Abstract

In recent years, green bonds have become an important part of the green financial system. In this paper, we investigate theoretically and empirically how green bond financing impacts corporate long-term value orientation. To study this relationship, we manually collect green bond financing data and use Python to construct a measure reflecting corporate long-term value. Using a sample of Chinese A-share bond issuing companies from 2016 to 2021, we find that (1) green bond financing can significantly promote companies to pursue long-term value, in which financing costs, management’s strategic risk-taking, and external supervision are the underlying mechanisms. (2) There is a synergistic effect between green bond financing and environmental regulation, which can jointly improve the intensity of corporate long-term value orientation. (3) The relationship between green bond financing and corporate long-term value is more significant in enterprises with heavily polluting, lower risk-taking levels, less strategic change, and lower financial mismatch risk. Our findings reveal the “corrective” effect of green bond financing on management’s strategic decision-making, which provides new empirical evidence for comprehensively and accurately evaluating the role of green bonds and promoting the development of the green bond market.

Similar content being viewed by others

Data availability

The datasets generated during the current study are available. The bond data are from the WIND database and CSMAR database. The data on sewage charges and environmental protection taxes are sourced from the WIND database and the “China Statistical Yearbook”; regional GDP data comes from the “China Statistical Yearbook.” Corporate green patent applications originate from the CNRDS database, and other corporate governance and financial data are obtained from the CSMAR database. The datasets used are available from the corresponding author on reasonable request.

Notes

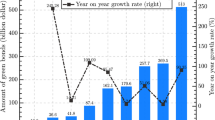

The data comes from the China Green Bond Market Report 2021, which was jointly compiled by the Climate Bond Initiative (CBI) and the China Bond Research and Development Center of the Central Government Bond Registration and Settlement Corporation.

The most fundamental impact that green bond financing brings to firms is the credit spread advantage, which reduces corporate financing costs (Hyun et al. 2020). In addition, financing costs is the most important driving factor in organizational investment decisions (Gianfrate and Peri 2019). Therefore, we choose financing cost to reflect the degree of corporate financing constraints.

China’s green bond market is currently in the development stage, and the number of A-share listed companies in non-financial industries is relatively limited. The explanatory variable is not suitable for tail reduction, so this paper excludes its abnormal values greater than 1.

Specifically, we use the machine learning method to identify 43 words that reflect the management's short-termism in annual reports (for example, 10 seed words such as “several months” and 33 expanded words such as “several days”). Then, we divide the frequency of 43 words by the total word frequency of annual reports. Considering the dimensional differences between variables, the short-term investment preference index (INV_S) of enterprises is obtained by multiplying the above calculation results by 1000.

Unless otherwise specified, all models in this paper control for the above three fixed effects and adjust for heteroskedasticity in the standard errors of the model regression coefficients.

Notethat since China implemented the Environmental Protection Tax Law on January 1, 2018, the sewage fee system has been changed to a comprehensive environmental protection tax. Thus, the GDP-adjusted environmental protection tax revenue adjusted for GDP is used for measurement in 2018 and subsequent years.

Due to space limitation, the regression results of control variables for the robustness test are not listed. If necessary, you can obtain them from the author.

Since the beginning of 2016, China's green bond market has entered a standardized stage. To retain the samples as much as possible, under this method the sample period has been extended to 2010–2021.

There is a lack of data on the measurement indicators of strategic risk-taking and analyst attention. Therefore, the sample size for testing these two mechanisms is less than that of the main regression. This paper will present the complete results.

The sample size is less than that of the main regression because of the missing data on the new variables introduced.

The codes for heavily polluting industries are B06, B07, B08, B09, B10, C15, C17, C18, C19, C22, C25, C26, C27, C28, C29, C30, C31, C32, C33, and D44.

References

Amore MD, Schneider C, Zaldokas A (2013) Credit supply and corporate innovation. J Financ Econ 109(3):835–855

Barua S, Chiesa M (2019) Sustainable financing practices through green bonds: what affects the funding size? Bus Strategy Environ 28(6):1131–1147

Baulkaran V (2019) Stock market reaction to green bond issuance. J Asset Manag 20(5):331–340

Bebchuk LA, Stole LA (1993) Do short-term objectives lead to under-or overinvestment in long-term projects? J Finance 48(2):719–729

Beloskar VD, Nageswara Rao SVD (2022) corporate social responsibility: is too much bad?—evidence from India. Asia-Pacific Finan Markets 29:221–252

Benlemlih M, Jaballah J, Kermiche L (2023) Does financing strategy accelerate corporate energy transition? Evidence from green bonds. Bus Strategy Environ 32(1):878–889

