Abstract

This paper extends the endogenous growth agent-based model in Fagiolo and Dosi (Struct Change Econ Dyn 14(3):237–273, 2003) to study the finance–growth nexus. We explore industries where firms produce a homogeneous good using existing technologies, perform R&D activities to introduce new techniques, and imitate the most productive practices. Unlike the original model, we assume that both exploration and imitation require resources provided by banks, which pool agent savings and finance new projects via loans. We find that banking activity has a positive impact on growth. However, excessive financialization can hamper growth. Indeed, we find a significant and robust inverted U-shaped relation between financial depth and growth. Overall, our results stress the fundamental (and still poorly understood) role played by innovation in the finance–growth nexus.

Similar content being viewed by others

Notes

We do not attach any meaning to the x and y dimensions. A 2-dimensional lattice is chosen only for descriptive reasons.

In the first period, agents allocate a fraction \(\gamma _2\) of their savings to create the initial equity of the bank.

Nonetheless, in Sect. 4.4 we test the consequences of different returns to scale regimes.

This assumption is made for consistency with the original FDM. In reality, firms do not stop production while performing R&D and we tested the consequences of production during sailing in “Appendix A.” Overall our results are not qualitatively affected.

Here one can imagine that more “risk averse” explorers would like to have larger savings, or borrow more resources, than the expected exploration cost. That is, they could apply a sort of safety buffer. We test the consequences of this assumption in “Appendix A.” Our results are not significantly affected by such refinement. Notice also that such dependence of exploration upon savings, combined with the way in which banks provide loans (see Sect. 3.5), makes the probability that a firm starts exploring increasing in the amount of savings.

The same happens if the explorer arrives, by chance, to an already known island.

One could relax such an assumption allowing firms to move only in the directions where the productivity of the new technologies should be higher than the one they currently master. We will consider this setting in future versions of the model.

One could imagine that bankrupt explorers should be more penalized, e.g., letting them go back to the origin or introducing some form of bankruptcy cost they should pay when restarting production. However, the cumulation of knowledge and the dynamic increasing returns which are generated while the explorer was sailing let the bankrupt agent fall behind with respect to the technological frontier. This constitutes already a fairly large penalization.

The probability of such an outcome is negligible, as the productivity of a newly discovered island is linked to the last production carried out by the explorer. For this reason, we make this assumption for keeping the setting as simple as possible. However, in future versions of the model we will consider a more sophisticated setting in which an explorer can continue to sail when she arrives on an already known island with lower productivity, or she can come back to her initial island.

In the case of multiple maxima, miner i chooses one of them at random.

Also in this case we assume that imitators do not produce during sailing for consistency with the FDM. An analysis of the consequences of production during sailing can be found in “Appendix A.” See also footnote 5.

One can also assume that adoption should be further favored by reducing the time and hence the cost, it takes to be performed. We analyze such scenario in “Appendix A.” Our results are robust to lower time for adoption.

We assume that the per-period share of production c consumed for imitation equals that for exploration.

Since “asymmetric information is a defining characteristic of credit markets” (Dell’Ariccia 2001, see also Bhattacharya and Thakor 1993; Van Damme 1994), this is the only viable way to introduce it in the model. Indeed, given our simple setting, if banks were able to distinguish between explorers and imitators, their information would be perfect. Nonetheless, we investigate the role of information asymmetry in Sect. 4.4.

Since a bankrupt agent may hold bank equity shares, we assume for simplicity that in such a case the shares are redistributed to the other shareholders proportionally to their positions. Investigating the effects of bank ownership structure goes beyond the objectives of the present analysis.

We define net position as the difference between agent’s deposit and outstanding loan. If liquidity is not enough to satisfy depositors, then it is distributed proportionally to net positions. A firm with negative net position does not receive anything.

The source code of the model, written in C++, is available upon request.

All our results do not significantly change if one increases Monte Carlo sample sizes. Extensive tests show that the MC distributions of the statistics of interest are sufficiently symmetric and unimodal. Thus, we can use MC sample averages to get meaningful synthetic indicators.

