Abstract

Purpose

The concept of criticality concerns the probability and the possible impacts of shortages in raw-material supply and is usually applied to regional economies or specific industries. With more and more products being highly dependent on potentially critical raw materials, efforts are being made to also incorporate criticality into the framework of life cycle sustainability assessment (LCSA). However, there is still some need for methodological development of indicators to measure raw-material criticality in LCSA.

Methods

We therefore introduce ‘economic product importance’ (EPI) as a novel parameter for the product-specific evaluation of the relevance and significance of a certain raw material for a particular product system. We thereby consider both the actual raw-material flows (life cycle inventories) and the life cycle cost. The EPI thus represents a measure for the material-specific product-system vulnerability (another component being the substitutability). Combining the product-system vulnerability of a specific product system towards a certain raw material with the supply disruption probability of that same raw material then yields the product-system specific overall criticality with regard to that raw material. In order to demonstrate our novel approach, we apply it to a case study on a battery-electric vehicle.

Results

Since our approach accounts for the actual amounts of raw materials used in a product and relates their total share of costs to the overall costs of the product, no under- or over-estimation of the mere presence of the raw materials with respect to their relevance for the product system occurs. Consequently, raw materials, e.g. rare earth elements, which are regularly rated highly critical, do not necessarily reach higher criticality ranks within our approach, if they are either needed in very small amounts only or if their share in total costs of the respective product system is very low. Accordingly, in our case study on a battery-electric vehicle product system, most rare earth elements are ranked less critical than bulk materials such as copper or aluminium.

Conclusion

Our EPI approach constitutes a step forward towards a methodology for the raw-material criticality assessment within the LCSA framework, mainly because it allows a product-specific evaluation of product-system vulnerability. Furthermore, it is compatible with common methods for the supply disruption probability calculation — such as GeoPolRisk, ESP or ESSENZ — as well as with available substitutability evaluations. The practicability and usefulness of our approach has been shown by applying it to a battery-electric vehicle.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and background

A well-informed decision between technology options and alternatives, especially with regard to novel and supposedly ‘green’ technologies, requires some kind of comprehensive multidimensional assessment in order to check for the multitude of possible environmental, economic and social — or sustainability — impacts that the respective technologies actually or potentially may have along their life cycles (i.e. including the stages of raw-material provision, manufacturing and use as well as re-use, recycling, and/or disposal). Then, based on the results of such an assessment, the various positive and/or negative impacts may be weighed against each other, eventually leading to a decision in favour of one technology option that combines a maximum of positive with a minimum of negative impacts. Furthermore, the assessment results may foster the systematic technological improvement of a technology option, first and foremost, by specifically addressing the technology-immanent causes of possible negative impacts.

Several approaches and methodologies for such a sustainability assessment have been developed, varying in scope, detail, and comprehensiveness (Lu et al. 2019; Sala et al. 2015, 2013a), with the life cycle sustainability assessment (LCSA) framework (Finkbeiner et al. 2010; Kloepffer 2008) being one rather comprehensive approach, which is frequently applied and focuses on products and processes while taking a life cycle perspective (Onat et al. 2017; Sala et al. 2013b; Wulf et al. 2019). Originating from the environmentally focussed life cycle assessment (LCA) methodology, developmental efforts with regard to LCSA have been — and still are — to a large extent concerned with the extension and operationalisation as well as integration of economic (e.g. Bachmann 2013; Onat et al. 2014; Wood and Hertwich 2013) and social indicators (e.g. Benoît et al. 2010; Kühnen and Hahn 2017) into the LCSA framework. Despite the considerable progress that has been achieved in this regard during only one decade, quite a few methodological challenges remain to be tackled (Costa et al. 2019; Dantas and Soares 2021; Fauzi et al. 2019). One issue of continuing high interest among the LC(S)A community refers to the question of how to evaluate — in an LC(S)A context — the mineral resources (or abiotic raw materials) that are being used by the assessed products or processes throughout their life cycles (Drielsma et al. 2016a; Sonderegger et al. 2020; Sonnemann et al. 2015).

Answering the question of how to treat raw-material use in LC(S)A methodology constitutes a still ongoing process, which is in particular due to the fact that there are a wide range of different aspects and partly diverging perspectives to the topic, resulting in a high overall complexity (André and Ljunggren 2021; Berger et al. 2020; Drielsma et al. 2016b). One major point in this regard concerns the ‘area of protection’ (AOP), which would be affected through raw-material use, and how exactly the impacts on that AOP are to be characterised and evaluated (Sonderegger et al. 2017). In this respect, the original approach has been to measure the ‘abiotic depletion potential’ (ADP) as one of the impact categories referring to the AOP of ‘natural resources’ (van Oers and Guinée 2016). However, there has not only been quite a debate (and some confusion) on how to define and measure the reservoir, so to speak, from which the natural resources, including abiotic raw materials, are being extracted and which would eventually be exhausted, thereby referring to (and sometimes mixing up) terms and definitions regularly used in geology and resource economics, such as ‘crustal content’, ‘resources’ or ‘reserves’ (Drielsma et al. 2016b). Also, the very idea of especially mineral resources being depleted and thus at some point in the future being completely used up has been contested, arguing that all mineral material will always be present (physically) within the earth’s geochemical system and just be made available (techno-economically) for use in society as long and to the extent demand creates the respective market forces and technology provides the technical means of extracting and processing the respective materials (Bradshaw et al. 2013; Northey et al. 2018). This latter argument constitutes a shift or widening in perspectives in at least two ways: First, the question of physical existence and ultimate physical depletion of natural stocks of mineral resources is complemented through a much broader analysis of techno-economic availability of raw-material commodities; second, additionally to the natural resources as the (only) AOP relevant for abiotic raw-material use, the assessed technology or product system itself and how it could be affected by (un-)availability of raw materials becomes a focal point of assessment (André and Ljunggren 2021; Berger et al. 2020; Sonderegger et al. 2020).

Analysing and evaluating the impacts of mineral resource use by — as well as mineral raw-material needs of — product systems has thus become a rather complex, i.e. multi-aspect and multi-perspective, endeavour that considers a multitude of geological, geo-, macro- and techno-economic as well as political and even social issues and dynamics of raw-material supply and demand, thereby paying particular attention to actual or potential causes and effects of situations, where demand cannot (sufficiently) be met. This topic is generally referred to as ‘criticality of raw materials’, or just ‘criticality’ (Dewulf et al. 2016; Erdmann and Graedel 2011; Graedel and Reck 2016; Graedel et al. 2015b; Jin et al. 2016; Northey et al. 2018; Schrijvers et al. 2020), and therefore efforts within LC(S)A development aiming at the life cycle assessment of raw-material usage are currently also dealing with the evaluation of raw-material criticality as well as with its integration into, or complementation to, LC(S)A methodology (Drielsma et al. 2016b; Koch et al. 2019; Mancini et al. 2018; Santillán-Saldivar et al. 2020; Sonnemann et al. 2015).

In general, criticality of raw materials is assessed on different levels (for reviews see: Achzet and Helbig 2013; Erdmann and Graedel 2011; Graedel and Reck 2016; Helbig et al. 2016a; Jin et al. 2016; Schrijvers et al. 2020), mainly on (national or regional) economy (e.g. for the European Union or the USA, respectively: European Commission 2020; Schulz et al. 2017) or sector level (e.g. for various industrial sectors in the European Union: Bobba et al. 2020; for the automobile industry: Knobloch et al. 2018), but also technology-specific (e.g. for various low-carbon energy technologies: Junne et al. 2020; for electric vehicles: Busch et al. 2014; Jones et al. 2020) as well as down to component level (e.g. for a specific spintronic device used in information and communication technologies: Palomino et al. 2021). Due to distinct goals and perspectives of studies, there is no common methodology or harmonized definition that would constitute a standard raw-material criticality assessment procedure for all cases (Dewulf et al. 2016; Mancini et al. 2018; Schrijvers et al. 2020). However, on a very general level, criticality assessment studies can be related to classical risk theory (Frenzel et al. 2017; Glöser et al. 2015). In this respect, the common approach is characterised by the application of two main dimensions within the assessment, which resemble the exposure and hazard — or likelihood of occurrence and damage — dichotomy of ‘risk’ (cf. André and Ljunggren 2021; Bradshaw et al. 2013; Glöser et al. 2015; Habib and Wenzel 2016): (1) the supply disruption probabilityFootnote 1 (SDP) of the raw material(s) assessed; and (2) the vulnerability of the system under study to a decrease in or a disruption of supply of the respective raw material(s) (e.g. Blengini et al. 2017; Cimprich et al. 2018; Miyamoto et al. 2019).

