Abstract

This study investigates how renewable energy markets reacted to the war in Ukraine in 2022 using event study and network connectedness analyses and compares this effect to traditional energy sources. Combining event study with connectedness analysis is of great interest in identifying abnormal returns from the Russia-Ukraine conflict event. The risk-return profiles make clean energy more appealing to investors, and increased investment in clean energy subsectors leads to improved climate change mitigation. Sampled data are wrangled daily from 03 August 2021 to 30 March 2022. The results confirm that renewable energy markets have positive and significant cumulative abnormalities while traditional energy markets are heavily affected during the post-war. Moreover, we find higher pairwise return connectedness after the announcement event than during and before the war in Ukraine. The geothermal and full cell markets are the more robust net information transmitter to other clean energy subsectors. Finally, renewable energy appeared more pertinent during and after the Russian invasion of Ukraine, given its properties to serve diversifications and hedging tools.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Renewable energy has paid more attention to the financial markets, in concurrence with the traditional energy sources within the plans to enhance eco-friendly growth (Liu et al. 2021a, b; Usman and Balsalobre-Lorente 2022), mitigate carbon dioxide (CO2) emissions (Chen et al. 2022; Si-Mohammed et al. 2022; Usman et al. 2022a), and reducing temperature and global warming (Acaroğlu and Güllü 2022; Usman et al. 2021). Worldwide renewable energy, including solar, wind, geothermal, full cell, and bio-clean fuels, are abundant, diverse, and not subject to import and export restrictions that let any nation become self-sufficient in energy (Jiang et al. 2022; Sadiq et al. 2023). The ambitions for sustainable renewable energy sources emerge mainly when the war event arises. The conflict between Russia and Ukraine caused an instant disruption in logistical supply chains for clean and non-clean energy in Europe, resulting in unexpected obstacles that led to recession, financial market concerns, and high levels of inflation around the world. In this context, the Russian invasion of Ukraine has brought back the energy security crisis. In addition to more geopolitical stability, renewable energy contributes to international peace (Overland 2019; Usman and Radulescu 2022; Ibrahim et al. 2022; Saqib et al. 2022; Su et al. 2021). The conflict between Russia and Ukraine is still impacting the world, and one of its most significant repercussions was the 58.3% increase in energy costs between December 2021 and June 2022. Beginning in 2022, Russia will produce around 10%, 15% of coal, 5.4% of uranium, and about 8% of gas in the energy world. Indeed, Russia exported 60% of its oil to OECD Europe and 20% to China. The invasion of Ukraine by Russia has sent shockwaves across the world’s energy markets, causing price instability, supply challenges, security concerns, and economic turmoil. From May to October 2022, Russia curtailed its gas exports to the European Union by over 80%, leaving the customs union with a significant energy mix deficit and an urgent need to find new energy sources.

Affected nations have been forced to act rapidly to develop new energy policies that prioritize long-term energy security while simultaneously allowing for the short-term satisfaction of current energy demand. This is due to the alteration of old energy trading routes. In addition, increased energy costs are expected to result in higher pricing for goods and higher interest rates that aim to increase the cost of borrowing money, which could cause projects that need finance to suffer from economic repercussions. Furthermore, the consequences of the war in Ukraine are detrimental to a company’s output, profitability, anticipated cash flows, and share values. For investors, portfolio managers, and regulators, wars’ effect on renewable energy markets is crucial (Yousaf et al. 2022). Indeed, most Western nations have imposed financial and economic sanctions on Russia, and the advanced global economy and emerging markets rely more on commodities and stock markets, which can demonstrate the channel effect of the war on the renewable and renewable energy markets.

The significance and unexplored influences of geopolitical risk on renewable (solar, wind, geothermal, full cell, and bio) and non-renewable energy (i.e. WTI, natural gas, and nuclear power) motivated this study to explore how regional and international conflicts, wars, terrorism attack, and border disputes. The Russo-Ukrainian conflict increased economic uncertainty that again affected traditional assets. The Russo-Ukrainian conflict relied on traditional and non-traditional energy, driving these markets to their highest prices in nearly a decade. Several countries have been forced to reconsider their energy supply needs. Russia is the largest producer and exporter of oil and gas to the world markets and, more specifically, to union Europe (U.S. Energy Information Administration 2021). At the same time, the union European and the USA have imposed significant sanctions on Russia (Li and Li 2022). It has been announced that they plan to wean themselves off Russian fossil fuels (European Commission 2022; Osička and Černoch 2022). Even though the war continues in Ukraine, traditional energy continues to flow around the world, including in Europe countries. On the contrary, the USA and the UK were the first nation who banned Russian energy. The biggest deal facing world energy is whether traditional and renewable energy markets will be affected by the Russian-Ukrainian conflict, especially if this war takes more time and the embargo on energy include Europe countries. In this context, little previous literature has shed light on the war in Ukraine 2022 on financial markets using the event study methodology. As a strategy and essential source, renewable and non-renewable energy contribute more to the Russian-Ukrainian conflict (Umar et al. 2022a). It is critical for international financial and global economic stability to use renewable energy (Aydin 2022; Sattich et al. 2022).

