Abstract

Banks generally enhance their competitiveness through credit diversification. However, credit diversification may trigger serious systemic risk through the effect of fire sales. Using data from the Chinese banking market, we quantify the fire sales of credits and provide empirical evidence for the impact of credit diversification on systemic risk. The results reveal that an increased level of credit diversification promotes systemic risk and is more pronounced among small banks. Both the credit loss and network complexity of individual banks contribute to the impact of credit diversification on systemic risk. Declining economic prospects will also promote credit diversification to cause more systemic risk. However, tight macroprudential regulation helps to mitigate the promotion of credit diversification. These findings provide regulatory insights for systemic risk prevention.

Similar content being viewed by others

References

Acemoglu D, Ozdaglar A, Tahbaz-Salehi A (2015) Systemic risk and stability in financial networks. Am Econ Rev 105:564–608. https://doi.org/10.1257/aer.20130456

Acharya V, Naqvi H (2012) The seeds of a crisis: a theory of bank liquidity and risk taking over the business cycle. J Financ Econ 106:349–366. https://doi.org/10.1016/j.jfineco.2012.05.014

Acharya VV, Pedersen LH, Philippon T, Richardson M (2017) Measuring systemic risk. Rev Financ Stud 30:2–47. https://doi.org/10.1093/rfs/hhw088

Alam Z, Alter A, Eiseman J, Gelos R, Kang H, Narita M, Nier E, Wang N (2019) Digging deeper-evidence on the effects of macroprudential policies from a new database. IMF working papers 2019/066, International Monetary Fund

Aldasoro I, Hardy B, Jager M (2022) The Janus face of bank geographic complexity. J Bank Finance 134:106040. https://doi.org/10.1016/j.jbankfin.2020.106040

Amihud Y, Noh J (2021) Illiquidity and stock returns II: cross-section and time-series effects. Rev Financ Stud 34:2101–2123. https://doi.org/10.1093/rfs/hhaa080

Armstrong C, Nicoletti A, Zhou FS (2022) Executive stock options and systemic risk. J Financ Econ 146:256–276. https://doi.org/10.1016/j.jfineco.2021.09.010

Battiston S, Puliga M, Kaushik R, Tasca P, Caldarelli G (2012) DebtRank: too central to fail? financial networks, the FED and systemic risk. Sci Rep 2:1–6. https://doi.org/10.1038/srep00541

Bhat G, Ryan SG, Vyas D (2019) The implications of credit risk modeling for banks’ loan loss provisions and loan-origination procyclicality. Manag Sci 65:2116–2141. https://doi.org/10.1287/mnsc.2018.3041

Biswas SS, Gómez F (2018) Contagion through common borrowers. J Financ Stab 39:125–132. https://doi.org/10.1016/j.jfs.2018.10.001

Blinder A, Ehrmann M, de Haan J, Jansen DJ (2017) Necessity as the mother of invention: monetary policy after the crisis. Econ Policy 32:707–755. https://doi.org/10.1093/epolic/eix013

Borio C (2014) The financial cycle and macroeconomics: what have we learnt? J Bank Financ 45:182–198. https://doi.org/10.1016/j.jbankfin.2013.07.031

Braverman A, Minca A (2018) Networks of common asset holdings: aggregation and measures of vulnerability. J Netw Theory Financ 4:53–78. https://doi.org/10.21314/jntf.2018.045

Brownlees C, Engle RF (2017) SRISK: a conditional capital shortfall measure of systemic risk. Rev Financ Stud 30:48–79. https://doi.org/10.1093/rfs/hhw060

Bülbül D, Hakenes H, Lambert C (2019) What influences banks’ choice of credit risk management practices? theory and evidence. J Financ Stab 40:1–14. https://doi.org/10.1016/j.jfs.2018.11.002

Caccioli F, Farmer JD, Foti N, Rockmore D (2015) Overlapping portfolios, contagion, and financial stability. J Econ Dyn Control 51:50–63. https://doi.org/10.1016/j.jedc.2014.09.041

Cai J, Eidam F, Saunders A, Steffen S (2018) Syndication, interconnectedness, and systemic risk. J Financ Stab 34:105–120. https://doi.org/10.1016/j.jfs.2017.12.005

Caporin M, Costola M, Garibal JC, Maillet B (2022) Systemic risk and severe economic downturns: a targeted and sparse analysis. J Bank Financ 134:106339. https://doi.org/10.1016/j.jbankfin.2021.106339

Cerutti E, Claessens S, Laeven L (2017) The use and effectiveness of macroprudential policies: new evidence. J Financ Stab 28:203–224. https://doi.org/10.1016/j.jfs.2015.10.004