In most raw-material criticality assessment studies, the SDP of a material is evaluated as the likelihood of a decrease in its supply, an increase in its demand or both (Schrijvers et al. 2020). In this context, different sets of numerous criteria or indicators are being used in order to account for the various technological, geological, economic, political, environmental and social factors that influence both parameters, i.e. the amounts of demand and/or supply of a raw material. For example, to evaluate the likelihood of a decrease in supply, common criteria/indicators include some measures of concentration of mining/processing sites in a single or only very few countries worldwide; a monopoly/oligopoly of mining/processing companies; geological abundance/scarcity; political, regulatory and social conditions/stability in the mining/processing countries/regions (governance); recyclability; substitutability (André and Ljunggren 2021; Buijs et al. 2012; Schrijvers et al. 2020). The evaluation of the likelihood of an increase in demand is less often pursued (Schrijvers et al. 2020) and usually includes some kind of measure derived from forecasting of (emerging) technologies and markets (Buijs et al. 2012; Schrijvers et al. 2020). To give an example, Gemechu et al. (2016) build their ‘GeoPolRisk’ SDP-assessment method on the criteria ‘production concentration’, ‘import shares’ and ‘domestic production’, focussing on geopolitical indicators that are highly dependent on the geographical area in question. Another example would be Bach et al. (2016), who use — apart from various other criteria in the categories ‘physical availability’, ‘environmental impacts’ and ‘social acceptance’ — a set of no less than eleven indicators in the category ‘socio-economic availability’ (i.e. ‘concentration of reserves’, ‘concentration of mine production’, ‘price variation’, ‘occurrence of co-products’, ‘political stability’, ‘demand growth’, ‘feasibility of exploration projects’, ‘company concentration’, ‘primary material use’, ‘mining capacity’ and ‘trade barriers’), which are — to a large extent — independent of the geographical location of the product system under study (‘ESSENZ’ method).

Vulnerability of a system or entity (such as a regional economy, a nation state, an industry, or a product) — within the raw-material criticality context — generally refers to the type as well as the severity of the potential impact that a disruption or shortage of supply of a certain raw material could have on that system or entity (Helbig et al. 2016a). This usually includes both the disturbances or damages the supply disruption or shortage could cause to the affected system (such as a curtailment or total halt in industrial production) as well as the available options for that system to counteract (such as substituting the material that has become scarce or unavailable by an alternative one). Accordingly, vulnerability in raw-material criticality assessment is usually described as the (un-)availability of substitutes and/or other possibilities to adapt demand and supply to anticipated changes as well as some measure of the economic value of the affected industry branches, technologies, or products relative to the overall national or regional economy (Helbig et al. 2016a; Schrijvers et al. 2020).

This study aims to contribute to the methodological development of a raw-material criticality evaluation that could be operationalised through an indicator, which could then be integrated into the indicator sets applied within the LCSA framework. In doing so, we would like to support and complement efforts already made by others to include raw-material criticality in LCA (Koch et al. 2019; Pell et al. 2019) and LCSA (Bach et al. 2016; Cimprich et al. 2017, 2018; Sonnemann et al. 2015). Unlike stand-alone criticality assessments, which usually refer to the criticality of materials on a global, regional or national level, LCSA-integration of criticality requires certain methodological adaptations as well as specifications in order to harmonise the raw-material criticality approach with the general LC(S)A approach. In this regard, a number of applicable methods have already been proposed elsewhere (Berger et al. 2020; Sonderegger et al. 2020), and we think that these methods form a good basis as well as show a high potential for further refinement in at least two respects: The first issue refers to the specificity in the level of analysis that is particularly chosen for the vulnerability assessment. In our opinion, the object of the vulnerability assessment should as far as possible match the object of the overall raw-material criticality assessment because a raw material may be of high importance for a certain regional economy (e.g. for the European Union: Blengini et al. 2017; Deloitte Sustainability et al. 2017), but not necessarily for a specific product being produced in that same region (e.g. for a dental X-ray equipment: Cimprich et al. 2018). Therefore, in our view, the evaluation of vulnerability within LCSA studies, which do have a life cycle–oriented product-system focus, could be pursued on a more product-specific level than is usually done within typical raw-material criticality assessments.

The second issue regards the number and types of aspects that are considered within the vulnerability assessment of a product system. In this regard, substitutability is regularly used as (the) one constituting factor of vulnerability in raw-material criticality assessments in general (André and Ljunggren 2021; Schrijvers et al. 2020). This is also the case for many life cycle–oriented raw-material criticality assessments of products, such as the studies by Cimprich et al. (2018) and Habib and Wenzel (2016), where vulnerability is operationalised on product level through a ‘substitutability’ factor. However, apart from a (sudden and complete) physical raw-material unavailability (termed ‘type 2’-events of criticality by Frenzel et al. 2017, p. 6), which would either lead to the (forced) substitution of that raw material by another one in the already existing product system or bring the production to a halt altogether, there are other scenarios of less severe supply shortages, which would, first of all, lead to price hikes of the respective raw material (called ‘type 1’ events of criticality by Frenzel et al. 2017, p. 6), which the affected product system would then have to bear. In fact, it is mainly these price spikes and volatilities that spurred the growing interest into the study of raw-material criticality (Buijs et al. 2012; Frenzel et al. 2017; Leader et al. 2019; Malala and Adachi 2021). While some studies and methodologies include price fluctuations in their assessment of the SDP, e.g. Bach et al. (2016) and Arendt et al. (2020), in our view, raw-material prices or raw-material costs should also be incorporated into the vulnerability assessment of the affected product systems. The reasoning behind would be that the higher or more severe a price increase of a certain raw material would be for a certain product system, the more vulnerable this product system would be with respect to that raw material. This is in line with other authors who, for instance, analysed price spike probabilities of raw materials and their impacts on national economy (Malala and Adachi 2021) or the competitiveness of certain clean energy technologies (Leader et al. 2019).

In the following, we will first introduce our proposed method for the assessment of raw-material criticality of product systems in an LCSA context. Then, we will apply our method to a case study and present its results. In the subsequent Sect. 4, the benefits as well as shortcomings of our novel approach will be explained in detail, and our results will be compared to the results of others. Finally, this article concludes with major implications and a brief outlook to further research needs.

2 Methods

As already outlined in Sect. 1, we propose a novel method for the criticality assessment in the context of the life cycle (sustainability) assessment framework, LC(S)A (Kloeppfer 2008; Finkbeiner et al. 2010). Figure 1 shows a schematic representation of our approach and depicts the various factors that are to be included for the criticality calculation and will be explained in this section step by step.

General set-up of the proposed assessment approach for raw-material criticality of product systems. This article focuses on the introduction and detailed description of the economic product importance (EPI) factor (coloured in dark blue). All other elements are referred to more generally (light blue)

Aiming at a differentiated assessment of raw-material criticality of product systems, we define an ‘economic product importance’ (EPI) factor. Within our approach, the EPI constitutes the first of two factors that determine the ‘product-system vulnerability’, with substitutability being the second one. Combining then the product-system vulnerability score with a value for the SDP, eventually results in a measure of the raw-material criticality for a given raw material used in a specific product system.

For the calculation of raw-material criticality, we developed the following formula:

where PSVx,p represents the product-system vulnerability of raw material x for product p, with the EPI specifically being calculated as:

where cx represents the amount or mass specific cost of raw material x (in e.g. €/kg), mx,p represents the inventory flow (e.g. amount or mass) of raw material x for product p (in e.g. kg), and Cp represents the total cost of the product p (in e.g. €).