In light of the facts above, studying how renewable energy responded to the Russian invasion of Ukraine has become even more critical. To the best of the authors’ knowledge, this is the first study focused on examining the reaction of sub-sector renewable energy markets to the Russian invasion of Ukraine (24 February 2022) using even study analysis. Moreover, this research compares the renewable energy market performance with conventional energy resources such as oil, gas, and nuclear energy. Additionally, this study considers reviewing the network spillover among the renewable energy index and the subsectors returns at different quantiles as the secondary objective.

Following the literature on renewable energy topics (Pham 2019; Wang et al. 2022; Ren and Lucey 2022), our study suggests five subsectors as a proxy of renewable energy to track and compare the performance of each renewable energy sector. The five subsectors are solar, wind, geothermal, full cell, and bio.

This study differs from the existing literature in the methodology aspect that employed event study and vector autoregressive (VAR) alongside, for the first time, exploring the abnormal returns from the Russia-Ukraine conflict clean energy, dynamic spillover, and connectedness network between the renewable and non-renewable energy markets. In this pursuit, this study adds to the literature on contagion, specifically the literature that holds that the phenomena of contagion are a result of “black swan” events, by using event study and VAR to explore the abnormal returns from the Russia-Ukraine conflict clean energy (Yarovaya et al. 2022). The Ukraine-Russian war is regarded as an unforeseen occurrence known as a “black swan” that could negatively affect energy supplies. In the same situation, conventional panel regression, whose distribution is normally distributed, does not apply since it requires sizeable historical sample sizes, which are never available for uncommon events by definition, contrary to the event study (Mackinlay 1997; Makhdum et al. 2022; Taleb 2007; Sadiq et al. 2022; Jahanger et al. 2022). Further, the event study has considerably increased (Boubaker et al. 2022; Gaied and Pandey 2022). The connectedness network allows tracking the interaction link and intensity nudes among abnormal subsector returns of clean energy, reflecting how these assets have become more dependent in tandem.

The remainder of the paper is organized as follows. Section 2 describes the recent literature review. The “Data and methodology” section presents the data and the methodology. The “Empirical results” section discusses the findings. Finally, the “Conclusions and policy implications” section concludes the paper.

Literature review

Extensive studies have examined the effect of uncertainty and instability in the financial market due to financial and economic shocks or pandemic crises on the clean energy markets. Liu et al. (2021a) applied the economic policy uncertainty index and found the significant impact caused by covid 19 and the financial crisis. Hemrit and Benlagha (2021) report a positive effect of employing the pandemic uncertainty index on the clean energy index. Ahmad et al. (2018) and Ferrer et al. (2018) established that the Chicago board options exchange volatility index considerably affects the renewable energy markets. At the same time, Dutta (2017) found this effect throughout the oil price uncertainty than other instability financial indices. Kuang (2021) generated the MSCI world to conclude that clean energy is more attractive to down the risk than dirty energy stock markets. In contrast, the streaming literature is silent about the effect of uncertainty and instability due to the war on the renewable energy markets. On the contrary, the dependence on traditional energy has been associated significantly with war (Rothkopf 2009) and terrorism (Johnston 2008; Le Billon and El Khatib 2004). Noguera-Santaella (2016) confirmed the positive relationship between non-renewable energy and the different war periods. Sweidan, (2021) demonstrated that geopolitical tension affects renewable energy, whereas Su et al. (2020) indicate no causality between geopolitical tension and renewable energy.

Furthermore, Dutta and Dutta (2022) observed that clean energy substitutes for non-renewable energy when the geopolitical increase. The deep substitution between traditional and renewable energy can change the current geopolitical land space (Sivaram and Saha 2018). Regardless of the Russo-Ukrainian conflict, the existing literature has shed light on the war on different assets using the event study methodology. Boubaker et al. (2022) found negative cumulative abnormalities that drew considerable impact of the Russian invasion of Ukraine on stock markets in developed and emerging markets. Likewise, Sun et al. (2022) documented that the stock market of oil and companies further the finance and manufacturing stock prices have been negatively affected by the Russian invasion of Ukraine event. Yousaf et al. (2022) pointed out similar results of negative reactions to G-20 stock markets. Ayed et al. (2022) also report the effect of the Russian invasion of Ukraine on cryptocurrency markets. Pham et al. (2022a) used the event study and connectedness analyses to examine the Paris climate agreement and the US election’s effect on the clean energy markets. They found that Biden winning the U.S. election and its reenter to the Paris climate agreement had a positive impact, contrary to trump’s election and withdrawal from the climate accord, where the reaction of cumulative abnormality is negative. Gaied and Pandey (2022) scrutinized an adverse reaction of the global currency to the Russo-Ukraine conflict.

Other stand literature focuses on the connectedness spillover and the relationship during the Russo-Ukrainian conflict, which seems higher and more significant during the war as an event window compared to the pre-war across various assets such as food prices (Saâdaoui et al. 2022). Umar et al. (2022a) examine the Russian evasion of Ukranian on global assets, including oil, gas, and gold. They document mixed relationships between the quantile on quantile regression. Adekoya et al. (2022) establish a strong connectedness between financial assets during the Russo-Ukrainian war compared to the pre-war. Likewise, Gong and Xu (2022) and Wang et al. (2022) found that the effect of the geopolitical risk generated by the war in Ukraine on various commodities increased compared to the pre-war. Patt and Steffen (2022) reported strong public support for renewable energy policies in Europe due to the Russia-Ukraine conflict. As a result of the war in Ukraine, the world is now experiencing a window of opportunity to boost climate change agreements through the acceleration of renewable energy deployment and phasing out of conventional energy (Deng et al. 2022; Massimo et al. 2022).

