Abstract

New energy strategies are crucial to address energy and environmental issues, but the energy consumption transition may also affect firm behavior with unintended economic consequences. Using data from A-share listed companies from 2010 to 2019, this paper investigates the impact of energy consumption structure transformation on firms’ total factor productivity (TFP) using China’s new energy demonstration city (NEDC) policy as a shock. It is found that the NEDC reduces firms’ TFP by about 6.4%. This conclusion still holds after a series of robustness and endogeneity tests. According to the channel analysis, NEDC reduces the efficiency of firms’ resource allocation and innovation, resulting in efficiency losses. Furthermore, differences in firms’ ownership and geographical location make the impact of NEDC on TFP heterogeneous. For example, the hindering effect of NEDC on TFP is more pronounced in private firms and firms in regions with lower marketization. This paper shows that the promotion and application of new energy may have certain economic costs. To better balance the benefits and costs of new energy strategies, the government and other relevant departments should increase policy flexibility and perfection.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Energy plays a key role in a country’s sustainable development and social stability (Samant et al. 2020). Excessive reliance on traditional energy sources not only exacerbates pollution but it also contributes directly to global warming and the frequency of extreme natural disasters. Furthermore, as the global economy grows in size, overexploitation of traditional energy sources may cause premature and irreversible resource depletion (Jalalimajidi et al. 2018). Since the beginning of the century, the frequency of environmental constraints and energy crises has compelled an increasing number of countries to address the energy crisis. On the one hand, many countries have attempted to redistribute energy allocation in economic development through administrative and market regulation mechanisms with the goal of optimizing energy output efficiency and thus reducing consumption of traditional energy sources. However, increasing energy efficiency necessitates not only long-term policy support but also matching service and consumption demand (Shove 2018). On the other hand, developed countries such as Europe and the USA are transforming their energy consumption by developing new energy projects and promoting the development of new energy industries, thereby alleviating energy challenges. As a result, research on the energy consumption transition is both practical and urgent.

In fact, numerous literatures have been conducted to investigate the economic effects of energy consumption transition, but the results have been mixed and ambiguous.Footnote 1 According to the literature, renewable energy consumption has a positive effect on economic growth (Emir and Bekun 2019; Koçak and Şarkgüneşi 2017), indicating that optimizing the energy structure can effectively counteract downward economic pressures. However, there is literature that provides empirical evidence that the energy transition is unrelated to economic growth (Payne 2009; Feng et al. 2009). Payne (2009), for example, concluded that the impact of renewable and nonrenewable energy sources on output was statistically insignificant. Moreover, Destek and Aslan (2017) showed that the economic effects of energy consumption transition differ by country; for example, the effect of renewable energy consumption on economic growth was neutral in most emerging economies but positive in Peru. Existing studies also focus on the social effects of the energy consumption transition, and they all generally support the positive effects in terms of reducing pollution and improving air quality (Wang et al. 2019a, b; Chen et al. 2018; Ozturk and Yuksel 2016; Sun et al. 2018).

However, existing literature seems to have neglected the impact of energy consumption transition on total factor productivity (TFP). TFP measures the efficiency of growth of output from the combined effect of input factors such as capital and labor (Solow 1957) and is the source of sustained economic growth (Krugman 2000). Global TFP growth has nearly stalled since 2010. As a result, the research on TFP has a broader connotation than simply examining the impact of energy consumption transition on output. While there is a small literature on the impact of renewable energy on TFP at the country level (Tugcu and Tiwari 2016; Sohag et al. 2021), the findings are inconsistent. At the same time, research on this topic still lacks a careful examination of micro-subject responses as well as strict causal inference. On the one hand, the cleaner energy consumption transition may encourage firms to increase their R&D investments in order to upgrade their original production facilities, and the impact of R&D investments on firms’ TFP is crucial (Baumann and Kritikos 2016). On the other hand, an increase in TFP may have an impact on firms’ market competitiveness, prompting them to take on more social responsibility (Campbell 2007) and change their current energy consumption structure. In summary, it can be seen that the mutual causal relationship between the two is highly likely to impact the credibility of causal inferences. Our research attempts to fill the gap in this area.

Based on existing research, theoretically, the energy consumption transition may have very different effects on firms’ TFP. On the one hand, the energy consumption transition may increase the TFP. Along with the energy consumption transition, enterprises’ existing production conditions cannot be adapted or satisfied; thus, in order to modify or upgrade the existing production conditions, enterprises will invest heavily in R&D and technological innovation, which will help promote the efficiency of internal resource allocation and increase the TFP. On the other hand, the energy consumption transition may also reduce the TFP. During the transition period, enterprises have to break the original input–output model and consider issues such as the uncertainty of the energy consumption transition. Enterprises may suffer from the double blow of resource allocation efficiency and declining innovation levels, resulting in a significant decline in TFP. To summarize, the relationship between the energy consumption transition and firm TFP is ambiguous and requires further empirical support.

This paper draws on the exogenous shock of the construction of the NEDC in China to explain the response of firms in this process. The Chinese context was chosen for four main reasons. First, China provides a representative context for examining the energy consumption transition. Over the past decades, China’s rapid economic growth has relied on a large number of energy-intensive manufacturing firms (He et al. 2020a, b). The crude development type has resulted in China becoming a large consumer of traditional energy sources. China has been the world’s largest energy consumer since 2010. According to the BP World Energy Statistical Yearbook (2022), China’s share of global energy consumption in 2021 was about 26.5%. As a result, the research on energy consumption transition in the Chinese context is distinct. Second, China’s green development concept provides an ideal experimental setting for our research. In recent years, the Chinese government has emphasized green growth and implemented several policies regulating energy consumption and environmental regulation (Zhang et al. 2022). The primary goal of these policies is to reduce pollution and carbon emissions, with the goal of reaching carbon neutrality by 2060 and a carbon peak by 2030. According to China’s National Energy Administration, China reduced CO2 emissions by 1.79 billion tons and sulfur dioxide emissions by 8.64 million tons in 2020. This context helps us observe the responses of enterprises in the process of energy consumption transition. Third, in the existing literature, there are significant differences in the effect of energy consumption transition on TFP among different countries (Tugcu and Tiwari 2016; Sohag et al. 2021).

The concept of NEDC was first introduced in China’s 12th Five-Year Plan for renewable energy development. The list of 81 demonstration cities (districts and counties) was released by China’s National Energy Administration in January 2014. The demonstration cities aim to optimize the energy consumption structure and promote the development of an ecological civilization (Zhang et al. 2022). Using this policy shock, this paper constructs a standard differences-in-differences model to investigate the impact of energy consumption transition on firm TFP. The NEDC reduces firms’ TFP by approximately 6.40%, according to the baseline regression results. We also consider various confounding factors and alternative explanations for the results, such as other policy overlays in the same period and control group selection bias, and the results remain conceivable. The channel analysis results demonstrate that NEDC reduces the enterprises’ resource allocation efficiency and innovation, which shocks TFP. Furthermore, we also examine the heterogeneity of NEDC policies. According to the results, the NEDC has a negative impact on TFP mainly in private firms and firms located in lower marketization regions.

