Abstract

Many countries have taken stringent climate policies to minimize the risks by climate change. But these policies could burden households and the poor with the extra costs and threaten their wellbeing. However, the consequences of climate policies on poverty and welfare loss are seldom presented in stringent long-term climate change mitigation projections. Carbon pricing is a cost-effective approach; how it affects households varies among countries. This study investigated the distributional effects and poverty implications of carbon pricing in China during the transition towards carbon neutrality and the Paris Agreement’s long-term goals. We assessed multiple poverty and equity standards in future scenarios with a newly developed integrated assessment model. It was found that climate change mitigation efforts would not greatly hinder poverty alleviation in China, with the poverty headcount under the $3.2/cap/day-threshold being less than 0.3 million people in 2050 in most scenarios. A carbon tax became a regressive factor mainly due to price increases in food and energy goods. This indicates that the distributional effects on carbon pricing should be considered. For example, supplementary policies that compensate for price changes, such as subsidies and early mitigation actions, that lead to modest price increases in the long term are worthy of consideration as valid instruments for the just transition towards the 2 °C or even 1.5 °C pathway.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

To tackle the threat from climate change, the Paris Agreement (PA) (UNFCCC 2015) declared a long-term climate goal of “holding the increase in the global average temperature to well below 2 °C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5 °C above pre-industrial levels.” Members submitted and updated their nationally determined contributions (NDCs) to achieve this long-term goal. Studies showed that there is either a significant implementation or ambition gap for all countries and the collective effort of current national policies falls short of the Paris Agreement’s objectives (Fawcett et al. 2015; Roelfsema et al. 2020). Further climate efforts should be pursued.

Climate change interacts with poverty and inequality directly through climate change impacts and vulnerability, and indirectly through climate policies (Taconet et al. 2020). The poor population is more susceptible to the impacts from both climate change damage and abatement. Changes in price, income, and productivity could also drag households into poverty. Climate policies affect poverty directly and indirectly. The direct channels include payments for environmental services (e.g., low-income farmers are paid for aiding afforestation) and direct taxation on emissions, while indirect channels often operate through markets (Hussein et al. 2013). Stringent climate policies without progressive redistribution will push an additional 50 million people into poverty worldwide (Soergel et al. 2021b). Policymakers should be deliberate when tailoring climate policies to avoid possible negative effects on the economy.

Carbon pricing is a common economic instrument for reducing GHG emissions. Common pricing mechanisms include carbon taxation and emissions trading systems (ETSs), etc. Many countries have already introduced taxes on carbon dioxide (CO2) emissions, for example, the tax rate worldwide is as low as $5.00/tCO2 in Chile and as high as $126/tCO2 in Sweden (Carbon Tax Center 2020; Jonsson et al. 2020).

Many studies have found that carbon taxes have a regressive effect on income distribution and exacerbate inequality (Wier et al. 2005; Kerkhof et al. 2008; Feng et al. 2010; Meng et al. 2014; Fremstad and Paul 2019). This can be explained by low-income households spending a relatively large share of their income on carbon-intensive goods, and are thus more sensitive to a carbon tax. Some studies have suggested otherwise. Yusuf and Resosudarmo (2015), using a computable general equilibrium (CGE) model with highly disaggregated household groups, suggested a carbon tax would not necessarily be regressive in Indonesia. Malerba et al. (2021) suggested that in Peru a carbon tax would leave relative inequality unchanged without compensation. Although it would increase poverty, this could be prevented if proper transfer schemes were in place. Dorband et al. (2019), using household expenditure data, a multiregional input–output (MRIO) table, and a microsimulation, reported a U-shaped relationship between the share of energy expenditure and national per capita income, which was used to explain the seemingly contradictory distributional effects of a carbon tax in countries with different income levels.

China is the largest greenhouse gas (GHG) emitter, accounting for over one quarter of the global GHG emissions (Kuramochi et al. 2020), and is an active player in GHG climate change mitigation. It is well on track to reach its first NDC target through current policies, but recent and expected emission trends are incompatible with the 2 °C or 1.5 °C goals (He et al. 2016; Wang et al. 2020a; Carlson et al. 2021). At the end of 2020, China announced its updated NDC targets and commitments toward carbon neutrality in 2060.

The country also faces an urgent need to alleviate poverty and improve inequality. It was announced in February 2021 that absolute poverty had been eliminated within the country (Xinhua News 2021). Following this significant achievement, there has been a shift in focus from poverty in rural to urban areas, and to the gap between rural and urban lifestyles (Walker and Yang 2020). Multi-dimensional poverty remains a concern and multiple poverty measurements are required (Chen et al. 2013; Sun and Xia 2019; Wang and Feng 2020). Questions arise regarding whether the country’s climate commitments and the alignment of climate policies with the PA’s long-term temperature goal would negatively affect its social and economic development, and the daily lives of the population.

There is existing literature on the distributional effects of a carbon tax in China. A carbon tax could reduce the primary income distribution and damage both household and business income (Wang and Liang 2015) and, therefore, before implementation in China it should be carefully assessed in terms of its design and impact on the economy (Cao 2009; Cao et al. 2021). When combined with a suitable recycling scheme, a carbon tax system could have a strong progressive impact on income distribution and benefit about 70% of the population (Brenner et al. 2007). Studies using input–output (IO) models showed that a carbon tax on CO2 emissions from fossil fuel combustion will widen the urban–rural income gap due to the coupling of a lower carbon tax revenue transfer and the higher price level of commodity prices for rural households (Liang and Wei 2012). This will have more influence on poor provinces and urban income segments that have more energy-intensive consumption and are more affected by commodity prices (Wang et al. 2019). A case study in Shanghai using an IO model found that a carbon tax on fossil fuels would be regressive (Jiang and Shao 2014), while a similar study in Guangdong Province found that carbon pricing would be increasingly progressive (Yan and Yang 2021). The prevailing studies in China have adopted IO models, and assumed linearities and limited substitution possibilities. No consensus on the distributional effects of carbon pricing in China has been reached yet.

No study has identified the long-term effects of carbon pricing on Chinese households, or the impact of stringent climate change mitigation on poverty and welfare distribution. The highly heterogenous population groups (Chen et al. 2013), dramatic socioeconomic reforms, dual nature of the Chinese economy (Garbaccio et al. 1999), and limited data accessibility make it difficult to project the resulting poverty outcomes. Here, we investigated the distributional implications of a carbon tax and its impact on poverty in China by building a set of long-term scenarios that presented the efforts to achieve the long-term goal of the Paris Agreement in an integrated assessment model (IAM) framework.

The remainder of this paper is structured as follows. The next section introduces the methodology, covering the basic details of the model, scenarios, and data. The subsequent section shows the main results, followed by the general scenarios and poverty trends. The effects of a carbon tax on household welfare are explained next. The penultimate section is a discussion. Then we present our main conclusions together with policy implications in in the final section.

Materials and methods

Overview

We used an IAM framework, the Asia–Pacific integrated model (AIM), for the projection of future scenarios. Expenditure and poverty projections at a fine scale were derived from future economic conditions and a newly developed distribution model based on data from household surveys. The AIM model was primarily developed for a global analysis based on international data, but here we incorporated Chinese national data in the model to improve the reliability of our national analysis. We adopted multiple measurements to assess the impacts of carbon pricing.