Dia E, VanHoose D (2018) Fixed costs and capital regulation: impacts on the structure of banking markets and aggregate loan quality. J Financ Stab 36:53–65. https://doi.org/10.1016/j.jfs.2018.02.007

Diem C, Pichler A, Thurner S (2020) What is the minimal systemic risk in financial exposure networks? J Econ Dyn Control 116:103900. https://doi.org/10.1016/j.jedc.2020.103900

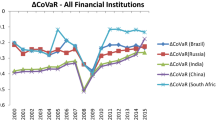

Duan Y, El Ghoul S, Guedhami O, Li H, Li X (2021) Bank systemic risk around COVID-19: a cross-country analysis. J Bank Financ 133:106299. https://doi.org/10.1016/j.jbankfin.2021.106299

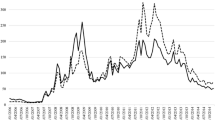

Duarte F, Eisenbach TM (2021) Fire-sale spillovers and systemic risk. J Financ 76:1251–1294. https://doi.org/10.1111/jofi.13010

Eisenberg L, Noe TH (2001) Systemic risk in financial systems. Manag Sci 47:236–249. https://doi.org/10.1287/mnsc.47.2.236.9835

Estrada E, Hatano N (2008) Communicability in complex networks. Phys Rev E 77:036111. https://doi.org/10.1103/physreve.77.036111

Festić M, Kavkler A, Repina S (2011) The macroeconomic sources of systemic risk in the banking sectors of five new EU member states. J Bank Financ 35:310–322. https://doi.org/10.1016/j.jbankfin.2010.08.007

Fricke C, Fricke D (2021) Vulnerable asset management? The case of mutual funds. J Financ Stab 52:100800. https://doi.org/10.1016/j.jfs.2020.100800

Galati G, Moessner R (2018) What do we know about the effects of macroprudential policy? Economica 85:735–770. https://doi.org/10.1111/ecca.12229

Giglio S, Kelly B, Pruitt S (2016) Systemic risk and the macroeconomy: an empirical evaluation. J Financ Econ 119:457–471. https://doi.org/10.1016/j.jfineco.2016.01.010

Huang X, Zhou H, Zhu H (2009) A framework for assessing the systemic risk of major financial institutions. J Bank Financ 33:2036–2049. https://doi.org/10.1016/j.jbankfin.2009.05.017

Huang X, Zhou H, Zhu H (2012) Systemic risk contributions. J Financ Serv Res 42:55–83. https://doi.org/10.1007/s10693-011-0117-8

Kabir MN, Rahman S, Rahman MA, Anwar M (2021) Carbon emissions and default risk: international evidence from firm-level data. Econ Model 103:105617. https://doi.org/10.1016/j.econmod.2021.105617

Kamani EF (2019) The effect of non-traditional banking activities on systemic risk: does bank size matter? Financ Res Lett 30:297–305. https://doi.org/10.1016/j.frl.2018.10.013

Laeven L, Levine R (2007) Is there a diversification discount in financial conglomerates? J Financ Econ 85:331–367. https://doi.org/10.1016/j.jfineco.2005.06.001

Lan C, Huang Z, Huang W (2020) Systemic risk in China’s financial industry due to the COVID-19 pandemic. Asian Econ Lett 1:18070. https://doi.org/10.46557/001c.18070

Maghyereh AI, Yamani E (2022) Does bank income diversification affect systemic risk: new evidence from dual banking systems. Financ Res Lett 47:102814. https://doi.org/10.1016/j.frl.2022.102814

Markose S, Giansante S, Shaghaghi AR (2012) ‘Too interconnected to fail’ financial network of US CDS market: topological fragility and systemic risk. J Econ Behav Organ 83:627–646. https://doi.org/10.1016/j.jebo.2012.05.016

Markowitz H (1952) The utility of wealth. J Political Econ 60:151–158. https://doi.org/10.1086/257177

Merton RC (1974) On the pricing of corporate debt: the risk structure of interest rates. J Financ 29:449–470. https://doi.org/10.2307/2978814

Paulin J, Calinescu A, Wooldridge M (2019) Understanding flash crash contagion and systemic risk: a micro–macro agent-based approach. J Econ Dyn Control 100:200–229. https://doi.org/10.1016/j.jedc.2018.12.008

Pennathur AK, Subrahmanyam V, Vishwasrao S (2012) Income diversification and risk: does ownership matter? An empirical examination of Indian banks. J Bank Financ 36:2203–2215. https://doi.org/10.1016/j.jbankfin.2012.03.021

