Abstract

The ‘internet’—familiar shorthand for information and communication technologies (ICT)—is built on a physical infrastructure owned by a variety of state and private actors, foreign and domestic, with multiple interests. It has not only driven change on a global scale; its spread also had a profound impact on the social sciences. However, our understanding of how its architecture, and especially its owners, influence its political and economic impact is still in its infancy. This paper presents the Telecommunications Ownership and Control (TOSCO) dataset on ownership of internet service providers (ISPs) that allows to recognize the internet as strategically built and used by governments and corporations. Along with a thorough discussion of the conceptualization and operationalization of ownership as a variable, the TOSCO dataset enables comparative large-N analysis of the determinants and effects of varying ownership structures and identities in the transforming context of 49 African countries, 2000–2019. We demonstrate its usefulness with descriptive statistics and regression analyses using replication data from research on the internet’s democratizing and corruption-reducing effects. In allowing for a more realistic account, TOSCO supports scholars and practitioners concerned with the determinants and effects of internet service provision, use and control in Africa and beyond.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Amidst the government-ordered internet shutdown in Egypt in January 2011, one internet service provider, Noor Telecom, has been running nearly uninterrupted. Noor’s continuing service may be related to anticipated economic losses if access to its customers was curtailed (Le Monde, 2011) as this mid-sized Kuwait-based private company services the high-profile businesses and key Egyptian economic institutions, including the country's stock exchange (Glanz & Markoff, 2011). The british Vodafone, in turn, not only blocked access to the internet during the uprising, but also forwarded its Egyptian customers pro-government messages (Garside, 2011). In reaction to strong public criticism, Vodafone met with civil society representatives, changed its leadership and developed a human rights-oriented policy (Vodafone, 2021). These anecdotes illustrate the differences in the behaviour of companies in specific situations, even if the regulatory framework is the same in the country of operation.

In this spirit, Demidova and Krishna (2008), among others, argue that the heterogeneity of firms should be taken into account when analysing international economic policy and development. Numerous studies demonstrate differences in firm performance, practices and preferences that depend on firm-level factors (rather than country properties), with ownership being the most important internal governance mechanism (e.g., Connelly et al., 2010; Douma et al., 2006; Jensen & Meckling, 1976; La Porta et al., 1999; Shleifer & Vishny, 1997). Previous empirical research primarily distinguishes between two dimensions: state and private ownership, and foreign and domestic ownership. In their cross-national time-series analysis of innovation in the telecommunications industry, Clò et al. (2020), for instance, show that state-owned companies tend to be more innovative than private-owned companies, in particular in countries with high-quality government and institutions. And, Luiz and Stephan (2012), among others, problematize the challenges that telecommunications firms face when making a decision to undertake foreign direct investment into development countries, especially African countries. By zooming into multinational enterprises (MNEs) from South Africa, they demonstrate how South African MNEs manage to internationalize into markets where other MNEs would not venture, turning a burden into an advantage.

However, studies of the determinants and effects of internet penetration, which often produce contradictory results, do not yet take these findings into account. On the one hand, political scientists emphasize the potential of modern information and communication technology (ICT) to foster anti-government movements, enable democratic change and promote good governance as well as economic development (e.g., Acemoglu & Robinson, 2000; Alozie et al., 2011; Freund & Weinhold, 2002; Howard & Mazaheri, 2009; Vu, 2011); on the other hand, they demonstrate that ICT can enable repressive regimes to impose further restrictions on civil liberties and may encourage corruptive behaviour (e.g., Gohdes, 2015; King et al., 2013; Lutscher et al., 2020; Rød & Weidmann, 2015; Sutherland, 2014). Taking into account the role of companies and, in particular the differential effects of their ownership, may help explain the observed patterns, according to the general argument that motivates the data collection presented here.

The key theoretical problem with existing accounts of the determinants and effects of internet penetration lies in the implicit assumption that the incumbent government can make any internet-providing company comply with its requests. However, and as Vendil Pallin’s (2017) case study on Russia discloses, a government’s leverage over ISPs depends on its relationship with the owner of these companies. For instance, the challenges and risks a government faces when seeking to extend its repressive control to foreign-owned companies differ from those associated with companies either owned by the state or by someone close to the incumbent (cf., Freyburg & Garbe, 2018). With ISPs there hence exists an industry-wide capacity to grant and restrict access to manifold internet-based services on which an increasingly digitalized economy and society relies. The potential for using this capacity may depend on the nature of those who own ISPs.

Yet, the cross-sectional, time-series data at company-level needed to systematically explore these and other questions is, to date, largely missing. The “extremely difficult and tedious” (Schneider et al., 2005, 706; cf. La Porta et al., 1999, 474) compilation of such historical and detailed data may be one reason why political scientists tend to treat the internet as a ‘black box’, largely neglecting its inner working and corresponding conditions of ownership and control (Wilson, 2015). With this paper, we introduce the first large-scale dataset on Telecommunications Ownership and Control (TOSCO) to help narrow this gap.Footnote 1

TOSCO provides detailed disaggregated information about ISP ownership in Africa at the level of shareholders that allows tailoring the definition of ownership to the needs of the researcher or practitioner (e.g., foreign shareholders; state ownership). The data also lends itself for network analysis, enabling to follow the development of specific actors or companies across countries and over time. The detailed coding descriptions that document sources and coding choices allow tracking individual coding decisions and context. Providing the autonomous system (AS) number for each ISP in the dataset, as well as the organization ID assigned by the internet registry AFRINIC, allows exploring the relationship between ISP ownership and internet activity measured at the level of AS, among other relationships. Focusing on the African continent, TOSCO allows addressing key issues in a context in which the internet is increasingly used not only for communication and information purposes but also for e-commerce and ICT-based public services such as e-health.

TOSCO enables cross-sectional, time-series large-N analysis of various economic, social and political determinants and effects of ISP ownership. Questions to be explored may include some of the following: What role do national political and economic factors play in the privatization of the telecommunications sector? How does the international and transnational integration of markets and polities affect a state’s capacity to maintain control of the digital flow of information and communication? What difference does telecommunications ownership make in terms of political liberalization, economic development, and citizens’ abilities to use ICT for the purpose of anti-regime protests? In what way is the allocation of internet coverage across ethnic groups influenced by the ownership of internet service providers? And, to what extent is compliance with the UN Guiding Principles on Business and Human Rights, which require ISPs to mitigate human rights impacts, determined by their ownership?

In what follows, we first conceptualize ownership as a variable, before we describe the dataset and present some descriptive patterns. We subsequently demonstrate its usefulness by re-visiting research on the effects of internet provision on a regime’s democratic quality (Rød & Weidmann, 2015) and its level of corruption (Bailard, 2009) when including data from TOSCO. In so doing, we show some ways of how our data can be aggregated, indicating the flexibility in using the dataset, and suggest avenues for further research. A better understanding of the determinants and effects of ownership in a politically and economically sensitive sector such as telecommunications is not only a valuable contribution to our knowledge about the impact of internet penetration; it is also crucial for the work of practitioners and policy-makers interested in exploiting the development potential of investment in ICT.

2 Conceptualizing ownership as variable in political science research

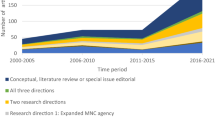

In recent years, political science research is gaining interest in corporate ownership as a variable, as our systematic literature review of top political science journals between 1945 and 2019 indicates (see Online Appendix 1). The few contributions that deal with the telecommunications sector focus primarily on explaining privatization and its effects (Durant et al., 1998; Jho, 2007; Mariotti et al., 2015; Schneider et al., 2005). Remaining studies concentrate on the ownership of media or natural resources.

These studies corroborate systematic relationships between owner identities and the outcome of interest. Media reporting on specific events, such as the US Supreme Court rulings or electoral campaigns, has been shown to vary depending on the financial interests of their corporate owners (e.g. Bailard, 2016; Dunaway & Lawrence, 2015; Hughes & Lawson, 2005; Markus & Charnysh, 2017). Wegenast and Schneider’s (2017) study of deposits of natural resources in sub-Saharan Africa reveals that state repression as answer to societal dissent is particularly likely if oil fields are majority-owned by international companies (cf. Luong & Weinthal, 2006). While this political science research highlights the relevance of ownership structures, it largely neglects to theorize the (political) power of a company’s shareholders.

