Abstract

We consider a public firm characterized by a moral hazard problem. A distinguished player is a CEO or activist shareholder who (i) is unrestricted to trade shares and (ii) has discretion to increase the value of this firm by exerting costly effort. von Lilienfeld-Toal and Rünzi (J Finance 69(3):1013–1050, 2014) investigate and confirm the empirical relevance of both these properties. This article shows that a distinguished player cannot be “priced in” correctly. In particular, such a firm is traded at a discount below its equilibrium value in a market equilibrium. Buyers can systematically earn excess returns on their investment. This prediction is indeed consistent with substantial positive abnormal returns for distinguished player firms within the S &P500 and S &P1500 sample reported in von Lilienfeld-Toal and Rünzi (J Finance 69(3):1013–1050, 2014).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

We call a distinguished player a value increasing shareholder—i.e. an owner-CEO or an activist investor—who (i) is unrestricted to trade shares of the firm on the stock market and (ii) has discretion to increase the value of this firm by exerting costly effort. Standard no-arbitrage equilibrium reasoning of asset pricing suggests that all relevant information should be priced in, including the ownership and the according future optimal effort of the value increasing shareholder. This, however, leads to a paradox. If the optimal effort decision is priced in, the distinguished player would be better off to sell his shares at this price, not exerting effort, and saving the private effort costs instead. We call this accordingly the distinguished player paradox. We show that in equilibrium, effort cannot be correctly priced in while it can be an equilibrium that the price is below the equilibrium value. A related paradox is discussed in Grossman and Stiglitz [18]. There, information acquisition is costly and does not have an impact on firm value while in our model effort is costly and has an impact on firm value.Footnote 1

The distinguished player paradox turns up in the empirical evidence in von Lilienfeld-Toal and Ruenzi [31] who show that standard asset pricing cannot explain the cross section of stock returns for firms with an owner-CEO. Instead, portfolios based on publicly available information on CEO ownership outperform the market by 4–10\(\%\) per year. This outperformance is robust and occurs after controlling for standard risk factors.

In this article we formalize the distinguished player paradox and propose a theoretical solution that is also consistent with the empirical evidence. We follow the literature on asset pricing with large shareholders (see e.g. Bolton and von Thadden [8], DeMarzo and Urosevic [11], or Admati et al. [1]) and analyze a market with a distinguished player who can trade on the stock market before directly influencing the firm’s value by exerting costly effort. As in this literature the distinguished player operates in a standard moral hazard context. For example, the distinguished player could be interpreted as the agent in the Grossman and Hart [17] model. Accordingly, we study the consequences of a distinguished player for the equilibrium trade price of the firm before the moral hazard problem is resolved.

An important aspect of our analysis is the observation that firm value and trade price are two distinct concepts and do not have to coincide. Rather, value and price are both determined endogenously. Firm value depends on the effort decision of the distinguished player which in turn depends on his ex post ownership after trading. In contrast, the equilibrium trade price originates in the market by clearing aggregated demand and supply. To enhance clarity of the main idea we proceed in two steps. In our first setting with a finite set of traders we allow for strategic interaction of rational traders in a general market game and derive a pricing prediction. In our second setting we show the robustness of this pricing prediction in a framework with non-rational noise traders and a continuum of outside investors lacking strategic impact on the trade price.

To discriminate the possible pricing predictions of the distinguished player paradox two classes of trade equilibria are of particular interest, true value and excess returns equilibria. In a true value equilibrium, shares of the firm are traded at the price that equals the equilibrium value of the firm. In excess returns equilibria, shares of the firm are traded at a price strictly below the equilibrium value of the firm. The relationship between excess returns equilibria and true value equilibria can be understood as follows. In a true value equilibrium, shares are traded at a price which is correct from the perspective of outside investors. However, the price is then too high for the distinguished player. In an excess returns equilibrium it is the other way around. In other words, asymmetry of valuations implies that a distinguished player’s optimal effort cannot be ”priced in correctly” since there is no single such price for all relevant traders. Our main results show that regarding the market price the distinguished player perspective prevails.

Our main results. (1) Trading shares of a firm at a price equal to the equilibrium value is not an equilibrium in rational call auction markets. In our language there is no true value trade equilibrium. This formalizes the aforementioned paradox of endogenous firm value and arbitrage free asset pricing. However, (2) there exist excess returns equilibria where traders buy and sell at a price strictly below the equilibrium value. Further, (3) excess returns equilibria are robust with respect to introducing noise traders and price taking behavior. (4) Conversely, excess returns equilibria do not exist without a distinguished player. (5) Together this yields what we call the distinguished player hypothesis: Investments in firms with a distinguished player systematically outperform those in firms without a distinguished player and thereby the whole market.

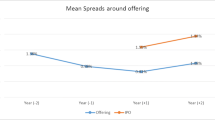

The distinguished player hypothesis and some of the implications of excess returns equilibria are investigated in von Lilienfeld-Toal and Ruenzi [31]. In the first part of their paper, they show that owner-CEO firms outperform the market and in the second part they then discuss possible reasons for this phenomenon. To investigate whether their results are consistent with excess returns equilibria, three features of the excess returns equilibria are discussed in more detail: (i) Excess returns are not due to standard risk factors, (ii) excess returns are an equilibrium phenomenon, and (iii) excess returns are more pronounced if the owner-CEO has a lot of discretion to influence the value of the firm. To achieve this, von Lilienfeld-Toal and Ruenzi [31] do the following: (i) They control for standard risk factors in a portfolio approach and in standard panel regressions. (ii) They investigate whether investors learn over time, if the findings can be explained by earnings surprises, and how limits of arbitrage affect their results. (iii) They sort firms along various measures of managerial discretion (the power of the CEO, resources available to the CEO, and possible restrictions of the CEOs’ actions by external governance) and find that the excess returns due to ownership are more pronounced among the firms in which CEOs have a lot of discretion. Overall, their results suggest that excess returns equilibria help to explain the abnormal returns of owner-CEO firms.Footnote 2 The distinguished player paradox therefore not only occurs in theory but solving it helps to understand and predict empirical regularities. The main ideas behind our results are now motivated in more detail.

Why is trade at the true value not an equilibrium? Suppose to the contrary that shares of the firm are traded at the correct value from an outside investor’s perspective. Then, the distinguished player prefers to sell his shares due to his lower valuation caused by private effort costs while outside investors are indifferent between trading and not trading. In an anonymous market this cannot be an equilibrium. The distinguished player decreases effort and saves effort costs if he manages to sell some shares. This implies that the distinguished player strictly gains if he can sell without having a significant impact on the share price. We show that in every candidate equilibrium, the distinguished player can indeed sell some shares without affecting the price. Hence, trade at a price equal to equilibrium value is not an equilibrium in this set-up and a distinguished player’s optimal effort decision systematically cannot be "priced in" correctly. Put differently, it is not possible in fully rational anonymous call auctions to construct an equilibrium which discards the distinguished player’s perspective. We continue with the natural subsequent question: Are there other trade equilibria? The answer is yes, excess returns equilibria.

Excess returns equilibria. The most salient property of an excess returns equilibrium is that the equilibrium trade price is strictly below the equilibrium value and therefore equilibrium-buyers strictly gain by buying an object below its value. Therefore we call these equilibria excess returns equilibria.

Excess returns equilibria can only exist if rational outside investors cannot gain by simply bidding up the stock price. Rationality contains the ability to anticipate that the distinguished player has an incentive to sell shares—or buy less—once the share price exceeds a certain threshold and that this threshold is below the equilibrium value. Hence, trade at the equilibrium value would encourage the distinguished player to sell his shares in an anonymous market and save on effort costs instead. We show that this logic indeed prevails in two different settings, (i) in a fully rational, strategic and (ii) in a noisy, price taking setup. The two settings provide two slightly different explanations for the same phenomenon.

