Abstract

In this study, we analyze illiquidity premia and their effect on the expected returns of German real estate securities. To this end, we use a unique data set that includes real estate stocks, real estate investment trusts (REITs), and open- and closed-end real estate funds for 2003–2017. We follow Amihud’s (JFM 5:31–56, 2002) structural approach; specifically, we estimate Amihud’s illiquidity factors, investigate the relationships between expected returns and illiquidity, and analyze the effects of expected and unexpected market illiquidity on future returns. We show that illiquidity plays an important role in expected returns for real estate stocks and investment trusts (REITs); however, it has less clear effects on open- and closed-end funds. We find that the adjusted ILLIQ includes appropriate correction factors for securities with low trading activity and is a useful improvement. We also find evidence of structural breaks in the relationship between returns and illiquidity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Both modern portfolio theory and asset pricing models imply a perfect capital market with boundless liquidity. Although economic theory incorporated the influence of liquidity for some time (e.g. Keynes 1930), capital market research has only about 30 years of data that incorporate liquidity in asset pricing within the scope of capital market models (Mishra 2008; Hibbert et al. 2009).Footnote 1 The global financial crisis of 2008 (GFC) indicated that prices react considerably to liquidity effects. This led to a clear increase in research activities on the one hand, but to more regulatory requirements for market participants on the other (see Tirole 2011).

Existing research concentrates primarily on the liquidity premia of stocks and bonds, and predominantly covers the North American markets (Hibbert et al. 2009; Rothböck et al. 2011). Few studies on the German stock market exist (Rothböck et al. 2011; Kempf et al. 2012; Paul et al. 2021). Moreover, a line of research on market microstructures focuses on the measurement of liquidity in market design (e.g., Schmidt and Iversen 1991; Küster-Simic 2001; Kindermann 2005). However, to the best of our knowledge, no study on liquidity premia for the German real estate market exists.

Nevertheless, the German real estate market is worth investigating for several reasons. First, real estate represents the largest asset class in the total wealth of German investors (Trübestein 2012). Second, several measures in recent decades aimed to expand the possibilities of indirect real estate acquisition through securitizations, such as the Real Estate Investment Trusts (REIT)-Act and the Investor Protection and Improvement Act (“Anlegerschutz- und Verbesserungsgesetz”). Third, the market recently endured significant illiquidity shocks (e.g., in open-end real estate funds [OEFs]).

For better comparability, we focus exclusively on securitized real estate investments in this study. We explicitly exclude direct investments from these analyses. We follow the prominent Amihud (2002) paper, extend our analyses with further illiquidity measures, and consider the relevant markets in a cross-sectional and time-series analysis. Thus, this study is the first to examine the liquidity premia for securities of the German real estate market.

The remainder of this paper proceeds as follows. In Sect. 2, we discuss the relevant aspects of illiquidity, its impact on security returns, and common illiquidity measures. Section 3 presents the research hypotheses. Section 4 outlines the data and methodology. In Sect. 5, we analyze the relationships between returns and illiquidity using a univariate portfolio analysis (Sect. 5.1) and cross-sectional analysis (Sect. 5.2). We provide a further analysis using the time-series regression analysis of expected and unexpected illiquidity in Sect. 5.3. Section 6 concludes.

2 Illiquidity in equity and real estate markets

According to Brunnermeier and Pedersen (2009), liquidity comprises market liquidity (the ease of trading an asset) and funding liquidity (the ease of obtaining funding). Market liquidity differs for the various classes of real estate property given their specific characteristics and market frictions. Research on market liquidity has significantly increased in the past decades, but is predominantly concerned with the US securities market, particularly the equity market thereof.Footnote 2 We contribute to this research by analyzing the German market for real estate securities for the first time.Footnote 3

2.1 (Il)-liquidity and returns

Investors are compensated for less liquid assets with higher returns. Amihud and Mendelson (1986) predict a positive relationship between the bid-ask spread and expected returns. Amihud and Mendelson (1989) empirically test this prediction and find that the bid–ask spread has a positive cross-sectional relationship with future stock returns after controlling for other variables, such as market beta, market capitalization, and volatility. In perhaps the most cited article on the relationship between liquidity and expected returns, Amihud (2002) suggests a measure of stock illiquidity and shows that illiquidity is positively related to expected market returns, both in time series and cross-section.

While early studies on the determinants of liquidity focused on the cross-sectional dependency of specific asset characteristics, the more recent literature focuses on the time-series characteristics of liquidity. Chordia et al. (2000, 2011), Hasbrouck and Seppi (2001), and Huberman and Halka (2001) observe a significant common component of liquidity at both market and industry levels (Holden 2013). They conclude that this effect aggregates at the portfolio level, which indicates that it is not possible to diversify liquidity shocks at the portfolio level, and supports the assertion that an aggregate liquidity factor plays a strong role in asset pricing (Bali et al. 2016).

Recent works (e.g., Amihud and Mendelson 2015) also consider liquidity commonality in a global context. They find a commonality between illiquidity return premia across countries after controlling for other firm effects, which is not driven by and is distinct from variations in the level of global illiquidity.

Malkhozov et al. (2017) construct country-specific illiquidity indices from pricing deviations on government bonds, which demonstrate a high cross-correlation. Nevertheless, the measures show a pronounced idiosyncratic behavior, especially during country-specific political or economic events. Thus, the global measurement has been characterized by four major peaks in particular over the last 20 years (e.g. the crisis of the European Exchange Rate Mechanism, the Asian crisis, the dot-com bubble burst, and the GFC). Against this background, it seems appropriate to separately consider the German market.

2.2 Empirical Evidence of Illiquidity in real estate markets

Illiquidity risk is also priced in real estate markets (Lin and Vandell 2007; Bond et al. 2007; Kawaguchi et al. 2008; Krainer et al. 2010). One strand of the literature studies the determinants of real estate investment pricing depending on market liquidity. Since the real estate market has more far-reaching data series for private real estate investments, early research focused on housing prices; in this context, the impact of market liquidity and the expected time necessary to sell a property near its fair market value is referred to as “time-on-market” (Lippman and McCall 1986; Krainer 2001; Lin and Vandell 2007; Cheng et al. 2008). Another strand focuses on macroeconomic effects and macroprudential policy to mitigate credit and house price growth.Footnote 4 In our study, we focus on the differences in liquidity in securitized real estate investments and their impact on expected returns.

Though the percentage of real estate investments of the total assets in Germany represents an above-average proportion, there is hardly any empirical research on the returns and drivers of performance, in contrast to the US and UK markets, which have been studied extensively (Maurer et al. 2004b). This may also be because the share of listed real estate stocks in Germany is significantly lower than in the USA, both in percentage terms and even more so in absolute figures.Footnote 5 In Germany, alternative indirect real estate investments such as open-end funds (OEFs) or closed-end funds (CEFs) play a major role in securitized real estate investments (Maurer et al. 2004a). However, the state of research in these asset classes is nearly exclusively restricted to the OEF segment (Maurer et al. 2004a, b; Schweizer et al. 2013; Fecht and Wedow 2014). Fecht and Wedow (2014) examine German OEFs from December 2005 to June 2006, a period in which these investments experienced an unprecedented liquidity crisis. Their results showed that a segmentation of funds for different investor groups might help mitigate panic. If the liquidity crisis of German OEFs in 2005/2006 was non-fundamental, then the impact of the GFC was much stronger. In its aftermath, investors showed higher preference for liquidity and were afraid to tie up capital in the OEF market for an uncertain period (Schnejdar et al. 2019). As opposed to listed property companies, the prices of OEF shares depend on property appraisals and are not directly determined by demand and supply on the secondary market. Since the daily quoted price reflects experts’ valuations of the properties, prices do not face financial volatility directly. As the valuation of a certain property takes place only once a year, the quoted price incorporates only a part of the market price of the underlying properties (Just and Maennig 2017). However, if share redemption is suspended, as observed in 2005/2006 and from 2008 in the context of the GFC, then the significance is not temporary, and the return–risk profiles of the OEFs will change considerably (Haß et al. 2012).

