Abstract

We investigate fat tails and network interconnections of geopolitical risk index and food prices, including the price of corn, rice, and wheat, using seven Bayesian vector heterogeneous autoregression fashions. This paper differentiates dynamically between network interlinkages between these variables during the short, medium, and long runs. We found some noteworthy results in our study. In the first place, network interlinkages exhibit remarkable differences over time. Interlinkages between variables in our designed networks are increased in the short, medium, and long term due to transient events occurring in markets during the studied period. During the Russia-Ukraine conflict, the long-term ties within the system are more significantly impacted. Additionally, based on net-directional linkages, each market’s role shifts (from sending to receiving shock and vice versa) during the pre- and post-Ukraine-Russia conflict, whereas these roles persist during the COVID-19 pandemic. Observations of short- and medium-term trends reveal that the geopolitical risk index is shock receivers transmitted to these markets by the rice and corn markets. The results indicate that the geopolitical risk index persists as shock receivers in terms of long-horizon measures.

Similar content being viewed by others

Data availability

Data is available on request due to privacy/ethical restrictions.

Notes

Note that we the lag number used in MA representation to Q = 100 horizons. Other values of Q are also considered, such as Q = {150, 200, 250} for the robustness checks.

The results from these models can be provided by authors upon request.

References

Abakah EJA, Tiwari AK, Lee CC, Ntow-Gyamfi M (2022) Quantile price convergence and spillover effects among Bitcoin, Fintech, and artificial intelligence stocks. Int Rev Finance 23(1):187–205. https://doi.org/10.1111/irfi.12393

Acharya VV, Pedersen LH, Philippon T, Richardson M (2017) Measuring systemic risk. Rev Financ Stud 30(1):2–47. https://doi.org/10.1093/rfs/hhw088

Adekoya OB, Oliyide JA, Yaya OS, Al-Faryan MAS (2022) Does oil connect differently with prominent assets during war? Analysis of intra-day data during the Russia-Ukraine saga. Resour Policy 77:102728. https://doi.org/10.1016/j.resourpol.2022.102728

Akhtaruzzaman M, Boubaker S and Sensoy A (2020) Financial contagion during COVID–19 crisis (SSRN Scholarly Paper 3584898). https://doi.org/10.2139/ssrn.3584898

Ali S, Yan Q, Razzaq A, Khan I, Irfan M (2023) Modeling factors of biogas technology adoption: a roadmap towards environmental sustainability and green revolution. Environ Sci Pollut Res 30(5):11838–11860. https://doi.org/10.1007/s11356-022-22894-0

Antonakakis N, Gupta R, Kollias C, Papadamou S (2017) Geopolitical risks and the oil-stock nexus over 1899–2016. Financ Res Lett 23:165–173. https://doi.org/10.1016/j.frl.2017.07.017

Ataguba JE (2020) COVID-19 pandemic, a war to be won: understanding its economic implications for Africa. Appl Health Econ Health Policy 18(3):325–328. https://doi.org/10.1007/s40258-020-00580-x

Awan A, Sadiq M, Hassan ST, Khan I, Khan NH (2022) Combined non-linear effects of urbanization and economic growth on CO2 emissions in Malaysia. An application of QARDL and KRLS. Urban Clim 46:101342. https://doi.org/10.1016/j.uclim.2022.101342

Azam W, Khan I, Ali SA (2023) Alternative energy and natural resources in determining environmental sustainability: a look at the role of government final consumption expenditures in France. Environ Sci Pollut Res Int 30(1):1949–1965. https://doi.org/10.1007/s11356-022-22334-z

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636

Baker SR, Bloom N, Davis SJ, Kost KJ, Sammon MC and Viratyosin T (2020)The unprecedented stock market impact of COVID-19 (w26945). National Bureau of Economic Research. https://doi.org/10.3386/w26945

Balcilar M, Gabauer D, Umar Z (2021) Crude oil futures contracts and commodity markets: new evidence from a TVP-VAR extended joint connectedness approach. Resour Policy 73:102219. https://doi.org/10.1016/j.resourpol.2021.102219

Barro RJ, Ursúa JF and Weng J (2020) The coronavirus and the great influenza pandemic: lessons from the “Spanish Flu” for the coronavirus’s potential effects on mortality and economic activity (Working Paper 26866). National Bureau of Economic Research. https://doi.org/10.3386/w26866

Baruník J, Křehlík T (2018) Measuring the frequency dynamics of financial connectedness and systemic risk*. J Financ Economet 16(2):271–296. https://doi.org/10.1093/jjfinec/nby001