In the fully rational environment (i) excess returns equilibria are characterized by the property that any deviation that drives up the market price towards the equilibrium value triggers the distinguished player to sell and decrease effort instead of raising the company value to the anticipated level which in turn causes even bigger losses to everybody. This latter property of excess returns equilibria is called pivotalness. Any failure to coordinate on a sufficiently low market price below the true value destroys wealth for all shareholders by removing incentives for the distinguished player to exert effort and generate positive externalities. This explanation requires a high degree of traders’ rationality and also awareness of their strategic influence. The question then is whether this high degree of rationality is necessary to support this explanation.

Surprisingly this is not the case as our setup (ii) demonstrates. We show that the downward pressure on equilibrium prices caused by the economic incentives for a distinguished player neither rests on full rationality of all traders and with it pivotalness nor on the strategic influence of traders on prices. We demonstrate this in a continuum-trader-version of the model with noise traders in the same call auction market structure. The basic idea prevails but with the following twist. With noise final allocations and prices are random. As before, the distinguished player plans to sell shares in those states of nature where the share price exceeds a certain threshold which now occurs with positive probability. As before, rational outside investors do not wish to buy shares in those states at prices above this threshold because they anticipate that the distinguished player then reduces costly effort. As a result, small rational outside investors all buy maximally at the low price but cannot gain by offering to buy at higher prices because these are realized in states where the distinguished player sells. Consequently, shares are underpriced in expectation. Note that this latter logic does not rest on pivotalness. In contrast to the strategic setting for small price takers now it is not rational to sell below the true value. Therefore, irrational noise traders are necessary to generate trade and liquidity. The punch line is, that even in a price-taking environment with noise the distinguished player’s incentives to sell his shares impose downward pressure on the trade price. This provides an additional theoretical explanation for excess returns equilibria.

The observation that excess returns equilibria are the only consistent outcome of a market with a moral hazard problem has several novel implications. Most obviously, in contrast to standard asset pricing theory “no-arbitrage” here is not synonymous with the notion that the market price equals the equilibrium value. Since rational equilibrium-buyers strictly gain even without any informational advantage excess returns are inconsistent with the standard notion of efficient markets and no-arbitrage in equilibrium (see for example Fama, [14] or Ross, [40]). Still, excess returns are an equilibrium phenomenon and “no-arbitrage” is still valid in a game theoretic sense since no rational investor can gain by buying or selling more or less.

Anonymity and institutional or contractual clauses. Is a distinguished player a relevant concept? Clearly, as any model it is a stylized and abstract simplification of the real world. Nevertheless, we claim that it is relevant for asset pricing unless either of the two defining properties unrestricted trade or discretion can be entirely ruled out. For unrestricted trade anonymity of the market plays a salient role for our reasoning. A sceptical reader may wonder, to which degree anonymity is realistic? We believe that most (centralized) real world stock markets are anonymous at least to some degree. Typically, traders do not know the identity of their counterpart and hence cannot be sure whether they buy from a distinguished player or an outside investor. This is in particular the case for trading by officers and directors. While SEC regulations do force insiders to report any traded securities (mainly on SEC form 4) these reports are filed ex post, i.e. after insiders traded their shares. Even if insiders announce their plans to trade ex ante (using SEC form 144 for restricted shares, for example), these shares will then be traded anonymously on the market and again traders are unable to observe who is their trading counterpart.

Contractual clauses principally could rule out unrestricted trade and thereby a distinguished player. In reality, however, they rarely prohibit trading from insiders—and not at all from activist investors. In fact, the majority of shares held by executives are common shares that are by definition not subject to a non-selling clause. In particular, von Lilienfeld-Toal and Ruenzi [31] restrict attention to unrestricted shares. For their sample covering all S &P 1,500 firms, the Execucomp database enables a precise differentiation between restricted and unrestricted shares. Privately stipulated contractual clauses are even less problematic for the case of activist investors like hedge funds who buy their shares on the open market. Activist investors, however, are less easy to observe but are another relevant class of investors who may be interpreted as distinguished players.

The paper proceeds as follows. Section 2 illustrates the main idea by a simple example. Section 3 establishes the reference model, introduces formally the idea of a distinguished player, and the corresponding market game. In Sect. 4 we consider a real world electronic call auction and show that trade at the true value does not occur in equilibrium. However, excess returns equilibria exist for these auctions. Section 5 derives robustness results and extends the existence of an excess returns equilibrium to a world with a continuum of traders and noise traders. Section 6 discusses in more detail the relationship of this theory to the related empirical and theoretical literature while Sect. 7 sums up. “Appendix A” introduces the full notation for strategies in the market game, “Appendix B” extends the language to stochastic market mechanisms, “Appendix C” formulates the full rules of the market mechanism while “Appendix D” contains all remaining proofs.

2 Intuitive example

Consider three rational players \(i\in I=\left\{ 0,1,2\right\} \) who jointly own a project. Suppose for simplicity that initial ownership of the project consists of three indivisible shares of equal size \(\left( \alpha _{0},\alpha _{1},\alpha _{2}\right) =\left( 1,1,1\right) \). Imagine that players \(i=1,2\) are wealthy investors in contrast to player \(i=0\). Player \(i=0\)—called the distinguished player—has a brilliant idea how to raise the value of the project from \(\underline{v}=0\) to \(\bar{v}=30\). To implement and materialize this idea the distinguished player has to work hard and exert effort \(e\in \left\{ 0,1\right\} \) facing private effort cost \(c(e)=4e\). Finally, the project is sold for its terminal value, i.e. each share is worth 10e. Everything is public information. Without trade this world is quite trivial, the distinguished player certainly exerts high effort \(e=1\) being aware of the fact that the final value of his share exceeds his private effort cost. Hence, the final value of each share is 10 and payoffs are \(\left( u_{0},u_{1},u_{2}\right) =\left( 6,10,10\right) \).

However, this was just the background story. The main object of interest in this article is an anonymous market for stakes of the project before the distinguished player decides on effort. The role of players \(i=1,2\) in this example is to perform a very simple version of this anonymous market. Instead of friends or business partners we imagine nameless anonymous shareholders.

Market game. While the rules of the market game in this example are specific and simple they already display some properties of real world stock markets as anonymity, trade volume maximization and price priority. Every player i simultaneously can either do nothing or announce one limit order. This order can either be a buy order of quantity 1 using a limit price \(p_{i}^{b}\in \left\{ 0,1,\ldots ,10\right\} \) or a sell order of quantity 1 using the limit price \(p_{i}^{s}\in \left\{ 0,1,\ldots ,10\right\} \). The distinguished player in this example is wealth constrained and cannot afford to buy. Therefore, \(i=0\) can only submit a sell order or do nothing. The market is assumed to clear as follows. There is trade if and only if at least one buy order \(p_{i}^{b}\) and one sell order \(p_{j}^{s}\) are submitted such that \(p_{j}^{s}\le p_{i}^{b}\). If there are more than one competing buy orders with different limit prices and one sell order, such that all buy prices are at least as high as the sell price only the buy order with the higher price is executed against the sell order. If the buy order prices coincide each of them is executed with equal probability. Correspondingly, if there are one buy order and more than one sell order with limit prices below the buying price only the lower sell order is executed, or again, if identical all are executed with equal probability. Finally, if there is more than one price maximizing the trade volume the market mechanism picks the reference price, i.e. the lowest such price.

