Abstract

Various bioeconomy strategies seek to replace fossil resources with renewable agrarian resources without departing from the agro-industrial model. Paradoxically, industrial agriculture is an extractive system itself, dependent on the constant supply of mineral resources to replace the nutrients extracted from the soil. This article analyses the evolution of nutrient flows in this system from a historical-theoretical perspective and focuses specifically on the nutrient phosphorus, derived from the raw material phosphate rock. Classified as a “low-cost bulk commodity” for decades, since 2007 phosphate rock has become a strategic resource in the context of the crisis of cheap nutrient supply (2007–2013), a period of unusually high fertilizer prices. By analyzing state and private actor strategies in Germany and Brazil to adapt to this new situation, it becomes clear that the control over flows of phosphorous is increasingly contested. This article argues that bioeconomy strategies are aggravating existing conflicts over phosphate supply, as well as global inequalities, which inter alia become evident in food crises. Technological innovations, which are promoted within bioeconomy strategies, only reduce the extractive character of industrial agriculture in a limited way, while they are securing the interests of dominant actors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Various bioeconomy strategies aim to replace fossil resources with renewable, agrarian resources without departing from the agro-industrial production model. Paradoxically, this model is in an extractive system itself: it is based on the constant supply of mineral resources to replace the nutrients extracted from the soil. There are three main nutrients used in plant fertilizers: nitrogen, potash and phosphorus. Nitrogen fertilizers are produced with natural gas in a synthetic process, but potash and phosphorus depend on mineral resources: potassium salts and phosphate rock.

With a focus on phosphate rock, this article asks what implications these extractive dependencies have on the formation of a bioeconomy and to what degree it is possible to process the nutrient problem with bioeconomy strategies. The regional emphasis is on strategies in Germany and Brazil as the former country is at the forefront of implementing bioeconomy strategies, while the latter is a major global biomass supplier. The paper will argue that the considered bioeconomy strategies intensify pre-existing conflicts surrounding the phosphate supply. While they only allow for a limited alteration of the extractive character of industrial agriculture, they can secure the interests of dominant actors. The cases in this paper are to outline the relevance of phosphate supply and the emerging conflicts around its access in an exemplary manner. However, an encompassing analysis of different bioeconomy strategies is beyond the scope of this paper.

The next section will present key features of industrial agriculture to evaluate selected bioeconomy strategies regarding their position on a continuation of this production model. The paper continues with a historical-theoretical section on nutrient flows in capitalist agriculture, before analyzing the phosphate industry in more detail. This includes the shift from a “low-cost bulk commodity” towards a strategic resource in the context of the crisis of cheap nutrient supply 2007–2013, when fertilizer prices were unusually high. The last section will present some sets of strategies that different actors have developed as a response to this crisis. Due to the limited scope of this article, it will only discuss actors in business and politics.

Methodologically the article relies on secondary sources, and pursues an analysis of policy papers, newspaper articles, and international databanks, such as the Observatory of Economic Complexity (OEC), IndexMundi and the United States Geological Survey (USGS).

Agriculture in the bioeconomy

To understand the meaning of the term "sustainable" agriculture, which is frequently used in bioeconomic strategies, it is helpful to sketch out the main features of various agricultural production models already in place. The first one is conventional or industrial agriculture.Footnote 1 It follows the central idea of industrialization to use machines in standardized procedures to increase the productivity of human labor. The decreasing amount of human labor in agriculture renders the production (a) land and capital intensive. Agricultural equipment such as tractors and combine harvesters is very expensive and needs large tracts of land to work effectively. The consequence is a (b) homogenization of diversified ecosystems since standardized procedures of planting, irrigation, weed control, machine harvesting and the use of chemicals are designed for a select few crops that are cultivated in monocultures. In addition to the massive loss of species, this leads to the destruction of natural metabolisms, which are necessary for plant growth. Instead of a circular nutrient flow between soil, plants and living beings, industrial agriculture establishes (c) an open through-flow system. The continuous supply of standardized, human-made inputs, such as seeds, pesticides and fertilizers, made it possible to override ecological limits and create new fields of capital accumulation. For example, through breeding and patents, seeds could become a globally traded commodity that farmers cannot access freely as a part of their harvesting within a natural cycle. Therefore, industrial agriculture is strongly shaped by (d) the interests of agribusinesses. Agribusinesses are companies that do not cultivate fields themselves, but produce inputs, such as seeds, or process and commercialize the harvests of farmers. Thus, they have an interest in “long” commodity chains, ideally ones that they control.

Due to the manifold negative socio-ecological effects of industrial agriculture that have become increasingly obvious in the twenty-first century, a discussion around alternative production models has started (Altieri 2000, pp. 80–88). Organic agriculture, whose products are certified with specific labels, is often regarded as a counter-project. It mostly changes point (e) by limiting or prohibiting the use of chemical inputs (pesticides and fertilizers). Farmers try to use nutrient cycles and “local” sources, such as planting legumes, which can fix nitrogen in the soil, but they can also use “external” organic sources of nutrients such as guano or lime (BÖLW 2022). Typically, production is more labor intensive and businesses smaller, but transnational commodity chains are not questioned as such. Therefore, parts of the agribusiness sector have tapped into this niche market by offering organic apples from overseas in supermarket chains, for instance.

The concept of agro-ecology is more far reaching, “[t]he chief goal being to develop locally adapted solutions for peasant farmers that work with the available resources” (INKOTA-Netzwerk et al. 2017, p 7). It is about using traditional, local knowledge and re-establishing or imitating natural metabolisms. Furthermore, a focus is on the local production und commercialization, as well as the democratic control through co-operatives. Therefore, this model is an explicit counter-project to the power of agribusinesses (Altieri 2000, p 89). It even includes a certain departure from the capitalist penetration of agriculture as its goal is the (re-)appropriation of land as a means of production and it stresses the use value of food (as opposed to its exchange value), which is already put in practice by initiatives of community-based agriculture. The goal is to achieve local and democratic control over the production and consumption of food (food sovereignty) (INKOTA-Netzwerk et al. 2017).

What is agricultural production then supposed to look like in an emergent bioeconomy? To answer this question in an exemplaryFootnote 2 manner, it is helpful to turn to two policy papers from Germany and Brazil. These countries are highly relevant for the global bioeconomy discussion in their own way: German governments have put a strong emphasis on the research and development of bioeconomy technologies and invested heavily over the last decade. For instance, 3.6 billion Euro have been earmarked for the period 2020–2024 by the Ministry of Agriculture and the Ministry of Education and Research (BMEL 2020). Brazil, in turn, is among the most important global biomass sources, with a growing significance. For instance, in 2020, Brazil became the leading soybean producer and exporter, accounting for 50% of the global market. The South American country produces one third of the world’s sugar cane, leading in exports. It is the third most important producer of corn and became the second largest exporter of the cereal (Embrapa 2021). All of these are “flex crops,” with multiple uses, such as food, feed, energy, and industrial use, making them highly relevant to bioeconomy strategies.

Turning to the actual policy papers, the first to consider is the paper on the national German bioeconomy strategy (Nationale Politikstrategie Bioökonomie, BMEL 2014), published by the Ministry of Food and Agriculture includes several detailed ideas about a bioeconomy, which have recently been updated (BMBF and BMEL 2020). Although the term “sustainable” is frequently used (150 hits on 70 pages of continuous text), there is no discussion of what a "sustainable" agricultural system should look like.

