Abstract

This article investigates the relationship between energy poverty and public expenditure for a sample of 20 Sub-Saharan countries over the period 2006–2020. This paper focuses on three research objectives. First is using a panel data threshold model with fixed effects proposed by Hansen (J Econom 93(2):345-368, 1999) to detect the presence of the nonlinear effect of public expenditure on energy poverty. Second, we try to explain the effect of public expenditure transmission channels on energy poverty. Third, we explore the impact of public expenditure on energy poverty considering the role of institution factors. Thus, our analysis approves the existence of a link between energy poverty and public expenditure with a threshold of about 17.65% of GDP. In addition, CO2 emissions can accelerate the growth of energy poverty in SSA countries. Indeed, the results show that in countries with high energy poverty, there is a bidirectional causal link between CO2 emissions and energy poverty. This would provide a better understanding of the relationship between public expenditure and energy poverty suggesting useful implications for policymakers in targeting sustainable energy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Despite progress in some areas, the world is far from achieving universal energy access by 2030. At current rates of advancement, 660 million people will still have no access to electricity by the end of the next decade. As the latest Sustainable Development Goals report (2021) points out, the prospects for clean cooking are even less bright, with more than 2 billion people still having to rely on inefficient stoves using polluting energy. In addition, the effects of the COVID-19 pandemic have wiped out much of the progress made toward poverty reduction. Global extreme poverty increased in 2020 for the first time since the Asian financial crisis of the late 1990s. However, energy economists are currently focusing on the concept of energy poverty as a key facet of sustainable development (Liu et al. 2022; Song et al. 2022).

Currently, energy poverty is a serious problem in Sub-Saharan Africa. Addressing this challenge is essential for better socioeconomic and human development (Khan 2019). Beyond significant regional disparities (between countries, between urban and rural areas), 70% of people in Sub-Saharan Africa lack access to electricity, and the number is increasing, as electrification efforts continue to lag population growth. Nevertheless, 769 million people still have no electricity access in 2020; three-quarters of them are in Sub-Saharan Africa (97 million living in urban areas and 471 million in rural areas). As a result, the efforts to understand the determinants of energy poverty have intensified. Although income poverty, energy prices, technology, inclusive growth, and financial development are identified as the main fundamentals of energy poverty, less attention has been paid to the government policy role through public expenditure (Chien et al. 2022; Hassan et al. 2022; Apergis et al. 2022). These facts make it important to study how public expenditure, more specifically, how government policies eradicate energy poverty through public expenditure (Oriavwote and Ukawe 2018; Nguyen and Su 2022).

Therefore, this paper aims to seal the empirical gaps in the current literature and contributes to the debate on sustainable energy policies in the Sub-Saharan African countries which suffer from the lowest proportion of all regions in the world in terms of electric energy access (United Nations 2022). To our best knowledge, no research has referred the case of Sub-Saharan African countries by examining the influence of public expenditure on energy poverty. Thus, the theoretical literature on public finance highlights the key role of the institutional outline in shaping the effectiveness of public expenditure (Nguyen et al. 2018). Institutions are the rules of the game that would impose constraints on economic agents. A strong institutional structure such as greater government efficiency, less corruption, and better regulatory quality, can advance the effectiveness of public expenditure and thus enhance the effects of fiscal policies in fighting energy poverty (Nguyen et al. 2021). It is therefore interesting to study how the quality of political institutions, specifically how improved good governance in Sub-Saharan countries eradicate energy poverty.

The main motivation for this research, compared to other associated studies, is to demonstrate the mechanism by which public expenditure influences energy poverty by providing support based on a solid theoretical and empirical background. It is important to identify the determinants of energy shortage. This helps clarify which households are most likely to be energy-starved and are therefore suitable for targeting supportive measures (Zhang 2019; Mendoza et al. 2019). Thus, this study aims to contribute to the debate on sustainable energy policies in a variety of ways. Specifically, this article focuses on three research objectives. First, the study surveys the effect of public expenditure on energy poverty for a panel of Sub-Saharan countries over the period 2006–2020. We estimate a panel threshold effect model proposed by Hansen (1999) to detect the presence of the nonlinear effect of public expenditure on energy poverty. Second, the paper seeks to explore the influence of public expenditure transmission channels on energy poverty. Third, we examine the influence of institutional factors including the relationship between public expenditure and energy poverty. The results found should contribute to the political involvement in defining the right policy decisions to reduce energy poverty through public expenditure. This would provide a better understanding of the relationship between government expenditure and energy poverty, as well as give useful implications for policymakers in targeting sustainable energy.

The rest of the article is unfolding as follows. The second section contains the literature review. The third section illustrates the empirical framework and methodology. The fourth section describes the data and variables. In the fifth section, the estimation results and discussion are highlighted. In section six, we test robustness. Finally, conclusions are made in the seventh section.

