Abstract

The main cause of environmental degradation is carbon emissions, which puts environmental sustainability in jeopardy. This ecological worry, the obligation for which falls on all economic actors, has not gone undetected, and so in 2021, the Glasgow Climate Pact (COP: 26) was organized, with the primary aim of decreasing global carbon emissions. Because the Post-Glasgow Agreement goals represent a significant challenge to achieving ecological responsibility, pressure is applied to the participating nations. However, earlier literature lacked sufficient investigation of factors useful for the mitigation of carbon emissions in E7 (China, Turkey, India, Russia, Brazil, Indonesia, and Mexico) economies. Hence, we aim to fill this research vacuum by predicting the impact of clean fuels and cooking technology availability, renewable energy, and environmental taxes on E7 economies’ carbon emissions from 2000 to 2020, while taking urbanization and population expansion into account. Evaluation is done using four different cross-sectional dependence (CSD) methods, as well as unit root tests (CIPS and CADF), cointegration analysis (Westerlund and Kao), and the Driscoll-Kraay and quantile-on-quantile long-run factor estimate methods. The long-run analysis revealed from our findings that environmental tax, renewable energy, and access to clean fuels and technologies for cooking decrease carbon emission for the E7 economies. On the other hand, urbanization and population growth enhance emissions for the E7 economies. Finally, our results hold up under a variety of policy interpretations that would aid in reducing carbon emissions and their negative effects on the environment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The COP-26 (Conference of the Parties) is a United Nations climate change conference that aims to bring countries together to take ambitious action to combat climate change and to accelerate the implementation of the Paris Agreement. The COP26 conference focused on important issues related to the global transition to clean energy and the need for finance to support mitigation and adaptation measures in developing countries. However, accessing such finance can be a challenge for emerging economies. One potential solution to this issue is the use of environmental taxes, which can provide a source of funding for clean energy initiatives and other efforts to reduce greenhouse gas emissions and address the impacts of climate change. Environmental taxes, such as carbon taxes, can be used to internalize the external costs of environmental pollution and provide economic incentives for individuals and businesses to adopt clean technologies and reduce their environmental impact. By providing a source of funding for clean energy and climate action, environmental taxes may help to accelerate the transition to low-carbon, climate-resilient economies and support the implementation of the Paris Agreement. This serves as the theme for our study.

The traditional model seems to be failing the world on its quest to reduce carbon emissions and make the world safer (Aoun et al. 2022; Srivastava et al. 2022). Pressuring governments all around the globe to find an efficient way to reduce air pollution and prevent climate change. The COVID-19 outbreak has highlighted the need to strengthen communities and ramp up the fight against climate change to reach a more egalitarian and sustainable future (Chopra et al. 2022; Sharma et al. 2022). While several countries have set targets for carbon neutrality, they are using a variety of environmental policy tools to get there, including regulatory instruments (“command-and-control,” market-based mechanisms, contractual arrangements, subsidies, environmental management systems, and informational campaigns) (Weber et al. 2022; Yong and Chang 2022). However, no device can handle every environmental problem adequately (Paramati et al. 2022). In accordance with national sustainability goals, governments develop a combination of economic and other regulatory mechanisms, leveraging their synergistic benefits (Kemp 2000; SDG 2019; WHO 2020: Bekun et al 2021; Gyamfi et al 2022b).

Command-and-control measures and market-based tools are two common approaches governments might use to encourage businesses to participate in sustainable production and consumption, serving the need for carbon reductions. According to Shapiro and McGarity (1991), the former involves requiring businesses to adopt environmentally friendly technology and often involves establishing performance criteria (such as emission caps) (Satola et al. 2021). However, due to the high expenses of monitoring and compliance (Muradian and Gómez-Baggethun 2021; Nanda 2021; Van Aaken and Simsek 2021), such norms are not particularly cost-effective. More crucially, command-and-control tactics are likely to deter businesses from moving beyond just complying, severely restricting the uptake and growth of SPC (Stoll and Mehling 2021). Market-based instruments (MBI), on the other hand, are thought to be much more successful than command-and-control techniques in stimulating long-term innovation (Liu et al. 2021; Tsai and Liao 2017). MBI are policies that give enterprises incentives (e.g., subsidies, tax breaks) to choose more sustainable choices (Zhang and Song 2022). These regulations enable enterprises to explore and create sustainable innovations by minimizing uncertainty. Unlike command-and-control techniques, which demand strict objectives, MBI allows enterprises to react to incentives commensurate with their market models or priorities (Rosenow et al. 2019).

From the above, it seems environmental tax an MBI offer a complementary approach toward carbon neutrality. Taxes that support the preservation of the environment and natural resources rather than financial interests are referred to as “environmental taxes” (Domguia et al. 2022). It is considered a reasonably economical and cost-effective strategy for addressing climate change (Doğan et al. 2022). Again, it is only logical enterprises bear environmental protection while supporting economic development since they are the primary polluters. Because renewable energy has been accepted as a means of reducing environmental deterioration, emerging economies have launched a number of policy efforts to promote green initiatives by increasing the percentage of clean energy consumption in the energy mix (Ahmed, Ahmad, Rjoub, et al. 2022a, b; Ali and Kirikkaleli 2022). Special emphasis has been placed on introducing access to clean energy and technology to enhance green energy consumption; also, governmental efforts such as tax credits have been implemented to stimulate investments in energy-efficient technology (Shaheen et al. 2022; Shahbaz et al. 2022b). These regulatory measures have had a considerable impact, with the percentage of renewable energy consumption in the energy mix almost doubling and predicted to rise further.

As such research on climate change mitigation’s co-benefits is becoming increasingly popular due to worries that its goals alone would not be sufficient to win the public’s support for more aggressive GHG emission reduction programs (Boyd et al. 2022; Ürge-Vorsatz et al. 2014; WHO 2019). An essential and crucial component of the mix is environmental tax (Braathen and Serret 2007). Environmental tax advocates stress the additional advantage of a cleaner environment and use tax revenues to compensate for existing tax cuts in other industries, producing the “double dividend” (DD) idea. According to the DD hypothesis, money collected from a pollution tax is utilized to pay for tax reductions in other sectors of the economy while serving a crucial role in controlling environmental deterioration (Barbier 2011; Sarpong et al 2020; Onifade et al 2021; Adedoyin et al 2021 Mahmood et al. 2022; Y. Sun et al. 2022a, b). Again, this research chooses to analyze this viewpoint in a fresh way in light of the possibility of co-benefits that the introduction of environmental tax may provide. This situation’s uniqueness is that the environmental tax’s co-benefit is derived from both clean energy usage and environmental protection. The complementary function it plays in modulating the use of renewable energy, which further reduces carbon emissions, is explored in this research.