For international markets, various studies investigate securities-based REITs.Footnote 6 Early results on the differences between REIT and non-REIT stock liquidity are mixed. For example, whereas Ghosh and Miles (1996) find that REIT liquidity is not comparable to non-REIT liquidity, Nelling et al. (1995) and Bhasin et al. (1997) show the contrary. Subrahmanyam (2007) finds persistent liquidity spillovers running from non-REITs to REITs, and that non-REIT liquidity indicators Granger-cause those in the REIT market, which is economically relevant. This result suggests that asset allocation decisions in the stock market lead to investments in the substitute real estate market with a time lag. Cheung et al. (2015) examine the effects of stock liquidity on firm value in a REIT setting. Analyzing the US REIT market from 1988 to 2007, Cannon and Cole (2011) find improved liquidity, with the notable exception of 2007. They find high correlations between bid–ask spreads and the volatility of stock returns using microstructure-based measures (bid–ask spread) and price-impact measures, and a negative impact of trade volume and market capitalization. Cannon and Cole (2011) suggest that price-impact measures can replace more sophisticated price-impact information.

Many studies have identified positive correlations between returns and illiquidity for real estate investments (Benveniste et al. 2001; Zheng et al. 2015). In line with theoretical expectations, Ametefe et al. (2016) find liquidity risk to be generally lower for REITs than for other equities. In their analysis of a range of alternative asset class benchmarks, Pedersen et al. (2018) show that private real estate fund performance has significant exposure to the general equity market, a listed real estate factor: the Pástor and Stambaugh (2003) equity market-traded liquidity risk factor, nominal duration, and corporate bond yield spreads.

Recent studies have examined the causal relationships in the context of the GFC. Glascock and Lu-Andrews (2014) highlight the macroeconomic factors driving the funding liquidity of REITs and their links to market liquidity across business cycles. Hoesli et al. (2017) finds the US REITs market is not only driven by its original liquidity or the liquidity of the real estate market. They find that there are co-movements between the US REIT and equity markets, which are particularly impacted by the liquidity channel. They are particularly significant in market turmoil (Hoesli et al. 2017).

Downs and Zhu (2019) examine the transmission channels between securitized markets and underlying investment markets for the real estate market with reference to regional arrangement and other (firm-) specific factors. The authors find that the original liquidity of the regional real estate market and other firm-specific financial parameters significantly affect the liquidity of securitized assets, supporting the investment channel transmission proposition.

There are fewer studies on private real estate. Ametefe et al. (2016) present an overview of and Sieracki et al. (2008) provide a descriptive summary of public non-listed real estate investments for US funds. Brounen et al. (2009) offer a descriptive summary for US, UK, Australian, and Continental European funds. Prior studies therefore consider German assets to only a limited extent, and do not analyze them exclusively.

Overall, prior studies indicate that in the German real estate market, fund-based solutions are relatively dominant over the listed investment vehicles (Just and Maennig 2017). While the market segment of closed-end funds (CEFs) has scant existing research to date, the results for OEFs differ according to the data series up to 2008 and suspended funds after the GFC. Moreover, the market share of listed securities increased. Other studies reveal positive correlations between returns and illiquidity for international real estate markets. Thus, a cross-market analysis of returns and any potential illiquidity effects for the German real estate market is lacking. We aim to fill this gap with our study.

3 Research hypotheses

As stated above, the continuing ability to liquidate is an essential basic assumption in the relevant capital market models, and furthermore in the stated prices of assets. Hence, it is important for market participants to have a basis to calculate whether and to what extent income return expectations move with (temporary) changes in liquidity. Therefore, we aim to answer the following questions: First, can we observe liquidity premia in different segments of the German capital market for real estate securities? To answer this question, we consider financial instruments whose underlyings are German and international real estate. We examine the return characteristics of CEFs, OEFs, real estate companies (REOCs; hereafter simply referred to as stocks or equities), and REITs. These securities differ substantially in their investment strategy and regulatory requirements. In addition, they have different potential for trading and market microstructures. Following the literature described in Sect. 2, we formulate our first hypothesis as follows:

Hypothesis 1

Various segments of the German capital market for real estate investments will have significantly different return and illiquidity parameters.

Second, is there a relationship between returns and liquidity premia for the securities of interest? Amihud (2002) describes a strong cross-sectional relationship between expected stock returns as a function of stock illiquidity and other variables. This question leads to the next hypothesis:

Hypothesis 2

Investors consider the existing illiquidity of securities in their investment decisions. They expect a higher return on illiquid securities, which we can measure in the capital market; that is, “illiquidity is priced”.

Third, how do fluctuations in liquidity affect returns? As studies by Amihud (2002), Acharya and Pedersen (2005), and Acerbi and Scandolo (2008) show, fluctuations in liquidity play a major role in asset pricing. Therefore, in a further step, we distinguish between expected and unexpected illiquidity. While expected illiquidity should be positively associated with returns, unexpected illiquidity should be negatively correlated. Therefore, we propose our last hypothesis:

Hypothesis 3

Ex ante security return is an increasing function of expected illiquidity, and unexpected illiquidity has a negative effect on contemporaneous unexpected stock return.

4 Methodology and data

4.1 Illiquidity measures

Liquidity is a broad concept and cannot be observed directly (Amihud 2002). Rather, it results from many individual factors that are largely easy to identify and quantify. There is a consensus in the literature that there are various aspects of liquidity that determine its different manifestations, although it is not conclusively defined (Díaz and Escribano 2020). According to Sarr and Lybek (2002) and Bervas (2006), a liquid market has five different dimensions: breadth, depth, immediacy, resilience, and tightness. Several liquidity measures have therefore been proposed to capture different aspects of liquidity. These include measures of bid-ask spread (Amihud and Mendelson 1986), turnover and volume (Brennan et al. 1998), price impact (Amihud 2002), and zero return (Lesmond et al. 1999; Bekaert et al. 2007). In various studies, the different factors and their impact on the dimensions of liquidity were analyzed in greater detail (see Aitken and Winn 1997; Aitken and Comerton-Forde 2003; Goyenko et al. 2009; Chai et al. 2010; Ametefe et al. 2016; Díaz and Escribano 2020). However, not all measures are suitable for all capital markets or capital market instruments. To address the different illiquidity effects as much as possible, we used illiquidity measures that capture different dimensions.Footnote 7 The data requirements vary for each measure. For example, transaction-cost-based metrics typically require detailed information about the order book for each security at each observation. In addition, we must consider the different trading practices and market microstructures. Often, the necessary data are no longer available. In the following, we present the measures we employ in our empirical analysis.

4.1.1 Amihud’s illiquidity ratio

First, we use the Amihud (2002) measure,Footnote 8 which is one of the most utilized measurements for illiquidity and which covers at least three main dimensions: depth, breadth, and tightness.Footnote 9 Lou and Shu (2017) argue that the Amihud measure has three important advantages over other indicators. First, it is based on a simple construction that compares the absolute daily price changes of the observed securities relative to the trading volume. Second, the data are typically available on a daily basis for long time series, which allows a more thorough analysis than with high-frequency data; that is, intra-day-based studies. Finally, numerous empirical studies demonstrated the close, positive interaction between ILLIQ and expected returns (e.g., Amihud 2002; Chordia et al. 2009). This positive return contribution is an illiquidity premium that compensates for price effects.

Amihud’s standard ILLIQ is the ratio of the absolute price change and the corresponding trading volume (Amihud 2002):

where \(R_{{{{imd}}}}\) is the return of security i on day d of month m and \({DVOL}_{{imd}}\) is the relevant trading volume (in EUR) of security i on day d of month m. \(D_{im}\) is the number of days with available trading activities for security i in month m. In line with the literature, we control for outliers by winsorizing the measures at 0.5% and 99.5%.

The average market illiquidity across the subsegments in each month is

where \(N_{{{m}}}\) is the number of stocks in month m of our sample. Since the monthly ILLIQ measures vary considerably, Amihud (2002) replaces ILLIQ with a standardized measure ILLIQMA, calculated as follows:

Other studies on illiquidity use these measures and their variants. Amihud and Noh (2018) refer to Brennan et al. (1998), who find that DVOL has a negative effect on expected returns. Trading volume and price changes are positively correlated (for a survey of the evidence, see Karpoff 1987). Datar et al. (1998) and Chordia et al. (2001) show that stock turnover negatively affects expected returns.