Literature review and theoretical background

Energy poverty and public expenditure

In recent years, the importance of energy has increased considerable interest among academic researchers and policymakers. Several studies have investigated the topic of energy security such as Radovanović et al. (2017) and Demski et al. (2018). Interestingly, only a few surveys have focused on energy poverty. This is primarily classified as the inability of the household to gather domestic energy needs. In the theoretical literature review, we can distinguish among three opposing views regarding the impact of public expenditure on economic growth. The Keynesian theory reveals that public expenditure has crowding effects on economic growth (Alexander 1952). Another strand of the literature, the neoclassical view, holds that increased public expenditure squeezed out private economic activity due to the rising impact of borrowing on interest rates (Mundell 1963; Fleming 1962). However, the Ricardian equivalence approach approves that public expenditure has no direct effect on economic growth (Barro 1990; Arestis 2011). In conjunction with these debates on theories, the empirical literature shows mixed results on the effect of public expenditure on economic growth. Likewise, some economic theories claim that public expenditure is one of the predominant pillars of fiscal policy through key roles to amend the income distribution (Facchini and Melki 2013). Excessive government expenditure can impede economic growth due to more intense competition and contribute to lower private-sector profits (Buiter 1977). This nonlinear association is known as the Armey curve (Altunc and Aydın 2013) and has been found in several studies over the past few decades.

Interestingly, the empirical literature that contributes to the subject continues in a premature stage. Any change in income inequality as an unpleasant result of energy poverty can be witnessed primarily under the multiple socioeconomic dimensions. Using the multidimensional energy poverty index (MEPI) approach, researchers review the special effects of different macroeconomic indicators on energy deprivation. The MEPI approach is used by Crentsil et al. (2019) in the case of Ghana who conclude that the reduction of energy poverty is driven by policy changes, whereas Koomson and Danquah (2021) assess that financial inclusion can decline energy poverty for the same countries. In a similar vein, Apergis et al. (2022) use the headcount ratio and construct a MEPI to evaluate the influence of education on energy poverty for a sample of 30 developing economies. The outcomes provided insights into the energy poverty and education relationship, supporting a negative association between them. The most related study to ours is the work of Nguyen and Su (2022). Focusing on their analysis of 56 developing countries, Nguyen and Su (2022) indicate that the relationship between public expenditure and energy poverty is nonlinear, suggesting that increases in public expenditure would decrease energy poverty. Based on the above discussion, one may suppose that the link between energy poverty and public expenditure can be nonlinear.

Income inequality and public expenditure -energy poverty nexus

Public expenditure is represented as the central policy to redistribute income distribution to achieve equity. However, some scholars argue that the effect of government expenditure is not always effective in reducing income inequality in developing countries (Lyubimov 2017). Nevertheless, income inequality is related to energy poverty (Sarkodie and Samuel 2020), suggesting that public fiscal expenditure can influence energy poverty via the channel of income inequality. Increased income inequality can exacerbate the hardship and challenges of low-income people who are vulnerable to energy poverty, particularly in the context of rising energy prices due to the scarcity of available resources. As a result, this study contends that the effects of public expenditure on energy poverty can be transmitted through income inequality.

Institutional quality and public expenditure-energy poverty nexus

The theoretical literature on public finance highlights the dominant role of the quality of the institutional environment in the effectiveness of the fiscal policy. Indeed, the efficiency of the distribution of public expenditure can be degraded due to political factors (Hemming et al. 2002). However, institutional frameworks are the rules of the game of humanity, which would impose constraints on economic agents. A strong institutional system such as greater government efficiency, higher control of corruption, and clearer regulatory quality can improve the efficiency of public expenditure and thus strengthen the effects of fiscal policies in the fight against energy poverty (Nguyen et al. 2018). These facts lend importance to the study of how the quality of political institutions, more specifically how improving good governance eradicated energy poverty.

Model and econometric methodology

Before appreciating the existence of the nonlinear relationship between energy poverty and public expenditure, it is necessary to specify a linear model. First, to identify the determinants of energy poverty, we regress a set of variables. Following previous theoretical and empirical studies by Apergis et al. (2022) and Nguyen and Su (2022), we estimate the following equation:

where \({\mathrm{EP}}_{\mathrm{it}}\) represents the energy poverty of country i at time t; \({\mathrm{EP}}_{it-1}\) is the lagged energy poverty variable; \({\mathrm{GOV}}_{it}\) is the government expenditure;\({X}_{it}\) is a vector of the explanatory variable, and \({\varepsilon }_{it}\) is the error term. However, the presence of a lagging dependent variable among the explanatory variables implies a correlation problem between the lagging endogenous variable and the error term. This endogeneity bias is primarily due to the problem of reverse causality. The presence of such problems can lead to biased results when applying traditional estimation methods such as ordinary least-squares (OLS) estimators and fixed-effects estimators. Three estimation methodologies are used. First, is the method of feasible generalized least squares (FGLS) and Driscoll–Kraay Standard Error approach to correct the autocorrelation of the observed residuals, and, second, the generalized method of moment estimators of Arellano and Bond (1991). Moreover, by clustering error terms by country and year, we can account for potential correlation within countries over time while ensuring that errors between different countries remain uncorrelated. This approach results in more precise standard errors, allowing for greater accuracy in our analysis (Petersen 2009; Cameron et al. 2011).

