Abstract

With the rapid growth of emerging market multinational enterprises (EMNEs), increasing interest has been focused on exploring the internationalization-performance (I-P) relationship of EMNEs. Yet findings on the relationship remain contradictory. Although researchers emphasize the home-country-bounded nature of EMNEs, less is known about how home-government features and the EMNEs’ political mindset affect their internationalization and performance. This study integrates and extends the literature on the I-P relationship of EMNEs using a meta-analysis covering a dataset of 218 effect sizes from 186 retrieved studies published between 1998 and 2021. Findings show that the I-P relationship is overall positive, yet it varies across diverse research designs and emerging markets and regions. Also, our findings indicate that home-country government quality and transformability exert significant positive impacts on the relationship, while nationalism negatively moderates the government’s impacts on the relationship. This study pushes the boundaries of EMNE literature through conceptualizing home-government features and incorporating consideration of nationalism in this research field.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Multinational enterprises (MNEs), defined as firms with at least one-tenth of their sales distribution in foreign markets or holding a minimum of three foreign subsidiaries, are notable players in bridging commercial networks and connections between countries (Rugman, 1981; Rugman et al., 2016). A burgeoning literature has been devoted to explicating the performance implications of internationalization (Bausch & Krist, 2007; Cuervo-Cazurra et al., 2018; Glaum & Oesterle, 2007; Kirca et al., 2012), yet traditional arguments based on advanced market MNEs (AMNEs) are insufficient to explain those from emerging markets (EMNEs). In the past 20 years, IB researchers have gradually come to acknowledge that, unlike AMNEs, EMNEs behave in distinctive ways in internationalization, such as in regard to fast-paced springboard expansion (Luo & Tung, 2007), opaque networking (Buckley, 2018), and government-created advantages and interventions (Ramamurti & Hillemann, 2018; Rugman et al., 2016), which, implicitly or explicitly, are due to their home country’s institutional idiosyncrasies. Although there has been a lively conversation on the internationalization and performance (I-P) of EMNEs, findings have not reached a consensus. The extant literature, based on differing emerging market contexts, has produced diversified and inconclusive linear relationships (positive or negative) (e.g., Holtbrügge & Berning, 2018; Liu et al., 2011), curvilinear relationships (U-shaped, inverted U-shaped, S-shaped, or M-shaped) (e.g., Hsu et al., 2013; Thomas, 2006; Xiao et al., 2019), or no significant relationships (Wan, 1998).

A widely accepted argument in EMNE research is associated with home-country government influences (Cuervo-Cazurra et al., 2018; Stoian & Mohr, 2016; Wei & Nguyen, 2020). One stream of research identifies the unique home government-created advantages (e.g., providing necessary information, loan access, grant subsidies, or assistance from the government agencies) that motivate and support EMNEs venturing abroad (Han et al., 2018; Holtbrügge & Berning, 2018; Lu et al., 2014; Rugman et al., 2016). The other stream captures negative influences of unfavourable home institutional environments on firm competitiveness, suggesting that the outward FDI by EMNEs is an escape strategy to deal with home-country institutional voids (Marano et al., 2017; Stoian & Mohr, 2016; Witt & Lewin, 2007). Despite extensive research effort, these contrasting views indicate that there is a need to assess home-government impacts on the I-P relationship in a more holistic way. Nevertheless, little in the literature considers how nationalism, defined as a sense of national superiority and a feeling that one’s homeland should be dominant (Kosterman & Feshbach, 1989, p. 271), affects a firm’s internationalization. Nationalism can fundamentally change the outward motivation and behaviours of MNEs, especially EMNEs that show a strong motivation to catch up, a spirit of collectivism, and are deeply embedded in their home-country institutional environments (Bobowik et al., 2014; Johnston, 2017; Rugman et al., 2016; Zhang & He, 2014). To fill the research gaps and advance the EMNE literature, this study has sought to answer the following question: How do home-country institutions matter in affecting the I-P relationship of EMNEs?

To address this question, we adopt a three-level meta-analysis to assess retrieved data on the I-P relationship, the influence of home-country governments, and the moderating effects of nationalism. We categorize dimensions of home-country governments discussed in the rich literature into a static aspect (government quality) versus a changing aspect (government transformability). First, home-country government quality refers to the perceived government ability to implement sound policies, enhance bureaucratic effectiveness, and provide credible commitments to socio-economic development policies (Rodríguez-Pose & Garcilazo, 2015). The extant literature suggests that government quality matters because it directly links with the degree of home institutional support for or intervention in EMNEs’ internationalization (Han et al., 2018; Lu et al., 2014). Second, government transformability captures the extent to which the government is willing to convert political systems or learn to shift into a different regime for development needs (Deng & Zhang, 2018). Studies suggest that changes of political systems, as reflected by high government transformability, affect the environmental uncertainties of EMNEs’ OFDI (Cuervo-Cazurra et al., 2018; Kim et al., 2010). Our systematic review process also identified a missing link in this research field, that is, the influence of EMNEs’ national sentiment. We argue that nationalism, as an institution that reflects the individuals’ attitudes toward protecting the national interest, moderates the government impacts on the I-P relationship through disturbing EMNEs’ motivation and purposes of internationalization (Balabanis et al., 2001; Johnston, 2017).

Using an institutional-based perspective, this study elucidates the puzzle concerning the I-P relationship of EMNEs through a three-level meta-analysis. Our findings revealed that home-country government quality and transformability positively affect the I-P relationship of EMNEs, and the sense of nationalism negatively moderates government’s impacts on the relationship. Overall, this study makes three contributions. First, findings contribute to resolving an ongoing debate in the EMNE literature by providing a more precise assessment of the I-P relationship of EMNEs. Second, although previous studies widely recognize that government quality exerts significant impacts on EMNEs (Han et al., 2018; Lu et al., 2014; Rugman et al., 2016), less attention has been devoted to the changing aspect of the governments. This study extends the institutional-based perspective by proposing a systemic conceptualization that considers both the static and changing aspects of the home-country government. Third, this study enriches insights of home-country institutional research by incorporating the effects of nationalism (Arikan & Shenkar, 2021; Contractor, 2021; Zhang & He, 2014). It echoes the recent calls for greater consideration of national sentiments in international business (IB) studies (Arikan & Shenkar, 2021; Contractor, 2021).

2 Literature Review

Considering the unique emerging market context and EMNEs’ firm-specific assets (FSAs), IB scholars have sought to explore the I-P relationship in the past 20 years (see Appendix 1). Some studies focus on costs (e.g., liability of country of origin, liability of foreignness, market adaptation costs) and benefits (e.g., knowledge-seeking, experiential learning, economies of global scale) and discover a linear I-P relationship (Holtbrügge & Berning, 2018; Liu et al., 2011). Some take a step further to consider the complexity of international activities at different stages of EMNEs’ internationalization and find curvilinear relationships (Hsu et al., 2013; Thomas, 2006; Xiao et al., 2019). The U-shaped relationship supporters suggest that costs will outweigh benefits in the early stage of internationalization but fall behind benefits in the mature stage (Chen & Tan, 2012; Gaur & Kumar, 2009). The inverted U-shaped advocates acknowledging that an optimal degree of internationalization exists, viz., the more EMNEs internationalize after reaching the threshold, the fewer the benefits they can gain (Chen & Hsu, 2010; Liu et al., 2011). The S-shaped defenders argue that firms will suffer loss in the initial stage of internationalization, then gain positive benefits in the mature stage, but eventually find internationalization difficult to manage when they are over-expanded (Chen et al., 2012). Some studies, however, find no significant evidence of the I-P relationship, arguing that it is the EMNEs’ capabilities in cost efficiency rather than internationalization itself that impact on performance (Wan, 1998). While the linear arguments are challenged because of ignorance of phases of internationalization, scholars also criticize that curvilinear arguments are not theoretically convincing because the underlying assumptions may not occur (Nguyen, 2017; Wei & Nguyen, 2017, 2020).

