Abstract

Many countries have set ambitious long-term emissions reduction targets for reaching the goal in alignment with the Paris Agreement. However, large-scale emission reduction efforts may influence poverty by various economic channels. Here, we show the extent to which climate change mitigation, excluding climate change impacts, has the potential to increase poverty, and have identified its factors such as income, price changes, and direct and indirect carbon pricing impacts. We found that the global poverty headcount could increase by 69 million (19%) in 2030 relative to the baseline for climate change mitigation with global uniform carbon prices. Moreover, our decomposition analysis revealed that both price and income change effects were major factors that could increase the poverty headcount, which are 55% and 40%, respectively. This adverse side effect could be mitigated by various measures, such as emission regulations and an enhancement of energy efficiency standards beyond the typical simple carbon tax. Our results imply that global climate change mitigation policy should place more attention on economic development in poor countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The Paris Agreement (UNFCCC 2015) (PA) was a turning point for international climate policy. It defined the long-term climate policy goal as holding the increase in the global average temperature to well below 2 °C above pre-industrial levels. Moreover, the PA also encouraged the pursuit of efforts to limit the temperature increase to 1.5 °C above pre-industrial levels. Many countries have now set so-called long-term strategies, declaring mid-century goals. Aligning with this long-term climate goal, most countries have submitted Nationally Determined Contributions (NDCs), determining near-term actions toward greenhouse gas (GHG) emissions reduction.

Low-income (or developing) countries are not exceptions to this global trend of pursuing decarbonisation or carbon neutrality. Given the current situation where non-OECD countries account for 72% of total global GHG emissions (Gütschow et al. 2021) and play an important role in reducing emissions (Unit ECI 2021), questions have arisen with regard to how poverty is affected by climate change mitigation and what policy instruments would reduce the emissions without harming economic growth or exacerbating poverty. Although the Sustainable Development Goals (SDGs) of SDG 1 “No poverty”, SDG8 “Sustainable economic growth” and SDG 13 “Climate actions” have been established, their synergies and trade-offs, or how to mitigate the trade-offs by achieving them simultaneously has not yet been well understood. Conventionally, these poverty and climate change mitigation interactions are often discussed within the context of sharing the effort/burden of how to allocate the globally required emissions reductions (den Elzen et al. 2009; van den Berg et al. 2019; Bauer et al. 2020). The central issue is: to what extent should economic development and emissions reduction be balanced under equity, efficiency and capability principles? Among the effort-sharing schemes, greenhouse development rights (GDR) is the most relevant to the poverty and economic development context. The scheme uses the Responsibility–Capacity Index (RCI) that considers income inequality within the countries and poverty (Baer 2013).

There are multiple political ways to motivate GHG emission reductions, among which carbon pricing is considered to be efficient and effective (Klenert et al. 2018). Regarding the distributional impacts within countries of carbon pricing (or carbon taxes) (Klenert et al. 2018; Bataille et al. 2018), it is well known that carbon pricing will affect household consumption and welfare, which is relevant to the variation of income levels and consumption patterns. Consequently, a carbon pricing policy would have heterogeneous impacts dependent on income and geographical region. From that perspective, there have been some studies in selected countries of this distributional effect within countries (Kerkhof et al. 2008; Callan et al. 2009; Dissou and Siddiqui 2014; Dorband et al. 2019; Hussein et al. 2013). For example, exempting the carbon tax implicitly or explicitly for low-income households may be possible by making changes to the income tax system or carbon tax revenue recycling (Fujimori et al. 2020; Jakob et al. 2016). Regarding the interaction between poverty and climate change impacts, earlier studies have reported that there would be regressive impacts in climate change impacts (Hallegatte and Rozenberg 2017; Diffenbaugh et al. 2007; Hallegatte et al. 2015, 2018). There are studies that explored the future poverty populations. Crespo Cuaresma et al. (2018), Jafino et al. (2020) and World Bank (2020) are remarkable studies presenting poverty conditions for future and multi-dimensional aspects of poverty. However, they do not assess the effects of climate change mitigation measures. Campagnolo and De Cian (2020) and Campagnolo and Davide (2019) show the changes in poverty headcount impacts associated with climate change mitigation. They made a significant advancement in poverty headcount projection methodology, which uses an econometric approach where GDP per capita and Palma ratio is used. Furthermore, the Palma ratio is represented as industrial structure, education, unemployment, etc. This approach allows seeing the effects of GDP and other industrial structural change impacts, whereas how the price mechanism would influence the poverty headcount is unrevealed. Soergel et al. (2021) showed climate change mitigation effects on poverty with variations of tax revenue recycling, and Fujimori et al. (2020) also attempted its potential. There have been also studies that applied partial equilibrium model highlighting the importance of subsidies (Poblete-Cazenave et al. 2021; Cameron et al. 2016). However, from these existing studies, it has not yet been known what factors such as income, price changes, and direct and indirect carbon pricing impacts can drive the poverty increases and what complementary policy measures need to be considered.