Data and methodology

Event study methodology

We follow the CAMP methodology to calculate the cumulative abnormal returns to study the renewable energy market’s reaction to the Russian invasion of Ukraine and compare its performance with conventional energy prices.

where AR represents the abnormal return for clean energy i on time t (the time used is the daily data), \({R}_{it}\) index return at time t, which can be described as follows and as shown in Eq. 2 and Fig. 1:

where \({T}_{it}\) index at time t, \({T}_{t-1}\) index at time t−1, \({R}_{it}\) index return at time t.

Rmt represents the explanatory return (MSCI world energy), and a^ and β^ represent the intercept and slope of the estimated parameters based on 142 days as a pre-event window starting from 03 August 2021. We defined 17 February 2022 as the even window (0 days) in which Russia’s announcement started to invade Ukraine. This is 1 week before the Russian invasion of Ukraine as the first day of the window event is mentioned (Ayed et al. 2022; Boubaker et al. 2022). The event window covered the period from 17 February 2022 (the period of the war in Ukraine) to 30 March 2022. This period represents an uncertain event for clean energy markets. We use 5 days before and after the zero-even window. The CAR is the cumulative abnormal, which can be written as follows:

Vector autoregressive (VAR) method

This study further examines the reaction of renewable energy to the Russian invasion of Ukraine and aims to explore the network connectedness among the renewable energy markets. We employ vector autoregressive (VAR) proposed by Diebold and Yilmaz (2014). It offers many advantages compatible with the objective of this study. This framework captured the dynamic total connectedness index TCI at different net pairwise values that compare the level effect between many periods and events. Extensive literature has used VAR to examine the connectedness in the financial domain, including climate change and clean energy indices (Elsayed et al. 2020; Song et al. 2019; Zhou et al. 2021). The mathematical representation of VAR is as follows:

where y and \({y}_{t-1}\) presents the vector with k*1 dimension. Vector, \(u \left(\tau \right)\) having the K*1 dimension conditional mean vector. \({\varnothing }_{j}\) \(\left(\tau \right)\) is a variance–covariance metric having k*k dimension VAR. As a consequence, the VAR model presents different connectedness measures; the total connectedness index can be written as follows:

equalzers the risk spillover over the total period. Connectedness from others is defined as follows:

It presents the connection of each variable receiving a shock from other variables.

Here, the above expression shows the return spillover transmitter. Finally, \({\mathrm{NET}}_{jt}={\mathrm{TO}}_{jt}-{\mathrm{FROM}}_{jt}\) represent net directional connectedness and the difference between from and to connectedness.

Data

We consider the S&P global clean energy index’s daily index (S&PGCEI). We use the uranium price (URA) to benchmark the nuclear energy market. To measure the dirty energy markets and oil and gas market performances, we use iShares global energy ETF (IEO) (Saeed et al. 2020). Therefore, this study investigates the war in Ukraine’s effect on sub-sector clean energy. Our study offers five subsectors as a proxy for renewable energy to measure and compare the performance of each renewable energy sector to accomplish this goal. The five subsectors are the NASDAQ OMX Solar index, the NASDAQ OMX Wind index, the NASDAQ OMX Geothermal index, the NASDAQ OMX Full Cell index, and the NASDAQ OMX Bio-Clean Fuels. The source of (S&PGCEI) is extracted from the popular S&P global link www.spglobal.com. The rest data are downloaded from yahoo finance and Bloomberg terminal.

Empirical results

Event study results

Table 1 documents the cumulative abnormal return for the individual index and subsectors of renewable energy with the conventional energy markets. It shows that the CAR post-event window (18 days) is negative for oil and gas markets and significantly positive for the geothermal and wind subsectors at different time frames, indicating the war’s effect supports these two assets’ adoption. The clean energy index S&PGCEI and bio subsector are positive at (t + 5) days after the event. The uranium price exhibited an insignificant reaction during the pre-and post-event window. From [1–1] to [− 5: + 5], even windows are significantly positive for almost variables except for the oil and gas variable, which is insignificant. The fuel cell and geothermal assets have a higher Cambin CAR at all time frames, followed by the clean energy index S&PGCEI and wind stock market. The solar index has a less reaction value, but it is positive and significant, illustrating the high response during third events windows of about 12% and 14%, respectively.

Moreover, all variables reported positive reactions during the announcement day. Overall, renewable energy response is relatively higher during and after the Russian invasion of Ukraine than before. These results of the effective clean energy market compare the non-renewable energy in line with the prior studies (Dawar et al. 2021; Kuang 2021), thus, illustrating that clean energy individual and subsectors indices are decoupled from conventional energy markets (Dutta and Dutta 2022; Ferrer et al. 2018). These results also reveal how the renewable energy markets reacted to the severe information coming from Europe and the USA about the acceleration of the speed transition to clean energy due to the war. It has become evident that the commission of European establishes incentive plants and strategies toward clean energy (Patt and Steffen 2022).