The prior literature focuses on studies showing that environmental taxes really do decrease pollution. Few papers, particularly in developing and rising countries, empirically investigate the impact of environmental taxes on the environment from the standpoint of clean energy (Fang et al. 2022; Shahzad 2020). Can environmental taxes supplement the benefits of renewable energy in protecting the environment? This study discusses how environmental taxes might enhance the energy structure and environmental quality through empirical data. It is investigated how environmental taxes and main energy use interact over time. Depending on emerging economies and if an environmental tax should be implemented. The empirical data that includes the dynamic impacts of clean energy and environmental levies on carbon neutrality in E7 nations is mostly ignored by the current research. The study’s goal was to close this gap by assessing how these factors, together with other control variables like population change, could affect carbon emissions in the E7 nations from 2000 to 2020.

For an emerging economy, such revenue further helps them in investing in green initiatives, providing an incentive to implement environmental taxes. In the context of clean energy and ecological sustainability, environmental taxes can play a significant role in incentivizing or constraining the adoption and use of these energy sources. On the one hand, environmental taxes can provide a financial incentive for individuals and businesses to switch to clean energy sources as the cost of using fossil fuels and other polluting energy sources increases (Ambhore and Ofori 2023; Gyamfi et al. 2022a; Ofori et al. 2023; Adebayo et al 2022; Steve et al 2022; Bamidele et al 2022). On the other hand, the implementation of environmental taxes can also pose challenges and trade-offs, such as the potential for increased energy costs for consumers and the need for effective policy design and implementation to ensure that the taxes are effective in achieving their goals. This conundrum makes it imperative for more research work.

The E7 was chosen due to the global economy’s development, which has provided newly industrialised countries with a possible future that might revolutionize the world economy. Such economies are fragile, and early policy implementation can steer them into green growth. This is due to the fact that citizens in these countries are affected by a variety of internal and foreign problems and policies.

This study is pertinent for three reasons: (1) it provides a framework to answer the question of whether environmental tax within Emerging 7 is an incentive or constraint on the use of clean energy geared towards carbon neutrality. This paper also discusses how tax revenues affect environmental quality, which is a significant concern. According to Doğan et al., (2022), tax revenue raises the cost of burning different fossil fuels, which lowers carbon emissions in society. This indicates that taxation is crucial and should be utilised as a powerful tool to restrict and regulate the airborne emissions of carbon-based compounds. Frey (2017) further demonstrated that businesses are less likely to use fossil fuels and promote sustainable energy alternatives when there is an adequate tax income stream.

(2) To persuade the E7 nations to use taxes to reduce emissions, a firm policy plan is required. However, there are significant differences in how various nations evaluate their environmental tax instrument policies. Considering the tax’s effects is a necessary step in establishing a reliable standard for the effect it has on emissions. According to Parry et al. (2022), there are significant differences in environmental levies across nations, reflecting the differences in obligations between nations to achieve the objectives of the Paris Agreement. Our empirical study indicates how enacting environmental taxes may improve climate welfare, promote technical advancement, and increase the usage of renewable energy sources. The study’s conclusions can also be used to suggest appropriate policy implications for sustainable development.

(3)This research will explore the effectiveness of environmental taxes as a policy tool for promoting the adoption of clean energy technologies, with a particular focus on their impact on ecological sustainability. It will consider the potential benefits and challenges associated with the implementation of environmental taxes, as well as the factors that influence their effectiveness. The research will also examine the experiences of different emerging countries and regions in using environmental taxes to encourage the adoption of clean energy technologies and will consider the potential for the use of these taxes to contribute to the transition to a more sustainable energy system. Overall, this research will provide valuable insights into the role of environmental taxes in promoting clean energy and ecological sustainability and will help policymakers and other stakeholders make informed decisions about the use of these policy tools.

Literature

The Emerging 7 administration has been compelled to accelerate the transition to sustainable development as a result of worries about climate change. Only with the proper economic tools and financial means is this feasible. Kosonen and Nicodème (2009) noted that fiscal tools play a significant role in accomplishing E7 energy and environmental objectives, whether used solely or in conjunction with other MBIs. As a result, two key subjects are covered in the scientific Literature regarding the connection between the environment, environmental taxation, and renewable energy. The first subject is how environmental taxes encourage the use of renewable energy (Doğan et al. 2022; Niu et al. 2018; Radmehr et al. 2022; Shahzad et al. 2021). The second subject is how using renewable energy is hampered by environmental rules (Bashir et al. 2022; Hájek et al. 2019). As such, our study objective will try to answer the following hypothesis.

H1—Environmental tax provides an economical route to the reduction of carbon emissions

Adopting environmental taxes is crucial and urgently needed for the government to reduce externalities, especially in light of the scarcity and non-renewability of natural resources(Pazienza 2011; X. Sun et al. 2022a, b). And expedite for the main contributors to be held accountable in the form of an appropriate levy. By internalizing the societal cost of environmental pollution and ecological loss, environmental taxes are a powerful tool for addressing externalities (Greaker et al. 2022). Thus, the social cost is changed into an internal business expense and represented as a market-based transfer of environmental resources. A suitable environmental tax may help cover the expenses of environmental harm, efficiently decrease pollution, and enhance the ecological environment (Long et al. 2022). The environmental tax is correlated with pollutant concentrations per the “polluter pays” concept. There are several sorts of pollution, each with a unique tax rate.

Most research back up the claim that environmental levies may boost business environmental efforts and cut pollution emissions(L. Wang et al. 2022a, b; Zhang et al. 2022). According to Chang et al. (2009), an environmental tax could produce the “triple dividend” of improved environmental conditions, increased employment, and higher corporate profits when there are significant environmental externalities and if the elasticity of cross-period substitution of consumption is low. The “double dividend” impact theory contends that environmental taxes might enhance the economic advantages of skewed taxes; as pollution control technologies advance, the theory of irrational resource allocation is likewise altered (Terkla 1984). Energy conservation and pollution control solutions are motivated by the presence of a positive net benefit (Pearce 1991). The absence of incentives for innovation was caused by the non-competitive character of green technology, which predetermined its public product qualities (Romer 1990). As a result, researchers are divided on the question of whether environmental levies have an incentive impact on technological advancement.