This paper contributes to the literature in the following aspects. First, this paper contributes to and expands research on the economic effects of energy consumption, as well as clarifies the economic costs of structural energy consumption transition. The effect of energy consumption, particularly new energy consumption, on economic growth is ambiguous in existing literatures (Emir and Bekun 2019; Payne 2009; Feng et al. 2009; Destek and Aslan 2017). Furthermore, the existing literature has mostly examined the effect of energy consumption transition on TFP from a macro perspective at the country level (Tugcu and Tiwari 2016; Sohag et al. 2021), but investigation on the response of micro subjects is lacking. Although the green energy transition has been shown to promote the TFP of energy-based firms in some literature (Zhang and Kong 2022), it has special significance for energy sector firms, and energy-based firms’ TFP may also have unique characteristics. Based on a broader sample, this paper assesses the impact of NEDC on firms’ TFP. We conclude that there is an economic cost in terms of productivity loss for firms in developing countries in the energy consumption structure transition. Therefore, this paper not only deepens and expands the research content on energy consumption structure transformation but also overcomes the limitations of existing research to some extent.

Second, this paper contributes to a better understanding of the impact of environmental policies on firm-level TFP. The NEDC policy is essentially an environmental policy, and its main goal is to reduce firm environmental pollution by guiding them to optimize their energy consumption structure through increased new energy consumption. However, whether the Porter hypothesis holds is debatable in the existing literature (Rubashkina et al. 2015; Gray and Shadbegian 2003), and this paper provides a further answer based on the Chinese context. The answer in the context of China, which is the largest developing country in the world in terms of energy consumption and economic size, may be instructive and informative for the development of environmental policies in other countries.

Third, this paper systematically examines the channel of the NEDC effect on TFP and highlights the critical roles of resource allocation efficiency and innovation. This finding contributes to a better understanding of corporate behavior in developing countries as they encourage new energy strategies. Additionally, we also provide theoretical and empirical evidence on how to optimize energy consumption transition policies.

The remainder of the paper is organized as follows: In the next section, we present background information about the new energy demonstration city policy in China and research hypotheses. In the third section, we present the data and methodology, including sample selection, variable measurement, and identification strategy. The fourth section demonstrates the main empirical results and delves into addressing the central concern regarding the causal interpretation. The fifth section provides the discussion of the underlying channel. The sixth section investigates heterogeneity. Finally, the conclusions and implications are discussed in the last section.

Institutional background and research hypothesis

Institutional background

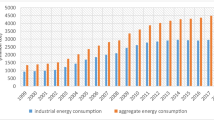

As China’s economy grows, so does the amount of traditional energy consumed. The contradiction between supply and demand in China’s energy consumption is constantly emerging under the guidance of “new development and post-governance.” China has gradually abandoned its original economic development type in pursuit of green development since 2012. General Secretary Xi Jinping stated that promoting green development requires adjusting the energy consumption structure and fostering clean energy industries. In this context, the Chinese government has introduced multiple policies aimed at environmental protection and energy consumption, including the NEDC.

This graph depicts the distribution of new energy demonstration cities. The horizontal axis represents each province in China, and the vertical axis represents the number of new energy demonstration cities in that province. Shanghai, Chongqing, Tianjin, Tibet, Hong Kong, Macau, and Taiwan do not have demonstration cities and are not included in the graph.

Figure 1 shows the number of new energy demonstration cities in each province. China’s eastern, central, and western regions each have 26, 29, and 27 demonstration cities, respectively. This suggests that the demonstration cities are widely dispersed, making them an ideal experimental setting for future research. Moreover, the notice specifies that the NEDC should strive for sustainable urban development, follow the development concept of new energy and new life, and actively promote the application of various new and renewable energy technologies (Zhang et al. 2022). The energy consumption transition in demonstration cities is more than just a title, and it also faces subsequent quality assessment by the central government. On the one hand, local governments must formulate specific plans and timetables for the transition based on their own city characteristics, as well as establish energy consumption monitoring stations for monitoring and assessment by higher authorities. On the other hand, the National Energy Administration and the National Development Bank have offered supporting financial services to the micro-components of the demonstration cities, covering a variety of aspects like credit, in an effort to mobilize the major energy consumers.

Some resource-based cities that may not only use new energy but also export it to other cities are on the list of new energy demonstration cities. This suggests that other cities’ energy consumption trends may also exhibit transition, which could affect estimation results. It is crucial to note that the evaluation standards for new energy demonstration cities are based on new energy consumption, not new energy output, as some may believe. For example, the assessment requirement for Chengde City in Hebei Province in 2015 is that the amount of alternative energy consumed by new energy should reach 9.5 million tons of standard coal per year, while the share of new energy consumption should reach 11.1% of the city’s total energy consumption.Footnote 2

Research hypothesis

The existing literature assesses the effects of NEDC primarily at the environmental and energy consumption levels, and all agree that the NEDC have positive effects. Using regional-level data in China, Zhang et al. (2022) discovered that the NEDC caused a significant increase in regional green energy consumption. According to Yang et al. (2021), the NEDC reduced wastewater emissions by around 12.88% and exhaust emissions by about 28.83% in Chinese cities. However, the assessment of the effects of NEDC policies at the economic development level is still lacking. Although some literature examines the impact of energy consumption structural transformation on a country’s TFP (Tugcu and Tiwari 2016; Sohag et al. 2021), regional TFP is a macro-addition to corporate TFP, and it is the firms that are the implementers of energy consumption policies. Therefore, an examination based on the firm perspective is not only helpful to judge the real effect of energy policies but also to clarify the policy response behavior of firms to optimize future policy arrangements. The original purpose of the NEDC was to promote the construction of ecological civilization and the role of renewable energy in environmental protection. From a broader viewpoint, the NEDC can be seen as a reflection of the Chinese government’s environmental regulation efforts at the energy consumption level. The Porter hypothesis argues that environmental regulation policies can increase firm costs and reduce firm performance, but reasonable regulation policies can offset this negative impact through institutional arrangements. This suggests that whether “good behavior” leads to “good results” for firms is unpredictable and dependent on institutional arrangements and internal firm decisions.

First, the NEDC policy may reduce the corporate TFP. On the one hand, the NEDC policy may reduce the efficiency of corporate resource allocation. The NEDC is a top-down energy policy initiated by the central government. Microentities, such as enterprises, need to adjust their decisions accordingly in order to meet the evaluation requirements and optimize the original traditional energy consumption patterns. However, enterprise production has a certain inertia, and there is a lock-in effect in the input–output patterns of different enterprises (Mattauch et al. 2015). Therefore, in the face of the NEDC policy, the adjustment of enterprises’ input–output patterns may make them deviate from the original optimal path, inevitably causing a loss of resource allocation efficiency. In addition, due to the restricted resource elements of firms, the production process of new energy consumption is sure to have a certain cost increase. Enterprises, for example, must modify or upgrade equipment to adapt to new energy input patterns. Therefore, enterprises face a choice of factor allocation in the process of energy structure transformation, and the reallocation of factors may reduce the efficiency of resource allocation through the crowding-out effect. On the other hand, the NEDC policy may hinder technological innovation in enterprises. Technological innovation is a driving force in achieving the structural transformation of energy consumption (Qu et al. 2023). However, corporate innovation activities are characterized by long cycles, large inputs, and high risks (Bansal and Hunter 2003), and whether enterprises engage in R&D innovation is determined by the cost–benefit trade-off (Borghesi et al. 2015). China’s intellectual property protection system is underdeveloped (Fang et al. 2017), and the compensatory effects of innovation may not be adequate to bridge the costs to enterprises. Tian et al. (2021) found that after a Chinese pilot program on green transformation was launched, innovation in cities declined by about 29%. It is well known that TFP is a comprehensive Solow residual, and it can be decomposed into the effects of technological progress and resource allocation (Chen et al. 2021). In summary, the following hypotheses are proposed:

-

Hypothesis 1. The NEDC decreases corporate TFP by reducing corporate resource allocation efficiency and innovation.