4.1.2 Turnover ratio

The Amihud (2002) illiquidity measure responds to changes in both the numerator and denominator. Lou and Shu (2017) present variations of this measure in a study that decomposes it and examines what affects its price.Footnote 10 For example, a higher trading volume leads to a lower illiquidity measure ceteris paribus. This relationship is very strong because the trading volume component has much larger cross-sectional fluctuations than the return component. Consequently, Amihud’s ILLIQ does not consider the relative proportion of potential trading volume, for example, related to shares issued or shares in free float. Such a turnover ratio, which relates trading volume in a period to shares outstanding, reflects the average holding period of assets. The higher the turnover, the lower the average holding period. Thus, turnover is a liquidity measure, as lower holding periods are associated with lower spreads (Amihud and Mendelson 1986). The turnover price–impact ratio implemented by Florackis et al. (2011) and Brennan et al. (2013) is independent of the size of the firm and is an unbiased measure. Since we analyze very different large financial instruments, we find the ratio of the Turnover, ILLIQAT, useful:

where \(TO_{{imd}}\) is the turnover of security i on day d of month m, calculated as the daily trading volume (in units) divided by the number of outstanding shares. For CEFs, we measure the number of shares issued as the issued nominal capital in 1 EUR shares. The other variables correspond to those in Eq. (1). Similarly to the Amihud ILLIQ, it represents several dimensions of illiquidity (at least depth, immediacy, and tightness), but overcomes the ability to measure liquidity because it is unbiased by size and is unambiguous to construct and interpret.

4.1.3 Zero-return measure

Lesmond et al. (1999) introduce a low-frequency proxy for illiquidity by observing days with zero returns. This is owing to the absence of trading based on new price-relevant information because of relatively high transaction costs. Moreover, stocks with lower liquidity are more likely to have zero-volume days and thus more likely to have zero-return days. Bekaert et al. (2007) and Goyenko et al. (2009) develop this approach to include a more direct consideration of days without trading volume as an indicator for illiquidity: “ZEROs2”:

where \({{ZEROs2}}_{im}\) is the portion of days with zero-volume trading of stock i in month m (\({{ZeroVol}}_{{im}} )~{\text{to~}}\) all trading days of this month \(({{TD}}_{m} )\). Though this measure has a different economic basis than zero returns, it is closely correlated (Kang and Zhang 2014). Higher transaction costs are related to lower liquidity if investors reduce their demand and concentrate their activities on a few transactions to avoid higher costs. Therefore, the bid–ask prices are a good assessment measure for the tightness of the market. Similarly, ZEROs2 covers the depth of the market over whose potential trading volume these transaction costs are spread at the equilibrium price.

4.1.4 Liu’s measure

Another illiquidity measure that integrates non-trading days in a two-factor approach is Liu’s (2006) LMx. It is a standardized turnover adjusted by the number of zero daily trading volume days over the prior \(x~{\text{months}}~\left( {x = 1,~6,~12} \right)\):

where \({{NZVx}}_{{im}}\) is the number of zero daily volume days in the prior x months for security i, x-month turnover is the sum of daily turnover over the prior x months; daily turnover is the ratio of the number of shares traded on a day to the number of shares outstanding at the end of the day; and NoTD is the total number of trading days in the market over the prior x months. The Deflator is chosen such that

for all securities of the sample. For \(x = 12\) the Deflator is set to 11.000, as suggested in Liu (2006).

This measure focuses on zero trading days over prior months, an essential sign of illiquidity. Thus, particular emphasis is placed on trading speed (immediacy), which existing research largely ignores. In the second step, turnover ratios are used to fine-tune the liquidity of different securities, accounting for both breadth and tightness (Liu 2006; Díaz and Escribano 2020).

4.1.5 Adjusted ILLIQ

An increasing number of studies have examined whether the proxies proposed for developed securities markets can also be applied to emerging markets, in which high-frequency data are often not available and the number of non-trading days is comparably high (Kang and Zhang 2014). The authors propose an adjustment of the Amihud measure by zero-volume days to compensate for these limitations:

This measure connects the considered dimensions of illiquidity of Amihud’s ILLIQ and the ZEROs2. Consequently, the dimensions of tightness and depth are accentuated.

4.2 Data

Our dataset includes daily transactions for OEFs, REOCs, CEFs, and REITs traded on the German stock exchanges, Fondsbörse Deutschland and Deutsche Zweitmarkt AG, between July 1, 2002 and June 30, 2017. Transaction data are available for shares starting in July 2002, for OEFs from August 2002, and for CEFs from April 2007. Since some parameters are determined based on rolling periods, analyses with this dataset are possible from July 2003 and July 2007, respectively: 168 months for stocks (including REITs) and OEFs and 120 months for CEFs. For REITs and individual stocks, we chose the companies listed in the German real estate equity index DIMAX.Footnote 11 All securities predominantly represent real estate as assets. For CEFs, we use a unique dataset that includes all real estate fund transactions on the German secondary market exchanges that have “European” real estate as their investment target. Most of these are German office properties. European commercial real estate and residential real estate play a subordinate role as investments.

For our analysis, we only consider individual securities if they fulfill the following criteria:

-

1.

The asset has return and volume data for more than 12 days during month m. Closed-end funds regularly show significantly lower trading activity. Therefore, we lower the criterion for this segment to 12 transactions per year. The securities nevertheless only became part of the sample if there was a trade in that month. This makes the estimated parameters more reliable.

-

2.

The price is greater than EUR 1.00 at the end-of-month m.

-

3.

A positive book-to-market ratio in month m. Because closed-end funds may have negative equity accounts owing to their construction, this restriction is necessary.

After filtering the total sample of 1099 securities, our final sample comprises 150 securities, with approximately 18.9 million transactions and a trading volume of about EUR 147 billion.Footnote 12 Table 1 summarizes the details of the sample.

Out of the 23 retail-investable OEFs, 17 were temporarily suspended by the investment fund company. In these periods, investors had no alternative but to trade on the exchanges to buy or sell the shares of these funds. Initially, investors traded OEF fund shares on the Hamburg regional stock exchange to minimize transaction costs. Whereas the buyer must pay an upfront fee (usually approx. 5%) when buying shares from the fund company, the exchange calculates typical trading expenses, which are equivalent to a considerable reduction in the bid–ask spread.Footnote 13 From October 2008, the trading volume increased significantly and the share price of the suspended funds fell to an average of approximately 5% below the NAV (Haß et al. 2014). The share prices were no longer based on property appraisals by the fund companies and were rather determined by supply and demand. Thus, investors now trading on the secondary market of the Hamburg Stock Exchange accepted substantial discounts on the NAV (Schnejdar et al. 2019).

We obtain the trading prices of the stocks, REITs, and OEFs directly from Deutsche Börse AG. For further analysis, we use closing prices only. We also collect market capitalization data, outstanding shares, and book-to-market ratios from Thomson Reuters Datastream. We retrieve information regarding corporate actions, such as dividends, from vwd Portfolio Manager.

For the analysis of the CEFs, we obtain the trading prices from Fondsbörse Deutschland and Deutsche Zweitmarkt AG, and the data on corporate actions, issued nominal capital, and the book value of the companies from their annual reports, available on eFonds24.

4.3 Illiquidity variables

Our first step is to analyze datasets for each category of securities following Amihud (2002) for the relationship between returns and illiquidity parameters. For this purpose, we apply a cross-section analysis of the effects of liquidity, risk, and other variables. Furthermore, we examine the effects of expected and unexpected market illiquidity on expected excess stock returns over time.

In Table 2, we present the descriptive statistics of the monthly returns and illiquidity measures for our sample of German real estate securities. It presents the time-series means for each cross-sectional value.

The monthly returns of real estate shares, at 1.75%, are higher than those of CEFs (0.66%) and OEFs (0.20%). In contrast, almost all illiquidity measures for the sample of closed-end funds show the highest average value. Only the Amihud ILLIQ on monthly data differ from this. The ranking of open-end funds depends on the illiquidity measure observed. For the measures that consider non-trading days (ZEROs2, LIU, ZHANG), this sample is classified as more liquid than the sample of stocks. This supports our hypotheses that there are different values of returns and illiquidity for the individual segments of securities. It seems obvious, however, that the illiquidity classification of the different security segments is not the only factor explaining the differences in returns.

Owing to the high skewness in the Amihud ILLIQs for all samples, we follow the literature and use logarithmized values. For example, ILLIQ 12m represents the natural logarithm of one plus the mean-adjusted firm-specific ILLIQMA over a 12-months rolling period, first multiplied by (106). We interpret this as the percentage price-impact of trading volume per EUR 1 Million (Bali et al. 2016).