Is trading at the true value an equilibrium? We first show that to trade at the high “true” value \(p^{*}=10\) cannot be an equilibrium. If there were such an equilibrium there must be a buy order of a non-distinguished player \(i=1,2\) with \(p_{i}^{b}=10\) and at least one sell order \(p_{j}^{s}=10\) of another player \(j\ne i\). Note first that player j cannot be the distinguished player since otherwise i could improve by not submitting a buy order. Hence, j is the other outside investor. However, this cannot be an equilibrium either since in this case the distinguished player can gain by submitting a sell order at \(p_{0}^{s}=9\). The price priority rule of the market mechanism makes sure that this order is executed and the distinguished player exerts low effort in turn. This, however, yields a market price \(p^{*}=9\) strictly below 10 which contradicts \( p^{*}=10\). The less interesting true value case where players trade at \(p^{*}=0\) and the distinguished player exerts low effort cannot be an equilibrium either for a similar argument. One might wonder if mixed strategies could help out to construct a true value equilibrium. It is obvious that mixing in effort does not help since after any realization of trade any mixed effort decision is strictly dominated by a pure effort decision, i.e. no effort if the distinguished player managed to sell and full effort if he did not sell. It is a little more tricky to see that mixing in the trading game cannot yield a true value equilibrium either. The idea of the proof (of our much more general theorem) is first to recognize that if all outside investors play pure strategies the distinguished player’s ex-post ownership is deterministic. Therefore, to obtain stochastic ex-post ownership for the distinguished player the distinguished player himself and at least one outside investor must be simultaneously indifferent between several pure trading strategies. However, this cannot be the case since their private valuations of the traded object differ once the distinguished player exerts effort with positive probability.

Excess returns equilibrium. Is there any other trade equilibrium where players do trade at a price that does not reflect the equilibrium value of the traded object? The answer is: Yes, for example at \(p^{*}=6\). To understand this equilibrium consider a situation in which the distinguished player submits a sell order at price \(p_{0}^{s}=7\). This looks like a decent strategy since selling can only raise his payoff compared to the payoff of not trading which is 6. Now, suppose that player \(i=1\) submits a buy order \(p_{1}^{b}=7\). Although this behavior at first hand looks risky since the distinguished player can sell at this price it turns out to be quite smart. The reason is that the unique best response of player \(i=2\) is now to submit a sell order \(p_{2}^{s}=6\). According to the market mechanism this implies market price 6 and yields player \(i=2\) a payoff of 6 and player \(i=1\) a payoff of 14.

To see that selling is indeed optimal for player \(i=2\) consider any deviation. A deviation will either result in a lower price which makes player \(i=2\) worse off. Alternatively, player \(i=2\) could submit a higher price (or no sell order at all). Then, whenever player 2 does not sell his shares, the distinguished player will sell instead. In this event the distinguished player will exert low effort and the pay-off of player \(i=2\) would be 0. This makes player \(i=2\) worse off.

Next, the distinguished player cannot improve because selling at a price of 6 yields the same payoff as not trading at all. Finally, player \(i=1\) cannot benefit from changing his order either. He cannot buy at a lower price and not buying would be worse.

It is not difficult to check that there are further equilibria. Clearly, the roles of the equilibrium winner \(i=1\) and equilibrium looser \(i=2\), i.e. the players who realize strict gains and losses relative to the equilibrium value by their trading behavior, may be permuted. There are also other equilibrium prices, all of them strictly below equilibrium value. However, to develop the full equilibrium structure of this example does not yield much additional insight for the general setting. More interesting is to add another player who behaves “irrationally” and trades for some exogenous reason, for example a liquidity shock. It is not difficult to see that this imposes trade with strictly positive probability, and that the same observations regarding expected prices and values carry over to such an extension with noise. However, to keep this example short we sum up our main insights and postpone this latter route to the general framework in Sect. 5.

To wrap up, in this setup everybody knows that high effort of the distinguished player is efficient. If the project is traded at a price equal to the according efficient true value the distinguished player would rather prefer to sell at this or even a lower price and then exert low effort. Therefore, trade at the high true value is not an equilibrium. More generally, if there is trade at the price that reflects the true value of the object, i.e. the value from the perspective of an outside investor there exists always a trader who can strictly improve, either the distinguished player or an outside investor. It is our first main result that non-existence of a true-value equilibrium is indeed a very robust observation. However, there exist excess returns equilibria where a buyer enjoys strict excess returns on his investment. More generally, the incentives of a distinguished player with the associated payoff externalities are inconsistent with equilibrium considerations of traditional asset pricing theory as traditional asset pricing theory focuses on the perspective of the outside investors.

The remainder of this article shows that all the critical observations in this example are surprisingly robust and are valid in much more general and realistic settings.

3 Market game with a distinguished player

We consider a publicly traded corporation which is owned by outside investors and a distinguished player. Denote the distinguished player by \(i=0\) and outside investors by \(i=1,\ldots ,N\).Footnote 3

Distinguished player. A distinguished player unifies the two abstract concepts discretion and unrestricted trade. First, by discretion we understand the future ability to influence the value of the firm by working hard and picking appropriate decisions. Discretion leads to a standard moral-hazard setting.Footnote 4 A non-verifiable effort choice \(e\in {\mathbb {R}}_+\) yields firm value \(v(e)=\underline{v}+e(\bar{v}-\underline{v})\). Effort e causes private effort costs c(e) with \(c'> 0\) and \(c''>0\) for \(e>0\). To compare results we include the case \(\Delta v \equiv \bar{v}-\underline{v}=0\) with zero discretion.

Second, unrestricted trade means the distinguished player is unrestricted to trade shares in an anonymous market before the effort choice and firm value are realized. With unrestricted trade the distinguished player cannot be forced not to trade stocks in the market.Footnote 5 We consider a standard static anonymous call auction with a market mechanism taken from real world electronic call auctions to be explained in detail below. Unrestricted trade implies that there are no (enforceable) contractual arrangements in place which dictate a certain level of ex-post ownership the distinguished player is required to own. In this aspect, we follow the related literature, e.g. Admati et al. [1] or DeMarzo and Urosevic [11], among others. Abstracting from contractual solutions to the moral hazard problem also holds empirically for two relevant potential candidates for distinguished players: owner-CEOs and activist investors. For example, von Lilienfeld-Toal and Ruenzi [31] show that roughly 10% of all CEOs in the S &P 1,500 companies in 2010 hold shares of 5% or more and these shares are unrestricted shares.Footnote 6 Activist investors like hedge funds typically buy shares on the open market (Brav et al. [9]) and are thereby unrestricted. Furthermore, owner-CEOs and activist investors also often have enough discretion to engage in firm-value increasing activities.

Ownership. Initial ownership of the firm is exogenous and denoted by \(\alpha =(\alpha _{0},\ldots ,\alpha _{N})\) with \(\sum _{i=0}^{N}\alpha _{i}=1\). To rule out non-well-defined best responses we suppose a discrete number M of indivisible shares. Hence, initially player i owns \(\alpha _{i}M\) shares of the firm. The market game to be described subsequently endogenously results in the final ownership denoted by \(\omega =\left( \omega _{0},\omega _{1},\ldots ,\omega _{N}\right) \).

Moral Hazard. In the market game to be defined, stakes of the firm are traded before the distinguished player picks his effort choice. Once the market game is over the distinguished player chooses effort to maximize the value \(\omega _{0}\left( \underline{v}+e\Delta v\right) -c(e)\) of his final stake \(\omega _{0}\) in the firm net of the private effort costs. Let

denote the unique optimal ex-post effort choice of the distinguished player.

Similarly, the payoff of any outside investor \(i=1,\ldots ,N\) after the market game is given as \(\omega _{i}\left( \underline{v}+e\Delta v\right) \), i.e. the final value of his stake after the distinguished player’s effort choice.

Prices and strategies. Suppose feasible pricesFootnote 7 are discrete and denoted as \(p \in P:=\left\{ \underline{p},\ldots ,\underline{v}, \underline{v}+\delta ,\underline{v}+2\delta ,\ldots ,\bar{v},\ldots ,\bar{p} \right\} \) with some sufficiently largeFootnote 8 price window P and exogenous tick size \(\delta \).

Strategies or market actions \(a_{i}\in A_{i}\) of an investor i are collections of buy and sell orders which can be constructed by using combinations of market orders, limit orders, and fill-or-kill orders. In “Appendix A”, p. 25ff, a strategy is defined more rigorously as a set of limit orders, market orders and non-convex all or nothing orders (fill or kill orders). There, we show how a set of orders defines an individual excess demand correspondence.