Bentley KA, Omer TC, Twedt BJ (2017) Does business strategy impact a firm’s information environment? J Account Audit Finance 10:1–25

Brochet F, Loumioti M, Serafeim G (2015) Speaking of the short-term: disclosure horizon and managerial myopia. Rev Account Stud 20(3):1122–1163

Brown JR, Martinsson G, Thomann C (2022) Can environmental policy encourage technical change? Emissions taxes and R&D investment in polluting firms. Rev Financ Stud 35:4518–4560

Bushee BJ (1998) The influence of institutional investors on myopic R&D investment behavior. Account Rev 73(3):305–333

Calel R, Dechezleprêtre A (2012) Environmental policy and directed technological change: evidence from the European Carbon Market. Rev Econ Stat 98(1):551–574

Chen YF, Lin FL, Yang SY (2015) Does institutional short-termism matter with managerial myopia? J Bus Res 68(4):845–850

Czakon W, Klimas P, Kawa A, Kraus S (2023) How myopic are managers? Development and validation of a multidimensional strategic myopia scale. J Bus Res 157:113573

Dong Z, Wang S, Zhang W, Shen H (2022) The dynamic effect of environmental regulation on firms’ energy consumption behavior—evidence from China’s industrial firms. Renew Sust Energ Rev 156:111966

Flammer C (2021) Corporate Green Bonds. J Financ Econ 142(2):499–516

Ge T, Li J, Sha R, Hao XL (2020) Environmental regulations, financial constraints and export green-sophistication: evidence from China’s enterprises. J Clean Prod 251:119671

Gianfrate G, Peri M (2019) The green advantage: exploring the convenience of issuing green bonds. J Clean Prod 219:127–135

Gigler F, Kanodia C, Sapra H, Venugopalan R (2014) How frequent financial reporting can cause managerial short-termism: an analysis of the costs and benefits of increasing reporting frequency? J Account Res 52(2):357–387

Guo B, Pérez-Castrillo D, Toldrà-Simats A (2019) Firms’ innovation strategy under the shadow of analyst coverage. J Financ Econ 131(2):456–483

Guo C, Su WH, Song XB, Hu XX (2022) Heterogeneous debt financing and environmental research & development: evidence from China. Int Rev Econ Finance 82:65–81

Hu N, Xue F, Wang H (2021) Does managerial myopia affect long-term investment? Based on text analysis and machine learning. Manag World 37(5):139–156

Hyun S, Park D, Tian S (2020) The price of going green: the role of greenness in green bond markets. Account Finance 60(1):73–95

Jin XJ, Ke YY, Chen XH (2022) Credit pricing for financing of small and micro enterprises under government credit enhancement: leverage effect or credit constraint effect. J Bus Res 138:185–192

Khurram MU, Xie WW, Mirza SS, Tong H (2023) Green bonds issuance, innovation performance, and corporate value: empirical evidence from China. Heliyon 9(4):e14895

Kish-Gephart J, Campbell JT (2015) You don’t forget your roots: the influence of CEO social class background on strategic risk taking. Acad Manage J 58(6):1614–1636

Lai S, Li Z, Yang YG (2020) East, West, home’s best: do local CEOs behave less myopically? Account Rev 95(2):227–255

Li SH, Wu ZY, Cheng X (2022) Key audit matters and managerial myopia. Audit Res 04:99–112

Liang X, Li S, Luo P (2022) Green mergers and acquisitions and green innovation: an empirical study on heavily polluting enterprises. Environ Sci Pollut Res 29:48937–48952

Liu M, Tan R, Zhang B (2021) The costs of “blue sky”: environmental regulation, technology upgrading, and labor demand in China. J Dev Econ 150:102610

Lundstrum LL (2002) Corporate investment myopia: a horserace of the theories. J Corp Finance 8(4):353–371

Manso G (2011) Motivating Innovation. J. Finance 66(5):1823–1860

Minnis M (2011) The value of financial statement verification in debt financing: evidence from private US firms. J Account Res 49(2):457–506

Pástor L, Stambaugh RF, Taylor LA (2021) Sustainable investing in equilibrium. J Financ Econ 142(2):550–571

Peng J, Xie R, Ma C, Fu Y (2021) Market-based environmental regulation and total factor productivity: evidence from Chinese enterprises. Econ Model 95(2):394–407

Pevzner M, Xie F, Xin X (2015) When firms talk, do investors listen? The role of trust in stock market reactions to corporate earnings announcements. J Financ Econ 117(1):190–223

Reboredo JC (2018) Green bond and financial markets: co-movement, diversification and price spillover effects. Energy Econ 74:38–50

Reboredo JC, Ugolini A (2020) Price connectedness between green bond and financial markets. Econ Model 88:25–38