Our assessment here considered only the impacts of climate policies, here represented by carbon pricing. The impacts of climate change on household wellbeing are not considered in the AIM/Poverty, Household, and Income distribution (AIM/PHI) model.

Model

AIM/Hub

The AIM/Hub model is the center of the AIM framework. It is a recursive dynamic CGE model where all goods and services transactions within the economic system are represented and emissions constraints are met by carbon pricing (Fujimori et al. 2012, 2017). A carbon price is determined endogenously under equilibrium conditions by the exogenously determined climate change mitigation pathways and is applied as a carbon tax levied on all sectors. We refer to this carbon price as a carbon tax. The tax revenue is recycled to the representative household in the CGE model in a lump sum manner but is not considered at finer levels, meaning that this recycling only changes the average income but indicates no redistribution among income brackets. If a per capita lump sum is applied, the Gini coefficient would be reduced because the income of the poor increases more in proportion. We used socioeconomic outputs, such as gross domestic product (GDP) loss, budgets, and price change to project household income and expenditure (for more details, see SI 1).

Previous studies indicated that the mitigation capacity for non-energy derived non-CO2 emissions in the agriculture sector could be saturated under a high carbon tax, and that a further reduction would require a decrease in demand for agricultural products (Fujimori et al. 2019). We set a carbon tax cap at $200/tCO2eq for these emissions.

AIM/PHI

We used a new model in the AIM framework called the AIM/PHI model, which determines the income distribution using a lognormal income distribution function and depicts household consumption and expenditure changes with An Implicitly Directly Additive Demand System (AIDADS) (Rimmer and Powell 1992), which is an implicit functional form that expresses the relationship between utility and consumption levels as an identity and outperforms many other popular demand systems (Meyer et al. 2011), in the expenditure model. It has been applied to give global-scale long-term poverty projections and to assess the potential of carbon tax revenue for tackling absolute poverty (Fujimori et al. 2020).

A two-stage process is adopted in the AIDADS calibration: a cross-country panel data analysis and a national consumption parameter estimation (SI 1). The cross-country panel data analysis compensated for the weakness of a single national calibration, i.e., a potential failure to reflect the long-term changes brought about by economic development due to the limited time span of household budget surveys. Income elasticities were given after AIDADS projections based on the equations in SI 1.3. The national AIDADS parameters were calibrated to fit the expenditure patterns captured by the national household budget survey and were constrained by the income elasticity projections in the cross-country panel analysis (see SI 1.3.4).

Key analyses

The poverty headcount under the poverty line of $3.2 per day and relative poverty were examined. The World Bank recognizes three poverty thresholds: $1.90 per day (international poverty line, IPL, 1.9-threshold), $3.20 per day (3.2-threshold) for poverty in lower-middle income countries, and $5.50 per day (5.5-threshold) for poverty in upper-middle-income countries. The standards shown in our analysis are based on purchasing power parities (PPPs) if no other explanation is given. China’s poverty alleviation efforts are rural-oriented and there is no official poverty line for urban areas (at the time of publication). The poverty standard in China is equivalent to $2.3 per day per capita in 2011 PPP dollars (The State Council Information Office of the People’s Republic of China 2021). The World Bank’s poverty thresholds are important references for poverty measurements in urban areas and on a national scale (Chen et al. 2018; Chen et al. 2019). We focused on the 3.2-threshold, while projections for all three thresholds are provided in SI 6.

Poverty alleviation in China has entered a new phase, where relative poverty should be reduced (Sun and Xia 2019). We adopted the definition of relative poverty as the “income level lower than 40% of the median disposable income level” (Walker and Yang 2020). Poverty in our study was expenditure-based, comparable with global standards and represented more serious poverty concerns than the income-based standard (Chen et al. 2018).

We decomposed the effects of climate policies on poverty headcount into the income effects, direct carbon tax effects, and indirect price effects (goods price change effects). The income effects were associated with the general macroeconomic income loss, as given by AIM/Hub and were reflected in the income module in AIM/PHI. The direct carbon tax effects corresponded to the carbon tax imposed on household consumption and activities that directly emit GHGs, e.g., the carbon price penalty on gas and liquid fuel consumption. The indirect price effects referred to the price changes due to emission abatement costs and taxation on residual emissions.

Welfare was measured by the equivalent variation ratio (EV, compared to the baseline), (see SI 1.2). This showed the adjustment in income as a proportion of the baseline income that would be needed to change the consumers’ utility to the level that would occur if the climate policies were adopted.

We tested the sensitivity of the model to critical model assumptions and alternative datasets (see SI 1.4). Other uncertainties are also discussed there.

Scenarios

We considered five national scenarios. The “baseline scenario” was based on national GDP and population projections (see SI 2 and 3) combined with other narratives in the Shared Socioeconomic Pathway 2 (SSP2) (Fricko et al. 2017) and no climate policies. The four climate change mitigation scenarios were based on the baseline, but meeting various climate change mitigation targets or climate policies. This assessment followed the framework of a global comparative national study (Fujimori et al. 2021) (Table 1). The climate policies covered carbon dioxide (CO2), methane (CH4), and nitrous oxide (N2O) emissions from energy and non-energy-related activities. The detailed parameter assumptions are presented in Fujimori et al. (2017).

“50% mitigation” corresponding to the global higher-2 °C scenario, where there is more than 50% chance of staying below 2 °C throughout this century; “65% mitigation” corresponding to the global lower-2 °C scenario, where the chance of staying below 2 °C throughout this century is over 66.7%; and “80% mitigation” was in line with the below-1.5 °C scenario, where there is over 66% chance of staying below-1.5 °C in 2100 (Rogelj et al. 2018). They were referred to as “optimal” scenarios in this study because the climate policy started without delay and followed cost-optimal pathways that were consistent with a series of global and national studies (McCollum et al. 2018; Li et al. 2019; Roelfsema et al. 2020; Wang et al. 2020b). The reduction rate in 2050 was taken from the average emissions in 2050 given by the aforementioned studies. Linear emissions reductions started from 2020.

The NDC scenario simulated the updated NDC and the pathway towards carbon neutrality by 2060, where a linear reduction started from 2030 and continued towards 2050. The emissions targets for 2050 were based on research outcomes reported by the Institute of Climate Change and Sustainable Development, China (2021).

Data

Two global databases and one national database were used in the demand system calibration. The Global Consumption Database (World Bank 2019) and EUROSTAT (EUROSTAT 2019) provide global comparable national expenditure data and were utilized in the model in our previous global study (Fujimori et al. 2020). We identified 12 goods and services for which data in both datasets could be compared (Table 2).

To better depict the household consumption pattern in China, we adopted household survey data in the China Family Panel Survey (Xie and Hu 2014). The survey covered 25 provinces and regions and was considered representative of 95% of the Chinese population (Xie and Zhou 2014; Zhao 2015). It provides detailed household information on income, expenditure, assets, and education, which was collected by household survey. We obtained detailed expenditure data from the questionnaires and fed it into the PHI model for AIDADS calibration (see SI 1.3.1).

