Abstract

This study assesses the role of government spending on environmental sustainability based on a framework that combines the environmental Kuznets curve (EKC) hypothesis with the Armey curve hypothesis. Specifically, the inverted U-shaped relationships between carbon (CO2) emissions and economic growth (EKC hypothesis) and between government spending and economic growth (Armey curve hypothesis) are analyzed using a composite EKC model tested for cross-sectional dependence and heterogeneity, panel unit root, panel co-integration, and the augmented mean group estimation. In so doing, this study pursues a potential transmission mechanism leading from government spending to CO2 emissions through the growth channel and presents a novel way to develop a better understanding of how economic growth policy and energy policy can be synchronized. Empirical results show that economic growth acts as a transmitter between government spending and CO2 emissions in the USA, UK, and Canada. However, the composite EKC hypotehesis is confirmed only for the USA and Canada, where the optimal level of government spending that maximizes CO2 emissions is 29.87% and 29.22% of GDP, respectively. In contrast, the optimal level of government spending equivalent to 28.30% of GDP minimizes CO2 emissions in the UK. The key policy implication is that governments can achieve sustainable economic growth by setting standards for their spending levels.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The link between government spending and energy policy has already been recognized as a critical component of global efforts. Recent initiatives demonstrate that this link has reached the highest political level as commitments to meet the Paris Agreement goals at COP21 and to implement the 2030 Agenda for Sustainable Development have been scrutinized in the public spotlight.Footnote 1 One area of great importance in this context is making financial flows consistent with a “sustainable” pathway to achieve long-term climate and development goals. This is evident in the proposals of António Guterres, the Secretary-General of the United Nations, who suggests that public money should flow to sustainable businesses that help the climate, implying the end of fossil fuel-oriented practices (UNDGC 2020). The Glasgow COP26 summit in late 2021 also underscores this connection with its international agreement to shift global public funds for the unabated fossil fuel energy into the renewable energy transition by the end of 2022 (Ware 2021).

Since public finance is a key mechanism to align funding policies with climate goals, developed countries, particularly the G7, have focused their agenda on directing the flow of public capital toward sustainable investments, for which at least EUR 1 trillion should be mobilized over the next decade (European Commission 2020). COVID-19 has accelerated this process through global stimulus packages. Governments from all across the world have allocated almost USD 19 trillion to mitigate the impact of the pandemic (ILO 2022). The amount of authorized government spending on clean energy has surpassed USD 480 billion, and the majority of this expenditure has occurred in G7 countries. The global clean energy stimulus is anticipated to be spent by the end of 2023 (IEA 2021). However, building such capacity requires resilient policies, significant collaboration, and a high degree of commitment for prioritizing renewable energy. To this end, governments need to diversify public sources to lessen carbon entanglement, align fiscal and budgetary incentives with climate goals and leverage the influence of government spending while ensuring an inclusive transition (OECD 2018).

As is seen, governments play a major role in stimulating the economy, and their contribution to economic growth is now more focused than ever on sustainable development goals especially in response to the pandemic. Hence, evaluating the impact of the size of government spending in the economy on eco-friendly growth deserves attention. Given the importance of government spending in delivering climate solutions, it is timely to provide policymakers with a new analytical tool based on the level of government spending to optimize their economic growth policies and energy policies to achieve a more sustainable environment. Intiutively, the environmental Kuznets curve (EKC) hypothesis and the Armey curve hypothesis appear as two different but not mutually exclusive postulates that may collectively lend insight into how government spending, economic growth, and environmental concerns interact with each other. Looking more closely to these theoretical constructs, the EKC hypothesis, which elucidates the inverted U-shaped curvilinear relationship between economic growth and environmental pollution, can be analyzed in combination with the Armey curve hypothesis, which explains a similar inverted U-shaped curvilinear relationship between economic growth and government spending, The basic premise is that economic growth driven by government spending via the Armey curve may translate into an increase in carbon (CO2) emissions through a single composite EKC model. This is plausible because economic growth, which is common to both hypotheses, is the dependent variable in the Armey curve hypothesis, while it is the independent variable in the EKC hypothesis. Moreover, the identical inverted U-shaped pattern of these two curves implies that it is possible to determine a maximum level of spending that allows policymakers to manage and allocate public resources in such a way that economic growth policies and energy policies are compatible with each other.

In this vein, this study differs from many past studies by investigating whether the impact of government spending on economic growth, i.e., GDP per capita, is transmitted to CO2 emissions by means of a composite variant of the EKC in G7 countries. This Armey curve–induced composite EKC model can provide useful information in two different perspectives: (1) when the model is inverted U-shaped and (2) when the model is U-shaped. The first case is illustrated in Fig. 1 and suggests that it is possible to identify a maximum level of government spending that maximizes CO2 emissions by maximizing economic growth. This implies that CO2 emissions decline following a turning point in government spending–induced economic growth. Additional government spending after that critical point, thus reduces GDP per capita (left-hand side) and CO2 emissions (right-hand side). This supports a more sustainable environment at the cost of economic growth, thereby creating a trade-off. In policy terms, this conjecture can be interpreted in the way that economic growth policies and energy policies would be compatible as long as they are aligned with sustainable development goals to promote sustained, inclusive, and sustainable economic growth, which may require some time.

However, in the second case, as shown in Fig. 2, it would be possible to determine a maximum level of government spending that minimizes CO2 emissions through a maximum level of GDP. This would imply that beyond a critical point, additional government spending is no longer necessary because it lowers GDP per capita (left-hand side) and increases CO2 emissions (right-hand side). Hence, it is possible to argue that both economic growth and energy policies are concurrently congruent with each other and an effective level of government spending would be attained easier to achieve sustainable development goals.

It is worth to note that the empirical analysis based on the composite EKC model must satisfy the following conditions: (1) The Armey curve hypothesis must be verified by an inverted U-shaped curve for a G7 country. (2) The composite EKC model must be significant for that G7 country. If the composite EKC model is inverted U-shaped, then the EKC hypothesis is also verified (see Fig. 1). A U-shaped composite EKC model, on the other hand, indicates that the EKC hypothesis is not supported by the Armey curve hypothesis (see Fig. 2).

In this framework, the corresponding variables of interest are government spending, GDP per capita, and CO2 emissions, which are inherently used in the EKC and the Armey curve literature. However, the use of renewable energy consumption as a control variable makes another difference in this study. It matters to include renewable energy consumption, since it would be reasonable to observe whether it has reached a point where it can affect economic growth and pollution levels. But, on top of that, this study does not merely opt for using “renewable energy consumption,” but rather it consciously precludes having an “energy consumption” variable in the modeling. This has conceptual and empirical grounds. As for the former, it is expected that greater use of renewables in final energy consumption will eventually lower global CO2 emissions (Boluk and Mert 2014) and will affect the turning point of the EKC (Yao et al. 2019). As for the latter, one of the reasons behind why EKC pattern cannot be observed in many studies is attributed to the high correlation between energy consumption, economic growth and CO2 emissions (Sugiawan and Managi 2016). Since it is well documented that higher economic growth requires higher energy consumption, leading to higher CO2 emissions (Ang 2007; Apergis et al. 2010), CO2 emissions are then imputed from energy consumption, which may make the relationship that is estimated by the EKC model somewhat tautological. Therefore, this study takes into account the potential of renewable energy consumption in modeling the EKC hypothesis.