Furthermore, NEDC may increase corporate TFP. In the first place, the NEDC supports increasing enterprises’ energy efficiency. At the city level, the NEDC greatly raises new energy consumption (Zhang et al. 2022). The increased diversity of energy consumption in enterprises helps to improve energy efficiency, which in turn improves output efficiency. Second, the NEDC fosters enterprise technical innovation. The trade-off between costs and benefits will determine whether enterprises engage in technological innovation to adapt to new energy consumption. On the other hand, the NEDC requires local governments, banks, and others to provide appropriate supporting policies for firms, such as credit incentives and financial subsidies (Bossink 2017), which may be sufficient to compensate for innovation externalities. Third, the NEDC has a signaling effect. On the one hand, new energy consumption transformation is an important support for green development, and the NEDC sends positive guidance to the market for enterprises in pilot regions. Under the signaling effect, the resources in the market will gather for the enterprises in the pilot areas. On the other hand, NEDC sends a clear signal of green development to enterprises, which helps them clarify the development direction, increase the input of new energy consumption sectors, and reduce the input of high-energy-consumption sectors. In summary, the following hypotheses are proposed:

-

Hypothesis 2. The NEDC increases corporate TFP by improving corporate energy efficiency, innovation, and resource allocation efficiency.

Data and methodology

Sample selection and data collection

To investigate the micro-impact of energy consumption transition on TFP, this paper selects data from Chinese A-share listed companies and city-level data from 2010 to 2019. The year 2010 was chosen as the starting point for the sample data because the Chinese economy was severely impacted by the global financial crisis in 2008 and did not initially recover until 2010. The year 2019 was chosen as the endpoint because of the strict lockdown and quarantine measures imposed in China following the global outbreak of COVID-19 in 2020, which resulted in the closure of businesses in some areas. The sample interval of 2010–2019 effectively avoids the influence of events such as the financial crisis on the estimation results, and the policy effects obtained are more accurate. In addition, the sample is processed as follows: (1) exclude listed financial and real estate firms; (2) exclude firms with continuous losses (known as ST and ST* enterprises); (3) exclude firms that filed for an IPO after 2013; and (4) exclude firms with significant missingness in the main variables. Finally, considering the influence of extreme values, the continuous variables are winsorized at the 1% and 99% levels. The data for the listed companies in this paper are from the CSMAR database, and the data for the cities are from the China Urban Statistical Yearbook.

Variable construction

Total factor productivity

Because OLS regressions may affect the validity of the estimation results due to endogeneity issues, we employ the LP method to calculate firm TFP (Levinsohn and Petrin 2003). The Cobb–Douglas production technology is assumed in the LP method:

where i and t denote the firm and the year, respectively. y, l, m, and k are the logs of the firm’s output, labor input, intermediate goods input, and capital input, respectively. μ is residual. Following the general approach of previous literature, we use the log of the firm’s operating income as a proxy variable for output, the log of the firm’s number of employees as a proxy variable for labor input, the log of cash paid for the purchase of goods and services as a proxy variable for intermediate inputs, and the log of the firm’s net fixed assets as a proxy variable for capital input. We can now calculate the firm’s TFP using the LP method. In addition, in the robustness test, we calculated the firm’s TFP using the OP method (Olley and Pakes 1996).

Energy consumption transition

The NEDC is defined as a standard differences-in-differences form, DID = Post × Treat. Post is a dummy variable that takes the value of 1 after the policy is implemented (2014–2019) and 0 otherwise. Treat is a dummy variable that takes the value of 1 if the firm’s city is one of the new energy demonstration cities. Our main variable of interest is DID. If the coefficient for this variable is positive, the TFP of the firm has increased as a result of the NEDC, and vice versa.

Control variables

Given the issue of bad control (Angrist and Pischke 2009), we select fewer control variables at the firm level, including only the most basic characteristics of firms (firm size, leverage, nature of ownership, and age). At the city level, we select the basic characteristics of the city at the start of the sample (2010) as control variables (economic development, financial sophistication, and government intervention) and include them in the regression equation as a year trend. In specific, at the firm level, firm size (Size) is denoted by the log of the firm’s total assets; leverage (Lev) is calculated as the ratio of the firm’s total liabilities to its total assets; nature of ownership (POE) is a dummy variable that takes the value of 1 if the firm is privately held and 0 otherwise; and firm age (Age) is denoted by the log of the current year less the year of the firm’s IPO. At the city level, economic development (Pgdp) is expressed as the logarithm of the city’s GDP per capita; financial sophistication (Cfin) is expressed as the share of the city’s financial institution loan balance in GDP; and government intervention (Cgov) is measured as the share of the city’s fiscal expenditure in GDP.

Table 1 shows the symbols and definitions of the variables used in this paper.

Empirical strategy

In order to examine the impact of the NEDC on firms’ TFP, the following model is constructed:

where i denotes the firm, c denotes the city in which the firm is located, and t denotes the year. tfpict is the log TFP of firm i in city c in year t, calculated by the LP method. DIDict then denotes whether firm i in city c is affected by the energy consumption transition in year t. X denotes the time-varying control variables at the firm level, such as firm size and leverage. C denotes the initial characteristics at the city level, and f(t) denotes the year trend. δ and η denote year fixed effects and firm fixed effects, respectively. Based on the previous research hypotheses, we focus on the sign, magnitude, and significance of the coefficient β.

Empirical results

Descriptive statistics

Table 2 shows the descriptive statistics for the main variables. After pre-processing the initial data set, it can be seen that a total of 9742 observations are retained in this paper. In terms of firm TFP, the maximum value during the sample period is 9.273 and the minimum value is 4.888, indicating that the sample firms have more significant TFP differences. The mean value of Treat is 0.181, implying that the treated firms account for approximately 18.1% of the total sample, which is reasonable. Furthermore, the mean value of POE is 0.680, suggesting that the share of private enterprises in the sample is approximately 68%, which is fairly similar to the share of private enterprises in the real situation in China. The characteristics of the remaining variables do not differ significantly from previous research and will not be repeated.

Univariate analysis

Table 3 displays the results of the univariate group differences test based on the TFP. Column (1) shows the mean TFP for the treated firms and column (2) demonstrates the mean TFP for the control firms. Table 3 shows that before the policy, the mean value of TFP for the treated firms is 6.655, while it is 6.758 for the control firms; a difference of 0.103. However, after the policy, the TFP for the treated firms rises to 6.855, and for the control firms it rises to 6.961, indicating a 0.106 increase. Furthermore, the t-test results between the different groups are all statistically significant at the 1% level. Initially, there is reason to believe that energy consumption transformation hinders enterprise TFP. Hypothesis 2 is supported.

Baseline estimates

Table 4 presents the results of the baseline regressions, where the dependent variable is the log of firm TFP. The four columns reflect varying combinations of controls. For column (1), we include only year fixed effects, firm fixed effects, and fixed effects for the year trend in TFP by firms (the interaction term between the mean of pre-policy firm TFP and the year dummy), which allows us to exclude the effects of time-invariant firm characteristics, macro-environmental shocks, and differences in firm pre-policy TFP. For column (2), we further include firm-level control variables to exclude some effects of basic firm characteristics. For column (3), we add further year trends in city characteristics, which are used to help us further exclude the differential shocks from firm TFP caused by differences in city development. For column (4), we also include year trends for industry, which is used to exclude effects due to differences in industry development. The standard errors in all regressions are clustered at the industry level.