2.1 Product system vulnerability

2.1.1 EPI

The proposed EPI indicates the economic vulnerability of a product system with regard to price hikes for a certain raw material. As such, the EPI complements the frequently stated argument (e.g. Cimprich et al. 2017, 2018; Habib and Wenzel 2016) that each and every raw material used for a product system is in principle essentially needed for the functionality of that system and is therefore in principle equally important to that system. This argument holds, in our opinion, in all those cases, where the material in question would — all of a sudden — be completely physically unavailable (type 2 events; Frenzel et al. 2017). However, since the SDP is based on supply decrease and/or demand increase (Schrijvers et al. 2020), imbalances — to varying degrees — of supply and demand in the raw-material markets can be expected, resulting, first and foremost, in price changes — also of varying degrees (cf. in general: Bustamante et al. 2019; for the example of rare earth elements: Binnemans et al. 2018; some historical examples of significant price hikes due to short-term supply decrease and/or demand increase are given in Leader et al. 2019; Malala and Adachi 2021). In this respect, physical non-availability can be regarded as being only the upper end, or most extreme case, on a rather continuous scale of price hikes: ‘prohibitively high cost, equivalent to no availability’ (Frenzel et al. 2017, p. 6). Therefore, in all other than the most extreme case, varying degrees (low to medium to high) of price hikes for raw materials (type 1 events; Frenzel et al. 2017, p. 6) constitute the prevalent effect of SDP materialisation, which must and will be borne — at least in the short to medium run — by the manufacturing companies themselves (lower margins) and/or passed through to intermediate customers and/or to end-consumers (higher prices) (Smith and Eggert 2016). But cost absorption or pass-through will have its limits, since it adversely affects the competitiveness of the producer and the product-system, respectively. Thus, in order to adequately reflect this mainly economically driven raw material–specific vulnerability of product systems, we propose the product-system–specific EPI factor that does not treat all raw materials used by the product system equally, but differentiates their importance with regard to the product system via their share in total cost, which is dependent on the raw-material price and on the amounts of raw material used in the product system.

For the determination of the EPI as described in Eq. (2), some measure of ‘total product cost’ is needed to adequately calculate the cost shares of the raw materials used. In this respect, a number of cost indicators can in principle be considered: (a) production cost or market price, (b) purchase cost or total-cost-of-ownership and (c) life cycle cost.

From the perspective of a company, an adequate choice could be (a) production costs or market price. A company’s margin is determined by the difference between product price and production costs. As such, cost increases due to price increases for raw materials must either be borne by the company in form of lower margins or passed through to customers by price increases. However, there are also factors limiting a company’s price setting like customers’ willingness-to-pay or market prices. A raw-material price increase in many cases not only affects a single company but also competitors, which might result in an adjusted market price. Therefore, of high importance from a company perspective might not only be the potential impact of raw-material price changes on own production cost but also on market price.

Taking a consumer perspective, (b) purchase cost or total-cost-of-ownership might be an adequate choice as this cost must be borne by the owner of the respective technology or product. The purchase cost might be equal, but is not necessarily congruent with, market prices, for there might be supporting schemes (e.g. subsidies), various types of discounts as well as additional costs directly related to the acquisition (e.g. purchase tax). Total-cost-of-ownership additionally includes operational expenditures, which come along with the utilisation of the product and give a comprehensive assessment of user cost. However, which cost is considered by a consumer is likely subject to the respective consumer and product. As such, both measures might generate valuable insights.

Most favourable — from a life cycle perspective — would, in our opinion, be the use of (c) life cycle costs (LCC), as these include all costs related to all (physical) activities along the whole life cycle of a product, irrespectively of which actor bears the costs (Moreau and Weidema 2015; Swarr et al. 2011). Since we generally adhere to the principle of whole life cycle coverage, which is also at the heart of LC(S)A, we would strongly suggest to apply this principle in LC(S)A-based raw-material criticality assessment, too. Thus, in our view, (environmental) LCC should be preferred for the calculation of the overall product costs to determine the EPI. However, with the elaboration of (a) and (b), we would also like to point out that the choice of how to measure the overall costs of a technology or a product system for the EPI calculation highly depends on the particular motivation and perspective as well as data availability of the respective study.

In any case — (a), (b), or (c) — we would like to stress that the raw-material flows considered in the EPI-calculation need to match the chosen product-system cost indicator. For example, taking the whole life cycle perspective, it would not be sufficient to solely consider those raw materials that are used for the production stage. Instead, raw-material flows in all life cycle stages that are within the scope of the study’s system boundaries have to be taken into consideration. In this respect, Eq. (2) could easily be extended and/or refined to allow for a life cycle stage–specific examination of the EPI.

2.1.2 Substitutability

Bearing costs is not the only option to cope with supply disruptions. Scarce materials might also be substituted (Goddin 2020; Graedel et al. 2015b). Indeed, substitutability is the most commonly used indicator to assess vulnerability to material supply disruption on various levels (Helbig et al. 2016a; Schrijvers et al. 2020), including product level (Cimprich et al. 2018, 2019). Since, in our opinion, substitutability is very application- or product-specific, we propose substitutability as the other, second factor to be considered within the product-system vulnerability assessment of the product system evaluated. Hereby, substitution can in principle take place at different product stages or levels, such as ‘element-for-element’ (referring to chemical elements), ‘technology-for-element’, ‘grade-for-grade’, component-for-componentFootnote 2 and ‘system-for-system’ substitution (Smith and Eggert 2016; cf. also: Habib and Wenzel 2016; Pavel et al. 2017). Which levels of substitutability should in the end be considered is dependent on the specific motivation and goal of the respective study. Since the substitution potential is highly use-case–specific (i.e. product- or application-specific), there is no generic approach available yet to objectively and quantitatively evaluate (raw-material) substitutability. Therefore, substitution potentials can presently only be evaluated through qualitative expert ratings (Helbig et al. 2016a). Conducting interviews or surveys among experts, however, presents some severe challenges with regard to time and effort (Graedel et al. 2012) as well as objectivity and transparency. Despite these challenges of ‘measuring’ substitutability, it should, in our opinion, be considered as one of the main factors that determine vulnerability in criticality assessments. To this end, we would suggest to draw on as much secondary data and intermediate results as possible in order to minimise the necessary time and effort needed for the evaluation of substitutability.

One relatively well-elaborated method to assess direct substitutability is provided as part of the Yale approach to criticality assessment (Graedel et al. 2012, 2015a, 2015b), which not only features a relatively high level of transparency but also includes a lot of qualitative data on functional performances of primary substitutes for a large number of different use cases. That method particularly excels by explicitly evaluating substitutability not only on the basis of technical performance but also with regard to substitute availability as well as environmental impact ratio and price ratio (the latter two comparing the performance of the original material with the one of the substitutes). Even though a product-level substitutability is not explicitly considered by Graedel et al. (2015a) and Graedel et al. (2012), their set of sub-indicators on corporate level might, in our opinion, be transferred to product-level evaluations through reasonable adjustments. Cimprich et al. (2018), in their criticality assessment of electric vehicles and dental X-ray equipment, do refer to Graedel et al. (2015b) in order to include substitutability into their GeoPolRisk-approach.

2.2 SDP

In the context of LCSA, different methodologies for SDP determination are applicable, whereby the choice should, in our opinion, be made with regard to the specific perspective of the respective study. While the GeoPolRisk method (Gemechu et al. 2016) appears rather appropriate for a national short-term perspective, for the perspective of a globally operating enterprise, the ESP/ESSENZ method (Bach et al. 2016) is deemed superior (Berger et al. 2020; Cimprich et al. 2019). Since the LCSA does not impose a requirement for a particular SDP method, further approaches might also be suitable and applicable with regard to the respective study’s goal and scope (see e.g.: Blengini et al. 2017; Graedel et al. 2012, 2015a; Helbig et al. 2016b, 2018).These are, in our opinion, quite elaborated and well-suited for raw-material criticality assessments, which is why we generally refer to these methods for the SDP calculation within our own approach.

It should be noted that — when applying our criticality assessment approach — the value of the SDP term has in any case to be smaller for a lower SDP and bigger for a higher SDP, regardless of the specific SDP-calculation method being used. This is because the product-system vulnerability score does also show smaller values for less vulnerable product systems and bigger values for more vulnerable ones. In this way, the overall raw-material criticality result will show large values for high SDP and high vulnerability scores. In cases where the SDP score is high, but the vulnerability score is low — or vice versa — the SDP and vulnerability scores will balance each other and result in medium high/low overall criticality values. Mathematically, this outcome is intended, since it does reflect the actual situation: a material with a relatively high potential of becoming scarce (i.e. having a high SDP) would be less problematic for a product system that shows only relatively little vulnerability to that material, but more problematic for a product system that is highly vulnerable to that same material.

3 Case study

3.1 Case study methodology

In order to demonstrate the functionality as well as the usefulness of our approach, we will, in the following, present a case study, in which we apply our approach to the product system of battery-electric vehicles (BEVs). Adhering to the general life cycle sustainability assessment (LCSA) approach (Kloepffer 2008), we take a life cycle perspective by including not only the manufacturing of the vehicle itself, but also considering the provision of raw materials, the use phase and — to some extent — the end-of-life stage. Furthermore, a systems view is applied in that also the necessary infrastructure (e.g. for the provision of electricity) is included.