An explicit departure from industrial agriculture cannot be found. Instead, there are several positive references to this production model, particularly in section 5.2 D (BMEL 2014, p. 50ff.). Here, one can read: “for a sustainable increase in yields, it is necessary to use modern breeding methods and, more importantly, achieve gains in efficiency regarding the application of energy, fertilizers and pesticides"Footnote 3 (p. 53). The idea is to make the use of inputs more efficient, but there is no stated goal of using different inputs or natural nutrient cycles. The policy paper expounds the problem of decreasing productivity gains in industrial agriculture, since global yields more than doubled after World War II, but started to stagnate around the turn of the millennium. According to the German ministry BMEL (2014, p. 53), now is the time to accelerate the yield increases through research and development. This also demonstrates the idea of continuing along the path of industrial agriculture rather than searching for new ways of agricultural production.

In Brazil, there is no detailed paper on a bioeconomy strategy, but there are some hints in the strategy paper on science, technology, and innovation (MCTIC 2016, pp. 94–100). Here, the policy ideas also focus on “technological progress [and] innovative solutions […] to improve the productivity and the quality of agricultural productionFootnote 4.” Likewise, there is no departure from the agro-industrial model.

In conclusion, the selected bioeconomy strategies seek to improve industrial agriculture and make it more sustainable, but they do not question this system of production as such. This means that the current open through-flow system of nutrients is likely to continue within a bioeconomy, even if some modifications are in the pipeline (cf. Sect. “Bioeconomy strategies and new technologies”). Before returning to this question, “Nutrients and capitalist agriculture: genealogy of a global through-flow system” provides a brief genealogy of this through-flow system to better understand the question of phosphorus supply in the current conjuncture.

Nutrients and capitalist agriculture: genealogy of a global through-flow system

While humanity went through a number of agricultural revolutions before modern times, such as the domestication of crops and animals, natural cycles of nutrients flowing from soil to plants to animals (and humans) and back to the soil via excreta were largely kept intact.

The origins of the open through-flow system can be traced back at least to the English agricultural revolution of the seventeenth century, which consisted of the introduction of new farming techniques and the re-organization of agrarian structures through the enclosure of the commons, which established a capitalist agricultural system (Wood 2000). On the one hand the conversion of pasture fields (formerly commons) into private arable land provided farmers with a yield-boosting nutrient source that would not reproduce within an agrarian cycle. According to agrarian historian Marc Overton (1996, p. 117), it “could be interpreted as a means of cashing in on reserves of nitrogen under permanent pasture for short-term gain.” On the other hand, the new class of capitalist farmers were driven by the motive of reducing labor costs and maximizing (short-term) profits. “The methods they adopted […] represented a fundamental break with much of the literature on best farming practices and actually interfered with preserving soil fertility in many cases” (Pomeranz 2000, p. 216).

While wheat output per acre had roughly doubled between 1600 and 1750, England and continental Europe were experiencing increasing problems of food supply since the late eighteenth century (Overton 1996, p. 1; 77). The solution was not a preservation of soil fertility, but tapping “external” sources of nutrients, that were not part of local agrarian cycles (Thompson 1968). During the nineteenth century, different resources were used: First ground bones, even imported from South America and Russia, then Guano and finally nitrate, both imported from the South American Pacific coast. While Guano, the excrements of seabirds, is a renewable fit-all mixture of nutrients, nitrates are non-renewable and only contain nitrogen (Cushman 2013, pp. 44–53). However, sources for the other main nutrients were available too, particularly since the opening of the potash mines in Strassfurt, Prussia, in 1861. Since the pioneer work of John Bennet Lawes in the 1830s, phosphorus fertilizer was continually produced from bones, coprolites and even phosphate rock, imported from Southern Europe, Pacific Islands, North America and North Africa by the turn of the twentieth century (Thompson 1968, p. 70; Nelson 1990, pp. 12–20). It is clear that for such an enormous re-organization and global sourcing of nutrient flows, quantum leaps in knowledge production about agricultural chemistry were necessary. Besides the aforementioned John Bennet Laws, the scientist mostly associated with these breakthroughs is Justus von Liebig (Foster and Magdoff 2000). This generation of agricultural chemists mainly achieved two things: (1) understanding the flows of nutrients between atmosphere, soil, plants and animals, while classifying the role of different nutrients. (2) The law of the minimum, stating that the effects of fertilization are limited by the element (nutrient) available in the least quantity. For effective fertilization, all nutrients have to be increased; if there is no potash, for example, the effects of phosphorus and nitrogen fertilizer are limited (Nelson 1990, pp. 12–18).

The work of Liebig and others was not only highly relevant for contemporary farmers, but also influenced social thinkers, such as Karl Marx. He took up Liebig’s concept of metabolism (Stoffwechsel) and transferred it to the labor process. Furthermore, Marx (1991, p. 949) pointed towards an “irreparable rift” in the metabolism between humans and the soil that is caused by the increasing urbanization of capitalist societies: the monocultural cultivation of crops takes nutrients from the soil without returning them since the consumption takes places elsewhere. In the cities, nutrients accumulate in wastewaters and acidify rivers and oceans.

While John Bellamy Foster and colleagues (2010) updated Marx’s analysis of the metabolic rift and focus on the destructive ecological consequences of capitalism from disrupted nutrient cycles to climate change, the work of Jason W. Moore (2015) points the attention towards the ecological conditions of capitalist development. Building on Marx’s observation (1990, p. 638) that “the original sources of wealth [are] the soil and the worker,” Moore writes that, each wave of long growth has been built on the appropriation of nature’s productivity for capital accumulation. Moore calls this cheap nature for capital accumulation: “[A] rising stream of low-cost food, labor power, energy and raw materials to the factory gates (or office doors, or…)” (Moore 2015, p. 53). He analyzes this historic process of channeling new sources of “unpaid work” into the commodity system as a movement of commodity frontiers that drive down production costs and increase the rate of profit.

The tapping of Guano and nitrate reserves to “renew” the fertility of exhausted European soils clearly constitutes such a frontier movement. Another significant commodity frontier and part of the global through-flow system has been the extension of monocultures in the European colonies. While the cultivation and export of sugar cane provided a cheap source of calories since colonization of Madeira and the Americas (Moore 2015, p. 169ff), in the late nineteenth century, the cultivation of grains on virgin soils in the settler colonies of North America and Oceania supplied Europe with cheap food (Weis 2007, p. 50ff.). In the meantime, European agriculture had become dependent on a single source for nitrogen: Chilean nitrates controlled by the British free trade system. The access to nitrates was even more critical since it was the central raw material for the manufacture of explosives (Foster and Magdoff 2000).

Amidst increasing geopolitical tensions, imperial Germany vehemently supported the research and development of the synthetic nitrogen compound ammonium, carried out by Fritz Haber and Carl Bosch in the chemical company BASF (Loeber 2010). The Haber–Bosch process, introduced in 1913, could override ecological limits again by tapping a “subterranean frontier,” because nitrogen fertilizers could now be produced synthetically with energy from fossil fuels (Foster and Magdoff 2000).

