Abstract

A reliable method of options pricing in real time would help various players, including hedgers and speculators, to make informed decisions. In this study, we develop an extensive simulation with multiple business environments, which includes the use of real data from the S&P 500 Index between the years 2010–2017 for the 30 days prior to expiration of the options. Forecasted tradability is computed based on the SH model: a theoretical model of real-time options pricing that takes into account players’ heterogeneity with regard to their willingness to accept offers proposed by the opposing player. The quality of the model is examined for the scenario in which the model players are speculators who act against the real market prices. We show that the equilibrium prices predicted by the SH model are close to the market prices (a deviation of up to approx. 3%) in an In-The-Money environment. Additionally, the tougher the players (i.e., the greater their level of unwillingness to accept a bid from the opposing player), the higher the average tradability. We also find that the level of willingness of the players has a greater effect on tradability than does option moneyness or the market trend.

Similar content being viewed by others

References

Avellaneda M, Lipkin M (2003) A market-induced mechanism for stock pinning. Quant Finance 3:417–425

Avellaneda M, Kasyan G, Lipkin MD (2012) Mathematical models for stock pinning near option expiration dates. Commun Pure Appl Math 65(7):949–974

Bollen NP, Whaley RE (2004) Does net buying pressure affect the shape of implied volatility functions? J Finance 59(2):711–753

Brandt MW, Wu T (2002) Cross-sectional tests of deterministic volatility functions. J Empir Finance 9(5):525–550

Buraschi A, Jiltsov A (2006) Model uncertainty and option markets with heterogeneous beliefs. J Finance 61(6):2841–2897

Cetin U, Jarrow R, Protter P, Warachka M (2006) Pricing options in an extended Black Scholes economy with illiquidity: theory and empirical evidence. Rev Financ Stud 19(2):493–529

Chen Z, Lux T (2018) Estimation of sentiment effects in financial markets: a simulated method of moments approach. Comput Econ 52(3):711–744

Cho YH, Engle RF (1999) Time-varying betas and asymmetric effect of news: empirical analysis of blue chip stocks (no. w7330). National Bureau of Economic Research.

Chou RK, Chung SL, Hsiao YJ, Wang YH (2011) The impact of liquidity on option prices. J Futur Mark 31(12):1116–1141

Compte O, Jehiel P (2004) The wait-and-see option in ascending price auctions. J Eur Econ Assoc 2(2–3):494–503

Cox JC, Ross SA, Rubinstein M (1979) Option pricing: a simplified approach. J Financ Econ 7(3):229–263

Doran JS, Fodor A, Krieger K (2010) Option market efficiency and analyst recommendations. J Bus Finance Account 37(5–6):560–590

Fedenia M, Grammatikos T (1992) Options trading and the bid-ask spread of the underlying stocks. J Bus 65(3):335–351

Golez B, Jackwerth JC (2012) Pinning in the S&P 500 futures. J Financ Econ 106(3):566–585

Huang W, Chen Z (2018) Modelling contagion of financial crises. N Am J Econ Finance. https://doi.org/10.1016/j.najef.2018.06.007

Jang H, Lee J (2019) Machine learning versus econometric jump models in predictability and domain adaptability of index options. Physica A 513:74–86

Kang SB, Luo H (2016) Heterogeneity in beliefs and expensive index options. Working paper

León Á, Mencía J, Sentana E (2009) Parametric properties of semi-nonparametric distributions, with applications to option valuation. J Bus Econ Stat 27(2):176–192

Linaras CE, Skiadopoulos G (2005) Implied volatility trees and pricing performance: evidence from the S&P 100 options. Int J Theor Appl Finance 8(08):1085–1106

Ni SX, Pearson ND, Poteshman AM (2005) Stock price clustering on option expiration dates. J Financ Econ 78(1):49–87

Officer DT, Trennepohl GL (1981) Price behavior of corporate equities near option expiration dates. Financ Manag 10(3):75–80

Rosenberg JV, Engle RF (2002) Empirical pricing kernels. J Financ Econ 64(3):341–372

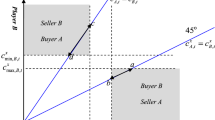

Shvimer Y, Herbon A (2019) Real-time waiting-price trading interval in a heterogeneous options market: a Bernoulli distribution. Working paper. https://management.biu.ac.il/files/management/shared/working_paper.pdf. Accessed 4 Aug 2019

Zhang Q, Han J (2013) Option pricing in incomplete markets. Appl Math Lett 26(10):975–978

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Modeling parameters

Table A.1 shows the values of the main parameters characterizing the trading floor that were used in the simulation runs.

Appendix B: Pseudo-code

Table B.1 briefly describes the simulation steps characterizing the trading mechanism of the SH model.

Rights and permissions

About this article

Cite this article

Shvimer, Y., Herbon, A. Tradability, closeness to market prices, and expected profit: their measurement for a binomial model of options pricing in a heterogeneous market. J Econ Interact Coord 15, 737–762 (2020). https://doi.org/10.1007/s11403-019-00259-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-019-00259-0