2.1 The power of shareholders

A review of the business literature reveals that a firm’s ownership and governance structure is pivotal in determining its corporate strategy. A company’s shareholders delegate decision‐making authority to managers with the expectation that those will decide and act in the shareholders’ best interests. Shareholders have the right to elect the members of the board of directors (BoD), to appoint the management team, to approve mergers, and to appropriate a company’s residual earnings, among others (Hansmann, 2013, 897). The BoD then is tasked with designing mechanisms that protect shareholder interests and putting those mechanisms into place (Walsh & Seward, 1990). Since the BoD (and the chief executive officer, CEO) are accountable to the shareholders at all times, it is the shareholders that stipulate, albeit indirectly, the strategic decisions of a company (Leech, 2013). Both the identities of a company’s owners as well as their concentration, relating to the number of shareholders and their relative shares, are seen as having important implications for a company’s corporate strategy, managerial decision-making, and performance (Jamali et al., 2008; Shleifer & Vishny, 1997; Sur et al., 2019; Thomsen & Pedersen, 2000).

In order to capture dynamics associated with varying ownership structures, we draw on the contemporary discussion of political power that revolve around Pitkin’s (1972, 277) conceptual distinction between the power over, i.e. influence, and the power to, i.e. capacity (Göhler, 2009, 35). Transferred to the sphere of corporate ownership, we understand ‘power-to’ as the ability of a shareholder to achieve a certain goal by setting the corporate strategy; which goals are to be pursued depends on the identities of the shareholders. ‘Power-over’, in turn, refers to the means and resources a shareholder needs to achieve these goals, such as the voting power defined by the number of shares held in a company. Having power-over implies having the ability to reduce the chance of the other shareholders, with potentially conflicting interests, to influence the firm’s corporate strategy (and thus its possible political impact). This chance depends on the way ownership is concentrated or dispersed among the different shareholders.

The “two faces of power” (Bachrach & Baratz, 1970) are related in that a shareholder’s power-over can define the extent to which it may actually be able to use its power-to; yet, in some circumstances a shareholder might be in a position to influence corporate strategies and public policies even if it holds minority shares only, precisely because of the capacities associated with its owner identity. This, however, is in part an empirical rather than a purely conceptual question.

2.2 Variations of owner identities: The power to determine corporate decisions

Drawing on business studies, we distinguish between four main types of owner identities in our dataset: the state, a single individual or family, a private corporation, and a financial institution (cf. Holderness, 2009; Nofsinger & Sias, 1999; Thomsen & Pedersen, 2000). These ideal–typical shareholder types vary not only in their goals and risk propensities but also differ in their capacity to control the management and thus in their power to achieve the preferred results, as summarized in Table 1 (cf. Strange, 2018, 1235). We assume a shareholder’s power to achieve its goals to be higher the more it has control over the management.

State-owned firms are typically run by bureaucrats equipped with concentrated control rights and objectives dictated by political interests (Shleifer & Vishny, 1997; Tusiime et al., 2011, 252).Footnote 2 State-owned firms are not necessarily interested in maximizing efficiency or profit but may pursue other, socio-political or even ideological goals such as the protection/discrimination of vulnerable minorities or the creation/maintenance of jobs (Hart et al., 1997). In that sense, state ownership may have a regulatory function (Thomsen & Pedersen, 2000, 694; Wavre, 2018, 2020), but can also serve to gain electoral votes (Villalonga, 2000). “[N]either exclusively profit driven, nor bound by hard budget constraints” (Cannizzaro & Weiner, 2018, 177), state-owned firms tend to be willing to take more risks as it is the public who ultimately “pays for the losses” (cf. Cuervo-Cazurra et al., 2014; La Porta et al., 1999, 476).

For a single individual or family owning shares of a company, the entrepreneur’s personality and interests typically define its business interests (Miller, 1987, 693). The resources brought to the company by the investor are linked to individual-specific concerns, including family values and the protection of capital (Arregle et al., 2007; Sur et al., 2013, 376). Individual/family owners are typically considered as being risk-averse and driving firm strategy to be conservative. They aim at ensuring the survival of the company, with the goal to pass direct control on to later generations (Miller et al., 2010, 203). Viewing “their images and reputations as inextricably connected to the firms they own [, individuals/families tend to be] unwilling to damage those reputations through irresponsible actions in part of their firms” (Dyer & Whetten, 2006, 797).

Corporate owners are conventional business corporations that pursue traditional economic goals, notably profit maximation, and are interested in firm-specific concerns, such as the generation of capability or the “uninterrupted supply of goods and resources” (Sur et al., 2013, 378). Telecommunications companies tend to invest in firms related to the telecommunications sector. In consequence, corporate owners commonly have the relevant expertise and know-how that allows them to not only contribute financial resources but to also provide managerial expertise as well as technical and organisational resources (Douma et al., 2006, 643; Sur et al., 2013, 379). Corporate owners are portrayed as generally risk-neutral but as cautious in their investment strategies (Cannizzaro & Weiner, 2018). They do not enter and leave a market rapidly but expand activities following long-term business-plans.

Finally, financial institutions, such as mutual funds, hedge funds, or insurance companies, invest in potentially profitable companies to arrive at financial returns in the best interest of their ultimate investors. As “delegated monitors” (Dam & Scholtens, 2012, 236), financial-institutional owners keep an “arm’s-length relationship” (Thomsen & Pedersen, 2000, 693) with the management. Their main goal is less the monitoring of the company’s strategies, but rather to safeguard and enhance their financial investment (Sur et al., 2013, 376). If an institutional investor is dissatisfied with a company’s share performance, it can relatively easily just sell its stakes (Douma et al., 2006, 643). This makes institutional investors “effectively risk-neutral and more willing to accept increased risk exposure” (Strange, 2018, 1234).

While sharing important key features, each of these four groups of shareholders is no homogeneous unit. Their goals and activities are likely to depend on the social, economic and political environments from which they originate (Estrin et al., 2016; Strange, 2018, 1236). We therefore include the shareholders’ headquarters, which we define as the country in which the company was originally founded and is registered (Birkinshaw et al., 2006, 684). Knowing the location of the headquarter makes it possible to distinguish between domestic and foreign owners and, in this context, to take into account factors such as the democratic quality of political rule and the jurisdiction to which a company is subject. This may matter regarding corporate responsibility and a firm’s legal obligations. A case in point are firms with headquarters in a member state of the European Union (EU), which are subject to the 2012 regulation on jurisdiction in civil matters.Footnote 3 Under this regulation, victims of human rights violations committed by companies can bring a claim against a company established in the EU, even if the harm that forms the basis for the claim occurred outside the EU (Van Dam et al., 2017). Differences between state-owned and privately-owned companies in the goals, and in the capacities to reach them, might vanish if both come from home countries with similarly high government quality (Estrin et al., 2016; Grøgaard et al., 2019).

2.3 Ownership concentration: The power over corporate decision-making

The extent to which an owner can reach its goals depends on the relative number of shares it owns. Power-over thus considers the concentration of ownership, in particular the percentage of shares that a certain shareholder, such as the state, owns in a company. Ownership concentration can range from one single controlling shareholder that “dictates corporate policy […] by managing the firm directly […to dispersed ownership with several shareholders…] too small and disorganized to impose their will” (Bennedsen & Wolfenzon, 2000, 114). While blockholding owners can exercise power over a company, the extent to which individual owners in dispersed settings can achieve their goals depends on the exact composition, as well as their respective identities.

Next to the single-controlling shareholder that can virtually define a company’s corporate strategy, the majority shareholder has decisive influence in the business operations and strategic direction of the company by virtue of controlling more than half (> 51 percent) of the voting interests (Thomsen & Pedersen, 2000). As Holderness and Sheehan (1988, 319) observe, “majority shareholders are usually directly involved in firm management. That is to say, majority shareholders do not merely monitor management teams, they lead them”. As such, the majority-shareholder model provides an important corrective to suggestions of global managerial dominance divorcing control ownership and control (cf. Gourevitch & Shinn, 2005, 5).