In particular, given that many countries are seeking carbon neutrality under the current international regime, i.e. the PA, it would be useful to understand more fully the interaction between climate change mitigation and poverty.

Here, we assessed the impacts of climate change mitigation policy on global poverty numerically by implementing an integrated assessment model (IAM). Primarily, we attempted to answer the questions of whether climate change mitigation policy would negatively or positively change poverty conditions and what were the major factors driving such changes. Because it was speculated that climate change mitigation could negatively affect poverty, we attempted to argue policy instruments that would potentially reduce these adverse side effects. Note that since our primary focus is to understand the interaction between climate change mitigation and poverty, we mainly investigated how the price and income changes associated with climate change mitigation would change poverty. This study eventually aims to contribute to climate policy making and particularly for the policy instrument designs regarding carbon pricing. Carbon pricing could have adverse side effects on unevenly depending on the income levels and probably this study could be used as a guide for such policy making. The current situation that generates actual poverty is complex and we admit that we cannot fully represent it. Thus, it would be better to interpret our results in a way that given the poverty headcount in the baseline, how can it be affected by climate change mitigation. For this purpose, we applied a state-of-the-art integrated assessment modelling framework, the Asia–Pacific Integrated Model (AIM) (Fujimori et al. 2017a, b), which includes energy, land use, economy and household consumption behavioural systems in an integrated platform that allows the poverty implications of global climate change mitigation to be assessed. Note that this study excludes the climate change impacts and climate change mitigation side effects such as air pollution changes.

Method

We developed scenarios focusing on the current international climate policy decisions associated with the PA. Four scenarios: baseline, NDC, well below 2 °C and well below 1.5 °C (hereafter WB2C and 1.5C) were analysed in this study. The scenario framework itself is more or less similar to the earlier study Fujimori et al. (2020) but the model versions are updated and results are also slightly different from that. We analysed four scenarios using Shared Socioeconomic Pathway 2 (SSP2) as the background socioeconomic assumption widely used as the middle of the five SSPs. While SSP3 and SSP4 could have a more unequal perspective than SSP2, and they may change the numbers, we took SSP2 because it is expected that the aspects that we mainly focused on would not be qualitatively affected as the previous study (Fujimori et al. 2020) using SSP variations did not show qualitative differences in the effectiveness of carbon taxes revenue. The baseline reflects the historical trend up to 2015, extended without additional climate policy. The NDC scenario assumed that each country’s emissions were consistent with their NDC submitted to the United Nations Framework Convention on Climate Change (UNFCCC) for the PA by that country (no updates submitted after 2020 were considered). The WB2C and 1.5C scenarios were consistent with temperature changes of 2 °C and 1.5 °C, respectively, assuming a globally uniform carbon price. This would imply that all countries participated in emission reduction efforts in a cost-efficient manner. The two scenarios were consistent with the recent IPCC (Inter-governmental Panel on Climate Change) special report on the 1.5 °C target (Rogelj et al. 2018). Comparisons of these scenarios clarified the effectiveness of stringent climate change mitigation policies. The primary analysis was conducted using a poverty line of $1.90 a day (2011 PPP), which is widely used in an international context (World Bank 2018a) and they are based on consumption data. In our country-wise poverty estimation, we considered the consumption (income) distribution within countries. We mainly used two indicators for poverty: a poverty headcount, which was the absolute population under the poverty line, and a poverty rate, which represents the ratio of the poverty headcount to the total population. There are two notifications here. First, considering the reality, the poverty threshold should ideally depend on countries, but here we adopt international uniform thresholds that would be better to be considered to interpret the results. Second, we did not include climate change effects (such as the impacts on agricultural yield, water resources and biodiversity indexes), although climate change will have impacts on these factors.

We used the AIM modelling framework as a tool for scenario quantification, which allowed us to assess macroeconomic factors globally, including the energy system, land use, agriculture, GHG emissions and climate. The model has been applied in various global and national studies (Ohashi et al. 2019; Hasegawa et al. 2018; Fujimori et al. 2019a, b). The core of the modelling framework is a computable general equilibrium (CGE) model called AIM/Hub (formerly named AIM/CGE). For this study, we used a model, AIM/PHI (poverty, household and income distribution model) that specifically computed the income distributions and household expenditures within countries and accounted for the poverty headcount. Compared with earlier studies (Hussein et al. 2013; Soergel et al. 2021), this model has an advantage to represent household goods-wise consumption by income segments so that we can identify the income and price factors appropriately.