Results

Greenhouse gas emissions and the carbon tax

Greenhouse gas emissions continued to increase after 2020 and followed a steeper reduction trajectory after 2030 in the NDC scenario (Fig. 1a). In the NDC scenario, GHG emissions peaked around 14,900 MtCO2eq in 2030 and the cumulative carbon budget from 2010 to 2050 was 422 GtCO2eq, which was in between the values for the 50% and 65% mitigation pathways.

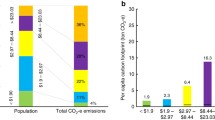

Scenario overviews. a GHG emissions trajectories from 2010 to 2050. The three optimal scenarios produced linear reductions from 2020. The NDC scenario produced a linear reduction from 2030. b The resulting carbon tax trajectories. c The GDP loss compared to the baseline. d The price change due to a carbon tax on the 12 goods and services. The updated NDC target to “lower carbon dioxide emissions per unit of GDP by ‘over 65%’ in 2030 compared to 2005 levels” can be achieved by bringing “its total installed capacity of wind and solar power to over 1.2 billion kilowatts by 2030”, which is also stated in the updated NDC. Therefore, no carbon price was implemented until 2030 in the NDC scenario. This improvement in capacity led to a tiny increase (less than 0.1%) in GDP and raised the price of residential goods and services by 1.33%. The delayed but rapidly rising carbon price in the NDC scenario entailed great economic risks judging both from the GDP loss and the price fluctuation. The price shown here is the relative commodity price, due to the numeraire used in the CGE model. It is different from the actual price or the CPI

In the three optimal scenarios, carbon taxes were highest in 2050, being 242 US$2010/tCO2eq in the 80% mitigation scenarios. The GDP loss rates increased by 2040, with the largest loss rate being 6.68%, but there was a decline later (Fig. 1b). In the NDC scenario, because of the stringent climate change mitigation post-2030, the carbon tax reached 84.0 US$2010/tCO2eq in 2040 and 1100 US$2010/tCO2eq in 2050. The GDP loss continued to increase during 2030 to 2050, reaching 9.60% and corresponding to 4280 billion US$2010 (MER GDP) in 2050. From this perspective, early climate change mitigation with a lower carbon tax was preferable for the country’s economy, and also led to a larger GHG reduction.

Poverty

Poverty headcount

More than 5.25 million people were still in poverty in 2030 if we adopted the higher poverty line (3.2-threshold) in the baseline scenario. The poverty headcount decreased rapidly, reaching 0.800 million in 2040 in the baseline scenario, and to less than 0.300 million in 2050 in all scenarios (Fig. 2b). A carbon tax would not significantly slow the pace of poverty alleviation in China, with poverty under the 3.2-threshold eliminated by mid-century. In the NDC scenario, although the poverty headcount declined at a much lower rate than in all other scenarios after 2030, the poverty headcount remained low due to the rapid decrease before 2030.

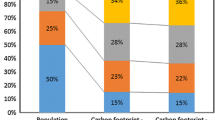

Poverty headcounts. a Historical trend of the poverty headcount in China. “$1.9”, “$3.2”, “$5.5” correspond to “1.9-threshold”, “3.2-threshold”, and “5.5-threshold”, respectively. b Poverty headcount projections (2020–2050). c Additional poverty headcount due to carbon taxes, decomposed by income-side, indirect price, and direct price effects. d Expenditure distribution in 2030 and 2050, with the relative poverty level arising from the baseline scenario. Area A represents people living under the 3.2-threshold in the baseline scenario. Area A + area B represents people living under relative poverty in the baseline scenario. The national poverty standard was regularly updated. The national poverty threshold (income for rural households) was updated from 206 CNY ($59.7) per year per capita in 1986 to 865 CNY ($105) per year per capita in 2001, and to the current standard of 2300 CNY (at the 2010 constant price) per year per capita in 2011 (The State Council Information Office of the People’s Republic of China 2021). While the poverty headcount declined in the coming decade regardless of the stringency of climate policy, relative poverty raised by carbon price was of concern in the optimal scenarios. The delayed but rapidly rising carbon price in the NDC scenario has more long-lasting impacts on poverty headcount by both the 3.2-threshold and relative poverty

Climate change mitigation along the optimal pathways substantially increased the poverty headcount in 2030, placing an additional 2.49 million people under the 3.2-threshold in the 80% scenario (Fig. 2c). The impact diminished in 2050. Compared to the optimal pathways, the NDC scenario placed less people at risk for poverty, albeit a more challenging emissions reduction and slower poverty alleviation post-2030.

Income loss was the main factor controlling the delay in poverty alleviation (Fig. 2c). The income effects accounted for 80.4%, 79.1%, and 77.8% of the additional poverty headcount in the 50%, 65%, and 80% mitigation scenarios in 2030. The share decreased to around 70% in 2040 and 50% in 2050 for the three scenarios. The additional poverty headcount in the NDC scenario was small and the changes in income- and expenditure-side effects from 2040 to 2050 were similar to the optimal scenarios. Direct-price effects were only observed for household energy consumption for residential services and accounted for around 2.00% of the additional poverty headcount under all scenarios.

Relative poverty

Relative poverty presents a different picture (Fig. 2b). In the baseline scenario, the relative poverty headcount continued to fall from 2020 to 2050, with an acceleration from 130 million to 91.8 million (for the full detail of the poverty headcount projections, see SI 6). In the three optimal scenarios, it increased in the coming decade and then decreased quickly after 2030. Our projection in the NDC scenario indicated a significantly slower decrease in relative poverty from 2040 to 2050. This could be explained by our finding (see later text) that welfare loss caused by a carbon tax could be regressive after 2040.

The relative poverty headcount in 2030 was projected to be around 131–132 million in the optimal climate change mitigation scenarios. The differences caused by climate change mitigation among the scenarios were amplified in 2050. Around 4.73 million people were placed in relative poverty in 2050 due to a carbon tax in the 80% scenario, in which climate change mitigation efforts had the most influence over poverty among the three optimal scenarios. Around 4.99 million more people fell into relative poverty due to carbon pricing in the NDC scenario in 2050, indicating that a high carbon tax in the long term due to delayed climate change mitigation would increase the time required to achieve equity.

Distributional effects

Welfare loss

As shown in Fig. 3a, poor households suffer more from carbon pricing, with most of the welfare loss caused by a loss in income. The poorest decile lost 1.36% (50% mitigation scenario) and 2.09% (80% mitigation scenario) more of their total welfare compared to the richest, due to a carbon tax in 2030. The gap between the poorest and richest decile widened to 1.88% (50% mitigation scenario) and 5.15% (80% mitigation scenario) in 2050, with the poor households suffering more welfare loss. In 2050, the large income loss and radical price changes in the NDC scenario led to an average welfare loss of 16.0%, with the EV ratio for the poorest and richest households being 18.7% and 12.8%, respectively.

