Abstract

The tourism industry is vulnerable to a range of economic and political factors, which can have both short-term and long-term impacts on tourist arrivals. The study aims to investigate the temporal dynamics of these factors and their impact on tourist arrivals. The method employed is a panel data regression analysis, using data from BRICS economies over a period of 1980–2020. The dependent variable is the number of tourist arrivals, while the independent variables are geopolitical risk, currency fluctuation, and economic policy. Control variables such as GDP, exchange rate, and distance to major tourist destinations are also included. The results show that geopolitical risk and currency fluctuation have a significant negative impact on tourist arrivals, while economic policy has a positive impact. The study also finds that the impact of geopolitical risk is stronger in the short term, while the impact of economic policy is stronger in the long term. Additionally, the study shows that the effects of these factors on tourist arrivals vary across BRICS countries. The policy implications of this study suggest that BRICS economies need to develop proactive economic policies that promote stability and encourage investment in the tourism industry.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Tourism has become one of the most important and fastest-growing industries in the world. BRICS economies have started to recognize the potential benefits of tourism in their economic development, and thus have made efforts to attract more tourists to their countries. However, the tourism industry is vulnerable to various external factors, such as geopolitical risks, currency fluctuations, and economic policies. The tourism industry is a major contributor to the economic development of BRICS economies. The impact of these factors on tourist arrivals has been widely studied in the literature, but there is a lack of research that specifically focuses on the temporal analysis of their relationship with tourist arrivals in BRICS economies.

Geopolitical risk is an important factor that influences tourist arrivals in BRICS economies. Political instability, conflicts, and terrorism can create a negative perception of the safety of a country, leading to a decrease in tourist arrivals (Li and Umair 2023). In addition, currency fluctuation can have a significant impact on the tourism industry. A change in exchange rates can affect the affordability of travel for tourists, leading to a decrease in demand. Moreover, economic policies can also influence tourist arrivals (Liu et al. 2023). The implementation of policies that support the tourism industry, such as infrastructure development and visa facilitation, can attract more tourists to a country. To understand the relationship between these variables and tourist arrivals in BRICS economies, a temporal analysis is necessary. By examining the data over a period of time, this study aims to provide insights into the causal relationship between geopolitical risk, currency fluctuation, economic policy, and tourist arrivals (Fang et al. 2022).

Pan et al. (2023) have explored the impact of geopolitical risk, currency fluctuations, and economic policy changes on tourism activities in BRICS economies. For instance, some studies have found that geopolitical risk can significantly affect tourist arrivals, with negative events such as terrorist attacks, political instability, and civil unrest reducing tourist inflows. Similarly, currency fluctuations can significantly impact tourism activities, with a strong local currency making travel more expensive for foreign tourists (Wu et al. 2022). Economic policy changes can also have an impact on tourist arrivals, with factors such as changes in taxation policies, trade restrictions, and interest rates affecting the cost of travel and consumer spending (Xiuzhen et al. 2022)(Ullah et al. 2020).

Since the currency exchange industry is the highest and most liquid capital market, an estimated $6.6 trn agreed to trade every day in BRICS nations during 2019 (Iqbal et al. 2019). It is inevitable that geopolitical risks (GPR), broad sense as the dangers, involved with currency fluctuations and economic policy of BRICS nations on tourist arrivals (Xia et al. 2020). For instance, after Russia annexed Crimea in 2014, the pound dropped half the value versus the dollar within that year, increasing the unpredictability of this exchange rate (Ikram et al. 2019a). As a crucial factor in valuation models, global financial regulation, investments, and offsetting choices, exchange rate volatility has garnered academics’ attention that halted exchange market and economic indicators of BRICS economies countries (Mohsin et al. 2023). Hence, there are a lot of efforts that are still needed in the research to predict fluctuations in exchange rates using objective support of geopolitical risk and economic policy (Agyekum et al. 2021). However, this is the motivation of current research to analyze the connection between geopolitical risk, economic policies, and currency fluctuations in BRICS nations.

This research presents a multivariate regression model along with lagged estimates and sensitivity analysis approach to the research objective. Most importantly, the objective of research is to estimate the relationship between currency fluctuations, geopolitical risk of BRICS nations, and the economic policies of mentioned settings. In the first part, our research examined the descriptive estimates for the study variables and the correlations among the constructs. In the second part, the study inferred the relationship of variables with the uncertainties of the BRICS member countries, while, in the third part, the study presented the conditional heteroskedasticity with lagged estimates, and in the last part, the study presented the sensitivity analysis estimate to confirm the robustness of the relationship among study variables by using the BRICS nations empirical data. Moreover, our quantitative study suggests that capital investment in gold is short-lived since the characteristic linkages are mostly applicable at the current time. Support for this may be found in the time it takes for the share market to respond to shifts in uncertainties (about one month) and the fact that neither the time-delayed dependent variable nor the time-lagging covariates are statically important.

This study examines the link between global concerns and currency devaluation in BRICS nations. Furthermore, it investigates the sensitivity of each BRICS economies currency to GPR and evaluates the in-sample and out-of-sample forecasting capabilities of GPR for exchange rate fluctuations. This is the first contribution. There are some ways that this research adds to the discussion of how accurately one can anticipate future changes in currency prices. Initially, we concentrate on the BRICS nations to analyze the consistency of exchange rate volatility in a cross-section of developing markets. This set of countries is chosen because, initially, they are heavily impacted by FDI flows, and, second, their exchange rates have been decided by varying exchange rate regimes. Until recently, market prices in these nations were carefully regulated by their monetary regimes. To examine such uncertainties in BRICS nation is the second contribution of research. Even though in-sample unpredictability does not ensure out-of-sample prediction advantages, the vast majority of studies dealing with exchange rate volatility prediction predicting are confined to in-sample predictability. This is the third contribution of research. Moreover, it has been established that economic policy uncertainty contributes to higher exchange rate volatility. To the best of our knowledge, no, it has been attempted in literary works to anticipate volatility in exchange rates in BRICS nations using GPR. Against such a background, we take into account parameters for both international and local (country-specific) geopolitical concerns, and we also take into account the prediction performance of crude price uncertainties for exchange rate volatility as part of our soundness study.