Pichler A, Poledna S, Thurner S (2021) Systemic risk-efficient asset allocations: minimization of systemic risk as a network optimization problem. J Financ Stab 52:100809. https://doi.org/10.1016/j.jfs.2020.100809

Poledna S, Martínez-Jaramillo S, Caccioli F, Thurner S (2021) Quantification of systemic risk from overlapping portfolios in the financial system. J Financ Stab 52:100808. https://doi.org/10.1016/j.jfs.2020.100808

Ramadiah A, Caccioli F, Fricke D (2020) Reconstructing and stress testing credit networks. J Econ Dyn Control 111:103817. https://doi.org/10.1016/j.jedc.2019.103817

Roukny T, Battiston S, Stiglitz JE (2018) Interconnectedness as a source of uncertainty in systemic risk. J Financ Stab 35:93–106. https://doi.org/10.1016/j.jfs.2016.12.003

Silva TC, Souza SRS, Tabak BM (2017) Monitoring vulnerability and impact diffusion in financial networks. J Econ Dyn Control 76:109–135. https://doi.org/10.1016/j.jedc.2017.01.001

Silva TC, Alexandre MDS, Tabak BM (2018) Bank lending and systemic risk: a financial-real sector network approach with feedback. J Financ Stab 38:98–118. https://doi.org/10.1016/j.jfs.2017.08.006

Tasca P, Battiston S (2016) Market procyclicality and systemic risk. Quant Financ 16:1219–1235. https://doi.org/10.1080/14697688.2015.1123817

Torna G (2018) The impact of expanded bank powers on loan portfolio decisions. J Financ Stab 38:1–17. https://doi.org/10.1016/j.jfs.2018.07.002

Wang C, Liu X, He J (2022) Does diversification promote systemic risk? J Financ Stab 61:101680. https://doi.org/10.1016/j.najef.2022.101680

Yang HF, Liu CL, Chou RY (2020) Bank diversification and systemic risk. Q Rev Econ Financ 77:311–326. https://doi.org/10.1016/j.qref.2019.11.003

Zheng C, Cheung A, Cronje T (2019) The moderating role of capital on the relationship between bank liquidity creation and failure risk. J Bank Financ 108:105651. https://doi.org/10.1016/j.jbankfin.2019.105651

Acknowledgements

This research is supported by the National Natural Science Foundation of China (No. 72173018) and the Ministry of Education of Humanities and Social Science (21YJC790108)

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A. Market value of credit

As the credit of banks cannot be traded directly in the market, we determine the market values based on the option pricing approach proposed by Merton (1974). Treating credit as credit default bonds, the present market values of credit are equal to the risk-free present value of credit minus the present value of expected default losses on credit under risk-neutral conditions, that is, the European put option pricing based on credit.

Suppose that Dj represents the total credit to sector j and \({\text{MV}}_{j}^{t}\) represents the market value of sector j at time t, which is characterized by a geometric Brownian motion as follows:

where T is the maturity of credit, r is the risk-free interest rate, \(\sigma_{V}\) is the volatility of sector j, and z is a standard normal distribution.

If the market value of sector j moves below its total credit, the repayment of credit will be affected. Therefore, the expected default loss of credit in sector j is expressed as the difference between the total credit and its market value. This is equivalent to the payoff at maturity for a put option pt whose underlying is the market value of sector j, which is expressed as

This equation is further expressed as a function of z by substituting Eq. (1) into it, that is,

By simplifying the maximum function that \(D_{j} - {\text{MV}}_{j}^{t} e^{{\left( {r - {{\sigma_{V}^{2} } \mathord{\left/ {\vphantom {{\sigma_{V}^{2} } 2}} \right. \kern-0pt} 2}} \right)\left( {T - t} \right) + \sigma_{V} \sqrt {T - t} z}} > 0\), we have \(z < - d_{2}\), where

Accordingly, the integration interval of Eq. (3) is adjusted as

Given that \(\int_{ - \infty }^{{ - d_{2} }} {e^{{\sigma_{V} \sqrt {T - t} z}} g\left( z \right){\text{d}}z} = \frac{{e^{{{{\sigma_{V}^{2} \left( {T - t} \right)} \mathord{\left/ {\vphantom {{\sigma_{V}^{2} \left( {T - t} \right)} 2}} \right. \kern-0pt} 2}}} }}{{\sqrt {2\pi } }}\int_{ - \infty }^{{ - d_{2} }} {e^{{{{ - \left( {z - \sigma_{V} \sqrt {T - t} } \right)^{2} } \mathord{\left/ {\vphantom {{ - \left( {z - \sigma_{V} \sqrt {T - t} } \right)^{2} } 2}} \right. \kern-0pt} 2}}} {\text{d}}z}\), we have

where \(N\left( \cdot \right)\) represents the cumulative probability density function of a standard normal distribution and \(d_{1} = d_{2} + \sigma_{V} \sqrt {T - t}\).