In the second step, we assume that the nonlinearity of the public expenditure-energy poverty relationship emerged since the fact that public expenditure may influence energy poverty indirectly through its impact on income inequality. In the field of environmental economics, this method has been applied extensively to evaluate the nonlinear influence of renewable energies on economic growth (Bhuiyan et al. 2022; Chenggang et al. 2022). To do this, we apply the panel threshold approach proposed by Hansen (1999). Nevertheless, the model is defined as follows:

As mentioned earlier, the explained variable \({Y}_{it}\) is a scalar, the threshold variable \({\varphi }_{it}\) is a scalar, and the regressor \({Z}_{it}\) is a k-item vector. I (.) is an indicator function of transitional regimes, and \({\varepsilon }_{it}\) is a random disturbance item. We obtain a threshold equation from Hansen (1999), which is:

Here, the panel data set is divided into two regimes depending on whether the real value of the threshold variable \({\varphi }_{it}\) is greater or less than the estimated threshold. These two regimes are distinguished by different estimated regression slopes, \({\mathrm{\alpha }}_{1}\) and \({\mathrm{\alpha }}_{2}\). The random variable \({\varepsilon }_{it}\) is independent and has a normal distribution with an average value equal to 0 and variance \({\partial }^{2}\). The double threshold model is defined in the following way:

Two regression coefficients are obtained from this model. First are coefficients according to the government expenditure regime. Otherwise, the coefficients linked to the exogenous variables, which make up vector Z, are identical in each of the government spending regimes. The panel threshold model is segmented into two regimes, and the Hansen calculations yield the sum of squared errors as follows:

where \({x}_{it}\left(\gamma \right)=\left\{\begin{array}{c}{x}_{it}I\left(\varphi \le \gamma \right)\\ {x}_{it}I\left(\varphi >\gamma \right)\end{array};\right.{Y}_{it}^{*}={Y}_{it}-{\overline{Y} }_{it}; {e}_{it}^{*}={e}_{it}-{\overline{e} }_{it}; {x}_{it}^{*}={x}_{it}-{\overline{x} }_{it}; {e}_{it}^{*}={e}_{it}-{\overline{e} }_{it};\)

In addition, the estimation of γ is achievable through the least squares method, and it can be determined by minimizing the concentrated sum of squared errors (5). The following are the least squares estimators:

Specifically, the single threshold model (i.e., panel threshold model with a sole threshold value) can be represented as

Second, to investigate the channel of the impacts of public expenditure on energy poverty through income inequality, the study forms a system equation of energy poverty and income inequality. Nevertheless, the single-equation models are inadequate in capturing the potential interdependence and reciprocity among energy poverty, income inequality, and government spending. Therefore, a multi-equation model estimation would allow for evaluating the indirect impact of public expenditure on energy poverty via income inequality, as well as verifying the consistency of the results obtained from the single-equation approach. Therefore, to take a further step, we conduct an estimation of a nonlinear dynamic simultaneous equation model, which comprises three equations and is specified in the following manner:

Although the variables utilized in the system of equations are identical to those employed in the single equation approach, we adopt a distinct estimator, namely, the three-stage least squares (3SLS) estimator, which is more effective.Footnote 1

Then, in the third set of regressions, we examine the hypothesis that the sensitivity of energy poverty to public expenditure depends on the level of quality of the institutional environment in Sub-Saharan countries. The novelty of this article lies in the estimation of the combined impact of conditional variables (public expenditure and institutional factors) and energy poverty. Accordingly, we incorporate an interaction term between public expenditure and institutional factors in Eq. (1).

Modified versions of Eq. (1) that include the interaction terms can be written as

Thus, we can assess the role of institutional quality in the effects of public expenditure on energy poverty. However, debates persist over the measurement of energy poverty and institutional quality and what comprises low and high levels of institutional factors in Sub-Saharan countries. Additionally, \({Inst}_{it}\) denotes the measures used to signify the level of institutional environment quality, and \({(GOV\times Inst )}\) is the interaction term between energy poverty and institutional factors.

Data and variable

Energy poverty indicator

The selection of energy poverty proxies in this study is mainly based on discussions by González-Eguino (2015) and Nguyen and Su (2022). Economic threshold, physical threshold, and technological threshold are known as the three main methods for assessing energy poverty; nevertheless, González-Eguino (2015) realizes that everyone has their limits. Based on the theoretical and empirical literature, energy poverty can be defined according to different proxies dependent on the availability of the dataset (Crentsil et al. 2019; Hassan et al. 2022; Apergis et al. 2022) including a population that has access to clean fuels and technologies for cooking of the total population (i), percentage of urban population with access to electricity (ii), percentage of rural population with access to electricity (iii), percentage of the population that has access to electricity of the total population (iv), log of electric power consumption per capita (v), percentage of the losses during electric power transmission as a percentage of total electricity output (vi), and percentage of renewable electricity output as a percentage of the total electricity output (vii).

This study recruits’ proxies of energy poverty: the percentage with access to clean fuels and technologies for cooking in the total population. It is crucial to note that an increase in these quantities implies a reduction in energy poverty. Figure 1 shows the proportion of access to clean fuels and technologies for cooking in the total population between 2010 and 2020. We see that the part of the world’s population without access to clean fuels and technologies for cooking was 35% in 2020, which means that almost 3 billion people or a third of the world’s population were without access to these means. Since 2010, the rate of global access to clean cooking has been increasing by 1% each year, with these advances being mainly correlated with progress in the regions of Central and South Asia as well as in East Asia and Southeast Asia. In contrast, access to clean cooking solutions in Sub-Saharan Africa has been slower than population growth, with the rate of access increasing slowly or not at all in some countries. For the first time in 2020, Sub-Saharan Africa was the region with the most significant number of people without access to clean fuels and technologies. Nearly 900 million people, or about 82% of the region’s population, do not have access to non-polluting means of cooking, which represents 35% of the global deficit in this area.