Particularly, the USA advanced this synthetic agricultural revolution and the industrialization of agriculture with state funding from the New Deal program in the 1930s. This meant the introduction of large-scale machinery (tractors, combine harvesters) as well as new inputs, such as seed and chemical fertilizers (Nelson 1990, pp. 193–215). As determined by the minimum law, the increasing consumption of cheap nitrogen fertilizer from the Haber–Bosch process also led to an expansion in the extraction of potash salts and phosphate rock (cf. below).

In the USA, this highly productive and state-subsidized model generated chronic wheat surpluses that were exported as food aid to Western Europe and selected countries of the Global South. In a second phase since the 1960s, the policy changed towards exporting the whole technological package of industrial agriculture: tractors, hybrid seeds, chemical fertilizers and more (Clapp 2016, p. 40). From the 1960s to the 1980s, the so-called Green Revolution reached most parts of Latin America and Asia, facilitating an increase by a factor of 2.4 in global average yield (Weis 2007, p. 17).

This was accompanied by a transnationalization of production and a decrease in trade barriers. After the debt crisis of the 1980s, the structural adjustment programs imposed by the World Bank and International Monetary Fund (IMF) intensified the export-orientation of agricultural sectors in the Global South, which re-established their colonial role as a raw-material supplier (Anlauf/Schmalz 2019). With the creation of the World Trade Organization (WTO) and the Agreement on Agriculture in 1994, this free trade system was completely institutionalized, although the Global North retained its “right” to subsidize agriculture and export surpluses of wheat and animal products (Patel 2012, p. 101ff.).

An increasingly globalized system of open nutrient flows developed through this process, in which a number of agricultural revolutions have provided quantum leaps in productivity, each time sourcing new materials for nutrient supply. Today, the daily food of most people in the Global North is based not only on transcontinentally traded crops. Also, to produce these crops at low cost, the (transcontinental) inflow of external nutrient sources has to be secured. This was the case over the course of decades, and socio-ecological scholars from green mainstream (Rockström et al. 2009, p. 472ff.) to eco-Marxism (Foster and Magdoff 2000) mostly looked at the output side of chemical fertilizers (e.g., eutrophication, greenhouse gases), if they dealt with the topic at all. This section has shown that we have a good historical record of the input side, but the contemporary organization of nutrient flows from the mine to the field is a barely researched area of investigation. There has been a heated debate among geologists and economists arguing over the global availability of phosphate rock in mathematical terms of (in)correct modeling (Cordell and White 2011; Scholz and Wellmer 2021). While this is briefly taken up in the following section, my contribution takes a different level of analysis by looking at specific actors, their interests, and power relations from the perspective of political economy. Geology and ecology most certainly frame the conditions, but how resources are used, meaning how nutrient flows are organized in particular commodity chains and who profits from this, is a question of power relations between and within societies.

The phosphate industry: from low-cost bulk commodity to strategic resource

To analyze nutrient flows in the phosphate industry in more detail, the analytical tool of the commodity chain is helpful. These “network[s] of labor and production processes whose end result is a finished commodity” (Hopkins/Wallerstein 1986, p. 159), crisscross the world system and are an expression of the unequal development between core and periphery. However, the generation of high profits does not necessarily depend on the degree of industrialization at a certain node of the chain, but more often on the degree of monopolization secured by political power (Anlauf and Schmalz 2019, pp. 200–204). While most commodity chain analyses begin with a finished product, this article departs from the extraction of raw materials, utilizing Moore's (2015) commodity frontier approach (see “Nutrients and capitalist agriculture: Genealogy of a global through-flow system”).

Phosphate rock as a low-cost bulk commodity (1945–2000)

The commodity chain of phosphate fertilizer starts with the extraction of phosphate rock, typically in large open-pit mines. The raw material is transported from the mine into industrial plants where phosphoric acidFootnote 5 is produced in a chemical process by adding sulfuric acid. In a third step, finished fertilizers are produced in industrial plants; either superphosphates containing only phosphorus or mixtures with nitrogen, such as mono- or di-ammonium-phosphate (MAP or DAP) (Potashcorp 2018, p. 23). Manufacturing these finished fertilizers is the highest stage of value creation, although trading and commercializing fertilizers often allows for the highest profits in this increasingly oligopolistic industry. On the one hand, states, therefore, have an interest in hosting these industries and exerting some kind of control over trade flows; on the other hand, this economic interest can be superseded by a strategic interest in securing inputs for a cheap food supply.

After the Haber–Bosch process had been established and spread globally, the production of phosphate fertilizers also increased dramatically, illustrating the interrelation of synthetic processes and mineral extraction. In the decades leading up to 1945, the production of phosphate rock hovered around 10 million tons; by 1948, the amount had already doubled. In the following decades, production levels increased steadily and reached 166 million tons in 1988 (Jasinski and Buckingham 2010).

In the twentieth century, the center of the phosphate industry developed in central Florida, home to large deposits of phosphate rock, with the International Minerals & Chemicals Corporation (IMC) becoming the dominant company (Nelson 1990, pp. 63–72; Martin 1994, p. 264f.). The global production of synthetic fertilizers increased significantly after World War II, but the share of US-production declined gradually. In the 1950s, roughly half of the global phosphate rock production took place in the USA, but by the end of the 1980s, this share decreased to a fourth (Jasinski and Buckingham 2010). During this period, many (semi-)peripheral countries started the creation of national phosphate industries under significant state control. Besides the Soviet Union, whose production reached similar levels to the USA in the 1980s, Morocco assumed an important role with its abundant reserves of phosphate rock (Rawashdeh and Maxwell 2011). Initially being a mere supplier of the raw material phosphate rock for the fertilizer industries located in European countries, the state-controlled enterprise OCP (Office Chérifien des Phosphates) started building a chemical industry in the 1960s. Nowadays, Morocco produces more than 30 million tons of phosphate rock, an amount similar to the USA (Jasinski 2020). Despite its successful program of industrializing phosphate rock, Morocco is also the largest exporter of the raw material. Finally, countries such as Brazil, Tunisia, Egypt and Syria built phosphate industries as a part of national development projects, but the capacity of phosphate rock production remained under 10 million tons per year (Rawashdeh and Maxwell 2011).

Against the backdrop of these global trends, phosphate rock and its derivatives were available cheaply on global markets. Indeed, they were considered a “low-cost bulk commodity” (UNIDO and IFCD 1998, p. 114), facilitated by the expansion of commodity frontier under state control. The real prices of phosphate rock dropped from 40 US$ per ton in the 1960s to less than 30 US$ per ton in the early 2000s, although this trend was interrupted by a price hike in the 1970s (Rawashdeh and Maxwell 2011). During this phase, neither farmers, politicians, nor consumers had to worry about the supply of cheap (phosphate-)fertilizer, which might be one of the reasons why so little about phosphate rock is known.

The collapse of the Soviet Union further accentuated the price decline in the 1990s. The US–American phosphate industry responded to the very low prices, which only allowed for low profits by another wave of fusions. IMC merged with a number of competitors in the 1990s, before becoming The Mosaic Company, in a 2004 merger with Cargill’s fertilizer division (Mosaic Company 2005). This company, initially controlled by a majority ownership of agri-business giant Cargill, assumed a dominant position in the phosphate industry. In addition to the state-controlled enterprises of the (semi-)periphery, the increased concentration of private companies in North America and their export cartels are a central element of the oligopolistic structure of the fertilizer industry (Taylor and Moss 2013, p. 16).