Equivalent variation (EV) ratio relative to the baseline scenario by decile. a Projections of the EV ratio (by income and price effects in total, and only by price effects), with the values showing the percentage of welfare change (negative = welfare loss, positive = welfare gain) for households in each income decile. b The EV ratio decomposition (by income and price effects in total, and only by price effects). Four consumer goods where the impacts on welfare were prominent were picked out and the remaining eight were aggregated into “Others”. Decile 1 is the lowest income segment and decile 10 is the highest segment

The price effects indicated the burden of a carbon tax when household income was compensated for by income subsidies to maintain a stable income, while price changes were not easily offset. Note that the subsidy may not only come from carbon tax revenue. In this case, the burden of a carbon tax was neutral (evenly distributed) in 2040, but gradually shifted to regressive around 2050 (Fig. 3a), particularly when the carbon tax was set at a higher level to achieve urgent and stringent climate change mitigation. The shift towards regressivity was not purely decided by the tax level. A carbon tax of 83 US$2010/tCO2eq in the 65% mitigation scenario in 2040 was neutral, while the lower carbon tax (76 US$2010/tCO2eq) in the 50% mitigation scenario in 2050 was regressive.

The decomposition of EV (Fig. 3b) revealed clear regressive effects of the Food&Drinks, neutral effects of Residentials, and progressive effects through Equipment and Transport. Their relationship determined whether a carbon tax was regressive, neutral, or progressive, while other sectors had less influence on the distribution (therefore they were aggregated into the Others category in Fig. 3b).

If only the price effect was considered, the conclusion was similar but the welfare gains due to the decrease in prices for goods and services in Health, Recreation, and Education offset much of the welfare loss. In the 80% mitigation scenario, the welfare loss (EV ratio, negative value) via Food&Drinks was less influential in 2030 (0.776% in decile 1 and 0.269% in decile 10) than that via Residentials (2.30% in decile 1 and 2.60% in decile 10). And the progressive effects through Equipment offset much of the regressive effects via Food&Drinks. Impacts via Food&Drinks were amplified in 2050 and dominated the regressivity in the 80% mitigation scenario, with the contribution of Food&Drinks to welfare loss being 2.81% in the lowest decile and 11.28% in the highest decile, while the welfare loss due to Residentials was around 1.05% across the income segments and even less via Equipment and Transport.

In the NDC scenario, despite the soaring carbon tax post-2040, welfare loss through price changes were smaller than in the 80% mitigation scenario. This was because of the large net-welfare gains (positive values, 2.32% in decile 1 and 2.59% in decile 10) in other categories. However, the welfare loss was more biased to low-income households due to the larger regressivity in Food&Drinks. In 2050, the welfare loss in Food&Drinks was 3.84% in decile 1 and 1.90% in decile 10, while the welfare loss in Residentials was around 1.45% for all segments.

Price changes

Price changes as a result of carbon taxes were used to determine the distributional impacts observed in our study, with the most acute price change occurring in Food&Drinks and Residentials (Fig. 1d). Prices in the Food&Drinks sector increased slowly but steadily in the optimal scenarios by mid-century, with an increase of 12.7% in 2050 in the 80% mitigation scenario. Considering the smaller price elasticity of food compared to other goods, this large increase over the decade suggested that there would be adverse effects on Chinese households, where the average expenditure on food is around 30% of household expenditure (National Bureau of Statistics 2021). The Food&Drinks sector is, therefore, likely to be a channel that passes the economic burden of climate change mitigation to households.

In all three optimal scenarios, price changes in the Residentials were already prominent in 2030. The price of Residentials increased by 9.30% in the 50% mitigation scenario, by 11.2% in the 65% mitigation scenario, and by 13.8% in the 80% mitigation scenario in 2030 compared to the baseline. It then decreased slightly by 2040, and then fell sharply to around 5.0% of the baseline in the three scenarios in 2050. In the NDC scenario, due to the early promotion of renewable energy and the decreasing energy demand, the price increase was not as large as in other climate change mitigation scenarios and did not display such a distinct difference as in other categories.

In the NDC scenario, the promotion of renewable energy slightly reduced the price of Food&Drinks but the effect due to a carbon tax took over from 2030, increasing the price change over the baseline from − 0.2% in 2030 to 17.8% in 2050. The price change in Residentials was less intensive in the NDC scenario. In 2030, the promotion of renewable energy raised the price of Residentials by 1.30%. Even with a higher carbon tax in 2040 and 2050, the increases were only 9.10% and 7.20% compared to the baseline. The tax level and price changes in this scenario were influenced by the postponement of climate change mitigation and the promotion of renewable energy. The high carbon tax post-2040 was mainly due to the postponed but urgent climate change mitigation. Its impact on the Residentials price was buffered by the promotion of renewable energy because the increase in electricity price was largely reduced by a larger wind- and solar-power capacity and lower carbon capture and storage (CCS) demand (see SI 4).

Among the 12 categories of consumer goods, Equipment, Transport, and Communication were less influenced by a carbon tax by mid-century. The price changes compared to the baseline were less than ± 5.0% in all scenarios. In the NDC scenario, where emissions constraints did not take effect until 2030, price changes before 2030 were induced by the promotion of renewable energy. However, this effect was less prominent than that induced by a carbon tax.

Expenditure and consumption changes

The composition of household expenditure did not vary much among scenarios, but there were changes across income segments and time. Not surprisingly, the largest expenditure changes were in Food&Drinks and Residentials. In the baseline scenario, the national average share of Food&Drinks (27.1%) and Alcohol&Others (5.80%) was 32.9% in 2020 (Fig. 4a), which was slightly higher than the latest published data, in which the share of food, beverages, and tobacco is 30.2% (National Bureau of Statistics 2021). With increasing income levels and improved living standards, this value decreased to 26.2% (Food&Drinks 20.9%) in 2050. In decile 1, the share of household expenditure on Food&Drinks was 31.6% in 2020 and 27.9% in 2050. With a higher income, the share of household expenditure on Food&Drinks decreased significantly, with the share in decile 10 in the baseline being 19.3% in 2020, which reduced to 12.1% in 2050. The difference in the share of household expenditure on Food&Drinks among the scenarios was minor.

Expenditure share by decile. a The expenditure pattern in 2020 given by the model, which was consistent across scenarios, b The share of household expenditure on each category of goods and services in the baseline scenario. c The change in consumption in each scenario. The small zig-zags are due to the “double-nature” setting (discrete income segments and continuous distribution functions) in our expenditure model and did not affect the final results. The loss in welfare and consumption was large but consistent with the macroeconomic level loss given by AIM/Hub

The share of household expenditure on Residentials was relatively stable across income segments and across scenarios. In 2020, the share of household expenditure on Residentials was 22.0% on average and for each decile (the difference among deciles 10 and 1 was less than + 0.1%), which was close to the latest available recorded value of 24.6% (National Bureau of Statistics 2021). This trend was captured and retained in our model, with the share of Residentials being 22.1% in the baseline in 2050.