The approach used here was a two-step calculation, as shown in Fig. 1. First, we ran AIM/Hub to derive macroeconomic indicators and price changes, and then we ran AIM/PHI using the AIM/Hub results as inputs. This approach has been discussed previously in the context of incorporating income distribution into CGE models (van Ruijven et al. 2015). We first ran the AIM/Hub model, which implemented emissions constraints that were consistent with the global long-term goals. This model gives equilibrium prices for the production and consumption of all goods and services by sector, including energy and agricultural goods as well as the production factor supply (labour, capital and land). Then, the prices of goods and macroeconomic impact (income losses) information were fed into the household model (AIM/PHI) (Fujimori et al. 2020), which generated household consumption by income class and poverty-related indicators. AIM/PHI model consisted of two parts: an income distribution model and expenditure model. The former estimated the income distribution. This income distribution was based on Gini coefficient (Rao et al. 2019) and macroeconomic conditions that were affected by income losses. Then, income information was fed into the expenditure model, which assessed the impacts of each price change on actual household consumption for each income segment implicitly assuming that the saving ratio was not affected by climate change mitigation. This assumption is based on the logic that saving-debt conditions would not be able to change persistently for the long-term future due to climate change mitigation without additional policy intervention (e.g. tax system changes). Overall, the combination of AIM/Hub and AIM/PHI modelling framework allows us to identify income and price effects on household consumption by individual income classes. For more details, see the in Supplementary Note. Supplementary Figures 13, 14, 15 and 18 also exhibit the model reproducibility of observations.

Results

Overview of poverty projection

The global poverty headcount was estimated to decrease continuously over the coming decades, from 736 million in 2015 to 355 million in 2030 and 90 million in 2050 in the baseline scenario (Fig. 2a). The main driver of this strong reduction of poverty was the income growth with stable equality conditions within countries, as represented by the Gini coefficient (Supplementary Figure 1). These numbers might be affected by the recent COVID-19 pandemic (Bertram et al. 2021; Quéré et al. 2021) although its effect has not been reflected yet. The poverty rate displayed a similar trend, varying from 0.11 to 0.043 and 0.0097 in 2015, 2030 and 2050 in the baseline, respectively. Comparing with an earlier study (Soergel et al. 2021), the baseline projection and additional poverty headcount associated with climate change mitigation at 2030 are close and they reported 350 and 52 million people, respectively, while this study does 355 and 65 million.

Panels a and b present the global trends in poverty headcount and poverty rate. Global income distribution by year in the baseline and 2030 and 2050 scenarios are shown in panels c, d and e, respectively. The regional breakdown of the poverty headcount is shown as the absolute number and share in panels f and g, respectively (the regional classifications for aggregated regions are given in Supplementary Note 1). Global total CO2 emissions, GDP losses and carbon prices are presented in panels h, i and j, respectively

Climate change mitigation increased the poverty headcount by 65 and 18 million people in 2030 and 2050 respectively in the WB2C scenario, which represented increases of 19% and 21% relative to the baseline level. The absolute headcount was very low in 2050 due to economic growth in the baseline scenario and, therefore, the absolute changes caused by climate change mitigation would be relatively small in 2050 (Fig. 2a, b). The 1.5C displayed a similar trend to the WB2C scenario, but the climate change mitigation impact was larger than WB2C. Climate change mitigation changed these poverty indicators in two main ways. First, the losses in general income associated with the abatement of emissions had macroeconomic impacts and decreased the growth of income and production (GDP) (Fig. 2h, i and Supplementary Figure 1), which made the population consumption distribution diverge leftward (Fig. 2c, d). Second, goods and service prices, particularly energy-related goods, were largely affected by carbon pricing, which had a distributional effect within countries on household consumption (Fig. 2j). This price effect may be regressive or progressive depending on the household expenditure structure, with the global total showing regressive results, resulting in increases in the poverty headcount. This is discussed in detail later.

Regionally, the overall effects of climate change mitigation on poverty were similar to the global situation. Historically, Asia and Africa have accounted for a large share of global poverty, but in Asia there has been a substantial decrease in the poverty headcount in recent decades. This trend continued in the baseline scenario. Asia currently accounts for 45% of the global total poverty headcount. The number was projected to decline to 24% and 19% in 2030 and 2050, respectively, in the baseline scenario (Fig. 2f, g). Under climate change mitigation, the trend was not very different among regions, although the magnitude was found to differ. The contribution of Asia to the global total increased compared with the baseline scenario and an additional 36 million people (44% relative to the baseline) could potentially fall into extreme poverty in 2030. Likewise, Africa and the Middle East currently have 41 million people under extreme poverty, which was projected to increase to 260 million in 2030 in the baseline scenario, but climate change mitigation generated an additional 25 million poverty headcount (10%) in the WB2C scenario (see the regional macro indicators Supplementary Figure 2–Supplementary Figure 6).