Dispersed owners have less capacity to influence the management individually (Armstrong et al., 2010, 210). Lloyd et al. (1987) distinguish between strong owner control, if one party holds more than 30 percent stock ownership; weak owner control if 10 to 30 percent stock ownership is owned by one party; and managerially controlled firms if no party holds 10 percent or more. Conceptually, these small investors present no separate type of ownership because each of the four types can be at least partially traded on the stock exchange. Together, however, they may represent significant shares of a company’s total ownership. For instance, in 2019 Vodafone UK is owned to almost 77 percent by individual small investors that trade at the London Stock Exchange. Typically, these small investors have only limited interest in getting involved in the management of a company but focus mostly on diversifying their investment portfolios (Connelly et al., 2010; Thomsen & Pedersen, 2000).

3 The Telecommunications Ownership and Control (TOSCO) dataset

TOSCO covers the ownership of commercial ISPs in all 49 independent mainland countries plus Madagascar,Footnote 4 that is 44 sub-Saharan and the five North African countries, from 2000 until 2019. The internet is said to have arrived to Africa (precisely South Africa) in 1991; yet, it is not before the early 2000s that it became accessible to a larger population across the whole continent (Aker & Mbiti, 2010; Commander et al., 2011; Nyirenda-Jere & Biru, 2015). The total number of ISPs included in TOSCO is 196 which amounts to 3,122 company-years over the time period covered, considering that not all companies existed over the whole period. While 108 companies were operative in Africa in 2000, it was 162 in 2019. The time dimension allows capturing interdependences and hierarchies among ISPs.

We focus on the African continent for predominantly two reasons. First, this region of the world is especially marked by economic and political transitions that we expect to drive cross-national variation in ISP ownership over time (Albiman & Sulong, 2016; Hadenius & Teorell, 2007; Levitsky & Way, 2010; Magaloni & Kricheli, 2010; Resnick & Van de Walle 2013). In light of this transforming context, TOSCO allows to investigate crucial questions of economic development and authoritarian survival associated with an increasing internet connectivity that are also relevant in other regions of the Global South. Second, in Africa, like in the Global South in general, countries rely on foreign investment in internet infrastructure if they wanted to foster the stimulating effect of ICT on economic development (Garbe, 2021; Jin & Cho, 2015). Overall, the telecommunications sector tends to be centralized in African countries, which is typical for the Global South where few ISPs tend to control internet traffic for larger parts of the population (Acharya et al., 2017; Main, 2001). Several of the multinational corporations providing internet access in Africa, including Airtel, Etisalat, Ooreedo or Viettel, have subsidiaries in other developing regions as well. Research on the African telecommunications sector may therefore credibly set the stage for cross-regional comparisons.

We concentrate on the most relevant ISPs in the African telecommunications sector. That is: Telecommunications companies that have a physical presence in the area in which they operate, hold official state licenses to operate cables, and own the communications infrastructure they use. Specifically, TOSCO includes all telecom companies that are members of the Global System for Mobile Communication (GSM) Association and started providing internet with second generation (2G) standards. These companies generally present the most dominant internet-providing companies, especially on the African continent where most consumers access the internet through their mobile phone, hence using GSM (mobile) technology. In Kenya, for instance, the three ISPs included in TOSCO have a reported total market share of 97 percent in 2020 (Safaricom, 63.6 percent; Airtel Kenya, 27.2 percent; Telkom Kenya, 6.2 percent; cf. Telecom Review 2021). We add the 14 operators that provide access through fixed lines only, which often used to be the state-owned monopoly providers.

Consequently, we exclude companies that represent only a small portion of internet users on the African continent or that do not own the infrastructure they use but run on the infrastructure of the operators covered by TOSCO. We therefore omit companies that provide 2G through cell phone service technologies competing to GSM, notably Code Division Multiple Access (CDMA) which is predominantly used in the Americas and Asia. We further exclude providers of only 3G (UMTS) and/or 4G (LTE/WiMax) services as well as Mobile Virtual Network Operators (MVNO). Since these providers rent the necessary infrastructure from GSM providers, they are directly affected by the behaviour of the ISPs included in TOSCO.

3.1 The organization of the TOSCO dataset

Our unit of analysis is the individual shareholder. For each ISP in a country, we consider all shareholders and their exact shares (first shareholder level), plus, if applicable, the shareholders owning each of these shareholders and their exact shares (second shareholder level). The data determines 699 shareholders in total; 324 at the first level and 375 at the second level. Overall, we only miss information for about 10 percent of the company-years.

To give an example, in 2019 Angola, access to the internet was mostly provided by three companies (see Fig. 1): Unitel, Movicel and Angola Telecom. Looking at their respective shareholders reveals that the state is indeed involved in all three companies. Angola Telecom is 100 percent state-owned. The country’s largest ISP Unitel is owned by four shareholders with each 25 percent of the shares, namely Africatel (Netherlands), Sonangol (Angola), Geni Holding (Angola) and Vidatel (Angola). Vidatel is owned 100 percent by Isabel dos Santos, the daughter of José Eduardo dos Santos, then president of Angola; the state oil company Sonangol is 100 percent owned by the Angolan state; and, Geni Holding is majority-owned by General Leopoldino Fragoso do Nascimento, then member of the government and known as one of the closest allies to the former president. As concerns Movicel, 20 percent of its shares is owned by the Angolan state, through Angola Telecom and the National Post and Telegraph Company. The remaining 80 percent is split between five ostensibly private Angolan companies; yet, four of them are majority-owned by the president’s entourage. The majority shareholder of the investment company Lambda includes the Minister of Telecommunications and Information Technologies José Carvalho da Rocha. Portmill Investments, Novatel and Modus Comunicare are owned by high-ranked military officials that served in the presidential guard. This example demonstrates the importance of the second shareholder level, as well as the biographic information about individual owners, for any study of the influence of specific actors, notably the state.

3.2 Data sources and coding decisions

The data included in TOSCO comes primarily from company and market analysis software (e.g., Thomson and Reuters’ Eikon [eikon.thomsonreuters.com] and Orbis [orbis.bvdinfo.com]), specialized blogs (e.g., Research ICT Africa [www.researchictafrica.net]), news websites like All Africa [AllAfrica.com] and Quartz Africa [https://qz.com/Africa], and Bloomberg Snapshot repositories [www.bloomberg.com]. This information is triangulated with the annual reports provided by the telecommunications companies and data from market research and analysis companies, in particular TeleGeography [www.telegeography.com], which are limited to the dominant companies. All empirical information we use is publicly available online. For each data entry, the corresponding sources are reported and saved as .pdf-file. In order to ensure data accuracy, we ran several cross checks, and all cases were independently coded by at least two trained research assistants; any discrepancies or uncertainties were discussed in the team at a weekly basis.

While we coded the ownership of each company with greatest care, for some cases, the actual ownership situation may be more complex than it appears in our data. Four reasons can be highlighted here. First, for the concerned countries, (reliable) data tend to be generally scarce; it is an open secret that data on socio-economic indicators in African countries is thin (Przeworski et al., 2000, 117). This holds also true for publicly available information about ownership of individual telecommunications companies. Examples include opaque ownership structures such as the one in Somalia where a functional state government is absent, and part of the public infrastructure, including telecommunications, are allegedly owned by warlords with connections to Al-Shabaab such as Ali Ahmed Nur Jim’ale (Iazzolino, 2015); and, cases in which the state administration lacks the capacity to make all companies register their shareholders, let alone make this information electronically available. In cases, in which it was impossible to rely on trustworthy sources to code all shareholders, we report the missing ones as ‘unknown’ so that its share can still be considered when determining properties such as the ownership concentration in a country.

Second, since in the early 2000s, the internet was only starting to reach the greater public in some African countries, transactions or company reports were neither made public back then nor uploaded ever since. To interpret certain key transactions that happened in the early 2000s, we had to rely on a limited number of news articles, with fewer possibilities to triangulate the information. Third, we aim to keep complex transnational corporate structures as parsimonious as possible. Specifically, if a company is ultimately owned 100 percent by a parent company with the same company brand, we directly refer to this parent company as ultimate beneficiary and do not include (sub-)regional subsidiaries as shareholders. An example is the French telecommunications giant Orange, which operated through various (sub-)regional subsidiaries before it opened an operational head office for the Middle East and Africa in Casablanca, Morocco, beginning of 2020. Since in all these cases, Orange (France) is the ultimate beneficiary, we do not include the sub-regional entities but directly refer to Orange (France).