With the price of Food&Drinks and the carbon tax increasing over time, low-income households spend a large share of their total expenditure on food and are less able to adjust to price changes; therefore, they suffer more welfare loss due to price changes (Fig. 4). The decrease in the consumption of products other than Food&Drinks either varied less among income segments (for example, Residentials) or was minor because of their small share of household total expenditure (for example, Equipment and Restaurant&Hotel), and therefore they had less influence on the distributional impacts of a carbon tax in the case of China. However, Residentials products are sensitive to a carbon tax, and their share of household expenditure varies among countries and is largely dependent on the income level. They should also be the focus of interest.

Discussion

We found that a carbon tax would not prominently exacerbate poverty or inequality in the short term in China. By comparing the NDC scenario and other climate change mitigation pathways, we found that a delayed climate change mitigation effort could incur more severe regressivity, although the promotion of renewable energy could buffer the shock of carbon pricing. While our model made strong assumptions, such as the income distribution function, and relied on limited household data, our newly developed methodology provides a framework for carbon tax assessment and ensuring a just transition towards low-carbon pathways.

Carbon pricing

Our model adopted a very strong assumption on carbon pricing: a carbon price is applied uniformly to all emissions sectors as an explicit carbon emissions tax. The Intergovernmental Panel on Climate Change (IPCC) special report “Global warming of 1.5 °C” stated that Higher-2 °C pathways required a carbon tax of 15–220 US$2010/tCO2eq in 2030, and 45–1050 US$2010/tCO2eq in 2050, while for Below-1.5 °C pathways the required carbon tax was 135–6050 US$2010/tCO2eq in 2030 and 245–14,300 US$2010/tCO2eq in 2050 (Rogelj et al. 2018). The tax rates in this study were in the lower range.

Common alternatives for carbon pricing instruments include explicit instruments, namely, an ETS, which is a crediting mechanism, and inexplicit instruments, such as a road tax, an energy tax, or subsidies for low-carbon technologies (World Bank 2020). How the carbon pricing is introduced and where the tax is implemented alters the effectiveness of climate change mitigation and the impacts on households.

Unlike the carbon tax investigated in this study, we consider the impacts of these alternative instruments on household income and expenditure to be less straightforward. For example, in a cap-and-trade emission trading system where a limited number of emission permits are issued by the government and traded among the companies, emission reductions are guaranteed by the emission caps, which are the sum of the emission permits, but the carbon price depends on the market. The scales and channels of the impact on households vary greatly according to the system’s design. China has operated pilot ETSs in the electricity supply sector in eight pilot regions, and officially launched its national ETS, covering emissions from all industries and regions in 2021 (Ministry of the Ecology and Environment of People’s Republic of China 2021). Because the electricity supply sector operates with “a highly regulated dispatch and pricing system,” few of the additional costs of carbon pricing are transmitted to final users due to the separated producer and consumer prices of the electricity supply sector (Ju and Fujikawa 2019).

The extent to which the impacts of this national ETS will be conveyed to consumers is unknown, but the enhanced scale and stringency of abatement could result in changes to households and individuals, as well as the country overall. The distributional impacts of other carbon pricing instruments could be more limited. For instance, carbon pricing in the form of fuel taxes is limited in scale compared to the carbon tax assumed in our study. The same applies to other sector-wise pricing instruments.

Poverty and inequality implications

Though the 3.2-threshold suggests an optimistic future, relative poverty would remain a fundamental societal issue. With economic development and improving living standards, a fixed poverty line could become less sensitive and would no longer be representative of poverty. Relative poverty is more relevant to the distribution of income and expenditure and its trajectory could partially reflect the temporal dynamics of distribution among income segments. There is a need for an assessment of relative poverty in future poverty projections and climate policy assessments in China.

Low consumption and inadequate living standards are at the heart of the concept of “poverty,” and health, literacy, and other factors also play a role. This multidimensional nature of poverty makes the projection of poverty complex and requires information and projections across non-income dimensions, which is difficult in our current model, but will be an important aspect of future research (Ferreira and Lugo 2013).

Concerning the distributional effects and inequality implications, the household consumption patterns were more relevant, especially the spending on energy services and foods. Because of our assumption that the household consumption bundle followed the historical trends recorded in the HBS and was captured by the AIDADS parameters, it was considered that there would be no substantial and discrete changes in household consumption brought about by advances in technology. The shifts in distributional effects were the result of relative commodity price changes, a rising income level, and income elasticities (see SI 5).

The largest price changes occurred in consumption related to Food&Drinks and Residentials. The distributional effects generated through foods and beverages, e.g., Food&Drinks, were regressive due to Engel’s law. Transport and Equipment showed clear progressivity. We found that the share of spending on residential goods and services, e.g., Residentials, was almost consistent across the income brackets, leading to neutral distributional effects through Residentials. This was a feature of the Chinese household and is the reason why this study could be distinguished from others in the published literature, revealing the regressivity of carbon pricing. Our findings also agree with the proposition of Dorband et al. (2019) that the relationship between the share of energy expenditure and income is crucial to the distributional effects of carbon pricing. Attention should also be given to the relative price changes in the food sectors. As demonstrated in our Chinese example, when the relative price increase of Food&Drinks reached a certain level, the regressive effects through Food&Drinks took over, resulting in a shift of the distributional effects from being slightly progressive or neutral to being regressive (Dorband et al. 2019).

A novel approach to carbon tax assessment

Our study presented a novel approach to carbon tax assessment and global comparative studies. We identified goods and services in the Food&Drinks, Residentials, Equipment, and Transport sectors as the most important factors for the distribution and scale of the impacts of a carbon tax. While the impacts via food and agriculture goods and services were regressive due to Engel’s law, the impacts via energy-related goods and services, especially the Residentials, either exacerbated, offset, or had no obvious effects on regressivity, depending on the share of spending across income segments and its price change. If the impacts via the energy sector were progressive, whether they could overcome the regressivity demonstrated by the welfare loss in the food sector was dependent on price changes in both sectors.

Other goods and services with net-welfare gains due to price effects were biased toward lower income segments. While they were less sensitive to carbon taxes in the optimal scenarios, they largely buffered the welfare loss by Food&Drinks and Residentials in the NDC scenario in the long term.

Dorband et al. (2019) reported that energy goods are what determine the distributional effects of carbon pricing which takes the form of a tax applied to fossil fuel related CO2 emissions. Our study covered carbon taxes on CO2 and non-CO2 emissions from energy and non-energy-related processes. A comparison between the two studies provides a novel way of quantifying the subsidies and exemptions based on non-CO2 or non-energy-related emissions in the food and agriculture sectors. From a food security perspective, carbon pricing on non-CO2 emissions could have an adverse impact on hunger (Hasegawa et al. 2018; Fujimori et al. 2019). Our findings are consistent with these reports.

Tax exemption and subsidies

High-carbon taxes can generate considerable welfare loss, particularly in the long term. An explicit carbon tax must be complemented with other policies or tax revenue recycling schemes to avoid distributional regressivity when aiming for stringent climate change mitigation.

Carbon tax revenue could provide income subsidies to avoid biased distributional effects. For example, in our 80% mitigation scenario, the revenue from carbon taxation was 744 billion dollars in 2050, while the national total welfare loss was about 2774 billion dollars. The tax revenue could not fully offset the nationwide welfare loss but was more than enough to compensate the poorest 40% of the population, whose combined welfare loss was 598 billion dollars in 2050. The carbon tax revenue can also be invested in renewable energy development and other low-emission technologies. In such cases, more stable electricity and fuel prices could be expected and the distributional effects could be mitigated.