Furthermore, traders with short investment horizons, such as hedge funds and traders, are becoming increasingly common, with institutional investors focusing on long-term market performance. According to the EU, and the UK, information about imposing a ban on oil and gas from Russia, the day traders make their decisions. The second trader with a long investment horizon decides that clean energy should be adopted more as part of the fight against climate change, energy security, and transition visions. Finally, it shows that clean energy became a substitute for traditional energy markets when investors expected more uncertainty about conventional energy markets, including the sanctions on the Russian energy industry. Investor sentiment is more critical to conducting financial investment when the market is volatile (Song et al. 2019). According to Table 1, the nuclear energy market outperforms other traditional energy sources throughout and after the event day. Russia continues to export nuclear energy to Europe despite European sanctions that have been in place for more than a year, not to mention the uranium industry, which has remained untouched by the Western sanctions. Another explanation is the postponement of nuclear power’s phase-out, which was used as an emergency reserve during the Russian-Ukrainian War, and the strengthening of energy security. Although the events surrounding the Russian-Ukrainian conflict are positively relevant to the clean energy market, results show the negative abnormal return reactions and increased information substance the event transmitted to traditional market energy. It also imposes uncertainty and concerns conventional energy markets in the short- and long-term.

Connectedness among clean energy subsectors

Figure 2 shows the network dynamic connectedness among the subsectors of clean energy. We distinguish between yellow color (net receiver) and blue color, which is a net transmitter. We observe that the fuel cell network was proved as a more robust net transmitter of the shock to the rest subsector of clean energy, followed by geothermal and wind, respectively. The solar stock market seems to be the largest net receiver of the shock flowing by the bio-stock markets. This enormous interaction link and intensity nudes among abnormal subsector returns of clean energy reveal how these assets have become more dependent on the profound transformation over the sample. These results reflect how the financialization effect and the integration among clean energy subsectors are more critical during the war in Ukraine.

Further, The finding explains the central role of fuel cell and solar subsector to be more attractive and competitive in financial markets related the combustion characteristics, lower cost, and CO2 emission (Nicoletti et al. 2016). In addition, the effect of dimension spillover explores that the volatility spillover from full cell to wind market seems to be the highest. In contrast, the volatility spillover from full cell to geothermal has been the least. Meanwhile, the volatility spillover from wind to geothermal was less than from the full cell. The volatility can thus be easily transported from geothermal to the bio and will disappear between bio and wind. These findings agree relatively with the results of Zhou et al. (2021). We can conclude that the volatility spillover among subsector of clean energy may vary. The geothermal and full cell energy markets are the most energy sources of volatility triggers, explaining their widespread use in electric vehicles, energy generation, heating systems, shipping, and aerospace sectors, as well as due to Russian-Ukrainian ramifications. Overall, The strengthening of renewable energy response, primarily due to the aggravation war in Marsh 2022, is consistent with the idea that volatility connectedness is driven by the transmission of shocks in the short term. However, in the long term, the possibility of volatility spillovers can outweigh short-term returns due to uncertainty aggravation, stagflation, and a lack of confidence. This finding is in line with the study (Patt and Steffen 2022).

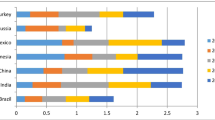

Figure 3 presents the heatmaps representing the pairwise direction connectedness based on each abnormal subsector of clean energy, a 143 days-rolling window, and ten forecasting horizons. Each heatmap range between 40 and 110% represented the high transmitter (yellow color), with the blue area as a lower net contributor of abnormal return. The horizontal axis presents the period observations of pre-announcement day to the post-window day, while the vertical axis presents stock markets pairwise. In general, we see a relatively warmer area of yellow, indicating the stronger transmission of the shock among sub-sector clean energy, especially during the post-event days. The fuel cell appears to be the more robust information transmitter against all sub-sector clean energy during the major Russian invasion of Ukraine period estimating. Geotherm switched between the high and the median transmission information to other subsectors. The pairwise wind-bio decreased during the estimation period, which is cleaner than the pairwise solar-geothermal. The total connectedness index (TCI) varies between 80 to 100%, and the higher TCI is still more stable during the Russian invasion of Ukraine window frame period. Considering the high pairwise correlations indicated, it is evident that the subsectors interact importantly. These findings of the high spillover are not surprising and reveal how clean energy is an essential player in the financial markets during bearish conditions market, which is in line with the prior literature (Ahmad et al. 2018; Ji et al. 2018; Usman et al. 2022b; Kuang 2021). Additionally, the bad news from the war event in Ukraine is more sensitive to an abnormal return than the news before the event window. The finding provides the importance of the renewable energy subsector in portfolio investments, serves the diversification opportunity among them, and gives its properties as hedging and haven against other assets during the war.

Robustness check

Table 2 analyzes the (Brown and Warner 1985) event study, which can be described as follow:

where AR represents the abnormal return for clean energy i on time t ( The time used is the daily data), \({\mathrm{R}}_{\mathrm{it}}\): index return at time t, \(\overset-{\underset.R}\) is the average of each clean energy index at the time t.