Fourth, and last, especially in non-democratic contexts, the distinction between firms that are owned by the state and firms owned by individuals/families is often blurred. The said individuals may occupy powerful positions in the government, have strong ties to influential government officials, or are close allies if not relatives of the incumbent (Arayssi & Jizi, 2019; Djankov et al., 2003). To analytically separate the owner identities, we code them as owned by "individual/family" shareholder. However, where known, we provide biographical details that can be used to determine whether the individual/family in question belongs to the immediate political environment, as the example of Angola in 2019 shows (see Fig. 1). In the descriptive and inferential analyses that follow, we treat a company that is majority-owned by a individual/family as state-owned if they belong to the ruling family or are member of the government, legislature, judiciary, or military. The dataset is constructed in such a way that this coding can be easily changed.

3.3 Descriptive overview

TOSCO allows for different ways of how to assess a company’s owner identity and ownership concentration (based on the aggregated identity of its shareholders) as well as a country’s ownership structure of the telecommunications sector (considering the aggregated identity of the companies). It can be screened on multiple criteria, including state involvement (e.g. indirect/direct), subsidiaries (e.g., number, country, foreign/domestic), and shareholders’ political-economic background (e.g. democratic; ex-colonial; industrialized). Our granulated data at the shareholder level allows researchers to define the thresholds according to their research needs and interests.

In providing some descriptives, we demonstrate three select possibilities of aggregating or filtering our data.Footnote 5 First, we determine the majority type of ownership for each company and count the absolute number of companies per type in a given year as a means to showcase their distribution over time. Second, we focus on the extent to which the telecommunications sector of a given country in a given year is dominated by the state. Third, and last, we account for the transnational character of the sector by featuring those shareholders with the highest number of subsidiaries, including the location of their headquarters as well as those of their subsidiaries.

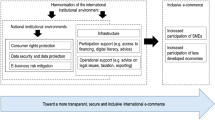

As to the first possibility, Fig. 2 shows the distribution of types of majority ownership (> 51 percent of the shares) across the African telecommunications sector over time. A company’s owner identity is typically determined based on the respective individual or aggregated percent of shares hold (Sur et al., 2019). If no single majority holder exists, we identify the majority owner type based on the totalled shares of the dominant shareholder group. To give an example, if the sum of shares of all private-corporate owners collectively exceeds 50 percent, this company would be majority-owned by corporations. In the absence of any individual or collective majority owner type, we view a company’s ownership as dispersed among a large number of small shareholders. Figure 2 corroborates that there are only few missing or ‘unknown’ values.

In Africa, as in most other parts in the world, the telecommunications sector was traditionally regulated by state-controlled monopolies. Figure 2 indicates that while, overall, the number of companies majority-owned by the domestic state remains relatively constant, in particular the number of companies owned by private corporations considerably increased over time. While 47 companies were majority-owned by the (domestic) state in 2000, the number went only slightly down to 42 in 2019; yet, since the number of total companies increased from 108 in the year 2000 to 137 in 2019, the relative number of state-owned companies decreased from about 44 percent in 2000 to 31 percent in 2019. The number of companies majority-owned by the state is somewhat higher if we take into account that some of the individually or family-owned companies belong to the incumbent’s political entourage (e.g., N2019 = 45). At the same time, the number of companies majority-owned by private corporations more than quintupled, from initially 10 to 58 in 2019.

Second, the retreat of the state from the telecommunications sector across the African continent is corroborated by Fig. 3. The figure maps state involvement in domestic ISPs by summing up the stakes held by the state in individual ISPs and dividing them by the total number of ISPs in a given country-year. It turns out that in several African countries, the share of fully state-owned companies is still 100 percent.

Patterns of state involvement in the telecommunications sector, 2000–2019. Note: The darker the squares are shaded, the higher the degree of domestic state involvement among all ISPs in a country in a given year, e.g. dark red squares mark 100 percent state-owned telecommunications sector; empty squares for years with no operating ISPs

In Djibouti, Eritrea and Ethiopia, the government has always been the only shareholder of the only ISP operating in the country. In most other countries, however, the degree to which the state is involved considerably decreased with time. In Rwanda and Mali, for instance, the state has no majority in any ISP anymore.

Third, and last, Table 2 captures the increasing transnational character of the telecommunications sector on the African continent. In fact, and as the table indicates, several big companies with headquarters in Africa (e.g. MTN, Maroc Telecom and Econet), Europe (e.g. Orange and Vodafone), and beyond (e.g. Airtel and Africell) hold shares in various ISPs across African countries. The share of companies with a headquarter abroad increased from 51 percent in 2000 to 66 percent in 2019. Due to an increasing awareness of the inefficiency of monopolist (state) operators and technological changes, many countries started liberalizing their markets in the 1990s (Alemu, 2018; Laffont & Tirole, 2000, 3). This trend came along with privatization but also internationalization.

Telecommunications turned into a “booming sector at the heart of economic development” (Alemu, 2018, 2), attracting major foreign investments from abroad. In view of the political and economic sensitivities associated with infrastructure ownership, privatized and/or foreign ownership provides a “barometer of states’ willingness to share authority with others” (Doh et al., 2004, 234; cf. Mudambi, 2003).

4 ISP ownership and selected political effects of the internet

We demonstrate the explanatory potential of the TOSCO data with regression analyses on the factors influencing the effect of internet penetration on democratic change and corruption, respectively. We draw first on the study by Rød and Weidmann (2015) and then on that by Bailard (2009), assessing in each case whether the ownership of the companies providing internet/mobile penetration moderates the respective effects. We propose that both political effects of the internet systematically vary with the ownership of those companies providing internet access, controlling for a country’s level of internet penetration (Freyburg & Garbe, 2018). The largely correlational analyses do not claim to be conclusive but are meant to primarily illustrate the potential of including ownership as a variable in internet studies and to stimulate further analyses.

4.1 Internet provision, democratization and ISP ownership

We expect the democratizing potential of the internet to depend on the extent to which the state owns the internet infrastructure in a country. Rød and Weidmann (2015) approach this question by way of a two-step analysis. First, they examine, and demonstrate, that the internet is more likely to expand in regimes experienced in the censorship and control of traditional media. Second, they explore how internet expansion affects changes toward democracy. Here, they find no evidence that “democracy advances in autocracies that expand the Internet [and if] anything, the relationship is the opposite” (ibid., 348). In developing their argument, they acknowledge that “[c]onveniently for autocrats, online services are often provided by state-run telecommunications agencies” (ibid., 340), which they assume to facilitate government control of internet-based communication; they further notice “that even when the suppliers of Internet connections are privately owned, they are often obliged to comply with government requests” (ibid.). Yet, they do not put this observation to a systematic empirical test. Our data allows to examine if state ownership of telecommunications companies is associated with democratization, while considering the level of internet penetration.

In more detail, following the power-to logic, we propose that if the state has substantial influence over the internet-providing companies, it has a higher capacity to control internet-based communication and information and hence to use internet services for its own benefits. State governments can use their shares in ISPs to exert direct influence over the company’s behaviour and make it comply with requests that may benefit the ruling elite. Depending on a government’s needs to control information flows (Hellmeier, 2016), this may include more direct forms of control such as the disruption of internet access during critical events, notably elections (Freyburg & Garbe, 2018; Rydzak et al., 2020) and censorship of content deemed critical of the government (Deibert et al., 2008), or more subtle forms of control, such as the surveillance of crucial opposition actors (Michaelsen, 2016).

In line with the power-over logic, we further expect that the more shares the state owns of the ISPs operating on its territory, the more likely it can effectively control and manipulate digital flows of communication and information. Assuming that authoritarian leaders are first and foremost concerned with accumulating political power as well as maintaining the regime in which they operate (Bueno de Mesquita et al., 2003; Geddes et al., 2014), owning shares of telecommunications companies enables the incumbent ruler to implement strategies of digital repression more effectively. Eventually, alternative forms of control—regulatory control through the threat of revoking the license to operate as well as technical control over the traffic transiting the physical lines—become obsolete if (at least considerable parts of) the physical infrastructure is in the hands of the state (cf. DeNardis & Musiani, 2016, 15; Vargas-Leon, 2016).

