Abstract

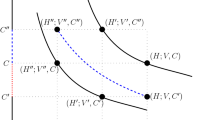

We provide a detailed characterization of the optimal consumption stream for the additive habit-forming utility maximization problem, in a framework of general discrete-time incomplete markets and random endowments. This characterization allows us to derive the monotonicity and concavity of the optimal consumption as a function of wealth, for several important classes of incomplete markets and preferences. These results yield a deeper understanding of the fine structure of the optimal consumption and provide a further theoretical support for the classical conjectures of Keynes (The general theory of employment, interest and money. Cambridge University Press, Cambridge, 1936).

Similar content being viewed by others

References

Abel A.: Asset prices under habit formation and catching up with the Joneses. Am. Econ. Rev. 80, 38–42 (1990)

Campbell J.Y., Cochrane J.: By force of habit: a consumption-based explanation of aggregate stock market behavior. J. Polit. Econ. 107, 205–251 (1999)

Carroll C., Kimball M.: On the concavity of the consumption function. Econometrica 64(4), 981–992 (1996)

Chan Y., Kogan L.: Catching up with the Joneses: heterogeneous preferences and the dynamics of asset prices. J. Polit. Econ. 110, 1255–1285 (2002)

Chapman D.A.: Habit formation and aggregate consumption. Econometrica 66(5), 1223–1230 (1998)

Constantinides G.M.: Habit formation: a resolution of the equity premium puzzle. J. Polit. Econ. 98(3), 519–543 (1990)

Dalang R., Morton A., Willinger W.: Equivalent martingale measures and no-arbitrage in stochastic securities market models. Stoch. Stoch. Rep. 29(2), 185–201 (1990)

Detemple J., Karatzas I.: Non-addictive habits: optimal consumption-portfolio policies. J. Econ. Theory 113, 265–285 (2003)

Detemple J., Zapatero F.: Asset prices in an exchange economy with habit formation. Econometrica c59, 1633–1657 (1991)

Detemple J., Zapatero F.: Optimal consumption-portfolio policies with habit formation. Math. Finan. 2(4), 251–274 (1992)

Duffie D.: Dynamic Asset Pricing Theory. Princeton University Press, Princeton (2001)

Duffie D., Fleming W., Soner H.M., Zariphopoulou T.: Hedging in incomplete markets with HARA utility. J. Econ. Dyn. Control 21, 753–781 (1997)

Englezos N., Karatzas I.: Utility maximization with habit formation: dynamic programming and stochastic PDEs. SIAM J. Control Optim. 48(2), 481–520 (2009)

Ekeland I., Lazrak A.: The golden rule when preferences are time inconsistent. Math. Finan. Econ. 4, 29–55 (2010)

Gomes F., Michaelides A.: Portfolio choice with internal habit formation: a life-cycle model with uninsurable labor income risk. Rev. Econ. Dynam. 6(4), 729–766 (2003)

Heaton J.: Consumption and portfolio policies with incomplete markets and short-sale constraints: the infinite-dimensional case. Econometrica 61(2), 353–385 (1993)

He H., Pearson N.D.: Consumption and portfolio policies with incomplete markets and short-sale constraints: the infinite-dimensional case. Math. Finan. 1, 1–10 (1991)

He H., Pearson N.D.: Consumption and portfolio policies with incomplete markets and short-sale constraints: the infinite-dimensional case. J. Econ. Theory 54, 259–304 (1991)

Hendersen V.: Explicit solutions to an optimal portfolio choice problem with stochastic income. J. Econ. Dyn. Control. 29(7), 1237–1266 (2005)

Karatzas I., Lehoczky J.P., Shreve S.E., Xu G.L.: Martingale and duality methods for utility maximisation in an incomplete market. SIAM J. Control Optim. 29, 702–730 (1991)

Karatzas I., Žitković G.: Optimal consumption from investment and random endowment in incomplete semimartingale markets. Ann. Probab. 31(4), 1821–1858 (2003)

Karp L.: Non-constant discounting in continuous time. J. Econ. Theory 132, 557–568 (2007)

Keynes J.M.: The General Theory of Employment, Interest and Money. Cambridge University Press, Cambridge (1936)

Malamud, S.: Asset pricing for idiosyncratically incomplete markets. PhD Thesis, ETH Zurich, Diss. ETH No. 16651 (2006)

Malamud S., Trubowitz E.: The structure of optimal consumption streams in general incomplete markets. Math. Finan. Econ. 1, 129–161 (2007)

Merton R.: Optimum consumption and portfolio rules in a continuous time model. J. Econ. Theory 3(4), 373–413 (1971)

Pliska S.: Introduction to Mathematical Finance: Discrete Time Models. Blackwell, Malden (1997)

Plott C.: Rational choice in experimental markets. J. Bus. 59, S301–S327 (1986)

Polkovnichenko V.: Life-cycle portfolio choice with additive habit formation preferences and uninsurable labor income risk. Rev. Finan. Stud. 20(1), 83–124 (2007)

Rásonyi M., Stettner Ł.: On utility maximization in discrete-time market models. Ann. Appl. Probab. 15, 1367–1395 (2005)

Taqqu M.S., Willinger W.: The analysis of finite security markets using martingales. Adv. Appl. Probab. 19, 1–25 (1987)

Zariphopoulou T.: Optimal asset allocation in a stochastic factor model—an overview and open problems. Adv. Finan. Model. Radon Ser. Comp. Appl. Math 8, 427–453 (2009)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Muraviev, R. Additive habit formation: consumption in incomplete markets with random endowments. Math Finan Econ 5, 67–99 (2011). https://doi.org/10.1007/s11579-011-0049-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-011-0049-y