In explaining the complexity of the I-P relationship in the context of EMNEs, a commonly adopted view is the institutional-based perspective (Deng & Zhang, 2018; Peng et al., 2008; Wei & Nguyen, 2017). On the one hand, host-country institutions, such as regulations, policies and institutional uncertainties, have received wide attention in IB literature, which reflects the EMNEs’ resource-seeking efficiencies and costs of market adaptation in host countries (Demirbag et al., 2010; Rugman et al., 2014). In this vein, the I-P relationship deteriorates if there are conflicting goals between EMNEs and host-country institutions, since these conflicts hinder EMNEs from embedding in the local environment for the exploration of new business opportunities and FSAs development (e.g., Demirbag et al., 2010; Rugman et al., 2014). On the other hand, in contrast to AMNEs, EMNEs rely more on parent-centric approaches, which means that EMNEs are constantly affected by home-country institutional support or constraints in making their outward investment decisions, including target-country selection, mode and speed of entry, and ownership structure (Holtbrügge & Berning, 2018; Wei & Nguyen, 2017). Hence researchers conclude that it is important to consider institutional dimensions that are specific to a home-country context in understanding the internationalization of EMNEs (Yiu et al., 2007).

Through our literature review, we identified two important gaps that remain unaddressed. The first gap is that, although home-country institutional influences are discussed in IB literature, there is a lack of systemic conceptualization of the home government’s role. Compared with developed countries, government is an essential part of institutions that lead economic development in emerging countries (Peng et al., 2008; Wang et al., 2012; Wu & Zhao, 2015). It shapes other institutions in the country, establishes business climates, and affects the development of FSAs that are critical to the EMNEs’ global competitiveness (Ramamurti & Hillemann, 2018). Hence the existing arguments on home-government influences need to be systematically summarized and categorized specifically for the EMNE research context. Based on the extant literature, we propose two main features of home governments that affect the ways that EMNEs internationalize. These are a static aspect – home-government quality combines the evaluations of governments in providing sound policies and regulative effectiveness (Cuervo-Cazurra et al., 2018) – and a changing aspect – home government transformability that takes into account the transformations of home-country institutions and the learning attitude of governments (Peng et al., 2008; Wan & Hoskisson, 2003).

The second gap we identified is that previous studies lack consideration of how nationalism, as an important institutional factor, affects EMNEs’ motivation and preferences to internationalize. Although nationalism has been discussed in cross-national research, its impact on MNEs, especially on EMNEs that are largely affected by their home-country context and committed to improving the national status quo, remains underexplored (Balabanis et al., 2001; Druckman, 1994; Johnston, 2017). In recent decades, nationalism has been on the rise and has constantly shaped firms’ international strategies and performance (Johnston, 2017; Zhang & He, 2014). Research shows that, compared with developed markets, the relative backwardness in political, economic, and education development in emerging markets is more likely to lead to a stronger sense of nationalism in individuals (Druckman, 1994; Johnston, 2017). Hence nationalism is of great significance in EMNE research, since these firms have a unique home-country-bounded nature and exhibit strong catch-up ambitions to achieve national goals (Cuervo-Cazurra et al., 2018; Luo & Tung, 2007; Wei & Nguyen, 2017). With a sense of nationalism, EMNEs become more intertwined with home-country governments and more prone to consider national security and interests in designing international strategies (Balabanis et al., 2001). Hence this study is positioned to address the research gaps by testing the moderating effects of home-country government quality and transformability on the I-P relationship of EMNEs and by examining how nationalism moderates government influences on the I-P relationship of EMNEs.

3 Hypothesis Development

In emerging countries, government influences are evident and can be exerted on a broad range of firms’ decision-making and strategies (Cuervo-Cazurra et al., 2018). Compared with AMNEs, EMNEs are “deeply rooted and embedded in” the home country’s institutional system (Rugman et al., 2014, p. 9), and hence the government is often regarded as their principal stakeholder as well as their largest partner. From a static aspect, home governments spell out the ‘rules of the game’ with which firms need to comply both in domestic markets and during their overseas venturing (Peng et al., 2008; Ramamurti & Hillemann, 2018; Wan & Hoskisson, 2003; Wei & Nguyen, 2017). Government influences can turn into advantages or disadvantages for EMNEs’ internationalization by making their FDI more intertwined with their home country’s political considerations (Rugman et al., 2014; Stoian & Mohr, 2016). These influences, as reflected by the quality of the home government, help EMNEs develop FSAs and heavily shape their propensity for taking risks overseas (Hennart, 2012). From a changing aspect, the transformation of the home government and changes incurred in institutional conditions exercise EMNEs’ uncertainty management capability and their ability to internationalize (Cuervo-Cazurra et al., 2018; Wei & Nguyen, 2017). Hence examining home-government influences through static and changing aspects provides considerable explanatory power on the complexity of the I-P relationship of EMNEs.

3.1 Home-Government Quality and EMNEs’ Internationalization

Home-country government quality captures the perceived effectiveness of the government’s formulation and implementation of sound policies, protection of property rights, and distribution of resources, which also represent the credibility of the government’s commitment to implementing policies (Kim et al., 2010; Wan & Hoskisson, 2003). In the IB field, it is well-established that home-country government quality affects EMNEs’ internationalization in manifold ways. One stream of research attributes the rapid expansion of EMNEs to country-specific advantages brought by the government, arguing that sufficient government support is the key to facilitating these global latecomers to compete and build world-class technologies (Rugman et al., 2014; Wan & Hoskisson, 2003; Wu et al., 2021). Another research stream presents an institutional escape view, arguing that EMNEs internationalize to escape from home-country regulatory and institutional voids, such as poor intellectual property rights protection, lack of market intermediaries, and inefficient legal systems (Marano et al., 2017; Stoian & Mohr, 2016; Witt & Lewin, 2007). This stream of work also holds that dysfunctional government and uncertain institutional environments in emerging countries determine EMNEs’ liability of origin in venturing abroad (Cuervo-Cazurra et al., 2018; Stoian & Mohr, 2016). Although approaching the issue from different angles, these research streams share common ground in EMNE research – the quality of home-country government is salient for EMNEs.

We argue that a high-quality government moderates the I-P relationship of EMNEs through reducing liability of country of origin and supporting their FSAs development. First, the healthy supply of regulations by high-quality government enables EMNEs to enjoy the benefits of efficient market transaction mechanisms and fair competition, thereby increasing their willingness to participate in global competition (Wan & Hoskisson, 2003; Wei & Nguyen, 2017). In this aspect, firms can avoid the misalignment of goals with their home-country government and become more likely to gain access to those complementary resources that are essential for improving competitiveness (Rugman et al., 2014). Second, since well-established factor markets and effective protection of intellectual property rights reduce the firms’ pressure in dealing with home-country institutional uncertainties, EMNEs can constantly invest more in FSAs development (i.e., technology, managerial expertise, and global brands). Consequently, EMNEs can explore their true potential in international competition (Cuervo-Cazurra et al., 2018; Hennart, 2012; Wei & Nguyen, 2017). Third, the credibility of the home-country government helps EMNEs reduce the liability of origin by improving their global image, which facilitates their foreign market embeddedness and implies improvement of the I-P relationship (Wei & Nguyen, 2017). Based on the above, we hypothesize:

Hypothesis 1: Home-country government quality is positively associated with the internationalization-performance relationship of EMNEs.

3.2 Home-Government Transformability and EMNEs’ Internationalization

Government transformability is defined as the government’s “capacity to create a fundamentally new system when ecological, economic, or social (including political) conditions make the existing system untenable” (Walker et al., 2004, p. 3). It consists of complex policies, rules and regulations and changes that constitute the home-country institutional framework (Kim et al., 2010). Drawing on the institutional-based perspective, government transformability is more adaptability-driven compared with government quality, which is more efficiency-driven, because it captures the speed of institutional changes (Peng et al., 2008; Wan & Hoskisson, 2003). While home-country government quality moderates the I-P relationship through affecting EMNEs’ FSAs development, government transformability mainly influences EMNEs’ capability in managing uncertainty in foreign country operations (Aulakh & Kotabe, 2008; Wan & Hoskisson, 2003). First, extant EMNE research has a lively discussion around why EMNEs can develop better uncertainty management capability in internationalization compared with their advanced-market counterparts (Wei & Nguyen, 2017). Scholars argue that government transformation in the home country forces EMNEs to respond to institutional changes by actively acquiring market information, diversifying risks in operations, and preparing for changeable decisions (Cuervo-Cazurra et al., 2018). EMNEs gradually become more resilient and proficient at managing abrupt institutional changes (Cuervo-Cazurra et al., 2018).

Second, when the home-country government adopts an open mindset in transforming existing institutional settings for better national development, it further encourages EMNEs to actively learn new knowledge and change their traditional business routines for global competition (Wan & Hoskisson, 2003). In times of a government’s rapid transformation, EMNEs are more likely to gain institutional support for pursuing high outbound international diversification or for taking risk to operate in favourable business locations (Wan & Hoskisson, 2003). In this regard, government transformability fosters the EMNEs’ FSAs exploration and leads them to embrace a long-term view in order to prepare for abrupt changes in foreign countries (Cuervo-Cazurra et al., 2018; Wan & Hoskisson, 2003). Over time, EMNEs become capable of reconfiguring resources for market adaptation (Aulakh & Kotabe, 2008).