Several empirical research (Farooq et al. 2019; King et al. 2019) demonstrate that environmental taxes reduce emissions. He et al. (2019) explore the dual rewards of recycling money from environmental taxes and validate previous research results, specifically, that carbon taxes are a successful strategy for lowering glasshouse gas emissions.

H2—Environmental tax complement clean energy to protect the environment

Environmental taxes, in the opinion of many academics, may help create a cleaner environment.

Regarding whether ETs have beneficial impacts on advancing green technology, enhancing energy efficiency, and producing a cleaner environment, the academic community has not yet come to a consensus (Fang et al. 2022). Green taxes, according to some academics, may aid in achieving more Environmentaly friendly aims(Mardones and Mena 2020; Wang et al. 2022a, b). For instance, its adoption has improved the quality of green investments, renewable energy investments, and the competitiveness of renewable energy technologies (Ahmed et al. 2022a; Lambertini et al. 2020; Yang et al. 2020; Wesseh and Lin 2019). Higher ET income led to greater emission reductions, as well as decreased fossil fuel energy use and production (Safi et al. 2021). Another school of thought contends that environmental fees may result in technological advancement, thereby alleviating the difficulties associated with high emissions (Borozan 2019; Ciaschini et al. 2012).

Despite significant growth in manufacturing production, the implied pollution tax in the USA doubled between 1990 and 2008, resulting in a 60% decrease in air pollutant emissions from the manufacturing sector (Shapiro and Walker 2018). Other papers, however, have shown that a carbon price does not succeed in reducing carbon emissions (King et al. 2019; Klenert and Mattauch 2016). Various places, nations, and types of pollutants are affected by ETs in different ways (Lin and Li 2011). (Mardones and Cabello 2019). The existing study examines the benefits of introducing environmental levies over other devices like regulations and tradeable licenses. According to traditional economic understanding, an increase in the price of ordinary items induced by taxation diminishes demand. Pigou (1920) Proposed the principle of imposing an environmental tax to absorb negative externalities in the first pioneering research on environmental tax.

Theoretical framework, empirical modelling, and data collection

The theoretical basis for how environmental measures like taxes and renewable energy sources affect the carbon neutrality goal is described in this section. Given that businesses are what drive the economy on a micro level, the sustainability of the whole society depends on how well their economic and environmental growth are integrated. Many countries have created environmental protection laws that have an influence on businesses in order to safeguard the environment. However, regulations and actions that are only intended to advance environmental protection compel businesses to divert a portion of their production and operating budgets to environmental protection, which raises their production costs, lowers their economic benefits, and breeds opposition (Palmer et al. 1995). Porter and Van der Linde (1995) put out the Porter hypothesis as a competing theory (pH). They claim that effective environmental regulation may boost enterprises’ technical innovation, lower compliance costs, and boost their industrial competitiveness, resulting in a scenario where everyone benefits. Based on this theory, academics and government agencies are looking at suitable environmental regulations to enhance businesses’ environmental performance without impairing it. These serve as the theme for our study.

The economy and the environment are affected by environmental policies, which are often known as environmental levies. Implementing environmental taxes, such as carbon taxes, is one way to reduce carbon emissions. According to Alola et al. (2022), environmental taxes, in particular, reduced the sales of gasoline, petrol, and natural gas, which in turn reduced carbon emissions. Environmental taxes, however, might have a detrimental impact on the economy, claim the decision-makers(Huang et al. 2022). The STRIPAT model, the carbon curse hypothesis, and the tenet of “pollute now, grow later” are among the theories that explain the factors influencing environmental quality.

However, additional human activities either reduce or increase carbon emissions (ecological destruction), and these things may occur via the indirect influence of socioeconomic variables. These factors, such as population and urbanization, are introduced into our model to apprise their contribution to the carbon neutrality targets. As a result, we take into account these two factors while modeling carbon emissions, and as a result, the following is how our basic models are stated for this empirical adventure: our model, therefore, is motivated by (Abbas et al. 2022; Bonilla et al. 2022; Doğan et al. 2022; Domguia et al. 2022; Fang et al. 2022; Hájek et al. 2019). Following that, QQR is used to analyse the link between the indicators in question.

The quantile-on-quantile approach (QQR)

A multivariate quantile regression model was used to examine how different quantiles of X affected various quantiles of Y. The model is represented as follows:

When \({X}_{t}\) represents the dependent indicators in time t and \({Y}_{t}\) symbolizes the independent indicator in period t. \({\epsilon }_{t}^{\theta }\) also represents the quantile error terms. in which the projected \(\theta\) quantile is zero. \({\upbeta }^{\uptheta }\) is an unidentified parameter for which we lack historical data pertaining to the relationship between Y and X.

Therefore, the study further explores quantile-on-quantile regression to test our hypotheses. The panel quantile linear regression evaluates, at various quantiles, the effect of the explanatory variables on the regress and. Koenker and Bassett Jr (1978) proposed quantile regression, creating an optimal solution that minimizes the absolute value of the residual. The quantile prediction model is based on an objective function that minimises the absolute value of the residual as opposed to the OLS, which minimises the residual’s sum of squares. Because of this, the quantile regression is less affected by outliers and offers more information about the estimate for various conditional distributions than the OLS does (Chernozhukov and Hansen 2008). The quantile regression model does not respond to monotonic modifications and has a conventional asymptotic normal distribution (Mu and He 2007)

As a result, the QR method outperforms the conventional least squares (OLS) method. The conditional average of the explained variable is evaluated using traditional linear regression proposed by Stone (1977) and (Cleveland 1979), which assesses the impact of certain quantiles of the explanatory variable (Hashmi et al. 2021; Ohajionu et al 2022). As a consequence, by combining traditional linear regression with fundamental quantile regression, we can analyze the impact of both the explanatory and explained factors on various quantiles. This provides a clearer picture of the interactions between the explanatory and explained factors.

It represents the conditional quantile of CO2 emission \({QDEP}_{it}\left(\tau /{X}_{it}\right)\) in the expression, with τtℎ representing the association among variables in the baseline Eqs. 1 and 2, if \({X}_{it}\) represents the vector of independent variables.