For an initial allocation \(\alpha \), the final allocation is \(\omega =\alpha +x-y \) with a net trade vector \(x-y\). Here, \((x,y)= \left( \left( x_{0},\ldots ,x_{N}\right) ,\left( y_{0},\ldots ,y_{N}\right) \right) \) is a buy-sell-transaction vector with the requirement that only multiples of indivisible shares are traded, i.e. \(x_{i},y_{i}\in \left\{ 0,\frac{1}{M},\frac{2}{M},\ldots ,\frac{M}{M}\right\} \) and \(\sum x_{i}-y_{i}=0\).

We call a player i strictly wealth constrained iff i can only submit sell orders.Footnote 9 For a wealth constrained player i a bid strategy consists only of selling bids.

Payoffs and Market Game.

A market mechanism collects the orders in an order book, announces the price at which trade occurs, and determines which orders are executed and who trades. More formally, for any initial ownership \(\alpha \in \Delta \) and any strategy profile \(a\in A\) a market mechanism \(\mu \) picks a price \(p^{\mu }(a)\in P\) and for any player a buy-sell-transaction vector \(x_{i}^{\mu }\left( a\right) ,y_{i}^{\mu }\left( a\right) \). Trade is voluntary which means that no trader can be forced to trade. This implies in particular that only submitted orders can be executed, i.e. net trades \(x_{i}^{\mu }\left( a\right) - y_{i}^{\mu }\left( a\right) \) are composed only by submitted orders. By specifying the trade vector the market mechanism \(\mu \) determines ex post ownership given as

A market mechanism \(\mu \) induces a market game \(\Gamma _{\mu }\) with strategy space A and payoff functions

for the distinguished player \(i=0\) and outside investors \(i=1,\ldots ,N\) respectively.

For any strategy profile the final allocation \(\omega ^{\mu }(a)\) picked by market mechanism \(\mu \) induces an optimal effort decision \(e(\omega ^{\mu }(a))\) and company value v(a) given as

A strategy profile \(a^{*}\) is a Nash equilibrium or just equilibrium of market game \(\Gamma _{\mu }\) if no trader can strictly improve or in the language of game theory every player plays a best response \(a_{i}^{*}\) to other players strategy profiles \(a_{-i}^{*}\). Correspondingly, \((p^{*},x^{*},y^{*})=\mu (\alpha ,a^{*})\) and \(\omega ^{*}=\alpha +x^{*}-y^{*}\) are called equilibrium price, equilibrium trades and equilibrium ex post allocation of equilibrium \(a^{*}\) under market mechanism \(\mu \). Furthermore, we call \(e(\omega (a^{*}))\) equilibrium effort denoted by \(e^{*}\).

No Trade Equilibrium. If no player submits an order no player can gain anything by submitting orders in this fully rational setup. This simple observation together with voluntary trade guarantees that without noise traders for any market mechanism there always exists a trivial no-trade equilibrium where no player submits orders. Since this equilibrium does not offer any meaningful implications for stock prices—our main object of interest—we turn attention to more interesting equilibria where we can observe a price such that trade occurs.

True value and excess returns equilibria. An equilibrium \(a^{*}\) with \(\omega ^*\ne \alpha \) is called trade equilibrium of \(\Gamma _{\mu }\). Excess returns for a firm are defined as

i.e. the difference between equilibrium firm value and equilibrium price. A trade equilibrium \(a^{*}\) in which the value increasing effort decision of the distinguished player is correctly anticipated or “priced in”—i.e. shares are traded at their equilibrium value—is called a true value equilibrium defined by

Conversely, a trade equilibrium in which shares are traded strictly below their equilibrium value is called an excess returns equilibrium, i.e.

A net equilibrium buyer i with \(x_{i}^{*}-y_{i}^{*}>0\) gains

and is called equilibrium winner. Although the role of its counterpart—the net equilibrium seller—is less attractive it can still be rational if the alternative is low effort of the distinguished player triggering a lower value for all.

4 Call auction equilibria

In this section we show that a distinguished player cannot be priced in correctly for the most basic form of real world auction, the electronic call auction. We concentrate in this paper on electronic call auctions, because (1) we can refer to exactly and fully specified rules (2) we do not need to specify the timing as to who trades when and knows what, and (3) these rules are used in the real world and in the literature.Footnote 10

Basic structureFootnote 11 of an electronic call auction:

-

1.

Price setting: The price is chosen as to maximize the limit order trade volume.

-

2.

Allocation: Limit orders are executed with price priority, i.e. buy orders with a higher bid price and sell orders with a lower bid price are served first.

We are now in a position to formulate our main results. The first result is negative. Trade at the true value is not an equilibrium in a fully rational market if trade is organized in an anonymous call market. Our second result is positive. In the same set-up excess returns equilibria exist and we can thereby analyze stock price behavior of firms with a distinguished player using the standard equilibrium concept in a fully rational framework.

Theorem 1

Consider the market game \(\Gamma _{\mu }\) with sufficiently small tick size \(\delta \). Then, the following is true.

-

(I)

Trade at the true value cannot be an equilibrium for the electronic call auction.

-

(II)

However, there exists an excess returns equilibrium for the electronic call auction. One particularly simple such equilibrium displays the following equilibrium strategies:

-

(DP)

The distinguished player submits a buy order for one share with an appropriate limit price \(\hat{p}\).

-

(OI)

Only one outside investor submits a sell order for one share using the same limit price \(\hat{p}\).

-

(DP)

Proof is to be found in “Appendix C”, p. 29ff.

The proof of the first part proceeds by characterizing any potential candidate true value equilibrium and finding a contradiction. In every candidate true value equilibrium the following is true. Either the distinguished player has an incentive to change his ex post holding and adjust effort accordingly. Or outside investors have an incentive to change their ex post holdings to trade less against the distinguished player. The driving force to rule out any stochastic ex-post ownership for the distinguished player is that outside investors and the distinguished player can never be indifferent at the same time between buying and selling due to different valuations for shares of the firm. Anonymity of electronic call auctions makes sure that outside investors or the distinguished player can indeed deviate and change ex post ownership \(\omega \).

The easiest way to prove part two—existence of an excess returns equilibrium—is to construct a particularly simple such equilibrium. Clearly, there are many possibilities for such equilibria and other equilibria may be more involved. The intuition for our proof of the second part follows the same idea of the introductory example in Sect. 2 and is as follows. In the equilibrium we construct to show existence of excess returns equilibria, the distinguished player buys shares and some outside investors sell shares. Shares are traded at a discount, below the equilibrium value which is why we observe excess returns. As a result, the distinguished player does not have an incentive to sell any of his shares or buy less shares as this would imply to forego the excess returns. Buying more shares is prevented due to the fact that there is no additional liquidity: there does not exist any other outside investor the distinguished player could buy additional shares from. Outside investors do not have an incentive to deviate from the equilibrium strategies (i.e. submitted orders) because buying more or selling less shares would trigger the distinguished player to buy less or sell more, thereby reducing effort and hence firm value. This would imply that the shares would be worth less than what a deviating outside investor would have paid for.

These results can be interpreted as follows: On the one hand, finding equilibrium stock prices for firms with a distinguished player is non-trivial. In fact, an equilibrium which resembles closest a standard asset pricing equilibrium, namely the true value equilibrium, is not an equilibrium in our stylized fully rational world. This is the first part and is a formal way to state that a situation with endogenous firm value due to standard moral hazard problems cannot always be analysed using standard equilibrium concepts. However, showing what is not an equilibrium is not satisfactory as we still do not know what to expect in such a situation and what actually constitutes an equilibrium. We therefore do not want to stop with the negative first result and instead try to find out what does constitute an equilibrium. This is the second part where we show existence of excess returns equilibria. These excess returns equilibria suggest that firms with important moral hazard problems tend to be underpriced in equilibrium. These equilibrium excess returns are a main motivation for von Lilienfeld-Toal and Ruenzi [31] to look at stock returns of owner-CEO firms who indeed find that there are excess returns for owner-CEO firms.