Proportion of population with access to clean fuels and technologies for cooking in the total population, 2010–2020 (percentage) Sources: World Bank (2022)

Control variables

To investigate the strong relationship between energy poverty and public expenditure, we control for other potential determining factors of poverty energy in our regression. Specifically, we consider the most used variable in the empirical theory: real GDP per capita (growth). The Gini index is a proxy for income inequality (Ineq). Foreign direct investment net inflows (% of GDP) and trade (% of GDP) are proxy for FDI net inflows and trade openness (Trade), respectively. The general government’s final consumption expenditure (% of GDP) is a proxy for measuring the overall level of government spending on goods and services that are consumed by the general public. The crude oil prices proxy for energy prices (E_price). The CO2 emissions are quantified in metric tons per annum of carbon emissions per capita (CO2).

For institutional variables, we apply a set of institutional factors taken from the Freedom House and Worldwide Governance Indicators (WGI). In fact, five indicators were selected, which are (i) democratic accountability, (ii) government effectiveness, (iii) regulatory quality, (iv) control of corruption, and (v) rule of law. These five indicators are collected, and their average is calculated to proxy for overall institutional quality (Inst) in Sub-Saharan African countries. The description of the other variables and data sources is set out in Table 12 of the Appendix.

Estimation results and discussion

Cross-sectional dependence and unit root testing

Before studying the benchmark regression between the variables, it is crucial to check the time series properties of the variables. As a first step, the cross-sectional dependence (CSD) statistic by Pesaran (2015) is applied to determine the correlation coefficients among the time series.

The results reported in Table 1 uniformly reject the null hypothesis of cross-section independence, providing evidence of cross-sectional dependence in the data at the 5% level of significance for all the variables, which means that a shock in one country may spill over onto other countries.

Table 2 presents the results proposed by Pesaran and Yamagata (2008) for analysis of the slope homogeneity performed to know the heterogeneity of panel data. In fact, the test rejects the null hypothesis at the 1% level of significance, meaning that country-specific characteristics should be considered.

Table 3 shows the results of the commonly used unit root test, namely, the Levin et al. (2002). However, the variable can be integrated at first difference. This means that indicators are moving in a parallel form for all countries in the case of Sub-Saharan Africa. This reveals that it is significant to examine the degree of correlation between our variables.

To this end, the correlation matrix, presented in Table 11 in the Appendix, appears that the exogenous variables are correlated, which can conceal the problem of multicollinearity, which can be mitigated by estimating other models integrating less related data. Government effectiveness and regulatory quality displayed a pairwise association of 0.892, which is considered high. In this view, we consider the composite index of the institutional factors in our estimates.

Table 4 provides the linearity tests of the data studied. It appears that the first F-statistics of the Wald test is 18.96, which is significant at the 5% level. The second F-statistic of the Fisher test is similarly significant at a 1% level. The findings strongly imply that the linearity tests carried out using two approaches approve the existence of a nonlinear relationship between public expenditure and energy poverty.

The effect of public expenditure on energy poverty regression

To evaluate how government spending impacts energy poverty in countries in Sub-Saharan Africa (SSA), we employ both the FGLS estimator and the Driscoll–Kraay regression to ensure the accuracy of our findings. To account for potential endogeneity issues, we utilize the difference GMM estimators by Arellano and Bond (1991).Footnote 2 Our analysis, as presented in Table 5, demonstrates that government spending, CO2 emissions, human capital, FDI, and trade balance are all significant determinants of energy poverty in this study. However, due to the dynamic nature of our model, we cannot extend our analysis beyond the FGLS method or other standard econometric estimators such as pooled OLS and fixed effects. This is because our model’s lagged dependent variable may be correlated with specific effects, which could lead to an endogeneity bias (Gnangnon 2019). In fact, before starting to analyze the results of the estimation, we found that the over-identification and validity tests of the instruments are successful because of the importance of AR (2) and the Hansen test. The results presented in Table 5 suggest that the control variables always keep the same expected sign in the three estimated specifications. This indicates the robustness of our model.

Furthermore, as indicated in Table 5, empirical results display that the foreign direct investment coefficient at the 5% level is positive and statistically significant. This finding is also supported by Ullah et al. (2021), who found that FDI inflows can encourage the establishment of large-scale renewable energy projects that have lower operating costs and higher shares of clean energy.

Turning to the trade coefficient, which serves as a measure of the trade opening index, its effect on energy poverty is positive and statically significant. Besides, the decision to include this variable in our regression can only be explained on the assumption that apart from globalization, international trade is also important for improving access to modern energy resources. For example, intra-regional trade has been known as a primary means of importing cleaner energy resources in the literature (Al-Tal et al. 2021).The empirical findings, which are somewhat coherent with previous empirical literature, show that the energy price amplified the energy poverty of the SSA region. At the 5% level, the E_price coefficient is negative and statistically significant. Consistent with Nguyen and Su (2021), this is especially the case in developing countries.