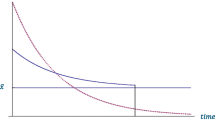

The crisis of cheap nutrient supply: 2007–2013

In early 2007, the situation of the phosphate industry changed drastically. That year, the prices of all fertilizers, including the raw-material phosphate rock, increased rapidly until it peaked in September 2008. The price of phosphate rock increased nearly tenfold within 1.5 years, rising from 45 US$ per ton (April 2007) to 430US$ per ton (September 2008). While prices declined almost as rapidly over the next year, they increased again in 2010 and remained at a relatively high level, which was three to five times higher than the prices of the 1990s and early 2000s. After 2013, prices were on a decline, but without reaching the level they were at before 2007, when they were at 40US$ per ton. In the first half of 2021, prices started increasing again (IndexMundi 2022).

The price shock of 2007/2008, and particularly the following longer period of high prices, was a serious problem for agrarian producers and countries with a strong agricultural sector. While prices for most agriculture products rose during this time as well, the increases in fertilizer prices were much higher (Gnutzmann and Spiewanowski 2015). This put farmers under great cost pressure, particularly small and medium farmers in the Global South whose purchasing power is limited. In India, a country completely dependent on imports of phosphate products, agrarian producers protested violently against supply shortages of fertilizers, with several casualties (Cordell 2010, p. 127).

Therefore, Arno Rosemarin and colleagues (2009) point out that the price spikes increased global inequalities. This is also evident in the food crises of 2007 and 2011, which mostly affected consumers with a low income in the Global South. Protests against higher prices of food stretched from Haiti to Egypt and Indonesia, while, according to official data, the number of people suffering from hunger increased by 100 million, totaling more than one billion for some time. Mainstream economists explained the spikes in international food prices with supply–demand imbalances due to agrofuel production and an increased demand in emerging economies, but critical scholars have pointed to the increased financialization of the food sector as an alternative explanation (Clapp 2016, p. 133ff). However, the increases in fertilizer prices and their raw materials are often left out of the picture although initial calculations claim that fertilizer supply “was an important driver of the [food] crisis, explaining up to 60% of the price increase” (Gnutzmann and Spiewanowski 2015).

These quantifications may or may not be precise, but it is clear that rising prices for fertilizers and their raw materials will translate into higher food prices, which has the great potential to destabilize the global agri-food system. Therefore, although higher prices for fertilizers are beneficial to individual companies of the sector, this moment constitutes a crisis for the larger agri-food system, which can be called the crisis of cheap nutrient supply.

In a similar way to the price hike of the 1970s, this latest period of high fertilizer prices also sparked a debate around an impeding phosphorus scarcity under the term Peak Phosphorus (Ulrich and Frossard 2014). Alluding to the Peak Oil thesis, the sustainability-researcher Dana Cordell and her colleagues (Cordell 2010; Cordell and White 2011) claimed that the production of phosphate rock is going to reach a peak around the year 2033 and decline afterwards, while production costs increase and demand continues to rise. Their argument has been vigorously rebutted by a number of scholars, based on dynamic modeling and data accounting (Ulrich and Frossard 2014, p. 694). In their overview of different critiques, Scholz and Wellmer (2021) prominently argue: “From a geologic, geoeconomic, and mathematical modeling perspective, the conclusions drawn by Cordell et al. […] are fundamentally flawed and incorrect.”

While this rebuttal might suggest a business as usual in the phosphate industry, I would like to point towards three shifts: first, while phosphate prices tend to go through short-term cycles over 7–10 years, consultants and business insiders expect a “[rising] plateau level of phosphate rockFootnote 6 prices” (Mew 2016, p. 1012; more details: Rahm et al. 2007, p. 5). Second, in a historical longitude perspective, the frequency of price escalations has increased. Often the price hike of 2008 is compared to the firstFootnote 7 global phosphate rock price peak in 1975 (Ulrich and Frossard 2014; Mew 2016). If we add the current price increase in international fertilizer prices to this series of events, we can see that interval period has decreased from 33 years to 10–15 years, indicating a higher frequency of disruptive price hikes. Third, as the North American production is declining, a rising share of the global phosphate rock production is coming under the control of state companies, particularly in China and Morocco. Mew (2016, p. 1010) calculated that “government-controlled companies accounted for two thirds of global phosphate rock production in 2013.” I will elaborate on this in the next section.

Current overview of the phosphate industry: strategic resource

Since the USA has become a net-importer of phosphate rock, it shares some interests with the EU, which is also strongly dependent on imports of phosphate rock and has a strongly subsidized agrarian sector with significant political leverage, too. However, the USA, unlike the EU, is home to the most important companies in the phosphate industry, mainly Mosaic, whose business strategy includes the export of finished fertilizers. For this group (USA and EU) the access to the cheap raw material phosphate rock is essential to supply the domestic fertilizer industry and also the agricultural sector. The EU has included phosphate rock on its list of critical raw materials, which are to be strategically secured (Ridder et al. 2012).

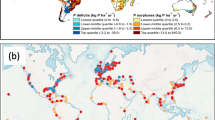

Globally speaking, the decreasing production in the USA has been offset by a massive increase in production levels in China. In 2004, China’s production was at roughly 25 million tons, but in 2018, it had increased to 120 million tons and was therefore far ahead of other producing countries, which were led by Morocco (34 million tons) and the USA (25 million tons) while other countries in the MENA-region have a much smaller production, such as Jordan (8.2 million tons) and Tunisia (3.7 million tons) (Jasinski 2020).

By 2001 China had become a leading exporter of phosphate rock, while importing large amounts of finished fertilizers. However, within a few years, the Chinese government successfully pursued a strategy of domestic value creation and quadrupled the production of phosphate fertilizers between the year 2000 and 2006, effectively displacing US-imports (Rahm et al. 2007, pp. 1–2). In the wake of the 2007 price spike, the Chinese government installed an export tax on phosphate products, as well as a national reserve system and declared phosphate rock the third most important strategic resource (Wellstead 2012). Although this strategy is primarily oriented towards supplying the domestic market, China also exports phosphate fertilizer, but not the raw material phosphate rock (OECFootnote 8 s.a. 2022). China also holds the 2nd largest reserve of phosphate rock, with an estimated 3.2 billion tons (Jasinski 2020).

However, this number is dwarfed by the reserves of Morocco, which are estimated at 50 billion tons, some of which is in the occupied territory of Western Sahara (Jasinski 2020). The policies in Morocco and other producing countries of the MENA region, such as Jordan, are less oriented towards the domestic markets (which are very small), but like China, these semi-peripheral countries are increasingly asserting their own interests by increasing their share of revenues from phosphate rock exports, on the one hand, and by increasing domestic value creation through exports of finished fertilizers or intermediate products, on the other (Ridder et al. 2012).This shows that, while geological scarcity might become relevant in the long term, currently there are rather politically-induced scarcities (export tariffs and domestic value creation in phosphate producing countries) that constitute a problem for the business as usual and the interests of transnational agribusinesses.

