2020a) Farm to Fork strategy. For a fair, healthy and environmentally-friendly food system. https://food.ec.europa.eu/system/files/2020-05/f2f_action-plan_2020_strategy-info_en.pdf. Accessed 11 Jan 2023

European Commission (2020b) A climate resilient Europe: prepare Europe for climate disruptions and accelerate the transformation to a climate resilient and just Europe by 2030: Publications Office, Luxemburg

European Commission (2020c) VAT rates applied in the Member States of the European Union. https://taxation-customs.ec.europa.eu/system/files/2020-10/vat_rates_en.pdf. Accessed 10 May 2023

European Court of Auditors (2018) Future of the CAP. https://www.eca.europa.eu/Lists/ECADocuments/Briefing_paper_CAP/Briefing_paper_CAP_EN.pdf Accessed 10 Jan 2024

European Court of Auditors (2021) Special Report 16/2021: Common Agricultural Policy (CAP) and climate. https://www.eca.europa.eu/Lists/ECADocuments/SR21_16/SR_CAP-and-Climate_EN.pdf. Accessed 16 Jan 2023

European Parliament (2022) Texts adopted—implementation of the Sixth VAT Directive. 2020/2263(INI). https://www.europarl.europa.eu/doceo/document/TA-9-2022-0034_EN.html. Accessed 23 Jan 2023

Eurostat (2020) Area under organic farming. https://ec.europa.eu/eurostat/databrowser/view/sdg_02_40/default/table?lang=en. Accessed 14 Jan 2023

Eyhorn F, Muller A, Reganold JP, Frison E, Herren HR, Luttikholt L, Mueller A, Sanders J, Scialabba NE-H, Seufert V, Smith P (2019) Sustainability in global agriculture driven by organic farming. Nat Sustain 2(4):253–255. https://doi.org/10.1038/s41893-019-0266-6

Eykelenboom M, van Stralen MM, Olthof MR, Renders CM, Steenhuis IHM (2020) Public acceptability of a sugar-sweetened beverages tax and its associated factors in the Netherlands. Eur J Public Health. https://doi.org/10.1093/eurpub/ckaa165.326

FAO (Food and Agricultural Organization) (2021) The State of Food and Nutrition in the World 2021. Food and Agriculture Organization, Rome.https://doi.org/10.4060/cb4476en

Figeczky G, Luttikholt L, Eyhorn F, Muller A, Schader C, Varini F (2021) Incentives to change: the experience of the organic sector. true cost accounting for food. Routledge, London, pp 96–111

Finley L, Chappell MJ, Thiers P, Moore JR (2018) Does organic farming present greater opportunities for employment and community development than conventional farming? A survey-based investigation in California and Washington. Agroecol Sustain Food Syst 42(5):552–572. https://doi.org/10.1080/21683565.2017.1394416

Forsa (2022) RTL/ntv Trendbarometer. In: Statista. https://de.statista.com/statistik/daten/studie/1285056/umfrage/mehrwertsteuerumverteilung-bei-obst-gemuese-fleisch-milch/. Accessed 10 Jan 2023

Fox N, Ward K (2008) Health, ethics and environment: a qualitative study of vegetarian motivations. Appetite 50(2–3):422–429. https://doi.org/10.1016/j.appet.2007.09.007

Federal Statistical Office (Statistisches Bundesamt) (2021) Aufwendungen privater Haushalte für Nahrungsmittel, Getränke und Tabakwaren in den Gebietsständen. https://www.destatis.de/DE/Themen/Gesellschaft-Umwelt/Einkommen-Konsum-Lebensbedingungen/Konsumausgaben-Lebenshaltungskosten/Tabellen/pk-ngt-evs.html. Accessed 26 Jan 2023

Federal Statistical Office (Statistisches Bundesamt) (2022) Konsumausgaben der privaten Haushalte in Deutschland für Nahrungsmittel und alkoholfreie Getränke in den Jahren 1991 bis 2021, In: Statista. https://de.statista.com/statistik/daten/studie/296809/umfrage/konsumausgaben-in-deutschland-fuer-nahrungsmittel-und-alkoholfreie-getraenke/. Accessed 20 Dec 2022

Federal Statistical Office (Statistisches Bundesamt) (2023) Verbraucherpreisindex für Deutschland. https://www.destatis.de/DE/Themen/Wirtschaft/Konjunkturindikatoren/Basisdaten/vpi041j.html. Accessed 23 Jan 2023