This paper will proceed as described below. The “Literature review” section provides a literary overview of research on gold returns and explains the theoretical and statistical justifications for the factors chosen to explain the phenomenon. The “Methodology” section presents an econometric model which establishes the connections between gold returns and various independent factors. Information for many nations is presented and discussed in the “Results and discussion” section. The “Multivariate regression output” section offers empirical evidence for single and multiple regressions and a delayed impact. The “Lag-based relationship estimation outputs” section shows verifiable research on how uncertainty affects the link between gold and stock prices. In the “Conclusion and policy implications” section, we draw certain conclusions and discuss their significance.

Literature review

The term “geopolitical risk” (GPR) is used to describe the dangers that arise from the disruption of foreign politics due to war, terrorism, or other forms of state-on-state conflict (Nguyen et al. 2019). It is not only cross-border trade that GPR impacts; it is also domestic policy, finance, and small business judgment (Shah et al. 2019). China’s GPR reached an all-time high in 2018 as a direct consequence of the trade dispute between the USA and China, disrupting world commerce and politics. Many Chinese people are worried about the effects of international relations on technology (Mohsin et al. 2020a). The question of how or if GPR influences the innovation process in China is an important one that has received little attention (Zhang et al. 2021).

Geopolitics refers to the intersection of territory and governance (Iqbal et al. 2022). This involves studying how a country’s actions affect its government, society, and armed forces. Increased military or political conflicts in a certain place threaten the regional or international economy, and this is what we mean when we talk about downside risks (Ikram et al. 2019b). For example, violence or terrorism could cause hydrocarbon commodity prices to rise, revenues to degrade, or the world economy to languish. Iram et al. (2020) were responding to a question on what may go wrong with the US capital market the following year. Economic theories found that upheaval, public fear, and financial disasters linked to global dangers lowered oil demand by increasing property degradation, defense budget, or preventative behavior (Mohsin et al. 2022b). An interruption in oil production might be caused by geopolitical tensions, as Mohsin et al. (2022a) highlighted. Both of these routes influence oil prices. Geopolitical risks (e.g., terrorist attacks on commercial establishments or innocent citizens) greatly affect investor and customer trust, ultimately impacting the stock system and the economy. Wars have massive and long-lasting effects on national GDP, international commerce, and global economic well-being (Wang et al. 2021). Cautionary spending may drive individuals to put off purchases and businesses to postpone expenditures. Terrorist attacks were shown to result in negative income and consumer spending (Fernandes et al. 2020).

According to research by Chang et al. (2022a), declining economies in 38 developing and developing nations are linked to rising geopolitical risk. An increase in defense expenditure (particularly during conflicts) encourages the issuance of fiat money, which drives up consumer interest rates and prices (Chang et al. 2022c). Also, wars always reduce the former when comparing the future supply of products with the existing collector (Chang et al. 2022e). Because of this, borrowing rates will rise because of the increased demand for existing commodities. About 40% of the world’s population and 23.2% of global GDP were located in BRICS countries in 2018. Its function in the global economy is growing more essential. There is a growing need for policymakers and companies to be kept abreast of macroeconomic fundamentals in yesterday’s more interconnected economy. There is a lot of interdependence and mutual impact between the industries of the BRICS and the industrialized nations. There are substantial commercial and financial linkages between BRICS members and major economies. Several researches suggest the economic consequences conveyed by developed countries to BRICS (Cumming et al. 2019). And there is research to imply that disruptions from GPR (global geopolitical risk) have a significant influence on developing economies (Anna et al. 2019), which might have knock-on effects for developed countries (Quigley et al. 2020). By focusing on the connection between the strategic dangers faced by BRICS nations and those faced by industrialized nations, this research adds to the current literature on the subject (Chang et al. 2023a).

Meanwhile, one body of research argues that GPR may boost economic policy rather than hinder it. First, according to Chang et al. (2022d), R&D investment is less sensitive to negative environmental variation caused by uncertainty since price changes differ from invested capital. Thus, it is possible that GPR will not dampen business creativity. Second, corporations may boost innovation to grab new opportunities for development provided by GPR and surpass rivals, as suggested by the key development option hypothesis. In particular, geopolitical conflicts between nations, such as war, terrorism, and nuclear dangers, would worsen world affairs, making importing and exporting knowledge and goods more difficult. As a result, GPR creates more room for both development prospects and unpredictability in economic marketplaces (Patil et al. 2018). Suppose a company in an environment of imperfect market lags or reduces its degree of innovation. In that case, it risks seeing its rivals swoop in and seize the growth possibilities provided by GPR. Therefore, GPR may encourage companies to concept to grab future opportunities when the predicted comparative edge via development is substantial (Raychaudhuri and Ghosh 2016). The effects of GPR on business creativity have been controversially studied before. Consequently, it is crucial to investigate if and how GPR promotes innovation. We statistically examine the effect of GPR on R&D expenditure and patent claims in China using the GPR index developed by Chang et al. (2023b). Chang et al. (2022b) also investigated how differences between businesses might function as a buffer. Moreover, people’s unique experiences with GPR lead to distinct approaches to deciding how to implement innovations. Industrial vulnerability to GPR is built using an enhanced Fama–French three-factor model (Wang et al. 2021).

This study highlights the previous research conducted on the impact of various factors on tourism activities in BRICS economies. The studies reviewed indicate that geopolitical risk, such as acts of terrorism, political instability, civil unrest, and natural disasters, can significantly reduce tourist inflows. Currency fluctuations, with a strong local currency making travel more expensive for foreign tourists, can also have a significant impact on tourism activities. Economic policy changes, including changes in taxation policies, trade restrictions, and interest rates, can affect the cost of travel and consumer spending, thereby impacting tourist arrivals. Overall, the literature review highlights the importance of investigating the impact of these factors on tourism activities in BRICS economies to inform policymakers and tourism industry stakeholders on developing policies and strategies that can attract tourists.