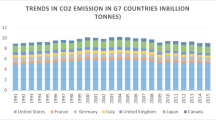

Finally, the G7 countries form a natural setting for at least three reasons. First, the G7 is well known as an informal group with coordinated political, economic, and policy responses to common dynamics of growth and prosperity. Second, the G7 is leading the way in working together to fully decarbonize the global economy in line with the Paris Agreement. Third, the G7 share of global renewable energy consumption is 36.1% by 2021, with an average growth rate of 9.3% over the past decade. While the USA is the second largest consumer of renewable energy after China with a share of 18.7%, Germany, Japan, the UK, Italy, France, and Canada rank fourth, sixth, seventh, ninth, tenth, and fourteenth, respectively (BP 2022). That said, although the high economic status enables them to follow common energy policies without harming their economies, G7 countries differ in their economic growth, government spending (Gurdal et al. 2021), CO2 emissions (Yilanci and Pata 2022), and exposure to energy security risks and their energy diversification strategies (Couharde et al. 2020).

Overall, this study adds to the body of knowledge by being one of the few studies to argue that the Armey curve hypothesis and the EKC hypothesis are complementary in that there is transmissibility between government spending and environmental concerns through the economic growth channel. Although numerous studies have addressed the confirmation of either hypothesis, previous research remains almost silent about their possible complementarity. By showing the transmission mechanism between the two hypotheses, this study makes a threefold contribution. (1) It shows the value of integrating two theories in a holistic and parsimonious manner to explain the interaction between economic growth policy and energy policy; (2) it introduces a new methodology that enables policymakers to determine certain thresholds for government spending and economic growth, which in turn would translate into an effective environmental management; and (3) renewable energy consumption is considered a key variable affecting both the growth and the environment.

The rest of the study is organized as follows. “Literature review” reviews the literature. “Data and methodology” describes the data and methodology. “Results and discussion” reports and discusses the main findings. “Conclusion and policy implications” concludes.

Literature review

The Armey curve literature

There are two main economic perspectives (classical and Keynesian) on government spending (Mitchell 2005). The first is the classical doctrine that government spending has a negative impact on economic growth (Roy 2009; Bergh and Karlsson 2010; Connolly and Li 2016; Afonso and Jalles 2016). Scholars who hold this view argue that the growth of government spending has shifted to inactive areas. Moreover, when government spending is funded by taxes or borrowings from the domestic market, factors like lower private sector investment and higher interest rates have a negative impact on growth (crowding-out effect). Consistent with arguments claiming that increasing government spending has no negative effects on economic growth, the second view originated by Keynes (1936) purports that stronger and more effective government spending will eliminate market disruptions and stimulate economic growth (Karras 1997; Wu et al. 2010; Akpan and Abang 2013; Choi and Son 2016). An increase in government spending will have a positive multiplier effect on investment and employment, and an increase in social spending will result in a rise in national welfare.

Over time, these two viewpoints were combined into a third one that considers both the positive and negative effects of government spending. Accordingly, studies following the third approach, known in the economics literature as the Armey curve hypothesis (Armey 1995), suggest that government spending positively affects growth up to a certain level, but negatively above a certain level. The Armey curve hypothesis postulates that an increase in government spending in the economy will boost economic growth up to a certain point. For any economy, there is an optimal level of government size. When that level is exceeded, the increase in government spending starts to have a negative effect on growth. Following Armey (1995), a multitude of studies has been conducted to assess this non-linear approach in examining the relationship between the government size and economic growth (Vedder and Gallaway 1998; Gwartney et al. 1998; Pevcin 2004; Chen and Lee 2005; Chobanov and Mladenova 2009; Abounoori and Nademi 2010; De Witte and Moesen 2010; Forte and Magazzino 2011; Altunc and Aydin 2013; Magazzino 2014; Hok et al. 2014; Asimakopoulos and Karavias 2016; Chen et al. 2017; Lazarus et al. 2017; Rennane 2019; Nuredin 2019; Bozma et al. 2019; Kim et al. 2020; Jain et al. 2021; Al-Abdulrazag 2021; Nouira and Kouni 2021; Isik et al 2022; Jain and Sinha 2022; Nikolova and Angelov 2022; Can and Aktas 2022). Most of these studies albeit conducted in many countries, with different methodologies, and over various sample periods share a common observation that there is a non-linear relationship between government size and economic growth.

The EKC-renewable energy consumption literature

The EKC hypothesis originally postulates an inverted U-shaped relationship between economic growth and income inequality, pointing to a certain level of development at which growth-related inequalities begin to decline (Kuznets 1955). It has been adapted to the energy literature to test the relationship between economic growth, i.e., per capita income and environmental quality. At the initiative of Grossman and Krueger (1991), numerous studies have attempted to establish the validity of the EKC hypothesis in both country-specific and cross-country contexts. The common practice in these studies is to model the relationship between economic growth and CO2 emissions to examine whether a similar inverted U formation exists, which states that environmental degradation and pollution increase in the early stages of economic growth; however, the situation reverses when per capita income, which is an indicator of growth, reaches a certain level.

Recently, a growing amount of research has focused on the effect of renewable energy consumption in this relationship. Among many others, Farhani and Shahbaz (2014), Dogan and Seker (2016), Jebli et al. (2016), Bilgili et al. (2016), Zaghdoudi (2017), Khoshnevis Yazdi and Ghorchi Beygi (2018), Balado-Naves et al. (2018), Inglesi-Lotz and Dogan (2018), Sinha and Shahbaz (2018), Chen et al. (2019), Elshimy and El-Aasar (2020), Altintas and Kassouri (2020), Sarwat et al. (2022), Miao et al. (2022), Murshed et al. (2022), Aydin and Cetintas (2022) provide evidence for the inverted U-shaped EKC. However, there are also studies arguing against the validity of the EKC hypothesis (Boluk and Mert 2014; Al-Mulali et al. 2015; Liu et al. 2017; Zoundi 2017; El-Aasar and Hanafy 2018; Ansari et al. 2020; Dogan et al. 2020; Yilanci and Pata 2020; Altintas and Kassouri 2020; Massagony and Budiono 2022).

The reviewed literature is summarized in Table 1 as follows:

The Armey curve EKC link and hypothesis development

The Armey curve hypothesis examines the impact of government spending on economic growth, while the EKC hypothesis looks at how economic growth affects CO2 emissions. Although there are mixed results, the literature largely justifies the validity of both hypotheses. Therefore, it is conceivable to consider the possibility that these two seemingly unrelated hypotheses are interconnected. Such a connection would manifest itself when, according to the same inverted U-shaped mathematical theorem, a rise in government spending causes to an increase in economic growth and, consequently, an increase in CO2 emissions. By this means, the Armey curve hypothesis and the EKC hypothesis can be merged into one pot and tested together by a single composite model combines the relationships between economic growth, government spending, and CO2 emissions.

