Abstract

Environmental technology innovations are widely recognized as the most suitable option to achieve sustainable and green development. Since banks and other financial institutions offer essential funding for investments in environmental technology projects, the banking sector and human resources are essential to developing and promoting environmental technology innovation. This study aims to investigate the impact of banking sector performance and human resources on environmental technology innovation in China, utilizing the ARDL method. The research focuses on the period spanning from 1996 to 2021. The outcomes of the ARDL model approve that short- and long-term banking sector performances positively impact environmental technology innovation in China. Among the four proxies for the banking sector’s performance, market capitalization, bank deposits, and bank Z-score are substantially and favorably associated with long-term environmental technology innovation in China. However, only the banking sector’s performance fosters environmental technology innovation in the short term; all other measures of banking sector performance are insignificant. Human resource positively impacts green innovation in China in the long run. Furthermore, China’s long-term GDP growth and environmental pressures support environmental technology innovation. Therefore, policymakers should provide specific incentives to encourage human resource management and financial institutions that lead to the advancement of environmental technology innovation.

Similar content being viewed by others

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Amuakwa-Mensah F, Näsström E (2022) Role of banking sector performance in renewable energy consumption. Appl Energy 306:118023

Arif BW, Ullah S (2021) From subcontractors to company owners: modeling firm-type choices in industrial clusters. J Glob Entrepreneur Res 11(1):153–161

Arner DW, Buckley RP, Zetzsche DA, Veidt R (2020) Sustainability, FinTech and financial inclusion. Eur Bus Organ Law Rev 21:7–35

Bleischwitz R, Yang M, Huang B, Xiaozhen XU, Zhou J, McDowall W et al (2022) The circular economy in China: achievements, challenges and potential implications for decarbonisation. Resour Conserv Recycl 183:106350

Cecere G, Corrocher N, Mancusi ML (2020) Financial constraints and public funding of eco-innovation: empirical evidence from European SMEs. Small Bus Econ 54:285–302

Chao T, Yunbao X, Chengbo D, Bo L, Ullah S (2023) Financial integration and renewable energy consumption in China: do education and digital economy development matter? Environ Sci Pollut Res 30(5):12944–12952

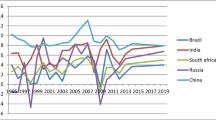

Chen R, Ramzan M, Hafeez M, Ullah S (2023) Green innovation-green growth nexus in BRICS: does financial globalization matter? J Innov Knowl 8(1):100286

De Marchi V (2012) Environmental innovation and R&D cooperation: empirical evidence from Spanish manufacturing firms. Res Policy 41(3):614–623

Ekins P, Zenghelis D (2021) The costs and benefits of environmental sustainability. Sustain Sci 16:949–965

Feng S, Zhang R, Li G (2022) Environmental decentralization, digital finance and green technology innovation. Struct Chang Econ Dyn 61:70–83

Fernando Y, Wah WX (2017) The impact of eco-innovation drivers on environmental performance: empirical results from the green technology sector in Malaysia. Sustain Prod Consum 12:27–43

Ghisetti C, Mancinelli S, Mazzanti M, Zoli M (2017) Financial barriers and environmental innovations: evidence from EU manufacturing firms. Clim Policy 17(sup1):S131–S147

Hong M, Li Z, Drakeford B (2021) Do the green credit guidelines affect corporate green technology innovation? Empirical research from China. Int J Environ Res Public Health 18(4):1682

Hu J, Hu M, Zhang H (2023) Has the construction of ecological civilization promoted green technology innovation? Environ Technol Innov 29:102960

Irfan M, Razzaq A, Sharif A, Yang X (2022) Influence mechanism between green finance and green innovation: exploring regional policy intervention effects in China. Technol Forecast Soc Change 182:121882

Ji Q, Zhang D (2019) How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 128:114–124

Kraus S, McDowell W, Ribeiro-Soriano DE, Rodríguez-García M (2021) The role of innovation and knowledge for entrepreneurship and regional development. Entrep Reg Dev 33(3-4):175–184