Table 4 shows that the coefficients of DID are significantly negative at the 10% level in all regressions. This suggests that, after the NEDC policy, the TFP of firms in demonstration cities is lower than that of firms in non-demonstration cities. That is, the NEDC reduces firm TFP. In column (4), for example, the TFP of firms in demonstration cities falls by approximately 6.4%. Hypothesis 1 is partially supported by empirical evidence. It should be highlighted that Zhang and Kong (2022) reveal that the green energy transition increases the TFP of energy enterprises. Meanwhile, Yang et al. (2022) show that the new energy transition increases green TFP significantly in resource-based cities. To some extent, the results of this paper differ from the existing research. The reason may be the heterogeneity effect of the policy. Both new energy enterprises and resource-based cities are more sensitive to the energy structure transition and need to build competitive advantages by responding positively to it. Furthermore, according to our estimations, the average TFP growth rate of Chinese firms from 2010 to 2019 is 5.6%. The NEDC may have caused at least a 1-year slowdown in firm TFP growth when compared to the results of the baseline regression. Without a doubt, the NEDC imposes significant economic costs on enterprises as well as the entire economy and society, but new energy consumption transition is currently the best strategy for balancing energy security and environmental protection. Therefore, the government should optimize the policy promotion framework and provide more convenience for market participants in order to ease the transition pain.

Robustness checks

Parallel trend test

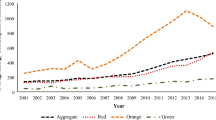

The most basic prerequisite for the differences-in-differences model is to satisfy the parallel trend. Specifically in this paper, the parallel trend assumption requires that there is no significant difference between the TFP of firms in the demonstration city and other cities before the NEDC policy. This paper employs the event study method to justify the test. The estimation results are shown in Fig. 3, where the horizontal axis denotes the sample interval (2010–2019) and the vertical axis denotes the estimated coefficients of DID. Our base period has been chosen to be 2013. The estimated coefficients in Fig. 2 before the policy have small and insignificant economic implications, and there is no significant trend. The estimated coefficients tend to be significantly lower after the policy, and this dynamic effect is clearly persistent. In conclusion, the results show that the model in this paper satisfies the parallel trend hypothesis.

This figure depicts the results of the parallel trend test for the TFP (Tfp_lp). The horizontal axis of the graph indicates the year, and the vertical axis indicates the magnitude of the estimated coefficient β. The solid line indicates the trend of the coefficient, and the dashed line is the 95% confidence interval.

Placebo test

On the one hand, this paper conducts a placebo test based on the policy point in time selected. In Eq. (2), the policy point in time is chosen to be 2014, i.e., Post is equal to 1 after 2014 and equal to 0 before. Here, we assume that the policy point in time is 2011, 2012, or 2013, respectively. If the counterfactual estimates are consistent with the baseline results, then it is possible that other policy or event shocks caused the result and the baseline results are biased. In contrast, if the counterfactual estimates are significantly different from those of the baseline results, then the results of the baseline regression are robust. Table 5 shows the result of the placebo test based on the above idea. In all specifications, the coefficients of DID are not different from zero. Moreover, the economic implications of the regression coefficients in all specifications are very small compared to the results of the baseline regression (0.064). To summarize, the decline in TFP is clearly due to the MEDC rather than the effects of other policy shocks or events.

On the other hand, we also conduct a placebo test based on the selection of the treated group. In this paper, the sample of firms is distributed among 247 cities, and the number of treated cities that are successfully merged with the firm data is 55, which is about 22%. For this reason, we define 22% of the randomly selected cities as treated cities based on the available data and then re-estimate Eq. (2). Because the treated cities in this process were chosen at random and did not suffer from the NEDC policy shock, the estimated coefficients should be normally distributed around 0. Figure 3 depicts the coefficient distribution after 1000 regressions. Where the horizontal axis represents the magnitude of the coefficient, the vertical axis represents the k-density of the estimated coefficients, and the vertical dashed line reflects the true coefficient value estimated in the baseline regression. As shown in Fig. 3, the estimated coefficients from the randomly chosen treated cities are mostly distributed in the range of −0.04 to 0.04, which is significantly different from the true coefficient (0.064). Furthermore, less than 10% of all estimated coefficients have p-values less than 0.1, and the vast majority are not statistically significant. This indicates that the baseline results are robust.

This figure shows the results of the placebo test based on changing the treated city. The solid line in the figure is the k-density of the 1000 estimated coefficients, and the vertical dashed line indicates the true coefficient values of the baseline regression estimates.

Other robustness tests

First, replace the dependent variables. Given the possibility of errors in firm TFP due to different calculation methods, we replace the firm TFP calculated by the LP method with the TFP calculated by the OP method and re-estimate Eq. (2). Column (1) of Table 6 displays the results, and the estimated coefficient is −0.060 and significant at the 5% level, which is consistent with the baseline results. Second, change the clustering level. In baseline regression, the standard errors are clustered at the industry level, which is changed here to be clustered at the firm and city level, respectively. The results are shown in Table 6 columns (2) and (3), where the standard errors of the estimated coefficients increase slightly with clustering level change, resulting in a slight decrease in statistical significance, but the results are still significant at the 10% level. Third, account for broader city-year trends. In order to control for a more thorough city-year trend, we extend Eq. (2) to include the interaction term of the city and year dummy variables. Column (4) of Table 6 shows the results, and the estimates are consistent with the baseline results. Fourth, higher-dimensional fixed effects are included. Given the variations in energy consumption across industries, firms in various industries within the same city may still experience varying degrees of impact despite the presence of structural shocks in energy consumption. To address this issue, an interaction term of city and industry dummy variables is included in Eq. (2). The results are shown in column (5) of Table 6. The estimated coefficient is −0.065, significant at the 5% level, and does not fluctuate significantly. In conclusion, the baseline regression results are plausible.

Addressing additional concerns

In the previous section, we identified that the NEDC reduces firms’ TFP. Although we conducted parallel trend tests as well as various other robustness tests, this causal inference result should be interpreted with caution. Because China’s economic development entered a period of deepening reforms during the sample period, there may have been the impact of superimposed shocks from other policies or events. Here, we will concentrate on the three most concerning situations. The first is the decline in firm TFP due to unknown or unobservable factors; the second is the impact of other events or policies during the same period; and the third is the bias in the results due to control group selection bias. To address these concerns, we employ methods such as the triple difference to examine the potential effect of the above scenarios on the results of this paper.

Triple difference test

First, we are concerned that the baseline results may reflect the effects of unobservable factors rather than the result of energy consumption transition. For example, differences in firm TFP result from the inherent characteristics of new energy demonstration and non-demonstration cities. Although we mitigate this concern by including a number of control variables in both the baseline regressions and the robustness tests, it remains unavoidable. In general, heavily polluting firms are energy intensive, and the increase in output depends on a large amount of energy consumption. Heavy-polluting firms should be hit harder by the NEDC policy. In other words, the TFP of heavily polluting firms should fall more after the policy. For this reason, we introduce a triple interaction term in Eq. (2), Treat × Post × Pollution, where Pollution is a dummy variable that takes the value of 1 if the enterprise is in heavily polluting industries and 0 otherwise. As a result, the triple difference term reflects the difference between the treatment effects of heavily polluting and non-heavily polluting firms, while the double difference term, Treat × Post, reflects the treatment effect of non-heavily polluting enterprises after the policy. The treatment effect for heavily polluting firms is the sum of the two coefficients. In addition, our model includes a post-policy dummy with a heavy pollution industry indicator, Post × Pollution, that captures the average difference between heavy and non-heavy polluting firms.