Funke F, Mattauch L, van den Bijgaart I, Godfray HCJ, Hepburn C, Klenert D, Springmann M, Treich N (2022) Toward optimal meat pricing: is it time to tax meat consumption? Rev Environ Econ Policy 16(2):219–240. https://doi.org/10.1086/721078

Gemmill-Herren B, Baker LE, Daniels PA (eds) (2021) True cost accounting for food. Routledge, London.https://doi.org/10.4324/9781003050803

German Federal Government (2021) Koalitionsvertrag 2021–2025. https://www.bundesregierung.de/resource/blob/974430/1990812/04221173eef9a6720059cc353d759a2b/2021-12-10-koav2021-data.pdf?download=1. Accessed 28 Jan 2023

GfK (Gesellschaft für Konsumforschung) (2022) Consumer Index Total Grocery 03|2022. Kulturmarken und Nachhaltigkeit in Zeiten knapper monetärer Budgets. https://www.gfk.com/hubfs/CI_03_2022.pdf. Accessed 15 Jan 2023

Graham T, Abrahamse W (2017) Communicating the climate impacts of meat consumption: the effect of values and message framing. Glob Environ Chang 44:98–108. https://doi.org/10.1016/j.gloenvcha.2017.03.004

Grunert KG, Hieke S, Wills J (2014) Sustainability labels on food products: Consumer motivation, understanding and use. Food Policy 44:177–189. https://doi.org/10.1016/j.foodpol.2013.12.001

Hayes R (2016) Internalizing externalities: techniques to reduce ecological impacts of food production. In: Steier G, Patel KK (eds) International food law and policy. Springer, Cham, pp 359–363

Heck S, Campos H, Barker I, Okello JJ, Baral A, Boy E, Brown L, Birol E (2020) Resilient agri-food systems for nutrition amidst COVID-19: evidence and lessons from food-based approaches to overcome micronutrient deficiency and rebuild livelihoods after crises. Food Secur 12(4):823–830. https://doi.org/10.1007/s12571-020-01067-2

Hempel C, Hamm U (2016) Local and/or organic: a study on consumer preferences for organic food and food from different origins. Int J Consum Stud 40(6):732–741. https://doi.org/10.1111/ijcs.12288

Hendriks S, Ruiz A, Herrero M, Baumers H, Galgani P, Mason-D’Croz D (2021) The true cost and true price of food. A paper from the scientific group of the U.N. Food Systems Summit. In: von Braun J, Afsana K, Fresco LO, Hassan M (eds) Science and innovations for food systems transformation and summit actions. United Nations, New York, pp 357–376

Holden P, Jones A (2021) Harmonizing the measurement of on-farm impacts. True cost accounting for food. Routledge, London, pp 85–95

Hülsbergen K-J, Schmid H, Chmelikova L, Rahmann G, Paulsen HM, Köpke U (2023) Umwelt- und Klimawirkungen des ökologischen Landbaus. Weihenstephaner Schriften Ökologischer Landbau und Pflanzenbausysteme, vol 16. Verlag Dr. Köster, Berlin

IINAS (2017) GEMIS - Global Emission Model of Integrated Systems. Version 4:95

Ion RA (2007) Reasons why People turn to vegetarian diet. Econ Agric 54(928-2016–73656):353–358. https://doi.org/10.22004/ag.econ.245701

IPCC (2022) Climate change 2022: impacts, adaptation and vulnerability. IPCC Sixth Assessment Report

Jagtap S, Trollman H, Trollman F, Garcia-Garcia G, Parra-López C, Duong L, Martindale W, Munekata PES, Lorenzo JM, Hdaifeh A, Hassoun A, Salonitis K, Afy-Shararah M (2022) The Russia-Ukraine conflict: its implications for the global food supply chains. Foods 11(14):2098. https://doi.org/10.3390/foods11142098

Janson M (2021) So viel teurer sind Bio-Lebensmittel. In: Statista. https://de.statista.com/infografik/24615/preisaufschlaege-fuer-bio-lebensmittel-in-deutschland/. Accessed 23 Jan 2023

Kabisch S, Wenschuh S, Buccellato P, Spranger J, Pfeiffer AF (2021) Affordability of different isocaloric healthy diets in Germany—an assessment of food prices for seven distinct food patterns. Nutrients 13:3037. https://doi.org/10.3390/nu13093037