Assuming that phosphate consumption per hectare will remain relatively constant (for possible deviations cf. “Bioeconomy strategies and new technologies”), a far-reaching realization of bioeconomy strategies is likely to increase demand for phosphate rock drastically and perpetuate these conflicts of interest. To give two examples: in Brazil, around 10 million hectares of sugar cane are cultivated for bioethanol production (Boyer 2019, p. 183ff.). But the IPCC (2018, p. 20) calculates that it could be necessary to expand the global area planted with energy crops to up to 600 million hectares, which is more than the size of the entire Brazilian territory. In a similar way, strategies with a stronger biotechnological focus need an agricultural resource base. Miriam Boyer (2019, p. 183ff.) calculates that an additional 6.8 million hectares of arable land is needed for the production of isoprene for car tires in a bacterial process, instead of using petroleum. These two examples illustrate that bioeconomy strategies intensify the problems around phosphate supply that have surfaced during the crisis of cheap nutrient supply. Even if the crops used for bioeconomy strategies will not compete with food crops (which is highly questionable), the demand for fertilizers is going to increase. This can lead to rising fertilizer prices and increased agricultural production costs. Hence, a bioeconomy which continues to function as an extractive system is going to increase global inequalities via the mechanism of nutrient flows.

On the other hand, the potential of such a bioeconomy depends on the access to cheap (phosphate) fertilizer, which cannot be seen as automatically given. In early 2021, fertilizer prices started to increase, along with many (primary) commodities and reached the highest levels since 2008 (IndexMundi 2022). The war in Ukraine will accentuate this trend, not only because of energy costs. Russia is also the most important supplier of phosphate rock in Western Europe and the Russian company Eurochem controls large parts of the phosphate derivate market with important operations in Lithuania and Belgium (Eurochem 2022). The disruptions of the war will further aggravate conflicts around the access to sources of phosphate rock and around the control over commodity chains. These conflicts have already surfaced during the last decades as the following section will show with a focus on South America.

Contested commodity chains in the phosphate industry

New phosphate frontiers and the concentration of market power

Brazil is a particularly relevant country for the question of nutrients in an emerging bioeconomy, particularly from a German perspective. First, Brazil is a strategic partner of the German bioeconomy strategy (BMEL 2014), which largely rests on agro-imports since the domestic arable land is far too small to substitute non-renewable resources at a constant level of resource consumption. Brazil in turn has strategically positioned itself as an agro-exporter even before the Bolsonaro-administration (Wilkinson 2019; cf. Sect. 2).

Second, the Brazilian agricultural sector is highly dependent on fertilizers, particularly in the agricultural frontiers in the Cerrado and Amazon regions, where savanna and rainforest are transformed into agricultural land, mostly for soy cultivation. Since these soils are often deficient in nutrients, the application rates of fertilizers are among the highest in the world. According to the Mosaic company, half a ton of chemical fertilizers is needed to bring one hectare of new land into production (Rahm 2015, p. 18).

Third, Brazil has a small national production of phosphate rock, but is highly dependent on the world market for phosphorus fertilizers (OEC 2022).

Therefore, the Brazilian national development bank BNDES started to put the problem of fertilizer supply on the political agenda, claiming that the “external dependency in a strategic sector for agrobusiness and for the country is preoccupyingFootnote 9” and that it could become “an obstacle for the production and competitiveness of Brazilian productsFootnote 10 (BNDES 2010).

The BNDES still holds a minority share (12%) in the transnational mining company Vale, which was a state-owned company until its privatization in the mid-1990s. Under the center-left governments of Lula da Silva (2003–2011) and Dilma Rouseff (2011–2016), Vale became a central actor in the national fertilizer strategy. Vale created a subsidy called Vale Fertilizantes that took over almost the entire fertilizer sector in Brazil with the goal of “supply[ing] the Brazilian market and help[ing to] develop the country’s agriculture” (Vale Fertilizantes 2016). Similar to the semi-peripheral countries mentioned above, through Vale Fertilizantes the government tried to control the phosphate commodity chain from the mine to field. However, Brazil only has a number of smaller phosphate mines that do not produce enough to supply the growing demands of the agricultural sector. Therefore, the Peruvian phosphate mine Bayóvar assumed an important role in this strategy.

As early as 2005, Vale had won an international tender for the Bayóvar mine in the Northern Peruvian department of Piura. In only 5 years, the company was able to complete the environmental impact assessment and build the entire machinery and infrastructure around the mine (Claps 2014). However, shortly before starting the commercial operation in 2010, Vale sold its minority shares to Mosaic (35%) and to the Japanese trading house Mitsui (20%). With this move, the Brazil-based company was able to recover its entire investment as phosphate prices had increased tenfold (Reuters 2010).

Peru’s insertion into global commodity chains of phosphate fertilizers was completely based on exports of the raw material phosphate rock, although different generations of Peruvian politicians and engineers had tried to build a national fertilizer industry around the Bayóvar deposit since the 1970s (CIPCA/EMRB 1994). However, since the authoritarian presidency of Alberto Fujimori (1990–2000), a neoliberal, export-oriented strategy became firmly established in the political institutions (Crabtree/Durand 2017).

After the inauguration of the Bayóvar mine in 2010, Peru became the fourth most important exporter of phosphate rock in the world (OEC 2022). The annual production of 3.9 million tons is relatively low, but most of the other phosphate producing countries, first and foremost the USA and China, do not export phosphate rock, but process it into fertilizer, often for the domestic market. With a legal framework encouraging direct investment and the entire phosphate rock production designed for export, the Bayóvar mine gives the involved actors a unique opportunity of direct access to cheap phosphate rock.

The flow of resources from Peru changed after the year 2016, when the national fertilizer strategy in Brazil found its end with the impeachment of Dilma Rousseff. In December 2016, Vale Fertilizantes was sold to transnational companies, with most shares going to Mosaic (Reuters 2016). The US–American company became the majority owner (75%) of the Bayóvar mine in Peru and started to acquire more than half of the mine’s annual production (O.E.C s.a. 2022). This has increased the share of Peruvian phosphate rock imports in the USA, reaching 87% (Jasinski 2020). With the direct access to a new cheap source of phosphate, Mosaic found a fix to declining domestic production and was able to reconstitute parts of its business based on these imports. The South American countries were left in a dependent position of importing or buying from Mosaic, which now controls large parts of the fertilizer sector in Brazil (Mosaic 2021).

Bioeconomy strategies and new technologies

In the wake of the crisis of cheap nutrient supply, efforts have been increased to find technological solutions against rising fertilizer prices. This section presents three of these strategies that have been developed by different actors.

A: High-precision agriculture

Although not explicitly designed to tackle the problem of nutrient supply, so-called “high-precision agriculture,” advanced by the agribusiness sector, can be seen as one of these strategies. With the help of drones, big data platforms and a new generation of tractors equipped with manifold sensors and screens, the exact composition of the soil is measured to apply only those nutrients needed in each square meter with “high precision.” The German bioeconomy strategy supports this idea since it allows for a more “sustainable” use of resources (BMEL 2014, p. 55). However, high precision agriculture increases the dependence of farmers on the agribusiness sector, which provides the new technologies and has a strong interest in its success. Even competitors such as Monsanto/Bayer and Dupont are collaborating in joint projects such as the Global-Harvest-Initiative, together with companies working in completely different sections such as Mosaic (fertilizers) and John Deere (tractors) (Suppan 2017, p. 3). The state-owned Brazilian Agricultural Research Corporation EMBRAPA is also part of this initiative and is working particularly on a nanotechnology-based reduction of fertilizers, which is to increase yields by 67%. Compared to agricultural revolutions of the past such as the Green Revolution that increased yields by more than 200% (cf. above), these self-set goals are quite modest. It is clear that high-precision agriculture will not initiate a quantum leap in yield output per acre.