This approach is first introduced by Ongan et al. (2022) and Isik et al. (2022) to the literature. Ongan et al. (2022) scrutinize the validity of the composite EKC hypothesis for NAFTA countries (i.e., the US, Canada, and Mexico). The authors find that the Armey curve hypothesis per se is verified only for the USA, while the EKC hypothesis per se is not supported in any country. The results also suggest that the composite EKC model does not have the empirical properties required to test for the transmission mechanism of the Armey curve hypothesis for any NAFTA country. Isik et al. (2022) follow the same path for 50 US states from 1990 to 2017. This state-level study reveals that the Armey curve hypothesis per se is validated for 15 states. However, only 7 of these states, namely Colorado, Georgia, Indiana, Kentucky, Maine, South Dakota, and Tennessee, provide evidence for the composite EKC model. The authors conclude that state policymakers can determine the maximum spending levels that will maximize their economic growth and maximize (minimize) CO2 emissions.

In both studies, which are currently the only ones available in the extant literature, academics and policymakers are encouraged for future attempts to consider the composite EKC model as a different viewpoint in analyzing the environmental stewardship of economic and energy policies at once. This paper, therefore, intends to answer whether a transmission mechanism of the Armey curve hypothesis exists in the context of the EKC hypothesis, which results in a single maximum level of government spending that maximizes or minimizes CO2 emissions. It also takes this novel approach one step further and proposes an innovative framework based on the controlling capability of renewable energy consumption in the Armey curve and EKC models. The reasoning is that renewable energy consumption will eventually affect the turning point of the EKC (Yao et al. 2019) by lowering global CO2 emissions (Boluk and Mert 2014). Moreover, possible high correlations between energy consumption, economic growth, and CO2 emissions (Ang 2007; Apergis et al. 2010; Sugiawan and Managi 2016) have the potential to distort the validity of the empirical analysis results.

As previously noted, since inverted U-shaped curves must be obtained to mathematically verify both the Armey curve hypothesis and the composite EKC hypothesis, this study jointly proposes the following hypotheses:

-

H1a: There is an inverted U-shaped relationship between government spending and economic growth for a G7 country under the control of renewable energy consumption (the Armey curve hypothesis).

-

H1b: There is an inverted U-shaped relationship between CO2 emissions and government spending–induced economic growth for a G7 country under the control of renewable energy consumption (the composite EKC hypothesis).

Data and methodology

This study strictly follows the methodology of Ongan et al. (2022) and Isik et al. (2022), but slightly modifies their model to include renewable energy consumption as a control variable and test whether there is a transmission mechanism running from the Armey curve to the EKC.

In this context, the following Armey curve and EKC models are used in order to derive the composite EKC model:

In Eq. (1) and Eq. (2), GDP and GS represent GDP per capita and government spending, respectively, in current prices in US dollars; REN denotes renewable energy consumption (% of total final energy consumption); CO2 stands for carbon emissions (million tonnes); ε and \(u\) are the error terms. A positive sign for β1 (\({b}_{1}\)) is expected since an increase in government spending (GDP per capita) will yield the same for GDP per capita (CO2 emissions). However, the sign for β2 (\({b}_{2}\)) should be negative as additional government spending (GDP per capita) will decrease GDP per capita (CO2 emissions) beyond a critical point. The Armey curve (the EKC) model in Eq. (1) [Eq. (2)] is verified when the signs for β1 (\({b}_{1}\)) and β2 (\({b}_{2}\)) are positive and negative, respectively, for a G7 country. It is anticipated that the sign for β3 (b3) would be positive (negative) because an increase in renewable energy consumption will lead to an increase (a decrease) in GDP per capita (CO2 emissions). Data for GDP, GS, and REN variables are from the World Development Indicators, while CO2 emissions data are from BP (2022). The sample period is set as 1971–2020 based on the availability of data.

After replacing the lnGDP variable in Eq. (2) with its equivalent in Eq. (1), the following composite EKC model is derived in Eq. (3):

The EKC hypothesis in Eq. (3) is tested by the Armey curve hypothesis using the signs of the coefficients \({b}_{1}\) and \({b}_{2}\). In other words, an inverted U-shaped curve is confirmed if b1 has a positive and b2 has a negative sign.

The methodology for conducting the empirical analysis in this study is fourfold. First, cross-sectional dependence is tested to determine whether common shocks have heterogeneous impact or spillover effects exist, and for slope heterogeneity to show that slope coefficients are identical across cross-sectional units. The Lagrange multiplier (LM) test (Breusch and Pagan 1980), CD and CDLM tests (Pesaran 2021), and the LMadj test (Pesaran et al. 2008) are used to test for cross-sectional dependence, while the \(\widetilde{\Delta }\) and \(\widetilde{\Delta }\) adj tests (Pesaran and Yamagata 2008) are used to test for slope heterogeneity. Second, the cross-sectional augmented Dickey-Fuller second generation panel unit root tests of Pesaran (2007), as known as CADF and CIPS tests, which take into account the cross-sectional dependence in the variables, are employed to check for the stationarity of the data. Third, error correction–based panel co-integration tests (Westerlund 2007) are performed to test for the presence of long-run relationships among integrated variables in the panel. As a final test, the augmented mean group (AMG) estimator (Eberhardt and Bond 2009), which accounts for cross-sectional dependence, is robust to non-stationary variables, and allows for heterogeneous slope coefficients across panel members, is used. The AMG estimator includes a common dynamic effect which indicates unobservable common factors in the main model. The augmented model includes the co-integration relationship that differs across countries when the unobservable common factors are part of the country-specific co-integrating relationship. This method provides the long-run parameters for the aggregate panel as well as the underlying country-specific regression results.

This study also determines the optimal level of government spending that maximizes (see Fig. 1) or minimizes (see Fig. 2) CO2 emissions as follows. First, the level of government spending of a G7 country is obtained from the first-order optimization condition dlnGDP/dlnGS, which is applied to Eq. (1):

The sufficient condition for maximization is d2lnGDP/dlnGS2 = 2 \({\beta }_{2}\) < 0, so \({\beta }_{2}\) should be negative. Since lnGS is positive by definition, \({\beta }_{1}\) should also be positive. Then, the optimal point for the composite EKC model is obtained in Eq. (3), from the first-order condition dCO2/dGS:

The value in Eq. (5) will be the optimal CO2 emissions level for Eq. (3). When Eq. (5) is inserted into d2CO2/dlnGS2 = 2b1 \({\beta }_{2}\)+2b2(β1 + 2 \({\beta }_{2}\) lnGS)2 + 4b2 \({\beta }_{2}\) (α + β1lnGS + \({\beta }_{2}\) lnGS2), the following formula is derived:

If \({\beta }_{2}\) is negative and the value of Eq. (7) is positive, then the Armey curve is inverted U-shaped, while the composite EKC is U-shaped. However, if both \({\beta }_{2}\) and the value of Eq. (7) are negative, then the Armey curve and the composite EKC both have the form of an inverted U.

Results and discussion

The findings of the tests for cross-sectional dependence and slope heterogeneity regarding the Armey curve, the EKC, and the composite EKC models are reported in Table 2.

As Table 2 suggests, the null hypothesis of no cross-sectional dependence is strongly rejected, indicating that a shock in one G7 country can affect other G7 members. This is not surprising because shocks can be easily spilled over to other countries due to the high level of integration between them. In addition, the null hypothesis of slope homogeneity is rejected, which reveals that each G7 country has its own dynamics. This is also expected since slope coefficients often differ across territorial units, i.e. countries, and they cannot be treated as a single entity, particularly in the case of large time-series (Pesaran and Smith 1995).