All details of the market mechanism are used in order to show the results of our Theorem 1. The details are fascinating and annoying at the same time. It is fascinating how the details are in fact relevant for the existence and non-existence proofs and annoying that every change in these assumptions may require a new proof. However, the crucial assumption for the results in Theorem 1 are the first two price setting rules (trade volume maximization and minimization of excess demand) as well as the first allocation rule (price priority). We are not aware of any real world electronic call auctions that do not follow these rules and therefore are confident that these results are reasonably robust within the class of call auction market mechanisms. Changing the other rules of the price setting and allocations rules may require to change the proofs (and every rule may require a different proof) but we conjecture that any other variation of these rules would lead to the same results.Footnote 12

We use two specific priority rules, namely concerning the splitting up of orders and fill-or-kill orders as they show up in various real world trading rules. Giving priority to first execute fully exercisable orders is applied in a similar manner at NYSE.Footnote 13 Fill-or-kill orders are allowed at some—e.g. Amsterdam or XETRA—but not all real world call auctions. Note, however, that they can be used in most continuous trading settings, e.g. NYSE or Paris.Footnote 14

Zero discretion.

We have shown that all trade equilibria are excess returns equilibria in a market with a distinguished player. Now we show that without a distinguished player excess returns equilibria disappear. Remember that this formulation of the model contains the special case \(\Delta v=0\) with no distinguished player or zero discretion. The following proposition shows that models without distinguished players have no excess returns equilibria and in this sense are not robust with respect to the introduction of arbitrarily small distinguished players \(\Delta v>0\) if excess returns equilibria exist.

Proposition 1

For a model with zero discretion \(\Delta v=0\) excess returns equilibria do not exist.

Proof to be found on p. 34.

The first part of Theorem 1 predicts that the presence of a value enhancing distinguished player can never be priced in correctly by a market. The reason is that in an anonymous market where the firm is traded at a price equal to the true value from the perspective of an outside investor a distinguished player with discretion always can gain by selling shares and saving on effort cost. The second part of Theorem 1 shows that under the same conditions excess returns equilibria exist in contrast to the case without discretion considered in Proposition 1. In other words, trading at a price strictly below equilibrium value is fully consistent with rationality and standard economic incentives. This comes about in a static complete information market setting. Both claims of Theorem 1 and the claim of Proposition 1 are consistent and predict the evidence reported in von Lilienfeld-Toal and Ruenzi [31]. Moreover, their evidence turned out to be inconsistent with various alternative explanations.

We have already seen in our introductory example that excess returns, i.e. the gap between trade price and the true value depends on discretion and can be substantial in equilibrium. It is also straightforward to construct equilibria with substantial excess returns in this general setup. In a fully rational setting it suffices if the distinguished player is the only seller who submits a fill or kill order to sell a large number of shares. The limit price of this critical order can then be substantially below its equilibrium value. While outside investors would be most happy to buy from other outside investors at this price they risk to loose the entire value enhancing contribution of the distinguished player if he succeeds to sell his substantial package.

5 Noise and small price takers

One main worry concerning the previous results is the high degree of rationality imposed on investors. We do not only impose that outside investors are aware of strategic interactions and the fact that their orders may have an impact on the distinguished players actions, we also assume that there is not even a small irrationality on the side of outside investors: there are no noise traders who trade for reasons exogenous to the model. In this section, we will now deviate from these assumptions and allow for outside investors to be non-strategic (they take prices and firm value as given) and for noise traders to enter the picture.

The critical aspect is the interplay of no noise and a finite number of investors. A finite number of investors alone does not seem to be restrictive, as the number of investors can be arbitrarily large (but finite). It is also possible to add a little bid of noise to our set-up and the excess returns equilibria would still survive. However, whether excess returns equilibria also survive if the noise is substantial and the number of investors is arbitrarily large is less obvious. Hence, we take the most extreme view and consider a continuum of investors and mild assumptions on the noise (noise is required to be symmetric and demand from noise traders is not big enough so that they buy out all rational investors).

Specifications. The set of investors in this section is given by

consisting of three types of investors. As before the distinguished player is \(i=0\). Furthermore, there is a continuum of small rational outside investors sitting on the interval \(i\in (0,1)\). The distinguished player initially owns proportion \(\alpha _{0}\ge 0\) of shares and rational outside investors together own \(\alpha _{r}<1-\alpha _{0}\) shares. Now we specify effort costs as \(c(e)=c \cdot e^2\). Moreover, we suppose the presence of irrational noise traders trading for exogenous reasons. Since only their aggregated behavior matters for rational investors they are treated from here as if they were a single irrational investor \(i=1\). These noise traders initially own together the remaining \(\alpha _{1}=1-\alpha _{0}-\alpha _{r}\) shares.Footnote 15

The distinguished player is assumed to be strictly wealth constrained. To make sure that best responses are well defined we further assume that every rational investor is budget constrained with a finite budget \(B_i <\infty \). The aggregated budget constraint across all rational investors is non-binding and larger than \(\bar{v}\) meaning that jointly outside investors can afford to buy the entire firm even at the highest reasonable price.

Noise. Suppose noise traders only submit market orders and hence only the excess demand correspondence of noise traders denoted by \(\tilde{Z}_{1}\) matters for the rest of the market. We further suppose that \(\tilde{Z}_{1}\) is a random variable with support \([-\alpha _{0},b]\subset \mathbb {R}\) where \( -\alpha _{0}<0<b\le \alpha _{r}\). The assumption \(b\le \alpha _{r}\) means that the event \(\tilde{Z}_{1}>\alpha _{r}\) that noise traders want to buy more than rational investors own has probability 0. We introduce this assumption to make sure that existence of excess returns equilibria is not driven by the specification of noise. The distribution function F is assumed to be continuous and symmetric. In particular, \(\Pr (\tilde{Z}_{1}=0)=0\) and \(F(0)=\frac{1}{2}\) meaning that the events \(\Pr (\tilde{Z}_{1} >0)=1-F(0)=\frac{1}{2}\) and \(\Pr (\tilde{Z}_{1} <0)=F(0)=\frac{1}{2}\) are equally likely.Footnote 16

Theorem 2

Consider sufficiently small tick size \(\delta >0\) and market mechanism \(\mu \). Then,

-

(i)

for any non-degenerate symmetric noise F, there exist initial ownership structures \(\alpha \) and effort cost parameter c such that an excess returns equilibrium exists. One possibility for equilibrium strategies displays the following structure:

-

DP

Distinguished player

The distinguished player \(i=0\) submits a single order with limit price \(p_{0}\) to sell his entire shares. The price limit \(p_{0}\) is the lowest discrete price at which the distinguished player has a strict incentive to sell instead of exerting high effort.

-

ROI

Rational outside investors

Outside investors submit maximal buy orders up to their budget constraint using \(p_{0}-\delta \) as a price limit and sell orders for all their shares using \(p_{0}\) as the limit price.

-

DP

-

(ii)

Without noise, an excess returns equilibrium cannot exist with a continuum of traders. Further, without discretion (\(\bar{v}=\underline{v}\)) excess returns equilibria do not exist under any non-degenerate distribution F.

Proof to be found on p. 34.

It should be noted that parameters can easily be specified such that excess returns can be substantial. Furthermore, for any noise, excess returns equilibria exist for a whole range of cost parameters and for every cost parameter it holds for a whole range of ownership structures.

