Abstract

Preferential trade agreements (PTAs) trigger investment through their commitment to a liberal market economy. Increasingly however, PTAs go far beyond liberalizing trade and investment flows. Especially controversial features included in most modern PTAs are environmental and labor standards. Do these standards affect business activity? If so, how do investors react to such non-trade issues in trade deals? The literature provides inconclusive findings about the impact of standards on foreign direct investment (FDI). Some contributors argue that strict standards decrease FDI, whilst others claim that environmental and labor protection increases productivity and, in consequence, inward investment. In all likelihood, the usage of aggregated FDI data, as is the case for most studies, causes confusion. I expect standards to influence investors’ decisions – but heterogeneously across sectors. Environmental and labor standards should reduce FDI in polluting and low-skilled labor endowed industries, but increase investment in environmentally clean and high-skilled labor abundant sectors. Based on an original dataset of environmental and social standards in trade agreements and at the sector-level disaggregated US-FDI data, I find robust support for my argument. The paper provides a more nuanced picture on the standards and investment nexus: Standards have no uniform effect on multinationals. Instead, they are good for some, but bad for other industries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Preferential trade agreements – as a commitment to a liberal market economy – trigger investment (Büthe and Milner 2008). Increasingly, however, PTAs go far beyond liberalizing trade and investment flows. An especially controversial feature found in most modern PTAs are economic and social as well as environmental protection issues (Bhagwati 2002; Krugman 1997). By now, 63% of all post-1945 preferential trade agreement (PTAs) cover at least one provision regulating environmental protection or labor rights.Footnote 1 Some fear that these non-trade issues (NTIs) restrict trade and investment (Business Europe 2014: 9). Yet, however, we lack research on whether NTIs in PTAs effect business activity at all; much less do we know which NTIs influence multinationals’decisions in what direction. In this paper, I ask whether and if so how environmental protection and labor rights clauses in PTAs impact foreign direct investment (FDI).

To answer this question, I revisit the literature on whether environmental and labor rights standards trigger or hamper FDI. Scholars have up to now been indecisive. Some academics argue that environmental and labor regulations deter investors. Others claim that productivity gains that emerge from NTIs create a favorable environment for multinational companies. One caveat in the literature is the assumption of industryFootnote 2 homogeneity. While firms in some sectors could favor NTIs, others might find them cumbersome.

I argue that NTIs are prone to influence investors’ decisions – but heterogeneously across industries. I argue that FDI in polluting and low-skilled labor endowed sectors decreases with NTIs. This is due to the reason that they rely on low production prices that potentially increase with stricter environment and labor standards. Contrarily, investors in clean or high-skilled labor abundant sectors should be indifferent or favor NTIs harmonization. In a North-South scenario, where FDI flows from industrialized to developing countries, technological innovation and experience with NTIs is likely to offer comparative advantages to foreign firms.

I test the argument using an original dataset of environmental standards and labor rights in US preferential trade agreements and sectoral bilateral FDI data. Since the US represents the only country for which industry- and dyad-level FDI data is publicly available, I focus on the American context. However, many developed countries incorporate NTIs in their trade deals. Thus, the argument presented below is generalizable to other trade powers that have an interest in strong environment and labor standards in their partner countries (e.g. Australia, Canada, the European Union, New Zealand, and the EFTA countries). I opt for PTAs, because the investment and standard- linkage is most prevalent in trade deals. Other treaty types that regulate investment flows, such as Bilateral Investment Treaties (BITs), mostly exclude NTIs. Only 5 % of all US BITs include labor and/or environmental standards.Footnote 3 By disaggregating FDI data, the study contributes to the yet inconclusive discussion on whether standards increase or decrease FDI (Konisky 2008; Palmer et al. 1995; Porter 1991; Potoski 2001; Reinhardt 1998; Rivera 2002; Rivera and Oh 2013; Woods 2006). Whereas the fine-grained FDI measure allows for a more accurate argument, the comparison across two different sets of standards promises generalization. This is the first study to compare the impact of environmental and labor standards on investors’ decisions and contributes to the question whether the literature on labor rights and FDI can be lumped together with scholarly work on environmental standards and investment. Until now only separate discussions have taken place. Further, I add to the trade and... debate. Recent studies examined provisions in and impacts of PTAs that go beyond trade (Brooks 2005; Hafner-Burton 2009; Mansfield and Pevehouse 2000; Rickard and Kono 2014; Spilker and Böhmelt 2012). Focusing on environmental and labor standards in PTAs, I study their effect on investment. The paper provides an answer to the question of whether NTIs in PTAs are mere decoration, or do have an actual impact on the economy.

1 Why we know so little on investors’ reactions to NTIs

Do higher standards attract or deter foreign investors? Several scholars investigated this question, but the answer remains ambiguous. One group of researchers argue that lower standards attract firms (Konisky 2008; Potoski 2001; Woods 2006). Others emphasize the advantage of strict regulations for (foreign) firms (Palmer et al. 1995; Porter 1991; Reinhardt 1998; Rivera 2002; Rivera and Oh 2013).

The argument underlying the higher standards leading to lower investment levels- hypothesis is that stricter regulations tend to increase production costs. According to scholars in this literature, business is prone to avoid strict standards. The central claim is that the relocation to pollution havens or low labor standards destinations might save costs. This concerns especially firms from countries with high regulation levels. Flanagan and Gould (2003), for instance, find that lower labor standards trigger FDI inflows. Even though Flanagan and Gould’s results are not robust over various specification, the results of Friedman et al. (1992) show that labor market conditions robustly and significantly influence investor decisions. According to Friedman et al. (1992), lower standards go hand in hand with higher FDI flows. Authors propose similar arguments for environmental regulations. Becker and Henderson (2000), Greenstone (2002), and List et al. (2003) find that a large difference in environmental stringency between home and host countries increases the incentive for firms to relocate. Also, Konisky (2008), Potoski (2001), and Woods (2006) state that investors seek destinations with lower standards than the regulations at home. The authors argue that weak workers’ and environmental protection motivate companies in the manufacturing and natural resource extraction sector to invest in developing countries. In short, the pursuit of lower production prices represents the underlying argument leading to the race to the bottom hypothesis.

The challengers of this hypothesis argue that the negative impact of higher standards on FDI is offset by other positive non-production-price effects. According to Kucera (2002), labor standards are likely to improve workers’ satisfaction and productivity. Gender equality, social stability, and a general increase in labor quality might attract investors (Kucera 2002). Furthermore, multinationals might benefit from environmental protection standards. Taking technology, innovation and customer desires into consideration, environmental regulations could foster FDI (Palmer et al. 1995; Porter 1991). Regarding environmental technology, for instance, leading firms can gain comparative advantage (Reinhardt 1998; Rivera 2002). Even more so, if companies relocate from countries with strict standards to countries that just recently upgraded their standards.