Since the purpose of this paper is primarily to introduce and describe our novel EPI-based raw-material criticality assessment approach, we build our case study mainly around the data provided in two studies published by other groups: Cimprich et al. (2019), on the one hand, compared three (i.e. focused on regional or global supply disruption probability, SDP) criticality approaches (GeoPolRisk, ESP and ESSENZ) and tested them on the material life cycle inventory of a BEV. From that study, we use the GeoPolRisk-EU-28 characterisation factors for the materials as well as the life cycle inventory flows of the BEV. The work of Bekel and Pauliuk (2019), on the other hand, combined a life cycle assessment (LCA) of a BEV with a life cycle costing (LCC). Since their basic assumptions regarding the BEV, e.g. lifetime performance and vehicle weight, fit the assumptions made by Cimprich et al. (2019) quite well, and both studies refer to a similar time-horizon and have a comparable regional scope, we also use the LCC data provided in the publication by Bekel and Pauliuk (2019). In order to calculate the EPI, we complemented the data from Cimprich et al. (2019) and Bekel and Pauliuk (2019) with data on raw-material prices from DERA (2018). All background data as well as assumptions made for the case study are provided in the Supplementary file. Please note that we did not include the substitutability term into the product-system vulnerability assessment. Therefore, in the case study we present here, the product-system vulnerability is represented through the EPI only. The reason for omitting substitutability for the case study is twofold: First, the main focus of this article is on the theory and methodology of the EPI, the relevance and usefulness of which we would like to emphasise in the case study. Second, as already explained in Sect. 2.1.2, the determination of substitutability is not a simple matter. For a product system as complex as a BEV, evaluating substitutability is particularly challenging, because the product system is made up of many components that contain the same material(s), but have different functionalities. Thus, assessing the substitutability of such multi-functionate materials with respect to technical performance alone would require quite some efforts in a highly integrated product system such as a BEV. Within the scope of this paper, incorporating substitutability would thus not have been feasible.

3.2 Case study results

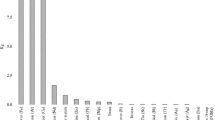

Figure 2 summarises the results of our raw-material criticality assessment approach being applied to a selection of raw materials used within a BEV product system.

taken from Cimprich et al. (2019) (GeoPolRisk characterisation factors EU-28)

Economic product importance (EPI), supply disruption probability (SDP) and raw-material criticality of a selection of seventeen raw materials from a life cycle inventory of a battery-electric vehicle (BEV) product system. For the EPI calculation, data have been used from Cimprich et al. (2019) (life cycle inventory data of BEV), from Bekel and Pauliuk (2019) (life cycle cost data of BEV) and from DERA (2018) (raw-material price data; average prices for the time period 2013–2017). The EPI values are equivalent to the raw materials’ cost shares (dimensionless) of the total cost of the product system. SDP values are dimensionless and have been

The diagram clearly shows that the overall criticality of any of the raw materials is neither dominated by the raw materials’ individual SDP nor by the raw materials’ individual EPI. Therefore, the overall ranking of the raw materials’ criticality is neither equivalent to the rankings with respect to the SDP nor with respect to the EPI alone. Instead, among those raw materials that show the highest overall criticality are raw materials that combine a very high EPI with an only moderate SDP (copper, aluminium, nickel and gold) as well as one raw material that combines an only medium high EPI with a very high SDP (neodymium). Among the raw materials that show a medium high criticality, we see mainly two combinations of SDP and EPI values: medium high EPI combined with medium high SDP (silver and zinc) as well as relatively high SDP combined with relatively low EPI (fluorspar, cerium, palladium, lanthanum, praseodymium and tin). Amongst the raw materials that have a rather low overall criticality are two raw materials showing a relatively high SDP but very low EPI (europium and samarium) and one with both medium low SDP and EPI. Titanium dioxide, finally, reaches the lowest criticality, because it combines a relatively high EPI with an extremely low SDP.

Having a closer and more differentiated look at these results reveals that three main types of raw materials can be distinguished with respect to the raw-material criticality of a BEV product system. Figure 3 plots the EPI of all raw materials assessed against their SDP, which yields three distinct clusters of raw materials.

Economic product importance (EPI) and supply disruption probability (SDP) of a selection of seventeen raw materials from a life cycle inventory of a battery-electric vehicle (BEV) product system. The EPI values (x-axis) are dimensionless and equivalent to the raw materials’ cost shares of the total cost of the product system. The SDP values are dimensionless (y-axis). Data sources are equivalent to those given in the capture of Fig. 2

The first one can be found in the upper left corner, containing all rare earth elements of the studied set of raw materials. They show by far the highest SDP of all raw materials in the set. (Please note that the GeoPolRisk framework, which is used here as the measure of SDP, assigns one and the same value to all rare earth elements.) But their EPI values are among the lowest of all raw materials assessed. Thus, except for neodymium, the raw materials of this cluster show only medium to very low overall raw-material criticality values for the BEV product system assessed (cf. Figure 2). This is in line with the view of Habib and Wenzel (2016, p. 3854), who note on ‘specialty metals’ that these ‘can be essential to a technology, but still used in very small quantities, and hence contribute insignificantly to the overall cost of the product. In such cases, an unexpected price hike for these speciality metals is often improbable to result in significant overall production cost increase or in any significant rollback of the overall technology’.

The second cluster can be found in the lower left corner of the diagram of Fig. 3. The cluster is made up of a number of raw materials the SDP and EPI of which show low to very low values. Therefore, all raw materials contained in this cluster are ranked low to very low with regard to their overall criticality (cf. Figure 2).

The third cluster contains three elements, namely gold, nickel and copper, all of which are situated in the lower right corner of the diagram (Fig. 3). The EPI of these three raw materials is high to very high (compared to all other raw materials of the set). Since, at the same time, their SDP is low, but not very low, their overall criticality reaches the highest values among all materials of the set, making copper the most critical raw material, nickel the third and gold the fourth critical one (for the BEV product system) of all raw materials assessed (cf. Figure 2).

The raw material that is ranked second with respect to its overall raw-material criticality is aluminium (cf. Figure 2). In case of aluminium, both SDP and EPI are medium high/low, which is why it does not fall into one of the three clusters presented above (cf. Figure 3). However, neither its SDP nor its EPI is low or very low, and thus aluminium is valued the second most critical raw material used in a BEV product system according to our assessment approach.

4 Discussion

As we have outlined in Sect. 1, raw-material criticality for technologies or product systems in the context of LCSA (Finkbeiner et al. 2010; Kloepffer 2008) is not only dependent on the raw materials’ SDP, but also on the product-specific vulnerability of the assessed technology or product system to the SDP of these raw materials. Particularly with regard to this product-system–specific vulnerability assessment, we see the potential as well as the possibility for a further methodological differentiation and refinement, which is why we suggest our EPI-factor as a complementary indicator within life cycle–oriented criticality assessments of product systems, as they have already been proposed by others.

Cimprich et al. (2017), for instance, introduced their ‘economic importance’ factor for each material assessed in order to measure vulnerability on product level (also comparing conventional with electric vehicles). However, by arguing that every input was equally important for the product system’s functionality, regardless of the specific amounts of materials actually used for the product, they eventually cancelled out the amounts (i.e. masses) of all material inventory flows. In this way, Cimprich et al. (2017) indeed avoid the mass-dominance problem typically observed with life cycle inventories of products (Mancini et al. 2018). Similarly, Cimprich et al. (2018) as well as Habib and Wenzel (2016) base their vulnerability assessments primarily on the raw-material substitutability, also not considering the actual amounts of the raw materials used for the assessed products. The approaches just mentioned may be deemed sufficient in all ‘type 2’ events of criticality (Frenzel et al. 2017, p. 6), where physical supply of a certain raw material is completely interrupted and e.g. a manufacturer of a certain product will have no other choice than substituting the unavailable material or stop production altogether — regardless of how small the quantity of material needed was. But, as mentioned by Cimprich et al. (2018) too, supply disruption can manifest in different ways, with price increases (rather than total physical unavailability) of raw materials being another probable and frequently observed scenario (called ‘type 1’ events by Frenzel et al. 2017, p. 6; cf. also Buijs et al. 2012; Leader et al. 2019; Malala and Adachi 2021). Therefore, we propose our EPI, which does take into consideration both the amount (e.g. the mass) of a certain raw material used within a product system as well as the raw material’s cost (per unit). The core logic of the EPI follows the argument that, from an economic perspective, the vulnerability of a product system to supply shortages of a certain raw material is determined by that raw material’s share of overall product system costs. This is based on the fact that the higher the cost share of a raw material is, the higher will be its relative impact on overall product system costs when the price (per unit) of that raw material increases (cf. Leader et al. 2019). Consequently, through the application of the EPI, a product system’s vulnerability and thus its criticality with regard to a certain raw material is neither fully driven by that material’s total amount used within the product system (Bach et al. 2016; Cimprich et al. 2017; Mancini et al. 2018) nor is the vulnerability more or less entirely determined by the material’s mere presence in the product system (regardless of the actual amounts of the material used in the product system), which would result in an overall criticality value that is proportional to that of the material’s SDP (Cimprich et al. 2017).Footnote 3 Instead, the EPI relates the physical weight of a raw material to its economic weight by considering both the absolute amount (i.e. mass) of a raw material used in a product system and the corresponding cost imposed by that raw material’s total amount used on the overall costs of the product system. The EPI, therefore, mitigates the mass-related conflict in LCA-based criticality evaluations: avoiding mass-dominance by not considering mass at all (Mancini et al. 2018) against promoting resource efficiency by putting particularly strong emphasis on the amounts of raw materials used (Cimprich et al. 2017).