These findings imply that dependencies among the cross-sections and heterogeneous slope coefficients require using panel econometric models that are robust to such considerations. Accordingly, the order of integration between the variables is next checked using second generation of panel unit root tests.

Test results of the CADF and CIPS panel unit root tests are demonstrated in Table 3.

According to the results in Table 3, all series include unit root at their levels, but are stationary at first differences under the presence of cross-sectional dependence. This is due to the fact that both the CADS test and CIPS test statistics of the first differences of each panel variable are lower than the corresponding critical values.

Since, the variables of interest are integrated of order one (i.e., I(1)), this study examines whether a structural long-run equilibrium relationship exists between the variables of interest in the models. Table 4 provides the results:

In Table 4, panel statistics are represented by the columns (Pa, Pt), whereas group mean statistics for overall co-integration are represented by the columns (Ga, Gt). The results indicate that the statistics of the co-integration test broadly support co-integration. For instance, Gt test statistic suggests that a co-integration relationship exists in the Armey curve model. Pt and Gt test statistics are significant for the EKC model to imply co-integration. Moreover, Gt test statistic shows that there is co-integration in the composite EKC model. All these findings confirm a stable long-run relationship among the variables in the models and warrant the estimation of the models by using the AMG estimator. On the other hand, it should be noted that the AMG estimator performs similarly well in terms of bias or root mean squared error in panels with non-stationary variables (co-integrated or not) (Eberhardt 2012). The final results are demonstrated in Table 5.

The results in panel A of Table 5 suggest that H1a, i.e., the Armey curve hypothesis, is confirmed for the USA, UK, and Canada with an inverted U-shaped curve. These results are consistent with Vedder and Gallaway (1998) and Bozma et al. (2019) for the USA and Di Matteo and Barbiero (2018) and Bozma et al. (2019) for Canada. The results also reveal that the optimal level of government spending, which maximizes growth, is 29.87% and 29.22% of GDP for the USA and Canada, respectively. However, in the case of the USA, the turning point of the Armey curve is calculated as 17.45% over the 1947–1997 period by Vedder and Gallaway (1998), while it is 12.46% over the 1980–2014 period according to Bozma et al. (2019). These differences may be due to various definitions of the Armey curve in relating government spending to economic growth as well as due to the choice of the sample period. Regardless of these technical concerns, recent actual data show that the US government spending is 14.7% as of 2020 (World Bank 2022). The case of Canada exhibits a similar pattern. Di Matteo and Barbiero (2018) find the optimal level of government spending as 22% between 1870 and 2013, whereas Bozma et al. (2019) indicate a level of 18.93% between 1980 and 2014. The corresponding World Bank data, however, show 22.7% for 2020. Thus, the USA and Canada both appear to be still in the positively sloped portion of the Armey curve—higher government spending is associated with higher level of growth.

Interestingly, the literature generally does not support the Armey curve hypothesis for the UK (Pevcin 2004; Bozma et al. 2019). For instance, De Witte and Moesen (2010) have shown that the UK is one of the few countries that should optimally increase its government spending, implying that the country has not yet reached the peak of the Armey curve. However, government spending increased so much in the sample period, particularly between 2019 and 2020 (HM Treasury 2022), that the relationship between government spending and GDP may have formed an inverted U in the UK. The model results also suggest that the optimal level of government spending that maximizes the economic growth in the UK is 28.30% of GDP. The most recent UK data show that the ratio of government spending to GDP is 22.2% (World Bank 2022). When viewed from this aspect, the results are consistent with De Witte and Moesen (2010) in the sense that the UK is still on its way to the peak of the Armey curve. This is because, the country, likewise in the USA and Canada cases, stands on the curve’s positively sloped portion.

On the other hand, the result regarding the U-shaped relationship for France seems to contradict prior literature that has provided strong evidence for an inverted U-shape (Facchini and Melki 2013; Bozma et al. 2019). This may be attributed to the legal environment in France. In a very interesting study, Facchini and Seghezza (2021) showed that there was a positive and significant relationship between the production of legislation and the government spending-to-GDP ratio during the period 1905–2015. The authors pointed out that an increasing number of laws and regulations leads to an expansion of government spending as well as to an inefficient allocation of resources that hinders economic growth, which echoes the inverted U-shaped Armey curve. Given the sample period, however, this legislative process may have improved, so that economic growth has been driven by increased government spending. Indeed, it has been recently reported that the French government has made significant progress in the transparency and accessibility of its regulatory system over the past decade (US Department of State 2022).

According to panel B of Table 5, the EKC hypothesis is verified only for the USA (Atasoy 2017; Shahbaz et al. 2017) and Canada (Ajmi et al. 2015; Olale et al. 2018). It is found that a U-shaped form of EKC exists for the UK, which is not in line with many studies such as Fosten et al. (2012) and Sephton and Mann (2016). However, there are others that confirm the findings as well (De Bruyn et al. 1998; Figueroa and Pastén, 2009; Bese and Kalayci 2021).

These results imply that the potential candidate countries to confirm the appropriateness of the composite EKC model would be the USA, the UK, and Canada, because the empirical properties of the composite EKC model are only satisfied when both the Armey curve hypothesis is validated and the composite EKC model is significant. The test results of the composite model in;panel C of Table 5, therefore, are important to deliver the information regarding the latter condition, i.e., the significance of the composite EKC model. Indeed, the results show that the USA, the UK, and Canada are the G7 countries where there is a transmission mechanism running from the Armey curve model to the EKC model. The composite EKC model for the USA and Canada validates the existence of the EKC hypothesis, indicating two inverted U-shaped curves (the Armey curve and the composite EKC). In other words, H1b cannot be rejected for these two countries. Considering the Armey curve results discussed immediately above, the optimal levels of government spending, which are found to be 29.87% and 29.22%, also maximize CO2 emissions for the USA and Canada, respectively (see Fig. 1). Both countries currently have some room to keep growing by spending at the cost of increasing pollution until their optimal levels where the CO2 emissions are maximized. When the optimal levels are once attained, further spending would evidently reduce GDP and CO2 emissions, which would confront policymakers with an inevitable choice between a higher growth and a cleaner environment. However, it would then be valuable to know at what point it is possible to avoid environmental degradation in lieu of economic growth, so that policymakers would have to give appropriate priority to “sustainable” growth policies. A similar path is unfolded for several US states in the literature. Isik et al. (2022) determine optimal levels of government spending that maximize both growth and CO2 emissions for Kentucky, Maine, South Dakota, and Tennessee and observe an analogous dilemma for the state policymakers in choosing between economic growth and sustainability. These empirical evidences prove the ability of the composite EKC model to serve policymakers in drafting aligned economic and energy policies at lower costs.