Methodology

Theoretical framework

Theoretically, GPR might influence the returns and volatility of currency exchange via various mechanisms, including reducing global trade flow variations in foreign corporations or investment projects and the creation of big businesses’ assumptions. To that end, a higher GPR is predicted to limit global markets by raising terms of trade and discouraging private individuals from investing in or buying imported imports. Currency exchange rates are affected when individuals shift their funds from nations with higher levels of exposure to those who have lower levels of exposure during a specific time. Each government’s exposure to GPR, whether GPR is a great nation or worldwide, economic indicators, haven attributes of its currencies, and currency exchange system will all play a role in determining the influence on currency exchange. The effect of these flow patterns on the volatility of exchange rates is unclear. Still, scientific research has discovered that during periods of fear or policy uncertainty, foreign money inflow from advanced nations increased on the assumption that economies in developed countries can function as safe places during times of higher risk appetite engendered by incidents of GPR. The impact of stock and bond portfolio inflows on the exchange rate changes is aggressive, especially based on several developing Asian countries, because enormous amounts raise the relationship between exchange rate and bond inflow. When considering developing markets, the exchange rate systems of individual countries will also define their vulnerabilities to GPR. Determine the significance, asymmetry, and heterogeneity of the spillovers between exchange rate ambiguity and currency values by analyzing the positional ripple effects and togetherness for both volatility and return of nine US dollar exchanges of the world’s greatest popular trading economies under the impact of trade-related unpredictability.

Study variables

Economic growth

Economic theory and past actual studies provide the basis for the variables that enter into the gold return calculation. Moment features, the results of empirical studies, and previous discoveries about whether the characteristics are relevant enough for it heavily influence the requirements of the statistical assessment and the shapes of the variables’ transformations.

Currency fluctuation

There are two kinds of player factors that contribute to the effect of the exchange rate fluctuations on gold return. For instance, when the US dollar falls in price, individuals in the home country often sell off treasury bonds and purchase metal out of worry for their fortune, driving up gold yields. Conversely, if the US dollar were to weaken, it would entice buyers from other countries to buy gold because the metal’s price in US dollars would fall. Therefore, a facie, we anticipate an inverse connection between the value of USD and the yield on silver. That is, the value of gold tends to rise in tandem with the USD’s decline. Gold is correlated negatively with the pound-dollar and renminbi currency fluctuations, as shown by Huang et al. (2022).

Geopolitical risk

Following Chenghui and Dilanchiev (2022), the study uses the geopolitical risk index to measure geopolitical risk in preceding research. As an upsurge in the measurement at time t has the same effect on variance at time t + 1 as a reduction, the first two GPR variables used as determinants in (2.1) are nonlinear measurements.

Uncertainties

As market volatility rises, gold prices tend to increase. Equity markets may fall due to rising economic policy uncertainty, affecting the gold trade as investors flee safety. As observed by Dilanchiev and Taktakishvili (2021), speculators may shift assets into the gold price as a buffer versus possible losses in capital if the stock market experiences a surprise in unpredictability caused by Fed policy innovations. Gold prices have been shown to increase in tandem with increases in downside risks in recent studies by Liu et al. (2022). Gold prices reached an all-time high due to the widespread fear that the COVID-19 epidemic will spread, as reported by Chabi Simin Najib et al. (2022). The jump in gold demand resulted from people making hedging choices in response to the increased unpredictability and equity market turmoil caused by worries of an epidemic. Therefore, the model has an adequate rationale for including a COVID-19 variable. Unknown parameters tend to show a certain amount of connections, making their presentation no easy affair like that of other forms of ambiguity that lack an accurate measure.

Estimation technique

As a result, the GARCH-MIDAS modeling architecture was used; this paradigm is built on the combined data sample method and permits the prediction of high-frequency episodes using knowledge of low-frequency series. Following these studies (Dilanchiev et al. 2021) (the ARCH and serial correlations testing at defined lags) of the data shown five marked panels, we examine the statistical aspects (regarding the location, spread, and shape). To be more precise, this result pertains to the classical minimum distance estimation method, which is considered in our research a feasible option for the GARCH-MIDAS model. Therefore, for any i-th observation in a random sample of size N, it is assumed that (please refer to Eqs. 1, 2, and 3):

While this is γ, a restricted variable category with the symbol is really indicated in Eq. (1), and it is assumed that a concurrent approach with the symbol occurs in equation γ;

Consideration of the solutions to the reduction problems serves as a mathematical demonstration of the reduction problem in equation γ. This is due to the weighted matrix’s replacing impact on the random solution, which has no bearing on the outcome of the GARCH-MIDAS approach when used for actual analysis.

The most interesting thing about the RWE is that it uses thresholds for regression identification criteria instead of structural ones when evaluating the loading array. The formula shows that there is a clear link, so the grade is (first-order) optimal (5). Here, a conventional two-step GMM is used to modify the scaling matrix in:

To compute the reduced form of weighting estimators (RWE), Eq. (5) is further elaborated in Eq. (6), Eq. (7), and Eq. (8) respectively. This is to estimate the GARCH-MIDAS technique,

in which,

where if the contingent average criteria is valid, then BG is equal to 0.

This study presents a novel approach for determining the optimal weighting matrix for GARCH-MIDAS estimates with precisely specified threshold regression models.

Study data

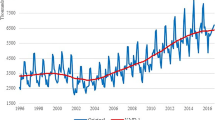

This research makes use of a wide variety of data, including the everyday currency value yields of the BRICS countries and the UK; various metrics (past and present ballpark data, recent, and great nation) of geopolitical risks (GPR, threat, and attack); and oil confusion, the former of which are utilized as a surrogate for external shocks as well, provided that traditionally, wild changes in the cost of oil have been connected with world issues and disaster risk reduction. In this case, it is crucial to remember that the conditioned variance obtained from an ARCH (1,1) model provides the basis for crude price unpredictability. From GFD, we may extrapolate the standard nominative exchange rate in dollars. The beginning dates for the studied nations’ currency value fluctuations, geopolitical developments, and oil uncertainties range from the 1980 to 2020 (for all BRICS countries). In addition to the oil price volatility as a proxy for external shocks, we also utilize a chronological dataset on geopolitics risk, acquired by having to count the incidence of things relating to regional tensions from automated content search queries of news outlets.