Spatial distribution maps provide an overview of the global heterogeneity of poverty. The poverty rates in the baseline scenario were remarkably high in African regions in 2030 (Fig. 3a). Somalia, Central African Republic and Madagascar were the countries where the most severe poverty remained, as expressed by poverty rates of 0.77, 0.61 and 0.52, respectively. In contrast, the map of the poverty headcount indicated that some countries had large poverty headcounts, e.g. Nigeria and India at 79 and 57 million people, respectively (Fig. 3c). In these countries, the poverty rates were not exceptionally high, but the poverty headcount was high due to their large populations. The changes in poverty rates from the baseline to mitigation scenarios (WB2C) were much more evenly distributed among countries than the baseline poverty rates (Fig. 3b). This was because in our climate change mitigation scenarios, a uniform carbon price was assumed. Interestingly, the absolute changes in the population affected by poverty associated with climate change mitigation were heterogeneous, with India being remarkably high (30 million: 50% of the baseline scenario) followed by Nigeria (5.5 million: 7% of the baseline scenario). This remarkable increase in the poverty headcount was primarily due to the high poverty level in the baseline scenario (see Supplementary Figure 7 for the regional consumption distribution). If the poverty rate was large in the baseline scenario, it was also sensitive to the mitigation policies in terms of poverty headcount (see Supplementary Figure 8 for the 1.5C scenario).

Income and price effects

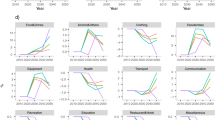

We then considered whether income or price effects were the dominant factors in increasing the poverty headcount. The price effects could be further split into direct carbon tax effects and indirect goods price change effects. The former corresponds to a carbon tax imposition on household consumption (e.g. carbon price penalty on gas consumption), while the latter refers to the price changes caused by emissions abatement costs and the carbon tax penalty on the residual emissions (e.g. electricity price changes associated with the renewable energy cost plus the carbon tax penalty on residual coal-fired power plants). We conducted a decomposition analysis of these three factors and observed that the three effects varied substantially across the scenarios and years investigated (see “Method” for details of the decomposition analysis). The income effect associated with general macroeconomic loss was the major factor across scenarios. In 2030, income effects accounted for 70% and 55% of the poverty headcount in the WB2C and 1.5C scenarios, respectively. In 2050, the income factor was dominant (over 70%) in all scenarios (Fig. 4a, b). With regard to the price effects, indirect price change effects were much larger than the direct carbon tax imposition effects. Although the carbon price in the 1.5C scenario was not very different from that in the WB2C scenario (Fig. 2j), the indirect price effect was much larger in the 1.5C scenario than in the WB2C scenario (40% and 24%, respectively). This was due to the increase in energy and food goods that was mainly driven by the abatement cost of agricultural non-CO2 emissions and the electricity sector (Fig. 4e and Supplementary Figure 11). In 2030, the effects of changes in the price of energy goods were much more prominent under stringent climate mitigation cases. The NDC scenario had low carbon prices leading to relatively fewer price changes. The third factor is direct carbon tax penalty on households but compared with the above two factors, this is minor. We also confirmed similar decomposition results under variations of poverty thresholds namely, 3.2 and 5.5 $/day/cap.

Decomposition of direct carbon tax, indirect price changes and income effects on the poverty headcounts. Panels a and b show the decomposition of mitigation scenario-wise global poverty changes relative to the baseline scenarios in 2030 and in 2050, and its proportional shares. Panels c and d show the regional (Asian and African) picture in 2030. Panel e illustrates the price changes relative to the baseline scenario. CtaxDirect, IncomeEff and PriceEff in the legends of panels a–d indicate a direct carbon tax on household consumption, income effects and indirect price effects, respectively

Regionally, the overall trends were similar in Asia and Africa (Fig. 4c, d) and income effects were dominant. The stronger the climate change mitigation ambition became, the larger the indirect price effect became. The country-wise results were not as homogenous as the aggregated regional results and were dependent on the household consumption structure (Supplementary Figure 12). For example, the indirect price effect was more prominent in Brazil, which was due to the relatively large price changes in food-related goods.

Discussion

How can we avoid these adverse side effects?

Having established that climate change mitigation policies have adverse implications for poverty, there is a need to implement countermeasures to avoid these adverse side effects. Here, we summarise and discuss the potential countermeasures (Table 1).