According to the result in Table 5, a negative and statistically significant association exists between CO2 emissions and energy poverty in the Sub-Saharan region. Specifically, given the distribution of CO2 and energy poverty, the cleanest energy-poor countries have higher CO2 emissions. Really, this can be explained by the fact that the poorest clean energy countries generally tend to burn very polluting and cheap biofuels, which can lead to the progressive rise in CO2 emissions. For human capital, the zero effect may indicate that human capital does not involve enough explanations related to energy poverty.

Under the result found by Oriavwote and Ukawe (2018), the coefficient of public expenditure has the effect of widening energy poverty. However, the coefficient of the public expenditure variable has an unexpected sign. Consequently, this relationship is explained by the fact that poverty reduction is favorable only under certain conditions. Therefore, we will use Eq. (2) to test the nonlinear relationship between the measurement of energy poverty and public expenditure. The main results regarding the impact of government spending thresholds on energy poverty are presented in Table 6. We observe that all the control variables demonstrate significance and directionality that aligns with existing literature on energy poverty determinants. Furthermore, the coefficients for these variables appear to be quite robust for both regimes in terms of their significance and magnitude.

Our research hypothesis, which is based on the existence of the relationship between public expenditure and energy poverty in Sub-Saharan countries, is therefore confirmed. First, our results suggest that when the level of government spending as a share of GDP is lower than the estimated threshold of 19.26%, the effect on energy poverty is negative and statistically significant. In these countries, public spending on health, education, and social protection may have a limited impact on energy poverty due to the lack of a strong economic base to support it. In addition, high levels of poverty in rural areas can limit the impact of energy efficiency and renewable energy development programs, as households often lack the financial resources to invest in cleaner technologies. Beyond this threshold level, there is a significant positive relation between energy poverty and government expenditure. However, there are examples of countries in Sub-Saharan Africa that have successfully reduced energy poverty through a combination of public poles, such as subsidies for clean energy and the implementation of rural electrification programs. Investments in energy infrastructure and regulations to encourage private investment can also play an important role in reducing energy poverty in these countries.

A possible explanation for these empirical results is that increasing public expenditure from low levels can reduce energy poverty, i.e., the cumulative effect of public expenditure on energy poverty stops at a point, and beyond that point, any further rise in public expenditure will increase energy poverty. Indeed, public expenditure is presented as a principal policy to reallocate income distribution to achieve equity (Crudu 2015). Nevertheless, the theoretical literature agrees that government expenditure is not always powerful in reducing income inequality in developing countries (Ivan 2017). In fact, increasing inequality may lead to greater hardship and challenges for low-income people at risk of energy poverty, especially in the context of rushing energy prices due to scarce and limited resources. At this level, examining the transmission channels between energy poverty and public expenditures with a particular focus on income inequality is important to understand how public policies can be used to reduce energy poverty and promote energy access for all, especially for the most vulnerable households in Sub-Saharan African countries.

Public expenditure and energy poverty: income inequality channel

Based on the results reported above, it is essential to recall that we find strong evidence of a non-linear relationship between fuel poverty and public expenditure. This allows us to hypothesize that income inequality could be considered a transmission channel through which public spending affects access to electricity.

Therefore, in this subsection, we will attempt to test this hypothesis by using the 3sls method to estimate a nonlinear panel dynamic model of simultaneous equations. This serves both to check the robustness of our main results when the equations are evaluated as a system and not separately and to find an explanation for the nonlinear relationship between energy poverty and government spending. The results presented in Table 7 indicate that income inequality positively affects energy poverty (column 1). This may suggest that the poorest populations often have limited financial means to purchase clean cooking fuels and technologies, forcing them to continue using traditional and inefficient fuels. Therefore, income inequality helps perpetuate a cycle of energy poverty where the poorest people are trapped in a situation where they have limited access to clean energy.

In addition, it should be noted that two-way relationships are detected between energy poverty and public expenditure and energy poverty and income inequality. The results reported in column (3) of Table 7 (Eq. 10) show a strong positive association between energy poverty and public expenditure. Similarly, income inequality appears to exert a positive effect on public spending. This suggests that in societies with high-income inequality, wealthier individuals tend to have more political and economic power, which may lead them to pressure governments to invest more in infrastructure and services that directly benefit wealthier individuals. There are often institutional barriers that prevent poorer populations from accessing clean fuels and technologies for cooking. For example, tax policies may favor the use of traditional fuels, while subsidy policies may benefit wealthier households that can afford more expensive technologies. These institutional barriers can contribute to a further widening of the gap between rich and poor in access to clean energy sources. The results found that income inequality is an important factor in the transmission of energy poverty, as low-income households often have less access to modern energy sources and are more vulnerable to energy price increases. Public spending can therefore play an important role in reducing income inequality and improving access to modern energy sources for low-income households. However, the results of these studies may also show that public spending is not always effective in reducing income inequality and energy poverty due to weak institutions and corruption that can limit the effectiveness of public programs.

Public expenditure and energy poverty: the role of institutional factors

The institutional and legal system can also play a pivotal role in eradicating energy poverty. To investigate the third hypothesis, we will estimate Eq. (11), which studies the relationship between public expenditure and access to clean fuels and technologies for cooking in interactions with institutional measures.