Tax exemption, where households do not pay for the GHGs emitted directly during their consumption of certain commodities, could also be an option. Such payments include the carbon tax embedded in fuel taxes, road taxes, and pricing. If exemption is provided for poor households, who are responsible for less GHG emissions, but are more vulnerable to a high tax rate, the negative effects of a carbon tax could be abated. Exempting poor households from a direct carbon tax may not necessarily be in the form of direct exemption, providing them with energy subsidies could also be an effective compensation. Our quantification of the direct price effect serves as a reference for subsidy design.

Because we showed that the food sector is the main contributor to the regressive welfare loss in China, measures to regulate food price changes and guarantee agricultural productivity are key to ensure food security and household welfare.

It was beyond the scope of our study to perform a comprehensive analysis of different countermeasures, but our model could be equipped with the flexibility to examine countermeasures in more depth in the future. For example, in AIM/Hub it is possible to investigate situations where carbon tax revenues are recycled as labor tax subsidies or are invested in low-emission technologies. It is also possible in AIM/PHI to examine the different transfer schemes of the subsidies. The main reason why we did not conduct an assessment of the countermeasures is that there is currently no guarantee of consistency in production and consumption between the two models, which is an innate weakness of the sequential soft-link strategy.

In addition to the countermeasures, there could be other positive effects of climate change mitigation such as job creation. In our modeling framework, from a macroscopic perspective, the total labor supply, which is determined by the population, and productivity, which is determined by labor quality, would not change from the baseline. Among the different income brackets, the creation and loss of jobs could have a considerable impact on income levels and distribution. This assessment requires a detailed occupational representation, which is currently difficult given the limitations of our models and the data availability. Future studies will be conducted to address these issues.

Strengths and limitations

Our methodology had several advantages over most previous methods. Previous studies have focused more on the direct effects of price changes on expenditure, while ignoring the change in consumption bundles and behavioral responses induced by price changes (Feng et al. 2010; Fremstad and Paul 2019). Another advantage is that within the IAM framework, societal dynamics and the deep reform propelled by climate change mitigation can be projected in the long term, while maintaining international consistency. Most studies have used an input–output analysis or static (or comparative static) CGE models, both of which are limited in terms of capturing the temporal dynamics (Beck et al. 2015; Hertel et al. 2015; Fremstad and Paul 2019).

There were also limitations and caveats to this study. First, the natural carbon sinks and negative emissions for certain land-use sectors in the NDC scenario were underestimated. A better depiction of land use, land-use change, and forestry in future studies could shed more light on the NDC and carbon neutrality pathway, as well as the potential food security concerns.

Second, the distributional impacts from the income side were not fully reflected in our projection. This was because of the model assumption, in which the shape of the income distribution was derived from Gini coefficient projections, which were fixed into the future for a certain SSP (Fujimori et al. 2020). Loss of GDP altered household income by shifting the distribution leftward. Future studies should focus more on household heterogeneity and distributional changes from the income-side. Another limitation generated by the lognormal distribution and Gini coefficient was the lack of flexibility in relative poverty, the calculation of which was heavily dependent on the shape of the distribution.

Third, our household model was sensitive to the input household data that were used for the parameter estimation. Data reliability and quality had a great influence on our results. The goods category may be too aggregated to represent the impact of the energy sector on households and further studies of energy goods and household consumption are needed.

There have been many recent studies of the impact of climate policies on poverty and equity (Goulder et al. 2019; Soergel et al. 2021a, b; Steckel et al. 2021). Our study featured a flexible demand system with large coverage of consumer goods, as well as a set of national scenarios and the latest national policy pathways. We noted that, in the national-specific context, a commitment to carbon neutrality may not pose a huge barrier to poverty alleviation, but an in-depth discussion of the welfare issues and countermeasures required to maintain the welfare level is required for the promotion of public acceptance of climate policies such as carbon pricing.

Any shocks related to climate change and their interaction with poverty and inequality were not assessed. Generally, the direct climate change impacts on poverty are the most prominent, with crop yields and the resulting changes in global commodity prices, labor productivity, and natural disasters identified as major channels (Ahmed et al. 2009; Hertel et al. 2010; Hallegatte and Rozenberg 2017). There have been largescale evaluations of these direct impacts as well as the indirect effects of climate change mitigation on income and poverty by building damage functions (Taconet et al. 2020) or simulations based on household surveys and case studies (Hallegatte and Rozenberg 2017; Hallegatte et al. 2017). Further assessments of poverty and distributional impacts by integrating climate-related impacts and climate change mitigation at national and finer levels are needed.

Conclusions

This study was the first attempt to quantify the long-term poverty headcount in China and to assess the distributional impact on households following the implementation of a carbon tax. We examined the national pathways for the Paris Agreement’s long-term goal and evaluated the Chinese NDC and carbon neutrality pathway. We adopted multiple measurements to depict different dimensions of poverty and the distributional impacts of a carbon tax to provide a new perspective of carbon tax and an assessment of climate change mitigation pathways.

A carbon tax would not greatly hinder poverty alleviation in China, even if the poverty threshold for LIMC is adopted. An assessment of the different threshold criteria would be meaningful for the establishment of future mitigation policies. In the NDC scenario, although the poverty headcount declined slowly after 2030, the NDC and carbon neutrality pathway placed fewer people at poverty risk. The more challenging emissions abatement and slower poverty alleviation conditions post-2030 in this pathway should not be ignored.

The impacts of a carbon tax on Chinese household expenditure were neutral or slightly regressive in the early stages of climate change mitigation, but there was a shift to strongly regressive impacts in the long term. A high carbon tax could harm the social equity and wealth of citizens. The current carbon tax level did not have an obvious regressive effect on household expenditure, suggesting that a carbon tax in China for early emission reduction would be effective.

The impacts on food and energy goods could lead to a change in household welfare following the imposition of a carbon tax, and these products were also key to determining regressivity and progressivity. A pathway aligned with the NDC and carbon neutrality deepened income inequality in the long term compared to the optimal pathways. With the expected advancements in clean energy, CCS technologies, and a well-designed tax revenue recycling scheme, it will be possible to alleviate and offset such negative impacts on households. Carbon tax exemption and subsidies on energy and food consumption for poor households could also be beneficial for poverty and inequality alleviation.