This study depicts the same finding in Table 2 that the renewable energy markets are more potent and less affected by the war in Ukraine that started on 24 February 2022, compared to traditional energy sources.

Conclusion and policy implications

This paper investigates the effect of the Russian invasion of Ukraine on the renewable and non-renewable energy markets using the event study and network connectedness methods. Our results show that CAR is a significant positive reaction for all renewable energy stocks estimated compared to the traditional energy to the Russian invasion of Ukraine. Secondly, the response of the clean energy subsector is more impacted by the event at different time frame windows. The network connectedness confirms these findings and pairwise spillover that the TCI increased during the post-event. This study contributes to the literature by focusing on clean energy and filling the gaps in the prior research survey on the impact of the Russian invasion of Ukraine on various assets. In addition, the development of our study is attributable to the reality of going toward the renewable energy race, and more public policies support it. The obtained finding using event study and connectedness methods consists of the financial investment to exploit renewable energy as an alternative to non-renewable energy in the future. Our results have many applications for investors and fund managers. They should adjust their investment by including green renewable energy as eco-friendly assets, good opportunity hedging, and a haven against uncertainties. For policymakers, new monetary and taxes exemptions policies should be adopted to support intensive strategies and plans for renewable energy. Also, the government should encourage private sectors and technology firms to deep transformation and speed transition to renewable energy. In this pursuit, it should create consortia to introduce modern, environmentally friendly technologies and boost the renewable energy industry, especially during this extreme geopolitical tension. The governments should increase the Pigovian taxes for fossil fuel exploitation to reallocate it to renewable energy subsidies. Regardless of how long the Russian-Ukraine conflict will last, long-term clean energy allocation decisions should consider the risk transmission from such uncertainty. This research indicates other policy suggestions based on the results, such as enabling eco-friendly project finance at a low-interest rate and should enhance the use of clean energy sources, including solar, wind, geothermal, full cell, and bio-clean fuels (bio). Even if Europe can use this transition period to sharpen its focus on accelerating renewable energy project flow, the long-term prognosis will improve. But, once again, the European Union and countries throughout the continent will need to race, and mustering the political will and significant financing required to develop debt financing and global renewable energy investment to accomplish Europe’s and the world’s green goals will be a colossal struggle. In these times, the firm should be connected to the broader national energy plan to achieve strategic objectives like energy security and lowering CO2 emission targets. If the action mentioned above is successful, it could push net-zero technologies below their respective clean energy subsector cost curves, allowing for faster global decarbonization.

For perspective research, the scholars may try to quantify the renewable energy risk using intraday data, which is helpful from the high-frequency information on the volatility. Moreover, it would compare their reaction to the Russian invasion of Ukraine and other events day and against more assets such as Bitcoin, bonds, and stock markets. We can also employ more recent models, such as the quantile vector autoregressive (QVAR) (Ando et al. 2022), and the TVP-VAR-SV model in a recent study by Gong and Xu (2022). Unarguably, a specific event study and the abnormal return can be considered in future research using the methodology in the study (Umar et al. 2022b) to track the abnormal return. Future studies can use realized semivariance (Barndorff-Nielsen et al. 2008; Pham et al. 2022b), which is helpful from the high-frequency data, to test the reliability of the empirical findings. It would investigate how energy markets linked to minerals and metals prices around the war event, where a certain amount of both types of energy is required to exploit metal resources and heavily relies on it, which directly impacts the price and future investment.

Data availability

The datasets used and/or analyzed during the current study are variability from the first author on reasonable request.

Abbreviations

- Solar:

-

NASDAQ OMX Solar index

- Wind:

-

NASDAQ OMX Wind index

- Geothermal:

-

NASDAQ OMX Geothermal index

- Full Cell:

-

NASDAQ OMX Full Cell index

- Bio:

-

NASDAQ OMX Bio-Clean Fuels

- AR:

-

Abnormal return

- CAR:

-

Cumulative abnormal return

- VAR:

-

Vector autoregressive method

- TCI:

-

Total connectedness Index

- S&PGCEI:

-

S&P Global Clean Energy Index

- URA:

-

Uranium

References

Acaroğlu H, Güllü M (2022) Climate change caused by renewable and non-renewable energy consumption and economic growth: a time series ARDL analysis for Turkey. Renewable Energy 193:234–447. https://doi.org/10.1016/j.renene.2022.04.138

Adekoya OB, Oliyide JA, Yaya OOS, Al-Faryan MAS (2022) Does oil connect differently with prominent assets during the war? Analysis of intra-day data during the Russia-Ukraine saga. Resour Policy 77(April):102728. https://doi.org/10.1016/j.resourpol.2022.102728

Ahmad W, Sadorsky P, Sharma A (2018) Optimal hedge ratios for clean energy equities. Econ Model 72(December 2017):278–295. https://doi.org/10.1016/j.econmod.2018.02.008

Ando T, Greenwood-Nimmo M, Shin Y (2022) Quantile connectedness: modeling tail behavior in the topology of financial networks. Manag Sci 68(04). https://doi.org/10.1287/mnsc.2021.3984

Aydin M (2022) The impacts of political stability, renewable energy consumption, and economic growth on tourism in Turkey: new evidence from Fourier Bootstrap ARDL approach. Renewable Energy 190:467–473. https://doi.org/10.1016/j.renene.2022.03.144