Table 7 shows the results of the triple difference tests. In column (1), we only include fixed effects for the year, firm, and year trend in TFP for each firm. In column (2), we also include fixed effects for city and industry-year trends. In column (3), we further include firm-level control variables. According to the results, the NEDC at TFP is hindered almost entirely by heavily polluting firms. In column (3), the effect on non-heavy polluting firms is only significant at the 10% level and is otherwise barely significant different from zero. Moreover, the estimated coefficient of Post × Pollution is not significant in all specifications, which helps to rule out any alternative explanations involving differences between heavily polluting and non-heavily polluting firms. Overall, the results in Table 7 rule out the contribution of unobservable factors.

The impact of other events

Since 2012, the Chinese government has been emphasizing green development, and the requirements for environmental protection and governance have been increasing day by day. Several environmental regulation policies were introduced during the sample period. As a result, an important concern is the causal association we observe between the NEDC and the decline in TFP, which may be due to the multiple environmental regulatory pressures faced by firms. To determine whether the results of the baseline regressions are impacted by policy overlays, we examine four levels based on carbon emissions trading pilot policies, green financial reforms, environmental protection tax laws, and low carbon city pilot policies.

First is the confounding impact of the carbon emissions trading pilot policy. China’s early environmental regulation policies were mainly command-and-control types, and the carbon emissions trading pilot policy was an early market-based environmental regulation policy implemented in China. Between 2013 and 2016, Chinese policies gradually introduced carbon emissions trading pilot policies in Shenzhen, Beijing, Tianjin, and other regions.Footnote 3 Without a doubt, the carbon emissions trading pilot policy has a positive impact on environmental quality. However, carbon emissions trading pilot policies may have an impact on corporate behavior. Zhang and Wang (2021) discovered that carbon emissions trading pilot policies reduced firm investment by 0.2449% overall, with the negative effect increasing as the policy proceeded. As a result, we introduce the carbon emissions trading pilot policy, DID_ce, based on Eq. (2), which takes the value 1 for firms in the pilot region after the policy and 0 otherwise. The results are shown in column (1) of Table 8, where the estimated coefficient of DID is −0.063 and significant at the 5% level after accounting for the carbon emissions trading pilot policy. This is not significantly different from the baseline results, implying that the result is not due to the carbon trading pilot policy.

Second is the confounding impact of the pilot zone for green financial reform. Aiming to promote the green development of the economy through green finance, the State Council selected five provinces in 2017: Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang. By 2020, the balance of green credit in pilot zones had exceeded 230 billion RMB, and the balance of green bonds was approximately 135 billion RMB. However, green finance may trigger a credit rationing phenomenon, reducing the availability of credit to polluting firms and increasing firm financing constraints (He et al. 2022), resulting in a decline in TFP. As a result, we introduce the green finance reform pilot area policy, DID_green, in Eq. (2), with firms in the pilot area taking a value of 1 in 2017 and beyond and 0 otherwise. The results are shown in column (2) of Table 8, and the baseline results are still robust after accounting for green finance reform.

Third is the confounding impact of environmental protection tax collection. The People’s Republic of China’s Environmental Protection Tax Law went into effect in 2018, highlighting the transformation from the imposition of environmental protection fees to an environmental protection tax. Overall, the implementation of the law strengthens the normative nature of environmental protection taxation. He et al. (2020a, b) used an event study approach to investigate its impact on firm performance and found that the transformation from environmental protection fees to taxes had a negative impact on most firms and harmed firm performance. As a result, we introduce the environmental protection tax law policy in Eq. (2), DID_tax, a variable that takes the value 1 for experimental firms in 2018 and beyond and 0 otherwise.Footnote 4 The results are shown in column (3) of Table 8, where the estimated coefficient of DID is −0.063 and significant at the 5% level after accounting for the imposition of environmental protection taxes. This implies that the implementation of the environmental protection tax law has no effect on the results.

Fourth is the confounding impact of low-carbon city pilot policies. To reduce carbon production and consumption and thus establish a sustainable energy ecosystem, the Chinese government established low-carbon city pilots starting in 2010. Low-carbon city policies can significantly reduce regional energy consumption intensity (Hong et al. 2021) and may have the same effect as the NEDC, which influences our results. As a result, we introduce the low-carbon city pilot policy in Eq. (2), DID_lc, and the pilot region firms take the value of 1 after the policy and 0 otherwise. The results are shown in column (4) of Table 8, and the conclusions of this paper still hold after considering the low-carbon city policy.

Overall, the results of the baseline regressions are virtually unchanged after accounting for the environmental regulatory pressures that firms face from multiple perspectives. This suggests that the decrease in firm TFP is not due to other environmental regulations but rather to the energy consumption transition.

Furthermore, we are concerned that the decrease in TFP may be due to real-economy factors such as industrial policy. Due to this, we will give more detail on this based on two events that occurred during the sample period: adjustments to industrial policy and de-capitalization policy.

First is the confounding impacts of industrial policy adjustment. Industrial policy is frequently employed in China, most notably in its Five-Year Plan. According to Aghion et al. (2015), industrial policy improves economic efficiency by allocating resources to competitive firms. Our sample period is in the 12th Five-Year Plan stage in 2015 and before, and then it enters the 13th Five-Year Plan. If the industrial policy changes during this process, it is likely that firms’ TFP will change as well. For this reason, we introduce the industrial policy, DID_ip, in Eq. (2). If the firm is in an industry that was encouraged during the 12th Five-Year Plan but is discouraged during the 13th Five-Year Plan, DID_ip is 1 in 2016 and beyond and 0 otherwise. The results are shown in column (5) of Table 8, where the coefficient of DID_ip is −0.078 and significant at the 1% level, indicating that industrial policy adjustment does reduce the TFP. However, the estimated coefficient of DID does not change significantly (compared to the baseline results), indicating that the conclusions remain robust after accounting for the impact of industrial policy adjustment.

Second is the confounding impacts of the de-capacity policy. In an effort to revive the economy after the 2008 global financial crisis, the Chinese government proposed a “four trillion” economic stimulus package. This indirectly resulted in significant overcapacity in foundational industrial sectors like steel and coal. The structural issues with China’s economy started to surface as the overcapacity issue got worse. In an effort to address the overcapacity and complete the transformation and upgrading of the industrial structure, the State Council released the Guidance Opinions of the State Council on Solving the Contradictions of Severe Overcapacity in 2013. Inevitably, the process of de-capacity increases environmental uncertainty for firms, which may intensify their precautionary motives and thus reduce productivity. Therefore, we introduce the de-capacity policy variable, DID_decap, based on Eq. (2), which takes the value of 1 for experimental firms after 2013 and 0 otherwise.Footnote 5 The results are shown in column (6) of Table 8, and the estimated coefficient of DID is −0.061 and significant at the 5% level, which indicates that the conclusions of baseline results remain robust after considering the effect of de-capacity policy.