Intuition. The following line of arguments provides the main intuition of the proof and shows why investors have no incentive to bid up the share price. In our excess returns equilibria with noise, the distinguished player sells his shares with strictly positive probability whenever \(p\ge p_0\). Shares are overvalued at these high prices which implies that \(p_0\in ( \underline{v},\bar{v})\). However, for any price \(p\le p_0 -\delta \), the distinguished player does not sell his shares. As a result, shares are undervalued if the resulting price is \(p\le p_0 -\delta \). Hence, rational investors want to sell if \(p\ge p_0\) and to buy if \(p\le p_0 -\delta \). This implies that the value of the firm is price dependent and investors are always rationed: There is excess demand if \(p\le p_0 -\delta \) and excess supply if \(p\ge p_0 \). Principally, rational investors can overcome the rationing by increasing their buy limits. The downside from this strategy is that they always buy shares, which are sometimes undervalued and sometimes overvalued.

We now discuss the role of noise traders. Interestingly, it turns out that the additional liquidity provided by irrational traders is even helpful to come up with another explanation for the excess returns phenomenon. Noise traders in this setting are important in two respects; i) noise traders make the price stochastic and ii) the distinguished player sells his shares to noise traders with positive probability. Concerning the first aspect, excess demand from noise traders is stochastic and hence prices are stochastic. With positive probability, the high price \(p_0\) occurs and with positive probability the low price \(p_0 -\delta \) occurs. As a result, outside investors do not know in advance whether or not the high or the low price will be realized. Outside investors react to this uncertainty by making use of limit orders. They are willing to buy shares at any price (weakly) below the low price. And outside investors are willing to sell shares whenever the price is (weakly) above the high price. Recall that the shares are undervalued conditional on the fact that the distinguished player does not sell his shares and overvalued conditional on the fact that the distinguished player does sell his shares. This implies that the extent of excess returns depends on the likelihood that the distinguished player sells his shares. For symmetric noise which we consider in the proposition, the undervaluation part dominates. This is true for the following reason. Under symmetric noise, the likelihood of observing the high and the low price is each equal to one half. The distinguished player never sells his shares at the low price and hence shares are always undervalued at the low price. If the high price is observed, the distinguished player does not sell his shares all the time - the distinguished player may be rationed. This rationing implies that on average shares will be undervalued and we observe excess returns. Note that this also implies that with very asymmetric noise and large buying pressure from noise traders, shares may be overvalued on average.

We now turn to the second role of noise traders. Noise traders are those investors who actually buy from the distinguished player. This does not happen all the time when the high price \(p_0\) occurs but it happens with positive probability. Hence, an important assumption is that excess demand from noise traders can be high enough to buy out the distinguished player. In this sense, noise traders provide liquidity. They make it possible that the distinguished player can sell his shares - not always but at least from time to time.

It is interesting to compare the noisy environment with our earlier analysis. First of all and most important, our voluntary trade property of market mechanisms no longer holds. Noise traders are irrational and are forced to trade for exogenous reasons.

Since the rationing factor is determined by comparing noise against rational investors, an increase of noise facilitates the existence of excess returns equilibria for two reasons. First, liquidity is increased which makes it more likely that the distinguished player can sell his shares on the market. Secondly, the rationing problem is reduced which implies that rational investors have a smaller incentive to increase their limit price used in their buy orders.Footnote 17

6 Related literature

The paper relates to empirical and theoretical contributions, in particular those jointly addressing corporate governance and asset pricing. We will first discuss the empirical literature and argue that there is evidence for (i) excess returns equilibria, (ii) the existence of distinguished players and (iii) non-atomistic, pivotal investors with price impact. Second, we discuss related theoretical contributions.

Empirical literature. In order to support the excess returns equilibrium phenomenon formulated by this theory, one has to identify a distinguished player. As potential candidates, von Lilienfeld-Toal and Ruenzi [31] investigate owner-CEOs who own a non-negligible fraction of shares. As shortly mentioned in the introduction, their contribution is twofold. In the first part of their paper, von Lilienfeld-Toal and Ruenzi [31] show that firms with an owner-CEO outperform the market significantly. Depending on the sample and the specification, they report annualized abnormal returns of 4–10% relative to standard risk factors. This result is robust in various dimensions. It holds in a portfolio approach with value weighting and equal weighting of stocks. It also holds in a panel regression approach where they control for standard covariates known to correlate with stock returns. They also consider different samples and find that the results occurs for a broad sample of firms and the S &P 1,500 index consisting of the larger firms listed in the US.

In the second part, they try to shed light on why these excess returns occur. They come up with three different potential explanations. Two are based on irrational markets and one is based on our excess returns equilibria (suggesting that the results are the sign of (highly) rational markets). The first explanation considers asymmetric information on the side of the owner-CEO, arguing that this private information is not fully priced because outside investors do not fully understand the extent of asymmetric information. The second is based on the notion that owner-CEOs exert effort but outside investors do not fully understand the importance of the value increasing effort (and due to limits of arbitrage this inefficiency is not arbitraged away by sophisticated investors). The third and final explanation is based on our notion of excess returns equilibria. Results reported in von Lilienfeld-Toal and Ruenzi [31] do not suggest that the abnormal returns of owner-CEO firms are due to asymmetric information. Rather, the findings of von Lilienfeld-Toal and Ruenzi [31] suggest that indeed, managerial effort and discretion play a crucial role in explaining these abnormal returns. Differentiating between the discretion based explanation in inefficient markets and discretion based explanations in rational markets (i.e. excess returns equilibria), von Lilienfeld-Toal and Ruenzi [31] further investigate the role of limits-to-arbitrage, learning over time, and earning surprises. It turns out that limits-to-arbitrage do not seem to play an important role for the results. Also, there is no evidence that investors learn about the abnormal returns over time. They find no evidence which suggests that analysts are surprised by the earnings reported in owner-CEO firms. When it comes to abnormal returns around earning announcements the results are mixed. On the one hand, von Lilienfeld-Toal and Ruenzi [31] do not find any significant abnormal returns around earning announcements for owner-CEO firms among the large and liquid S &P 1,500 firms. On the other hand, there is evidence that investors are surprised by the earning announcements in their full sample. Still the quantitative magnitude of these surprises seem small and can only account for a small part of the annualized abnormal returns. Overall, the findings in von Lilienfeld-Toal and Ruenzi [31] suggest that excess returns equilibria are helpful candidates in explaining the abnormal returns of owner-CEO firms.

Other potential candidates for distinguished players are founder-CEOs. Fahlenbrach [12] finds that founder-CEO firms outperform the market by approximately \(10\%\) and these results are again robust to various specifications. While these results are consistent with excess returns equilibria, they are inconsistent with true value equilibria. Hence, true value equilibria may not only fail to exist in theory, empirical evidence also suggests that excess returns equilibria are more relevant, provided good candidates for distinguished players are found.

Aforementioned papers also document the empirical importance of distinguished players and value increasing shareholders for listed US firms. For example, within the S &P 1500 firm universe, according to von Lilienfeld-Toal and Ruenzi [31] more than \(10\%\) of firms have an officer who owns more than \(5\%\) of outstanding stocks. Fahlenbrach [12] reports that founder-CEOs are present in \(11\%\) of the largest US firms (founders hold on average \(11\%\) of shares of a firm). A similar emphasis is put forward in Holderness [19]. In a representative sample of 375 US firms he reports that \(96\%\) of US firms have at least one blockholder who owns more than \(5\%\) of shares of the firm. Average ownership of all blockholders, directors, and officers is \(43\% \) (median \(43\%\)), average ownership of the largest shareholder is \(26\%\) (median \(17\%\)), and average ownership of officers and directors is \(24\%\) (median \(17\%\)). The latter finding is consistent with results in Fahlenbrach and Stulz [13] who look at the much larger universe of US firms covered in the compact disclosure discs. They analyze 27,636 firm years from 1988–2003 and report mean ownership of officers and directors to be \(22.4\%\) (median \(15.8\%\)).