For all three subsegments, the parameters of the illiquidity measures change only non-significantly from July 2007 to June 2017. There is a significant shift in the returns on stocks, which fell from 1.75 to 0.90% in monthly means. For open-end funds, the reduction in returns is 0.05% per month.Footnote 14

4.4 Additional variables

Following Amihud (2002), we add further variables that appear to affect either returns or illiquidity to our regression model. Brennan et al. (1998) show that past stock returns affect their expected returns. We calculate R100 for each stock as the return of stock i over the last 5 months (about 100 trading days). R100YR is the return of stock i over the rest of the period; that is, from the last 5–12 months. We calculate continuously compounded returns \(\left( {r_{{{\text{it}}}} = \ln \frac{{P_{{{\text{it}}}} }}{{P_{{{\text{it}} - 1}} }}} \right)\) for corporate actions. Owing to the very different characteristics of the individual stocks in size and market valuation, we analyze the book-to-market-ratio (BMR) to measure these effects.

BETAiy as a measure of risk calculated as the slope coefficient, estimated following the Scholes and Williams (1977) method and using the CDAX as the market index. The total risk of the asset is VOLAim; that is, the standard deviation of the monthly returns on asset i over the last 12 months. BMR is the ratio of the book value and the market value. We use SIZE as the natural logarithm of the market capitalization of stock i during m. Both BMR and SIZE have significant explanatory effects for expected returns in many studies (Fama and French 1992, 1993).

5 Results and discussion

5.1 Illiquidity and stock returns

We begin our investigation of the cross-sectional relationship between illiquidity and expected returns with univariate portfolio analyses for all four real estate segments. We sort the assets at the end of each year into quintile portfolios by the ascending order of the chosen log-transformed ILLIQ variable. We then calculate the equally weighted returns of these portfolios each month and report the time-series averages of the portfolio returns. We also calculate the return spread between the top and the bottom quintiles, as well as the associated t-statistic based on the null hypothesis that the mean of the return spread is zero. Table 3 reports the results of the portfolio analysis with Amihud’s (2002) ILLIQ as the sorting criterion for each subsegment.Footnote 15 Except for the OEF segment, all the categories have an illiquidity premium. However, this premium is only statistically significant (at least to the 5% level, using Newey and West-adjusted t-statistics) for the subsegments of shares or the entire sample. The illiquidity premium was not statistically significant for the CEFs. The raw return of the stocks and CEFs increased in most cases with rising illiquidity measures of the examined securities, which was economically significant.

At this point, we refer back to our first research question of whether we can observe liquidity premia in each segment of the German capital market for real estate securities and its associated hypothesis that each segment has significantly different return and illiquidity parameters. Based on the results presented in Table 3, we conclude that the subsegments of our sample have different levels of illiquidity and returns. The spread portfolios based on illiquidity achieve higher statistically significant excess returns, except for those that consist exclusively of OEFs or CEFs. The excess returns of the spread portfolios sorted by Amihud’s (2002) ILLIQ are 1.31% for the sample of stocks and REITs, 1.36% for the whole sample (both statistically significant) and 0.07% for the CEFs (statistically not significant). The alternative illiquidity measures (see Supplementary Material) generally confirm the results on the spread portfolios. However, using the turnover version of the ILLIQ reverses the sign of the spread portfolio for the CEFs, showing the importance of the return and trading volume components for the illiquidity effects on the subsegments. For the total sample, the spread portfolio fails to lose significance when Liu's measure and ZEROs2 are used.

5.2 Cross-section relationship between illiquidity and returns

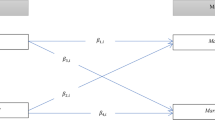

In this section, we examine the relationship between expected return, illiquidity, and other possible influencing factors. Following Amihud (2002), we start with a cross-sectional regression analysis of the subsegments over the sample period:

In Eq. (9), \(R_{im}\) is the return on stock i in month m, with returns adjusted for delisted stocks to avoid survivorship bias. \(X_{{{\text{ji~m}} - {{l}}}}\) is characteristic j of stock i estimated from data in month m minus l and known to investors at the beginning of the period in which they make their investment decisions. We integrate a time lag using variable l to analyze the persistence of the results. The coefficients \(k_{jm}\) measure the effect of stock characteristic j on the expected returns and \(U_{imy}\) are the residuals, \(k_{{\it{0}m}}\) is the monthly constant over all securities.

Table 4 provides the correlation coefficients between the cross-sectional means of the liquidity measures, BMR, SIZE (natural log of market capitalization), prior-period returns (R100), and standard deviation (VOLA, rolling 12 months). For all subsegments, we find low correlation coefficients between ILLIQ and the other factors, which indicates that the illiquidity component in the regression analysis serve as an additional explanatory variable. Only for stocks and REITs does SIZE have a strong negative correlation—ILLIQ 1m (− 0.71), ILLIQ 12m (− 0.70), and ZHANG (− 0.59)—which corresponds to Bali et al. (2016) results. The past returns reveal low to negative correlation coefficients between − 0.07 and 0.04 with the average illiquidity parameters of the same period.Footnote 16

Constantinides and Scholes (1980) suggest that stocks with higher volatility should have lower expected returns. The correlations between ILLIQs and VOLA are low for all subsegments (between 0.23 and 0.59). Theoretically, risk and illiquidity are positively related.

We examine the effect of illiquidity on stock return separately for each subsegment. We follow Fama and MacBeth’s (1973) test procedureFootnote 17 and estimate a cross-sectional-model for each month m = 1, 2,…,12. We analyze the cross-sectional relationship for the illiquidity measures for the 1-factor (only the relevant ILLIQ), 4-factor (ILLIQ measure, R100, R100YR, and BETA), and 7-factor models (the 4-factor model plus SIZE, BMR, and VOLA). Table 5 presents the results for stocks and REITs.

The cross-sectional regression analysis of stock returns sorted on the ILLIQs shows that it has a statistically significant influence on the expected stock returns of our sample in the 1-factor model for all lags of 1–3 months. We find the strongest effect at lag 1. The further the illiquidity measure shifts into the past (lags 2–3), the weaker the illiquidity effects are, both in size and significance. For the sake of brevity, we only present the coefficients and t-statistics for the control variables for the regression analyses with the ILLIQ 12m. The results for other illiquidity measures only differ slightly and are available on request from the authors.

If we extend the model to a 4-factor regression, the effects of illiquidity weaken, both in coefficients and significance, compared to the 1-factor model. However, they remain significant at the 5% level, up to a lag of 2 months. BETA has no measurable influence in all regression analyses. In contrast, the past returns are statistically significant, although the effect of the previous months (R100) is stronger and more constant than that of the returns of earlier periods (at lag 2, the coefficient of R100 of 0.04 is three times larger than that of R100YR). The adjusted-R2s are about 4 times as high as the 1-factor model.

When the model is extended by the factors SIZE, VOLA, and BMR, the effects above reduce further. ILLIQ 12m remains significant until lag 2, and SIZE and VOLA remain statistically insignificant across all lags. On the other hand, BMR, across all regression analyses, is positive and highly significant for the expected returns of the equity sample (t-statistics ranged from 5.81 in lag 1 to 4.67 in lag 3).Footnote 18 This result coincides with expectations based on Fama and French (1992; 1993). The adjusted-R2s continue to increase. For most of the models, the intercepts remain statistically insignificant across all lags.

To place this result in an economic context, we use, for example, the average coefficient of ILLIQ 12m from the 7-factor regression analysis with a lag of 2 months of 0.001753Footnote 19 (1.753 for 1.000 EUR trading volume). We multiply this value by the cross-sectional standard deviation of ILLIQ 12m of 3.0625 (Table 2) and find that a one-standard deviation difference in ILLIQ 12m is equivalent with a difference in expected returns of 0.54% per month. To examine the difference in expected returns between stocks in the lowest and highest quintile portfolio sorted on ILLIQ 12m, we multiply the average coefficient of 0.001753 by the difference between the average values of ILLIQ 12m for these corner-portfolios of 7.97 (illiquidity value of portfolio “Illiquidity”; i.e., 14.17, minus the illiquidity value of portfolio “Liquidity”; i.e., 6.20; see Table 3). The results indicate that the expected return of the stocks in the most illiquid portfolio is about 1.40% (0.001753 × 7.97 = 0.00140) per month higher than that of stocks in the lowest quintile portfolio. This is in line with our results of the portfolio sorting (see Table 3). Both results show that illiquidity is economically important in the pricing of stocks and REITs.