Therefore, the present value of the expected default loss of credit in sector j is

From this, the market value of credit, defined as the difference between the risk-free discounted value of credit and the present value of the expected default losses, is determined by:

Define \(g_{i} = {{\left( {{\text{MV}}_{j}^{t} - D_{j} } \right)} \mathord{\left/ {\vphantom {{\left( {{\text{MV}}_{j}^{t} - D_{j} } \right)} {{\text{MV}}_{j}^{t} }}} \right. \kern-0pt} {{\text{MV}}_{j}^{t} }}\) as the initial leverage ratio of sector j and t = 0; then,

Appendix B. Dynamic updates of the equilibrium

We consider the contagion process of systemic risk arising from the interaction between interbank loans and credit markets in this paper. As there is a cascade of insolvency events, both interbank defaults and credit depreciations in the banking market are dynamically updated until equilibrium is reached when no more insolvency events occur. The insolvent banks in equilibrium are determined by the following algorithm: The variables \(L_{i}^{0} { = }b_{i}^{0}\) and \(f_{j}^{0} = 1\) are defined at the initial time t = 0, where \(b_{i}^{0} = \sum\nolimits_{k = 1}^{N} {L_{ki} }\). The following processes are repeated until convergence. All insolvent banks are in the set \(F^{t}\) when the algorithm ends.

-

I.t=t+1.

-

II.Determine the set of insolvent banks

$$F^{t} { = }\left\{ {i \in \left[ {1,N} \right]|SR_{i}^{t} = w_{i}^{0} } \right\}$$(34)where \(SR_{i}^{t}\) is the measured systemic risk contribution of bank i at time t.

-

III.Calculate the market value of credits based on fire sales

$$f_{j}^{t} = \exp \left( { - \beta_{j} \sum\limits_{i \in F}^{N} {s_{ij} } } \right)$$(35)where \(s_{ij}\) denotes the present value of liquidated credits from insolvent bank i to sector j.

-

IV.Determine interbank repayments

$$L_{i}^{t} = \min \left\{ {b_{i}^{0} ,w_{i}^{0} + b_{i}^{0} + \sum\limits_{j = 1}^{M} {V_{ij}^{t} } - \sum\limits_{j = 1}^{M} {V_{ij}^{0} } + \sum\limits_{k = 1}^{N} {\pi_{is} b_{k}^{t} } - L_{i}^{0} } \right\}$$(36)where \(V_{ij}^{t}\) denotes the market value of credit at time t from bank i to sector j. \(b_{k}^{t} = \sum\nolimits_{i = 1}^{N} {L_{ik}^{t} }\) indicates that it is a fixed-point iteration problem.

-

V.The algorithm ends if \(t \ge 2\) and \(F^{t} = F^{t - 1}\).

Appendix C. DebtRank method

For systemic risk measurement based on network models, the systemic cost function is generally used. The systemic cost function measures the situation in which an insolvent bank leads to the failure of other banks through the product of the number and probability of failures. However, if the affected banks have sufficient capital to cover the shocks, systemic risk will be underestimated by the systemic cost of failures. This problem is solved by a DebtRank method (Battiston et al. 2012), where the net worth losses caused by counterparties for surviving banks are contained in systemic risk.

DebtRank uses cumulative net worth losses for systemic risk measurement. Therefore, the systemic risk contribution of bank i at time t is represented by the relative net worth losses, that is,

The bank goes bankrupt when the loss is greater than its net worth, which is expressed as \({\text{DR}}_{i}^{t} = 1\).

The net worth loss is mainly contributed by interbank defaults and credit fire sales in this study. Therefore, the net worth loss of bank i is expanded as

The real payment of interbank loans received by a creditor depends on the failure of its counterparties in DebtRank. Therefore, the real value of interbank lending from bank i to bank k at time t is determined by its initial value and the default probability of bank k as follows:

This means that the changes in net worth lead to a dynamic default probability. Accordingly, the relative net worth loss of bank i is expressed as

We further take the size of banks into account in DebtRank and multiply \({\text{DR}}_{i}^{t}\) by the net worth of bank i. Then, systemic risk measurement is constructed as follows:

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wang, C., Chen, B. & Liu, X. Credit diversification and banking systemic risk. J Econ Interact Coord 19, 59–83 (2024). https://doi.org/10.1007/s11403-023-00401-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-023-00401-z