Results and discussion

Preliminary findings

The past few years have seen generally reduced levels of worldwide geopolitical risk compared to history and long-term averages. With regard to GPR and GPR attacks specifically, it can be seen that both are more dispersed about their mean value, and a sign of risk increases in the cultural range era than over the more recent past. Russia and India have the lowest and greatest great nation GPR, respectively, with the median falling between 1.201 and 0.649. China’s GPR is the most subordinate variable of the BRICS nations, whereas India’s looks to be the most unpredictable (see Table 1).

First, during times of market volatility, such as a stock market drop, individuals are shown to shift cash from the sale of equities to gold, corresponding with the positive link between gold returns and share prices. This action represents the belief that gold is a haven during stock economic slowdowns and may be used as a protection against the share market. The findings corroborate those of Kuo et al. (2019). Furthermore, the rate of inflation component is positive and statistically significant, suggesting that an increase in the inflation rate would encourage financial firms to retain gold as a buffer versus economic gain. Because of this change, the gold return increases as a desire for the precious metal grows. This result accords with the data showing gold reacts substantially to the announcement of CPI news and functions as a hedge against rising prices (Yang et al. 2020). Third, a positive earnings growth coefficient indicates a negative relationship between gold returns and income growth. Lower economic expansion during the COVID-19 pandemic has been linked to the rise in gold prices. The results we obtained corroborate the findings and the data gathered by Chishti et al. (2021).

There is a positive statistically significant approximation for the coefficient of Vr,t, which brings us to the fifth point. This result demonstrates how reporters’ perceptions and expressions of real-time doubt affect gold values. Therefore, the published news of ambiguity produces turbulence in the money system, influencing the gold market. A higher EPU is consistent with the theory that a higher EPU reduces economic activity and increases employment by delaying output. Most people keep gold on hand as hedging against the possibility of a decline in their purchasing power because of financial volatility. Accastello et al. (2019) find that EPU is a decisive factor in considering gold as a place of refuge, particularly after 2008. The data is also consistent with research by Chai et al. (2020) that found commodity prices respond dynamically to changes in EPU in China (see Table 2).

Multivariate regression output

Table 2’s persuasive data suggests that a general equilibrium strategy is warranted when depending on a single element. Also, it is possible that a single predictor variable does not provide enough coverage to describe gold return behavior adequately. Moreover, in multiple scenarios, biased approximations are likely to be generated due to the absence of certain covariates serving as control variables. Because of this, we use a multidimensional model to make our estimates. Table 3 displays the findings, all values in Table 3 explain the anticipated signs, and consistent with basic linear regression. However, the adjusted R2 is much higher, suggesting that the predicted outcomes increase using a multiple-regression model. US investors can also acquire gold via cross-border competition using commodities other than the dollar (see Table 3). In this way, the USD equivalents of the commodity prices are calculated using market rates. Now that we know how golden returns fluctuate in the American market, we can look at how it acts in other important gold markets, including the UK, the European Union, China, and India. Table 4 summarizes the estimated gold return calculation from a global viewpoint. The following are the particular presumptions. At the same time, local factors (such as GDP growth) are considered drivers of commodity prices. Probabilistic relationships between a golden return and its antecedents for the preponderance of parameters which are providing the qualitatively similar findings in marketplace as in the US market (see Table 3). Based on these results, it seems that, other than in India, gold fulfills a comparable purpose in all markets we examined. However, the stock return coefficients are indicating variation.

According to our findings, the currency markets are bearish, suggesting that rising gold prices lead to a devaluation of the home currency. That is why there is a good correlation, too. In contrast to its major commercial competitor, the USA, both nations have substantially weaker challenging situations. Aside from a few isolated cases in India, all other parameter estimations are in line with predictions regarding both their signals and their degrees of statistical significance. Gold is often traded between buyers and sellers in local marketplaces using the respective country’s currency. Only the US and Indian markets exhibit a negative and substantial association between gold return and stock return. In light of this study, one might conclude that investors in these two sectors switch their holdings from equities to gold when stock markets fall (Maity and Sharma 2020). However, the fitted values of the stock return parameter in the UK, the European Union, and China suggest that this occurrence does not manifest in many other marketplaces. This result indicates that gold is not seen as a place of refuge in the event of a worldwide stock market crash. The findings of this research constantly support the idea that gold is a strong hedge against concerns originating from disturbances in macroeconomic factors, such as an increase in the inflation rate or a slowdown in earnings growth. This is confirmed by the fact that both the income and inflation coefficients are positive, indicating a faster inflation rate. As so, it agrees with earlier research (Aggelopoulos and Georgopoulos 2017). The outcomes of the tests showed that these ambiguity factors are good statistical measurements for various sources of doubt that might account for the fluctuation of commodity prices. The data agree with the scholarship that backs the idea of utilizing many seeds of doubt. This research lends credence to the idea that a larger gold return is favorably connected with elevated EPU when the gold price is stated in the national currency. In contrast, most of those studies utilize the gold price represented in USD.

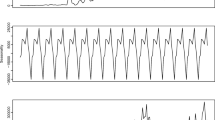

Lag-based relationship estimation outputs

The GARCH-MIDAS-X model’s superiority goes beyond the in-sample data. The accuracy from our (30- and 60-day ahead) projections is improved in systems that include all three main GPR proxies individually compared to those that do not. The examples of China and South Africa show this to be true. Aside from the 60 days when GPR was the only forecast, GARCH-MIDAS-X is the method of choice in Brazil. As the traditional GARCH-MIDAS is often adopted, the previous GPR proxies in Russia and India are unique. Consistent with the preceding, the GARCH-MIDAS-X model that includes any of the last GPR indicators is often chosen over the standard GARCH-MIDAS model (Table 5). And this is on top of Table 2’s already-confirmed unpredictability, which demonstrates the value of factoring in some degree of political risk whenever one is trying to forecast shifts in the value of a currency. While a GARCH-MIDAS-X consistently outperforms the GPR benchmarks in the in-sample for all BRICS nations, the usefulness of any of the GPR proxies in a prediction for currency depreciation may vary on the BRICS nation being evaluated.