The Basel II capital requirement is 8%, while in our baseline parametrization we fix it to 10%. Our choice captures the additional capital buffer that risk averse banks hold in order to reduce their solvability risk.

For a critical discussion of empirical validation of agent-based models, see Fagiolo et al. (2017).

See Fagiolo and Dosi (2003) for more details.

We thank an anonymous referee for having pointed out this.

Such an exercise can also be considered as a preliminary—and admittedly very partial—sensitivity analysis of the model. Indeed, we test the robustness of our findings when the value of one or two parameters is changed keeping all the other parameters as in the baseline parameterization in Table 1.

We further tested the effect of lower levels of innovation cumulativeness; overall the results are consistent with the intuition provided here. This analysis can be found in “Appendix A.”

Notice also how, from Eq. (1), individual production decreases with the number of miners when \(\alpha <1\).

We also tested how the economy reacts to changes in bank setup costs and in the number of banks. Overall, our results are robust and consistent with the effect of credit on the exploration–exploitation trade-off. For this reason, we do not report such analyses, which are nevertheless available from the authors upon request.

References

Acemoglu D, Zilibotti F (1997) Was prometheus unbound by chance? risk, diversification, and growth. J Polit Econ 105(4):709–751

Allen F, Gale D (1997) Financial markets, intermediaries, and intertemporal smoothing. J Polit Econ 105(3):523–546

Amore MD, Schneider C, Žaldokas A (2013) Credit supply and corporate innovation. J Financ Econ 109(3):835–855

Arcand JL, Berkes E, Panizza U (2015) Too much finance? J Econ Growth 20(2):105–148

Arribas I, Peiró-Palomino J, Tortosa-Ausina E (2017) Is full banking integration desirable? J Bank Finance. https://doi.org/10.1016/j.jbankfin.2017.08.002

Arrow KJ (1971) The economic implications of learning by doing. In: Readings in the theory of growth, pp 131–149

Bagehot W (1873) Lombard street: a description of the money market. Scribner, Armstrong & Company, London

Beck T, Büyükkarabacak B, Rioja FK, Valev NT (2012) Who gets the credit? and does it matter? household vs. firm lending across countries. BE J Macroecon 12(1):1–46

Beck T, Levine R (2004) Stock markets, banks, and growth: panel evidence. J Bank Finance 28(3):423–442

Beck T, Levine R, Loayza N (2000) Finance and the sources of growth. J Financ Econ 58(1):261–300

Bencivenga VR, Smith BD (1993) Some consequences of credit rationing in an endogenous growth model. J Econ Dyn Control 17(1–2):97–122

Benczur P, Karagiannis S, Kvedaras V (2017) Finance and economic growth: financing structure and non-linear impact. Technical report, Joint Research Centre, European Commission (Ispra site)

Berger AN, Espinosa-Vega MA, Frame WS, Miller NH (2011) Why do borrowers pledge collateral? new empirical evidence on the role of asymmetric information. J Financ Intermed 20(1):55–70

Bhattacharya S, Thakor AV (1993) Contemporary banking theory. J Financ Intermed 3(1):2–50

Bodenhorn H (2016) Two centuries of finance and growth in the united states, 1790–1980. Technical report, National Bureau of Economic Research

Boyd JH, Prescott EC (1986) Financial intermediary-coalitions. J Econ Theory 38(2):211–232

Campbell JY, Mankiw NG (1989) International evidence on the persistence of economic fluctuations. J Monet Econ 23(2):319–333

Capolupo R (2018) Finance, investment and growth: evidence for Italy. Econ Notes 47(1):145–186

Cecchetti SG, Kharroubi E (2012) Reassessing the impact of finance on growth. BIS working papers 381, Bank for International Settlements

Cecchetti SG, Kharroubi E (2018) Why does credit growth crowd out real economic growth? NBER working paper 25079, National Bureau of Economic Research