Kahiluoto H (2020) Food systems for resilient futures. Food Secur 12(4):853–857. https://doi.org/10.1007/s12571-020-01070-7

Kassie GT, Martin W, Tokgoz S (2022) Analysis of the impacts of agricultural incentives on the performance of agricultural value chains, International Food Policy Research Institute Washington, DC

Koesling M, Flaten O, Lien G (2008) Factors influencing the conversion to organic farming in Norway. Int J Agric Resour Gov Ecol 7:78–95. https://doi.org/10.1504/IJARGE.2008.016981

Kremen C, Miles A (2012) Ecosystem services in biologically diversified versus conventional farming systems: benefits, externalities, and trade-offs. Ecol Soc. https://doi.org/10.5751/ES-05035-170440

Kurth T, Rubel H, zum Meyer Felde A, Krüger J-A, Zielcke S, Günther M, Kemmerling B (2019) Sustainably securing the future of agriculture, Boston Consulting Group. https://web-assets.bcg.com/e8/be/1e68bff34487ac9fad313f5a8309/sustainably-securing-the-future-of-agriculture.pdf

Kurz V (2018) Nudging to reduce meat consumption: Immediate and persistent effects of an intervention at a university restaurant. J Environ Econ Manag 90:317–341. https://doi.org/10.1016/j.jeem.2018.06.005

Li S, Kallas Z (2021) Meta-analysis of consumers’ willingness to pay for sustainable food products. Appetite 163:105239. https://doi.org/10.1016/j.appet.2021.105239

Lohmann PM, Gsottbauer E, Doherty A, Kontoleon A (2022) Do carbon footprint labels promote climatarian diets? Evidence from a large-scale field experiment. J Environ Econ Manag 114:102693. https://doi.org/10.1016/j.jeem.2022.102693

Macdiarmid JI, Douglas F, Campbell J (2016) Eating like there’s no tomorrow: public awareness of the environmental impact of food and reluctance to eat less meat as part of a sustainable diet. Appetite 96:487–493. https://doi.org/10.1016/j.appet.2015.10.011

Matei A, Swagemakers P, Dominguez Garcia M, Da Silva L, Ventura F, Milone P (2017) State support in Brazil for a local turn to food. Agriculture 7(1):5. https://doi.org/10.3390/agriculture7010005

Maye D, Kirwan J, Schmitt E, Keech D, Barjolle D (2016) PDO as a mechanism for reterritorialisation and agri-food governance: a comparative analysis of cheese products in the UK and Switzerland. Agriculture 6(4):54. https://doi.org/10.3390/agriculture6040054

McMichael AJ, Powles JW, Butler CD, Uauy R (2007) Food, livestock production, energy, climate change, and health. Lancet 370(9594):1253–1263. https://doi.org/10.1016/S0140-6736(07)61256-2

Michalke A, Stein L, Fichtner R, Gaugler T, Stoll-Kleemann S (2022) True cost accounting in agri-food networks: a German case study on informational campaigning and responsible implementation. Sustain Sci 17:2269–2285. https://doi.org/10.1007/s11625-022-01105-2

Michalke A, Köhler A, Messmann L, Thorenz A, Tuma A, Gaugler T (2023) True cost accounting of organic and conventional food production. J Clean Prod

Milošević G, Kulić M, Đurić Z, Đurić O (2020) The taxation of agriculture in the republic of Serbia as a factor of development of organic agriculture. Sustainability 12(8):3261. https://doi.org/10.3390/su12083261

Muller A, Schader C, El-Hage Scialabba N, Brüggemann J, Isensee A, Erb K-H, Smith P, Klocke P, Leiber F, Stolze M, Niggli U (2017) Strategies for feeding the world more sustainably with organic agriculture. Nat Commun 8(1):1290. https://doi.org/10.1038/s41467-017-01410-w

Muller P, Böhm M, Csillag P, Donati M, Drut M, Ferrer-Pérez H, Gauvrit L, Gil JM, Hoang V, Malak-Rawlikowska A, Mattas K, Napasintuwong O, Nguyen V, Papadopoulos I, Ristic B, Stojanovic Z, Török Á, Tsakiridou E, Veneziani M, Bellassen V (2021) Are certified supply chains more socially sustainable? A bargaining power analysis. J Agric Food Ind Organ 19(2):177–192. https://doi.org/10.1515/jafio-2019-0039