Although the Armey curve for the UK is inverted U-shaped, the EKC hypothesis is not verified by the composite EKC model because of its U-shaped form. Thus, H1b is rejected for the case of the UK. The optimal level of government spending in the country, already calculated as 28.30%, also indicates the point that minimizes CO2 emissions (see Fig. 2). Thus, there is no need for further government spending beyond this point, as it would both reduce growth and harm the environment. Isik et al. (2022) corroborate these findings in that some US states, namely Colorado, Georgia, and Indiana, have their optimal levels of spending that maximize economic growth and minimize CO2 emissions. These results imply that the composite EKC model once again is able to provide policymakers an important decision-making tool in evaluating the consequences of additional spending.

Finally, the model results demonstrate that an increase in renewable energy consumption leads to a significant reduction in CO2 emissions in almost all G7 countries. This is in parallel to previous studies suggesting a significant negative relationship between renewable energy consumption and CO2 emissions in G7 countries (Raza and Shah 2018; Isik et al. 2020; Zhao et al. 2022). However, the impact of renewable energy consumption on economic growth is not consistent. For instance, renewable energy consumption appears to increase economic growth in Italy, the USA, and the UK, while it has a negative impact in France and Canada. While the literature also offers inconclusive results, the negativity, or at least weakness, in the relationship between renewable energy consumption and economic growth is G7 countries is more prominent (Behera and Mishra 2020; Okumus et al. 2021; Khan et al. 2022; Wang et al. 2022; Ghosh et al. 2022). This can be taken as evidence that renewable energy consumption, while clearly reducing environmental degradation, has not yet reached a point where it boosts economic growth in these countries. Moreover, certain limitations of renewable energy investments such as high upfront costs, geographical issues, and high storage capacity requirements may be leading to hesitancy for the economic agents in the industry (Khan et al. 2022).

Table 6 displays the shapes of the Armey curve, the EKC, and the composite EKC models in a nutshell.

Before concluding, a robustness check is performed as a last resort by replacing CO2 emissions with greenhouse gas emissions and ecological footprint as alternative indicators for environmental degradation. Greenhouse gas emissions are conceptually defined as the sum of emissions of various gases including CO2 (EPA 2022). Ecological footprint, however, is a measure of the pressure that humans exert on the planet as a whole (FootprintNetwork 2022). Since these two indicators are more comprehensive than CO2 emissions (Dada et al. 2022a, 2022b), they would give an idea about the applicability of the composite EKC model for G7 countries in broader settings. According to the results portrayed in Appendix, the significant relationships in the composite EKC model appear to gradually get lost. For instance, the USA remains the only country for the validation of the composite EKC model with greenhouse gas emissions, while none of the countries provide significant evidence when ecological footprint is considered though the majority of countries have expected coefficient signs. These findings indicate that government spending–induced EKC hypothesis cannot be verified with the current composite model for most of the G7 countries. However, the literature contains conflicting results for the traditional EKC hypothesis as well in the context of broadscale measures (i.e., greenhouse gas emissions or ecological footprint) of pollution. For instance, Wang et al. (2020), Nathaniel (2021) and Ghosh et al. (2022) argue that a standard EKC is empirically valid, while Yilanci and Ozgur (2019) and Pata and Yilanci (2020) fail to confirm the EKC hypothesis for the G7 countries. This is probably by virtue of the fact that the EKC hypothesis is very sensitive to the environmental degradation indicators under concern (Altintas and Kassouri 2020). Another explanation would be that it would take more time for the G7 governments to spend to have influence on various aspects of pollution through the growth channel. Consequently, having a focus on the CO2 emissions would represent a good starting point for developing sound policies to mitigate environmental degradation.

Conclusion and policy implications

G7 countries have recently taken serious initiatives in support of long-term environmental goals, including their commitment to net-zero emissions of greenhouse gases by 2050 and emission reduction targets by 2030. However, all of these commitments require significant financial resources, especially from the government. In this context, it is extremely important to explore the role of government spending in achieving a more sustainable environment.

In this study, the EKC hypothesis for G7 countries is tested between 1971 and 2020, taking into account a possible transmission mechanism extending from the Armey curve hypothesis. The empirical methodology is based on the construction of a composite EKC model that allows determining the optimal level of government spending that minimizes or maximizes CO2 emissions and provides information for policymakers to make appropriate economic and environmental policy decisions.

Various analyses on cross-sectional dependence and heterogeneity, panel unit root, panel co-integration, and augmented mean group estimation are performed. The results show that the government spending-economic growth (the Armey curve model) nexus can be used to explain the relationship between CO2 emissions and economic growth (the composite EKC model) for the USA, the UK, and Canada. The EKC hypothesis, which is derived based on the Armey curve hypothesis, is valid for the USA and Canada. The optimal level of government spending that maximizes CO2 emissions is calculated to be 29.87% and 29.22% of GDP per capita for the USA and Canada, respectively. On the other hand, despite the composite EKC hypothesis is not verified, this study finds the optimal level of government spending that minimizes CO2 emissions in the UK as 28.30% of GDP per capita. On the other hand, the US consistently satisfies the empirical properties of the composite EKC model when the regressand is greenhouse gas emissions. However, the model seems not to provide statistically significant results for the estimation of maximum or minimum levels of ecological footprint among the G7 countries.

This being the case, the composite EKC model approach would offer important policy implications. First and foremost, it can help policymakers to take precautionary measures when setting harmonized growth and energy policies. The novel policy method introduced in this study has two facets: (1) it determines the threshold at which government spending maximizes economic growth; (2) a compatible energy policy can be formed based on that certain threshold. This integrated perspective provides an important clue for achieving the targets for reducing the pollution levels that countries must comply with within the framework of the Paris Agreement. By using the optimal government sizes as an auxiliary indicator for reducing CO2 emissions, it would be possible to maximize economic growth through government spending and to pursue a corollary environmental policy. For this reason, the composite model enables policymakers to calculate the optimal level of government spending as a more environmentally friendly growth strategy proposal for countries. Another policy implication concerns model results, which show that the increase in renewable energy consumption leads to a significant reduction in CO2 emissions in almost all G7 countries. It is inevitable for decision-makers to replace traditional energy with renewable energy for a sustainable environment. However, the relationship of this shift with other economic indicators (such as economic growth) at the beginning of the process can be investigated better with an overarching framework as the composite model suggests. Furthermore, the model sheds light on the relationship between renewable energy and growth. Although the literature is controversial, there are signs that this relationship is negative or weak in the G7 countries. Increasing the use of renewable energy at the expense of growth is far from the policy sets that countries will actually implement. However, understanding the nature of the process will guide policymakers. When countries are dedicated to replace the use of conventional energy with renewable energy, they may face high production costs and a decrease in energy efficiency in the short term, which may cause a slowdown in growth. Therefore, with a new agenda through the lens of government spending, the costs and production constraints in renewable energy can be mitigated in a way that supports growth from a holistic perspective. Last but not least, creating sub-categories for optimal government size would provide clearer results in the examination of the relationship between environmental sustainability and government spending. There are many classifications of government spending. The composite model can be adapted to other studies which investigate the relationship between any sub-classification of government spending and the EKC hypothesis. It is however important to note that not all government spending is equally efficient and their impacts on the economic environment can be very different.