Since the EPI represents essentially the total cost of the total amount of a raw material used in a product system relative to the overall cost of that system, it gives back values between [0] and [1] (with zero for all cases in which a raw material is not part of a product or its life cycle, and one if the raw material in focus makes up for all of the product cost — the latter arguably being a rather theoretical case). It should be noted that relatively low scores do not necessarily signal insignificance with respect to the economic product importance of the respective material (i.e. low EPI values do not necessarily mean low ‘importance’ with respect to product-related economic values). Especially when assessing hi-tech products, relatively low EPI scores are to be commonly expected, since raw-material costs usually account only for a minor share of total costs in processing industries (Wilting and Hanemaaijer 2014) and might, furthermore, be distributed across a broad range of different raw materials. Still, relatively low costs for raw materials within a certain product system may very well become highly relevant, depending on the specific case and perspective. If, for instance, a product system that is already marketed with a very low profit margin for the producer sees a significant price increase for one or more raw materials essentially needed for the production of that product (i.e. if a typical criticality scenario occurs), the resulting increase in the raw materials’ related cost of production could lead to an increase in the total cost of production, making the respective product eventually unprofitable for the producer. Therefore, meaningful thresholds for (in-)significance can, in our opinion, not be defined on a general basis for the specific values of EPI calculated in real case studies for particular products.

Comparing the results of our case study (cf. Sect. 3) to other raw-material criticality assessments demonstrates in which way our approach stands out against others and what kind of insights can be gained through an application of our method. Most obvious, in this regard, is the fact that the raw materials’ relative level of criticality (i.e. the ranking of the raw materials), which we calculated using our approach, significantly differs from the criticality rankings generated by other authors. Cimprich et al. (2017), for instance, assessed the criticality of a large set of materials for a BEV, thereby also applying the GeoPolRisk factors for the SDP calculation. However, since they did not account for any concrete amounts of materials present in the life cycle inventory of the BEV (their formula ‘cancels out’ the inventory flows; Cimprich et al. 2017, p. 758), their results resemble the GeoPolRisk-SDP values for the materials assessed (Cimprich et al. 2017). Consequently, in the study by Cimprich et al. (2017), neodymium, as one of the rare earth elements that usually show very high SDPs, is rated as the most critical raw material (with a GeoPolRisk EU-28 value of 0.5181), followed by magnesium (with a value of 0.4435) and all other materials assessed with considerably lower values (below 0.2318) (Cimprich et al 2017, Table S1, Supplementary Material, p. 1). In our study, neodymium is only ranked fifth (with a criticality-value of 1.1242*10−4, with gold, nickel, aluminium and copper showing considerably higher values for overall criticality (2.6827*10−4, 2.9466*10−4, 3.1681*10−4 and 8.1204*10−4 respectively; cf. Figure 2 and sheet ‘Critic Calc’ in Supplement). This is due to the fact that we do consider the total amounts of raw materials used in the product system, which are relatively large for nickel, aluminium and copper (in kg/vehicle-km: 2.78422*10−4, 6.79816*10−4, and 7.81613*10−4, respectively; cf. sheet ‘EPI Calc’ in Supplement) as well as the total cost share of the materials used with regard to the overall cost of the product system, which is relatively high for gold (0.521%; cf. sheet EPI Calc in Supplement). Since Cimprich et al. (2017) — in their study on a BEV — do not take these factors into consideration, they value the criticality of aluminium and copper rather low (0.0820 and 0.0713, respectively) and the criticality of nickel and gold even very low (0.0505 and 0.0198, respectively, as compared to neodymium that receives a value of 0.5181; Cimprich et al 2017, Table S1, Supplementary Material, p. 1).

One further advantage of our approach can be seen in its ability to capture the dynamics of raw-material supply and its impact on cost developments, as can be demonstrated with copper and samarium. In our case study, the raw-material criticality of copper was ranked highest (8.1204*10−4), because it combines the highest EPI value (8.6951*10−3) with a still considerably high SDP value (ranked 6th with a value of 0.093; cf. Figure 2 and sheet ‘Critic Calc’ in Supplement).Footnote 4 Since the EPI value equals the cost share of the raw material relative to the overall cost of the product system (cf. Figures 2 and 3), it can be seen that the amounts of copper used over the life cycle of a BEV product system result in a cost share of about 0.9% (assuming the copper average-price for the time period 2013–2017). Therefore, a cost increase of the raw-material price of copper of about 10%, which occurred for the time period July 2017–June 2018 as compared to the time period 2013–2017 (DERA 2018), or of about 52% (increase in average price of copper in April 2021 as compared to 2013–2017 average; DERA 2021) translates into an increase in overall cost of the BEV product system of about 0.09% or about 0.47%, respectively. Whether or not such a (relatively small) increase in overall cost of a product system would (already) be valued problematic will certainly depend on many factors, such as the companies’ profit margins or the customers’ willingness to pay. However, such cost impacts are probably not negligible, a view also articulated by Leader et al. (2019), who analysed potential cost impacts of price increases in cobalt, lithium, manganese and nickel as well as a number of rare earth elements on components of clean energy technologies such as fuel-cell stacks for fuel-cell vehicles, permanent-magnet generators for wind turbines and lithium-ion batteries for electric vehicles. They used, on the one hand, historic price-spike data and, on the other hand, generally assumed a doubling in raw-material prices, which resulted in total price increases of up to 17% for the fuel-cell stack and up to 41% for the permanent-magnet generators (both based on historic raw-material price-spike data) as well as up to 27% for certain lithium-ion battery types (assuming a doubling in raw-material prices) (Leader et al. 2019).

Turning to samarium, on the other hand, gives quite another picture. Since samarium belongs to the rare earth elements (which are treated as one single group of materials in the GeoPolRisk SDP-calculation method), it shows by far the highest SDP value (0.4268, as compared to the 2nd ranked fluorspar with a value of only 0.1498; cf. Figures 2 and 3 as well as sheet ‘Critic Calc’ in Supplement). However, due to the extremely small amounts needed in the BEV product system, its EPI is by far the lowest (about 0.0006%, followed by 2nd-ranked europium with a value of 0.0025%; cf. Figures 2 and 3 as well as sheet ‘EPI Calc’ in Supplement) of all materials assessed. Consequently, either the total amount of samarium needed in the product system or its raw-material price would have to increase more than 1.000-fold in order to reach an overall criticality that would be comparable to that of copper. Although rare earth elements do indeed show quite remarkable fluctuations in price — the average price of samarium dropped 32.5% for the period July 2017–June 2018 (DERA 2018) and even 41.8% for the period May 2020–April 2021 as compared to the average price for the period 2013–2017 (DERA 2021), respectively —, price increases or decreases over several orders of magnitude can be deemed highly improbable even for rare earth elements (at least over such time periods that are relevant for the life cycles of product systems). To allow for a broader and more detailed interpretation, the changes in average prices for all raw materials for the time period July 2017–June 2018 as compared to the average prices for the period 2013–2017 have been analysed (cf. Fig. S1 in the Supplement) and their impact on overall criticality calculated (cf. Fig. S2 in the Supplement). It turns out that price changes occurred within limits of −84.9% (for europium) and 44.8% for zinc). These price changes, in turn, led to very few changes in the ranking of the materials with respect to overall criticality: the top five (copper, aluminium, nickel, gold, and neodymium; in descending order) did not change at all; in the mid-tier, a few materials changed places by ‘climbing up’ or ‘falling down’ up to three ranks; the bottom four ranks changed only slightly by switching ranks (from europium, lead, samarium, titanium dioxide to lead, samarium, europium, titanium dioxide; in descending order). Since the SDP-data used have been the same (there were no updated data for the GeoPolRisk factors available), the calculated percentual changes in overall criticality resemble the percentual changes in raw-material prices, with the biggest changes shown by europium (−84%) and zinc (44.8%).