Murphy B, Martini M, Fedi A, Loera BL, Elliott CT, Dean M (2022) Consumer trust in organic food and organic certifications in four European countries. Food Control 133:108484. https://doi.org/10.1016/j.foodcont.2021.108484

Neglian A, Mertens A (2023) Inflationsdämpfer Bio-Lebensmittel. IW-Kurzbericht Nr. 80/2023, Berlin/Köln.https://www.iwkoeln.de/studien/adriana-neligan-armin-mertens-inflationsdaempfer-bio-lebensmittel.html Accessed 10 Nov 2023

Nègre F (2023) Direct payments. Fact Sheet of the European Union. https://www.europarl.europa.eu/erpl-app-public/factsheets/pdf/en/FTU_3.2.5.pdf Accessed 11 Jan 2024

Pedersen AB, Nielsen H (2017) Effectiveness of pesticide policies: experiences from Danish pesticide regulation 1986–2015. In: Coll M, Wajnberg E (eds) Environmental pest management. Challenges for agronomists, ecologists, economists and policymakers. Wiley, Hoboken, pp 279–319

Penz E, Hofmann E (2021) What stirs consumers to purchase carbon-friendly food? Investigating the motivational and emotional aspects in three studies. Sustainability 13(15):8377. https://doi.org/10.3390/su13158377

Perino G, Schwickert H (2023) Animal welfare is a stronger determinant of public support for meat taxation than climate change mitigation in Germany. Nat Food 4:160–169. https://doi.org/10.1038/s43016-023-00696-y

Pieper M, Michalke A, Gaugler T (2020) Calculation of external climate costs for food highlights inadequate pricing of animal products. Nat Commun 11(1):6117. https://doi.org/10.1038/s41467-020-19474-6

Pretty J, Ball AS, Lang T, Morison J (2005) Farm costs and food miles: An assessment of the full cost of the UK weekly food basket. Food Policy 30(1):1–19. https://doi.org/10.1016/j.foodpol.2005.02.001

Pretty J, Brett C, Gee D, Hine R, Mason C, Morison J, Rayment M, van der Bijl G, Dobbs T (2010) Policy challenges and priorities for internalizing the externalities of modern agriculture. J Environ Plan Manag 44(2):263–283. https://doi.org/10.1080/09640560123782

Rasidovic A, Oebel B, Stein L, Michalke A, Gaugler T (2023) Soziale externe Kosten: Ein Framework zur Monetarisierung von Tierwohl zur Berechnung wahrer Lebensmittelpreise. In: One Step Ahead—einen Schritt voraus! Beiträge zur 16. Wissenschaftstagung Ökologischer Landbau, Frick (CH), 7. bis 10. März 2023, Verlag Dr. Köster, Berlin. https://orgprints.org/id/eprint/50747/. Accessed 30 Nov 2023

Reganold JP, Wachter JM (2016) Organic agriculture in the twenty-first century. Nat Plants 2(2):1–8. https://doi.org/10.1038/nplants.2015.221

Reisch L, Eberle U, Lorek S (2013) Sustainable food consumption: an overview of contemporary issues and policies. Sustain Sci Pract Policy 9(2):7–25. https://doi.org/10.1080/15487733.2013.11908111

Richardson K, Steffen W, Lucht W, Bendtsen J, Cornell SE, Donges JF, Drüke M, Fetzer I, Bala G, Von Bloh W, Feulner G, Fiedler S, Gerten D, Gleeson T, Hofmann M, Huiskamp W, Kummu M, Mohan C, Nogués-Bravo D, Petri S, Porkka M, Rahmstorf S, Schaphoff S, Thonicke K, Tobian A, Virkki V, Wang-Erlandsson L, Weber L, Rockström J (2023) Earth beyond six of nine planetary boundaries. Sci Adv 9:eadh2458. https://doi.org/10.1126/sciadv.adh2458

Ritchie H, Roser M (2013) Land use. https://ourworldindata.org/land-use. Accessed 26 Jan 2023

Roosen J, Staudigel M, Rahbauer S (2022) Demand elasticities for fresh meat and welfare effects of meat taxes in Germany. Food Policy 106:102194. https://doi.org/10.1016/j.foodpol.2021.102194