B: Sustainable intensification

A number of large producers in the Center-West Region of Brazil are experimenting with alternative technologies. This “new class of mega farmer [is] anxious to explore solutions that lower costs and provide leverage in relation to the incumbent agricultural inputs players” (Wilkinson 2019, p. 11f.), who have been mentioned above. More than 2300 producers are organized in the “Sustainable Agriculture Group” which is collaborating with a local university to experiment with new crop rotations, conventional seeds, and organic fertilizers. Particularly in the state of Goias, more than 250,000 hectares are fertilized with “natural” nutrient sources. Among these are plants that fix nutrients in the soil as well as po de rocha, a powder made from local minerals that are rich in nutrients, such as volcanic rock (MAPA 2019). But there is no definite break with conventional methods: a combination of synthetic and alternative fertilizers is to increase yields while lowering costs and decreasing the dependence on the agribusiness sector. Hence, this strategy mainly has economic motives and less ecological concerns.

C: Nutrient recycling

Another approach to reduce the application of fertilizers from a finite resource base is being implemented in Germany. According to the new Sewage Sludge Ordinance of 2017 (Klärschlammverordnung), all cities with more than 50,000 inhabitants have to recycle phosphorusFootnote 11 from their sewage sludges starting in 2029. This would allow the reduction of imports of phosphate products by up to 40% (Deutsche Phosphor-Plattform 2019). Despite the discourse of a circular economy, after a successful implementation, phosphate rock extracted from mines would still be the major source of phosphorus fertilizer in Germany. However, the German bioeconomy strategy is supporting these efforts of nutrient recycling (BMEL 2014, p. 64). Leading scientists, funded by the federal ministry of science and education, tested different methods of recycling phosphorus, but they concluded that “[a]ll processes which have been investigated within this project cannot be run economically efficient yet” (Pinnekamp et al. 2011, p. iv). Hence, the ministry of environment is funding pilot projects with several million euro to help implement nutrient recycling in Germany (BMU 2017). But this strategy is not only about environmental concerns: technologies for recycling phosphorus from sewage sludge, as well as technologies for producing fertilizers from recycled materials, each have a market potential of up to 100 million euro. Pinnekamp et al. (2011, p. 15) think that it is important to take advantage of the “dominant” research and development in Germany to establish a “lead-market” against the competition of other countries. Hence, this strategy is also about positioning Germany as a business location for the age of sustainability and securing national interest against competitors. Regarding the commodity chains of phosphate fertilizers, in which actors from semi-periphery have been exercising more control, this strategy provides a lever to regain control.

The common element of all these strategies is that they mainly follow economic motives to improve or strengthen the position of the respective actors in the phosphate fertilizer commodity chain. Furthermore, they are a reaction to the crisis of cheap nutrient supply and seek to reduce the consumption of the finite resource phosphate rock. They do not, however, question the extractive character of industrial agriculture per se. Hence, when analyzing these nutrient flows, it is clear that even a bioeconomy that puts these strategies in practice will remain an extractive system.

Conclusion

The article at hand has demonstrated that the presented bioeconomy strategies do not question the production model of industrial agriculture. This model has historically been constituted as a through-flow system of open nutrient flows in which moments of crisis have been overcome by technological revolutions and the access to cheap raw materials. At present (2022), the access to cheap fertilizers can be seen as a central challenge for the viability of industrial agriculture and the realization of a bioeconomy based on this production system. It is becoming increasingly difficult and/or expensive to access resources such as phosphate rock, and various actors are struggling to arrange commodity chains according to their interests. A far-reaching implementation of bioeconomy strategies would intensify these struggles and drive up the prices for food, regardless of the question whether bioeconomy crops compete with land for food crops or not. This could lead to new outbreaks of hunger similar to those during the food crises of 2007/2008 and 2011. The food price escalation in early 2022 has been largely attributed to the blocked Ukrainian grain exports, but again fertilizer prices are another important factor in the food price increase. This is not only because fertilizer prices are related to energy prices, but because Russia is an important supplier of phosphate products, while its ally Belorussia ranks among the top exporters of potash products. The disruptions of the war and potential embargos will further tighten fertilizer supply.

Considering the analysis of nutrient flows in this article, the bioeconomy appears to be an exclusive project which can particularly be realized by actors who can secure their access to cheap sources of phosphorus. There is no replacement for this nutrient, and the raw material phosphate rock is a finite resource that will not be available for far-reaching implementations of a bioeconomy across the globe. The technological innovations that are promoted as a part of bioeconomy strategies can be seen as the respective actors’ attempts to adjust themselves within a new constellation in which phosphate rock is a contested or strategic resource, after being considered a “low-cost bulk commodity” for decades. The strategies do not depart from the main pillars of industrial agriculture, but they can reduce the through-flow of nutrients backed by the discourse of sustainability and efficiency. However, these technologies will not initiate an agricultural revolution, such as the historical ones considered above, which provided quantum leaps in productivity and brought completely new resources into the picture. None of this is currently on the horizon. Therefore, nutrient flows and particularly phosphorus supply will continue to be a politically contested issue.

The insights of this article have been limited in a number of ways. First, the article is mainly based on secondary sources as well as online databases. Field research with different actors along the commodity chain is needed to gain further in-depth insights. Second, a broader focus on different current and/or future bioeconomy strategies around the globe might reveal more nuanced deviations from the global through flow system of nutrients. Third, this article has focused on the access to phosphate rock and has bracketed the socio-ecological impacts of mining (Claps 2014) and fertilizer production (Fortis 2022). Finally, this article’s focus has been on problems and responses in the mainstream sector. The perspective of social movements would be an important part of debates around a socio-ecological transformation. For instance, a politicization of the nutrient problem in industrial agriculture could also be an argument to strengthen grassroots alternatives such as agro-ecology and decentralized recycling systems. The metabolic and political potential of these strategies should be part of future analyses.

Notes

For a broader discussion on bioeconomy strategies around the globe see several contributions in Backhouse et al. (2021). Note that most strategies share the technological optimism that is very present in the passages cited in this section.

Quotations in foreign languages have been translated by the author. Original source: “Für eine nachhaltige Steigerung der Ernteerträge […] sind, neben dem Einsatz moderner Züchtungsmethoden, Effizienzverbesserungen insbesondere in Bezug auf den Einsatz von Energie, Dünge- und Pflanzenschutzmitteln notwendig”.

Original source: “[…] avanço tecnológico [e] soluções inovadoras para […] melhorar a produtividade e a qualidade da produção agropecuária”.

Because this paper is just an introduction to this topic, it does not include the trade of this intermediate product in the following analysis to briefly present a complex issue.

Phosphate rock.

In their historical comparison of phosphorus scarcity discourses, Ulrich and Frossard (2014) also include an earlier debate in 1938/1939 that only took place in the USA.

The Observatory of Economic Complexity (OEC) is a visualization of UNCTAD trade data. https://oec.world/.

Original source: “dependência externa é preocupante em um setor estratégico para o agronegócio e para o país”.

Original quote: “tornar-se um entrave à produção e à competitividade dos produtos brasileiros”.

Interestingly, only phosphorus has to be recycled, other nutrients will still be lost. This confirms the thesis that currently phosphorus is the critical element or “bottleneck” for the viability of industrial agriculture.