References

Ahmed SA, Diffenbaugh NS, Hertel TW (2009) Climate volatility deepens poverty vulnerability in developing countries. Environ Res Lett. https://doi.org/10.1088/1748-9326/4/3/034004

Beck M et al (2015) Carbon tax and revenue recycling: Impacts on households in British Columbia. Resour Energy Econ 41:40–69. https://doi.org/10.1016/j.reseneeco.2015.04.005

Brenner M, Riddle M, Boyce JK (2007) A Chinese sky trust?. Distributional impacts of carbon charges and revenue recycling in China. Energy Policy 35(3):1771–1784. https://doi.org/10.1016/j.enpol.2006.04.016

Cao J (2009) Road of low-carbon development: the design of Chinese carbon tax policy and a model analysis (in Chinese). J Financ Res 12:19–29

Cao J et al (2021) The general equilibrium impacts of carbon tax policy in China: a multi-model comparison. Energy Econ. https://doi.org/10.1016/j.eneco.2021.105284

Carbon Tax Center (2020) Where carbon is taxed. https://www.carbontax.org/where-carbon-is-taxed/. Accessed 11 Mar 2021

Carlson D, Robinson S-a, Blair C, McDonough M (2021) China’s climate ambition: revisiting its first nationally determined contribution and centering a just transition to clean energy. Energy Policy 155:112350. https://doi.org/10.1016/j.enpol.2021.112350

Chen K et al (2019) Post-2020 rural urban integrative poverty reduction strategy: development status, evolution, new vision and key areas. China Rural Econ 1:1–15

Chen Z, Shen Y, Zhou Y (2013) On the absolute and relative changes in the poverty in China’s villages and on the setting of the relative poverty line (in Chinese). Manag World 1:67–76

Chen K, Wu G, He X, Bi J, Wang Z (2018) From rural to rural urban integration in China: identifying new vision and key areas for post-2020 poverty reduction strategy. International Food Policy Research Institute (IFPRI), East & Central Asia Office, Beijing, China

Dorband II et al (2019) Poverty and distributional effects of carbon pricing in low- and middle-income countries—a global comparative analysis. World Dev 115:246–257. https://doi.org/10.1016/j.worlddev.2018.11.015

EUROSTAT (2019) EUROSTAT household budget surveys. https://ec.europa.eu/eurostat/web/household-budgetsurveys

Fawcett AA et al (2015) Can Paris pledges avert severe climate change? Science 350(6265):1168–1169. https://doi.org/10.1126/science.aad5761

Feng K et al (2010) Distributional effects of climate change taxation: the case of the UK. Environ Sci Technol 44(10):3670–3676. https://doi.org/10.1021/es902974g

Ferreira FHG, Lugo MA (2013) Multidimensional poverty analysis: looking for a middle ground. World Bank Res Obs 28(2):220–235. https://doi.org/10.1093/wbro/lks013

Fremstad A, Paul M (2019) The impact of a carbon tax on inequality. Ecol Econ 163:88–97. https://doi.org/10.1016/j.ecolecon.2019.04.016

Fricko O et al (2017) The marker quantification of the Shared Socioeconomic Pathway 2: a middle-of-the-road scenario for the 21st century. Glob Environ Change 42:251–267. https://doi.org/10.1016/j.gloenvcha.2016.06.004

Fujimori S, Masui T, Matsuoka Y (2012) AIM/CGE [basic] manual. Discussion paper series: Center for Social and Environmental Systems Research, National Institute Environmental Studies, (01), p 74. https://doi.org/10.1016/S1043-2760(97)84344-5

Fujimori S et al (2017) SSP3: AIM implementation of shared socioeconomic pathways. Glob Environ Change 42:268–283. https://doi.org/10.1016/j.gloenvcha.2016.06.009

Fujimori S et al (2019) A multi-model assessment of food security implications of climate change mitigation. Nat Sustain 2(5):386–396. https://doi.org/10.1038/s41893-019-0286-2

Fujimori S, Hasegawa T, Oshiro K (2020) An assessment of the potential of using carbon tax revenue to tackle poverty. Environ Res Lett 15(11):114063

Fujimori S et al (2021) A framework for national scenarios with varying emission reductions. Nat Clim Change 11(6):472–480. https://doi.org/10.1038/s41558-021-01048-z

Garbaccio FR, Ho SM, Jorgenson WD (1999) Controlling carbon emissions in China. Environ Dev Econ 4(4):493–518

Goulder LH et al (2019) Impacts of a carbon tax across US household income groups: what are the equity-efficiency trade-offs? J Public Econ 175:44–64. https://doi.org/10.1016/j.jpubeco.2019.04.002

Hallegatte S, Rozenberg J (2017) Climate change through a poverty lens. Nat Clim Change 7(4):250–256. https://doi.org/10.1038/nclimate3253

Hallegatte S et al (2017) Unbreakable: building the resilience of the poor in the face of natural disasters. Climate change and development. License: C. World Bank, Washington, DC

Hasegawa T et al (2018) Risk of increased food insecurity under stringent global climate change mitigation policy. Nat Clim Change 8(8):699–703. https://doi.org/10.1038/s41558-018-0230-x

He G et al (2016) SWITCH-China: a systems approach to decarbonizing China’s power system. Environ Sci Technol 50(11):5467–5473. https://doi.org/10.1021/acs.est.6b01345

Hertel TW, Burke MB, Lobell DB (2010) The poverty implications of climate-induced crop yield changes by 2030. Glob Environ Change. https://doi.org/10.1016/j.gloenvcha.2010.07.001

Hertel TW, Verma M, Ivanic M, Magalhaes E, Ludena C, Rios AR (2015) GTAP-POV: a framework for assessing the national poverty impacts of global economic and environmental policies. https://publications.iadb.org/handle/11319/7242

Hussein Z, Hertel T, Golub A (2013) Climate change mitigation policies and poverty in developing countries. Environ Res Lett. https://doi.org/10.1088/1748-9326/8/3/035009

Institute of Climate Change and Sustainable Development of Tsinghua University et al (2021) China’s long-term low-carbon development strategies and pathways. Comprehensive report. Springer, Singapore

Jiang Z, Shao S (2014) Distributional effects of a carbon tax on Chinese households: a case of Shanghai. Energy Policy 73:269–277. https://doi.org/10.1016/j.enpol.2014.06.005

Jonsson S, Ydstedt A, Asen E (2020) Looking back on 30 years of carbon taxes in Sweden. https://taxfoundation.org/sweden-carbon-tax-revenue-greenhouse-gas-emissions/. Accessed 6 Mar 2022

Ju Y, Fujikawa K (2019) Modeling the cost transmission mechanism of the emission trading scheme in China. Appl Energy 236:172–182. https://doi.org/10.1016/j.apenergy.2018.11.068

Kerkhof AC et al (2008) Taxation of multiple greenhouse gases and the effects on income distribution. A case study of the Netherlands. Ecol Econ 67(2):318–326. https://doi.org/10.1016/j.ecolecon.2007.12.015

Kuramochi T et al (2020) Global emissions trends and G20 status and outlook—emissions gap report Chapter 2. Emissions Gap Report, (Cop 24), pp 3–22

Li N et al (2019) Air quality improvement co-benefits of low-carbon pathways toward well below the 2 °C climate target in China. Environ Sci Technol 53(10):5576–5584. https://doi.org/10.1021/acs.est.8b06948

Liang QM, Wei YM (2012) Distributional impacts of taxing carbon in China: results from the CEEPA model. Appl Energy 92:545–551. https://doi.org/10.1016/j.apenergy.2011.10.036

Malerba D, Gaentzsch A, Ward H (2021) Mitigating poverty: the patterns of multiple carbon tax and recycling regimes for Peru. Energy Policy 149:111961. https://doi.org/10.1016/j.enpol.2020.111961