One group of shareholders that are reasonable candidates for non-price taking, pivotal outside investors are institutional investors who control more than 100 million US dollars. It is well documented that trades of this group of investors have an influence on the price. Chan and Lakonishok [10, p. 1147] argue that “For many institutional investors, however, even a moderately-sized position in a stock may represent a large fraction of the stock’s trading volume”. They document an average price impact of \(1\%\) for buy orders or \(-0.35\%\) for sell orders. Their sample consists of NYSE and AMEX trades of 37 large investment management firms from July 1986 until the end of 1988. Noteworthy, the trades of these 37 institutional investors accounted for approximately \(5\%\) of trading volume on NYSE and AMEX in this time period.

Apart from the importance of trading volume of institutional investors, it is also known that the ownership of institutional investors is economically significant. Gompers and Metrick [15] consider the holdings of institutional investors from 1980–1996. Shareholdings of institutions is increasing over time and in December 1996, the last quarter of their sample, institutional investors hold more than \(50\%\) of the market capitalization of US firms. We interpret these observations that there are only a few important institutional investors as supportive for the assumption that outside investors can act strategically rather than as pure price takers. In December 1996, there are only 1303 institutions. In particular, the largest 100 institutions hold approximately one third (37.1%) of the entire market capitalization and the largest 10 institutions hold \(14.6\%\) of market capitalization of all US firms.

Theoretical literature. Most of the theoretical literature about large shareholders and trading games only analyzes what we call true value equilibria. Prominent examples include Shleifer and Vishny [42], Admati et al. [1], Maug [33], DeMarzo and Urosevic [11], Kahn and Whinton [24], or Magill and Quinzii [32]. All these papers study a large and value increasing shareholder who may increase a firm’s value while increasing a firm’s value causes private effort costs. Some of them are more general in other important respects (asymmetric information, dynamic framework,...) while they typically consider true value equilibria. Feedback effects from asset pricing to corporate decisions may not only occur due to costly effort but also due to learning, see for example Ozdenoren and Yuan [37] or a recent overview by Bond et al. [7].

With respect to excess returns equilibria closest to our paper are Lilienfeld-Toal [30] and Blonski and von Lilienfeld-Toal [5]. Lilienfeld-Toal [30] identifies an excess returns equilibrium and then turns attention to the empirical implications of excess returns. In particular, it argues that excess returns equilibria are consistent with (i) negative abnormal returns around unlock days and (ii) positive abnormal returns for firms with a distinguished player. In contrast to our paper it does not show that trade at the true value is not an equilibrium, and does not consider irrational traders and a continuum of outside investors.

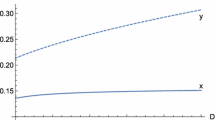

In Blonski and von Lilienfeld-Toal [5] outside investors are treated in reduced form which vastly simplifies the mathematical structure from a market game to an optimization problem. In this context we analyze the trading incentives of a manager with discretion in an anonymous market and show that there exists a unique critical price where the manager’s optimal ownership drops discontinuously creating a strong feedback effect. At this price the firm value drops from a value strictly above market price to a value strictly below it. Powerful market forces drive the trade price towards this value-discontinuity. This approach yields testable predictions on the size and the sign of the resulting excess returns.

Note that excess returns equilibria may also occur in the model of Bolton and von Thadden (1993) which is concerned with corporate control. In contrast to this article it does not focus, however, on (asset) pricing implications of excess returns equilibria. In particular, it does not relate excess returns to no-arbitrage in asset pricing. Rather, they are mainly interested in the question when blocks of shares remain, vanish or are newly created. The reason as to why excess returns equilibria may exist in the model of Bolton and von Thadden [8] is similar to our notion of pivotalness. A related explanation of takeovers is given by Bagnoli and Lipman [2] or Holmström and Nalebuff [21]. The latter papers analyze potential solutions to the free rider problem first mentioned by Grossman and Hart [16].Footnote 18

Our setting can be viewed as double sided auctions with strategic trading and the paper relates to this branch of market microstructure theory. Papers falling within our framework are for example Kyle [27], Kyle [28], Rochet and Vila [39], or Reny and Perry [38]. While their exact specification of price setting and quantity allocation rules is similar to the present market mechanism, the economic environment we are interested in is distinct as compared to these papers. Moreover, market microstructure theory is also interested in the price impact of individual trades which is aptly pointed out by O’Hara [36]: “... asset pricing ignores the central fact that market microstructure focuses on: Asset prices evolve in markets”.

The present article also relates to the literature on no trade theorems, for example Milgrom and Stokey [34] or Tirole [43]. The driving force behind no trade theorems is the fact that there are no gains from trade or negative gains from trade in the presence of transaction costs. In the class of models we are interested in, gains from trade are zero for true value equilibria and consequently, true value equilibria in the traditional sense fail to exist for positive bid ask spreads. In excess returns equilibria, in contrast, gains from trade are no longer zero sum since the owner manager’s threat to sell is viable and trade at a low price prevents the owner manager from selling. Further, as in the no-trade theorem literature our continuum-trader-version shows that noise is needed to initiate trade and provide liquidity.

Further, the paper relates to the vast literature on agency problems as in Holmström [20] or Grossman and Hart [17]. In particular, models with bilateral contracting and non-exclusive contracts are concerned with externalities among trading partners. Examples are Bisin and Guaitoli [3], Bizer and DeMarzo [4], Kahn and Mookherjee [23] and Segal and Whinston [41]. In these papers, a distinguished player can write contracts with many players while in our model, the distinguished player can anonymously trade with many outside investors.

Finally, our model relates to the literature on large games since it establishes a prime example of a semi-anonymous game where players’ payoffs only depend on aggregated actions of player-types rather than on the entire individual action profile. In this context we only consider two types of players, regular investors and the distinguished player. Now, semi-anonymity is a critical property since it means that traders do not care about the composition of bids among regular shareholders. However, being of a different type, the distinguished player’s actions impose externalities and distinctly enter the preferences of other traders. Equilibria of semi-anonymous games in general are characterized in Blonski [6]. Strong theoretical support for their relevance provides Kalai [25] who shows that equilibria of semi-anonymous games are robust with respect to the extensive form of the underlying game when the number of players gets large. This result is relevant and important for markets with continuous time trading where it is generally hard to know on which information traders base their decisions. With few traders for any kind of strategic trading game theorists would expect that traders’ information affects the outcome substantially. Kalai shows, however, that equilibria of any extensive form are approximately ex-post Nash—i.e. deviation incentives get arbitrarily small—if the number of players gets large. Since the deviation incentives in our non-existence proof for true value equilibria are substantial Kalai’s result gets powerful in this context since it implies that we can neither expect true value equilibria to exists in dynamic versions for this model including all kinds of information asymmetries nor in continuous time trading markets.

7 Conclusions

We consider firms with a distinguished player who can trade shares and influence firm value. Due to private effort costs, the valuation of shares differs between the distinguished player and outside investors. We formalize the resulting complexity of finding an equilibrium share price for these firms. In particular, we show that shares of a firm with a distinguished player cannot be priced correctly. Trading at the true value is not consistent with incentives and rational behavior if the market is anonymous. In contrast, excess returns equilibria exist in both, a fully rational world and a world with noise and a continuum of traders. It turns out that the existence of a distinguished player is necessary for excess returns equilibria to exist.

Our theory is general in the sense that it contains the benchmark case of a frictionless efficient market without distinguished player and with the usual true value equilibria as the special case \(\Delta v=\bar{v}-\underline{v}=0\). Our results indicate that the analysis of models with frictionless markets become substantially more complex with the introduction of an arbitrarily smallFootnote 19 distinguished player.

The analysis of equilibria of firms with a distinguished player is non-trivial, because the valuation of the distinguished player and the outside investors do not coincide. Any equilibrium share price will either be too high from the perspective of the distinguished player or too high from the perspective of the outside investors. We show that the perspective of the distinguished player is more relevant when solving for the equilibrium share price.

The main intuition behind the existence of excess returns equilibria is as follows. Whenever share prices of a firm exceed a certain threshold, the distinguished player prefers to sell his shares—or does not want to buy shares—and reduce effort subsequently. As a result, shares are traded below this threshold price. Due to the private effort costs, this threshold price is below the equilibrium value.