Given the strong argumentation and (partial) evidence for both hypotheses, the investors’ reactions to NTIs remains a puzzle. Several reasons for this indefinite answer are conceivable. For one, measuring environmental and labor protection standards consistently across countries is challenging. Secondly, scholars used aggregated FDI data. This comes with the accompanying factor of measurement errors (For details on the measurement bias see Arel-Bundock 2016; Kerner 2014; Kerner and Lawrence 2014). Among other issues discrepancies in data-collection methods across countries, ignorance of debt funded assets, and the mix-up of the direct and the ultimate owner cause wrong data at the aggregated FDI-level. Importantly, it is not only empirically, but also theoretically problematic to assess aggregated FDI. Motivating factors differ between vertical and horizontal FDI. Vertical investors outsource to benefit from different and mostly cheaper input factors. Horizontal investors aim to tap foreign markets. Very likely, FDI effects differ between the two scenarios. Authors acknowledge this, but at the same time state that due to missing data most studies focus on net effects (Büthe and Milner 2008). Further, ignoring sector heterogeneity might lead to inconclusive answers, too. Industries relying on environmentally friendly technology are prone to increase their investment with stricter standards. In contrast, high-emission and natural resource dependent industries are likely to reduce FDI once NTIs are put in place. Similarly, skilled-labor force reliant sectors might perceive labor rights as an opportunity, but low-skilled labor endowed industries could hesitate to expand further if NTIs tighten.

In this paper, I assess the effect of NTIs in PTAs on disaggregated FDI data. Both features, the assessment of international rather than domestic standards and the usage of disaggregated rather than aggregated FDI, offer a fresh perspective on the discussion over investors’ reactions on standards. Examining international rather than domestic environmental and labor standards could ease the comparison across countries. Commitments to international NTIs might be more credible (Büthe and Milner 2008). This is due to the reason that domestic actors can hold the violating state accountable to international treaty partners. Moreover, assessing international law might be less complex than domestic law. Also, preferential trade agreements represent an interesting case concerning the promotion of environmental protection and labor rights: The variables of interest, investment and trade, are directly linked to NTIs. Many modern PTAs cover such standards and make PTAs an important forum to regulate NTIs. In the past, when NTIs were rarely linked to trade, investors had to consider domestic standards of partner countries. Moving abroad meant to leave the regulatory space at home and enter new territory. With the inclusion of NTIs in PTAs, rules of the home country apply in partner states, too. Multinationals investing in a PTA partner state no longer depart from the legal context of environmental protection- and labor standards in the home country. This has potential effects on investor decisions: Some might benefit from unified standards; others could be worse off than in a situation of rule-asymmetries.

Furthermore, opening up the black box of PTA design offers new insights on the impact of PTAs on FDI. We already know that PTAs per se increase FDI (Büthe and Milner 2008). Yet the positive effect could be more exclusive if PTAs cover NTIs. Ecologically green sectors and high-skilled labor sectors might increase their FDI and environmental-polluting industries and low-skilled labor sectors could decrease investment. In short, NTIs in PTAs potentially regulate in which sectors FDI grows.

Beyond the PTA perspective, disaggregated FDI data should help to better understand the impact of standards on investment. Sector-level emission and factor endowment data allows the specification of a more precise theory. Baccini et al. (2017) show that disaggregation matters for explaining trade and investment of multinationals. The authors argue that the distribution of trade liberalization benefits is unequal across companies and depends on firms’ activities. Disaggregated FDI data is likely to also advance our understanding of investors’ reactions to NTIs. Next I explain why investors are prone to care about standards in such treaties.

2 Why NTIs in PTAs matter for investors

We know that trade agreements per se have a positive impact on FDI. The binding commitment to stick to a liberal market economy ensures investors that their investment can prosper. Büthe and Milner (2008: 741) argue that commitments via trade agreements are more credible to investors than domestic policy choices, because “reneging on them [international commitments] is more costly”. But what if the commitments go beyond a liberal market economy? What if PTAs additionally call for the protection of the environment and labor rights?

The Pac Rim Caman LLC versus El Salvador case under the Central American Free Trade Agreement (CAFTA) serves as an interesting example here. Pac Rim, a Canadian company, intended to expand its exploration permit. The firm wanted a larger underground gold mining site in Eldorado El Salvador. The government of El Salvador refused to guarantee a further construction license. As a consequence, the investor filed a claim against the state under the Investor-State Dispute settlement mechanisms regulated in Article 10.20 under CAFTA.Footnote 4

The company argued that by not granting a further exploration permit, El Salvador violated investment law.Footnote 5 Several civil society members engaged in the discussion and submitted opinion letters on the litigation. In the end, the tribunal under CAFTA sided with the state and argued that the investor’s interpretation of the law was wrong and the underground exploration might cause environmental risks to surface landowners. The court argued that the expansion of the mining site might expose El Salvadorian soil and people to hazardous chemicals and water pollution. (Gallus, 2013) This would be in conflict with domestic and international environmental regulation. Under CAFTA, parties are obliged to enforce its own environmental protection laws (Article 17.1 and 17.2 of CAFTA-DR):

“A Party shall not fail to effectively enforce its environmental laws [...] The Parties recognize that it is inappropriate to encourage trade or investment by weakening or reducing the protections afforded in domestic environmental law” (Article 17.2 CAFTA-DR).

In the end, the reference in CAFTA to international and domestic environmental regulation might have hindered the investor from winning the case under the preferential trade agreement. Firms operating in an industry that reports a large ecological footprint, such as the mining sector, where Pac Rim belongs to, are expected to be especially sensitive to environmental regulations in PTAs.

Another instance represents the Metalclad versus Mexico case under the North American Free Trade Agreement (NAFTA). Metalclad aimed to construct a waste landfill in Guadalcazar in Mexico. Metalclad filed a complaint against local municipalities, who denied the construction of the waste landfill site. The company referred to Articles 1105 (Minimum Standard of Treatment) and 1110 (Expropriation) of NAFTA. Local municipalities based their denial regarding the construction of the new site on the Mexican Ecological Decree, which the tribunal evaluated as discriminatory against foreign investors. Additionally, NAFTA lacks a clause similar to the one in CAFTA, which calls for the enforcement of domestic environmental law. In the end, the tribunal decided that in denying Metalclad request, Mexico breached obligations under NAFTA that guarantee fair and equitable treatment of foreign investors. One reason was that the municipal government had no authority to deny the construction permit on environmental grounds. Hence the slightly less restricting environmental protection (EP) law under NAFTA might have increased the chance for Metalclad to win the case. (International Centre for Settlement of Investment Disputes, 2000).

Investor disputes refer not only to environmental protection, but also to labor rights. Véola, a French company, filed a dispute against Egypt under the French-Egypt bilateral investment treaty (BIT). Egypt cancelled a 15-year-old contract – including tasks like street cleaning and waste collection. The government argued that Véola failed to keep payments in line with inflation and other potential cost increases. Furthermore, the company is understood to have complained about Egypt’s new labor legislations. According to Véola, the introduction of a minimum wage in Egypt would have resulted in an unjustifiable burden to the foreign company. In 2012, the firm turned to the arbitration panel under the French-Egypt BIT. This case is still pending at the time of writing. (Peterson 2012) The respective BIT, however, covers neither labor nor environmental standards. However, in the hypothetical case, where Véola files the dispute under a PTA that hinges on protecting a minimum wage, Véola might struggle to assert itself.

But even in the absence of an investor-to-state dispute settlement mechanism, environmental and labor standards in PTAs might restrict firms’ activities - especially if firms violate regulations. For example, under the Labor Enforcement Plan of Guatemala under CAFTA, parties call for the monitoring of export companies:

“The Labor Ministry will conduct annual inspections of all companies that receive tax and tariff benefits under special provisions of Guatemalan law (Decree 29-89) to confirm compliance with labor laws and reject new applications for benefits received from labor law violators.” (USTR 2013)

Investors are among the beneficiaries of tax and tariff reductions. Due to the increasing complexity of PTAs, they might be confronted with issues that go beyond investment and trade. Multinationals potentially have to defend themselves against alleged labor or environmental standard violation. Firms in compliance with regulations, on the other hand, should be indifferent. Or, they might even favor standards. This seems plausible, when regulations yield competitive advantages for investors vis-à-vis domestic firms. Local companies in developing countries might struggle more to comply with such regulations than foreign firms. Then, innovation and experience with such standards might improve competitiveness versus local companies. In summary, I expect investors to care about non-trade issues in trade deals. In the following section, I provide an argument on explaining the varying reactions of investors to standards.