We expect the effect of internet ownership to be independent of the level of internet penetration. Authoritarian countries have incentives to expand internet provision to achieve economic or political goals (King et al., 2013; Stier, 2017; Xu, 2021) and to main control over the provision and use of internet services. Even in countries with low internet penetration, governments seek to control internet access, partially because access is usually reserved to urban and political (opposition) elites (Nisbet et al., 2012). Ethiopia, for instance, has one of the worldwide lowest levels of internet penetration and use—and still experienced at least six internet shutdowns between 2016 and 2019 (ITU 2021). And, in Chad with only approx. five percent of the population using the internet, the government repeatedly orders the suspension of internet access. Taken together, we therefore expect: The more shares the state owns in ISPs operating on its territory, the lower the likelihood of democratic change in that country.

To test our argument, we replicate Rød and Weidmann’s (2015) study on a sub-sample of African authoritarian countries between 2000 and 2010 (N = 340), using their replication data and code—yet, we include a variable Share of state-owned ISPs that indicates the share of ISPs that are majority-owned by the state in a given country-year (see Fig. 3). Following Rød and Weidmann (2015), we use random effects logistic regressions with indicators of democracy derived from Polity IV (Marshall et al., 2014) and Geddes et al., (2014, 2016) as dependent variables, % Internet penetration and Change (∆) in internet penetration from one year to the next as independent variables, plus a number of controls likely to influence democratization, such as financial capabilities and wealth, domestic unrest, regime type, and the size of the population (Rød & Weidmann, 2015, 343). We include the number of ISPs per country as additional control variable.

In line with the original study, we run the models using first Democratic change (Polity IV) as dependent variable, which is operationalized as dichotomous variable taking the value 1 if a regime moves in a democratic direction and 0 otherwise, and then Democratization, which is a dichotomous variable indicating transitions to democracy as operationalized by Geddes et al., (2014, 2016). Table 3 presents the results of the regression analyses with Democratic change (Polity IV) as dependent variable.Footnote 6

As expected, the share of state-owned ISPs per country-year is statistically significantly negatively associated with democratic change both in the model controlling for internet penetration rates from the previous year (Model 3) and for a change in internet penetration rates (Model 4). Online Appendix 3 visualizes the predicted probabilities of democratic change along with changing levels of state ownership. In contrast to the results in the original regression analyses by Rød and Weidmann (2015) on autocracies worldwide, Change in internet penetration turns out to be significantly negatively associated with democratic change in the African sub-sample (Model 2), while internet penetration in the previous year remains insignificantly associated (Model 1). This mixed pattern remains robust if we include our SOE variable, suggesting that rather than internet penetration per se, it is the involvement of the state in companies providing access to the internet that can explain receding democratization in some countries. The findings call for a more thorough investigation of the conditions under which state control by ownership can support or challenge authoritarian rule.

4.2 Internet provision, corruption and ISP ownership

We expect the potential of the internet to curtail corruption—the abuse of public office for private gain, including bribery of public officials (Transparency International n.d.)—to be conditioned on the origin of the companies providing access. Several empirical studies suggest that corruption decreases with increasing access to internet services (e.g., Bailard, 2009; Kanyam et al., 2017; Sassi & Ben Ali, 2017). The main argument is that ICT reduce the discretion of public officials, enable the monitoring of and reporting about decision-makers, and foster mobilization against corruption at large scale. Bailard (2009), in particular, argues that access to mobile phones mitigates corruption both through increased transparency and accountability. The rapid diffusion of mobile phones decentralizes information and shrinks “the veil of secrecy that shields corrupt behavior” (Bailard 2009, 337), e.g. by enabling aid agencies to directly communicate with targeted recipients on the ground (ibid., 338). In addition, mobile phones can increase the likelihood of detecting corruption, “thereby changing the cost–benefit calculus of corrupt behavior” (ibid.).

Taking a power-over perspective, we argue that a higher share of foreign shareholders in a country’s telecommunications sector stimulates the competitive pressure in the market and promotes price efficiency (Wallsten, 2001; cf. Kwok & Tadesse, 2006, 770). By reducing the costs for mobile phone usage, privatization thus provides more people with the opportunity to monitor and respond to corruptive behavior. Bailard (2009, 341) herself acknowledges that privatization contributes “to expanded networks, reduced tariffs, and more affordable service provision”. In the international context of the telecommunications sector, privatization typically also implies the denationalization of the previously government-dominated industry. Specifically foreign investment likely increases competition due to the technological advantages of specialized multinational firms (Barrios et al., 2005). Against this, our first expectation is as follows: With increasing participation of foreign investors, the diffusion of mobile phones decreases corruption more substantially.

Besides, and from a power-to logic, foreign investors are demonstrated to generally avoid corruption, thereby directly contributing to reducing corruption. For instance, representatives of multinational corporations are said to likely “be reluctant to offer a bribe” (Kwok & Tadesse, 2006, 769), thereby constraining governmental officials in conducting business as usual (cf. Cruz & Graham, 2022, 132). Especially foreign investors from democratically constituted states may face regulatory pressure from the home country and the international business community (Kwok & Tadesse, 2006; Oliver, 1997). Investors coming from a corruptive environment themselves, however, are more likely to support the host country’s system of corruption (Ledyaeva et al., 2013; cf. Habib & Zurawicki, 2002). For instance, they may be willing to pay large sums in exchange for a monopoly license giving them a privileged position in the market (Lambsdorff & Cornelius, 2000). While the telecom sector is only one sector among many, it is a sector that attracts considerable FDI, in particular in an environment as booming as that of the African continent (cf. Karombo, 2021; Walker, 2019). For instance, in Nigeria, the percentage share of telecommunications in total FDI increased from 1.7% in 2006 to 24% in 2013 (Arawomo & Apanisile, 2018), that is almost a third of all FDI went into the telecom sector alone. We therefore expect the relationship between foreign ISP ownership and corruption to vary across regime types of the investor’s home country, as stipulated by our second expectation: With increasing participation of foreign-authoritarian (foreign-democratic) investors, the diffusion of mobile phones increases (decreases) corruption more substantially.

To test our argument, we re-visit Bailard’s (2009) study and compare levels of corruption across all African mainland countries (N = 49), extending the scope of the analysis from the original time period [1999; 2008] to [2000; 2011].Footnote 7 Following Bailard, we include the corruption perception index (CPI) as dependent variable, using an inverted score such that higher values indicate higher levels of perceived corruption. As independent variables, we use the share of ISPs majority-owned by foreign, foreign-autocratic, and foreign-democratic investors in the total number of ISPs per country-year. To determine the regime type of a foreign ISP’s home country, we rely on data from the Varieties of Democracy project (V-Dem; Coppedge et al., 2020), following the Regimes in the World classification by Lührmann et al. (2018). In line with Bailard (2009, 341), we further include the strength of democratic practices, regulatory quality, and gross domestic product per capita in USD as controls. In reproducing the original models, we run OLS regressions including country and year fixed effects.

Table 4 provides an overview of the results. As in Bailard’s original analyses, the logged mobile penetration is independently negatively associated with corruption (Model 1). However, the results further indicate that this relationship is moderated by the origin of the investor. First, the higher the share of foreign investors, the stronger the negative relationship between mobile penetration and corruption (Model 2). Second, the regime type of the investor also moderates this relationship. If more investors come from authoritarian regimes, the positive effect of mobile penetration decreases (Model 3), whereas it increases with investors coming from more democratic regimes (Model 4).

5 Discussion and outlook

Largely out of public view, beneath the layers of application and content, the internet has a complex technical architecture. It is specifically this physical infrastructure that, connecting the individual customer to the internet, is key to controlling the flow of digital information and communication. Internet service providers with control over the physical infrastructure can extend that control into applications and content. Therefore, a state government’s ability to control access to the internet and its use, or its interruption, depends on the extent to which it controls the ISPs that grant internet access to customers on its territory. To better understand how technology, politics, and economy are interacted, we suggest taking into account the role of those ISPs that provide last-mile connection to end-users. We therefore propose that the ownership structure of ISPs is key to explaining the determinants and the effects of the internet, including its democratizing potential or effects on corruption. Yet, existing studies commonly miss to consider this factor in a systematic manner.

In this paper, we presented TOSCO, a dataset that maps the owner identity of all ISPs operating on the whole African continent between 2000 and 2019. In Africa, the number of people with access to internet has grown tremendously over the last decade. New opportunities in communicating and accessing information are expected to challenge Africa’s long-lived autocrats. The rising number of recent internet shutdowns indicates that incumbent rulers may indeed attribute some danger to this new technology. At the same time, authoritarian rulers seek investment in modern information and communication technologies as a means to stimulate economic growth and to cope with social and economic grievances if perceived as threats to their regimes’ stability.