Data

Our analysis makes a panel dataset for E7 countries from 2000 to 2020 based on availability (China, Turkey, India, Russia, Brazil, Indonesia, and Mexico). The E7 countries’ commitment to achieving a carbon neutrality goal by 2030 plays a crucial influence in the selection of nations after the COP26 promise. Table 1 gives the data’s executive summary.

Result and discussion

This section deals with the empirical finding of the study, which are the summary statistics and correlation coefficient examination. Table 2 shows the basic measurement of the coefficients under study it was observed that all the variables confirmed a negatively skewed analysis span. In respect of the dataset’s peaks, as indicated by kurtosis, population, urbanization, and access to clean fuel and technology have a heavily tails while renewable energy, environmental tax, and emission have light tails. When we fail to reject the Jarque–Bera likelihood function, the normality evaluation assessment demonstrates that all series are normally distributed, which is a desirable result. Moreover, the variance inflation factor (VIF) from Table 4 shows that there is no multicollinearity among the selected coefficients. For the correlation analysis presented in Table 3, it is observed that all the independent variables are negatively significantly correlated with the dependent variable except urbanization, which has a positive connection with carbon emission. There is, nonetheless, a critique of Pearson correlation evaluation, so more econometric analysis is required; this is addressed in the subsequent stage of the current investigation (Table 4).

The study examines the data series for CD utilizing the Breusch and Pagan (1980) LM, Pesaran (2015) scaled LM, Peseran (2007) CD, and bias-corrected scaled LM techniques. The outcomes of the assessments are shown in Table 5. The study rejects the null hypothesis of no cross-sectional linking in all four tests for all the factors at a one percent significance level for E7 economies. The Pesaran-Yamagata (2008) SH technique in Table 6 as well proves that the null of SH is rejected at a 1% level of significance. This suggests that all the succeeding econometric investigations must demonstrate robustness alongside CD as well as SH.

Based on the analysis, all factors are shown stationary at first difference, as shown by the econometric analysis of Pesaran’s (2007) CIPS and CADF unit root techniques (see Table 7). Moreover, from the outcome of the cointegration analyses in Table 4 (from Westerlund 2007 and Kao Residual Cointegration Test), it is clear that there is a long-run connection among the factors. However, both techniques show a null hypothesis that there is rejected at 1% significant level indicating a cointegration between the factors for both techniques (Table 8).

Discussion of findings

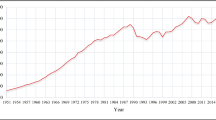

Table 9 shows a baseline regression that analyzes the effects of environmental tax, renewable energy, access to clean fuel and technology, population growth, and urban population on E7’s carbon dioxide (CO2) emissions. However, the quantile-on-quantile regression was adopted as the main technique in support of its graphs in Fig. 1 and Table 11, which shows that all the variables are stable, while Driscoll-Kraay’s fixed effect based on its error corrections is used as a robustness check for this study.

From the analysis, it was observed that, for all the quantiles (lower, median, and upper), environmental tax is negatively significantly related to carbon emission. This means environmental tax is having positive impact on the E7 environment. Similarly, Chien et al (2021) and Khan et al (2021)confirmed a similar result and argued that environmental tax is encouraging news for addressing environmental deterioration like carbon emissions. Nonetheless, Shahzad’s (2020) empirical findings suggested that the significance of environmental tax in dealing with carbon emissions is still equivocal; therefore, additional research is needed. However, renewable energy from all the quantile analysis shows a negatively significant relationship with emission. Using clean energy instead of polluting energy is one way to lessen the impact on the environment. These findings are consistent with those of Gyamfi et al (2021) for E7 economies and Bekun et al. (2019) for the EU countries, which also indicate that ecological degradation reduces when renewable energy grows. Nevertheless, access to clean fuel and technologies for cooking also have a negatively significant relationship with carbon emission for the E7 economies, which implies that it helps in combating environmental degradation for the understudy countries. Intuitively, this makes sense from a purely economic standpoint, as switching to clean energy sources eliminates a major threat to human progress that was previously hindered by the economy. Previous studies by Acheampong et al. (2023), Alola et al. (2021), Lee et al. (2017), and Lee et al. (2022) support this conclusion. In particular, Lee et al. (2017) concluded that the acceptance of clean energy improves the level of household well-being since clean energy is associated with education, assets, income status, and governmental incentives. Again, population growth and urbanization are seen to have a negative significant connection with carbon emission from all the quantiles. This implies that the ecological cost of urbanization and population growth of the E7 economies—which includes a rise in both population growth and urban population—is higher than its perceived benefits. The harmful effect of undomesticated urban cities validates with the analysis of Agboola et al. (2022) and Ozatac et al. (2017).

For the Driscoll-Kraay fixed effect OLS analysis (Table 10), which was used for sensitivity analysis for the study where variables are added and dropped, it was observed that at model 1, when there was no clean energy in the equation, the environmental tax was negatively insignificant related with carbon emission. Population growth is negatively significantly related to carbon emission, and urban population is positively related to carbon emission. For model 2, it was observed that environmental tax and renewable energy are negatively insignificant connected with carbon emission, whiles population and urbanization are positive and significantly linked with carbon emission. Moreover, model 3 shows that environmental tax is negatively insignificant connected with carbon emission, population and urbanization are positively significantly linked with carbon emission, while access to clean fuels and technologies for cooking also has a negatively significant connection with carbon emission. For model 4 where all the variables are utilized, it was observed that environmental tax, renewable energy, and access to clean fuels and technologies for cooking have negatively significant relationship with carbon emission. In contrast, population growth and urban population have a positive significant connection with carbon emission for the E7 economies (Appendixed Fig. 2).

The results are important because they show what needs to be done in the countries studied at the level of the COP:26 accord to make the environment more resilient. The year 2050 may seem far off, but leaders still have time to specify concrete policies that will bring the world to decarbonization by then. To stop the prices of renewable energy from going up, it is necessary to use new technology in manufacturing. The fact that numerous manufacturing sectors worldwide are embracing Industry 4.0 to implement sustainable production methods adds to the evidence (Shahbaz et al. 2022a). Similarly, renewable energy must be expanded significantly to replace fossil fuels as the world’s principal power source (Gyamfi et al 2021; Agozie et al. 2022; Onifade et al 2022; Gyamfi 2022; Appiah et al 2022).