2.1 Explaining investors’ reactions to NTIs in PTAs

I argue that both hypotheses – namely 1.) standards have a negative impact on investment and 2.) standards have a positive impact on investment – are partly true. In the following, I aim to disentangle the underlying motivation structures of different investment decisions in order to hypothesize in which situations one would expect a negative or a positive impact of NTIs in PTAs on FDI.

A crucial aspect is the variation in what and how industries produce. Powell (1996), Rumelt (1991), Schmalensee (1985), and Tashman and Rivera (2010) argue that industries build upon different competition dynamics: Sectors vary, for example, in terms of cost structure and regulatory requirements. These differences result in differing strategies. The costs of compliance vary from industry to industry (Rivera and Oh 2013). Certain firms have to bear higher production costs after the introduction of NTIs. Others experience an increase in productivity, reduce work stoppage, and increase profits. The first should apply to sectors that benefit from low costs determined by weak standards. For instance, did US firms in the battery sector move to Mexico, inter alia, to benefit from lower environmental regulations (Frey 2003). Or, investments by multinationals in the garment sector were often driven by lower wages and longer working hours in Bangladesh and Cambodia than at home (Berik and van der Rodgers 2010). Even if compliance with standards is not examined across the board, monitoring apparatus scrutinize especially those industries with the reputation of high pollution levels and cheap workforce (Shah and Rivera 2007). Thus, the negative reaction to environmental protection and labor rights issues should depend on the degree to which high standards increase production costs. On the contrary, firms depending on green technology or high skilled workers could favor stricter standards (Palmer et al. 1995; Porter 1991; Rivera and Oh 2013). Beyond the reduction of regulatory uncertainty (Rivera and Oh 2013: 248–249), the commitment to international environmental and labor rights standards might attract firms from ecologically clean and high-skilled labor endowed sectors. In this case, the productivity and profit gain by green technology and quality labor should correlate with positive reactions to NTIs in PTAs.

2.2 The question then is: In which sectors are investment motivations mainly driven by low-standard shopping and who potentially benefits from stricter NTIs?

Concerning environmental regulations, production prices in pollution heavy industries are characterized by a greater dependence upon standards than in relatively clean sectors (Jaffe et al. 1995; Van Beers and Van den Bergh 1997). This should influence investors’ decisions (Becker and Henderson 2000; Rauscher 1995). The variation in pollution levels, which is substantive across sectors, might explain diverging reactions to environmental protection standards (Cole and Elliott 2005; He 2006). Whereas, the information sector – covering inter alia media production, broadcasting, and computer programming – have no or only a marginal impact on the environment. The utilities sector – consisting of companies engaged in producing and delivering amongst others electric power, natural gas, and water – report a larger ecological footprint. Both firms, Pac Rim Cayman LLC and Metalclad, mentioned in the section above as companies involved in investor-state disputes and being accused for environmental violations, stem from dirty industries. The first operates in the mining and the latter in the waste management sector. Lower tariffs towards many countries opens a wide range of investment opportunities and firms fearing accusations of environmental pollution might decide against an investment in a country with whom the home state shares an agreement covering strict environmental standards. From this follows the first hypothesis:

-

Hypothesis 1a: Investment in sectors that report a greater environmental impact is likely to shrink with environmental standards in PTAs.

On the other hand, there might be sectors benefiting from higher standards. As an example, Rivera (2002) shows that (foreign) firms in-line with Costa Rica’s regulations on sustainable tourism improved their economic competitiveness. With respect to stricter standards, a certain segment of investors that compete in the domestic market might be privileged, namely those that possess or even make business with knowledge and technological innovation regarding environmental protection. Palmer et al. (1995) argues that in terms of environmental technology innovative firms are often pro ecological standards. In a North-South setting, as in the empirical analysis of this paper, where multinationals outsource from the US towards developing PTA partner countries, the firm coming from the developed country may benefit from their edge in knowledge vis-à-vis companies in the developing country. This is due to the reason that foreign companies coming from the North are likely to have experienced business environments with stricter standards. Operating in such an environment, might have forced them to gain precognition on how to efficiently comply with such regulations. Potentially they further learned how to use environmental protection standards and the expectations of consumers to comply with them to their advantage. As a consequence, these firms are likely to be equipped not only with a greater knowledge on how to deal with such regulations, but also with innovative business plans that are based on green and fair production strategies. In contrast, in developing countries firms are likely to be (yet) inexperienced and struggle to creatively deal with environmental issues. Thus, I expect the following:

-

Hypothesis 1b: Investment in sectors that report a relatively small ecological footprint is prone to increase with environmental standards in PTAs.

With regard to workers’ rights, labor abundant sectors should react more strongly towards labor standards in trade agreements than capital intensive firms. Whereas wholesale trade and service sectors fall under the first category, the petroleum industry corresponds to the latter. A potential increase in production costs resulting from a rise in labor standards emerges only if labor is crucial to the production process in the respective sector. In these labor abundant sectors, wage costs frequently determine investors’ decisions (Gupta 1983). Therefore, it is important to further differentiate between sectors with high and sectors with low wage levels. Wages represent two factors that are crucial in determining the marginal change of production costs by a change in labor rights: For one, wage levels proxy the average skill level of occupations in the sector. The majority of the employees in the electric equipment sector, which is labor abundant, represents electrical and electronic equipment assemblers with a relatively low wage level (Bureau of Labor Statistics 2016). The majority of employees in the machinery sector, also labor abundant, work as team assemblers - having responsibility for assembling an entire product or component of a product and relatively higher skill and wage levels than the average worker in the electronic equipment sector (Bureau of Labor Statistics 2016). Despite both being labor intensive industries, firms in the electric equipment sector are likely to react differently to standards than companies in the machinery sector. The first relies on a cheap workforce. Given that an increase in standards is prone to trigger higher wages (Bentolila et al. 1994; Heckman et al. 2000), these sectors might dislike costly labor standards in PTAs. From this argumentation, I derive hypothesis 2a:

-

Hypothesis 2a: Investment in sectors that are low-skilled labor endowed is prone to shrink with labor rights in PTAs.

Contrarily, in high-skilled labor endowed sectors companies are competing for a qualified workforce (Noe 2010). These companies value the worker’s quality rather than its cost (Moran 2002; Santoro 2000; Spar 1999). The introduction of or the up-valuation of labor rights through trade deals in host countries potentially changes the business setting and might lead to a situation where firms coming from countries with long experiences in strict regulations are prone to have a comparative advantage over companies that have operated in countries with weak standards. Qualified workers that seek a job that, beyond good salary, guarantees workers’ rights might be tempted to favor foreign firms – that report a long record in operating in a high-labor standard business environment – over domestic ones. Moran (2002) shows that foreign firms, which came from industrialized countries and invested in the electronics-, auto parts-, chemicals-, pharmaceuticals-, and medical equipment sector in developing countries, offered better working conditions than domestic companies. This is due to the reason that they are likely to find the company coming from the North more trustworthy in terms of upholding strong labor protection. Hence, in high-skilled labor endowed industries, foreign firms from developed countries may gain comparative advantage over domestic companies. From this follows hypothesis 2b:

-

Hypothesis 2b: Investment in sectors that are high-skilled labor endowed is prone to increase with labor rights in PTAs.