Boubaker S, Goodell JW, Pandey DK, Kumari V (2022) Heterogeneous impacts of wars on global equity markets: evidence from the invasion of Ukraine. Finance Res Lett 48:102934. https://doi.org/10.1016/j.frl.2022.102934

Boungou W, Yatié A (2022) The impact of the Ukraine-Russia war on world stock market returns. Econ Lett 215:110516. https://doi.org/10.1016/j.econlet.2022.110516

Calabrese R, Osmetti SA (2019) A new approach to measure systemic risk: a bivariate copula model for dependent censored data. Eur J Oper Res 279(3):1053–1064. https://doi.org/10.1016/j.ejor.2019.06.027

Caldara D, Iacoviello M (2022) Measuring geopolitical risk. Am Econ Rev 112(4):1194–1225. https://doi.org/10.1257/aer.20191823

Chan JCC (2020) Large Bayesian VARs: a flexible Kronecker error covariance structure. J Bus Econ Stat 38(1):68–79. https://doi.org/10.1080/07350015.2018.1451336

Chen S-S (2009) Oil price pass-through into inflation. Energy Econ 31(1):126–133. https://doi.org/10.1016/j.eneco.2008.08.006

Chen Y (2018) Blockchain tokens and the potential democratization of entrepreneurship and innovation. Bus Horiz 61(4):567–575. https://doi.org/10.1016/j.bushor.2018.03.006

Chen M-H, Jang SS, Kim WG (2007) The impact of the SARS outbreak on Taiwanese hotel stock performance: an event-study approach. Int J Hosp Manag 26(1):200–212. https://doi.org/10.1016/j.ijhm.2005.11.004

Chen W, Hamori S, Kinkyo T (2014) Macroeconomic impacts of oil prices and underlying financial shocks. J Int Finan Markets Inst Money 29:1–12. https://doi.org/10.1016/j.intfin.2013.11.006

Chiu CW, Mumtaz H, Pinter G (2017) Forecasting with VAR models: fat tails and stochastic volatility. Int J Forecast 33(4):1124–1143. https://doi.org/10.1016/j.ijforecast.2017.03.001

Chowdhury MAF, Meo MS, Aloui C (2021) How world uncertainties and global pandemics destabilized food, energy and stock markets? Fresh evidence from quantile on quantile regressions. Int Rev Financ Anal 76:101759. https://doi.org/10.1016/j.irfa.2021.101759

Corbet S, Larkin C, Lucey B (2020) The contagion effects of the COVID-19 pandemic: evidence from gold and cryptocurrencies. Financ Res Lett 35:101554. https://doi.org/10.1016/j.frl.2020.101554

Corsi F (2009) A simple approximate long-memory model of realized volatility. J Financ Economet 7(2):174–196. https://doi.org/10.1093/jjfinec/nbp001

Creal D, Koopman SJ, Lucas A (2011) A dynamic multivariate heavy-tailed model for time-varying volatilities and correlations. J Bus Econ Stat 29(4):552–563. https://doi.org/10.1198/jbes.2011.10070

Dimitrakopoulos S, Kolossiatis M (2020) Bayesian analysis of moving average stochastic volatility models: modeling in-mean effects and leverage for financial time series. Economet Rev 39(4):319–343. https://doi.org/10.1080/07474938.2019.1630075

Ellington M (2021) Fat tails, serial dependence, and implied volatility index connections. Eur J Oper Res. https://doi.org/10.1016/j.ejor.2021.09.038

Engle RF and Campos-Martins S (2020) Measuring and hedging geopolitical risk (SSRN Scholarly Paper 3685213). https://doi.org/10.2139/ssrn.3685213

Engle R, Kelly B (2012) Dynamic equicorrelation. J Bus Econ Stat 30(2):212–228. https://doi.org/10.1080/07350015.2011.652048

Gates B (2020) Responding to Covid-19—a once-in-a-century pandemic? N Engl J Med 382(18):1677–1679. https://doi.org/10.1056/NEJMp2003762

Giglio S, Maggiori M, Stroebel J and Utkus S (2020) Inside the mind of a stock market crash (Working Paper 27272). National Bureau of Economic Research. https://doi.org/10.3386/w27272

Gilbert CL (2010) How to understand high food prices. J Agric Econ 61(2):398–425. https://doi.org/10.1111/j.1477-9552.2010.00248.x

Gong X, Xu J (2022) Geopolitical risk and dynamic connectedness between commodity markets. Energy Econ 110:106028. https://doi.org/10.1016/j.eneco.2022.106028

Guenette JD, Kenworthy PG and Wheeler CM (2022) Implications of the war in Ukraine for the global economy. World Bank. https://openknowledge.worldbank.org/handle/10986/37372