First, the macroeconomic impacts associated with emissions reductions were largely due to income losses. It would not be easy to moderate this income loss, but one way would be a social transformation, in which the societal system has a lower energy demand, undergoes dietary changes and benefits from advanced technological development which eventually could mitigate the macroeconomic cost associated with general climate change mitigation (Liu et al. 2020; Grubler et al. 2018; van Vuuren et al. 2018). The potential of lowering energy demand would depend on the regions and sectors. For example, in high-income countries with high energy efficiency, lifestyle changes such as dematerialisation and living in a relatively smaller area may play an important role. In low or middle-income countries, implementing new energy-efficient technologies would contribute, but probably considering low emissions or high energy efficiency in the new infrastructure development or urban planning would play a significant role in the development. While this would avoid the adverse side effects, technological progress in energy demand and supply is uncertain and cannot be relied upon. In addition, SDG1 “No poverty” insists that the poor have access to land, natural resources and technologies, as well as reduced exposure to climate events and its relative risks, which also strongly resonates with improving smallholder income. When considering the impacts of climate change, mitigation is not always a cost and could have the benefit of avoiding severe impacts. However, in the near term (e.g. 2030), the impacts would be limited compared to the long-term effects, and issues of income loss therefore need to be considered (Takakura et al. 2019).

Second, because the imposition of a carbon tax is one of the factors that would increase energy and food goods prices, leading to increases in the poverty headcount, there should be a central debate to assess carbon tax as a realistic political instrument for developing counties that face extreme poverty. There are various alternative political instruments in carbon pricing, including emissions reductions. Even among the measures using market mechanisms, there are alternatives, for example subsidies and a cap and trade policy. However, a carbon tax is potentially an efficient mechanism, with other instruments requiring information on the emissions and abatement costs to realise an economically efficient reduction equivalent to the carbon tax. This implies that non-carbon tax measures would generate high emissions reduction costs, leading to large macroeconomic impacts, while the relative changes in the poverty headcount would be more modest than with a direct carbon tax. Therefore, it might be worth considering non-carbon tax instruments in low-income countries, which would also be consistent with the current energy poverty debate (Cameron et al. 2016) as well as more inclusive policy designs beyond simple carbon pricing (Fujimori et al. 2018).

Third, even under carbon tax conditions, there is room to mitigate the impacts of household consumption. For example, exempting the carbon tax implicitly or explicitly for low-income households may be possible by making changes to the income tax system or carbon tax revenue recycling (Fujimori et al. 2020). If the carbon tax is exempted from household consumption, the power of a carbon tax to generate emissions reductions is diminished and stronger emissions reduction policies would be required than without such an exemption. Using carbon tax revenue recycling as a source of revenue is a realistic option, but the government would need to obtain a full picture of individual household income.

Forth, the current modelling approach does not allow us to investigate how to eradicate poverty more in depth (e.g. how we can change the current baseline projection). To address this, we might need more elaboration in the poverty modelling with consideration of social and microeconomic aspects. Moreover, considering the model results from the temporal perspective and these adverse side effects, strong emissions reduction efforts in the near term (e.g. 2030) might be better to be discussed. Relatively large adverse side effects happen in 2030 mainly due to the combination of the remaining baseline poverty and high carbon prices. At 2050, even carbon price level would not change so much from 2030, while the baseline poverty goes to a substantially lower level which lessens the adverse side effects. Therefore, postponing emissions reduction efforts to the later timing could look attractive from this poverty aspect. However, we would like to note here that delayed action requires substantial negative emissions in the latter half of this century to meet the long-term climate objective, which should be seriously considered as trade-off.

It would be relatively easier for developed countries to get the picture of individual household income and support low-income classes using the current system. On the other hand, it would be particularly challenging for developing countries. Therefore, a carbon tax may not be an attractive option for such countries. Implementing energy efficiency standards, direct emissions (or energy consumption) regulations and other various political instruments may need to be considered. Interestingly, the efficiency of the carbon tax for emissions reduction and equality would be a trade-off that should be value-judged finally. It should be noted that the efficiency of the carbon tax for emissions reduction and that for equality would be under a trade-off relationship. Moreover, interestingly, supposing that carbon neutrality or similar conditions are achieved at some point, the carbon tax revenue will vanish, implying that the option of the carbon tax revenue may have different poverty implications depending on the emission level. It could also be possible that the role of carbon tax revenue for income redistribution would be limited to the short to medium term before emissions are eliminated, and in the long term such as later than mid-century, society would largely not be able to rely on the carbon tax revenue.