I have argued that polluting sectors as well as low-skilled labor abundant industries, should be prone to react negatively to such standards. In contrast, ecologically clean and high-skill labor endowed sectors are expected to increase FDI with NTIs in PTAs.

2.3 Statistical analysis of investors’ reactions to NTIs in PTAs

2.3.1 Operationalization of the key variables

To test the argument, I need foreign direct investment at the country-dyad-industry level. Unfortunately, disaggregated data on FDI at the industry and dyad level is scarcely available. The Bureaux of Economic Analysis (BEA) of the United States Department of Commerce offers such data. BEA conducts compulsory outward investment surveys, where concepts and definitions are consistently used. For these reasons, the BEA dataset is the most comprehensive and reliable source for disaggregated FDI data. Due to limited data availability in other countries, I focus on US outward FDI, which is available at three-digit-industry level. The dataset is an unbalanced panel of 36 partner countries of the US over the 1982–2015 period. 19 out of the 36 countries have joined a PTA with the US during the observation period. The maximum length of the time series is 33 years.

Institutional designs of labor as well as environmental protection standards in PTAs represent the main explanatory variables, where different modes of legalization (Abbott et al. 2000) capture variation in design. More specifically, the variable accounts for the degree of precision, obligation, and delegation of standards (Abbott et al. 2000). High precision means that the legal text defines rules in a clear manner. Precise text limits the room for interpretation. Imprecise agreements make a general call towards NTIs. Precise agreements, in contrast, name specific NTIs. Among others, countries could list waste management, Co2 emission reduction, protection of biodiversity to define environmental protection. Equal pay for equal work, the right to rest and leisure, right to minimum pay, the right to bargain collectively, the prohibition of forced labor describe inter alia labor standards in NTIs. Obligation defines the degree of bindingness of a specific regulation. Classified as mediocre level of obligation, the US Colombia PTA states that member states must comply (Article 17.1). This goes beyond mere promotion, but omits sanctioning. Contrarily, the CAFTA-DR allows for monetary assessment in situations of non-compliance (Article 20.18). Delegation accounts for the degree to which countries transfer monitoring and enforcement tasks to third parties. The Colombia US PTA calls for strong involvement of third actors, such as non-governmental organizations, trade-unions, science, and business. These actors should support the government to improve environmental protection standards. Further, they allow domestic courts to decide over litigations. The US agreements with Korea and Singapore, in contrast, limits the interaction with external actors. Instead, these PTAs emphasize conciliation mechanisms between governments.

Due to two reasons, I opt for the concept of legalization rather than for a measure of depth or the pure presence or absence of NTIs: First, the mode of legalization concept captures the nature of environmental protection and labor rights clauses well. The three-dimensionality of the mode of legalization index matches the logic of NTIs clauses, where parties define NTIs (precision), state the bindingness of NTIs (obligation), and list participating third parties (delegation). Second, all three dimensions are crucial in defining the commitment level towards NTIs. Research has shown that precision (Richardson and Kegley 1980), obligation (Hafner-Burton 2009), and the involvement of third parties (Bracic 2016; Simmons 2009) matters in the implementation process. Thus, a higher level of NTIs commitment should translate in stronger investors’ reactions.

To account for variation in the mode of legalization, I coded 110 data-point in all post-1945 PTAs. The code-book captures the three dimensions of the concept of legalization, namely obligation, precision, and delegation. The obligation dimension consists of seven data-points, ranging from promotional intends to conditionality. Sixteen aspects define the degree of delegation, where I code the involvement of third actors in filing disputes, in monitoring procedures, in dispute settlement mechanisms, and in the implementation process. Finally, I code general and specific definitions on environmental protection and labor rights to account for precision. By means of latent trait analysis, I aggregate the data-points to an index on environmental protection and labor rights (Bartholomew et al. 2011; Rasch 1980)Footnote 6.

Compared to other PTAs, US agreements score high on the mode of legalization index. Exceptions are the agreements with Israel, Canada, and Vietnam. These PTAs are shallow about environmental protection and labor rights. The US-Israel PTA includes only one clause on labor rights, where the parties commit to not weakening labor rights by dint of trade and investment promotion. Furthermore, these labor rights are not precisely defined. Similarly, the US-Vietnam PTA covers this basic clause for both the environment and labor. Also, the Canada-US PTA include environmental protection in addition to labor rights. But, in contrast to the Israel and Vietnam PTA, this agreement includes precise definitions what member states mean by labor rights and EP. The Jordan-US PTA is even stronger in terms of obligation and precision. Other US-PTAs differ in the degree of delegation. Some consult many actors during the monitoring and implementation process (NAFTA, Bahrain-US, Morocco-US, and Oman-US,) and some list only a limited amount of third actors (Jordan-US, Korea-US, and Singapore-US). Many PTAs allow individuals to file disputes (Australia-US, CAFTA, Morocco-US, and NAFTA), others do not guarantee this right (Panama-US and Singapore-US). Domestic courts are involved in some (CAFTA, Korea-US, Morocco-US, and Peru-US), but not all (US-Vietnam, Jordan-US), implementation processes. Table 1 lists the labor rights- and EP-indices in US PTAs compared to the mean indices by Australia, Canada, the EU, the European Free Trade Association, Japan, New Zealand, and other North-South PTAs.

Next, to measure heterogeneity across industries, I add three attributes: environmental impact of, average skill level of workers in, and labor-endowment of sectors.

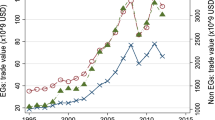

First, the environmental footprint of industries represents the moderating variable in hypothesis 2. Whereas some sectors report low environmental impact others are greater polluters. The US Environmental Protection Agency (EPA) published data on the environmental impact of US industries. They cover 13 environmental impact categories on the sector level in 2009 (EPA 2010). Time variant data exists, but inconsistently across years. Thus, I take the measure of 2009 and use it as a time invariant sector characteristic. These 13 impact categories covered by EPA are abiotic depletion, competition sub-factor, global warming potential, ozone layer depletion-, human toxicity-, freshwater aquatic ecotoxicity-, marine aquatic ecotoxicity-, terrestrial ecotoxicity-, freshwater sedimental ecotoxicity-, marine sedimental ecotoxicity-, photochemical oxidation-, acidification-, and eutrophication potential. EPA provides absolute values of impact and the percentage of total ecological impact per sector. I take the latter and calculate the mean over all 13 impact categories. The utilities sector (e.g. power production) portrays the most polluting industry. Other sources assessing the ecological footprint assign similar ranks to sectors (Hendrickson 2006; Joshi 1999). This confirms the reliability of the data. Data beyond the US context is hardly available. However, I compare data provided by CAIT climate change explorer, who offer information on sector-level pollution for 185 countries with EPA data. Figure 1 shows the correlation between BEA and CAIT data. CAIT covers only six sectors, whereas EPA includes 13 categories. Moreover, many data-points in CAIT are missing. Since pollution levels of US sectors highly correlate with pollution level in other countries and because the coverage of BEA is better than of CAIT, I chose BEA data for the analysis.