The correlations between ILLIQ and the other variables are not surprising. BETA is not statistically significant in any model. One reason for this may be that we use the CDAX as a proxy for the German stock market. The particular investment focus of these stocks will dilute the beta effect. Following the literature,Footnote 20 we can also determine the statistical significance of the relevance of the effect of the returns of the immediate previous periods on the expected return for our sample.

Turning to OEFs, Table 6 shows that the illiquidity ratios are not statistically significant in any model using Amihud’s ILLIQ, regardless of the chosen time lag. This result corresponds to the analysis of the return premium after portfolio sorting by illiquidity ratios (Table 3). In the 4-factor model, only the return variables R100 and R100YR have statistical significance. This effect is further enhanced by the 7-factor model. Furthermore, BMR is positively significant at a 1% level for all lags. Interestingly, the effect of volatility turns negative for OEFs. This reverse relationship between volatility and expected return, which is statistically significant for all lags, corresponds to the insights of Constantinides and Scholes (1980). The size effect (SIZE) is also positive for regressions up to lag 2. Both variables also serve as proxies for illiquidity and may explain the lesser importance of ILLIQ measures in this segment. The constant in our 7-factor models has a significant negative value in the model calculated with a time lag of one month, which indicates that there are other nominal influencing variables that are not yet represented in our models. The explanatory power, measured by the adjusted R2, are higher in all models in this market segment than in the equity sample.

Table 7 shows the results for the cross-sectional regression analyses for the CEF sample. The coefficients of the illiquidity parameters up to lag 3 are higher than for stocks and REITs, and substantially higher than for OEFs for all lags; but they are not statistically significant in any model. Analogous to the analyses of OEFs, the added variables only have relevance in the 7-factor model. Previous-period returns have a significant impact with a positive coefficient from lag 2 on, and SIZE (lag 1) and VOLA (lag 2) have a negative impact. These results correspond to the univariate portfolio analyses in Table 3.

For robustness, we analyze different illiquidity measures in comparison to ILLIQ 12m. The turnover variant (ILLIQ AT 12m) shows no additional power. Obviously, if the bid–ask spreads are too large, trading activity in (very) low-capitalized companies remains absent and there are no sharp price changes with regards to the turnover (cf. Sect. 4.1.2). This is confirmed by the high significance of Goyenko et al. (2009)’s ZEROs2, which represents the dimension of density. In contrast, ILLIQ 1m and ILLIQ AT 1m often show negative signs for short lags, implying that this represents unexpected illiquidity. Skewness and kurtosis (see Table 2) make stable regressions more difficult. The adjusted ILLIQ of Kang and Zhang (2014) accounts for non-trading days and thus exploits the positive effect of ZEROs2 described above. However, since it is built on monthly ILLIQ data, we do not find significant results overall in our analyses.Footnote 21 Liu’s (2006) LMx uses a turnover variable and is therefore similar in parts to the turnover ILLIQ. We use a version based on rolling 12-month data. It confirms the results of both ILLIQ 12m and ILLIQ AT 12m in almost all models. The impact of non-trading days can be seen in the slopes of the coefficients across time-lags, which are similar to those of the ZEROs2.

For the OEFs, ILLIQ and ILLIQ AT show better results on a monthly basis up to a lag of 2 months. This indicates rapid and pronounced effects that disappear after a short period. These results were confirmed by the turnover variant and ZHANG’s adjusted ILLIQ. At a lag of one month, the coefficients on many measures were negative in several models, providing evidence of a negative effect of unexpected illiquidity, as described earlier for equities. OEFs are regularly traded on the stock market (the mean of ZEROs2 is 0.1453, corresponding to a trading probability of about 85.5% per month). Therefore, considering the non-trading days with the measures ZEROs2 and LMx does not provide any explanatory power. Consequently, the immediacy dimension does not matter in this sample.

While CEFs have a high number of non-trading days (mean of ZEROs2 is 0.8934), this is a steady trend (standard deviation of 0.0713). Because neither ZEROs2, nor ZHANG or LMx measure significant effects on expected returns, this does not generate illiquidity shocks. Using the ILLIQ AT 12m produces results with a negative sign. For CEFs, because outstanding shares do not change during the term, ILLIQ and ILLIQ AT should move in the same direction for each security. The analysis result is based on a change in the sample. While trading volumes have increased over the period under consideration, turnover ratios have not remained stable. This implies that CEFs with larger market capitalization have traded more in the secondary market over time than those with smaller market capitalization.

The robustness test shows that ILLIQ provides plausible results for all three subsegments. Depending on the security category, longer rollover periods provide more stable results for the cross-sectional analysis. The choice of illiquidity measure matters for all subsegments. The effects of illiquidity persist after adding other control variables for the stocks and REITs and OEF samples; however, their statistical significance drops below 10%. For the sample of CEFs, many coefficients for illiquidity are negative but also not significant.

The results in Tables 5, 6 and 7 provide an answer to our second key question of whether a relationship between returns and illiquidity premia exists for German real estate securities. For the sample of stocks and REITs, the estimated cross-sectional regression analyses strongly support the second hypothesis that illiquidity is priced. We can quantify this using many variations of our illiquidity measure. Furthermore, we can determine the significance of the other company-specific factors. In particular, previous-period returns (R100 and R100YR) and BMR are significant, which confirms earlier findings. However, we must view the effect of illiquidity on OEFs and CEFs differently.

5.3 The effect of market illiquidity on expected excess returns over time

In this section, we focus on the effects of market liquidity over time on the returns of securities portfolios. We hypothesize that the expected market liquidity over time will have a positive effect on the expected excess return on securities (surplus securities in short-term EUR government bonds or 1-month EURIBOR money market interest rates). This conjecture is in line with the positive cross-sectional relationship between returns and illiquidity. If investors expect higher market liquidity, then they value assets accordingly to achieve a higher expected return. This behavior would suggest that the excess return on assets, traditionally interpreted as a “risk premium”, includes a premium for illiquidity (Amihud 2002). Following the methodology of French et al. (1987) we estimate the expected illiquidity using an autoregressive model, and we use this estimate to test the common hypotheses that the ex-ante excess stock return is an increasing function of the expected illiquidity, and the unexpected illiquidity has a negative impact on the simultaneous unexpected stock return.

5.3.1 Estimating procedure

We use the Amihud (2002) procedure with monthly data. For better comparability of the different illiquidity parameters for the time-series analysis, we follow Bank et al. (2010) and construct a market illiquidity index. The index starts for the stock sample with a value of 100 at the end of June 2003 and is computed for the following months using Eq. (10). The monthly illiquidity characteristic changes of the individual securities (\(\Delta ~{{LIQ}}_{sm} )\) are arithmetically equally weighted in the index development. Therefore, \(N_{sm}\) in Eq. (11) is the number of securities of our sample s with observations in month m. The illiquidity indices of the other samples are calculated as of the end of June 2003 (open-end funds) and June 2007 (closed-end funds) relative to the index of the stock sample. For the following months, the index developments were based on Eqs. (10) and (11)

The cross-sectional regression analyses showed already that—depending on the subsegments—the use of averaged illiquidity measures is more robust. Therefore, we now average parameters over the periods of the preceding M = 2, 3,… 12 months:

The ex-ante effect of market illiquidity on stock excess return is

where \({{RM}}_{m} ~\) is the monthly market return and \({{RF}}_{m}\) is the monthly risk-free return. The expected market illiquidity for month m based on information in the prior period, m-l, \(\ln {{LIQ}}_{m}^{E}\) is—following Eq. (12)—for each subsegment and rolling period \(\overline{LIQ} _{{sm} - l}^{M}\). We hypothesized that \(f_{1}\) > 0. We assume that market illiquidity follows an autoregressive model:

At the beginning of month m, investors determine the expected illiquidity for the coming period, \(\ln {{LIQ}}_{{{m}}}^{E}\), based on information in month m – l:

Then, they set market prices at the beginning of the new period that will generate the expected return for the month m, according to the model:

where \(g_{0} = ~f_{0} + ~f_{1} ~c_{0}\) and \(g_{1} = ~f_{1} ~c_{1}\).