Cincotti S, Raberto M, Teglio A (2010) Credit money and macroeconomic instability in the agent-based model and simulator eurace. Econ Open Assess E J 4:1–32

Cingano F, Manaresi F, Sette E (2016) Does credit crunch investment down? new evidence on the real effects of the bank-lending channel. Rev Financ Stud 29(10):2737–2773

Cochrane JH (1988) How big is the random walk in gnp? J Polit Econ 96(5):893–920

Dawid H, Delli Gatti D (2018) Agent-based macroeconomics. In: Handbook of computational economics, vol 4, pp 63–156. Elsevier

De la Fuente A, Marín J (1996) Innovation, bank monitoring, and endogenous financial development. J Monet Econ 38(2):269–301

Dell’Ariccia G (2001) Asymmetric information and the structure of the banking industry. Eur Econ Rev 45(10):1957–1980

Dosi G (1984) Technical change and industrial transformation: the theory and an application to the semiconductor industry. Springer, New York

Dosi G (1988) Sources, procedures, and microeconomic effects of innovation. J Econ Lit 26:1120–1171

Dosi G, Egidi M (1991) Substantive and procedural uncertainty. J Evol Econ 1(2):145–168

Dosi G, Lovallo D (1997) Rational entrepreneurs or optimistic martyrs? Some considerations on technological regimes, corporate entries, and the evolutionary role of decision biases. Cambridge University Press, Cambridge

Dosi G, Nelson R (1994) An introduction to evolutionary theories in economics. J Evol Econ 4:153–172

Dosi G, Nelson RR (2010) Technological change and industrial dynamics as evolutionary processes. In: Hall BH, Rosenberg N (eds) Handbook of the economics of innovation, chapter 4. Elsevier, Amsterdam

Dosi G, Roventini A (2019) More is different... and complex! the case for agent-based macroeconomics. J Evol Econ 29:1–37

Dosi G, Fagiolo G, Roventini A (2010) Schumpeter meeting keynes: a policy-friendly model of endogenous growth and business cycles. J Econ Dyn Control 34(9):1748–1767

Dosi G, Fagiolo G, Napoletano M, Roventini A (2013) Income distribution, credit and fiscal policies in an agent-based keynesian model. J Econ Dyn Control 37(8):1598–1625

Dosi G, Fagiolo G, Napoletano M, Roventini A, Treibich T (2015) Fiscal and monetary policies in complex evolving economies. J Econ Dyn Control 52:166–189

Epstein GA (2005) Financialization and the world economy. Edward Elgar Publishing, Cheltanham

Fagiolo G (2000) Endogenous growth in open-ended economies with locally interacting agents. Technical report, Laboratory of Economics and Management (LEM), Sant’Anna School of Advanced Studies, Pisa, Italy

Fagiolo G, Dosi G (2003) Exploitation, exploration and innovation in a model of endogenous growth with locally interacting agents. Struct Change Econ Dyn 14(3):237–273

Fagiolo G, Roventini A (2017) Macroeconomic policy in dsge and agent-based models redux: new developments and challenges ahead. J Artif Soc Soc Simul 20(1):1

Fagiolo G, Guerini M, Lamperti F, Moneta A, Roventini , et al (2017) Validation of agent-based models in economics and finance. Technical report, Laboratory of Economics and Management (LEM), Sant’Anna School of Advanced Studies, Pisa, Italy

Fujita M, Thisse J-F (2013) Economics of agglomeration: cities, industrial location, and globalization. Cambridge University Press, Cambridge

Giebel M, Kraft K (2018) Bank credit supply and firm innovation. Discussion paper 18-011, Centre for European Economic Research

Greenwood J, Jovanovic B (1990) Financial development, growth, and the distribution of income. J Polit Econ 98(5 Part 1):1076–1107

Greenwood J, Smith BD (1997) Financial markets in development, and the development of financial markets. J Econo Dyn Control 21(1):145–181

Jerzmanowski M (2017) Finance and sources of growth: evidence from the us states. J Econ Growth 22(1):97–122