Ayed S, Mohamed A, Barguellil A (2022) War and cryptocurrency markets: an empirical investigation. SSRN Electron J 1–14. https://doi.org/10.2139/ssrn.4116377

Barndorff-Nielsen O E. Kinnebrock S. Shephard N (2008) Measuring downside risk-realised semivariance. CREATES Research Paper, (2008-42). https://dx.doi.org/10.2139/ssrn.1262194

Boubaker S, Goodell JW, Pandey DK, Kumari V (2022) Heterogeneous impacts of wars on global equity markets: evidence from the invasion of Ukraine. Finance Res Lett 48(May). https://doi.org/10.1016/j.frl.2022.102934

Brown SJ, Warner JB (1985) Using daily stock returns. The case of event studies. J Financ Econ 14(1):3–31. https://doi.org/10.1016/0304-405X(85)90042-X

Chen C, Pinar M, Stengos T (2022) Renewable energy and CO2 emissions: new evidence with the panel threshold model. Renewable Energy 194:117–128. https://doi.org/10.1016/j.renene.2022.05.095

Dawar I, Dutta A, Bouri E, Saeed T (2021) Crude oil prices and clean energy stock indices: lagged and asymmetric effects with quantile regression. Renewable Energy 163:288–299. https://doi.org/10.1016/j.renene.2020.08.162

Deng M, Leippold M, Wagner AF, Wang Q (2022) Stock prices and the Russia-Ukraine War: sanctions, energy, and ESG. SSRN Electron J 17207. https://doi.org/10.2139/ssrn.4080181

Diebold FX, Yilmaz K (2014) On the network topology of variance decompositions: measuring the connectedness of financial firms. J Econ 182(1):119–134. https://doi.org/10.1016/j.jeconom.2014.04.012

Dutta A (2017) Oil price uncertainty and clean energy stock returns : new evidence from crude oil volatility index. J Clean Prod 164:1157–1166. https://doi.org/10.1016/j.jclepro.2017.07.050

Dutta A, Dutta P (2022) Geopolitical risk and renewable energy asset prices : implications for sustainable development. Renewable Energy 196:518–525. https://doi.org/10.1016/j.renene.2022.07.029

Elsayed AH, Nasreen S, Tiwari AK (2020) Time-varying co-movements between energy market and global financial markets: implication for portfolio diversification and hedging strategies. Energy Economics 90:104847. https://doi.org/10.1016/j.eneco.2020.104847

European Commission (2022) European Commission-Press release REPowerEU: Joint European action for more affordable, secure and sustainable energy. March, 1–3

Ferrer R, Shahzad SJH, López R, Jareño F (2018) Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Econ 76:1–20. https://doi.org/10.1016/j.eneco.2018.09.022

Gaied CS, Pandey DK (2022) Does the Russia-Ukraine War lead to currency asymmetries? A US dollar tale. J Econ Asymmetries 26(July):e00265. https://doi.org/10.2139/ssrn.4119189

Gong X, Xu J (2022) Geopolitical risk and dynamic connectedness between commodity markets. Energy Econ 110(April). https://doi.org/10.1016/j.eneco.2022.106028

Hemrit W, Benlagha N (2021) Does renewable energy index respond to the pandemic uncertainty? Renewable Energy 177:336–347. https://doi.org/10.1016/j.renene.2021.05.130

Ibrahim RL, Ajide KB, Usman M, Kousar R (2022) Heterogeneous effects of renewable energy and structural change on environmental pollution in Africa: do natural resources and environmental technologies reduce pressure on the environment? Renewable Energy 200:244–256. https://doi.org/10.1016/j.renene.2022.09.134

Jahanger A, Usman M, Ahmad P (2022) Investigating the effects of natural resources and institutional quality on CO2 emissions during globalization mode in developing countries. Int J Environ Sci Technol 1–20. https://doi.org/10.1007/s13762-022-04638-2

Jiang Y, Batool Z, Raza S M F, Haseeb M, Ali S, Zain Ul Abidin S (2022) Analyzing the asymmetric effect of renewable energy consumption on environment in STIRPAT-Kaya-EKC Framework: A NARDL approach for China. Inter J Environ Res Pub Heal. 19(12):7100. https://doi.org/10.3390/ijerph19127100

Ji Q, Liu B, Nehler H, Uddin GS (2018) PT SC. Energy Economics, #pagerange#. https://doi.org/10.1016/j.eneco.2018.10.010

Johnston PF (2008) Oil and terrorism Al Qaeda’s threat. Defence R&D Canada Centre for Operational Research & Analysis, April

Kuang W (2021) Are clean energy assets a safe haven for international equity markets? J Clean Prod 302:127006. https://doi.org/10.1016/j.jclepro.2021.127006

Le Billon P, El Khatib F (2004) From free oil to “freedom oil”: Terrorism, war and US geopolitics in the Persian Gulf. Geopolitics 9(1):109–137. https://doi.org/10.1080/14650040412331307852

Li Z, Li T (2022) Economic sanctions and regional differences: evidence from sanctions on Russia. Sustainability (Switzerland) 14(10):1–23. https://doi.org/10.3390/su14106112