Finally, exempting emissions reductions from the least developed countries could be an option for the international community. As Fig. 5 indicates, the least developed countries with the highest poverty rates (more than 90%) emit only 10% of the global CO2. This implies that economic and social development in the least developed countries would have little impact on total global emissions due to their small share of global CO2 emissions, while poor people could be shielded from the adverse side effects of climate mitigation. There are discussions that need to happen regarding the global sharing of effort in climate mitigation, which are relevant to the concept of green development rights (Baer 2013). There should also be consideration of carbon leakage and carbon border adjustment if some countries are exempted from emission reductions. To determine or suggest a specific effort-sharing scheme is beyond the scope of this study, but the above insights may contribute to the international political discussion.

Caveats

Finally, there are some caveats in this study. In our modelling, the income side has room to improve at least from three perspectives. First is to consider the income distribution changes associated with climate change mitigation. Manufacturing and energy sectors would be affected by energy structural changes which cause a shift in labour from fossil-fuel-based industries to others. Eventually, these changes would affect individual households. Under some specific conditions, particularly at the individual household level, these factors could be major determinants of poverty under some national circumstances which could be heterogeneous for various countries (Hussein et al. 2013). Second point is inclusion of saving. We implicitly assume that saving level is kept as the base year, but it would be dependent on countries and income classes and the final results of poverty headcount could be affected positively or negatively. Third, we used the Implicitly Additive Demand System (AIDADS) function to represent household expenditure behaviour, with parameters obtained from the best available global and regional data (World Bank 2018b). However, the data quality for developing counties was not good and improvements in household survey data would lead to a better understanding of our estimates. This quality issue presented a challenge for goods classification. Energy and food goods are currently highly disaggregated, and it would be useful to separate them because energy and food consumption are important elements determining the responses to climate change mitigation. Currently, more than a billion people still rely on traditional biomass energy. The transition in energy composition would be an important element to better understand poverty and energy poverty (Poblete-Cazenave et al. 2021). However, due to the data limitation, we have not yet represented these detailed energy consumption in our modelling framework. Finally, the results of household model (AIM/PHI) has not yet been fed back to the CGE model (AIM/Hub) but it would be desired to be fully coupled. This improvement would allow us to get fully consistent macroeconomic feedback into the poverty estimates. For example, as Fujimori et al. (2020) did, carbon tax revenue recycling policy could be more elaborated. As is mentioned in the introduction, multi-dimensional poverty assessment would be demanded for the future research to provide a comprehensive view on poverty. This obviously requires further model extension and new development, but considering our current poverty main argument, it would be also worth it to go that direction.

Conclusions

This study examined the future poverty implications associated with climate change mitigation, considering macroeconomic losses and price changes as a channel to poverty, particularly in low-income countries. The adverse side effects varied temporally and spatially. The estimated change in poverty rates relative to the baseline were relatively small, but there was concern in terms of the increase in the absolute number of people living in poverty. A decomposition analysis suggested that the reduction of poverty should be sought not only through lower commodity prices but also higher incomes.

We considered potential countermeasures to the abovementioned adverse side effects. It is often the case that, in political options, there are pros and cons for each political instrument and, therefore, policymakers should consider comprehensively the wide range of potential effects. We believe that there is no single best solution and the actual measures depend on the conditions in each individual country. However, it is clear that carbon pricing is not always good for poor countries and should only be implemented alongside other supplementary policies, with the role of government being critical.

We think advancing other research disciplines relevant to poverty and development would be useful to elaborate this research. In particular, the theoretical and empirical assessment would largely contribute. For example, household survey data are currently limited, but if the data availability improves and more empirical studies are accumulated, we could consider revising the functional form in our model. This could eventually also give rise to interesting research areas that would not be limited to the poverty represented by economic conditions but would also consider food, energy, health and other SDG-related aspects.

Data availability

Scenario data are accessible via https://doi.org/10.7910/DVN/BVGZ2S. Data derived from the original scenario database, which are shown in figures but are not in the above database, are available upon reasonable request from the corresponding author.

Code availability

All code used for data analysis and creating the figures is available at https://doi.org/10.7910/DVN/BVGZ2S.

References

Baer P (2013) The greenhouse development rights framework for global burden sharing: reflection on principles and prospects. Wiley Interdiscip Rev: Clim Change 4(1):61–71

Bataille C, Guivarch C, Hallegatte S, Rogelj J, Waisman H (2018) Carbon prices across countries. Nat Clim Change 8(8):648–650

Bauer N, Bertram C, Schultes A, Klein D, Luderer G, Kriegler E et al (2020) Quantification of an efficiency–sovereignty trade-off in climate policy. Nature 588(7837):261–266

Bertram C, Luderer G, Creutzig F, Bauer N, Ueckerdt F, Malik A et al (2021) COVID-19-induced low power demand and market forces starkly reduce CO2 emissions. Nat Clim Change 11(3):193–196

Callan T, Lyons S, Scott S, Tol RSJ, Verde S (2009) The distributional implications of a carbon tax in Ireland. Energy Policy 37(2):407–412