Kaminsky GL, Reinhart CM (1999) The twin crises: the causes of banking and balance-of-payments problems. Am Econ Rev 89:473–500

King RG, Levine R (1993a) Finance and growth: Schumpeter might be right. Q J Econ 108(3):717–737

King RG, Levine R (1993b) Finance, entrepreneurship and growth. J Monet Econ 32(3):513–542

Kneer C (2013) Finance as a magnet for the best and brightest: Implications for the real economy. Working paper 392, DNB

Law SH, Singh N (2014) Does too much finance harm economic growth? J Bank Finance 41:36–44

LeBaron B, Tesfatsion L (2008) Modeling macroeconomies as open-ended dynamic systems of interacting agents. Am Econ Rev 98:246–250

Levine R (1991) Stock markets, growth, and tax policy. J Finance 46(4):1445–1465

Levine R (2005) Finance and growth: theory and evidence. Handb Econ Growth 1:865–934

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality and causes. J Monet Econ 46(1):31–77

Loayza N, Ouazad A, Rancière R (2018) Financial development, growth, and crisis: Is there a trade-off? Working paper 24474, National Bureau of Economic Research

Madsen JB, Ang JB (2016) Finance-led growth in the oecd since the nineteenth century: how does financial development transmit to growth? Rev Econ Stat 98(3):552–572

Nelson R, Winter S (1982) An evolutionary theory of economic change. Harvard University Press, Cambridge

Nelson R, Winter S (2002) Evolutionary theorizing in economics. J Econ Perspect 16:23–46

Nyasha S, Odhiambo NM (2018) Financial development and economic growth nexus: a revisionist approach. Econ Notes 47(1):223–229

Philippon T, Reshef A (2013) An international look at the growth of modern finance. J Econ Perspect 27(2):73–96

Rajan RG, Zingales L (1998) Financial dependence and growth. Am Econ Rev 88(3):559–586

Riccetti L, Russo A, Gallegati M (2016) Financialisation and crisis in an agent based macroeconomic model. Econ Model 52:162–172

Robinson J (1952) The generalization of the general theory. In: Robinson J (ed) The rate of interest and other essays. MacMillan, London

Schularick M, Taylor AM (2012) Credit booms gone bust: monetary policy, leverage cycles, and financial crises, 1870–2008. Am Econ Rev 102(2):1029–1061

Schumpeter JA (1911) The theory of economic development. Harvard University Press, Cambridge

Silverberg G, Verspagen B (1995) Evolutionary theorizing on economic growth. IIASA working papers WP-95-078, IIASA, Laxenburg, Austria

Sirri E, Tufano P (1995) The economics of pooling. In: Crane DB et al (eds) The Global Financial System: A Functional Approach. Harvard Business School Press, Cambridge

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Stiglitz JE, Weiss A (1983) Incentive effects of terminations: applications to the credit and labor markets. Am Econ Revd 73(5):912–927

Stolbov M (2017) Causality between credit depth and economic growth: evidence from 24 oecd countries. Empir Econ 53(2):493–524

Teece D, Peteraf M, Leih S (2016) Uncertainty, innovation, and dynamic capabilities: an introduction. Calif Manag Rev 58(4):5–12

Tesfatsion L, Judd K (eds) (2006) Handbook of computational economics II: agent-based computational economics. North Holland, Amsterdam

Van Damme E (1994) Banking: a survey of recent microeconomic theory. Oxf Rev Econ Policy 10(4):14–33

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

G.F., D.G. and A.R. gratefully acknowledge support by the European Union’s Horizon 2020 research and innovation program under Grant Agreement No. 640772-DOLFINS. G.F. and A.R. gratefully acknowledge support by the European Union’s Horizon 2020 research and innovation program under Grant Agreement No. 649186-ISIGrowth. Thanks to Marina Mastrorillo, Tommaso Ferraresi, and Delio Panaro for their contribution to the development of the ideas behind this version of the model. We also thank two anonymous referees for their valuable comments.