Although the proposed methodology is quite straight forward, it should be applied with caution because our approach can certainly not fully display the complexity of the scarcity-price-relationship of raw materials. Although the general idea borrowed from market economy, which implies that a decreasing supply of a good at steady or increasing demand leads to higher prices for that good, may be plausible and generally apply to raw materials too, there is more to it than that. For instance, as Gleich et al. (2013) in their statistical analysis of prices for 42 commodities over a time-span of 26 years have shown, there are at least eleven factors influencing commodity prices — to varying extents and in different ways for different commodities. Another aspect in this regard constitutes the fact that there are dynamic interdependencies between supply increase/decrease and price increase/decrease, which work in both directions: not only can a decrease in supply lead to price increases, but also higher prices may lead to increases in supply (Achzet and Helbig 2013; Bradshaw et al. 2013; Fu et al. 2019; Ioannidou et al. 2019), e.g. through driving efforts to mine lower-grade ores, which would not have been economical at lower raw-material prices.

Moreover, the application of our approach to real cases, as can be seen in the case study above, poses a number of challenges that should be subject to further research efforts. Firstly, depending on the specific product system that is to be assessed, compiling the necessary life cycle inventories of all raw materials used may be a quite difficult a task to accomplish, because many modern, especially hi-tech products are of high complexity and contain hundreds to thousands of deeply integrated components incorporating almost all elements from the periodic table. Additionally, confidentiality issues at the side of the manufacturers of the products more often than not significantly hinder data acquisition with regard to raw-material inventories. For similar reasons, it may, secondly, be quite difficult to acquire the data on raw-material prices necessary for the cost calculations. In this respect, there are serious constraints to both the raw-material prices used in the product system at the time of assessment as well as to the future changes in these raw-material prices due to supply shortages or disruptions. The biggest challenge of all, however, probably lies, thirdly, in the evaluation of substitutability. Here, substitute performance appears to be particularly hard to determine, since it can usually not simply be derived from a material itself, i.e. its physical and chemical properties, but is very much product and application specific and may even differ for different components and/or different functions of these components within or across product systems. Consequently, the determination of substitutability requires a great deal of highly specific expert knowledge, the acquisition of which is extremely resource consuming with regard to time and effort needed.

5 Conclusion and outlook

In the preceding sections of this article, we introduce and describe a novel approach to assess raw-material criticality on product-system level. The proposed methodology thereby combines common criticality assessments, which typically evaluate SDPs for a broad spectrum of materials on a global, regional or national scale, with a LC(S)A perspective and methodology, which characteristically determines the ‘cradle-to-grave’ resource demands and other environmental (as well as economic and social) impacts of products via detailed and comprehensive life cycle inventories of materials and energy needed. Although there have already been attempts by others to integrate raw-material criticality into LC(S)A, the approach presented here does, to the best of our knowledge, for the first time define and apply a raw-material- and product-specific economic product importance (EPI) indicator that directly relates the SDP as well as the usage of a certain (amount of a) raw material within a product system to the raw material’s share of total cost of that product system along its life cycle. Since our framework, at the same time, allows in theory to integrate raw-material substitutability including its various sub-dimensions, it enables a differentiated evaluation of a product system’s vulnerability to decreases or disruptions in raw-material supplies. As a result, our approach allows raw-material criticality assessments on product-system level. This is mainly due to the fact that the functions applied within our approach moderate between, on the one hand, the raw material’s SDP and, on the other hand, the amounts of a raw material present in a product system as well as the relative cost of the raw material to the product system. Therefore, the danger that one or more of the aforementioned factors could be overestimated or underestimated is reduced. However, as mentioned in the Sect. 4, our approach still simplifies the complexity of supply/demand and price relations, and there are still some challenges in applying the proposed criticality assessment methodology to real cases, e.g. with regard to the collection of inventory data or material price data. Also, determining substitutability remains one of the biggest challenges for conducting a criticality assessment, as this requires a lot of time and expert knowledge particularly for complex products.

However, since we deem none of the just mentioned methodological hurdles impossible to be overcome through further research, we regard our approach for product-level criticality assessment feasible in the short to medium run. Moreover, we hope that the distinct features of our approach, which we have explained and discussed in detail throughout the previous sections of this article, could be of good use and value to LC(S)A-integrated raw-material criticality assessments of products, as they will help to identify ‘critical’ issues related to the raw-material base of products and thus foster the improvement of existing as well as the design of novel products towards a greener and more sustainable future.

Data availability

All data generated or analysed during this study are included in this published article and its supplementary information file.

Notes

Supply disruption probability is regularly referred to as supply ‘risk’ (e.g. Blengini et al. 2017; Graedel et al. 2012; Helbig et al. 2016b). As the underlying conceptualisations are not in accordance with classical risk theory, the term supply risk is highly misleading (Frenzel et al. 2017). Therefore, in this study, the term supply disruption probability is used instead (in accordance with e.g. Cimprich et al. 2019).

Smith and Eggert (2016) develop their framework of material substitution on the example of permanent magnets, which is why they actually refer to ‘magnet-for-magnet’ substitution. In their study, the magnets are discussed as components in wind turbines and electric vehicles, so the more general term for the ‘magnet-for-magnet’ substitution would translate into ‘component-for-component’ substitution, if the framework of Smith and Eggert (2016) was transferred to other products or applications.

Please note that Cimprich et al. (2018) also assessed the substitutability of a raw material as part of the vulnerability assessment, which we also value as an essential part of such an assessment, even though we did not demonstrate this ourselves in this article.

Rare earth elements are treated as one single group of materials in the GeoPolRisk SDP-calculation method.

References

Achzet B, Helbig C (2013) How to evaluate raw material supply risks—an overview. Resour Policy 38:435–447. https://doi.org/10.1016/j.resourpol.2013.06.003

André H, Ljunggren M (2021) Towards comprehensive assessment of mineral resource availability? Complementary roles of life cycle, life cycle sustainability and criticality assessments. Resour Conserv Recycl 167.https://doi.org/10.1016/j.resconrec.2021.105396

Arendt R, Muhl M, Bach V, Finkbeiner M (2020) Criticality assessment of abiotic resource use for Europe– application of the SCARCE method. Resour Policy 67.https://doi.org/10.1016/j.resourpol.2020.101650

Bach V, Berger M, Henßler M, Kirchner M, Leiser S, Mohr L, Rother E, Ruhland K, Schneider L, Tikana L, Volkhausen W, Walachowicz F, Finkbeiner M (2016) Integrated method to assess resource efficiency – ESSENZ. J Clean Prod 137:118–130. https://doi.org/10.1016/j.jclepro.2016.07.077

Bachmann TM (2013) Towards life cycle sustainability assessment: drawing on the NEEDS project’s total cost and multi-criteria decision analysis ranking methods. Int J Life Cycle Assess 18:1698–1709. https://doi.org/10.1007/s11367-012-0535-3

Bekel K, Pauliuk S (2019) Prospective cost and environmental impact assessment of battery and fuel cell electric vehicles in Germany. Int J Life Cycle Assess 24:2220–2237. https://doi.org/10.1007/s11367-019-01640-8

Benoît C, Norris GA, Valdivia S, Ciroth A, Moberg A, Bos U, Prakash S, Ugaya C, Beck T (2010) The guidelines for social life cycle assessment of products: just in time! Int. J Life Cycle Assess 15:156–163. https://doi.org/10.1007/s11367-009-0147-8

Berger M, Sonderegger T, Alvarenga R, Bach V, Cimprich A, Dewulf J, Frischknecht R, Guinée J, Helbig C, Huppertz T, Jolliet O, Motoshita M, Northey S, Peña CA, Rugani B, Sahnoune A, Schrijvers D, Schulze R, Sonnemann G, Valero A, Weidema BP, Young SB (2020) Mineral resources in life cycle impact assessment: part II – recommendations on application-dependent use of existing methods and on future method development needs. Int J Life Cycle Assess 25:798–813. https://doi.org/10.1007/s11367-020-01737-5

Binnemans K, Jones PT, Müller T, Yurramendi L (2018) Rare earths and the balance problem: how to deal with changing markets? J Sustain Metall 4:126–146. https://doi.org/10.1007/s40831-018-0162-8