Nevertheless, the authorities must diligently accompany the operation of imposing ecological fees on fossil fuel use. These actions are critical for shifting to green economic output (Dogan et al. 2020) and, thus, lowering pollution levels (Khan et al 2021). The goals of COP:26 are within range in this setting, but they will not be realized without the involvement of all economic entities.

Conclusion and policy recommendations

Anxieties about decreasing ecological poverty carry a great concern that must be investigated in the nations that endorsed the COP accord: 26. In light of this; the study looks at the E7 economies’ long-term connection between environmental tax, renewable energy, access to clean fuels and technologies for cooking, urban population and population growth to the environment from 2000 through 2020. A series of pilot tests are used in the study to limit the effect of cross-sectional correlation and make sure the results are accurate. Unlike previous studies, this one uses Sim and Zhou’s (2015) quantile-on-quantile (QQ) regression, which takes into account the fixed effects of the panel. The Driscoll-Kraay fixed effect OLS also validates the results of the regressions using QQ. From the empirical findings, it was observed that environmental tax, renewable energy, and access to clean fuels and technologies for cooking all decrease environmental pollution for the E7 economies through the quantiles. On the other hand, urban population growth and pupation growth also have a positively significant connection with emissions for the E7 economies. This proves that these variables enhance pollution within the E7 countries.

This would support the case for prioritizing renewable energy sources over non-renewable ones that contribute more to emissions through carbon emission particulates in order to lower the high levels of carbon emissions in the economies of focus. This research shows that the environmental protection laws that are already in place in the E7 economies are working. It also shows that environmental taxes and clean energy are good for the environment. The governments of these countries should start new research and development projects on technologies that are good for the environment. They should also work with the private sector to come up with new ways to fight the most harmful things, like carbon emissions from business operations. Investors should be taught to put their money into companies that are using eco-friendly technologies to reduce their negative effects on the environment, and laws should be made and put into place to encourage corporations to do this.

Additionally, in order to effectively address the environmental issues brought on by economic expansion, the E7 nations must change their economies into green ones. Sustainability in the manufacturing process refers to the development of items that are created in an inexpensive manner. These goods are produced in the most effective method possible while also being mindful of the environment. This manufacturing technique promotes the security of the workforce, the community, and the goods. Therefore, innovation-driven sustainable industrialisation should be the main emphasis.

Compared to the majority of the globe, the E7 economies rely too much on nonrenewable energy sources. Environmental and emission taxes, for example, are a form of the carbon-emitting material price that can sway both producers and consumers toward renewable energy. Both businesses and individuals need to be incentivized to favor ecologically sustainable goods and services. It is imperative to switch to renewable energy sources from those that produce carbon dioxide. Because diesel cars put out a lot of carbon and fine particles, vehicle registration, and use fees can make people less likely to buy them. The car industry and other forms of mobility in these countries should make the switch to electric propulsion. Strategies like these would aid in the transformation of the entire economy in support of the ecosystem, and they would help the E7 countries develop an eco-friendly environment.

Similar to how the US economy is doing, the proceeds from the carbon tax should go toward supporting initiatives that encourage the use of clean energy sources in order to improve the lives of the general public. Similarly, green employment creation can benefit from this boost. Disappointingly, the COVID-19 pandemic has been linked to a rise in income disparity as a result of widespread rising unemployment. There will be a 24 million increase in employment due to green job expansion. The widespread implementation of the carbon tax could result in a dramatic transition to a green economy. This research suggests that a carbon tax can be used as a long-term economic austerity to increase the usage of renewable energy and reduce the adverse effects of climate change. Since the pandemic has taught us to strike environmental threats before they strike back, COVID-19’s shock will speed up the transition to a low-carbon economy (Doğan et al 2022).

The authors of this article also assure that they follow the publishing procedures and agree to publish it as any form of access article, confirming access standards and licensing to subscribe.

Data availability

The data will be available upon reasonable request.

References

Abbas S, Gui P, Chen A, Ali N (2022) The effect of renewable energy development, market regulation, and environmental innovation on CO2 emissions in BRICS countries. Environ Sci Pollut Res 29(39):59483–59501. https://doi.org/10.1007/s11356-022-20013-7

Acheampong AO, Opoku EEO, Dogah KE (2023) The political economy of energy transition: the role of globalization and governance in the adoption of clean cooking fuels and technologies. Technol Forecast Soc Chang 186:122156

Adebayo TS, Bekun FV, Rjoub H, Agboola MO, Agyekum EB, Gyamfi BA (2022) Another look at the nexus between economic growth trajectory and emission within the context of developing country: fresh insights from a nonparametric causality-in-quantiles test. Environ Devel Sustain 1–23

Adedoyin FF, Bein MA, Gyamfi BA, Bekun FV (2021) Does agricultural development induce environmental pollution in E7? A myth or reality. Environ Sci Pollut Res 28:41869–41880

Agboola PO, Hossain M, Gyamfi BA, Bekun FV (2022) Environmental consequences of foreign direct investment influx and conventional energy consumption: evidence from dynamic ARDL simulation for Turkey. Environ Sci Pollut Res 29(35):53584–53597

Agozie DQ, Gyamfi BA, Bekun FV, Ozturk I, Taha A (2022) Environmental Kuznets Curve hypothesis from lens of economic complexity index for BRICS: evidence from second generation panel analysis. Sustainable Energy Technol Assess 53:102597

Ahmed Z, Ahmad M, Murshed M, Ibrahim Shah M, Mahmood H, Abbas S (2022a) How do green energy technology investments, technological innovation, and trade globalization enhance green energy supply and stimulate environmental sustainability in the G7 countries? Gondwana Res 112:105–115. https://doi.org/10.1016/j.gr.2022.09.014

Ahmed Z, Ahmad M, Rjoub H, Kalugina OA, Hussain N (2022b) Economic growth, renewable energy consumption, and ecological footprint: Exploring the role of environmental regulations and democracy in sustainable development. Sustain Dev 30(4):595–605

Ali M, Kirikkaleli D (2022) The asymmetric effect of renewable energy and trade on consumption-based CO2 emissions: the case of Italy. Integr Environ Assess Manag 18(3):784–795

Alola AA, Okere KI, Muoneke OB, Dike GC (2022) Do bureaucratic policy and socioeconomic factors moderate energy utilization effect of net zero target in the EU? J Environ Manag 317:115386. https://doi.org/10.1016/j.jenvman.2022.115386

Alola AA, Ozturk I, Bekun FV (2021) Is clean energy prosperity and technological innovation rapidly mitigating sustainable energy-development deficit in selected sub-Saharan Africa? A Myth or Reality Energy Policy 158:112520