Figure 2 shows the FDI position of US firms in PTA partner states. The dark line shows investment by polluting- and the light-gray line reports FDI by non-polluting industries. I expect that these two lines diverge in countries signing PTAs with strict environmental protection issues. The effect is lower in Singapore, who signed a PTA with relatively weak environmental protection clauses. In contrast, countries that committed more ambitiously to the reduction of an ecological footprint, such as Colombia, Costa Rica, Panama, and Mexico, report an increase in FDI by non-polluting- and a decrease of investments by polluting sectors. Obviously, one cannot draw inference from this graph, but it seems that polluting sectors tend to decrease investment after and even before a PTA with strict environmental protection standards enters into effect. Interestingly, the figure further shows anticipation effects. Investors seem to react even before a trade agreement enters into force. Due to this observation, I test beyond the post-effect, the pre-effect of NTIs in PTAs on FDI.

Second, the median wage level within a sector measures the skill level of workers across sectors. The World Bank offers a dataset covering wages of 161 occupations assigned to two- digit SIC industry codes around the globe over a period from 1983 to 2008Footnote 7. I use the median wage level of each sector and compare it to the entire sample. The median wage levels range from 10 to 26 Dollars per hour. If the median wage level is below 15 Dollars (e.g. the median across the entire sample), I classify a sector as ‘low-skilled labor’ and otherwise ‘high-skilled labor’ industry. Whereas jobs in the food and manufacturing sector are weakly paid, wages in the electronic equipment, transport equipment, and utilities sector are well paid (Table 2).

Third, I derive information on labor intensity per sector from the Bureau of Labor Statistics. Labor intensity measures the percentage value of labor costs from total production costs per sector. Wholesale trade, service sectors, machinery, and electronic equipment score highest in terms of labor intensity in the production process. Similar to the above presented sector attributes, labor intensity varies over time. Figure 3 shows investment positions in US-PTA partner countries for high-skilled labor endowed and low-skilled labor endowed industries. The gray line shows FDI in high-skilled and the dark line in low-skilled labor endowed sectors. My theory predicts a divergence of the two lines after the entry into force of an agreement, where the gray line should report an upward and the black line a downward trend. Again, claiming inference is yet too early, but by trend low-skilled labor endowed sectors decrease FDI after an US-PTA entered into force. Contrarily, high-skilled labor endowed industries seem to react positively to standards in PTAs. This seems to be especially the case in Chile, Colombia, Korea, and Panama. All of these countries committed strongly to labor rights. Similar to Fig. 2, Fig. 3 reports an anticipation effect.

Similar to the measure on pollution levels, I measure the labor endowment and wage level of the industries in the US and not in the destination country. This allows to maximize the number of observations. Data is scarcely available for investment destination countries, and if so not reliably comparable across partner states. Again, I compare US data with data from all other countries. The World Bank provides information on both cases, but wage-level data is often missing for developing countries.Footnote 8 The correlation between industry-wage of the US and of other countries is high (r = 0.82). Relying on US production data is legitimate for two reasons. For one, production structures of sectors are unlikely to vary substantially across countries – especially if the parent company is the same. Second, as the validity checks show, the skilled-labor intensity and labor abundance of an industry is prone to correspond to the skilled-labor intensity and labor abundance of the same industry in partner countries they invest in (Yeaple 2003: 727).

Beyond standards, I control for the economic depth of PTAs. Economically deeper PTAs are prone to include more NTIs. Economic depth and NTIs correlate positively (r = 0.19). Büthe and Milner (2008) show that the commitment to an open market via international trade agreements increases the likelihood of inward FDI. Especially vertical investors, whom I expect to decrease FDI with stricter standards, are likely to respond positively to trade liberalization (Markusen and Maskus 2003). Therefore, it is important to account for the degree to which a treaty lowers trade barriers. The DESTA-project provides data on economic depth (Dür et al. 2014). Again by dint of latent-trait analysis, the data-points that refer to trade liberalization are aggregated to a single index.

2.3.2 Estimation strategy

To test the argument, I estimate the following equation:

Where the dependent variable is the total US FDI position in sector i, for country j in year t (hypothesis 1a-b), the total US FDI position in low-skilled or high-skilled labor sectors (hypothesis 2a-b). Sensitivity jt measures a sector’s sensitivity – pollution levels (time-invariant), skill level of workers, and labor endowment (varies over time) – to environmental and labor standards respectively. NTI jt stands for economic and social rights or environmental protection issues, and depth jt for the economic depth of the respective PTA country j holds at time t. α j accounts for partner country-, γ t for year-, and σ i for the sector fixed effects.

One might suspect that an endogeneity problem is at stake. To tackle this concern, I implement two strategies that aim at reducing the selection bias. First, I use an approach on correcting the selection bias on continuous variables suggested by Baser (2006), who estimates a Tobit model to explain variation in the selection process and includes the residuals (res_1st_stage) of this estimation in the second stage model that explains variation in FDI. Following this approach, I use the same explanatory variables in the selection model as the ones in the output model. Second, I use a sample including all actual and potential FDI partner countries of the US – covering PTA-, non-PTA-, FDI-, and non-FDI partners. Combined with fixed country and year effects, I estimate a difference in difference model. This conservative estimation strategy should provide a rigorous test of the above presented hypothesis.

2.3.3 Findings

In the following, I report results on whether cost-sensitivity of sectors towards standards is likely to reduce investment after the entry into force of the respective PTA. Figure 4Footnote 9 shows the – to pollution levels – conditional effects of EP standards on FDI. Polluting sectors are significantly more likely to reduce investment in PTA-partner states that have strict ecological regulations. The threshold, after which trade deals with strong environmental language, such as for instance NAFTA, significantly reduce FDI, lies at 4.1. The mining, metal, chemical, food, petroleum, and utilities sector report an environmental impact scale greater than 4. The statistical analysis shows that companies in these sectors tend to respond negatively to EP issues in trade deals. The findings confirm the above presented anecdotal evidence, where a firm in the mining-, and a company in the waste management sector came in the crossfire of investor and environmental protection. On the other hand, clean industries, such as machinery, technical and financial service sector, invest more in PTA-partner countries with strict environmental protection standards. However, I find that the negative reaction of polluting sectors to EP standards in PTAs is more substantial than the positive response by non-polluting industries. After the entry into force of a PTA with EP standards, industries with zero ecological footprint invest 10% more than industries with an average polluting level (score of 4.93). Sectors with an environmental impact score of 10, in contrast, invest 39% less than the average polluting industry.

Figure 5 shows the – to the labor endowment – conditional effect of labor rights on FDI in (a) low-skilled labor and in (b) high skilled labor sectors. As expected, the effect of standards is the exact opposite in the two scenarios. Whereas workers’ rights in low-skill labor endowed sectors significantly decrease FDI, they increase investment in high-skilled labor endowed industries. If labor costs compose more than 42% of total production costs, firms in sectors with a low average wage level are prone to reduce investment with strict social standards in PTAs (for instance the Costa-Rica US or the Honduras US PTA). Companies operating in high wage sectors increase FDI after the introduction of labor rights regulations through trade agreements. The difference of workers’ rights-coefficients in the low-wage sector and the high-wage sector model is significant with p < 0.001. In line with Kucera (2002), I find that high-skilled sectors with a labor endowment larger than 39% are likely to increase FDI with stricter standards. Again, the substantial negative effects are larger than the substantial positive effects. For low-skill-50%-labour abundant sectors, social standards in PTAs tend to reduce FDI by 19% compared to an industry with an average labor abundance (mean among low-skilled labor sectors = 0.32). Contrarily, high-skilled-40%-labour endowed industries are likely to increase investment by 6 % vis-à-vis – in terms of labor endowment – average industries (mean among high-skilled labor sectors = 0.27).