Gupta M, Abdelsalam M, Khorsandroo S, Mittal S (2020) Security and privacy in smart farming: challenges and opportunities. IEEE Access 8:34564–34584. https://doi.org/10.1109/ACCESS.2020.2975142

Herrero AG (2020) The pandemic requires a coordinated global economic response. Intereconomics 2020(2):66–67

Ichev R, Marinč M (2018) Stock prices and geographic proximity of information: evidence from the Ebola outbreak. Int Rev Financ Anal 56:153–166. https://doi.org/10.1016/j.irfa.2017.12.004

Jackman M, Moore W (2021) Does it pay to be green? An exploratory analysis of wage differentials between green and non-green industries. J Econ Dev 23(3):284–298. https://doi.org/10.1108/JED-08-2020-0099

Jebabli I, Arouri M, Teulon F (2014) On the effects of world stock market and oil price shocks on food prices: an empirical investigation based on TVP-VAR models with stochastic volatility. Energy Econ 45:66–98. https://doi.org/10.1016/j.eneco.2014.06.008

Jie H, Khan I, Alharthi M, Zafar MW, Saeed A (2023) Sustainable energy policy, socio-economic development, and ecological footprint: the economic significance of natural resources, population growth, and industrial development. Util Policy 81:101490. https://doi.org/10.1016/j.jup.2023.101490

Knaul FM, Farmer PE, Krakauer EL, Lima LD, Bhadelia A, Kwete XJ, Arreola-Ornelas H, Gómez-Dantés O, Rodriguez NM, Alleyne GAO, Connor SR, Hunter DJ, Lohman D, Radbruch L, Madrigal M del RS, Atun R, Foley KM, Frenk J, Jamison DT,…Zimmerman C (2018) Alleviating the access abyss in palliative care and pain relief—an imperative of universal health coverage:the Lancet Commission report. The Lancet, 391(10128), 1391–1454. https://doi.org/10.1016/S0140-6736(17)32513-8

Li J, Li C, Chavas J-P (2017) Food price bubbles and government intervention: is China different? Can J Agric Econ/Rev Can D’agroeconomie 65(1):135–157. https://doi.org/10.1111/cjag.12106

Li Y, Cong Z, Xie Y, Wang Y, Wang H (2022) The relationship between green finance, economic factors, geopolitical risk and natural resources commodity prices: evidence from five most natural resources holding countries. Resour Policy 78:102733. https://doi.org/10.1016/j.resourpol.2022.102733

Liu H, Alharthi M, Atil A, Zafar MW, Khan I (2022a) A non-linear analysis of the impacts of natural resources and education on environmental quality: green energy and its role in the future. Resour Policy 79:102940. https://doi.org/10.1016/j.resourpol.2022.102940

Liu H, Khan I, Zakari A, Alharthi M (2022b) Roles of trilemma in the world energy sector and transition towards sustainable energy: a study of economic growth and the environment. Energy Policy 170:113238. https://doi.org/10.1016/j.enpol.2022.113238

Mawejje J (2016) Food prices, energy and climate shocks in Uganda. Agric Food Econ 4(1):4. https://doi.org/10.1186/s40100-016-0049-6

McKibbin W, Morris A, Panton AJ and Wilcoxen PJ (2017) Climate change and monetary policy: dealing with disruption. In CAMA Working Papers (2017–77; CAMA Working Papers). Centre for Applied Macroeconomic Analysis, Crawford School of Public Policy, The Australian National University. https://ideas.repec.org/p/een/camaaa/2017-77.html

Mhalla M (2020) The impact of novel coronavirus (COVID-19) on the global oil and aviation markets. J Asian Scic Res 10(2):96–107. https://doi.org/10.18488/journal.2.2020.102.96.104

Mumtaz H, Theodoridis K (2018) The changing transmission of uncertainty shocks in the U.S. J Bus Econ Stat 36(2):239–252. https://doi.org/10.1080/07350015.2016.1147357

Myers RJ, Johnson SR, Helmar M, Baumes H (2014) Long-run and short-run co-movements in energy prices and the prices of agricultural feedstocks for biofuel. Am J Agr Econ 96(4):991–1008. https://doi.org/10.1093/ajae/aau003

Nonejad N (2022) An interesting finding about the ability of geopolitical risk to forecast aggregate equity return volatility out-of-sample. Finan Res Lett 47:102710. https://doi.org/10.1016/j.frl.2022.102710

Pavlyshenko BM (2020) Regression approach for modeling COVID-19 spread and its impact on stock market (arXiv:2004.01489). arXiv. https://doi.org/10.48550/arXiv.2004.01489

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58(1):17–29. https://doi.org/10.1016/S0165-1765(97)00214-0