Now, trade can occur for two reasons. Equilibrium sellers—selling shares below the equilibrium value—can be pivotal and highly rational. They then know that not selling shares will trigger the distinguished player to sell shares instead, cut back on the costly effort and reduce firm value. This renders everyone worse off, including deviating equilibrium sellers. In the absence of pivotal traders, noise traders may fill the liquidity gap. Noise traders may sell for exogenous and stochastic reasons. Then, the equilibrium share price is stochastic and the distinguished player has an incentive to sell at the high realizations of the share price but not at the low realizations of the share price. Rational buyers may then prefer not to buy at high share prices but only buy at low share prices. As a consequence, they are not increasing demand—by submitting bids with higher buy limits—and hence they are not increasing the share price even though on average, shares are traded below the equilibrium value.

Additional research questions arise naturally. For example, what happens in a dynamic formulation, under asymmetric information, or with risk aversion?Footnote 20 While the economic intuition behind our results is quite strong, it is also apparent that a rigorous formulation of such questions is not straightforward at all. In fact, all our proofs turn out to be involved and full of details.

Since there are two different explanations for trade to occur in an excess returns equilibrium (fully rational, pivotal players or irrational noise traders), it would be interesting to empirically account for the importance of each explanation. Even though there exists some evidence for excess returns equilibria (von Lilienfeld-Toal and Ruenzi [31] and Fahlenbrach [12]), it is a worthwhile task to identify excess returns equilibria in other circumstances or conversely to identify circumstances where excess returns do not exist.

Investigating different aspects and puzzles of asset pricing, both in theoretical and empirical work also promises to be fruitful. The importance to carefully investigate asset pricing phenomena in light of this theory becomes clear when it comes to judging the empirically observed excess returns. Observing abnormal returns due to a certain investment strategy, as documented by [31], need not be a sign of irrational behavior but might be the result of excess returns equilibria and highly rational behavior.

Notes

Krebs [26] and Muendler [35] have shown that the the Grossmann-Stiglitz-paradox disappears—i.e. the price can be fully revealing with costly information acquisition—if finitely many players can use mixed strategies. We consider both, a setting with a finite number of players and a setting with an infinite number of players and show that the distinguished player paradox is more difficult to overcome. Neither finite models nor mixed strategies can resolve the incentive asymmetry between distinguished player and outside investors.

von Lilienfeld-Toal and Ruenzi [31] not only focus on excess returns but also document that owner-CEOs run their firms more efficiently, engage in less empire building, and pay themselves a lower salary.

To study the role of small investors and price taking behavior we turn to a continuum of investors in Sect. 5.

For this theory it is irrelevant whether this influence is positive or negative or can go in either direction. Once it is negative exerting high effort should then be replaced by not stealing to obtain the same abstract incentive structure.

While the distinguished player is de jure unrestricted to trade shares, it is not clear whether the distinguished player finds other investors to trade. The availability of parties to trade with (i.e. the order book) is an endogenous outcome of the model.

For the S &P 1,500 firms, the Execucomp database provides information on unrestricted shares and von Lilienfeld-Toal and Rünzi [31] restrict attention to unrestricted shareholdings.

Real world market mechanisms distinguish between buy and sell prices \(p_{b},p_{s}\). The difference \(\gamma :=p_{b}-p_{s}\ge 0\) is called bid ask spread. An earlier version of this paper considers a market with bid-ask spread and transaction cost. Since none of the present results depends on it we simply omit them to save on notation.

I.e. suppose finite \(\underline{p}<\underline{v}\) and \(\bar{p}>\bar{v}\) to make sure the minimal and maximal price is always well defined.

For example, this is likely to be a reason why the distinguished player needs funding by outsiders. Otherwise he would prefer to own the entire firm and run it himself.

Trading rules can be ordered by continuous trading vs. call auctions and electronic market places vs. dealer markets. For existence, one cannot use dealer markets since they are insufficiently explicit. For example, as a rule specialists on the NYSE “... have an exchange mandated obligation to maintain fair and orderly markets.” (Lehmann and Modest [29, p. 952]). To show existence, it is necessary to overcome the lack of preciseness in the regulation of specialists. In the literature, this problem has been treated by assuming that there is perfect competition between market makers and hence assuming that equilibrium price equals equilibrium value. Since the major goal of this paper is to derive the equilibrium trade price and the firm value independently and endogenously, this approach is not feasible here. Moreover, continuous trading is more specific and more involved as we would have to specify the timing of orders and the available information for every trader.

The full specification is explained and motivated in full detail in “Appendix C”.

It is known that these details are important. For example Reny and Perry [38] put similar emphasis on the exact specification of the rationing rules. We have shown in an earlier version of this paper Blonski and von Lilienfeld-Toal [5] that all the results hold for three different real world electronic call auction rules, i.e. NYSE, Amsterdam and Tokyo which use different price priority and allocation rules.

In a description of the NYSE market rules, (Huang and Stoll [22, p. 506]) describe the preference of NYSE for fully executable orders as follows: “The NYSE does not follow a strict time priority rule. To minimize the breaking up of large orders, the time priority rule applies only to the first limit order. The remaining limit orders follow a size priority rule; namely limit orders that match the size of the market order at the best price are given priority over other limit orders..” It can be argued that the upstairs market used at NYSE and many other exchanges—e.g. Paris Bourse or XETRA—also gives priority to large orders since only large orders can be traded upstairs (and also downstairs).

See Venkataraman [44, p. 1450].

More formally, initial ownership structure \(\alpha \in \Delta \) in this section is a measure with \(\int _{I}\alpha _{i}di=1\). Outside investors are small investors who individually own 0 and only jointly own a strictly positive fraction of shares.

The symmetry condition is sufficient but not neccessary. A weaker sufficient but more technical condition is to assume that the probability that the distinguished player can sell his entire stake against noise traders is not too small and not too large.

More precisely, we can show that excess returns equilibria are more important when noise increases in the following twofold sense. Firstly, the maximum quantity of excess returns that can be supported in an excess returns equilibrium increases. Furthermore, the measure of the set of parameters increase that support excess returns equilibria. Note, though, that these statements apply to the specific class of excess returns equilibria we construct to show existence in Theorem 2.

In one sense, our model could be interpreted as a generalization of Bagnoli and Lipman (1985) and Holmström and Nalebuff [21] if the distinguished player’s value-enhancing capability only unfolds for \(\alpha _0 \ge \frac{1}{2}\), the strategy space of the distinguished player is limited to a takeover bid, and other shareholders can only submit sell orders.

The size of the distinguished player is defined by his maximal contribution to the company’s fundamental value.

Blonski and von Lilienfeld-Toal [5] show in a simpler decision-theoretic framework that with a risk-averse manager the agency problem cannot be priced in correctly, i.e. the firm’s value systematically differs from its market price.

To allow traders as in reality to choose demand and supply rather than just the sum of both—i.e. excess demand—opens the possibility for “beller strategies” in which a trader might, for example, try to bid up the stock price by submitting buy orders and simultaneously selling stocks. It turns out that these strategies complicate our existence proofs but we want to consider them since they are not ruled out in most real world trading systems.

It is necessary to differentiate in our notation the cases including and excluding fill or kill orders since in most real world market mechanisms kill or fill orders are treated differently. For example, they are not written in the order book and thereby have no direct influence on the market price.

Fill or kill orders can be submitted. However, they do not have an impact on price setting. This means that the price and the corresponding executable trading volume or excess demand are calculated as if the fill-or-kill order was not present. A description of the Amsterdam stock exchange (AON are all or nothing orders which is another word for fill or kill orders) as taken from http://www.keytradebank.com/form.html?level=form &option=rul &market=aex is similar: "on the segment of the double auction,.. the fixing price is calculated without the AON orders. Just before the fixing, the AON orders are added to the orderbook."