Blengini GA, Nuss P, Dewulf J, Nita V, Peirò LT, Vidal-Legaz B, Latunussa C, Mancini L, Blagoeva D, Pennington D, Pellegrini M, van Maercke A, Solar S, Grohol M, Ciupagea C (2017) EU methodology for critical raw materials assessment: policy needs and proposed solutions for incremental improvements. Resour Policy 53:12–19. https://doi.org/10.1016/j.resourpol.2017.05.008

Bobba S, Carrara S, Huisman J, Mathieux F, Pavel C (2020) Critical raw materials for strategic technologies and sectors in the EU: a foresight study. Publications Office of the European Union, Luxemburg

Bradshaw AM, Reuter B, Hamacher T (2013) The potential scarcity of rare elements for the Energiewende. Green 3:93–111. https://doi.org/10.1515/green-2013-0014

Buijs B, Sievers H, Tercero Espinoza LA (2012) Limits to the critical raw materials approach. Proceedings of the Institution of Civil Engineers - Waste and Resource Management 165:201–208. https://doi.org/10.1680/warm.12.00010

Busch J, Steinberger JK, Dawson DA, Purnell P, Roelich K (2014) Managing critical materials with a technology-specific stocks and flows model. Environ Sci Technol 48:1298–1305. https://doi.org/10.1021/es404877u

Bustamante M, Marion T, Roth R (2019) Advancing the state of prospective materials criticality screening: integrating structural commodity market and incentive price formation insights. Miner Met Mater Ser 321–324.https://doi.org/10.1007/978-3-030-10386-6_38

Cimprich A, Young SB, Helbig C, Gemechu ED, Thorenz A, Tuma A, Sonnemann G (2017) Extension of geopolitical supply risk methodology: characterization model applied to conventional and electric vehicles. J Clean Prod 162:754–763. https://doi.org/10.1016/j.jclepro.2017.06.063

Cimprich A, Karim KS, Young SB (2018) Extending the geopolitical supply risk method: material “substitutability” indicators applied to electric vehicles and dental X-ray equipment. Int J Life Cycle Assess 23:2024–2042. https://doi.org/10.1007/s11367-017-1418-4

Cimprich A, Bach V, Helbig C, Thorenz A, Schrijvers D, Sonnemann G, Young SB, Sonderegger T, Berger M (2019) Raw material criticality assessment as a complement to environmental life cycle assessment: examining methods for product-level supply risk assessment. J Ind Ecol 23:1226–1236. https://doi.org/10.1111/jiec.12865

Costa D, Quinteiro P, Dias AC (2019) A systematic review of life cycle sustainability assessment: Current state, methodological challenges, and implementation issues. Sci Total Environ 686:774–787. https://doi.org/10.1016/j.scitotenv.2019.05.435

Dantas T, Soares SR (2021) Systematic literature review on the application of life cycle sustainability assessment in the energy sector. Environ Dev Sustain. https://doi.org/10.1007/s10668-021-01559-x

Deloitte Sustainability, British Geological Survey, Bureau de Recherches Géologiques et Minières, Netherlands Organisation for Applied Scientific Research (2017) Study on the review of the list of Critical Raw Materials: Criticality Assessments, Brussels. https://op.europa.eu/en/publication-detail/-/publication/08fdab5f-9766-11e7-b92d-01aa75ed71a1/language-en. Accessed 20210312

DERA - Deutsche Rohstoffagentur, Bundesanstalt für Geowissenschaften und Rohstoffe (2018) Preismonitor Juni 2018, Berlin. https://www.deutsche-rohstoffagentur.de/DE/Themen/Min_rohstoffe/Produkte/Preisliste/pm_18_06.pdf;jsessionid=876E382BED6328451D2747F4B942404D.2_cid292?__blob=publicationFile&v=3. Accessed 6 May 2021

DERA - Deutsche Rohstoffagentur, Bundesanstalt für Geowissenschaften und Rohstoffe (2021) Preismonitor April 2021, Berlin. https://www.deutsche-rohstoffagentur.de/DERA/DE/Aktuelles/Monitore/2021/04-21/2021-04-preismonitor.pdf;jsessionid=236538BB3A85540B53314B91CA1B8AC1.2_cid284?__blob=publicationFile&v=2. Accessed 2 June 2021

Dewulf J, Blengini GA, Pennington D, Nuss P, Nassar NT (2016) Criticality on the international scene: Quo vadis? Resour. Policy 50:169–176. https://doi.org/10.1016/j.resourpol.2016.09.008

Drielsma J, Allington R, Brady T, Guinée J, Hammarstrom J, Hummen T, Russell-Vaccari A, Schneider L, Sonnemann G, Weihed P (2016a) Abiotic raw-materials in life cycle impact assessments: an emerging consensus across disciplines. Resources 5:12. https://doi.org/10.3390/resources5010012

Drielsma JA, Russell-Vaccari AJ, Drnek T, Brady T, Weihed P, Mistry M, Simbor LP (2016b) Mineral resources in life cycle impact assessment—defining the path forward. Int J Life Cycle Assess 21:85–105. https://doi.org/10.1007/s11367-015-0991-7

Erdmann L, Graedel TE (2011) Criticality of non-fuel minerals: a review of major approaches and analyses. Environ Sci Technol 45:7620–7630. https://doi.org/10.1021/es200563g

European Commission (2020) Critical raw materials resilience: charting a path towards greater security and sustainability: communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Brussels. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020DC0474&from=EN. Accessed 15 October 2021

Fauzi RT, Lavoie P, Sorelli L, Heidari MD, Amor B (2019) Exploring the current challenges and opportunities of life cycle sustainability assessment. Sustainability 11:636. https://doi.org/10.3390/su11030636

Finkbeiner M, Schau EM, Lehmann A, Traverso M (2010) Towards Life Cycle Sustainability Assessment Sustainability 2:3309–3322. https://doi.org/10.3390/su2103309

Frenzel M, Kullik J, Reuter MA, Gutzmer J (2017) Raw material ‘criticality’—sense or nonsense? J Phys d: Appl Phys 50:123002. https://doi.org/10.1088/1361-6463/aa5b64

Fu X, Polli A, Olivetti E (2019) High-resolution insight into materials criticality: quantifying risk for by-product metals from primary production. J Ind Ecol 23:452–465. https://doi.org/10.1111/jiec.12757

Gemechu ED, Helbig C, Sonnemann G, Thorenz A, Tuma A (2016) Import-based indicator for the geopolitical supply risk of raw materials in life cycle sustainability assessments. J Ind Ecol 20:154–165. https://doi.org/10.1111/jiec.12279

Gleich B, Achzet B, Mayer H, Rathgeber A (2013) An empirical approach to determine specific weights of driving factors for the price of commodities-a contribution to the measurement of the economic scarcity of minerals and metals. Resour Policy 38:350–362. https://doi.org/10.1016/j.resourpol.2013.03.011

Glöser S, Tercero Espinoza L, Gandenberger C, Faulstich M (2015) Raw material criticality in the context of classical risk assessment. Resour Policy 44:35–46. https://doi.org/10.1016/j.resourpol.2014.12.003

Goddin JR (2020) Chapter 13 - Substitution of critical materials, a strategy to deal with the material needs of the energy transition? In: Bleicher A, Pehlken A (eds) The material basis of energy transitions. Elsevier, San Diego, pp 199–206

Graedel TE, Reck BK (2016) Six years of criticality assessments: what have we learned so far? J Ind Ecol 20:692–699. https://doi.org/10.1111/jiec.12305

Graedel TE, Barr R, Chandler C, Chase T, Choi J, Christoffersen L, Friedlander E, Henly C, Jun C, Nassar NT, Schechner D, Warren S, Yang M-Y, Zhu C (2012) Methodology of metal criticality determination. Environ Sci Technol 46:1063–1070. https://doi.org/10.1021/es203534z

Graedel TE, Harper EM, Nassar NT, Nuss P, Reck BK (2015a) Criticality of metals and metalloids. Proc Natl Acad Sci USA 112:4257–4262. https://doi.org/10.1073/pnas.1500415112

Graedel TE, Harper EM, Nassar NT, Reck BK (2015b) On the materials basis of modern society. Proc Natl Acad Sci USA 112:6295–6300. https://doi.org/10.1073/pnas.1312752110

Habib K, Wenzel H (2016) Reviewing resource criticality assessment from a dynamic and technology specific perspective – using the case of direct-drive wind turbines. J Clean Prod 112:3852–3863. https://doi.org/10.1016/j.jclepro.2015.07.064