Lin B, Ma R (2022) Green technology innovations, urban innovation environment and CO2 emission reduction in China: fresh evidence from a partially linear functional-coefficient panel model. Technol Forecast Soc Change 176:121434

Liu J, Jiang Y, Gan S, He L, Zhang Q (2022) Can digital finance promote corporate green innovation? Environmental Science and Pollution Research 29(24):35828–35840

Liu N, Liu C, Da B, Zhang T, Guan F (2021) Dependence and risk spillovers between green bonds and clean energy markets. J Clean Prod 279:123595

Liu S, Yan MR (2018) Corporate sustainability and green innovation in an emerging economy—an empirical study in China. Sustainability 10(11):3998

Lv C, Shao C, Lee CC (2021) Green technology innovation and financial development: do environmental regulation and innovation output matter? Energy Econ 98:105237

Madaleno M, Dogan E, Taskin D (2022) A step forward on sustainability: the nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ 109:105945

Munawar S, Yousaf HQ, Ahmed M, Rehman S (2022) Effects of green human resource management on green innovation through green human capital, environmental knowledge, and managerial environmental concern. J Hosp Tour Manag 52:141–150

Omer AM (2008) Green energies and the environment. Renew Sust Energ Rev 12(7):1789–1821

Park H, Kim JD (2020) Transition towards green banking: role of financial regulators and financial institutions. Asian J Sustain Soc Responsib 5(1):1–25

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(3):289–326

Sahoo S, Kumar A, Upadhyay A (2023) How do green knowledge management and green technology innovation impact corporate environmental performance? Understanding the role of green knowledge acquisition. Bus Strategy Environ 32(1):551–569

Singh SK, Del Giudice M, Chierici R, Graziano D (2020) Green innovation and environmental performance: the role of green transformational leadership and green human resource management. Technol Forecast Soc Change 150:119762

Soundarrajan P, Vivek N (2016) Green finance for sustainable green economic growth in India. Agric Econ 62(1):35–44

Ullah S, Majeed MT, Arif BW (2021) Social capital and firms’ choice of financing under credit constraints: microeconomic evidence from Pakistan. Decision 48:3–13

UNEP (2019) Emissions gap report 2019, Nairobi. https://www.unep.org/resources/emissions-gapreport-2019

Usman A, Ozturk I, Hassan A, Zafar SM, Ullah S (2021) The effect of ICT on energy consumption and economic growth in South Asian economies: an empirical analysis. Telemat Informat 58:101537

Van LTH, Vo AT, Nguyen NT, Vo DH (2021) Financial inclusion and economic growth: an international evidence. Emerg Mark Finance Trade 57(1):239–263

Wei X, Ren H, Ullah S, Bozkurt C (2023) Does environmental entrepreneurship play a role in sustainable green development? Evidence from emerging Asian economies. Econ Res-Ekon Istraz 36(1):73–85

Xiang X, Liu C, Yang M (2022) Who is financing corporate green innovation? Int Rev Econ Finance 78:321–337

Yu CH, Wu X, Zhang D, Chen S, Zhao J (2021) Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 153:112255

Yuan G, Ye Q, Sun Y (2021) Financial innovation, information screening and industries’ green innovation—industry-level evidence from the OECD. Technol Forecast Soc Change 171:120998

Zhang W, Li G, Guo F (2022) Does carbon emissions trading promote green technology innovation in China? Appl Energy 315:119012

Zhu Z, Tan Y (2022) Can green industrial policy promote green innovation in heavily polluting enterprises? Evidence from China. Econ Anal Policy 74:59–75

Author information

Authors and Affiliations

Contributions

This idea was given by Qiang Yi. Qiang Yi analyzed the data and wrote the complete paper.

Corresponding author

Ethics declarations

Ethical approval

Not applicable

Consent to participate

The author is free to contact any of the people involved in the research to seek further clarification and information.

Consent for publication

Not applicable

Competing interests

The author declares no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yi, Q. Diffusion of environmental technology innovation through the lens of banking sector performance and human resource management: an influential step towards environmental sustainability. Environ Sci Pollut Res 30, 102428–102437 (2023). https://doi.org/10.1007/s11356-023-29396-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-29396-7