As a result of taking into account major policy shocks that existed during the sample, it can be said that the conclusion that the NEDC reduces the TFP remains robust. To summarize, these results provide sufficient confidence to attribute the decline in TFP to the exogenous event shock of structural energy consumption transformation.

Control group selection bias

Bias in control firm selection may also result in biased results. For this reason, we will use three methods to evaluate the potential impact of this bias.

First, firms in the same province as the treated firm but in a different city are chosen as control firms. In the baseline regression, we use firms in cities that are not affected by the policy as the control group. However, due to China’s vast size, the level of economic development varies greatly between provinces. The economic development level of eastern coastal cities, for example, is significantly higher than that of western inland cities. Although we control for the initial urban characteristics in Eq. (2) and pass the parallel trend test in the previous section, there are still cases where the treated and control firms have large differences before the policy. To ensure that the initial differences are within manageable limits, we replace the original control firms with firms located in the same province as the treated firms but in different cities. The conclusions remain robust compared to the baseline results (−0.064), though the statistical and economic significance is slightly lower.

Second, the sample excludes firms with locations in municipalities directly under the central government, provincial capitals, and planned cities. Generally speaking, the financial and business environment faced by firms may be more favorable in core cities. Therefore, these firms may be neither treated nor control firms. As a result, we exclude firms that are located in core cities and re-estimated using Eq. (2). The results are shown in column (2) of Table 9, and the estimated coefficient of DID is −0.119, which is significant at the 5% level. The negative impact of energy consumption transformation is significantly greater than the baseline result (−0.064). The possible reason for this result is that the original control firms included more firms in the core cities, resulting in an underestimation of the baseline regression results.

Third, the propensity score matching (PSM) method is used to match new energy demonstration cities with control cities. Specifically, we choose control cities for demonstration cities using nearest neighbor matching, radius matching, and kernel matching, respectively, and then evaluate the balance of the matched covariates. Finally, only the successfully matched samples are preserved and re-estimated using Eq. (2). The results are shown in columns (3)–(5) of Table 9, and the estimated coefficients of DID remain all significantly negative at the 5% level, implying the robustness of the baseline results.

Overall, our basic conclusion does not change after replacing the control firms with the regressions. Although the estimated coefficients differ from the baseline results in Table 9, they are not significantly different on average. As a result, the results remain robust even after taking the concern of control group selection bias into account.

Impact of omitting corporate governance

Corporate governance has a significant impact on firm performance, so the fact that firms have lower TFP after the NEDC may be due to differences in corporate governance. Moreover, internal governance has a greater impact on TFP than external governance (Tian and Twite 2011). As a result, we address this concern by including variables related to corporate governance in the baseline regression equation. First is the ratio of independent directors (Indratio), which is expressed as the proportion of the number of independent directors to the total number of board members. Second is the concentration of equity (Top1), which is expressed as the percentage of shares held by the top shareholder. Third is the board size (Board), which is expressed as the natural logarithm of the total number of board members. Fourth is the dual position (Dual), which is a dummy variable that takes the value of 1 if the chairman is also the CEO and 0 otherwise.

Table 10 shows the regression results after considering corporate governance. Specifically, the variable of the ratio of independent directors is added in column (1) of Table 10 to consider the effect of corporate governance in terms of independent directors’ monitoring decisions. The variable of the percentage of shareholding of the largest shareholder is added in column (2) of Table 10 to consider the effect of equity concentration. The variable of board size is added in column (3) of Table 10 to consider the influence of board decision-making. Column (4) of Table 10 provides a duality variable that takes into account the effect of board power. Column (5) of Table 10 then includes all the above variables. The coefficient of DID is almost consistent with the baseline regression result (−0.064). Therefore, according to Altonji et al. (2005), the results of the baseline regression in this paper are unlikely to be due to unobservable factors at the corporate governance level.

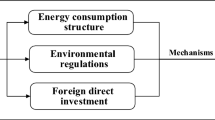

Underlying channel test

We presented a large body of believable causal evidence in the previous section that associated the energy consumption transition with a decline in TFP. As previously stated, TFP can be decomposed into the effects of technological progress and resource allocation (Chen et al. 2021). Therefore, the decrease in firms’ TFP may be due to the effect of NEDC policy on firms’ resource allocation and technological innovation. For that purpose, we will verify each of the two channels.Footnote 6

For the resource allocation efficiency channel, this paper draws on Wurgler (2000) to estimate the impact of the NEDC on firm resource allocation using the following modelFootnote 7:

where Invest denotes firm investment, expressed by the expenses for the purchase and construction of fixed assets, intangible assets, and other long-term assets scaled by total assets. Q denotes the firm’s investment opportunity, expressed by the sum of the market value of equity and the book value of debt then divided by the book value of assets. The meaning of the remaining variables is consistent with Eq. (2). β1 captures the impact of the NEDC on firms’ resource allocation.

For the technology innovation channel, this paper verifies this by examining the impact of NEDC on firms’ innovation inputs and outputs. Specifically, innovation input is mostly expressed as a change in corporate R&D expenditure, while innovation output is primarily expressed as a change in the number of corporate patent applications. Therefore, the natural logarithm of corporate R&D expenditure (rd) is used to represent corporate innovation inputs, while the natural logarithm of the number of corporate invention patent (Pati), utility model patent (Patu), and design patent (Patd) applications is used to represent corporate innovation outputs.

Table 11 reports the regression results of the channel test. In column (1), the coefficient of the interaction term is negative and significant at the 10% level, demonstrating that the NEDC reduces firms’ resource allocation efficiency. In column (2), the coefficient of DID is negative at the 10% level, indicating that the NEDC reduces firms’ R&D investment. Furthermore, when taken with the results in columns (3)–(5), the NEDC suppresses enterprises’ innovation output, particularly utility model patents and design patents. Overall, the NEDC has an effect on firm TFP through lowering firm resource allocation efficiency and innovation. Hypothesis 1 is fully supported.

Heterogeneity analysis

In the previous section, we identified the policy effects of NEDC. However, policy effectiveness may vary based on firm characteristics or regional characteristics. For this reason, in this section, we conduct a heterogeneity analysis based on firm and regional characteristics.

Difference in corporate ownership

Compared with private enterprises (POEs), state-owned enterprises (SOEs) have a greater social responsibility. In addition, because SOEs are backed by government credit, they are not only subject to more administrative guidance but also have access to more preferential policies. For example, SOEs have access to more bank credit than private enterprises (Chan et al. 2012). Thus, the effect of the NEDC may differ depending on the nature of firm ownership. As shown in columns (1) and (2) of Table 12, the estimated coefficient of DID in the POE sample is −0.086 and significant at the 1% level, while the policy effector of NEDC is absent in the SOE sample. In other words, POEs are more affected by the structural transformation in energy consumption than SOEs. A potential reason is that POEs are more sensitive to uncertainty risks and seek to maximize short-term profits. Moreover, POEs are subject to stronger financing constraints and may not have sufficient resource support for the transformation.

Difference in regional marketization

A higher level of marketization in a region usually indicates greater market competitiveness and economic dynamism. Therefore, the efficiency of NEDC may vary depending on the level of regional marketization. For this purpose, we divide the sample based on ownership and marketization. In order to group firms, we use the mean value of their marketization index in the pre-policy provinces. High marketization regions are those that are above the median, and low marketization regions are those that are below the median. The regional marketization index is obtained from Wang et al. (2019a, b). The results in Table 12 columns (3) and (4) suggest that the NEDC has a greater impact on firms’ TFP in regions with lower marketization. The possible reasons for this are, first, the higher marketization, the more well-developed factor markets, and the more efficient resource allocation due to the adequate flow of factors. Second, the higher marketization and the more standardized the market order, the greater enterprise innovation vitality and motivation.