Third, high government transformability implies that governments are not rigid and inflexible, but willing to get access to a broader range of knowledge sources and become more connected with global networks (Li et al., 2018). The changes of home-country government then offer EMNEs networking advantages and enable them to reduce the liability of foreignness in host countries. Taking these together, we hypothesize:

Hypothesis 2: Home-country government transformability is positively associated with the internationalization-performance relationship of EMNEs.

3.3 The Moderating Effects of Nationalism

The resurgence of nationalism in recent decades has received comparatively less attention from IB researchers, despite its pronounced impacts on the involvement of politics in firms’ internationalization (Arikan & Shenkar, 2021; Contractor, 2021; Zhang & He, 2014). In line with the institutional-based perspective, nationalism, as a belief in national superiority and hostile attitudes to outgroups (i.e., other nations), exerts profound and enduring impacts on EMNEs (Balabanis et al., 2001; Kosterman & Feshbach, 1989). This is because researchers find that the relative backwardness of economic, sociocultural and political development in emerging markets is more likely to lead to nationalistic behaviours of firms (Balabanis et al., 2001; Druckman, 1994; Johnston, 2017). For example, Balabanis et al. (2001) suggest that nationalism is a political and economic phenomenon that affects the degree to which individuals are “motivated to help their country” (pp. 159–160). Zhang and He (2014) also argue that individuals’ sense of nationalism is linked with their home country’s need to upgrade economic and institutional infrastructure in order to advance national competitiveness (p. 214).

Moreover, many emerging countries have higher levels of collectivism and power distance compared to developed countries such as Chile, China, Indonesia, South Korea, and Thailand (Hofstede, 2001). Hence researchers suggest that firms from emerging countries are more willing to fight for their countries, as they are more likely to feel obligated to protect their national interests and care about social welfare (Bobowik et al., 2014). In addition, the impacts of nationalism on EMNEs are evident in their expansion path and catch-up momentum (Zhang & He, 2014). Previous studies show that nationalistic firms often act in an aggressive manner to show their loyalty and normative commitment to their home countries (Druckman, 1994; Johnston, 2017). In the IB field, EMNEs often embrace aggressive postures in international expansion (Luo & Tung, 2007; Shirodkar & Shete, 2022). In order to enhance competitiveness, these global market latecomers tend not to follow the traditional incremental expansion path but adopt a springboard approach to aggressively acquiring foreign assets (Luo & Tung, 2007; Wei & Nguyen, 2020). Hence the unique home-country-bounded nature and competitive attitudes of EMNEs imply the importance of considering the impact of nationalism on their international operations.

We argue that a sense of nationalism undermines the positive effects of government quality on the I-P relationship. In the literature, nationalism is considered an important factor affecting the links between government policies and firm actions (Druckman, 1994). From the benefit-taking perspective, nationalism shifts EMNEs’ attention toward the set of government policies in promoting OFDI, which can mitigate the FSAs development benefits provided by a high-quality government. EMNEs, under the influence of nationalism, tend to perceive that part of their internationalization duty is to protect the domestic market and enhance home-country development (Balabanis et al., 2001). Rather than using government-supported resources to cooperate with host-country stakeholders, nationalism guides EMNEs to pursue national interest and security in their foreign operations (Balabanis et al., 2001; Bonikowski & DiMaggio, 2016). The “my country first” and “willing to fight” nationalist approaches further hinder EMNEs from leveraging preferential FDI policies to develop market-related capabilities and FSAs (Johnston, 2017; Morse & Shive, 2011). As a consequence, although high-quality government helps EMNEs eliminate their disadvantaged position by improving their global image, their nationalistic behaviours and self-protection attitude may reduce such advantages (Druckman, 1994).

From the cost-reduction perspective, the sense of national pride and hostility toward foreign outsiders shapes firms’ perceptions of the content and meaning of governments’ FDI-supporting policies, which induces firms to adopt practices that are not consistent with previous ones (Geng et al., 2016; Reay & Hinings, 2009). Under nationalistic institutional settings, firms tend to adopt actions that commit to the home country’s economic, social and political status quo (Druckman, 1994). Their self-protection attitudes and commitment to their home country lead them to face greater liability of foreignness (LOF), which weakens government-created advantages in improving the I-P relationship. Although emerging market governments strive to provide resources and policy support to encourage EMNEs that are learning and embedding in foreign countries, nationalism changes the firms’ minds and forces them to navigate new routes in internationalization (Chen et al., 2021; Geng et al., 2016). Consequently, firms will face higher costs for FSAs exploitation and a deteriorating I-P relationship (Kaldor, 2004). One recent example may be the 2021 backlash by AMNEs such as Hennes & Mauritz (H&M) over Xinjiang cotton in China. Due to perceived negative influence on home-country national interest, Alibaba and other large e-commerce Chinese EMNEs withdrew their cooperation from the H&M clothing brand (Canales, 2021). Despite the Chinese government encouraging their firms to seek cooperation with global brands, nationalism has changed these firms’ attitudes toward global cooperation. Hence we observe that nationalism shapes the EMNEs’ behaviours and attitudes, thus moderating the impacts of home-government quality on the I-P relationship. Hence, we propose:

Hypothesis 3a: A sense of nationalism negatively moderates the effect of home-government quality on the internationalization-performance relationship of EMNEs.

We suggest that the uncertainty-managing advantages created by home-government transformability are reduced with a sense of nationalism. First, previous studies find that nationalism leads firms to become less strategic-focused (Balabanis et al., 2001; Kaldor, 2004). Although home-country governments actively change the institutional settings to offer their firms a broader range of options for venturing abroad, firms often embrace a stereotyped view in internationalization. The stereotypes generally consist of perceptions such as “You should support your country even when it is wrong” (Johnston, 2017, p. 28), or perceiving the host country as “a simple, single-minded aggressive enemy” (Druckman, 1994, p. 51). As a result, firms will make decisions without designing a comprehensive strategic plan for that action (Druckman, 1994). Moreover, nationalism is regarded as “negative internationalism” in the literature; it strengthens firms’ exclusions of others and offers little empathy for other nations’ welfare (Balabanis et al., 2001, p. 162). In this vein, although government transformations encourage EMNEs to develop FSAs and integrate into the global network, nationalism makes them less likely to seek cooperation with firms from other nations. By changing the signals provided by government transformations, nationalism offers a new but confusing signal to EMNEs and adjusts their ways of decision-making in foreign countries. As a result, it weakens the advantages of government transformation in enhancing the I-P relationship.

Second, nationalism changes EMNEs’ motivation for learning to manage uncertainties in foreign markets. Through a set of institutional transformations, a home government directs EMNEs toward learning, adapting and exploring new opportunities for long-term development (Cuervo-Cazurra et al., 2018; Wan & Hoskisson, 2003). Yet, when EMNEs embrace an exaggerated national self-image, they are likely to fall into a ‘success trap’: they perceive their home country as superior to host countries, and thus become less likely to adjust themselves to fit into and learn from the new environment (Johnston, 2017; Kaldor, 2004). With a sensitivity to the needs of others, they tend to adopt aggressive actions to take advantage of the target country rather than being a humble learner or long-term partner (Druckman, 1994). Consequently, the government’s transformation efforts in enhancing their firms’ ability to deal with uncertainties and enhance performance in internationalization will be in vain. In addition, even though their home-country governments strive to transform themselves to become more connected with global networks, the dominance of nationalism makes firms less likely to follow the pace of their government (Li et al., 2018). As a result, EMNEs’ capabilities developed for FSAs exploitation in response to home-government transformations may no longer function in the host country (Johnston, 2017; Kaldor, 2004). We thus hypothesize:

Hypothesis 3b: A sense of nationalism negatively moderates the effect of home-government transformability on the internationalization-performance relationship of EMNEs.