Cameron C, Pachauri S, Rao N, McCollum D, Rogelj J, Riahi K (2016) Policy trade-offs between climate mitigation and clean cook-stove access in South Asia. Nat Energy 1:e15010

Campagnolo L, Davide M (2019) Can the Paris deal boost SDGs achievement? An assessment of climate mitigation co-benefits or side-effects on poverty and inequality. World Dev 122:96–109

Campagnolo L, De Cian E (2020) Can the Paris Agreement support achieving the sustainable development goals? In: Buchholz W, Markandya A, Rübbelke D, Vögele S (eds) Ancillary benefits of climate policy: new theoretical developments and empirical findings. Springer International Publishing, Cham, pp 15–50

Crespo Cuaresma J, Fengler W, Kharas H, Bekhtiar K, Brottrager M, Hofer M (2018) Will the Sustainable Development Goals be fulfilled? Assessing present and future global poverty. Palgrave Commun 4(1):29

den Elzen M, Hof A, van Vuuren D (2009) Regional total climate change costs for different burden sharing regimes and concentration targets. In: IOP conference series: Earth and environmental science 2009, vol 6, no 32. IOP Publishing, p 322005

Diffenbaugh NS, Giorgi F, Raymond L, Bi X (2007) Indicators of 21st century socioclimatic exposure. Proc Natl Acad Sci USA 104(51):20195–20198

Dissou Y, Siddiqui MS (2014) Can carbon taxes be progressive? Energy Econ 42:88–100

Dorband II, Jakob M, Kalkuhl M, Steckel JC (2019) Poverty and distributional effects of carbon pricing in low- and middle-income countries—a global comparative analysis. World Dev 115:246–257

Fujimori S, Hasegawa T, Masui T, Takahashi K, Herran DS, Dai H et al (2017a) SSP3: AIM implementation of shared socioeconomic pathways. Glob Environ Change Hum Policy Dimens 42:268–283

Fujimori S, Hasegawa T, Masui T (2017b) AIM/CGE V2.0: basic feature of the model. In: Fujimori S, Kainuma M, Masui T (eds) Post-2020 climate action: global and Asian perspectives. Springer Singapore, Singapore, pp 305–328

Fujimori S, Hasegawa T, Rogelj J, Su X, Havlik P, Krey V et al (2018) Inclusive climate change mitigation and food security policy under 1.5 °C climate goal. Environ Res Lett 13(7):074033

Fujimori S, Hasegawa T, Krey V, Riahi K, Bertram C, Bodirsky BL et al (2019a) A multi-model assessment of food security implications of climate change mitigation. Nat Sustain 2(5):386–396

Fujimori S, Oshiro K, Shiraki H, Hasegawa T (2019b) Energy transformation cost for the Japanese mid-century strategy. Nat Commun 10(1):4737

Fujimori S, Hasegawa T, Oshiro K (2020) An assessment of the potential of using carbon tax revenue to tackle poverty. Environ Res Lett 15(11):114063

Grubler A, Wilson C, Bento N, Boza-Kiss B, Krey V, McCollum DL et al (2018) A low energy demand scenario for meeting the 15 °C target and sustainable development goals without negative emission technologies. Nat Energy 3(6):515–527

Gütschow J, Günther A, Jeffery L, Gieseke R, Gebel R, Stevens D et al (2021) The PRIMAP-hist national historical emissions time series (1850–2018) (v2. 2, updated February 2021), zenodo. https://doi.org/10.5281/zenodo.5494497

Hallegatte S, Rozenberg J (2017) Climate change through a poverty lens. Nat Clim Change 7:250

Hallegatte S, Fay M, Barbier EB (2018) Poverty and climate change: introduction. Environ Dev Econ 23(3):217–233

Hallegatte S, Bangalore M, Bonzanigo L, Fay M, Kane T, Narloch U et al (2015) Shock waves: managing the impacts of climate change on poverty. The World Bank, Washington, DC

Hasegawa T, Fujimori S, Havlík P, Valin H, Bodirsky BL, Doelman JC et al (2018) Risk of increased food insecurity under stringent global climate change mitigation policy. Nat Clim Change 8(8):699–703

Hussein Z, Hertel T, Golub A (2013) Climate change mitigation policies and poverty in developing countries. Environ Res Lett 8(3):035009

Jafino BA, Walsh B, Rozenberg J, Hallegatte S (2020) Revised estimates of the impact of climate change on extreme poverty by 2030. Policy Research Working Paper, World Bank, Bank, W., Washington DC. Available at: http://hdl.handle.net/10986/34555

Jakob M, Chen C, Fuss S, Marxen A, Rao ND, Edenhofer O (2016) Carbon pricing revenues could close infrastructure access gaps. World Dev 84:254–265