The results presented in Table 8 show a significant positive effect on the quality of institutional factors, which confirms that a strong institutional factor could amplify the positive effects of public expenditure on energy poverty. Moreover, it suggests that good institutional factors can act as a catalyst for the impacts of public expenditure on energy poverty (Nguyen and Su 2022). These conclusions represent a new challenge for Sub-Saharan countries. In fact, a strong institutional quality environment neutralizes the negative effect of public expenditure. This implies that to expand access to clean cooking fuels and technologies, Sub-Saharan economies must continue to improve the quality of their legal and institutional environment, including protecting property rights and respecting contracts.

More specifically, governments of Sub-Saharan countries should devote more attention to rebuilding public institutions. Clearly, good public expenditure management remains a valuable tool for eradicating energy poverty. However, to reap more of the constructive role of the institutional system, Sub-Saharan economies must undertake real reforms mainly in terms of controlling corruption and strengthening the rule of law.

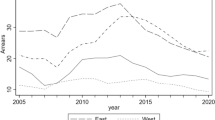

Robustness tests

To empirically check the robust relationship between energy poverty and public expenditure, we first re-estimate Eq. (1) by employing the alternative indicators of energy poverty,,replacing the proxy access to clean fuels and technologies for cooking in the total population (EP) with the percentage of access to electricity (EP_1), the percentage of rural population with access to electricity (EP_2), and the percentage of urban population with access to electricity (EP_3) for econometric estimation based on the difference GMM techniques. The corresponding estimation is displayed in Table 9.The time trend of an alternative variable of energy poverty is shown in Fig. 2. However, regional inequalities are great, revealing a real divide between North Africa and South Africa on the one hand and Sub-Saharan Africa on the other. The limited impacts of electrification on economic development have been reflected in both rural and urban areas. For more than 2 decades, rural regions have been less affected by the electrification of the total population. As already illustrated in Fig. 2, 28% of the rural population of SSA has access to electricity compared to 78% of the urban population.

According to the results in Table 9, the coefficient of public expenditure in the first and third columns is significantly positive, while regarding EP_2, the coefficient of public expenditure is negative, which justifies our result found previously. Indeed, access to electricity is considered a primary socioeconomic objective. Above all, the inability of national electricity companies to absorb new rural customers without worsening their own financial situation limits the implementation of political will and the operationalization of financing for electrification in the rural zone. In fact, electrification would be equally targeted at urban and rural regions. Many rural areas have considerable untapped economic potential, off-season crops and value-added agri-food processing, that could be unlocked through the provision of electricity. This is particularly relevant given that in many African countries, most of the population resides in a rural region and the agricultural sector employs the bulk of the workforce. This situation can be explained in part by (i) the lack of physical infrastructure in electricity production, which is developed by the slowness on a continental scale of the electrification process given the volume of investments required, (ii) a deficiency in the quality of the institutional environment which translates into action plans that are too often insufficient to stimulate a dynamic supply, and (iii) the low income of rural households, which is at the root of the endemic weakness of demand, which forces any rural electrification policy to be integrated into a poverty reduction strategy.

Dumitrescu–Hurlin causality tests

Following approval of the effects of the control and independent variables on energy poverty, this research also recognizes the causalities that might exist between the variables, which likewise require robust evidence supporting the relation between public expenditure and energy poverty. Indeed, this test proves to be robust to cross-sectional dependence, which checks in the fifth Section. Consequently, we use the panel causality test suggested by Dumitrescu and Hurlin (2012) to investigate the underlying link between the variables. The basic regression is

with i = 1,….; N and t = 1,…,T.

The results of the causality test are described in Table 10. In addition, the causal relationship diagram between the variables is shown in Fig. 3 established on the findings in Table 10. The outcome of the causality test supports the existence of a unidirectional causal link of government expenditure to income inequality at 1% level of significance in Sub Saharan countries. The presence of a causality relation between these two indicators explains the previous findings of an association of complementarity between them. In fact, The Dumitrescu–Hurlin panel causality result shows the absence of a causality link between energy poverty and public expenditure.

Notably, this involves the results previously found in the earlier section, which postulates that the correlation between energy poverty and public expenditure is conditioned by other factors. The results also emphasized the complementarity between institutional quality and government expenditure that stimulates the reduction of energy poverty. Specifically, our finding supports the view that public expenditure eradicates energy poverty in countries with a developed institutional system.

Conclusion

This paper aims to examine the effects of public expenditure on energy poverty in Sub-Saharan African countries over the period 2006–2020. Empirically, the study proceeded in essentially three steps. First, we estimate the effects of public expenditure on energy poverty. To this end, we estimated a panel data threshold model invented by Hansen (1999). Second, we try to explain the effect of public expenditure transmission channels on energy poverty. Third, we explore the effect of public expenditure on energy poverty considering the role of institutional factors. In this respect, the empirical results confirm the existence of a nonlinear association between public expenditure and energy poverty, with a threshold of around 17.65% of GDP. It is noteworthy that above the threshold of nearly 18% of GDP, public expenditure crowds out energy poverty.