One limitation of this study is that it uses the general level of government spending in the transmission between the Armey curve hypothesis and the EKC hypothesis. It would be more appropriate to consider a direct measure for government spending that is devoted specifically to environment protection. However, although the data for government spending to protect the environment are available for some countries, they are relatively new and only extend for a few years.Footnote 2A second limitation is owing to the composite model itself at the center of this study. The mathematical reasoning inherent in the model may not be generalized to other occasions such as different countries or even other variables just as was the case for different pollutants in this study. Hence, it is highly recommended that the composite approach that this study argues should be kept under scrutiny and be augmented when necessary—if not required—in order to allow researchers annotate new information about the relationships among the variables of interest. A final limitation is that the relationships prevailing in both hypotheses may be time-varying. Particularly COVID-19 will lead to a severe structural break within the data so that the models should be revisited to handle the possible effects of the pandemic. These would be considered as topics for future research.

Data availability

All the data are available on request.

Notes

United Nation’s 2030 Agenda for Sustainable Development addresses the United Nations Framework Convention on Climate Change (UNFCCC) as the principal international, intergovernmental platform for facilitating the negotiation of the global response to climate change. The UNFCCC, initiated at the Rio Earth Summit in 1992, mandates annual climate meetings, the so-called Conference of Parties (COP).

For EU, for instance, please see Eurostat’s database on the general government spending by function (COFOG) at https://ec.europa.eu/eurostat/databrowser/view/gov_10a_exp/default/table?lang=en. For the USA, please see https://www.census.gov/programs-surveys/gov-finances/data/datasets.html.

References

Abounoori E, Nademi Y (2010) Government size threshold and economic growth in Iran. Int J Bus Dev Stud 2:95–108

Afonso A, Jalles J (2016) Economic performance, government size, and institutional quality. Empirica 43(1):83–109

Ajmi AN, Hammoudeh S, Nguyen DK, Sato J (2015) On the relationships between CO2 emissions, energy consumption and income: the importance of time variation. Energy Econ 49:629–638

Akpan U, Abang D (2013) Does government spending spur economic growth? Evidence from Nigeria. J Econ Sustain Dev 4(9):36–52

Al-Abdulrazag B (2021) The optimal government size in the kingdom of Saudi Arabia: an ARDL bounds testing approach to cointegration. Cogent Econ Finance 9(1):2001960

Al-Mulali U, Saboori B, Ozturk I (2015) Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy 76:123–131

Altintas H, Kassouri Y (2020) Is the environmental Kuznets Curve in Europe related to the per-capita ecological footprint or CO2 emissions? Ecol Ind 113:106187

Altunc O, Aydin C (2013) The relationship between optimal size of government and economic growth: empirical evidence from Turkey, Romania and Bulgaria. Proc Soc Behav Sci 92:66–75

Ang JB (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35(10):4772–4778

Ansari MA, Ahmad MR, Siddique S, Mansoor K (2020) An environment Kuznets curve for ecological footprint: evidence from GCC countries. Carbon Manag 11(4):355–368

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69(11):2255–2260

Armey R (1995) The freedom revolution. Rognery Publishing Co, Washington, DC

Asimakopoulos S, Karavias Y (2016) The impact of government size on economic growth: a threshold analysis. Econ Lett 139:65–68

Atasoy BS (2017) Testing the environmental Kuznets curve hypothesis across the US: evidence from panel mean group estimators. Renew Sustain Energy Rev 77:731–747

Aydin C, Cetintas Y (2022) Does the level of renewable energy matter in the effect of economic growth on environmental pollution? New evidence from PSTR analysis. Environ Sci Pollut Res 1-12 29:81624

Balado-Naves R, Baños-Pino J, Mayor M (2018) Do countries influence neighbouring pollution? A spatial analysis of the EKC for CO2 emissions. Energy Policy 123:266–279

Behera J, Mishra AK (2020) Renewable and non-renewable energy consumption and economic growth in G7 countries: evidence from panel autoregressive distributed lag (P-ARDL) model. IEEP 17(1):241–258

Bergh A, Karlsson M (2010) Government size and growth: accounting for economic freedom and globalization. Public Choice 142(1):195–213

Bese E, Kalayci S (2021) Environmental Kuznets curve (EKC): empirical relationship between economic growth, energy consumption, and CO2 emissions: evidence from 3 developed countries. Panoeconomicus 68(4):483–506

Bilgili F, Kocak E, Bulut U (2016) The dynamic impact of renewable energy consumption on CO2 emissions: a revisited Environmental Kuznets Curve approach. Renew Sustain Energy Rev 54:838–845

Bozma G, Basar S, Eren M (2019) Investigating validation of Armey curve hypothesis for G7 countries using ARDL model. Doğuş Üniversitesi Dergisi 20(1):49–59

Boluk G, Mert M (2014) Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: evidence from a panel of EU (European Union) countries. Energy 74:439–446

BP (2022) bp Statistical Review of World Energy. London: BP. BP Website

Breusch T, Pagan A (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Can C, Aktas E (2022) Quantifying the optimal long-run level of government expenditures in Turkey: 1968–2019. Ekon Vjesnik: Rev Contemp Entrepreneurship, Bus, Econ Issues 35(1):69–86

Chen C, Yao S, Hu P, Lin Y (2017) Optimal government investment and public debt in an economic growth model. China Econ Rev 45:257–278

Chen S, Lee C (2005) Government size and economic growth in Taiwan: a threshold regression approach. J Policy Modeling 27(9):1051–1066

Chen Y, Wang Z, Zhong Z (2019) CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew Energy 131:208–216

Chobanov D, Mladenova A (2009) What is the optimum size of government? Institute for Market Economic, Bulgaria

Choi J, Son M (2016) A note on the effects of government spending on economic growth in Korea. J Asia Pacific Econ 21(4):651–663

Connolly M, Li C (2016) Government spending and economic growth in the OECD countries. J Econ Policy Reform 19(4):386–395

Couharde C, Karanfil F, Kilama EG, Omgba L (2020) The role of oil in the allocation of foreign aid: the case of the G7 donors. J Comp Econ 48(2):363–383

Dada JT, Adeiza A, Noor AI, Marina A (2022) Investigating the link between economic growth, financial development, urbanization, natural resources, human capital, trade openness and ecological footprint: evidence from Nigeria. J Bioecon 1-27 24:153

Dada JT, Ajide FM, Arnaut M, and Adeiza A (2022b) On the shadow economy-environmental sustainability nexus in Africa: the (ir) relevance of financial development. Int J Sustain Dev World Ecol 1–15. https://doi.org/10.1080/13504509.2022b.2115576

De Bruyn SM, van den Bergh JC, Opschoor J (1998) Economic growth and emissions: reconsidering the empirical basis of environmental Kuznets curves. Ecol Econ 25(2):161–175

De Witte K, Moesen W (2010) Sizing the government. Public Choice 145(1):39–55

Di Matteo L, Barbiero TP (2018) Economic growth and the public sector: a comparison of Canada and Italy. Rev Econ Anal 10:221–243

Dogan E, Seker F (2016) Determinants of CO2 emissions in the European Union: the role of renewable and non-renewable energy. Renew Energy 94:429–439

Dogan E, Ulucak R, Kocak E, Isik C (2020) The use of ecological footprint in estimating the environmental Kuznets curve hypothesis for BRICST by considering cross-section dependence and heterogeneity. Sci Total Environ 723:138063