As Figs. 6 and 7 indicate, it seems that there is an anticipation effect at stake – meaning that multinationals make their investment decisions already before a PTA enters into force. For this purpose, I run the same estimations as presented above, but alter the lag of the institutional design variables (e.g. NTIs and economic depth of the PTA). In the following, I present the effect of NTIs in PTAs on investor decisions two, four, and eight years before the trade deal enters into effect.Footnote 10 Figure 6 shows the anticipation effect of environmental protection issues in PTAs, and Fig. 7 reports these for labor rights in trade agreements. Indeed, there is an anticipation effect. Already, two years before a treaty turns into effect, multinationals react to EP in PTAs. This effect, however, seems to be rather short term. With a lag larger than four years, the effect becomes insignificant. The anticipation is less pronounced for labor rights issues. Neither the two-, four-, nor the eight-year lagged labor rights clause correlates with lower investment in low-skilled labor abundant sectors or with higher investment in high-skilled labor endowed industries. With respect to both issue areas, environmental protection and labor standards, the anticipation-effect is smaller than the post-effect and decreases with larger lags.

2.3.4 Robustness checks

In addition to the above presented models, I run several alternative specifications in order to test the robustness of the results. First, and to ensure that the findings are not due to a general trend in FDI, I estimate a placebo difference in difference. Only if the trend in the outcome before the event are not statistically different between the control and treatment group, can one ensure an isolated effect of the true NTI-values in PTAs on FDI. For this purpose, I drop observations, where NTIs are greater than zero, and then assign random values of NTIs for the treatment group. Neither of the hypotheses shows significant placebo effects. This brings further support to my argument.

Second, I include the lagged dependent variable as an explanatory variable.Footnote 11 The magnitude of the coefficients decreases and the test on hypothesis 2b fails to meet the significance level. However, the anticipation effect might reduce the efficiency of this estimation.

Third, I alter the sample. Instead of all actual and potential US-PTA partners, I use a sample on actual US-PTA partners only. Both, the environmental impact and labor-endowment hypothesis remain in terms of magnitude and significance constant after these changes.

Fourth, I depart from a log-linear OLS regression by estimating three models of three different types: a pooled-ordinary least squares specification, a random effects model including market size, geographic distance, and excluding country-fixed effects, and a Poisson Maximum Likelihood estimation. The results hold in all of these variants with an exception of hypothesis 2b in the Poisson Maximum Likelihood estimation.

Sixth, I estimate a model without the economic depth variable. Due to the positive correlation between economic depth and NTIs in PTAs (r = 0.19), a plausible concern is multicollinearity. The results remain stable with and without the depth-measure. Seventh, I estimate an expanded model, where I control for GDP, population size, and geographic distance to the US. Moreover, the model accounts for the presence of Bilateral Investment Treaties (BITs) between the US and partner countries. Since 1945, the US signed 43 BITs of which 38 entered into force. I coded all of these agreements in terms of NTIs and found only two BITs with substantial NTIs clauses, namely the BIT with Rwanda signed in 2008 and the BIT with Uruguay signed in 2006. These are also the two latest BITs of the US. I assign a value of 2 for an inforce BIT with NTIs and a value of 1 for an inforce BIT without NTIs. Even after I control for these four additional variables, the magnitude and significance level of the main explanatory variables remain stable.

Finally, and only relevant for the environmental impact hypothesis, I substitute the EP impact measure with a time-variant index, namely the energy input level per sector. Similar to the labor endowment data, the Bureau of Economic Analysis offers information on energy use. Though, the distribution of this variable is skewed, I find support for my hypothesis.

Overall, the robustness checks confirm the baseline models:Footnote 12 Whereas polluting and low-skilled endowed sectors react negatively, ecologically clean and high-skilled abundant industries respond positively to environmental and labor standards in PTAs.

2.3.5 Conclusion

Preferential trade agreements increasingly incorporate environmental and labor standards. Some scholars have already examined the effect of labor rights in PTAs on domestic compliance (Hafner-Burton 2009; Kim 2012; Postnikov and Bastiaenes 2014; Spilker and Böhmelt 2012). However, it is yet unclear whether these standards influence business too. With this article, I aim to answer two questions: a.) Do environmental and labor standards in preferential trade agreements influence investment behavior? b.) If yes, are reactions homogeneous or heterogeneous across sectors?

The fact that scholars have based their analysis on aggregated FDI data might explain the inconclusive findings on investors’ reactions to non-trade-issues (NTIs). Some argue that regulations decrease the attractiveness of a country as an investment destination (Konisky 2008; Potoski 2001; Woods 2006), others emphasize the increased productivity and consequently greater amenity of an investment location resulting from higher standards (Kucera 2002; Palmer et al. 1995; Porter 1991; Reinhardt 1998; Rivera 2002; Rivera and Oh 2013). I claim that both strands of the literature explain investment behavior, but tackle different segments of business. I expect companies in polluting- or low-skilled labor endowed industries to react negatively to regulations in PTAs. Firms in ecologically clean- or high-skilled labor abundant sectors, in contrast, should increase FDI with stronger environmental and labor language in trade deals.

I test the argument on an original dataset of non-trade issues in PTAs and bilateral and sectoral investment data. The disaggregated FDI data and the fine-grained standard measure allow the scrutiny of investors’ reactions on the inclusion of NTIs in PTAs. Because disaggregated FDI data remains unavailable for any other country than the US, I focus on the American context. The theory, however, is generalizable beyond the US. Many Western countries include environmental and labor rights standards in their trade deals. Australia, Canada, the European Union, New Zealand, and the EFTA countries are among the greatest ambassadors for the inclusion of NTIs in PTAs. Two reasons speak for the validity of the here presented argument in these other contexts: First, the investors in these Western countries are prone to follow similar incentive-structures than US firms, where some sectors operate in polluting and low-skilled labor endowed sectors and others build on green technology and high-skilled labor force (Grugel 2004). Second, increasingly these Western countries assimilate the US approach to regulate NTIs via PTAs – e.g. setting up dispute settlement mechanisms for environmental and labor law matters. Figure 8 shows the convergence of the institutional design in Australian, Canadian, EU, New Zealand, and EFTA PTAs and the regulatory set-up of US PTAs. From this follows that PTAs of other countries have become very similar and comparable to US trade agreements.

Overall, the results in the baseline model as well as a wide range of robustness checks confirm my expectations. Polluting as well as low-skilled labor abundant industries tend to decrease investment with the introduction of NTIs in PTAs. In contrast, ecologically clean and high-skilled labor reliant sectors seem to increase FDI.

Further research could investigate whether exporters are sensitive to environmental and labor standards in PTAs, too. Moreover, once bilateral sectoral FDI data is available beyond the US context, the study could be broadened in terms of geographic scope.