We denote unexpected excess returns by the residual \(u_{m}\). We hypothesize that \(g_{1} > 0\); higher expected market illiquidity will lead to higher ex-ante stock excess return. Consequently, rising expected illiquidity must lead to price decreases at the time of observation (t0), which corresponds to an effect of unexpected illiquidity at time t−1. Both effects together generate the following model:

where \(\ln {{LIQ}}_{m}^{U}\) is the unexpected illiquidity in month m, and \(\ln {{AILLIQ}}_{m}^{U} = ~v_{m}\), the residual from Eq. (14). We test the two hypotheses in the following model:

H1: \(g_{1} > 0\), and

H2: \(g_{2} < 0\).

First, we calculate the residuals \(v_{m}\) from Eq. (14) after we adjust the coefficients using Kendall’s (1954)-bias correction method.Footnote 22 Next, we use these residuals as \(\ln {{LIQ}}_{m}^{U}\) in Eq. (17). \({{RM}}_{m}\) is the arithmetic-weighted return of all assets in month m, which are part of our sample and fulfill the conditions described in Sect. 4.2 and \({{RF}}\) is the 1-month EURIBOR interest rate of the relevant period.

Finally, we estimate the monthly returns of our samples adding \({{JANDUM}}_{{\text{m}}}\), a January dummy, that accounts for the well-known January effect.

5.3.2 Results

We regress the illiquidity measures described in Sect. 4.1 for all rolling periods and with lags of 1–3 months for our three samples. Table 8 provides the results of the time-series regression analyses.

We find that expected illiquidity measured with ILLIQ affects expected returns with increasing coefficients with longer rolling periods, as well as with longer lags from 1 month onward, in the equity sample (Panel A). Apart from short rolling periods, the parameters for the expected illiquidity were positively associated with the returns. The unexpected illiquidity has negative effects, but these were not statistically significant at the 10% level. The robustness test with ILLIQ AT and the ZHANGs measure confirm these results–in the latter case, with significant results for unexpected illiquidity. Liu’s (2006) LMx shows decreasing coefficients for decreasing illiquidity, which are significant for short rolling periods. LMx by design already uses 12-months data. Further smoothing of the measure does not produce more stable results. The expected illiquidity measured by ZEROs2 is (highly) significant with increasing sign. However, both LMx and ZEROs2 have unexpected illiquidity with a positive sign.

The regression analyses yield autocorrelation effects, made evident by the Durbin-Watson (DW) test results of between 1.24 and 1.29. We therefore correct the results according to the Newey and West (1987) method. In addition, the F-tests return results below the critical threshold. The regression analyses of the ILLIQ are significantly less significant than those in Amihud (2002). The other measures partially report coefficients with reversed signs to our hypotheses. Obviously, the regression procedure in Amihud (2002) is not (yet) sufficiently specified for our sample. Moreover, it is remarkable that the well-known January effect is not statistically significant.

As can be seen from Table 8 (Panel B), the results of the time-series regression analyses of the OEFs are similar to those of the stock sample. There are differences in the robustness test with the turnover ratio (ILLIQ AT), which generates negative signs in the coefficients of the expected illiquidity. This effect is already well-known from cross-sectional analysis. The regression analyses with ZHANG’s measure show increasing effects of expected illiquidity with rising significance. Unexpected illiquidity is predominantly not statistically significant. The Durbin-Watson test fails to provide any indication of autocorrelation.

Table 8, Panel C presents the results for CEFs. The time regression analysis yields increasing effects of expected illiquidity for the “classical” ILLIQs as regressors. As in the previous analyses, the values of the coefficients of expected illiquidity have positive signs and are increasing with the lag length, which are statistically significant for longer rolling periods. This is in line with the results of the cross-sectional analysis. However, unexpected illiquidity shows decreasing magnitudes of coefficients over time, as in the analyses of the samples of equities and OEFs, and at longer roll periods, these values are also negative, as assumed. The turnover ratio confirms the results of ILLIQ. However, as in the other samples, they remain statistically at a significance level below 10%. Further, in this sample, the robustness test for the measure according to Kang and Zhang (2014) produces robust results. Expected illiquidity has an increasingly positive effect on excess returns and is increasingly (highly) statistically significant. The cross-sectional analysis confirms that owing to the high number of non-trading days, the measures LMx and ZEROs2 cannot be reasonably applied to the sample of CEFs. Figure 1 reveals the nearly horizontal nature of the corresponding time series, and the constant of the regression becomes increasingly statistically significant.

Market illiquidity indices. This figure shows the development of the market indices for the illiquidity measures used, based on rolling 12-month data. We used this method for seven illiquidity measures. ILLIQ 1m and ILLIQ 12m were based on Amihud (2002) and were the mean-adjusted ILLIQ over rolling one resp. 12 months as calculated in Eq. (3) (see Sect. 4.1.1), ILLIQ AT 1m and ILLIQ AT 12m were the Turnover Ratios calculated by Eq. (4) (see Sect. 4.1.2), ZHANG was calculated by Eq. (8) (see Sect. 4.1.5), LIU was calculated by Eq. (6) (see Sect. 4.1.4) and ZEROs2 was calculated by Eq. (5) (see Sect. 4.1.3). The indices are calculated as shown in Eq. (10) and Eq. (11). The illiquidity measures are normalized to 100 for the sample of stocks and REITs as of end of June 2003. The indices of the other samples reflect the relative position in June 2003 to the stock sample and their individual evolution in the subsequent periods

Figure 1 illustrates considerable shifts in the time series surrounding or in the aftermath of the GFC. Therefore, in a further step, we examine whether the time-series regression analyses provide indications of structural breaks. We use the Quandt-Andrews breakpoint test for one or more unknown structural breaks (see Andrews 1993; Andrews and Ploberger 1994) to sequentially analyze whether the regression coefficients differ significantly in each subperiod. We apply three different test statistics: the maximum F statistic (SupF), the exponential F statistic (ExpF), and the average F statistic (AveF). For brevity, Table 9 only provides the SupF-Test.Footnote 23 The p-values are based on Hansen (1997). In addition, the last column shows the times at which the limit value of the SupF statistics is exceeded. These are not necessarily the possible structural breaks, but they provide initial indications.

The SupF statistics have the greatest explanatory power and are highly significant for the sample of stocks and REITs across all lags (see Table 9, Panel A). The maximum F statistics are reached between May 2006 and January 2009. Only a few models based on ZEROs2 show no evidence of structural breaks.

Panel B shows the results for the OEF sample. Except for the ZHANG measure, we found an indication of at least one structural break based on the maximum F statistics in nearly all models. The limit was exceeded in most models first in September 2013. However, as explained, this subsample included both the OEFs, which investors can trade at any time via the fund companies, and those whose units were at least temporarily suspended from issue and/or redemption by the fund company (“frozen” funds). This may have diluted the stronger effects of the “frozen” funds subgroup. For the subgroup of closed-end funds, the references to structural breaks were highly significant for all statistics and from February to April 2009 (see Panel C).

We determined the importance of effects from the GFC by adding the dummy variable FinCrisD, which equals 1 for the period of September 2008 to February 2009, and 0 otherwise, see Eq. (19).

Table 10, 11 and 12 present the results for the three subsegments. Unsurprisingly, we found that FinCrisD had a significant, negative effect on the stock returns and increased the effects of expected illiquidity for ILLIQ and Kang and Zhang’s (2014) adjusted ILLIQ (see Table 10, Panel A). For the other measures, the results from Table 9 remained almost unchanged. This is plausible since during the GFC there was no significant reduction in trading activity.Footnote 24 Consequently, the LMx and ZEROs2 measures do not provide any further information.

Apart from the expected effects of expected and unexpected illiquidity on expected returns, we should observe a second effect called “flight to liquidity” when examining the individual sub-portfolios. For this purpose, we divided the respective sample into portfolios based on market capitalization, whereby the smallest companies were assigned to portfolio P1. Owing to the small number of securities considered, only three portfolios were formed. Our analysis of this effect for the sample of stocks and REITs, which we present in Table 10 (Panel B), is contrary to that of Amihud (2002). He found that securities with lower (vs. higher) liquidity showed above-average lower returns in periods of market illiquidity, as investors sell these shares and prefer more liquid equities. Thus, we should expect that smaller, illiquid equities will have a stronger impact on market liquidity, whereas the effect should be weaker for more liquid equities. Only ZEROs2 focusing on the tightness dimension yielded this effect described by Amihud (2002). For ILLIQ, we found that the excess returns of the P1 (small firms) and P3 (larger firms) portfolios were more sensitive to expected market illiquidity than those of medium-sized firms. This was also supported by other measures of illiquidity. The turnover ratio even showed that with increasing market capitalization the effect of illiquidity increases.