4 Meta-Analysis

4.1 Research Design

Our empirical context is those MNEs that originated from countries identified as emerging countries by the International Monetary Fund (IMF), the Market Potential Index (MPI), and BBVA Research (Zhou et al., 2016). To synthesize existing findings on the internationalization-performance of EMNEs, we adopted a meta-analysis method and followed established guidelines (Hunter & Schmidt, 2004). Compared with individual studies that often lack statistical power to strengthen their arguments due to inevitable sampling errors, meta-analysis as a statistical research synthesis method enables the aggregation of results across independent studies while correcting for a variety of statistical artefacts (Hunter & Schmidt, 2004; King et al., 2004). By using a meta-analysis, we can provide extensive summaries of previous findings and push forward the boundaries of current research by testing the impacts of home-country government and their sense of nationalism (Rothstein et al., 2006). It is also noteworthy that meta-analysis is becoming a widely recognized research method and is gaining more acceptance in various research fields, because it helps scholars obtain a more in-depth assessment of relationships between different variables (Bachrach et al., 2019; Cao et al., 2018; Ding et al., 2021).

To identify relevant studies on the I-P relationship of EMNEs, we searched for studies by using the Web of Science, EBSCO Business Source Complete, ProQuest, and Google Scholar (Miao et al., 2017; Wenke et al., 2020). We designed two keyword strings by following existing studies (Kirca et al., 2012; Marano et al., 2016, p. 1): the first-order string is “internationalisation OR internationalization OR globalisation OR globalization OR cross-nation* OR cross-border* OR International* OR multination* OR transnation*)”, AND 2) the second-order string is “firm* OR compan* OR business* OR corporat* OR enterprise* OR commerc* OR trad* OR investment*”. We also conducted targeted research from leading journals in the management and IB fields, such as Academy of Management Journal (AMJ), Journal of International Business Studies (JIBS), Strategic Management Journal (SMJ), Journal of World Business (JWB), Journal of Business Research (JBR), Management International Review (MIR), International Business Review (IBR), Asia Pacific Journal of Management (APJM), Journal of International Management (JIM), and Global Strategy Journal (GSJ), among others. After gathering the initial set of articles, we manually searched the reference lists of previous literature reviews and meta-analyses to avoid missing relevant articles (Bausch & Krist, 2007; Ding et al., 2021; Miao et al., 2017; Tang & Gudergan, 2018).

We used three inclusion and exclusion criteria to determine the final sample (Miao et al., 2017). First, we excluded studies that analysed the I-P relationship by focusing on those home countries that are not listed as Emerging Economies (King et al., 2004). Those primary studies that used multiple emerging markets data and did not use different panels to separate firms from different emerging markets for analysis were also excluded. Second, following existing studies, we excluded articles that targeted born-global firms, exporting small- and medium-sized enterprises (SMEs), and the international activities by top management teams (TMT) (De Clercq et al., 2012; Nguyen, 2017; Rodriguez-Ruiz et al., 2019; Rugman et al., 2016). Third, those studies that used purely qualitative studies or were quantitative but have not reported statistical description, correlations of variables and sample size were excluded (Wenke et al., 2020). In sum, our systematic review processes yielded 186 published articles with 218 samples from 1998 to 2021 (September). Details of the systematic review procedure are shown in Fig. 1.

4.2 Coding and Measures

To code the collected sample studies, we used a random sampling method to select 30 sample studies and, based on the selected sample, we designed a protocol to extract data from the studies. Because meta-analysis does not allow us to test the causal relationship between internationalization and performance, we checked the research design and variable measurements in each study to mitigate reverse causality concerns (Hunter & Schmidt, 2004). The dependent variable is the effect size of the relationship between internationalization and firm performance, which was calculated following Hunter and Schmidt (2004) by using Pearson’s correlation between the two variables reported in the primary studies.

Explanatory variables: We used multi-items to construct the three home-country institutional variables and adopted confirmatory factor analysis to test construct validity. Home-country government quality was operationalized using four items from the World Economic Forum (WEF) and Global Competitiveness Index (GCI) following existing studies; this measures individuals’ perception of government’s effectiveness, credibility, stability and taxation incentives (Dikova & Van Witteloostuijn, 2007; Fogel, 2006; Fullerton, 1982). The construct validity and reliability were ensured (Cronbach’s alpha = 0.856, AVE = 0.717, CR = 0.906). Home-government transformability was measured using three items extracted from the Bertelsmann Transformation Index (BTI), which indicates the government’s creativity, flexibility and adaptability (Pavitt & Walker, 1976; Witt & Lewin, 2007; Young et al., 2018). Confirmatory factor analysis shows that the validity and reliability of this construct were established (Cronbach’s alpha = 0.901, AVE = 0.883, CR = 0.958). Following previous studies in measuring “nationalism”, we collected data from the World Values Survey (WVS) and used four items to construct generalized nationalism. These items indicate whether individuals are willing to fight for their country (Ariely, 2012), whether they feel pride in their nation’s institutions (Bobowik et al., 2014; Huddy & Khatib, 2007), and their perceived importance of national politics (Bonikowski, 2016). The construct validity and reliability were satisfactory (Cronbach’s alpha 0.849, AVE = 0.585, CR = 0.916) (see Appendix 2). The correlation between these dimensions shows a significant positive relationship (see Appendix 3).

Study-level coding: Following existing literature, we coded internationalization into three subgroups: depth of internationalization, breadth of internationalization, and duration of internationalization (Abdi & Aulakh, 2018; Nguyen, 2017). Depth of internationalization refers to those retrieved studies using standardizable indicators such as foreign sales to total sales, foreign assets to total assets, or foreign employees to total employees to measure internationalization (Nguyen, 2017). Studies that focused on the geographical dispersion of EMNEs and the count number of host countries were grouped in the breadth of internationalization (Nguyen, 2017). For those using time-based measures such as the number of years since the EMNE has entered the foreign market, we coded them in the duration of internationalization subgroup (Abdi & Aulakh, 2018). We clarified firm performance into four groups following existing systematic reviews (Bausch & Krist, 2007; Ding et al., 2021; Nguyen, 2017). Financial performance refers to accounting-based measures such as return on assets (ROA), return on equity (ROE), and return on sales (ROS) (Nguyen, 2017). Innovation performance includes measures such as total number of patents or patent citations, number of new products, new product sales, and other innovation-related variables (Ding et al., 2021; Fu et al., 2018). Growth-orientated performance includes measures such as sales growth, increase in market share, or productivity growth (Hu et al., 2019). Composite measures comprise those using a combination of the categories above or multiple items to capture managers’ perceptions of firm performance (Trąpczyński & Banalieva, 2016).

We also included a set of study-level variables to control for sample heterogeneity. Compared with large and old EMNEs, SMEs and young ventures generally face deficiencies in resources and capabilities (Lu & Beamish, 2001). We followed the definitions of SMEs provided by the Small Business Administration (SBA) and Internal Revenue Service (IRS)Footnote 1 to code the collected studies, based on their reported statisticsFootnote 2 of firm size (1 = SMEs, 0 otherwise) (Lu & Beamish, 2001) and reported average firm age (1 = above 15, 0 otherwise) (Fan et al., 2021). Compared with export, franchising and other non-equity modes, a higher degree of foreign controls exposes EMNEs to greater environmental risks in host countries (Tseng & Lee, 2010). We thus controlled entry modes based on whether the entry involved equity controls over foreign operations: 1 equals equity modes such as wholly-owned subsidiary (WOS), mergers and acquisitions (M&As), or shared control joint ventures (JVs) (Tseng & Lee, 2010). Publicly listed firms often have better access to financing sources; we coded firm status as 1 if studies focused on listed firms, and 0 otherwise (Shi et al., 2012). We coded state ownership based on the statistics reported in retrieved studies, as state-owned firms are more likely to achieve home-government support (Fan et al., 2021; Wei & Nguyen, 2017). We also coded those studies that controlled R&D expense into a subgroup because firms’ knowledge-based FSAs and intangibility affects their international strategies and performance (Nguyen, 2017). Moreover, target country environments affect EMNEs’ capability to deploy and exploit FSAs (Nguyen, 2017). Since most of the studies included in our sample pool did not clarify the target countries of EMNEs, we used three subgroups to distinguish target-country heterogeneity, including targeting developing countries (e.g., Yayla et al., 2018), targeting developed countries (e.g., Holtbrügge & Berning, 2018), and others that have not mentioned specific target countries (e.g., Nicholson & Salaber, 2013).