References

Altieri M (2000) Ecological impacts of industrial agriculture and the possibilities of truly sustainable farming. In: Magdoff F, Foster JB, Buttel F (eds) Hungry for profit: the agribusiness threat to farmers, food, and the environment. NYU Press, New York, pp 77–92

Anlauf A, Schmalz S (2019) Globalisierung und Ungleichheit. In: Fischer K, Grandner M (ed) Globale Ungleichheit. Über Zusammenhänge von Kolonialismus, Arbeitsverhältnissen und Naturverbrauch. Wien, pp 192–211

Backhouse M, Lehmann R, Lorenzen K, Lühmann M, Puder J, Rodríguez F, Tittor A (2021) Bioeconomy and global inequalities socio-ecological perspectives on biomass sourcing and production. Springer, Cham

BMBF and BMEL (2020) Nationale Bioökonomiestrategie. Berlin. https://www.bmbf.de/files/bio%c3%b6konomiestrategie%20kabinett.pdf, accessed: 29 Jun 2021

BMEL (2014) Nationale Politikstrategie Bioökonomie. Nachwachsende Ressourcen und biotechnologische Verfahren als Basis für Ernährung, Industrie und Energie. Berlin. http://www.bio-step.eu/fileadmin/BioSTEP/Bio_strategies/Nationale_Politikstrategie_Biooekonomie.pdf, accessed 29 Jun 2021

BMEL (2020) Nationale Bioökonomiestrategie. https://www.bmel.de/DE/themen/landwirtschaft/bioeokonomie-nachwachsende-rohstoffe/nationale-biooekonomiestrategie.html, accessed 22 Jun 2022

BMU (2017) Phosphor—zu wertvoll für die Müllverbrennung. https://www.bmu.de/pressemitteilung/phosphor-zu-wertvoll-fuer-die-muellverbrennung/, accessed 29 Jun 2021

BNDES (2010) Panorama atual e perspectivas de desenvolvimento do setor de fertilizantes no Brasil. Informe Setorial No. 16, January 2010. https://www.bndes.gov.br/SiteBNDES/export/sites/default/bndes_pt/Galerias/Arquivos/conhecimento/setorial/informe-16AI.pdf, accessed 29 Jun 2021

BÖLW (2022) Wie wird im Ökologischen Landbau gedüngt? https://www.boelw.de/service/bio-faq/landwirtschaft/artikel/wie-wird-im-oekologischen-landbau-geduengt/, accessed 14 Mar 2022

Boyer, M (2019) Alternativen zum Extraktivismus oder alternative Extraktivismen? In: Ramirez M, Schmalz S (ed) Extraktivismus—Lateinamerika nach dem Ende des Rohstoffbooms. München, pp 177–192

CIPCA and EMRB (1994) Bayóvar en el desarrollo regional. Piura.

Clapp J (2016) Food. Cambridge University Press, Cambridge

Claps LM (2014) Phosphates mining rocks the boats in northern Peru. Upside down world, 21.05.2014. http://upsidedownworld.org/archives/peru-archives/phosphates-mining-rocks-the-boats-in-northern-peru, accessed 29 Jun 2021

Cordell D (2010) The story of phosphorus sustainability implications of global phosphorus scarcity for food security. Linköping Studies in Arts and Science No. 509, Department of Water and Environmental Studies, Linköping University

Cordell D, White S (2011) Peak phosphorus: clarifying the key issues of a vigorous debate. Sustainability 3:2027–2049. https://doi.org/10.3390/su3102027

Crabtree J, Durand F (2017) Peru: elite power and political capture. Bloomsbury Publishing, London

Cushman G (2013) Guano and the opening of the pacific world: a global ecological history. Cambridge University Press, New York

Deutsche Phosphor-Plattform (2019) Die meistgestellten Fragen von Bürgern und Entscheidungsträgern zum Thema “Phosphorrecycling”. https://www.deutsche-phosphor-plattform.de/wp-content/uploads/2019/02/FAQs-zur-Phosphorr%C3%Bcckgewinnung.pdf, accessed 29 Jun 2021

Embrapa (2021) Brazil is the world's fourth largest grain producer and top beef exporter, study shows. https://www.embrapa.br/en/busca-de-noticias/-/noticia/62619259/brazil-is-the-worlds-fourth-largest-grain-producer-and-top-beef-exporter-study-shows, accessed 22 Jun 2022

Eurochem (2022) Global Operations. https://www.eurochemgroup.com/about-us/global-operations/, accessed 14 Mar 2022

Fortis B (2022) Environmentalists target mountains of fertilizer waste. https://undark.org/2022/04/13/environmentalists-target-mountains-of-fertilizer-waste/, accessed 22 Jun 2022

Foster JB, Magdoff F (2000) Liebig, Marx, and the depletion of soil fertility: relevance for today’s agriculture. In: Magdoff F, Foster JB, Buttel F (eds) Hungry for profit: the agribusiness threat to farmers, food, and the environment. NYU Press, New York, pp 43–60

Foster JB, Clark B, York R (2010) The ecological rift - capitalism's war on the earth. Monthly Review Press, New York

Gnutzmann H, Spiewanowski P (2015) Did the fertilizer cartel cause the food crisis? FREE Policy Brief Series, 23.3.2015. https://freepolicybriefs.org/2015/03/23/did-the-fertilizer-cartel-cause-the-food-crisis-2/, accessed 29 Jun 2021

Hopkins TK, Wallerstein I (1986) Commodity chains in the world-economy prior to 1800. Review 10(1):157–170

Indexmundi (2022) Commodity prices. https://www.indexmundi.com/commodities/. Accessed 29 June 2022

INKOTA-Netzwerk, FIAN, Brot für die Welt, Forum Umwelt und Entwicklung, Heinrich-Böll-Stiftung, MISEREOR, Oxfam and Rosa-Luxemburg-Stiftung (ed) (2017) Better and different—transforming food systems through agroecology. https://webshop.inkota.de/file/1709/download?token=BIUdB_6-, accessed 29 Jun 2021

IPCC (2018) Global warming of 1.5 °C—summary for policy makers. https://report.ipcc.ch/sr15/pdf/sr15_spm_final.pdf, accessed 29 Jun 2021

Jasinski SM (2020) Phosphate rock. USGS Mineral Commodity Summaries. https://pubs.usgs.gov/periodicals/mcs2020/mcs2020-phosphate.pdf, accessed 29 Jun 2021

Jasinski SM, Buckingham DA (2010) Phosphate rock statistics 1900–2009. U.S Geological Service

Loeber K (2010) Der niedergang des chilesalpeters: chemische forschung, militärische interessen, ökonomische auswirkungen. Wissenschaftlicher Verlag, Berlin

MAPA (2019) Produtores rurais buscam bioinsumos para reduzir custo da produção e aumentar rentabilidade. https://www.gov.br/agricultura/pt-br/assuntos/noticias/produtores-rurais-buscam-bioinsumos-para-reduzir-custo-da-producao-e-aumentar-rentabilidade, accessed 29 Jun 2021

Martin J (1994) IMC Fertilizer Group, Inc. In: Kepos P (ed) International directory of company histories, vol. 8. Detroit/London, pp 265–266

Marx K (1990) Capital: a critique of political economy, volume 1 (Fawkes translation). Penguin, London

Marx K (1991) Capital: a critique of political economy, volume III (Fernbach translation). Penguin, London