Additional analyses

Additional analyses

In Appendix, we collect some additional analyses we made to check the robustness of our results.

First we investigate what happens when more “risk averse” explorers are considered. To do that, we assume that the amount of resources necessary to start an exploration is

with \(\theta \ge 0\) representing a safety buffer. That is, for precautionary motives an explorer requests more resources than those she expects to consume during the travel.

Figure 17 shows the results with different values of \(\theta \). As one can notice, no significant difference emerges from the introduction of such safety mechanisms. This is due to the fact that the positive effect of lowering the risk of bankruptcy is counterbalanced by the negative effect of committing more resources to fewer explorations. This is confirmed by the expansion of financial depth. Indeed, banks end up financing less (but larger) projects; thus, when an innovative project fails, it has more severe consequences on the economy.

Safety buffer for exploration. Left: \(\theta =0\) (baseline). Mid: \(\theta =0.1\). Right: \(\theta =0.2\). Top: MC average of log GDP with a banking sector (\(N_b=5\)) and without (\(N_b=0\)). Bottom: MC average of \(G_t^{10}\) for the different subsamples generated by the deciles of \(\overline{\mathrm{FD}}^{10}_{t-10}\). Confidence bands are set as three standard errors away from Monte Carlo sample averages

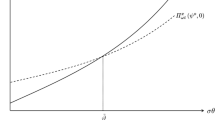

Next, we consider the case in which production is possible also during imitation and exploration. To do that, we assume that in each period of sailing an agent is able to generate the amount of GDP she was producing during her last period as miner on the island she left. Figure 18 shows the comparison between our baseline setting and this new scenario. As expected production during navigation has a positive effect on growth, which becomes even more evident when a banking sector is present. Indeed, in this setting the imitation and exploration boosting provided by credit does not correspond anymore to a lack of accumulation. The relation between financial depth and growth is still inverted U shaped, and it is interesting to notice how the financial sectors shrink. Moreover, an expansion of finance produces a negative effect on growth relatively earlier. These are the consequences of larger accumulation of resources, which dynamically increases the risk of over-exploration.

Production during imitation or exploration. Left: no production (baseline). Right: production during sailing equal to last production. Top: MC average of log GDP with a banking sector (\(N_\mathrm{b}=5\)) and without (\(N_\mathrm{b}=0\)). Bottom: MC average of \(G_t^{10}\) for the different subsamples generated by the deciles of \(\overline{\mathrm{FD}}^{10}_{t-10}\). Confidence bands are set as three standard errors away from Monte Carlo sample averages

In the previous setting, however, production during navigation implies that exploration and imitation activities are basically costless. In the baseline setting, instead, moving in the technological space entails two costs. Indeed, foregone production (an opportunity cost) should be added to the explicit cost of foregone consumption described in Sects. 3.3 and 3.4. Hence, we explore now some intermediate cases. Figure 19 compares the results obtained under the baseline setting with those one gets when firms are allowed to generate a share of their last production as miners to finance explicit exploration and imitation costs. More specifically, we assume that production during sailing finances half of the explicit navigation cost and we investigate what happens when such cost increases by 50% (mid panels) or remains as in the baseline (right panels). Thus, in the first case the total cost of sailing decreases by 25% of the baseline explicit cost in terms of foregone consumption, while in the second case the total cost decreases by 50% of the baseline explicit cost. As one can notice, our results are overall robust to these different specifications. Since in both cases the total cost is significantly reduced, exploration and imitation become cheaper than in the baseline and this has a positive effect on long-run growth. Moreover, in those cases firms need to borrow less resources and the financial sector shrinks. Thus, the negative effect of a large financial sector is reduced and the risk of observing credit fueled over-exploration decreases.