The negative confidence factors in the Indian market suggest that gold is seen as a liquid asset that may be utilized to protect consumer demands against losses when ambiguity rises. Therefore, gold owners will sell this commodity to stabilize their earnings and fulfill their consumption requests during economic turmoil. As a consequence of this trend, we find that gold prices are negatively correlated with the unpredictability suggested by the rainfall hypothesis in India. The preceding statistical evidence assumes that the parameter relationships are time-bound. Factors including communication lag, marketplace friction, and the usage of seems by market players all have a role in how quickly the marketplace reacts to variations in the variables studied (Baffes et al. 2020). This is why we provide delayed estimations in the following section. We find the predicted findings to be rather intriguing. There is strong evidence of a lagging impact for a few of the covariates; nevertheless, the presence of others with opposite signals implies that these modifications are temporary at best. Separate national economies, levels of risk aversion, parameter tolerances, and false relationships can contribute to inconsistent findings (Table 6).

Sensitivity analysis

Table 7 shows the results of a sensitivity analysis with different scenarios for historical geopolitical risk with currency fluctuations, recent geopolitical risk with economic stability, and country uncertainty for the five countries: India, China, Russia, South Africa, and Brazil.

For historical geopolitical risk with currency fluctuations, all countries show significant results for all variables, with India and China having the highest coefficients. For recent geopolitical risk with economic stability, India shows significant results for all variables, while China shows significant results for four variables. Russia, South Africa, and Brazil show significant results for three variables each.Regarding country uncertainty, all countries show values below 1, indicating that the uncertainty variable has a weak impact on the model. We demonstrate that the unpredictability variable is statistically important for three of the five nations we investigated (Brazil, India, and South Africa), and its sign is consistently negative. When using up-to-date GPR data, the same nations have very comparable characteristics. Nevertheless, we discover contrary information between the most up-to-date global GPR data collected from individual countries. In contrast to the latter, the latter has a minus number. That is to say, foreign currency rates in Brazil, India, and South Africa are more susceptible to international (rather than local) geopolitical threats. The beta weights are still larger than 1, indicating that recent discoveries are given more weight than those made at far larger time delays.

Table 7 shows the results in a three-panel layout. There is quantitative support for all parameter estimates that are useful for predicting the long- and short-term behavior of volatility in exchange rates. The combined ARCH and GARCH concepts support a view of persistently high but eventually neutral return volatility. All the beta weights are larger than one, indicating that more emphasis is being placed on recent events than on those occurring at a considerable distance in the past. But even though the calculated coefficients on the GPR proxies’ prediction are high in all situations except China when GPR danger is used and India and China when GPR assault is used, statistically significant difference for the GPR proxies is discovered irrespective of whether GPR proxy is utilized. Concerning all the BRICS nations, excluding Russia (positively signed both in the long- and short-term sample data) and China, there is a striking departure from the position when a broader range of data specimens is employed (negatively signed both in the long and short-range data sample). Specifically for Brazil, India, and South Africa, this finding suggests that the direction of predictability may be sample-dependent. While historical GPR data show that Russia’s currency is the most volatile, current data reveal that Brazil’s, India’s, and South Africa’s have grown more volatile in recent years. China seems to be the least susceptible. In Table 7, we can see the results of comparing the GARCH-MIDAS-X model, which uses more current GPR variables to predict exchange rate volatility, to the more traditional GARCH-MIDAS model.

Discussion

In light of the findings, we compare the prediction errors of GARCH-MIDAS-X models that independently include country-specific GPRs and oil uncertainty to those of a standard GARCH-MIDAS model to gauge the dependability of currency exchange return across the BRICS nations. For both in-sample (30-day) and out-of-sample (60-day) prediction ranges helps to the assess of results. Table 4 compares the findings from Tables 3 and 5, which show the worldwide GPRs’ previous and current data standings, respectively. During the study period, the GARCH-MIDAS-X model with nation GPR fared better than the standard in all BRICS countries, excluding China. It continuously outperformed the traditional in all BRICS countries save India. When comparing the short and long out-of-sample periods in Brazil, Russia, and China for oil uncertainties, the GARCH-MIDAS-X model is favored above the traditional GARCH-MIDAS. In China’s performances, neither the GARCH-MIDAS-X nor the standard GARCH-MIDAS model performed noticeably better. Compared to the standard GARCH-MIDAS model, which does not include the external variable, the GARCH-MIDAS-X models that independently contain great nation GPR and oil uncertainties do substantially better (Feng et al. 2021).

In terms of predicted effectiveness, we find that the GARCH-MIDAS-X model performs better than the traditional GARCH-MIDAS model when using oil unpredictability and the three main GPR proxy servers to anticipate the volatility of exchange rates of BRICS countries during the in-sample period (Banguero et al. 2020). However, when using only the most recent GPR proxy servers, the comparative RMSE values were close to one (see result from Table 4). Likewise, the GARCH-MIDAS-X model’s superiority over the traditional GARCH-MIDAS extends beyond the in-sample timeframe, with a consistent trend in both out-of-sample timespan specifications (30- and 60-day ahead forecast periods). Incorporating the various GPR proxies (particularly historical data) and oil uncertainties into the GARCH-MIDAS architecture improves accuracy over a GARCH-MIDAS structure without these indicators, as shown by the results. Lastly, for the sake of brevity, we evaluate the monetary weight of out-of-sample prediction of GPR when adjusting for varying degrees of risk appetite and solvency ratio (Albrizio et al. 2017). Our findings demonstrate that when tail risk level and profitability ratios are believed to be 1 and 5, in both, our prediction model variations (particularly the different versions integrating recent and historical GPR-attack, and oil ambiguity) focus on providing greater financial prosperity but with increased danger than the traditional GARCH-MIDAS model.