To demonstrate the potential of the TOSCO dataset, we ran two illustrative regression analyses on the relationship between internet penetration and democratic change and corruption, respectively. The findings from our replications of the studies by Rød and Weidmann (2015) and by Bailard (2009), on a sub-sample of African countries, and including the theoretically appropriate aggregate of our ISP ownership variable, indeed suggest that both political effects of the internet systematically vary with the ownership of those companies providing internet access, controlling for a country’s level of internet penetration. Our largely correlational analyses highlight that, rather than internet penetration as such, it may be the ownership of internet-providing companies that helps or hinders democratization and corruption. This is particularly relevant in light of increasing internet connectivity, in which questions about the effects of internet penetration as such will soon become obsolete.

While TOSCO allows to enter new ground in the analysis of the determinants and consequences of internet penetration, taking into account a pivotal factor of internet control—infrastructure ownership, we need to acknowledge that the African telecommunications sector is currently experiencing drastic changes in the provision of internet infrastructure, with foreign companies investing in the hardware that is used by ISPs (e.g., fibre optics, copper cables, towers). For example, Chinese companies have built large networks of fibre optics in Africa, on which many local ISPs rely (Gagliardone & Geall, 2014), and content providers like Google, Facebook, or Amazon seek to set up their own independent networks (Nothias, 2020). It yet remains to be studied whether and how this diversification of internet infrastructure and the role of new players emerging in the field will change ISPs’ control over access to the internet in the long run. In any case, these developments signal that the telecommunications sector in African countries, and in particular the question of who owns and therefore controls the infrastructure, continues to be an exciting laboratory for studies of the determinants and effects of internet penetration.

Data availability

The dataset, the codebook and additional supplementary material, including the R code and Online Appendix, is available on the Review of International Organization’s webpage as well as the interactive web platform www.tosco-data.com.

Notes

The dataset, the codebook and additional supplementary material, including the R code and Online Appendix, is available on the Review of International Organization’s webpage as well as the interactive web platform www.tosco-data.com.

State governments can own shares of a company either directly (i.e. by the central government itself) or indirectly (i.e. through other state-owned companies like pension funds, national banks, political parties or other state-owned institutions such as the National Petroleum Corporation in Ghana).

EU Regulation No. 1215/2012 of 12 December 2012 on jurisdiction and the recognition and enforcement of judgments in civil and commercial matters (recast), OJ L 351/1, 20 December 2012.

Due to data availability and connectivity, we exclude the small islands Cape Verde, Comoros, Mauritius, La Reunion, Sao Tome and Principe, and the Seychelles.

Replication codes are provided in the supplemental materials.

If Democratization (Geddes, Wright and Franz) is used as dependent variable, none of the independent variables—% Internet penetration, Change in internet penetration, and Share of SOE—turns out to be significant, see Online Appendix 2.

We refrain from including country-years after 2011 due a change in Transparency International’s methodology of the corruption perception index (CPI), such that CPI values from 2012 are not comparable with those from previous years (Transparency International 2012).

References

Acemoglu, D., & Robinson, J. (2000). Political losers as a barrier to economic development. American Economic Review, 90(2), 126–130.

Acharya, H., Chakravarty, S., & Gosain, D. (2017). Few throats to choke: On the current structure of the internet. Proceedings of the IEEE 42nd Conference on Local Computer Networks (LCN): 339–346.

Aker, J., & Mbiti, M. (2010). Mobile phones and economic development in Africa. The Journal of Economic Perspectives, 24(3), 207–232.

Albiman, M., & Sulong, Z. (2016). The role of ICT use to the economic growth in sub-Saharan African region (SSA). Journal of Science and Technology Policy Management, 7(3), 306–329.

Alemu, R. (2018). The Liberalisation of the Telecommunications Sector in Sub-Saharan Africa and Fostering Competition in Telecommunications Services Markets: An Analysis of the Regulatory Framework in Uganda. Springer.

Alozie, N., Akpan-Obong, P., & Foster, W. (2011). Sizing up information and communication technologies as agents of political development in sub-Saharan Africa. Telecommunications Policy, 35(8), 752–763.

Arawomo, O., & Apanisile, J. (2018). Determinants of foreign direct investment in the Nigerian telecommunication sector. Modern Economy, 9(05), 907–923.

Arayssi, M., & Jizi, M. (2019). Does corporate governance spillover firm performance? A study of valuation of MENA companies. Social Responsibility Journal, 15(5), 597–620.

Armstrong, C., Guay, W., & Weber, J. (2010). The role of information and financial reporting in corporate governance and debt contracting. Journal of Accounting and Economics, 50(2–3), 179–234.

Arregle, J., Hitt, M., Sirmon, D., & Very, P. (2007). The development of organizational social capital: Attributes of family firms. Journal of Management Studies, 44(1), 73–95.

Bachrach, P., & Baratz, M. (1970). Power and Poverty: Theory and Practice. Oxford University Press.

Bailard, C. (2009). Mobile phone diffusion and corruption in Africa. Political Communication, 26(3), 333–353.

Bailard, C. (2016). Corporate ownership and news bias revisited: Newspaper coverage of the supreme court’s citizens united ruling. Political Communication, 33(4), 583–604.

Barrios, S., Görg, H., & Strobl, E. (2005). Foreign direct investment, competition and industrial development in the host country. European Economic Review, 49(7), 1761–1784.

Bennedsen, M., & Wolfenzon, D. (2000). The balance of power in closely held corporations. Journal of Financial Economics, 58(1–2), 113–139.

Birkinshaw, J., Braunerhjelm, P., Holm, U., & Terjesen, S. (2006). Why do some multinational corporations relocate their headquarters overseas? Strategic Management Journal, 27(7), 681–700.

Bueno de Mesquita, B., Morrow, J., Siverson, R., & Smith, A. (2003). The Logic of Political Survival. MIT Press.

Cannizzaro, A., & Weiner, R. (2018). State ownership and transparency in foreign direct investment. Journal of International Business Studies, 49(2), 172–195.

Clò, S., Florio, M., & Rentocchini, F. (2020). Firm ownership, quality of government and innovation: Evidence from patenting in the telecommunication industry. Research Policy, 49(5), 103960.

Commander, S., Harrison, R., & Menezes-Filho, N. (2011). ICT and productivity in developing countries: New firm-level evidence from Brazil and India. Review of Economics and Statistics, 93(2), 528–541.

Connelly, B., Hoskisson, R., Tihanyi, L., & Certo, S. (2010). Ownership as a form of corporate governance. Journal of Management Studies, 47(8), 1561–1589.

Coppedge, M., Gerring, J., Knutsen, C., Lindberg, S., Teorell, J., Altman, D., Bernhard, M., Fish, M., Glynn, A., & Hicken, A. (2020). V-Dem Dataset V10. Gothenburg: Varieties of Democracy (V-Dem) Project.

Cruz, C., & Graham, B. (2022). Social ties and the political influence of firms. Review of International Organizations, 17, 117–142.

Cuervo-Cazurra, A., Inkpen, A., Musacchio, A., & Ramaswamy, K. (2014). Governments as owners: State-owned multinational companies. Journal of International Business Studies, 45(8), 919–942.

Dam, L., & Scholtens, B. (2012). Does ownership type matter for corporate social responsibility? Corporate Governance: An International Review, 20(3), 233–252.

Deibert, R., Palfrey, J., Rohozinski, R., & Zittrain, J. (2008). Access Denied: The Practice and Policy of Global Internet Filtering. The MIT Press.

Demidova, S., & Krishna, K. (2008). Firm heterogeneity and firm behavior with conditional policies. Economics Letters, 98(2), 122–128.

DeNardis, L. & Musiani, F. (2016). Governance by infrastructure. Musiani, F., D. Cogburn, L. DeNardis & N. Levison (eds.) The Turn to Infrastructure in Internet Governance (pp. 3–21). Palgrave Macmillan.

Djankov, S., McLiesh, C., Nenova, T., & Shleifer, A. (2003). Who owns the media? The Journal of Law and Economics, 46(2), 341–382.