OEFs (see Table 11, Panel A) do not change substantially in the absolute values of the coefficients and retain the signs of the regression analyses without the GFC dummy. The values for FinCrisD were not as pronounced as in the case of equities and REITs; but this may also indicate that the relevant period for OEFs differs from that of the equity sample. Based on ILLIQ, OEFs show the expected size effect. This was also robust when using the other measures–except for the Turnover Ratio. As shown in Sect. 5.2, ILLIQ AT shows inverse effects of illiquidity on returns.

Table 12 shows the results of the regression analyses for CEFs. On the one hand, the results from Table 9 are validated and strengthened by the addition of the financial crisis dummy. Regarding unexpected illiquidity, on the other hand, there was no consistent pattern. Using the ILLIQ with a lag of one month, coefficients increased with increasing roll period, while a decreasing trend was expected. Using the ZHANG measure, unexpected illiquidity had a positive effect on returns. Note that the (il)liquidity index LIQX for this measure and sample rose steadily until the peak in 2010 and then showed a very consistent trend (see Fig. 1). Consequently, the economic effect of unexpected illiquidity as a residual of the AR-process of illiquidity according to Eq. (14) was marginal and thus should not be overestimated, especially as it is usually non-significant.

The size effects at the portfolio level were in line with the findings we made when analyzing the stock sample. We demonstrated a highly significant portfolio effect on expected illiquidity and unexpected illiquidity for portfolio P3, each with a positive sign. This means that the securities with higher market capitalization reacted to unexpected market illiquidity with positive changes in returns. As trading activities are much less extensive overall than for equities, REITs, and open-ended funds, this may be equivalent to a kind of “flight to liquidity”, as these securities generally also generate larger trading volumes.

Overall, we conclude that market liquidity influences the market returns of our sub-samples over the entire sample period. Contrary to Amihud’s (2002) findings, these effects on the expected and unexpected illiquidity of the subsegments were not fully consistent in both significance and sign. Nevertheless, the time series and cross-section regression analyses showed that these were not robust results. Rather, our results suggest structural breaks effects for the GFC period, which require more intensive consideration. Thus, we can now answer our third key question of how fluctuations in liquidity affect returns. For all of our samples, we can accept the hypothesis that expected illiquidity has a positive effect. We also found a negative effect of unexpected illiquidity on future returns for our sample of stocks, REITs, and OEFs. In contrast, unexpected illiquidity had a positive effect on CEFs. We can furthermore state the importance of choosing the illiquidity measure regarding securities. While Amihud’s (2002) ILLIQ generally serves well in both cross-sectional and time-series studies, the choice of averaged illiquidity data is advantageous, at least for the samples of stocks, REITs, and CEFs. Of the remaining measures, Kang and Zhang’s (2014) adjusted ILLIQ sticks out, offering interesting advantages especially for the securities with lower trading activity. Liu’s (2006) LMx and Goyenko et al.’s (2009) ZEROs2 formally emphasizes non-trading days such that they are not useful for markets with low activity.

6 Conclusion

We empirically examined the illiquidity premia for the German real estate market. We followed Amihud (2002); however, we extended it with alternative measures of illiquidity that capture additional dimensions. First, we analyzed the cross-sectional relationship between illiquidity and expected returns. While prior studies proposed numerous measures of liquidity, we focused on the most commonly used measure suggested by Amihud (2002). We can generally state that the securities-based asset classes for German real estate investments differ significantly in their risk/return ratios. We demonstrated that, consistent with the findings throughout the empirical asset pricing literature, illiquidity has a strong positive cross-sectional relationship with the future returns of real estate stocks and REITs. However, integrating other firm-specific factors, such as the market-book value ratio or momentum, reduced these effects; although they remained significant. However, this illustrates that a more comprehensive analysis of firm-specific factors is relevant to make a well-founded investment decision.

For the other market segments, the results were less clear. In addition, the robustness test showed that selecting the illiquidity standard is important, especially for time-series effects. Owing to the varying growth in trading volumes and the outstanding shares in the individual market segments over time, we can derive different results. Therefore, an analysis of the different ILLIQ variations can provide valuable insights. Here, Kang and Zhang’s (2014) measure, which extends Amihud’s (2002) ILLIQ by a factor for non-trading days, seems a useful extension. In contrast, other measures further weighting non-trading days are not appropriate. Moreover, in many models averaged illiquidity data stabilized the results.

Second, our analysis of the impact of unexpected illiquidity on future returns resulted in diverse findings. While the results of earlier studies hold for the OEF segment, we can only partially confirm the results for the equity market.

Lastly, our analysis suggests the presence of a structural break in the relationship between real estate returns and market liquidity, which affects the importance of illiquidity significantly. In addition, we must consider other, special factors related to “suspended” OEFs, given that asset price reductions may lead to price changes, and correspondingly high ILLIQs. However, these do not necessarily result in higher returns after the unexpected event occurs.

Further studies on the special features of the market microstructure of the trading venues for CEFs and the effects of trading opportunities for OEFs, which investors can return to the issuer daily at net asset value under certain conditions, must be considered. In-depth research is required to determine whether structural breaks can be identified, as well as their effects on regression analyses.

Data availability

The authors will make the results of the analysis available on request. The raw data used require the approval of the Karlsruhe Institute of Technology, Fondsbörse Deutschland AG, and Deutsche Zweitmarkt AG.

Notes

Hibbert et al. (2009) provided an overview of the estimates of liquidity premia across multiple asset classes.

In addition to real estate shares, specific financial instruments such as open-ended and closed-end real estate funds exist in Germany. We provide a brief summary of the main characteristics of these securities in the Supplementary material.

Agnello and Schuknecht (2011) examined the characteristics and determinants of booms and busts in housing prices for a sample of 18 industrialized countries from 1980 to 2007. Chang (2011) found that the unexpected component of monetary policy is more important in REIT returns than the expected component of monetary policy. In particular, unexpected contractionary monetary policy has a significant negative impact on REIT returns and the negative effect in a bust market is stronger than it is in a boom market. Wiley (2017) shows for the US property market, credit policy through the lending channel also plays an important role in asset performance. Although this cycle cannot be fully explained, illiquidity in the real estate market leads to sluggish and prolonged price formation cycles.

According to Trübestein (2012), the relative share of the market capitalization of REITs in the market value of all investable properties in Germany (3%) was less than half compared to North America (7%) in 2011. Niskanen and Falkenbach (2012) stated that the German REIT market in 2009 represented only 0.14% of the total value of the global REIT market.

With the introduction of REITs in 1960 in the US, and later in many other economies, the goal was to make transparent and fungible real estate investments available to the public. In the 1980s and 1990s, the global REIT market developed very slowly. At the turn of the millennium, there was a worldwide trend of REIT laws that had a significant impact on the importance of REIT investments, see Trübestein (2012). For descriptive overviews of listed REITs, see Corgel et al. (1995), Zietz et al. (2003), Feng et al. (2011).

Amihud himself does not consider it to be the most accurate illiquid measure (Amihud 2002, p. 32). However, these “finer and more accurate” methods require a large amount of microstructure data, which are often not available. This is also evident, for example, in our sample.

Díaz and Escribano (2020) emphasized the following: “However, there is no unequivocal classification of measures that may measure regarding to which dimension is assessed by each one.” On the one hand, they stated that Amihud’s (2002) ILLIQ can be assigned to the dimensions of depth, immediacy, and tightness (p. 5). On the other hand, they assigned Amihud’s (2002) measure in Table 2 to the dimensions breadth and depth. Ametefe et al. (2016) classified ILLIQ to the dimensions of depth and resilience.

With the ILLIQ variants, Lou and Shu (2017) aimed to subdivide the illiquidity effect into price and trading volume components. Amihud and Noh (2018) commented on these statements and noted that this decomposition is correct only under certain assumptions. In our study, we used the ILLIQ alternatives exclusively to indicate the significance of the different numerators and denominators.

The Deutsche Immobilienaktienindex (DIMAX) was launched by Bankhaus Ellwanger and Geiger in 1989.