Country-level controls: At the country level, we controlled cultural influences by using home country power distance and individualism collected from Hofstede Insights (Smith & Hume, 2005). Previous research suggests that the two cultural dimensions significantly affect EMNEs’ international behaviours and decisions – power distance affects their tolerance of power inequities and individualism measures the relative importance of firms’ own views and the societal members’ welfare (Smith & Hume, 2005). Trade openness was controlled using export intensity, since this reflects the home country’s openness to trade and the likelihood of OFDI of EMNEs (Ozturk et al., 2021). The intensity of local market competition and labour market characteristics affects the EMNEs’ propensity to internationalize; hence we controlled market concentration and labour market flexibility using data collected from GCI (Dikova & Van Witteloostuijn, 2007). Quality of education is an important social-economic development indicator to reflect the prevalence of emphasis on R&D and knowledge-based assets; hence we collected data from GCI and controlled the quality of the education system in the home country (Fogel, 2006).

4.3 Meta-Analysis Procedures

We conducted a meta-analysis to examine the I-P relationship of EMNEs, following the Hedges and Olkin–type meta-analytic procedure to test the heterogeneity of the relationship. We used the three-level hierarchical linear modeling (HLM) method to test the influences of home-country government and the moderating effects of nationalism on the relationship, because retrieved studies are nested within different emerging economies (Rabl et al., 2014). The three-level HLM model is set as follows:

Level 1 model:

Level 2 model:

Level 3 model:

Level 1 of the model focuses on firms and establishments, Level 2 is based on the grouping of studies, and Level 3 is based on country-level variables (Fischer & Mansell, 2009). \({ES}_{ijk}\) is the Fisher’s effect size, \({\sigma }_{ijk}^{2}\) is the sampling variance of Level 1 (firm level). \({U}_{0jk}\) is the sampling variance of Level 2 (study level) and \({V}_{0ik}\) is the sampling variance of Level 3 (country level). \({\gamma }_{1}\) is the regression coefficient of Level 3 and \({\delta }_{00k}\) is the intercept of Level 2. We use the full maximum-likelihood estimation method to conduct the analysis and all the variables are added in the model as grand-mean centered (Fischer & Mansell, 2009; Rabl et al., 2014). We chose the random-effect analysis technique in our meta-analysis, because internationalization strategies and paths differ across emerging markets, and the sample studies have highly heterogeneous effect sizes (Rabl et al., 2014).

5 Results

Tables 1 and 2 offer the meta-analysis results of the I-P relationship based on study-level subgroups (Table 1) and emerging economies/regions subgroups (Table 2). In Table 1, both the unweighted mean effect size (\({Z}^{a}\)= 0.077) and weighted mean effect size (\({Z}^{b}\)= 0.017) are positive, indicating an overall positive I-P relationship. The weighted effect size of the breadth of internationalization \(({Z}^{a}\)= 0.115, \({Z}^{b}\)= 0.104) is larger than depth and duration measures \(({Z}^{a}\)= 0.054, \({Z}^{b}\)= 0.007), suggesting that studies examining the I-P relationship through the number of foreign countries will find a better performance of EMNEs. In performance subgroups, the effect size of internationalization-innovation performance (\({Z}^{a}\)= 0.124, \({Z}^{b}\)= 0.149) is larger than internationalization-financial performance (\({Z}^{a}\)= 0.035, \({Z}^{b}\)= 0.002), indicating that EMNEs generally gain more learning benefits than financial profits in foreign countries. Interestingly, although only a few studies present specific target countries (K = 25), we find that those studies targeted at developed countries have slightly larger unweighted and weighted mean effect sizes (\({Z}^{a}\)= 0.063, \({Z}^{b}\)= 0.068), compared with those targeted at developing countries (\({Z}^{a}\)= 0.024, \({Z}^{b}\)= 0.059). This finding lent supports to previous EMNE research that suggests latecomers can access strategic assets and earn more benefits when they enter advanced markets (Luo & Tung, 2007; Tang & Gudergan, 2018).

The percentage of variance due to artefacts caused by between-studies variability (I2) is greater than 75%, showing a high heterogeneity among all the sample subgroups. In the heterogeneity test, the Q statistic (\({\mathcal{X}}^{2}\)= 4311.58) showed a significant level of 99%, indicating that the effect size of the full sample is heterogeneous. The Q values of the heterogeneity test are all significant in all subgroups except entry modes, which shows that the grouping method is valid based on the sample statistics and the I-P relationship is less heterogeneous between equity modes and other entry modes (Hunter & Schmidt, 2004).

Table 2 shows the meta-analysis by countries and regions with K > = 2. Except for Indonesia (\({Z}^{a}\)= −0.074, \({Z}^{b}\)= −0.026), Iran (\({Z}^{a}\)= −0.272, \({Z}^{b}\)= −0.272) and Mexico (\({Z}^{a}\)= −0.023, \({Z}^{b}\)= −0.016), the mean weighted effect sizes of other economies are all positive. The most research samples are Chinese EMNEs (K = 112, N = 147,065), with a mean weighted effect size of 0.070 and a mean unweighted effect size of 0.024. The 95% confidence intervals (CIs) include zero, which means no statistically significant difference between these subgroups (Rabl et al., 2014). It is observed that most of the country-level subgroups are statistically significant, except for Colombia (CIs = −0.053/0.163), Hong Kong (CIs = −0.070/0.117), Indonesia (CIs = −0.060/0.009), South Korea (CIs = −0.005/0.040), Mexico (CIs = −0.093/0.062), Russia (CIs = −0.019/0.050), Turkey (CIs = −0.012/0.136), and Vietnam (CIs = −0.003/0.003). A large number of studies focus on the Confucian Asia region (K = 156, N = 178,612) and find positive effect sizes (\({Z}^{a}\)= 0.069; \({Z}^{b}\)= 0.042). The largest effect size across different regions is in South America (\({Z}^{a}\)= 0.490; \({Z}^{b}\)= 0.132), followed by Africa and Middle East (\({Z}^{a}\)= 0.153; \({Z}^{b}\)= 0.104), and Latin America (\({Z}^{a}\)= 0.016; \({Z}^{b}\)= 0.009). The Q statistics show that the heterogeneity of groupings of some countries and in Latin America is not significant, which may be attributed to the small number of sample studies in these countries (Rabl et al., 2014).

Table 3 shows the results of hypothesis testing using three-level HLM in meta-analysis. The variance inflation factor (VIF) values of the variables in all models and the mean VIF (2.15) are below the threshold value 5, indicating that multicollinearity is not a concern in this study (Kalnins, 2018). Home-country government quality exerts significant positive impacts on the I-P relationship of EMNEs (β = 0.093, p = 0.004), indicating that, as government quality improves by 1 SD, the I-P relationship enhance approximately 0.093. This confirms that high-quality home governments can promote the internationalization of EMNEs through developing sound business regulations and policies, which also help firms reduce transaction costs and enhance their competitiveness in international activities (Marano et al., 2016). Table 3 shows that increasing government transformability can lead to a better I-P relationship (β = 0.057, p = 0.047). That is, home government with high creativity, flexibility and adaptability promotes and supports EMNEs’ foreign market exploration and exploitation activities, leading to positive performance outcomes (Lu et al., 2014; Young et al., 2018). Thus hypothesis 1 and hypothesis 2 are supported.

In testing the moderating effect of nationalism, we find that the coefficient of the interaction term of government quality and generalized nationalism is negative and marginally significant (β = −0.063, p = 0.078). That is, as EMNEs’ generalized nationalism increases by 1 SD, the impacts of government quality on EMNEs’ performance will decrease by 0.063. Similarly, the interaction of government transformability and generalized nationalism exerts significantly negative impacts on the I-P relationship (β = −0.090, p = 0.013). If the generalized nationalism increases by 1 SD, the impact of government transformability on EMNEs’ internationalization performance will decrease by 0.090. Thus hypotheses 3a and 3b, which propose that the sense of nationalism negatively moderates the effects of home-country government influences on the I-P relationship of EMNEs, are supported.

We conducted a set of additional tests to check the non-publication bias and robustness of our findings. First, we adopted the “trim-and-fill”, cumulative meta-analysis, fail-safe N (FSN) to test the non-publication bias following previous studies (Cao et al., 2018; Hunter & Schmidt, 2004). Results of the tests show that our results are not susceptible to non-publication bias. There are no imputed missing studies found in the trim-and-fill test, and the funnel plot’s symmetry in Appendix 4 shows that publication bias is not a concern (Cao et al., 2018). Second, we adopted Harman’s single-factor test to re-examine the moderating effects of home-country government quality and transformability on the I-P relationship (Harman, 1967). Results in Table 4 show the same direction of regression coefficient as that in our main tests. Third, although we did not include studies focusing on born-global firms in our meta-analysis, some instant exporters and firms that overly focused on domestic markets might not be regarded as EMNEs (Rodríguez-Ruiz et al., 2019; Rugman et al., 2016). We thus revised the sampling approaches and removed those studies that claimed firms as EMNEs but merely reported the firms’ export activities (N = 20). We re-tested our hypotheses using this subsample and found that the results remain unchanged (see Table 4). Detailed results are shown in Appendix 5.