Additionally, our prediction model versions with each ambiguity indicator demonstrated economic improvements concerning Russia, India, and China, with larger rewards and greater risks. Expected profits are always coupled with increased danger, and this pattern holds over a wide range of risk tolerance and liquidity ratio (Erasmus and Makina 2014). Whereas introducing ambiguity indicators increases economic advantages concerning yields, the related risk factors are likewise considerable. While the market’s inherent volatility creates a high risk, our dynamic model promises increased profits. It is analytically and financially important to include oil unpredictability and GPR (historical, current, or nation-specific) in the prediction model for BRICS economies exchange rate fluctuations.

Conclusion and policy implications

We conducted a temporal analysis of the role of geopolitical risk, currency fluctuation, and economic policy on tourist arrivals in BRICS economies from 1980 to 2020. Using a panel regression model with fixed effects, we analyzed data from BRICS economies.

Our findings suggest that these factors have significant and varying impacts on tourist arrivals in BRICS economies. Specifically, we found that geopolitical risk has a negative and significant impact on tourist arrivals. Currency depreciation has a negative and significant impact on tourist arrivals in the short term, but the effect weakens over time. Economic policy has a positive and significant impact on tourist arrivals, particularly when policies are favorable to the tourism industry. Tourist arrivals in BRICS economies have generally increased over time, but the growth rate has slowed in recent years. The impact of these factors on tourist arrivals varies across regions, with Asia and Latin America more heavily influenced by currency fluctuations, while Africa is more sensitive to geopolitical risks.

The BRICS economies exchange rates seem more vulnerable to world GPR than national GPR, according to a further study indicating discrepancies between the latest global GPR data and the great nation GPR data. Furthermore, we provide evidence of potential non-sample size-related economic advantages of including GPR in the pricing of currency exchange portfolios. Throughout this study, we use several GPR indicators, including world (historical and current) data and GRP data for individual BRICS economies countries, to assess the exposure of BRICS economies currency exchange to GPR. The major goals of this article are to (1) assess whether GPR can accurately predict future fluctuations in exchange rate rates and (2) assess whether GPR can predict exactly future fluctuations in exchange rate rates when employing different prediction timeframes.

The empirical results on the role of geopolitical risk, currency fluctuation, and economic policy on tourist arrivals in BRICS economies have important policy implications for policymakers and tourism industry stakeholders. Some of the key policy implications are as follows:

-

(1)

Mitigating geopolitical risk—policymakers should work to mitigate geopolitical risk factors such as terrorism, political instability, and civil unrest to maintain the safety and security of tourists. Measures such as enhanced security, crisis management plans, and emergency response systems can help to reassure tourists and prevent the negative impact of geopolitical risk on tourist arrivals.

-

(2)

Managing currency fluctuations—as currency fluctuations can significantly impact tourism activities, policymakers and tourism industry stakeholders should develop strategies to manage currency fluctuations effectively. Such strategies can include pricing policies that are responsive to changes in exchange rates, diversification of tourism products to attract a wider range of visitors, and investment in tourism infrastructure to enhance the value proposition of tourism products.

-

(3)

Developing stable economic policies—stable economic policies can help to attract tourists by promoting economic growth, increasing consumer confidence, and improving the overall economic environment. Policymakers should work to develop stable economic policies that promote sustainable economic growth, including investment in tourism infrastructure, tax policies that encourage private sector investment, and measures that promote economic diversification.

-

(4)

Enhancing marketing strategies—policymakers and tourism industry stakeholders should develop targeted marketing strategies that are responsive to changes in geopolitical risk, currency fluctuations, and economic policy changes. Marketing strategies can include promoting destinations that are perceived as safe and secure, offering pricing incentives to counteract currency fluctuations, and targeting niche markets that are less sensitive to changes in economic policies.

Overall, the research on the role of geopolitical risk, currency fluctuation, and economic policy on tourist arrivals in BRICS economies highlights the importance of developing policies and strategies that can effectively manage these factors. By doing so, policymakers and tourism industry stakeholders can help to promote sustainable tourism growth and economic development in BRICS economies.

Although this study has contributed to the literature, it is important to recognize its limitations. Data availability and reliability may pose a challenge, particularly for BRICS economies where statistical data may be scarce or not readily accessible. The study focused on a specific period, and geopolitical risks, currency fluctuations, and economic policies may vary over time. Hence, the generalizability of the findings may be limited. This study does not account for other factors that may influence tourist arrivals, such as cultural and social factors, natural disasters, and health crises. We only focused on BRICS economies, and the results may not be applicable to developed economies.

Although our study provides valuable insights into the effectiveness of a new medication for treating depression. There are several avenues for future research that could build upon our findings such as; conduct a comparative analysis of the impact of geopolitical risk, currency fluctuation, and economic policy on tourist arrivals across different regions, such as Asia, Africa, or Latin America; explore the role of technology and digitalization in mitigating the impact of geopolitical risk, currency fluctuation, and economic policy on the tourism industry in BRICS economies; investigate the role of cultural factors and perceptions of safety and security in tourist decision-making in the context of BRICS economies; analyze the potential impact of climate change on tourism in BRICS economies and the role of policy interventions in mitigating this impact.

These future research directions could help further our understanding of the complex relationships between geopolitical risk, currency fluctuation, economic policy, and tourist arrivals in BRICS economies.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Accastello C, Bieniasz A, Blaško R et al (2019) Conflicting demands on the natural resources in Northern Sweden: a participatory scenario development study. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500170

Aggelopoulos E, Georgopoulos A (2017) Bank branch efficiency under environmental change: a bootstrap DEA on monthly profit and loss accounting statements of Greek retail branches. Eur J Oper Res 261:1170–1188

Agyekum EB, Amjad F, Mohsin M, Ansah MNS (2021) A bird’s eye view of Ghana’s renewable energy sector environment: a multi-criteria decision-making approach. Util Policy. https://doi.org/10.1016/j.jup.2021.101219

Albrizio S, Kozluk T, Zipperer V (2017) Environmental policies and productivity growth: evidence across industries and firms. J Environ Econ Manag 81:209–226. https://doi.org/10.1016/J.JEEM.2016.06.002

Anna M, Bobba S, Ardente F et al (2019) Energy and environmental assessment of a traction lithium-ion battery pack for plug-in hybrid electric vehicles. J Clean Prod 215:634–649. https://doi.org/10.1016/j.jclepro.2019.01.056

Baffes J, Dieppe AM, Guenette JD et al (2020) Global Economic Prospects: June 2020.