Liu T, Nakajima T, Hamori S (2021a) The impact of economic uncertainty caused by COVID-19 on renewable energy stocks. Empirical Economics 0123456789. https://doi.org/10.1007/s00181-021-02087-3

Liu X, Kong H, Zhang S (2021b) Can urbanization, renewable energy, and economic growth make environment more eco-friendly in Northeast Asia? Renewable Energy 169:23–33. https://doi.org/10.1016/j.renene.2021.01.024

Mackinlay AC (1997) American Economic Association Event studies in economics and dinance. J Econ Lit 35(1), 13–39. http://www.jstor.org/stable/2729691%5Cn

Makhdum MSA, Usman M, Kousar R, Cifuentes-Faura J, Radulescu M, Balsalobre-Lorente D (2022) How do institutional quality, natural resources, renewable energy, and financial development reduce ecological footprint without hindering economic growth trajectory? Evidence from China. Sustainability 14(21):13910. https://doi.org/10.3390/su142113910

Massimo F, Markus L, Tobias W (2022) Swiss Finance Institute Research Paper Series N ° 17–23. Swiss Finance Institute Research Paper Series

Nicoletti G, Bruno R, Arcuri N, Nicoletti G (2016) Real costs assessment of solar-hydrogen and some fossil fuels using a combustion analysis. J Combustion 2016. https://doi.org/10.1155/2016/6527510

Noguera-Santaella J (2016) Geopolitics and the oil price. Econ Model 52(August 2007):301–309. https://doi.org/10.1016/j.econmod.2015.08.018

Osička J, Černoch F (2022) European energy politics after Ukraine: the road ahead. Energy Res Soc Sci 91(March):102757. https://doi.org/10.1016/j.erss.2022.102757

Overland I (2019) The geopolitics of renewable energy: Debunking four emerging myths. Energy Res Soc Sci 49(August 2018):36–40. https://doi.org/10.1016/j.erss.2018.10.018

Patt A, Steffen B (2022) A historical turning point? Early evidence on how the Russia-Ukraine war changes public support for clean energy policies. Energy Res Soc Sci 91(June), Working Paper. https://doi.org/10.1016/j.erss.2022.102758

Pham L (2019) Do all clean energy stocks respond homogeneously to oil price? Energy Econ 81:355–379. https://doi.org/10.1016/j.eneco.2019.04.010

Pham SD, Do HX, Nguyen TTT (2022b) Dynamic volatility connectedness between thermal coal futures and major cryptocurrencies: evidence from China. Energy Econ 112(April):106114. https://doi.org/10.1016/j.eneco.2022.106114

Pham L, Hao M, Truong H, Trinh HH (2022a) The impact of climate policy on U.S. clean energy firms: a firm-level examination of stock return, volume, volatility, and connectedness. SSRN Electron J. https://doi.org/10.2139/ssrn.4100609

Ren B, Lucey B (2022) A clean, green haven?—examining the relationship between clean energy, clean and dirty cryptocurrencies. Energy Econ 109(January):105951. https://doi.org/10.1016/j.eneco.2022.105951

Rothkopf DJ (2009) Is a green world a safer world? Not Necessarily. Foreign Policy 174:134–137. search.proquest.com

Saâdaoui F, Ben S, Goodell JW (2022) Causality of geopolitical risk on food prices : considering the Russo – Ukrainian conflict. 49(June)

Sadiq M, Shinwari R, Wen F, Usman M, Hassan S T, Taghizadeh-Hesary F (2023) Do globalization and nuclear energy intensify the environmental costs in top nuclear energy-consuming countries? Progress in Nuclear Energy 156:104533. https://doi.org/10.1016/j.pnucene.2022.104533

Sadiq M, Shinwari R, Usman M, Ozturk I, Maghyereh AI (2022) Linking nuclear energy, human development and carbon emission in BRICS region: do external debt and financial globalization protect the environment? Nucl Eng Technol 54(9):3299–3309. https://doi.org/10.1016/j.net.2022.03.024

Saeed T, Bouri E, Vo XV (2020) Hedging strategies of green assets against dirty energy assets. Energies 13(12). https://doi.org/10.3390/en13123141

Sattich T, Morgan R, Moe E (2022) Searching for energy independence, finding renewables? Energy security perceptions and renewable energy policy in Lithuania. Polit Geogr 96(September 2021):102656. https://doi.org/10.1016/j.polgeo.2022.102656

Saqib N, Usman M, Radulescu M, Sinisi C I, Secara C G, Tolea C (2022) Revisiting EKC hypothesis in context of renewable energy, human development and moderating role of technological innovations in E-7 countries? Front Environ Sci 10:2509. https://doi.org/10.3389/fenvs.2022.1077658

Si-Mohammed K, Sunil T, Diogo F, Shahzadi I (2022) Assessing the EKC hypothesis by considering the supply chain disruption and greener energy : findings in the lens of sustainable development goals. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-23351-8

Sivaram V, Saha S (2018) The geopolitical implications of a clean energy future from the perspective of the United States. In: Scholten, D. (Eds) The Geopolitics of Renewables. Lecture Notes in Energy, 61. https://doi.org/10.1007/978-3-319-67855-9_5