Sangiorgi I, Schopohl L (2023) Explaining green bond issuance using survey evidence: Beyond the greenium. Br Account Rev 55(1):101071

Schuster CL, Nicolai AT, Covin JG (2020) Are founder-led firms less susceptible to managerial myopia? Entrep Theory Pract 44(3):391–421

Seo HJ, Kang SJ, Baek YJ (2020) Managerial myopia and short-termism of innovation strategy: financialisation of Korean firms. Cambridge J Econ 44(6):1197–1220

Sheng X, Guo SL, Chang XC (2022) Managerial myopia and firm productivity: evidence from China. Finance Res Lett 49:103083

Stein JC (1989) Efficient capital markets, inefficient firms: a model of myopic corporate behavior. Q J Econ 104(4):655–669

Sun Y, Wu S, Wang Z (2023) The impact of green credit policies on heavy polluting enterprises’ transition from reality to emptiness. Chinese J Popul Resour Environ 33(03):91–101

Tan XJ, Dong HM, Liu YS, Su X, Li ZX (2022a) Green bonds and corporate performance: a potential way to achieve green recovery. Renew Energ 200:59–68

Tan CZ, He CY, Shi ZZ, Mo GL, Geng XX (2022b) How does CEO demission threat affect corporate risk-taking? J Bus Res 139:935–944

Tang DY, Zhang Y (2020) Do shareholders benefit from green bonds? J Corp Finance 61:1–18

Tian X, Wang TY (2014) Tolerance for failure and corporate innovation. Rev Financ Stud 27(1):211–255

Tian LH, Wang KD (2019) Arch—criminal or scapegoat? Margin trading, short selling, and managerial myopia. Econ Rev 01:106–120

Wang T, Bansal P (2012) Social responsibility in new ventures: profiting from a long-term orientation. Strateg Manag J 33(10):1135–1153

Wang JZ, Chen X, Li XX, Yu J, Zhong R (2020) The market reaction to green bond issuance: evidence from China. Pacific Basin Finance J 60:28–40

Wang LX, Yang F, Zhao N (2021a) Financial friction, resource misallocation and total factor productivity: theory and evidence from China. J Appl Econ 24(1):393–408

Wang YL, Lei XD, Long RY (2021b) Can green credit policy promote the corporate investment efficiency? Chinese J Popul Resour Environ 31(01):123–133

Wang T, Liu XX, Wang H (2022) Green bonds, financing constraints, and green innovation. J Clean Prod 38(1):135134

Wibbens PD, Siggelkow N (2020) Introducing LIVA to measure long-term firm performance. Strateg Manag J 41(5):867–890

Zeng S, Hu J, Gu F, Carlos LA (2023) Financial information, green certification, government subsidies and green bond credit spreads—evidence from China. Int Entrep Manag J 19(1):321–341

Zerbib OD (2019) The effect of pro-environmental preferences on bond prices: evidence from green bonds. J Bank Financ 98:39–60

Zhang D, Vigne S (2020) How does innovation efficiency contribute to green productivity? A financial constraint perspective. J Clean Prod 280:124000

Zhang R, Li Y, Liu Y (2021) Green bond issuance and corporate cost of capital. Pacific Basin Finance J 69:1–22

Zhang JJ, Yang G, Ding XH, Qin J (2022a) Can green bonds empower green technology innovation of enterprises? Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-23192-5

Zhang Z, Duan H, Shan S, Liu Q, Geng W (2022b) The impact of green credit on the green innovation level of heavy-polluting enterprises—evidence from China. Int J Environ Res Public Health 19(2):650

Zhang DY, Meng L, Zhang JT (2023) Environmental subsidy disruption, skill premiums and ESG performance. Int Rev Financial Anal 90:102862

Zhou Z, Xu L, Guo P, Ai H (2023) Environmental regulation and corporate financialization: insight from blue sky protection campaign in China. Environ Sci Pollut Res 30(19):54993–55008

Author information

Authors and Affiliations

Contributions

Hailin Wang contributed to conceptualization, writing—review and editing, supervision, and project administration. Linlin Duan contributed to formal analysis, data curation, writing-original draft, and writing-review and editing. Hao Zeng contributed to Python software and conceptualization.

Corresponding author

Ethics declarations

Ethics approval

This is an original article that did not use other information that requires ethical approval.

Consent to participate

All authors participated in this article.

Consent for publication

All authors have given consent to the publication of this article.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wang, H., Duan, L. & Zeng, H. Green bond financing, environmental regulation, and long-term value orientation: evidence from Chinese-listed companies. Environ Sci Pollut Res 30, 123335–123350 (2023). https://doi.org/10.1007/s11356-023-30986-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-30986-8