Conclusion and policy recommendations

Based on China’s new energy demonstration cities’ policy, this paper employs a differences-in-differences model to examine the impact of the NEDC on firms’ TFP. We found that the NEDC reduces the TFP. To eliminate the interference of unobservable factors and policy overlay on the above results, this paper conducts a series of robustness tests, such as placebo tests, replacement variables, and consideration of the confounding effects of other policies. The baseline results are still robust. Furthermore, we investigate the underlying channel of the NEDC. The results show that the energy consumption structure transition reduces the efficiency of enterprise resource allocation, hinders enterprise technological innovation, and eventually leads to a decline in TFP. According to the results of the heterogeneity analysis, the negative impact of the NEDC is more pronounced in private firms and regions with lower marketization.

The conclusions provide a new perspective for the government and other relevant departments to have a more comprehensive understanding of the energy consumption transition and also provide practical ideas to further enhance the implementation of new energy promotion policies. First, the government and other departments should clarify the economic costs of the new energy consumption transition and balance the benefits and costs during the energy policy implementation process. In the selection of demonstration cities, it is necessary to consider not only whether the city can meet the energy consumption targets but also to apply policies based on the characteristics of enterprises and industries in the region. In addition, we should actively learn from and absorb the experience of successful cases of new energy city construction in other countries or regions and constantly improve the new energy promotion policy. Second, we discover that the new energy promotion policy reduces enterprise resource allocation efficiency and innovation, highlighting that enterprises lack foresight and science for the application of new energy at present. On the one hand, policymakers should be aware that forcing enterprises to change their energy consumption structure may exacerbate the deterioration of their living environment, especially at a time when multiple factors, such as COVID-19, are overlapping. On the other hand, the energy consumption targets should be flexible and liberal enough to enhance firms’ ability to respond and transform. Third, this paper demonstrates that the effects of NEDC are driven significantly by firm or geographical characteristics. This demonstrates that the promotion of new energy consumption policies is still in its early stages and that in order to promote the new energy consumption transition, the promotion of policy initiatives needs to be enhanced to clarify the development prospects of new energy for enterprises.

Moreover, although the institutional context of this paper is China, it still has some relevance to other developing countries around the world. After all, the issue of harmonizing energy and economic development is of great practical urgency. Therefore, developing countries can address the issues of energy consumption and pollution by building new energy demonstration cities. It is important to note, however, that the promotion of demonstration projects has some economic costs. It may be possible to strike a balance between costs and benefits by promoting them in medium and large cities with greater advantages in terms of technological innovation, the financial environment, and human capital.

Of course, this paper also has some limitations. First, the economic effect of the NEDC is based on the TFP perspective test. More multi-perspective examination may be more beneficial for us to accurately assess the magnitude of economic costs. Second, the channels of influence focused on in this paper are resource allocation efficiency and innovation. In order to more accurately assess the policy effects, the input and output perspectives can be examined concurrently in future research.

Third, the NEDC’s economic effects may be enterprise heterogeneous, and a future heterogeneity perspective can be used to conduct a more comprehensive policy effect assessment. In conclusion, enriching research in the new energy consumption transition will help us understand economic development in the new energy era more comprehensively.

Data availability

The datasets are available from the corresponding author on reasonable request.

Notes

Much of the existing literature examines the energy transition from the standpoint of renewable and non-renewable energy sources. Although there are slight differences between new and renewable energy sources, the vast majority of new energy sources belong to the category of renewable energy. Therefore, this paper does not distinguish the differences between the two in detail.

Specifically, the pilot was launched in Shenzhen, Beijing, Shanghai, Tianjin, and Guangdong in 2013; in Hubei and Chongqing in 2014; and in Fujian in 2016.

In this policy, not all enterprises’ tax burden standard changed, and a significant number of enterprises still adhere to the original standard. As a result, enterprises with an increased environmental tax burden as a result of the policy are considered the treated group, while enterprises with an unchanged tax burden are considered the control group.

According to the guidance, the treated firms are those in the steel, cement, electrolytic aluminum, flat glass, and shipbuilding industries.

Appendix Table 13 provides descriptive statistics for the variables mentioned in this section.

In fact, Eq. (3) captures the effect of NEDC policy on capital allocation efficiency. The flow of capital is accompanied by the flow of other productive resources, and changes in the resource allocation of enterprises are primarily reflected in changes in capital allocation. Therefore, it is reasonable to use capital allocation efficiency instead of resource allocation efficiency.

References

Aghion P, Cai J, Dewatripont M, Du L, Harrison A, Legros P (2015) Industrial policy and competition. Am Econ J Macroecon 7(4):1–32. https://doi.org/10.1257/mac.20120103

Altonji J, Elder T, Taber C (2005) Selection on observed and unobserved variables: assessing the effectiveness of Catholic schools. J Polit Econ 113(1):151–184. https://doi.org/10.1086/426036

Angrist J, Pischke J (2009) Mostly harmless econometrics: an empiricist’s companion. Princeton University Press

Bansal P, Hunter T (2003) Strategic explanations for the early adoption of ISO 14001. J Bus Ethics 46:289–299. https://doi.org/10.1023/A:1025536731830

Baumann J, Kritikos AS (2016) The link between R&D, innovation and productivity: are micro firms different? Res Policy 45(6):1263–1274. https://doi.org/10.1016/j.respol.2016.03.008

Borghesi S, Cainelli G, Mazzanti M (2015) Linking emission trading to environmental innovation: evidence from the Italian manufacturing industry. Res Policy 44(3):669–683. https://doi.org/10.1016/j.respol.2014.10.014

Bossink B (2017) Demonstrating sustainable energy: a review based model of sustainable energy demonstration projects. Renew Sustain Energy Rev 77:1349–1362. https://doi.org/10.1016/j.rser.2017.02.002

Campbell J (2007) Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad Manag Rev 32(3):946–967. https://doi.org/10.5465/amr.2007.25275684

Chan K, Dang V, Yan I (2012) Chinese firms’ political connection, ownership, and financing constraints. Econ Lett 115(2):164–167. https://doi.org/10.1016/j.econlet.2011.12.008

Chen J, Zhou C, Wang S, Li S (2018) Impacts of energy consumption structure, energy intensity, economic growth, urbanization on PM2. 5 concentrations in countries globally. Appl Energy 230:94–105. https://doi.org/10.1016/j.apenergy.2018.08.089

Chen H, Guo W, Feng X, Wei W, Liu H, Feng Y, Gong W (2021) The impact of low-carbon city pilot policy on the total factor productivity of listed enterprises in China. Resour Conserv Recycl 169:105457. https://doi.org/10.1016/j.resconrec.2021.105457

Destek M, Aslan A (2017) Renewable and non-renewable energy consumption and economic growth in emerging economies: evidence from bootstrap panel causality. Renew Energy 111:757–763. https://doi.org/10.1016/j.renene.2017.05.008

Emir F, Bekun F (2019) Energy intensity, carbon emissions, renewable energy, and economic growth nexus: new insights from Romania. Energy Environ 30(3):427–443. https://doi.org/10.1177/0958305X18793108