Doh, J., Teegen, H., & Mudambi, R. (2004). Balancing private and state ownership in emerging markets’ telecommunications infrastructure: Country, industry, and firm influences. Journal of International Business Studies, 35(3), 233–250.

Douma, S., George, R., & Kabir, R. (2006). Foreign and domestic ownership, business groups, and firm performance: Evidence from a large emerging market. Strategic Management Journal, 27(7), 637–657.

Dunaway, J., & Lawrence, R. (2015). What predicts the game frame? Media ownership, electoral context, and campaign news. Political Communication, 32(1), 43–60.

Durant, R., Legge, J., & Moussios, A. (1998). People, profits, and service delivery: Lessons from the privatization of British Telecom. American Journal of Political Science, 42(1), 117–140.

Dyer, W., & Whetten, D. (2006). Family firms and social responsibility: Preliminary evidence from the S&P 500. Entrepreneurship Theory and Practice, 30(6), 785–802.

Estrin, S., Meyer, K., Nielsen, B., & Nielsen, S. (2016). Home country institutions and the internationalization of state owned enterprises: A cross-country analysis. Journal of World Business, 51(2), 294–307.

Freund, C., & Weinhold, D. (2002). The internet and international trade in services. American Economic Review, 92(2), 236–240.

Freyburg, T., & Garbe, L. (2018). Blocking the bottleneck: Internet shutdowns and ownership at election times in Sub-Saharan Africa. International Journal of Communication, 12, 3896–3916.

Gagliardone, I., & Geall, S. (2014). China in Africa’s media and telecommunications: cooperation, connectivity and control. Norwegian Peacebuilding Resource Centre (NOREF) Expert Analysis.

Garbe, L. (2021). Political determinants of foreign investment in internet infrastructure in African autocracies. Unpublished manuscript. University of St.Gallen, Switzerland.

Garside, J. (2011). Vodafone under fire for bowing to Egyptian pressure. The Guardian, July 26.

Geddes, B., Wright, J., & Frantz, E. (2014). Autocratic breakdown and regime transitions: A new data set. Perspectives on Politics, 12(2), 313–331.

Geddes, B., Wright, J., & Frantz, E. (2016). Autocratic regimes code book. https://sites.psu.edu/dictators/wp-content/uploads/sites/12570/2016/05/GWF-Codebook.pdf. Accessed 28 May 2022

Glanz, J. & Markoff, J. (2011). Egypt Leaders Found ‘‘Off’’ Switch for Internet. New York Times, February 15.

Gohdes, A. (2015). Pulling the plug: Network disruptions and violence in civil conflict. Journal of Peace Research, 52(3), 352–367.

Göhler, G. (2009). Power to and power over (pp. 27–39). Sage.

Gourevitch, P., & Shinn, J. (2005). Political Power and Corporate Control: The New Global Politics of Corporate Governance. Princeton University Press.

Grøgaard, B., Rygh, A., & Benito, G. (2019). Bringing corporate governance into internalization theory: State ownership and foreign entry strategies. Journal of International Business Studies, 50(8), 1310–1337.

Habib, M., & Zurawicki, L. (2002). Corruption and foreign direct investment. Journal of International Business Studies, 33(2), 291–307.

Hadenius, A., & Teorell, J. (2007). Pathways from authoritanianism. Journal of Democracy, 18(1), 143–157.

Hansmann, H. (2013). Ownership and organizational form. R. Gibbons & J. Roberts (Eds.) The Handbook of Organizational Economics (pp. 891–917). Princeton University Press.

Hart, O., Shleifer, A., & Vishny, R. (1997). The proper scope of government: Theory and an application to prisons. The Quarterly Journal of Economics, 112(4), 1127–1161.

Hellmeier, S. (2016). The dictator’s digital toolkit: Explaining variation in internet filtering in authoritarian regimes. Politics & Policy, 44(6), 1158–1191.

Holderness, C. (2009). The myth of diffuse ownership in the United States. Review of Financial Studies, 22(4), 1377–1408.

Holderness, C., & Sheehan, D. (1988). The role of majority shareholders in publicly held corporations: An exploratory analysis. Journal of Financial Economics, 20, 317–346.

Howard, P., & Mazaheri, N. (2009). Telecommunications reform, internet use and mobile phone adoption in the developing world. World Development, 37(7), 1159–1169.

Hughes, S., & Lawson, C. (2005). The barriers to media opening in Latin America. Political Communication, 22(1), 9–25.

Iazzolino, G. (2015). Following mobile money in Somaliland. Rift Valley Institute Research Paper 4. https://riftvalley.net. Accessed 28 May 2022

International Telecommunications Union, ITU (2021). Country Profiles. https://www.itu.int. Accessed 28 May 2022

Jamali, D., Safieddine, A., & Rabbath, M. (2008). Corporate governance and corporate social responsibility synergies and interrelationships. Corporate Governance: An International Review, 16(5), 443–459.

Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Jho, W. (2007). Global political economy of technology standardization: A case of the Korean mobile telecommunications market. Telecommunications Policy, 31(2), 124–138.

Jin, S., & Cho, C. (2015). Is ICT a new essential for national economic growth in an information society? Government Information Quarterly, 32(3), 253–260.

Kanyam, D., Kostandini, G., & Ferreira, S. (2017). The mobile phone revolution: Have mobile phones and the internet reduced corruption in Sub-Saharan Africa? World Development, 99, 271–284.

Karombo, T. (2021). Africa’s telecom sector is seeing a boom in investment. Tribune Wired, https://www.tribunewired.com/2021/06/11/africas-telecom-sector-is-seeing-a-boom-in-investment/. Accessed 28 May 2022

King, G., Pan, J., & Roberts, M. (2013). How censorship in China allows government criticism but silences collective expression. American Political Science Review, 107(2), 326–343.

Kwok, C. C., & Tadesse, S. (2006). The MNC as an agent of change for host-country institutions: FDI and corruption. Journal of International Business Studies, 37(6), 767–785.

La Porta, R., Lopez-De-Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world. The Journal of Finance, 54(2), 471–517.

Laffont, J., & Tirole, J. (2000). Competition in Telecommunications. MIT Press.

Lambsdorff, J. G., & Cornelius, P. (2000). Corruption, foreign investment and growth. K. Schwab, J. Sachs, et al., The Africa Competitiveness Report 2000/2001 (pp. 70–78). Oxford University Press.

Ledyaeva, S., Karhunen, P., & Kosonen, R. (2013). Birds of a feather: Evidence on commonality of corruption and democracy in the origin and location of foreign investment in Russian regions. European Journal of Political Economy, 32, 1–25.

Leech, D. (2013). Shareholder voting power and ownership control of companies. D. Leech. Power, Voting, and Voting Power: 30 Years After (pp. 475–498). Springer.

Levitsky, S., & Way, L. (2010). Competitive Authoritarianism: Hybrid Regimes after the Cold War. Cambridge University Press.

Lloyd, W., Modani, N., & Hand, J. (1987). The effect of the degree of ownership control on firm diversification, market value, and merger activity. Journal of Business Research, 15(4), 303–312.

Lührmann, A., Tannenberg, M., & Lindberg, S. (2018). Regimes of the world (RoW): Opening new avenues for the comparative study of political regimes. Politics and Governance, 6(1), 60–77.

Luiz, J., & Stephan, H. (2012). The multinationalisation of Soth African telecommunications firms into Africa. Telecommunications Policy, 36(8), 621–635.

Luong, P., & Weinthal, E. (2006). Rethinking the resource curse: Ownership structure, institutional capacity, and domestic constraints. Annual Review of Political Science, 9, 241–263.

Lutscher, P., Weidmann, N., Roberts, M., Jonker, M., King, A., & Dainotti, A. (2020). At home and abroad: The use of denial-of-service attacks during elections in nondemocratic regimes. Journal of Conflict Resolution, 64(2/3), 373–401.

Magaloni, B., & Kricheli, R. (2010). Political order and one-party rule. Annual Review of Political Science, 13, 123–143.

Main, L. (2001). The global information infrastructure: Empowerment or imperialism? Third World Quarterly, 22(1), 83–97.

Mariotti, S., Mutinelli, M., Nicolini, M., & Piscitello, L. (2015). Productivity spillovers from foreign multinational enterprises to domestic manufacturing firms: To what extent does spatial proximity matter? Regional Studies, 49(10), 1639–1653.