Helbig C, Wietschel L, Thorenz A, Tuma A (2016a) How to evaluate raw material vulnerability - an overview. Resour Policy 48:13–24. https://doi.org/10.1016/j.resourpol.2016.02.003

Helbig C, Bradshaw AM, Kolotzek C, Thorenz A, Tuma A (2016b) Supply risks associated with CdTe and CIGS thin-film photovoltaics. Appl Energy 178:422–433. https://doi.org/10.1016/j.apenergy.2016.06.102

Helbig C, Bradshaw AM, Wietschel L, Thorenz A, Tuma A (2018) Supply risks associated with lithium-ion battery materials. J Clean Prod 172:274–286. https://doi.org/10.1016/j.jclepro.2017.10.122

Ioannidou D, Heeren N, Sonnemann G, Habert G (2019) The future in and of criticality assessments. J Ind Ecol 23:751–766. https://doi.org/10.1111/jiec.12834

Jin Y, Kim J, Guillaume B (2016) Review of critical material studies. Resour Conserv Recycl 113:77–87. https://doi.org/10.1016/j.resconrec.2016.06.003

Jones B, Elliott R, Nguyen-Tien V (2020) The EV revolution: the road ahead for critical raw materials demand Appl Energy 280.https://doi.org/10.1016/j.apenergy.2020.115072

Junne T, Wulff N, Breyer C, Naegler T (2020) Critical materials in global low-carbon energy scenarios: the case for neodymium, dysprosium, lithium, and cobalt. Energy 211:118532. https://doi.org/10.1016/j.energy.2020.118532

Kloepffer W (2008) Life cycle sustainability assessment of products. Int J Life Cycle Assess 13:89–95. https://doi.org/10.1065/lca2008.02.376

Knobloch V, Zimmermann T, Gößling-Reisemann S (2018) From criticality to vulnerability of resource supply: The case of the automobile industry. Resour Conserv Recycl 138:272–282. https://doi.org/10.1016/j.resconrec.2018.05.027

Koch B, Peñaherrera F, Pehlken A (2019) Criticality and LCA – building comparison values to show the impact of criticality on LCA. EJSD 8:304. https://doi.org/10.14207/ejsd.2019.v8n4p304

Kühnen M, Hahn R (2017) Indicators in social life cycle assessment: a review of frameworks, theories, and empirical experience. J Ind Ecol 21:1547–1565. https://doi.org/10.1111/jiec.12663

Leader A, Gaustad G, Babbitt C (2019) The effect of critical material prices on the competitiveness of clean energy technologies Mater Renew Sustain Energy 8.https://doi.org/10.1007/s40243-019-0146-z

Lu Z, Broesicke OA, Chang ME, Yan J, Xu M, Derrible S, Mihelcic JR, Schwegler B, Crittenden JC (2019) Seven approaches to manage complex coupled human and natural systems: a sustainability toolbox. Environ Sci Technol 53:9341–9351. https://doi.org/10.1021/acs.est.9b01982

Malala ON, Adachi T (2021) Japan’s critical metals in the medium term: a quasi-dynamic approach incorporating probability. Miner. Econ. https://doi.org/10.1007/s13563-021-00262-7

Mancini L, Benini L, Sala S (2018) Characterization of raw materials based on supply risk indicators for Europe. Int J Life Cycle Assess 23:726–738. https://doi.org/10.1007/s11367-016-1137-2

Miyamoto W, Kosai S, Hashimoto S (2019) Evaluating metal criticality for low-carbon power generation technologies in Japan. Minerals 9:95. https://doi.org/10.3390/min9020095

Moreau V, Weidema BP (2015) The computational structure of environmental life cycle costing. Int J Life Cycle Assess 20:1359–1363. https://doi.org/10.1007/s11367-015-0952-1

Northey SA, Mudd GM, Werner TT (2018) Unresolved complexity in assessments of mineral resource depletion and availability. Nat Resour Res 27:241–255. https://doi.org/10.1007/s11053-017-9352-5

van Oers L, Guinée J (2016) The abiotic depletion potential: background, updates, and future. Resources 5:16. https://doi.org/10.3390/resources5010016

Onat NC, Kucukvar M, Tatari O (2014) Integrating triple bottom line input–output analysis into life cycle sustainability assessment framework: the case for US buildings. Int J Life Cycle Assess 19:1488–1505. https://doi.org/10.1007/s11367-014-0753-y

Onat N, Kucukvar M, Halog A, Cloutier S (2017) Systems thinking for life cycle sustainability assessment: a review of recent developments, applications, and future perspectives. Sustainability 9:706. https://doi.org/10.3390/su9050706

Palomino A, Marty J, Auffret S, Joumard I, Sousa RC, Prejbeanu IL, Ageron B, Dieny B (2021) Evaluating critical metals contained in spintronic memory with a particular focus on Pt substitution for improved sustainability. SM&T 28:e00270. https://doi.org/10.1016/j.susmat.2021.e00270

Pavel CC, Thiel C, Degreif S, Blagoeva D, Buchert M, Schüler D, Tzimas E (2017) Role of substitution in mitigating the supply pressure of rare earths in electric road transport applications. SM&T 12:62–72. https://doi.org/10.1016/j.susmat.2017.01.003

Pell RS, Wall F, Yan X, Bailey G (2019) Applying and advancing the economic resource scarcity potential (ESP) method for rare earth elements. Resour Policy 62:472–481. https://doi.org/10.1016/j.resourpol.2018.10.003

Sala S, Farioli F, Zamagni A (2013a) Progress in sustainability science: lessons learnt from current methodologies for sustainability assessment: Part 1. Int J Life Cycle Assess 18:1653–1672. https://doi.org/10.1007/s11367-012-0508-6

Sala S, Farioli F, Zamagni A (2013b) Life cycle sustainability assessment in the context of sustainability science progress (part 2). Int J Life Cycle Assess 18:1686–1697. https://doi.org/10.1007/s11367-012-0509-5

Sala S, Ciuffo B, Nijkamp P (2015) A systemic framework for sustainability assessment. Ecol Econ 119:314–325. https://doi.org/10.1016/j.ecolecon.2015.09.015

Santillán-Saldivar J, Gaugler T, Helbig C, Rathgeber A, Sonnemann G, Thorenz A, Tuma A (2020) Design of an endpoint indicator for mineral resource supply risks in life cycle sustainability assessment The case of Li-ion batteries. J Ind Ecol. https://doi.org/10.1111/jiec.13094

Schrijvers D, Hool A, Blengini GA, Chen W-Q, Dewulf J, Eggert R, van Ellen L, Gauss R, Goddin J, Habib K, Hagelüken C, Hirohata A, Hofmann-Amtenbrink M, Kosmol J, Le Gleuher M, Grohol M, Ku A, Lee M-H, Liu G, Nansai K, Nuss P, Peck D, Reller A, Sonnemann G, Tercero L, Thorenz A, Wäger PA (2020) A review of methods and data to determine raw material criticality. Resour Conserv Recycl 155:104617. https://doi.org/10.1016/j.resconrec.2019.104617

Schulz KJ, DeYoung, John H., Jr., Seal II RR, Bradley DC (eds.) (2017) Critical mineral resources of the United States—economic and environmental geology and prospects for future supply. U.S. Geological Survey Professional Paper 1802. https://pubs.er.usgs.gov/publication/pp1802. Accessed 15 October 2021

Smith BJ, Eggert RG (2016) Multifaceted material substitution: the case of NdFeB magnets, 2010–2015. JOM 68:1964–1971. https://doi.org/10.1007/s11837-016-1913-2

Sonderegger T, Berger M, Alvarenga R, Bach V, Cimprich A, Dewulf J, Frischknecht R, Guinée J, Helbig C, Huppertz T, Jolliet O, Motoshita M, Northey S, Rugani B, Schrijvers D, Schulze R, Sonnemann G, Valero A, Weidema BP, Young SB (2020) Mineral resources in life cycle impact assessment—part I: a critical review of existing methods. Int J Life Cycle Assess 25:784–797. https://doi.org/10.1007/s11367-020-01736-6

Sonderegger T, Dewulf J, Fantke P, de Souza DM, Pfister S, Stoessel F, Verones F, Vieira M, Weidema B, Hellweg S (2017) Towards harmonizing natural resources as an area of protection in life cycle impact assessment. Int J Life Cycle Assess 22:1912–1927. https://doi.org/10.1007/s11367-017-1297-8