In conclusion, the paper shows that standards in PTAs do have an economic impact and are more than mere cheap talk for businesses. More precisely, the findings suggest that questions on investors’ reactions require disaggregated FDI data, where the distinction between sectors might solve inconclusive (academic) debates. Standards attract some investors and deter others. This implies that there is a trade-off between high standards that trigger FDI from clean or high-skilled labor endowed sectors and low standards that speak to polluting or low-skilled labor abundant industries. This brings more nuance to the discussion over whether we see a race to the bottom or to the top. Further academic work on the effect of standards on FDI should take sector-heterogeneity seriously. Given the ever-denser PTA network, the growing number in investor-to-state disputes, and the increasing public debate on investment and environmental as well as labor standards, it will be highly worthwhile to continue analyzing the investment and non-trade issue linkage. Despite the call for sector-disaggregation, generalization seems valuable across issue areas. I show that similar mechanisms for environmental and labor standards are at stake. Thus, I conclude with an invitation for an intensified dialogue between scholars working on environmental protection and scholars dealing with labor rights.

Notes

The number is based on the author's own assessment. Environmental protection means to care for natural resources (water, soil, forest), to reduce waste and air pollution, and to protect wildlife and game. Labor rights cover the right to work and rights at work, including freedom of association, right to collective bargaining, prohibition of all forms of forced labor, prohibition of child labor, non-discrimination in employment (the right for equal pay and opportunity at work), right to rest and leisure, and the right of minimum pay.

I use sectors and industries interchangeable. Both terms define general segments in the economy. For a list of sectors see Appendix.

Only two out of 38 US-BITs cover substantial clauses on NTIs. In Article 12 and 13, the Ruanda-US BIT and the Uruguay-US BIT mention labor and environmental protection issues.

Even though Pac Rim has originally been a Canadian firm, the company created a US subsidiary in 2007 under which it filed the dispute through CAFTA.

Pac Rim referred to Article 10.3 (national treatment), Article 10.4 (most-favored-nation treatment), Article 10.5 (minimum standard of treatment) and Article 10.7 (expropriation) in CAFTA-DR.

The detailed coding-scheme and factor loadings can be found in the appendix. In total, the EP index ranges from 2.39 to 7.264 (mean = 2.504) and the labor index reaches from 2.152 to 6.400 (mean = 2.504).

Since data is unavailable after 2008, I use the 2008 wage level for the years 2009 to 2015. Therefore, I have time-variant data until 2009 and time-invariant data after 2008.

Wage level data is missing for 57 percent of all data-points in the full sample, but only 15 percent of information remains unobserved for the US. Factor endowment ist o my knowledge not available beyond the OECD countries.

The full output tables corresponding to all graphs can be found in the appendix.

Alternatively, I could use the negotiation duration. However, there is little variation across US PTAs in terms of negotiation duration, which ranges from one year (Bahrain US PTA) to three years (Panama US).

Since the lagged variable approach frequently results in bias in other estimates (Bellemare et al. 2017), I decide against this approach as baseline.

Hypothesis 1a, 1b, and 2a pass all tests. Hypothesis 2b fails to meet the significance level in the lagged dependent variable and the Poisson Maximum Likelihood model.

References

Abbott, K. W., Keohane, R. O., Moravcsik, A., Slaughter, A.-M., & Snidal, D. (2000). The Concept of Legalization. International Organization, 54(3), 401–419.

Arel-Bundock, V. (2016). The Political Determinants of Foreign Direct Investment: A Firm- Level Analysis. International Interactions, 43(3), 424–452.

Baccini, L., Pinto, P., & Weymouth, S. (2017). The distributional consequences of preferential trade liberalization: a firm-level analysis. International Organization.

Bartholomew, D. J., Knott, M., & Moustaki, I. (2011). Latent variable models and factor analysis: A unified approach. Wiley series in probability and statistics (3rd ed.). Hoboken: Wiley.

Baser, O. (2006). Controlling Selection Bias on Continuous Variables. Value in Health, 9(3), A86.

Becker, R., & Henderson, V. (2000). Effects of Air Quality Regulations on Polluting Indus- tries. Journal of Political Economy, 108(2), 379–421.

Bellemare, M., Masaki T. & T. Pepinsky (2017). Lagged Explanatory Variables and the Estimatioon of Causal Effect. The Journal of Politics, 79(3), 949-963.

Bentolila, S., Dolado, J. J., Franz, W., & Pissarides, C. (1994). Labour Flexibility and Wages: Lessons from Spain. Economic Policy, 9(18), 53–99.

Berik, G., & van der Rodgers, Y. M. (2010). Options for enforcing labour standards: Lessons from Bangladesh And Cambodia. Journal of International Development, 22(1), 56–85.

Bhagwati, J. (2002). Afterword: The Question of Linkage. The American Journal of International Law, 96(1), 126–134.

Bracic, A. (2016). Reaching the Individual: EU Accession, NGOs, and Human Rights. American Political Science Review, 110(3), 530–546.

Brooks, S. G. (2005). Producing Security: Multinational Corporations, Globalization, and the Changing Calculus of Conflict: Multinational Corporations, Globalization, and the Changing Calculus of Conflict. Princeton studies in international history and politics. Princeton: Princeton University Press.

Bureau of Labor Statistics (2016). Industries at a Glance: Electrical Equipment, Appliance, and Component Manufacturing: NAICS 335: United States Department of Labor.

Business Europe (2014, November). Trade-Roadmap for the European Commission. https://www.businesseurope.eu/sites/buseur/files/media/imported/2014-01000-E.pdf. Accessed 4 Apr 2017.

Büthe, T., & Milner, H. V. (2008). The Politics of Foreign Direct Investment into Developing Countries: Increasing FDI through International Trade Agreements? American Journal of Political Science, 52(4), 741–762.

Cole, M. A., & Elliott, R. J. R. (2005). FDI and the Capital Intensity of Dirty Sectors: A Missing Piece of the Pollution Haven Puzzle. Review of Development Economics, 9(4), 530–548.

Dür, A., Baccini, L., & Elsig, M. (2014). The Design of International Trade Agreements: Introducing a New Dataset. The Review of International Organizations, 9(3), 353–375.

EPA (2010). Sustainable Materials Management: The Road Ahead. https://www.epa.gov/smm/sustainable-materials-management-road-ahead. Accessed 25 Feb 2017.

Flanagan, R. J., & Gould, W. B. (2003). International labor standards: Globalization, trade, and public policy. Stanford law and politics. Stanford: Stanford University Press.

Frey, R. S. (2003). The Transfer of Core-Based Hazardous Production Processes to the Export Processing Zones of the Periphery: The Maquiladora Centers of Northern Mexico. Journal of World-Systems Research, 9(2), 317.

Friedman, J., Gerlowski, D. A., & Silberman, J. (1992). What Attracts Foreign Multinational Corporations? Evidence from Branch Plant Location in the United States. Journal of Regional Science, 32(4), 403–418.

Gallus, N. (2013). Pac Rim Cayman LLC v Republic of El Salvador. ICSID Review 28(1), 15-20.

Greenstone, M. (2002). The Impacts of Environmental Regulations on Industrial Activity: Evidence from the 1970 and 1977 Clean Air Act Amendments and the Census of Manufactures. Journal of Political Economy, 110(6), 1175–1219.

Grugel, J. B. (2004). New Regionalism and Modes of Governance — Comparing US and EU Strategies in Latin America. European Journal of International Relations, 10(4), 603–626.

Gupta, V. K. (1983). A Simultaneous Determination of Structure, Conduct and Performance in Canadian Manufacturing. Oxford Economic Papers, 35(2), 281–301.

Hafner-Burton, E. M. (2009). Forced to be good: Why trade agreements boost human rights. Ithaca: Cornell University Press.