Kerkhof AC, Moll HC, Drissen E, Wilting HC (2008) Taxation of multiple greenhouse gases and the effects on income distribution: a case study of the Netherlands. Ecol Econ 67(2):318–326

Klenert D, Mattauch L, Combet E, Edenhofer O, Hepburn C, Rafaty R et al (2018) Making carbon pricing work for citizens. Nat Clim Change 8(8):669–677

Le Quéré C, Peters GP, Friedlingstein P, Andrew RM, Canadell JG, Davis SJ et al (2021) Fossil CO2 emissions in the post-COVID-19 era. Nat Clim Change 11(3):197–199

Liu J-Y, Fujimori S, Takahashi K, Hasegawa T, Wu W, Geng Y et al (2020) The importance of socioeconomic conditions in mitigating climate change impacts and achieving Sustainable Development Goals. Environ Res Lett 16(1):014010

Ohashi H, Hasegawa T, Hirata A, Fujimori S, Takahashi K, Tsuyama I et al (2019) Biodiversity can benefit from climate stabilization despite adverse side effects of land-based mitigation. Nat Commun 10(1):5240

Poblete-Cazenave M, Pachauri S, Byers E, Mastrucci A, van Ruijven B (2021) Global scenarios of household access to modern energy services under climate mitigation policy. Nat Energy 6(8):824–833

Rao ND, Sauer P, Gidden M, Riahi K (2019) Income inequality projections for the Shared Socioeconomic Pathways (SSPs). Futures 105:27–39

Rogelj J, Popp A, Calvin KV, Luderer G, Emmerling J, Gernaat D et al (2018) Scenarios towards limiting global mean temperature increase below 1.5 °C. Nat Clim Change 8:325–332

Soergel B, Kriegler E, Bodirsky BL, Bauer N, Leimbach M, Popp A (2021) Combining ambitious climate policies with efforts to eradicate poverty. Nat Commun 12(1):2342

Takakura J, Fujimori S, Hanasaki N, Hasegawa T, Hirabayashi Y, Honda Y et al (2019) Dependence of economic impacts of climate change on anthropogenically directed pathways. Nat Clim Change 9(10):737–741

Unit ECI (2021) Taking stock; a global assessment of net zero targets. [cited 2021 3rd, April]. https://eciu.net/analysis/reports/2021/taking-stock-assessment-net-zero-targets. Accessed 3 Apr 2021

United Nations Framework Convention on Climate Change, (UNFCCC) (2015) Adoption of the Paris Agreement. Proposal by the President (1/CP21). [cited 2016 02, Feb.]. http://unfccc.int/resource/docs/2015/cop21/eng/10a01.pdf. Accessed 3 Apr 2021

van den Berg NJ, van Soest HL, Hof AF, den Elzen MGJ, van Vuuren DP, Chen W et al (2019) Implications of various effort-sharing approaches for national carbon budgets and emission pathways. Clim Change 162(4):1805–1822

van Ruijven BJ, O’Neill BC, Chateau J (2015) Methods for including income distribution in global CGE models for long-term climate change research. Energy Econ 51:530–543

van Vuuren DP, Stehfest E, Gernaat DEHJ, van den Berg M, Bijl DL, de Boer HS et al (2018) Alternative pathways to the 1.5 °C target reduce the need for negative emission technologies. Nat Clim Change 8(5):391–397

World Bank (2018a) Poverty and shared prosperity 2018: piecing together the poverty puzzle. World Bank, Washington, DC

World Bank (2018b) Global consumption database. The World Bank, Washington, DC

World Bank (2020) Poverty and shared prosperity 2020: reversals of fortune. The World Bank, Washington, DC

Acknowledgements

SF, KO, TH, JT, KT are supported by the Environment Research and Technology Development Fund (JPMEERF20211001 and JPMEERF20202002) of the Environmental Restoration and Conservation Agency of Japan. SF, KO, TH are supported by JSPS KAKENHI (19H02273, 23H01537). This research is financially supported by The Sumitomo Electric Industries Group CSR Foundation.

Author information

Authors and Affiliations

Contributions

SF, KO and TH designed the research; SF set up and ran the model, carried out analysis of the modelling results, created figures, and drafted the paper; SZ and KS contributed to improve the model and all authors contributed to writing of the entire manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Handled by Xianbing Liu, Institute for Global Environment Strategies, Japan.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fujimori, S., Hasegawa, T., Oshiro, K. et al. Potential side effects of climate change mitigation on poverty and countermeasures. Sustain Sci 18, 2245–2257 (2023). https://doi.org/10.1007/s11625-023-01369-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11625-023-01369-2