Song Y, Ji Q, Du YJ, Geng JB (2019) The dynamic dependence of fossil energy, investor sentiment and renewable energy stock markets. Energy Econ 84:104564. https://doi.org/10.1016/j.eneco.2019.104564

Su CW, Khan K, Tao R, Umar M (2020) A review of resource curse burden on inflation in Venezuela. Energy 204:117925. https://doi.org/10.1016/j.energy.2020.117925

Su CW, Khan K, Umar M, Zhang W (2021) Does renewable energy redefine geopolitical risks? Energy Policy 158(September):112566. https://doi.org/10.1016/j.enpol.2021.112566

Sun M, Song H, Zhang C (2022) The effects of 2022 Russian invasion of Ukraine on global stock markets: an event study approach. SSRN Electron J. https://doi.org/10.2139/ssrn.4051987

Sweidan OD (2021) The geopolitical risk effect on the US renewable energy deployment. J Clean Prod 293:126189. https://doi.org/10.1016/j.jclepro.2021.126189

Taleb NN (2007) Black swans and the domains of statistics. Am Stat 6(3):198–200. https://doi.org/10.1198/000313007X219996

US Energy Information Administration (2021) Annual Energy Outlook 2021. Table A2 Energy Consumption by Sector and Source. 1–41. https://www.eia.gov/outlooks/aeo/pdf/appa.pdf

Umar M, Riaz Y, Yousaf I (2022a) Impact of Russian-Ukraine war on clean energy, conventional energy, and metal markets: evidence from event study approach. Resour Policy 79:102966. https://doi.org/10.1016/j.resourpol.2022.102966

Umar Z, Bossman A, Choi S-Y, Teplova T (2022b) Does geopolitical risk matter for global asset returns? Evidence from quantile-on-quantile regression. Financ Res Lett 48(March):102991. https://doi.org/10.1016/j.frl.2022.102991

Usman M, Balsalobre-Lorente D (2022) Environmental concern in the era of industrialization: can financial development, renewable energy and natural resources alleviate some load? Energy Policy 162:112780. https://doi.org/10.1016/j.enpol.2022.112780

Usman M, Radulescu M (2022) Examining the role of nuclear and renewable energy in reducing carbon footprint: does the role of technological innovation really create some difference? Sci Total Environ 841:156662. https://doi.org/10.1016/j.scitotenv.2022.156662

Usman M, Makhdum MSA, Kousar R (2021) Does financial inclusion, renewable and non-renewable energy utilization accelerate ecological footprints and economic growth? Fresh evidence from 15 highest emitting countries. Sustain Cities Soc 65:102590. https://doi.org/10.1016/j.scs.2020.102590

Usman M, Balsalobre-Lorente D, Jahanger A, Ahmad P (2022a) Are Mercosur economies going green or going away? An empirical investigation of the association between technological innovations, energy use, natural resources and GHG emissions. Gondwana Res 113:53–70. https://doi.org/10.1016/j.gr.2022.10.018

Usman M, Jahanger A, Radulescu M, Balsalobre-Lorente D (2022b) Do nuclear energy, renewable energy, and environmental-related technologies asymmetrically reduce ecological footprint? Evidence from Pakistan. Energies 15(9). https://doi.org/10.3390/en15093448

Wang Y, Bouri E, Fareed Z, Dai Y (2022) Geopolitical risk and the systemic risk in the commodity markets under the war in Ukraine. Financ Res Lett 49(June):103066. https://doi.org/10.1016/j.frl.2022.103066

Wang L, Dilanchiev A, Haseeb M (2022) The environmental regulation and policy assessment effect on the road to green recovery transformation. Econ Analy Policy 76:914–929. https://doi.org/10.1016/j.eap.2022.10.006

Yarovaya L, Brzeszczyński J, Goodell JW, Lucey B, Lau CKM (2022) Rethinking financial contagion: Information transmission mechanism during the COVID-19 pandemic. J Int Finan Markets Inst Money 79. https://doi.org/10.1016/j.intfin.2022.101589

Yousaf I, Patel R, Yarovaya L (2022) The reaction of G20+ stock markets to the Russia-Ukraine conflict ‘black-swan’ event: evidence from event study approach. SSRN Electron J. https://doi.org/10.2139/ssrn.4069555

Zhou W, Gu Q, Chen J (2021) From volatility spillover to risk spread: an empirical study focuses on renewable energy markets. Renewable Energy 180:329–342. https://doi.org/10.1016/j.renene.2021.08.083

Author information

Authors and Affiliations

Contributions

Kamel Si Mohammed: conceptualization, introduction, methodology, interpreted results, writing—original draft preparation. Muhammad Usman: project administration, formal analysis, supervision, validation, finalizing the manuscript, revised draft, writing—original draft preparation, review, and editing. Paiman Ahmad: visualization, writing—original draft preparation. Urangoo Bulgamaa: literature review, review, and editing.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mohammed, K.S., Usman, M., Ahmad, P. et al. Do all renewable energy stocks react to the war in Ukraine? Russo-Ukrainian conflict perspective. Environ Sci Pollut Res 30, 36782–36793 (2023). https://doi.org/10.1007/s11356-022-24833-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-24833-5