Banguero E, Correcher A, Pérez-Navarro Á et al (2020) Diagnosis of a battery energy storage system based on principal component analysis. Renew Energy. https://doi.org/10.1016/j.renene.2019.08.064

Chabi Simin Najib D, Fei C, Dilanchiev A, Romaric S (2022) Modeling the impact of cotton production on economic development in Benin: a technological innovation perspective. Front Environ Sci 10. https://doi.org/10.3389/fenvs.2022.926350

Chai X, Hu L, Zhang Y et al (2020) Specific ACE2 expression in cholangiocytes may cause liver damage after 2019-nCoV infection. biorxiv, 2020-02.

Chang L, Chen K, Saydaliev HB, Faridi MZ (2022a) Asymmetric impact of pandemics-related uncertainty on CO2 emissions: evidence from top-10 polluted countries. Stoch Environ Res Risk Assess 36:4103–4117. https://doi.org/10.1007/s00477-022-02248-5

Chang L, Gan X, Mohsin M (2022b) Studying corporate liquidity and regulatory responses for economic recovery in COVID-19 crises. Econ Anal Policy 76:211–225. https://doi.org/10.1016/j.eap.2022.07.004

Chang L, Lu Q, Ali S, Mohsin M (2022) How does hydropower energy asymmetrically affect environmental quality? Evidence from quantile-based econometric estimation. Sustain Energy Technol Assess 53:102564. https://doi.org/10.1016/j.seta.2022.102564

Chang L, Taghizadeh-Hesary F, Chen H, Mohsin M (2022) Do green bonds have environmental benefits? Energy Econ 115:106356. https://doi.org/10.1016/j.eneco.2022.106356

Chang L, Taghizadeh-Hesary F, Saydaliev HB (2022e) How do ICT and renewable energy impact sustainable development? Renew Energy 199:123–131. https://doi.org/10.1016/j.renene.2022.08.082

Chang L, Moldir M, Zhang Y, Nazar R (2023) Asymmetric impact of green bonds on energy efficiency: fresh evidence from quantile estimation. Util Policy 80:101474. https://doi.org/10.1016/j.jup.2022.101474

Chang L, Shi F, Taghizadeh-Hesary F, Saydaliev HB (2023) Information and communication technologies development and the resource curse. Resour Policy 80:103123. https://doi.org/10.1016/j.resourpol.2022.103123

Chenghui Lu, Dilanchiev A (2022) The nexus of financial deepening and poverty: the case of Black Sea region economies. Singapore Econ Rev 1–23.https://doi.org/10.1142/S0217590822440064

Chishti MZ, Ahmad M, Rehman A, Khan MK (2021) Mitigations pathways towards sustainable development: assessing the influence of fiscal and monetary policies on carbon emissions in BRICS economies. J Clean Prod 292. https://doi.org/10.1016/j.jclepro.2021.126035

Cumming D, Deloof M, Manigart S, Wright M (2019) New directions in entrepreneurial finance. J Bank Financ 100:252–260. https://doi.org/10.1016/j.jbankfin.2019.02.008

Dilanchiev A, Taktakishvili T (2021) Currency depreciation nexus country’s export: evidence from Georgia. Univers J Account Financ 9:1116–1124. https://doi.org/10.13189/ujaf.2021.090521

Dilanchiev A, Aghayev A, Rahman M et al (2021) Dynamic analysis for measuring the impact of remittance inflows on inflation: evidence from Georgia. Int J Financ Res 12:339. https://doi.org/10.5430/ijfr.v12n1p339

Erasmus C, Makina D (2014) An empirical study of bank efficiency in South Africa using the standard and alternative approaches to data envelopment analysis ( DEA ). J Econ Behav Stud 6:310–317

Fang W, Liu Z, Surya Putra AR (2022) Role of research and development in green economic growth through renewable energy development: empirical evidence from South Asia. Renew Energy 194:1142–1152. https://doi.org/10.1016/j.renene.2022.04.125

Feng H, Fu S, Xu Y (2021) Fault diagnosis of rotating machinery based on BN-1DCNN model. Zhendong yu Chongji/Journal Vib Shock 40:302–308. https://doi.org/10.13465/j.cnki.jvs.2021.19.038

Fernandes SC da, Pigosso DCA, McAloone TC, Rozenfeld H (2020) Towards product-service system oriented to circular economy: a systematic review of value proposition design approaches. J Clean Prod 257.https://doi.org/10.1016/j.jclepro.2020.120507

Huang W, Chau KY, Kit IY et al (2022) Relating sustainable business development practices and information management in promoting digital green innovation: evidence from China. Front Psychol 13:930138. https://doi.org/10.3389/fpsyg.2022.930138

Ikram M, Mahmoudi A, Shah SZA, Mohsin M (2019a) Forecasting number of ISO 14001 certifications of selected countries: application of even GM (1,1), DGM, and NDGM models. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-04534-2

Ikram M, Sroufe R, Mohsin M et al (2019b) Does CSR influence firm performance? A longitudinal study of SME sectors of Pakistan. J Glob Responsib. https://doi.org/10.1108/jgr-12-2018-0088

Iqbal W, Yumei H, Abbas Q et al (2019) Assessment of wind energy potential for the production of renewable hydrogen in Sindh Province of Pakistan. Processes. https://doi.org/10.3390/pr7040196

Iqbal N, Tufail MS, Mohsin M, Sandhu MA (2022) Assessing social and financial efficiency: the evidence from microfinance institutions in Pakistan. Pakistan J Soc Sci 39:149–161

Iram R, Zhang J, Erdogan S et al (2020) Economics of energy and environmental efficiency: evidence from OECD countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-07020-x

Kuo TC, Chiu MC, Chung WH, Yang TI (2019) The circular economy of LCD panel shipping in a packaging logistics system. Resour Conserv Recycl 149:435–444. https://doi.org/10.1016/j.resconrec.2019.06.022