Production during sailing and cost of exploration and imitation. Left: baseline. Mid: production covers half of the explicit navigation cost which increases by 50%. Right: production covers half of the baseline explicit navigation cost. Top: MC average of log GDP with a banking sector (\(N_\mathrm{b}=5\)) and without (\(N_\mathrm{b}=0\)). Bottom: MC average of \(G_t^{10}\) for the different subsamples generated by the deciles of \(\overline{\mathrm{FD}}^{10}_{t-10}\). Confidence bands are set as three standard errors away from Monte Carlo sample averages

Now we explore how our results change when the strength of cumulativeness in technical change weakens. As in the original FDM, cumulativeness plays an important role since it is at the core of the dynamic increasing returns process that drives self-sustained exponential growth. Indeed, as one can notice in Fig. 20, with lower values of \(\phi \) growth declines and such reduction is more evident when a financial sector is active. This follows from the fact that, in this scenario, discovering a new technology is less rewarding and agents take more time to pay back their loans. The inverted U-shaped relation between finance and growth is robust to lower values of \(\phi \), even if the negative effect of large financial depth seems to weaken. This is because larger exploration is needed when new technologies are only marginally more productive than old ones; thus, over-exploration becomes less likely.

Strength of cumulative learning effect. Left: \(\phi =0.2\). Mid: \(\phi =0.3\). Right: \(\phi =0.4\). Top: MC average of log GDP with a banking sector (\(N_\mathrm{b}=5\)) and without (\(N_\mathrm{b}=0\)). Bottom: MC average of \(G_t^{10}\) for the different subsamples generated by the deciles of \(\overline{\mathrm{FD}}^{10}_{t-10}\). Confidence bands are set as three standard errors away from Monte Carlo sample averages

Then, we analyze how our results change when imitators move faster in the technological space. Thus, adopting an already existing technology, as well as having the relevant advantages of being deterministic and moving through the shortest path, has also the advantage of a reduced time for implementation and hence a lower cost. As one can notice in Fig. 21, favoring imitation implies higher growth and such effect becomes even stronger when a financial sector is active. This follows from a mitigation of the incidence of over-exploration: faster and cheaper adoption implies that, on average, firms devote more resources to imitation than to exploration, equilibrating the trade-off. This is confirmed by the form of the inverted U-shaped relation between financial depth and growth, whose maximum shifts to the right.

Speed of imitators. Left: 1 step per period (baseline). Mid: 1.5 steps per period. Right: 2 steps per period. Top: MC average of log GDP with a banking sector (\(N_\mathrm{b}=5\)) and without (\(N_\mathrm{b}=0\)). Bottom: MC average of \(G_t^{10}\) for the different subsamples generated by the deciles of \(\overline{\mathrm{FD}}^{10}_{t-10}\). Confidence bands are set as three standard errors away from Monte Carlo sample averages

Minimum capital requirement. Left: \(\chi =0.5\). Mid: \(\chi =2\). Right: \(\chi =5\). Top: MC average of log GDP with a banking sector (\(N_\mathrm{b}=5\)) and without (\(N_\mathrm{b}=0\)). Bottom: MC average of \(G_t^{10}\) for the different subsamples generated by the deciles of \(\overline{\mathrm{FD}}^{10}_{t-10}\). Confidence bands are set as three standard errors away from Monte Carlo sample averages

In the end, we complement the analyses in Figs. 11 and 12 observing how our results vary when large values of minimum capital requirement are considered. As one can notice in Fig. 22, when \(\chi \) increases too much growth is negatively affected. This is because, when banks have to restrain credit because of a large capital requirement, the economy suffers of a lack of imitation and exploration, especially in the first phases of development. This is also confirmed by the fact that the relation between financial depth and growth becomes increasingly positive and steep, while over-exploration is a very rare event.

Rights and permissions

About this article

Cite this article

Fagiolo, G., Giachini, D. & Roventini, A. Innovation, finance, and economic growth: an agent-based approach. J Econ Interact Coord 15, 703–736 (2020). https://doi.org/10.1007/s11403-019-00258-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-019-00258-1

Keywords

- Agent-based models

- Innovation

- Exploration versus exploitation

- Endogenous growth

- Banking sector

- Finance–growth nexus