McCollum DL et al (2018) Energy investment needs for fulfilling the Paris Agreement and achieving the Sustainable Development Goals. Nat Energy 3(7):589–599. https://doi.org/10.1038/s41560-018-0179-z

Meng S, Siriwardana M, Mcneill J (2014) The impact of the Australian carbon tax on industries and households. Margin J Appl Econ Res 8(1):15–37. https://doi.org/10.1177/0973801013506399

Meyer S, Yu X, Abler D (2011) Comparison of several demand systems. In: Agricultural and Applied Economics Association’s 2011 AAEA & NAREA joint annual meeting, Pittsburgh, Pennsylvania, pp 1–24

Ministry of the Ecology and Environment of People’s Republic of China (2021) Carbon emission trading management procedures (trial implementation). http://www.mee.gov.cn/xxgk2018/xxgk/xxgk02/202101/t20210105_816131.html. Accessed 5 Jan 2021

National Bureau of Statistics (2021) Income and expenditure of residents in 2020. http://www.stats.gov.cn/tjsj/zxfb/202101/t20210118_1812425.html. Accessed 31 Mar 2021

Rimmer MT, Powell A (1992) An implicitly directly additive demand system: estimates for Australia. In: Centre of Policy Studies (CoPS)

Roelfsema M et al (2020) Taking stock of national climate policies to evaluate implementation of the Paris Agreement. Nat Commun 11(1):1–12. https://doi.org/10.1038/s41467-020-15414-6

Rogelj J et al (2018) Mitigation pathways compatible with 1.5°C in the context of sustainable development, Global warming of 1.5°C. An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change

Soergel B, Kriegler E, Weindl I et al (2021a) A sustainable development pathway for climate action within the UN 2030 Agenda. Nat Clim Change 11(8):656–664. https://doi.org/10.1038/s41558-021-01098-3

Soergel B, Kriegler E, Bodirsky BL et al (2021b) Combining ambitious climate policies with efforts to eradicate poverty. Nat Commun. https://doi.org/10.1038/s41467-021-22315-9

Steckel JC et al (2021) Distributional impacts of carbon pricing in developing Asia. Nat Sustain 4(11):1005–1014. https://doi.org/10.1038/s41893-021-00758-8

Sun JW, Xia T (2019) China’s poverty alleviation strategy and the delineation of the relative poverty line after 2020: an analysis based on theories, policies and data. China Rural Econ 10:98–113

Taconet N, Méjean A, Guivarch C (2020) Influence of climate change impacts and mitigation costs on inequality between countries. Clim Change 160(1):15–34. https://doi.org/10.1007/s10584-019-02637-w

The State Council Information Office of the People’s Republic of China (2021) Poverty alleviation: China’s experience and contribution. http://www.xinhuanet.com/politics/2021-04/06/c_1127295868.htm. Accessed 27 July 2021

United Nations/Framework Convention on Climate Change (UNFCCC) (2015) The Paris agreement. In: 21st Conference of the Parties, Paris

Walker R, Yang L (2020) New actions in China’s poverty reduction strategy: relative poverty indicators and social security policies. ILO Research Bulletin 2020 (ILO Brief July 2020). https://www.ilo.org/wcmsp5/groups/public/---asia/---ro-bangkok/---ilo-beijing/documents/briefingnote/wcms_752717.pdf. Accessed 7 Mar 2021

Wang XL, Feng HX (2020) China’s multidimensional relative poverty standards in the post-2020 Era: international experience and policy orientation. China Rural Econ 3:2–21

Wang Q, Liang QM (2015) Will a carbon tax hinder China’s efforts to improve its primary income distribution status? Mitig Adapt Strat Glob Change 20(8):1407–1436. https://doi.org/10.1007/s11027-014-9553-8

Wang Q et al (2019) Distributional impact of carbon pricing in Chinese provinces. Energy Econ 81:327–340. https://doi.org/10.1016/j.eneco.2019.04.003

Wang H, Chen W, Bertram C et al (2020a) Early transformation of the Chinese power sector to avoid additional coal lock-in. Environ Res Lett. https://doi.org/10.1088/1748-9326/ab5d99

Wang H, Chen W, Zhang H et al (2020b) Modeling of power sector decarbonization in China: comparisons of early and delayed mitigation towards 2-degree target. Clim Change 162(4):1843–1856. https://doi.org/10.1007/s10584-019-02485-8

Wier M, Birr-Pedersen K, Jacobsen HK, Klok J (2005) Are CO2 taxes regressive? Evidence from the Danish experience. Ecol Econ 52(2):239–251. https://doi.org/10.1016/j.ecolecon.2004.08.005

World Bank (2019) Global consumption database. https://datatopics.worldbank.org/consumption/?utm_content=buffer8bd65&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

World Bank (2020) State and trends of carbon pricing 2020. Edited by World Bank License: CC BY 3.0 IGO. World Bank, Washington, DC

Xie Y, Hu J (2014) An introduction to the China Family Panel Studies (CFPS). Chin Sociol Rev 47(1):3–29. https://doi.org/10.2753/CSA2162-0555470101.2014.11082908

Xie Y, Zhou X (2014) Income inequality in today’s China. Proc Natl Acad Sci USA 111(19):6928–6933. https://doi.org/10.1073/pnas.1403158111

Xinhua News (2021) The central people’s government of the people’s republic of china: the general assembly of poverty alleviation (in Chinese). http://www.gov.cn/xinwen/2021-02/25/content_5588866.htm#1. Accessed 11 Mar 2021

Yan J, Yang J (2021) Carbon pricing and income inequality: a case study of Guangdong Province, China. J Clean Prod. https://doi.org/10.1016/j.jclepro.2021.126491

Yusuf AA, Resosudarmo BP (2015) On the distributional impact of a carbon tax in developing countries: the case of Indonesia. Environ Econ Policy Stud 17(1):131–156

Zhao F (2015) Recalculating the housing consumption of Chinese urban household. Contemp Financ Mag 2015(1):3–9

Acknowledgements

This research was supported by the Japan Society for the Promotion of Science (JSPS) KAKENHI (Grant number 19H02273), the Environment Research and Technology Development Fund (Grant numbers JPMEERF20211001, JPMEERF20202002) of the Environmental Restoration and Conservation Agency of Japan, the FRIEND (Fine Particle Research Initiative in East Asia Considering National Differences) Project through the National Research Foundation of Korea (NRF) funded by the Ministry of Science and ICT (2020M3G1A1114621), and the Sumitomo Foundation.

Author information

Authors and Affiliations

Contributions

SZ and SF conceived the study and designed the scenarios. All authors contributed to the methodology, software preparations, and model constructions. Material preparation, data collection and analysis were performed by SZ and supervised by SF. SZ prepared the figures. The first draft of the manuscript was written by SZ and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Handled by Siddharth Sareen, University of Stavanger, Norway.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zhao, S., Fujimori, S., Hasegawa, T. et al. Poverty and inequality implications of carbon pricing under the long-term climate target. Sustain Sci 17, 2513–2528 (2022). https://doi.org/10.1007/s11625-022-01206-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11625-022-01206-y