More specifically, the results have major significance for policymakers who pursue eradicating energy poverty. In the first place, policymakers should be cautious in setting fiscal policy. Specifically, public expenditure should not be developed without a specified threshold since excessive public expenditure would increase energy poverty. Extensive empirical literature points out that public expenditure has a nonlinear effect on economic development, mainly in developing countries (Asimakopoulos and Karavias 2016; Divino et al. 2020). The outcomes found in this study endorse that the nonlinear impact causes a worsening of social problems, particularly energy poverty. In other words, governments should consider an optimal public expenditure solution in their medium-term and long-term strategies. This planning will boost economic development as far as its importance to overcome social and environmental problems. This consideration is also more significant with the current health crisis challenges (COVID-19) since people without access to electricity or clean fuels are more vulnerable to the effects of the pandemic (Zaman et al. 2021). Moreover, the study shows that public expenditure has the effect of increasing inequality, which is then transmitted to energy poverty. In other words, government policy implementations through public expenditure must take into consideration the externality of public expenditure on income inequality as one of the requirements to combat energy poverty, as access to electricity and income inequality are probable to be inseparably linked. In general, findings suggest that policymakers in Sub-Saharan African countries can do better to fight energy poverty through policy-based actions. They must apply more regulations on public expenditure and institutional factors to direct them toward sustainable development. This result highlights the need for more attention to public expenditure composition and energy poverty in future research studies. More recently, the empirical literature has emphasized the negative impact of economic uncertainty on various economic factors such as investment, economic growth, unemployment, and monetary and fiscal policy orientations (Xiahui and Minxing 2021; Siksnelyte-Butkiene 2022). As a potential future perspective, this work should focus on the role of global economic uncertainty in the dynamics of energy poverty and the influence of public expenditure.

Data availability

All the data are available in the public databases as provided in the manuscript.

Notes

The 3SLS estimator is favored over 2SLS techniques due to its ability to correct for both endogeneity and contemporaneous correlation of the error terms across equations.

We test the validity of our instruments using both the Hansen test and the Arellano-Bond test for second-order autocorrelation. The Hansen test check the null hypothesis that the instruments are uncorrelated with the error term.

References

Alexander S (1952) Effects of a devaluation on a trade balance. Staff Papers – Int Monetary Fund 2(2):263

Al-Tal R, Murshed M, Ahmad P, Alfar AJK, Bassim M, Elheddad M, Nurmakhanova M, Mahmood H (2021) The non-linear effects of energy efficiency gains on the incidence of energy poverty. Sustainability 13:11055

Altunc OF, Aydın C (2013) The relationship between optimal size of government and economic growth: Empirical evidence from Turkey, Romania, and Bulgaria. Procedia Soc Behav Sci 92:66–75

Apergis N, Polemis M, Soursou SE (2022) Energy poverty and education: fresh evidence from a panel of developing countries. Energy Econ 106:105430

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Arestis P (2011) Fiscal policy is still an effective instrument of macroeconomic policy. Panoeconomicus 58(2):143–156

Asimakopoulos S, Karavias Y (2016) The impact of government size on economic growth: a threshold analysis. Econ Lett 139:65e8

Barro R (1990) Government spending in a simple model of economic growth. J Polit Econ 98:S103–S125

Baum CF, Schaffer ME, Stillman S (2007) Enhanced routines for instrumental variables/GMM estimation and testing. Stata J 7(4):465–506. https://econpapers.repec.org/article/tsjstataj/v_3a7_3ay_3a2007_3ai_3a4_3ap_3a465-506.htm

Bhuiyan MA, Zhang Q, Khare V, Mikhaylov A, Pinter G, Huang X (2022) Renewable energy consumption and economic growth nexus—a systematic literature review. Front Environ Sci 10:878394. https://doi.org/10.3389/fenvs.2022.878394

Buiter WH (1977) Crowding out’ and the effectiveness of fiscal policy. J Public Econ 7(3):309–328

Cameron CA, Gelbach J, Miller DL (2011) Robust inference with multi-way clustering. J Bus Econ Stat 29:238–249

Chien F, Hsu CC, Zhang Y et al (2022) Unlocking the role of energy poverty and its impacts on the financial growth of household is there any economic concern. EnvironSci Pollut Res 29:13431–13444

Crentsil AO, Asuman D, Fenny AP (2019) Assessing the determinants and drivers of multidimensional energy poverty in Ghana. Energy Policy 133:110884

Crudu R (2015) The influence of fiscal policy on income inequality in European Union’s member states. Bus Syst Econ 5(1):46–60

Demski C, Poortinga W, Whitmarsh L, Böhm G, Fisher S, Steg L, Pohjolainen P (2018) National context is a key determinant of energy security concerns across Europe. Nat Energy 3(10):882–888

Divino JA, Maciel TGN, Wilfredo D (2020) Government size, the composition of public spending and economic growth in Brazil. Econ Modell 91:155e66

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29:1450–1460. https://doi.org/10.1016/j.econmod.2012.02.014

Facchini F, Melki M (2013) Efficient government size: France in the 20th century. Eur J Polit Econ 31:1–14

Fleming JM (1962) Domestic financial policies under fixed and floating exchange rates. Int Monet Fund Work Paper 9(3):369–380

Gnangnon SK (2019) Does multilateral trade liberalization help reduce poverty in developing countries? Oxf Dev Stud 47(4):435–451

González-Eguino M (2015) Energy poverty: an overview. Renew Sust Energ Rev 47:377–385

Hansen BE (1999) Threshold effects in non-dynamic panels: estimation, testing, and inference. J Econom 93(2):345–368