Eberhardt M (2012) Estimating panel time-series models with heterogeneous slopes. The Stata Journal 12(1):61–71

Eberhardt M, Bond S (2009) Cross-section dependence in non stationary panel models: a novel estimator. University Library of Munich

El-Aasar K, Hanafy S (2018) Investigating the environmental Kuznets curve hypothesis in Egypt: the role of renewable energy and trade in mitigating GHGs. Int J Energy Econ Policy 8(3):177–184

Elshimy M, El-Aasar K (2020) Carbon footprint, renewable energy, non-renewable energy, and livestock: testing the environmental Kuznets curve hypothesis for the Arab world. Environ Dev Sustain 22(7):6985–7012

EPA (2022) Overview of greenhouse gases. US Environmental Protection Agency Web Site: https://www.epa.gov/ghgemissions/overview-greenhouse-gases. Accessed 14 Nov 2022

European Commission (2020) Financing the green transition: The European Green Deal Investment Plan. European Commission Web Site: https://ec.europa.eu/commission/presscorner/detail/en/ip_20_17. Accessed 12 Nov 2022

Facchini F, Melki M (2013) Efficient government size: France in the 20th century. Eur J Polit Econ 31:1–14

Facchini F, Seghezza E (2021) Legislative production and public spending in France. Public Choice 189(1):71–91

Farhani S, Shahbaz M (2014) What role of renewable and non-renewable electricity consumption and output is needed to initially mitigate CO2 emissions in MENA region? Renew Sustain Energy Rev 40:80–90

Figueroa BE, Pastén CR (2009) Country specific environmental Kuznets curves: a random coefficient approach applied to high-income countries. Estudios De Economí 36(1):5–32

FootprintNetwork. (2022) Ecological Footprint. Global footprint network web site: https://www.footprintnetwork.org/our-work/ecological-footprint/. Accessed 12 Nov 2022

Forte F, Magazzino C (2011) Optimal size government and economic growth in EU countries. Econ Politica 28(3):295–322

Fosten J, Morley B, Taylor T (2012) Dynamic misspecification in the environmental Kuznets curve: evidence from CO2 and SO2 emissions in the United Kingdom. Ecol Econ 76:25–33

Ghosh S, Balsalobre-Lorente D, Doğan B, Paiano A, Talbi B (2022) Modelling an empirical framework of the implications of tourism and economic complexity on environmental sustainability in G7 economies. J Clean Prod 376:134281

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement. National Bureau of economic research. Working paper, vol 3914. NBER, Cambridge. https://doi.org/10.3386/w3914

Gurdal T, Aydin M, Inal V (2021) The relationship between tax revenue, government expenditure, and economic growth in G7 countries: new evidence from time and frequency domain approaches. Econ Chang Restruct 54(2):305–337

Gwartney J, Lawson R, Holcombe R (1998) The size and functions of the government and economic growth. Joint Economic Committee Study, Washington

HM Treasury (2022) Public spending statistics: February 2022. GOV.UK: https://www.gov.uk/government/statistics/public-spending-statistics-release-february-2022/public-spending-statistics-february-2022. Accessed 13 Nov 2022

Hok L, Jariyapan P, Buddhawongsa P, Tansuchat R (2014) Optimal size of government spending: empirical evidence from eight countries in Southeast Asia. Empir Econom Quant Econ Lett 3(4):31–44

IEA (2021) How much will renewable energy benefit from global stimulus packages? IEA web site: https://www.iea.org/articles/how-much-will-renewable-energy-benefit-from-global-stimulus-packages. Accessed 29 Oct 2022

ILO (2022) Global Estimates of modern slavery: forced labour and forced marriage. International Labour Organization, Geneva

Inglesi-Lotz R, Dogan E (2018) he role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub-Saharan Africa’s Βig 10 electricity generators. Renew Energy 123:36–43

Isik C, Ahmad M, Pata UK, Ongan S, Radulescu M, Adedoyin FF, ... and Ongan A (2020) An evaluation of the tourism-induced environmental Kuznets curve (T-EKC) hypothesis: evidence from G7 Countries. Sustainability 12(21):9150

Isik C, Ongan S, Bulut U, Karakaya S, Irfan M, Alvarado R, ... Rehman A (2022) Reinvestigating the Environmental Kuznets Curve (EKC) hypothesis by a composite model constructed on the Armey curve hypothesis with government spending for the US States. Environ Sci Pollut Res 29:16472–16483

Jain M, Nagpal A, Jain A (2021) Government size and economic growth:an empirical examination of selected emerging economies. South Asian J Macroecon Public Finance 10(1):7–39

Jain N, Sinha N (2022) Re-visiting the Armey curve hypothesis: an empirical evidence from India. South Asian J Macroecon Public Finance 11:168. https://doi.org/10.1177/22779787211054007

Jebli M, Youssef S, Ozturk I (2016) Testing environmental Kuznets curve hypothesis: the role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol Ind 60:824–831

Karras G (1997) On the optimal government size in Europe: theory and empirical evidence. Manch Sch 65(3):280–294

Keynes J (1936) General theory of employment, ınterest and money. Macmillan, London

Khan Z, Badeeb RA, Nawaz K (2022) Natural resources and economic performance: Evaluating the role of political risk and renewable energy consumption. Resour Policy 78:102890

Khoshnevis Yazdi S, Ghorchi Beygi E (2018) The dynamic impact of renewable energy consumption and financial development on CO2 emissions: for selected African countries. Energy Sources Part B 13(1):13–20

Kim M, Han Y, Tierney H, Vargas E (2020) The economic consequences of government spending in South Korea. Econ Bull 40(1):308–315

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45(1):1–28

Lazarus W, Khobai H, Le Roux P (2017) overnment size and economic growth in Africa and the Organization for Economic Cooperation and Development Countries. Int J Econ Financ Issues 7(4):628–637

Liu X, Zhang S, Bae J (2017) The impact of renewable energy and agriculture on carbon dioxide emissions: investigating the environmental Kuznets curve in four selected ASEAN countries. J Clean Prod 164:1239–1247

Magazzino C (2014) Government size and economic growth in Italy: an empirical analyses based on new data (1861–2008). Int J Empir Finance 3(2):38–54

Massagony A and Budiono (2022) Is the Environmental Kuznets Curve (EKC) hypothesis valid on CO2 emissions in Indonesia? Int J Environ Stud 1–12. https://doi.org/10.1080/00207233.2022.2029097

Miao Y, Razzaq A, Adebayo TS, Awosus A (2022) Do renewable energy consumption and financial globalisation contribute to ecological sustainability in newly industrialized countries? Renew Energy 187:688–697

Mitchell DJ (2005) The impact of government spending on economic growth. The Heritage Foundation 1813:1–18

Murshed M, Mahmood H, Ahmad P, Rehman A, Alam MS (2022) Pathways to Argentina’s 2050 carbon-neutrality agenda: the roles of renewable energy transition and trade globalization. Environ Sci Pollut Res 29(20):29949–29966

Nathaniel SP (2021) Biocapacity, human capital, and ecological footprint in G7 countries: the moderating role of urbanization and necessary lessons for emerging economies. Energy, Ecol Environ 6(5):435–450