Rossi A (2017) Beyond food provisioning: the transformative potential of grassroots innovation around food. Agriculture 7(1):6. https://doi.org/10.3390/agriculture7010006

Rotz S, Fraser EDG (2015) Resilience and the industrial food system: analyzing the impacts of agricultural industrialization on food system vulnerability. J Environ Stud Sci 5(3):459–473. https://doi.org/10.1007/s13412-015-0277-1

Rovai M, Andreoli M (2016) Combining multifunctionality and ecosystem services into a win-win solution. The case study of the Serchio River Basin (Tuscany—Italy). Agriculture 6(4):49. https://doi.org/10.3390/agriculture6040049

Sachse I, Bandel T (2019) Taxation as a tool towards true cost accounting. https://www.agroecologia.net/wp-content/uploads/2019/04/Taxation-as-a-tool-towards-true-cost-accounting_Final-Report_DV13.pdf. Accessed 03 Aug 2022

Sanchez-Sabate R, Sabaté J (2019) Consumer attitudes towards environmental concerns of meat consumption: a systematic review. Int J Environ Res Public Health 16(7):1220. https://doi.org/10.3390/ijerph16071220

Sanders J, Heß J (eds) (2019) Leistungen des ökologischen Landbaus für Umwelt und Gesellschaft, 2nd edn. Johann Heinrich von Thünen-Institut, Braunschweig. https://doi.org/10.3220/REP1576488624000

Schemmel JP, Schumacher K (2020) Zukunftsfähige Konjunkturimpulse zur Bewältigung der wirtschaftlichen Folgen der Corona-Krise, Öko-Institut e.V. https://www.oeko.de/fileadmin/oekodoc/Zukunftsfaehige-Konjunkturimpulse.pdf. Accessed 16 Jan 2023

Scherer L, Tomasik B, Rueda O, Pfister S (2018) Framework for integrating animal welfare into life cycle sustainability assessment. Int J Life Cycle Assess 23:1476–1490. https://doi.org/10.1007/s11367-017-1420-x

Schipanski ME, MacDonald GK, Rosenzweig S, Chappell MJ, Bennett EM, Kerr RB, Blesh J, Crews T, Drinkwater L, Lundgren JG, Schnarr C (2016) Realizing resilient food systems. Bioscience 66(7):600–610. https://doi.org/10.1093/biosci/biw052

Schröck R (2013) Analyse der Preiselastizitäten der Nachfrage nach Biolebensmitteln unter Berücksichtigung nicht direkt preisrelevanten Verhaltens der Verbraucher, BÖLN. https://orgprints.org/id/eprint/22414/13/22414-08OE148-uni-giessen-herrmann-2013-preiselastizitaeten_biolebensmittel.pdf. Accessed 26 Jan 2023

Seidel F, Oebel B, Stein L, Michalke A, Gaugler T (2023) The true price of external health effects from food consumption. Nutrients 15(15):3386. https://doi.org/10.3390/nu15153386

Seubelt N, Michalke A, Gaugler T (2022) Influencing factors for sustainable dietary transformation—a case study of German food consumption. Foods. https://doi.org/10.3390/foods11020227

Slunge D, Alpizar F (2019) Market-based instruments for managing hazardous chemicals: a review of the literature and future research agenda. Sustainability 11(16):4344. https://doi.org/10.3390/su11164344

Springmann M, Mason-D’Croz D, Robinson S, Wiebe K, Godfray HCJ, Rayner M, Scarborough P (2017) Mitigation potential and global health impacts from emissions pricing of food commodities. Nat Clim Change 7(1):69–74. https://doi.org/10.1038/nclimate3155

Springmann M, Mason-D’Croz D, Sherman R, Wiebe K, Godfray HCJ, Rayner M, Scarborough P (2018) Health-motivated taxes on red and processed meat: a modelling study on optimal tax levels and associated health impacts. PLoS ONE 13(11):e0204139. https://doi.org/10.1371/journal.pone.0204139

Stahlbrand L (2016) The food for life catering mark: implementing the sustainability transition in university food procurement. Agriculture 6(3):46. https://doi.org/10.3390/agriculture6030046

Statista (2023) Food—Germany | Statista Market Forecast. https://www.statista.com/outlook/cmo/food/germany. Accessed 23 Jan 2023