The sample of OEFs and CEFs is based on the original dataset of all fund shares traded on German stock exchanges during this period that met the above selection criteria. With these 23 OEFs, the sample represents, on average, over 90% of the market capitalisation of the funds accessible to private investors in Germany (Benk et al. 2008). For the CEFs, the sample of 60 financial instruments covers about 4% of the total market (see Trübestein 2012). However, this is the most liquid sub-segment of closed-end real estate funds. It should also be noted that the size of the portfolio volume referred to there is regularly based on the invested equity of the funds at the time of issue and not on the current market capitalisation. The selection of real estate shares and REITs is based on the DIMAX index.

Haß et al. (2014) show that prior to 2008, the trading price was less than 0.5% above the NAV of the fund.

The data are presented in the Supplementary Material.

We present the analyses with alternative illiquidity measures in the Supplementary Material (Table 3, Panels B–G).

The illiquidity measures of stocks and REITs are highly correlated. This coincides with Lou and Shu’s (2017) findings concerning the US stock market. However, the correlations between ILLIQs and the corresponding “turnover” measures are weaker than those in Lou and Shu (2017) and range from 0.56 to 0.60.

Amihud (2002) states that he performs the cross-sectional regression analysis with the “usual Fama MacBeth (1973) method” (FMB). Although the FMB only applies market factors, Litzenberger and Ramaswamy (1979) and others also consider this procedure with firm-specific factors. In the literature, however, the latter is also often referred to as the FMB method, see Chordia et al. (2020) and Jegadeesh et al. (2019).

Amihud (2002) described the cross-sectional regression analyses without the ratio of book-to-market equity (BE/ME), as Easley et al. (2002) and Loughran (1997) found no significant effects in the sample of NYSE shares they used in their studies. However, the result could be explained by the inclusion of market capitalization (SIZE) (Berk 1995). On the other hand, we found no relevance of the dividend yield (DIVYLD), which, in Amihud’s studies, had significant negative effects on expected returns.

See, for example, Carhart (1997) and Chordia et al. (2014). Chordia et al. found that increasing market liquidity reduces anomalies, such as the momentum effect. In the regression analyses presented above, highly significant illiquidity parameters accompanied these effects from previous periods. However, without further investigation, we cannot equate the effects from previous periods with momentum effects.

We ran cross-sectional analyses with a ZHANG measure based on rolling 12-month ILLIQs. Accordingly, illiquidity was significantly positively related to ex-ante returns in many models. Nevertheless, the results for our sample were not superior to those of the ILLIQ 12m (see the Supplementary material).

The ordinary least squares analysis—when including the lagged dependent variables in the regression model with a small sample—leads to biased estimates, and this bias increases as the number of irrelevant variables increases. Therefore, we use Kendall’s (1954) method to adjust the estimated coefficients in Eq. (15).

The results for ExpF- and AveF are qualitatively similar to the SupF statistic and are available on request from the authors.

In the period from September 1, 2008 to February 28, 2009, the mean value of ZEROs2 for the stock sample was 0.2047 (September 1, 2009 to February 28, 2010: 0.1965), for OEFs 0.1443 (0.094), and for CEFs 0.9114 (0.9219).

References

Acerbi, C., Scandolo, G.: Liquidity risk theory and coherent measures of risk. Quant. Financ. 8(7), 681–692 (2008)

Acharya, V.V., Pedersen, L.H.: Asset pricing with liquidity risk. J. Financ. Econ. 77(2), 375–410 (2005). https://doi.org/10.1016/j.jfineco.2004.06.007

Agnello, L., Schuknecht, L.: Booms and busts in housing markets: determinants and implications. J. Hous. Econ. 20(3), 171–190 (2011). https://doi.org/10.1016/j.jhe.2011.04.001

Aitken, M., Comerton-Forde, C.: How should liquidity be measured? Pac. Basin Financ. J. 11(1), 45–59 (2003)

Aitken, M., Winn. R.: What is this thing called liquidity? Working paper (1997)

Ametefe, F., Devaney, S., Marcato, G.: Liquidity: a review of dimensions, causes, measures, and empirical applications in real estate markets. J. Real Estate Lit. 24(1), 3–29 (2016)

Amihud, Y.: Illiquidity and stock returns: cross-section and time-series effects. J. Financ. Mark. 5(1), 31–56 (2002)

Amihud, Y., Mendelson, H.: Asset pricing and the bid-ask spread. J. Financ. Econ. 17(2), 223–249 (1986). https://doi.org/10.1016/0304-405X(86)90065-6

Amihud, Y., Mendelson, H.: The effects of beta, bid-ask spread, residual risk, and size on stock returns. J. Financ. 44(2), 479–486 (1989). https://doi.org/10.1111/j.1540-6261.1989.tb05067.x

Amihud, Y., Mendelson, H.: The pricing of illiquidity as a characteristic and as risk. Multinatl Financ. J. 19(3), 149–168 (2015)

Amihud, Y., Noh, J.: Illiquidity and stock returns ii: cross-section and time-series effects. SSRN Electron. J. (2018). https://doi.org/10.2139/ssrn.3139180

Andrews, D.W.K.: Tests for parameter instability and structural change with unknown change point. Econometrica 61(4), 821–856 (1993)

Andrews, D.W.K., Ploberger, W.: Optimal tests when a nuisance parameter is present only under the alternative. Econometrica 62(6), 1383–1414 (1994)

Bali, T.G., Engle, R.F., Murray, S.: Empirical asset pricing: the cross section of stock returns. Wiley, Hoboken (2016)

Bank, M., Larch, M., Peter, G.: Investors’ compensation for illiquidity: evidence from the german stock market. Eur. Financ. eJ. (2010)

Bekaert, G., Harvey, C.R., Lundblad, C., Siegel, S.: Global growth opportunities and market integration. J. Financ. 62(3), 1081–1137 (2007). https://doi.org/10.1111/j.1540-6261.2007.01231.x

Benk, K., Haß, L.H., Johanning, L., Schweizer, D., Rudolph, B. . Offene Immobilienfonds als wesentlicher Baustein einer erfolgreichen Asset Allocation (2008)

Benveniste, L., Capozza, D.R., Seguin, P.J.: The value of liquidity. Real Estate Econ. 29(4), 633–660 (2001)

Berk, J.B.: A critique of size-related anomalies. Rev. Financ. Stud. 8(2), 275–286 (1995)

Bervas, A.: Market liquidity and its incorporation into risk management. Financ. Stab. Rev. 8, 63–79 (2006)

Bhasin, V., Cole, R.A., Kiely, J.K.: Changes in REIT liquidity 1990–1994: evidence from intra-day transactions. Real Estate Econ. 25(4), 615–630 (1997). https://doi.org/10.1111/1540-6229.00730

Bond, S.A., Hwang, S., Lin, Z., Vandell, K.D.: Marketing period risk in a portfolio context: theory and empirical estimates from the UK commercial real estate market. J. Real Estate Financ. Econ. 34(4), 447–461 (2007). https://doi.org/10.1007/s11146-007-9022-1

Brennan, M., Chordia, T., Subrahmanyam, A.: Alternative factor specifications, security characteristics, and the cross-section of expected stock returns. J. Financ. Econ. 49(3), 345–373 (1998)

Brennan, M., Huh, S.-W., Subrahmanyam, A.: An Analysis of the amihud illiquidity premium. Rev. Asset. Pric Stud. 3(1), 133–176 (2013). https://doi.org/10.1093/rapstu/ras017

Brennan, M.J., Subrahmanyam, A.: Market microstructure and asset pricing: on the compensation for illiquidity in stock returns. J. Financ. Econ. 41(3), 441–464 (1996). https://doi.org/10.1016/0304-405X(95)00870-K

Brounen, D., Eichholtz, P., Ling, D.: The Liquidity of Property Shares: An International Comparison. Real Estate Economics 37(3), 413–445 (2009). https://doi.org/10.1111/j.1540-6229.2009.00247.x

Brunnermeier, M.K., Pedersen, L.H.: Market liquidity and funding liquidity. Rev. Financ. Stud. 22(6), 2201–2238 (2009). https://doi.org/10.1093/rfs/hhn098

Cannon, S.E., Cole, R.A.: Changes in REIT liquidity 1988–2007: evidence from daily data. J. Real Estate Financ. Econ. 43(1–2), 258–280 (2011)

Carhart, M.M.: On persistence in mutual fund performance. J. Financ. 52(1), 57–82 (1997). https://doi.org/10.1111/j.1540-6261.1997.tb03808.x