Nikolova V, Angelov A (2022) The Armey curve: an empirical analysis of selected Balkan countries and Russia for the period 2006-2019. Finance: Theory and Pract 26(1):55–65

Nouira R, Kouni M (2021) Optimal government size and economic growth in developing and MENA countries: a dynamic panel threshold analysis. Middle East Dev J 13(1):59–77

Nuredin B (2019) Determine of the optimal size government spending in Algeria during the period (1970–2017). Strateg Dev J 9(16):53–72

OECD (2018) Financing Climate Futures: Rethinking Infrastructure. OECD Publishing, Paris

Okumus I, Guzel AE, Destek MA (2021) Renewable, non-renewable energy consumption and economic growth nexus in G7: fresh evidence from CS-ARDL. Environ Sci Pollut Res 28(40):56595–56605

Olale E, Ochuodho TO, Lantz V, El Armali J (2018) The environmental Kuznets curve model for greenhouse gas emissions in Canada. J Clean Prod 184:859–868

Ongan S, Isik C, Bulut U, Karakaya S, Alvarado R, Irfan M, ... Hussain I (2022) Retesting the EKC hypothesis through transmission of the ARMEY curve model: an alternative composite model approach with theory and policy implications for NAFTA countries. Environ Sci Pollut Res 29:46587–46599

Pata UK, Yilanci V (2020) Financial development, globalization and ecological footprint in G7: further evidence from threshold cointegration and fractional frequency causality tests. Environ Ecol Stat 27(4):803–825

Pesaran M (2021) General diagnostic tests for cross-sectional dependence in panels. Empir Econ 60(1):13–50

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22(2):265–312

Pesaran MH, Smith R (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econom 68(1):79–113

Pesaran M, Yamagata T (2008) Testing slope homogeneity in large panels. J Econom 142(1):50–93

Pesaran M, Ullah A, Yamagata T (2008) A bias-adjusted LM test of error cross-section independence. Economet J 11(1):105–127

Pevcin P (2004) Economic output and the optimal size of government. Econ Bus Rev Central South-Eastern Europe 6(3):213–227

Raza SA, Shah N (2018) Testing environmental Kuznets curve hypothesis in G7 countries: the role of renewable energy consumption and trade. Environ Sci Pollut Res 25(27):26965–26977

Rennane M (2019) The optimal volume of government spending and economic growth in Algeria during the period (2019–1973). J Roa Ektisadiah 9(2):53–64

Roy A (2009) Evidence on economic growth and government size. Appl Econ 41(5):607–614

Sarwat S, Godil DI, Ali L, Ahmad B, Dinca G, Khan SA (2022) The role of natural resources, renewable energy, and globalization in testing EKC theory in BRICS countries: method of Moments Quantile. Environ Sci Pollut Res 29(16):23677–23689

Sephton P, Mann J (2016) Compelling evidence of an environmental Kuznets curve in the United Kingdom. Environ Resource Econ 64(2):301–315

Shahbaz M, Solarin SA, Hammoudeh S, Shahzad SJ (2017) Bounds testing approach to analyzing the environment Kuznets curve hypothesis with structural beaks: the role of biomass energy consumption in the United States. Energy Econ 68:548–565

Sinha A, Shahbaz M (2018) Estimation of environmental Kuznets curve for CO2 emission: role of renewable energy generation in India. Renew Energy 119:703–711

Sugiawan Y, Managi S (2016) The environmental Kuznets curve in Indonesia: exploring the potential of renewable energy. Energy Policy 98:187–198

UNDGC (2020) Climate Change and COVID-19: UN urges nations to ‘recover better'. United Nations Web Site: https://www.un.org/en/un-coronavirus-communications-team/un-urges-countries-%E2%80%98build-back-better%E2%80%99. Accessed 28 Oct 2022

US Department of State (2022) Investment climate statements: custom report excerpts. Bureau of Economic and Business Affairs: https://www.state.gov/report/custom/eeb56f5184/#!

Vedder R, Gallaway L (1998) Government size and economic growth. Paper prepared for the Joint Economic Committee of the US Congress, Washington

Wang Z, Bui Q, Zhang B, Pham TLH (2020) Biomass energy production and its impacts on the ecological footprint: an investigation of the G7 countries. Sci Total Environ 743:140741

Wang Q, Wang L, Li R (2022) Renewable energy and economic growth revisited: the dual roles of resource dependence and anticorruption regulation. J Clean Prod 337:130514

Ware J (2021) End of Coal in Sight at COP26. UNFCCC Web Site: https://unfccc.int/news/end-of-coal-in-sight-at-cop26#:~:text=With%20these%20ambitious%20commitments%20we,not%20leave%20any%20nation%20behind. Accessed 30 Oct 2022

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69(6):709–748

World Bank (2022) General government final consumption expenditure (% of GDP). World Development Indicators: https://databank.worldbank.org/source/world-development-indicators/Series/NE.CON.GOVT.ZS

Wu S, Tang J, Lin E (2010) The impact of government expenditure on economic growth: how sensitive to the level of development? J Policy Modeling 32(6):804–817

Yao S, Zhang S, Zhang X (2019) Renewable energy, carbon emission and economic growth: a revised environmental Kuznets Curve perspective. J Clean Prod 235:1338–1352

Yilanci V, Ozgur O (2019) Testing the environmental Kuznets curve for G7 countries: evidence from a bootstrap panel causality test in rolling windows. Environ Sci Pollut Res 26(24):24795–24805

Yilanci V, Pata UK (2020) Investigating the EKC hypothesis for China: the role of economic complexity on ecological footprint. Environ Sci Pollut Res 27(26):32683–32694

Yilanci V, Pata UK (2022) On the interaction between fiscal policy and CO2 emissions in G7 countries: 1875–2016. J Environ Econ Policy 11(2):196–217

Zaghdoudi T (2017) Oil prices, renewable energy, CO2 emissions and economic growth in OECD countries. Econom Bull 37(3):1844–1850

Zhao W, Liu Y, Huang L (2022) Estimating environmental Kuznets curve in the presence of eco-innovation and solar energy: An analysis of G-7 economies. Renew Energy 189:304–314

Zoundi Z (2017) CO2 emissions, renewable energy and the environmental Kuznets curve, a panel cointegration approach. Renew Sustain Energy Rev 72:1067–1075

Author information

Authors and Affiliations

Contributions

Burak Pirgaip, Seda Bayrakdar, and Muhammed Veysel Kaya contributed to the study conception and design. Material preparation, data collection, and analysis were performed by Burak Pirgaip. The first draft of the manuscript was written by Burak Pirgaip and Seda Bayrakdar and Burak Pirgaip, Seda Bayrakdar, and Muhammed Veysel Kaya commented on previous versions of the manuscript. Burak Pirgaip, Seda Bayrakdar, and Muhammed Veysel Kaya read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Pirgaip, B., Bayrakdar, S. & Kaya, M.V. The role of government spending within the environmental Kuznets curve framework: evidence from G7 countries. Environ Sci Pollut Res 30, 81513–81530 (2023). https://doi.org/10.1007/s11356-023-25180-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-25180-9

Keywords

- Government spending

- Economic growth

- Armey curve

- Environmental Kuznets curve

- Renewable energy consumption

- Carbon emissions

- G7 countries