Qian L, Zeng Q, Li T (2022) Geopolitical risk and oil price volatility: evidence from Markov-switching model. Int Rev Econ Financ 81:29–38. https://doi.org/10.1016/j.iref.2022.05.002

Ramelli S and Wagner AF (2020) Feverish stock price reactions to COVID-19 (SSRN Scholarly Paper 3550274). https://doi.org/10.2139/ssrn.3550274

Rigotti L, Shannon C (2005) Uncertainty and risk in financial markets. Econometrica 73(1):203–243. https://doi.org/10.1111/j.1468-0262.2005.00569.x

Saâdaoui F, Ben Jabeur S, Goodell JW (2022) Causality of geopolitical risk on food prices: considering the Russo-Ukrainian conflict. Finan Res Lett 49:103103. https://doi.org/10.1016/j.frl.2022.103103

Schoenfeld J (2020) The invisible risk: pandemics and the financial markets (SSRN Scholarly Paper 3567249). https://doi.org/10.2139/ssrn.3567249

Sharif A, Aloui C, Yarovaya L (2020) COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: fresh evidence from the wavelet-based approach. Int Rev Finan Anal 70:101496. https://doi.org/10.1016/j.irfa.2020.101496

Taghizadeh-Hesary F, Zakari A, Yoshino N and Khan I (2022) Leveraging on energy security to alleviate poverty in Asian economies. The Singapore Economic Review. 1–28. https://doi.org/10.1142/S0217590822440015

Tauseef Hassan S, Wang P, Khan I, Zhu B (2023) The impact of economic complexity, technology advancements, and nuclear energy consumption on the ecological footprint of the USA: towards circular economy initiatives. Gondwana Res 113:237–246. https://doi.org/10.1016/j.gr.2022.11.001

Topcu M, Gulal OS (2020) The impact of COVID-19 on emerging stock markets. Finan Res Lett 36:101691. https://doi.org/10.1016/j.frl.2020.101691

Umar Z, Bossman A, Choi S-Y, Teplova T (2022) Does geopolitical risk matter for global asset returns? Evidence from quantile-on-quantile regression. Finan Res Lett 48:102991. https://doi.org/10.1016/j.frl.2022.102991

Wang Q, Yang X, Li R (2022) The impact of the COVID-19 pandemic on the energy market – a comparative relationship between oil and coal. Energy Strateg Rev 39:100761. https://doi.org/10.1016/j.esr.2021.100761

Xiao X, Tian Q, Hou S, Li C (2019) Economic policy uncertainty and grain futures price volatility: evidence from China. China Agric Econ Rev 11(4):642–654. https://doi.org/10.1108/CAER-11-2018-0224

Zaremba A, Kizys R, Aharon DY and Umar Z (2021) Term spreads and the COVID-19 pandemic: evidence from international sovereign bond markets. Finance Res Lett 102042. https://doi.org/10.1016/j.frl.2021.102042

Zhang D, Broadstock DC (2020) Global financial crisis and rising connectedness in the international commodity markets. Int Rev Finan Anal 68:101239. https://doi.org/10.1016/j.irfa.2018.08.003

Zhang D, Hu M, Ji Q (2020) Financial markets under the global pandemic of COVID-19. Finan Res Lett 36:101528. https://doi.org/10.1016/j.frl.2020.101528

Funding

This paper was supported by National Economics University.

Author information

Authors and Affiliations

Contributions

Le Thanh Ha contributed to all stages of preparing, drafting, writing, and revising this review article. Le Thanh Ha made a substantial, direct, and intellectual contribution to the work during different preparation stages. Le Thanh Ha read, revised, and approved the final version of this manuscript.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

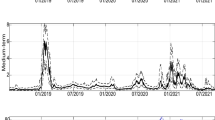

Horizon-specific network interlinkage measures. Note. We plot the posterior median, and one standard deviation percentiles of the posterior distribution of horizon-specific network interlinkage measures, \({D}_{d}\). Network interlinkages at short horizons (from 1 day to 1 week), at medium horizons (from 1 week to 1 month), and at long horizons (larger than 1 month) are, respectively, displayed at the top, middle, and bottom panels

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ha, L.T. Fat tails, serial dependence, and interlinkages of the geopolitical risk and food market during the COVID-19 pandemic and war crisis: an application of Bayesian vector heterogeneous autoregressions. Environ Sci Pollut Res (2023). https://doi.org/10.1007/s11356-023-29565-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11356-023-29565-8

Keywords

- Bayesian vector heterogeneous autoregressions

- Network interlinkages

- Geopolitical risk

- Food prices

- COVID-19, Ukraine-Russia conflict