Fang L, Lerner J, Wu C (2017) Intellectual property rights protection, ownership, and innovation: evidence from China. Rev Financ Stud 30(7):2446–2477. https://doi.org/10.1093/rfs/hhx023

Feng T, Sun L, Zhang Y (2009) The relationship between energy consumption structure, economic structure and energy intensity in China. Energy Policy 37(12):5475–5483. https://doi.org/10.1016/j.enpol.2009.08.008

Gray W, Shadbegian R (2003) Plant vintage, technology, and environmental regulation. J Environ Econ Manag 46(3):384–402. https://doi.org/10.1016/S0095-0696(03)00031-7

He G, Wang S, Zhang B (2020a) Watering down environmental regulation in China. Q J Econ 135(4):2135–2185. https://doi.org/10.1093/qje/qjaa024

He Y, Wen C, He J (2020b) The influence of China Environmental Protection Tax Law on firm performance - evidence from stock markets. Appl Econ Lett 27(13):1044–1047. https://doi.org/10.1080/13504851.2019.1659488

He L, Zhong T, Gan S (2022) Green finance and corporate environmental responsibility: evidence from heavily polluting listed enterprises in China. Environ Sci Pollut Res 29:74081–74096. https://doi.org/10.1007/s11356-022-21065-5

Hong M, Chen S, Zhang K (2021) Impact of the “low-carbon city pilot” policy on energy intensity based on the empirical evidence of Chinese cities. Front Environ Sci 9:717737. https://doi.org/10.3389/fenvs.2021.717737

Jalalimajidi M, Seyedhosseini S, Makui A, Babakhani M (2018) Developing a comprehensive model for new energy replacement in the country’s development program using a robust optimization approach. Energy Environ 29(6):868–890. https://doi.org/10.1177/0958305X18758635

Koçak E, Şarkgüneşi A (2017) The renewable energy and economic growth nexus in Black Sea and Balkan countries. Energy Policy 100:51–57. https://doi.org/10.1016/j.enpol.2016.10.007

Krugman PR (2000) The return of depression economics. WW Norton & Company, New York

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70(2):317–341. https://doi.org/10.1111/1467-937X.00246

Mattauch L, Creutzig F, Edenhofer O (2015) Avoiding carbon lock-in: policy options for advancing structural change. Econ Model 50:49–63. https://doi.org/10.1016/j.econmod.2015.06.002

Olley S, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econometrica 64(6):1263–1297

Ozturk M, Yuksel YE (2016) Energy structure of Turkey for sustainable development. Renew Sustain Energy Rev 53:1259–1272. https://doi.org/10.1016/j.rser.2015.09.087

Payne JE (2009) On the dynamics of energy consumption and output in the US. Appl Energy 86(4):575–577. https://doi.org/10.1016/j.apenergy.2008.07.003

Qu F, Xu L, He C (2023) Leverage effect or crowding out effect? Evidence from low-carbon city pilot and energy technology innovation in China. Sustain Cities Soc 91:104423. https://doi.org/10.1016/j.scs.2023.104423

Rubashkina Y, Galeottim M, Verdolini E (2015) Environmental regulation and competitiveness: empirical evidence on the Porter hypothesis from European manufacturing sectors. Energy Policy 83:288–300. https://doi.org/10.1016/j.enpol.2015.02.014

Samant S, Thakur-Wernz P, Hatfield DE (2020) Does the focus of renewable energy policy impact the nature of innovation? Evidence from emerging economies. Energy Policy 137:457–468. https://doi.org/10.1016/j.enpol.2019.111119

Shove E (2018) What is wrong with energy efficiency? Build Res Inform 46(7):779–789. https://doi.org/10.1080/09613218.2017.1361746

Sohag K, Chukavina K, Samargandi N (2021) Renewable energy and total factor productivity in OECD member countries. J Clean Prod 296:126499. https://doi.org/10.1016/j.jclepro.2021.126499

Solow R (1957) Technical change and the aggregate production function. Rev Econ Stat 39(3):312–320

Sun J, Li G, Wang Z (2018) Optimizing China’s energy consumption structure under energy and carbon constraints. Struct Chang Econ Dyn 47:57–72. https://doi.org/10.1016/j.strueco.2018.07.007

Tian G, Twite G (2011) Corporate governance, external market discipline and firm productivity. J Corp Finan 17(3):403–417. https://doi.org/10.1016/j.jcorpfin.2010.12.004

Tian Y, Song W, Liu M (2021) Assessment of how environmental policy affects urban innovation: evidence from China’s low-carbon pilot cities program. Econ Anal Policy 71:41–56. https://doi.org/10.1016/j.eap.2021.04.002

Tugcu C, Tiwari A (2016) Does renewable and/or non-renewable energy consumption matter for total factor productivity (TFP) growth? Evidence from the BRICS. Renew Sustain Energy Rev 65:610–616. https://doi.org/10.1016/j.rser.2016.07.016

Wang S, Li C, Zhou H (2019a) Impact of China’s economic growth and energy consumption structure on atmospheric pollutants: based on a panel threshold model. J Clean Prod 236:117694. https://doi.org/10.1016/j.jclepro.2019.117694

Wang X, Fan G, Hu L (2019b) China marketization index report by provinces (2018). Social Science Literature Press, Beijing (in Chinese)

Wurgler J (2000) Financial markets and the allocation of capital. J Financ Econ 58(1–2):187–214. https://doi.org/10.1016/S0304-405X(00)00070-2

Yang X, Zhang J, Ren S, Ran Q (2021) Can the new energy demonstration city policy reduce environmental pollution? Evidence from a quasi-natural experiment in China. J Clean Prod 287:125015. https://doi.org/10.1016/j.jclepro.2020.125015

Yang X, Wang W, Wu H, Wang J, Ran Q, Ren S (2022) The impact of the new energy demonstration city policy on the green total factor productivity of resource-based cities: empirical evidence from a quasi-natural experiment in China. J Environ Planning Manage 66(2):293–326. https://doi.org/10.1080/09640568.2021.1988529

Zhang D, Kong Q (2022) Green energy transition and sustainable development of energy firms: an assessment of renewable energy policy. Energy Econ 111:106060. https://doi.org/10.1016/j.eneco.2022.106060

Zhang Y, Wang W (2021) How does China’s carbon emissions trading (CET) policy affect the investment of CET-covered enterprises? Energy Econ 98:105224. https://doi.org/10.1016/j.eneco.2021.105224

Zhang Q, Huang X, Xu Y, Bhuiyan MA, Liu P (2022) New energy demonstration city pilot and green energy consumption: evidences from China. Energy Rep 8:7735–7750. https://doi.org/10.1016/j.egyr.2022.06.009

Funding

This study was supported by the Social Science Foundation of Shandong Province (No.19BYSJ38).

Author information

Authors and Affiliations

Contributions

Zhiyuan Zhang: conceptualization, methodology, writing the original draft, supervision, funding acquisition, and project administration. Yongfan Ma: methodology, software, formal analysis, writing the original draft, reviewing, and editing.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

All authors carefully read and approved the study.

Consent for publication

All authors are agreed to publish the manuscript.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhang, Z., Ma, Y. The impact of energy consumption structure transformation on firms’ total factor productivity: evidence from China. Environ Sci Pollut Res 30, 76950–76968 (2023). https://doi.org/10.1007/s11356-023-27682-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-27682-y