MCTIC (Ministério da Ciência, Tecnologia, Inovações e Comunicações) (2016) Estratégia Nacional de Ciência, Tecnologia e Inovação 2016–2022. Brasilia. http://www.finep.gov.br/images/a-finep/Politica/16_03_2018_Estrategia_Nacional_de_Ciencia_Tecnologia_e_Inovacao_2016_2022.pdf, accessed 29 Jun 2021

Mew MC (2016) Phosphate rock costs, prices and resources interaction. Sci Total Environ 542:1008–1012

Moore J (2015) Capitalism in the web of life. Ecology and the accumulation of capital. Verso Books, London

Mosaic Company, The (2005) Annual report for the fiscal year ended May 31, 2005. https://d18rn0p25nwr6d.cloudfront.net/CIK-0001285785/7c5d3d5e-fef1-4349-ac3c-2373ffb2cd12.pdf, accessed 17 Dec 2021

Mosaic Company, The (2021) Form 10-K: annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 For the Year Ended December 31, 2020. https://d18rn0p25nwr6d.cloudfront.net/CIK-0001285785/999dd77d-af60-4d79-b479-93b22d053d07.pdf, accessed 26 May 2022

Nelson LB (1990) History of the US Fertilizer Industry. Muscle Shoals: Tennessee Valley Authority

OEC (2022) Trade data visualizations. https://oec.world/en

Overton M (1996) Agricultural revolution in England. Cambridge University Press, Cambridge

Patel R (2012) Stuffed and starved: the hidden battle for the world food system. Melville House, New York

Pinnekamp J, Weinfurtner K, Sartorius C, Gäth S (2011) Phosphorrecycling—Ökologische und wirtschaftliche Bewertung verschiedener Verfahren und Entwicklung eines strategischen Verwertungskonzepts für Deutschland. Abschlussbericht. https://www.cleaner-production.de/fileadmin/assets/02WA0807_-_Abschlussbericht.pdf, accessed 29 Jun 2021

Pomeranz K (2000) The great divergence - China, Europe, and the making of the modern world economy. Princeton Univ. Press, Princeton, NJ

Potashcorp (2018) Annual Report 2017. www.nutrien.com/sites/default/files/uploads/2018-02/2017%20PotashCorp%20Annual%20Report.pdf, accessed 29 Jun 2021

Rahm M (2015) Outlook for Brazil. Presentation at the Sixth CRU-GPCA Fertilizer Convention. 16.9.2015. Dubai. https://www.sec.gov/Archives/edgar/data/1285785/000124378615000153/exhibit991crugpcapresent.htm, accessed 29 Jun 2021

Rahm M, Fung J, Philippi M (2007) The new phosphate cycle. Market Mosaic 3(3)

Rawashdeh R, Maxwell P (2011) The evolution and prospects of the phosphate industry. Miner Econ 24:15–27. https://doi.org/10.1007/s13563-011-0003-8

Reuters (2010) Brazil Vale sells Bayovar stake to Mosaic, Mitsui. https://www.reuters.com/article/vale-bayovar-idAFN3124886420100401, accessed 22 Jun 2022

Reuters (2016) Vale acuerda venta de negocio de fertilizantes a Mosaic por 2.500 mln dlr. https://www.reuters.com/article/mineria-vale-mosaic-idLTAKBN1481AJ, accessed 22 Jun 2022

Ridder M, de Jong S, Polchar J, Lingemann S (2012) Risks and opportunities in the global phosphate rock market—robust strategies in times of uncertainty. The Hague Centre for Strategic Studies (HCSS). https://www.phosphorusplatform.eu/images/download/HCSS_17_12_12_Phosphate.pdf, accessed 29 Jun 2021

Rockström J, Steffen W, Noone K, Persson Å, Stuart-Chapin F, Lambin EF, Lenton TM, Scheffer M, Folke C, Schellnhuber HJ, Nykvist B, de Wit CA, Hughes T, van der Leeuw S, Rodhe H, Sörlin S, Snyder PK, Costanza R, Svedin U, Falkenmark M, Karlberg L, Corell RW, Fabry VJ, Hansen J, Walker B, Liverman D, Richardson K, Crutzen P, Foley JA (2009) A safe operating space for humanity. Nature 461:472–475. https://doi.org/10.1038/461472a

Rosemarin A, de Bruijne G, Caldwell I (2009) Peak phosphorus: the next inconvenient truth. In: The Broker, 4.8.2009. https://www.thebrokeronline.eu/peak-phosphorus/, accessed 29 Jun 2021

Scholz RW, Wellmer FW (2021) Endangering the integrity of science by misusing unvalidated models and untested assumptions as facts: general considerations and the mineral and phosphorus scarcity fallacy. Sustain Sci 16:2069–2086

Suppan S (2017) Applying nanotechnology to fertilizer: rationales, research, risks and regulatory challenges. Institute for Agriculture and Trade Policy. https://www.iatp.org/sites/default/files/2017-10/2017_10_10_Nanofertilizer_SS_f.pdf, accessed 29 Jun 2021

Taylor CR, Moss DL (2013) The fertilizer oligopoly—the case for global antitrust enforcement. The American Antitrust Institute. https://www.antitrustinstitute.org/wp-content/uploads/2013/10/FertilizerMonograph.pdf, accessed 29 Jun 2021

Thompson FML (1968) The Second Agricultural Revolution, 1815–1880. Econ Hist Rev 21(1):62–77

Ulrich AE, Frossard E (2014) On the history of a reoccurring concept: phosphorus scarcity. Sci Total Environ 490:694–707

UNIDO and IFDC (1998) Fertilizer manual. Kluwer Academic Publ, Dordrecht

Vale Fertilizantes (2016) Official Homepage. http://www.valefertilizantes.com, accessed 28 Jul 2016

Weis T (2007) The global food economy. Zed Books, London

Wellstead J (2012) Remaking China’s phosphate industry. Resource Investing News, 3.5.2012. https://www.businessinsider.com/remaking-chinas-phosphate-industry-2012-5?IR=T, accessed 29 Jun 2021

Wilkinson J (2019) Large-scale forces, global tendencies and rural actors in the light of the SDG goals. 2030—Food, agriculture and rural development in Latin America and the Caribbean, No. 5, FAO. Santiago de Chile. http://www.fao.org/3/ca5058en/ca5058en.pdf, accessed 29 Jun 2021

Wood EM (2000) The Agrarian origins of capitalism. In: Magdoff F, Foster JB, Buttel F (eds) Hungry for profit: the agribusiness threat to farmers, food, and the environment. NYU Press, New York, pp 23–41

Acknowledgements

Thanks to Megan Hanson for proofreading and to the editors and reviewers of the journal Peripherie for helpful comments on an earlier version of this article. Also, I want to thank Stefan Schmalz, Jakob Graf, Julia Lingenfelder, Renata Motta and Federico Masson for thoughts on my broader research project.

Funding

Open Access funding enabled and organized by Projekt DEAL. This study is funded by Rosa Luxemburg Stiftung.

Author information

Authors and Affiliations

Corresponding author

Additional information

Handled by Andrea Saltelli, University of Bergen, Norway.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Anlauf, A. An extractive bioeconomy? Phosphate mining, fertilizer commodity chains, and alternative technologies. Sustain Sci 18, 633–644 (2023). https://doi.org/10.1007/s11625-022-01234-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11625-022-01234-8