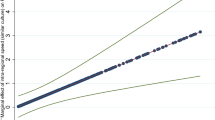

Fourth, we estimated home-country influences using the traditional meta-regression approach and present the bubble plots in Fig. 2. The impacts of government quality, transformability, and the moderating effects of nationalism on the I-P relationship remain the same as our main tests. Therefore, our findings are robust to the consideration of non-publication bias, different samples, alternative variables, and different empirical approaches.

6 Discussion and Implications

Although the relationship between internationalization and performance of EMNEs has received increasing attention from IB researchers in the past two decades, findings are mixed and inconclusive (Holtbrügge & Berning, 2018; Liu et al., 2011; Wei & Nguyen, 2020). This study aims to provide a more comprehensive view of the relationship by analysing existing primary studies through a meta-analysis. Given the home country-bounded nature of EMNEs compared with that of AMNEs, we propose that the role of home-country institutions should be adequately considered in the EMNE context (Luo & Tung, 2007; Wei & Nguyen, 2017). Drawing on an institutional-based perspective, this study navigates the variations of the I-P relationship by taking into account the influences of home-government quality and transformability and rising nationalism in changing EMNEs’ outward motives. Our findings generate novel insights into the literature, present fruitful managerial implications, and open up a broad range of future research avenues.

6.1 Theoretical Implications

This study extends the current literature in three ways. First, it focuses on the EMNE context and provides a clearer picture of the mixed findings on the I-P relationship of EMNEs. Although IB researchers have systematically reviewed the I-P relationship, arguments drawn from examinations of MNEs cannot explain the relationship of EMNEs (Hennart, 2012; Luo & Tung, 2007). In this study, we explain the unique home-bounded nature and latecomer characteristics of EMNEs and highlight the need to distinguish EMNEs and AMNEs in I-P relationship research. Through a meta-analysis, we consolidate available evidence on one of the most researched questions in the IB field with as-yet inconclusive findings (Lindner et al., 2018). Our findings generate strong quantitative conclusions based on the results of the I-P relationship provided in primary studies. We also disentangled the key determinants of the I-P relationship of EMNEs, such as firm characteristics, research settings, and home-country heterogeneity. We argue that research in this field should go beyond estimating the magnitude and sign of the relationship to focus more on investigating underlying factors at the managerial-, firm-, industry- and country-level that affect the relationship (Lindner et al., 2018; Oesterle & Wolf, 2011). Our study also responds to calls for using the meta-analytical approach to resolve inconsistent arguments in the IB field (Lindner et al., 2018).

Second, we identify that one central component of EMNE research lies in discussion of home-country institutional influence (Cuervo-Cazurra et al., 2018; Stoian & Mohr, 2016; Wei & Nguyen, 2020). Studies suggest that EMNEs are more embedded in home-country contexts and their FSAs are built upon the support or intervention by home-country government compared with AMNEs (Rugman et al., 2014; Wei & Nguyen, 2017). Embracing this insight, we integrate the institutional-based perspective to explain the I-P relationship of EMNEs. We systematically identify two complementary aspects of home-government features: government quality from a static aspect and government transformability from a changing aspect. In this vein, we extend the application of the institutional-based perspective in IB research by adding a holistic view of the role of home-country government in investigating the I-P relationship of EMNEs. We suggest that home-government quality moderates the relationship through affecting EMNEs’ FSAs development, while home-government transformability influences EMNEs’ uncertainty-managing capability in foreign markets. Our findings not only reaffirm the previous arguments of the impacts of government quality on EMNEs’ internationalization but also shed light on the influence of the other side of the coin. That is, the transformability of home governments also plays a role in shaping the I-P relationship of EMNEs. Hence the multifaceted roles of the home government are revealed, which to an extent enriches the institutional-based perspective.

Third, although the past two decades have witnessed the rise of nationalism, its impact on EMNEs has received surprisingly limited attention (Arikan & Shenkar, 2021; Contractor, 2021). This study fills the research gap and enriches the institutional-based perspective by integrating nationalism as an important home-country institutional factor affecting EMNEs. We suggest that EMNEs’ outward motives are shaped by the nationalism sentiment, given these firms are more rooted in their home countries (Balabanis et al., 2001; Druckman, 1994; Johnston, 2017). In addition, the long-standing collectivist culture in many emerging countries leads to their firms being more committed to fulfilling the national economic, sociocultural, and political goals in internationalization (Bobowik et al., 2014; Druckman, 1994; Hofstede, 2001). Therefore, by providing new signals to guide firms toward adopting new practices, nationalism moderates the government’s impacts on the I-P relationship (Balabanis et al., 2001). This study constructs a generalized nationalism variable and finds that nationalism negatively moderates the impacts of home-country government’s impacts on the I-P relationship. Our findings generate fresh insights into the EMNE literature and enrich the institutional-based perspective by adding a new aspect home-country institution (i.e., nationalism) into IB research. Moreover, we cater to the recent call for answering how heightened nationalism affects EMNEs (Arikan & Shenkar, 2021; Contractor, 2021; Zhang & He, 2014). Findings in this research also create challenges and opportunities for future research to test how national sentiments shape the international strategies of EMNEs, and MNEs in general.

6.2 Managerial Implications

Our study also has managerial implications for emerging market policy makers and corporate managers in charge of international business. The new evidence provided in this study suggests that not only does home-government quality affect EMNEs but also government transformability, which shapes EMNE internationalization and performance. Hence we suggest emerging country governments spend more effort improving institutional transparency, decision-making quality and policy sustainability (Wan & Hoskisson, 2003) in order to support their firms in developing FSAs and reducing liability of origin in foreign markets. Governments should also develop innovative and flexible political systems to connect with local society and global networks, thereby enabling their firms address uncertain management capability and embed in new institutional environments so as to reduce liability of foreignness (Li et al., 2018).

Our findings of the negative impacts of nationalism on EMNEs’ internationalization draw attention to the importance of managing political risk in internationalization (Zhang & He, 2014). We suggest that government officials build up more liberalized markets and minimize the impacts of nationalism in business. Decision-makers of EMNEs should avoid using excessive protective practices but rather adopt non-market strategies, such as corporate social responsibility actions, and enhance interactions with host-country stakeholders (Marano et al., 2016; Wu et al., 2021). They also need to adopt more flexible governance structures in order to adapt to changing policy initiatives (Luo & Tung, 2007). By doing so, firms can enhance their global legitimacy and alleviate the negative impacts of nationalism on their international expansions and performance.

6.3 Limitations and Future Research

We acknowledge this study is subject to several limitations, which also suggest future research directions. First, meta-analyses are inherently limited in indicating causality, unless primary studies provide clear statements on the causal relationship between variables and thereby allow making inferences (Bachrach et al., 2019; Jeong & Harrison, 2017). This is also a common limitation indicated by other meta-analyses (cf., Cao et al., 2018). To mitigate reverse causality concerns, we tested the reverse causality issue by using a two-sample t-test and the result was insignificant (t = 0.609, p = 0.543), indicating that reverse causality is not a concern. We suggest future studies pay attention to potential causality concerns and use lagged internationalization variables to test the I-P relationship.

Second, although studies that examine the I-P relationship of born-global firms and exporting SMEs are not included in this research, we find that some studies did not specify the degree of internationalization by EMNEs, such as the foreign sales ratio or the number of foreign subsidiaries. Hence the extent to which the sampled firms in some studies can be counted as EMNEs by following the two criteria (i.e., a ratio of foreign sales/total sales of 10%; minimum three foreign subsidiaries) is doubtful (Rugman et al., 2016; Wei & Nguyen, 2020). Future research should also clearly distinguish domestic and foreign market performance of EMNEs, thus enabling us to justify the marginal effects of internationalization performance (Nguyen, 2017).