Hassan ST, Batool B, Zhu B, Khan I (2022) Environmental complexity of globalization, education, and income inequalities: new insights of energy poverty. J Clean Prod 340:130735

Hemming R, Kell M, Mahfouz S (2002) The effectiveness of fiscal policy in stimulating economic activity: a review of the literature. Available at SSRN 880868. https://ssrn.com/abstract=880868

Ivan L (2017) Income inequality revisited 60 years later: Piketty vs Kuznets. Eussian J Econ 3(1):42e53

Khan HZ (2019) Socio-economic and environmental factors influenced pro-poor growth process: new development triangle. Environ Sci Pollut Res 26:29157–29172

Koomson I, Danquah M (2021) Financial inclusion and energy poverty: empirical evidence from Ghana. Energy Econ 94:105085

Levin A, Lin CF, Chu C-SJ (2002) Unit root tests in panel data: asymptotic and finite sample properties. J Econom 108:1–22

Liu J, Jain V, Sharma P, Ali SA, Shabbir MS, Ramos-Meza CS (2022) The role of Sustainable Development Goals is to eradicate multidimensional energy poverty and improve social wellbeing’s. Energ Strat Rev 42:100885

Lyubimov I (2017) Income inequality revisited 60 years later: Piketty vs Kuznets. Russian J Econ 3(1):42–53

Mendoza CB, Cayonte DD, Leabres MS, Manaligod RL (2019) Understanding multidimensional energy poverty in the Philippines. Energy Policy 133:110886

Mundell RA (1963) Capital mobility and stabilization policy under fixed and flexible exchange rates. Can J Econ Polit Sci 29(4):475–485

Nguyen PC (2018) The effectiveness of fiscal policy: contributions from institutions and external debts. J Asia Bus Econ Stud 25(1):50e66

Nguyen CP, Nguyen NA, Schinckus C, Su TD (2018) The ambivalent role of institutions in the CO2 emissions: the case of emerging countries. Int J Energy Econ Policy 8(5):7

Nguyen CP, Su TD, Bui TD et al (2021) Financial development and energy poverty: global evidence. Environ SciPollutRes 28:35188–35225

Nguyen CP, Su TD (2022) The influences of government spending on energy poverty: evidence from developing countries. Energy 238(Part A):121785. https://doi.org/10.1016/j.energy.2021.121785

Oriavwote VE, Ukawe A (2018) Government expenditure and poverty reduction in Nigeria. J Econ Public Financ 4(2):156

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Econom Rev 34:1089–1117

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econom 142(1):50–93

Petersen M (2009) Estimating standard errors in finance panel data sets: comparing approaches. Rev Financial Stud 22(2009):435–480

Radovanović M, Filipović S, Pavlović D (2017) Energy security measurement–a sustainable approach. Renew Sustain Energy Rev 68:1020–1032

Roodman D (2009) How to do xtabond2: an introduction to difference and system GMM in Stata. Stand Genomic Sci 9(1):86–136

Sarkodie SA, Samuel A (2020) Electricity access and income inequality in South Africa: evidence from Bayesian and NARDL analyses. Energy Strat Rev 29:100480

Siksnelyte-Butkiene I (2022) Combating energy poverty in the face of the COVID-19 pandemic and the global economic uncertainty. Energies 15:3649

Song Y, Shahzad U, Paramati SR (2022) Impact of energy infrastructure investments on renewable electricity generation in major Asian developing economies. Austr Econ Papers 62(1):1–23. https://doi.org/10.1111/1467-8454.12282

Ullah S, Khan M, Yoon S-M (2021) Measuring energy poverty and its impact on economic growth in Pakistan. Sustainability 13:10969

United Nations (2022) Report on the Sustainable Development Goals. Global Report of the Secretary-General, United Nations

Windmeijer F (2005) A finite sample correction for the variance of linear efficient two-step GMM estimators. J Econom 126:25–50

World Bank (2022) World Bank Data. Available online: https://data.worldbank.org/indicator/EG.ELC.ACCS.ZS. Accessed 3 Jul 2022

Xiahui C, Minxing J (2021) Economic policy uncertainty, financial expenditure and energy poverty: evidence based on a panel threshold model. Sustainability, MDPI 13(21):1–12

Zaman R, Vliet O, Posch A (2021) Energy access and pandemic resilient livelihoods: the role of solar energy safety nets. Energy Res Soc Sci 71:101805

Zhang DL (2019) A multidimensional measure of energy poverty in China and its impacts on health: an empirical study based on the China family panel studies. Energy Policy 131:72–81

Author information

Authors and Affiliations

Contributions

Bousnina Rihab contributed to the study’s conception, data collection, and analysis, and wrote the first draft of the manuscript. Gabsi Foued Badr supervised the process. Finally, all authors reviewed, edited, and commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

List of countries: Benin, Burkina Faso, Burundi, Central African Republic, Comoros, Eritrea, Ethiopia, Gambia, Ghana, Guinea, Kenya, Madagascar, Malawi, Mali, Mozambique, Rwanda, Senegal, Togo, Uganda, Zambia.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bousnina, R., Gabsi, F.B. Energy poverty, government expenditure, and institution factors in Sub-Saharan Africa countries: evidence based on a panel threshold model. Environ Sci Pollut Res 30, 65512–65526 (2023). https://doi.org/10.1007/s11356-023-27005-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-27005-1