Ambhore S, Ofori EK (2023) Exploring psychological well-being in business and economics arena: A bibliometric analysis. Health Science Reports 6(1):e1044

Aoun A, Ghandour M, Ilinca A, Ibrahim H (2022) Revamping energy sector with a trusted network: blockchain technology. Blockchain Technology in Corporate Governance: Transforming Business and Industries 163–195

Appiah M, Gyamfi BA, Adebayo TS, Bekun FV (2022) Do financial development, foreign direct investment, and economic growth enhance industrial development? Fresh evidence from Sub-Sahara African countries. Portuguese Econ J 1–25

Bamidele R, Ozturk I, Gyamfi BA, Bekun FV (2022) Tourism-induced pollution emission amidst energy mix: evidence from Nigeria. Environ Sci Pollut Res 1–10

Barbier E (2011). The policy challenges for green economy and sustainable economic development. In: Natural resources forum (Vol. 35, No. 3, pp. 233–245). Oxford, UK: Blackwell Publishing Ltd.

Bashir MF, Ma B, Bashir MA, Radulescu M, Shahzad U (2022) Investigating the role of environmental taxes and regulations for renewable energy consumption: evidence from developed economies. Economic Research-Ekonomska Istraživanja 35(1):1262–1284

Bekun FV, Alola AA, Sarkodie SA (2019) Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029

Bekun FV, Gyamfi BA, Onifade ST, Agboola MO (2021) Beyond the environmental Kuznets Curve in E7 economies: accounting for the combined impacts of institutional quality and renewables. J Clean Prod 314:127924

Bonilla D, Banister D, Nieto US (2022) Tax or clean technology? measuring the true effect on carbon emissions mitigation for Sweden and Norway. Energies 15(11):3885

Borozan D (2019) Unveiling the heterogeneous effect of energy taxes and income on residential energy consumption. Energy Policy 129:13–22

Boyd D, Pathak M, van Diemen R, Skea J (2022) Mitigation co-benefits of climate change adaptation: A case-study analysis of eight cities. Sustain Cities Soc 77:103563

Braathen NA, Serret Y (2007) Instrument mixes for environmental policy. OECD, Paris

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Chernozhukov V, Hansen C (2008) Instrumental variable quantile regression: a robust inference approach. Journal of Econometrics 142(1):379–398

Chien F, Sadiq M, Nawaz MA, Hussain MS, Tran TD, Le Thanh T (2021) A step toward reducing air pollution in top Asian economies: The role of green energy, eco-innovation, and environmental taxes. J Environ Manage 297:113420

Chopra M, Singh SK, Gupta A, Aggarwal K, Gupta BB, Colace F (2022) Analysis & prognosis of sustainable development goals using big data-based approach during COVID-19 pandemic. Sustain Technol Entrep 1(2):100012

Ciaschini M, Pretaroli R, Severini F, Socci C (2012) Regional double dividend from environmental tax reform: an application for the Italian economy. Res Econ 66(3):273–283

Cleveland WS (1979) Robust locally weighted regression and smoothing scatterplots. J Am Stat Assoc 74(368):829–836

Doğan M, Timothy DJ (2020) Beyond tourism and taxes: the ecomuseum and social development in the Ak-Chin tribal community. J Tour Cult Chang 18(2):133–149

Doğan B, Chu LK, Ghosh S, Truong HHD, Balsalobre-Lorente D (2022) How environmental taxes and carbon emissions are related in the G7 economies? Renewable Energy 187:645–656

Domguia EN, Pondie TM, Ngounou BA, Nkengfack H (2022) Does environmental tax kill employment? Evidence from OECD and non-OECD countries. J Clean Prod 380:134873

Fang G, Yang K, Tian L, Ma Y (2022) Can environmental tax promote renewable energy consumption? — An empirical study from the typical countries along the Belt and Road. Energy 260:125193. https://doi.org/10.1016/j.energy.2022.125193

Farooq MU, Shahzad U, Sarwar S, ZaiJun L (2019) The impact of carbon emission and forest activities on health outcomes: Empirical evidence from China. Environ Sci Pollut Res 26(13):12894–12906

Frey M (2017) Assessing the impact of a carbon tax in Ukraine. Climate Policy 17(3):378–396

Greaker M, Hagem C, Skulstad A (2022) Internalizing negative environmental impacts from wind power production: Coasian bargaining, offsetting schemes and environmental taxes

Gyamfi BA (2022) Consumption-based carbon emission and foreign direct investment in oil-producing Sub-Sahara African countries: the role of natural resources and urbanization. Environ Sci Pollut Res 29(9):13154–13166

Gyamfi BA, Adedoyin FF, Bein MA, Bekun FV, Agozie DQ (2021) The anthropogenic consequences of energy consumption in E7 economies: juxtaposing roles of renewable, coal, nuclear, oil and gas energy: evidence from panel quantile method. J Clean Prod 295:126373

Gyamfi BA, Onifade ST, Ofori EK (2022a) Synthesizing the impacts of information and communication technology advancement and educational developments on environmental sustainability: A comparative analyses of three economic blocs—BRICS, MINT, and G7 economies. Sustain Dev

Gyamfi BA, Onifade ST, Nwani C, Bekun FV (2022b) Accounting for the combined impacts of natural resources rent, income level, and energy consumption on environmental quality of G7 economies: a panel quantile regression approach. Environ Sci Pollut Res 29(2):2806–2818

Hájek M, Zimmermannová J, Helman K, Rozenský L (2019) Analysis of carbon tax efficiency in energy industries of selected EU countries. Energy Policy 134:110955

Hashmi SM, Chang BH, Rong L (2021) Asymmetric effect of COVID-19 pandemic on E7 stock indices: Evidence from quantile-on-quantile regression approach. Res Int Bus Financ 58:101485

He P, Chen L, Zou X, Li S, Shen H, Jian J (2019) Energy taxes, carbon dioxide emissions, energy consumption and economic consequences: a comparative study of nordic and G7 countries. Sustainability 11(21):6100

Huang Y, Haseeb M, Usman M, Ozturk I (2022) Dynamic association between ICT, renewable energy, economic complexity and ecological footprint: is there any difference between E-7 (developing) and G-7 (developed) countries? Technol Soc 68:101853