Third, although we searched for articles relevant to internationalization of EMNEs with our best endeavours, we failed to include all studies, especially unpublished articles or important studies published in other major languages. In line with other meta-analyses (e.g., Cao et al., 2018; Fischer & Mansell, 2009; Jeong & Harrison, 2017; King et al., 2004), the number of articles included in our study can only be considered a large sample not the total population of studies on the I-P relationship of EMNEs. In addition, our study is also limited in dealing with substitute explanations and firm-level and country-level omitted variables. We cannot control the host country’s characteristics, as most of the primary studies did not specify the target countries of EMNEs. Without this information, we are unable to examine how the sense of nationalism in host countries, both in emerging or developed countries, affects the EMNEs. This limitation is also found in previous meta-analyses in MNE research (Bausch & Krist, 2007; Ding et al., 2021; Tang & Gudergan, 2018). Hence we suggest future studies on this topic specify target countries and conduct primary research to examine how home and host country nationalism affects EMNEs and AMNEs. Researchers can also consider within-EMNE differences in studying the relationship. For example, consideration of EMNEs’ marketing expenses or distinguishing EMNEs from different cultural/ideological clusters may detect significantly different degrees of I-P relationship (Wang et al., 2012).

Fourth, overlapping coding is a common limitation of the meta-analytic approach (Jeong & Harrison, 2017). At study level, some studies in our sample adopted surveys or interviews to measure EMNEs’ overall performance, which may simultaneously cover a firm’s financial performance, innovation or/and other performance. To completely eliminate possible overlaps in coding, future meta-analytical research on this topic should have a more comprehensive variable coding method – for example, by contacting the authors of the collected studies and inviting them to explain how they measured the variables used, so that sample studies can be coded into more specific subgroups. Our study is also limited in further exploring linear and curvilinear relationships, although these may exist. Because most primary studies did not report the correlation between the square (or cube) term of internationalization and performance, we can only assess the effect size of the relationship. Hence we encourage future studies to test different types of curvilinear relationships using a comprehensive EMNE dataset and diversified analytical methods.

7 Conclusion

Despite the widespread attention to the rise of EMNEs, the relationship between internationalization and performance remains an under-addressed issue. This study adopts a meta-analysis to fill the research gaps and provide fresh insights into the EMNE literature. Based on a large body of available evidence, we find that overall internationalization benefits EMNEs, and the existence of this positive relationship is contingent upon firms’ home-country government and their sense of nationalism. Our research explicates the home-country-bounded nature of EMNEs and adds value to the institutional-based perspective by identifying the diverse home-country government features and considering the influence of nationalism. We hope that the novel findings in this study provide a stepping stone for future research in this topic.

Notes

The SBA defines SMEs based on the number of employees: firms with fewer than 500 employees are regarded as SMEs; The IRS classifies SMEs based on the total assets: firms with total assets of $10 million or less are SMEs.

For sample studies that reported logarithm transformed values of firm size or age, we back-transformed the value before coding.

References

Abdi, M., & Aulakh, P. S. (2018). Internationalization and performance: Degree, duration, and scale of operations. Journal of International Business Studies, 49(7), 832–857.

Ariely, G. (2012). Globalisation and the decline of national identity? An exploration across sixty-three countries. Nations and Nationalism, 18(3), 461–482.

Arikan, I., & Shenkar, O. (2021). Neglected elements: What we should cover more of in international business research. Journal of International Business Studies. (Online first). https://doi.org/10.1057/s41267-021-00472-9

Aulakh, P. S., & Kotabe, M. (2008). Institutional changes and organizational transformation in developing economies. Journal of International Management, 14(3), 209–216.

Bachrach, D., Lewis, K., Kim, Y., Patel, P., Campion, M., & Thatcher, S. (2019). Transactive memory systems in context: a meta-analytic examination of contextual factors in transactive memory systems development and team performance. Journal of Applied Psychology, 104(3), 464–493.

Balabanis, G., Diamantopoulos, A., Mueller, R. D., & Melewar, T. C. (2001). The impact of nationalism, patriotism and internationalism on consumer ethnocentric tendencies. Journal of International Business Studies, 32(1), 157–175.

Bausch, A., & Krist, M. (2007). The effect of context-related moderators on the internationalization-performance relationship: Evidence from meta-analysis. Management International Review, 47(3), 319–347.

Bobowik, M., Páez, D., Liu, J. H., Licata, L., Klein, O., & Basabe, N. (2014). Victorious justifications and criticism of defeated: Involvement of nations in world wars, social development, cultural values, social representations of war, and willingness to fight. International Journal of Intercultural Relations, 43, 60–73.

Bonikowski, B. (2016). Nationalism in settled times. Annual Review of Sociology, 42, 427–449.

Bonikowski, B., & DiMaggio, P. (2016). Varieties of American popular nationalism. American Sociological Review, 81(5), 949–980.

Brache, J., & Felzensztein, C. (2019). Exporting firm’s engagement with trade associations: Insights from Chile. International Business Review, 28(1), 25–35.

Buckley, P. J. (2018). Internalisation theory and outward direct investment by emerging market multinationals. Management International Review, 58(2), 195–224.

Canales, K. (2021). H&M was wiped from the internet in China, sending a chilling warning to other retailers. Business Insider. Retrieved March 30, 2021, from https://www.businessinsider.com.au/hm-boycott-wipedfrom-internet-china-2021-3?r=US&IR=T

Cao, Z., Li, Y., Jayaram, J., Liu, Y., & Lumineau, F. (2018). A meta-analysis of the exchange hazards–interfirm governance relationship: An informal institutions perspective. Journal of International Business Studies, 49(3), 303–323.

Capar, N., Chinta, R., & Dikec, A. (2015). The relationship between internationalization and performance: The case of Turkish firms. Southern Business & Economic Journal, 38(2), 1–17.

Chen, H., & Hsu, C. W. (2010). Internationalization, resource allocation and firm performance. Industrial Marketing Management, 39(7), 1103–1110.

Chen, S., & Tan, H. (2012). Region effects in the internationalization–performance relationship in Chinese firms. Journal of World Business, 47(1), 73–80.

Chen, C. J., Huang, Y. F., & Lin, B. W. (2012). How firms innovate through R&D internationalization? An S-curve Hypothesis. Research Policy, 41(9), 1544–1554.

Chen, L., Li, Y., & Fan, D. (2021). Who are the most inclined to learn? Evidence from Chinese multinationals’ internationalization in the European Union. Asia Pacific Journal of Management, 38(1), 231–257.

Chiao, Y. C., Yang, K. P., & Yu, C. M. J. (2006). Performance, internationalization, and firm-specific advantages of SMEs in a newly-industrialized economy. Small Business Economics, 26(5), 475–492.

Chiao, Y. C., Yu, C. M. J., Li, P. Y., & Chen, Y. C. (2008). Subsidiary size, internationalization, product diversification, and performance in an emerging market. International Marketing Review, 25(6), 612–633. https://doi.org/10.1108/02651330810915556

Cieślik, J., Kaciak, E., & Thongpapanl, N. T. (2015). Effect of export experience and market scope strategy on export performance: Evidence from Poland. International Business Review, 24(5), 772–780.

Contractor, F. J. (2021). The world economy will need even more globalization in the post-pandemic 2021 decade. Journal of International Business Studies. (Online first). https://doi.org/10.1057/s41267-020-00394-y

Cuervo-Cazurra, A., Ciravegna, L., Melgarejo, M., & Lopez, L. (2018). Home country uncertainty and the internationalization-performance relationship: Building an uncertainty management capability. Journal of World Business, 53(2), 209–221.

Cui, L., & Xu, Y. (2019). Outward FDI and profitability of emerging economy firms: Diversifying from home resource dependence in early stage internationalization. Journal of World Business, 54(4), 372–386.

De Clercq, D., Sapienza, H. J., Yavuz, R. I., & Zhou, L. (2012). Learning and knowledge in early internationalization research: Past accomplishments and future directions. Journal of Business Venturing, 27(1), 143–165.

Demirbag, M., McGuinness, M., & Altay, H. (2010). Perceptions of institutional environment and entry mode. Management International Review, 50(2), 207–240.

Deng, P., & Zhang, S. (2018). Institutional quality and internationalization of emerging market firms: Focusing on Chinese SMEs. Journal of Business Research, 92, 279–289.

Dikova, D., & Van Witteloostuijn, A. (2007). Foreign direct investment mode choice: Entry and establishment modes in transition economies. Journal of International Business Studies, 38(6), 1013–1033.

Ding, S., McDonald, F., & Wei, Y. (2021). Is Internationalization Beneficial to Innovation? Evidence from a Meta-analysis. Management International Review, 61(4), 469–519.

Druckman, D. (1994). Nationalism, patriotism, and group loyalty: A social psychological perspective. Mershon International Studies Review, 38(Supplement_1), 43–68.