He, J. (2006). Pollution haven hypothesis and environmental impacts of foreign direct in- vestment: The case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecological Economics, 60(1), 228–245.

Heckman, J., Pagés-Serra, C., Edwards, A. C., & Guidotti, P. (2000). The Cost of Job Security Regulation: Evidence from Latin American Labor Markets. Economica, 1(1), 109–154.

Hendrickson, C. T. (2006). Environmental Life Cycle Assessment of Goods and Services: An Input-output Approach. Washington, DC: Routledge.

International Centre for Settlement of Investment Dipsutes (2000). CASE No. ARB(AF)/97/1:Metalclad Corporation versus United Mexican States. URL: https://www.italaw.com/sites/default/files/casedocuments/ita0510.pdf

Jaffe, A. B., Peterson, S. R., Portney, P. R., & Stavins, R. N. (1995). Environmental Regulation and the Competitiveness of U.S. Manufacturing: What Does the Evidence Tell Us? Journal of Economic Literature, 33(1), 132–163.

Joshi, S. (1999). Product Environmental Life-Cycle Assessment Using Input-Output Techniques. Journal of Industrial Ecology, 3(2–3), 95–120.

Kerner, A. (2014). What We Talk About When We Talk About Foreign Direct Investment. International Studies Quarterly, 58(4), 804–815.

Kerner, A., & Lawrence, J. (2014). What’s the Risk? Bilateral Investment Treaties, Political Risk and Fixed Capital Accumulation. British Journal of Political Science, 44(1), 107–121.

Kim, M. (2012). Ex Ante Due Diligence: Formation of PTAs and Protection of Labor Rights. International Studies Quarterly, 56(4), 704–719.

Konisky, D. (2008). Regulator Attitudes and the Environmental Race to the Bottom Argument. Journal of Public Administration Research and Theory, 18(2), 321–344.

Krugman, P. (1997). What Should Trade Negotiators Negotiate About? Journal of Economic Literature, 35(1), 113–120.

Kucera, D. (2002). Core labour standards and foreign direct investment. International Labour Review, 141(1–2), 31–69.

List, J. A., Millimet, D. L., Fredriksson, P. G., & McHone, W. W. (2003). Effects of Environmental Regulations on Manufacturing Plant Births: Evidence from a Propensity Score Matching Estimator. The Review of Economics and Statistics, 85(4), 944–952.

Mansfield, E. D., & Pevehouse, J. C. (2000). Trade Blocs, Trade Flows, and International Conflict. International Organization, 54(4), 775–808.

Markusen, J. R., & Maskus, K. E. (2003). General-Equilibrium Approaches to the Multinational Enterprise: A Review of Theory and Evidence. In E. K. Choi & J. Harrigan (Eds.), Handbook of International Trade (pp. 320–349). Oxford: Blackwell Publishing Ltd..

Moran, T. H. (2002). Beyond sweatshops: Foreign direct investment and globalization in developing countries. Washington, DC: Brookings Institution.

Noe, R. A. (2010). Human Resource Management: Gaining a competitive advantage (7 edn). Boston: McGraw-Hill.

Palmer, K., Oates, W. E., & Portney, P. R. (1995). Tightening Environmental Standards: The Benefit-Cost or the No-Cost Paradigm? The Journal of Economic Perspectives, 9(4), 119–132.

Peterson, L. E. (2012). French company, Veolia, launches claim against Egypt over terminated waste contract and labor wage stabilization promises. http://www.iareporter.com/articles/ french-company-veolia-launches-claim-against-egypt-over-terminated-waste-contract-and-lab. Accessed 10 Dec 2016.

Porter, M. E. (1991). America’s Green Strategy. Scientific American, 246(4), 168.

Postnikov, E., & Bastiaenes, I. (2014). Does Dialogue Work? The Effectiveness of Labor Standards in EU Preferential Trade Agreements. Journal of European Public Policy, 21(6), 923–940.

Potoski, M. (2001). Clean Air Federalism: Do States Race to the Bottom? Public Administration Review, 61(3), 335–343.

Powell, T. C. (1996). How Much Does Industry Matter? An Alternative Empirical Test. Strategic Management Journal, 17(4), 323–334.

Rasch, G. (1980). Probabilistic models for some intelligence and attainment tests. Chicago: University of Chicago Press.

Rauscher, M. (1995). Environmental regulation and the location of polluting industries. International Tax and Public Finance, 2(2), 229–244.

Reinhardt, F. L. (1998). Environmental Product Differentiation: Implications for Corporate Strategy. California Management Review, 40(4), 43–73.

Richardson, N. R., & Kegley, C. W. (1980). Trade Dependence and Foreign Policy Compliance: A Longitudinal Analysis. International Studies Quarterly, 24(2), 191.

Rickard, S. J., & Kono, D. Y. (2014). Think globally, buy locally: International agreements and government procurement. The Review of International Organizations, 9(3), 333–352.

Rivera, J. (2002). Assessing a voluntary environmental initiative in the developing world: The Costa Rican Certification for Sustainable Tourism. Policy Sciences, 35(4), 333–360.

Rivera, J., & Oh, C. H. (2013). Environmental Regulations and Multinational Corporations’ Foreign Market Entry Investments. Policy Studies Journal, 41(2), 243–272.

Rumelt, R. P. (1991). How much does industry matter? Strategic Management Journal, 12(3), 167–185.

Santoro, M. A. (2000). Profits and principles: Global capitalists and human rights in China. Ithaca: Cornell University Press.

Schmalensee, R. (1985). Do Markets Differ Much? American Economic Review, 75(3), 341–351.

Shah, K. U., & Rivera, J. E. (2007). Export processing zones and corporate environmental performance in emerging economies: The case of the oil, gas, and chemical sectors of Trinidad and Tobago. Policy Sciences, 40(4), 265–285.

Simmons, B. A. (2009). Mobilizing for human rights : international law in domestic politics. Cambridge: Cambridge University Press.

Spar, D. L. (1999). Foreign investment and human rights. Challenge, 42, 55–67.

Spilker, G., & Böhmelt, T. (2012). The impact of preferential trade agreements on governmental repression revisited. The Review of International Organizations, 8(3), 343-361.

Tashman, P., & Rivera, J. (2010). Are Members of Business for Social Responsibility More Socially Responsible? Policy Studies Journal, 38(3), 487–514.

USTR (2013). Fact Sheet: Guatemala Agrees to Comprehesnive Labour Enforcement Plan. https://ustr.gov/about-us/policy-offices/press-office/. Accessed 18 Nov 2016.

Van Beers, C., & Van den Bergh, J. C. (1997). An Empirical Multi-Country Analysis of the Impact of Environmental Regulations on Foreign Trade Flows. Kyklos, 50(1), 29–46.

Woods, N. D. (2006). Interstate Competition and Environmental Regulation: A Test of the Race-to-the-Bottom Thesis. Social Science Quarterly, 87(1), 174–189.

Yeaple, S. R. (2003). The Role of Skill Endowments in the Structure of U.S. Outward Foreign Direct Investment. The Review of Economics and Statistics, 85(3), 726–734.

Acknowledgements

Open access funding provided by Paris Lodron University of Salzburg.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Lechner, L. Good for some, bad for others: US investors and non-trade issues in preferential trade agreements. Rev Int Organ 13, 163–187 (2018). https://doi.org/10.1007/s11558-018-9299-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11558-018-9299-2