Markus, S., & Charnysh, V. (2017). The flexible few: Oligarchs and wealth defense in developing democracies. Comparative Political Studies, 50(12), 1632–1665.

Marshall, M., Gurr, T., & Jaggers, K. (2014). Political regime characteristics and transitions, 1800-2013. Polity IV project. Center for Systemic Peace. https://www.systemicpeace.org/polity/polity4x.htm. Accessed 18 Nov 2022

Michaelsen, M. (2016). Exit and voice in a digital age: Iran’s exiled activists and the authoritarian state. Globalizations, 15(2), 248–264.

Miller, D. (1987). The genesis of configuration. The Academy of Management Review, 12(4), 686–701.

Miller, D., Le Breton-Miller, I., & Lester, R. (2010). Family ownership and acquisition behavior in publicly-traded companies. Strategic Management Journal, 31(2), 201–223.

Le Monde (2011). Egypte : Le FAI Noor disparaît à son tour des écrans. Le Monde, January 30.

Mudambi, R. (2003). Privatization and Globalization: The Changing Role of the State in Business. Edward Elgar Publishing.

Nisbet, E., Stoycheff, E., & Pearce, K. (2012). Internet use and democratic demands: A multinational, multilevel model of internet use and citizen attitudes about democracy. Journal of Communication, 62(2), 249–265.

Nofsinger, J., & Sias, R. (1999). Herding and feedback trading by institutional and individual investors. The Journal of Finance, 54(6), 2263–2295.

Nothias, T. (2020). Access granted: Facebook’s free basics in Africa. Media, Culture & Society, 42(3), 329–348.

Nyirenda-Jere, T., & Biru, T. (2015). Internet development and internet governance in Africa. Geneva (Switzerland) & Reston (USA): Internet Society. https://www.internetsociety.org/resources/doc/2015/internet-development-and-internet-governance-in-africa/. Accessed 28 May 2022

Oliver, C. (1997). Sustainable competitive advantage: Combining institutional and resource-based views. Strategic Management Journal, 18(9), 697–713.

Pallin, C. (2017). Internet control through ownership: The case of Russia. Post-Soviet Affairs, 33(1), 16–33.

Pitkin, H. (1972). Wittgenstein and Justice. University of California Press.

Przeworski, A., Alvarez, R., Alvarez, M., Cheibub, J., Limongi, F., & Neto, F. (2000). Democracy and Development: Political Institutions and Well-being in the World, 1950–1990 (Vol. 3). Cambridge University Press.

Resnick, D., & Van de Walle, N. (2013). Democratic Trajectories in Africa: Unravelling the Impact of Foreign Aid. Oxford University Press.

Rød, E., & Weidmann, N. (2015). Empowering activists or autocrats? The internet in authoritarian regimes. Journal of Peace Research, 52(3), 338–351.

Rydzak, J., Karanja, M., & Opiyo, N. (2020). Dissent does not die in darkness: Network shutdowns and collective action in African countries. International Journal of Communication, 14, 4265–4286.

Sassi, S., & Ben Ali, M. (2017). Corruption in Africa: What role does ICT diffusion play. Telecommunications Policy, 41(7–8), 662–669.

Schneider, V., Fink, S., & Tenbücken, M. (2005). Buying out the state: A comparative perspective on the privatization of infrastructures. Comparative Political Studies, 38(6), 704–727.

Shleifer, A., & Vishny, R. (1997). A survey of corporate governance. The Journal of Finance, 52(2), 737–783.

Stier, S. (2017). Internet diffusion and regime type: Temporal patterns in technology adoption. Telecommunications Policy, 41(1), 25–34.

Strange, R. (2018). Corporate ownership and the theory of the multinational enterprise. International Business Review, 27(6), 1229–1237.

Sur, S., Lvina, E., & Magnan, M. (2013). Why do boards differ? Because owners do: Assessing ownership impact on board composition. Corporate Governance: An International Review, 21(4), 373–389.

Sur, S., Gassmann, H., & Zhang, J. (2019). Defining ownership: An empirical assessment of the ownership measures. Canadian Journal of Administrative Sciences, 36(1), 5–19.

Sutherland, E. (2014). Corruption and internet governance. Info/ Digital Policy, Regulation and Governance, 16(29), 1–15.

Telecom Review (2021). A study on Kenya’s mobile market. Telecom Review Africa. https://www.telecomreviewafrica.com/en/articles/features/2268-a-study-on-kenya-s-mobile-market. Accessed 28 May 2022

Thomsen, S., & Pedersen, T. (2000). Ownership structure and economic performance in the largest European companies. Strategic Management Journal, 21(6), 689–705.

Transparency International (n.d.). What is Corruption. https://www.transparency.org/en/what-is-corruption. Accessed 18 Nov 2022

Tusiime, I., Nkundabanyanga, S., & Nkote, I. (2011). Corporate governance: Ownership structure, board structure and performance of public sector entities. Journal of Public Administration and Policy Research, 9(3), 250–260.

Van Dam, C., Gregor, F., Brachotte, S., & Morrow, P. (2017). Corporate responsibility to respect human rights vis-à-vis legal duty of care. A. Rubio, J. José, & K. Yiannibas (Eds.) Human Rights in Business. Removal of Barriers to Access to Justice in the European Union (pp. 119–138). Routledge.

Vargas-Leon, P. (2016). Tracking internet shutdown practices: Democracies and hybrid regimes. In F. Musiani, D. Cogburn, L. DeNardis, & N. Levinson (Eds.), The Turn to Internet Infrastructure in Internet Governance (pp. 166–188). Palgrave Macmillan.

Villalonga, B. (2000). Privatization and efficiency: Differentiating ownership effects from political, organizational, and dynamic effects. Journal of Economic Behavior & Organization, 42(1), 43–74.

Vodafone (2021). Business & human rights ressource centre. https://www.vodafone.com/sustainable-business/operating-responsibly/human-rights. Accessed 28 May 2022

Vu, K. (2011). ICT as a source of economic growth in the information age: Empirical evidence from the 1996–2005 period. Telecommunications Policy, 35(4), 357–372.

Walker, M. (2019). The African Boom in Investment in Communications Infrastructure. The Fintech Times, October 24, https://thefintechtimes.com/the-african-boom/. Accessed 28 May 2022

Wallsten, S. (2001). An Econometric Analysis of Telecom Competition, Privatization, and Regulation in Africa and Latin America. The Journal of Industrial Economics, 49, 1–19.

Walsh, J., & Seward, J. (1990). On the efficiency of internal and external corporate control mechanisms. Academy of Management Review, 15(3), 421–458.

Wavre, V. (2018). Policy Diffusion and Telecommunications Regulation. Springer.

Wavre, V. (2020). The rise of the policy-takers: Universal service policy adoption in Jordan and Morocco. Journal of Digital Media & Policy, 15(6). https://doi.org/10.1386/jdmp_00039_1

Wegenast, T., & Schneider, G. (2017). Ownership matters: Natural resources property rights and social conflict in sub-Saharan Africa. Political Geography, 61, 110–122.

Wilson, S. (2015). How to control the internet: Comparative political implications of the Internet's engineering. First Monday, 20(2). https://doi.org/10.5210/fm.v20i2.5228

Xu, X. (2021). To repress or to co-opt? Authoritarian control in the age of digital surveillance. American Journal of Political Science, 65(2), 309–325.

Acknowledgements

Financial support by the Swiss Network for International Studies (SNIS) and the Basic Research Fund (GFF) of the University of St.Gallen is gratefully acknowledged. We thank Dominic Brotschi, Johannes Matt, Carlos Morado, Helen Pittam, Henry Schmees, Suen Wang for excellent research assistance. Suso Baleato, Ron Deibert, Marlies Glasius, Simon Hug, Moses Karanja, Carl Henrik Knutsen, Steven Livingston, Philipp Lutscher, Marcus Michaelsen, Cliff Morgan, Daniel Mwesigwa, Espen Rød, Thomas Sattler, Gerald Schneider, Daniela Stockmann, Rebecca Tapscott, Jan Rydzak, André Walter, Tim Wegenast, Cinzia dal Zotto, and further participants at conferences, workshops, and research seminars provided valuable feedback. We are indebted to Amreesh Phokeer (AFRINIC) as well as François Rancy and Mario Maniewicz (both ITU) for providing us with access to crucial information.

Funding