Du, J., Chang, X., & Wu, X. (2019). The strategic fit of international expansion between temporal and spatial dimensions: Evidence from Chinese MNEs. Emerging Markets Finance and Trade, 55(4), 743–758.

Fan, D., Wu, S., Su, Y., & Li, Y. (2021). Managing expatriates to achieve mutual benefits: An integrative model and analysis. Journal of International Management. (Online first). https://doi.org/10.1016/j.intman.2021.100882

Fischer, R., & Mansell, A. (2009). Commitment across cultures: A meta-analytical approach. Journal of International Business Studies, 40(8), 1339–1358.

Fogel, K. (2006). Oligarchic family control, social economic outcomes, and the quality of government. Journal of International Business Studies, 37(5), 603–622.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50.

Fu, X., Hou, J., & Liu, X. (2018). Unpacking the relationship between outward direct investment and innovation performance: Evidence from Chinese firms. World Development, 102, 111–123.

Fullerton, D. (1982). On the possibility of an inverse relationship between tax rates and government revenues. Journal of Public Economics, 19(1), 3–22.

Gaur, A. S., & Kumar, V. (2009). International diversification, business group affiliation and firm performance: Empirical evidence from India. British Journal of Management, 20(2), 172–186.

Gaur, A., & Delios, A. (2015). International diversification of emerging market firms: The role of ownership structure and group affiliation. Management International Review, 55(2), 235–253.

Geng, X., Yoshikawa, T., & Colpan, A. M. (2016). Leveraging foreign institutional logic in the adoption of stock option pay among Japanese firms. Strategic Management Journal, 37(7), 1472–1492.

Glaum, M., & Oesterle, M. J. (2007). 40 years of research on internationalization and firm performance: More questions than answers? Management International Review, 47(3), 307–317.

Gubbi, S. R., Aulakh, P. S., Ray, S., Sarkar, M. B., & Chittoor, R. (2010). Do international acquisitions by emerging-economy firms create shareholder value? The case of Indian firms. Journal of International Business Studies, 41(3), 397–418.

Guo, W., & Clougherty, J. A. (2020). Cross-border acquisition activity by Chinese multinationals and domestic-productivity upgrading. Asia Pacific Journal of Management (Online first). https://doi.org/10.1007/s10490-020-09742-w

Han, X., Liu, X., Xia, T., & Gao, L. (2018). Home-country government support, interstate relations and the subsidiary performance of emerging market multinational enterprises. Journal of Business Research, 93, 160–172.

Harman, H. H. (1967). Modern factor analysis. University of Chicago Press.

Hennart, J. F. (2012). Emerging market multinationals and the theory of the multinational enterprise. Global Strategy Journal, 2(3), 168–187.

Hofstede, G. (2001). Culture’s consequences: Comparing values, behaviors, institutions and organizations across nations (2nd ed.). Sage.

Holtbrügge, D., & Berning, S. C. (2018). Market entry strategies and performance of Chinese firms in Germany: The moderating effect of home government support. Management International Review, 58(1), 147–170.

Hsu, W. T., Chen, H. L., & Cheng, C. Y. (2013). Internationalization and firm performance of SMEs: The moderating effects of CEO attributes. Journal of World Business, 48(1), 1–12.

Hu, H. W., Cui, L., & Aulakh, P. S. (2019). State capitalism and performance persistence of business group-affiliated firms: A comparative study of China and India. Journal of International Business Studies, 50(2), 193–222. https://doi.org/10.1057/s41267-018-0165-5

Huang, Y., Xie, E., & Wu, Z. (2021). Portfolio characteristics of outward foreign direct investment and dynamic performance of emerging economy firms: An option portfolio perspective. International Business Review, 30(4), 101750. https://doi.org/10.1016/j.ibusrev.2020.101750

Huddy, L., & Khatib, N. (2007). American patriotism, national identity, and political involvement. American Journal of Political Science, 51(1), 63–77.

Hunter, J., & Schmidt, F. (2004). Methods of meta-analysis: Correcting error and bias in research findings (2nd ed.). Sage.

Jain, N. K., & Prakash, P. (2016). Multinationality and performance: The moderating influence of internationalization motives and resources. International Studies of Management & Organization, 46(1), 35–49.

Jeong, S. H., & Harrison, D. A. (2017). Glass breaking, strategy making, and value creating: Meta-analytic outcomes of women as CEOs and TMT members. Academy of Management Journal, 60(4), 1219–1252.

Johnson, J., Yin, E., & Tsai, H. (2009). Persistence and learning: Success factors of Taiwanese firms in international markets. Journal of International Marketing, 17(3), 39–54.

Johnston, A. I. (2017). Is Chinese Nationalism Rising? Evidence from Beijing. International Security, 41(3), 7–43.

Kale, P., & Singh, H. (2017). Management of overseas acquisitions by developing country multinationals and its performance implications: The Indian example. Thunderbird International Business Review, 59(2), 153–172.

Kaldor, M. (2004). Nationalism and globalisation. Nations and Nationalism, 10(1–2), 161–177.

Kalnins, A. (2018). Multicollinearity: How common factors cause Type 1 errors in multivariate regression. Strategic Management Journal, 39(8), 2362–2385.

Kim, H., Kim, H., & Hoskisson, R. E. (2010). Does market-oriented institutional change in an emerging economy make business-group-affiliated multinationals perform better? An institution-based view. Journal of International Business Studies, 41(7), 1141–1160.

Kim, H., Wu, J., Schuler, D. A., & Hoskisson, R. E. (2019). Chinese multinationals’ fast internationalization: Financial performance advantage in one region, disadvantage in another. Journal of International Business Studies, 51(7), 1076–1106.

King, D. R., Dalton, D. R., Daily, C. M., & Covin, J. G. (2004). Meta-analyses of post-acquisition performance: Indications of unidentified moderators. Strategic Management Journal, 25(2), 187–200.

Kirca, A. H., Roth, K., Hult, G. T. M., & Cavusgil, S. T. (2012). The role of context in the multinationality-performance relationship: A meta-analytic review. Global Strategy Journal, 2(2), 108–121.

Kosterman, R., & Feshbach, S. (1989). Toward a measure of patriotic and nationalistic attitudes. Political Psychology, 10, 257–274.

Kumar, V., & Singh, N. (2008). Internationalization and performance of Indian pharmaceutical firms. Thunderbird International Business Review, 50(5), 321–330.

Li, L., Liu, X., Yuan, D., & Yu, M. (2017). Does outward FDI generate higher productivity for emerging economy MNEs? – Micro-level evidence from Chinese manufacturing firms. International Business Review, 26(5), 839–854.

Li, J., Meyer, K. E., Zhang, H., & Ding, Y. (2018). Diplomatic and corporate networks: Bridges to foreign locations. Journal of International Business Studies, 49(6), 659–683.

Lindner, T., Klein, F., & Schmidt, S. (2018). The effect of internationalization on firm capital structure: A meta-analysis and exploration of institutional contingencies. International Business Review, 27(6), 1238–1249.

Liu, Y., Lin, W. T., & Cheng, K. Y. (2011). Family ownership and the international involvement of Taiwan’s high-technology firms: The moderating effect of high-discretion organizational slack. Management and Organization Review, 7(2), 201–222.

Lu, J. W., & Beamish, P. W. (2001). The internationalization and performance of SMEs. Strategic Management Journal, 22(6–7), 565–586.

Lu, J., Liu, X., Wright, M., & Filatotchev, I. (2014). International experience and FDI location choices of Chinese firms: The moderating effects of home country government support and host country institutions. Journal of International Business Studies, 45(4), 428–449.

Luo, Y., & Tung, R. L. (2007). International Expansion of Emerging Market Enterprises: A Springboard Perspective. Journal of International Business Studies, 38(4), 481–498.

Marano, V., Arregle, J. L., Hitt, M. A., Spadafora, E., & Van Essen, M. (2016). Home country institutions and the internationalization-performance relationship: A meta-analytic review. Journal of Management, 42(5), 1075–1110.

Marano, V., Tashman, P., & Kostova, T. (2017). Escaping the iron cage: Liabilities of origin and CSR reporting of emerging market multinational enterprises. Journal of International Business Studies, 48(3), 386–408.

Miao, C., Coombs, J. E., Qian, S., & Sirmon, D. G. (2017). The mediating role of entrepreneurial orientation: A meta-analysis of resource orchestration and cultural contingencies. Journal of Business Research, 77, 68–80.