Li C, Umair M (2023) Does green finance development goals affects renewable energy in China. Renew Energy 203:898–905. https://doi.org/10.1016/j.renene.2022.12.066

Liu Y, Dilanchiev A, Xu K, Hajiyeva AM (2022) Financing SMEs and business development as new post Covid-19 economic recovery determinants. Econ Anal Policy 76:554–567. https://doi.org/10.1016/j.eap.2022.09.006

Liu F, Umair M, Gao J (2023) Assessing oil price volatility co-movement with stock market volatility through quantile regression approach. Resour Policy 81:103375. https://doi.org/10.1016/j.resourpol.2023.103375

Maity P, Sharma S (2020) Block chain technology in coffee industry in India. PRAGATI J Indian Econ 7:61. https://doi.org/10.17492/PRAGATI.V7I1.196024

Mohsin M, Naseem S, Zia‐ur‐Rehman M et al (2023) The crypto‐trade volume, GDP, energy use, and environmental degradation sustainability: An analysis of the top 20 crypto‐trader countries. Int J Finance Econ 28(1):651–667

Mohsin M, Nurunnabi M, Zhang J et al (2020a) The evaluation of efficiency and value addition of IFRS endorsement towards earnings timeliness disclosure. Int J Financ Econ. https://doi.org/10.1002/ijfe.1878

Mohsin M, Taghizadeh-Hesary F, Iqbal N, Saydaliev HB (2022a) The role of technological progress and renewable energy deployment in green economic growth. Renew Energy. https://doi.org/10.1016/j.renene.2022.03.076

Mohsin M, Taghizadeh-Hesary F, Shahbaz M (2022b) Nexus between financial development and energy poverty in Latin America. Energy Policy 165:112925. https://doi.org/10.1016/j.enpol.2022.112925

Nguyen HM, Bui NH, Vo DH, McAleer M (2019) Energy consumption and economic growth: evidence from Vietnam. J Rev Glob Econ 8:350–361. https://doi.org/10.6000/1929-7092.2019.08.30

Pan W, Cao H, Liu Y (2023) “Green” innovation, privacy regulation and environmental policy. Renew Energy 203:245–254. https://doi.org/10.1016/j.renene.2022.12.025

Patil S, Nemade V, Soni PK (2018) Predictive modelling for credit card fraud detection using data analytics. Procedia Comput Sci 132:385–395. https://doi.org/10.1016/J.PROCS.2018.05.199

Quigley MC, Attanayake J, King A, Prideaux F (2020) A multi-hazards earth science perspective on the COVID-19 pandemic: the potential for concurrent and cascading crises. Environ Syst Decis. https://doi.org/10.1007/s10669-020-09772-1

Raychaudhuri A, Ghosh SK (2016) Biomass supply chain in Asian and European countries. Procedia Environ Sci 35:914–924. https://doi.org/10.1016/j.proenv.2016.07.062

Shah SAA, Zhou P, Walasai GD, Mohsin M (2019) Energy security and environmental sustainability index of South Asian countries: a composite index approach. Ecol Indic 106:105507. https://doi.org/10.1016/j.ecolind.2019.105507

Ullah K, Rashid I, Afzal H et al (2020) SS7 vulnerabilities—a survey and implementation of machine learning vs rule based filtering for detection of SS7 network attacks. IEEE Commun Surv Tutorials 22:1337–1371. https://doi.org/10.1109/COMST.2020.2971757

Wang P, Casner RG, Nair MS, et al (2021) Increased resistance of SARS-CoV-2 variant P. 1 to antibody neutralization. Cell host & microbe 29(5):747-751

Wu Q, Yan D, Umair M (2022) Assessing the role of competitive intelligence and practices of dynamic capabilities in business accommodation of SMEs. Econ Anal Policy. https://doi.org/10.1016/j.eap.2022.11.024

Xia Z, Abbas Q, Mohsin M, Song G (2020) Trilemma among energy, economic and environmental efficiency: can dilemma of EEE address simultaneously in era of COP 21? J Environ Manag. https://doi.org/10.1016/j.jenvman.2020.111322

Xiuzhen X, Zheng W, Umair M (2022) Testing the fluctuations of oil resource price volatility: a hurdle for economic recovery. Resour Policy 79:102982. https://doi.org/10.1016/j.resourpol.2022.102982

Yang Y, Tang D, Zhang P (2020) Effects of fiscal decentralization on carbon emissions in China. Int J Energy Sect Manag. https://doi.org/10.1108/IJESM-03-2019-0001

Zhang D, Mohsin M, Rasheed AK et al (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy. https://doi.org/10.1016/j.enpol.2021.112256

Acknowledgements

The third author would like to thank Robert B. Miller and Howard E. Thompson for their continuous guidance and encouragement. This research has been supported by Asia University, China Medical University Hospital, The Hang Seng University of Hong Kong, the Research Grants Council (RGC) of Hong Kong (project numbers 12502814 and 12500915), and the Ministry of Science and Technology (MOST, Project Numbers 106-2410-H-468-002 and 107-2410-H-468-002-MY3), Taiwan.

Funding

This study is supported via funding from Prince Sattam Bin Abdulaziz University. (Project No: PSAU/2023/R/1444)

Author information

Authors and Affiliations

Contributions

Conceptualization and data collection: Anis Ali; methodology, software, and validation: Huong Tran Thi Thu; formal analysis and supervision: Phan The Cong; writing of original draft: Geovanny Genaro Reivan Ortiz; editing: Wing-Keung Wong; proof reading and revisions: Shamim Akhter.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Arshian Sharif

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Preprints

This manuscript is uploaded or submitted not for preprint services.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Reivan-Ortiz, G.G., Cong, P.T., Wong, WK. et al. Role of geopolitical risk, currency fluctuation, and economic policy on tourist arrivals: temporal analysis of BRICS economies. Environ Sci Pollut Res 30, 78339–78352 (2023). https://doi.org/10.1007/s11356-023-27736-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-27736-1