Kemp R (2000) Technology and Environmental Policy—Innovation effects of past policies and suggestions for improvement. Innov Environ 1:35–61

Khan SAR, Ponce P, Yu Z (2021) Technological innovation and environmental taxes toward a carbon-free economy: An empirical study in the context of COP-21. J Environ Manage 298:113418

King M, Tarbush B, Teytelboym A (2019) Targeted carbon tax reforms. Eur Econ Rev 119:526–547

Klenert D, Mattauch L (2016) How to make a carbon tax reform progressive: the role of subsistence consumption. Econ Lett 138:100–103

Koenker R, Bassett Jr G (1978) Regression quantiles. Econometrica: journal of the Econometric Society 33–50

Kosonen K, Nicodème G (2009) Taxation papers: The role of fiscal instruments in environmental policy. Office for Official Publications of the European Communities, EU

Lambertini L, Pignataro G, Tampieri A (2020) The effects of environmental quality misperception on investments and regulation. Int J Prod Econ 225:107579

Lee CC, Olasehinde‐Williams G, Gyamfi BA (2022) The synergistic effect of green trade and economic complexity on sustainable environment: a new perspective on the economic and ecological components of sustainable development. Sustain Dev

Lee SO, Hong A, Hwang J (2017) ICT diffusion as a determinant of human progress. Inf Technol Dev 23(4):687–705

Lin B, Li X (2011) The effect of carbon tax on per capita CO2 emissions. Energy Policy 39(9):5137–5146

Liu L, Jiang J, Bian J, Liu Y, Lin G, Yin Y (2021) Are environmental regulations holding back industrial growth? Evidence from China. J Clean Prod 306:127007. https://doi.org/10.1016/j.jclepro.2021.127007

Long F, Lin F, Ge C (2022) Impact of China’s environmental protection tax on corporate performance: Empirical data from heavily polluting industries. Environ Impact Assess Rev 97:106892

Mahmood N, Zhao Y, Lou Q, Geng J (2022) Role of environmental regulations and eco-innovation in energy structure transition for green growth: Evidence from OECD. Technol Forecast Soc Chang 183:121890

Mardones C, Cabello M (2019) Effectiveness of local air pollution and GHG taxes: the case of Chilean industrial sources. Energy Econ 83:491–500

Mardones C, Mena C (2020) Economic, environmental and distributive analysis of the taxes to global and local air pollutants in Chile. J Clean Prod 259:120893

Mu Y, He X (2007) Power transformation toward a linear regression quantile. J Am Stat Assoc 102(477):269–279

Muradian R, Gómez-Baggethun E (2021) Beyond ecosystem services and nature’s contributions: Is it time to leave utilitarian environmentalism behind? Ecol Econ 185:107038

Nanda VP (2021) Global climate change and international law and institutions. In: World Climate Change (pp. 227–239). Routledge

Niu T, Yao X, Shao S, Li D, Wang W (2018) Environmental tax shocks and carbon emissions: an estimated DSGE model. Struct Chang Econ Dyn 47:9–17

Ofori EK, Onifade ST, Ali EB, Alola AA, Zhang J (2023) Achieving carbon neutrality in post COP26 in BRICS, MINT, and G7 economies: the role of financial development and governance indicators. J Clean Prod 387:135853. https://doi.org/10.1016/j.jclepro.2023.135853

Ohajionu UC, Gyamfi BA, Haseki MI, Bekun FV (2022) Assessing the linkage between energy consumption, financial development, tourism and environment: evidence from method of moments quantile regression. Environ Sci Pollut Res 1–15

Onifade ST, Gyamfi BA, Bekun FV, Altuntaş M (2022) Significance of air transport to tourism-induced growth hypothesis in E7 economies: exploring the implications for environmental quality. Tourism: An International Interdisciplinary Journal 70(3):339–353

Onifade ST, Gyamfi BA, Haouas I, Bekun FV (2021) Re-examining the roles of economic globalization and natural resources consequences on environmental degradation in E7 economies: are human capital and urbanization essential components? Resour Policy 74:102435

Ozatac N, Gokmenoglu KK, Taspinar N (2017) Testing the EKC hypothesis by considering trade openness, urbanization, and financial development: the case of Turkey. Environ Sci Pollut Res 24(20):16690–16701

Palmer K, Oates WE, Portney PR (1995) Tightening environmental standards: the benefit-cost or the nocost paradigm? J Econ Perspect 9(4):119–132

Paramati SR, Shahzad U, Doğan B (2022) The role of environmental technology for energy demand and energy efficiency: Evidence from OECD countries. Renew Sustain Energy Rev 153:111735

Parry I, Heine D, Kizzier K, Smith T (2022) A carbon levy for international maritime fuels. Review of Environmental Economics and Policy 16(1):25–41

Pazienza P (2011) Should we tax tourism? Theoretical justifications from the economics of non-renewable resource use. Environ Econ 2(1):8–16

Pearce D (1991) The role of carbon taxes in adjusting to global warming. Econ J 101(407):938–948

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econ 142(1):50–93

Pigou AC (1920) Co-operative societies and income tax. Econ J 30(118):156–162

Porter ME, Linde CVD (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9(4):97–118

Radmehr R, Shayanmehr S, Ali EB, Ofori EK, Jasińska E, Jasiński M (2022) Exploring the nexus of renewable energy, ecological footprint, and economic growth through globalization and human capital in g7 economics. Sustainability 14(19):12227

Romer PM (1990) Endogenous technological change. J Polit Econ 98(5, Part 2):S71–S102

Rosenow J, Cowart R, Thomas S (2019) Market-based instruments for energy efficiency: a global review. Energ Effi 12(5):1379–1398

Safi A, Chen Y, Wahab S, Zheng L, Rjoub H (2021) Does environmental taxes achieve the carbon neutrality target of G7 economies? Evaluating the importance of environmental R&D. J Environ Manag 293:112908. https://doi.org/10.1016/j.jenvman.2021.112908

Sarpong SY, Bein MA, Gyamfi BA, Sarkodie SA (2020) The impact of tourism arrivals, tourism receipts and renewable energy consumption on quality of life: a panel study of Southern African region. Heliyon 6(11):e05351

Satola D, Balouktsi M, Lützkendorf T, Wiberg AH, Gustavsen A (2021) How to define (net) zero greenhouse gas emissions buildings: the results of an international survey as part of IEA EBC annex 72. Build Environ 192:107619

SDG U (2019) Sustainable development goals. The energy progress report. Tracking SDG 7

Shahbaz M, Gyamfi BA, Bekun FV, Agozie DQ (2022a) Toward the fourth industrial revolution among E7 economies: assessment of the combined impact of institutional quality, bank funding, and foreign direct investment. Eval Rev 46(6):779–803

Shahbaz M, Nwani C, Bekun FV, Gyamfi BA, Agozie DQ (2022b) Discerning the role of renewable energy and energy efficiency in finding the path to cleaner consumption and production patterns: New insights from developing economies. Energy 260:124951

Shaheen F, Lodhi MS, Rosak-Szyrocka J, Zaman K, Awan U, Asif M, Ahmed W, Siddique M (2022) Cleaner technology and natural resource management: An environmental sustainability perspective from China. Clean Technologies 4(3):584–606

Shahzad U (2020) Environmental taxes, energy consumption, and environmental quality: Theoretical survey with policy implications. Environ Sci Pollut Res 27(20):24848–24862

Shahzad U, Radulescu M, Rahim S, Isik C, Yousaf Z, Ionescu SA (2021) Do environment-related policy instruments and technologies facilitate renewable energy generation? Exploring the contextual evidence from developed economies. Energies 14(3):690

Shapiro JS, Walker R (2018) Why is pollution from US manufacturing declining? The roles of environmental regulation, productivity, and trade. Am Econ Rev 108(12):3814–3854

Shapiro SA, McGarity TO (1991) Not so paradoxical: the rationale for technology-based regulation. Duke LJ 729

Sharma GD, Kraus S, Srivastava M, Chopra R, Kallmuenzer A (2022) The changing role of innovation for crisis management in times of COVID-19: an integrative literature review. J Innov Knowl 100281.

Srivastava T, Virk S, Ganguli S (2022) An overview of the intelligent green technologies for sustainable smart cities. Intelligent Green Technologies for Sustainable Smart Cities 1–17

Steve YS, Murad AB, Gyamfi BA, Bekun FV, Uzuner G (2022) Renewable energy consumption a panacea for sustainable economic growth: panel causality analysis for African blocs. Int J Green Energy 19(8):847–856

Stoll C, Mehling MA (2021) Climate change and carbon pricing: overcoming three dimensions of failure. Energy Res Soc Sci 77:102062

Stone CJ (1977) Consistent nonparametric regression. Ann Stat 5:595–620

Sun X, Ren J, Wang Y (2022a) The impact of resource taxation on resource curse: Evidence from Chinese resource tax policy. Resour Policy 78:102883

Sun Y, Guan W, Cao Y, Bao Q (2022b) Role of green finance policy in renewable energy deployment for carbon neutrality: evidence from China. Renew Energy 197:643–653. https://doi.org/10.1016/j.renene.2022.07.164

Terkla D (1984) The efficiency value of effluent tax revenues. J Environ Econ Manag 11(2):107–123

Tsai KH, Liao YC (2017) Innovation capacity and the implementation of eco-innovation: toward a contingency perspective. Bus Strateg Environ 26(7):1000–1013

Ürge-Vorsatz D, Herrero ST, Dubash NK, Lecocq F (2014) Measuring the co-benefits of climate change mitigation. Annu Rev Environ Resour 39(1):549–582

Van Aaken A, Simsek B (2021) Rewarding in international law. Am J Int Law 115(2):195–241

Wang L, Chen Z, Mahmood MT, Mehdi MNJ, Ullah S, Nazam M, Hafeez M (2022a) Do transportation taxes promote pro-environmental behaviour? An empirical investigation. Environ Sci Pollut Res 1–9

Wang X, Khurshid A, Qayyum S, Calin AC (2022b) The role of green innovations, environmental policies and carbon taxes in achieving the sustainable development goals of carbon neutrality. Environ Sci Pollut Res 29(6):8393–8407

Weber C, Möst D, Fichtner W (2022) Regulation: grids and environment. Economics of Power Systems. Springer, Berlin, pp 175–233

Wesseh PK Jr, Lin B (2019) Environmental policy and ‘double dividend’ in a transitional economy. Energy Policy 134:110947

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

WHO (2019) Health, environment and climate change, Seventy-second world health assembly. Retrieved 11/29/2022 from http://www.searo.who.int/docs/default-source/climate-change/who-global-strategy-on-health-environment-and-climate-change-a7215.pdf?sfvrsn=20e72548_2

WHO (2020) WHO global strategy on health, environment and climate change: the transformation needed to improve lives and wellbeing sustainably through healthy environments

Yang J, Chen ML, Fu CY, Chen XD (2020) Environmental policy, tax, and the target of sustainable development. Environ Sci Pollut Res 27(12):12889–12898

Yong SK, Chang Y (2022) Emissions tax and executive compensation: a public–private joint mechanism to promote environmental and energy management. Singapore Econ Rev 1–21

Zhang Y, Song Y (2022) Tax rebates, technological innovation and sustainable development: evidence from Chinese micro-level data. Technol Forecast Soc Chang 176:121481

Zhang Y, Khan I, Zafar MW (2022) Assessing environmental quality through natural resources, energy resources, and tax revenues. Environmental Science and Pollution Research 29(59):89029–89044

Zhou Y, Wang M, Hao H, Johnson L, Wang H, Hao H (2015) Plug-in electric vehicle market penetration and incentives: a global review. Mitig Adapt Strateg Glob Chang 20:777–795

Author information

Authors and Affiliations

Contributions

Kwabena Agyarko Sarpong: conceptualization, write up. Wanzhen Xu: write up, supervision, editing. Bright Akwasi Gyamfi: write up, editing. Elvis Kwame Ofori: write up, analysis; editing.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Highlights

• Examine the effect of environmental tax, renewable energy, and clean cooking technology on CO2 emission for E7 economies.

• Driscoll-Kraay and quantile-on-quantile techniques are used in this study.

• Environmental tax improves the E7 economies’ environment.

• Both clean cooking technology and renewable energy also enhance E7’s environment.

• Clean energy and effective environmental tax implementation are essential for carbon neutralization for the E7 economies.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sarpong, K.A., Xu, W., Gyamfi, B.A. et al. Can environmental taxes and green-energy offer carbon-free E7 economies? An empirical analysis in the framework of COP-26. Environ Sci Pollut Res 30, 51726–51739 (2023). https://doi.org/10.1007/s11356-023-25904-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-25904-x